Securities Act File No. [ ]

As filed with the Securities and Exchange Commission on May 22, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Pre Effective Amendment No. | ❑ | |||

| Post Effective Amendment No. | ❑ |

(Check appropriate box or boxes.)

GOLDMAN SACHS TRUST

(Exact Name of Registrant as Specified in Charter)

71 South Wacker Drive

Chicago, Illinois 60606

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code (312) 655-4400

CAROLINE L. KRAUS, ESQ.

Goldman Sachs & Co. LLC

200 West Street

New York, New York 10282

(Name and Address of Agent for Service)

COPY TO:

GEOFFREY R.T. KENYON, ESQ.

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

Title of Securities Being Registered: Class A, Class C, Institutional, Class IR, Class R, Class R6 and Class T Shares of Goldman Sachs Concentrated Growth Fund, a series of the Registrant. The Registrant has registered an indefinite amount of securities pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended; accordingly, no fee is payable herewith in reliance upon Section 24(f).

It is proposed that this filing will become effective on June 21, 2017 pursuant to Rule 488 under the Securities Act of 1933.

GOLDMAN SACHS FOCUSED GROWTH FUND

71 South Wacker Drive

Chicago, Illinois 60606

[●] 2017

Dear Shareholder:

We are writing to inform you of an important matter concerning your investment in the Goldman Sachs Focused Growth Fund (the “Acquired Fund”). At a meeting held on April 18-19, 2017, the Board of Trustees of the Acquired Fund (the “Board”) approved a reorganization pursuant to which the Acquired Fund will be reorganized with and into another series of the Goldman Sachs Trust – the Goldman Sachs Concentrated Growth Fund (the “Surviving Fund,” and together with the Acquired Fund, the “Funds”). Shareholders were first notified of the reorganization on April 21, 2017 in a supplement to the Acquired Fund’s then effective Prospectus and Summary Prospectus.

After careful consideration, the Board, including a majority of the Trustees who are not “interested persons” of the Funds, as that term is defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”), approved the reorganization. After considering the recommendation of Goldman Sachs Asset Management, L.P. (“GSAM”), the investment adviser to the Acquired Fund and the Surviving Fund, the Board, including a majority of the Independent Trustees, concluded that: (i) the reorganization will benefit the shareholders of each Fund; (ii) the reorganization is in the best interests of each Fund; and (iii) the interests of the shareholders of each Fund will not be diluted as a result of the reorganization.

Effective on or about July [28], 2017 (the “Closing Date”), you will own shares in the Surviving Fund equal in dollar value to your interest in the Acquired Fund on the Closing Date. No sales charge, redemption fees or other transaction fees will be imposed in the reorganization. The reorganization is intended to be a tax-free reorganization for Federal income tax purposes.

NO ACTION ON YOUR PART IS REQUIRED REGARDING THE REORGANIZATION. YOU WILL AUTOMATICALLY RECEIVE SHARES OF THE SURVIVING FUND IN EXCHANGE FOR YOUR SHARES OF THE ACQUIRED FUND AS OF THE CLOSING DATE. THE BOARD IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

If you have any questions regarding the attached Information Statement/Prospectus or other materials, please contact the Acquired Fund at 1-800-526-7384.

By Order of the Board of Trustees of the Goldman

Sachs Trust,

James A. McNamara

President

COMBINED INFORMATION STATEMENT

FOR

GOLDMAN SACHS FOCUSED GROWTH FUND (a series of the GOLDMAN SACHS TRUST)

AND

PROSPECTUS FOR

GOLDMAN SACHS CONCENTRATED GROWTH FUND

(a series of the GOLDMAN SACHS TRUST)

The address, telephone number and website of the Goldman Sachs Focused Growth Fund and the Goldman Sachs Concentrated Growth Fund is:

71 South Wacker Drive

Chicago, Illinois 60606

1-800-526-7384

www.gsamfunds.com

Shares of the Goldman Sachs Concentrated Growth Fund have not been approved or disapproved by the U.S. Securities and Exchange Commission (the “SEC”). The SEC has not passed upon the adequacy of this Information Statement/Prospectus. Any representation to the contrary is a criminal offense.

An investment in either the Goldman Sachs Focused Growth Fund (the “Acquired Fund”) or the Goldman Sachs Concentrated Growth Fund (the “Surviving Fund,” and together with the Acquired Fund, the “Funds”) is not a bank deposit and is not insured or guaranteed by the U.S. Federal Deposit Insurance Corporation or any other government agency.

This Information Statement/Prospectus sets forth information about the Surviving Fund that an investor needs to know before investing. Please read this Information Statement/Prospectus carefully before investing and keep it for future reference.

The date of this Information Statement/Prospectus is [●], 2017.

For more complete information about each Fund, please read the Fund’s Prospectus and Statement of Additional Information, as they may be amended and/or supplemented. Each Fund’s Prospectus and Statement of Additional Information, and other additional information about each Fund, have been filed with the SEC (www.sec.gov) and are available upon written or oral request and without charge by writing to the address above or calling the following toll-free number: 1-800-526-7384.

INTRODUCTION

This combined information statement/prospectus, dated [●]’ 2017 (the “Information Statement/Prospectus”), is being furnished to shareholders of the Acquired Fund in connection with an Agreement and Plan of Reorganization between the Acquired Fund and the Surviving Fund (the “Plan”), pursuant to which the Acquired Fund will (i) transfer substantially all of its assets and liabilities attributable to each class of its shares to the Surviving Fund in exchange for shares of the Surviving Fund; and (ii) distribute to its shareholders a portion of the Surviving Fund shares to which each shareholder is entitled (as discussed below) in complete liquidation of the Acquired Fund (the “Reorganization”). At a meeting held on April 18-19, 2017, the Board of Trustees of the Funds (the “Board” or “Trustees”) approved the Plan. A copy of the Plan is attached to this Information Statement/Prospectus as Exhibit A. Shareholders should read this entire Information Statement/Prospectus, including the exhibits, carefully.

After considering the recommendation of Goldman Sachs Asset Management, L.P. (“GSAM” or the “Investment Adviser”), investment adviser to the Acquired Fund and the Surviving Fund, the Board concluded that: (i) the Reorganization will benefit the shareholders of each Fund; (ii) the Reorganization is in the best interests of each Fund; and (iii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization.

NO ACTION IS REQUIRED REGARDING THE REORGANIZATION. AS DISCUSSED MORE FULLY BELOW, THE FUNDS ARE RELYING ON RULE 17a-8 UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED, AND, THEREFORE, SHAREHOLDERS OF THE ACQUIRED FUND ARE NOT BEING ASKED TO VOTE ON OR APPROVE THE PLAN. THE BOARD IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

Background to the Reorganization

GSAM, an SEC-registered investment adviser, serves as investment adviser to the Acquired Fund, an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). GSAM also serves as investment adviser to the Surviving Fund, also an investment company registered under the 1940 Act. GSAM serves as investment adviser to the Funds under the same Management Agreement, dated April 30, 1997. The Investment Adviser recommended to the Board that it approve the reorganization of the Acquired Fund with and into the Surviving Fund, an existing series of Goldman Sachs Trust (the “Trust”) because it believes that the Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund to be better positioned for asset growth. The Investment Adviser also believes that the Reorganization is preferable to liquidating the Acquired Fund, as it will provide you and other shareholders with the opportunity to invest in a fund that: (i) has a significantly larger asset base to better pursue its investment objective and strategy, particularly in companies that are considered by the Investment Adviser to be positioned for long-term growth; and (ii) is part of the Goldman Sachs Funds – a large, diverse fund family. Moreover, the Surviving Fund had higher performance than the Acquired Fund over the one-year period ended December 31, 2016. While, as of December 31, 2016, the “Since Inception” performance of the Acquired Fund was higher than the “Since Inception” performance of the Surviving Fund, the Surviving Fund has a significantly longer performance record (the Surviving Fund commenced operations in 2002; the Acquired Fund commenced operations in 2012).

