| |

| SECURITIES AND EXCHANGE COMMISSION |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: | (811-05346) |

| | |

| Exact name of registrant as specified in charter: | Putnam Variable Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Stephen Tate, Vice President |

| | |

| | Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq. |

| | |

| | 1211 Avenue of the Americas |

| | |

| | Boston, Massachusetts 02199 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | December 31, 2024 |

| | |

| Date of reporting period: | January 1, 2024 – December 31, 2024 |

| |

| Item 1. Report to Stockholders: |

| |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: |

| | |

Putnam VT Global Asset Allocation Fund | |

Class IA true |

| Annual Shareholder Report | December 31, 2024 |

|

This annual shareholder report contains important information about Putnam VT Global Asset Allocation Fund for the period January 1, 2024, to December 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

Class IA1 | $92 | 0.85% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended December 31, 2024, Class IA shares of Putnam VT Global Asset Allocation Fund returned 16.63%. The Fund compares its performance to the Russell 3000 Index and the Putnam Balanced Blended Benchmark†, which returned 23.81% and 12.80%, respectively, for the same period.

| |

Top contributors to performance: |

| Security selection effects relative to the benchmark within these underlying strategies: |

| ↑ | Quantitative U.S. Large Cap Equity strategy |

| ↑ | Quantitative International Enhanced Equity |

| ↑ | Fundamental Global Asset Allocation equity strategy |

| |

Top detractors from performance: |

| ↓ | Security selection effects within the underlying Quantitative U.S. Small Cap Equity strategy detracted from benchmark-relative results. |

Use of derivatives and the impact on performance:

The Fund utilized futures for managing exposure to market risk, for hedging prepayment risk, for hedging interest rate risk, for gaining exposure to interest rates and for equitizing cash, which collectively detracted from performance.

| Putnam VT Global Asset Allocation Fund | PAGE 1 | 38923-ATSIA-0225 |

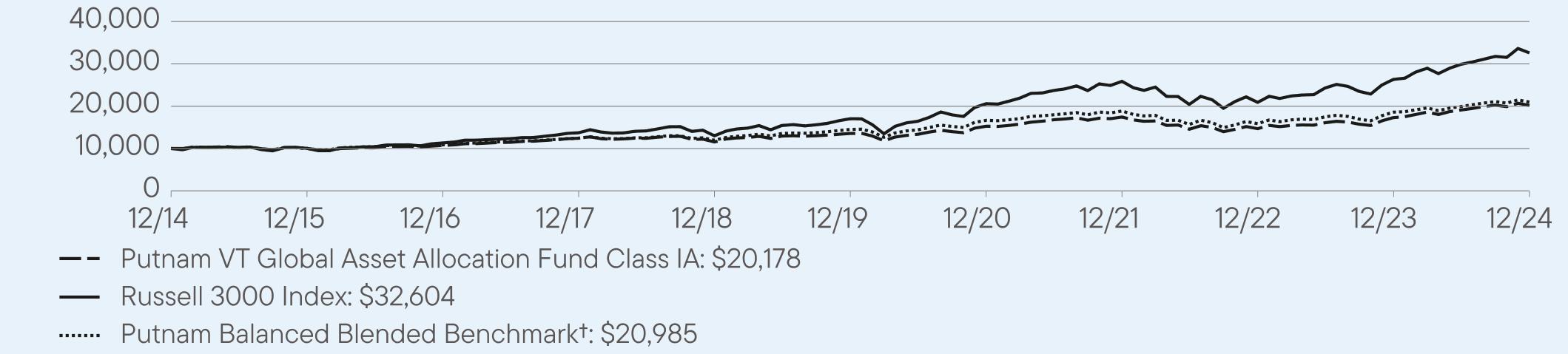

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class IA 12/31/2014 — 12/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended December 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class IA | 16.63 | 8.27 | 7.27 |

Russell 3000 Index | 23.81 | 13.86 | 12.55 |

Putnam Balanced Blended Benchmark† | 12.80 | 7.65 | 7.69 |

| † | The Putnam Balanced Blended Benchmark is comprised of 50% Russell 3000 Index, 35% Bloomberg U.S. Aggregate Index, 10% MSCI EAFE Index-NR, and 5% JPMorgan Developed High Yield Index. |

Performance does not reflect expenses incurred from investing through variable annuity or variable life insurance products, which if reflected, would reduce performance of the Fund.

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of December 31, 2024)

| |

Total Net Assets | $102,799,336 |

Total Number of Portfolio Holdings* | 1,306 |

Total Management Fee Paid | $558,954 |

Portfolio Turnover Rate | 234% |

| * | Includes derivatives, if applicable. |

| Putnam VT Global Asset Allocation Fund | PAGE 2 | 38923-ATSIA-0225 |

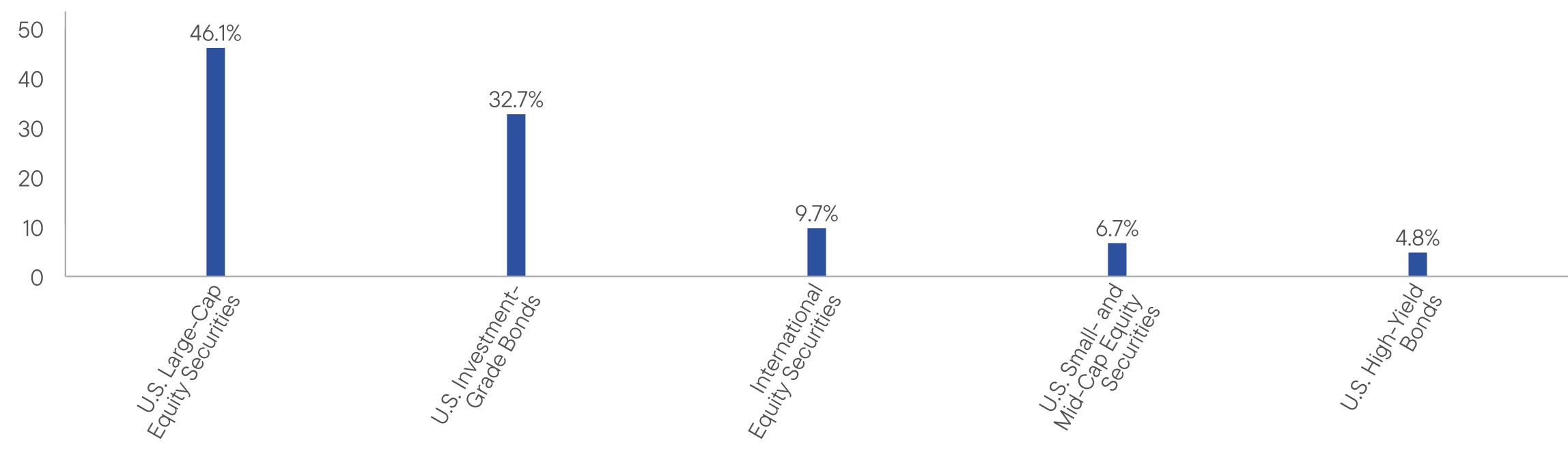

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Templeton”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Templeton to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s then-current sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Templeton. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts were identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL in respect of your Fund. Franklin Advisers is a direct, wholly-owned subsidiary of Franklin Templeton. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

Effective November 1, 2024 (the “Effective Date”), PIL, a sub-advisor of the Fund prior to the Effective Date, merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Templeton (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory agreement between Franklin Advisers and PIL with respect to the Fund was terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Franklin Advisers and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by May 1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam VT Global Asset Allocation Fund | PAGE 3 | 38923-ATSIA-0225 |

10000100421074312426115531356515272174481468817300201781000010048113271372113002170352059325877209072633432604100001003510875124431195814513166611886415872186032098546.132.79.76.74.8

| | |

Putnam VT Global Asset Allocation Fund | |

Class IB true |

| Annual Shareholder Report | December 31, 2024 |

|

This annual shareholder report contains important information about Putnam VT Global Asset Allocation Fund for the period January 1, 2024, to December 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

Class IB1 | $119 | 1.10% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended December 31, 2024, Class IB shares of Putnam VT Global Asset Allocation Fund returned 16.36%. The Fund compares its performance to the Russell 3000 Index and the Putnam Balanced Blended Benchmark†, which returned 23.81% and 12.80%, respectively, for the same period.

| |

Top contributors to performance: |

| Security selection effects relative to the benchmark within these underlying strategies: |

| ↑ | Quantitative U.S. Large Cap Equity strategy |

| ↑ | Quantitative International Enhanced Equity |

| ↑ | Fundamental Global Asset Allocation equity strategy |

| |

Top detractors from performance: |

| ↓ | Security selection effects within the underlying Quantitative U.S. Small Cap Equity strategy detracted from benchmark-relative results. |

Use of derivatives and the impact on performance:

The Fund utilized futures for managing exposure to market risk, for hedging prepayment risk, for hedging interest rate risk, for gaining exposure to interest rates and for equitizing cash, which collectively detracted from performance.

| Putnam VT Global Asset Allocation Fund | PAGE 1 | 38923-ATSIB-0225 |

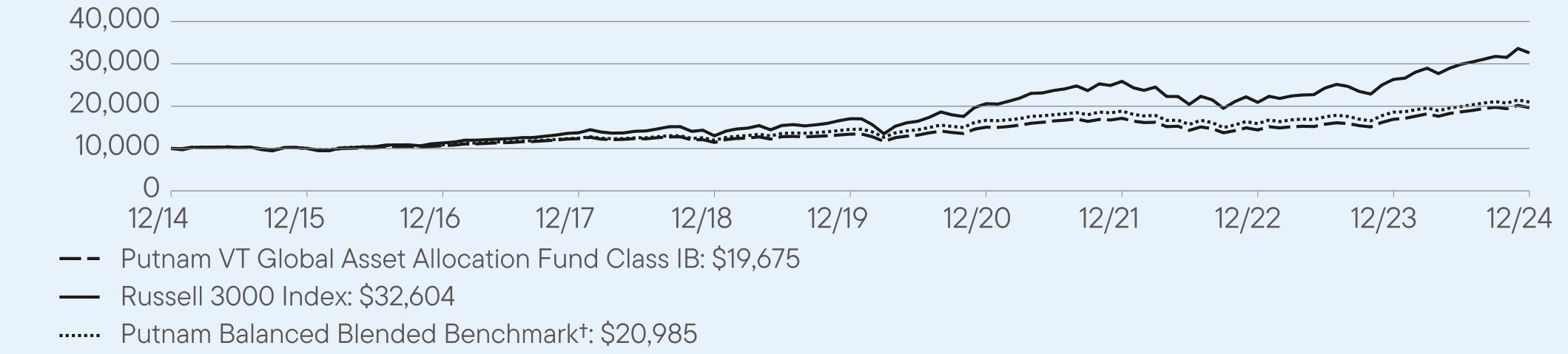

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class IB 12/31/2014 — 12/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended December 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class IB | 16.36 | 8.00 | 7.00 |

Russell 3000 Index | 23.81 | 13.86 | 12.55 |

Putnam Balanced Blended Benchmark† | 12.80 | 7.65 | 7.69 |

| † | The Putnam Balanced Blended Benchmark is comprised of 50% Russell 3000 Index, 35% Bloomberg U.S. Aggregate Index, 10% MSCI EAFE Index-NR, and 5% JPMorgan Developed High Yield Index. |

Performance does not reflect expenses incurred from investing through variable annuity or variable life insurance products, which if reflected, would reduce performance of the Fund.

