0000822977gsam:Russell1000Index44494AdditionalIndexMember2023-08-310000822977gsam:Russell1000GrowthIndex43196AdditionalIndexMember2014-08-310000822977gsam:C000055752Memberoef:WithoutSalesLoadMember2019-09-012024-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Copies to:

| | |

Robert Griffith, Esq. Goldman Sachs & Co. LLC 200 West Street New York, NY 10282 | | Stephen H. Bier, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: August 31, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders for the Goldman Sachs Enhanced Core Equity Fund, Goldman Sachs Large Cap Core Fund, Goldman Sachs Mid Cap Growth Fund, Goldman Sachs Small Cap Growth Fund, Goldman Sachs Small/Mid Cap Growth Fund, Goldman Sachs Strategic Growth Fund, Goldman Sachs Technology Opportunities Fund, Goldman Sachs U.S. Equity ESG Fund, Goldman Sachs Equity Income Fund, Goldman Sachs Focused Value Fund, Goldman Sachs Large Cap Value Fund, Goldman Sachs Mid Cap Value Fund, Goldman Sachs Small Cap Value Fund, Goldman Sachs Small/Mid Cap Value Fund, Goldman Sachs Enhanced Dividend Global Equity Portfolio, and Goldman Sachs Tax-Advantaged Global Equity Portfolio is filed herewith.

Annual Shareholder Report

August 31, 2024

Goldman Sachs Enhanced Dividend Global Equity Portfolio

This annual shareholder report contains important information about Goldman Sachs Enhanced Dividend Global Equity Portfolio (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $56 | 0.51% |

How did the Fund perform and what affected its performance?

Global equities performed strongly as waning inflation levels globally suggested the peaking of central bank tightening cycles and potential interest rate cuts in several developed markets. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports and a strong rally, especially in technology stocks, driven by enthusiasm around artificial intelligence. Weaker labor market data near the end of the reporting period fueled volatility as investors focused on the health of the U.S. economy.

Top Contributors to Performance:

The Portfolio benefited compared to the Enhanced Dividend Global Equity Composite Index ("EDGE Composite Index") from a strategic underweight in emerging markets equities, which generated positive returns but lagged the gains of developed markets equities broadly.

Strategic overweights in U.S. and non-U.S. developed markets equities, especially the Portfolio’s exposure to U.S. large-cap technology stocks, bolstered relative performance.

Tactical allocations to fixed income, equities and, to a lesser extent, commodities and a trend-based rotation tilt contributed positively to the Portfolio’s relative performance.

Top Detractors from Performance:

The call writing strategies of two of the Portfolio’s Underlying Funds–Goldman Sachs U.S. Equity Dividend and Premium Fund and Goldman Sachs International Equity Dividend and Premium Fund–detracted from their performance, as global equity markets posted double-digit gains.

Relative to the Index, the Portfolio’s underweight position in investment grade fixed income limited returns.

Goldman Sachs MLP Energy Infrastructure Fund and Goldman Sachs Global Real Estate Securities Fund, which were removed as Underlying Funds on June 28, 2024, underperformed their respective benchmark indices.

Currency-related tactical allocations detracted slightly from the Portfolio’s relative performance.

Strategic equities weightings

Investment grade fixed income - UW

Underlying Fund Performance

The above represents key factors.

Goldman Sachs Enhanced Dividend Global Equity Portfolio

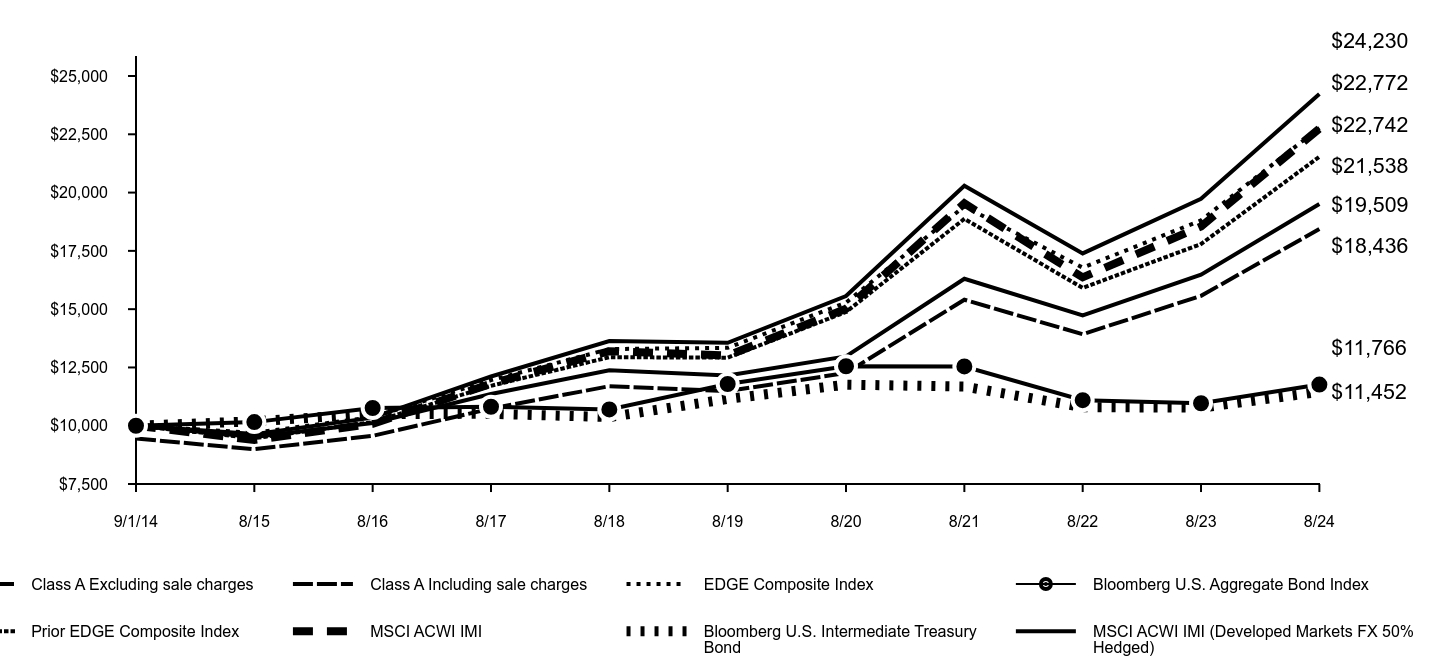

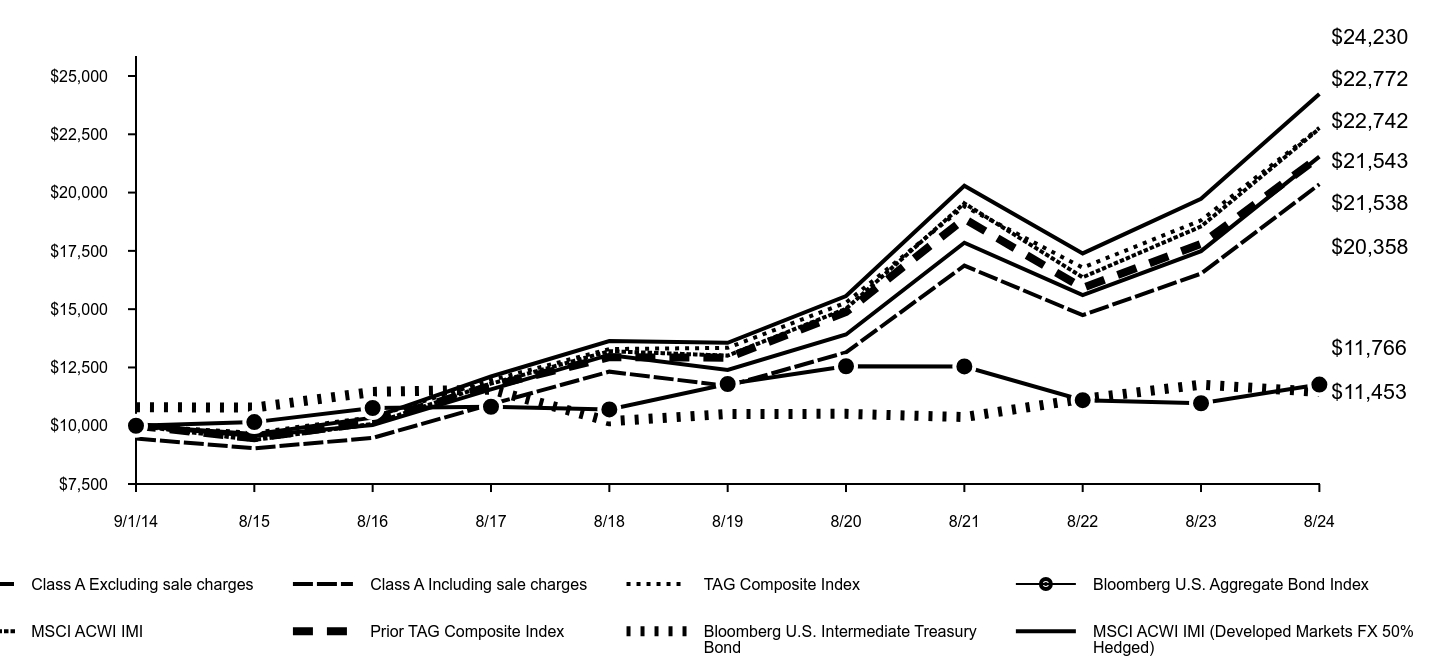

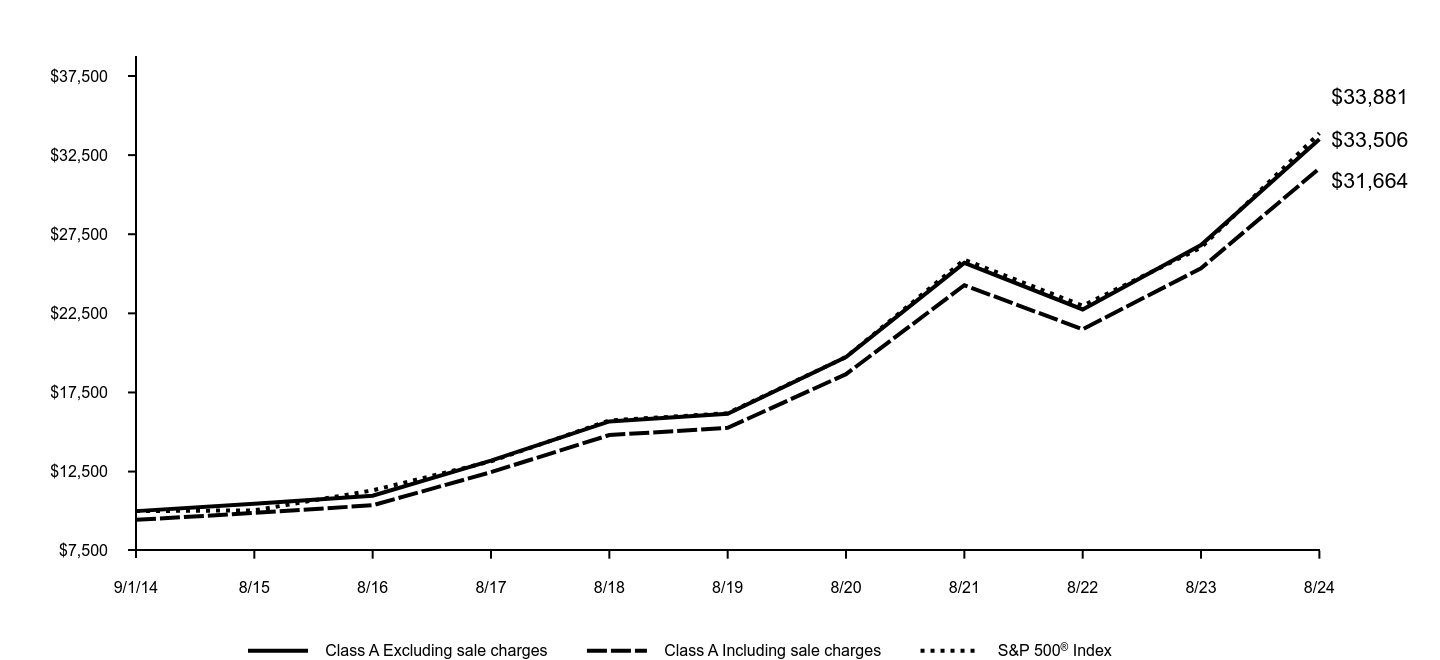

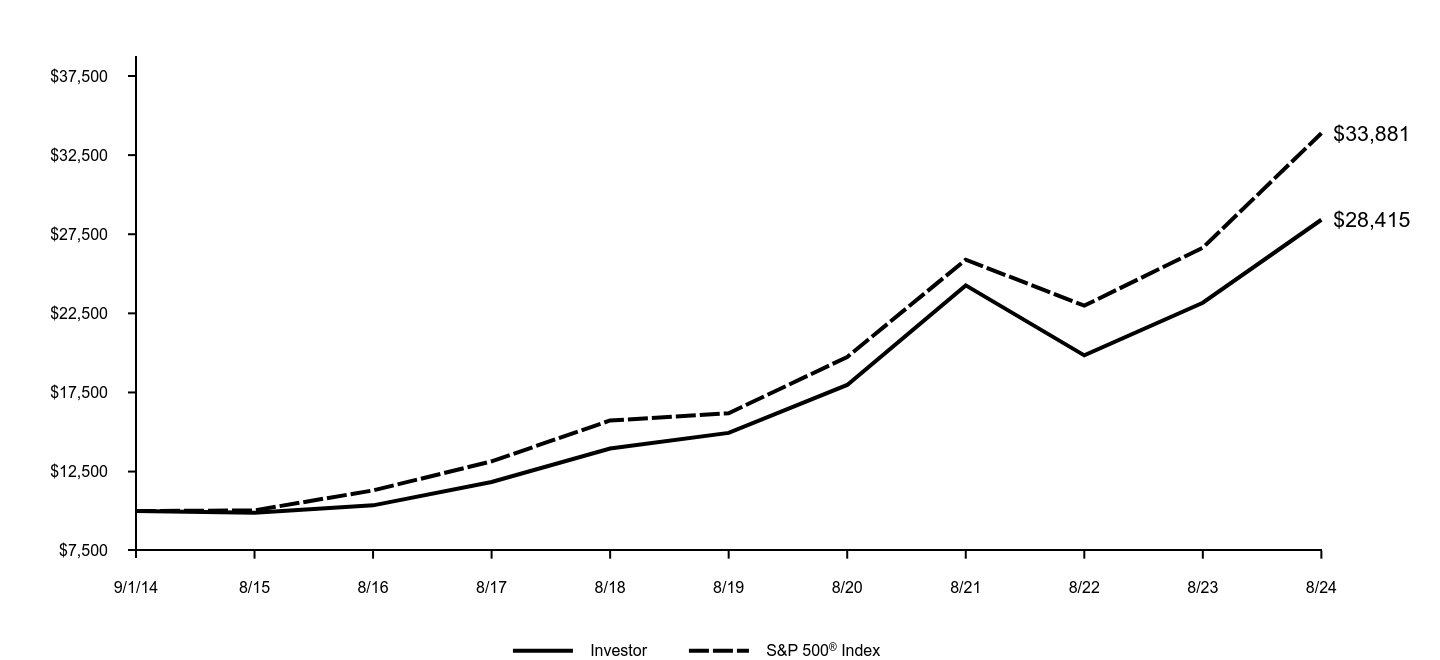

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's performance benchmark and any additional performance benchmark(s) are also shown.

As of the close of business on June 28, 2024, the Fund’s benchmark index, the EDGE Composite Index, was changed from a custom benchmark comprised of the MSCI ACWI IMI (Unhedged) (90%) and Bloomberg U.S. Aggregate Bond Index (10%) ("Prior EDGE Composite Index") to a custom benchmark comprised of the MSCI ACWI IMI (Developed Markets FX 50% Hedged) (90%) and Bloomberg U.S. Intermediate Treasury Index (10%). The Investment Adviser believes that the new composition of the EDGE Composite Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy.

| Class A Excluding sale charges | Class A Including sale charges | EDGE Composite Index | Bloomberg U.S. Aggregate Bond Index | Prior EDGE Composite Index | MSCI ACWI IMI | Bloomberg U.S. Intermediate Treasury Bond | MSCI ACWI IMI (Developed Markets FX 50% Hedged) |

|---|

| 9/1/14 | $10,000 | $9,450 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 8/15 | $9,518 | $8,995 | $9,697 | $10,156 | $9,466 | $9,390 | $10,190 | $9,641 |

| 8/16 | $10,121 | $9,565 | $10,373 | $10,762 | $10,156 | $10,082 | $10,507 | $10,348 |

| 8/17 | $11,361 | $10,736 | $11,955 | $10,815 | $11,714 | $11,804 | $10,510 | $12,111 |

| 8/18 | $12,377 | $11,696 | $13,289 | $10,701 | $12,940 | $13,197 | $10,373 | $13,636 |

| 8/19 | $12,157 | $11,488 | $13,341 | $11,790 | $12,920 | $13,008 | $11,151 | $13,559 |

| 8/20 | $12,975 | $12,261 | $15,279 | $12,553 | $14,878 | $15,017 | $11,763 | $15,563 |

| 8/21 | $16,302 | $15,405 | $19,411 | $12,543 | $18,873 | $19,538 | $11,680 | $20,296 |

| 8/22 | $14,735 | $13,925 | $16,779 | $11,098 | $15,910 | $16,365 | $10,796 | $17,390 |

| 8/23 | $16,480 | $15,573 | $18,809 | $10,966 | $17,794 | $18,547 | $10,778 | $19,736 |

| 8/24 | $19,509 | $18,436 | $22,772 | $11,766 | $21,538 | $22,742 | $11,452 | $24,230 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A Excluding sale charges | 18.38% | 9.91% | 6.90% |

| Class A Including sale charges | 11.83% | 8.67% | 6.30% |

| EDGE Composite Index | 21.07% | 11.28% | 8.57% |

| MSCI ACWI IMI (Developed Markets FX 50% Hedged) | 22.77% | 12.30% | 9.25% |

| Bloomberg U.S. Intermediate Treasury Bond | 6.26% | 0.53% | 1.36% |

| Prior EDGE Composite Index | 21.04% | 10.75% | 7.97% |

| MSCI ACWI IMI | 22.62% | 11.81% | 8.56% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return, principal value and market price will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Enhanced Dividend Global Equity Portfolio

Key Fund Statistics (as of August 31, 2024)

| Total Net Assets | $446,101,199 |

| # of Portfolio Holdings | 20 |

| Portfolio Turnover Rate | 10% |

| Total Net Advisory Fees Paid | $590,710 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Underlying Funds | 90.9% |

| Investment Company | 6.5% |

| Exchange-Traded Funds | 0.7% |

Goldman Sachs Enhanced Dividend Global Equity Portfolio

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The blended returns are calculated by Goldman Sachs using end of day index level values licensed from MSCI (“MSCI Data”). For the avoidance of doubt, MSCI is not the benchmark “administrator” for, or a “contributor”, “submitter” or “supervised contributor” to, the blended returns, and the MSCI Data is not considered a “contribution” or “submission” in relation to the blended returns, as those terms may be defined in any rules, laws, regulations, legislation or international standards. MSCI Data is provided “AS IS” without warranty or liability and no copying or distribution is permitted. MSCI does not make any representation regarding the advisability of any investment or strategy and does not sponsor, promote, issue, sell or otherwise recommend or endorse any investment or strategy, including any financial products or strategies based on, tracking or otherwise utilizing any MSCI Data, models, analytics or other materials or information.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Enhanced Dividend Global Equity Portfolio

38143H167-AR-0824 Class A

Annual Shareholder Report

August 31, 2024

Goldman Sachs Enhanced Dividend Global Equity Portfolio

Institutional Class: GIDGX

This annual shareholder report contains important information about Goldman Sachs Enhanced Dividend Global Equity Portfolio (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $21 | 0.19% |

How did the Fund perform and what affected its performance?

Global equities performed strongly as waning inflation levels globally suggested the peaking of central bank tightening cycles and potential interest rate cuts in several developed markets. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports and a strong rally, especially in technology stocks, driven by enthusiasm around artificial intelligence. Weaker labor market data near the end of the reporting period fueled volatility as investors focused on the health of the U.S. economy.

Top Contributors to Performance:

The Portfolio benefited compared to the Enhanced Dividend Global Equity Composite Index ("EDGE Composite Index") from a strategic underweight in emerging markets equities, which generated positive returns but lagged the gains of developed markets equities broadly.

Strategic overweights in U.S. and non-U.S. developed markets equities, especially the Portfolio’s exposure to U.S. large-cap technology stocks, bolstered relative performance.

Tactical allocations to fixed income, equities and, to a lesser extent, commodities and a trend-based rotation tilt contributed positively to the Portfolio’s relative performance.

Top Detractors from Performance:

The call writing strategies of two of the Portfolio’s Underlying Funds–Goldman Sachs U.S. Equity Dividend and Premium Fund and Goldman Sachs International Equity Dividend and Premium Fund–detracted from their performance, as global equity markets posted double-digit gains.

Relative to the Index, the Portfolio’s underweight position in investment grade fixed income limited returns.

Goldman Sachs MLP Energy Infrastructure Fund and Goldman Sachs Global Real Estate Securities Fund, which were removed as Underlying Funds on June 28, 2024, underperformed their respective benchmark indices.

Currency-related tactical allocations detracted slightly from the Portfolio’s relative performance.

Strategic equities weightings

Investment grade fixed income - UW

Underlying Fund Performance

The above represents key factors.

