Exhibit 17(ttt)

PROSPECTUS MARCH 1, 2006

AXA ENTERPRISE MULTIMANAGER FUNDS TRUST

AXA Enterprise Multimanager Growth Fund

AXA Enterprise Multimanager Core Equity Fund

AXA Enterprise Multimanager Value Fund

AXA Enterprise Multimanager Mid Cap Growth Fund

AXA Enterprise Multimanager Mid Cap Value Fund

AXA Enterprise Multimanager International Equity Fund

AXA Enterprise Multimanager Technology Fund

AXA Enterprise Multimanager Health Care Fund

AXA Enterprise Multimanager Core Bond Fund

The Securities and Exchange Commission has not approved any fund’s shares or determined whether this Prospectus is accurate or complete. Anyone who tells you otherwise is committing a crime.

ENTERPRISE

Fund Distributors, Inc.

An AXA Financial Company

INTRODUCTION

AXA Enterprise Multimanager Funds Trust (“Trust”) is comprised of distinct mutual funds, each with its own investment strategy and risk/reward profile. This prospectus describes Class A, Class B, Class C, Class P and Class Y shares of each of the AXA Enterprise Multimanager Funds.* Each fund is a diversified fund, except AXA Enterprise Multimanager Technology Fund and AXA Enterprise Multimanager Health Care Fund, which are non-diversified funds. AXA Enterprise Multimanager Technology Fund and AXA Enterprise Multimanager Health Care Fund are sometimes referred to as “sector funds.” Information on each fund, including investment objectives, investment strategies and investment risks, can be found on the pages following this introduction. In addition, a Glossary of Terms can also be found at the back of this prospectus. The investment objective of a fund is not a fundamental policy and may be changed without a shareholder vote. Each fund (except the AXA Enterprise Multimanager Growth Fund and AXA Enterprise Multimanager Value Fund) has a policy to invest at least 80% of its net assets (plus borrowings for investment purposes) in a particular type of investment. These policies may not be changed without providing at least sixty (60) days’ written notice to shareholders of the relevant fund.

The investment manager to each fund is AXA Equitable Life Insurance Company (“AXA Equitable”). The day-to-day portfolio management of each fund is provided by one or more investment sub-advisers. Information regarding AXA Equitable and the sub-advisers is included under “Management Team” in this prospectus. AXA Equitable may allocate a fund’s assets to additional sub-advisers subject to approval of the Trust’s board of trustees. In addition, AXA Equitable may, subject to the approval of the Trust’s board of trustees, appoint, dismiss and replace sub-advisers and amend sub-advisory agreements without obtaining shareholder approval. If a new sub-adviser is retained for a fund, shareholders would receive notice of such action. However, AXA Equitable may not enter into a sub-advisory agreement with an “affiliated person” of AXA Equitable (as that term is defined in Section 2(a)(3) of the Investment Company Act of 1940, as amended (“1940 Act”)) (“Affiliated Adviser”), such as Alliance Capital Management L.P. and AXA Rosenberg Investment Management LLC, unless the sub-advisory agreement with the Affiliated Adviser is approved by the affected fund’s shareholders.

The distributor for each fund is Enterprise Fund Distributors, Inc. (the “Distributor”).

An investment in a fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Because you could lose money by investing in these funds, be sure to read all risk disclosures carefully before investing.

| * | On December 13, 2004, all Class A shares of the Trust then outstanding were renamed Class P shares and the Trust began offering new Class A shares, as described in this Prospectus. Class P shares are no longer available for purchase, except through exchanges of Class P shares of another fund and through dividend reinvestments, as described in this Prospectus. Also on that date, Class Z shares of the Trust were renamed Class Y shares. |

Table of

CONTENTS

| | |

Goals, Strategies & Risks | | |

| |

AXA Enterprise Multimanager Growth Fund | | 1 |

AXA Enterprise Multimanager Core Equity Fund | | 3 |

AXA Enterprise Multimanager Value Fund | | 5 |

AXA Enterprise Multimanager Mid Cap Growth Fund | | 7 |

AXA Enterprise Multimanager Mid Cap Value Fund | | 9 |

AXA Enterprise Multimanager International Equity Fund | | 11 |

AXA Enterprise Multimanager Technology Fund | | 13 |

AXA Enterprise Multimanager Health Care Fund | | 16 |

AXA Enterprise Multimanager Core Bond Fund | | 19 |

| |

Fund Fees & Expenses | | |

| |

Fund Fees & Expenses | | 22 |

| |

More About Investment Strategies & Risks | | |

| |

More About Investment Strategies & Risks | | 25 |

| |

Management Team | | |

| |

The Manager and the Sub-advisers | | 28 |

| |

Fund Services | | |

| |

Investing in the Funds | | 46 |

How Sales Charges are Calculated | | 48 |

Ways to Reduce or Eliminate Sales Charges | | 53 |

It’s Easy to Open an Account | | 55 |

Buying Shares | | 56 |

Selling Shares | | 57 |

Selling Shares in Writing | | 59 |

Exchanging Shares | | 60 |

Restrictions on Buying, Selling and Exchanging Shares | | 61 |

How Fund Shares are Priced | | 63 |

Dividends and Other Distributions | | 64 |

Tax Consequences | | 64 |

Additional Information | | 65 |

| |

Glossary of Terms | | 67 |

| |

Description of Benchmarks | | 68 |

| |

Financial Highlights | | 70 |

AXA ENTERPRISE MULTIMANAGER GROWTH FUND

| | |

Manager: | | AXA Equitable |

| |

Sub-advisers: | | Alliance Capital Management L.P. RCM Capital Management LLC TCW Investment Management Company |

Key Terms

| • | | Growth Investing — An investment style that emphasizes companies with strong earnings growth. Growth investing is generally considered more aggressive than “value” investing. |

| • | | Large Cap Companies — Companies with market capitalization in excess of $5 billion. |

Investment Goal

Long-term growth of capital.

Principal Investment Strategies

Under normal circumstances, the fund intends to invest primarily in equity securities of U.S. large capitalization companies. Large capitalization companies are companies with market capitalization in excess of $5 billion at the time of investment.

The fund intends to invest primarily in common stocks, but it may also invest in other securities that the sub-advisers believe provide opportunities for capital growth, such as preferred stocks, warrants and securities convertible into common stock. The fund also may invest, to a limited extent, in foreign securities, including depositary receipts of foreign based companies, including companies in developing countries.

Utilizing a due diligence process covering a number of key factors, AXA Equitable selects sub-advisers to manage the fund’s assets. These key factors include, but are not limited to, the sub-adviser’s reputation, organizational stability, investment personnel, long-term performance, investment philosophy and style and correlation with other sub-advisers retained for other allocated portions of the fund. AXA Equitable normally allocates the fund’s assets to three or more sub-advisers. AXA Equitable monitors the sub-advisers and may dismiss, replace or add sub-advisers subject to the approval of the Trust’s board of trustees.

The sub-advisers focus on identifying companies expected to grow at a faster rate than the U.S. economy. This process involves researching and evaluating individual companies for potential investment. The sub-advisers may sell a security for a variety of reasons, including to seek more attractive growth prospects.

For temporary defensive purposes, the fund may invest, without limit, in cash, money market instruments or high quality short-term debt securities, including repurchase agreements. To the extent that the fund is invested in these instruments, the fund will not be pursuing its investment goal.

