UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Caroline Kraus, Esq. | Copies to: | |

| Goldman Sachs & Co. LLC | Geoffrey R.T. Kenyon, Esq. | |

| 200 West Street | Dechert LLP | |

| New York, New York 10282 | 100 Oliver Street | |

| 40th Floor | ||

| Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Annual Report | December 31, 2020 | |||

Fund of Funds Portfolios | ||||

Balanced Strategy | ||||

Growth and Income Strategy | ||||

Growth Strategy | ||||

Satellite Strategies | ||||

Goldman Sachs Fund of Funds Portfolios

| ∎ | BALANCED STRATEGY |

| ∎ | GROWTH AND INCOME STRATEGY |

| ∎ | GROWTH STRATEGY |

| ∎ | SATELLITE STRATEGIES |

| 1 | ||||

| 3 | ||||

| 21 | ||||

| 22 | ||||

| 30 | ||||

| 36 | ||||

| 44 | ||||

| 52 | ||||

| 60 | ||||

| 68 | ||||

| 90 | ||||

| 92 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

MARKET REVIEW

Goldman Sachs Fund of Funds Portfolios

The capital markets and the Portfolios were most influenced during the 12-month period ended December 31, 2020 (the “Reporting Period”) by the spread of COVID-19, a contraction in global economic growth and historic financial stimulus by central banks and governments around the world.

When the Reporting Period began in January 2020, investors generally held a stable pro-growth outlook for the U.S. and global economies. However, in February, twin shocks — the COVID-19 pandemic and collapsing crude oil prices — forced them to recalibrate their risk tolerance. A historic level of market volatility, including the quickest transition from an equity bull market to an equity bear market in modern financial market times, further clouded the near-term investing outlook. (A bull market is a market in which securities prices are rising. A bear market is a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.) As fear spread through the financial markets, risk assets broadly sold off. Global equities, as represented by the MSCI ACWI Investable Market Index, fell 21.0% during the first calendar quarter. Developed markets equities, as represented by the MSCI World Index, were down 19.7%, and emerging markets equities, as represented by the MSCI Emerging Markets Index, were down 23.6%. Within developed markets, U.S. equities, as measured by the S&P 500 ® Index, dropped 19.6%. As for fixed income, the 10-year U.S. Treasury yield plummeted. In response to the economic and financial challenges wrought by the spread of COVID-19, central banks and governments around the world enacted unprecedented levels of monetary and fiscal stimulus. In the U.S., more than $2 trillion of fiscal support, combined with the return of the U.S. Federal Reserve’s (“Fed”) zero interest rate policy, sought to help the country weather the human and economic maelstrom while simultaneously laying the foundation for economic recovery once COVID-19 risks recede.

The fastest quarterly decline in the global equity market since the fourth quarter of 2008 was followed in the second quarter of 2020 by the fastest recovery since the fourth quarter of 1984. The recovery was mainly catalyzed by three factors. First, unprecedented monetary easing and fiscal stimulus globally provided a backstop for risk assets and eased liquidity concerns. The Fed was somewhat more dovish than market expected at its June meeting. (Dovish tends to suggest lower interest rates; opposite of hawkish.) Meanwhile, the European Union announced a €750 billion recovery fund, taking a step closer towards the fiscal integration of the Eurozone. China and Japan also delivered meaningful fiscal action. Second, starting mid-April 2020, the growth rate of new COVID-19 cases showed signs of flattening in hotspots such as the U.S., Europe and China, with daily growth rates falling to low single digits and recovery rates starting to rise. As a result, authorities relaxed lockdown restrictions, gradually re-opened parts of their economies, announced social distancing norms and increased testing. The narrative shifted from COVID-19 infections to therapeutics and vaccines. Third, certain economic indicators started to recover. These included global purchasing manager indices, which inched up; U.S. non-farm payrolls, which provided consecutive positive surprises; and consumer and business sentiment that appeared to be bottoming. Global equities, as represented by the MSCI ACWI Investable Market Index, rose 19.3%. U.S. equities, as measured by the S&P 500® Index, rose 20.5%. Developed markets equities, as represented by the MSCI World Index, and emerging markets equities, as represented by the MSCI Emerging Markets Index, were up approximately 18.7% and 18.2%, respectively. As for fixed income, the 10-year U.S. Treasury yield edged down slightly in its smallest quarterly change on record.

At the start of the third quarter of 2020, the key theme in the marketplace was the reopening of the U.S. and global economy. Initial concerns centered on whether a rushed reopening would bring a new wave of COVID-19 infections that might cause a relapse and renewed shutdown of the economy. Steadily over the course of the summer, even as positive test results accumulated, the severe consequences of COVID-19, such as hospitalizations and the tally of patients on ventilators, remained well below prior peak levels. This reality, combined with growing optimism about an eventual approval of a COVID-19 vaccine, acted as a tailwind to equities broadly, continuing their positive momentum from the second quarter of 2020. Toward the end of the third calendar quarter, investors increasingly focused on unsuccessful partisan negotiations to reach a compromise on additional fiscal support for the economy as well as on the then-upcoming U.S. Presidential and Congressional elections in November. U.S. economic data remained sufficiently healthy, allowing investors to look beyond near-term elections and fiscal concerns. Against this backdrop, developed markets equities, as measured by the MSCI World Index, and emerging market equities, as measured by the MSCI Emerging Markets Index, rose 6.8% and 8.6%, respectively. Within developed markets equities, U.S. stocks, as represented by the S&P 500® Index, led the rally, registering a gain of 8.9%. In fixed income, the 10-year U.S. Treasury yield rose slightly.

1

MARKET REVIEW

During the fourth quarter of 2020, global economic activity remained resilient in spite of renewed worries about rising COVID–19 cases, delays in additional U.S. fiscal stimulus, and general market uncertainty surrounding the possibility of a contested U.S. Presidential election. Although an increase in COVID-19 cases, especially in Europe and the U.S., drove heightened financial market volatility, the announcement that the Pfizer and Moderna vaccines had better than consensus expected efficacy appeared to be a huge relief for policymakers and market participants. Investor confidence was further bolstered by the strong economic data from Asia, and from China in particular. In addition, major global central banks appeared to reassure market participants by committing to accommodative monetary policies. In the U.S., the Fed introduced forward guidance for its asset purchases, stating it would continue to increase its U.S. Treasury and mortgage-backed securities holdings until substantial further progress was made towards its maximum employment and price stability goals. Similarly, the European Central Bank committed to continued support for the economy by expanding and extending its Pandemic Emergency Purchase Programme. Overall, this favorable mix of recovering global economies, positive news flow on vaccines, and strong forward guidance from the major central banks was supportive of risk assets, particularly equities, in the fourth calendar quarter. Global equities, as represented by the MSCI ACWI Investable Market Index, rose 15.7%. U.S. equities, as measured by the S&P 500® Index, rose 12.15%. Developed markets equities, as represented by the MSCI World Index, and emerging markets equities, as represented by the MSCI Emerging Markets Index, were up approximately 13.9% and 19.7%, respectively. As for fixed income, the 10-year U.S. Treasury yield rose during the fourth quarter of 2020, but it remained well below its highs near the beginning of the calendar year.

Looking Ahead

At the end of the Reporting Period, we believed high efficacy rates for COVID-19 vaccines and expectations for a broad vaccination rollout in North America and Europe by mid-2021 were likely to fuel a sustained and expanding rebound in global economic activity. Overall, we anticipated above-trend economic growth in the medium term, driven by pent-up demand, ongoing and significant fiscal and monetary policy support, high savings rates and extensive rebuilding of inventories.

At the asset class level, we believed that while on an absolute basis, equity valuations were high at the end of the Reporting Period, they were attractive in relative terms, and we expected them to remain so in the near term. As for fixed income, we believed low interest rates were likely to persist. In our view, short-term yields will likely remain anchored by central bank monetary policy, which should, in turn, limit a rise in longer-term yields. At the end of the Reporting Period, we anticipated that ongoing policy support from governments and central banks, as well as low financing costs, would keep credit spreads relatively tight. (Credit spreads are yield differentials between corporate bonds and U.S. Treasury securities of comparable maturity.)

2

PORTFOLIO RESULTS

Goldman Sachs Fund of Funds Portfolios – Asset Allocation

Investment Objectives

The Goldman Sachs Balanced Strategy Portfolio seeks current income and long-term capital appreciation. The Goldman Sachs Growth and Income Strategy Portfolio seeks long-term capital appreciation and current income. The Goldman Sachs Growth Strategy Portfolio seeks long-term capital appreciation and, secondarily, current income.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Multi-Asset Solutions (“MAS”) Team discusses the performance and positioning of the Goldman Sachs Fund of Funds Portfolios — Asset Allocation (the “Portfolios”) for the 12-month period ended December 31, 2020 (the “Reporting Period”).

| Q | How did the Portfolios perform during the Reporting Period? |

| A | Goldman Sachs Balanced Strategy Portfolio — During the Reporting Period, the Balanced Strategy Portfolio’s Class A, Class C, Institutional, Service, Investor, Class R6, Class R and Class P Shares generated average annual total returns of 10.71%, 9.90%, 11.05%, 10.52%, 10.97%, 11.06%, 10.39% and 11.15%, respectively. This compares to the 11.13% average annual total return of the Portfolio’s blended benchmark, which is composed 60% of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (“Bloomberg Barclays Global Index”) and 40% of the MSCI All Country World Index (Net, USD, Unhedged) (“MSCI ACWI Index”), during the same period. |

| The components of the Portfolio’s blended benchmark, the Bloomberg Barclays Global Index and the MSCI ACWI Index, generated average annual total returns of 5.56% and 16.21%, respectively, during the Reporting Period. |

| Goldman Sachs Growth and Income Strategy Portfolio — During the Reporting Period, the Growth and Income Strategy Portfolio’s Class A, Class C, Institutional, Service, Investor, Class R6, Class R and Class P Shares generated average annual total returns of 12.29%, 11.44%, 12.68%, 12.18%, 12.64%, 12.70%, 12.05% and 12.70%, respectively. This compares to the 13.31% average annual total return of the Portfolio’s blended benchmark, which is composed 40% of the Bloomberg Barclays Global Index and 60% of the MSCI ACWI Index, during the same period. |

| The components of the Portfolio’s blended benchmark, the Bloomberg Barclays Global Index and the MSCI ACWI Index, generated average annual total returns of 5.56% and 16.21%, respectively, during the Reporting Period. |

| Goldman Sachs Growth Strategy Portfolio — During the Reporting Period, the Growth Strategy Portfolio’s Class A, Class C, Institutional, Service, Investor, Class R6, Class R and Class P Shares generated average annual total returns of 13.96%, 13.10%, 14.29%, 13.81%, 14.24%, 14.35%, 13.61% and 14.36%, respectively. This compares to the 15.02% average annual total return of the Portfolio’s blended benchmark, which is composed 80% of the MSCI ACWI Index and 20% of the Bloomberg Barclays Global Index, during the same period. |

| The components of the Portfolio’s blended benchmark, the Bloomberg Barclays Global Index and the MSCI ACWI Index, generated average annual total returns of 5.56% and 16.21%, respectively, during the Reporting Period. |

| Q | What key factors were responsible for the Portfolios’ performance during the Reporting Period? |

| A | The Portfolios seek to achieve their respective investment objectives by investing mainly in a combination of underlying funds and exchange-traded funds (“ETFs”) (collectively, the “Underlying Funds”). Some of the Portfolios’ Underlying Funds invest primarily in fixed income or money market instruments (the “Underlying Fixed Income Funds”); some of the Underlying Funds invest primarily in equity securities (the “Underlying Equity Funds”); and other Underlying Funds invest dynamically across equity, fixed income, commodity and other markets using various strategies including a managed-volatility or trend-following approach (the “Underlying Dynamic Funds”). |