Goldman Sachs Enhanced Dividend Global Equity Portfolio

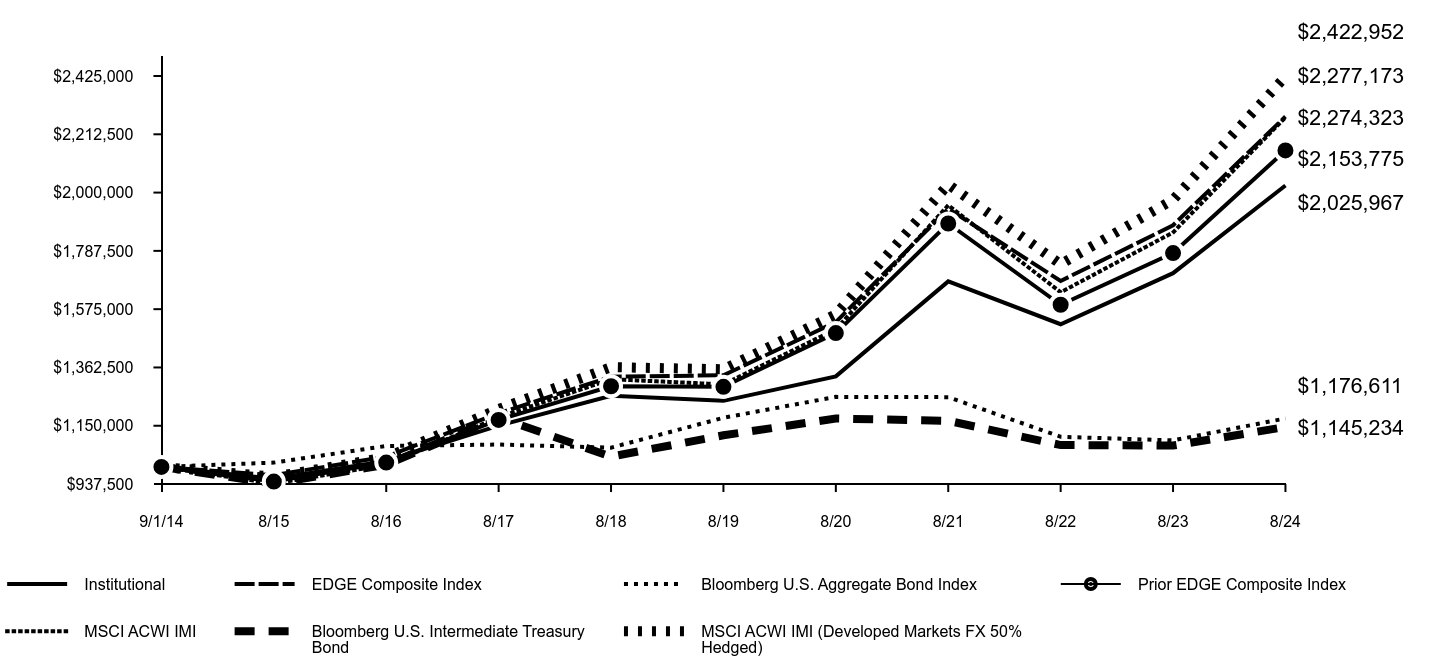

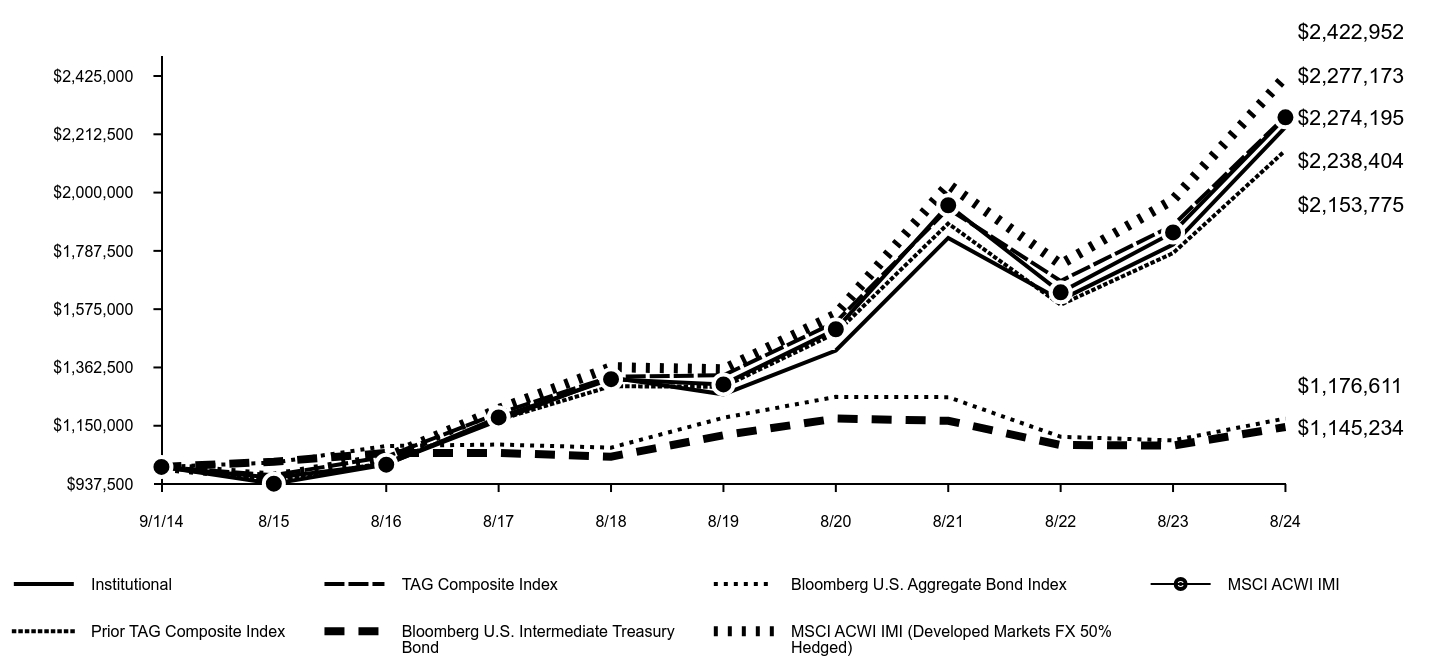

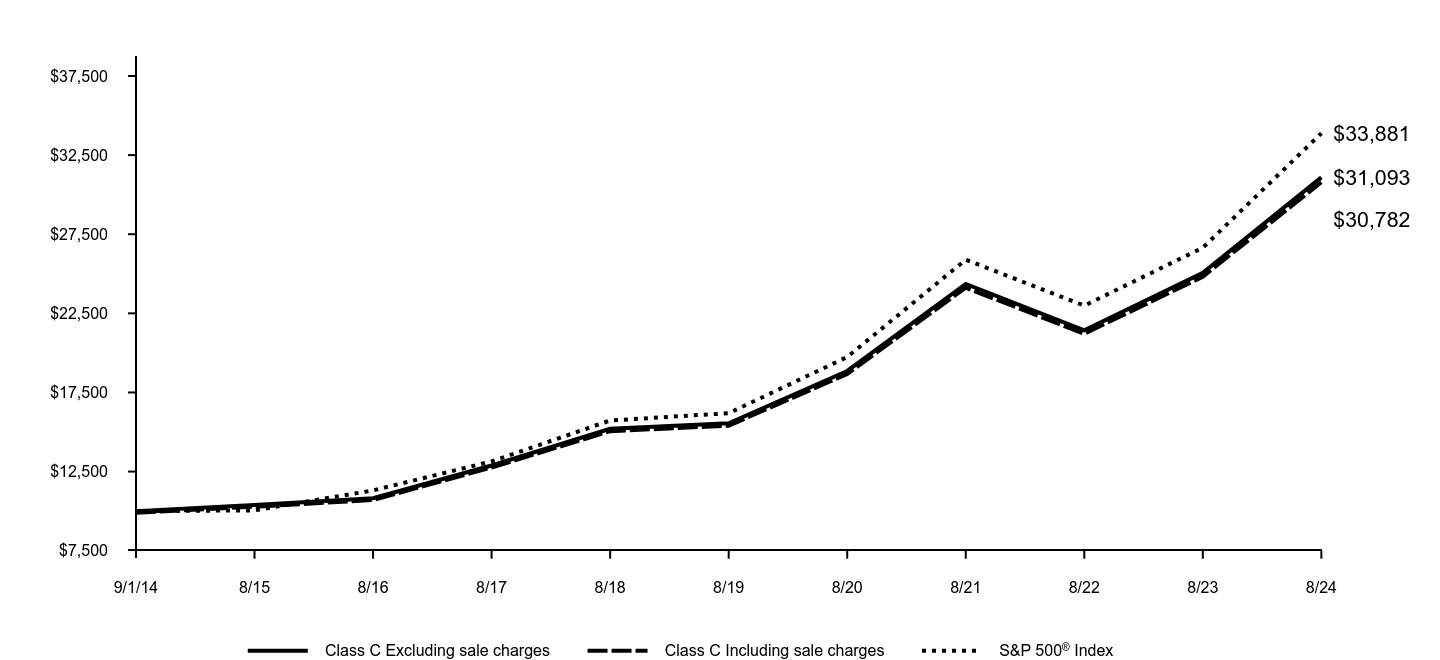

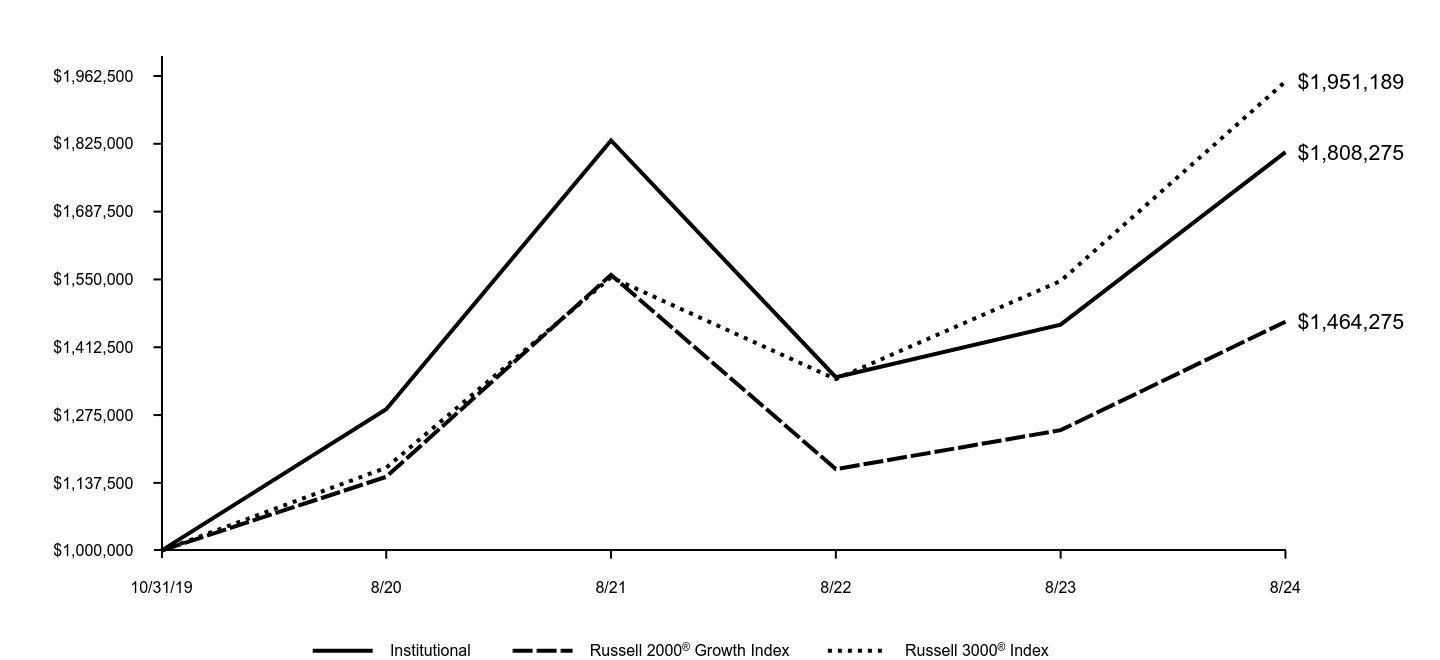

The following graph assumes an initial $1,000,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's performance benchmark and any additional performance benchmark(s) are also shown.

As of the close of business on June 28, 2024, the Fund’s benchmark index, the EDGE Composite Index, was changed from a custom benchmark comprised of the MSCI ACWI IMI (Unhedged) (90%) and Bloomberg U.S. Aggregate Bond Index (10%) ("Prior EDGE Composite Index") to a custom benchmark comprised of the MSCI ACWI IMI (Developed Markets FX 50% Hedged) (90%) and Bloomberg U.S. Intermediate Treasury Index (10%). The Investment Adviser believes that the new composition of the EDGE Composite Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy.

| Institutional | EDGE Composite Index | Bloomberg U.S. Aggregate Bond Index | Prior EDGE Composite Index | MSCI ACWI IMI | Bloomberg U.S. Intermediate Treasury Bond | MSCI ACWI IMI (Developed Markets FX 50% Hedged) |

|---|

| 9/1/14 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

| 8/15 | $957,100 | $969,700 | $1,015,600 | $946,600 | $939,000 | $939,000 | $964,100 |

| 8/16 | $1,021,130 | $1,037,288 | $1,076,231 | $1,015,607 | $1,008,204 | $1,008,204 | $1,034,769 |

| 8/17 | $1,150,405 | $1,195,475 | $1,081,505 | $1,171,401 | $1,180,406 | $1,180,406 | $1,211,093 |

| 8/18 | $1,259,118 | $1,328,889 | $1,070,149 | $1,294,047 | $1,319,693 | $1,037,343 | $1,363,570 |

| 8/19 | $1,240,735 | $1,334,072 | $1,178,983 | $1,291,977 | $1,300,822 | $1,115,144 | $1,355,934 |

| 8/20 | $1,329,944 | $1,527,913 | $1,255,263 | $1,487,840 | $1,501,669 | $1,176,254 | $1,556,341 |

| 8/21 | $1,676,394 | $1,941,060 | $1,254,259 | $1,887,325 | $1,953,821 | $1,168,020 | $2,029,624 |

| 8/22 | $1,520,155 | $1,677,853 | $1,109,769 | $1,591,015 | $1,636,521 | $1,079,601 | $1,738,982 |

| 8/23 | $1,706,221 | $1,880,873 | $1,096,562 | $1,779,391 | $1,854,669 | $1,077,765 | $1,973,570 |

| 8/24 | $2,025,967 | $2,277,173 | $1,176,611 | $2,153,775 | $2,274,323 | $1,145,234 | $2,422,952 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Institutional | 18.74% | 10.29% | 7.31% |

| EDGE Composite Index | 21.07% | 11.28% | 8.57% |

| MSCI ACWI IMI (Developed Markets FX 50% Hedged) | 22.77% | 12.30% | 9.25% |

| Bloomberg U.S. Intermediate Treasury Bond | 6.26% | 0.53% | 1.36% |

| Prior EDGE Composite Index | 21.04% | 10.75% | 7.97% |

| MSCI ACWI IMI | 22.62% | 11.81% | 8.56% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return, principal value and market price will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Enhanced Dividend Global Equity Portfolio

Key Fund Statistics (as of August 31, 2024)

| Total Net Assets | $446,101,199 |

| # of Portfolio Holdings | 20 |

| Portfolio Turnover Rate | 10% |

| Total Net Advisory Fees Paid | $590,710 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Underlying Funds | 90.9% |

| Investment Company | 6.5% |

| Exchange-Traded Funds | 0.7% |

Goldman Sachs Enhanced Dividend Global Equity Portfolio

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The blended returns are calculated by Goldman Sachs using end of day index level values licensed from MSCI (“MSCI Data”). For the avoidance of doubt, MSCI is not the benchmark “administrator” for, or a “contributor”, “submitter” or “supervised contributor” to, the blended returns, and the MSCI Data is not considered a “contribution” or “submission” in relation to the blended returns, as those terms may be defined in any rules, laws, regulations, legislation or international standards. MSCI Data is provided “AS IS” without warranty or liability and no copying or distribution is permitted. MSCI does not make any representation regarding the advisability of any investment or strategy and does not sponsor, promote, issue, sell or otherwise recommend or endorse any investment or strategy, including any financial products or strategies based on, tracking or otherwise utilizing any MSCI Data, models, analytics or other materials or information.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Enhanced Dividend Global Equity Portfolio

38143H175-AR-0824 Institutional Class

Annual Shareholder Report

August 31, 2024

Goldman Sachs Enhanced Dividend Global Equity Portfolio

This annual shareholder report contains important information about Goldman Sachs Enhanced Dividend Global Equity Portfolio (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $19 | 0.17% |

How did the Fund perform and what affected its performance?

Global equities performed strongly as waning inflation levels globally suggested the peaking of central bank tightening cycles and potential interest rate cuts in several developed markets. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports and a strong rally, especially in technology stocks, driven by enthusiasm around artificial intelligence. Weaker labor market data near the end of the reporting period fueled volatility as investors focused on the health of the U.S. economy.

Top Contributors to Performance:

The Portfolio benefited compared to the Enhanced Dividend Global Equity Composite Index ("EDGE Composite Index") from a strategic underweight in emerging markets equities, which generated positive returns but lagged the gains of developed markets equities broadly.

Strategic overweights in U.S. and non-U.S. developed markets equities, especially the Portfolio’s exposure to U.S. large-cap technology stocks, bolstered relative performance.

Tactical allocations to fixed income, equities and, to a lesser extent, commodities and a trend-based rotation tilt contributed positively to the Portfolio’s relative performance.

Top Detractors from Performance:

The call writing strategies of two of the Portfolio’s Underlying Funds–Goldman Sachs U.S. Equity Dividend and Premium Fund and Goldman Sachs International Equity Dividend and Premium Fund–detracted from their performance, as global equity markets posted double-digit gains.

Relative to the Index, the Portfolio’s underweight position in investment grade fixed income limited returns.

Goldman Sachs MLP Energy Infrastructure Fund and Goldman Sachs Global Real Estate Securities Fund, which were removed as Underlying Funds on June 28, 2024, underperformed their respective benchmark indices.

Currency-related tactical allocations detracted slightly from the Portfolio’s relative performance.

Strategic equities weightings

Investment grade fixed income - UW

Underlying Fund Performance

The above represents key factors.