On April 18-19, 2017, the Board, including a majority of the Trustees who are not “interested persons” of the Funds, as that term is defined in the 1940 Act (the “Independent Trustees”), voted to approve the Reorganization. In approving the Reorganization, the Board, including a majority of the Independent Trustees, concluded that: (i) the Reorganization will benefit the shareholders of each Fund; (ii) the Reorganization is in the best interests of each Fund; and (iii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization. The Board also considered and approved the terms and conditions of the Plan.

At its meeting, the Board received and evaluated materials provided by the Investment Adviser regarding the Reorganization and its effect on the existing shareholders of the Funds. The Board also evaluated and

ii

discussed: (i) any material differences between each Fund’s investment objective, strategies, policies and risks; (ii) the specific terms of the Reorganization; and (iii) other information, such as the relative sizes of the Funds, the performance records of the Funds and the expenses of the Funds and the anticipated asset growth of the Funds in the foreseeable future. In addition, the Board considered additional factors, which are discussed in more detail below under “Why did the Board approve the Reorganization?”

The Independent Trustees were assisted in their consideration of the Reorganization by independent counsel.

Questions and Answers

How will the Reorganization affect me?

Under the terms of the Plan, the Acquired Fund will transfer substantially all of its assets to the Surviving Fund and the Surviving Fund will assume all of the liabilities of the Acquired Fund. Subsequently, the Acquired Fund will be liquidated and you will become a shareholder of the Surviving Fund. You will receive shares of the Surviving Fund that are equal in aggregate net asset value to the shares of the Acquired Fund that you held immediately prior to the Closing Date (as defined below). Shareholders of each class of shares of the Acquired Fund will receive the corresponding class of the Surviving Fund, as follows:

Acquired Fund | Surviving Fund | |||

| Class A | ® | Class A | ||

| Class C | ® | Class C | ||

| Institutional | ® | Institutional | ||

| Class IR | ® | Class IR | ||

| Class R | ® | Class R | ||

| Class R6 | ® | Class R6 | ||

| Class T | ® | Class T |

No sales charge, contingent deferred sales charge (“CDSC”), commission, redemption fee or other transactional fee will be charged as a result of the Reorganization.

When will the Reorganization occur?

The Reorganization is scheduled to occur on or about [July 28], 2017, but may occur on such earlier or later date as the parties agree in writing (the “Closing Date”).

How will the Reorganization affect the fees to be paid by the Surviving Fund, and how do they compare with the fees paid by the Acquired Fund?

For the fiscal year ended August 31, 2016, the Acquired Fund’s effective management fee (after giving effect to the current management fee waiver and breakpoints) was 0.76% and the Surviving Fund’s effective management fee (after giving effect to the current management fee waiver and breakpoints) was 0.78%. However, post-Reorganization, the Investment Adviser will further waive the Surviving Fund’s effective management fee such that it equals the 0.76% currently charged to the Acquired Fund. Accordingly, shareholders of the Acquired Fund are expected to pay the same management fee upon consummation of the Reorganization.

The Acquired Fund’s gross expense ratio for the fiscal year ended August 31, 2016 (before giving effect to the current expense limitation arrangements) for Class A, Class C, Institutional, Class IR, Class R and Class R6 Shares was 2.35%, 3.14%, 1.91%, 1.90%, 2.56% and 1.87%, respectively. It is estimated that post-Reorganization, the Surviving Fund’s gross expense ratio for Class A, Class C, Institutional, Class IR, Class R, Class R6 and Class T Shares will be 1.67%, 2.42%, 1.27%, 1.42%, 1.92%, 1.25%, and 1.67%, respectively. The Acquired Fund’s net

iii

expense ratio for the fiscal year ended August 31, 2016 (after giving effect to the current fee waiver and expense limitation arrangements) for Class A, Class C, Institutional, Class IR, Class R and Class R6 Shares was 1.21%, 1.96%, 0.82%, 0.96%, 1.47% and 0.78%, respectively. It is estimated that post-Reorganization, the Surviving Fund’s net expense ratio for Class A, Class C, Institutional, Class IR, Class R, Class R6 and Class T Shares will be 1.17%, 1.92%, 0.80%, 0.92%, 1.42%, 0.78%, and 1.17%, respectively. Class T Shares had not yet commenced operations as of August 31, 2016. Accordingly, upon the consummation of the Reorganization, shareholders of the Acquired Fund are expected to be subject to the same or a lower net expense ratio for each class. Pro forma expense information is included in this Information Statement/Prospectus under “Summary – The Funds’ Fees and Expenses.”

Why did the Board approve the Reorganization?

In approving the Reorganization, the Board, including a majority of the Independent Trustees, concluded that: (i) the Reorganization is in the best interests of each Fund; and (ii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization. The Trustees also believe that the Reorganization offers a number of potential benefits. These potential benefits and considerations include the following:

| • | The Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund to be better positioned for asset growth. |

| • | The Reorganization is preferable to liquidating the Acquired Fund, which may be treated as a taxable event, as it will provide you and other shareholders with the opportunity to invest in a fund that has a significantly larger asset base to better pursue its investment objective and strategy, particularly in companies that are considered by the Investment Adviser to be positioned for long-term growth. The Funds have a similar universe of permissible investments, however the Surviving Fund normally invests in a larger number of companies that are positioned for long-term growth and may invest a smaller percentage of its assets in fixed income securities and a larger percentage of its assets in equity investments. Although each Fund may invest up to 25% of its total assets in foreign securities, the Surviving Fund may invest 10% of its total assets in emerging country securities, whereas the Acquired Fund may invest 25% of its total assets in such securities. These differences, as well as other differences, are discussed in more detail below under “Summary — Comparison of the Acquired Fund with the Surviving Fund and Comparison of Principal Investment Risks of Investing in the Funds.” |

| • | The Surviving Fund had higher performance than the Acquired Fund over the one-year period ended December 31, 2016. While, as of December 31, 2016, the “Since Inception” performance of the Acquired Fund was higher than the “Since Inception” performance of the Surviving Fund, the Surviving Fund has a significantly longer performance record (the Surviving Fund commenced operations in 2002; the Acquired Fund commenced operations in 2012). |

| • | The Reorganization is expected to qualify as a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), and, therefore, you will not recognize gain or loss for federal income tax purposes on the exchange of your shares of the Acquired Fund for the shares of the Surviving Fund. Alternatively, liquidation of the Acquired Fund could give rise to a taxable event. |

Additional considerations are discussed in more detail below under “Summary – Reasons for the Reorganization and Board Considerations.”

iv

Who bears the expenses associated with the Reorganization?

GSAM has agreed to pay the legal, auditor/accounting and other costs, including brokerage, trading taxes and other transaction costs, associated with each Fund’s participation in the Reorganization. GSAM estimates that these costs will be approximately $195,000.

Will the Investment Adviser benefit from the Reorganization?

Although reorganizing the Acquired Fund with and into the Surviving Fund (instead of liquidating the Acquired Fund) will benefit GSAM by managing a larger pool of assets, which will produce increased management fees that will accrue to GSAM, the Investment Adviser believes that the combined Fund would be better positioned for asset growth than the Acquired Fund on its own.

What are the Federal income and other tax consequences of the Reorganization?

As a condition to the closing of the Reorganization, the Funds must receive an opinion of Dechert LLP to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Code. Accordingly, subject to the limited exceptions described below under the heading “Tax Status of the Reorganization,” it is expected that neither you nor a Fund will recognize gain or loss as a direct result of the Reorganization, and that the aggregate tax basis of the Surviving Fund shares that you receive in the Reorganization will be the same as the aggregate tax basis of the shares that you surrendered in the Reorganization.

