Reporting progress 2018 CHS OwnerExchanging Forums ideas Growing stronger together 1

Welcome to your CHS Owner Forum McPherson, Kansas 2

3

Welcome <REGIONAL DIRECTOR> Good morning. As your regional directors on the CHS Board of Directors, we would like to welcome you, and introduce ourselves, in case we haven’t had a chance to meet yet. Each director introduces himself, gives background and talks about his farm operation. Thanks again for coming, and now we’d like to introduce you to our CHS Board of Directors chairman, Dan Schurr. <DAN> Good morning. Welcome to the 2018 CHS Owner Forum. This event is one of 11 the board of directors and your CHS management team is hosting throughout the country. We’re excited for this opportunity for all of us to be together. If we haven’t met before, I’m Dan Schurr. I’ve served on the board for 12 years, elected by Region 7. I farm in Le Claire, Iowa, where I grow corn and soybeans and operate a commercial trucking business. It’s been quite the year. The Board and leadership team have worked hard 4

over this past year to “right the ship.” We recognized changes were needed, and we’re well on our way. We are on a solid path. A path that ensures CHS continues to be a reliable and trusted partner for you. We're pleased with the progress that's been made. I’m pleased to welcome Jay Debertin, the president and CEO of CHS. <JAY> Thanks, Dan. I am excited to be here today. Thanks for coming out. I know our late spring has many busy with field work, so the fact that you’re here, taking time to meet with us, means a great deal. We appreciate your partnership and believe it’s the driving force behind our shared success. On behalf of everyone at CHS, I want to thank you for your business. And you have my pledge – that we stand ready to work alongside you to strengthen and grow your business, your local cooperative and the cooperative system. I truly believe that when you win, we all win. 4

TODAY’S AGENDA 8 a.m. Registration and networking 8:30 a.m. Business updates CHS future direction Financial update Market insights Q&A 11 a.m. Leadership for the Future Workshop 12:15 p.m. Lunch <JAY> We’ve got a busy morning ahead of us. We’re going to start off by sharing an update on our three key priorities and outlining how we’ll continue to move this company forward. We’ve brought along some of our best and brightest to share market and industry insights later this morning. We’ll spend some time talking about an issue on the radar of many cooperative leaders. I’ll say this up front – we don’t have the answers to this challenge – but we’re hoping today’s conversation can help to stir up ideas we can all try. And, of course, we’re going to have ample time for questions – both during the presentation and after. As we move through the morning, please jot down any questions you have. We’re going to stop after each presentation to answer questions, but I want to make sure we don’t miss any. And, if we don’t have a chance to get to them before we wrap up for lunch, we’re not going anywhere after the meeting, so please stop us for a conversation. 5

FORWARD-LOOKING STATEMENTS This document and the accompanying oral presentation contains, CHS Inc. (“CHS”) publicly available documents may contain, and CHS officers, directors and other representatives may from time to time make, “forward–looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward–looking statements can be identified by words such as “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward–looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on CHS’s current beliefs, expectations and assumptions regarding the future of its businesses, financial condition and results of operations, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the control of CHS. CHS’s actual results and financial condition may differ materially from those indicated in the forward–looking statements. Therefore, you should not place undue reliance on any of these forward–looking statements. Important factors that could cause CHS’s actual results and financial condition to differ materially from those indicated in the forward–looking statements are discussed or identified in CHS’s public filings made with the U.S. Securities and Exchange Commission, including in the “Risk Factors” discussion in Item 1A of the CHS Annual Report on Form 10–K for the fiscal year ended August 31, 2017. Any forward–looking statements made by CHS or its representatives in this document and the accompanying oral presentation are based only on information currently available to CHS and speak only as of the date on which the statement is made. CHS undertakes no obligation to publicly update any forward–looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except as required by applicable law. 6 <JAY> Before we get started, please take a moment to review this slide, which has important information for our time together. Some of the business and financial topics we discuss may be considered forward–looking statements under United States securities laws. It’s important to understand that actual events and results could differ from our comments today. 6

<JAY> Pause. What a difference a year can make. Pause. Last year at these meetings, I stood in front of you as a new CEO ready to help move CHS forward. I stood in front of you ready to help our organization start fresh. It’s been a busy year. And while there’s still work to do, I’m excited to share with you the latest. I’ll highlight the work that we’ve done to strengthen the company, but let me first recognize a few members of the team that’s driven these efforts. Introduce SLT or other key leaders present. 7