Principal Investment Risks

An investment in the fund is not guaranteed; you may lose money by investing in the fund. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The principal risks presented by the fund are:

| • | | Equity Risk — Stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of such securities will change based on changes in a company’s financial condition and in overall market and economic conditions. |

| • | | Foreign Investing and Emerging Markets Risk — The value of a fund’s investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the U.S. dollar. Foreign markets also may be less liquid and more volatile than U.S. markets. These risks are greater generally for investments in emerging market issuers than for issuers in more developed countries. |

| • | | Investment Style Risk — The sub-advisers primarily use a particular style or set of styles – in this case “growth” styles – to select investments for the fund. Those styles may be out of favor or may not produce the best results over short or longer time periods. They may also increase the volatility of the fund’s share price. Growth stocks tend to be more volatile than value stocks, so in a declining market, their prices may decrease more than value stocks. |

| • | | Issuer-Specific Risk — The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the market as a whole. The fund could lose all of its investment in a company’s securities. |

| • | | Large Capitalization Risk — Larger more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Many larger companies also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. |

1

| • | | Portfolio Management Risk — The risk that the strategies used by a fund’s sub-advisers and their securities selections fail to produce the intended result. |

| • | | Sub-Adviser Selection Risk — The risk that AXA Equitable’s process for selecting or replacing a sub-adviser and its decision to select or replace a sub-adviser does not produce the intended result. |

More information about the risks of an investment in the fund is provided below in “More About Investment Strategies & Risks.”

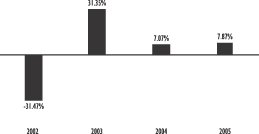

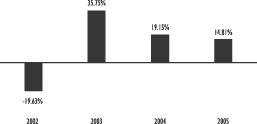

FUND PERFORMANCE

The following information gives some indication of the risks of an investment in the fund by showing yearly changes in the fund’s performance and by comparing the fund’s performance with a broad measure of market performance. Both the bar chart and table below assume reinvestment of dividends and other distributions and include the effect of expense limitations that were in place during the period shown. Since AXA Equitable may add to, dismiss or replace the sub-advisers in a fund, the fund’s historical performance may cover periods when portions of the fund were advised by different sub-advisers. Past performance (before and after taxes) is not an indication of future performance.

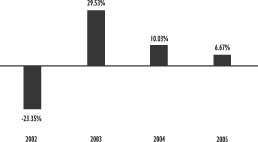

Calendar Year Annual Total Returns (Class Y)

The following bar chart illustrates the calendar year annual total returns for the fund’s Class Y shares. The inception date for the Class Y shares is December 31, 2001. The returns for the fund’s Class A, B, C and P shares would be lower than the Class Y returns shown in the bar chart because those other classes have higher total expenses. In addition, the Class Y returns shown in the bar chart do not reflect sales charges, which would apply to Class A, B, C and P shares; if such sales charges were reflected, the returns shown would be lower.

| | |

Best quarter (% and time period) | | Worst quarter (% and time period) |

13.89% (2003 2nd Quarter) | | –19.11% (2002 2nd Quarter) |

Average Annual Total Returns for the periods ended December 31, 2005

The table below shows how the average annual total returns (adjusted to reflect applicable sales charges) for each class of the fund (before and after taxes) for the one-year and since-inception periods compare to those of a broad-based

index. The table also shows hypothetical total returns that have been calculated to reflect return after taxes on distributions and return after taxes on distributions and assumed sale of fund shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns to an investor depend on the investor’s own tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of fund shares at the end of the measurement period.

| | | | |

| | | |

Average Annual Total Returns

(For the periods ended December 31, 2005) | | 1 Year | | Since Inception* |

Class A—Return Before Taxes | | 2.30% | | 1.90% |

Return After Taxes on Distributions | | 2.30% | | 1.90% |

Return After Taxes on Distributions

& Sale of Fund Shares | | 1.50% | | 1.62% |

Class B—Return Before Taxes | | 1.84% | | –0.76% |

Return After Taxes on Distributions | | 1.84% | | –0.77% |

Return After Taxes on Distributions

& Sale of Fund Shares | | 1.20% | | –0.65% |

Class C—Return Before Taxes | | 5.85% | | –0.03% |

Return After Taxes on Distributions | | 5.85% | | –0.04% |

Return After Taxes on Distributions

& Sale of Fund Shares | | 3.80% | | –0.03% |

Class P—Return Before Taxes | | 1.69% | | –0.67% |

Return After Taxes on Distributions | | 1.69% | | –0.74% |

Return After Taxes on Distributions & Sale of Fund Shares | | 1.10% | | –0.61% |

Class Y—Return Before Taxes | | 7.87% | | 0.98% |

Return After Taxes on Distributions | | 7.87% | | 0.87% |

Return After Taxes on Distributions

& Sale of Fund Shares | | 5.12% | | 0.76% |

Russell 1000 Growth Index** | | 5.26% | | 1.15% |

| * | The inception date for the fund’s Class A shares is December 13, 2004. The fund’s Class A shares have no operating history or performance information of their own prior to that date. The performance shown for the fund’s Class A shares for periods prior to that date is the performance of the fund’s Class P shares adjusted to reflect the fees and expenses of the fund’s Class A shares. The inception date for the fund’s Class B, Class C, Class P and Class Y shares is December 31, 2001. |

| ** | Index returns do not reflect any deductions for expenses, brokerage commissions, sales charges or taxes. For more information on this index, see the following section “Description of Benchmarks.” |

2

AXA ENTERPRISE MULTIMANAGER CORE EQUITY FUND

| | |

Manager: | | AXA Equitable |

| |

Sub-advisers: | | Alliance Capital Management L.P. (Bernstein Unit) Janus Capital Management LLC Thornburg Investment Management, Inc. |

Key Terms

| • | | Core Investing — An investment style that includes both the strategies used when seeking either growth companies (those with strong earnings growth) or value companies (those that may be temporarily out of favor or have earnings or assets not fully reflected in their stock price). |

| • | | Large Cap Companies — Companies with market capitalization in excess of $5 billion. |

Investment Goal

Long-term growth of capital.

Principal Investment Strategies

Under normal circumstances, the fund intends to invest at least 80% of its net assets, plus borrowings for investment purposes, in equity securities, including at least 65% of its total assets in equity securities of U.S. large capitalization companies. Large capitalization companies are companies with market capitalization in excess of $5 billion at the time of investment.

The fund intends to invest primarily in common stocks, but it may also invest in other securities that the sub-advisers believe provide opportunities for capital growth, such as preferred stocks, warrants and securities convertible into common stock. The fund also may invest, to a limited extent, in foreign securities, including depositary receipts of foreign based companies, including companies in developing countries.

Utilizing a due diligence process covering a number of key factors, AXA Equitable selects sub-advisers to manage the fund’s assets. These key factors include, but are not limited to, the sub-adviser’s reputation, organizational stability, investment personnel, long-term performance, investment philosophy and style and correlation with other sub-advisers retained for other allocated portions of the fund. AXA Equitable normally allocates the fund’s assets to three or more sub-advisers. AXA Equitable monitors the sub-advisers and may dismiss, replace or add sub-advisers subject to the approval of the Trust’s board of trustees.

Each sub-adviser generally chooses investments that include either companies with above average growth prospects, companies selling at reasonable valuations, or both. Among other things, these processes involve researching and evaluating individual companies for potential investment. Each sub-adviser may sell a security for a variety of reasons, such as to invest in a company offering superior investment opportunities.

For temporary defensive purposes, the fund may invest, without limit, in cash, money market instruments or high quality short-term debt securities, including repurchase agreements. To the extent that the fund is invested in these instruments, the fund will not be pursuing its investment goal.