Performance is driven by three sources of return: long-term strategic asset allocation, medium-term and short-term dynamic allocation, and excess returns from investments in |

3

PORTFOLIO RESULTS

Underlying Funds. Long-term strategic asset allocation is the process by which we seek to budget or allocate portfolio risk, as opposed to capital, across a set of asset allocation risk factors, including but not limited to, equity, interest rate, emerging markets, credit, momentum and active risk. The resulting strategic asset allocations are implemented using a range of bottom-up security selection strategies across equity, fixed income and dynamic asset classes, which may utilize fundamental or quantitative investment techniques. We then incorporate our medium-term and short-term dynamic views into the Portfolios in order to react to changes in the economic cycle and the markets, respectively. Each Portfolio’s positioning may therefore change over time based on our medium-term and short-term market views on dislocations and attractive investment opportunities. These views may impact the relative weighting across asset classes, the allocation to geographies, sectors and industries as well as the Portfolios’ duration and sensitivity to inflation. (Duration is a measure of a portfolio’s sensitivity to changes in interest rates.) |

| During the Reporting Period, the Portfolios generated strongly positive returns on an absolute basis. In relative terms, all three Portfolios — the Goldman Sachs Balanced Strategy Portfolio, the Goldman Sachs Growth and Income Strategy Portfolio and the Goldman Sachs Growth Strategy Portfolio — underperformed their respective benchmark indices.1 |

| Long-term strategic asset allocation added to the performance of all three Portfolios during the Reporting Period. Our short-term dynamic decisions also bolstered the Portfolios’ returns. Conversely, the Portfolios were hurt by our medium-term dynamic views. Security selection within the Underlying Funds had mixed results on the performance of the Portfolios overall. |

| During the Reporting Period, our long-term strategic asset allocation added to the performance of the Portfolios, with those having greater equity exposure producing greater positive returns. In addition, the Portfolio benefited from the gains of our long U.S. interest rate options strategy, through which we seek to profit if interest rates fall, remain constant or rise less than anticipated. (Our long U.S. interest rate options strategy is a macroeconomic hedge that buys put options on short-term interest rates. A put option is an option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying asset at a specified price within a specified time.) |

| Our medium-term dynamic views, which seek to respond to changes in the business or economic cycle, detracted from the performance of all three Portfolios. Overall, the Portfolios were hampered by our decision to reduce risk, which we accomplished through decreased allocations to equities, especially through the Portfolios’ allocations to the Goldman Sachs Dynamic Global Equity Fund. Within fixed income, our medium-term dynamic view that the Portfolios have reduced exposures to non-investment grade fixed income and have allocations to U.S. Treasury futures detracted from performance during the Reporting Period. |

| Our short-term dynamic views, which seek to take advantage of what we consider short-term market mispricing, added to the performance of all three Portfolios. We express our short-term dynamic views through the Goldman Sachs Tactical Tilt Overlay Fund (the “Underlying Tactical Fund”), which generated positive returns during the Reporting Period. |

| Regarding security selection within the Underlying Funds, it detracted from the performance of the Goldman Sachs Growth Strategy Portfolio during the Reporting Period. On the positive side, security selection within the Underlying Funds added to the performance of the Goldman Sachs Balanced Strategy Portfolio. Security selection within the Underlying Funds had a rather neutral impact on the performance of the Goldman Sachs Growth and Income Strategy Portfolio during the Reporting Period. |

| Q | How did the Portfolios’ Underlying Funds perform relative to their respective benchmark indices during the Reporting Period? |

| A | Among Underlying Fixed Income Funds, the Goldman Sachs Global Income Fund, the Goldman Sachs Emerging Markets Debt Fund, the Goldman Sachs Core Fixed Income Fund and the Goldman Sachs Local Emerging Market Debt Fund outperformed their respective benchmark indices. The Goldman Sachs High Yield Floating Rate Fund, the Goldman Sachs High Yield Fund and the Goldman Sachs Investment Grade Bond ETF underperformed their respective benchmark indices. Among Underlying Equity Funds, the Goldman Sachs International Equity Insights Fund, the Goldman Sachs Emerging Markets Equity Insights Fund, the Goldman Sachs Global Real Estate Securities Fund and the Goldman Sachs Global Infrastructure Fund outperformed |

| 1 | As measured by Institutional Shares. |

4

PORTFOLIO RESULTS

their respective benchmark indices. The Goldman Sachs International Small Cap Insights Fund, the Goldman Sachs ActiveBeta® Large Cap Equity ETF and the Goldman Sachs Dynamic Global Equity Fund underperformed their respective benchmark indices. Among Underlying Dynamic Funds, the Goldman Sachs Managed Futures Strategy Fund and the Goldman Sachs Alternative Premia Fund underperformed their respective benchmark indices. |

| The Underlying Tactical Fund outperformed its cash benchmark during the Reporting Period. |

| Q | How did the Portfolios use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, all three Portfolios used derivatives for passive replication of asset classes. Specifically, each of the Portfolios held a strategic position in S&P 500® Index futures (positive impact on performance). They also employed put options on U.S. large cap equities (neutral impact). |

| Within fixed income, all three Portfolios invested in a strategy that utilized interest rate options to profit if interest rates fall, remain constant, or rise less than anticipated (positive impact). In addition, U.S. Treasury futures were used to express our medium-term dynamic views on longer-term Treasury securities and to position the Portfolios toward the long-term end of the U.S. Treasury yield curve (negative impact). (Yield curve is a spectrum of interest rates based on maturities of varying lengths.) |

| The three Portfolios used forward foreign currency exchange contracts within a foreign currency hedging strategy (negative impact), which seeks to manage the risk associated with investing in non-U.S. currencies. |

| During the Reporting Period overall, some of the Portfolios’ Underlying Funds, including the Underlying Tactical Fund, used derivatives to apply their active investment views with greater versatility and potentially to afford greater risk management precision. As market conditions warranted during the Reporting Period, some of these Underlying Funds engaged in forward foreign currency exchange contracts, financial futures contracts, options, swap contracts and structured securities to attempt to enhance portfolio return and for hedging purposes. |

| Q | What changes did you make during the Reporting Period within the Portfolios? |

| A | During the Reporting Period, we made changes to our long-term strategic allocations. In October 2020, we implemented new long-term strategic allocations that we believed would enhance diversification and potentially generate additional excess returns. Specifically, we increased the Portfolios’ exposures to emerging markets debt, U.S. investment grade corporate bonds, emerging markets equities and international small-cap stocks. At the same time, we reduced their allocations to real assets, global investment grade corporate bonds and the Underlying Tactical Fund. Within fixed income, we reduced the Goldman Sachs Balanced Strategy Portfolio’s strategic allocation to global fixed income, added a strategic allocation to U.S. core fixed income and increased the allocation to emerging markets debt. In the Goldman Sachs Growth and Income Portfolio, we decreased the strategic allocation to global fixed income and increased strategic allocations to U.S. investment grade corporate bonds and emerging markets debt. As for the Goldman Sachs Growth Portfolio, we decreased its strategic allocation to U.S. investment grade corporate bonds and increased its strategic allocation to emerging markets debt. Within real assets, we decreased strategic allocations to global real estate securities in all three Portfolios. |

| We also made changes to our medium-term dynamic views during the Reporting Period. During March and April 2020, amid the COVID-19-related sell-off and increased market uncertainty, we sought to reduce risk in the Portfolios and decreased their overall exposures to equities. In June, we re-established the Portfolios’ allocations to equities, as the markets appeared to grow more optimistic about a potential economic recovery. Another change in our medium-term dynamic views was our decision in April to reduce the Portfolios’ exposures to our long U.S. interest rate options strategy. At the same time, we added longer-maturity U.S. Treasury futures to help maintain and adjust the Portfolios’ duration positions. In October, we shifted the Portfolios’ medium-term dynamic allocations toward our strategic asset allocations. Specifically, we increased the Portfolios’ exposures to non-investment grade fixed income and removed their exposures to 30-year Treasury futures, as the new strategic asset allocation incorporated our preference for emerging markets debt and U.S. investment grade corporate bonds over global fixed income into the long-term positioning of the Portfolios. |

| In addition, in October 2020, the Portfolios’ allocation to Goldman Sachs Alternative Premia Fund was eliminated. |