In addition, in connection with the Reorganization, it is currently expected that a portion of the Acquired Fund’s portfolio assets (approximately 36%) will be sold prior to the consummation of the Reorganization, which may result in the Acquired Fund realizing capital gains. Taking into account net capital losses and capital loss carryforwards expected to be available to offset realized gains, it is currently estimated that the Acquired Fund will be required to distribute to its shareholders approximately $38,289 (approximately $0.0354 per share), although the actual amount of such distribution could be higher or lower depending on market conditions and on transactions entered into by the Acquired Fund prior to the Closing Date. Shareholders of the Acquired Fund will generally be taxed on any resulting capital gain distributions. It is also estimated that such portfolio repositioning will result in brokerage and other transaction costs, including trading taxes, of approximately $1,614 (approximately 0.1 basis points).

Why are shareholders not being asked to vote on the Reorganization?

The Trust’s Declaration of Trust and applicable state law do not require shareholder approval of the Reorganization. Moreover, Rule 17a-8 under the 1940 Act does not require shareholder approval of the Reorganization, provided certain conditions are met. Because applicable legal requirements do not require shareholder approval under these circumstances and the Board has determined that the Reorganization is in the best interests of each Fund, shareholders are not being asked to vote on the Reorganization.

Where can I get more information?

| Each Fund’s current prospectus and any applicable supplements. | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com). |

v

| Each Fund’s current statement of additional information and any applicable supplements. | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com). | |

| Each Fund’s most recent annual and semi-annual reports to shareholders. | On file with the SEC (http://www.sec.gov) (file nos. 811¬-5349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com). | |

| A statement of additional information for this Information Statement/Prospectus, dated [●], 2017 (the “SAI”). The SAI contains additional information about the Surviving Fund. | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384. The SAI is incorporated by reference into this Information Statement/Prospectus | |

| To ask questions about this Information Statement/Prospectus. | Call the toll-free telephone number: 1-800-526-7384. | |

Each Fund’s: (i) prospectus and statement of additional information, dated April 28, 2017, and any supplements thereto, (ii) February 28, 2017 Semi-Annual Report, and (iii) August 31, 2016 Annual Report, are incorporated by reference into this Information Statement/Prospectus, which means they are considered legally a part of this Information Statement/Prospectus. The materials have been filed with the SEC (www.sec.gov) and are available upon written or oral request and without charge by writing to the address above or calling the following toll-free number: 1-800-526-7384.

vi

| 1 | ||||

| 1 | ||||

Comparison of Principal Investment Risks of Investing in the Funds | 3 | |||

| 5 | ||||

| 9 | ||||

| 12 | ||||

| 14 | ||||

| 14 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

FUNDAMENTAL AND NON-FUNDAMENTAL INVESTMENT POLICIES OF THE FUNDS | 18 | |||

| 20 | ||||

| 25 | ||||

| 27 | ||||

| 32 | ||||

| 32 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 | ||||

-i-

GOLDMAN SACHS FOCUSED GROWTH FUND

AND

GOLDMAN SACHS CONCENTRATED GROWTH FUND

The following is a summary of more complete information appearing later in this Information Statement/Prospectus or incorporated by reference herein. You should read carefully the entire Information Statement/Prospectus, including the form of Agreement and Plan of Reorganization attached as Exhibit A, because it contains details that are not in the summary.

Comparison of the Acquired Fund with the Surviving Fund

Although each Fund seeks to achieve its investment objective by investing in a portfolio of companies that are considered by the Investment Adviser to be positioned for long-term growth, there are some important differences between the principal investment strategies of the Surviving Fund and those of the Acquired Fund. These differences are discussed in more detail in the side-by-side chart below to facilitate comparison.

The Acquired Fund | The Surviving Fund | |||

| Type of fund | The Funds are non-diversified under the 1940 Act. | |||

| Investment objective | Each Fund seeks long-term growth of capital. | |||

| How will each Fund seek to achieve its investment objective? | The Fund invests, under normal circumstances, at least 80% of its Net Assets (net assets plus any borrowing for investment purposes measured at the time of purchase) in equity investments, including common stocks, preferred stocks, and other securities and instruments having equity characteristics. The Fund seeks to achieve its investment objective by investing, under normal circumstances, in approximately 20-25 companies that are considered by the Investment Adviser to be positioned for long-term growth.

The Fund may invest in securities of companies of any capitalization. Although the Fund invests primarily in publicly traded U.S. securities, it may invest up to 25% of its total assets in foreign securities, including securities of issuers in emerging countries and securities quoted in foreign currencies.

The Fund may also invest up to 20% of its Net Assets in fixed income securities, such as Government, corporate and bank debt obligations. | The Fund invests, under normal circumstances, at least 90% of its Total Assets (total assets measured at the time of purchase) in equity investments selected for their potential to achieve capital appreciation over the long term. The Fund seeks to achieve its investment objective by investing, under normal circumstances, in approximately 30-40 companies that are considered by the Investment Adviser to be positioned for long-term growth.

The Fund may invest in securities of companies of any capitalization. Although the Fund invests primarily in publicly traded U.S. securities, it may invest up to 25% of its Total Assets in foreign securities, including securities of issuers in emerging countries and securities quoted in foreign currencies.

The Fund may invest up to 10% of its Total Assets in fixed income securities, such as government, corporate and bank debt obligations. | ||

1

The Acquired Fund | The Surviving Fund | |||

| How are each Fund’s investments allocated? | Each Fund uses a fundamental equity growth investment process which involves evaluating potential investments based on specific characteristics believed to indicate a high-quality business with sustainable growth, including strong business franchises, favorable long-term prospects, and excellent management. The Investment Adviser will also consider valuation of companies when determining whether to buy and/or sell securities. The Investment Adviser may decide to sell a position for various reasons, including when a company’s fundamental outlook deteriorates, because of valuation and price considerations, for risk management purposes or when a company is deemed to be misallocating capital. In addition, the Investment Adviser may sell a position in order to meet shareholder redemptions. | |||

| What is each Fund’s limit with respect to an investment in a single industry or group of industries? | Each Fund may not invest 25% or more of its total assets in the securities of one or more issuers conducting their principal business activities in the same industry (excluding the U.S. Government or any of its agencies or instrumentalities). | |||

| Benchmark | Each Fund’s benchmark is the Russell 1000® Growth Index. | |||

| Fund turnover | Each Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example, but are reflected in the Fund’s performance.

The Acquired Fund’s and Surviving Fund’s portfolio turnover rate for the fiscal year ended August 31, 2016 each was 55% of the average value of the respective portfolio. | |||

| Investment Adviser | GSAM serves as the investment adviser of each Fund. | |||

| Fund management team | Each Fund has the same portfolio management team, which consists of Steven M. Barry, Stephen E. Becker and Timothy M. Leahy.

Steven M. Barry, Managing Director, Chief Investment Officer – Fundamental Equity, Chief Investment Officer – Growth Equity, has managed the Acquired Fund since 2012 and the Surviving Fund since 2002. Mr. Barry joined the Investment Adviser as a portfolio manager in 1999. Mr. Barry became Chief Investment Officer of Fundamental Equity in 2009. From 1988 to 1999, he was a portfolio manager at Alliance Capital Management.

Stephen E. Becker, CFA, Managing Director, has managed the Acquired Fund and the Surviving Fund since 2013. Mr. Becker joined the Investment Adviser in 1999. He is a portfolio manager for the Growth Team and Member of the U.S. Equity Investment Committee.

Timothy M. Leahy, CFA, Managing Director, has managed the Acquired Fund since 2012 and the Surviving Fund since 2009. Mr. Leahy joined the Investment Adviser in | |||

2

The Acquired Fund | The Surviving Fund | |||

September 2005 and is a portfolio manager for the Growth Team. Prior to joining the Investment Adviser, he was a senior analyst in the Global Investment Research Division of Goldman Sachs. Prior to joining Goldman Sachs in 1999, Mr. Leahy was a research associate with First Union Capital Markets.