Principal Investment Risks

An investment in the fund is not guaranteed; you may lose money by investing in the fund. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The principal risks presented by the fund are:

| • | | Equity Risk — Stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of such securities will change based on changes in a company’s financial condition and in overall market and economic conditions. |

| • | | Foreign Investing and Emerging Markets Risk — The value of a fund’s investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the U.S. dollar. Foreign markets also may be less liquid and more volatile than U.S. markets. These risks are greater generally for investments in emerging market issuers than for issuers in more developed countries. |

| • | | Issuer-Specific Risk — The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the market as a whole. The fund could lose all of its investment in a company’s securities. |

| • | | Large-Capitalization Risk — Larger more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Many larger companies also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. |

3

| • | | Portfolio Management Risk — The risk that the strategies used by a fund’s sub-advisers and their securities selections fail to produce the intended result. |

| • | | Sub-Adviser Selection Risk — The risk that AXA Equitable’s process for selecting or replacing a sub-adviser and its decision to select or replace a sub-adviser does not produce the intended result. |

More information about the risks of an investment in the fund is provided below in “More About Investment Strategies & Risks.”

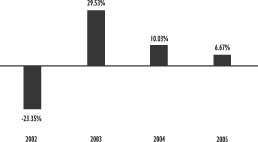

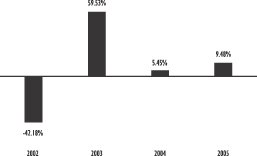

FUND PERFORMANCE

The following information gives some indication of the risks of an investment in the fund by showing yearly changes in the fund’s performance and by comparing the fund’s performance with a broad measure of market performance. Both the bar chart and table below assume reinvestment of dividends and other distributions and include the effect of expense limitations that were in place during the period shown. Since AXA Equitable may add to, dismiss or replace the sub-advisers in a fund, the fund’s historical performance may cover periods when portions of the fund were advised by different sub-advisers. Past performance (before and after taxes) is not an indication of future performance.

Calendar Year Annual Total Returns (Class Y)

The following bar chart illustrates the calendar year annual total returns for the fund’s Class Y shares. The inception date for the Class Y shares is December 31, 2001. The returns for the fund’s Class A, B, C and P shares would be lower than the Class Y returns shown in the bar chart because those other classes have higher total expenses. In addition, the Class Y returns shown in the bar chart do not reflect sales charges, which would apply to Class A, B, C and P shares; if such sales charges were reflected, the returns shown would be lower.

| | |

Best quarter (% and time period) | | Worst quarter (% and time period) |

16.26% (2003 2nd Quarter) | | –16.07% (2002 3rd Quarter) |

Average Annual Total Returns

for the periods ended December 31, 2005

The table below shows how the average annual total returns (adjusted to reflect applicable sales charges) for each class of the fund (before and after taxes) for the one-year and since-inception periods compare to those of a broad-based index. The table also shows hypothetical total returns that have been calculated to reflect return after taxes on distributions and return after taxes on distributions and assumed sale of fund shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns to an investor depend on the investor’s own tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of fund shares at the end of the measurement period.

| | | | |

| | | |

Average Annual Total Returns

(For the periods ended December 31, 2005) | | 1 Year | | Since Inception* |

Class A—Return Before Taxes | | 1.19% | | 2.44% |

Return After Taxes on Distributions | | 0.64% | | 1.90% |

Return After Taxes on Distributions & Sale of Fund Shares | | 1.51% | | 2.08% |

Class B—Return Before Taxes | | 0.63% | | 2.19% |

Return After Taxes on Distributions | | 0.04% | | 1.98% |

Return After Taxes on Distributions & Sale of Fund Shares | | 1.20% | | 1.82% |

Class C—Return Before Taxes | | 4.63% | | 2.88% |

Return After Taxes on Distributions | | 4.04% | | 2.68% |

Return After Taxes on Distributions & Sale of Fund Shares | | 3.80% | | 2.42% |

Class P—Return Before Taxes | | 0.57% | | 2.21% |

Return After Taxes on Distributions | | 0.02% | | 1.92% |

Return After Taxes on Distributions & Sale of Fund Shares | | 1.11% | | 1.78% |

Class Y—Return Before Taxes | | 6.67% | | 3.90% |

Return After Taxes on Distributions | | 5.99% | | 3.52% |

Return After Taxes on Distributions & Sale of Fund Shares | | 5.12% | | 3.19% |

Standard and Poor’s 500 Index** | | 4.91% | | 3.92% |

| * | The inception date for the fund’s Class A shares is December 13, 2004. The fund’s Class A shares have no operating history or performance information of their own prior to that date. The performance shown for the fund’s Class A shares for periods prior to that date is the performance of the fund’s Class P shares adjusted to reflect the fees and expenses of the fund’s Class A shares. The inception date for the fund’s Class B, Class C, Class P and Class Y shares is December 31, 2001. |

| ** | Index returns do not reflect any deductions for expenses, brokerage commissions, sales charges or taxes. For more information on this index, see the following section “Description of Benchmarks.” |

4

AXA ENTERPRISE MULTIMANAGER VALUE FUND

| | |

Manager: | | AXA Equitable |

| |

Sub-advisers: | | Alliance Capital Management L.P. Institutional Capital Corporation MFS Investment Management |

Key Terms

| • | | Value Investing — An investment style that focuses on companies that may be temporarily out of favor or have earnings or assets not fully reflected in their stock prices. |

| • | | Large Cap Companies — Companies with market capitalization in excess of $5 billion. |

Investment Goal

Long-term growth of capital.

Principal Investment Strategies

Under normal circumstances, the fund intends to invest primarily in equity securities of U.S. large capitalization companies. Large capitalization companies are companies with market capitalization in excess of $5 billion at the time of investment.

The fund intends to invest primarily in common stocks, but it may also invest in other securities that the sub-advisers believe provide opportunities for capital growth, such as preferred stocks, warrants and securities convertible into common stock. The fund also may invest, to a limited extent, in foreign securities, including depositary receipts of foreign based companies, including companies in developing countries.

Utilizing a due diligence process covering a number of key factors, AXA Equitable selects sub-advisers to manage the fund’s assets. These key factors include, but are not limited to, the sub-adviser’s reputation, organizational stability, investment personnel, long-term performance, investment philosophy and style and correlation with other sub-advisers retained for other allocated portions of the fund. AXA Equitable normally allocates the fund’s assets to three or more sub-advisers. AXA Equitable monitors the sub-advisers and may dismiss, replace or add sub-advisers subject to the approval of the Trust’s board of trustees.

The sub-advisers focus primarily on stocks that are currently under-priced using certain financial measurements, including the stock’s price-to-earnings and price-to-book ratios and dividend income potential. This process involves researching and evaluating individual companies for potential investment. This approach often leads the fund to focus on “strong companies” in out-of-favor sectors or out-of-favor companies exhibiting a catalyst for change. The sub-advisers may sell a security for a variety of reasons, such as because it becomes overvalued or shows deteriorating fundamentals.

For temporary defensive purposes, the fund may invest, without limit, in cash, money market instruments or high quality short-term debt securities, including repurchase agreements. To the extent that the fund is invested in these instruments, the fund will not be pursuing its investment goal.