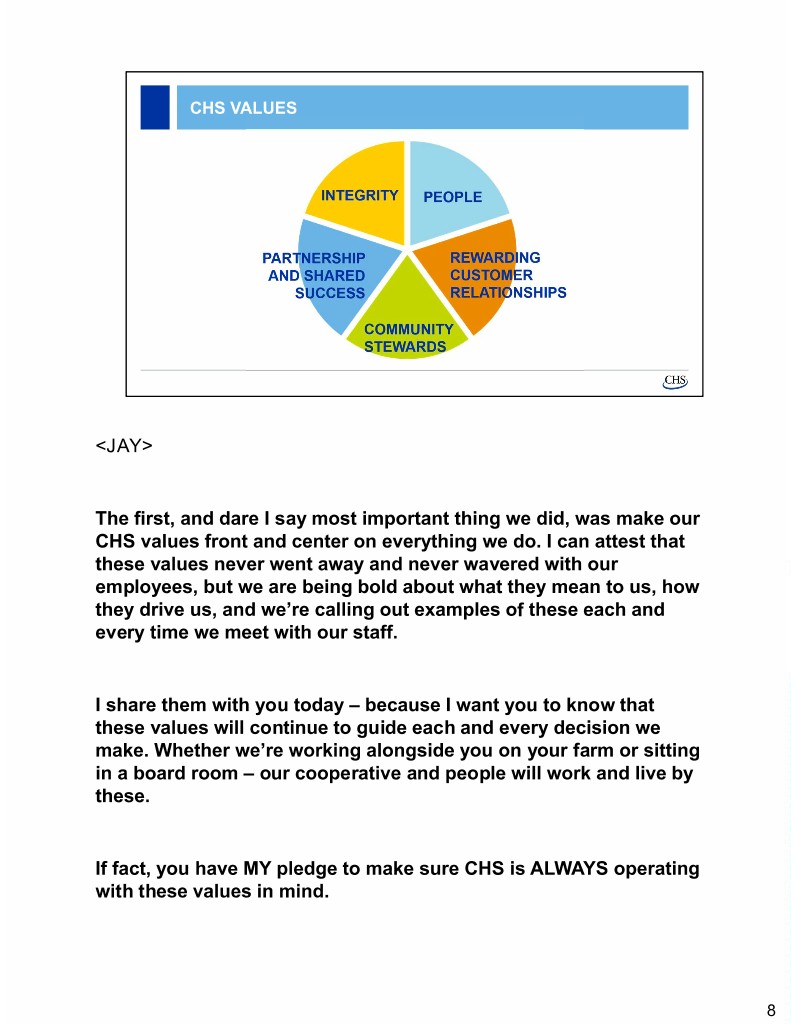

CHS VALUES <JAY> The first, and dare I say most important thing we did, was make our CHS values front and center on everything we do. I can attest that these values never went away and never wavered with our employees, but we are being bold about what they mean to us, how they drive us, and we’re calling out examples of these each and every time we meet with our staff. I share them with you today – because I want you to know that these values will continue to guide each and every decision we make. Whether we’re working alongside you on your farm or sitting in a board room – our cooperative and people will work and live by these. If fact, you have MY pledge to make sure CHS is ALWAYS operating with these values in mind. 8