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of December 31, 2024)

| |

Total Net Assets | $102,799,336 |

Total Number of Portfolio Holdings* | 1,306 |

Total Management Fee Paid | $558,954 |

Portfolio Turnover Rate | 234% |

| * | Includes derivatives, if applicable. |

| Putnam VT Global Asset Allocation Fund | PAGE 2 | 38923-ATSIB-0225 |

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

Portfolio Composition (% of Total Net Assets)

| U.S. Money Market Securities, if any, represent the market value weights of cash, short-term securities, and derivative notional offsets in the portfolio. Holdings and allocations may vary over time. |

HOW HAS THE FUND CHANGED?

On May 31, 2023, Franklin Resources, Inc. (“Franklin Templeton”) and Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), announced that they had entered into a definitive agreement for a subsidiary of Franklin Templeton to acquire Putnam Holdings in a stock and cash transaction (the “Transaction”). The Transaction was completed on January 1, 2024. As part of the Transaction, your Fund’s investment advisor, Putnam Investment Management, LLC (“Putnam Management”), a wholly-owned subsidiary of Putnam Holdings, and your Fund’s then-current sub-advisors, Putnam Investments Limited (“PIL”) and The Putnam Advisory Company, LLC (“PAC”), indirect, wholly-owned subsidiaries of Putnam Holdings, became indirect, wholly-owned subsidiaries of Franklin Templeton. In connection with the Transaction, shareholders of your Fund approved a new management contract with Putnam Management and new sub-advisory contracts with PIL and PAC. The new contracts were identical to the previous contracts, except for the effective dates, initial terms, updates to fund names as necessary to reflect previous name changes, and certain non-substantive changes.

Effective July 15, 2024, Putnam Management transferred its management contract for your Fund to Franklin Advisers, Inc. (“Franklin Advisers”), and Franklin Advisers replaced Putnam Management as the investment advisor to your Fund. In connection with the transfer, your Fund’s portfolio managers, along with supporting research analysts and certain other investment staff of Putnam Management, also became employees of Franklin Advisers. Putnam Management also transferred to Franklin Advisers its sub-management agreement with PIL in respect of your Fund. Franklin Advisers is a direct, wholly-owned subsidiary of Franklin Templeton. In addition, effective July 15, 2024, Franklin Advisers retained Putnam Management as a sub-advisor to your Fund pursuant to a new sub-advisory agreement.

Effective November 1, 2024 (the “Effective Date”), PIL, a sub-advisor of the Fund prior to the Effective Date, merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Templeton (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory agreement between Franklin Advisers and PIL with respect to the Fund was terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Franklin Advisers and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by May 1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) 225-1581 or

funddocuments@putnam.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam VT Global Asset Allocation Fund | PAGE 3 | 38923-ATSIB-0225 |

10000100171069012329114341339315041171401439316909196751000010048113271372113002170352059325877209072633432604100001003510875124431195814513166611886415872186032098546.132.79.76.74.8

| |

| (a) The fund’s principal executive, financial and accounting officers are employees of Putnam Investment Management, LLC, the Fund’s investment manager, or Franklin Templeton. As such they are subject to a comprehensive Code of Ethics adopted and administered by Putnam Investment Management, LLC and Franklin Templeton which is designed to protect the interests of the firm and its clients. The Fund has adopted a Code of Ethics which incorporates the Code of Ethics of Franklin Templeton with respect to all of its officers and Trustees who are employees of Putnam Investment Management, LLC and Franklin Templeton. For this reason, the Fund has not adopted a separate code of ethics governing its principal executive, financial and accounting officers. |

| |

| (c) In connection with the acquisition of Putnam Investments by Franklin Templeton, the Putnam Investments Code of Ethics was amended effective January 1, 2024 to reflect revised compliance processes, including: (i) Compliance with the Putnam Investments Code of Ethics will be viewed as compliance with the Franklin Templeton Code for certain Putnam employees who are dual-hatted in Franklin Templeton advisory entities (ii) Certain Franklin Templeton employees are required to hold shares of Putnam mutual funds at Putnam Investor Services, Inc. and (iii) Certain provisions of the Putnam Investments Code of Ethics are amended that are no longer needed due to organizational changes. Effective March 4, 2024, the majority of legacy Putnam employees transitioned to Franklin Templeton policies outlined in the Franklin Templeton Code. |

| |

| Item 3. Audit Committee Financial Expert: |

| |

| The Funds’ Audit, Compliance and Risk Committee is comprised solely of Trustees who are “independent” (as such term has been defined by the Securities and Exchange Commission (“SEC”) in regulations implementing Section 407 of the Sarbanes-Oxley Act (the “Regulations”)). The Trustees believe that each member of the Audit, Compliance and Risk Committee also possesses a combination of knowledge and experience with respect to financial accounting matters, as well as other attributes, that qualifies him or her for service on the Committee. In addition, the Trustees have determined that each of Mr. McGreevey and Mr. Singh qualifies as an “audit committee financial expert” (as such term has been defined by the Regulations) based on their review of his or her pertinent experience and education.The SEC has stated, and the funds’ amended and restated agreement and Declaration of Trust provides, that the designation or identification of a person as an audit committee financial expert pursuant to this Item 3 of Form N-CSR does not impose on such person any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such person as a member of the Audit, Compliance and Risk Committee and the Board of Trustees in the absence of such designation or identification. |

| |

| Item 4. Principal Accountant Fees and Services: |

| |

| The following table presents fees billed in each of the last two fiscal years for services rendered to the fund by the fund’s independent auditor: |

Fiscal year ended | Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

December 31, 2024 | $119,462 | $ — | $9,616 | $ — |

December 31, 2023 | $120,835 | $ — | $10,636 | $ — |

| |

| For the fiscal years ended December 31, 2024 and December 31, 2023, the fund’s independent auditor billed aggregate non-audit fees in the amounts of $873,852 and $370,768 respectively, to the fund, the fund’s investment manager and any entity controlling, controlled by or under common control with the fund’s investment manager that provides ongoing services to the fund. |

| |

| Audit Fees represent fees billed for the fund’s last two fiscal years relating to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements. |

| |

| Audit-Related Fees represent fees billed in the fund’s last two fiscal years for services traditionally performed by the fund’s auditor, including accounting consultation for proposed transactions or concerning financial accounting and reporting standards and other audit or attest services not required by statute or regulation. |

| |

| Tax Fees represent fees billed in the fund’s last two fiscal years for tax compliance, tax planning and tax advice services. Tax planning and tax advice services include assistance with tax audits, employee benefit plans and requests for rulings or technical advice from taxing authorities. |

| |

| Pre-Approval Policies of the Audit, Compliance and Risk Committee. The Audit, Compliance and Risk Committee of the Putnam funds has determined that, as a matter of policy, all work performed for the funds by the funds’ independent auditors will be pre-approved by the Committee itself and thus will generally not be subject to pre-approval procedures. |

| |

| The Audit, Compliance and Risk Committee also has adopted a policy to pre-approve the engagement by the fund’s investment manager and certain of its affiliates of the funds’ independent auditors, even in circumstances where pre-approval is not required by applicable law. Any such requests by the fund’s investment manager or certain of its affiliates are typically submitted in writing to the Committee and explain, among other things, the nature of the proposed engagement, the estimated fees, and why this work should be performed by that particular audit firm as opposed to another one. In reviewing such requests, the Committee considers, among other things, whether the provision of such services by the audit firm are compatible with the independence of the audit firm. |

| |

| The following table presents fees billed by the fund’s independent auditor for services required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2–01 of Regulation S-X. |

Fiscal year ended | Audit-Related Fees | Tax Fees | All Other Fees | Total Non-Audit Fees |

December 31, 2024 | $ — | $791,963 | $72,273 | $864,236 |

December 31, 2023 | $ — | $360,132 | $ — | $360,132 |

| |

| Item 5. Audit Committee of Listed Registrants |

| |

| The registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements and Other Important Information in Item 7 below. |

| |

| Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Putnam

VT Global Asset Allocation

Fund

Financial Statements and Other Important Information

Annual | December 31, 2024

Table of Contents

| | Financial Statements and Other Important Information—Annual | franklintempleton.com |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Putnam Variable Trust and Shareholders of

Putnam VT Global Asset Allocation Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund's portfolio, of Putnam VT Global Asset Allocation Fund (one of the funds constituting Putnam Variable Trust, referred to hereafter as the “Fund”) as of December 31, 2024, the related statement of operations for the year ended December 31, 2024, the statement of changes in net assets for each of the two years in the period ended December 31, 2024, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2024 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2024 and the financial highlights for each of the five years in the period ended December 31, 2024 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2024 by correspondence with the custodian, transfer agent, agent banks and brokers; when replies were not received from brokers or agent banks, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 18, 2025

We have served as the auditor of one or more investment companies in the Putnam Funds family of funds since at least 1957. We have not been able to determine the specific year we began serving as auditor.