The SAI provides additional information about the portfolio managers’ compensation and other accounts managed by the portfolio managers. | ||||

| Fiscal year end | August 31 | |||

As the above table indicates, despite significant similarities, there are some differences between the principal investment strategies of the Surviving Fund and those of the Acquired Fund. For example, the Surviving Fund invests 90% of its Total Assets in equity investments and up to 10% of its Total Assets in fixed income securities, whereas the Acquired Fund invests 80% of its Net Assets in equity investments and up to 20% of its Net Assets in fixed income securities. In addition, the Surviving Fund invests, under normal circumstances, in approximately 30-40 companies (versus the approximately 20-25 companies invested in by the Acquired Fund) that the Investment Adviser considers to be positioned for long-term growth. Although each Fund may invest up to 25% of its total assets in foreign securities, the Surviving Fund may invest 10% of its total assets in emerging country securities, whereas the Acquired Fund may invest 25% of its total assets in such securities.

The Surviving Fund’s principal investment strategies, including the additional markets to which you would be exposed as a shareholder of the Surviving Fund, may impact performance and the risk/return profile of your investment. The investment philosophy of the Funds, as well as additional information on portfolio risks, securities and techniques, is described in more detail in Exhibit B.

Comparison of Principal Investment Risks of Investing in the Funds

The Acquired Fund and Surviving Fund have identical investment objectives. Each Fund’s investment objective is to “seek long-term growth of capital.” The Acquired Fund has a policy to invest at least 80% of its Net Assets in equity investments, including common stocks, preferred stocks and other securities and instruments having equity characteristics, whereas the Surviving Fund invests at least 90% of its Total Assets in equity investments. In addition, while both Funds may invest in securities of companies of any capitalization, the Acquired Fund invests in approximately 20-25 companies under normal circumstances while the Surviving Fund invests in approximately 30-40 companies. The Funds therefore have a similar universe of permissible investments, and the Funds also have the same fundamental equity growth investment process. In addition, both Funds are “non-diversified” under the 1940 Act.

Loss of money is a risk of investing in the Funds. An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. A Fund should not be relied upon as a complete investment program. Stated allocations may be subject to change. There can be no assurance that a Fund will achieve its investment objective. Investment in the Funds involves substantial risks which prospective investors should consider carefully before investing.

| Principal investment risks applicable to each Fund | Investment Style Risk. Different investment styles (e.g., “growth”, “value” or “quantitative”) tend to shift in and out of favor depending upon market and economic conditions and investor sentiment. The Fund may outperform or underperform other funds that employ a different investment style.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio |

3

securities at times when it would not otherwise do so, which may negatively impact the Fund’s net asset value (“NAV”) and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

Market Risk. The value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets.

Mid-Cap and Small-Cap Risk. Investments in mid-capitalization and small-capitalization companies involve greater risks than those associated with larger, more established companies. These securities may be subject to more abrupt or erratic price movements and may lack sufficient market liquidity, and these issuers often face greater business risks.

Non-Diversification Risk. The Fund is non-diversified, meaning that it is permitted to invest a larger percentage of its assets in fewer issuers than diversified mutual funds. Thus, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio, and may be more susceptible to greater losses because of these developments. Under normal circumstances, the Acquired Fund intends to invest in approximately 20-25 companies and the Surviving Fund intends to invest in approximately 30-40 companies.

Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in the future. | ||

| Principal investment risks applicable to the Acquired Fund only | Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. The imposition of exchange controls, sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States and other governments, or from problems in share registration, settlement or custody, may also result in losses. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign securities) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in emerging countries. | |

| Principal investment risks applicable to the Surviving Fund Only | None. | |

Additional information on portfolio risks, securities and techniques is described in more detail in Exhibit B. An additional discussion of these risks is included in the “Risks of the Funds” section of the current prospectus of the Funds, which is incorporated herein by reference. The materials have been filed with the SEC (www.sec.gov) and are available upon written or oral request and without charge by writing to the address above or calling the following toll-free number: 1-800-526-7384.

4

Shareholders of both Funds pay various fees and expenses, either directly or indirectly. The tables below show the fees and expenses that you would pay if you were to buy and hold shares of each Fund. The expenses in the tables appearing below are based on the expenses of the Funds for the twelve-month period ended August 31, 2016. Class T Shares of the Fund were not in existence as of August 31, 2016 and the “Other Expenses” for Class T Shares have been estimated to reflect expenses expected to be incurred during the current fiscal year. For financial statement purposes, the Surviving Fund will be the accounting survivor of the Reorganization. As the accounting survivor, the Surviving Fund’s operating history will be used for financial reporting purposes. The tables also show the pro forma expenses of the combined Fund after giving effect to the Reorganization based on pro forma net assets as of August 31, 2016.

Class A Shares

| Focused Growth Fund (Class A Shares) | Concentrated Growth Fund (Class A Shares) | Concentrated Growth Fund (Combined Fund Class A – Pro Forma) | ||||||||||

Shareholder fees (paid directly from your investment) |

| |||||||||||

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.50 | % | 5.50 | % | 5.50 | % | ||||||

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | None | None | None | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||

Management Fees | 1.00 | % | 1.00 | % | 1.00 | % | ||||||

Distribution and/or Service (12b-1) Fees | 0.25 | % | 0.25 | % | 0.25 | % | ||||||

Other Expenses2 | 1.10 | % | 0.38 | % | 0.42 | % | ||||||

Service Fees | N | one | N | one | N | one | ||||||

All Other Expenses | 1. | 10% | 0. | 38% | 0. | 42% | ||||||

Total Annual Fund Operating Expenses | 2.35 | % | 1.63 | % | 1.67 | % | ||||||

Fee Waiver and Expense Limitation3 | (1.14 | )% | (0.44 | )% | (0.50 | )% | ||||||

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3 | 1.21 | % | 1.19 | % | 1.17 | % | ||||||

5

Class C Shares

| Focused Growth Fund (Class C Shares) | Concentrated Growth Fund (Class C Shares) | Concentrated Growth Fund (Combined Fund Class C – Pro Forma) | ||||||||||

Shareholder fees (paid directly from your investment) |

| |||||||||||

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None | None | |||||||||

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | 1.00 | % | 1.00 | % | 1.00 | % | ||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||

Management Fees | 1.00 | % | 1.00 | % | 1.00 | % | ||||||

Distribution and/or Service (12b-1) Fees | 0.75 | % | 0.75 | % | 0.75 | % | ||||||

Other Expenses2 | 1.39 | % | 0.63 | % | 0.67 | % | ||||||

Service Fees | 0. | 25% | 0. | 25% | 0. | 25% | ||||||

All Other Expenses | 1. | 14% | 0. | 38% | 0. | 42% | ||||||

Total Annual Fund Operating Expenses | 3.14 | % | 2.38 | % | 2.42 | % | ||||||

Fee Waiver and Expense Limitation3 | (1.18 | )% | (0.43 | )% | (0.50 | )% | ||||||

Total Annual Fund Operating Expenses After Expense Limitation3 | 1.96 | % | 1.95 | % | 1.92 | % | ||||||

Institutional Shares

| Focused Growth Fund (Institutional Shares) | Concentrated Growth Fund (Institutional Shares) | Concentrated Growth Fund (Institutional Shares – Pro Forma) | ||||||||||

Shareholder fees (paid directly from your investment) |

| |||||||||||

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None | None | |||||||||

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | None | None | None | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||

Management Fees | 1.00 | % | 1.00 | % | 1.00 | % | ||||||

Distribution and/or Service (12b-1) Fees | None | None | None | |||||||||

Other Expenses2 | 0.91 | % | 0.23 | % | 0.27 | % | ||||||

Service Fees | N | one | N | one | N | one | ||||||

All Other Expenses | 0. | 91% | 0. | 23% | 0. | 27% | ||||||

Total Annual Fund Operating Expenses | 1.91 | % | 1.23 | % | 1.27 | % | ||||||

Fee Waiver and Expense Limitation3 | (1.09 | )% | (0.41 | )% | (0.47 | )% | ||||||

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3 | 0.82 | % | 0.82 | % | 0.80 | % | ||||||

6

Class IR Shares

| Focused Growth Fund (Class IR Shares) | Concentrated Growth Fund (Class IR Shares) | Concentrated Growth Fund (Combined Fund Class IR Shares – Pro Forma) | ||||||||||