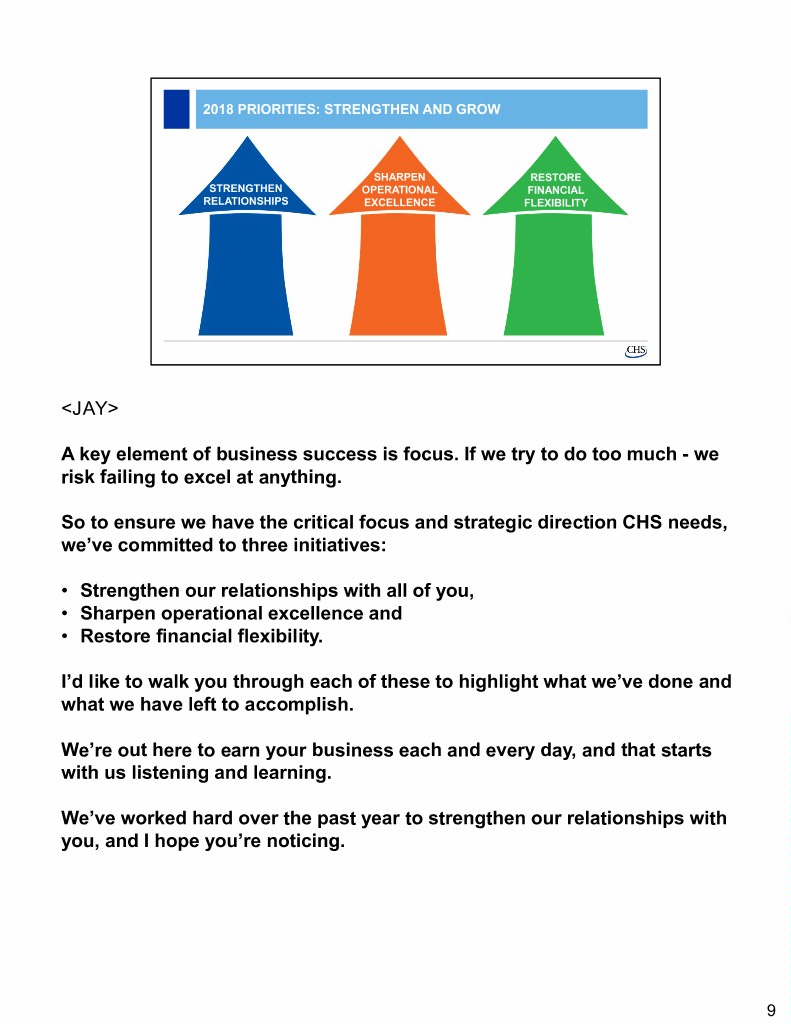

2018 PRIORITIES: STRENGTHEN AND GROW SHARPEN RESTORE STRENGTHEN OPERATIONAL FINANCIAL RELATIONSHIPS EXCELLENCE FLEXIBILITY <JAY> A key element of business success is focus. If we try to do too much - we risk failing to excel at anything. So to ensure we have the critical focus and strategic direction CHS needs, we’ve committed to three initiatives: • Strengthen our relationships with all of you, • Sharpen operational excellence and • Restore financial flexibility. I’d like to walk you through each of these to highlight what we’ve done and what we have left to accomplish. We’re out here to earn your business each and every day, and that starts with us listening and learning. We’ve worked hard over the past year to strengthen our relationships with you, and I hope you’re noticing. 9

STRENGTHEN RELATIONSHIPS Annual Meeting Owner Forums New Leaders Forum Quarterly Emails <JAY> Simply put, we’re sharing more. Whether good or bad news – we’re committed to being transparent and candid in the decisions and actions that impact you. And you all have done the same. We’ve appreciated your willingness to share your perspective with us, and we ask that you continue to share. From time to time, we’re going to have a difference of opinion – but that’s OK. These conversations have helped and will continue to help us diversify our thinking and strengthen our decisions. 10