Principal Investment Risks

An investment in the fund is not guaranteed; you may lose money by investing in the fund. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The principal risks presented by the fund are:

| • | | Equity Risk — Stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of such securities will change based on changes in a company’s financial condition and in overall market and economic conditions. |

| • | | Foreign Investing and Emerging Markets Risk – The value of a fund’s investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the U.S. dollar. Foreign markets also may be less liquid and more volatile than U.S. markets. These risks are greater generally for investments in emerging market issuers than for issuers in more developed countries. |

| • | | Investment Style Risk — The sub-advisers primarily use a particular style or set of styles – in this case “value” styles – to select investments for the fund. Those styles may be out of favor or may not produce the best results over short or longer time periods. They may also increase the volatility of the fund’s share price. |

| • | | Issuer-Specific Risk — The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the market as a whole. The fund could lose all of its investment in a company’s securities. |

5

| • | | Large-Capitalization Risk — Larger more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Many larger companies also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. |

| • | | Portfolio Management Risk — The risk that the strategies used by a fund’s sub-advisers and their securities selections fail to produce the intended result. |

| • | | Sub-Adviser Selection Risk — The risk that AXA Equitable’s process for selecting or replacing a sub-adviser and its decision to select or replace a sub-adviser does not produce the intended result. |

More information about the risks of an investment in the fund is provided below in “More About Investment Strategies & Risks.”

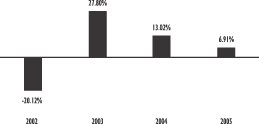

FUND PERFORMANCE

The following information gives some indication of the risks of an investment in the fund by showing yearly changes in the fund’s performance and by comparing the fund’s performance with a broad measure of market performance. Both the bar chart and table below assume reinvestment of dividends and other distributions and include the effect of expense limitations that were in place during the period shown. Since AXA Equitable may add to, dismiss or replace the sub-advisers in a fund, the fund’s historical performance may cover periods when portions of the fund were advised by different sub-advisers. Past performance (before and after taxes) is not an indication of future performance.

Calendar Year Annual Total Returns (Class Y)

The following bar chart illustrates the calendar year annual total returns for the fund’s Class Y shares. The inception date for the Class Y shares is December 31, 2001. The returns for the fund’s Class A, B, C and P shares would be lower than the Class Y returns shown in the bar chart because those other classes have higher total expenses. In addition, the Class Y returns shown in the bar chart do not reflect sales charges, which would apply to Class A, B, C and P shares; if such sales charges were reflected, the returns shown would be lower.

| | |

Best quarter (% and time period) | | Worst quarter (% and time period) |

16.02% (2003 2nd Quarter) | | –17.25% (2002 3rd Quarter) |

Average Annual Total Returns

for the periods ended December 31, 2005

The table below shows how the average annual total returns (adjusted to reflect applicable sales charges) for each class of the fund (before and after taxes) for the one-year and since-inception periods compare to those of a broad-based index. The table also shows hypothetical total returns that have been calculated to reflect return after taxes on distributions and return after taxes on distributions and assumed sale of fund shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns to an investor depend on the investor’s own tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of fund shares at the end of the measurement period.

| | | | |

| | | |

Average Annual Total Returns

(For the periods ended December 31, 2005) | | 1 Year | | Since Inception* |

Class A—Return Before Taxes | | 1.16% | | 2.82% |

Return After Taxes on Distributions | | 0.19% | | 1.46% |

Return After Taxes on Distributions & Sale of Fund Shares | | 1.21% | | 1.92% |

Class B—Return Before Taxes | | 0.64% | | 5.13% |

Return After Taxes on Distributions | | –0.32% | | 4.71% |

Return After Taxes on Distributions & Sale of Fund Shares | | 0.89% | | 4.23% |

Class C—Return Before Taxes | | 4.64% | | 5.79% |

Return After Taxes on Distributions | | 3.68% | | 5.38% |

Return After Taxes on Distributions & Sale of Fund Shares | | 3.49% | | 4.81% |

Class P—Return Before Taxes | | 0.54% | | 5.03% |

Return After Taxes on Distributions | | –0.50% | | 4.39% |

Return After Taxes on Distributions & Sale of Fund Shares | | 0.80% | | 4.00% |

Class Y—Return Before Taxes | | 6.71% | | 6.85% |

Return After Taxes on Distributions | | 5.52% | | 6.11% |

Return After Taxes on Distributions & Sale of Fund Shares | | 4.84% | | 5.52% |

Russell 1000 Value Index** | | 7.05% | | 8.19% |

| * | The inception date for the fund’s Class A shares is December 13, 2004. The fund’s Class A shares have no operating history or performance information of their own prior to that date. The performance shown for the fund’s Class A shares for periods prior to that date is the performance of the fund’s Class P shares adjusted to reflect the fees and expenses of the fund’s Class A shares. The inception date for the fund’s Class B, Class C, Class P and Class Y shares is December 31, 2001. |

| ** | Index returns do not reflect any deductions for expenses, brokerage commissions, sales charges or taxes. For more information on this index, see the following section “Description of Benchmarks.” |

6

AXA ENTERPRISE MULTIMANAGER MID CAP GROWTH FUND

| | |

Manager: | | AXA Equitable |

| |

Sub-advisers: | | Alliance Capital Management L.P. Franklin Advisers, Inc. Provident Investment Counsel, Inc. |

Key Terms

| • | | Growth Investing — An investment style that emphasizes companies with strong earnings growth. Growth investing is generally considered more aggressive than “value” investing. |

| • | | Mid Cap Companies — Companies with market capitalization within the range of companies in the Russell Midcap Growth Index. |

Investment Goal

Long-term growth of capital.

Principal Investment Strategies

Under normal circumstances, the fund intends to invest at least 80% of its net assets, plus borrowings for investment purposes, in equity securities of U.S. mid-capitalization companies. Mid-capitalization companies are companies with market capitalization within the range of companies in the Russell Midcap Growth Index at the time of investment. The market capitalization of companies included in this index currently ranges from approximately $885 million to $16 billion.

The fund intends to invest primarily in common stocks, but it may also invest in other securities that the sub-advisers believe provide opportunities for capital growth, such as preferred stocks, warrants and securities convertible into common stock.

Utilizing a due diligence process covering a number of key factors, AXA Equitable selects sub-advisers to manage the fund’s assets. These key factors include, but are not limited to, the sub-adviser’s reputation, organizational stability, investment personnel, long-term performance, investment philosophy and style and correlation with other sub-advisers retained for other allocated portions of the fund. AXA Equitable normally allocates the fund’s assets to three or more sub-advisers. AXA Equitable monitors the sub-advisers and may dismiss, replace or add sub-advisers subject to the approval of the Trust’s board of trustees.

The sub-advisers utilize an aggressive, growth-oriented investment style that emphasizes companies that are either in or entering into the growth phase of their business cycle. In choosing investments, sub-advisers utilize a process that involves researching and evaluating individual companies for potential investment. The sub-advisers may sell a security for a variety of reasons, such as to invest in a company offering superior investment opportunities.

For temporary defensive purposes, the fund may invest, without limit, in cash, money market instruments or high quality short-term debt securities, including repurchase agreements. To the extent that the fund is invested in these instruments, the fund will not be pursuing its investment goal.