5

FUND BASIC

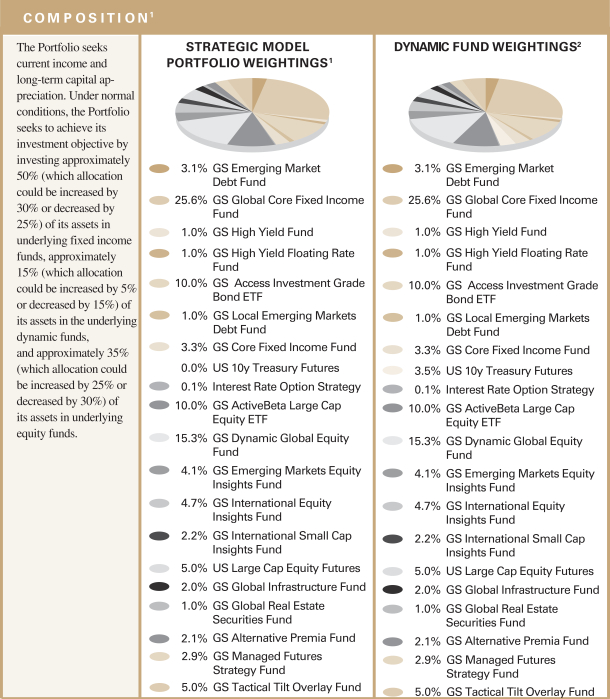

Balanced Strategy

as of December 31, 2020

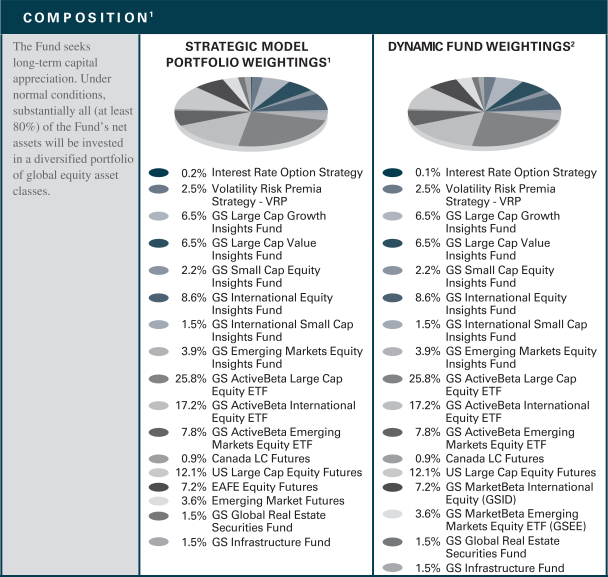

| 1 | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each underlying fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. On a monthly basis or as needed, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

| 2 | Generally, dynamic fund weightings are rebalanced approximately monthly, but they may be rebalanced more or less frequently at the discretion of the Investment Adviser based on the market environment and its macro views. The weightings in the chart above reflect the allocations as of December 31, 2020. Actual Fund weighting in the Portfolio may differ from the figures shown above due to rounding, differences in returns of the Underlying Funds, or both. The above figures are not indicative of future allocations. |

6

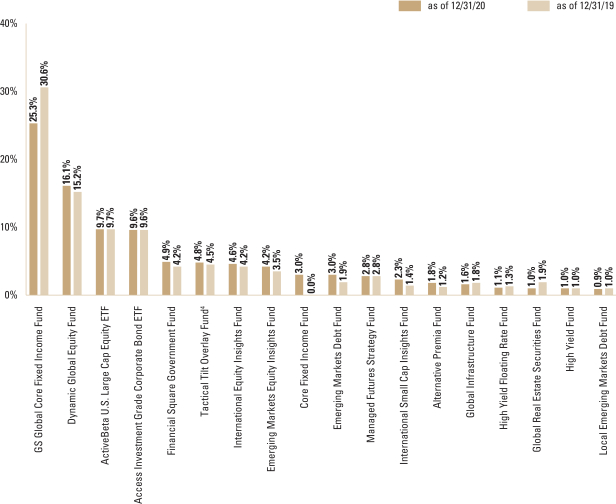

FUND BASICS

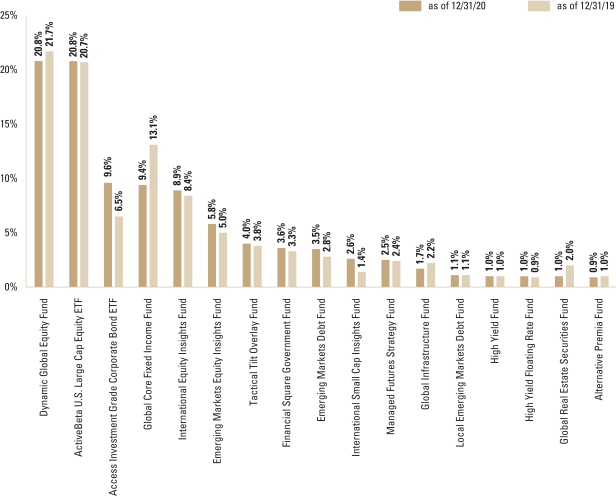

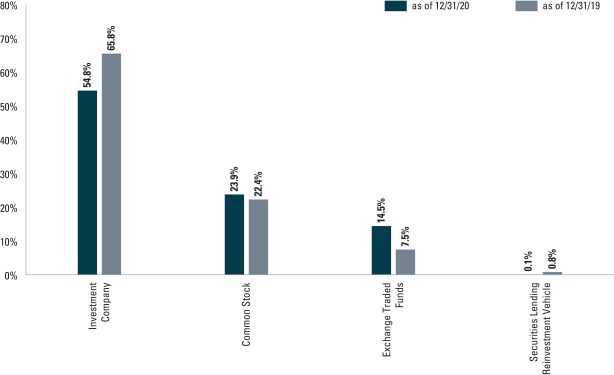

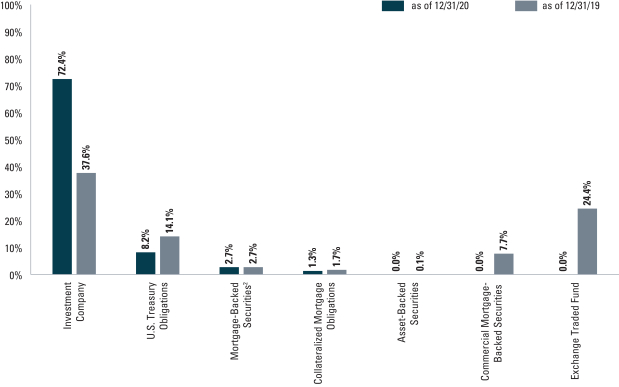

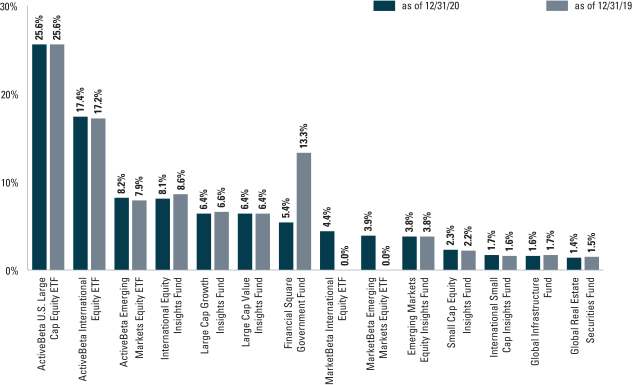

| OVERALL UNDERLYING FUND WEIGHTINGS3 |

| Percentage of Net Assets |

| 3 | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph depicts the Portfolio’s investments but may not represent the Portfolio’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

7

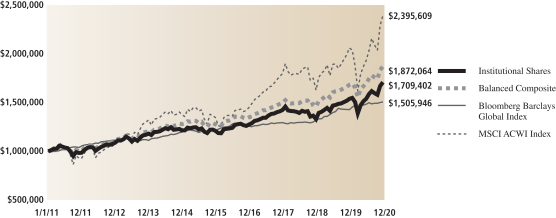

GOLDMAN SACHS BALANCED STRATEGY PORTFOLIO

Performance Summary

December 31, 2020

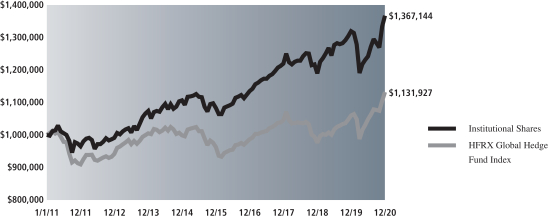

The following graph shows the value, as of December 31, 2020, of a $1,000,000 investment made on January 1, 2011 in Institutional Shares at NAV. For comparative purposes, the performance of the Portfolio’s benchmarks, the Balanced Strategy Composite Index (the “Balanced Composite”), which is comprised of 60% of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (the “Bloomberg Barclays Global Index”) and 40% of the MSCI® All Country World Index (Net, USD, Unhedged) (the “MSCI ACWI Index”), the Bloomberg Barclays Global Index and the MSCI ACWI Index (each with distributions reinvested), are shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| Balanced Strategy Portfolio’s 10 Year Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from January 1, 2011 through December 31, 2020.

| Average Annual Total Return through December 31, 2020 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A | ||||||||||||||

Excluding sales charges | 10.71% | 6.77% | 5.10% | —% | ||||||||||

Including sales charges | 4.62% | 5.56% | 4.51% | —% | ||||||||||

| ||||||||||||||

Class C | ||||||||||||||

Excluding contingent deferred sales charges | 9.90% | 5.95% | 4.31% | —% | ||||||||||

Including contingent deferred sales charges | 8.90% | 5.95% | 4.31% | —% | ||||||||||

| ||||||||||||||

Institutional | 11.05% | 7.15% | 5.50% | —% | ||||||||||

| ||||||||||||||

Service | 10.52% | 6.78% | 5.05% | —% | ||||||||||

| ||||||||||||||

Investor | 10.97% | 7.03% | 5.35% | —% | ||||||||||

| ||||||||||||||

Class R6 (Commenced July 31, 2015) | 11.06% | 7.16% | N/A | 6.19% | ||||||||||

| ||||||||||||||

Class R | 10.39% | 6.53% | 4.86% | —% | ||||||||||

| ||||||||||||||

Class P (Commenced April 17, 2018) | 11.15% | N/A | N/A | 6.97% | ||||||||||

| ||||||||||||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Investor, Class R6, Class R and Class P Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

For more information about your Portfolio, please refer to www.GSAMFUNDS.com. There, you can learn more about your Portfolio’s investment strategies, holdings, and performance.

8

FUND BASICS

Growth and Income Strategy

as of December 31, 2020

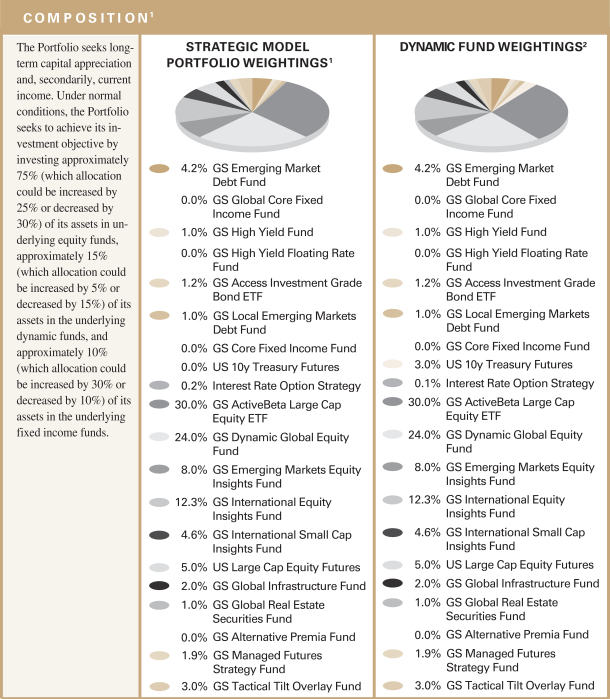

| 1 | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each underlying fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. On a monthly basis or as needed, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

| 2 | Generally, dynamic fund weightings are rebalanced approximately monthly, but they may be rebalanced more or less frequently at the discretion of the Investment Adviser based on the market environment and its macro views. The weightings in the chart above reflect the allocations as of December 31, 2020. Actual underlying fund weighting in the Portfolio may differ from the figures shown above due to rounding, differences in returns of the underlying funds, or both. The above figures are not indicative of future allocations. |