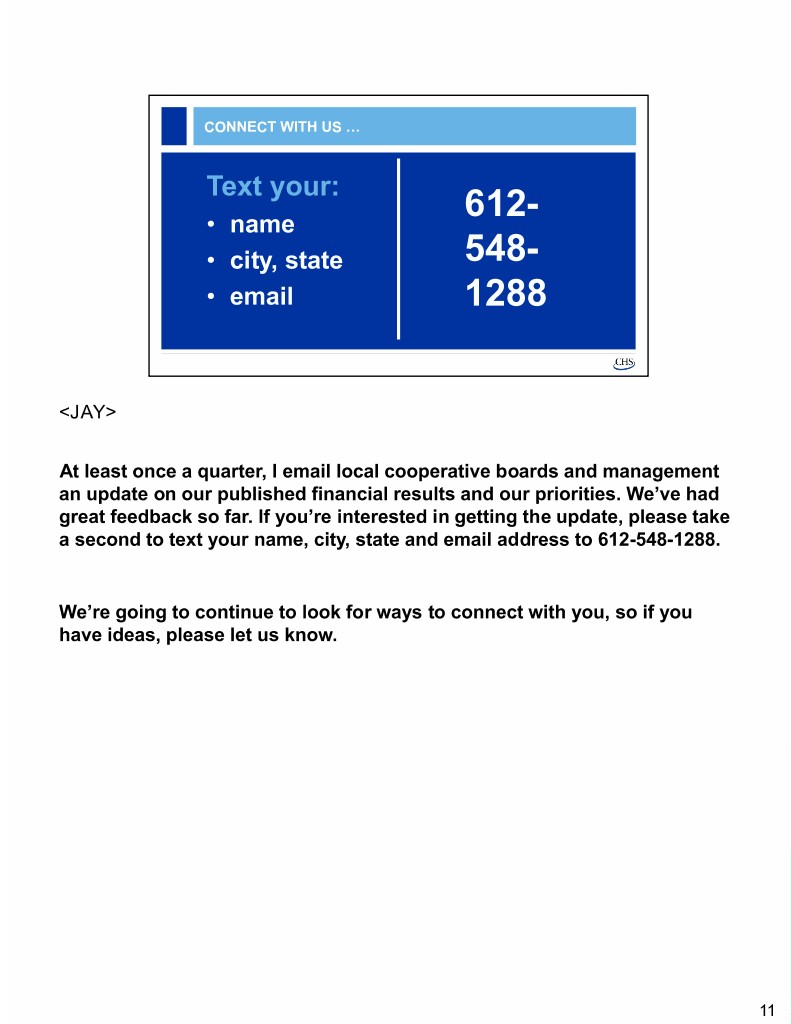

CONNECT WITH US … Text your: 612- • name • city, state 548- • email 1288 <JAY> At least once a quarter, I email local cooperative boards and management an update on our published financial results and our priorities. We’ve had great feedback so far. If you’re interested in getting the update, please take a second to text your name, city, state and email address to 612-548-1288. We’re going to continue to look for ways to connect with you, so if you have ideas, please let us know. 11

SHARPEN OPERATIONAL EXCELLENCE <JAY> Our second priority is to sharpen operational excellence. We’re developing and implementing a series of control improvements to help manage our risk exposure and enable stronger risk management. We’re calling it our enterprise credit center of excellence. The Board’s Audit Committee is overseeing this work, and we’re implementing a series of recommended business model improvements and risk management plans to better manage credit risks. We’ve also been working to improve our technology systems. It’s a multi- year project and, while much work remains, once complete, we believe these systems will enable us to save money and increase efficiency across the entire organization and save money. In addition, we’re identifying ways to increase our supply chain efficiency. For example, trucks hauling out of the CF Nitrogen facility in Port Neal, Iowa, are backhauling on nearly half of their trips. And we’re identifying some new opportunities to partner with local cooperatives to better serve our owners. While these may seem small, these kinds of efficiencies can have a big impact. And our CHS team is identifying opportunities like this across our businesses and geographies. 12

With the current energy and ag markets, we know you need a partner you can count on. CHS wants to be that partner. With our global presence, market expertise and supply chain capabilities, partnering with CHS can connect you to customers around the globe. CHS has a global presence intended to efficiently and profitably connect your crops with global grain buyers. We’re working to improve our performance in these areas. For example, to create stronger alignment and integrate our supply chain functions across all regions, we consolidated the global grain marketing business into a single platform. I want to assure you this retooling doesn’t mean we’re stepping back. It means we’re looking at every opportunity to be more effective, to create better efficiencies and to increase our operational excellence. Most of all, we’ve made a strategic shift to view what we do internationally through the lens of the farmers who own us. We must always ask ourselves, “does it add value for you?” This will mean as much for the things we won’t do as it does for the things we will pursue. 12