| Putnam VT Global Asset Allocation Fund | 1 |

The fund’s portfolio 12/31/24 |

| | COMMON STOCKS (68.4%)* | Shares | Value |

| | Advertising and marketing services (0.1%) | | |

| | Publicis Groupe SA (France) | 806 | $85,806 |

| | Trade Desk, Inc. (The) Class A † | 482 | 56,649 |

| | | | 142,455 |

| | Automotive (1.4%) | | |

| | Carvana Co. † | 858 | 174,483 |

| | Ford Motor Co. | 6,215 | 61,529 |

| | Subaru Corp. (Japan) | 4,300 | 76,404 |

| | Tesla, Inc. † | 2,532 | 1,022,523 |

| | Toyota Motor Corp. (Japan) | 1,100 | 21,478 |

| | Volvo AB Class B (Sweden) | 3,426 | 83,259 |

| | | | 1,439,676 |

| | Basic materials (2.2%) | | |

| | Air Liquide SA (France) | 263 | 42,753 |

| | Archer-Daniels-Midland Co. | 1,149 | 58,047 |

| | Axalta Coating Systems, Ltd. † | 1,646 | 56,326 |

| | BHP Group, Ltd. (ASE Exchange) (Australia) | 4,851 | 118,339 |

| | BHP Group, Ltd. (London Exchange) (Australia) | 371 | 9,066 |

| | CF Industries Holdings, Inc. | 755 | 64,417 |

| | Cie de Saint-Gobain SA (France) | 1,262 | 112,143 |

| | CRH PLC | 645 | 59,675 |

| | DuPont de Nemours, Inc. | 815 | 62,144 |

| | Evonik Industries AG (Germany) | 1,004 | 17,452 |

| | Fortescue, Ltd. (Australia) | 5,951 | 67,012 |

| | Freeport-McMoRan, Inc. | 1,558 | 59,329 |

| | Glencore PLC (United Kingdom) | 10,568 | 46,543 |

| | HeidelbergCement AG (Germany) | 606 | 74,879 |

| | Holcim AG (Switzerland) | 1,197 | 115,253 |

| | Huntsman Corp. | 3,286 | 59,247 |

| | International Flavors & Fragrances, Inc. | 705 | 59,608 |

| | Linde PLC | 149 | 62,382 |

| | Louisiana-Pacific Corp. | 1,820 | 188,461 |

| | LyondellBasell Industries NV Class A | 878 | 65,209 |

| | Mosaic Co. (The) | 2,351 | 57,788 |

| | NewMarket Corp. | 69 | 36,456 |

| | Northern Star Resources, Inc. (Australia) | 1,218 | 11,572 |

| | Nucor Corp. | 476 | 55,554 |

| | Olin Corp. | 1,617 | 54,655 |

| | Packaging Corp. of America | 329 | 74,068 |

| | PPG Industries, Inc. | 522 | 62,353 |

| | Rio Tinto PLC (United Kingdom) | 1,268 | 74,850 |

| | ROCKWOOL International A/S Class B (Denmark) | 62 | 22,062 |

| | Sealed Air Corp. | 1,774 | 60,014 |

| | Sherwin-Williams Co. (The) | 168 | 57,108 |

| | Shin-Etsu Chemical Co., Ltd. (Japan) | 3,800 | 125,161 |

| | Westlake Corp. | 529 | 60,650 |

| | Weyerhaeuser Co. R | 2,049 | 57,679 |

| | | | 2,208,255 |

| | Building materials (0.2%) | | |

| | Mohawk Industries, Inc. † | 505 | 60,161 |

| | Owens Corning | 382 | 65,062 |

| | Trane Technologies PLC | 153 | 56,511 |

| | Vulcan Materials Co. | 238 | 61,221 |

| | | | 242,955 |

| | Capital goods (2.9%) | | |

| | ABB, Ltd. (Switzerland) | 2,388 | 128,948 |

| | Airbus SE (France) | 286 | 45,797 |

| | AISIN Corp. (Japan) | 5,100 | 56,978 |

| | Allison Transmission Holdings, Inc. | 669 | 72,292 |

| | Caterpillar, Inc. | 184 | 66,748 |

| | | | |

| 2 |

| Putnam VT Global Asset Allocation Fund |

| | COMMON STOCKS (68.4%)* cont. | Shares | Value |

| | Capital goods cont. | | |

| | Crown Holdings, Inc. | 705 | $58,296 |

| | Curtiss-Wright Corp. | 181 | 64,231 |

| | Dassault Aviation SA (France) | 123 | 25,133 |

| | Donaldson Co., Inc. | 834 | 56,170 |

| | Eaton Corp. PLC | 194 | 64,383 |

| | Flowserve Corp. | 1,237 | 71,152 |

| | GE Vernova, Inc. † | 195 | 64,141 |

| | GEA Group AG (Germany) | 823 | 40,881 |

| | Graco, Inc. | 670 | 56,474 |

| | Hitachi, Ltd. (Japan) | 800 | 19,592 |

| | Komatsu, Ltd. (Japan) | 500 | 13,621 |

| | Lockheed Martin Corp. | 1,495 | 726,480 |

| | Mitsubishi Electric Corp. (Japan) | 4,200 | 70,920 |

| | Northrop Grumman Corp. | 146 | 68,516 |

| | Parker Hannifin Corp. | 75 | 47,702 |

| | Pentair PLC | 615 | 61,894 |

| | Republic Services, Inc. | 297 | 59,750 |

| | RTX Corp. | 3,318 | 383,959 |

| | Schindler Holding AG (Switzerland) | 102 | 28,181 |

| | Smiths Group PLC (United Kingdom) | 1,161 | 24,892 |

| | Textron, Inc. | 862 | 65,934 |

| | Vertiv Holdings Co. Class A | 3,162 | 359,235 |

| | Vinci SA (France) | 938 | 96,573 |

| | Waste Management, Inc. | 300 | 60,537 |

| | | | 2,959,410 |

| | Commercial and consumer services (2.4%) | | |

| | Automatic Data Processing, Inc. | 2,783 | 814,668 |

| | Block, Inc. Class A † | 893 | 75,896 |

| | Booking Holdings, Inc. | 9 | 44,716 |

| | Ecolab, Inc. | 269 | 63,032 |

| | Euronet Worldwide, Inc. † | 599 | 61,601 |

| | Global Payments, Inc. | 541 | 60,624 |

| | Mastercard, Inc. Class A | 1,385 | 729,299 |

| | PayPal Holdings, Inc. † | 7,227 | 616,824 |

| | | | 2,466,660 |

| | Communication services (1.0%) | | |

| | American Tower Corp. R | 316 | 57,948 |

| | AT&T, Inc. | 2,423 | 55,172 |

| | Comcast Corp. Class A | 4,756 | 178,493 |

| | Crown Castle, Inc. R | 656 | 59,539 |

| | Deutsche Telekom AG (Germany) | 327 | 9,798 |

| | Juniper Networks, Inc. | 1,638 | 61,343 |

| | KDDI Corp. (Japan) | 3,400 | 108,292 |

| | Koninklijke KPN NV (Netherlands) | 13,814 | 50,372 |

| | Telstra Group, Ltd. (Australia) | 20,959 | 51,943 |

| | Ubiquiti, Inc. | 182 | 60,411 |

| | Verizon Communications, Inc. | 7,090 | 283,529 |

| | | | 976,840 |

| | Communications equipment (0.5%) | | |

| | Arista Networks, Inc. † | 772 | 85,329 |

| | Motorola Solutions, Inc. | 965 | 446,052 |

| | | | 531,381 |

| | Computers (5.8%) | | |

| | AppFolio, Inc. Class A † | 274 | 67,601 |

| | Apple, Inc. | 19,440 | 4,868,165 |

| | Check Point Software Technologies, Ltd. (Israel) † | 100 | 18,670 |

| | Cisco Systems, Inc. | 1,054 | 62,397 |

| | Dropbox, Inc. Class A † | 2,002 | 60,140 |

| | Dynatrace, Inc. † | 1,130 | 61,416 |

| | Fortinet, Inc. † | 648 | 61,223 |

| | NetApp, Inc. | 523 | 60,710 |

| | | | |

| Putnam VT Global Asset Allocation Fund |

| 3 |

| | COMMON STOCKS (68.4%)* cont. | Shares | Value |

| | Computers cont. | | |

| | RingCentral, Inc. Class A † | 1,846 | $64,628 |

| | ServiceNow, Inc. † | 344 | 364,681 |

| | Snowflake, Inc. Class A † | 188 | 29,029 |

| | Synopsys, Inc. † | 121 | 58,729 |

| | Teradata Corp. † | 1,872 | 58,313 |

| | Twilio, Inc. Class A † | 842 | 91,003 |

| | Zoom Video Communications, Inc. Class A † | 996 | 81,284 |

| | | | 6,007,989 |

| | Conglomerates (1.2%) | | |

| | 3M Co. | 6,063 | 782,673 |

| | AMETEK, Inc. | 346 | 62,370 |

| | General Electric Co. | 378 | 63,047 |

| | Marubeni Corp. (Japan) | 1,200 | 18,010 |

| | Mitsubishi Corp. (Japan) | 6,100 | 99,806 |

| | Mitsui & Co., Ltd. (Japan) | 5,200 | 107,843 |

| | Siemens AG (Germany) | 353 | 68,833 |

| | | | 1,202,582 |

| | Consumer (0.2%) | | |

| | Clorox Co. (The) | 380 | 61,716 |

| | Kimberly-Clark Corp. | 492 | 64,472 |

| | LVMH Moet Hennessy Louis Vuitton SA (France) | 25 | 16,445 |

| | Pandora A/S (Denmark) | 531 | 97,149 |

| | | | 239,782 |

| | Consumer staples (4.3%) | | |

| | Auto Trader Group PLC (United Kingdom) | 6,809 | 67,374 |

| | BellRing Brands, Inc. † | 863 | 65,018 |

| | Bunzl PLC (United Kingdom) | 99 | 4,076 |

| | Carlsberg A/S Class B (Denmark) | 130 | 12,486 |

| | Chipotle Mexican Grill, Inc. † | 1,014 | 61,144 |

