UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Copies to:

| Caroline Kraus, Esq. | Stephen H. Bier, Esq. | |

| Goldman Sachs & Co. LLC | Dechert LLP | |

| 200 West Street | 1095 Avenue of the Americas | |

| New York, New York 10282 | New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2022

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Semi-Annual Report | April 30, 2022 | |||

Dividend Focus Funds | ||||

Income Builder | ||||

Rising Dividend Growth | ||||

Goldman Sachs Dividend Focus Funds

| ∎ | INCOME BUILDER |

| ∎ | RISING DIVIDEND GROWTH |

Market Review | 1 | |||

| 6 | ||||

| 12 | ||||

| 34 | ||||

| 37 | ||||

| 37 | ||||

| 43 | ||||

| 50 | ||||

| 70 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

MARKET REVIEW

The following are highlights both of key factors affecting the global capital markets broadly and the U.S. equity and energy MLP markets more specifically as well as of any key changes made to the Goldman Sachs Dividend Focus Funds (the “Funds”) during the six months ended April 30, 2022 (the “Reporting Period”). Attribution highlights are provided for those Funds that materially outperformed or underperformed their respective benchmark during the Reporting Period. A fuller review will appear in the Funds’ annual shareholder report covering the 12 months ended October 31, 2022.

Market and Economic Review

Global Capital Markets

| • | Overall, the global capital markets struggled during the Reporting Period. The MSCI World Index returned -11.30%; the MSCI Emerging Markets Index returned -14.15%; and the Bloomberg Global Aggregate Index returned -11.69%. The Russell 1000® Value Index returned -3.95% and the ICE BofAML BB to B US High Yield Constrained Index returned -7.16% for the Reporting Period. |

| • | As the Reporting Period began in November 2021, developed markets equities, as measured by the MSCI World Index, and emerging market equities, as measured by the MSCI Emerging Markets Index, were resilient despite elevated U.S. inflation data. However, with the emergence of the COVID-19 Omicron variant and concerns around tighter monetary policy from the U.S. Federal Reserve (the “Fed”) at the end of the month, global equities experienced a sharp sell-off, more than erasing earlier month gains, and bond yields declined. High yield corporate bonds edged down, as investor sentiment was challenged by interest rate volatility, softer oil prices, concerns about the Omicron variant and high levels of supply. |

| • | After a weak November, global equities recovered strongly in December 2021 and bond yields generally rose, as financial markets proved rather immune to rising COVID-19 cases due to the lower severity of the Omicron variant and in line with healthy economic growth globally and expectations of tighter monetary policy in the U.S. and Europe. High yield corporate bonds posted modest gains as investor risk appetite improved. |

| • | In response to higher inflationary pressures, the U.S. Fed signaled a more aggressive interest rate hike path than it had previously indicated and announced its plan to double the pace of its asset purchase tapering beginning in January 2022. |

| • | Entering 2022, the rapidly evolving outlook for inflation and Fed policy had already complicated the macroeconomic outlook, but the February Russian invasion of Ukraine significantly increased uncertainty and volatility. |

| • | For the first quarter of 2022 overall, valuations declined broadly across multiple asset classes. Credit spreads widened as bond yields simultaneously rose in response to inflationary pressures. Against this backdrop, high yield corporate bonds retreated. Global equities, both in the developed and emerging markets, declined significantly. |

| • | Fed officials raised short-term interest rates by 25 basis points in March, the first U.S. rate hike since the end of 2018. (A basis point is 1/100th of a percentage point.) Fed officials also forecast six more increases by the end of 2022. |

| • | Elsewhere, the Bank of England and Norway’s central bank raised their policy interest rates. The European Central Bank (“ECB”) delivered a hawkish message but did not hike rates, signaling its asset purchases would conclude in the third quarter of 2022 and suggesting to many that ECB policymakers were more focused on upside inflation risks than on downside economic growth risks. |

| • | April 2022 proved to be another difficult month for capital markets, as both equities and fixed income markets were down sharply, pressured by sustained high inflation, hawkish central banks and the prolonged conflict in Ukraine. (Hawkish tends to suggest higher interest rates; opposite of dovish.) |

1

MARKET REVIEW

U.S. Equities

| • | Overall, U.S. equities struggled during the Reporting Period. The Standard & Poor’s 500 Index (the “S&P 500 Index”) ended the Reporting Period with a return of -9.65%. The Russell 3000® Index generated a return of -11.75%. |

| • | Persistent supply-chain disruptions, hawkish Fed policy and inflationary pressures remained the common themes during the Reporting Period, while the biggest headlines were the COVID-19 variants and the start of the yet ongoing Russia/Ukraine war. |

| • | As the Reporting Period began in November 2021, the S&P 500 Index fell, though retail earnings upside surprises and hints of easing supply chain constraints supported the U.S. equity market’s upward trajectory through most of the month. |

| • | Later in November, a $1 trillion infrastructure bill was signed into law, and Fed Chair Powell was appointed for a second term, bringing clarity to the Fed’s leadership. |

| • | However, renewed concerns around COVID-19 developments pressured U.S. equities, with the emergence of the more contagious Omicron variant triggering a sell-off. Persistently high inflation also weighed on market sentiment. |

| • | In December, the S&P 500 Index rebounded despite record COVID-19 case counts in many population centers in the U.S., as studies showed the variant was generally accompanied by milder symptoms than previous variants. |

| • | Positive seasonality and the so-called “Santa Rally” also lifted the S&P 500 Index towards the end of the month. |

| • | The Fed walked back its use of “transitory” in describing the inflationary environment, announced it would double its pace of asset purchase tapering and indicated potential interest rate hikes in 2022. |

| • | The S&P 500 Index fell in the first quarter of 2022, marking its first quarterly decline since the first quarter of 2020. |

| • | The dramatic repricing of the Fed’s interest rate hike path and expectations for a more aggressive balance sheet runoff phase were accelerated due to concerns about elevated and persistent inflation pressures. |

| • | Tensions arising from geopolitical conflict, most notably Russia’s invasion of Ukraine, also brought about concern, as commodity prices became volatile and the global supply chain came back into question. |

| • | Dampened corporate earnings momentum, the velocity and magnitude of the U.S. Treasury yield increase, and the overhang of the Omicron variant bringing about supply chain issues and worker shortages further played into the bearish narrative during the quarter. |

| • | In April 2022, the S&P 500 Index decreased, as U.S. equities remained under pressure, ending the month with its worst one-day return since June 11, 2020 and in correction territory. |

| • | First quarter inflation, as measured by the Consumer Price Index, was reported in April, with the 8.5% year-over-year increase marking the largest 12-month advance since December 1981. |

| • | Later in the month, Fed Chair Powell confirmed a 50 basis point interest rate hike was on the table for May 2022 and that the Fed was expected to formally announce the start of its balance sheet runoff. |

| • | Geopolitical overhang brought concern, as it affected energy prices, leading, in turn, to low consumer sentiment and potentially changing consumer spending trends. |

| • | Moreover, tightening financial conditions, spans of yield curve inversion (meaning short-term U.S. Treasury yields were higher than longer-term U.S. Treasury yields) and negative real wage growth dynamics drove some recession talk. |

| • | China’s unwillingness to deviate from its zero-tolerance approach to COVID-19 and related lockdowns affecting supply chains as well as labor shortages and negative U.S. Gross Domestic Product growth for the first quarter of 2022 were also prevalent themes for the month even as the U.S. labor market remained strong and early corporate earnings reports highlighted a number of positive themes. |

2

MARKET REVIEW

| • | For the Reporting Period overall, all segments of the U.S. equity market declined, but value stocks significantly outperformed growth stocks across the capitalization spectrum in part as a potential byproduct of anticipated higher interest rates in the near term. |

| • | The best performing sectors within the S&P 500 Index during the Reporting Period were energy, consumer staples, utilities and materials, while the weakest performing sectors were communication services, consumer discretionary, financials and information technology. |

Energy MLPs

| • | During the Reporting Period, commodity prices saw significant strength, with West Texas Intermediate (“WTI”) crude oil and natural gas prices up 30.60% and 33.51%, respectively. |

| • | Early in the Reporting Period, commodity prices moved higher, as the market reacted to an emerging “energy crisis” amid rebounding economic activity and disciplined commodities supply. |

| • | Later in November 2021, concerns around the spread of the COVID-19 Omicron variant drove a brief but sharp sell-off in commodities and energy-related equities. The spread of the Omicron variant raised concerns about the potential impact on near-term demand. However, data suggested that although highly transmissible, the variant was “less severe,” which ultimately helped ease market fears. |

| • | Despite the brief sell-off, the fundamental backdrop for commodities remained strong heading into 2022. |

| • | U.S. oil demand continued to tick higher, and supply struggled to keep pace given years of upstream1 capital expenditure cuts, strong discipline from OPEC+2 and U.S. producers remaining focused on maximizing free cash flow. |

| • | This dynamic ultimately led to undersupplied energy markets, which were exacerbated by the Russian invasion of Ukraine on February 24th, given Russia’s position as a major global exporter of crude oil and natural gas. |

| • | Following the invasion of Ukraine, crude oil prices reached $128 per barrel — their highest level since 2008 — and continued to experience significant volatility through the end of the Reporting Period driven by developments surrounding the Russia/Ukraine conflict, the possibility of a European Union ban on Russian oil and potential oil demand-side concerns stemming from rising COVID-19 cases and lockdown procedures in China. |

| • | While the midstream3 energy markets traded alongside the volatility in crude oil prices during April 2022, driven by geopolitical developments and China lockdown procedures, the sector continued to outperform the broader U.S. equity markets. |

| • | For the Reporting Period as a whole, midstream energy markets moved higher alongside strong commodity prices. |

| • | The Alerian MLP Index4, which measures energy infrastructure master limited partnerships (“MLPs”), and the Alerian Midstream Energy Index5, which measures the broader midstream sector inclusive of both energy MLPs and “C” corporations, generated total returns of 13.70% and 13.90%, respectively, during the Reporting Period, significantly outperforming broader equity markets, as represented by the -9.65% return of the S&P 500 Index. |

| 1 | The upstream component of the energy industry is usually defined as those operations stages in the oil and gas industry that involve exploration and production. Upstream operations deal primarily with the exploration stages of the oil and gas industry, with upstream firms taking the first steps to first locate, test and drill for oil and gas. Later, once reserves are proven, upstream firms will extract any oil and gas from the reserve. |

| 2 | OPEC+ is comprised of the Organization of the Petroleum Exporting Countries (“OPEC”) and Russia. |

| 3 | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side (i.e., energy producers) and the demand side (i.e., energy end-users for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport energy commodities. |

| 4 | Source: Alerian. The Alerian MLP Index is the leading gauge of energy infrastructure MLPs. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). It is not possible to invest directly in an unmanaged index. |

| 5 | Source: Alerian. The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return (AMNA), total-return (AMNAX), net total-return (AMNAN), and adjusted net total-return (AMNTR) basis. It is not possible to invest directly in an unmanaged index. |