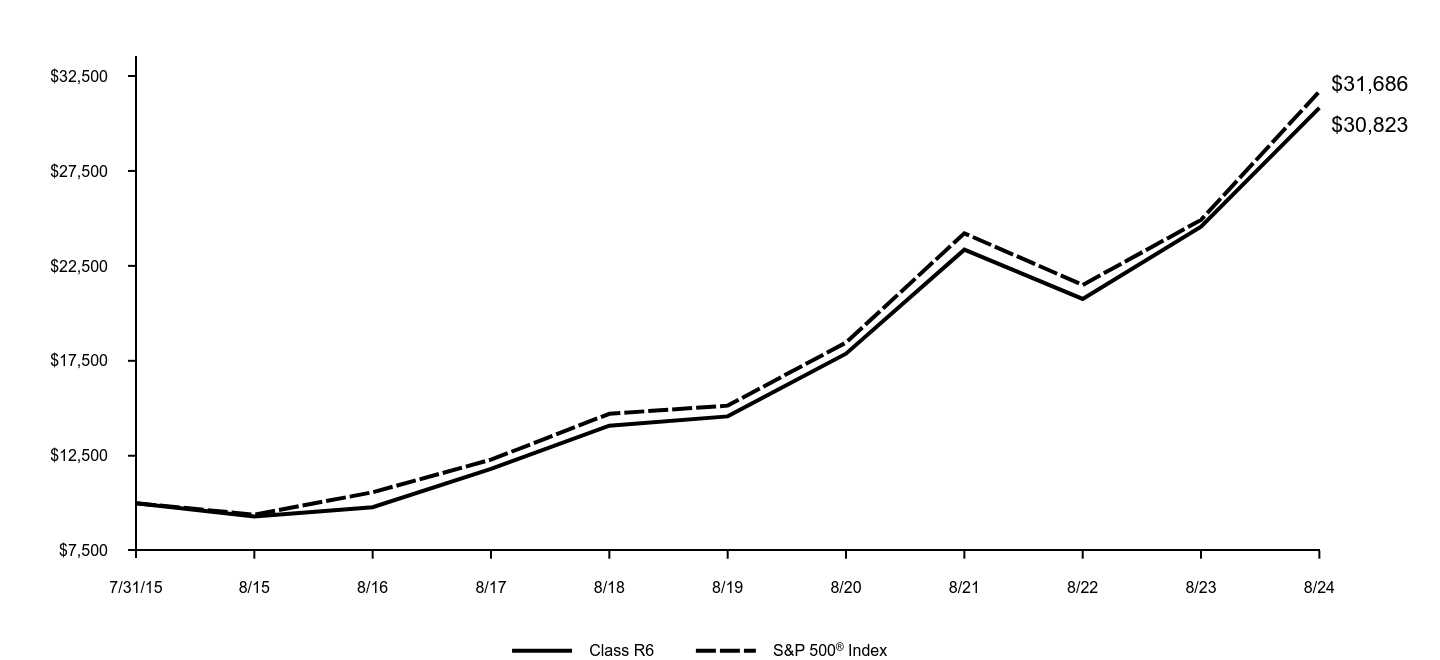

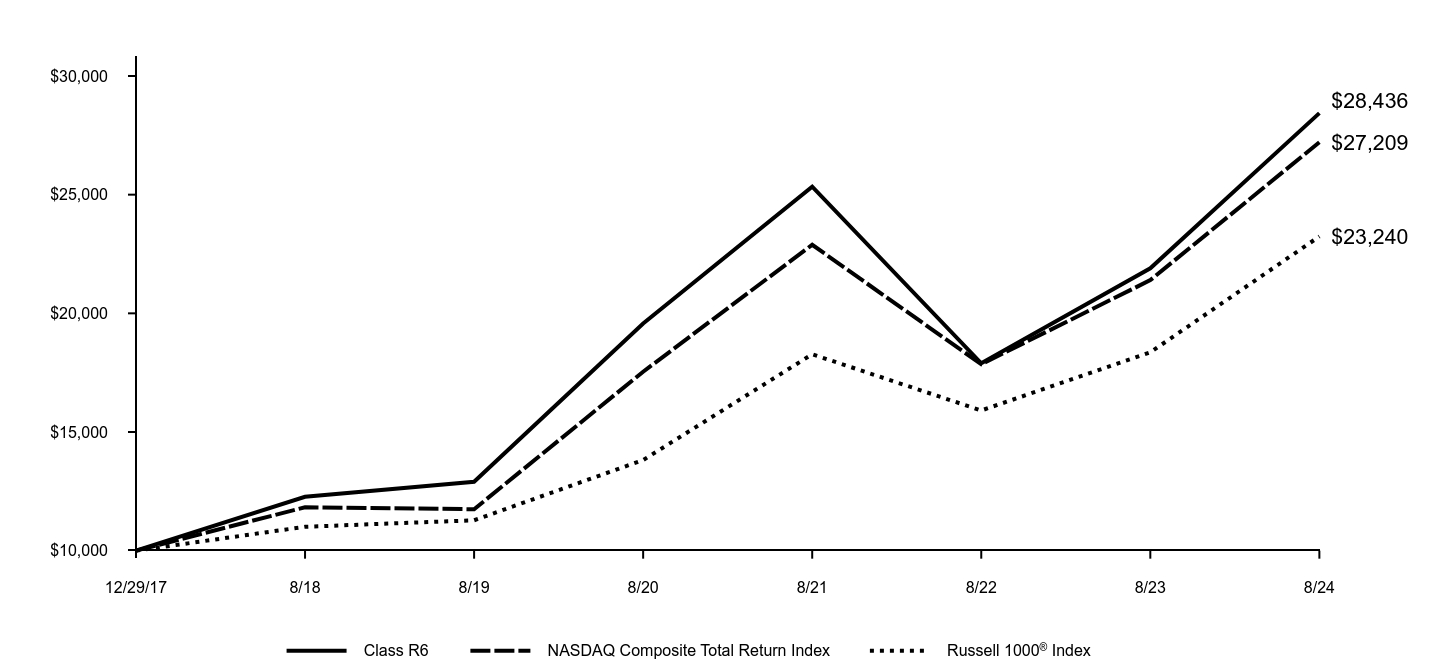

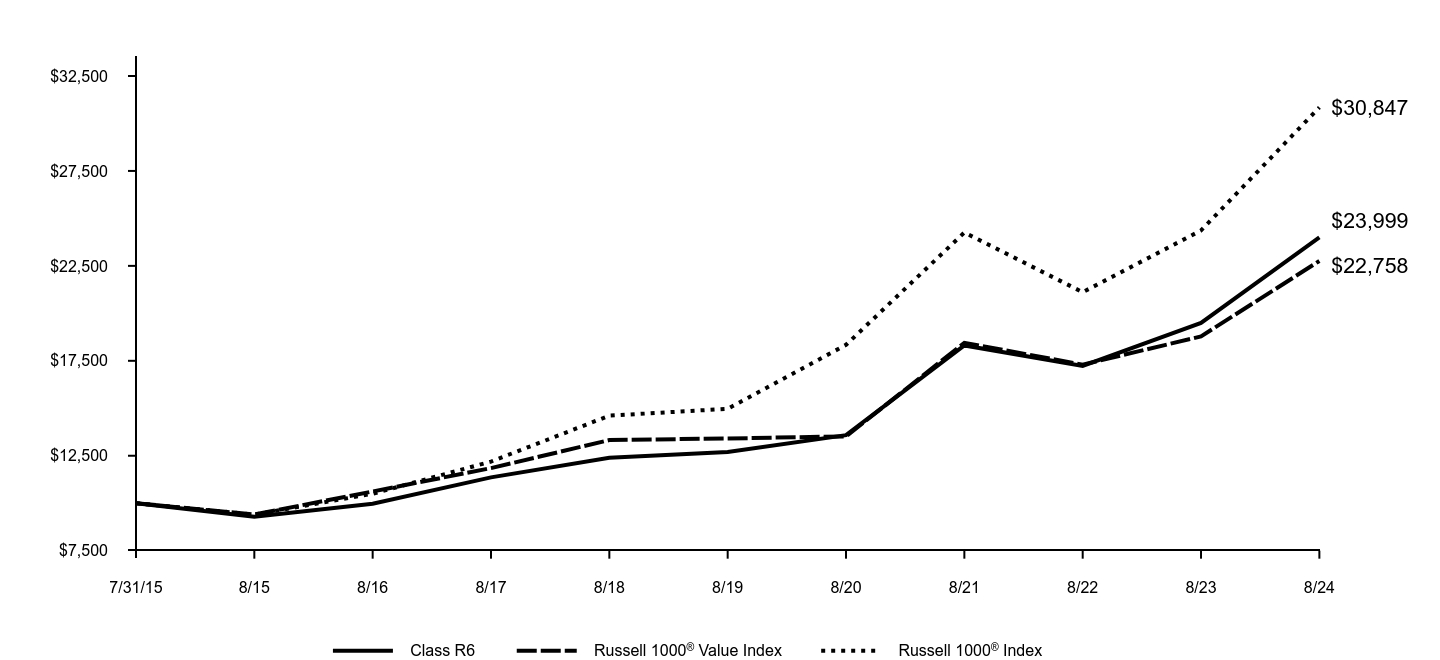

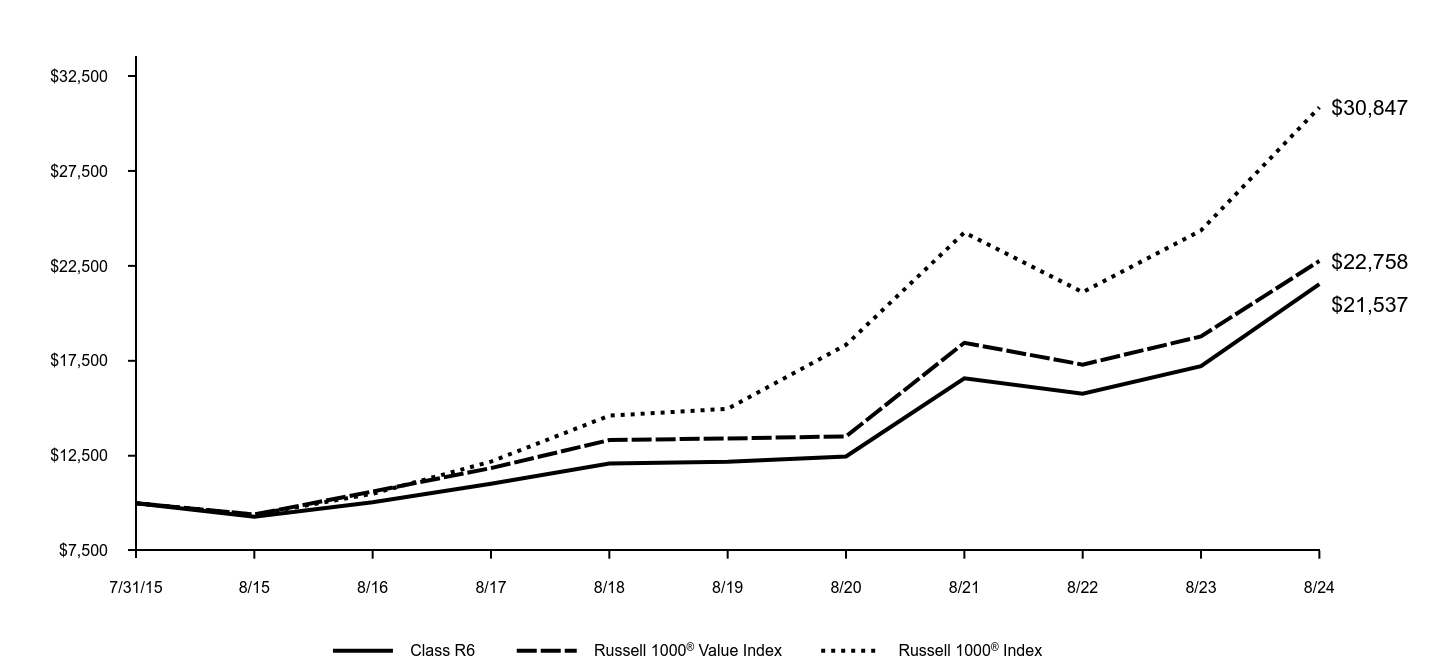

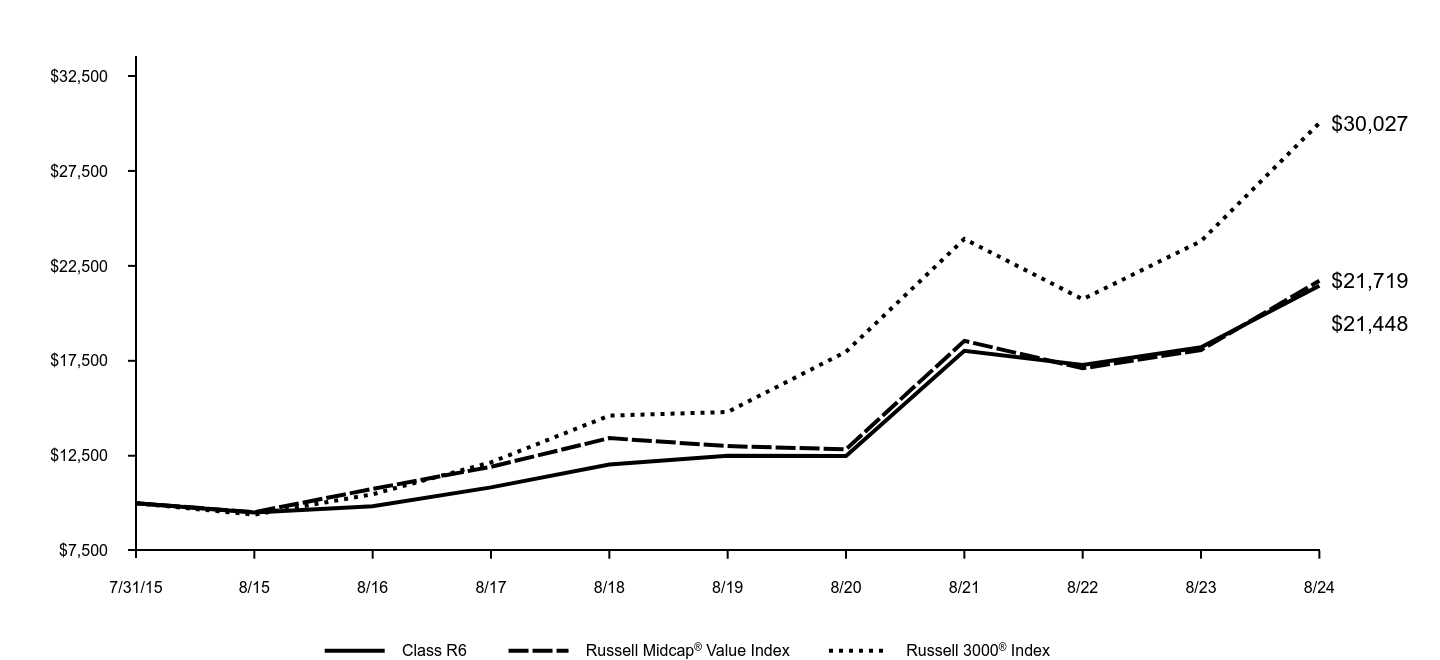

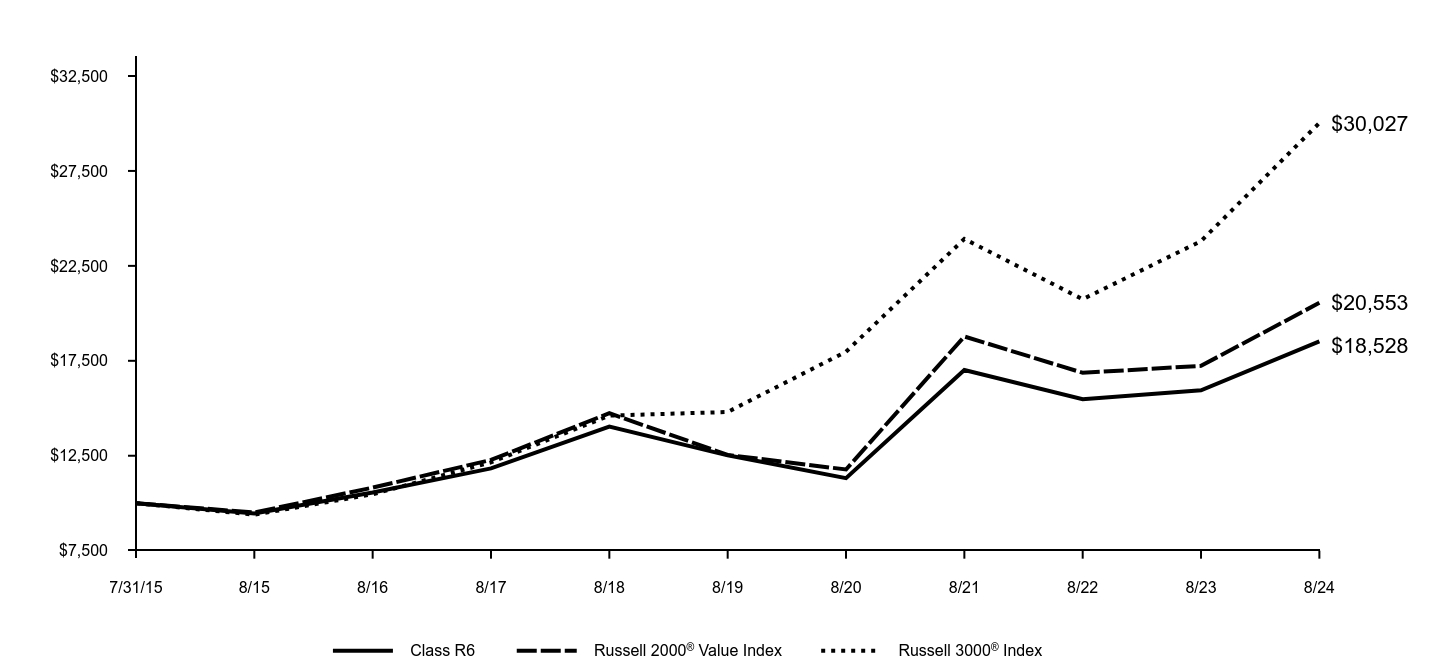

Goldman Sachs Enhanced Dividend Global Equity Portfolio

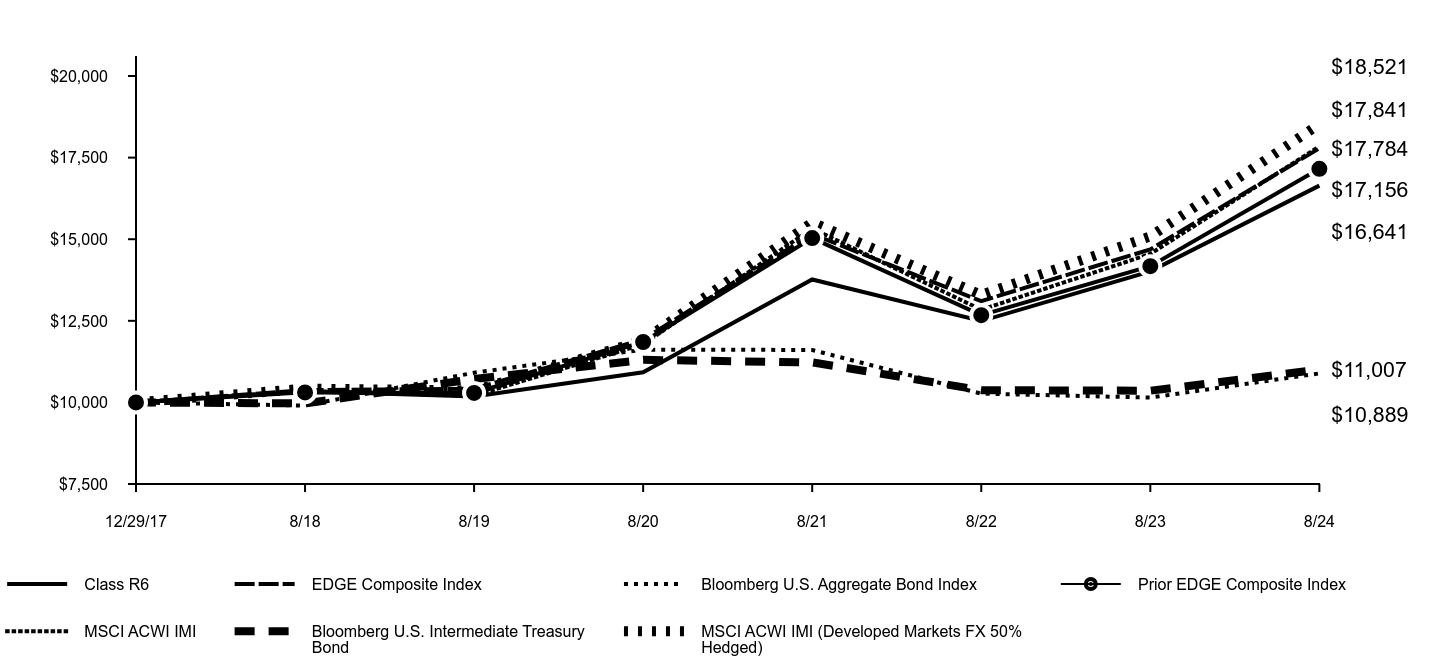

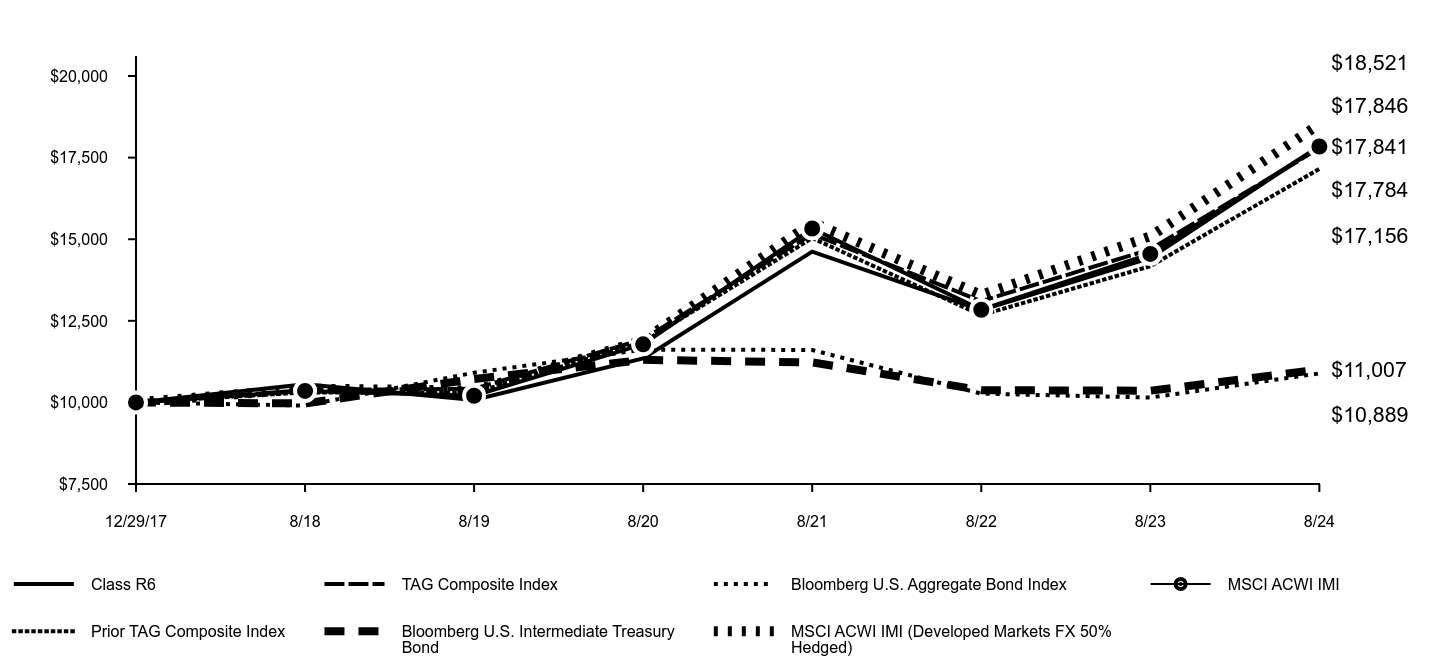

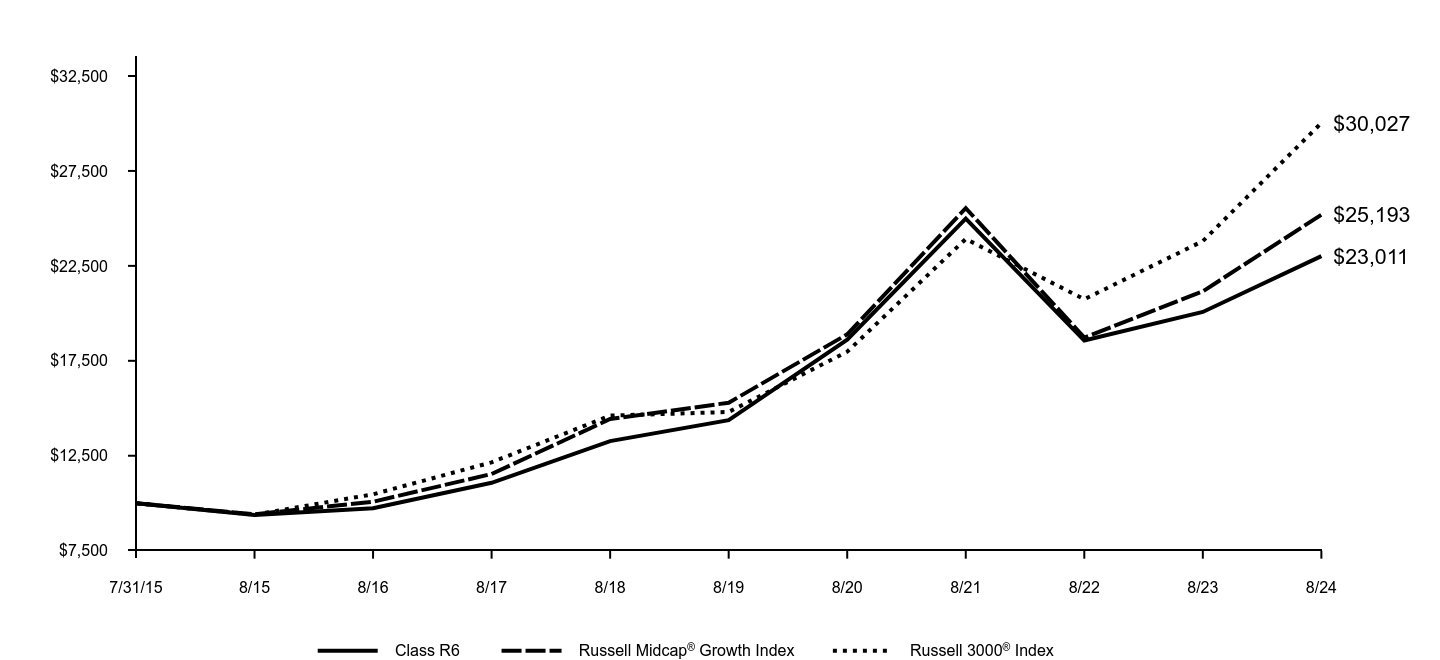

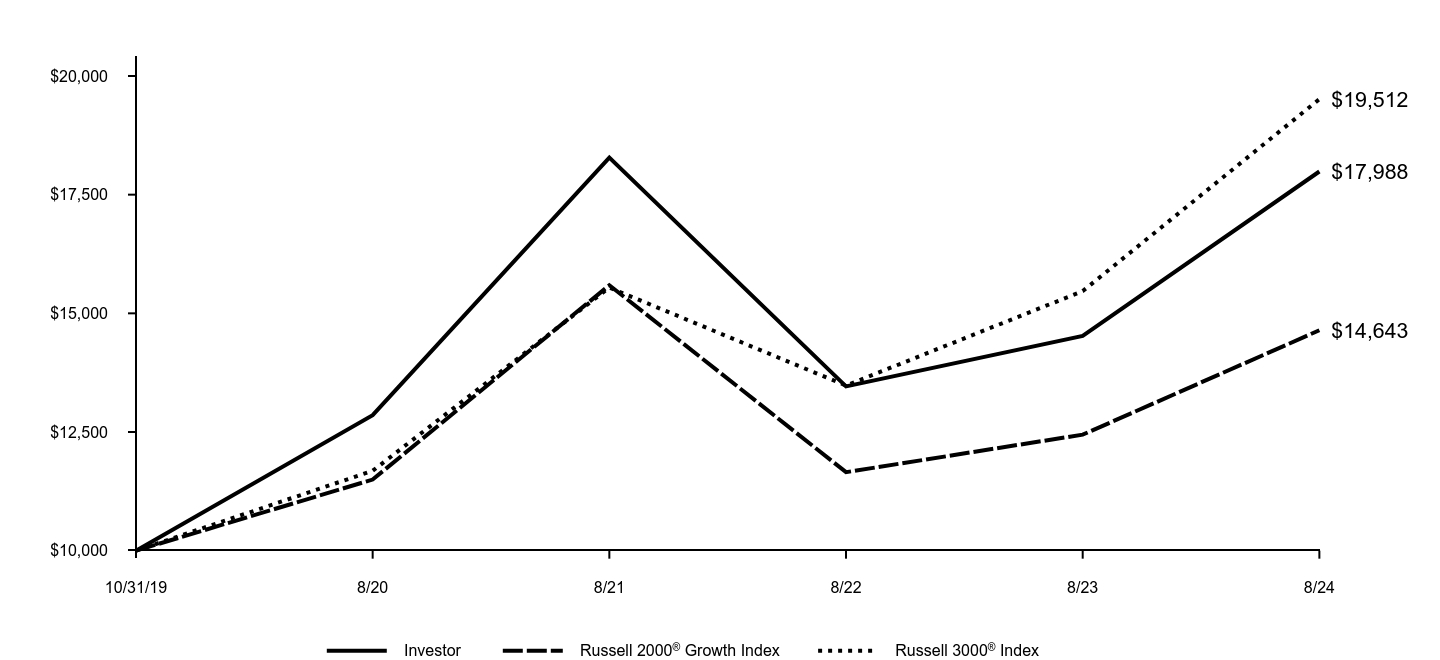

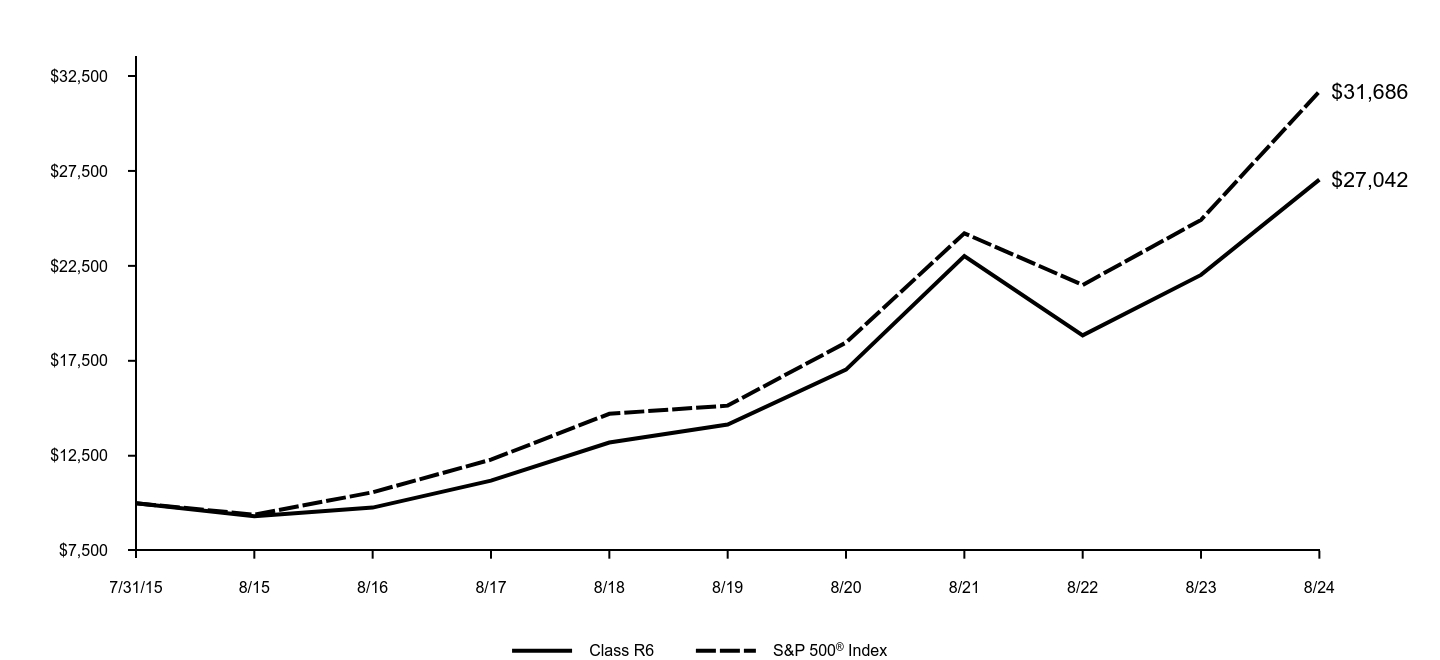

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's performance benchmark and any additional performance benchmark(s) are also shown.

As of the close of business on June 28, 2024, the Fund’s benchmark index, the EDGE Composite Index, was changed from a custom benchmark comprised of the MSCI ACWI IMI (Unhedged) (90%) and Bloomberg U.S. Aggregate Bond Index (10%) ("Prior EDGE Composite Index") to a custom benchmark comprised of the MSCI ACWI IMI (Developed Markets FX 50% Hedged) (90%) and Bloomberg U.S. Intermediate Treasury Index (10%). The Investment Adviser believes that the new composition of the EDGE Composite Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy.

| Class R6 | EDGE Composite Index | Bloomberg U.S. Aggregate Bond Index | Prior EDGE Composite Index | MSCI ACWI IMI | Bloomberg U.S. Intermediate Treasury Bond | MSCI ACWI IMI (Developed Markets FX 50% Hedged) |

|---|

| 12/29/17 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 8/18 | $10,339 | $10,378 | $9,904 | $10,308 | $10,353 | $9,970 | $10,423 |

| 8/19 | $10,180 | $10,418 | $10,911 | $10,292 | $10,205 | $10,718 | $10,365 |

| 8/20 | $10,923 | $11,932 | $11,617 | $11,852 | $11,781 | $11,305 | $11,897 |

| 8/21 | $13,766 | $15,159 | $11,608 | $15,034 | $15,328 | $11,226 | $15,514 |

| 8/22 | $12,493 | $13,103 | $10,271 | $12,674 | $12,839 | $10,376 | $13,293 |

| 8/23 | $14,017 | $14,689 | $10,148 | $14,174 | $14,550 | $10,359 | $15,086 |

| 8/24 | $16,641 | $17,784 | $10,889 | $17,156 | $17,841 | $11,007 | $18,521 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception |

|---|

| Class R6 (Commenced December 29, 2017) | 18.72% | 10.32% | 7.92% |

| EDGE Composite Index | 21.07% | 11.28% | 9.00% |

| MSCI ACWI IMI (Developed Markets FX 50% Hedged) | 22.77% | 12.30% | 9.67% |

| Bloomberg U.S. Intermediate Treasury Bond | 6.26% | 0.53% | 1.45% |

| Prior EDGE Composite Index | 21.04% | 10.75% | 8.42% |

| MSCI ACWI IMI | 22.62% | 11.81% | 9.06% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.28% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return, principal value and market price will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Enhanced Dividend Global Equity Portfolio

Key Fund Statistics (as of August 31, 2024)

| Total Net Assets | $446,101,199 |

| # of Portfolio Holdings | 20 |

| Portfolio Turnover Rate | 10% |

| Total Net Advisory Fees Paid | $590,710 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Underlying Funds | 90.9% |

| Investment Company | 6.5% |

| Exchange-Traded Funds | 0.7% |

Goldman Sachs Enhanced Dividend Global Equity Portfolio

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The blended returns are calculated by Goldman Sachs using end of day index level values licensed from MSCI (“MSCI Data”). For the avoidance of doubt, MSCI is not the benchmark “administrator” for, or a “contributor”, “submitter” or “supervised contributor” to, the blended returns, and the MSCI Data is not considered a “contribution” or “submission” in relation to the blended returns, as those terms may be defined in any rules, laws, regulations, legislation or international standards. MSCI Data is provided “AS IS” without warranty or liability and no copying or distribution is permitted. MSCI does not make any representation regarding the advisability of any investment or strategy and does not sponsor, promote, issue, sell or otherwise recommend or endorse any investment or strategy, including any financial products or strategies based on, tracking or otherwise utilizing any MSCI Data, models, analytics or other materials or information.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Enhanced Dividend Global Equity Portfolio

38148U197-AR-0824 Class R6

Annual Shareholder Report

August 31, 2024

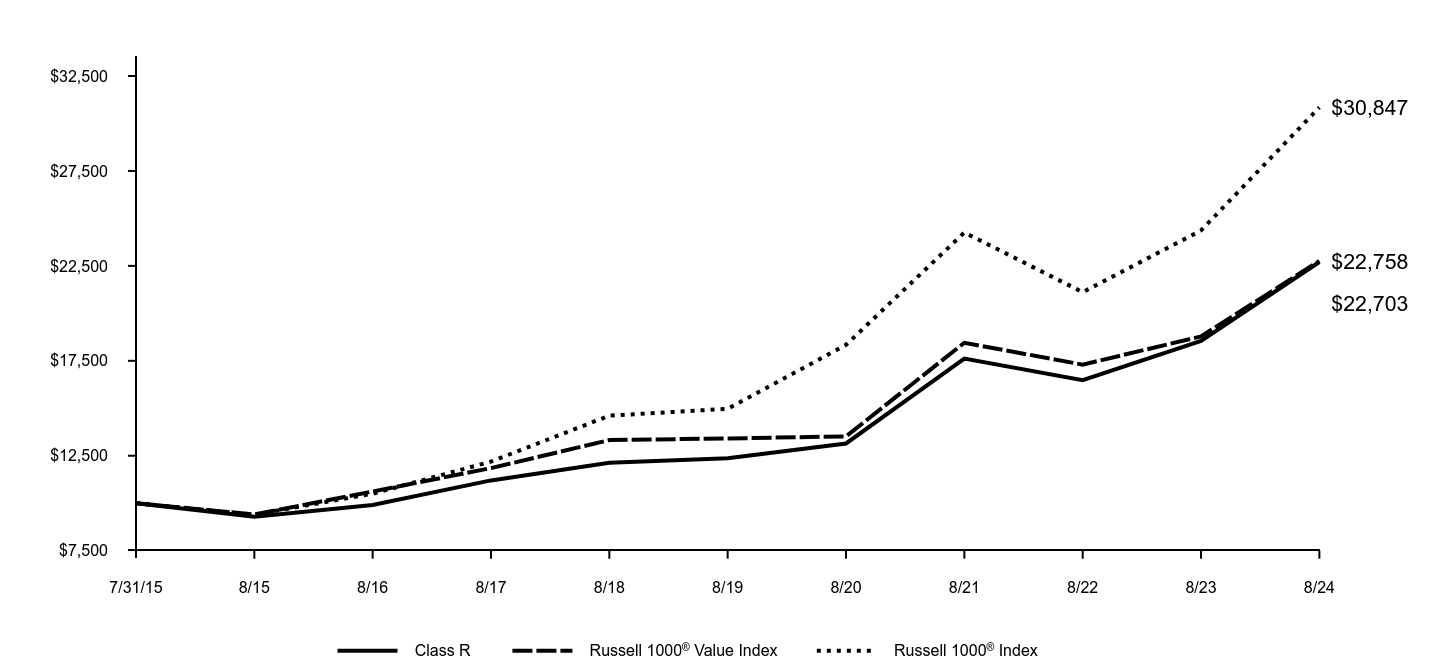

Goldman Sachs Enhanced Dividend Global Equity Portfolio

This annual shareholder report contains important information about Goldman Sachs Enhanced Dividend Global Equity Portfolio (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| P | $20 | 0.18% |

How did the Fund perform and what affected its performance?