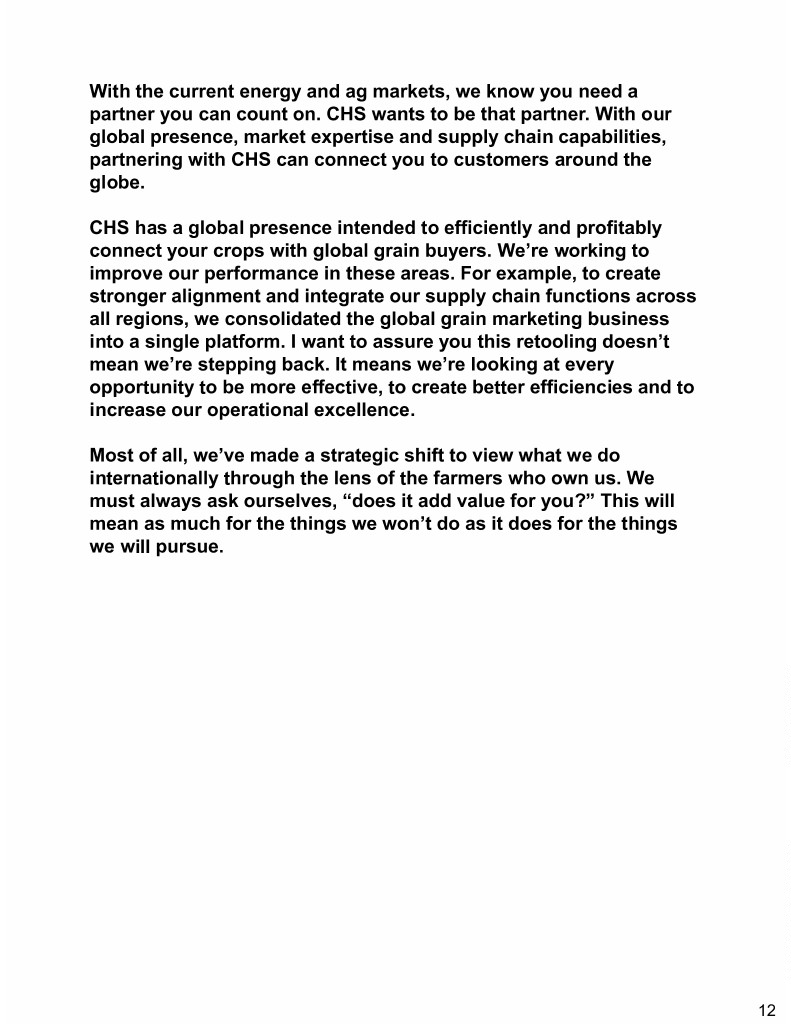

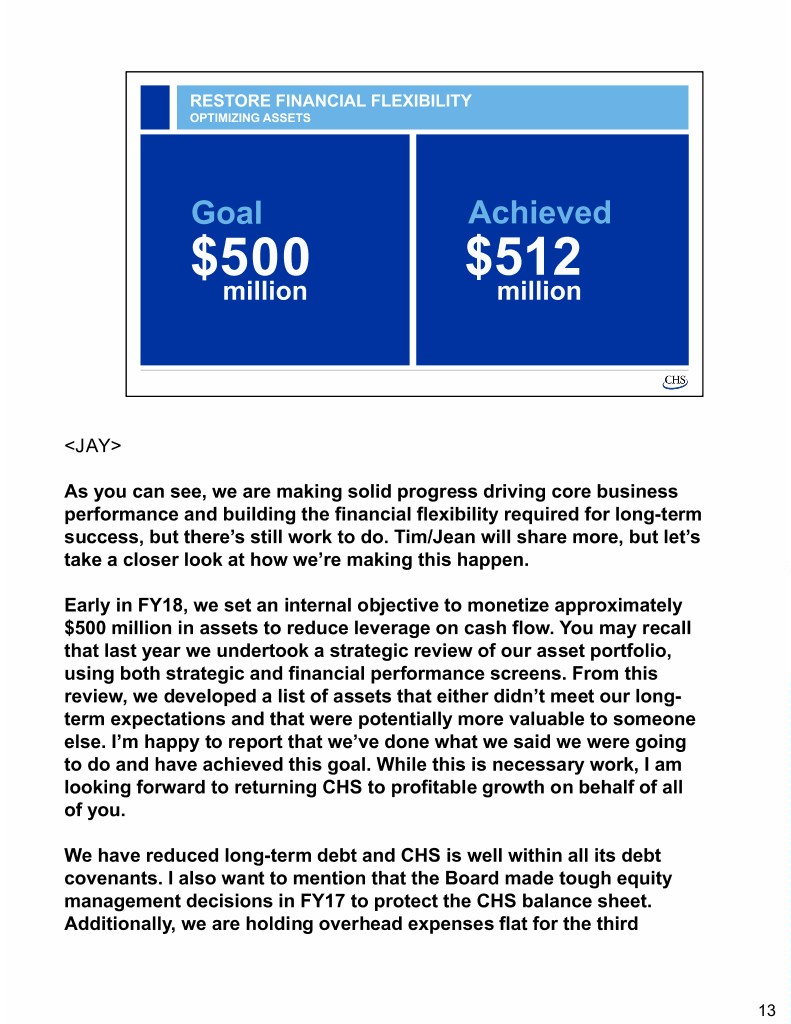

RESTORE FINANCIAL FLEXIBILITY OPTIMIZING ASSETS Goal Achieved $500 $512 million million <JAY> As you can see, we are making solid progress driving core business performance and building the financial flexibility required for long-term success, but there’s still work to do. Tim/Jean will share more, but let’s take a closer look at how we’re making this happen. Early in FY18, we set an internal objective to monetize approximately $500 million in assets to reduce leverage on cash flow. You may recall that last year we undertook a strategic review of our asset portfolio, using both strategic and financial performance screens. From this review, we developed a list of assets that either didn’t meet our long- term expectations and that were potentially more valuable to someone else. I’m happy to report that we’ve done what we said we were going to do and have achieved this goal. While this is necessary work, I am looking forward to returning CHS to profitable growth on behalf of all of you. We have reduced long-term debt and CHS is well within all its debt covenants. I also want to mention that the Board made tough equity management decisions in FY17 to protect the CHS balance sheet. Additionally, we are holding overhead expenses flat for the third 13