Principal Investment Risks

An investment in the fund is not guaranteed; you may lose money by investing in the fund. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The principal risks presented by the fund are:

| • | | Equity Risk — Stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of such securities will change based on changes in a company’s financial condition and in overall market and economic conditions. |

| • | | Investment Style Risk — The sub-advisers primarily use a particular style or set of styles – in this case “growth” styles – to select investments for the fund. Those styles may be out of favor or may not produce the best results over short or longer time periods. They may also increase the volatility of the fund’s share price. Growth stocks tend to be more volatile than value stocks, so in a declining market, their prices may decrease more than value stocks. |

| • | | Issuer-Specific Risk — The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the market as a whole. The fund could lose all of its investment in a company’s securities. |

| • | | Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and price that the seller would like. This may result in a loss or may be costly to a fund. |

| • | | Mid-Capitalization Risk — Risk is greater for the common stocks of mid-capitalization companies because they generally are more vulnerable than larger companies to adverse business or economic developments and they may have more limited resources. The securities of mid-capitalization companies also |

7

| | may trade less frequently and in smaller volume than securities of larger companies. As a result, the value of such securities may be more volatile than the securities of larger companies, and the fund may experience difficulty in purchasing or selling such securities at the desired time and price. |

| • | | Portfolio Management Risk — The risk that the strategies used by a fund’s sub-advisers and their securities selections fail to produce the intended result. |

| • | | Sub-Adviser Selection Risk — The risk that AXA Equitable’s process for selecting or replacing a sub-adviser and its decision to select or replace a sub-adviser does not produce the intended result. |

More information about the risks of an investment in the fund is provided below in “More About Investment Strategies & Risks.”

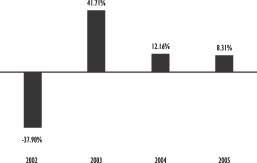

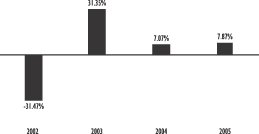

FUND PERFORMANCE

The following information gives some indication of the risks of an investment in the fund by showing yearly changes in the fund’s performance and by comparing the fund’s performance with a broad measure of market performance. Both the bar chart and table below assume reinvestment of dividends and other distributions and include the effect of expense limitations that were in place during the period shown. Since AXA Equitable may add to, dismiss or replace the sub-advisers in a fund, the fund’s historical performance may cover periods when portions of the fund were advised by different sub-advisers. Past performance (before and after taxes) is not an indication of future performance.

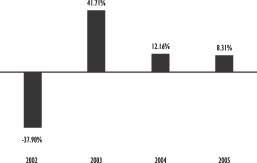

Calendar Year Annual Total Returns (Class Y)

The following bar chart illustrates the calendar year annual total returns for the fund’s Class Y shares. The inception date for the Class Y shares is December 31, 2001. The returns for the fund’s Class A, B, C and P shares would be lower than the Class Y returns shown in the bar chart because those other classes have higher total expenses. In addition, the Class Y returns shown in the bar chart do not reflect sales charges, which would apply to Class A, B, C and P shares; if such sales charges were reflected, the returns shown would be lower.

| | |

Best quarter (% and time period) | | Worst quarter (% and time period) |

20.53% (2003 2nd Quarter) | | –22.35% (2002 2nd Quarter) |

Average Annual Total Returns

for the periods ended December 31, 2005

The table below shows how the average annual total returns (adjusted to reflect applicable sales charges) for each class of the fund (before and after taxes) for the one-year and since- inception periods compare to those of a broad-based index. The table also shows hypothetical total returns that have been calculated to reflect return after taxes on distributions and return after taxes on distributions and assumed sale of fund shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns to an investor depend on the investor’s own tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of fund shares at the end of the measurement period.

| | | | |

| | | |

Average Annual Total Returns (For the periods ended December 31,

2005) | | 1 Year | | Since Inception* |

Class A—Return Before Taxes | | 2.72% | | 5.22% |

Return After Taxes on Distributions* | | 2.72% | | 5.22% |

Return After Taxes on Distributions & Sale of Fund Shares | | 1.77% | | 4.44% |

Class B—Return Before Taxes | | 2.20% | | –0.08% |

Return After Taxes on Distributions | | 2.20% | | –0.08% |

Return After Taxes on Distributions & Sale of Fund Shares | | 1.43% | | –0.06% |

Class C—Return Before Taxes | | 6.32% | | 0.64% |

Return After Taxes on Distributions | | 6.32% | | 0.64% |

Return After Taxes on Distributions & Sale of Fund Shares | | 4.11% | | 0.55% |

Class P—Return Before Taxes | | 2.22% | | 0.02% |

Return After Taxes on Distributions | | 2.22% | | 0.02% |

Return After Taxes on Distributions & Sale of Fund Shares | | 1.44% | | 0.02% |

Class Y—Return Before Taxes | | 8.31% | | 1.68% |

Return After Taxes on Distributions | | 8.31% | | 1.68% |

Return After Taxes on Distributions & Sale of Fund Shares | | 5.40% | | 1.44% |

Russell Midcap Growth Index** | | 12.10% | | 7.61% |

| * | The inception date for the fund’s Class A shares is December 13, 2004. The fund’s Class A shares have no operating history or performance information of their own prior to that date. The performance shown for the fund’s Class A shares for periods prior to that date is the performance of the fund’s Class P shares adjusted to reflect the fees and expenses of the fund’s Class A shares. The inception date for the fund’s Class B, Class C, Class P and Class Y shares is December 31, 2001. |

| ** | Index returns do not reflect any deductions for expenses, brokerage commissions, sales charges or taxes. For more information on this index, see the following section “Description of Benchmarks.” |

8

AXA ENTERPRISE MULTIMANAGER MID CAP VALUE FUND

| | |

Manager: | | AXA Equitable |

| |

Sub-advisers: | | AXA Rosenberg Investment Management LLC TCW Investment Management Company Wellington Management Company, LLP |

Key Terms

| • | | Value Investing — An investment style that focuses on companies that may be temporarily out of favor or have earnings or assets not fully reflected in their stock prices. |

| • | | Mid Cap Companies — Companies with market capitalization within the range of companies in the Russell Midcap Value Index. |

Investment Goal

Long-term growth of capital.

Principal Investment Strategies

Under normal circumstances, the fund intends to invest at least 80% of its net assets, plus borrowings for investment purposes, in equity securities of U.S. mid-capitalization companies. Mid-capitalization companies are companies with market capitalization within the range of companies in the Russell Midcap Value Index at the time of investment. The market capitalization of companies included in this index currently ranges from approximately $658 million to $16 billion.

The fund intends to invest primarily in common stocks, but it may also invest in other securities that the sub-advisers believe provide opportunities for capital growth, such as preferred stocks, warrants and securities convertible into common stock.

Utilizing a due diligence process covering a number of key factors, AXA Equitable selects sub-advisers to manage the fund’s assets. These key factors include, but are not limited to, the sub-adviser’s reputation, organizational stability, investment personnel, long-term performance, investment philosophy and style and correlation with other sub-advisers retained for other allocated portions of the fund. AXA Equitable normally allocates the fund’s assets to three or more sub-advisers. AXA Equitable monitors the sub-advisers and may dismiss, replace or add sub-advisers subject to the approval of the Trust’s board of trustees.

The sub-advisers utilize a value-oriented investment style that emphasizes companies deemed to be currently under-priced according to certain financial measurements, which may include price-to-earnings and price-to-book ratios and dividend income potential. This process involves researching and evaluating individual companies for potential investment by the fund. This approach will often lead the fund to focus on “strong companies” in out-of-favor sectors or out-of-favor companies exhibiting a catalyst for change. The sub-advisers may sell a security for a variety of reasons, such as because it becomes overvalued or shows deteriorating fundamentals.

For temporary defensive purposes, the fund may invest, without limit, in cash, money market instruments or high quality short-term debt securities, including repurchase agreements. To the extent that the fund is invested in these instruments, the fund will not be pursuing its investment goal.