Global equities performed strongly as waning inflation levels globally suggested the peaking of central bank tightening cycles and potential interest rate cuts in several developed markets. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports and a strong rally, especially in technology stocks, driven by enthusiasm around artificial intelligence. Weaker labor market data near the end of the reporting period fueled volatility as investors focused on the health of the U.S. economy.

Top Contributors to Performance:

The Portfolio benefited compared to the Enhanced Dividend Global Equity Composite Index ("EDGE Composite Index") from a strategic underweight in emerging markets equities, which generated positive returns but lagged the gains of developed markets equities broadly.

Strategic overweights in U.S. and non-U.S. developed markets equities, especially the Portfolio’s exposure to U.S. large-cap technology stocks, bolstered relative performance.

Tactical allocations to fixed income, equities and, to a lesser extent, commodities and a trend-based rotation tilt contributed positively to the Portfolio’s relative performance.

Top Detractors from Performance:

The call writing strategies of two of the Portfolio’s Underlying Funds–Goldman Sachs U.S. Equity Dividend and Premium Fund and Goldman Sachs International Equity Dividend and Premium Fund–detracted from their performance, as global equity markets posted double-digit gains.

Relative to the Index, the Portfolio’s underweight position in investment grade fixed income limited returns.

Goldman Sachs MLP Energy Infrastructure Fund and Goldman Sachs Global Real Estate Securities Fund, which were removed as Underlying Funds on June 28, 2024, underperformed their respective benchmark indices.

Currency-related tactical allocations detracted slightly from the Portfolio’s relative performance.

Strategic equities weightings

Investment grade fixed income - UW

Underlying Fund Performance

The above represents key factors.