3

MARKET REVIEW

| • | In our view, midstream fundamentals remained, at the end of the Reporting Period, the healthiest on record. |

| • | Management teams were no longer prioritizing growth and instead focusing on capital discipline, balance sheet strength, and above all, generating free cash flow and returning it back to investors via dividends and buybacks. |

| • | At the same time, from a valuation perspective, the midstream sector screened as inexpensive, trading at a 3.1x discount to the S&P 500 Index on an enterprise value/earnings before interest, taxes, depreciation and amortization (“EBITDA”) basis, which was far below the long-term average premium of 1.2x versus the S&P 500 Index. |

| • | The midstream sector continued to offer some of the highest yields in the equity asset class at the end of the Reporting Period, with the Alerian MLP Index yielding more than 7%, which was five times that of the S&P 500 Index and twice the yields of both utilities and real estate investment trusts. |

| • | Strong oil and natural gas prices supported earnings momentum across the sector with the majority of the top U.S. midstream companies beating consensus EBITDA expectations for the fourth quarter of 2021.6 |

| • | The midstream sector benefited, we believe, not only from this constructive fundamental backdrop during the Reporting Period but also from technical factors including strong money flows from energy equity investors. |

Fund Changes and Highlights

Goldman Sachs Income Builder Fund

| • | Effective January 3, 2022, Alexandra Wilson-Elizondo became a portfolio manager for the Fund, joining Ashish Shah, Ron Arons, Collin Bell, Charles “Brook” Dane and Neill Nuttall. |

Goldman Sachs Rising Dividend Growth Fund

| • | While posting disappointing absolute returns, the Fund outperformed its benchmark, the Standard & Poor’s® 500 Index (with dividends reinvested) (the “S&P 500 Index”), on a relative basis during the Reporting Period. |

| • | The Fund’s dividend-paying investments outperformed the S&P 500 ex-Energy Index, the benchmark used for the dividend-paying growers portion of the Fund, during the Reporting Period. |

| • | While sector allocations are the result of stock selection in the dividend-paying growers portion of the Fund, having an average underweight in communication services was a significant positive contributor to relative returns during the Reporting Period. Effective stock selection in the communication services, information technology and materials sectors also added notable value. |

| • | These positive contributors were only partially offset by having an average underweight position in the utilities sector and by weaker stock selection in the utilities, financials, industrials, consumer staples and health care sectors, which detracted from relative performance during the Reporting Period. |

| • | Further, not holding certain individual stocks that outperformed the S&P 500 ex-Energy Index during the Reporting Period —including Apple, Berkshire Hathaway, Johnson & Johnson, Procter & Gamble and AbbVie — dampened relative results. |

| • | The Fund’s MLP & Energy Infrastructure Sleeve outperformed the Alerian MLP Index, the benchmark used for the MLP & Energy Infrastructure Sleeve of the Fund, during the Reporting Period. |

| • | Relative overweights to the gathering & processing and integrated sub-industries contributed most positively. These sub-industries benefited from the strong recovery in crude oil and natural gas liquid prices during the Reporting Period given that these sub-industries are close to the wellhead and therefore tend to be sensitive to commodity price movements. |

| 6 | Ten of the top 15 U.S. midstream companies in the Alerian US Midstream Energy Index beat consensus EBITDA expectations for the fourth quarter of 2021. |

4

MARKET REVIEW

| • | Stock selection in and a relative underweight to the pipeline transportation/petroleum sub-industry added value as well. This sub-industry benefited from the strong commodity backdrop but to a lesser degree, as the companies within this sub-industry generally have lower commodity price beta, or volatility of returns relative to the overall market. Our focus within the sub-industry was on what the Goldman Sachs Energy Infrastructure & Renewables Team viewed as high quality companies with strong dividend/distribution coverage, cash flow growth potential, a robust outlook for free cash flow generation and a healthy balance sheet. |

| • | These positive contributors were only partially offset by having an overweight exposure to the power generation sub-industry, particularly renewable power generation companies, which detracted. During the Reporting Period, concerns around inflation and higher U.S. interest rates drove a broad rotation from growth to value stocks, which ultimately weighed on the clean energy sector, including renewable power generation companies. |

5

Income Builder Fund

as of April 30, 2022

| PERFORMANCE REVIEW |

| |||||||||||||

| November 1, 2021–April 30, 2022 | Fund Total Return (based on NAV)1 | Russell 1000® Value Index2 | ICE BofAML BB to B U.S. High Yield Constrained Index3 | |||||||||||

Class A | -5.84 | % | -3.94 | % | -7.16 | % | ||||||||

Class C | -6.19 | -3.94 | -7.16 | |||||||||||

Institutional | -5.69 | -3.94 | -7.16 | |||||||||||

Investor | -5.75 | -3.94 | -7.16 | |||||||||||

Class R6 | -5.72 | -3.94 | -7.16 | |||||||||||

Class P | -5.68 | -3.94 | -7.16 | |||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. This index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. It is not possible to invest directly in an unmanaged index. |

| 3 | The ICE BofAML BB to B U.S. High Yield Constrained Index contains all securities in the ICE BofAML U.S. High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. Similarly, the face values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6

FUND BASICS

| TOP TEN EQUITY HOLDINGS AS OF 4/30/224 | ||||||||

Holding | % of Net Assets | Line of Business | ||||||

JPMorgan Chase & Co. | 1.0 | % | Banks | |||||

Johnson & Johnson | 0.9 | Pharmaceuticals | ||||||

UnitedHealth Group, Inc. | 0.9 | Health Care Providers & Services | ||||||

Bristol-Myers Squibb Co. | 0.9 | Pharmaceuticals | ||||||

Schneider Electric SE ADR | 0.8 | Electrical Equipment | ||||||

Shell PLC ADR | 0.7 | Oil, Gas & Consumable Fuels | ||||||

Bank of America Corp. | 0.7 | Banks | ||||||

Zurich Insurance Group AG ADR | 0.7 | Insurance | ||||||

Medtronic PLC | 0.7 | Health Care Equipment & Supplies | ||||||

Nordea Bank Abp ADR | 0.7 | Banks | ||||||

| 4 | The top 10 holdings may not be representative of the Fund's future investments. |

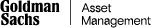

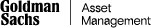

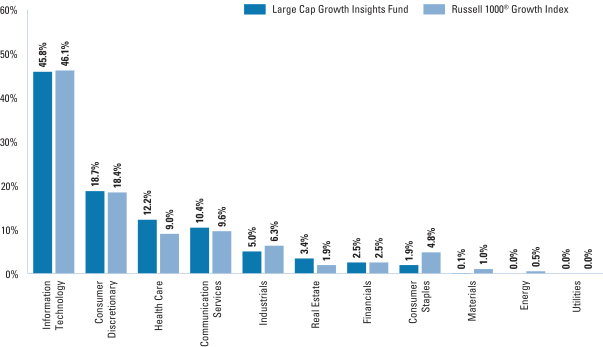

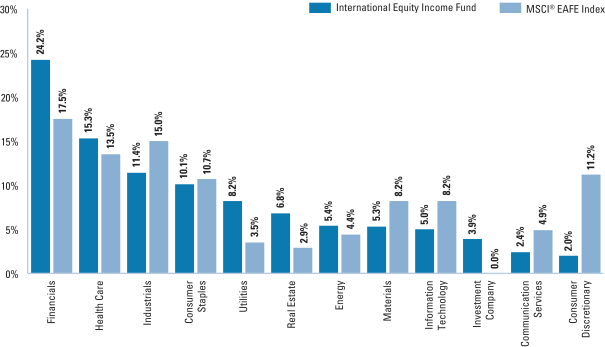

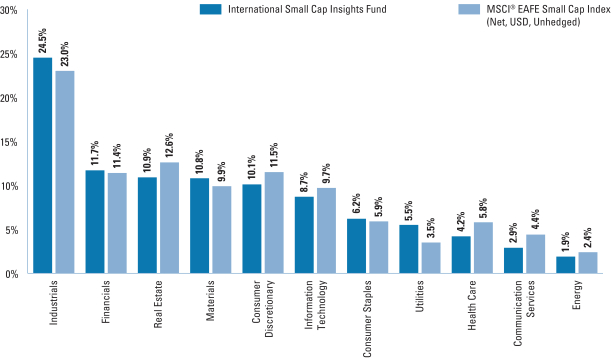

| FUND’S EQUITY SECTOR ALLOCATIONS VS. BENCHMARK5 | ||||||

| As of April 30, 2022 | ||||||

| 5 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund's overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard ("GICS"), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of the total value of the Fund's Equity investments. The graph depicts the Fund's investments but may not represent the Fund's market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

7

FUND BASICS

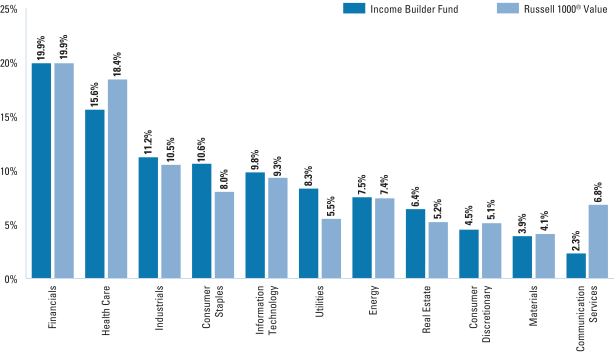

| FUND’S FIXED INCOME COMPOSITION6 |

| 6 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of the Fund's Fixed Income investments. The graph depicts the Fund's investments but may not represent the Fund's market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

8

FUND BASICS

Rising Dividend Growth Fund

as of April 30, 2022

| PERFORMANCE REVIEW |

| |||||||||

| November 1, 2021–April 30, 2022 | Fund Total Return (based on NAV)1 | S&P 500 Index2 | ||||||||

Class A | -5.14 | % | -9.65 | % | ||||||

Class C | -5.51 | -9.65 | ||||||||

Institutional | -4.99 | -9.65 | ||||||||

Investor | -4.96 | -9.65 | ||||||||

Class R6 | -4.92 | -9.65 | ||||||||

Class R | -5.21 | -9.65 | ||||||||

Class P | -4.99 | -9.65 | ||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The S&P 500 Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

FUND BASICS

| TOP TEN HOLDINGS AS OF 4/30/223 | ||||||||

| �� | Holding | % of Net Assets | Line of Business | |||||

Comcast Corp. Class A | 2.1 | % | Media | |||||

NextEra Energy, Inc. | 2.1 | Electric Utilities | ||||||

Activision Blizzard, Inc. | 2.1 | Entertainment | ||||||

MPLX LP | 1.9 | Oil, Gas & Consumable Fuels | ||||||

Energy Transfer LP | 1.8 | Oil, Gas & Consumable Fuels | ||||||

Western Midstream Partners LP | 1.8 | Oil, Gas & Consumable Fuels | ||||||

Mastercard, Inc. Class A | 1.6 | IT Services | ||||||

Visa, Inc. Class A | 1.6 | IT Services | ||||||

Microsoft Corp. | 1.5 | Software | ||||||

QUALCOMM, Inc. | 1.5 | Semiconductors & Semiconductor Equipment | ||||||

| 3 | The top 10 holdings may not be representative of the Fund’s future investments. The top 10 holdings exclude investments in money market funds. |