Shareholder fees (paid directly from your investment) |

| |||||||||||

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None | None | |||||||||

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | None | None | None | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||

Management Fees | 1.00 | % | 1.00 | % | 1.00 | % | ||||||

Distribution and/or Service (12b-1) Fees | None | None | None | |||||||||

Other Expenses2 | 0.90 | % | 0.38 | % | 0.42 | % | ||||||

Service Fees | N | one | N | one | N | one | ||||||

All Other Expenses | 0. | 90% | 0. | 38% | 0. | 42% | ||||||

Total Annual Fund Operating Expenses | 1.90 | % | 1.38 | % | 1.42 | % | ||||||

Fee Waiver and Expense Limitation3 | (0.94 | )% | (0.44 | )% | (0.50 | )% | ||||||

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3 | 0.96 | % | 0.94 | % | 0.92 | % | ||||||

Class R Shares

| Focused Growth Fund (Class R Shares) | Concentrated Growth Fund (Class R Shares) | Concentrated Growth Fund (Combined Fund Class R Shares – Pro Forma) | ||||||||||

Shareholder fees (paid directly from your investment) |

| |||||||||||

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None | None | |||||||||

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | None | None | None | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||

Management Fees | 1.00 | % | 1.00 | % | 1.00 | % | ||||||

Distribution and/or Service (12b-1) Fees | 0.50 | % | 0.50 | % | 0.50 | % | ||||||

Other Expenses2 | 1.06 | % | 0.39 | % | 0.42 | % | ||||||

Service Fees | N | one | N | one | N | one | ||||||

All Other Expenses | 1. | 06% | 0. | 39% | 0. | 42% | ||||||

Total Annual Fund Operating Expenses | 2.56 | % | 1.89 | % | 1.92 | % | ||||||

Fee Waiver and Expense Limitation3 | (1.09 | )% | (0.44 | )% | (0.50 | )% | ||||||

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3 | 1.47 | % | 1.45 | % | 1.42 | % | ||||||

7

Class R6 Shares

| Focused Growth Fund (Class R6 Shares) | Concentrated Growth Fund (Class R6 Shares) | Concentrated Growth Fund (Combined Fund Class R6 Shares – Pro Forma) | ||||||||||

Shareholder fees (paid directly from your investment) |

| |||||||||||

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None | None | |||||||||

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | None | None | None | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||

Management Fees | 1.00 | % | 1.00 | % | 1.00 | % | ||||||

Distribution and/or Service (12b-1) Fees | None | None | None | |||||||||

Other Expenses2 | 0.87 | % | 0.21 | % | 0.25 | % | ||||||

Service Fees | N | one | N | one | N | one | ||||||

All Other Expenses | 0. | 87% | 0. | 21% | 0. | 25% | ||||||

Total Annual Fund Operating Expenses | 1.87 | % | 1.21 | % | 1.25 | % | ||||||

Fee Waiver and Expense Limitation3 | (1.09 | )% | (0.40 | )% | (0.47 | )% | ||||||

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3 | 0.78 | % | 0.81 | % | 0.78 | % | ||||||

Class T Shares

| Focused Growth Fund (Class T Shares) | Concentrated Growth Fund (Class T Shares) | Concentrated Growth Fund (Combined Fund Class T Shares – Pro Forma) | ||||||||||

Shareholder fees (paid directly from your investment) |

| |||||||||||

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 2.50 | % | 2.50 | % | 2.50 | % | ||||||

Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or sales proceeds)1 | None | None | None | |||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||

Management Fees | 1.00 | % | 1.00 | % | 1.00 | % | ||||||

Distribution and/or Service (12b-1) Fees | 0.25 | % | 0.25 | % | 0.25 | % | ||||||

Other Expenses2 | 1.10 | % | 0.38 | % | 0.42 | % | ||||||

Service Fees | N | one | N | one | N | one | ||||||

All Other Expenses | 1. | 10% | 0. | 38% | 0. | 42% | ||||||

Total Annual Fund Operating Expenses | 2.35 | % | 1.63 | % | 1.67 | % | ||||||

Fee Waiver and Expense Limitation3 | (1.14 | )% | (0.44 | )% | (0.50 | )% | ||||||

Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3 | 1.21 | % | 1.19 | % | 1.17 | % | ||||||

| 1 | A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase. |

| 2 | The ‘Other Expenses” for Class T Shares have been estimated to reflect expenses expected to be incurred during the current fiscal year. |

| 3 | The Investment Adviser has agreed to waive a portion of its management fees in order to achieve an effective net management fee rate of 0.76% and 0.78% as an annual percentage rate of the average daily net assets of the |

8

| Acquired Fund and Surviving Fund, respectively; and (ii) reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, taxes, interest, brokerage fees, shareholder meeting, litigation, indemnification and extraordinary expenses) to 0.004% and 0.004% of the average daily net assets of the Acquired Fund and the Surviving Fund, respectively. Additionally, Goldman Sachs & Co., the Fund’s transfer agent, has agreed to waive a portion of its transfer agency fee (a component of “Other Expenses”) equal to 0.03% as an annual percentage rate of the average daily net assets attributable to Class A, Class C, Class IR, Class R and Class T Shares of the Surviving Fund. These arrangements will remain in effect through at least April 28, 2018 and, prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Board of Trustees. The Surviving Fund’s “Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation” have been restated to reflect the fee waiver and expense limitations currently in effect. Effective on the Closing Date, the Investment Adviser has agreed to waive its management fees by an additional 0.02% in order to achieve an effective net management fee rate of 0.76% as an annual percentage rate of the average daily net assets of the Surviving Fund. This arrangement will remain in effect through at least July 28, 2018 and prior to such date, the Investment Adviser may not terminate the arrangement without the approval of the Board of Trustees. |

Expense Example

This Example is intended to help you compare the cost of investing in each Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your applicable shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, and that each Fund’s operating expenses remain the same (except that the Example incorporates the expense limitation arrangements for only the first year). Pro forma expenses are included assuming a Reorganization of the Funds. The examples are for comparison purposes only and are not a representation of either Fund’s actual expenses or returns, either past or future. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Focused Growth Fund | Concentrated Growth Fund | Concentrated Growth Fund (Combined Fund – Pro Forma) | ||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||||||||||||||

Class A | $ | 667 | $ | 1,140 | $ | 1,638 | $ | 3,006 | $ | 665 | $ | 995 | $ | 1,349 | $ | 2,342 | $ | 663 | $ | 1,002 | $ | 1,363 | $ | 2,378 | ||||||||||||||||||||||||

Class C | ||||||||||||||||||||||||||||||||||||||||||||||||

Assuming complete redemption at end of period | $ | 299 | $ | 858 | $ | 1,542 | $ | 3,366 | $ | 298 | $ | 701 | $ | 1,232 | $ | 2,683 | $ | 295 | $ | 707 | $ | 1,246 | $ | 2,719 | ||||||||||||||||||||||||

Assuming no redemption | $ | 199 | $ | 858 | $ | 1,542 | $ | 3,366 | $ | 198 | $ | 701 | $ | 1,232 | $ | 2,683 | $ | 195 | $ | 707 | $ | 1,246 | $ | 2,719 | ||||||||||||||||||||||||

Institutional Class | $ | 84 | $ | 494 | $ | 930 | $ | 2,114 | $ | 84 | $ | 350 | $ | 636 | $ | 1,452 | $ | 82 | $ | 357 | $ | 652 | $ | 1,493 | ||||||||||||||||||||||||

Class IR | $ | 98 | $ | 506 | $ | 939 | $ | 2,146 | $ | 96 | $ | 394 | $ | 713 | $ | 1,619 | $ | 94 | $ | 401 | $ | 729 | $ | 1,659 | ||||||||||||||||||||||||

Class R | $ | 150 | $ | 693 | $ | 1,263 | $ | 2,814 | $ | 148 | $ | 551 | $ | 980 | $ | 2,176 | $ | 145 | $ | 555 | $ | 991 | $ | 2,203 | ||||||||||||||||||||||||

Class R6 | $ | 80 | $ | 482 | $ | 909 | $ | 2,101 | $ | 83 | $ | 344 | $ | 626 | $ | 1,431 | $ | 80 | $ | 350 | $ | 642 | $ | 1,470 | ||||||||||||||||||||||||

Class T | $ | 370 | $ | 859 | $ | 1,373 | $ | 2,784 | $ | 368 | $ | 709 | $ | 1,074 | $ | 2,098 | $ | 367 | $ | 716 | $ | 1,089 | $ | 2,136 | ||||||||||||||||||||||||

Upon consummation of the Reorganization, the Surviving Fund will be the accounting and performance survivor.