Principal Investment Risks

An investment in the fund is not guaranteed; you may lose money by investing in the fund. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The principal risks presented by the fund are:

| • | | Equity Risk — Stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of such securities will change based on changes in a company’s financial condition and in overall market and economic conditions. |

| • | | Investment Style Risk — The sub-advisers primarily use a particular style or set of styles – in this case “value” styles – to select investments for the fund. Those styles may be out of favor or may not produce the best results over short or longer time periods. They may also increase the volatility of the fund’s share price. |

| • | | Issuer-Specific Risk — The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the market as a whole. The fund could lose all of its investment in a company’s securities. |

| • | | Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and price that the seller would like. This may result in a loss or may be costly to a fund. |

| • | | Mid-Capitalization Risk — Risk is greater for the common stocks of mid-capitalization companies because they generally are more vulnerable than larger companies to adverse business or economic developments and they may have more limited |

9

| | resources. The securities of mid-capitalization companies also may trade less frequently and in smaller volume than securities of larger companies. As a result, the value of such securities may be more volatile than the securities of larger companies, and the fund may experience difficulty in purchasing or selling such securities at the desired time and price. |

| • | | Portfolio Management Risk — The risk that the strategies used by a fund’s sub-advisers and their securities selections fail to produce the intended result. |

| • | | Sub-Adviser Selection Risk — The risk that AXA Equitable’s process for selecting or replacing a sub-adviser and its decision to select or replace a sub-adviser does not produce the intended result. |

More information about the risks of an investment in the fund is provided below in “More About Investment Strategies & Risks.”

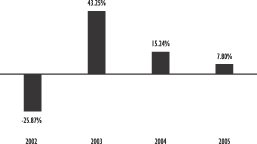

FUND PERFORMANCE

The following information gives some indication of the risks of an investment in the fund by showing yearly changes in the fund’s performance and by comparing the fund’s performance with a broad measure of market performance. Both the bar chart and table below assume reinvestment of dividends and other distributions and include the effect of expense limitations that were in place during the period shown. Since AXA Equitable may add to, dismiss or replace the sub-advisers in a fund, the fund’s historical performance may cover periods when portions of the fund were advised by different sub-advisers. Past performance (before and after taxes) is not an indication of future performance.

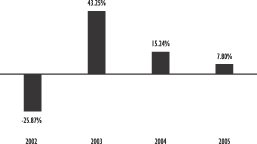

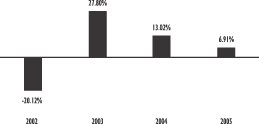

Calendar Year Annual Total Returns (Class Y)

The following bar chart illustrates the calendar year annual total returns for the fund’s Class Y shares. The inception date for the Class Y shares is December 31, 2001. The returns for the fund’s Class A, B, C and P shares would be lower than the Class Y returns shown in the bar chart because those other classes have higher total expenses. In addition, the Class Y returns shown in the bar chart do not reflect sales charges, which would apply to Class A, B, C and P shares; if such sales charges were reflected, the returns shown would be lower.

| | |

Best quarter (% and time period) | | Worst quarter (% and time period) |

19.66% (2003 2nd Quarter) | | –20.69% (2002 3rd Quarter) |

Average Annual Total Returns

for the periods ended December 31, 2005

The table below shows how the average annual total returns (adjusted to reflect applicable sales charges) for each class of the fund (before and after taxes) for the one-year and since- inception periods compare to those of a broad-based index. The table also shows hypothetical total returns that have been calculated to reflect return after taxes on distributions and return after taxes on distributions and assumed sale of fund shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns to an investor depend on the investor’s own tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of fund shares at the end of the measurement period.

| | | | |

| | | |

Average Annual Total Returns (For the periods ended December 31, 2005) | | 1 Year | | Since Inception* |

Class A—Return Before Taxes | | 2.24% | | 4.42% |

Return After Taxes on Distributions | | 0.49% | | 2.71% |

Return After Taxes on Distributions & Sale of Fund Shares | | 3.38% | | 3.58% |

Class B—Return Before Taxes | | 2.07% | | 5.51% |

Return After Taxes on Distributions | | 0.20% | | 5.03% |

Return After Taxes on Distributions & Sale of Fund Shares | | 3.39% | | 4.68% |

Class C—Return Before Taxes | | 5.82% | | 6.10% |

Return After Taxes on Distributions | | 3.95% | | 5.62% |

Return After Taxes on Distributions & Sale of Fund Shares | | 5.83% | | 5.19% |

Class P—Return Before Taxes | | 1.68% | | 5.43% |

Return After Taxes on Distributions | | –0.06% | | 4.90% |

Return After Taxes on Distributions & Sale of Fund Shares | | 3.00% | | 4.56% |

Class Y—Return Before Taxes | | 7.80% | | 7.17% |

Return After Taxes on Distributions | | 5.97% | | 6.60% |

Return After Taxes on Distributions & Sale of Fund Shares | | 7.08% | | 6.05% |

Russell Midcap Value Index** | | 12.65% | | 14.83% |

| * | The inception date for the fund’s Class A shares is December 13, 2004. The fund’s Class A shares have no operating history or performance information of their own prior to that date. The performance shown for the fund’s Class A shares for periods prior to that date is the performance of the fund’s Class P shares adjusted to reflect the fees and expenses of the fund’s Class A shares. The inception date for the fund’s Class B, Class C, Class P and Class Y shares is December 31, 2001. |

| ** | Index returns do not reflect any deductions for expenses, brokerage commissions, sales charges or taxes. For more information on this index, see the following section “Description of Benchmarks.” |

10

AXA ENTERPRISE MULTIMANAGER INTERNATIONAL EQUITY FUND

| | |

Manager: | | AXA Equitable |

| |

Sub-advisers: | | Alliance Capital Management L.P. (Bernstein Unit) J.P. Morgan Investment Management Inc. Marsico Capital Management, LLC |

Key Term

| • | | International Investing — Focuses primarily on companies organized or headquartered outside the U.S. |

Investment Goal

Long-term growth of capital.

Principal Investment Strategies

Under normal circumstances, the fund intends to invest at least 80% of its net assets, plus borrowings for investment purposes, in equity securities of companies, including at least 65% of its total assets in equity securities of foreign companies (companies organized or headquartered outside of the U.S.). Foreign securities include securities issued by companies in countries with either developed or developing economies. The fund does not limit its investment to issuers within a specific market capitalization range.

The fund intends to invest primarily in common stocks, but it may also invest in other securities that the sub-advisers believe provide opportunities for capital growth, such as preferred stocks, warrants and securities convertible into common stock. The fund also may invest, to a limited extent, in illiquid securities.

Utilizing a due diligence process covering a number of key factors, AXA Equitable selects sub-advisers to manage the fund’s assets. These key factors include, but are not limited to, the sub-adviser’s reputation, organizational stability, investment personnel, long-term performance, investment philosophy and style and correlation with other sub-advisers retained for other allocated portions of the fund. AXA Equitable normally allocates the fund’s assets to three or more sub-advisers. AXA Equitable monitors the sub-advisers and may dismiss, replace or add sub-advisers subject to the approval of the Trust’s board of trustees.

Each of the sub-advisers utilizes an approach that concentrates its efforts on identifying foreign companies with good prospects for future growth. Other factors, such as country and regional factors, are considered by the sub-advisers. While the sub-advisers believe that the identification, research and selection of individual stocks is of great importance to the fund’s success, regional issues or political and economic considerations also play a role in the overall success of the fund. The sub-advisers may sell a security for a variety of reasons, such as to invest in a company offering superior investment opportunities.

For temporary defensive purposes, the fund may invest, without limit, in U.S. securities, cash, money market instruments or high quality short-term debt securities, including repurchase agreements. To the extent that the fund is invested in cash instruments, the fund will not be pursuing its investment goal.