9

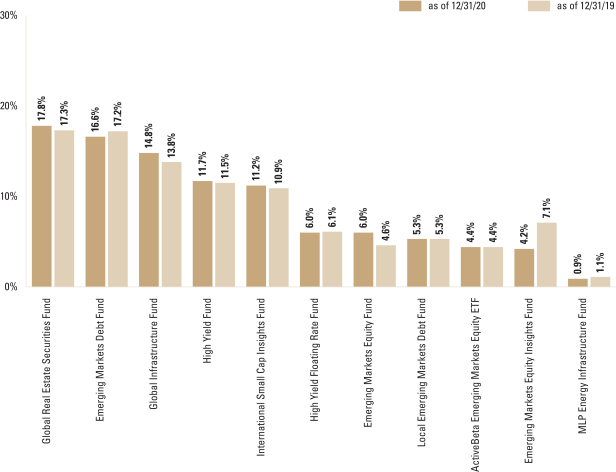

FUND BASICS

| OVERALL UNDERLYING FUND WEIGHTINGS3 |

| Percentage of Net Assets |

| 3 | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph depicts the Portfolio’s investments but may not represent the Portfolio’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

10

GOLDMAN SACHS GROWTH AND INCOME STRATEGY PORTFOLIO

Performance Summary

December 31, 2020

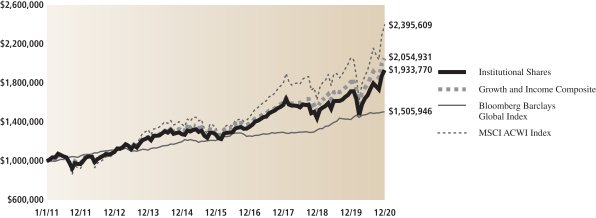

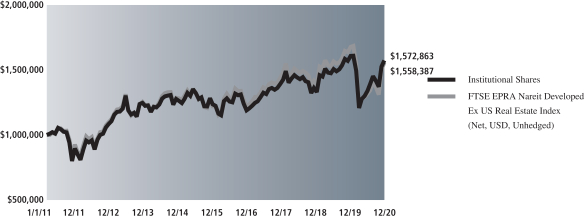

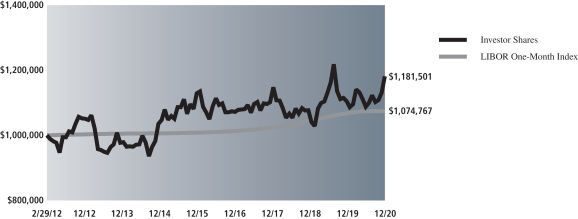

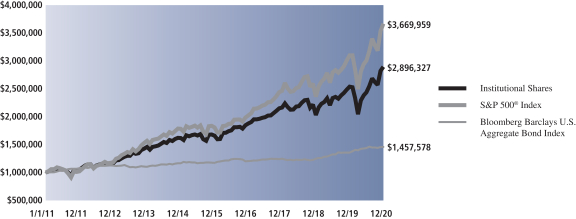

The following graph shows the value, as of December 31, 2020, of a $1,000,000 investment made on January 1, 2011 in Institutional Shares at NAV. For comparative purposes, the performance of the Portfolio’s benchmarks, the Growth and Income Strategy Composite Index (the “Growth and Income Composite”), which is comprised of 60% of the MSCI® All Country World Index (Net, USD, Unhedged) (the “MSCI ACWI Index”) and 40% of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (the “Bloomberg Barclays Global Index”), the Bloomberg Barclays Global Index and the MSCI ACWI Index (each with distributions reinvested), are shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| Growth and Income Strategy Portfolio’s 10 Year Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from January 1, 2011 through December 31, 2020.

| Average Annual Total Return through December 31, 2020 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A | ||||||||||||||

Excluding sales charges | 12.29% | 8.31% | 6.40% | —% | ||||||||||

Including sales charges | 6.13% | 7.08% | 5.80% | —% | ||||||||||

| ||||||||||||||

Class C | ||||||||||||||

Excluding contingent deferred sales charges | 11.44% | 7.48% | 5.61% | —% | ||||||||||

Including contingent deferred sales charges | 10.34% | 7.48% | 5.61% | —% | ||||||||||

| ||||||||||||||

Institutional | 12.68% | 8.71% | 6.81% | —% | ||||||||||

| ||||||||||||||

Service | 12.18% | 8.19% | 6.30% | —% | ||||||||||

| ||||||||||||||

Investor | 12.64% | 8.59% | 6.67% | —% | ||||||||||

| ||||||||||||||

Class R6 (Commenced July 31, 2015) | 12.70% | 8.71% | N/A | 7.43% | ||||||||||

| ||||||||||||||

Class R | 12.05% | 8.02% | 6.13% | —% | ||||||||||

| ||||||||||||||

Class P (Commenced April 17, 2018) | 12.70% | N/A | N/A | 7.54% | ||||||||||

| ||||||||||||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Investor, Class R6, Class R and Class P Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

For more information about your Portfolio, please refer to www.GSAMFUNDS.com. There, you can learn more about your Portfolio’s investment strategies, holdings, and performance.

11

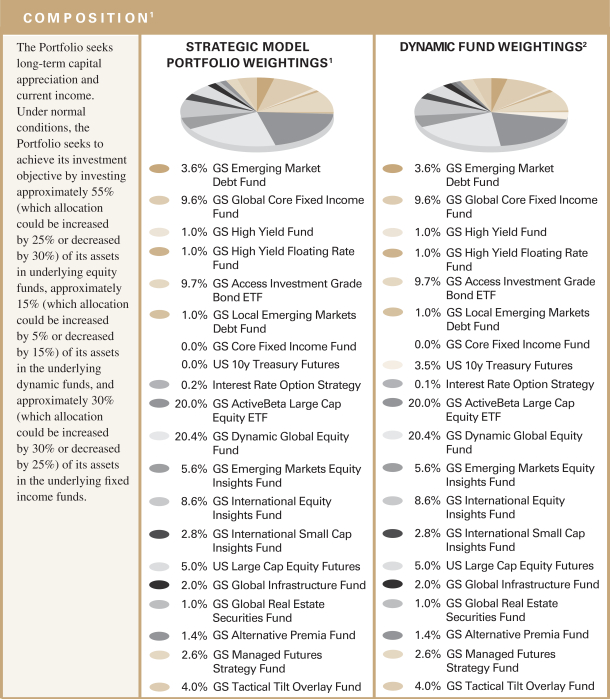

FUND BASICS

Growth Strategy

as of December 31, 2020

| 1 | Strategic allocation is the process of determining the areas of the global markets in which to invest, and in what long-term proportion, for each underlying fund. Our global approach attempts to generate strong long-term returns across geographies and asset classes, and is determined through a careful review of market opportunities and risk/return tradeoffs. On a monthly basis or as needed, we shift assets around the strategic allocation, over and under-weighting asset classes and countries relative to the neutral starting point, seeking to benefit from changing short-term conditions in global capital markets. This is called tactical asset allocation. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

| 2 | Generally, dynamic fund weightings are rebalanced approximately monthly, but they may be rebalanced more or less frequently at the discretion of the Investment Adviser based on the market environment and its macro views. The weightings in the chart above reflect the allocations as of December 31, 2020. Actual underlying fund weighting in the Portfolio may differ from the figures shown above due to rounding, differences in returns of the underlying funds, or both. The above figures are not indicative of future allocations. |

12

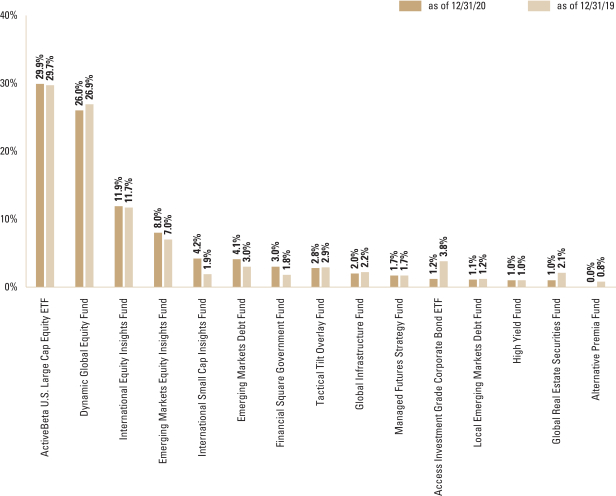

FUND BASICS

| OVERALL UNDERLYING FUND WEIGHTINGS3 |

| Percentage of Net Assets |

| 3 | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph depicts the Portfolio’s investments but may not represent the Portfolio’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

13

GOLDMAN SACHS GROWTH STRATEGY PORTFOLIO

Performance Summary

December 31, 2020

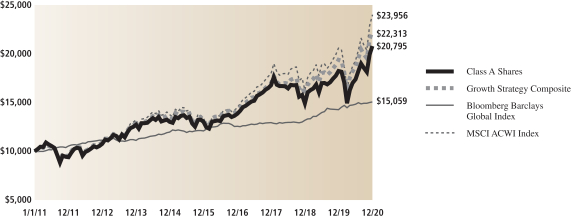

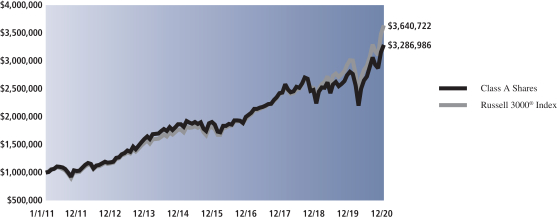

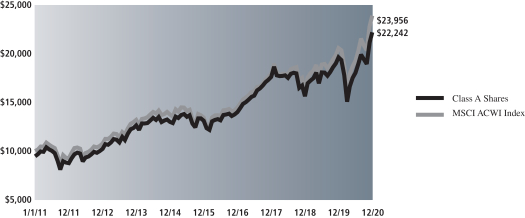

The following graph shows the value, as of December 31, 2020, of a $10,000 investment made on January 1, 2011 in Class A Shares at NAV. For comparative purposes, the performance of the Portfolio’s benchmarks, the Growth Strategy Composite Index (the “Growth Strategy Composite”), which is comprised of 80% of the MSCI® All Country World Index (Net, USD, Unhedged) (the “MSCI ACWI Index”) and 20% of the Bloomberg Barclays Global Aggregate Bond Index (Gross, USD, Hedged) (the “Bloomberg Barclays Global Index”), the Bloomberg Barclays Global Index and the MSCI ACWI Index (each with distributions reinvested), are shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| Growth Strategy Portfolio’s 10 Year Performance |