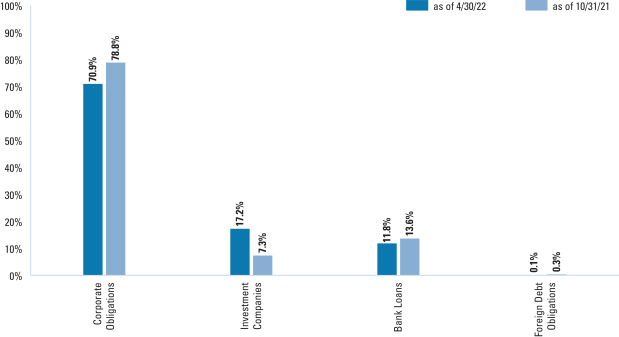

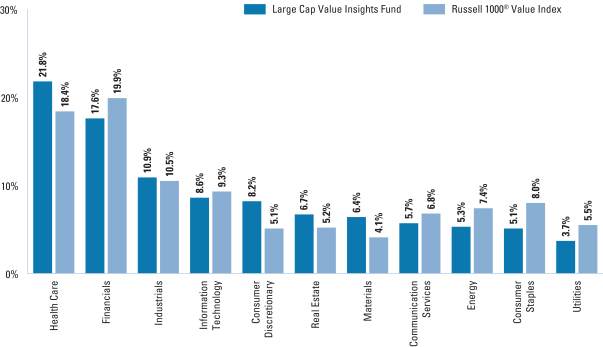

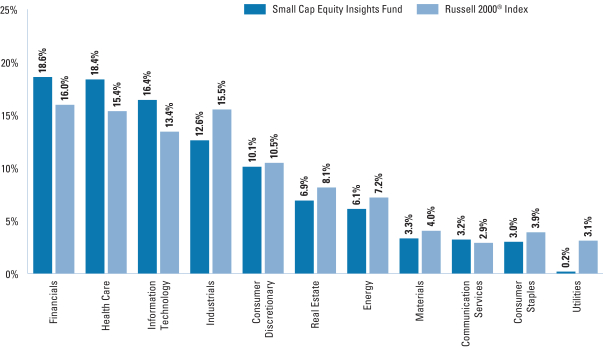

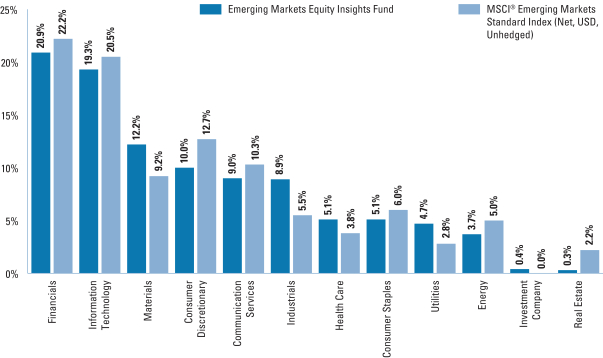

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

| As of April 30, 2022 |

| 4 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investments in securities lending reinvestment vehicle, if any). The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

10

PORTFOLIO RESULTS

Index Definition

Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

MSCI World Index captures large and mid cap representation across 23 Developed Markets countries which include Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US.. With 1,539 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets countries which include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. With 1,398 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

11

GOLDMAN SACHS INCOME BUILDER FUND

April 30, 2022 (Unaudited)

| Shares | Description | Value | ||||||

| Common Stocks – 37.8% | ||||||||

| Aerospace & Defense – 0.5% | ||||||||

| 50,057 | L3Harris Technologies, Inc. | $ | 11,626,239 | |||||

|

| |||||||

| Banks – 3.9% | ||||||||

| 450,337 | Bank of America Corp. | 16,068,024 | ||||||

| 434,861 | BNP Paribas SA ADR | 11,258,551 | ||||||

| 198,767 | JPMorgan Chase & Co. | 23,724,829 | ||||||

| 80,085 | M&T Bank Corp. | 13,345,365 | ||||||

| 1,556,813 | Nordea Bank Abp ADR | 15,723,811 | ||||||

| 236,060 | Truist Financial Corp. | 11,413,501 | ||||||

|

| |||||||

| 91,534,081 | ||||||||

|

| |||||||

| Beverages – 0.7% | ||||||||

| 60,985 | Coca-Cola Europacific Partners PLC | 3,046,201 | ||||||

| 188,057 | The Coca-Cola Co. | 12,150,363 | ||||||

|

| |||||||

| 15,196,564 | ||||||||

|

| |||||||

| Biotechnology – 0.3% | ||||||||

| 27,920 | Amgen, Inc. | 6,510,665 | ||||||

|

| |||||||

| Capital Markets – 0.9% | ||||||||

| 13,077 | BlackRock, Inc. | 8,168,940 | ||||||

| 91,688 | Morgan Stanley | 7,389,136 | ||||||

| 59,418 | Singapore Exchange Ltd. ADR | 6,307,815 | ||||||

|

| |||||||

| 21,865,891 | ||||||||

|

| |||||||

| Chemicals – 0.7% | ||||||||

| 23,093 | Air Products & Chemicals, Inc. | 5,405,378 | ||||||

| 38,535 | Linde PLC | 12,021,379 | ||||||

|

| |||||||

| 17,426,757 | ||||||||

|

| |||||||

| Commercial Services & Supplies – 0.6% | ||||||||

| 102,594 | Republic Services, Inc. | 13,775,296 | ||||||

|

| |||||||

| Communications Equipment – 0.9% | ||||||||

| 300,718 | Cisco Systems, Inc. | 14,729,167 | ||||||

| 35,606 | Intelsat Emergence SA | 1,126,040 | ||||||

| 156,086 | Juniper Networks, Inc. | 4,919,831 | ||||||

|

| |||||||

| 20,775,038 | ||||||||

|

| |||||||

| Construction & Engineering – 0.3% | ||||||||

| 284,572 | Vinci SA ADR | 6,829,728 | ||||||

|

| |||||||

| Consumer Finance – 0.4% | ||||||||

| 54,047 | American Express Co. | 9,442,551 | ||||||

|

| |||||||

| Containers & Packaging – 0.2% | ||||||||

| 108,738 | International Paper Co. | 5,032,395 | ||||||

|

| |||||||

| Diversified Telecommunication Services – 0.7% | ||||||||

| 811,562 | AT&T, Inc. | 15,306,059 | ||||||

|

| |||||||

| Electric Utilities – 1.3% | ||||||||

| 1,699,227 | Enel SpA ADR | 10,943,022 | ||||||

| 191,905 | NextEra Energy, Inc. | 13,629,093 | ||||||

| 90,901 | Xcel Energy, Inc. | 6,659,407 | ||||||

|

| |||||||

| 31,231,522 | ||||||||

|

| |||||||

| Common Stocks – (continued) | ||||||||

| Electrical Equipment – 1.4% | ||||||||

| 98,703 | Eaton Corp. PLC | $ | 14,313,909 | |||||

| 630,886 | Schneider Electric SE ADR | 17,961,324 | ||||||

|

| |||||||

| 32,275,233 | ||||||||

|

| |||||||

| Electronic Equipment, Instruments & Components – 0.3% | ||||||||

| 54,717 | TE Connectivity Ltd. | 6,827,587 | ||||||

|

| |||||||

| Energy Equipment & Services(a) – 0.1% | ||||||||

| 84,943 | Noble Corp. | 2,712,230 | ||||||

|

| |||||||

| Equity Real Estate Investment Trusts (REITs) – 2.4% | ||||||||

| 49,202 | Alexandria Real Estate Equities, Inc. | 8,962,636 | ||||||

| 44,616 | American Tower Corp. | 10,753,348 | ||||||

| 39,127 | AvalonBay Communities, Inc. | 8,900,610 | ||||||

| 39,066 | Boston Properties, Inc. | 4,594,162 | ||||||

| 79,672 | Duke Realty Corp. | 4,362,042 | ||||||

| 115,306 | Healthpeak Properties, Inc. | 3,783,190 | ||||||

| 181,238 | Hudson Pacific Properties, Inc. | 4,219,221 | ||||||

| 206,746 | Ventas, Inc. | 11,484,740 | ||||||

|

| |||||||

| 57,059,949 | ||||||||

|

| |||||||

| Food & Staples Retailing – 0.3% | ||||||||

| 52,305 | Walmart, Inc. | 8,002,142 | ||||||

|

| |||||||

| Food Products – 1.9% | ||||||||

| 76,515 | Archer-Daniels-Midland Co. | 6,852,683 | ||||||

| 125,443 | General Mills, Inc. | 8,872,583 | ||||||

| 49,017 | McCormick & Co., Inc. | 4,929,640 | ||||||

| 141,430 | Mondelez International, Inc. Class A | 9,119,407 | ||||||

| 106,375 | Nestle SA ADR | 13,684,080 | ||||||

|

| |||||||

| 43,458,393 | ||||||||

|

| |||||||

| Health Care Equipment & Supplies – 1.0% | ||||||||

| 151,837 | Medtronic PLC | 15,845,709 | ||||||

| 52,611 | Zimmer Biomet Holdings, Inc. | 6,352,778 | ||||||

| 5,261 | Zimvie, Inc.(a) | 118,373 | ||||||

|

| |||||||

| 22,316,860 | ||||||||

|

| |||||||

| Health Care Providers & Services – 1.5% | ||||||||

| 147,635 | CVS Health Corp. | 14,192,153 | ||||||

| 41,644 | UnitedHealth Group, Inc. | 21,178,056 | ||||||

|

| |||||||

| 35,370,209 | ||||||||

|

| |||||||

| Hotels, Restaurants��& Leisure – 1.0% | ||||||||

| 47,131 | McDonald’s Corp. | 11,743,160 | ||||||

| 42,526 | Starbucks Corp. | 3,174,141 | ||||||

| 62,925 | Yum! Brands, Inc. | 7,362,854 | ||||||

|

| |||||||

| 22,280,155 | ||||||||

|

| |||||||

| Household Products – 1.2% | ||||||||

| 60,652 | Kimberly-Clark Corp. | 8,420,317 | ||||||

| 32,302 | The Clorox Co. | 4,634,368 | ||||||

| 97,772 | The Procter & Gamble Co. | 15,697,295 | ||||||

|

| |||||||

| 28,751,980 | ||||||||

|

| |||||||

| 12 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| Shares | Description | Value | ||||||