consecutive year. Here are some of the actions taken: • CHS sold soy processing plants at South Sioux City, Nebraska, Hutchinson, Kansas, and Creston, Iowa, and has closed the Eagan, Minnesota, Innovation and Technology Center. • CHS Europe sold its CHS Agromarket grain origination assets near Krasnodar, Russia. • CHS Country Operations sold its Canadian retail assets and its 50 percent share of a joint venture with United Farmers of Alberta. • CHS sold 33 Cenex Zip Trip locations in Washington and Idaho. We remain committed to providing high-quality service at our remaining 35 Cenex Zip Trip store locations in Montana, Minnesota, Wyoming, North Dakota and South Dakota. • CHS sold and signed a 20-year lease agreement on its headquarters building in Inver Grove Heights, Minnesota. Similar to other companies, we decided to sell the building and lease the space long-term. • CHS sold CHS Insurance to USI, a premier brokerage firm dedicated to providing solutions to clients and servicing local communities. • CHS sold the Council Bluffs pipeline and refined fuels terminal in Council Bluffs, Iowa, to NuStar Pipeline Operating Partnership L.P. We believe these actions help position CHS to move forward, allowing us to focus on strengthening our core business portfolio for growth. 13

STRENGTHEN AND GROW <JAY> Our work on these three key priorities IS strengthening CHS. This work will not end after this year. While you’ll likely see new priorities next year – we will continue to ensure we’re running this company efficiently and effectively, profitably and with you in mind. This stuff is foundational. It’s important to our success long-term. And, it’s who we are. Pause. We will always be prepared to take necessary actions to maintain a strong portfolio and balance sheet. That said, we are moving from a focus on selling assets to a focus on growth. 14

DRIVE BUSINESS PERFORMANCE BY INCREASING… LISTENING VALUE EFFICIENCY PARTNERSHIPS SOLUTIONS <JAY> When we take a closer look at how we will drive business performance, it comes down to five key things: • Listening to our customers’ needs and responding to them. • Creating value in all we do, so customers look at CHS as a key or primary element to success. • Identifying efficiencies across our geographies and our business, so we’re getting the most out of our supply chains. • Establishing and growing our partnerships, with an end goal of helping you be more successful. • Building solutions. We aren’t an R&D company – but we know our business - well. We’ll continue to use our expertise to identify and create solutions for the challenges famers experience today. 15

DEFINE GROWTH <JAY> Before we start – I’d like to define how we’re defining growth. We know that challenging markets will continue in both the ag andenergy space. As such, our opportunities for growth are going to look different than they have for the past few years. And that’s OK. In fact, growth over these next few years is going to look similar to what it looked like over the past 90 years. So, let’s take a closer look at what it will look like. 16

DEFINE GROWTH S BUSINESS FUTURE PEOPLE PERFORMANCE FOCUS <JAY> Our growth will be strategic - thoughtful – targeted - and collaborative. We will be driven by our business performance. We’ll continue to focus on developing our people. We know that you need a partner on the farm, someone that can help share insight and that cares about your bottom-line. All of that is important to us too. Later on this morning, we’re going to spend some time walking through the challenges we have as a cooperative system to recruit and maintain top talent. We don’t have the answers – but we’ll work as a group to come up with some ideas. And, we’re using our unique position to analyze where we’re headed - five, ten, twenty years down the road. This analysis will help us understand where the industry is heading and anticipate what you will need. 17