The bar chart and table below provide an indication of the risks of investing in each Fund by showing: (i) changes in the performance of each Fund’s Class A Shares from year to year; and (ii) how the average annual total returns of each Fund’s Class A, Class C, Institutional, Class IR, Class R, Class R6 and Class T Shares compare to those of a broad-based securities market index.

9

Each Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the front cover of this Information Statement/Prospectus.

Acquired Fund Past Performance

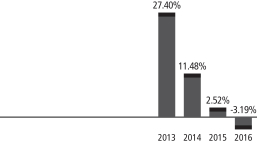

| TOTAL RETURN | CALENDAR YEAR (CLASS A) | |

Best Quarter Q4’ 13 +9.26% Worst Quarter Q3’ 15 –4.97% |  | |

AVERAGE ANNUAL TOTAL RETURN

For the period ended December 31, 2016 | 1 Year | Since Inception | ||||||

Class A Shares (Inception 1/31/12) | ||||||||

Returns Before Taxes | (8.49 | )% | 9.55 | % | ||||

Returns After Taxes on Distributions | (8.63 | )% | 8.32 | % | ||||

Returns After Taxes on Distributions and Sale of Fund Shares | (4.68 | )% | 7.33 | % | ||||

Russell 1000® Growth Index | 7.06 | % | 13.40 | % | ||||

|

|

|

| |||||

Class C Shares (Inception 1/31/12) | ||||||||

Returns Before Taxes | (4.81 | )% | 10.02 | % | ||||

Russell 1000® Growth Index | 7.06 | % | 13.40 | % | ||||

|

|

|

| |||||

Institutional Shares (Inception 1/31/12) | ||||||||

Returns Before Taxes | (2.72 | )% | 11.28 | % | ||||

Russell 1000® Growth Index | 7.06 | % | 13.40 | % | ||||

|

|

|

| |||||

Class IR Shares (Inception 1/31/12) | ||||||||

Returns Before Taxes | (2.87 | )% | 11.12 | % | ||||

Russell 1000® Growth Index | 7.06 | % | 13.40 | % | ||||

|

|

|

| |||||

Class R Shares (Inception 1/31/12) | ||||||||

Returns | (3.42 | )% | 10.55 | % | ||||

Russell 1000® Growth Index | 7.06 | % | 13.40 | % | ||||

|

|

|

| |||||

10

For the period ended December 31, 2016 | 1 Year | Since Inception | ||||||

Class R6 Shares (Inception 7/31/15)* | ||||||||

Returns | (2.68 | )% | 11.30 | % | ||||

Russell 1000® Growth Index | 7.06 | % | 13.40 | % | ||||

|

|

|

| |||||

Class T Shares (Inception 4/28/17)** | ||||||||

Returns Before Taxes | (8.49 | )% | 9.55 | % | ||||

Russell 1000® Growth Index | 7.06 | % | 13.40 | % | ||||

|

|

|

| |||||

| * | Class R6 Shares commenced operations on July 31, 2015. Prior to that date, the performance of the Class R6 Shares shown in the table above is that of the Institutional Shares. Performance has not been adjusted to reflect the lower expenses of Class R6 Shares. Class R6 Shares would have had similar returns (because these share classes represent interests in the same portfolio of securities) that differed only to the extent that Class R6 Shares and Institutional Shares have different expenses. |

| ** | As of the date of the Prospectus, Class T Shares have not commenced operations. Performance of Class T Shares shown in the table above is that of Class A Shares. Performance has not been adjusted to reflect the lower maximum sales charge (load) imposed on purchases of Class T Shares. Class T Shares would have had higher returns because: (i) Class A Shares and Class T Shares represent interests in the same portfolio of securities; and (ii) Class T Shares impose a lower maximum sales charge (load) on purchases. |

Surviving Fund Past Performance

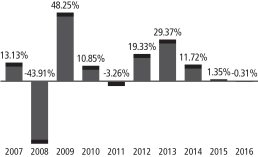

| TOTAL RETURN | CALENDAR YEAR (CLASS A) | |

Best Quarter Q2 ‘09 +20.85% Worst Quarter Q4 ‘08 –31.57% |  | |

AVERAGE ANNUAL TOTAL RETURN

For the period ended December 31, 2016 | 1 Year | 5 Years | 10 Years | Since Inception | ||||||||||||

Class A Shares (Inception 9/3/02) | ||||||||||||||||

Returns Before Taxes | (5.76 | )% | 10.49 | % | 5.19 | % | 6.40 | % | ||||||||

Returns After Taxes on Distributions | (5.91 | )% | 8.27 | % | 4.01 | % | 5.48 | % | ||||||||

Returns After Taxes on Distributions and Sale of Fund Shares | (3.14 | )% | 8.10 | % | 4.04 | % | 5.20 | % | ||||||||

Russell 1000® Growth Index | 7.06 | % | 14.48 | % | 8.33 | % | 8.88 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

Class C Shares (Inception 9/3/02) | ||||||||||||||||

Returns Before Taxes | (2.05 | )% | 10.90 | % | 5.00 | % | 6.01 | % | ||||||||

Russell 1000® Growth Index | 7.06 | % | 14.48 | % | 8.33 | % | 8.88 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

11

For the period ended December 31, 2016 | 1 Year | 5 Years | 10 Years | Since Inception | ||||||||||||

Institutional Shares (Inception 9/3/02) | ||||||||||||||||

Returns Before Taxes | 0.08 | % | 12.20 | % | 6.21 | % | 7.25 | % | ||||||||

Russell 1000® Growth Index | 7.06 | % | 14.48 | % | 8.33 | % | 8.88 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

Class IR Shares (Inception 11/30/07) | ||||||||||||||||

Returns Before Taxes | (0.11 | )% | 12.03 | % | N/A | 5.20 | % | |||||||||

Russell 1000® Growth Index | 7.06 | % | 14.48 | % | N/A | 7.82 | % | |||||||||

|

|

|

|

|

|

|

| |||||||||

Class R Shares (Inception 11/30/07) | ||||||||||||||||

Returns | (0.52 | )% | 11.48 | % | N/A | 4.70 | % | |||||||||

Russell 1000® Growth Index | 7.06 | % | 14.48 | % | N/A | 7.82 | % | |||||||||

|

|

|

|

|

|

|

| |||||||||

Class R6 Shares (Inception 7/31/15)* | ||||||||||||||||

Returns | 0.09 | % | 12.21 | % | 6.22 | % | 7.25 | % | ||||||||

Russell 1000® Growth Index | 7.06 | % | 14.48 | % | 8.33 | % | 8.88 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

Class T Shares (Inception 4/28/17)** | ||||||||||||||||

Returns Before Taxes | (5.76 | )% | 10.49 | % | 5.19 | % | 6.40 | % | ||||||||

Russell 1000® Growth Index | 7.06 | % | 14.48 | % | 8.33 | % | 8.88 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

| * | Class R6 Shares commenced operations on July 31, 2015. Prior to that date, the performance of the Class R6 Shares shown in the table above is that of the Institutional Shares. Performance has not been adjusted to reflect the lower expenses of Class R6 Shares. Class R6 Shares would have had similar returns (because these share classes represent interests in the same portfolio of securities) that differed only to the extent that Class R6 Shares and Institutional Shares have different expenses. |

| ** | As of the date of the Prospectus, Class T Shares have not commenced operations. Performance of Class T Shares shown in the table above is that of Class A Shares. Performance has not been adjusted to reflect the lower maximum sales charge (load) imposed on purchases of Class T Shares. Class T Shares would have had higher returns because: (i) Class A Shares and Class T Shares represent interests in the same portfolio of securities; and (ii) Class T Shares impose a lower maximum sales charge (load) on purchases. |