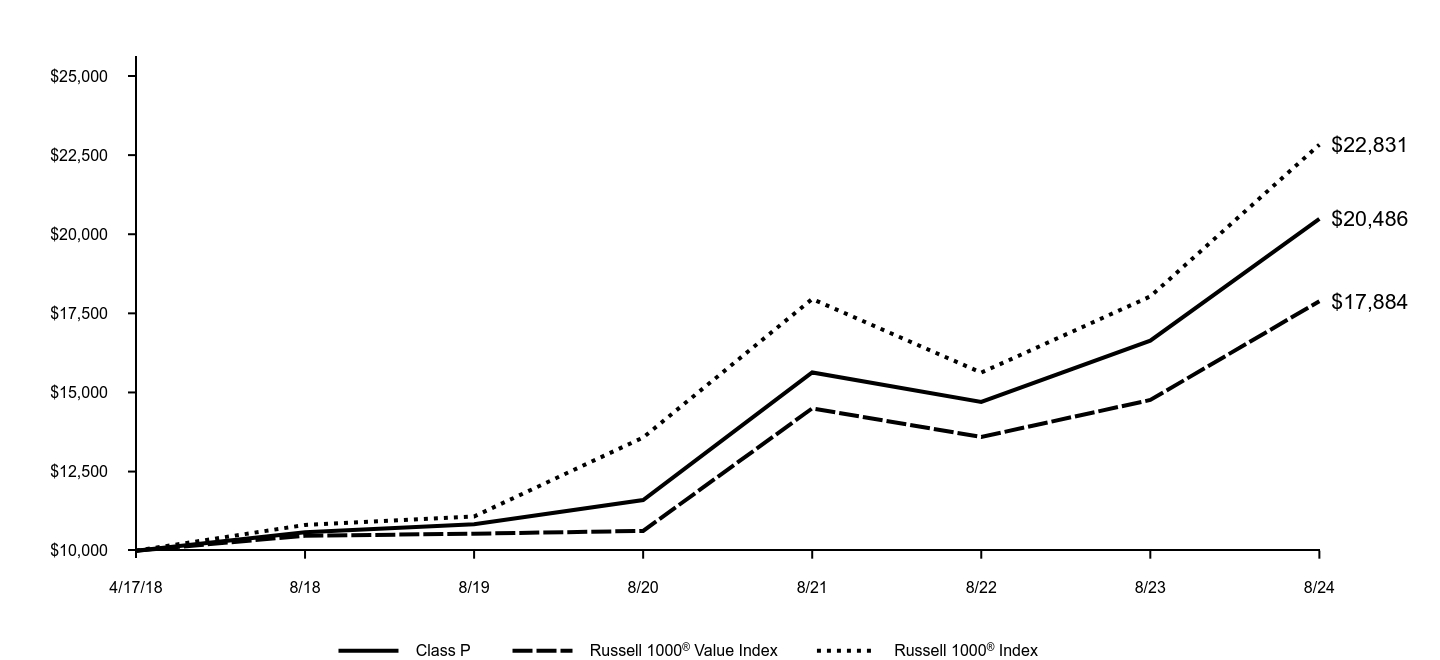

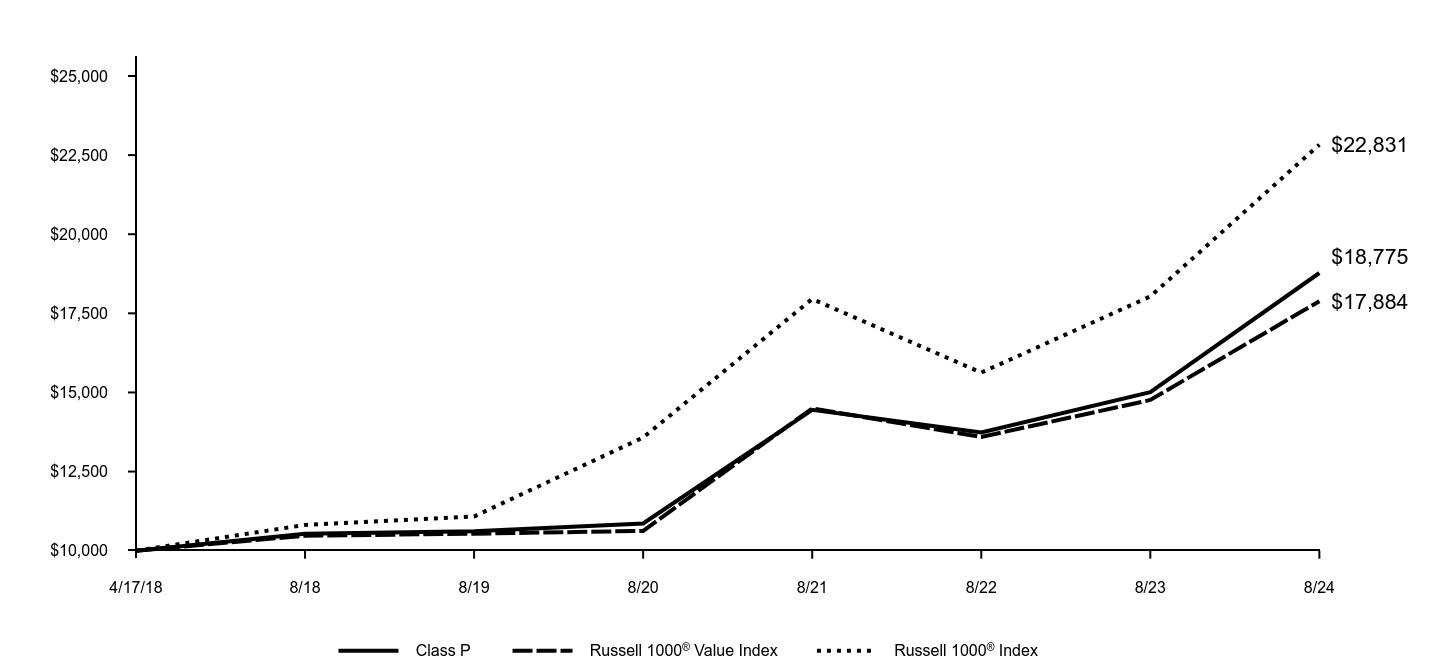

Goldman Sachs Enhanced Dividend Global Equity Portfolio

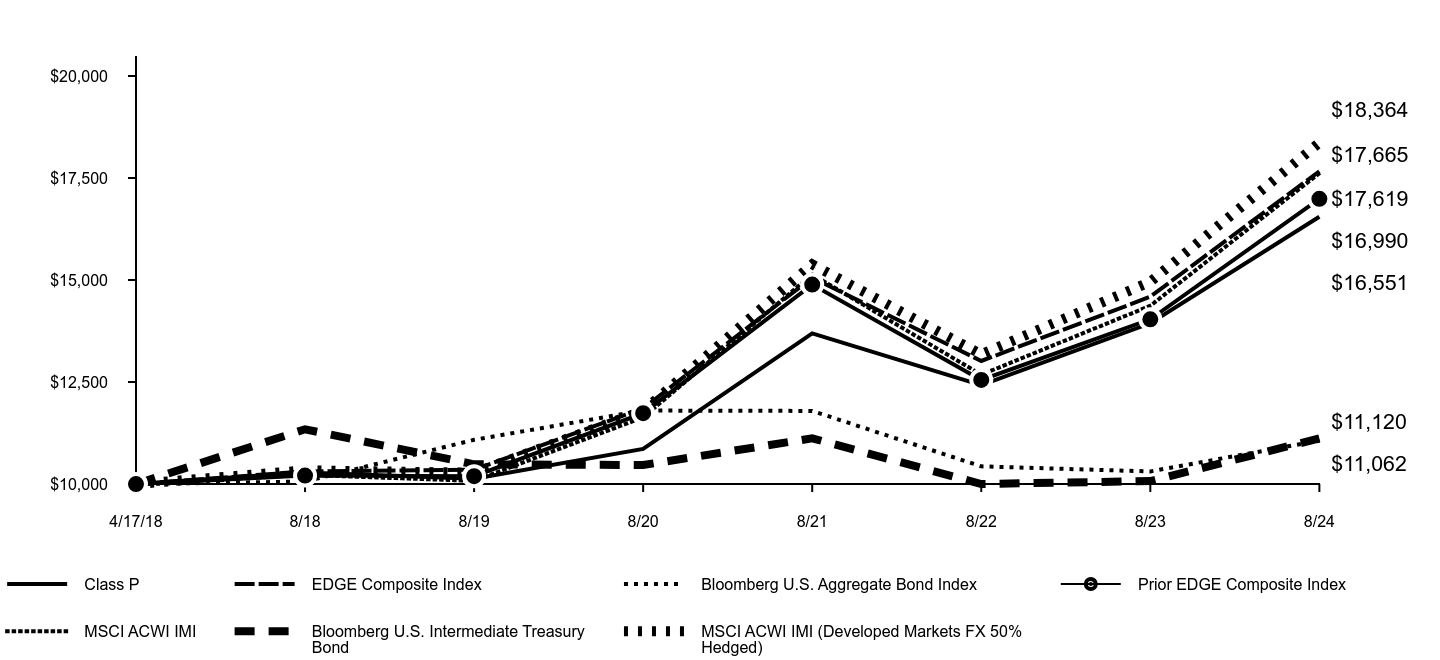

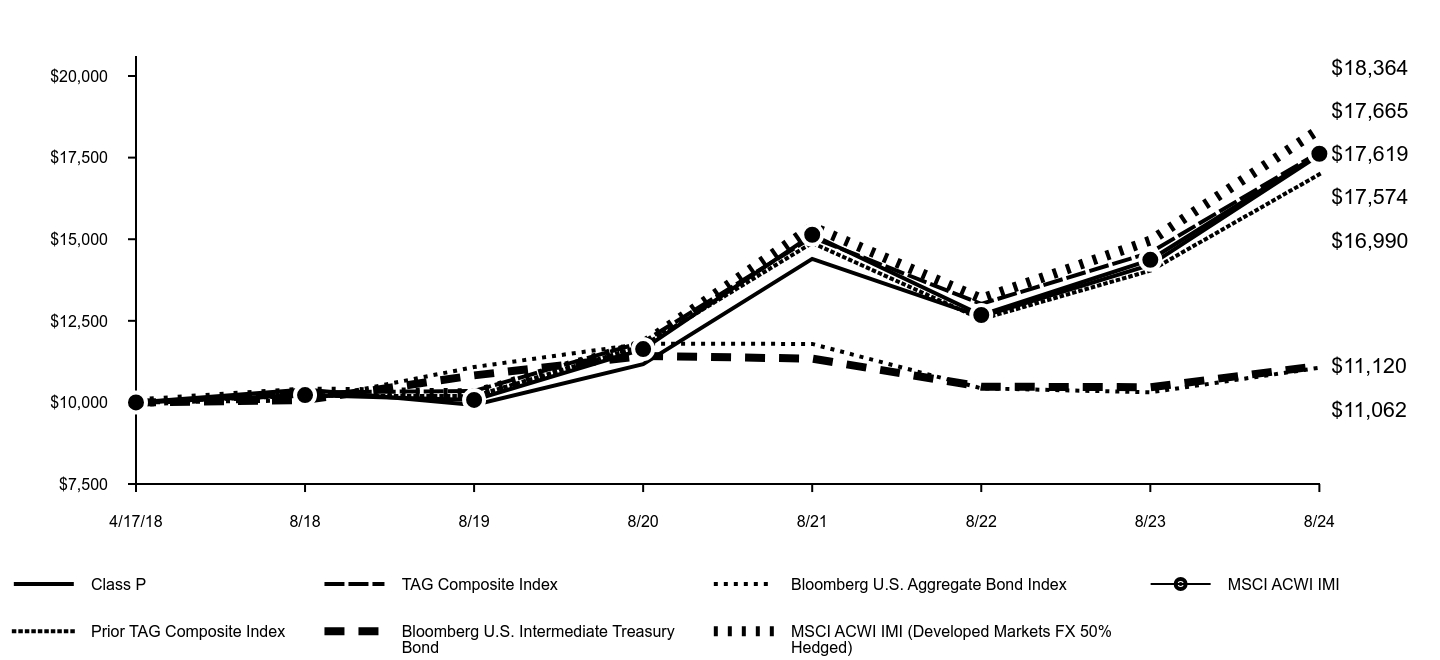

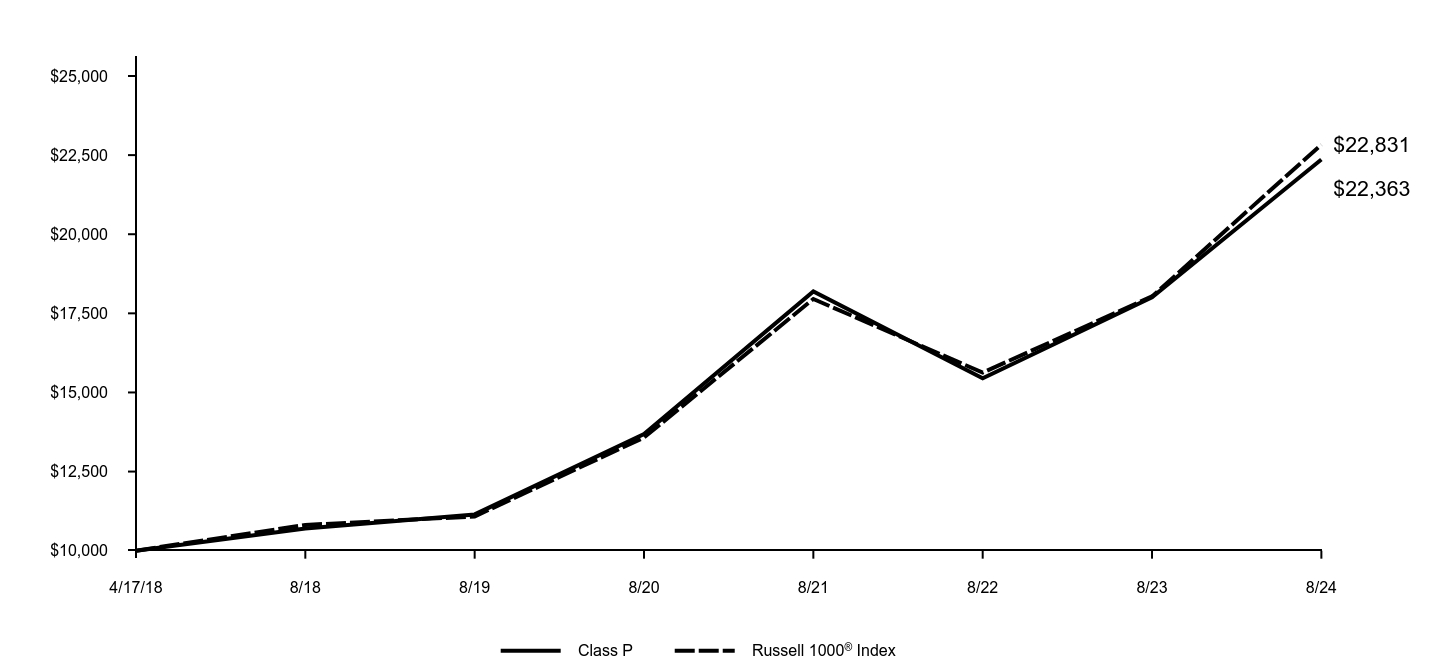

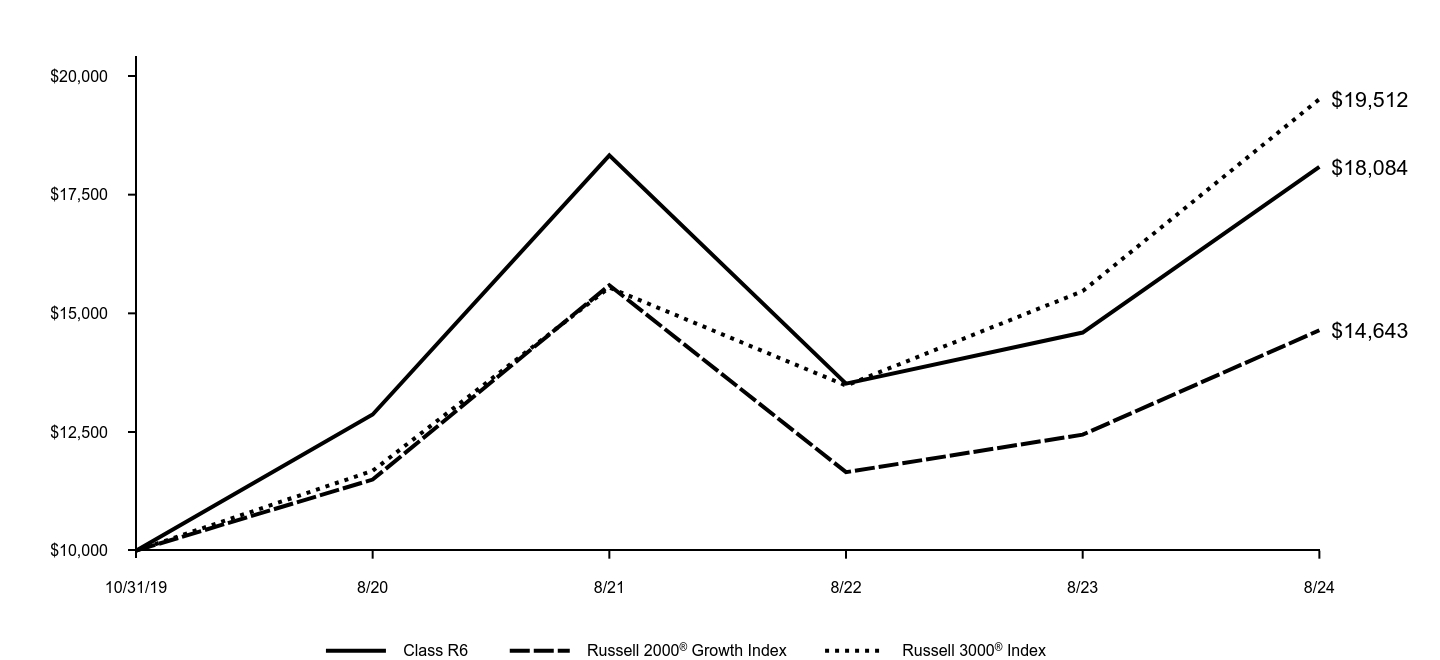

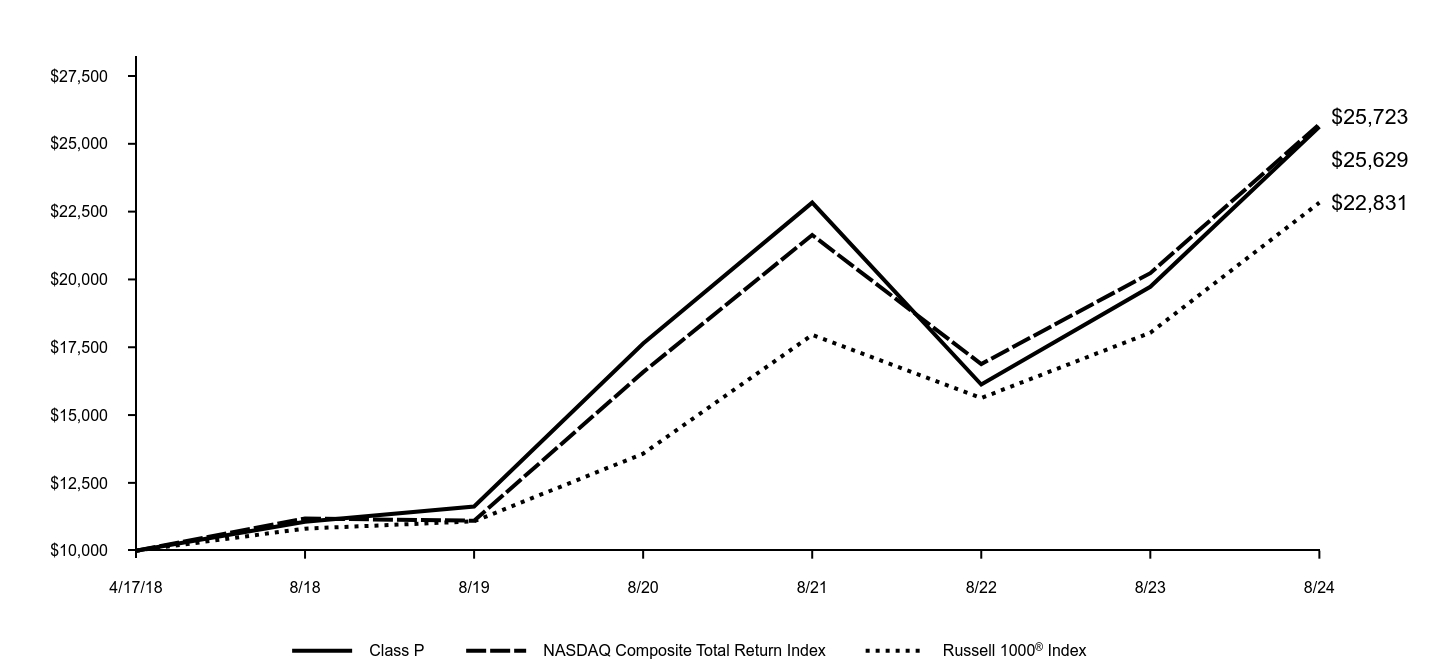

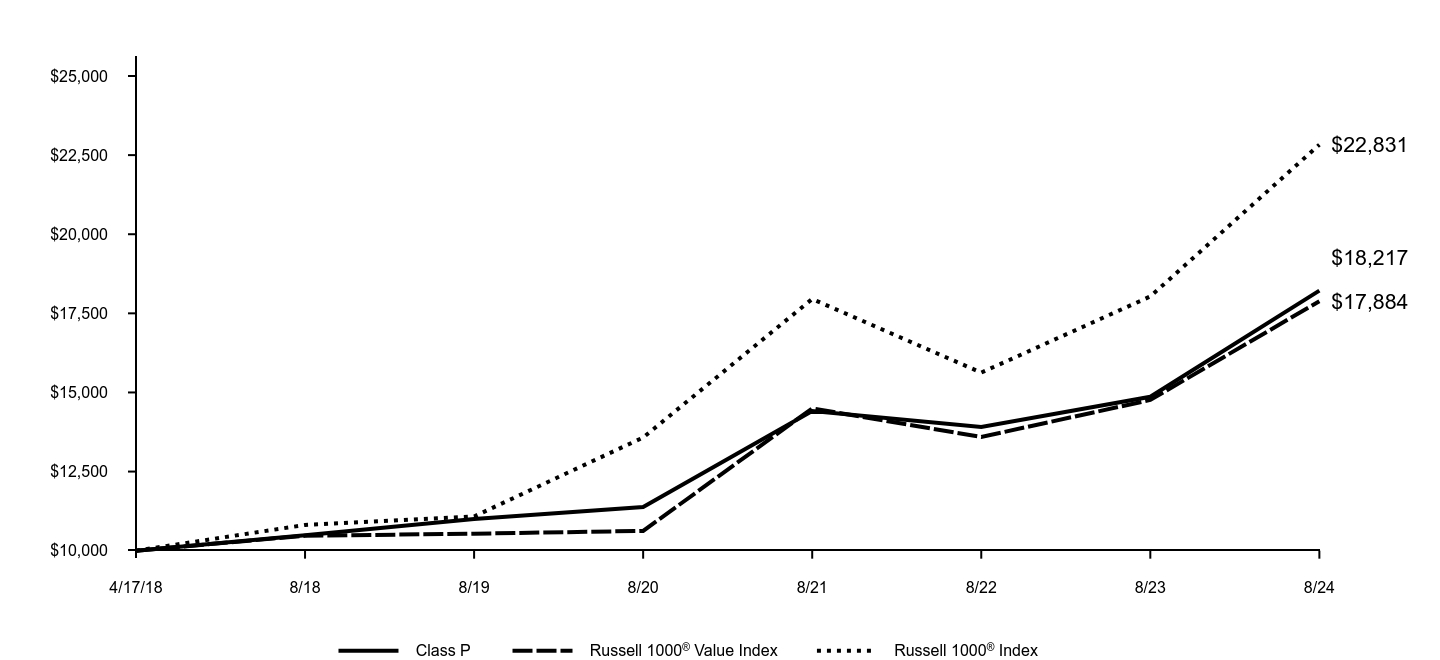

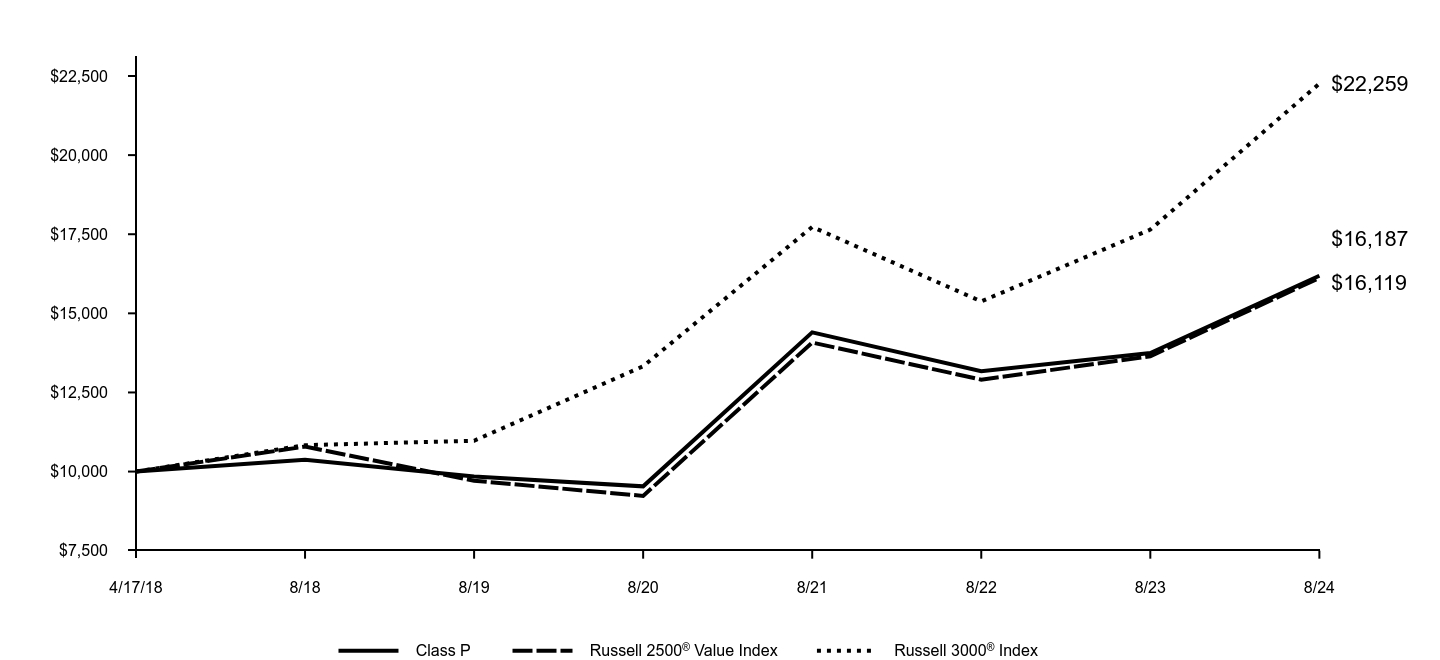

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's performance benchmark and any additional performance benchmark(s) are also shown.

As of the close of business on June 28, 2024, the Fund’s benchmark index, the EDGE Composite Index, was changed from a custom benchmark comprised of the MSCI ACWI IMI (Unhedged) (90%) and Bloomberg U.S. Aggregate Bond Index (10%) ("Prior EDGE Composite Index") to a custom benchmark comprised of the MSCI ACWI IMI (Developed Markets FX 50% Hedged) (90%) and Bloomberg U.S. Intermediate Treasury Index (10%). The Investment Adviser believes that the new composition of the EDGE Composite Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy.

| Class P | EDGE Composite Index | Bloomberg U.S. Aggregate Bond Index | Prior EDGE Composite Index | MSCI ACWI IMI | Bloomberg U.S. Intermediate Treasury Bond | MSCI ACWI IMI (Developed Markets FX 50% Hedged) |

|---|

| 4/17/18 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 8/18 | $10,280 | $10,309 | $10,061 | $10,208 | $10,224 | $11,342 | $10,335 |

| 8/19 | $10,131 | $10,349 | $11,084 | $10,192 | $10,078 | $10,483 | $10,277 |

| 8/20 | $10,862 | $11,853 | $11,801 | $11,737 | $11,634 | $10,466 | $11,796 |

| 8/21 | $13,692 | $15,058 | $11,792 | $14,888 | $15,137 | $11,121 | $15,383 |

| 8/22 | $12,424 | $13,016 | $10,433 | $12,551 | $12,679 | $10,000 | $13,180 |

| 8/23 | $13,940 | $14,591 | $10,309 | $14,037 | $14,369 | $10,073 | $14,958 |

| 8/24 | $16,551 | $17,665 | $11,062 | $16,990 | $17,619 | $11,120 | $18,364 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception |

|---|

| Class P (Commenced April 17, 2018) | 18.73% | 10.30% | 8.22% |

| EDGE Composite Index | 21.07% | 11.28% | 9.33% |

| MSCI ACWI IMI (Developed Markets FX 50% Hedged) | 22.77% | 12.30% | 10.00% |

| Bloomberg U.S. Intermediate Treasury Bond | 6.26% | 0.53% | 1.68% |

| Prior EDGE Composite Index | 21.04% | 10.75% | 8.67% |

| MSCI ACWI IMI | 22.62% | 11.81% | 9.29% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.59% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return, principal value and market price will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Enhanced Dividend Global Equity Portfolio

Key Fund Statistics (as of August 31, 2024)

| Total Net Assets | $446,101,199 |

| # of Portfolio Holdings | 20 |

| Portfolio Turnover Rate | 10% |

| Total Net Advisory Fees Paid | $590,710 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Underlying Funds | 90.9% |

| Investment Company | 6.5% |

| Exchange-Traded Funds | 0.7% |

Goldman Sachs Enhanced Dividend Global Equity Portfolio

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The blended returns are calculated by Goldman Sachs using end of day index level values licensed from MSCI (“MSCI Data”). For the avoidance of doubt, MSCI is not the benchmark “administrator” for, or a “contributor”, “submitter” or “supervised contributor” to, the blended returns, and the MSCI Data is not considered a “contribution” or “submission” in relation to the blended returns, as those terms may be defined in any rules, laws, regulations, legislation or international standards. MSCI Data is provided “AS IS” without warranty or liability and no copying or distribution is permitted. MSCI does not make any representation regarding the advisability of any investment or strategy and does not sponsor, promote, issue, sell or otherwise recommend or endorse any investment or strategy, including any financial products or strategies based on, tracking or otherwise utilizing any MSCI Data, models, analytics or other materials or information.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Enhanced Dividend Global Equity Portfolio

38150B830-AR-0824 Class P

Annual Shareholder Report

August 31, 2024

Goldman Sachs Tax-Advantaged Global Equity Portfolio

This annual shareholder report contains important information about Goldman Sachs Tax-Advantaged Global Equity Portfolio (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $61 | 0.55% |

How did the Fund perform and what affected its performance?

Global equities performed strongly as waning inflation levels globally suggested the peaking of central bank tightening cycles and potential interest rate cuts in several developed markets. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports and a strong rally, especially in technology stocks, driven by enthusiasm around artificial intelligence. Weaker labor market data near the end of the reporting period fueled volatility as investors focused on the health of the U.S. economy.

Top Contributors to Performance:

The Portfolio benefited compared to the Tax-Advantaged Global Composite Index ("TAG Composite Index") from a strategic underweight in emerging markets equities, which generated positive returns but lagged the gains of developed markets equities broadly.

Strategic overweights in U.S. and non-U.S. developed markets equities, especially the Portfolio’s exposure to U.S. large-cap technology stocks, bolstered relative returns.

Goldman Sachs U.S. Tax-Managed Equity Fund and Goldman Sachs International Tax-Managed Equity Fund, the two Underlying Funds in which the Portfolio held its largest weightings, outperformed their respective benchmark indices most during the reporting period.

Tactical allocations to fixed income, equities and, to a lesser extent, commodities and a trend-based rotation tilt contributed positively to the Portfolio’s relative performance.

Top Detractors from Performance:

Relative to the TAG Composite Index, the Portfolio’s underweight in investment grade fixed income detracted from performance.

Goldman Sachs MLP Energy Infrastructure Fund and Goldman Sachs Global Real Estate Securities Fund, which were removed as Underlying Funds on June 28, 2024, underperformed their respective benchmark indices.

Currency-related tactical allocations detracted slightly from the Portfolio’s relative performance.

Underlying Fund performance

Strategic equities weightings

Fixed income-related tactical allocations

Equity-related tactical allocations

Investment grade fixed income - UW

Currency-related tactical allocations

The above represents key factors.