Principal Investment Risks

An investment in the fund is not guaranteed; you may lose money by investing in the fund. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The principal risks presented by the fund are:

| • | | Currency Risk — The risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect an investment. A change in the value of any such currency against the U.S. dollar will result in a change in the U.S. dollar value of a fund’s assets and income. |

| • | | Equity Risk — Stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of such securities will change based on changes in a company’s financial condition and in overall market and economic conditions. |

| • | | Foreign Investing and Emerging Markets Risks — The value of the fund’s investments in foreign securities may fall due to adverse political, social and economic developments abroad and decreases in foreign currency values relative to the U.S. dollar. Foreign markets also may be less liquid and more volatile than U.S. markets. These risks are greater generally for investments in emerging market issuers than for issuers in more developed countries. |

| • | | Issuer-Specific Risk — The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the market as a whole. The fund could lose all of its investment in a company’s securities. |

| • | | Large-Capitalization Risk — To the extent the fund invests in securities of large-capitalization issuers, it will be exposed to the risks of investing in such issuers. Larger more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Many larger companies also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. |

| • | | Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and price that the seller would like. This may result in a loss or may be costly to a fund. |

11

| • | | Portfolio Management Risk — The risk that the strategies used by a fund’s sub-advisers and their securities selections fail to produce the intended result. |

| • | | Small- and Mid-Capitalization Risk — To the extent the fund invests in securities of small- and mid-capitalization issuers, it will be exposed to the risks of investing in such issuers. Risk is greater for the securities of small- and mid-capitalization companies because they generally are more vulnerable than larger companies to adverse business or economic developments and they may have more limited resources. The securities of small- and mid-capitalization companies also may trade less frequently and in smaller volume than larger companies. As a result, the value of such securities may be more volatile than the securities of larger companies, and the fund may experience difficulty in purchasing or selling such securities at the desired time and price. In general, these risks are greater for small-capitalization companies than for mid-capitalization companies. |

| • | | Sub-Adviser Selection Risk — The risk that AXA Equitable’s process for selecting or replacing a sub-adviser and its decision to select or replace a sub-adviser does not produce the intended result. |

More information about the risks of an investment in the fund is provided below in “More About Investment Strategies & Risks.”

FUND PERFORMANCE

The following information gives some indication of the risks of an investment in the fund by showing yearly changes in the fund’s performance and by comparing the fund’s performance with a broad measure of market performance. Both the bar chart and table below assume reinvestment of dividends and other distributions and include the effect of expense limitations that were in place during the period shown. Since AXA Equitable may add to, dismiss or replace the sub-advisers in a fund, the fund’s historical performance may cover periods when portions of the fund were advised by different sub-advisers. Past performance (before and after taxes) is not an indication of future performance.

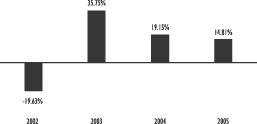

Calendar Year Annual Total Returns (Class Y)

The following bar chart illustrates the calendar year annual total returns for the fund’s Class Y shares. The inception date for the Class Y shares is December 31, 2001. The returns for the fund’s Class A, B, C and P shares would be lower than the Class Y returns shown in the bar chart because those other classes have higher total expenses. In addition, the Class Y returns shown in the bar chart do not reflect sales charges, which would apply to Class A, B, C and P shares; if such sales charges were reflected, the returns shown would be lower.

| | |

Best quarter (% and time period) | | Worst quarter (% and time period) |

24.54% (2003 2nd Quarter) | | –22.89% (2002 3rd Quarter) |

Average Annual Total Returns

for the periods ended December 31, 2005

The table below shows how the average annual total returns (adjusted to reflect applicable sales charges) for each class of the fund (before and after taxes) for the one-year and since-inception periods compare to those of a broad-based index. The table also shows hypothetical total returns that have been calculated to reflect return after taxes on distributions and return after taxes on distributions and assumed sale of fund shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns to an investor depend on the investor’s own tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of fund shares at the end of the measurement period.

| | | | |

| | | |

Average Annual Total Returns (For the periods ended December 31, 2005) | | 1 Year | | Since Inception* |

Class A—Return Before Taxes | | 8.89% | | 12.50% |

Return After Taxes on Distributions | | 7.72% | | 11.04% |

Return After Taxes on Distributions & Sale of Fund Shares | | 6.33% | | 10.03% |

Class B—Return Before Taxes | | 8.61% | | 8.85% |

Return After Taxes on Distributions | | 7.59% | | 8.53% |

Return After Taxes on Distributions & Sale of Fund Shares | | 6.18% | | 7.53% |

Class C—Return Before Taxes | | 12.61% | | 9.43% |

Return After Taxes on Distributions | | 11.59% | | 9.11% |

Return After Taxes on Distributions & Sale of Fund Shares | | 8.78% | | 8.04% |

Class P—Return Before Taxes | | 8.14% | | 8.67% |

Return After Taxes on Distributions | | 6.90% | | 8.08% |

Return After Taxes on Distributions & Sale of Fund Shares | | 5.85% | | 7.19% |

Class Y—Return Before Taxes | | 14.81% | | 10.53% |

Return After Taxes on Distributions | | 13.40% | | 9.83% |

Return After Taxes on Distributions & Sale of Fund Shares | | 10.21% | | 8.76% |

Morgan Stanley Capital

International EAFE Index** | | 13.54% | | 12.30% |

| * | The inception date for the fund’s Class A shares is December 13, 2004. The fund’s Class A shares have no operating history or performance information of their own prior to that date. The performance shown for the fund’s Class A shares for periods prior to that date is the performance of the fund’s Class P shares adjusted to reflect the fees and expenses of the fund’s Class A shares. The inception date for the fund’s Class B, Class C, Class P and Class Y shares is December 31, 2001. |

| ** | Index returns do not reflect any deductions for expenses, brokerage commissions, sales charges or taxes. For more information on this index, see the following section “Description of Benchmarks.” |

12

AXA ENTERPRISE MULTIMANAGER TECHNOLOGY FUND

| | |

Manager: | | AXA Equitable |

| |

Sub-advisers: | | Firsthand Capital Management, Inc. RCM Capital Management LLC, Wellington Management Company, LLP |

Key Term

| • | | Sector Fund — A fund that invests in only a subset of the overall equity market, in this case the Technology Sector. |

Investment Goal

Long-term growth of capital.

Principal Investment Strategies

Under normal circumstances, the fund intends to invest at least 80% of its net assets, plus borrowings for investment purposes, in equity securities of companies principally engaged in the technology sector. Such companies include, among others, those in the internet products and services, computer, electronic, hardware and components, communication, software, e-commerce, information service, healthcare equipment and services, including medical devices, biotechnology, chemical products and synthetic materials, defense and aerospace industries, environmental services, nanotechnology, energy equipment and services, and electronic manufacturing services. The fund does not limit its investment to issuers with a specific market capitalization range. While the fund can invest in securities of U.S. and foreign companies, the majority of fund assets are expected to be invested in securities of U.S. companies.

The fund intends to invest primarily in common stocks, but it may also invest in other securities that the sub-advisers believe provide opportunities for capital growth, such as preferred stocks, warrants and securities convertible into common stock. The fund is non-diversified, which means that it may invest in a limited number of issuers.

Utilizing a due diligence process covering a number of key factors, AXA Equitable selects sub-advisers to manage the fund’s assets. These key factors include, but are not limited to, the sub-adviser’s reputation, organizational stability, investment personnel, long-term performance, investment philosophy and style and correlation with other sub-advisers retained for other allocated portions of the fund. AXA Equitable normally allocates the fund’s assets to three or more sub-advisers. AXA Equitable monitors the sub-advisers and may dismiss, replace or add sub-advisers subject to the approval of the Trust’s board of trustees.