Performance of a $10,000 investment, with distributions reinvested, from January 1, 2011 through December 31, 2020.

| Average Annual Total Return through December 31, 2020 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A | ||||||||||||||

Excluding sales charges | 13.96% | 9.81% | 7.59% | —% | ||||||||||

Including sales charges | 7.72% | 8.58% | 6.98% | —% | ||||||||||

| ||||||||||||||

Class C | ||||||||||||||

Excluding contingent deferred sales charges | 13.10% | 8.99% | 6.79% | —% | ||||||||||

Including contingent deferred sales charges | 11.95% | 8.99% | 6.79% | —% | ||||||||||

| ||||||||||||||

Institutional | 14.29% | 10.22% | 8.01% | —% | ||||||||||

| ||||||||||||||

Service | 13.81% | 9.69% | 7.48% | —% | ||||||||||

| ||||||||||||||

Investor | 14.24% | 10.09% | 7.86% | —% | ||||||||||

| ||||||||||||||

Class R6 (Commenced July 31, 2015) | 14.35% | 10.24% | N/A | 8.66% | ||||||||||

| ||||||||||||||

Class R | 13.61% | 9.54% | 7.31% | —% | ||||||||||

| ||||||||||||||

Class P (Commenced April 17, 2018) | 14.36% | N/A | N/A | 8.39% | ||||||||||

| ||||||||||||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Investor, Class R6, Class R and Class P Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

For more information about your Portfolio, please refer to www.GSAMFUNDS.com. There, you can learn more about your Portfolio’s investment strategies, holdings, and performance.

14

PORTFOLIO RESULTS

Goldman Sachs Fund of Funds Portfolios – Satellite Strategies Portfolio

Investment Objective

The Portfolio seeks long-term capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Multi-Asset Solutions (“MAS”) Team discusses the performance and positioning of the Goldman Sachs Fund of Funds Portfolios — Satellite Strategies Portfolio (the “Portfolio”) for the 12-month period ended December 31, 2020 (the “Reporting Period”).

| Q | How did the Portfolio perform during the Reporting Period? |

| A | During the Reporting Period, the Portfolio’s Class A, Class C, Institutional, Service, Investor, Class R6, Class R and Class P Shares generated average annual total returns of 3.40%, 2.59%, 3.81%, 3.32%, 3.55%, 3.79%, 3.09% and 3.82%, respectively. This compares to the 11.58% average annual total return of the Portfolio’s blended benchmark, which is composed 40% of the Bloomberg Barclays U.S. Aggregate Bond Index (the “Bloomberg Barclays U.S. Index”), 30% of the Standard & Poor’s 500 Index (the “S&P 500® Index”) and 30% of the MSCI EAFE Net Total Return Index (the “MSCI EAFE Index”), during the same period. |

| The components of the blended benchmark, the Bloomberg Barclays U.S. Index, the S&P 500® Index and the MSCI EAFE Index, generated average annual total returns of 7.49%, 18.34% and 7.79%, respectively, during the same period. |

| Q | How did various satellite asset classes perform during the Reporting Period? |

| A | During the Reporting Period, satellite asset classes produced positive absolute returns, with the exception of real assets, notably energy master limited partnerships (“MLPs”). Relative to traditional equity and fixed income classes, satellite asset classes underperformed during the Reporting Period. |

| In the first quarter of 2020, when the Reporting Period began, all of the satellite asset classes represented in the Portfolio fell deeply into negative territory following the emergence of COVID-19 and the collapse of crude oil prices. Equity satellite asset classes broadly declined, led by emerging markets stocks, which have a high beta relative to global economic activity and are sensitive to global trade. (In this context, beta is a measure of the volatility of a security.) Within fixed income satellite asset classes, non-investment grade fixed income suffered a significant decline, with high yield corporate bonds and emerging markets debt posting double-digit negative returns. At the end of the second calendar quarter, all satellite asset classes remained in negative territory, though they had regained a significant amount of lost ground. By the end of the third quarter, the performance of high yield corporate bonds turned positive for the 2020 calendar year, while the performance of other satellite asset classes stayed negative. The fourth quarter saw a continued recovery across satellite asset classes, highlighted by an impressive rebound in emerging markets equities and in both U.S. and international small-cap equities. |

| Equity satellite asset classes generated positive returns for the Reporting Period overall. U.S. small cap equities, as measured by the Russell 2000® Index, performed best, gaining 19.96%. Emerging markets equities, as measured by the MSCI Emerging Markets Index (Net, Unhedged), also performed strongly, rising 18.31%. International small cap equities, as represented by the MSCI EAFE Small Cap Equity Index (Net, Unhedged), gained 12.34%. |

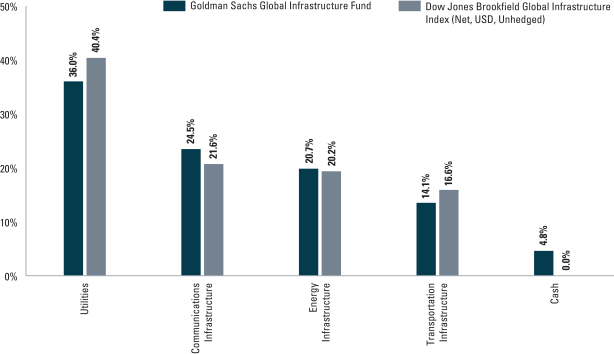

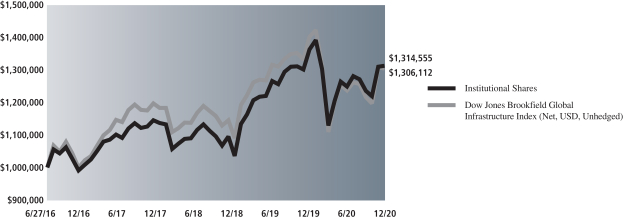

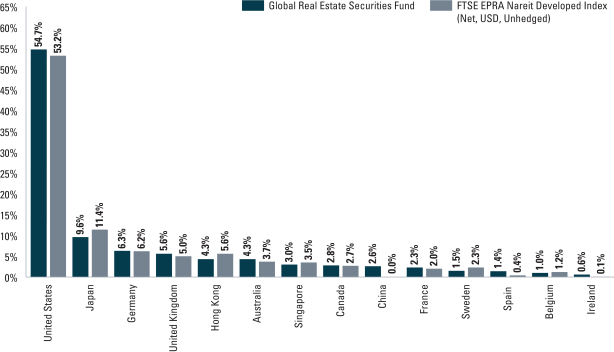

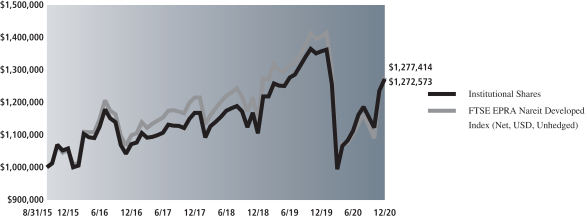

| As for real assets, they were broadly negative for the Reporting Period overall. U.S. energy MLPs, as measured by the Alerian MLP Index, declined 28.69%. Global real estate, as measured by the FTSE/NAREIT Developed Index (Net, Unhedged), dropped 8.91%. Global infrastructure securities, as represented by the Dow Jones Brookfield Global Infrastructure Index (Net, Unhedged), were down 6.97%. |

As for fixed income satellite asset classes, they all recorded positive returns for the Reporting Period overall. High yield corporate bonds, as measured by the Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index, performed best, up 7.05%. Leveraged loans, as measured by the Credit Suisse Leveraged Loan Index, gained 2.78%. U.S. dollar- |

15

PORTFOLIO RESULTS

denominated emerging markets debt, as represented by the J.P. Morgan Emerging Market Bond Index Global Diversified Index, rose 5.26%. Emerging markets local debt, as measured by the J.P. Morgan Government Bond Index — Emerging Markets Global Diversified Index (Unhedged), was up 2.69%. |

| Q | What key factors were responsible for the Portfolio’s performance during the Reporting Period? |

| A | The Portfolio seeks to achieve its investment objective by investing mainly in a combination of underlying funds and exchange-traded funds (“ETFs”) (collectively, the “Underlying Funds”). Some of the Portfolio’s Underlying Funds invest primarily in fixed income or money market instruments (the “Underlying Fixed Income Funds”), and some of the Underlying Funds invest primarily in equity securities (the “Underlying Equity Funds”). |

| The Portfolio’s performance is driven by three sources of return: long-term strategic asset allocation, medium-term dynamic allocation, and excess returns from investments in Underlying Funds. Long-term strategic asset allocation is the process by which we seek to budget or allocate portfolio risk, as opposed to capital, across a set of asset allocation risk factors, including but not limited to, equity, interest rate, emerging markets, credit, momentum and active risk. We apply a factor-based risk budgeting approach to develop a strategic allocation across the satellite asset classes included in the Portfolio. Our model focuses on broad asset classes, such as emerging markets, high yield credit and real assets. We then incorporate our medium-term dynamic views into the Portfolio in order to react to changes in the economic cycle. The Portfolio’s positioning may therefore change over time based on our medium-term dynamic views of attractive investment opportunities. These views may impact relative weighting across asset classes, the allocation to geographies, sectors and industries as well as the Portfolio’s duration and sensitivity to inflation. (Duration is a measure of a portfolio’s sensitivity to changes in interest rates.) |

| During the Reporting Period, our strategic asset allocation generated positive absolute returns but underperformed the Portfolio’s blended benchmark of core asset classes. Our medium-term dynamic allocation detracted from the Portfolio’s performance. On the positive side, security selection within the Underlying Funds added to the Portfolio’s returns during the Reporting Period, with outperformance largely concentrated in the Underlying Equity Funds. |

| Strategic asset allocation detracted from the Portfolio’s relative performance during the Reporting Period. The Portfolio was hurt by its strategic allocations to real assets, as U.S. energy MLPs, global real estate securities and global infrastructure securities each generated negative absolute returns and underperformed the equity component of the blended benchmark. Contributing positively were the Portfolio’s strategic allocations to equity satellite asset classes, especially emerging markets equities and international small cap equities. Both generated positive absolute returns and outperformed the equity component of the blended benchmark. Within fixed income, all of the Portfolio’s strategic allocations to satellite asset classes added overall to its performance, with each producing positive absolute returns. However, with one exception, i.e., U.S. dollar-denominated emerging markets debt, they all underperformed the fixed income component of the blended benchmark. |

| As for our medium-term dynamic asset allocation, the Portfolio was hampered by our preference for energy MLPs and global infrastructure securities over international small cap stocks and emerging markets equities, as real asset classes underperformed equity satellite asset classes during the Reporting Period. |

| Q | How did the Portfolio’s Underlying Funds perform relative to their respective benchmark indices during the Reporting Period? |

| A | During the Reporting Period, security selection within the Underlying Funds overall added to the Portfolio’s returns. Among Underlying Equity Funds, the Goldman Sachs Emerging Markets Equity Fund, the Goldman Sachs Emerging Markets Equity Insights Fund, the Goldman Sachs Global Real Estate Securities Fund and the Goldman Sachs Global Infrastructure Fund outperformed their respective benchmark indices. The Goldman Sachs ActiveBeta® Emerging Markets Equity ETF, the Goldman Sachs International Small Cap Insights Fund and the Goldman Sachs MLP Energy Infrastructure Fund underperformed their respective benchmark indices. Among Underlying Fixed Income Funds, the Goldman Sachs Emerging Markets Debt Fund and the Goldman Sachs Local Emerging Markets Debt Fund outperformed their respective benchmark indices. The Goldman Sachs High Yield Fund underperformed its benchmark index, while the performance of the Goldman Sachs High Yield Floating Rate Fund versus its benchmark index was rather flat. |