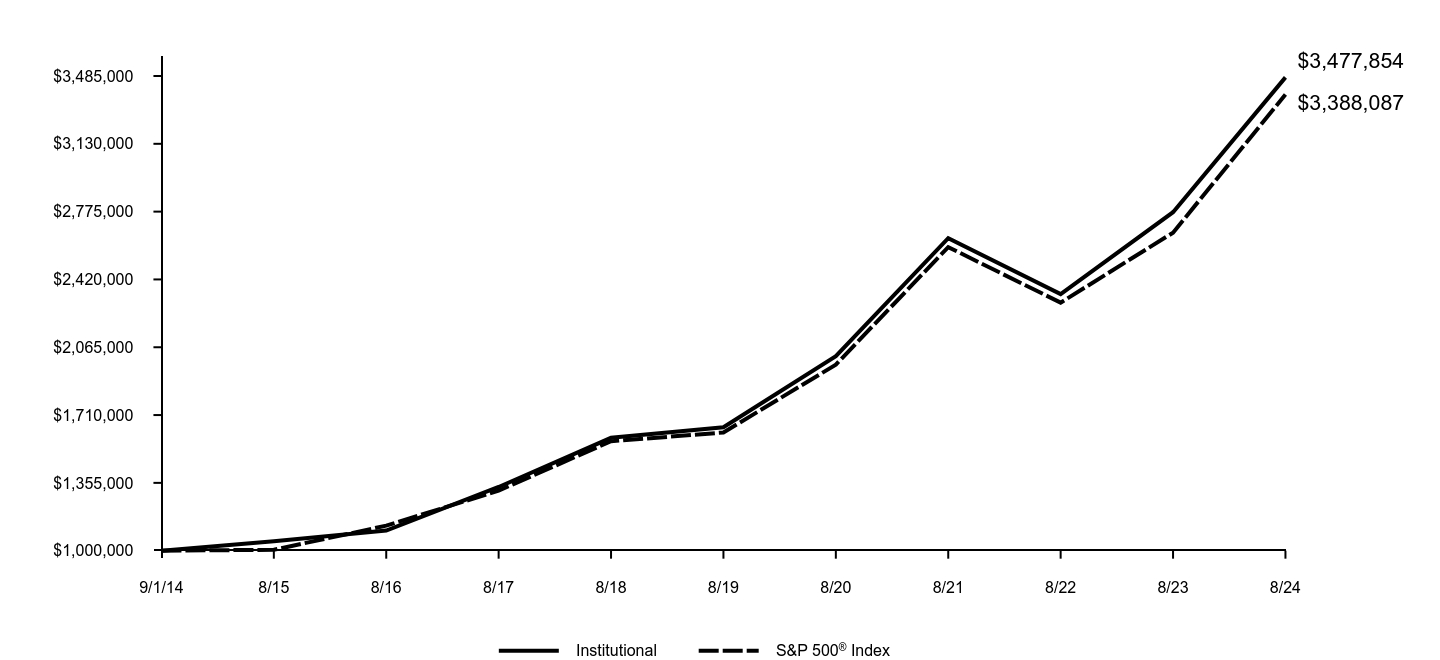

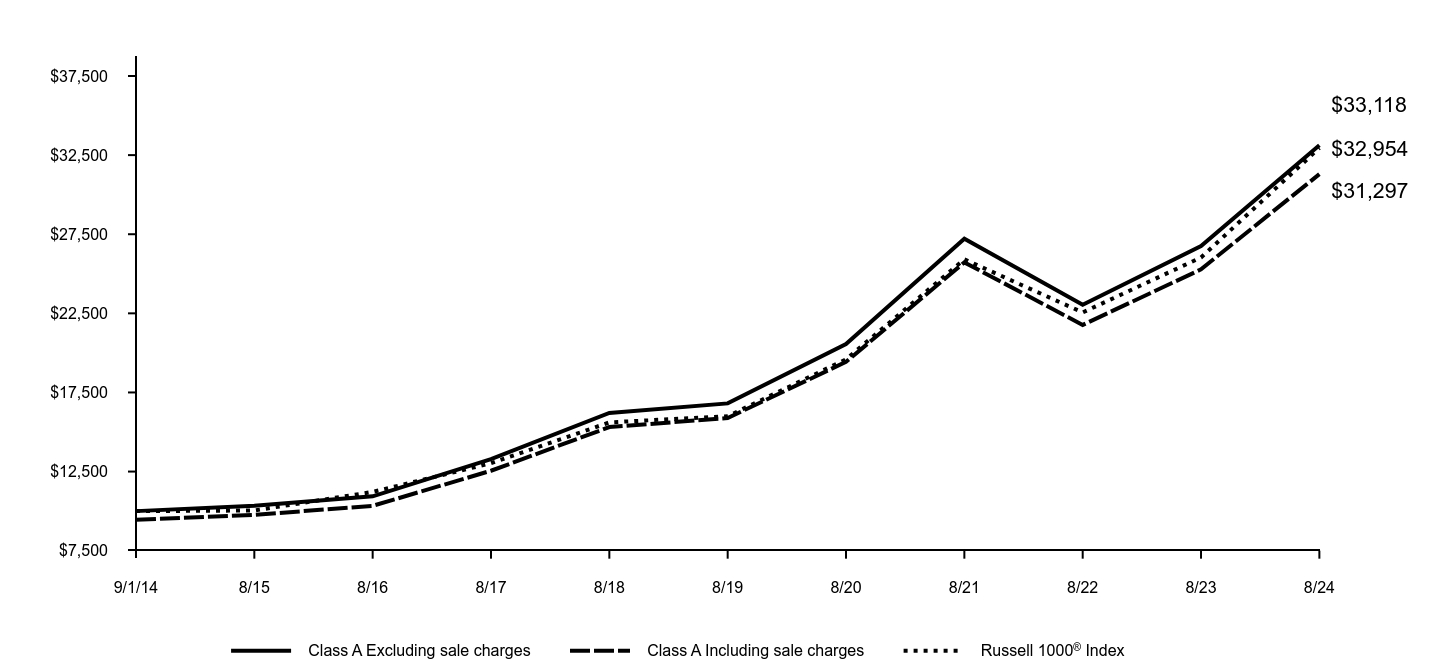

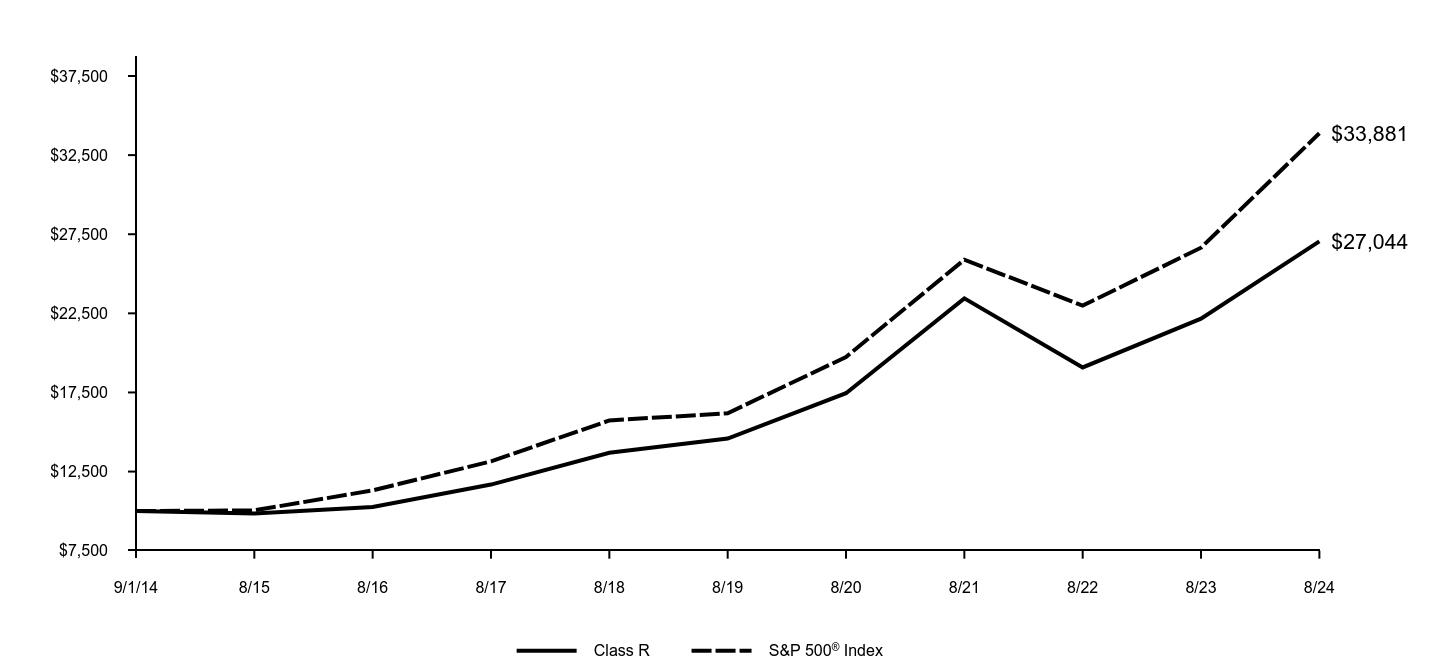

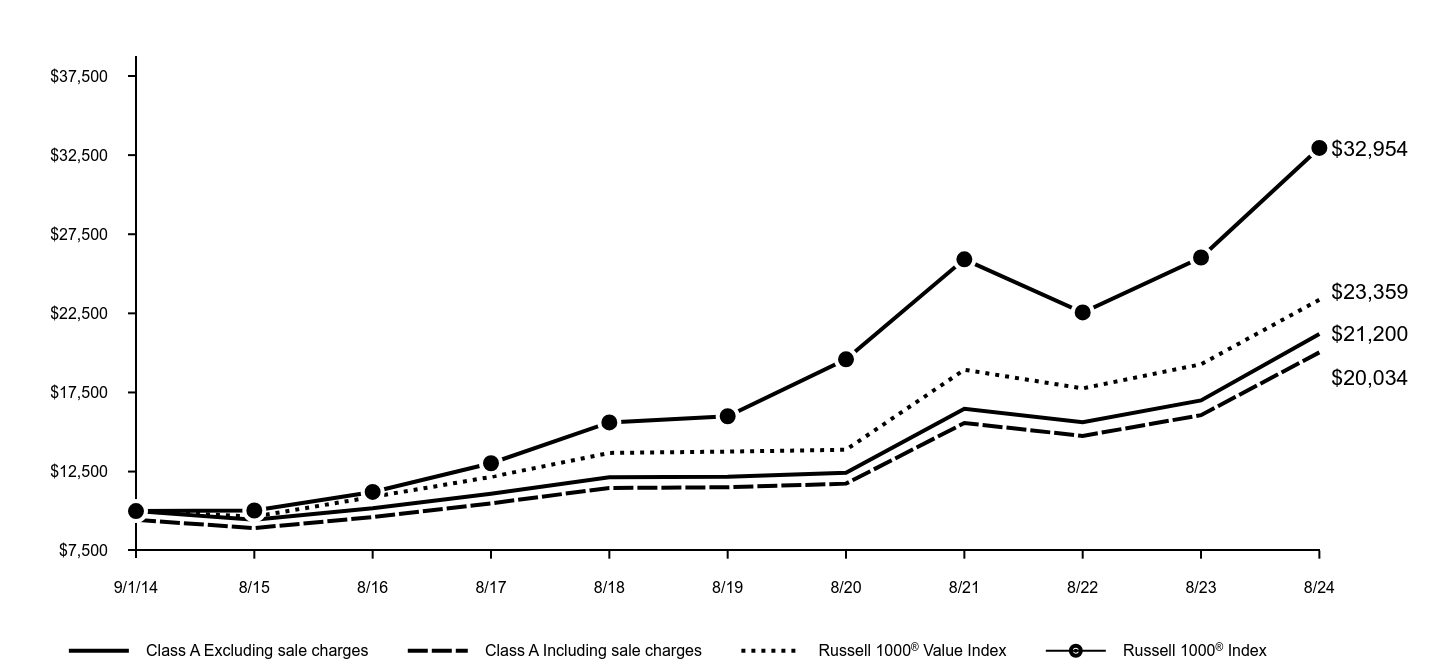

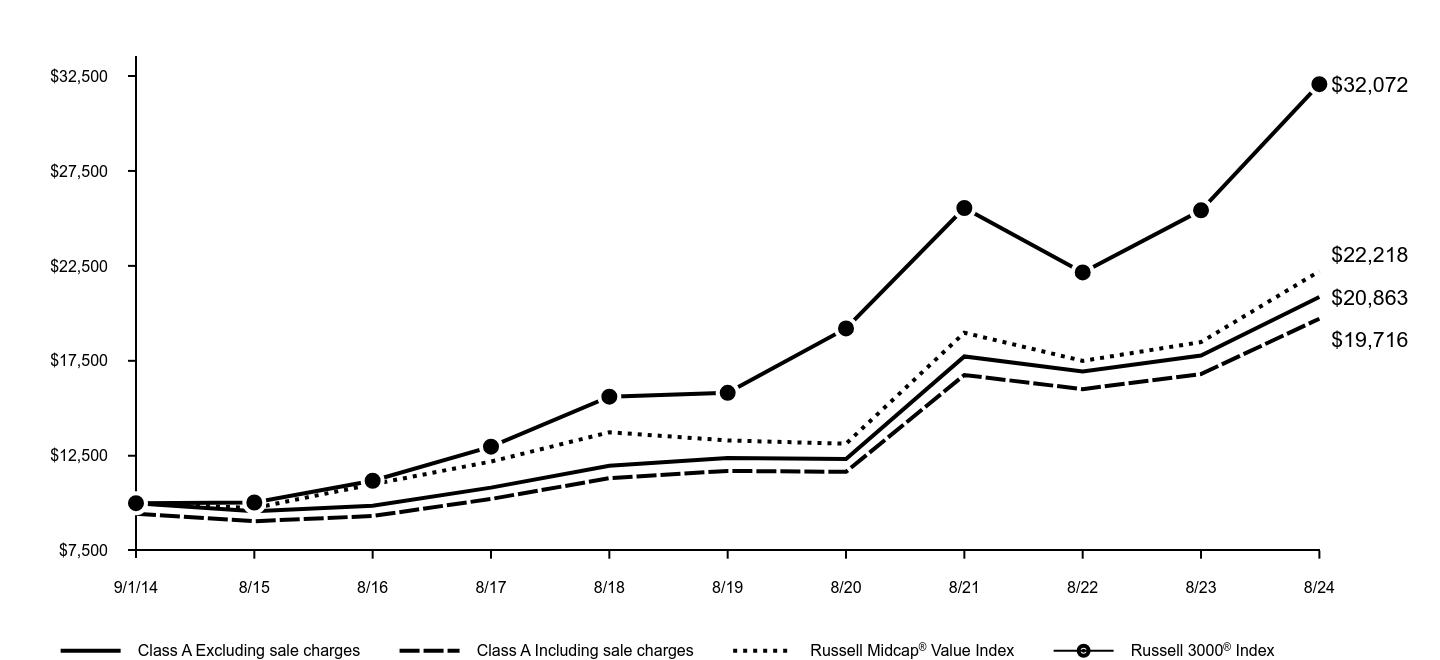

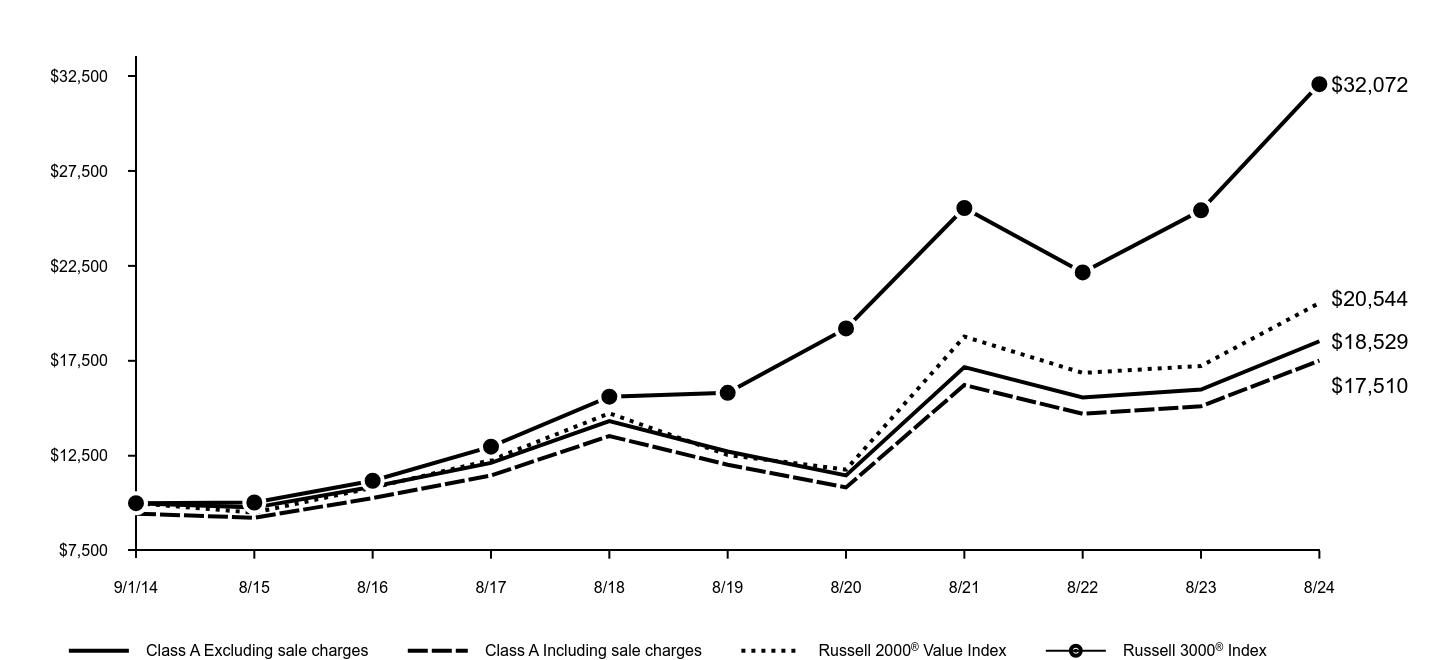

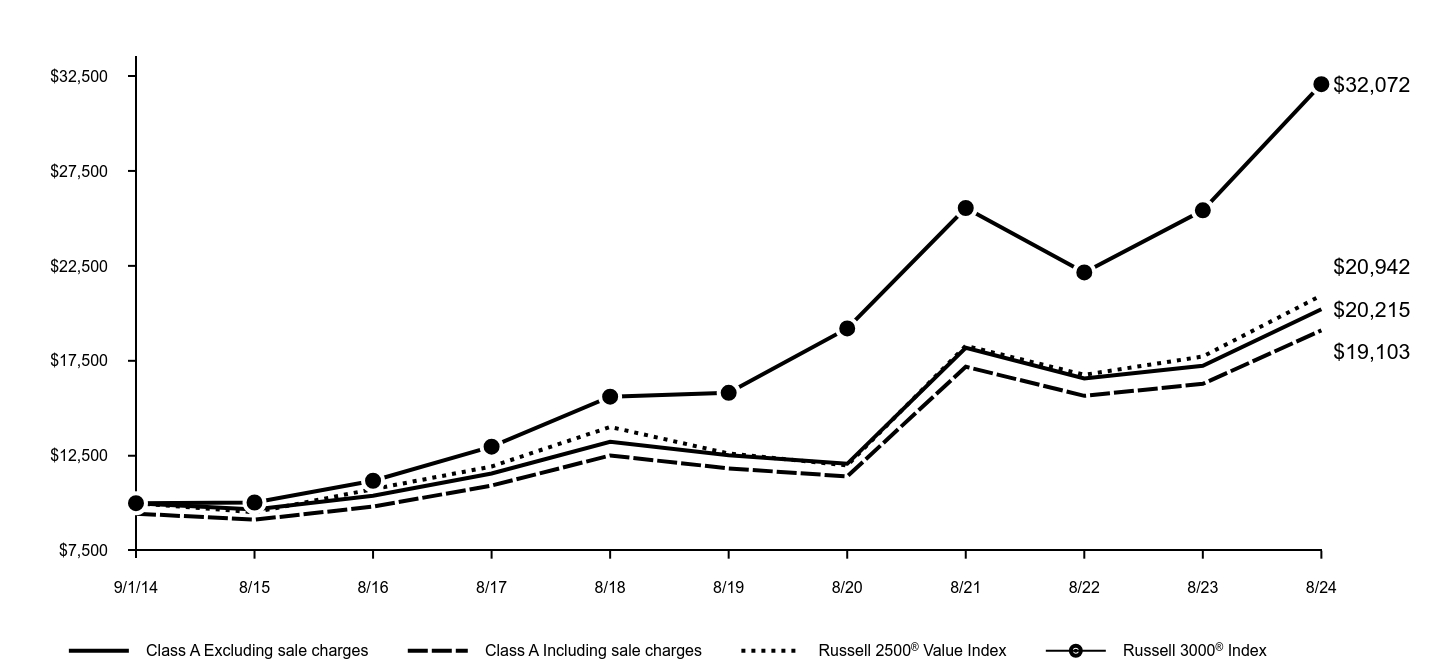

Goldman Sachs Tax-Advantaged Global Equity Portfolio

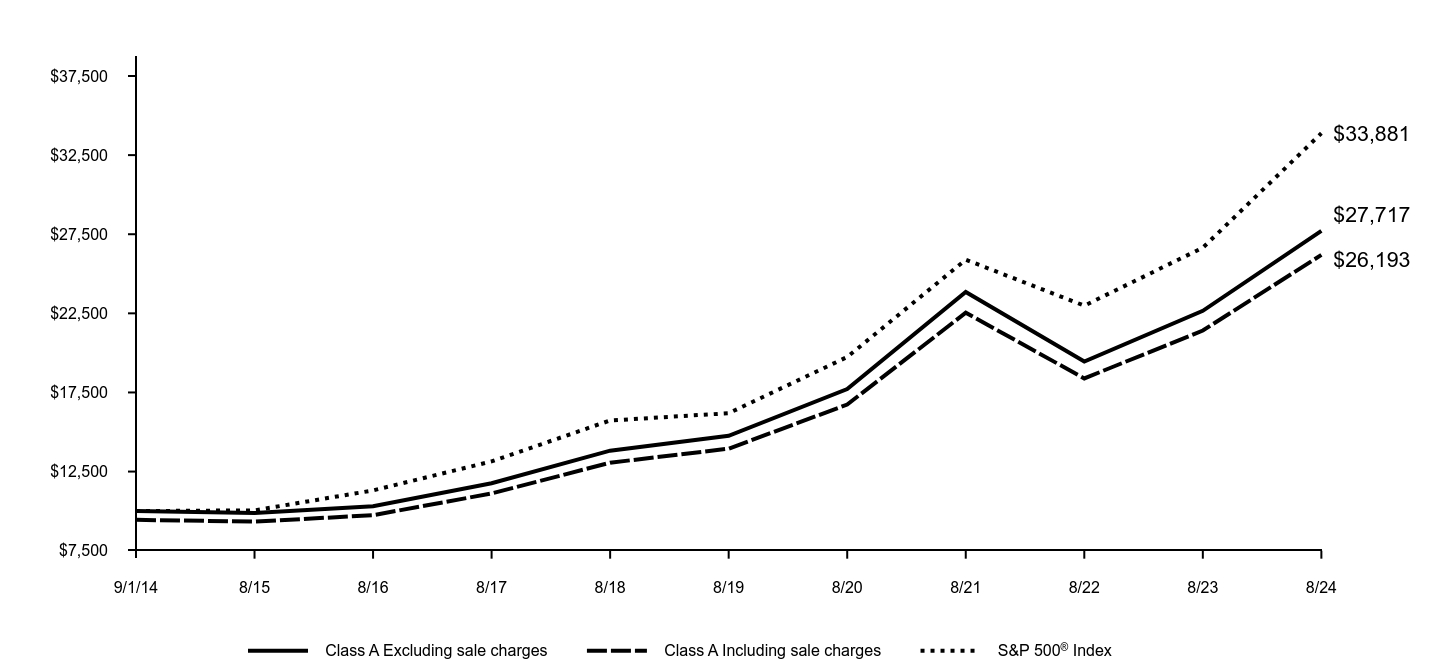

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

As of the close of business on June 28, 2024, the Fund’s performance benchmark index, the TAG Composite Index, was changed from a custom benchmark comprised of the MSCI ACWI IMI (Unhedged) (90%) and Bloomberg U.S. Aggregate Bond Index (10%) ("Prior TAG Composite Index") to a custom benchmark comprised of the MSCI ACWI IMI (Developed Markets FX 50% Hedged) (90%) and Bloomberg U.S. Intermediate Treasury Index (10%). The Investment Adviser believes that the new composition of the TAG Composite Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy.

| Class A Excluding sale charges | Class A Including sale charges | TAG Composite Index | Bloomberg U.S. Aggregate Bond Index | MSCI ACWI IMI | Prior TAG Composite Index | Bloomberg U.S. Intermediate Treasury Bond | MSCI ACWI IMI (Developed Markets FX 50% Hedged) |

|---|

| 9/1/14 | $10,000 | $9,450 | $10,000 | $10,000 | $10,000 | $10,000 | $10,796 | $10,000 |

| 8/15 | $9,561 | $9,035 | $9,697 | $10,156 | $9,390 | $9,466 | $10,778 | $9,641 |

| 8/16 | $10,029 | $9,478 | $10,373 | $10,762 | $10,082 | $10,156 | $11,452 | $10,348 |

| 8/17 | $11,557 | $10,921 | $11,955 | $10,815 | $11,804 | $11,714 | $11,549 | $12,111 |

| 8/18 | $13,037 | $12,320 | $13,289 | $10,701 | $13,197 | $12,940 | $10,190 | $13,636 |

| 8/19 | $12,391 | $11,709 | $13,341 | $11,790 | $13,008 | $12,920 | $10,507 | $13,559 |

| 8/20 | $13,912 | $13,147 | $15,279 | $12,553 | $15,017 | $14,878 | $10,510 | $15,563 |

| 8/21 | $17,848 | $16,867 | $19,411 | $12,543 | $19,538 | $18,873 | $10,373 | $20,296 |

| 8/22 | $15,601 | $14,743 | $16,779 | $11,098 | $16,365 | $15,910 | $11,151 | $17,390 |

| 8/23 | $17,487 | $16,525 | $18,809 | $10,966 | $18,547 | $17,794 | $11,763 | $19,736 |

| 8/24 | $21,543 | $20,358 | $22,772 | $11,766 | $22,742 | $21,538 | $11,453 | $24,230 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A Excluding sale charges | 23.19% | 11.68% | 7.97% |

| Class A Including sale charges | 16.41% | 10.42% | 7.36% |

| TAG Composite Index | 21.07% | 11.28% | 8.57% |

| MSCI ACWI IMI (Developed Markets FX 50% Hedged) | 22.77% | 12.30% | 9.25% |

| Bloomberg U.S. Intermediate Treasury Bond | 6.26% | 0.53% | 1.36% |

| Prior TAG Composite Index | 21.04% | 10.75% | 7.97% |

| MSCI ACWI IMI | 22.62% | 11.81% | 8.56% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return, principal value and market price will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Tax-Advantaged Global Equity Portfolio

Key Fund Statistics (as of August 31, 2024)

| Total Net Assets | $4,480,881,997 |

| # of Portfolio Holdings | 19 |

| Portfolio Turnover Rate | 9% |

| Total Net Advisory Fees Paid | $5,484,694 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Underlying Funds | 89.5% |

| Investment Company | 7.8% |

| Exchange-Traded Funds | 0.7% |

Goldman Sachs Tax-Advantaged Global Equity Portfolio

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The blended returns are calculated by Goldman Sachs using end of day index level values licensed from MSCI (“MSCI Data”). For the avoidance of doubt, MSCI is not the benchmark “administrator” for, or a “contributor”, “submitter” or “supervised contributor” to, the blended returns, and the MSCI Data is not considered a “contribution” or “submission” in relation to the blended returns, as those terms may be defined in any rules, laws, regulations, legislation or international standards. MSCI Data is provided “AS IS” without warranty or liability and no copying or distribution is permitted. MSCI does not make any representation regarding the advisability of any investment or strategy and does not sponsor, promote, issue, sell or otherwise recommend or endorse any investment or strategy, including any financial products or strategies based on, tracking or otherwise utilizing any MSCI Data, models, analytics or other materials or information.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Tax-Advantaged Global Equity Portfolio

38142B120-AR-0824 Class A

Annual Shareholder Report

August 31, 2024

Goldman Sachs Tax-Advantaged Global Equity Portfolio

Institutional Class: TIGGX

This annual shareholder report contains important information about Goldman Sachs Tax-Advantaged Global Equity Portfolio (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $21 | 0.19% |

How did the Fund perform and what affected its performance?

Global equities performed strongly as waning inflation levels globally suggested the peaking of central bank tightening cycles and potential interest rate cuts in several developed markets. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports and a strong rally, especially in technology stocks, driven by enthusiasm around artificial intelligence. Weaker labor market data near the end of the reporting period fueled volatility as investors focused on the health of the U.S. economy.

Top Contributors to Performance:

The Portfolio benefited compared to the Tax-Advantaged Global Composite Index ("TAG Composite Index") from a strategic underweight in emerging markets equities, which generated positive returns but lagged the gains of developed markets equities broadly.

Strategic overweights in U.S. and non-U.S. developed markets equities, especially the Portfolio’s exposure to U.S. large-cap technology stocks, bolstered relative returns.

Goldman Sachs U.S. Tax-Managed Equity Fund and Goldman Sachs International Tax-Managed Equity Fund, the two Underlying Funds in which the Portfolio held its largest weightings, outperformed their respective benchmark indices most during the reporting period.

Tactical allocations to fixed income, equities and, to a lesser extent, commodities and a trend-based rotation tilt contributed positively to the Portfolio’s relative performance.

Top Detractors from Performance:

Relative to the TAG Composite Index, the Portfolio’s underweight in investment grade fixed income detracted from performance.

Goldman Sachs MLP Energy Infrastructure Fund and Goldman Sachs Global Real Estate Securities Fund, which were removed as Underlying Funds on June 28, 2024, underperformed their respective benchmark indices.

Currency-related tactical allocations detracted slightly from the Portfolio’s relative performance.

Underlying Fund performance

Strategic equities weightings

Fixed income-related tactical allocations

Equity-related tactical allocations

Investment grade fixed income - UW

Currency-related tactical allocations

The above represents key factors.