| | Coca-Cola Co. (The) | 3,272 | 203,715 |

| | Coca-Cola Consolidated, Inc. | 51 | 64,259 |

| | Coca-Cola HBC AG (Italy) | 1,732 | 59,169 |

| | Colgate-Palmolive Co. | 2,140 | 194,547 |

| | Costco Wholesale Corp. | 65 | 59,558 |

| | DoorDash, Inc. Class A † | 3,820 | 640,805 |

| | Etsy, Inc. † | 1,200 | 63,468 |

| | Henkel AG & Co. KGaA Vorzug (Preference) (Germany) | 263 | 23,075 |

| | Imperial Brands PLC (United Kingdom) | 3,367 | 107,673 |

| | Ingredion, Inc. | 430 | 59,151 |

| | Keurig Dr Pepper, Inc. | 1,921 | 61,703 |

| | Koninklijke Ahold Delhaize NV (Netherlands) | 2,915 | 95,084 |

| | L’Oreal SA (France) | 27 | 9,558 |

| | Maplebear, Inc. † | 3,438 | 142,402 |

| | Marks & Spencer Group PLC (United Kingdom) | 1,102 | 5,161 |

| | Mondelez International, Inc. Class A | 6,693 | 399,773 |

| | Monster Beverage Corp. † | 1,221 | 64,176 |

| | Nestle SA (Switzerland) | 442 | 36,263 |

| | Nissin Food Products Co., Ltd. (Japan) | 1,200 | 28,990 |

| | PepsiCo, Inc. | 405 | 61,584 |

| | Philip Morris International, Inc. | 7,656 | 921,400 |

| | Recruit Holdings Co., Ltd. (Japan) | 2,100 | 145,967 |

| | Tesco PLC (United Kingdom) | 13,861 | 63,752 |

| | Tyson Foods, Inc. Class A | 1,007 | 57,842 |

| | Uber Technologies, Inc. † | 8,609 | 519,295 |

| | Unilever PLC (United Kingdom) | 1,200 | 68,185 |

| | WH Group, Ltd. (Hong Kong) | 108,000 | 83,229 |

| | | | 4,449,882 |

| | Electronics (5.9%) | | |

| | Amphenol Corp. Class A | 835 | 57,991 |

| | Broadcom, Inc. | 3,896 | 903,249 |

| | Cirrus Logic, Inc. † | 569 | 56,661 |

| | | | |

| 4 |

| Putnam VT Global Asset Allocation Fund |

| | COMMON STOCKS (68.4%)* cont. | Shares | Value |

| | Electronics cont. | | |

| | Garmin, Ltd. | 294 | $60,640 |

| | Hoya Corp. (Japan) | 900 | 111,696 |

| | Monolithic Power Systems, Inc. | 51 | 30,177 |

| | NVIDIA Corp. | 30,036 | 4,033,534 |

| | Qorvo, Inc. † | 963 | 67,343 |

| | Qualcomm, Inc. | 4,426 | 679,922 |

| | SCREEN Holdings Co., Ltd. (Japan) | 100 | 5,904 |

| | Trimble Inc. † | 874 | 61,757 |

| | | | 6,068,874 |

| | Energy (2.2%) | | |

| | Baker Hughes Co. | 1,537 | 63,048 |

| | BP PLC (United Kingdom) | 9,861 | 48,743 |

| | Cheniere Energy, Inc. | 295 | 63,387 |

| | ConocoPhillips | 605 | 59,998 |

| | Coterra Energy, Inc. | 2,602 | 66,455 |

| | DCC PLC (Ireland) | 504 | 32,294 |

| | Eneos Holdings, Inc. (Japan) | 14,300 | 75,020 |

| | Equinor ASA (Norway) | 4,556 | 108,064 |

| | Exxon Mobil Corp. | 2,925 | 314,642 |

| | Halliburton Co. | 2,293 | 62,347 |

| | HF Sinclair Corp. | 1,655 | 58,008 |

| | INPEX Corp. (Japan) | 1,400 | 17,614 |

| | Marathon Petroleum Corp. | 3,902 | 544,329 |

| | Norsk Hydro ASA (Norway) | 2,977 | 16,376 |

| | OMV AG (Austria) | 751 | 29,125 |

| | Phillips 66 | 510 | 58,104 |

| | Repsol SA (Spain) | 1,597 | 19,432 |

| | Schlumberger, Ltd. | 1,461 | 56,015 |

| | Shell PLC (London Exchange) (United Kingdom) | 910 | 28,366 |

| | TechnipFMC PLC (United Kingdom) | 12,553 | 363,284 |

| | TotalEnergies SE (France) | 451 | 25,127 |

| | Valero Energy Corp. | 485 | 59,456 |

| | Weatherford International PLC | 796 | 57,017 |

| | | | 2,226,251 |

| | Entertainment (—%) | | |

| | Sony Group Corp. (Japan) | 500 | 10,538 |

| | | | 10,538 |

| | Financials (10.1%) | | |

| | 3i Group PLC (United Kingdom) | 2,627 | 116,936 |

| | AerCap Holdings NV (Ireland) | 300 | 28,710 |

| | Affiliated Managers Group, Inc. | 336 | 62,133 |

| | AIA Group, Ltd. (Hong Kong) | 10,200 | 73,265 |

| | AIB Group PLC (Ireland) | 10,356 | 57,268 |

| | Allianz SE (Germany) | 232 | 71,308 |

| | Allstate Corp. (The) | 1,574 | 303,451 |

| | Ally Financial, Inc. | 6,355 | 228,844 |

| | American Express Co. | 216 | 64,107 |

| | American International Group, Inc. | 874 | 63,627 |

| | Ameriprise Financial, Inc. | 133 | 70,813 |

| | Annaly Capital Management, Inc. R | 1,620 | 29,646 |

| | AvalonBay Communities, Inc. R | 283 | 62,252 |

| | AXA SA (France) | 307 | 10,926 |

| | Axis Capital Holdings, Ltd. | 700 | 62,034 |

| | Banco de Sabadell SA (Spain) | 7,219 | 14,028 |

| | Banco Santander SA (Spain) | 26,097 | 120,731 |

| | Bank Hapoalim BM (Israel) | 5,282 | 63,765 |

| | Bank Leumi Le-Israel BM (Israel) | 4,395 | 52,289 |

| | Bank of America Corp. | 4,494 | 197,511 |

| | Bank of New York Mellon Corp. (The) | 6,346 | 487,563 |

| | Barclays PLC (United Kingdom) | 8,710 | 29,137 |

| | Berkshire Hathaway, Inc. Class B † | 507 | 229,813 |

| | | | |

| Putnam VT Global Asset Allocation Fund |

| 5 |

| | COMMON STOCKS (68.4%)* cont. | Shares | Value |

| | Financials cont. | | |

| | BlackRock, Inc. | 63 | $64,582 |

| | BNP Paribas SA (France) | 539 | 33,093 |

| | Brixmor Property Group, Inc. R | 2,543 | 70,797 |

| | Capital One Financial Corp. | 353 | 62,947 |

| | CBRE Group, Inc. Class A † | 492 | 64,595 |

| | Chubb, Ltd. | 223 | 61,615 |

| | Citigroup, Inc. | 13,192 | 928,585 |

| | Citizens Financial Group, Inc. | 1,485 | 64,984 |

| | Commonwealth Bank of Australia (Australia) | 90 | 8,516 |

| | Corebridge Financial, Inc. | 7,439 | 222,649 |

| | Covivio (France) R | 106 | 5,372 |

| | Credit Agricole SA (France) | 1,543 | 21,231 |

| | DBS Group Holdings, Ltd. (Singapore) | 2,820 | 90,368 |

| | Deutsche Boerse AG (Germany) | 86 | 19,811 |

| | Equitable Holdings, Inc. | 6,135 | 289,388 |

| | Equity Lifestyle Properties, Inc. R | 930 | 61,938 |

| | Equity Residential R | 827 | 59,346 |

| | Erste Group Bank AG (Czech Republic) | 1,238 | 76,627 |

| | Essex Property Trust, Inc. R | 491 | 140,151 |

| | Eurazeo SE (France) | 152 | 11,338 |

| | Euronext NV (France) | 455 | 51,045 |

| | Evercore, Inc. Class A | 213 | 59,041 |

| | Everest Group, Ltd. | 179 | 64,880 |

| | Exor NV (Netherlands) | 515 | 47,213 |

| | First Horizon Corp. | 3,097 | 62,374 |

| | First Industrial Realty Trust, Inc. R | 1,202 | 60,256 |

| | Futu Holdings, Ltd. (Hong Kong) † | 100 | 7,999 |

| | Globe Life, Inc. | 701 | 78,176 |

| | Goldman Sachs Group, Inc. (The) | 319 | 182,666 |

| | HSBC Holdings PLC (United Kingdom) | 13,783 | 135,392 |

| | Intercontinental Exchange, Inc. | 401 | 59,753 |

| | Intesa Sanpaolo SpA (Italy) | 21,003 | 84,239 |

| | Investor AB Class B (Sweden) | 4,283 | 113,444 |

| | Invitation Homes, Inc. R | 2,002 | 64,004 |

| | Jones Lang LaSalle, Inc. † | 225 | 56,957 |

| | JPMorgan Chase & Co. | 517 | 123,930 |

| | KeyCorp | 3,649 | 62,544 |

| | Klepierre SA (France) R | 477 | 13,737 |

| | Lloyds Banking Group PLC (United Kingdom) | 147,678 | 100,853 |

| | Marsh & McLennan Cos., Inc. | 302 | 64,148 |

| | MetLife, Inc. | 7,369 | 603,374 |

| | MGIC Investment Corp. | 2,520 | 59,749 |

| | Mid-America Apartment Communities, Inc. R | 409 | 63,219 |

| | Mitsubishi UFJ Financial Group, Inc. (Japan) | 5,900 | 68,881 |

| | Mizrahi Tefahot Bank, Ltd. (Israel) | 562 | 24,328 |

| | Morgan Stanley | 486 | 61,100 |

| | Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen (Germany) | 252 | 127,150 |