16

PORTFOLIO RESULTS

| Q | How did the Portfolio use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, the Portfolio did not directly invest in derivatives. However, some of the Underlying Funds used derivatives to apply their active investment views with greater versatility and to potentially afford greater risk management precision. As market conditions warranted, some of these Underlying Funds may have engaged in forward foreign currency exchange contracts, financial futures contracts, options, swap contracts and structured securities to attempt to enhance portfolio return and for hedging purposes. |

| Q | What changes did you make during the Reporting Period within the Portfolio? |

| A | We made some adjustments to the Portfolio’s strategic allocations during the Reporting Period. In March 2020, as the emergence of COVID-19 seemed to heighten perceived risks for the emerging markets, we reduced the Portfolio’s strategic allocation to emerging markets equities in favor of increasing its strategic allocation to global infrastructure securities. We further decreased the Portfolio’s strategic allocation to emerging markets equities during April before increasing it again in June. |

17

FUND BASICS

Satellite Strategies Portfolio

as of December 31, 2020

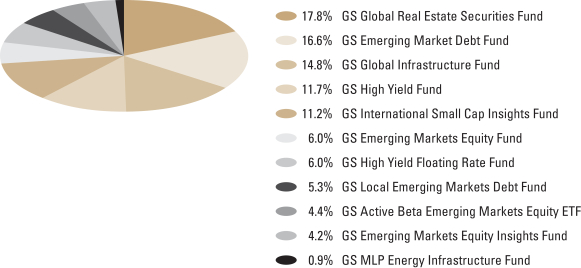

| TARGET RISK-CONTRIBUTION INVESTMENT PORTFOLIO1 AS OF 12/31/20 | ||||||

| Percentage of Investment Portfolio | ||||||

| ||||||

| 1 | Generally, dynamic fund weightings are rebalanced approximately monthly, but they may be rebalanced more or less frequently at the discretion of the Investment Adviser based on the market environment and its macro views. The weightings in the chart above reflect the allocations as of December 31, 2020. Actual underlying fund weighting in the Portfolio may differ from the figures shown above due to rounding, differences in returns of the underlying funds, or both. The above figures are not indicative of future allocations. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

18

FUND BASICS

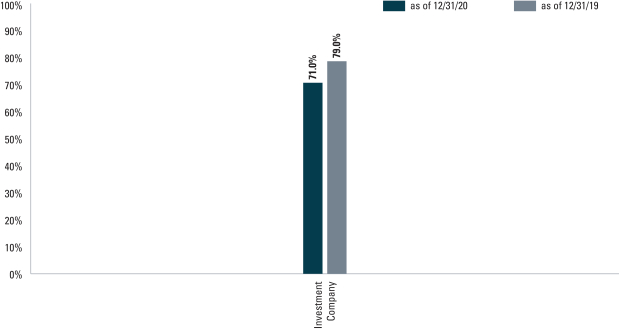

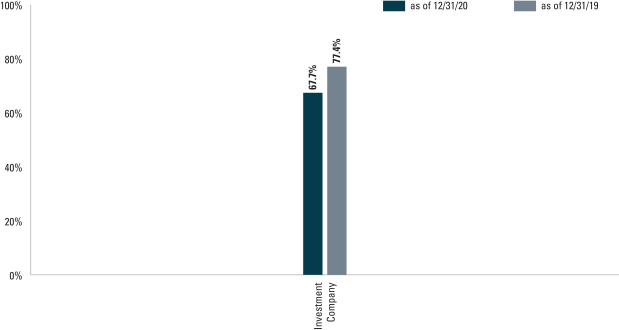

| OVERALL UNDERLYING FUND WEIGHTINGS2 |

| Percentage of Net Assets |

| 2 | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each underlying fund reflects the value of that underlying fund as a percentage of net assets of the Portfolio. Figures in the above graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

19

GOLDMAN SACHS SATELLITE STRATEGIES PORTFOLIO

Performance Summary

December 31, 2020

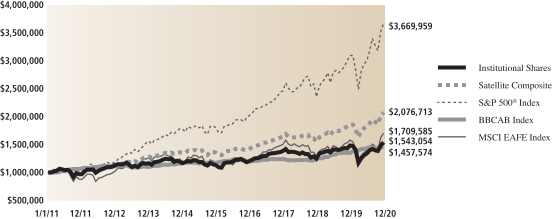

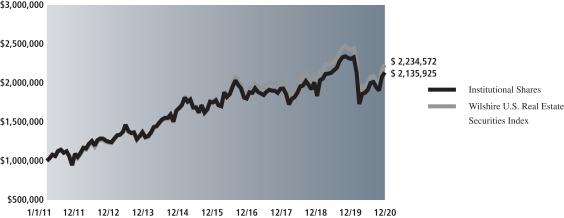

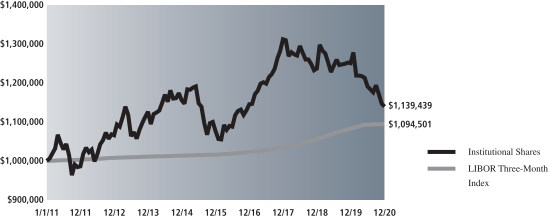

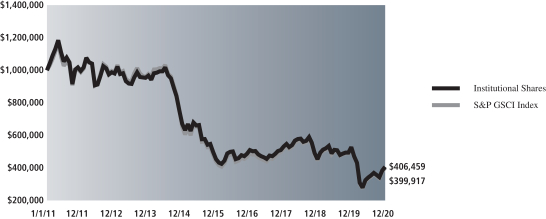

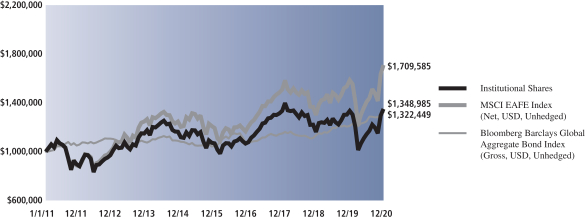

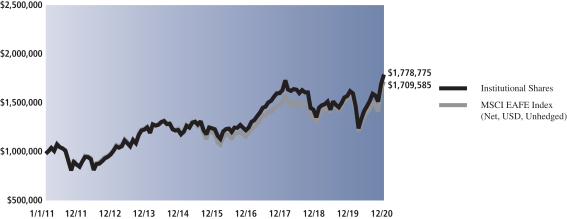

The following graph shows the value, as of December 31, 2020, of a $1,000,000 investment made on January 1, 2011 in Institutional Shares at NAV. For comparative purposes, the performance of the Portfolio’s benchmarks, the Satellite Strategies Composite Index (the “Satellite Composite”), which is comprised of 40% of the Bloomberg Barclays U.S. Aggregate Bond Index (the “BBCAB Index”), 30% of the Standard & Poor’s 500 Index (the “S&P 500® Index”), and 30% of the MSCI® Europe, Australasia and Far East Index (the “MSCI EAFE Index”), the S&P 500® Index, the BBCAB Index and the MSCI EAFE Index (Gross, USD, Unhedged) (all with distributions reinvested), are shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| Satellite Strategies Portfolio’s 10 Year Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from January 1, 2011 through December 31, 2020.

| Average Annual Total Return through December 31, 2020 | One Year | Five Years | Ten Years | Since Inception | ||||||||||

Class A | ||||||||||||||

Excluding sales charges | 3.40% | 5.83% | 4.01% | —% | ||||||||||

Including sales charges | -2.25% | 4.65% | 3.43% | —% | ||||||||||

| ||||||||||||||

Class C | ||||||||||||||

Excluding contingent deferred sales charges | 2.59% | 5.04% | 3.22% | —% | ||||||||||

Including contingent deferred sales charges | 1.59% | 5.04% | 3.22% | —% | ||||||||||

| ||||||||||||||

Institutional | 3.81% | 6.27% | 4.43% | —% | ||||||||||

| ||||||||||||||

Service | 3.32% | 5.75% | 3.92% | —% | ||||||||||

| ||||||||||||||

Investor | 3.55% | 6.09% | 4.26% | —% | ||||||||||

| ||||||||||||||

Class R6 (Commenced July 31, 2015) | 3.79% | 6.27% | N/A | 4.89% | ||||||||||

| ||||||||||||||

Class R | 3.09% | 5.58% | 3.75% | —% | ||||||||||

| ||||||||||||||

Class P (Commenced April 17, 2018) | 3.82% | N/A | N/A | 4.05% | ||||||||||

| ||||||||||||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Investor, Class R6, Class R and Class P Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

For more information about your Portfolio, please refer to www.GSAMFUNDS.com. There, you can learn more about your Portfolio’s investment strategies, holdings, and performance.

20

GOLDMAN SACHS FUND OF FUNDS PORTFOLIOS

Alerian MLP Index is the leading gauge of energy infrastructure master limited partnerships. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX).

Bloomberg Barclays U.S. Corporate High-Yield 2% Issuer Capped Bond Index, an unmanaged index, covers the universe of U.S. dollar denominated, non-convertible, fixed rate, non-investment grade debt. Index holdings must have at least one year to final maturity, at least $150 million par amount outstanding, and be publicly issued with a rating of Ba1 or lower.

Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market.

FTSE EPRA/NAREIT Developed Index is a free-float adjusted, market capitalization-weighted index designed to track the performance of listed real estate companies in developed countries worldwide. Constituents of the Index are screened on liquidity, size and revenue.

J.P. Morgan Emerging Market Bond Index — Global Diversified Index is an unmanaged index of external debt instruments of emerging countries. The index is positioned as the investable benchmark that includes only those countries that are accessible by most of the international investor base and is popular largely due to its diversification weighting scheme and country coverage.

