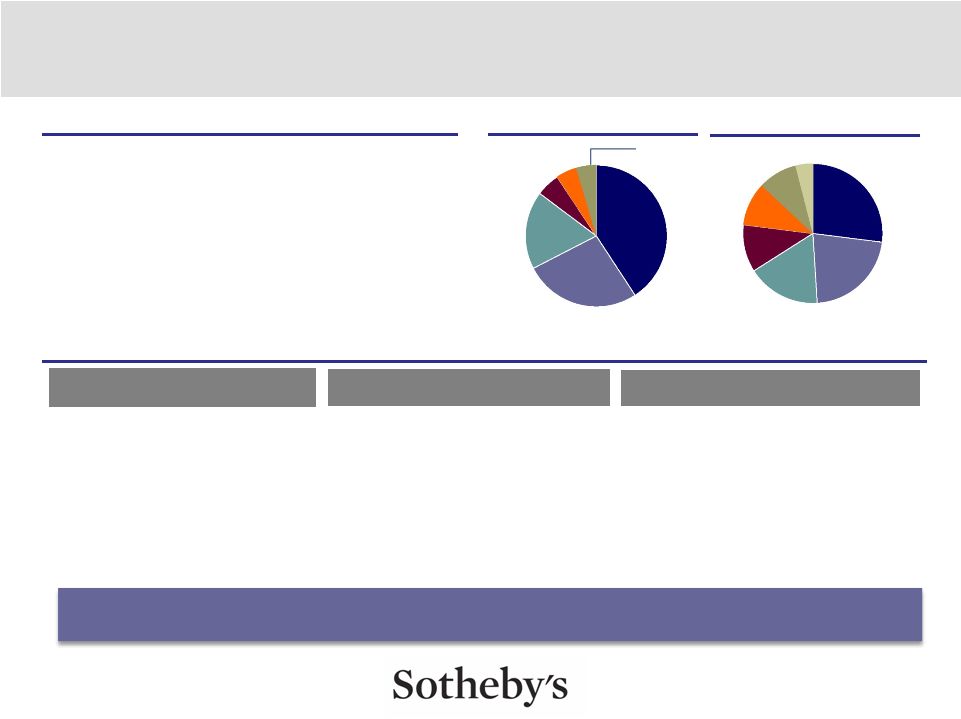

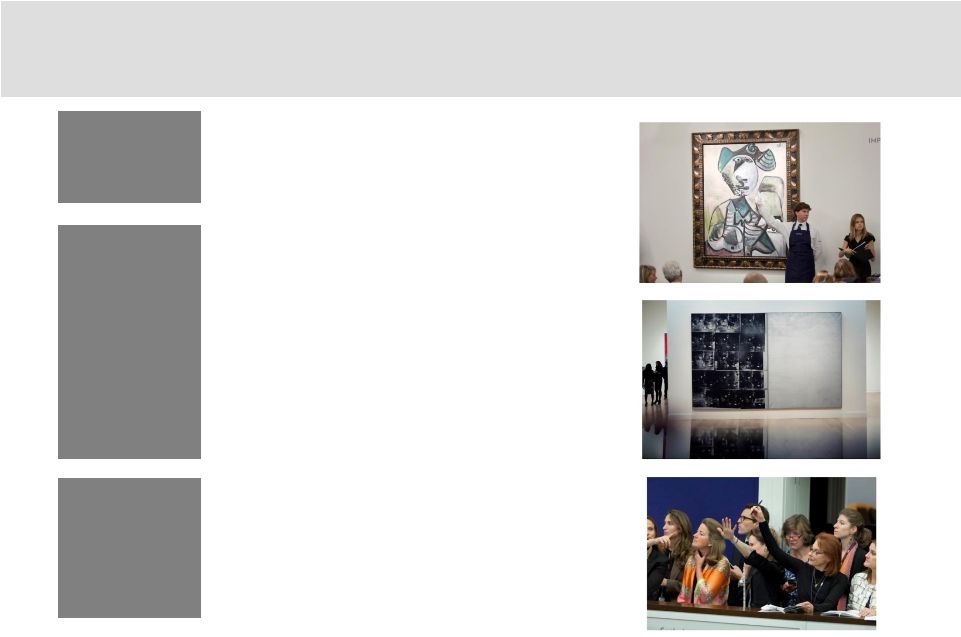

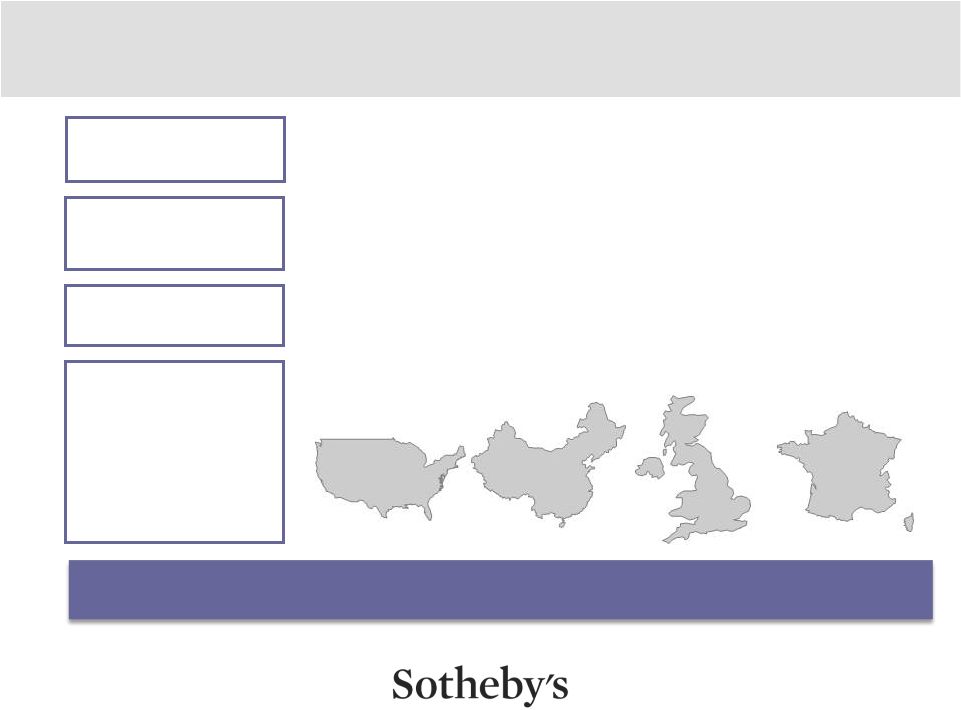

4 OVERVIEW OF SOTHEBY’S Financial Services (2% of Revenues) Agency (93% of Revenues) Key Facts • High value market maker in the art and collectibles market place, adding value through expertise • Matches buyers and sellers through the auction or private sale process • Expertise in valuing art and relationships create opportunities to provide liquidity to clients • Provides art owners with financing secured by works of art, through near-term auction advances and general purpose term loans • SFS supports activity in the core Agency business and generated ~10% of Sotheby’s Agency auction sales during past 5 years • Unique market position and relationships create attractive investment opportunities • Directly purchases and resells works of art • Includes retail wine sales Revenues by Region¹ Three Business Segments Note: Percentages do not add to 100% due to Other revenue and rounding. ¹ Revenue by region based on auction sale location. Sotheby’s Is the Only Publicly Traded Investment Opportunity in the Art Market and Has No Relevant Public Market Comparables Revenues by Category United States 41% U.K. 27% China 18% France 5% Switzerland 5% Rest of World 4% Other Paintings 9% Old Masters 4% Contemporary 27% Impressionist 22% Asian 17% Other 11% Jewelry 10% • Strong Prospects for Growth o 90 locations in 40 countries o 9 auction sales rooms around the world o Received bids from over 100 countries in 2013 • Industry Leader with Global Presence o One of only two global auction franchises and the fastest growing auction house in 2013 and Q1 2014, following a diversified path to growth o Global, enduring brand serving high net worth individuals o No company better positioned as wealth creation leads to additional collectors Principal (4% of Revenues) |