| | NatWest Group PLC (United Kingdom) | 5,752 | 28,825 |

| | NN Group NV (Netherlands) | 921 | 40,163 |

| | Nordea Bank ABP (Finland) | 1,092 | 11,895 |

| | Northern Trust Corp. | 537 | 55,043 |

| | OneMain Holdings, Inc. | 614 | 32,008 |

| | PNC Financial Services Group, Inc. (The) | 330 | 63,641 |

| | Popular, Inc. (Puerto Rico) | 668 | 62,832 |

| | Primerica, Inc. | 224 | 60,798 |

| | Principal Financial Group, Inc. | 788 | 60,999 |

| | Progressive Corp. (The) | 266 | 63,736 |

| | Prudential Financial, Inc. | 507 | 60,095 |

| | Public Storage R | 202 | 60,487 |

| | QBE Insurance Group, Ltd. (Australia) | 1,385 | 16,448 |

| | Reinsurance Group of America, Inc. | 320 | 68,362 |

| | | | |

| 6 |

| Putnam VT Global Asset Allocation Fund |

| | COMMON STOCKS (68.4%)* cont. | Shares | Value |

| | Financials cont. | | |

| | RLI Corp. | 377 | $62,141 |

| | Robinhood Markets, Inc. Class A † | 5,388 | 200,757 |

| | Sekisui Chemical Co., Ltd. (Japan) | 1,300 | 22,259 |

| | Sekisui House, Ltd. (Japan) | 1,800 | 42,919 |

| | Simon Property Group, Inc. R | 3,459 | 595,674 |

| | SLM Corp. | 2,455 | 67,709 |

| | State Street Corp. | 2,019 | 198,165 |

| | Stifel Financial Corp. | 566 | 60,041 |

| | Sun Communities, Inc. R | 503 | 61,854 |

| | Synchrony Financial | 1,349 | 87,685 |

| | Talanx AG (Germany) | 299 | 25,430 |

| | Tokio Marine Holdings, Inc. (Japan) | 600 | 21,533 |

| | Travelers Cos., Inc. (The) | 261 | 62,872 |

| | Truist Financial Corp. | 1,353 | 58,693 |

| | UBS Group AG (Switzerland) | 1,077 | 32,974 |

| | UniCredit SpA (Italy) | 2,943 | 117,862 |

| | Unum Group | 2,041 | 149,054 |

| | VICI Properties, Inc. R | 2,122 | 61,984 |

| | Virtu Financial, Inc. Class A | 1,868 | 66,650 |

| | Webster Financial Corp. | 1,032 | 56,987 |

| | Wells Fargo & Co. | 1,059 | 74,384 |

| | Willis Towers Watson PLC | 205 | 64,214 |

| | Zions Bancorp NA | 1,225 | 66,456 |

| | Zurich Insurance Group AG (Switzerland) | 132 | 78,509 |

| | | | 10,380,680 |

| | Gaming and lottery (0.2%) | | |

| | Aristocrat Leisure, Ltd. (Australia) | 2,488 | 105,070 |

| | La Francaise des Jeux SAEM (France) | 583 | 22,452 |

| | Light & Wonder, Inc. † | 650 | 56,147 |

| | | | 183,669 |

| | Health care (6.7%) | | |

| | Abbott Laboratories | 2,394 | 270,785 |

| | AbbVie, Inc. | 2,441 | 433,766 |

| | Agilent Technologies, Inc. | 461 | 61,931 |

| | Alnylam Pharmaceuticals, Inc. † | 261 | 61,416 |

| | Amgen, Inc. | 234 | 60,990 |

| | AstraZeneca PLC (United Kingdom) | 180 | 23,468 |

| | Becton, Dickinson and Co. | 295 | 66,927 |

| | bioMerieux (France) | 194 | 20,764 |

| | Boston Scientific Corp. † | 677 | 60,470 |

| | Bristol-Myers Squibb Co. | 5,411 | 306,046 |

| | Cardinal Health, Inc. | 517 | 61,146 |

| | Chugai Pharmaceutical Co., Ltd. (Japan) | 1,100 | 48,489 |

| | Cigna Group (The) | 2,304 | 636,227 |

| | Cooper Cos., Inc. (The) † | 660 | 60,674 |

| | CSL, Ltd. (Australia) | 116 | 20,236 |

| | Daiichi Sankyo Co., Ltd. (Japan) | 4,300 | 117,662 |

| | Danaher Corp. | 278 | 63,815 |

| | Demant A/S (Denmark) † | 777 | 28,598 |

| | Dexcom, Inc. † | 815 | 63,383 |

| | Edwards Lifesciences Corp. † | 977 | 72,327 |

| | Eli Lilly and Co. | 1,488 | 1,148,736 |

| | Exelixis, Inc. † | 2,088 | 69,530 |

| | Fisher & Paykel Healthcare Corp., Ltd. (New Zealand) | 451 | 9,693 |

| | Fresenius SE & Co. KGaA (Germany) † | 1,162 | 40,334 |

| | FUJIFILM Holdings Corp. (Japan) | 2,100 | 43,448 |

| | GSK PLC (United Kingdom) | 5,158 | 87,001 |

| | HCA Healthcare, Inc. | 223 | 66,933 |

| | Hologic, Inc. † | 445 | 32,080 |

| | IDEXX Laboratories, Inc. † | 142 | 58,708 |

| | Incyte Corp. † | 809 | 55,878 |

| | | | |

| Putnam VT Global Asset Allocation Fund |

| 7 |

| | COMMON STOCKS (68.4%)* cont. | Shares | Value |

| | Health care cont. | | |

| | Insulet Corp. † | 242 | $63,179 |

| | Ipsen SA (France) | 232 | 26,592 |

| | Johnson & Johnson | 970 | 140,281 |

| | Lonza Group AG (Switzerland) | 43 | 25,380 |

| | Medpace Holdings, Inc. † | 182 | 60,466 |

| | Medtronic PLC | 4,970 | 397,004 |

| | Merck & Co., Inc. | 8,165 | 812,254 |

| | Merck KGaA (Germany) | 40 | 5,821 |

| | Natera, Inc. † | 467 | 73,926 |

| | Neurocrine Biosciences, Inc. † | 519 | 70,844 |

| | Novartis AG (Switzerland) | 2,085 | 202,990 |

| | Novo Nordisk A/S Class B (Denmark) | 2,180 | 188,094 |

| | Olympus Corp. (Japan) | 1,500 | 22,395 |

| | Omega Healthcare Investors, Inc. | 1,637 | 61,960 |

| | Otsuka Holdings Company, Ltd. (Japan) | 1,000 | 54,400 |

| | Pfizer, Inc. | 2,427 | 64,388 |

| | QIAGEN NV (Netherlands) | 1,399 | 62,297 |

| | Regeneron Pharmaceuticals, Inc. † | 87 | 61,973 |

| | Roche Holding AG (Switzerland) | 211 | 58,997 |

| | Sonova Holding AG (Switzerland) | 53 | 17,332 |

| | Tenet Healthcare Corp. † | 539 | 68,038 |

| | Thermo Fisher Scientific, Inc. | 114 | 59,306 |

| | UnitedHealth Group, Inc. | 120 | 60,703 |

| | Universal Health Services, Inc. Class B | 342 | 61,362 |

| | | | 6,871,443 |

| | Homebuilding (0.3%) | | |

| | Lennar Corp. Class A | 398 | 54,275 |

| | PulteGroup, Inc. | 521 | 56,737 |

| | Taylor Wimpey PLC (United Kingdom) | 8,219 | 12,509 |

| | Toll Brothers, Inc. | 1,384 | 174,315 |

| | | | 297,836 |

| | Household furniture and appliances (—%) | | |

| | Hoshizaki Corp. (Japan) | 400 | 15,728 |

| | Rational AG (Germany) | 20 | 17,130 |

| | | | 32,858 |

| | Lodging/Tourism (—%) | | |

| | InterContinental Hotels Group PLC (United Kingdom) | 256 | 31,852 |

| | | | 31,852 |

| | Media (1.0%) | | |

| | Informa PLC (United Kingdom) | 2,863 | 28,554 |

| | Netflix, Inc. † | 1,169 | 1,041,953 |

| | | | 1,070,507 |

| | Publishing (0.1%) | | |

| | New York Times Co. (The) Class A | 1,109 | 57,723 |

| | TOPPAN Holdings, Inc. (Japan) | 3,100 | 82,237 |

| | | | 139,960 |

| | Retail (5.2%) | | |

| | adidas AG (Germany) | 252 | 61,983 |

| | Amazon.com, Inc. † | 12,181 | 2,672,390 |

| | Associated British Foods PLC (United Kingdom) | 3,364 | 85,810 |

| | Fast Retailing Co., Ltd. (Japan) | 400 | 134,937 |

| | Gap, Inc. (The) | 2,882 | 68,102 |

| | Home Depot, Inc. (The) | 562 | 218,612 |

| | Industria de Diseno Textil SA (Spain) | 2,119 | 108,544 |

| | Next PLC (United Kingdom) | 307 | 36,417 |

| | Target Corp. | 489 | 66,103 |

| | TJX Cos., Inc. (The) | 7,608 | 919,122 |

| | Walmart, Inc. | 11,061 | 999,361 |

| | | | 5,371,381 |

| | | | |

| 8 |

| Putnam VT Global Asset Allocation Fund |

| | COMMON STOCKS (68.4%)* cont. | Shares | Value |

| | Semiconductor (0.5%) | | |

| | Applied Materials, Inc. | 375 | $60,986 |

| | ASML Holding NV (Netherlands) | 348 | 243,751 |

| | Disco Corp. (Japan) | 200 | 53,055 |

| | KLA Corp. | 99 | 62,382 |

| | Lam Research Corp. | 812 | 58,651 |

| | | | 478,825 |

| | Software (5.4%) | | |

| | Adobe, Inc. † | 1,535 | 682,584 |

| | AppLovin Corp. Class A † | 188 | 60,880 |

| | Atlassian Corp. Class A † | 413 | 100,516 |

| | Autodesk, Inc. † | 255 | 75,370 |

| | Cadence Design Systems, Inc. † | 255 | 76,617 |

| | Guidewire Software, Inc. † | 372 | 62,712 |

| | Intuit, Inc. | 98 | 61,593 |

| | Manhattan Associates, Inc. † | 205 | 55,399 |

| | Microsoft Corp. | 8,233 | 3,470,210 |

| | Nexon Co., Ltd. (Japan) | 700 | 10,413 |

| | Oracle Corp. | 379 | 63,157 |

| | Pegasystems, Inc. | 1,603 | 149,400 |

| | ROBLOX Corp. Class A † | 1,197 | 69,258 |

| | SAP SE (Germany) | 432 | 106,261 |

| | Veeva Systems, Inc. Class A † | 2,158 | 453,720 |

| | Workday, Inc. Class A † | 257 | 66,314 |

| | | | 5,564,404 |

| | Technology (0.1%) | | |

| | CACI International, Inc. Class A † | 155 | 62,629 |

| | | | 62,629 |

| | Technology services (5.2%) | | |

| | Accenture PLC Class A | 180 | 63,322 |

| | Alphabet, Inc. Class A | 10,834 | 2,050,876 |

| | DocuSign, Inc. † | 765 | 68,804 |

| | Fair Isaac Corp. † | 27 | 53,755 |

| | Fiserv, Inc. † | 311 | 63,886 |

| | Gartner, Inc. † | 122 | 59,105 |

| | Leidos Holdings, Inc. | 1,627 | 234,386 |

| | LY Corp. (Japan) | 22,500 | 59,492 |

| | Meta Platforms, Inc. Class A | 3,631 | 2,125,987 |

| | NEC Corp. (Japan) | 200 | 17,115 |

| | Pinterest, Inc. Class A † | 2,061 | 59,769 |

| | Prosus NV (China) | 2,280 | 90,573 |

| | Salesforce, Inc. | 521 | 174,186 |

| | Scout24 SE (Germany) | 185 | 16,324 |

| | VeriSign, Inc. † | 331 | 68,504 |

| | Western Union Co. (The) | 5,825 | 61,745 |

| | Zebra Technologies Corp. Class A † | 156 | 60,250 |

| | | | 5,328,079 |

| | Textiles (0.1%) | | |

| | Hermes International (France) | 36 | 86,377 |

| | | | 86,377 |

| | Toys (0.2%) | | |

| | Bandai Namco Holdings, Inc. (Japan) | 300 | 7,154 |

| | Hasbro, Inc. | 995 | 55,630 |

| | Nintendo Co., Ltd. (Japan) | 1,900 | 110,659 |

| | | | 173,443 |

| | Transportation (1.1%) | | |

| | A.P. Moeller-Maersck A/S Class B (Denmark) | 35 | 58,232 |

| | Aena SME SA (Spain) | 232 | 47,351 |

| | CSX Corp. | 2,775 | 89,549 |

| | DHL Group (Germany) | 1,437 | 50,729 |

| | FedEx Corp. | 223 | 62,737 |

| | Kirby Corp. † | 543 | 57,449 |

| | | | |

| Putnam VT Global Asset Allocation Fund |

| 9 |

| | COMMON STOCKS (68.4%)* cont. | Shares | Value |

| | Transportation cont. | | |

| | Norfolk Southern Corp. | 252 | $59,144 |

| | Qantas Airways, Ltd. (voting rights) (Australia) † | 17,073 | 94,515 |

| | SITC International Holdings Co., Ltd. (Hong Kong) | 5,000 | 13,259 |

| | Union Pacific Corp. | 1,975 | 450,379 |

| | United Parcel Service, Inc. Class B | 492 | 62,041 |

| | Westinghouse Air Brake Technologies Corp. | 315 | 59,721 |

| | | | 1,105,106 |

| | Utilities and power (1.9%) | | |

| | AES Corp. (The) | 4,723 | 60,785 |

| | American Electric Power Co., Inc. | 701 | 64,653 |

| | Constellation Energy Corp. | 318 | 71,140 |

| | Dominion Energy, Inc. | 1,211 | 65,224 |

| | Duke Energy Corp. | 616 | 66,368 |

| | E.ON SE (Germany) | 4,549 | 52,987 |

| | Edison International | 858 | 68,503 |

| | ENGIE SA (France) | 6,570 | 104,196 |

| | Eni SpA (Italy) | 1,291 | 17,659 |

| | Eversource Energy | 1,060 | 60,876 |

| | Exelon Corp. | 10,611 | 399,398 |

| | Iberdrola SA (Spain) | 8,161 | 112,460 |

| | Kansai Electric Power Co., Inc. (The) (Japan) | 2,700 | 29,926 |

| | National Fuel Gas co. | 1,066 | 64,685 |

| | NRG Energy, Inc. | 681 | 61,440 |

| | PG&E Corp. | 8,007 | 161,581 |

| | RWE AG (Germany) | 538 | 16,067 |

| | Vistra Corp. | 3,489 | 481,028 |

| | | | 1,958,976 |

| | Total common stocks (cost $43,476,720) | $70,311,555 |

| | CORPORATE BONDS AND NOTES (12.0%)* | Principal amount | Value |

| | Basic materials (0.7%) | | | |

| | ArcelorMittal SA sr. unsec. unsub. notes 7.00%, 10/15/39 (France) | | $20,000 | $21,364 |

| | Arcosa, Inc. 144A company guaranty sr. unsec. notes 6.875%, 8/15/32 | | 5,000 | 5,086 |

| | ATI, Inc. sr. unsec. notes 7.25%, 8/15/30 | | 10,000 | 10,300 |

| | ATI, Inc. sr. unsec. notes 5.125%, 10/1/31 | | 5,000 | 4,727 |

| | ATI, Inc. sr. unsec. notes 4.875%, 10/1/29 | | 5,000 | 4,767 |

| | ATI, Inc. sr. unsec. sub. notes 5.875%, 12/1/27 | | 15,000 | 14,881 |

| | Avient Corp. 144A sr. unsec. notes 6.25%, 11/1/31 | | 5,000 | 4,937 |

| | Avient Corp. 144A sr. unsec. unsub. notes 7.125%, 8/1/30 | | 10,000 | 10,258 |