| Common Stocks – (continued) | ||||||||

| Industrial Conglomerates – 0.5% | ||||||||

| 55,558 | Honeywell International, Inc. | $ | 10,751,029 | |||||

|

| |||||||

| Insurance – 2.1% | ||||||||

| 57,493 | Chubb Ltd. | 11,869,430 | ||||||

| 53,639 | Marsh & McLennan Cos., Inc. | 8,673,426 | ||||||

| 176,940 | MetLife, Inc. | 11,621,419 | ||||||

| 354,323 | Zurich Insurance Group AG ADR | 16,001,227 | ||||||

|

| |||||||

| 48,165,502 | ||||||||

|

| |||||||

| IT Services – 1.3% | ||||||||

| 23,409 | Accenture PLC Class A | 7,031,127 | ||||||

| 87,579 | Cognizant Technology Solutions Corp. Class A | 7,085,141 | ||||||

| 59,024 | Fidelity National Information Services, Inc. | 5,852,230 | ||||||

| 74,302 | International Business Machines Corp. | 9,823,467 | ||||||

|

| |||||||

| 29,791,965 | ||||||||

|

| |||||||

| Machinery – 0.7% | ||||||||

| 38,428 | Cummins, Inc. | 7,270,193 | ||||||

| 51,033 | Illinois Tool Works, Inc. | 10,059,115 | ||||||

|

| |||||||

| 17,329,308 | ||||||||

|

| |||||||

| Media – 0.1% | ||||||||

| 194,739 | Bright Pattern Holding Co.(b) | 9,737 | ||||||

| 85,038 | The New York Times Co. Class A | 3,258,656 | ||||||

|

| |||||||

| 3,268,393 | ||||||||

|

| |||||||

| Metals & Mining – 0.5% | ||||||||

| 180,605 | Rio Tinto PLC ADR | 12,844,628 | ||||||

|

| |||||||

| Multi-Utilities – 1.5% | ||||||||

| 101,680 | Ameren Corp. | 9,446,072 | ||||||

| 124,474 | CMS Energy Corp. | 8,550,119 | ||||||

| 120,920 | National Grid PLC ADR | 8,967,427 | ||||||

| 54,312 | Sempra Energy | 8,763,785 | ||||||

|

| |||||||

| 35,727,403 | ||||||||

|

| |||||||

| Multiline Retail – 0.4% | ||||||||

| 43,286 | Target Corp. | 9,897,344 | ||||||

|

| |||||||

| Oil, Gas & Consumable Fuels – 2.8% | ||||||||

| 1,000 | Chesapeake Energy Corp. | 82,020 | ||||||

| 79,436 | Chevron Corp. | 12,445,238 | ||||||

| 142,691 | ConocoPhillips | 13,629,844 | ||||||

| 189,153 | Devon Energy Corp. | 11,003,030 | ||||||

| 4,135 | Noble Corp. | 132,031 | ||||||

| 40,884 | Pioneer Natural Resources Co. | 9,504,304 | ||||||

| 304,945 | Shell PLC ADR | 16,293,211 | ||||||

| 86,915 | Summit Midstream Partners LP(a) | 1,474,078 | ||||||

|

| |||||||

| 64,563,756 | ||||||||

|

| |||||||

| Pharmaceuticals – 3.2% | ||||||||

| 109,401 | AstraZeneca PLC ADR | 7,264,226 | ||||||

| 271,022 | Bristol-Myers Squibb Co. | 20,399,826 | ||||||

| 49,369 | Eli Lilly & Co. | 14,422,166 | ||||||

|

| |||||||

| Common Stocks – (continued) | ||||||||

| Pharmaceuticals – (continued) | ||||||||

| 122,568 | Johnson & Johnson | $ | 22,118,621 | |||||

| 130,254 | Novartis AG ADR | 11,466,260 | ||||||

|

| |||||||

| 75,671,099 | ||||||||

|

| |||||||

| Road & Rail – 0.3% | ||||||||

| 33,547 | Union Pacific Corp. | 7,859,727 | ||||||

|

| |||||||

| Semiconductors & Semiconductor Equipment – 1.0% | ||||||||

| 25,687 | KLA Corp. | 8,200,832 | ||||||

| 132,254 | Marvell Technology, Inc. | 7,681,312 | ||||||

| 40,875 | Texas Instruments, Inc. | 6,958,969 | ||||||

|

| |||||||

| 22,841,113 | ||||||||

|

| |||||||

| Software – 0.2% | ||||||||

| 18,538 | Microsoft Corp. | 5,144,666 | ||||||

|

| |||||||

| Specialty Retail – 0.3% | ||||||||

| 21,862 | Advance Auto Parts, Inc. | 4,364,311 | ||||||

| 11,642 | The Home Depot, Inc. | 3,497,257 | ||||||

|

| |||||||

| 7,861,568 | ||||||||

|

| |||||||

| Technology Hardware, Storage & Peripherals – 0.1% | ||||||||

| 45,337 | NetApp, Inc. | 3,320,935 | ||||||

|

| |||||||

| Water Utilities – 0.3% | ||||||||

| 46,955 | American Water Works Co., Inc. | 7,234,826 | ||||||

|

| |||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $721,398,850) | $ | 887,880,786 | ||||||

|

| |||||||

| Shares | Dividend Rate | Value | ||||||

| Preferred Stocks(c) – 0.4% | ||||||||

| Capital Markets(d) – 0.2% | ||||||||

Morgan Stanley, Inc. (3M USD LIBOR + 3.708%) |

| |||||||

| 183,597 | 6.375 | % | $ | 4,779,030 | ||||

| ||||||||

| Diversified Telecommunication Services – 0.1% | ||||||||

Qwest Corp. |

| |||||||

| 43,276 | 6.500 | 967,219 | ||||||

| ||||||||

| Insurance(d) – 0.1% | ||||||||

Delphi Financial Group, Inc. (3M USD LIBOR + 3.190%) |

| |||||||

| 143,849 | 3.696 | 2,948,904 | ||||||

| ||||||||

| TOTAL PREFERRED STOCKS |

| |||||||

| (Cost $8,780,987) |

| $ | 8,695,153 | |||||

| ||||||||

| Principal Amount | Interest Rate | Maturity Date | Value | |||||||||||

| Corporate Obligations – 42.0% | ||||||||||||||

| Advertising(c)(e) – 0.1% | ||||||||||||||

Terrier Media Buyer, Inc. | ||||||||||||||

| $ | 2,850,000 | 8.875 | % | 12/15/27 | $ | 2,778,750 | ||||||||

|

| |||||||||||||

| The accompanying notes are an integral part of these financial statements. | 13 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments (continued)

April 30, 2022 (Unaudited)

| Principal Amount | Interest Rate | Maturity Date | Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Aerospace & Defense(c) – 0.7% | ||||||||||||||

Bombardier, Inc.(e) | ||||||||||||||

| $ | 900,000 | 7.500 | % | 12/01/24 | $ | 895,500 | ||||||||

| 998,000 | 7.500 | 03/15/25 | 968,060 | |||||||||||

Spirit AeroSystems, Inc. | ||||||||||||||

| 4,715,000 | 4.600 | 06/15/28 | 4,066,687 | |||||||||||

The Boeing Co. | ||||||||||||||

| 3,432,000 | 5.150 | 05/01/30 | 3,418,032 | |||||||||||

| 1,652,000 | 5.805 | 05/01/50 | 1,652,958 | |||||||||||

TransDigm, Inc. | ||||||||||||||

| 3,300,000 | 5.500 | 11/15/27 | 3,019,500 | |||||||||||

| 315,000 | 4.625 | 01/15/29 | 273,263 | |||||||||||

| 266,000 | 4.875 | 05/01/29 | 232,750 | |||||||||||

Triumph Group, Inc. | ||||||||||||||

| 2,885,000 | 7.750 | 08/15/25 | 2,805,662 | |||||||||||

|

| |||||||||||||

| 17,332,412 | ||||||||||||||

|

| |||||||||||||

| Agriculture – 0.4% | ||||||||||||||

BAT Capital Corp.(c) | ||||||||||||||

| 10,000,000 | 4.390 | 08/15/37 | 8,516,600 | |||||||||||

MHP SE(a) | ||||||||||||||

| 270,000 | 7.750 | 05/10/24 | 136,350 | |||||||||||

|

| |||||||||||||

| 8,652,950 | ||||||||||||||

|

| |||||||||||||

| Airlines – 0.5% | ||||||||||||||

American Airlines, Inc./AAdvantage Loyalty IP Ltd.(e) | ||||||||||||||

| 522,000 | 5.500 | 04/20/26 | 517,433 | |||||||||||

| 1,717,000 | 5.750 | 04/20/29 | 1,648,320 | |||||||||||

Azul Investments LLP(c) | ||||||||||||||

| 200,000 | 5.875 | 10/26/24 | 178,225 | |||||||||||

| 200,000 | 7.250 | (e) | 06/15/26 | 170,725 | ||||||||||

Delta Air Lines, Inc.(c) | ||||||||||||||

| 3,600,000 | 7.375 | 01/15/26 | 3,834,000 | |||||||||||

| | Hawaiian Brand Intellectual Property Ltd./HawaiianMiles Loyalty | | ||||||||||||

| 2,155,000 | 5.750 | 01/20/26 | 2,095,737 | |||||||||||

United Airlines, Inc.(c)(e) | ||||||||||||||

| 1,625,000 | 4.375 | 04/15/26 | 1,564,062 | |||||||||||

| 2,080,000 | 4.625 | 04/15/29 | 1,908,400 | |||||||||||

|

| |||||||||||||

| 11,916,902 | ||||||||||||||

|

| |||||||||||||

| Automotive – 1.4% | ||||||||||||||

BorgWarner, Inc.(e) | ||||||||||||||

| 2,000,000 | 5.000 | 10/01/25 | 2,055,140 | |||||||||||

Clarios Global LP/Clarios U.S. Finance Co.(c)(e) | ||||||||||||||

| 1,850,000 | 8.500 | 05/15/27 | 1,852,313 | |||||||||||

Dana, Inc.(c) | ||||||||||||||

| 2,075,000 | 4.250 | 09/01/30 | 1,784,500 | |||||||||||

Dealer Tire LLC/DT Issuer LLC(c)(e) | ||||||||||||||

| 5,637,000 | 8.000 | 02/01/28 | 5,531,306 | |||||||||||

Ford Motor Co.(c) | ||||||||||||||

| 3,726,000 | 3.250 | 02/12/32 | 3,029,059 | |||||||||||

Ford Motor Credit Co. LLC(c) | ||||||||||||||

| 1,600,000 | 4.140 | 02/15/23 | 1,600,038 | |||||||||||

| 400,000 | 4.687 | 06/09/25 | 391,890 | |||||||||||

| 4,260,000 | 3.375 | 11/13/25 | 4,090,985 | |||||||||||

| 3,111,000 | 4.950 | 05/28/27 | 3,026,636 | |||||||||||

| 1,640,000 | 3.815 | 11/02/27 | 1,492,981 | |||||||||||

|

| |||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Automotive – (continued) | ||||||||||||||