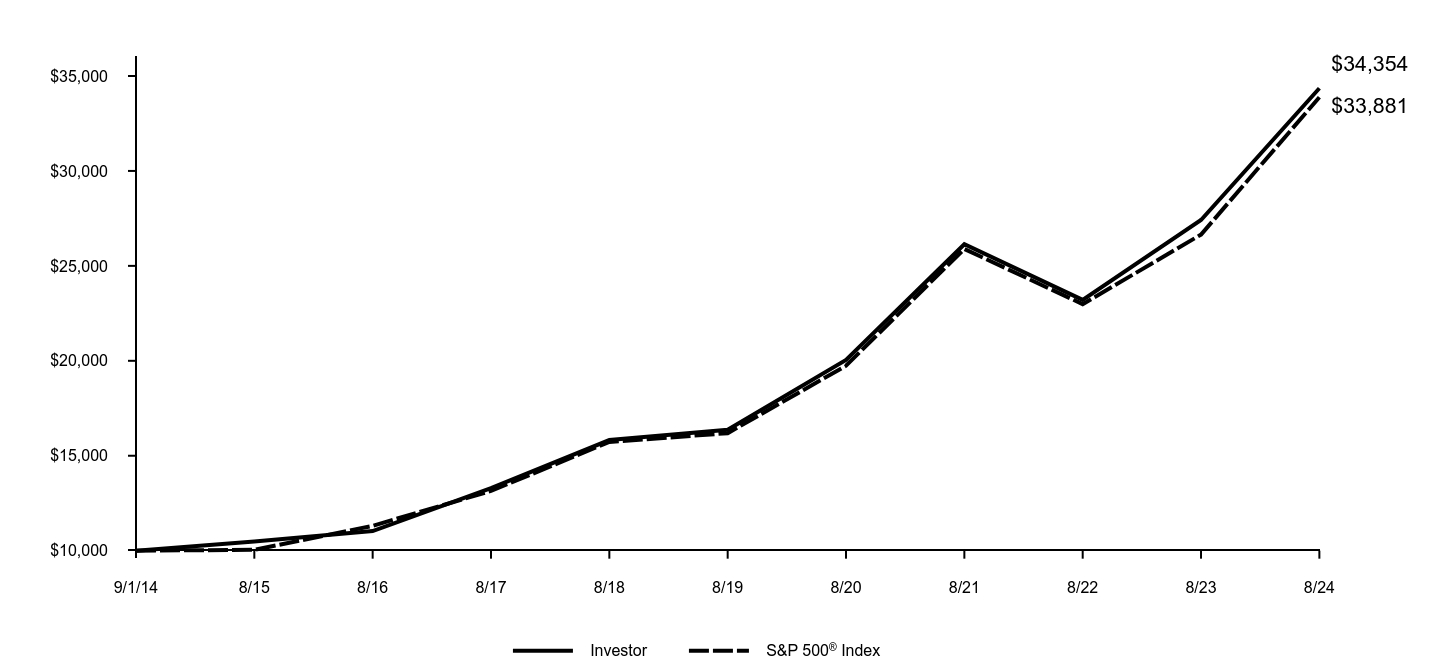

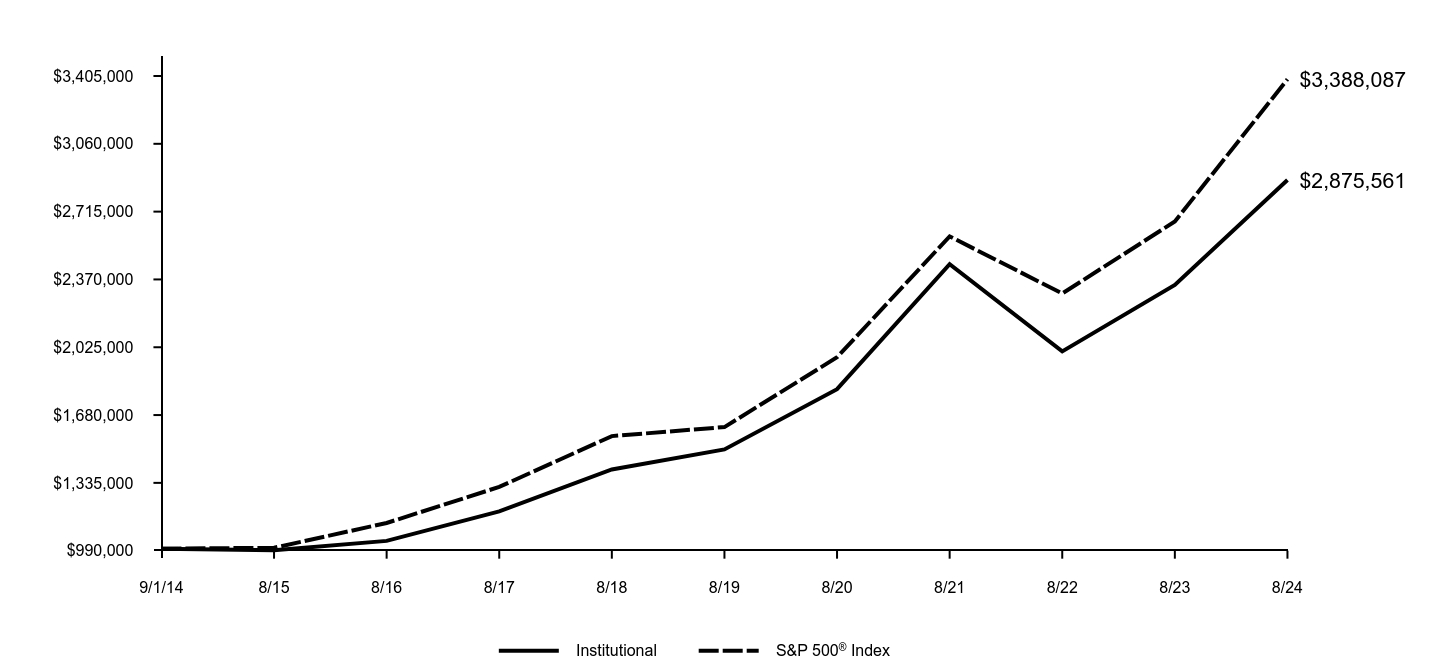

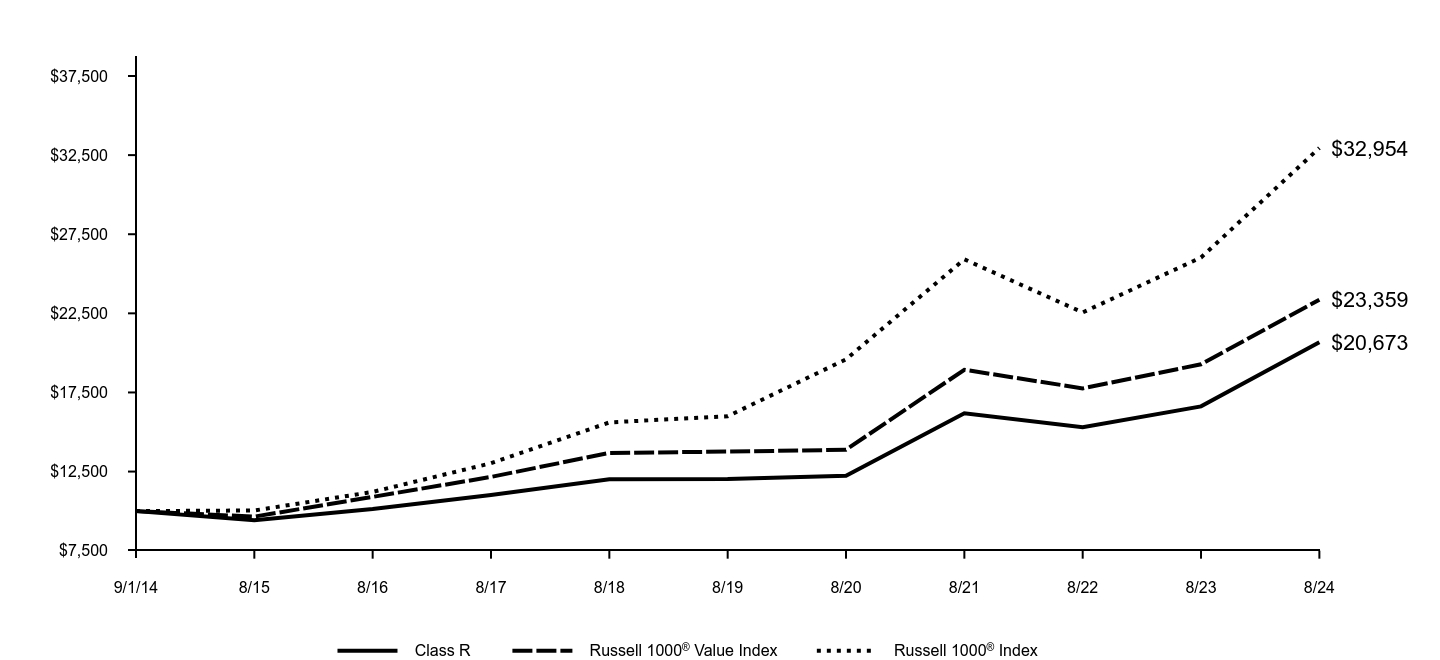

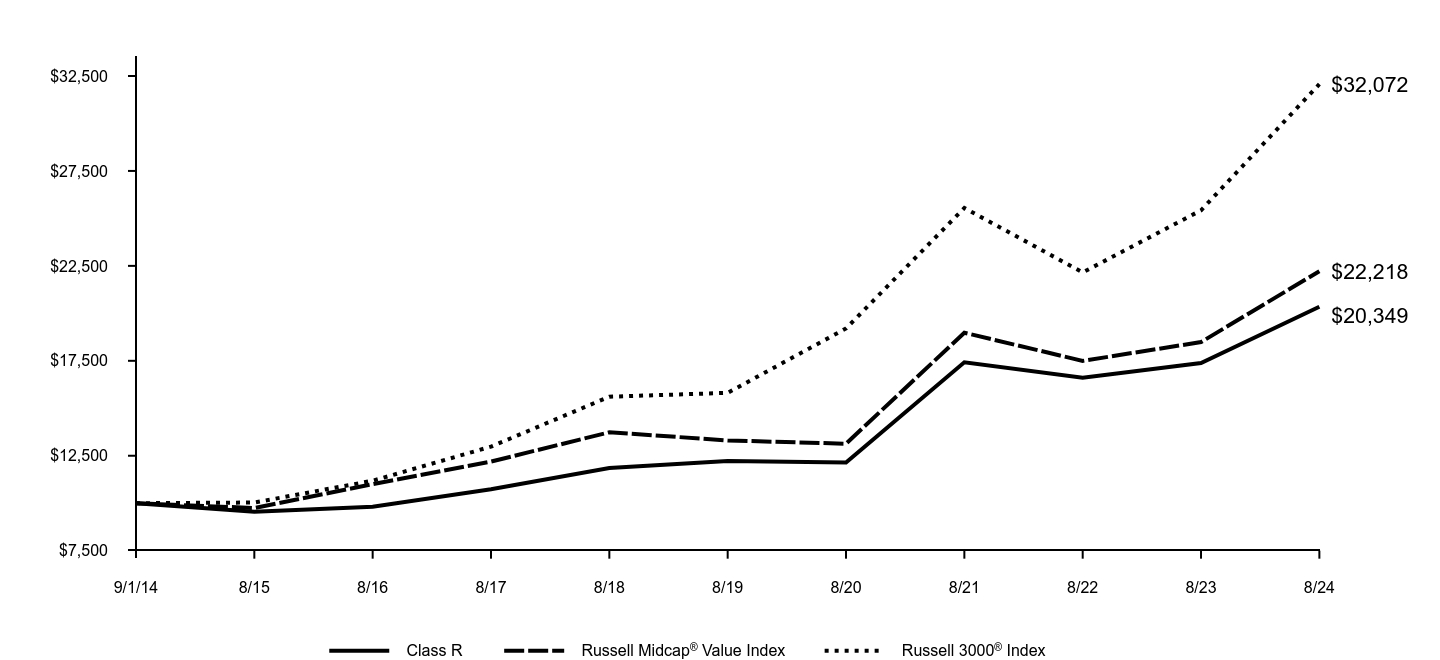

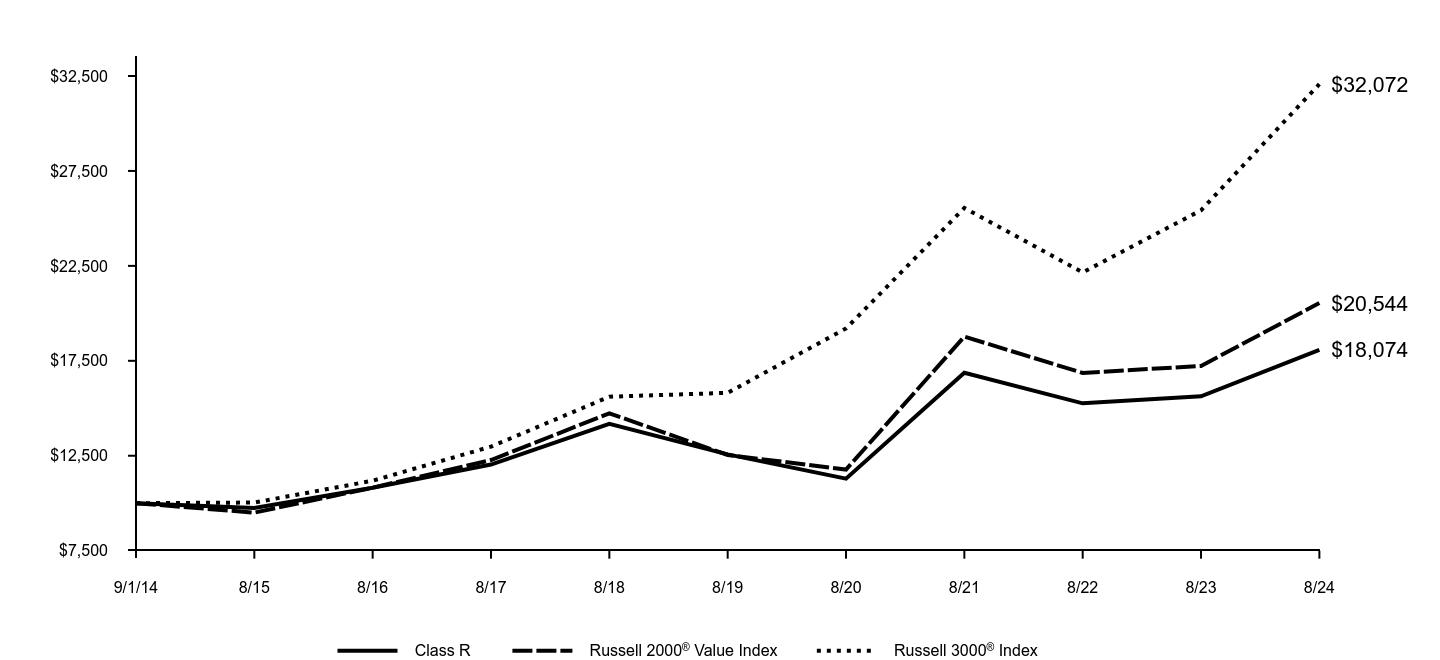

Goldman Sachs Tax-Advantaged Global Equity Portfolio

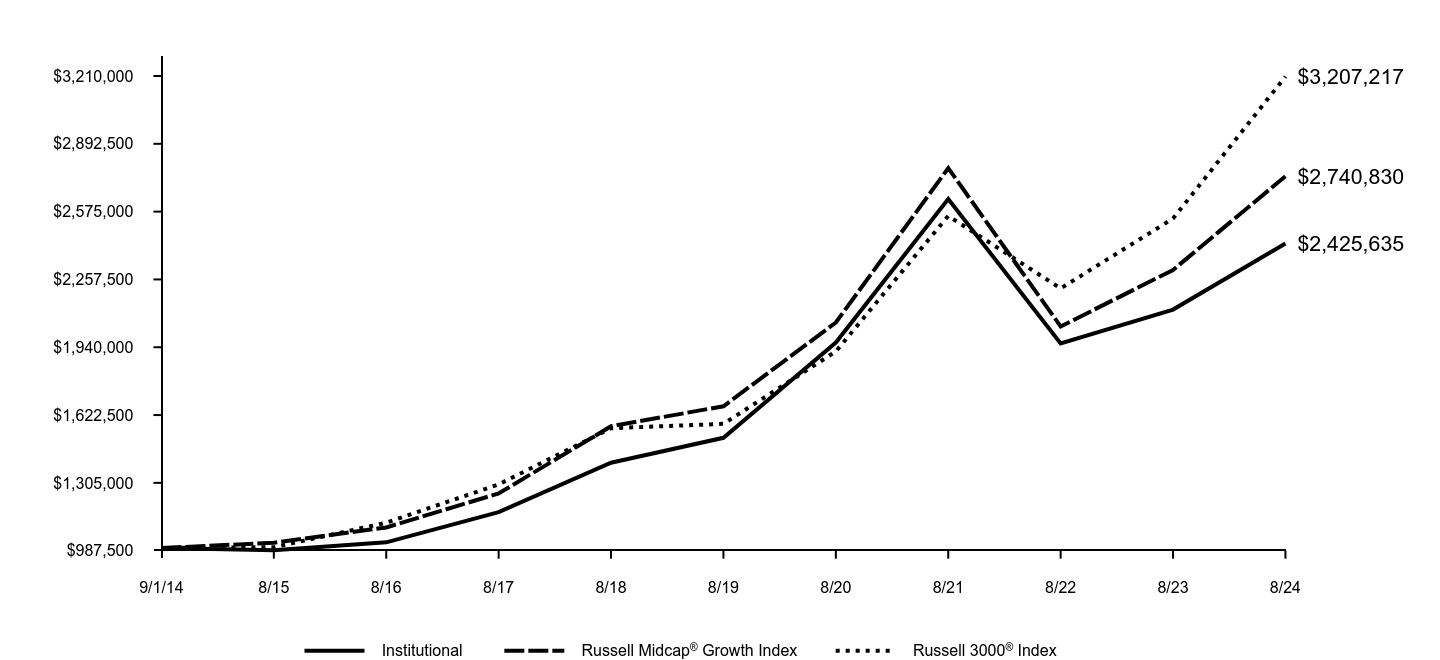

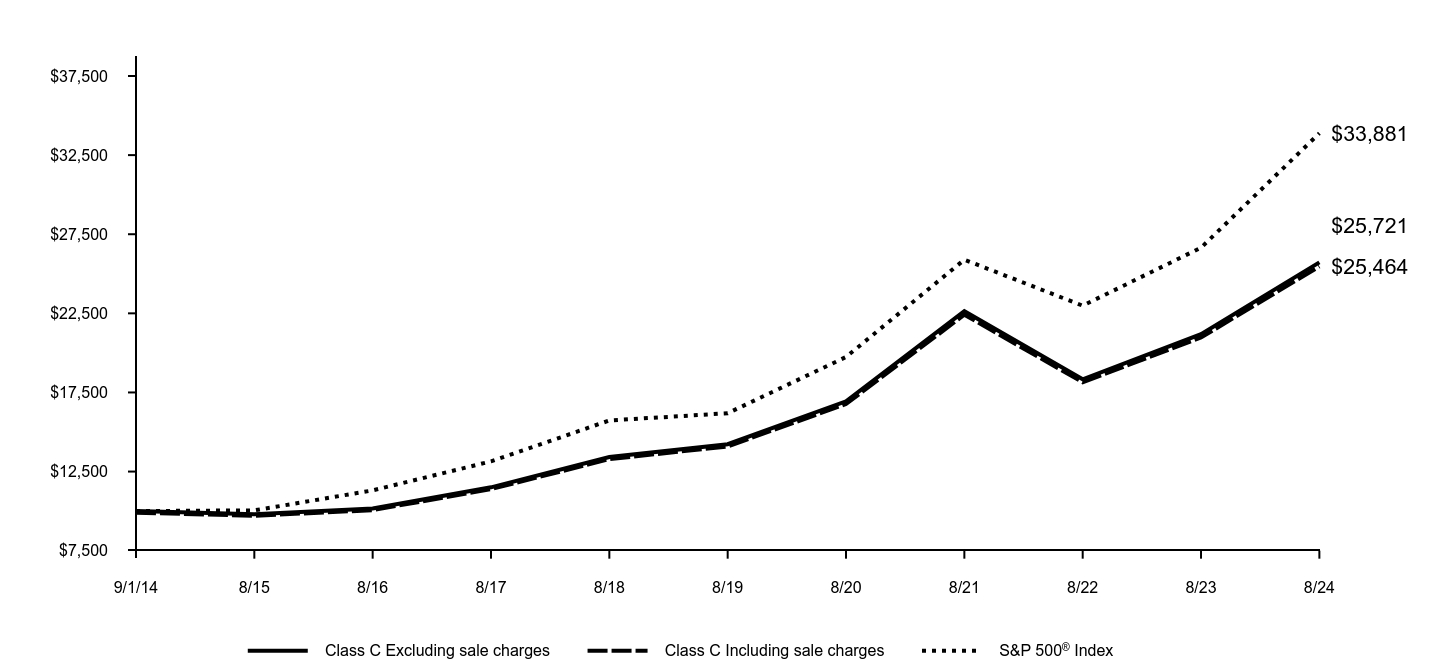

The following graph assumes an initial $1,000,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

As of the close of business on June 28, 2024, the Fund’s performance benchmark index, the TAG Composite Index, was changed from a custom benchmark comprised of the MSCI ACWI IMI (Unhedged) (90%) and Bloomberg U.S. Aggregate Bond Index (10%) ("Prior TAG Composite Index") to a custom benchmark comprised of the MSCI ACWI IMI (Developed Markets FX 50% Hedged) (90%) and Bloomberg U.S. Intermediate Treasury Index (10%). The Investment Adviser believes that the new composition of the TAG Composite Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy.

| Institutional | TAG Composite Index | Bloomberg U.S. Aggregate Bond Index | MSCI ACWI IMI | Prior TAG Composite Index | Bloomberg U.S. Intermediate Treasury Bond | MSCI ACWI IMI (Developed Markets FX 50% Hedged) |

|---|

| 9/1/14 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

| 8/15 | $960,400 | $969,700 | $1,015,600 | $939,000 | $946,600 | $1,019,000 | $964,100 |

| 8/16 | $1,010,725 | $1,037,288 | $1,076,231 | $1,008,204 | $1,015,607 | $1,050,691 | $1,034,769 |

| 8/17 | $1,169,813 | $1,195,475 | $1,081,505 | $1,180,406 | $1,171,401 | $1,051,006 | $1,211,093 |

| 8/18 | $1,325,632 | $1,328,889 | $1,070,149 | $1,319,693 | $1,294,047 | $1,037,343 | $1,363,570 |

| 8/19 | $1,264,521 | $1,334,072 | $1,178,983 | $1,300,822 | $1,291,977 | $1,115,144 | $1,355,934 |

| 8/20 | $1,424,356 | $1,527,913 | $1,255,263 | $1,501,669 | $1,487,840 | $1,176,254 | $1,556,341 |

| 8/21 | $1,834,713 | $1,941,060 | $1,254,259 | $1,953,821 | $1,887,325 | $1,168,020 | $2,029,624 |

| 8/22 | $1,608,860 | $1,677,853 | $1,109,769 | $1,636,521 | $1,591,015 | $1,079,601 | $1,738,982 |

| 8/23 | $1,810,128 | $1,880,873 | $1,096,562 | $1,854,669 | $1,779,391 | $1,077,765 | $1,973,570 |

| 8/24 | $2,238,404 | $2,277,173 | $1,176,611 | $2,274,195 | $2,153,775 | $1,145,234 | $2,422,952 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Institutional | 23.66% | 12.09% | 8.38% |

| TAG Composite Index | 21.07% | 11.28% | 8.57% |

| MSCI ACWI IMI (Developed Markets FX 50% Hedged) | 22.77% | 12.30% | 9.25% |

| Bloomberg U.S. Intermediate Treasury Bond | 6.26% | 0.53% | 1.36% |

| Prior TAG Composite Index | 21.04% | 10.75% | 7.97% |

| MSCI ACWI IMI | 22.62% | 11.81% | 8.56% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return, principal value and market price will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Tax-Advantaged Global Equity Portfolio

Key Fund Statistics (as of August 31, 2024)

| Total Net Assets | $4,480,881,997 |

| # of Portfolio Holdings | 19 |

| Portfolio Turnover Rate | 9% |

| Total Net Advisory Fees Paid | $5,484,694 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Underlying Funds | 89.5% |

| Investment Company | 7.8% |

| Exchange-Traded Funds | 0.7% |

Goldman Sachs Tax-Advantaged Global Equity Portfolio

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The blended returns are calculated by Goldman Sachs using end of day index level values licensed from MSCI (“MSCI Data”). For the avoidance of doubt, MSCI is not the benchmark “administrator” for, or a “contributor”, “submitter” or “supervised contributor” to, the blended returns, and the MSCI Data is not considered a “contribution” or “submission” in relation to the blended returns, as those terms may be defined in any rules, laws, regulations, legislation or international standards. MSCI Data is provided “AS IS” without warranty or liability and no copying or distribution is permitted. MSCI does not make any representation regarding the advisability of any investment or strategy and does not sponsor, promote, issue, sell or otherwise recommend or endorse any investment or strategy, including any financial products or strategies based on, tracking or otherwise utilizing any MSCI Data, models, analytics or other materials or information.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Tax-Advantaged Global Equity Portfolio

38142B112-AR-0824 Institutional Class

Annual Shareholder Report

August 31, 2024

Goldman Sachs Tax-Advantaged Global Equity Portfolio

This annual shareholder report contains important information about Goldman Sachs Tax-Advantaged Global Equity Portfolio (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $20 | 0.18% |

How did the Fund perform and what affected its performance?

Global equities performed strongly as waning inflation levels globally suggested the peaking of central bank tightening cycles and potential interest rate cuts in several developed markets. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports and a strong rally, especially in technology stocks, driven by enthusiasm around artificial intelligence. Weaker labor market data near the end of the reporting period fueled volatility as investors focused on the health of the U.S. economy.

Top Contributors to Performance:

The Portfolio benefited compared to the Tax-Advantaged Global Composite Index ("TAG Composite Index") from a strategic underweight in emerging markets equities, which generated positive returns but lagged the gains of developed markets equities broadly.

Strategic overweights in U.S. and non-U.S. developed markets equities, especially the Portfolio’s exposure to U.S. large-cap technology stocks, bolstered relative returns.

Goldman Sachs U.S. Tax-Managed Equity Fund and Goldman Sachs International Tax-Managed Equity Fund, the two Underlying Funds in which the Portfolio held its largest weightings, outperformed their respective benchmark indices most during the reporting period.

Tactical allocations to fixed income, equities and, to a lesser extent, commodities and a trend-based rotation tilt contributed positively to the Portfolio’s relative performance.

Top Detractors from Performance:

Relative to the TAG Composite Index, the Portfolio’s underweight in investment grade fixed income detracted from performance.

Goldman Sachs MLP Energy Infrastructure Fund and Goldman Sachs Global Real Estate Securities Fund, which were removed as Underlying Funds on June 28, 2024, underperformed their respective benchmark indices.

Currency-related tactical allocations detracted slightly from the Portfolio’s relative performance.

Underlying Fund performance

Strategic equities weightings

Fixed income-related tactical allocations

Equity-related tactical allocations

Investment grade fixed income - UW

Currency-related tactical allocations

The above represents key factors.

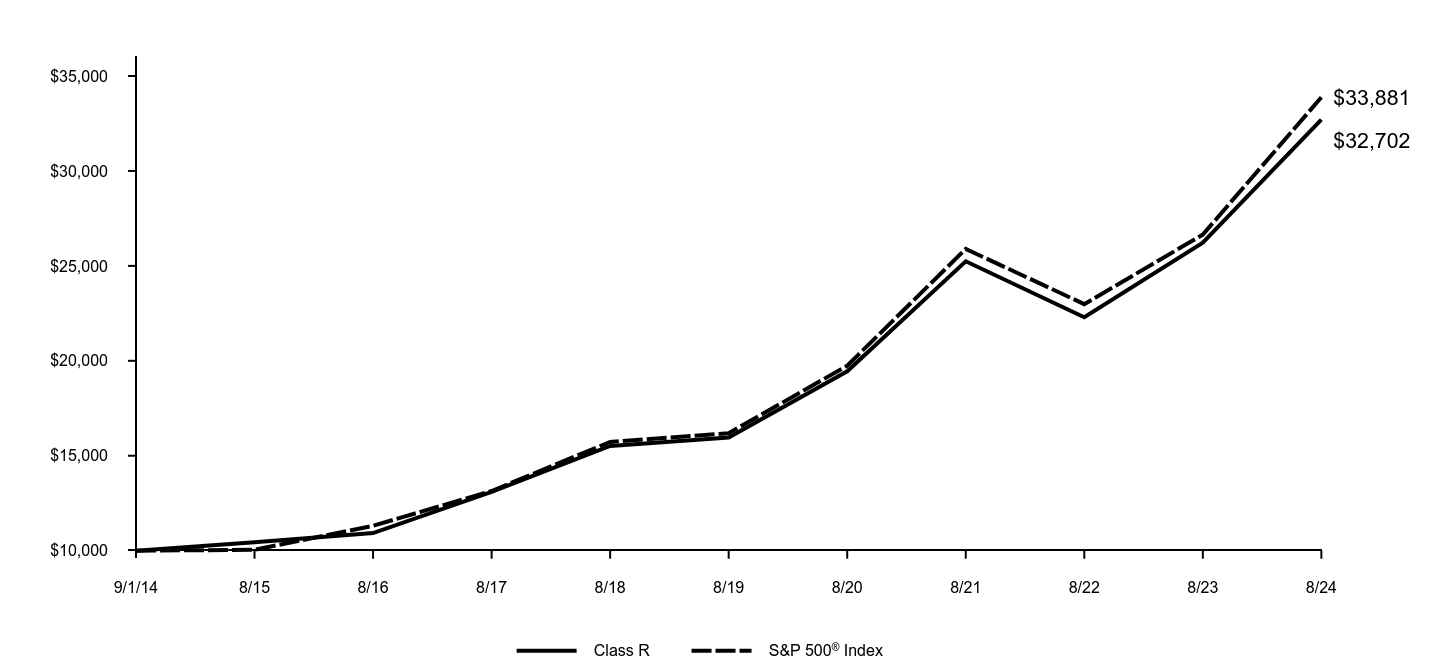

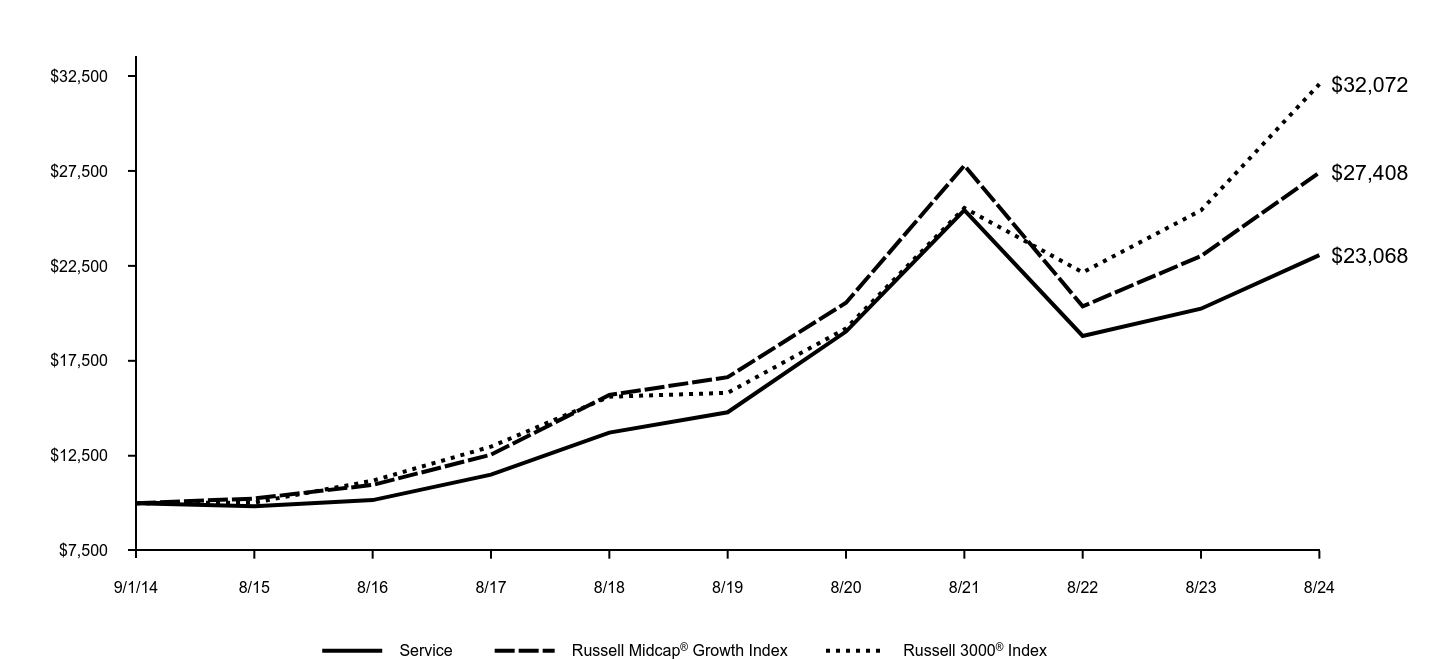

Goldman Sachs Tax-Advantaged Global Equity Portfolio

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

As of the close of business on June 28, 2024, the Fund’s performance benchmark index, the TAG Composite Index, was changed from a custom benchmark comprised of the MSCI ACWI IMI (Unhedged) (90%) and Bloomberg U.S. Aggregate Bond Index (10%) ("Prior TAG Composite Index") to a custom benchmark comprised of the MSCI ACWI IMI (Developed Markets FX 50% Hedged) (90%) and Bloomberg U.S. Intermediate Treasury Index (10%). The Investment Adviser believes that the new composition of the TAG Composite Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy.

| Class R6 | TAG Composite Index | Bloomberg U.S. Aggregate Bond Index | MSCI ACWI IMI | Prior TAG Composite Index | Bloomberg U.S. Intermediate Treasury Bond | MSCI ACWI IMI (Developed Markets FX 50% Hedged) |

|---|

| 12/29/17 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 8/18 | $10,558 | $10,378 | $9,904 | $10,353 | $10,308 | $9,970 | $10,423 |

| 8/19 | $10,075 | $10,418 | $10,911 | $10,205 | $10,292 | $10,718 | $10,365 |

| 8/20 | $11,347 | $11,932 | $11,617 | $11,781 | $11,852 | $11,305 | $11,897 |

| 8/21 | $14,620 | $15,159 | $11,608 | $15,328 | $15,034 | $11,226 | $15,514 |

| 8/22 | $12,830 | $13,103 | $10,271 | $12,839 | $12,674 | $10,376 | $13,293 |

| 8/23 | $14,430 | $14,689 | $10,148 | $14,550 | $14,174 | $10,359 | $15,086 |

| 8/24 | $17,846 | $17,784 | $10,889 | $17,841 | $17,156 | $11,007 | $18,521 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception |

|---|

| Class R6 (Commenced December 29, 2017) | 23.67% | 12.10% | 9.06% |

| TAG Composite Index | 21.07% | 11.28% | 9.00% |

| MSCI ACWI IMI (Developed Markets FX 50% Hedged) | 22.77% | 12.30% | 9.67% |

| Bloomberg U.S. Intermediate Treasury Bond | 6.26% | 0.53% | 1.45% |

| Prior TAG Composite Index | 21.04% | 10.75% | 8.42% |

| MSCI ACWI IMI | 22.62% | 11.81% | 9.06% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.28% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return, principal value and market price will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Tax-Advantaged Global Equity Portfolio

Key Fund Statistics (as of August 31, 2024)

| Total Net Assets | $4,480,881,997 |

| # of Portfolio Holdings | 19 |

| Portfolio Turnover Rate | 9% |

| Total Net Advisory Fees Paid | $5,484,694 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Underlying Funds | 89.5% |

| Investment Company | 7.8% |

| Exchange-Traded Funds | 0.7% |

Goldman Sachs Tax-Advantaged Global Equity Portfolio

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The blended returns are calculated by Goldman Sachs using end of day index level values licensed from MSCI (“MSCI Data”). For the avoidance of doubt, MSCI is not the benchmark “administrator” for, or a “contributor”, “submitter” or “supervised contributor” to, the blended returns, and the MSCI Data is not considered a “contribution” or “submission” in relation to the blended returns, as those terms may be defined in any rules, laws, regulations, legislation or international standards. MSCI Data is provided “AS IS” without warranty or liability and no copying or distribution is permitted. MSCI does not make any representation regarding the advisability of any investment or strategy and does not sponsor, promote, issue, sell or otherwise recommend or endorse any investment or strategy, including any financial products or strategies based on, tracking or otherwise utilizing any MSCI Data, models, analytics or other materials or information.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Tax-Advantaged Global Equity Portfolio

38148U189-AR-0824 Class R6

Annual Shareholder Report

August 31, 2024

Goldman Sachs Tax-Advantaged Global Equity Portfolio

This annual shareholder report contains important information about Goldman Sachs Tax-Advantaged Global Equity Portfolio (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| P | $20 | 0.18% |

How did the Fund perform and what affected its performance?