The after-tax returns are for Class A Shares only. The after-tax returns for Class C, Institutional, Class IR and Class T Shares, and returns for Class R and Class R6 Shares (which are offered exclusively to employee benefit plans), will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Reasons for the Reorganization and Board Considerations

The Investment Adviser recommended to the Board that it approve the reorganization of the Acquired Fund with and into the Surviving Fund, an existing series of the Trust because they believe that the Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund be better positioned for asset growth. The Investment Adviser also believes that the Reorganization is preferable to liquidating the Acquired Fund, which may be

12

treated as a taxable event, as it will provide you and other shareholders with the opportunity to invest in a fund that: (i) has a significantly larger asset base to better pursue its investment objective and strategy, particularly in companies that are considered by the Investment Adviser to be positioned for long-term growth; and (ii) is part of the Goldman Sachs Funds – a large, diverse fund family. Moreover, the Surviving Fund had higher performance than the Acquired Fund over the one-year period ended December 31, 2016. While, as of December 31, 2016, the Acquired Fund had higher performance than the Surviving Fund “Since Inception,” the Surviving Fund has a significantly longer performance record (the Surviving Fund commenced operations in 2002; the Acquired Fund commenced operations in 2012).

On April 18-19, 2017, the Board, including a majority of the Independent Trustees, voted to approve the Reorganization. In approving the Reorganization, the Board, including a majority of the Independent Trustees, concluded that: (i) the Reorganization will benefit the shareholders of each Fund; (ii) the Reorganization is in the best interests of each Fund; and (iii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization.

At its meeting, the Board received and evaluated materials provided by the Investment Advisers regarding the Reorganization and its effect on the existing shareholders of the Funds. The Board also evaluated and discussed: (i) any material differences between each Fund’s investment objective, strategies, policies and risks; (ii) the specific terms of the Reorganization; and (iii) other information, such as the relative sizes of the Funds, the performance records of the Funds and the expenses of the Funds and the anticipated asset growth of the Funds in the foreseeable future.

The Trustees also believe that the Reorganization offers a number of potential benefits. These potential benefits and considerations include the following:

| • | The Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund to be better positioned for asset growth. |

| • | The Reorganization is preferable to liquidating the Acquired Fund, which may be treated as a taxable event, as it will provide you and other shareholders with the opportunity to invest in a fund that has a significantly larger asset base to better pursue its investment objective and strategy, particularly in companies that are considered by the Investment Adviser to be positioned for long-term growth. The Funds have a similar universe of permissible investments and have the same portfolio management teams. However, the Acquired Fund may invest up to 20% of its Net Assets in fixed income securities while the Surviving Fund may invest only 10% of its Total Assets in fixed income securities Although each Fund may invest up to 25% of its total assets in foreign securities, the Surviving Fund may invest 10% of its total assets in emerging country securities, whereas the Acquired Fund may invest 25% of its total assets in such securities. These differences, as well as other differences, are discussed in more detail above under “Summary – Comparison of the Acquired Fund with the Surviving Fund and Comparison of Principal Investment Risks of Investing in the Funds.” |

| • | The Reorganization is expected to qualify as a “reorganization” within the meaning of Section 368 of the Code, and, therefore, you will not recognize gain or loss for federal income tax purposes on the exchange of your shares of the Acquired Fund for the shares of the Surviving Fund. Alternatively, liquidation of the Acquired Fund could give rise to a taxable event. |

| • | No sales charge, CDSC, commission, redemption fee or other transactional fee will be charged as a result of the Reorganization. |

| • | The Surviving Fund and the Acquired Fund have identical management fee schedules across all breakpoints. For the fiscal year ended August 31, 2016, the Acquired Fund’s effective net management fee rate was 0.78% and the Surviving Fund’s effective net management fee rate was 0.76%. However, post-Reorganization, the Investment Adviser will further waive the Surviving Fund’s effective management fee rate such that it equals the 0.76% currently charged to the Acquired Fund. |

13

| • | The Reorganization is expected to result in net expense ratios that are the same or lower than the current net expense ratios for each class of the Acquired Fund. |

| • | The Surviving Fund had higher performance than the Acquired Fund over the one-year period ended December 31, 2016. While, as of December 31, 2016, the “Since Inception” performance of the Acquired Fund was higher than the “Since Inception” performance of the Surviving Fund, the Surviving Fund has a significantly longer performance record (the Surviving Fund commenced operations in 2002; the Acquired Fund commenced operations in 2012). |

| • | GSAM has agreed to pay the legal, auditor/accounting and other costs, including brokerage, trading taxes and other transaction costs, associated with each Fund’s participation in the Reorganization. GSAM estimates that these costs will be approximately $195,000. |

The Board concluded that the Reorganization and the Agreement and Plan of Reorganization likely would benefit the Funds and their shareholders and that each should be approved.

Buying, Selling and Exchanging Shares of the Funds

The minimum initial investment for Class A and Class C Shares of each Fund is, generally, $1,000. The minimum initial investment for Institutional Shares of each Fund is, generally, $1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and its affiliates. There is no minimum for initial purchases of Class IR, Class R, Class R6 and Class T Shares of each Fund. Those share classes with a minimum initial investment requirement do not impose it on certain employee benefit plans, and Institutional Shares do not impose it on certain investment advisers investing on behalf of other accounts.

For each Fund, the minimum subsequent investment for Class A and Class C shareholders is $50, except for certain employee benefit plans, for which there is no minimum. There is no minimum subsequent investment for Institutional, Class IR, Class R, Class R6 or Class T shareholders. You may purchase and redeem (sell) shares of the Fund on any business day through certain banks, trust companies, brokers, dealers, investment advisers and other financial institutions (“Intermediaries”).

If you purchase a Fund through an Intermediary, the Fund and/or its related companies may pay the Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson or visit your Intermediary’s website for more information.

The procedures for making purchases, redemptions and exchanges of the Acquired Fund are identical to those of the Surviving Fund. Please see the “Shareholder Guide” in Exhibit C to this Information Statement/Prospectus for additional information on making purchases, redemptions and exchanges.

OTHER IMPORTANT INFORMATION CONCERNING THE REORGANIZATION

Fund Securities and Portfolio Repositioning

If the Reorganization is effected, management will analyze and evaluate the portfolio securities of the Acquired Fund being transferred to the Surviving Fund. However, each Fund’s portfolio securities are subject to adjustments in the ordinary course of business prior to, or in anticipation of, the Reorganization. In connection with

14

the Reorganization, it is currently expected that a portion of the Acquired Fund’s portfolio assets (approximately 36%) will be sold prior to the consummation of the Reorganization. Actual portfolio sales will depend on portfolio composition, market conditions and other factors at the time of, or prior to, the Reorganization and will be at the discretion of the Investment Adviser. The extent and duration to which the portfolio securities of the Acquired Fund will be maintained by the Surviving Fund will be determined consistent with the Surviving Fund’s investment objective, strategies and policies, any restrictions imposed by the Code and in the best interests of each Fund’s shareholders (including former shareholders of the Acquired Fund). Subject to market conditions at the time of any such disposition, the disposition of the portfolio securities by the Funds may result in a capital gain or loss for the Funds. The actual tax consequences of any disposition of portfolio securities will vary depending upon the specific security(ies) being sold and the Surviving Fund’s ability to use any available tax loss carryforwards. Taking into account net capital losses and capital loss carryforwards expected to be available to offset realized gains, it is currently estimated that the Acquired Fund will be required to distribute to its shareholders approximately $38,289 (approximately $0.0354 per share), although the actual amount of such distribution could be higher or lower depending on market conditions and on transactions entered into by the Acquired Fund prior to the Closing Date. Shareholders of the Acquired Fund will generally be taxed on any resulting capital gain distributions. It is also currently estimated that such portfolio repositioning will result in brokerage and other transaction costs, including trading taxes, of approximately $1,614 (approximately 0.1 basis points). However, GSAM has agreed to pay these brokerage and other transaction costs.