J.P. Morgan Government Bond Index — Emerging Markets Global Diversified Index is an unmanaged index of debt instruments issued by emerging markets governments in local currency. As emerging markets look increasingly toward their domestic market for sources of finance, investors are looking more closely at local markets in search for higher yield and greater diversification.

MSCI ACWI Investable Market Index captures large, mid and small cap representation across 23 developed markets and 27 emerging markets countries.

MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI EAFE Small Cap Index is an equity index that captures small-cap representation across developed markets countries around the world, excluding the U.S. and Canada. The index covers approximately 14% of the free float-adjusted market capitalization in each country.

MSCI Emerging Markets Index captures large-cap and mid-cap representation across 26 emerging markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

S&P 500® Index is a U.S. stock market index based on the market capitalizations of 500 large companies having common stock listed on the New York Stock Exchange or NASDAQ. The S&P 500® Index components and their weightings are determined by S&P Dow Jones Indices.

Russell 2000® Index is an unmanaged index of common stock prices that measures the performance of the 2000 smallest companies in the Russell 3000® Index. The Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

Dow Jones Brookfield Global Infrastructure Index is designed to measure the performance of pure-play infrastructure companies domiciled globally. The index covers all sectors of the infrastructure market. To be included in the index, a company must derive at least 70% of cash flows from infrastructure lines of business.

Bloomberg Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities.

It is not possible to invest directly in an unmanaged index.

21

GOLDMAN SACHS BALANCED STRATEGY PORTFOLIO

December 31, 2020

| Shares | Description | Value | ||||||

| Underlying Funds(a) – 92.8% | ||||||||

| Dynamic – 9.4% | ||||||||

| 2,807,393 | Goldman Sachs Tactical Tilt Overlay Fund – Class R6 | $ | 27,119,421 | |||||

| 1,533,395 | Goldman Sachs Managed Futures Strategy Fund – Class R6 | 16,008,647 | ||||||

| 1,502,104 | Goldman Sachs Alternative Premia Fund – Class R6 | 10,364,519 | ||||||

|

| |||||||

| 53,492,587 | ||||||||

|

| |||||||

| Equity – 29.8% | ||||||||

| 4,228,452 | Goldman Sachs Dynamic Global Equity Fund – Class R6 | 91,461,424 | ||||||

| 1,920,345 | Goldman Sachs International Equity Insights Fund – Class R6 | 26,385,543 | ||||||

| 2,064,556 | Goldman Sachs Emerging Markets Equity Insights Fund – Class R6 | 24,134,655 | ||||||

| 1,012,147 | Goldman Sachs International Small Cap Insights Fund – Class R6 | 12,823,897 | ||||||

| 791,766 | Goldman Sachs Global Infrastructure Fund – Class R6 | 9,319,088 | ||||||

| 541,278 | Goldman Sachs Global Real Estate Securities Fund – Class R6 | 5,537,277 | ||||||

|

| |||||||

| 169,661,884 | ||||||||

|

| |||||||

| Exchange Traded Funds – 19.3% | ||||||||

| 729,000 | Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF | 55,178,010 | ||||||

| 969,154 | Goldman Sachs Access Investment Grade Corporate Bond ETF | 54,505,221 | ||||||

|

| |||||||

| 109,683,231 | ||||||||

|

| |||||||

| Fixed Income – 34.3% | ||||||||

| 10,907,526 | Goldman Sachs Global Income Fund – Class R6 | 144,088,415 | ||||||

| 1,543,199 | Goldman Sachs Core Fixed Income Fund – Class R6 | 17,438,154 | ||||||

| 1,321,561 | Goldman Sachs Emerging Markets Debt Fund – Class R6 | 16,968,849 | ||||||

| 662,055 | Goldman Sachs High Yield Floating Rate Fund – Class R6 | 6,143,867 | ||||||

| 848,451 | Goldman Sachs High Yield Fund – Class R6 | 5,506,449 | ||||||

| 836,896 | Goldman Sachs Local Emerging Markets Debt Fund – Class R6 | 5,071,590 | ||||||

|

| |||||||

| 195,217,324 | ||||||||

|

| |||||||

| TOTAL UNDERLYING FUNDS – 92.8% | ||||||||

| (Cost $479,308,663) | $ | 528,055,026 | ||||||

|

| |||||||

| Shares | Dividend Rate | Value | ||||||

| Investment Company(a) – 4.9% | ||||||||

| | Goldman Sachs Financial Square Government Fund – | | ||||||

| 27,861,603 | 0.026% | $ | 27,861,603 | |||||

| (Cost $27,861,603) | ||||||||

|

| |||||||

| TOTAL INVESTMENTS – 97.7% | ||||||||

| (Cost $507,170,266) | $ | 555,916,629 | ||||||

|

| |||||||

| | OTHER ASSETS IN EXCESS OF LIABILITIES – 2.3% | 13,099,386 | ||||||

|

| |||||||

| NET ASSETS – 100.0% | $ | 569,016,015 | ||||||

|

| |||||||

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. | ||

(a) | Represents an Affiliated Issuer. | |

| ||

Currency Abbreviations: | ||

AUD | —Australian Dollar | |

CHF | —Swiss Franc | |

DKK | —Danish Krone | |

EUR | —Euro | |

GBP | —British Pound | |

HKD | —Hong Kong Dollar | |

ILS | —Israeli Shekel | |

JPY | —Japanese Yen | |

NOK | —Norwegian Krone | |

NZD | —New Zealand Dollar | |

SEK | —Swedish Krona | |

SGD | —Singapore Dollar | |

USD | —U.S. Dollar | |

Investment Abbreviation: | ||

ETF | —Exchange Traded Fund | |

PLC | —Public Limited Company | |

| ||

| 22 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS BALANCED STRATEGY PORTFOLIO

| ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At December 31, 2020, the Portfolio had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| Counterparty | Currency Purchased | Currency Sold | Settlement Date | Unrealized Gain | ||||||||||||||||

MS & Co. Int. PLC | USD | 679,899 | HKD | 5,270,000 | 03/17/21 | $ | 2 | |||||||||||||

| USD | 385,366 | CHF | 340,000 | 03/17/21 | 435 | |||||||||||||||

| USD | 120,379 | DKK | 730,000 | 03/17/21 | 352 | |||||||||||||||

| USD | 1,804,503 | EUR | 1,470,000 | 03/17/21 | 5,513 | |||||||||||||||

| USD | 164,528 | SEK | 1,350,000 | 03/17/21 | 307 | |||||||||||||||

| TOTAL | $ | 6,609 | ||||||||||||||||||

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED LOSS

| Counterparty | Currency Purchased | Currency Sold | Settlement Date | Unrealized Loss | ||||||||||||||||

MS & Co. Int. PLC | USD | 85,526 | ILS | 280,000 | 03/17/21 | $ | (1,728 | ) | ||||||||||||

| USD | 291,529 | SGD | 390,000 | 03/17/21 | (3,592 | ) | ||||||||||||||

| USD | 7,083,262 | JPY | 738,000,000 | 03/17/21 | (70,528 | ) | ||||||||||||||

| USD | 1,963,124 | AUD | 2,640,000 | 03/17/21 | (73,479 | ) | ||||||||||||||

| USD | 767,769 | SEK | 6,525,000 | 03/17/21 | (25,965 | ) | ||||||||||||||

| USD | 7,354,679 | EUR | 6,070,000 | 03/17/21 | (73,805 | ) | ||||||||||||||

| USD | 2,316,333 | CHF | 2,070,000 | 03/17/21 | (27,217 | ) | ||||||||||||||

| USD | 3,949,835 | GBP | 2,950,000 | 03/17/21 | (86,244 | ) | ||||||||||||||

| USD | 164,895 | NOK | 1,450,000 | 03/17/21 | (4,169 | ) | ||||||||||||||

| USD | 84,683 | NZD | 120,000 | 03/17/21 | (1,684 | ) | ||||||||||||||

| USD | 597,129 | DKK | 3,670,000 | 03/17/21 | (6,297 | ) | ||||||||||||||

| USD | 190,866 | HKD | 1,480,000 | 03/17/21 | (73 | ) | ||||||||||||||

| TOTAL | �� | $ | (374,781 | ) | ||||||||||||||||

FUTURES CONTRACTS — At December 31, 2020, the Portfolio had the following futures contracts:

| Description | Number of Contracts | Expiration Date | Notional Amount | Unrealized Appreciation/ (Depreciation) | ||||||||||||

Long position contracts: | ||||||||||||||||

S&P 500 E-Mini Index | 134 | 03/19/21 | $ | 25,116,960 | $ | 634,591 | ||||||||||

10 Year U.S. Treasury Notes | 218 | 03/22/21 | 30,101,031 | 16,861 | ||||||||||||

| TOTAL FUTURES CONTRACTS | $ | 651,452 | ||||||||||||||

| The accompanying notes are an integral part of these financial statements. | 23 |

GOLDMAN SACHS BALANCED STRATEGY PORTFOLIO

Schedule of Investments (continued)

December 31, 2020

| ADDITIONAL INVESTMENT INFORMATION (continued) |

PURCHASED OPTIONS CONTRACTS — At December 31, 2020, the Portfolio had the following purchased and written options:

EXCHANGE TRADED OPTIONS ON FUTURES

| Description | Exercise Price | Expiration Date | Number of Contracts | Notional Amount | Market Value | Premiums Paid (Received) by Portfolio | Unrealized Appreciation/ (Depreciation) | |||||||||||||||||||||||

Purchased option contracts |

| |||||||||||||||||||||||||||||

Calls |

| |||||||||||||||||||||||||||||

Eurodollar Futures | $ | 98.250 | 03/15/2021 | 95 | $ | 237,500 | $ | 375,250 | $ | 105,908 | $ | 269,342 | ||||||||||||||||||

Eurodollar Futures | 98.250 | 06/14/2021 | 84 | 210,000 | 332,850 | 94,695 | 238,155 | |||||||||||||||||||||||

Eurodollar Futures | 98.250 | 09/13/2021 | 82 | 205,000 | 323,900 | 96,540 | 227,360 | |||||||||||||||||||||||

| TOTAL | 261 | $ | 652,500 | $ | 1,032,000 | $ | 297,143 | $ | 734,857 | |||||||||||||||||||||

|

| |

Abbreviations: | ||

MS & Co. Int. PLC—Morgan Stanley & Co. International PLC | ||

|

|

| 24 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS GROWTH AND INCOME STRATEGY PORTFOLIO