| | Beacon Roofing Supply, Inc. 144A sr. unsec. unsub. notes 4.125%, 5/15/29 | | 10,000 | 9,496 |

| | Big River Steel, LLC/BRS Finance Corp. 144A sr. notes 6.625%, 1/31/29 | | 13,000 | 13,013 |

| | Boise Cascade Co. 144A company guaranty sr. unsec. notes 4.875%, 7/1/30 | | 15,000 | 14,330 |

| | Builders FirstSource, Inc. 144A company guaranty sr. unsec. bonds 6.375%, 6/15/32 | | 5,000 | 4,976 |

| | Builders FirstSource, Inc. 144A company guaranty sr. unsec. bonds 4.25%, 2/1/32 | | 5,000 | 4,420 |

| | Builders FirstSource, Inc. 144A sr. unsec. bonds 6.375%, 3/1/34 | | 5,000 | 4,941 |

| | Celanese US Holdings, LLC company guaranty sr. unsec. bonds 6.379%, 7/15/32 (Germany) | | 25,000 | 25,405 |

| | Celanese US Holdings, LLC company guaranty sr. unsec. notes 6.33%, 7/15/29 (Germany) | | 10,000 | 10,210 |

| | Celanese US Holdings, LLC company guaranty sr. unsec. notes 6.165%, 7/15/27 (Germany) | | 53,000 | 53,808 |

| | Celanese US Holdings, LLC company guaranty sr. unsec. notes 1.40%, 8/5/26 (Germany) | | 15,000 | 14,041 |

| | Cerdia Finanz GmbH 144A sr. notes 9.375%, 10/3/31 (Germany) | | 5,000 | 5,216 |

| | CF Industries, Inc. company guaranty sr. unsec. bonds 4.95%, 6/1/43 | | 50,000 | 44,130 |

| | Cleveland-Cliffs, Inc. 144A company guaranty sr. unsec. notes 7.375%, 5/1/33 | | 10,000 | 9,834 |

| | Cleveland-Cliffs, Inc. 144A company guaranty sr. unsec. notes 7.00%, 3/15/32 | | 10,000 | 9,834 |

| | Commercial Metals Co. sr. unsec. notes 4.375%, 3/15/32 | | 5,000 | 4,483 |

| | Commercial Metals Co. sr. unsec. notes 4.125%, 1/15/30 | | 5,000 | 4,600 |

| | CP Atlas Buyer, Inc. 144A sr. unsec. notes 7.00%, 12/1/28 | | 5,000 | 4,403 |

| | FMC Corp. sr. unsec. unsub. notes 5.65%, 5/18/33 | | 20,000 | 19,795 |

| | FMG Resources August 2006 Pty, Ltd. 144A sr. unsec. notes 6.125%, 4/15/32 (Australia) | | 10,000 | 9,887 |

| | Glencore Funding, LLC 144A company guaranty sr. unsec. bonds 5.634%, 4/4/34 | | 15,000 | 14,942 |

| | Glencore Funding, LLC 144A company guaranty sr. unsec. notes 5.371%, 4/4/29 | | 10,000 | 10,084 |

| | | | |

| 10 |

| Putnam VT Global Asset Allocation Fund |

| | CORPORATE BONDS AND NOTES (12.0%)* cont. | Principal amount | Value |

| | Basic materials cont. | | | |

| | Glencore Funding, LLC 144A company guaranty sr. unsec. notes 2.50%, 9/1/30 | | $34,000 | $29,492 |

| | Graphic Packaging International, LLC 144A company guaranty sr. unsec. notes 3.50%, 3/1/29 | | 5,000 | 4,585 |

| | HudBay Minerals, Inc. 144A company guaranty sr. unsec. notes 6.125%, 4/1/29 (Canada) | | 15,000 | 15,073 |

| | Huntsman International, LLC sr. unsec. bonds 2.95%, 6/15/31 | | 15,000 | 12,514 |

| | Intelligent Packaging, Ltd., Finco, Inc./Intelligent Packaging, Ltd. LLC Co-Issuer 144A sr. notes 6.00%, 9/15/28 (Canada) | | 25,000 | 24,669 |

| | International Flavors & Fragrances, Inc. sr. unsec. notes 4.45%, 9/26/28 | | 20,000 | 19,572 |

| | International Flavors & Fragrances, Inc. 144A company guaranty sr. unsec. bonds 3.468%, 12/1/50 | | 5,000 | 3,279 |

| | International Flavors & Fragrances, Inc. 144A sr. unsec. notes 2.30%, 11/1/30 | | 10,000 | 8,497 |

| | International Flavors & Fragrances, Inc. 144A sr. unsec. notes 1.832%, 10/15/27 | | 5,000 | 4,596 |

| | LSF11 A5 HoldCo, LLC 144A sr. unsec. notes 6.625%, 10/15/29 | | 15,000 | 15,443 |

| | Mauser Packaging Solutions Holding Co. 144A company guaranty notes 9.25%, 4/15/27 | | 10,000 | 10,162 |

| | Mauser Packaging Solutions Holding Co. 144A sr. bonds 7.875%, 4/15/27 | | 15,000 | 15,322 |

| | Mercer International, Inc. sr. unsec. notes 5.125%, 2/1/29 (Canada) | | 10,000 | 8,655 |

| | Mercer International, Inc. 144A sr. unsec. notes 12.875%, 10/1/28 (Canada) | | 5,000 | 5,389 |

| | Miter Brands Acquisition Holdco, Inc./MIWD Borrower, LLC 144A company guaranty sr. notes 6.75%, 4/1/32 | | 10,000 | 10,053 |

| | Novelis Corp. 144A company guaranty sr. unsec. notes 4.75%, 1/30/30 | | 15,000 | 13,862 |

| | Nutrien, Ltd. sr. unsec. bonds 5.25%, 1/15/45 (Canada) | | 20,000 | 18,458 |

| | Nutrien, Ltd. sr. unsec. bonds 4.125%, 3/15/35 (Canada) | | 25,000 | 22,174 |

| | Pactiv Evergreen Group Issuer, LLC/Pactiv Evergreen Group Issuer, Inc. 144A sr. notes 4.375%, 10/15/28 | | 5,000 | 5,001 |

| | Rain Carbon, Inc. 144A sr. notes 12.25%, 9/1/29 | | 10,000 | 10,581 |

| | SCIH Salt Holdings, Inc. 144A sr. notes 4.875%, 5/1/28 | | 20,000 | 18,837 |

| | SCIH Salt Holdings, Inc. 144A sr. unsec. notes 6.625%, 5/1/29 | | 15,000 | 14,258 |

| | Smyrna Ready Mix Concrete, LLC 144A sr. notes 8.875%, 11/15/31 | | 10,000 | 10,517 |

| | Standard Industries Solutions, Inc./NY 144A sr. unsec. notes 6.50%, 8/15/32 | | 15,000 | 15,037 |

| | TMS International Holding Corp. 144A sr. unsec. notes 6.25%, 4/15/29 | | 10,000 | 9,650 |

| | United States Steel Corp. sr. unsec. sub. bonds 6.65%, 6/1/37 | | 10,000 | 9,731 |

| | Vibrantz Technologies, Inc. 144A sr. unsec. notes 9.00%, 2/15/30 | | 15,000 | 13,789 |

| | Westlake Corp. sr. unsec. bonds 3.125%, 8/15/51 | | 40,000 | 24,922 |

| | Westlake Corp. sr. unsec. bonds 2.875%, 8/15/41 | | 20,000 | 13,500 |

| | WestRock MWV, LLC company guaranty sr. unsec. unsub. notes 8.20%, 1/15/30 | | 30,000 | 34,064 |

| | WestRock MWV, LLC company guaranty sr. unsec. unsub. notes 7.95%, 2/15/31 | | 10,000 | 11,290 |

| | WR Grace Holdings, LLC 144A sr. unsec. notes 5.625%, 8/15/29 | | 10,000 | 9,208 |

| | | | | 810,348 |

| | Capital goods (0.9%) | | | |

| | Adient Global Holdings, Ltd. 144A company guaranty sr. unsec. unsub. notes 8.25%, 4/15/31 (Ireland) | | 15,000 | 15,346 |

| | Berry Global, Inc. company guaranty sr. notes 5.50%, 4/15/28 | | 2,000 | 2,020 |

| | Berry Global, Inc. 144A company guaranty sr. notes 1.65%, 1/15/27 | | 23,000 | 21,544 |

| | Berry Global, Inc. 144A company guaranty sr. notes 1.57%, 1/15/26 | | 44,000 | 42,481 |

| | Boeing Co. (The) sr. unsec. bonds 5.705%, 5/1/40 | | 5,000 | 4,763 |

| | Boeing Co. (The) sr. unsec. notes 2.95%, 2/1/30 | | 3,000 | 2,681 |

| | Boeing Co. (The) sr. unsec. notes 2.70%, 2/1/27 | | 13,000 | 12,401 |

| | Boeing Co. (The) sr. unsec. notes 3.20%, 3/1/29 | | 5,000 | 4,610 |

| | Boeing Co. (The) sr. unsec. unsub. notes 6.388%, 5/1/31 | | 10,000 | 10,460 |

| | Boeing Co. (The) sr. unsec. unsub. notes 6.298%, 5/1/29 | | 10,000 | 10,371 |

| | Boeing Co. (The) sr. unsec. unsub. notes 6.259%, 5/1/27 | | 7,000 | 7,168 |

| | Boeing Co. (The) sr. unsec. unsub. notes 6.125%, 2/15/33 | | 90,000 | 93,094 |

| | Bombardier, Inc. 144A sr. unsec. notes 7.00%, 6/1/32 (Canada) | | 5,000 | 5,093 |

| | Bombardier, Inc. 144A sr. unsec. unsub. notes 8.75%, 11/15/30 (Canada) | | 10,000 | 10,762 |

| | Chart Industries, Inc. 144A company guaranty sr. notes 7.50%, 1/1/30 | | 15,000 | 15,614 |

| | Chart Industries, Inc. 144A company guaranty sr. unsec. notes 9.50%, 1/1/31 | | 5,000 | 5,379 |

| | Clarios Global LP 144A sr. notes 6.75%, 5/15/28 | | 5,000 | 5,095 |

| | Clean Harbors, Inc. 144A company guaranty sr. unsec. unsub. notes 6.375%, 2/1/31 | | 5,000 | 5,038 |

| | Dornoch Debt Merger Sub, Inc. 144A sr. unsec. notes 6.625%, 10/15/29 | | 5,000 | 4,055 |

| | GFL Environmental, Inc. 144A company guaranty sr. unsec. notes 4.75%, 6/15/29 (Canada) | | 10,000 | 9,612 |

| | GFL Environmental, Inc. 144A sr. notes 6.75%, 1/15/31 (Canada) | | 5,000 | 5,141 |

| | Graham Packaging Co., Inc. 144A company guaranty sr. unsec. sub. notes 7.125%, 8/15/28 | | 15,000 | 14,856 |

| | Great Lakes Dredge & Dock Corp. 144A company guaranty sr. unsec. notes 5.25%, 6/1/29 | | 15,000 | 13,994 |

| | Honeywell International, Inc. sr. unsec. bonds 3.812%, 11/21/47 | | 55,000 | 42,196 |