Final Distribution of Acquired Fund

Prior to the Closing Date, the Acquired Fund will pay its shareholders a cash distribution consisting of any undistributed investment company taxable income and/or any undistributed realized net capital gains, including any net gains realized from any sales of assets prior to the Closing Date. These distributions will be taxable to shareholders that are subject to tax. It is currently estimated that the Acquired Fund will be required to distribute to its shareholders approximately $0.1001 per share of net investment company taxable income and $0.0354 of capital gains, although the actual amount of such distribution could be higher or lower depending on market conditions and on transactions entered into by the Acquired Fund and shareholder activity prior to the Closing Date.

Tax Capital Loss Carryforwards

Federal income tax law permits a regulated investment company to carry forward indefinitely its net capital losses that arise in a tax year beginning after December 22, 2010. As of August 31, 2016 the Acquired Fund had capital loss carry forwards of $(168,628). Additionally, as of August 31, 2016, the Surviving Fund had capital loss carry forwards of $(1,011,477). The amount of the Funds’ capital loss carryovers as of the date of the Reorganization may differ substantially from these amounts. The Surviving Fund’s ability to use the capital loss carryovers of the Acquired Fund, if any, to offset gains of Surviving Fund in a given tax year after the Reorganization may be limited by loss limitation rules under Federal tax law. The impact of those loss limitation rules will depend on the relative sizes of, and the losses and gains in, the Funds at the time of the Reorganization and thus cannot be calculated precisely at this time.

The ability of the Surviving Fund to use capital losses to offset gains (even in the absence of the Reorganization) depends on factors other than loss limitations, such as the future realization of capital gains or losses.

15

The following table sets forth the capitalization of the Funds as of February 28, 2017. The table also sets forth the pro forma combined capitalization of the combined Fund as if the Reorganization had occurred on February 28, 2017. If the Reorganization is consummated, the net assets, net asset value per share and shares outstanding on the Closing Date will vary from the information below due to changes in the market value of the portfolio securities of the Funds between February 28, 2017 and the Closing Date, changes in the amount of undistributed net investment income and net realized capital gains of the Funds during that period resulting from income and distributions, and changes in the accrued liabilities of the Funds during the same period.

| The Acquired Fund (February 28, 2017) | The Surviving Fund (February 28, 2017) | Adjustments | Surviving Fund – Pro Forma (February 28, 2017) | |||||||||||||

Net Assets | ||||||||||||||||

Class A Shares | $ | 220,901 | $ | 5,575,787 | N/A | $ | 5,796,688 | |||||||||

Class C Shares | $ | 181,926 | $ | 2,154,453 | N/A | $ | 2,336,379 | |||||||||

Institutional Shares | $ | 15,728,957 | $ | 123,086,761 | N/A | $ | 138,815,718 | |||||||||

Class IR Shares | $ | 61,208 | $ | 609,346 | N/A | $ | 670,554 | |||||||||

C1ass R Shares | $ | 17,898 | $ | 25,698 | N/A | $ | 43,596 | |||||||||

Class R6 Shares | $ | 10,482 | $ | 10,566 | N/A | $ | 21,048 | |||||||||

Class T Shares1 | N/A | N/A | N/A | N/A | ||||||||||||

Net Asset Value Per Share | ||||||||||||||||

Class A Shares | $ | 14.83 | $ | 15.98 | N/A | $ | 15.98 | |||||||||

Class C Shares | $ | 14.39 | $ | 13.59 | N/A | $ | 13.59 | |||||||||

Institutional Shares | $ | 15.01 | $ | 16.88 | N/A | $ | 16.88 | |||||||||

Class IR Shares | $ | 14.97 | $ | 16.18 | N/A | $ | 16.18 | |||||||||

C1ass R Shares | $ | 14.75 | $ | 15.55 | N/A | $ | 15.55 | |||||||||

Class R6 Shares | $ | 15.01 | $ | 16.88 | N/A | $ | 16.88 | |||||||||

Class T Shares1 | N/A | N/A | N/A | N/A | ||||||||||||

Shares Outstanding | ||||||||||||||||

Class A Shares | $ | 14,896 | $ | 349,013 | $ | (1,072 | ) | $ | 362,837 | |||||||

Class C Shares | $ | 12,642 | $ | 158,525 | $ | 745 | $ | 171,912 | ||||||||

Institutional Shares | $ | 1,048,121 | $ | 7,291,535 | $ | (116,311 | ) | $ | 8,223,345 | |||||||

Class IR Shares | $ | 4,089 | $ | 37,649 | $ | (306 | ) | $ | 41,432 | |||||||

C1ass R Shares | $ | 1,214 | $ | 1,652 | $ | (63 | ) | $ | 2,803 | |||||||

Class R6 Shares | $ | 698 | $ | 626 | $ | (77 | ) | $ | 1,247 | |||||||

Class T Shares1 | N/A | N/A | N/A | N/A | ||||||||||||

| 1 | As noted above, Class T Shares of the Funds were not yet effective on February 28, 2017 and have not commenced operations since that time. |

It is impossible to predict how many shares of the Surviving Fund will actually be received and distributed by the Acquired Fund on the Closing Date. The table should not be relied upon to determine the amount of the Surviving Fund shares that will actually be received and distributed.

TERMS OF THE AGREEMENT AND PLAN OF REORGANIZATION

The description of the Plan contained herein includes the material provisions of the Plan, but this description is qualified in its entirety by the attached form copy of the Plan.

Timing. The Reorganization is scheduled to occur on or about [July 28], 2017 (i.e., Closing Date), but may occur on such earlier or later date as the parties agree in writing.

16

Transfer and Valuation of the Assets. The Plan contemplates the transfer of substantially all of the assets of the Acquired Fund to, and the assumption of the liabilities of the Acquired Fund by, the Surviving Fund, in exchange for the applicable shares of the Surviving Fund having an aggregate net asset value equal to the aggregate net asset value of the applicable shares of the Acquired Fund on the Closing Date. The Acquired Fund would then distribute to its shareholders the portion of the Surviving Fund shares to which each such shareholder is entitled. Thereafter, the Acquired Fund would be liquidated. All computations of value will be made by State Street Bank and Trust Company, in its capacity as administrator for the Acquired Fund.

Conditions to Closing the Reorganization. The obligation of each Fund to consummate the Reorganization is subject to the satisfaction of certain conditions, including the Fund’s performance of all of its obligations under the Plan, the receipt of certain documents and financial statements from the Funds and the receipt of all consents, orders and permits necessary to consummate the Reorganization. The Funds’ obligations are also subject to the receipt of a favorable opinion of Dechert LLP as to the U.S. federal income tax consequences of the Reorganization.

Termination of the Plan. The Plan may be terminated and the Reorganization may be abandoned by resolution of the Board at any time prior to the Closing Date, if circumstances should develop that, in the opinion of the Board, make proceeding with the Plan inadvisable.

Cost of the Reorganization. GSAM (or an affiliate) has agreed to pay the legal and other costs associated with each Fund’s participation in the Reorganization.

TAX STATUS OF THE REORGANIZATION

The Reorganization is conditioned upon the receipt of an opinion from Dechert LLP, counsel to the Trust, substantially to the effect that, for federal income tax purposes:

| • | The transfer to the Surviving Fund of substantially all of the Acquired Fund’s assets in exchange solely for the issuance of the Surviving Fund shares to the Acquired Fund and the assumption of all of the Acquired Fund’s liabilities by the Surviving Fund, followed by the distribution of the Surviving Fund shares to the Acquired Fund shareholders in complete liquidation of the Acquired Fund, will constitute a “reorganization” within the meaning of Section 368(a) of the Code; |