Schedule of Investments

December 31, 2020

| Shares | Description | Value | ||||||

| Underlying Funds(a) – 94.6% | ||||||||

| Dynamic – 7.4% | ||||||||

| 3,795,619 | Goldman Sachs Tactical Tilt Overlay Fund – Class R6 | $ | 36,665,679 | |||||

| 2,217,967 | Goldman Sachs Managed Futures Strategy Fund – Class R6 | 23,155,572 | ||||||

| 1,235,011 | Goldman Sachs Alternative Premia Fund – Class R6 | 8,521,575 | ||||||

|

| |||||||

| 68,342,826 | ||||||||

|

| |||||||

| Equity – 40.8% | ||||||||

| 8,871,471 | Goldman Sachs Dynamic Global Equity Fund – Class R6 | 191,889,910 | ||||||

| 5,970,921 | Goldman Sachs International Equity Insights Fund – Class R6 | 82,040,448 | ||||||

| 4,560,645 | Goldman Sachs Emerging Markets Equity Insights Fund – Class R6 | 53,313,938 | ||||||

| 1,880,665 | Goldman Sachs International Small Cap Insights Fund – Class R6 | 23,828,029 | ||||||

| 1,355,117 | Goldman Sachs Global Infrastructure Fund – Class R6 | 15,949,729 | ||||||

| 871,865 | Goldman Sachs Global Real Estate Securities Fund – Class R6 | 8,919,181 | ||||||

|

| |||||||

| 375,941,235 | ||||||||

|

| |||||||

| Exchange Traded Funds – 30.4% | ||||||||

| 2,526,237 | Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF | 191,210,878 | ||||||

| 1,576,107 | Goldman Sachs Access Investment Grade Corporate Bond ETF | 88,640,258 | ||||||

|

| |||||||

| 279,851,136 | ||||||||

|

| |||||||

| Fixed Income – 16.0% | ||||||||

| 6,534,255 | Goldman Sachs Global Income Fund – Class R6 | 86,317,513 | ||||||

| 2,488,689 | Goldman Sachs Emerging Markets Debt Fund – Class R6 | 31,954,762 | ||||||

| 1,628,836 | Goldman Sachs Local Emerging Markets Debt Fund – Class R6 | 9,870,744 | ||||||

| 1,478,530 | Goldman Sachs High Yield Fund – Class R6 | 9,595,658 | ||||||

| 965,809 | Goldman Sachs High Yield Floating Rate Fund – Class R6 | 8,962,704 | ||||||

|

| |||||||

| 146,701,381 | ||||||||

|

| |||||||

| TOTAL UNDERLYING FUNDS – 94.6% | ||||||||

| (Cost $749,019,022) | $ | 870,836,578 | ||||||

|

| |||||||

| Shares | Dividend Rate | Value | ||||||

| Investment Company(a)– 3.6% | ||||||||

| | Goldman Sachs Financial Square Government Fund – | | ||||||

| 33,271,131 | 0.026% | $ | 33,271,131 | |||||

| (Cost $33,271,131) | ||||||||

|

| |||||||

| TOTAL INVESTMENTS – 98.2% | ||||||||

| (Cost $782,290,153) | $ | 904,107,709 | ||||||

|

| |||||||

| | OTHER ASSETS IN EXCESS OF LIABILITIES – 1.8% | 17,003,582 | ||||||

|

| |||||||

| NET ASSETS – 100.0% | $ | 921,111,291 | ||||||

|

| |||||||

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. | ||

(a) | Represents an Affiliated Issuer. | |

| ||

Currency Abbreviations: | ||

AUD | —Australian Dollar | |

CHF | —Swiss Franc | |

DKK | —Danish Krone | |

EUR | —Euro | |

GBP | —British Pound | |

GBP | —Great British Pound | |

HKD | —Hong Kong Dollar | |

ILS | —Israeli Shekel | |

JPY | —Japanese Yen | |

NOK | —Norwegian Krone | |

NZD | —New Zealand Dollar | |

SEK | —Swedish Krona | |

SGD | —Singapore Dollar | |

USD | —U.S. Dollar | |

Investment Abbreviation: | ||

ETF | —Exchange Traded Fund | |

| ||

| ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At December 31, 2020, the Portfolio had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| Counterparty | Currency Purchased | Currency Sold | Settlement Date | Unrealized Gain | ||||||||||||||||

MS & Co. Int. PLC | USD | 1,268,199 | HKD | 9,830,000 | 03/17/21 | $ | 5 | |||||||||||||

| The accompanying notes are an integral part of these financial statements. | 25 |

GOLDMAN SACHS GROWTH AND INCOME STRATEGY PORTFOLIO

Schedule of Investments (continued)

December 31, 2020

| ADDITIONAL INVESTMENT INFORMATION (continued) |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED LOSS

| Counterparty | Currency Purchased | Currency Sold | Settlement Date | Unrealized Loss | ||||||||||||||||

MS & Co. Int. PLC | USD | 133,981 | ILS | 440,000 | 03/17/21 | $ | (3,131 | ) | ||||||||||||

| USD | 455,191 | SGD | 610,000 | 03/17/21 | (6,409 | ) | ||||||||||||||

| USD | 2,866,804 | AUD | 3,880,000 | 03/17/21 | (126,386 | ) | ||||||||||||||

| USD | 10,414,840 | JPY | 1,087,000,000 | 03/17/21 | (121,976 | ) | ||||||||||||||

| USD | 4,006,025 | CHF | 3,580,000 | 03/17/21 | (47,072 | ) | ||||||||||||||

| USD | 13,546,180 | EUR | 11,180,000 | 03/17/21 | (135,937 | ) | ||||||||||||||

| USD | 5,567,115 | GBP | 4,170,000 | 03/17/21 | (138,122 | ) | ||||||||||||||

| USD | 237,636 | NOK | 2,100,000 | 03/17/21 | (7,215 | ) | ||||||||||||||

| USD | 1,376,689 | SEK | 11,700,000 | 03/17/21 | (46,558 | ) | ||||||||||||||

| USD | 984,367 | DKK | 6,050,000 | 03/17/21 | (10,380 | ) | ||||||||||||||

| USD | 126,878 | NZD | 180,000 | 03/17/21 | (2,674 | ) | ||||||||||||||

| TOTAL | $ | (645,860 | ) | |||||||||||||||||

FUTURES CONTRACTS — At December 31, 2020, the Portfolio had the following futures contracts:

| Description | Number of Contracts | Expiration Date | Notional Amount | Unrealized Appreciation/ (Depreciation) | ||||||||||||

Long position contracts: | ||||||||||||||||

S&P 500 E-Mini Index | 169 | 03/19/21 | $ | 31,677,360 | $ | 800,881 | ||||||||||

10 Year U.S. Treasury Notes | 360 | 03/22/21 | 49,708,125 | 34,242 | ||||||||||||

| TOTAL FUTURES CONTRACTS | $ | 835,123 | ||||||||||||||

PURCHASED AND WRITTEN OPTIONS CONTRACTS — At December 31, 2020, the Fund had the following purchased and written options:

EXCHANGE TRADED OPTIONS ON FUTURES

| Description | Exercise Price | Expiration Date | Number of Contracts | Notional Amount | Market Value | Premiums Paid (Received) by Portfolio | Unrealized Appreciation/ (Depreciation) | |||||||||||||||||||||||

Purchased option contracts |

| |||||||||||||||||||||||||||||

Calls |

| |||||||||||||||||||||||||||||

Eurodollar Futures | $ | 98.250 | 06/14/2021 | 137 | $ | 342,500 | $ | 542,863 | $ | 154,443 | $ | 388,420 | ||||||||||||||||||

Eurodollar Futures | 98.250 | 09/13/2021 | 134 | 335,000 | 529,300 | 157,761 | 371,539 | |||||||||||||||||||||||

Eurodollar Futures | 98.250 | 03/15/2021 | 157 | 392,500 | 620,149 | 175,026 | 445,123 | |||||||||||||||||||||||

| TOTAL | 428 | $ | 1,070,000 | $ | 1,692,312 | $ | 487,230 | $ | 1,205,082 | |||||||||||||||||||||

|

| |

Abbreviations: | ||

MS & Co. Int. PLC—Morgan Stanley & Co. International PLC | ||

|

|

| 26 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS GROWTH STRATEGY PORTFOLIO

Schedule of Investments

December 31, 2020

| Shares | Description | Value | ||||||

| Underlying Funds(a) – 94.9% | ||||||||

| Dynamic – 4.6% | ||||||||

| 2,277,150 | Goldman Sachs Tactical Tilt Overlay Fund – Class R6 | $ | 21,997,267 | |||||

| 1,259,834 | Goldman Sachs Managed Futures Strategy Fund – Class R6 | 13,152,672 | ||||||

|

| |||||||

| 35,149,939 | ||||||||

|

| |||||||

| Equity – 53.0% | ||||||||

| 9,313,814 | Goldman Sachs Dynamic Global Equity Fund – Class R6 | 201,457,800 | ||||||

| 6,703,822 | Goldman Sachs International Equity Insights Fund – Class R6 | 92,110,514 | ||||||

| 5,338,540 | Goldman Sachs Emerging Markets Equity Insights Fund – Class R6 | 62,407,531 | ||||||

| 2,540,127 | Goldman Sachs International Small Cap Insights Fund – Class R6 | 32,183,409 | ||||||

| 1,298,901 | Goldman Sachs Global Infrastructure Fund – Class R6 | 15,288,059 | ||||||

| 732,822 | Goldman Sachs Global Real Estate Securities Fund – Class R6 | 7,496,765 | ||||||

|

| |||||||

| 410,944,078 | ||||||||

|

| |||||||

| Exchange Traded Funds – 31.1% | ||||||||

| 3,057,660 | Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF | 231,434,286 | ||||||

| 171,088 | Goldman Sachs Access Investment Grade Corporate Bond ETF | 9,621,989 | ||||||

|

| |||||||

| 241,056,275 | ||||||||

|

| |||||||

| Fixed Income – 6.2% | ||||||||

| 2,460,581 | Goldman Sachs Emerging Markets Debt Fund – Class R6 | 31,593,857 | ||||||

| 1,459,728 | Goldman Sachs Local Emerging Markets Debt Fund – Class R6 | 8,845,950 | ||||||

| 1,189,484 | Goldman Sachs High Yield Fund –Class R6 | 7,719,752 | ||||||

|

| |||||||

| 48,159,559 | ||||||||

|

| |||||||

| TOTAL UNDERLYING FUNDS – 94.9% | ||||||||

| (Cost $601,348,432) | $ | 735,309,851 | ||||||

|

| |||||||

| Shares | Dividend Rate | Value | ||||||

| Investment Company(a) – 3.0% | ||||||||

| | Goldman Sachs Financial Square Government Fund – | | ||||||

| 23,241,499 | 0.026% | $ | 23,241,499 | |||||

| (Cost $23,241,499) | ||||||||

|

| |||||||

| TOTAL INVESTMENTS – 97.9% | ||||||||

| (Cost $624,589,931) | $ | 758,551,350 | ||||||

|

| |||||||