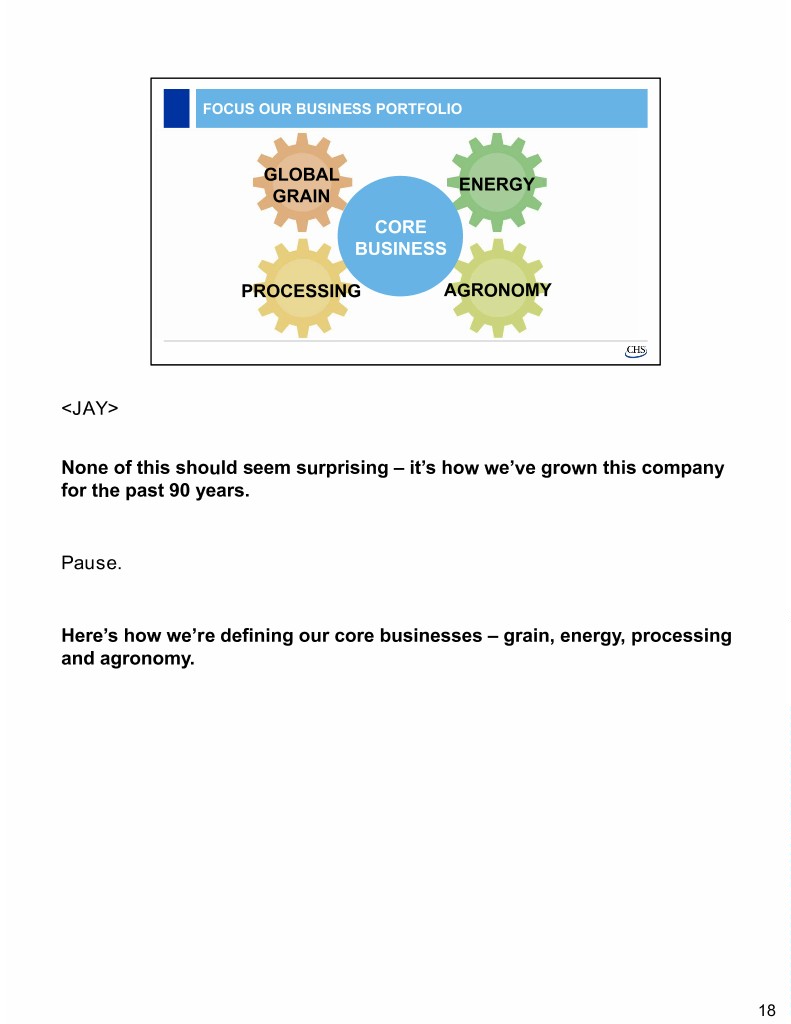

FOCUS OUR BUSINESS PORTFOLIO GLOBAL ENERGY GRAIN CORE BUSINESS PROCESSING AGRONOMY <JAY> None of this should seem surprising – it’s how we’ve grown this company for the past 90 years. Pause. Here’s how we’re defining our core businesses – grain, energy, processing and agronomy. 18