General Motors Co.(c) | ||||||||||||||

| 3,000,000 | 6.600 | 04/01/36 | 3,234,390 | |||||||||||

General Motors Financial Co., Inc.(c) | ||||||||||||||

| 1,975,000 | 5.650 | 01/17/29 | 2,033,539 | |||||||||||

NIO, Inc.(f) | ||||||||||||||

| 190,000 | 0.000 | (g) | 02/01/26 | 158,758 | ||||||||||

| 40,000 | 0.500 | 02/01/27 | 31,698 | |||||||||||

Real Hero Merger Sub 2, Inc.(c)(e) | ||||||||||||||

| 360,000 | 6.250 | 02/01/29 | 292,500 | |||||||||||

Wheel Pros, Inc.(c)(e) | ||||||||||||||

| 1,420,000 | 6.500 | 05/15/29 | 1,070,325 | |||||||||||

|

| |||||||||||||

| 31,676,058 | ||||||||||||||

|

| |||||||||||||

| Banks – 2.8% | ||||||||||||||

Absa Group Ltd.(c)(d) (5 year CMT + 5.411%) | ||||||||||||||

| 460,000 | 6.375 | 12/31/99 | 437,000 | |||||||||||

Access Bank PLC | ||||||||||||||

| 400,000 | 6.125 | (e) | 09/21/26 | 373,700 | ||||||||||

(5 year CMT + 8.070%) | ||||||||||||||

| 460,000 | 9.125 | (c)(d) | 10/07/49 | 423,200 | ||||||||||

| | Alfa Bank AO Via Alfa Bond Issuance PLC(a)(c)(d) (5 year CMT + | | ||||||||||||

| 360,000 | 5.950 | 04/15/30 | 18,000 | |||||||||||

Banco BBVA Peru SA(c)(d) (5 year CMT + 2.750%) | ||||||||||||||

| 190,000 | 5.250 | 09/22/29 | 190,154 | |||||||||||

Banco Continental SAECA | ||||||||||||||

| 720,000 | 2.750 | 12/10/25 | 655,110 | |||||||||||

Banco Davivienda SA(c)(d)(e) (10 year CMT + 5.097%) | ||||||||||||||

| 220,000 | 6.650 | 12/31/99 | 196,460 | |||||||||||

Banco de Bogota SA | ||||||||||||||

| 330,000 | 6.250 | 05/12/26 | 327,896 | |||||||||||

Banco do Brasil SA(c)(d) (10 Year CMT + 4.398%) | ||||||||||||||

| 200,000 | 6.250 | 10/29/49 | 185,538 | |||||||||||

Banco Industrial SA/Guatemala(c)(d)(e) (5 Year CMT + 4.442%) | ||||||||||||||

| 930,000 | 4.875 | 01/29/31 | 881,175 | |||||||||||

Banco Mercantil del Norte SA(c)(d) | ||||||||||||||

(5 year CMT + 4.643%) | ||||||||||||||

| 340,000 | 5.875 | (e) | 12/31/99 | 301,708 | ||||||||||

(5 year CMT + 4.967%) | ||||||||||||||

| 690,000 | 6.750 | 12/31/99 | 663,176 | |||||||||||

Banco Santander SA | ||||||||||||||

| 2,000,000 | 3.490 | 05/28/30 | 1,821,040 | |||||||||||

Bank Hapoalim BM(c)(d)(e) (5 year CMT + 2.155%) | ||||||||||||||

| 460,000 | 3.255 | 01/21/32 | 414,000 | |||||||||||

Bank Leumi Le-Israel BM(c)(d)(e) (5 Year CMT + 1.631%) | ||||||||||||||

| 710,000 | 3.275 | 01/29/31 | 647,165 | |||||||||||

Bank of America Corp.(c)(d) (3M USD LIBOR + 3.898%) | ||||||||||||||

| 4,000,000 | 6.100 | 12/29/49 | 4,063,400 | |||||||||||

BBVA Bancomer SA(c)(d) (5 Year CMT + 2.650%) | ||||||||||||||

| 530,000 | 5.125 | 01/18/33 | 490,250 | |||||||||||

BNP Paribas SA(e) | ||||||||||||||

| 2,700,000 | 4.375 | 05/12/26 | 2,673,297 | |||||||||||

BPCE SA(e) | ||||||||||||||

| 4,150,000 | 4.625 | 09/12/28 | 4,119,497 | |||||||||||

Citigroup, Inc.(c)(d) | ||||||||||||||

(3M USD LIBOR + 4.517%) | ||||||||||||||

| 1,890,000 | 6.250 | 12/29/49 | 1,908,900 | |||||||||||

|

| |||||||||||||

| 14 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| Principal Amount | Interest Rate | Maturity Date | Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Banks – (continued) | ||||||||||||||

Citigroup, Inc.(c)(d) – (continued) | ||||||||||||||

(SOFR + 3.914%) | ||||||||||||||

| $ | 900,000 | 4.412 | % | 03/31/31 | $ | 879,651 | ||||||||

Credit Bank of Moscow Via CBOM Finance PLC | ||||||||||||||

| 260,000 | 4.700 | (e) | 01/29/25 | 37,700 | ||||||||||

(5 Year USD Swap + 5.416%) | ||||||||||||||

| 280,000 | 7.500 | (c)(d) | 10/05/27 | 35,000 | ||||||||||

Credit Suisse Group AG(c)(d)(e) (5 Year USD Swap + 4.598%) | ||||||||||||||

| 1,702,000 | 7.500 | 12/29/49 | 1,706,255 | |||||||||||

Deutsche Bank AG(c)(d) | ||||||||||||||

(5 Year CMT + 4.524%) | ||||||||||||||

| 800,000 | 6.000 | 12/31/99 | 748,000 | |||||||||||

(5 Year USD Swap + 2.248%) | ||||||||||||||

| 2,000,000 | 4.296 | 05/24/28 | 1,957,010 | |||||||||||

First Bank of Nigeria Ltd. Via FBN Finance Co. BV(e) | ||||||||||||||

| 200,000 | 8.625 | 10/27/25 | 198,500 | |||||||||||

Freedom Mortgage Corp.(c)(e) | ||||||||||||||

| 3,225,000 | 7.625 | 05/01/26 | 2,934,750 | |||||||||||

| 2,610,000 | 6.625 | 01/15/27 | 2,247,862 | |||||||||||

ING Groep NV(c)(d) (5 Year USD Swap + 4.446%) | ||||||||||||||

| 5,000,000 | 6.500 | 12/29/49 | 5,037,500 | |||||||||||

Intesa Sanpaolo SpA(e) | ||||||||||||||

| 8,000,000 | 5.017 | 06/26/24 | 7,904,000 | |||||||||||

Ipoteka-Bank ATIB | ||||||||||||||

| 450,000 | 5.500 | 11/19/25 | 401,850 | |||||||||||

Itau Unibanco Holding SA(c)(d) (5 Year CMT + 3.981%) | ||||||||||||||

| 500,000 | 6.125 | 12/31/99 | 481,375 | |||||||||||

JPMorgan Chase & Co.(c)(d) | ||||||||||||||

(3M USD LIBOR + 3.330%) | ||||||||||||||

| 4,000,000 | 6.125 | 12/31/49 | 4,005,200 | |||||||||||

(SOFR + 2.515%) | ||||||||||||||

| 441,000 | 2.956 | 05/13/31 | 387,820 | |||||||||||

Natwest Group PLC | ||||||||||||||

| 2,975,000 | 6.000 | 12/19/23 | 3,062,474 | |||||||||||

NBK Tier 1 Financing 2 Ltd.(c)(d) (6 Year USD Swap + 2.832%) | ||||||||||||||

| 790,000 | 4.500 | 12/31/99 | 755,092 | |||||||||||

Standard Chartered PLC(c)(d)(e) (5 Year CMT + 3.805%) | ||||||||||||||

| 4,255,000 | 4.750 | 12/31/99 | 3,629,302 | |||||||||||

| | Tinkoff Bank JSC Via TCS Finance Ltd.(c)(d)(e) (5 year CMT + | | ||||||||||||

| 200,000 | 6.000 | 12/31/49 | 10,000 | |||||||||||

Truist Financial Corp.(c)(d) (10 Year CMT + 4.349%) | ||||||||||||||

| 2,237,000 | 5.100 | 12/31/99 | 2,209,798 | |||||||||||

Turkiye Vakiflar Bankasi TAO | ||||||||||||||

| 200,000 | 6.000 | 11/01/22 | 199,140 | |||||||||||

UBS Group AG(c)(d) (5 Year USD Swap + 4.590%) | ||||||||||||||

| 4,000,000 | 6.875 | 12/29/49 | 4,050,000 | |||||||||||

UniCredit SpA(c)(d)(e) (5 Year CMT + 4.750%) | ||||||||||||||

| 1,525,000 | 5.459 | 06/30/35 | 1,376,206 | |||||||||||

United Bank for Africa PLC | ||||||||||||||

| 670,000 | 7.750 | 06/08/22 | 657,144 | |||||||||||

| 200,000 | 6.750 | 11/19/26 | 190,163 | |||||||||||

Uzbek Industrial and Construction Bank ATB | ||||||||||||||

| 600,000 | 5.750 | 12/02/24 | 541,950 | |||||||||||

Yapi ve Kredi Bankasi A/S(c)(d) (5 Year USD Swap + 11.245%) | ||||||||||||||

| 260,000 | 13.875 | 12/31/99 | 278,005 | |||||||||||

|

| |||||||||||||

| 66,712,413 | ||||||||||||||

|

| |||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Beverages(c) – 0.7% | ||||||||||||||

Anadolu Efes Biracilik Ve Malt Sanayii AS(e) | ||||||||||||||

| $ | 420,000 | 3.375 | % | 06/29/28 | $ | 345,450 | ||||||||

| | Anheuser-Busch Cos., LLC/Anheuser-Busch InBev Worldwide, | | ||||||||||||

| 8,050,000 | 4.700 | 02/01/36 | 7,972,881 | |||||||||||

| | Central American Bottling Corp./CBC Bottling Holdco SL/Beliv | | ||||||||||||