The sub-advisers select securities based upon fundamental analysis, such as an analysis of earnings, cash flows, competitive position and management’s abilities. The sub-advisers may sell a security for a variety of reasons, such as to invest in a company with more attractive growth prospects.

For temporary defensive purposes, the fund may invest, without limit, in cash, money market instruments or high quality short-term debt securities, including repurchase agreements. To the extent that the fund is invested in these instruments, the fund will not be pursuing its investment goal.

Principal Investment Risks

An investment in the fund is not guaranteed; you may lose money by investing in the fund. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The principal risks presented by the fund are:

| • | | Equity Risk — Stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of such securities will change based on changes in a company’s financial condition and in overall market and economic conditions. |

| • | | Technology Sector Risk — The value of the fund’s shares is particularly vulnerable to factors affecting the technology sector, such as dependency on consumer and business acceptance as new technology evolves, large and rapid price movements resulting from competition, rapid obsolescence of products and services and short product cycles. Many technology companies are small and at an earlier stage of development and, therefore, may be subject to risks such as those arising out of limited product lines, markets and financial and managerial resources. |

| • | | Issuer-Specific Risk — The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the market as a whole. The fund could lose all of its investment in a company’s securities. |

13

| • | | Large-Capitalization Risk — To the extent the fund invests in securities of large-capitalization issuers, it will be exposed to the risks of investing in such issuers. Larger more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and consumer tastes. Many larger companies also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. |

| • | | Non-Diversification Risk — As a non-diversified mutual fund, more of the fund’s assets may be focused in the common stocks of a small number of issuers, which may make the value of the fund’s shares more sensitive to changes in the market value of a single issuer or industry than shares of a diversified mutual fund. |

| • | | Sector Concentration Risk — Since the fund invests primarily in a particular sector, it could experience greater volatility than stock funds investing in a broader range of industries. |

| • | | Small- and Mid-Capitalization Risk — To the extent the fund invests in securities of small- and mid-capitalization issuers, it will be exposed to the risks of investing in such issuers. Many companies in the technology sector have relatively small market capitalization. Risk is greater for the common stocks of those companies because they generally are more vulnerable than larger companies to adverse business or economic developments and they may have more limited resources. The securities of small- and mid-capitalization companies also may trade less frequently and in smaller volume than larger companies. As a result, the value of such securities may be more volatile than the securities of larger companies, and the fund may experience difficulty in purchasing or selling such securities at the desired time and price. In general, these risks are greater for small-capitalization companies than for mid-capitalization companies. |

| • | | Foreign Investing Risk — The value of the fund’s investments in foreign securities may fall due to adverse political, social and economic developments abroad and decreases in foreign currency values relative to the U.S. dollar. Foreign markets also may be less liquid and more volatile than U.S. markets. |

| • | | Portfolio Management Risk — The risk that the strategies used by a fund’s sub-advisers and their securities selections fail to produce the intended result. |

| • | | Sub-Adviser Selection Risk — The risk that AXA Equitable’s process for selecting or replacing a sub-adviser and its decision to select or replace a sub-adviser does not produce the intended result. |

More information about the risks of an investment in the fund is provided below in “More About Investment Strategies & Risks.”

FUND PERFORMANCE

The following information gives some indication of the risks of an investment in the fund by showing yearly changes in the fund’s performance and by comparing the fund’s performance with a broad measure of market performance. Both the bar chart and table below assume reinvestment of dividends and other distributions and include the effect of expense limitations that were in place during the period shown. Since AXA Equitable may add to, dismiss or replace the sub-advisers in a fund, the fund’s historical performance may cover periods when portions of the fund were advised by different sub- advisers. Past performance (before and after taxes) is not an indication of future performance.

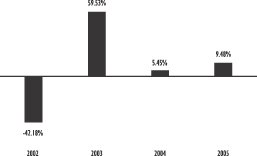

Calendar Year Annual Total Returns (Class Y)

The following bar chart illustrates the calendar year annual total returns for the fund’s Class Y shares. The inception date for the Class Y shares is December 31, 2001. The returns for the fund’s Class A, B, C and Class P shares would be lower than the Class Y returns shown in the bar chart because those other classes have higher total expenses. In addition, the Class Y returns shown in the bar chart do not reflect sales charges, which would apply to Class A, B, C and Class P shares; if such sales charges were reflected, the returns shown would be lower.

| | |

Best quarter (% and time period) | | Worst quarter (% and time period) |

27.53% (2003 2nd Quarter) | | –26.99% (2002 2nd Quarter) |

14

Average Annual Total Returns

for the periods ended December 31, 2005

The table below shows how the average annual total returns (adjusted to reflect applicable sales charges) for each class of the fund (before and after taxes) for the one-year and since-inception periods compare to those of a broad-based index. The table also shows hypothetical total returns that have been calculated to reflect return after taxes on distributions and return after taxes on distributions and assumed sale of fund shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns to an investor depend on the investor’s own tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the after-tax returns may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of fund shares at the end of the measurement period.

| | | | |

| | | |

Average Annual Total Returns (For the periods ended December 31, 2005) | | 1 Year | | Since Inception* |

Class A—Return Before Taxes | | 3.92% | | 4.62% |

Return After Taxes on Distributions | | 1.75% | | 2.54% |

Return After Taxes on Distributions & Sale of Fund Shares | | 2.87% | | 2.88% |

Class B—Return Before Taxes | | 3.44% | | –0.13% |

Return After Taxes on Distributions | | 1.12% | | –0.69% |

Return After Taxes on Distributions & Sale of Fund Shares | | 2.58% | | –0.39% |

Class C—Return Before Taxes | | 7.43% | | 0.58% |

Return After Taxes on Distributions | | 5.11% | | 0.03% |

Return After Taxes on Distributions & Sale of Fund Shares | | 5.18% | | 0.21% |

Class P—Return Before Taxes | | 3.20% | | –0.08% |

Return After Taxes on Distributions | | 1.05% | | –0.63% |

Return After Taxes on Distributions & Sale of Fund Shares | | 2.40% | | –0.35% |

Class Y—Return Before Taxes | | 9.48% | | 1.58% |

Return After Taxes on Distributions | | 7.21% | | 1.00% |

Return After Taxes on Distributions & Sale of Fund Shares | | 6.49% | | 1.04% |

Russell 1000 Technology Index**,# | | 2.32% | | –1.27% |

Russell 1000 Index** | | 6.27% | | 4.77% |

| # | We believe that this index reflects more closely the market sectors in which the fund invests. |

| * | The inception date for the fund’s Class A shares is December 13, 2004. The fund’s Class A shares have no operating history or performance information of their own prior to that date. The performance shown for the fund’s Class A shares for periods prior to that date is the performance of the fund’s Class P shares adjusted to reflect the fees and expenses of the fund’s Class A shares. The inception date for the fund’s Class B, Class C, Class P and Class Y shares is December 31, 2001. |

| ** | Index returns do not reflect any deductions for expenses, brokerage commissions, sales charges or taxes. For more information on this index, see the following section “Description of Benchmarks.” |

15

AXA ENTERPRISE MULTIMANAGER HEALTH CARE FUND

| | |

Manager: | | AXA Equitable |

| |

Sub-advisers: | | A I M Capital Management, Inc. RCM Capital Management LLC Wellington Management Company, LLP |

Key Term

| • | | Sector Fund — A fund that invests in only a subset of the overall equity market, in this case the Health Care Sector. |

Investment Goal

Long-term growth of capital.

Principal Investment Strategies