| | Howmet Aerospace, Inc. sr. unsec. unsub. notes 6.75%, 1/15/28 | | 35,000 | 36,621 |

| | Howmet Aerospace, Inc. sr. unsec. unsub. notes 4.85%, 10/15/31 | | 15,000 | 14,718 |

| | | | |

| Putnam VT Global Asset Allocation Fund |

| 11 |

| | CORPORATE BONDS AND NOTES (12.0%)* cont. | Principal amount | Value |

| | Capital goods cont. | | | |

| | Howmet Aerospace, Inc. sr. unsec. unsub. notes 3.00%, 1/15/29 | | $27,000 | $25,120 |

| | Johnson Controls International PLC sr. unsec. bonds 4.95%, 7/2/64 | | 65,000 | 55,006 |

| | Johnson Controls International PLC sr. unsec. notes 3.90%, 2/14/26 | | 6,000 | 5,944 |

| | Madison IAQ, LLC 144A sr. notes 4.125%, 6/30/28 | | 10,000 | 9,475 |

| | Madison IAQ, LLC 144A sr. unsec. notes 5.875%, 6/30/29 | | 15,000 | 14,180 |

| | Manitowoc Co., Inc. (The) 144A company guaranty notes 9.25%, 10/1/31 | | 10,000 | 10,263 |

| | Oshkosh Corp. sr. unsec. sub. notes 4.60%, 5/15/28 | | 9,000 | 8,889 |

| | Otis Worldwide Corp. sr. unsec. notes 2.565%, 2/15/30 | | 15,000 | 13,332 |

| | Owens-Brockway Glass Container, Inc. 144A company guaranty sr. unsec. notes 7.25%, 5/15/31 | | 15,000 | 14,617 |

| | Panther BF Aggregator 2 LP/Panther Finance Co., Inc. 144A company guaranty sr. unsec. notes 8.50%, 5/15/27 | | 15,000 | 15,051 |

| | Republic Services, Inc. sr. unsec. unsub. notes 5.00%, 11/15/29 | | 60,000 | 60,357 |

| | Ritchie Bros Holdings, Inc. 144A company guaranty sr. notes 6.75%, 3/15/28 | | 5,000 | 5,118 |

| | Ritchie Bros Holdings, Inc. 144A company guaranty sr. unsec. unsub. notes 7.75%, 3/15/31 | | 5,000 | 5,235 |

| | RTX Corp. sr. unsec. bonds 4.875%, 10/15/40 | | 20,000 | 18,448 |

| | RTX Corp. sr. unsec. notes 5.15%, 2/27/33 | | 5,000 | 4,960 |

| | RTX Corp. sr. unsec. unsub. notes 4.125%, 11/16/28 | | 5,000 | 4,869 |

| | Spirit AeroSystems, Inc. company guaranty sr. unsec. unsub. notes 4.60%, 6/15/28 | | 10,000 | 9,491 |

| | Spirit AeroSystems, Inc. 144A company guaranty sr. notes 9.75%, 11/15/30 | | 15,000 | 16,618 |

| | Spirit AeroSystems, Inc. 144A sr. unsub. notes 9.375%, 11/30/29 | | 5,000 | 5,359 |

| | Terex Corp. 144A company guaranty sr. unsec. notes 5.00%, 5/15/29 | | 10,000 | 9,531 |

| | Terex Corp. 144A sr. unsec. notes 6.25%, 10/15/32 | | 5,000 | 4,907 |

| | TransDigm, Inc. company guaranty sr. unsec. sub. notes 5.50%, 11/15/27 | | 10,000 | 9,835 |

| | TransDigm, Inc. company guaranty sr. unsec. sub. notes 4.875%, 5/1/29 | | 10,000 | 9,451 |

| | TransDigm, Inc. 144A company guaranty sr. notes 6.00%, perpetual maturity | | 15,000 | 14,713 |

| | TransDigm, Inc. 144A sr. notes 6.875%, 12/15/30 | | 10,000 | 10,156 |

| | TransDigm, Inc. 144A sr. notes 6.625%, 3/1/32 | | 10,000 | 10,103 |

| | Waste Connections, Inc. sr. unsec. bonds 5.00%, 3/1/34 | | 10,000 | 9,766 |

| | Waste Connections, Inc. sr. unsec. bonds 3.20%, 6/1/32 | | 2,000 | 1,751 |

| | Waste Connections, Inc. sr. unsec. sub. bonds 3.50%, 5/1/29 | | 30,000 | 28,401 |

| | Waste Management, Inc. company guaranty sr. unsec. notes 4.875%, 2/15/29 | | 33,000 | 33,170 |

| | WESCO Distribution, Inc. 144A company guaranty sr. unsec. notes 6.625%, 3/15/32 | | 15,000 | 15,264 |

| | WESCO Distribution, Inc. 144A company guaranty sr. unsec. notes 6.375%, 3/15/29 | | 5,000 | 5,073 |

| | | | | 879,566 |

| | Communication services (1.2%) | | | |

| | American Tower Corp. sr. unsec. bonds 2.70%, 4/15/31 R | | 5,000 | 4,320 |

| | American Tower Corp. sr. unsec. sub. notes 2.75%, 1/15/27 R | | 125,000 | 120,091 |

| | AT&T, Inc. sr. unsec. bonds 3.55%, 9/15/55 | | 41,000 | 27,602 |

| | AT&T, Inc. sr. unsec. notes 4.10%, 2/15/28 | | 15,000 | 14,680 |

| | AT&T, Inc. sr. unsec. unsub. bonds 2.55%, 12/1/33 | | 60,000 | 48,352 |

| | AT&T, Inc. sr. unsec. unsub. notes 4.75%, 5/15/46 | | 77,000 | 66,931 |

| | CCO Holdings, LLC/CCO Holdings Capital Corp. 144A sr. unsec. bonds 5.375%, 6/1/29 | | 8,000 | 7,658 |

| | CCO Holdings, LLC/CCO Holdings Capital Corp. 144A sr. unsec. bonds 4.75%, 3/1/30 | | 60,000 | 54,859 |

| | CCO Holdings, LLC/CCO Holdings Capital Corp. 144A sr. unsec. notes 4.25%, 2/1/31 | | 10,000 | 8,727 |

| | CCO Holdings, LLC/CCO Holdings Capital Corp. 144A sr. unsec. unsub. notes 4.75%, 2/1/32 | | 15,000 | 13,182 |

| | Charter Communications Operating, LLC/Charter Communications Operating Capital Corp. company guaranty sr. notes 2.25%, 1/15/29 | | 27,000 | 23,819 |

| | Charter Communications Operating, LLC/Charter Communications Operating Capital Corp. company guaranty sr. sub. bonds 4.80%, 3/1/50 | | 10,000 | 7,522 |

| | Charter Communications Operating, LLC/Charter Communications Operating Capital Corp. company guaranty sr. sub. notes 4.908%, 7/23/25 | | 11,000 | 10,991 |

| | Charter Communications Operating, LLC/Charter Communications Operating Capital Corp. sr. bonds 3.70%, 4/1/51 | | 110,000 | 68,784 |

| | Comcast Corp. company guaranty sr. unsec. notes 3.45%, 2/1/50 | | 19,000 | 13,020 |

| | Comcast Corp. company guaranty sr. unsec. unsub. bonds 3.999%, 11/1/49 | | 7,000 | 5,304 |

| | Crown Castle, Inc. sr. unsec. bonds 3.80%, 2/15/28 R | | 25,000 | 24,068 |

| | Crown Castle, Inc. sr. unsec. bonds 3.65%, 9/1/27 R | | 34,000 | 32,981 |

| | Crown Castle, Inc. sr. unsec. sub. notes 1.05%, 7/15/26 R | | 23,000 | 21,746 |

| | Crown Castle, Inc. sr. unsec. unsub. bonds 3.70%, 6/15/26 R | | 12,000 | 11,812 |

| | Deutsche Telekom International Finance BV company guaranty sr. unsec. unsub. bonds 8.75%, 6/15/30 (Netherlands) | | 73,000 | 84,869 |

| | | | |

| 12 |

| Putnam VT Global Asset Allocation Fund |

| | CORPORATE BONDS AND NOTES (12.0%)* cont. | Principal amount | Value |

| | Communication services cont. | | | |

| | DIRECTV Holdings, LLC/DIRECTV Financing Co., Inc. 144A sr. notes 8.875%, 2/1/30 | | $5,000 | $4,926 |

| | DIRECTV Holdings, LLC/DIRECTV Financing Co., Inc. 144A sr. notes 5.875%, 8/15/27 | | 10,000 | 9,754 |

| | DISH DBS Corp. 144A company guaranty sr. notes 5.25%, 12/1/26 | | 5,000 | 4,554 |

| | EchoStar Corp. company guaranty sr. sub. notes 10.75%, 11/30/29 | | 10,000 | 10,764 |

| | Frontier Communications Holdings, LLC 144A company guaranty sr. notes 8.75%, 5/15/30 | | 10,000 | 10,577 |

| | Frontier Communications Holdings, LLC 144A company guaranty sr. notes 5.875%, 10/15/27 | | 10,000 | 9,976 |

| | Level 3 Financing, Inc. 144A company guaranty sr. notes 10.50%, 5/15/30 | | 15,000 | 16,410 |

| | Rogers Communications, Inc. company guaranty sr. unsec. notes 5.00%, 2/15/29 (Canada) | | 25,000 | 24,851 |

| | Sprint Capital Corp. company guaranty sr. unsec. unsub. notes 6.875%, 11/15/28 | | 21,000 | 22,308 |

| | T-Mobile USA, Inc. company guaranty sr. bonds 2.25%, 11/15/31 | | 60,000 | 49,869 |

| | T-Mobile USA, Inc. company guaranty sr. notes 3.875%, 4/15/30 | | 7,000 | 6,590 |

| | T-Mobile USA, Inc. company guaranty sr. notes 3.75%, 4/15/27 | | 78,000 | 76,225 |

| | T-Mobile USA, Inc. company guaranty sr. unsec. bonds 5.05%, 7/15/33 | | 15,000 | 14,693 |

| | T-Mobile USA, Inc. company guaranty sr. unsec. bonds 2.875%, 2/15/31 | | 10,000 | 8,800 |

| | T-Mobile USA, Inc. company guaranty sr. unsec. notes 3.375%, 4/15/29 | | 15,000 | 14,011 |

| | TCI Communications, Inc. sr. unsec. unsub. notes 7.125%, 2/15/28 | | 65,000 | 69,437 |

| | Verizon Communications, Inc. sr. unsec. bonds 3.70%, 3/22/61 | | 47,000 | 31,908 |

| | Verizon Communications, Inc. sr. unsec. unsub. notes 4.40%, 11/1/34 | | 65,000 | 60,255 |

| | Verizon Communications, Inc. sr. unsec. unsub. notes 4.329%, 9/21/28 | | 76,000 | 74,471 |

| | Verizon Communications, Inc. sr. unsec. unsub. notes 2.10%, 3/22/28 | | 20,000 | 18,397 |

| | | | | 1,210,094 |

| | Consumer cyclicals (1.6%) | | | |

| | Alimentation Couche-Tard, Inc. 144A company guaranty sr. unsec. notes 3.55%, 7/26/27 (Canada) | | 25,000 | 24,168 |