| 400,000 | 5.250 | 04/27/29 | 378,000 | |||||||||||

Constellation Brands, Inc. | ||||||||||||||

| 2,275,000 | 2.875 | 05/01/30 | 2,023,089 | |||||||||||

| 3,975,000 | 2.250 | 08/01/31 | 3,299,409 | |||||||||||

Keurig Dr Pepper, Inc. | ||||||||||||||

| 1,055,000 | 3.200 | 05/01/30 | 964,914 | |||||||||||

| 308,000 | 3.800 | 05/01/50 | 260,275 | |||||||||||

|

| |||||||||||||

| 15,244,018 | ||||||||||||||

|

| |||||||||||||

| Building Materials – 0.6% | ||||||||||||||

Builders FirstSource, Inc.(c)(e) | ||||||||||||||

| 1,187,000 | 6.750 | 06/01/27 | 1,221,126 | |||||||||||

| 1,800,000 | 5.000 | 03/01/30 | 1,656,000 | |||||||||||

Cemex SAB de CV(c)(d)(e) (5 year CMT + 4.534%) | ||||||||||||||

| 470,000 | 5.125 | 12/31/99 | 426,658 | |||||||||||

CP Atlas Buyer, Inc.(c)(e) | ||||||||||||||

| 2,160,000 | 7.000 | 12/01/28 | 1,803,600 | |||||||||||

DiversiTech Holdings, Inc.(d) | ||||||||||||||

(1M USD LIBOR) | ||||||||||||||

| 1,843,571 | 4.453 | 12/22/28 | 1,812,470 | |||||||||||

(1M USD LIBOR) | ||||||||||||||

| 625,000 | 7.453 | 12/21/29 | 606,250 | |||||||||||

Grupo Cementos De Chihuahua SAB de CV(c)(e) | ||||||||||||||

| 450,000 | 3.614 | 04/20/32 | 390,938 | |||||||||||

Masonite International Corp.(c)(e) | ||||||||||||||

| 2,075,000 | 5.375 | 02/01/28 | 1,986,813 | |||||||||||

Standard Industries, Inc.(c)(e) | ||||||||||||||

| 1,880,000 | 4.375 | 07/15/30 | 1,579,200 | |||||||||||

Standard Industries, Inc.(c)(e) | ||||||||||||||

| 4,054,000 | 3.375 | 01/15/31 | 3,273,605 | |||||||||||

|

| |||||||||||||

| 14,756,660 | ||||||||||||||

|

| |||||||||||||

| Chemicals – 0.8% | ||||||||||||||

Air Products & Chemicals, Inc.(c) | ||||||||||||||

| 200,000 | 2.800 | 05/15/50 | 155,566 | |||||||||||

Ashland LLC(c)(e) | ||||||||||||||

| 3,225,000 | 3.375 | 09/01/31 | 2,789,625 | |||||||||||

ASP Unifrax Holdings, Inc.(c)(e) | ||||||||||||||

| 1,025,000 | 5.250 | 09/30/28 | 900,719 | |||||||||||

Axalta Coating Systems LLC(c)(e) | ||||||||||||||

| 3,100,000 | 3.375 | 02/15/29 | 2,681,500 | |||||||||||

Braskem Netherlands Finance BV | ||||||||||||||

| 220,000 | 4.500 | 01/31/30 | 198,880 | |||||||||||

Herens Holdco S.a.r.l.(c)(e) | ||||||||||||||

| 1,795,000 | 4.750 | 05/15/28 | 1,604,281 | |||||||||||

INEOS Quattro Finance 2 PLC(c)(e) | ||||||||||||||

| 780,000 | 3.375 | 01/15/26 | 711,750 | |||||||||||

Ingevity Corp.(c)(e) | ||||||||||||||

| 1,305,000 | 3.875 | 11/01/28 | 1,167,975 | |||||||||||

|

| |||||||||||||

| The accompanying notes are an integral part of these financial statements. | 15 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments (continued)

April 30, 2022 (Unaudited)

| Principal Amount | Interest Rate | Maturity Date | Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Chemicals – (continued) | ||||||||||||||

Minerals Technologies, Inc.(c)(e) | ||||||||||||||

| $ | 1,695,000 | 5.000 | % | 07/01/28 | $ | 1,576,350 | ||||||||

Rayonier AM Products, Inc.(c)(e) | ||||||||||||||

| 281,000 | 7.625 | 01/15/26 | 266,247 | |||||||||||

Sasol Financing USA LLC(c) | ||||||||||||||

| 280,000 | 4.375 | 09/18/26 | 260,400 | |||||||||||

The Chemours Co.(c)(e) | ||||||||||||||

| 4,560,000 | 4.625 | 11/15/29 | 3,950,100 | |||||||||||

Tianqi Finco Co. Ltd. | ||||||||||||||

| 200,000 | 3.750 | 11/28/22 | 190,600 | |||||||||||

Valvoline, Inc.(c)(e) | ||||||||||||||

| 885,000 | 3.625 | 06/15/31 | 716,850 | |||||||||||

WR Grace Holdings LLC(c)(e) | ||||||||||||||

| 1,855,000 | 5.625 | 08/15/29 | 1,597,619 | |||||||||||

|

| |||||||||||||

| 18,768,462 | ||||||||||||||

|

| |||||||||||||

| Commercial Services – 1.2% | ||||||||||||||

Allied Universal Holdco LLC/Allied Universal Finance Corp.(c)(e) | ||||||||||||||

| 2,557,000 | 6.625 | 07/15/26 | 2,467,505 | |||||||||||

| 1,700,000 | 6.000 | 06/01/29 | 1,406,750 | |||||||||||

APi Escrow Corp.(c)(e) | ||||||||||||||

| 575,000 | 4.750 | 10/15/29 | 523,969 | |||||||||||

APi Group DE, Inc.(c)(e) | ||||||||||||||

| 4,304,000 | 4.125 | 07/15/29 | 3,857,460 | |||||||||||

APX Group, Inc.(c)(e) | ||||||||||||||

| 4,286,000 | 5.750 | 07/15/29 | 3,503,805 | |||||||||||

Avis Budget Car Rental LLC/Avis Budget Finance, Inc.(c)(e) | ||||||||||||||

| 1,605,000 | 5.375 | 03/01/29 | 1,516,725 | |||||||||||

HealthEquity, Inc.(c)(e) | ||||||||||||||

| 1,058,000 | 4.500 | 10/01/29 | 966,748 | |||||||||||

Limak Iskenderun Uluslararasi Liman Isletmeciligi AS(c)(e) | ||||||||||||||

| 200,000 | 9.500 | 07/10/36 | 184,725 | |||||||||||

Metis Merger Sub LLC(c)(e) | ||||||||||||||

| 717,000 | 6.500 | 05/15/29 | 623,790 | |||||||||||

NESCO Holdings II, Inc.(c)(e) | ||||||||||||||

| 3,083,000 | 5.500 | 04/15/29 | 2,905,728 | |||||||||||

North Queensland Export Terminal Pty Ltd. | ||||||||||||||

| 200,000 | 4.450 | 12/15/22 | 193,000 | |||||||||||

Rent-A-Center, Inc.(c)(e) | ||||||||||||||

| 850,000 | 6.375 | 02/15/29 | 735,250 | |||||||||||

Sabre Global, Inc.(c)(e) | ||||||||||||||

| 2,405,000 | 9.250 | 04/15/25 | 2,576,356 | |||||||||||

Techem Verwaltungsgesellschaft 674 MBH(c) | ||||||||||||||

| EUR | 668,190 | 6.000 | 07/30/26 | 692,360 | ||||||||||

The ADT Security Corp.(c)(e) | ||||||||||||||

| $ | 4,387,000 | 4.125 | 08/01/29 | 3,717,982 | ||||||||||

The Bidvest Group UK PLC(c)(e) | ||||||||||||||

| 470,000 | 3.625 | 09/23/26 | 430,050 | |||||||||||

Verisure Holding AB(c)(e) | ||||||||||||||

| EUR | 725,000 | 3.250 | 02/15/27 | 687,598 | ||||||||||

Verisure Midholding AB(c) | ||||||||||||||

| 800,000 | 5.250 | (e) | 02/15/29 | 751,276 | ||||||||||

| 1,450,000 | 5.250 | 02/15/29 | 1,360,603 | |||||||||||

|

| |||||||||||||

| 29,101,680 | ||||||||||||||

|

| |||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Commercial Services & Supplies – 0.0% | ||||||||||||||

Chesapeake Energy Corp. | ||||||||||||||

| $ | 2,000,000 | 5.500 | 09/15/26 | 37,500 | ||||||||||

|

| |||||||||||||

| Computers(c) – 0.8% | ||||||||||||||

Booz Allen Hamilton, Inc.(e) | ||||||||||||||

| 2,513,000 | 3.875 | 09/01/28 | 2,318,242 | |||||||||||

Dell International LLC/EMC Corp. | ||||||||||||||

| 2,699,000 | 8.100 | 07/15/36 | 3,312,861 | |||||||||||

Hewlett Packard Enterprise Co. | ||||||||||||||

| 3,000,000 | 6.200 | 10/15/35 | 3,278,400 | |||||||||||

KBR, Inc.(e) | ||||||||||||||

| 1,161,000 | 4.750 | 09/30/28 | 1,091,340 | |||||||||||

Presidio Holdings, Inc.(e) | ||||||||||||||

| 2,095,000 | 8.250 | 02/01/28 | 2,047,863 | |||||||||||

Unisys Corp.(e) | ||||||||||||||

| 1,060,000 | 6.875 | 11/01/27 | 1,073,250 | |||||||||||

Virtusa Corp.(e) | ||||||||||||||

| 2,371,000 | 7.125 | 12/15/28 | 2,169,465 | |||||||||||

Western Digital Corp. | ||||||||||||||

| 3,000,000 | 4.750 | 02/15/26 | 2,985,000 | |||||||||||

|

| |||||||||||||

| 18,276,421 | ||||||||||||||

|

| |||||||||||||

| Distribution & Wholesale(c)(e) – 0.3% | ||||||||||||||

American Builders & Contractors Supply Co., Inc. | ||||||||||||||

| 2,760,000 | 3.875 | 11/15/29 | 2,435,700 | |||||||||||

BCPE Empire Holdings, Inc. | ||||||||||||||

| 2,446,000 | 7.625 | 05/01/27 | 2,293,125 | |||||||||||

IAA, Inc. | ||||||||||||||

| 750,000 | 5.500 | 06/15/27 | 733,125 | |||||||||||

Ritchie Bros Holdings, Inc. | ||||||||||||||

| 440,000 | 4.750 | 12/15/31 | 440,000 | |||||||||||

|

| |||||||||||||

| 5,901,950 | ||||||||||||||

|

| |||||||||||||

| Diversified Financial Services – 3.0% | ||||||||||||||

AerCap Holdings NV(c)(d) (5 Year CMT + 4.535%) | ||||||||||||||

| 1,825,000 | 5.875 | 10/10/79 | 1,709,414 | |||||||||||

AerCap Ireland Capital DAC/AerCap Global Aviation Trust(c) | ||||||||||||||

| 3,625,000 | 3.000 | 10/29/28 | 3,151,720 | |||||||||||

Air Lease Corp.(c) | ||||||||||||||

| 2,750,000 | 3.750 | 06/01/26 | 2,644,785 | |||||||||||

Ally Financial, Inc. | �� | |||||||||||||

| 4,000,000 | 8.000 | 11/01/31 | 4,761,880 | |||||||||||

(7 year CMT + 3.481%) | ||||||||||||||

| 3,415,000 | 4.700 | (c)(d) | 12/31/99 | 2,928,362 | ||||||||||

Aviation Capital Group LLC(c)(e) | ||||||||||||||

| 800,000 | 1.950 | 01/30/26 | 714,048 | |||||||||||

Avolon Holdings Funding Ltd.(c)(e) | ||||||||||||||

| 3,450,000 | 5.250 | 05/15/24 | 3,474,736 | |||||||||||

| 1,927,000 | 2.528 | 11/18/27 | 1,657,220 | |||||||||||

B3 SA – Brasil Bolsa Balcao(e) | ||||||||||||||

| 290,000 | 4.125 | 09/20/31 | 252,445 | |||||||||||

Castlelake Aviation Finance DAC(c)(e) | ||||||||||||||

| 2,420,000 | 5.000 | 04/15/27 | 2,178,000 | |||||||||||

Coinbase Global, Inc.(c)(e) | ||||||||||||||

| 2,234,000 | 3.375 | 10/01/28 | 1,742,520 | |||||||||||

| | Global Aircraft Leasing Co. Ltd.(c)(e)(h) (PIK 7.250%, Cash | | ||||||||||||

| 1,879,174 | 6.500 | 09/15/24 | 1,627,834 | |||||||||||

|

| |||||||||||||

| 16 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| Principal Amount | Interest Rate | Maturity Date | Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Diversified Financial Services – (continued) | ||||||||||||||