Global equities performed strongly as waning inflation levels globally suggested the peaking of central bank tightening cycles and potential interest rate cuts in several developed markets. Further boosting investor sentiment was generally positive economic data, favorable corporate earnings reports and a strong rally, especially in technology stocks, driven by enthusiasm around artificial intelligence. Weaker labor market data near the end of the reporting period fueled volatility as investors focused on the health of the U.S. economy.

Top Contributors to Performance:

The Portfolio benefited compared to the Tax-Advantaged Global Composite Index ("TAG Composite Index") from a strategic underweight in emerging markets equities, which generated positive returns but lagged the gains of developed markets equities broadly.

Strategic overweights in U.S. and non-U.S. developed markets equities, especially the Portfolio’s exposure to U.S. large-cap technology stocks, bolstered relative returns.

Goldman Sachs U.S. Tax-Managed Equity Fund and Goldman Sachs International Tax-Managed Equity Fund, the two Underlying Funds in which the Portfolio held its largest weightings, outperformed their respective benchmark indices most during the reporting period.

Tactical allocations to fixed income, equities and, to a lesser extent, commodities and a trend-based rotation tilt contributed positively to the Portfolio’s relative performance.

Top Detractors from Performance:

Relative to the TAG Composite Index, the Portfolio’s underweight in investment grade fixed income detracted from performance.

Goldman Sachs MLP Energy Infrastructure Fund and Goldman Sachs Global Real Estate Securities Fund, which were removed as Underlying Funds on June 28, 2024, underperformed their respective benchmark indices.

Currency-related tactical allocations detracted slightly from the Portfolio’s relative performance.

Underlying Fund performance

Strategic equities weightings

Fixed income-related tactical allocations

Equity-related tactical allocations

Investment grade fixed income - UW

Currency-related tactical allocations

The above represents key factors.

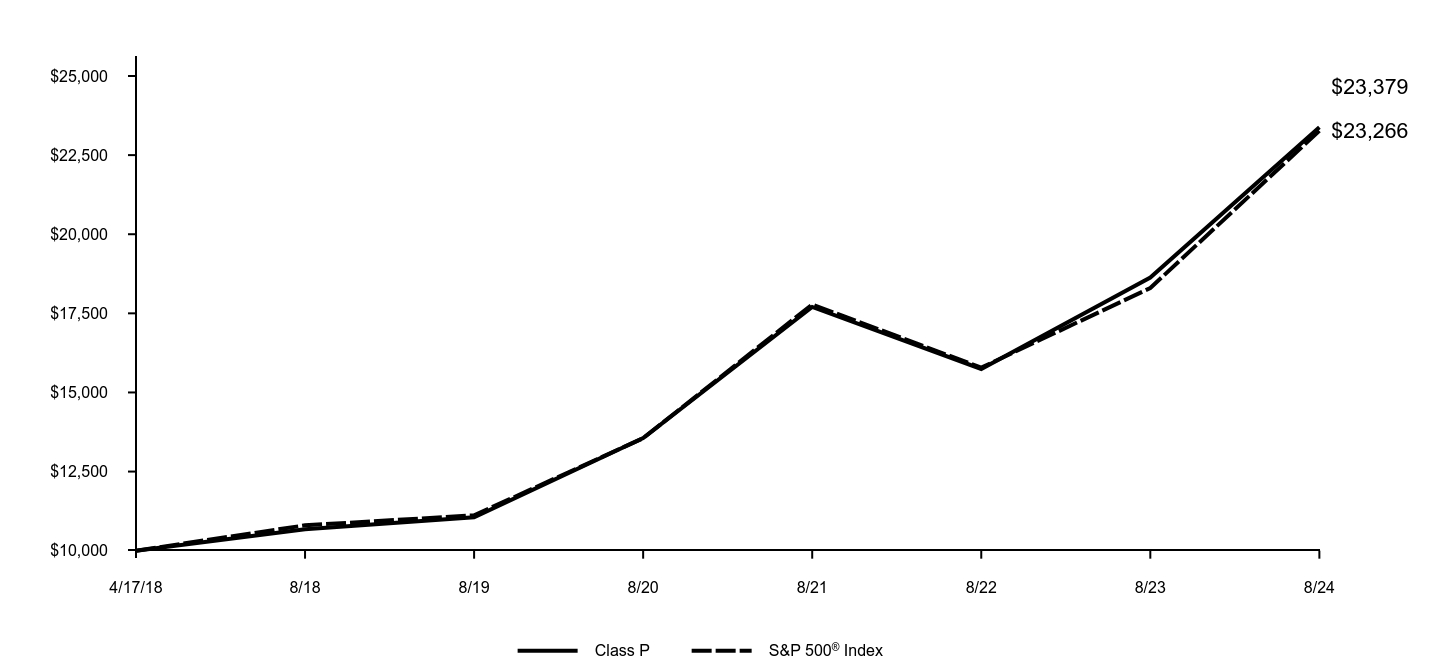

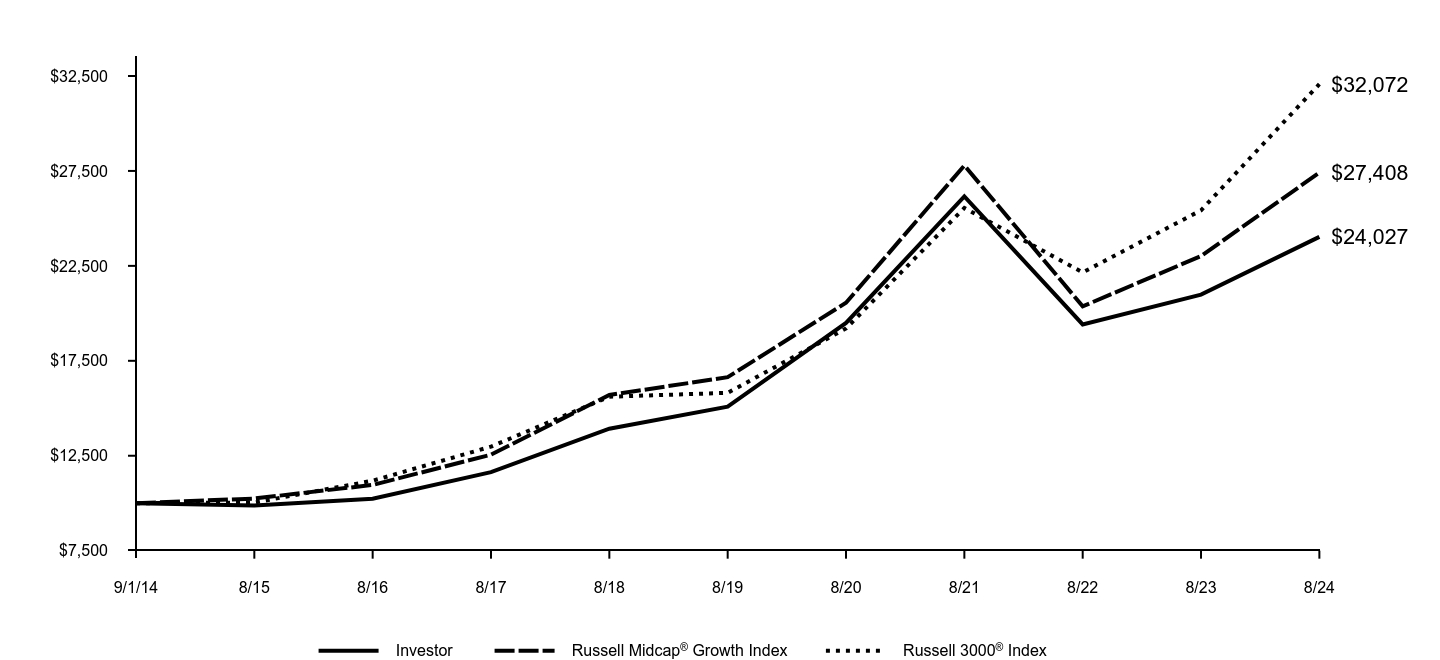

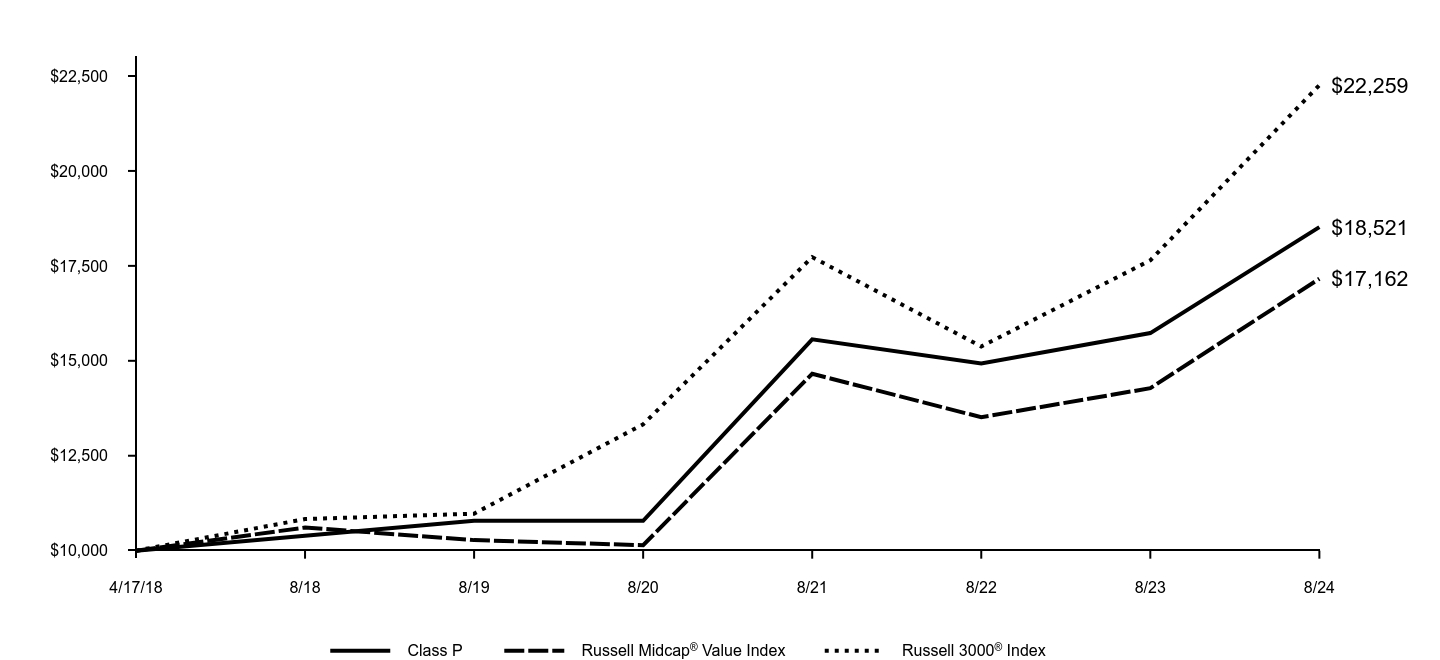

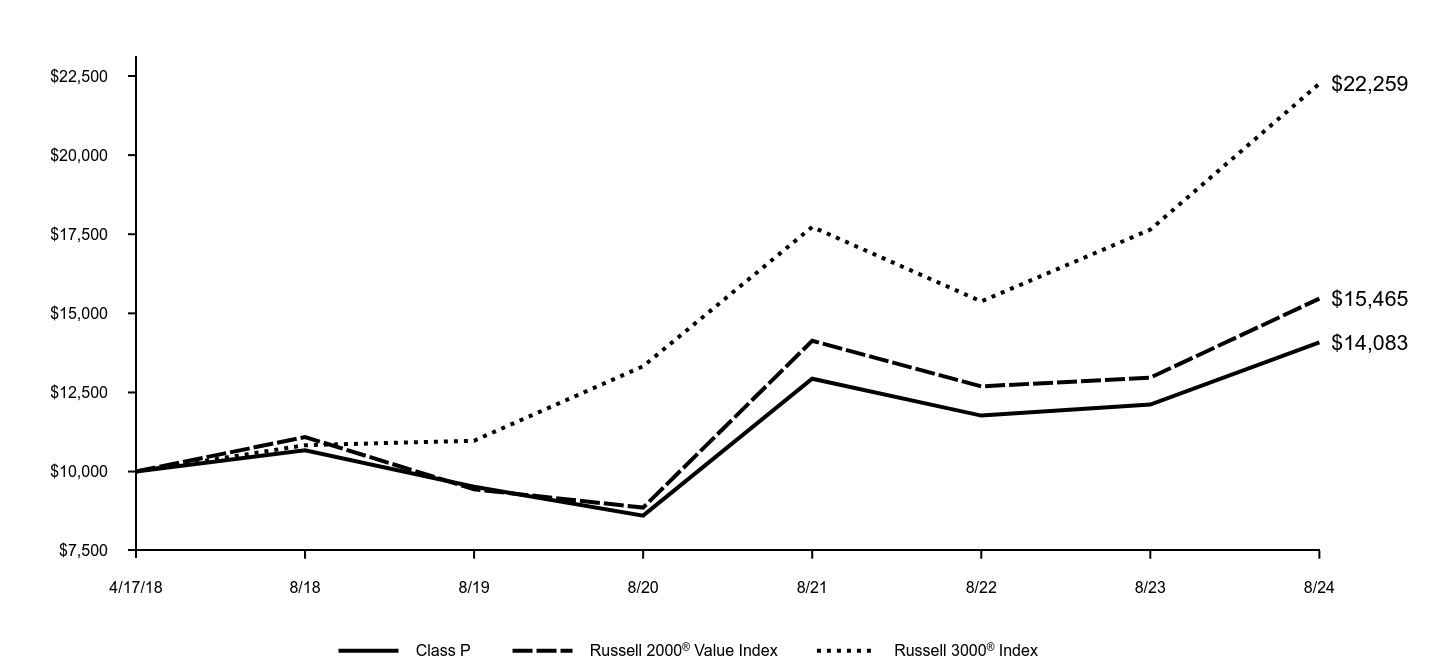

Goldman Sachs Tax-Advantaged Global Equity Portfolio

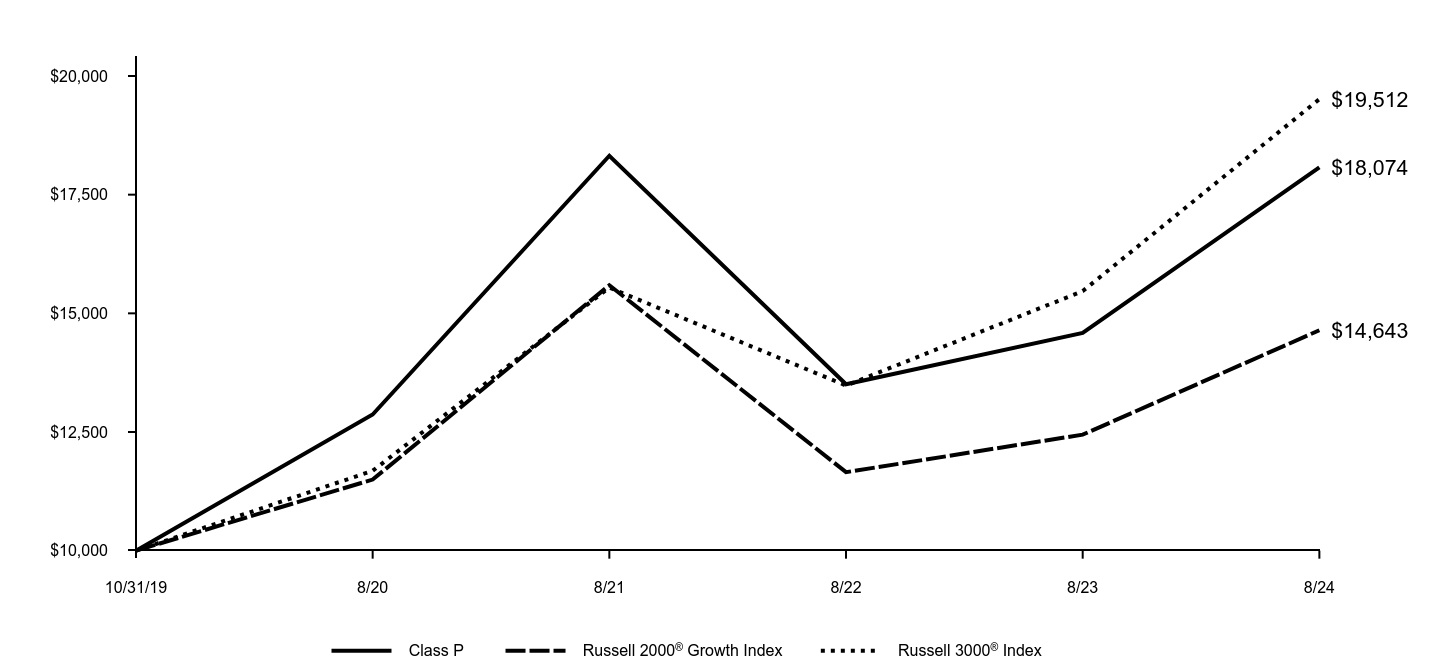

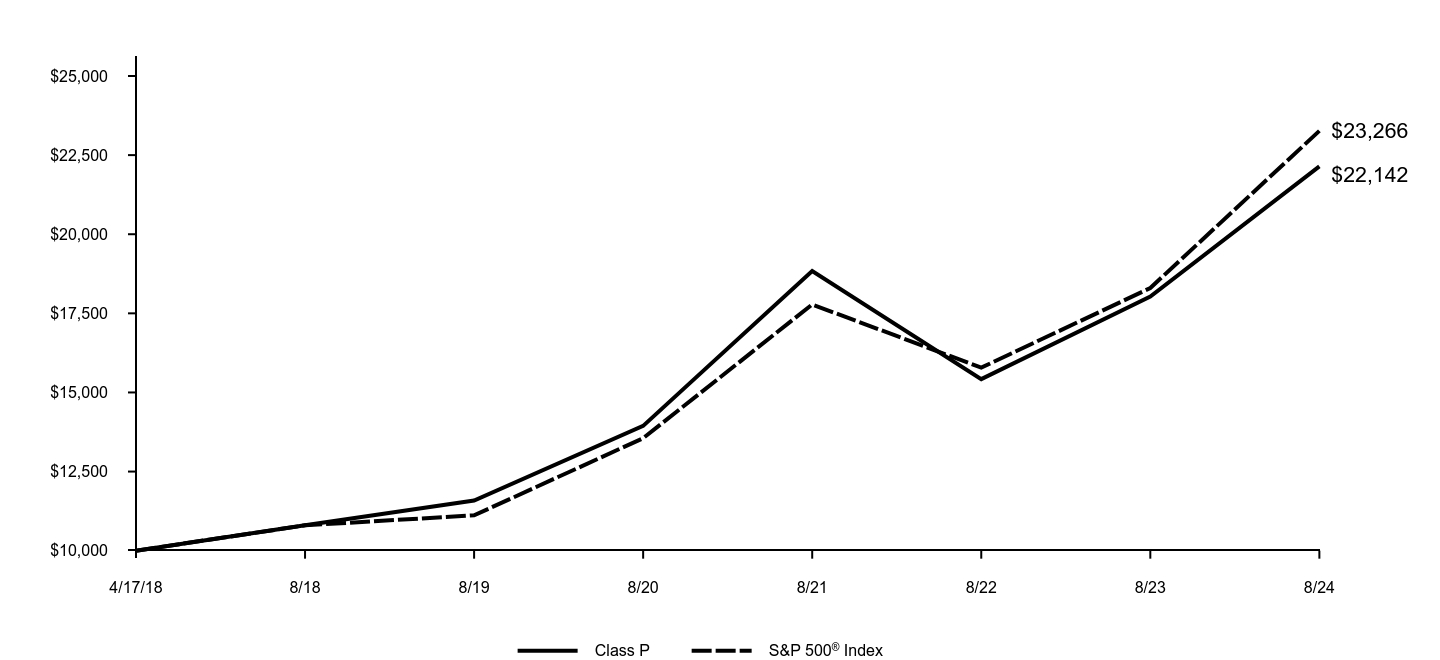

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

As of the close of business on June 28, 2024, the Fund’s performance benchmark index, the TAG Composite Index, was changed from a custom benchmark comprised of the MSCI ACWI IMI (Unhedged) (90%) and Bloomberg U.S. Aggregate Bond Index (10%) ("Prior TAG Composite Index") to a custom benchmark comprised of the MSCI ACWI IMI (Developed Markets FX 50% Hedged) (90%) and Bloomberg U.S. Intermediate Treasury Index (10%). The Investment Adviser believes that the new composition of the TAG Composite Index is an appropriate index against which to measure performance in light of the Fund’s investment strategy.

| Class P | TAG Composite Index | Bloomberg U.S. Aggregate Bond Index | MSCI ACWI IMI | Prior TAG Composite Index | Bloomberg U.S. Intermediate Treasury Bond | MSCI ACWI IMI (Developed Markets FX 50% Hedged) |

|---|

| 4/17/18 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 8/18 | $10,398 | $10,309 | $10,061 | $10,224 | $10,208 | $10,073 | $10,335 |

| 8/19 | $9,920 | $10,349 | $11,084 | $10,078 | $10,192 | $10,828 | $10,277 |

| 8/20 | $11,172 | $11,853 | $11,801 | $11,634 | $11,737 | $11,422 | $11,796 |

| 8/21 | $14,397 | $15,058 | $11,792 | $15,137 | $14,888 | $11,342 | $15,383 |

| 8/22 | $12,629 | $13,016 | $10,433 | $12,679 | $12,551 | $10,483 | $13,180 |

| 8/23 | $14,211 | $14,591 | $10,309 | $14,369 | $14,037 | $10,466 | $14,958 |

| 8/24 | $17,574 | $17,665 | $11,062 | $17,619 | $16,990 | $11,120 | $18,364 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception |

|---|

| Class P (Commenced April 17, 2018) | 23.66% | 12.10% | 9.24% |

| TAG Composite Index | 21.07% | 11.28% | 9.33% |

| MSCI ACWI IMI (Developed Markets FX 50% Hedged) | 22.77% | 12.30% | 10.00% |

| Bloomberg U.S. Intermediate Treasury Bond | 6.26% | 0.53% | 1.68% |

| Prior TAG Composite Index | 21.04% | 10.75% | 8.67% |

| MSCI ACWI IMI | 22.62% | 11.81% | 9.29% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.59% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return, principal value and market price will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at:am.gs.comto obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs Tax-Advantaged Global Equity Portfolio

Key Fund Statistics (as of August 31, 2024)

| Total Net Assets | $4,480,881,997 |

| # of Portfolio Holdings | 19 |

| Portfolio Turnover Rate | 9% |

| Total Net Advisory Fees Paid | $5,484,694 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Underlying Funds | 89.5% |

| Investment Company | 7.8% |

| Exchange-Traded Funds | 0.7% |

Goldman Sachs Tax-Advantaged Global Equity Portfolio

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The blended returns are calculated by Goldman Sachs using end of day index level values licensed from MSCI (“MSCI Data”). For the avoidance of doubt, MSCI is not the benchmark “administrator” for, or a “contributor”, “submitter” or “supervised contributor” to, the blended returns, and the MSCI Data is not considered a “contribution” or “submission” in relation to the blended returns, as those terms may be defined in any rules, laws, regulations, legislation or international standards. MSCI Data is provided “AS IS” without warranty or liability and no copying or distribution is permitted. MSCI does not make any representation regarding the advisability of any investment or strategy and does not sponsor, promote, issue, sell or otherwise recommend or endorse any investment or strategy, including any financial products or strategies based on, tracking or otherwise utilizing any MSCI Data, models, analytics or other materials or information.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Tax-Advantaged Global Equity Portfolio

38150B236-AR-0824 Class P

Annual Shareholder Report

August 31, 2024

Goldman Sachs Enhanced Core Equity Fund

This annual shareholder report contains important information about Goldman Sachs Enhanced Core Equity Fund (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $105 | 0.93% |

How did the Fund perform and what affected its performance?