| | Alimentation Couche-Tard, Inc. 144A sr. unsec. notes 2.95%, 1/25/30 (Canada) | | 14,000 | 12,628 |

| | Allied Universal Holdco, LLC/Allied Universal Finance Corp. 144A sr. notes 7.875%, 2/15/31 | | 15,000 | 15,350 |

| | American Builders & Contractors Supply Co., Inc. 144A sr. notes 4.00%, 1/15/28 | | 15,000 | 14,385 |

| | American Builders & Contractors Supply Co., Inc. 144A sr. unsec. notes 3.875%, 11/15/29 | | 10,000 | 9,080 |

| | Anywhere Real Estate Group, LLC/Anywhere Co-Issuer Corp. 144A company guaranty notes 7.00%, 4/15/30 | | 12,000 | 10,659 |

| | Bath & Body Works, Inc. company guaranty sr. unsec. sub. bonds 6.875%, 11/1/35 | | 20,000 | 20,492 |

| | BCPE Ulysses Intermediate, Inc. 144A sr. unsec. notes 7.75%, 4/1/27 ‡‡ | | 5,000 | 4,951 |

| | Block, Inc. sr. unsec. notes 3.50%, 6/1/31 | | 40,000 | 35,253 |

| | BMW US Capital, LLC 144A company guaranty sr. unsec. notes 3.95%, 8/14/28 | | 35,000 | 33,828 |

| | Boyd Gaming Corp. 144A sr. unsec. bonds 4.75%, 6/15/31 | | 20,000 | 18,517 |

| | Caesars Entertainment, Inc. 144A sr. notes 7.00%, 2/15/30 | | 20,000 | 20,386 |

| | Caesars Entertainment, Inc. 144A sr. unsec. notes 6.00%, 10/15/32 | | 5,000 | 4,826 |

| | Caesars Entertainment, Inc. 144A sr. unsec. notes 4.625%, 10/15/29 | | 20,000 | 18,741 |

| | Camelot Return Merger Sub, Inc. 144A sr. notes 8.75%, 8/1/28 | | 10,000 | 9,593 |

| | Carnival Corp. 144A company guaranty sr. notes 7.00%, 8/15/29 | | 5,000 | 5,205 |

| | Carnival Corp. 144A company guaranty sr. unsec. unsub. notes 10.50%, 6/1/30 | | 5,000 | 5,345 |

| | Carnival Corp. 144A sr. unsec. notes 5.75%, 3/1/27 | | 30,000 | 29,956 |

| | Carnival Holdings Bermuda, Ltd. 144A company guaranty sr. unsec. unsub. notes 10.375%, 5/1/28 (Bermuda) | | 5,000 | 5,331 |

| | Carvana Co. 144A company guaranty sr. sub. notes 9.00%, 12/1/28 ‡‡ | | 8,594 | 9,184 |

| | Churchill Downs, Inc. 144A sr. unsec. notes 5.75%, 4/1/30 | | 10,000 | 9,821 |

| | Cinemark USA, Inc. 144A company guaranty sr. unsec. notes 5.25%, 7/15/28 | | 10,000 | 9,761 |

| | Clear Channel Outdoor Holdings, Inc. 144A company guaranty sr. notes 7.875%, 4/1/30 | | 20,000 | 20,608 |

| | Clear Channel Outdoor Holdings, Inc. 144A company guaranty sr. unsec. sub. notes 7.75%, 4/15/28 | | 15,000 | 13,552 |

| | Crocs, Inc. 144A company guaranty sr. unsec. notes 4.25%, 3/15/29 | | 10,000 | 9,286 |

| | D.R. Horton, Inc. company guaranty sr. unsec. bonds 5.00%, 10/15/34 | | 10,000 | 9,661 |

| | D.R. Horton, Inc. company guaranty sr. unsec. unsub. notes 1.30%, 10/15/26 | | 60,000 | 56,501 |

| | EMRLD Borrower LP/Emerald Co-Issuer, Inc. 144A sr. notes 6.625%, 12/15/30 | | 20,000 | 20,052 |

| | FirstCash, Inc. 144A sr. unsec. notes 6.875%, 3/1/32 (Mexico) | | 30,000 | 30,160 |

| | Foundation Building Materials, Inc. 144A company guaranty sr. unsec. notes 6.00%, 3/1/29 | | 15,000 | 13,242 |

| | Global Payments, Inc. sr. unsec. notes 2.15%, 1/15/27 | | 6,000 | 5,690 |

| | Gray Television, Inc. 144A company guaranty sr. unsec. unsub. notes 5.375%, 11/15/31 | | 15,000 | 8,016 |

| | Great Canadian Gaming Corp. 144A sr. notes 8.75%, 11/15/29 (Canada) | | 15,000 | 15,369 |

| | Hanesbrands, Inc. 144A company guaranty sr. unsec. unsub. notes 9.00%, perpetual maturity | | 15,000 | 16,009 |

| | Home Depot, Inc. (The) sr. unsec. unsub. bonds 5.30%, 6/25/54 | | 20,000 | 19,178 |

| | Home Depot, Inc. (The) sr. unsec. unsub. notes 4.95%, 6/25/34 | | 20,000 | 19,742 |

| | Hyatt Hotels Corp. sr. unsec. notes 5.75%, 1/30/27 | | 22,000 | 22,344 |

| | Hyatt Hotels Corp. sr. unsec. unsub. notes 4.85%, 3/15/26 | | 47,000 | 47,003 |

| | Hyundai Capital America 144A sr. unsec. notes 6.375%, 4/8/30 (South Korea) | | 2,000 | 2,091 |

| | | | |

| Putnam VT Global Asset Allocation Fund |

| 13 |

| | CORPORATE BONDS AND NOTES (12.0%)* cont. | Principal amount | Value |

| | Consumer cyclicals cont. | | | |

| | Hyundai Capital America 144A sr. unsec. notes 5.40%, 1/8/31 (South Korea) | | $4,000 | $4,001 |

| | Hyundai Capital America 144A sr. unsec. notes 4.875%, 11/1/27 (South Korea) | | 20,000 | 19,959 |

| | Hyundai Capital America 144A sr. unsec. notes 4.55%, 9/26/29 (South Korea) | | 5,000 | 4,856 |

| | Hyundai Capital America 144A sr. unsec. notes 6.50%, 1/16/29 (South Korea) | | 35,000 | 36,547 |

| | Hyundai Capital America 144A sr. unsec. notes 5.35%, 3/19/29 (South Korea) | | 8,000 | 8,048 |

| | Interpublic Group of Cos., Inc. (The) sr. unsec. sub. bonds 4.65%, 10/1/28 | | 47,000 | 46,659 |

| | Iron Mountain, Inc. 144A company guaranty sr. unsec. sub. notes 6.25%, 1/15/33 | | 25,000 | 24,917 |

| | LBM Acquisition, LLC 144A company guaranty sr. unsec. notes 6.25%, 1/15/29 | | 10,000 | 9,209 |

| | Levi Strauss & Co. 144A sr. unsec. sub. bonds 3.50%, 3/1/31 | | 25,000 | 21,917 |

| | LGI Homes, Inc. 144A company guaranty sr. unsec. notes 8.75%, 12/15/28 | | 15,000 | 15,744 |

| | Light & Wonder International, Inc. 144A company guaranty sr. unsec. notes 7.25%, 11/15/29 | | 15,000 | 15,326 |

| | Live Nation Entertainment, Inc. 144A sr. notes 6.50%, 5/15/27 | | 5,000 | 5,059 |

| | Mattel, Inc. 144A company guaranty sr. unsec. notes 3.375%, 4/1/26 | | 5,000 | 4,902 |

| | McGraw-Hill Education, Inc. 144A sr. notes 7.375%, 9/1/31 | | 10,000 | 10,247 |

| | McGraw-Hill Education, Inc. 144A sr. notes 5.75%, 8/1/28 | | 5,000 | 4,887 |

| | McGraw-Hill Education, Inc. 144A sr. unsec. notes 8.00%, 8/1/29 | | 15,000 | 15,019 |

| | MIWD Holdco II, LLC/MIWD Finance Corp. 144A company guaranty sr. unsec. notes 5.50%, 2/1/30 | | 10,000 | 9,471 |

| | Moody’s Corp. sr. unsec. notes 2.00%, 8/19/31 | | 50,000 | 41,568 |

| | Moody’s Corp. sr. unsec. sub. bonds 5.00%, 8/5/34 | | 15,000 | 14,683 |

| | NCL Corp., Ltd. 144A company guaranty sr. notes 8.125%, 1/15/29 | | 10,000 | 10,544 |

| | NCL Corp., Ltd. 144A sr. unsec. unsub. notes 7.75%, 2/15/29 | | 10,000 | 10,508 |

| | Netflix, Inc. sr. unsec. bonds 4.90%, 8/15/34 | | 10,000 | 9,798 |

| | Netflix, Inc. sr. unsec. unsub. notes 5.875%, 11/15/28 | | 10,000 | 10,368 |

| | Netflix, Inc. 144A sr. unsec. bonds 5.375%, 11/15/29 | | 53,000 | 54,057 |

| | News Corp. 144A company guaranty sr. unsec. unsub. bonds 5.125%, 2/15/32 | | 4,000 | 3,778 |

| | News Corp. 144A sr. unsec. notes 3.875%, 5/15/29 | | 10,000 | 9,285 |

| | Nexstar Media, Inc. 144A company guaranty sr. unsec. notes 4.75%, 11/1/28 | | 10,000 | 9,335 |

| | Omnicom Group, Inc./Omnicom Capital, Inc. sr. unsec. unsub. notes 3.60%, 4/15/26 | | 65,000 | 64,127 |

| | Outfront Media Capital, LLC/Outfront Media Capital Corp. 144A company guaranty sr. notes 7.375%, 2/15/31 | | 15,000 | 15,692 |

| | Outfront Media Capital, LLC/Outfront Media Capital Corp. 144A company guaranty sr. unsec. notes 5.00%, 8/15/27 | | 10,000 | 9,739 |

| | Paramount Global sr. unsec. unsub. notes 3.70%, 6/1/28 | | 15,000 | 14,135 |

| | Paramount Global sr. unsec. unsub. notes 2.90%, 1/15/27 | | 12,000 | 11,488 |

| | Penn Entertainment, Inc. 144A sr. unsec. notes 5.625%, 1/15/27 | | 10,000 | 9,852 |

| | Prime Security Services Borrower, LLC/Prime Finance, Inc. 144A company guaranty notes 6.25%, 1/15/28 | | 15,000 | 14,935 |

| | Royal Caribbean Cruises, Ltd. 144A sr. unsec. notes 6.25%, 3/15/32 | | 5,000 | 5,064 |

| | Royal Caribbean Cruises, Ltd. 144A sr. unsec. notes 6.00%, 2/1/33 | | 20,000 | 19,967 |

| | Royal Caribbean Cruises, Ltd. 144A sr. unsec. notes 5.625%, 9/30/31 | | 10,000 | 9,843 |

| | Royal Caribbean Cruises, Ltd. 144A sr. unsec. notes 5.50%, 8/31/26 | | 10,000 | 9,997 |

| | Royal Caribbean Cruises, Ltd. 144A sr. unsec. notes 4.25%, 7/1/26 | | 5,000 | 4,909 |

| | RR Donnelley & Sons Co. 144A sr. notes 9.50%, 8/1/29 | | 20,000 | 20,332 |