Intercorp Financial Services, Inc., Series I(c) | ||||||||||||||

| $ | 340,000 | 4.125 | % | 10/19/27 | $ | 315,520 | ||||||||

Jefferies Finance LLC/JFIN Co-Issuer Corp.(c)(e) | ||||||||||||||

| 3,829,000 | 5.000 | 08/15/28 | 3,485,485 | |||||||||||

LD Holdings Group LLC(c)(e) | ||||||||||||||

| 1,910,000 | 6.500 | 11/01/25 | 1,566,200 | |||||||||||

Midcap Financial Issuer Trust(c)(e) | ||||||||||||||

| 2,567,000 | 6.500 | 05/01/28 | 2,210,829 | |||||||||||

| 810,000 | 5.625 | 01/15/30 | 644,963 | |||||||||||

Nationstar Mortgage Holdings, Inc.(c)(e) | ||||||||||||||

| 2,651,000 | 5.500 | 08/15/28 | 2,419,053 | |||||||||||

Navient Corp. | ||||||||||||||

| 3,000,000 | 5.500 | 01/25/23 | 3,011,250 | |||||||||||

| 4,388,000 | 5.500 | (c) | 03/15/29 | 3,850,470 | ||||||||||

NFP Corp.(c)(e) | ||||||||||||||

| 3,360,000 | 6.875 | 08/15/28 | 2,965,200 | |||||||||||

OneMain Finance Corp. | ||||||||||||||

| 1,602,000 | 7.125 | 03/15/26 | 1,622,025 | |||||||||||

| 1,643,000 | 4.000 | (c) | 09/15/30 | 1,343,153 | ||||||||||

Oxford Finance LLC / Oxford Finance Co-Issuer II, Inc.(c)(e) | ||||||||||||||

| 1,365,000 | 6.375 | 02/01/27 | 1,380,356 | |||||||||||

Raymond James Financial, Inc.(c) | ||||||||||||||

| 900,000 | 4.650 | 04/01/30 | 910,737 | |||||||||||

Rocket Mortgage LLC/Rocket Mortgage Co-Issuer, Inc.(c)(e) | ||||||||||||||

| 2,305,000 | 2.875 | 10/15/26 | 2,037,074 | |||||||||||

| 2,390,000 | 4.000 | 10/15/33 | 1,913,377 | |||||||||||

The Charles Schwab Corp.(c)(d) | ||||||||||||||

(3M USD LIBOR + 3.315%) | ||||||||||||||

| 2,195,000 | 3.838 | 12/29/49 | 2,180,864 | |||||||||||

(5 year CMT + 3.168%) | ||||||||||||||

| 2,875,000 | 4.000 | 12/31/99 | 2,621,684 | |||||||||||

(5 Year CMT + 4.971%) | ||||||||||||||

| 1,250,000 | 5.375 | 12/31/99 | 1,263,100 | |||||||||||

Unifin Financiera SAB de CV(c)(d) (5 year CMT + 6.308%) | ||||||||||||||

| 280,000 | 8.875 | 12/31/99 | 90,615 | |||||||||||

United Wholesale Mortgage LLC(c)(e) | ||||||||||||||

| 3,195,000 | 5.500 | 04/15/29 | 2,671,819 | |||||||||||

VistaJet Malta Finance PLC/XO Management Holding, Inc.(c)(e) | ||||||||||||||

| 1,230,000 | 7.875 | 05/01/27 | 1,156,200 | |||||||||||

| 3,525,000 | 6.375 | 02/01/30 | 3,066,750 | |||||||||||

|

| |||||||||||||

| 69,569,688 | ||||||||||||||

|

| |||||||||||||

| Electrical – 0.7% | ||||||||||||||

AES Panama Generation Holdings SRL(c) | ||||||||||||||

| 460,000 | 4.375 | 05/31/30 | 409,400 | |||||||||||

Calpine Corp.(c)(e) | ||||||||||||||

| 4,215,000 | 3.750 | 03/01/31 | 3,551,137 | |||||||||||

Cikarang Listrindo Tbk PT(c) | ||||||||||||||

| 520,000 | 4.950 | 09/14/26 | 507,585 | |||||||||||

EnfraGen Energia Sur SA | ||||||||||||||

| 200,000 | 5.375 | 12/30/30 | 144,280 | |||||||||||

Eskom Holdings SOC Ltd. | ||||||||||||||

| 430,000 | 7.125 | 02/11/25 | 409,252 | |||||||||||

Lamar Funding Ltd. | ||||||||||||||

| 470,000 | 3.958 | 05/07/25 | 455,841 | |||||||||||

LLPL Capital Pte Ltd. | ||||||||||||||

| 400,982 | 6.875 | 02/04/39 | 391,659 | |||||||||||

|

| |||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Electrical – (continued) | ||||||||||||||

Minejesa Capital B.V. | ||||||||||||||

| 260,000 | 4.625 | 08/10/30 | 234,029 | |||||||||||

Mong Duong Finance Holdings BV | ||||||||||||||

| 530,000 | 5.125 | 05/07/29 | 473,025 | |||||||||||

NRG Energy, Inc.(c) | ||||||||||||||

| 2,800,000 | 3.750 | (e) | 06/15/24 | 2,767,688 | ||||||||||

| 115,000 | 5.750 | 01/15/28 | 112,413 | |||||||||||

| 448,000 | 3.375 | (e) | 02/15/29 | 381,920 | ||||||||||

Pacific Gas & Electric Co.(c) | ||||||||||||||

| 1,470,000 | 3.500 | 08/01/50 | 1,025,193 | |||||||||||

Pike Corp.(c)(e) | ||||||||||||||

| 2,420,000 | 5.500 | 09/01/28 | 2,208,250 | |||||||||||

Sempra Energy(c)(d) (5 Year CMT + 4.550%) | ||||||||||||||

| 3,335,000 | 4.875 | 12/31/99 | 3,287,810 | |||||||||||

|

| |||||||||||||

| 16,359,482 | ||||||||||||||

|

| |||||||||||||

| Electrical Components & Equipment(c)(e) – 0.1% | ||||||||||||||

Wesco Distribution, Inc. | ||||||||||||||

| 1,473,000 | 7.250 | 06/15/28 | 1,524,555 | |||||||||||

|

| |||||||||||||

| Electronics(c)(e) – 0.2% | ||||||||||||||

II-VI, Inc. | ||||||||||||||

| 1,225,000 | 5.000 | 12/15/29 | 1,148,438 | |||||||||||

Imola Merger Corp. | ||||||||||||||

| 3,117,000 | 4.750 | 05/15/29 | 2,933,876 | |||||||||||

TTM Technologies, Inc. | ||||||||||||||

| 799,000 | 4.000 | 03/01/29 | 703,120 | |||||||||||

|

| |||||||||||||

| 4,785,434 | ||||||||||||||

|

| |||||||||||||

| Engineering & Construction – 0.4% | ||||||||||||||

Aeropuertos Dominicanos Siglo XXI SA(c) | ||||||||||||||

| 630,000 | 6.750 | 03/30/29 | 609,131 | |||||||||||

Arcosa, Inc.(c)(e) | ||||||||||||||

| 1,221,000 | 4.375 | 04/15/29 | 1,111,110 | |||||||||||

| | ATP Tower Holdings LLC/Andean Tower Partners Colombia | | ||||||||||||

| 950,000 | 4.050 | 04/27/26 | 855,000 | |||||||||||

Dycom Industries, Inc.(c)(e) | ||||||||||||||

| 2,764,000 | 4.500 | 04/15/29 | 2,487,600 | |||||||||||

Global Infrastructure Solutions, Inc.(c)(e) | ||||||||||||||

| 2,805,000 | 5.625 | 06/01/29 | 2,566,575 | |||||||||||

IHS Holding Ltd.(c)(e) | ||||||||||||||

| 200,000 | 5.625 | 11/29/26 | 190,000 | |||||||||||

| 200,000 | 6.250 | 11/29/28 | 188,000 | |||||||||||

International Airport Finance SA(c) | ||||||||||||||

| 197,647 | 12.000 | 03/15/33 | 205,792 | |||||||||||

Mexico City Airport Trust | ||||||||||||||

| 320,000 | 5.500 | 10/31/46 | 255,200 | |||||||||||

|

| |||||||||||||

| 8,468,408 | ||||||||||||||

|

| |||||||||||||

| Entertainment(c)(e) – 0.8% | ||||||||||||||

Allen Media LLC/Allen Media Co-Issuer, Inc. | ||||||||||||||

| 1,575,000 | 10.500 | 02/15/28 | 1,425,375 | |||||||||||

Banijay Entertainment SASU | ||||||||||||||

| 1,800,000 | 5.375 | 03/01/25 | 1,768,500 | |||||||||||

Boyne USA, Inc. | ||||||||||||||

| 1,275,000 | 4.750 | 05/15/29 | 1,188,938 | |||||||||||

|

| |||||||||||||

| The accompanying notes are an integral part of these financial statements. | 17 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments (continued)

April 30, 2022 (Unaudited)

| Principal Amount | Interest Rate | Maturity Date | Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Entertainment(c)(e) – (continued) | ||||||||||||||

Lions Gate Capital Holdings LLC | ||||||||||||||

| $ | 2,540,000 | 5.500 | % | 04/15/29 | $ | 2,247,900 | ||||||||

Motion Bondco DAC | ||||||||||||||

| 3,250,000 | 6.625 | 11/15/27 | 2,973,750 | |||||||||||

Penn National Gaming, Inc. | ||||||||||||||

| 3,067,000 | 4.125 | 07/01/29 | 2,599,282 | |||||||||||

Scientific Games International, Inc. | ||||||||||||||

| 500,000 | 7.000 | 05/15/28 | 513,125 | |||||||||||

SeaWorld Parks & Entertainment, Inc. | ||||||||||||||

| 4,880,000 | 5.250 | 08/15/29 | 4,440,800 | |||||||||||

Six Flags Entertainment Corp. | ||||||||||||||

| 1,854,000 | 5.500 | 04/15/27 | 1,812,285 | |||||||||||

|

| |||||||||||||

| 18,969,955 | ||||||||||||||

|

| |||||||||||||

| Environmental(c) – 0.5% | ||||||||||||||

Covanta Holding Corp. | ||||||||||||||

| 670,000 | 5.000 | 09/01/30 | 603,838 | |||||||||||

GFL Environmental, Inc.(e) | ||||||||||||||

| 730,000 | 5.125 | 12/15/26 | 717,225 | |||||||||||

| 5,647,000 | 4.000 | 08/01/28 | 4,969,360 | |||||||||||

Madison IAQ LLC(e) | ||||||||||||||

| 4,294,000 | 4.125 | 06/30/28 | 3,767,985 | |||||||||||

| 485,000 | 5.875 | 06/30/29 | 395,275 | |||||||||||

Stericycle, Inc.(e) | ||||||||||||||

| 1,950,000 | 5.375 | 07/15/24 | 1,957,312 | |||||||||||

|

| |||||||||||||

| 12,410,995 | ||||||||||||||

|

| |||||||||||||

| Finance Bonds(c)(e) – 0.1% | ||||||||||||||

Global Infrastructure Solutions, Inc. | ||||||||||||||

| 1,390,000 | 7.500 | 04/15/32 | 1,294,438 | |||||||||||

|

| |||||||||||||

| Food & Drug Retailing – 1.0% | ||||||||||||||

| | Albertsons Cos., Inc./Safeway, Inc./New Albertsons | | ||||||||||||

| 2,595,000 | 4.625 | 01/15/27 | 2,429,569 | |||||||||||

| 1,995,000 | 5.875 | 02/15/28 | 1,937,644 | |||||||||||

| 502,000 | 4.875 | 02/15/30 | 456,820 | |||||||||||

Arcor SAIC | ||||||||||||||

| 110,000 | 6.000 | 07/06/23 | 109,725 | |||||||||||

Bellis Acquisition Co. PLC(c)(e) | ||||||||||||||

| GBP | 475,000 | 3.250 | 02/16/26 | 522,311 | ||||||||||

H-Food Holdings LLC/Hearthside Finance Co., Inc.(c)(e) | ||||||||||||||

| $ | 2,820,000 | 8.500 | 06/01/26 | 2,647,275 | ||||||||||

Kraft Heinz Foods Co.(c) | ||||||||||||||

| 2,303,000 | 5.000 | 07/15/35 | 2,294,226 | |||||||||||

| 2,592,000 | 4.375 | 06/01/46 | 2,269,832 | |||||||||||

Performance Food Group, Inc.(c)(e) | ||||||||||||||

| 1,150,000 | 5.500 | 10/15/27 | 1,114,062 | |||||||||||

Post Holdings, Inc.(c)(e) | ||||||||||||||

| 5,984,000 | 4.625 | 04/15/30 | 5,131,280 | |||||||||||

United Natural Foods, Inc.(c)(e) | ||||||||||||||

| 1,455,000 | 6.750 | 10/15/28 | 1,455,000 | |||||||||||

US Foods, Inc.(c)(e) | ||||||||||||||

| 2,690,000 | 4.750 | 02/15/29 | 2,474,800 | |||||||||||

| 1,020,000 | 4.625 | 06/01/30 | 918,000 | |||||||||||

|

| |||||||||||||

| 23,760,544 | ||||||||||||||

|

| |||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Forest Products&Paper(c)(e) – 0.0% | ||||||||||||||

Glatfelter Corp. | ||||||||||||||

| 670,000 | 4.750 | 11/15/29 | 536,000 | |||||||||||

|

| |||||||||||||

| Gaming(c) – 0.1% | ||||||||||||||

MGM China Holdings Ltd.(e) | ||||||||||||||

| 915,000 | 4.750 | 02/01/27 | 768,600 | |||||||||||

MGM Resorts International | ||||||||||||||

| 1,832,000 | 4.750 | 10/15/28 | 1,685,440 | |||||||||||

Wynn Macau Ltd.(e) | ||||||||||||||

| 330,000 | 5.625 | 08/26/28 | 265,238 | |||||||||||

| 550,000 | 5.125 | 12/15/29 | 434,500 | |||||||||||

|

| |||||||||||||

| 3,153,778 | ||||||||||||||

|

| |||||||||||||

| Gas(c) – 0.2% | ||||||||||||||

AmeriGas Partners LP/AmeriGas Finance Corp. | ||||||||||||||

| 4,125,000 | 5.875 | 08/20/26 | 4,063,125 | |||||||||||

China Oil & Gas Group Ltd. | ||||||||||||||

| 102,857 | 5.500 | 01/25/23 | 102,266 | |||||||||||

|

| |||||||||||||

| 4,165,391 | ||||||||||||||

|

| |||||||||||||

| Healthcare Providers & Services(c) – 1.1% | ||||||||||||||

CAB SELAS(e) | ||||||||||||||

| EUR | 1,175,000 | 3.375 | 02/01/28 | 1,103,722 | ||||||||||

Catalent Pharma Solutions, Inc.(e) | ||||||||||||||

| $ | 1,005,000 | 3.125 | 02/15/29 | 871,837 | ||||||||||

| 840,000 | 3.500 | 04/01/30 | 732,900 | |||||||||||

Chrome Holdco SASU(e) | ||||||||||||||

| EUR | 2,100,000 | 5.000 | 05/31/29 | 1,927,195 | ||||||||||

CHS/Community Health Systems, Inc.(e) | ||||||||||||||

| $ | 1,540,000 | 6.125 | 04/01/30 | 1,266,650 | ||||||||||

| 2,170,000 | 4.750 | 02/15/31 | 1,839,075 | |||||||||||

DaVita, Inc.(e) | ||||||||||||||

| 3,800,000 | 3.750 | 02/15/31 | 3,097,000 | |||||||||||

Encompass Health Corp. | ||||||||||||||

| 1,200,000 | 4.500 | 02/01/28 | 1,107,000 | |||||||||||

HCA, Inc. | ||||||||||||||

| 250,000 | 5.875 | 02/15/26 | 258,750 | |||||||||||

Laboratoire Eimer Selas(e) | ||||||||||||||

| EUR | 500,000 | 5.000 | 02/01/29 | 460,364 | ||||||||||

LifePoint Health, Inc.(e) | ||||||||||||||

| $ | 2,635,000 | 5.375 | 01/15/29 | 2,252,925 | ||||||||||

MEDNAX, Inc.(e) | ||||||||||||||

| 725,000 | 5.375 | 02/15/30 | 679,688 | |||||||||||

Molina Healthcare, Inc.(e) | ||||||||||||||

| 1,893,000 | 3.875 | 05/15/32 | 1,665,840 | |||||||||||

Mozart Debt Merger Sub, Inc.(e) | ||||||||||||||

| 3,270,000 | 3.875 | 04/01/29 | 2,861,250 | |||||||||||

| 2,285,000 | 5.250 | 10/01/29 | 1,987,950 | |||||||||||

Rede D’or Finance S.a.r.l. | ||||||||||||||

| 370,000 | 4.500 | 01/22/30 | 323,149 | |||||||||||

Select Medical Corp.(e) | ||||||||||||||

| 1,700,000 | 6.250 | 08/15/26 | 1,685,125 | |||||||||||

Tenet Healthcare Corp.(e) | ||||||||||||||

| 2,000,000 | 6.250 | 02/01/27 | 1,990,000 | |||||||||||

|

| |||||||||||||

| 26,110,420 | ||||||||||||||

|

| |||||||||||||

| 18 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| Principal Amount | Interest Rate | Maturity Date | Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Holding Companies-Diversified(c) – 0.0% | ||||||||||||||

KOC Holding A/S | ||||||||||||||

| $ | 700,000 | 6.500 | % | 03/11/25 | $ | 697,944 | ||||||||

|

| |||||||||||||

| Home Builders – 0.6% | ||||||||||||||

| | Brookfield Residential Properties, Inc./Brookfield Residential US | | ||||||||||||

| 1,642,000 | 4.875 | 02/15/30 | 1,387,490 | |||||||||||

Century Communities, Inc.(c)(e) | ||||||||||||||

| 4,550,000 | 3.875 | 08/15/29 | 3,833,375 | |||||||||||

Installed Building Products, Inc.(c)(e) | ||||||||||||||

| 800,000 | 5.750 | 02/01/28 | 756,000 | |||||||||||

LGI Homes, Inc.(c)(e) | ||||||||||||||

| 3,698,000 | 4.000 | 07/15/29 | 3,050,850 | |||||||||||

PulteGroup, Inc. | ||||||||||||||

| 3,000,000 | 7.875 | 06/15/32 | 3,615,000 | |||||||||||

Taylor Morrison Communities, Inc.(c)(e) | ||||||||||||||

| 1,301,000 | 5.125 | 08/01/30 | 1,180,657 | |||||||||||

|

| |||||||||||||

| 13,823,372 | ||||||||||||||

|

| |||||||||||||

| Home Furnishings(c)(e) – 0.1% | ||||||||||||||

Tempur Sealy International, Inc. | ||||||||||||||

| 1,515,000 | 3.875 | 10/15/31 | 1,257,450 | |||||||||||

|

| |||||||||||||

| Household Products(c) – 0.1% | ||||||||||||||

Central Garden & Pet Co. | ||||||||||||||

| 1,380,000 | 4.125 | 10/15/30 | 1,197,150 | |||||||||||

Spectrum Brands, Inc. | ||||||||||||||

| 108,000 | 5.750 | 07/15/25 | 109,080 | |||||||||||

|

| |||||||||||||

| 1,306,230 | ||||||||||||||

|

| |||||||||||||

| Housewares(c) – 0.4% | ||||||||||||||

CD&R Smokey Buyer, Inc.(e) | ||||||||||||||

| 1,094,000 | 6.750 | 07/15/25 | 1,113,145 | |||||||||||

Newell Brands, Inc. | ||||||||||||||

| 1,380,000 | 5.750 | 04/01/46 | 1,297,200 | |||||||||||

SWF Escrow Issuer Corp.(e) | ||||||||||||||

| 3,255,000 | 6.500 | 10/01/29 | 2,514,488 | |||||||||||

The Scotts Miracle-Gro Co. | ||||||||||||||

| 3,702,000 | 4.000 | 04/01/31 | 3,044,895 | |||||||||||

Turkiye Sise ve Cam Fabrikalari A/S | ||||||||||||||

| 530,000 | 6.950 | 03/14/26 | 515,193 | |||||||||||

|

| |||||||||||||

| 8,484,921 | ||||||||||||||

|

| |||||||||||||

| Insurance – 0.8% | ||||||||||||||

Acrisure LLC/Acrisure Finance, Inc.(c)(e) | ||||||||||||||

| 1,550,000 | 10.125 | 08/01/26 | 1,629,438 | |||||||||||

| 2,230,000 | 4.250 | 02/15/29 | 1,945,675 | |||||||||||

| 2,490,000 | 6.000 | 08/01/29 | 2,175,637 | |||||||||||

| | Alliant Holdings Intermediate LLC/Alliant Holdings | | ||||||||||||

| 1,666,000 | 6.750 | 10/15/27 | 1,576,453 | |||||||||||

American International Group, Inc.(c) | ||||||||||||||

| 2,250,000 | 3.400 | 06/30/30 | 2,133,112 | |||||||||||