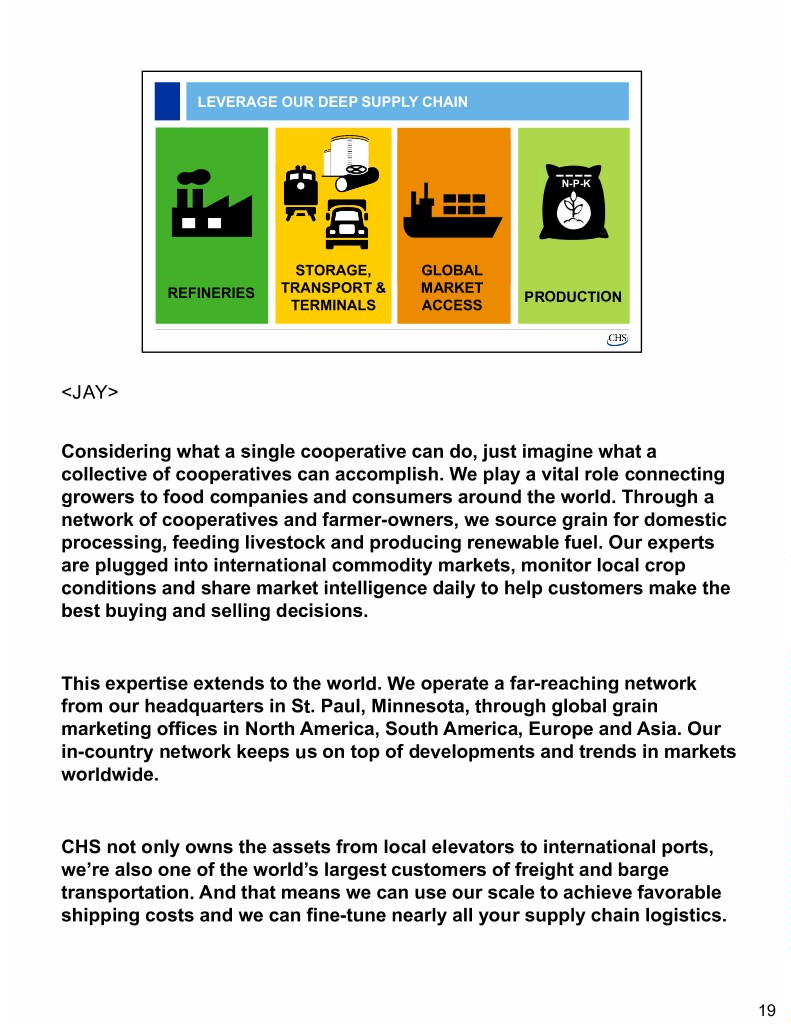

LEVERAGE OUR DEEP SUPPLY CHAIN N-P-K STORAGE, GLOBAL TRANSPORT & MARKET REFINERIES PRODUCTION TERMINALS ACCESS <JAY> Considering what a single cooperative can do, just imagine what a collective of cooperatives can accomplish. We play a vital role connecting growers to food companies and consumers around the world. Through a network of cooperatives and farmer-owners, we source grain for domestic processing, feeding livestock and producing renewable fuel. Our experts are plugged into international commodity markets, monitor local crop conditions and share market intelligence daily to help customers make the best buying and selling decisions. This expertise extends to the world. We operate a far-reaching network from our headquarters in St. Paul, Minnesota, through global grain marketing offices in North America, South America, Europe and Asia. Our in-country network keeps us on top of developments and trends in markets worldwide. CHS not only owns the assets from local elevators to international ports, we’re also one of the world’s largest customers of freight and barge transportation. And that means we can use our scale to achieve favorable shipping costs and we can fine-tune nearly all your supply chain logistics. 19

what does STRENGTHEN & GROW mean for you? <JAY> So, what does all of this mean for you – • It means dependability. Just as your great-grandparents, grandparents and parents could count on the cooperative, you can count on CHS. • It means speed and space – we're uniquely positioned to help you achieve more on your farm. We understand that every minute you're sitting in line to unload, you're losing dollars in the field. • We’re going to increase our value to you. • We’re going to establish partnerships that work for you and us. • And we’re going to be laser-focused on the future. Planning and preparing so we have what you need, when you need it. 20

FINANCIAL UPDATE <JAY> Introduce Tim/Jean <TIM or JEAN> Thanks, Jay. I’m excited to be here with you today and to provide an update on CHS financials. 21

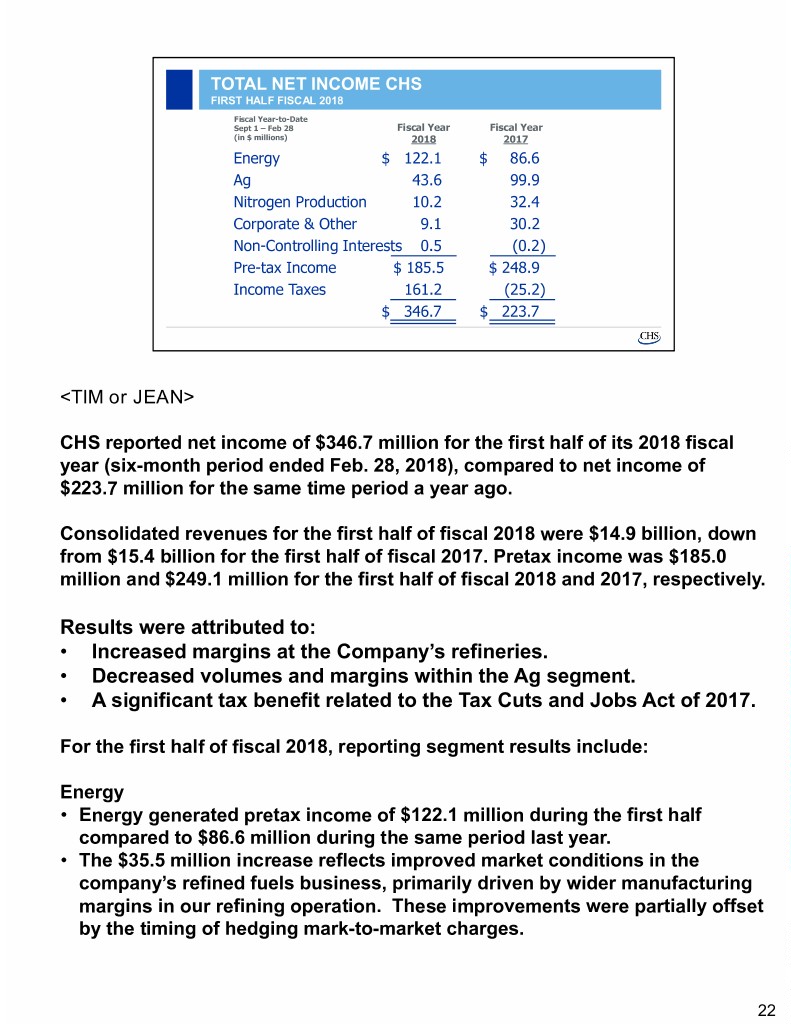

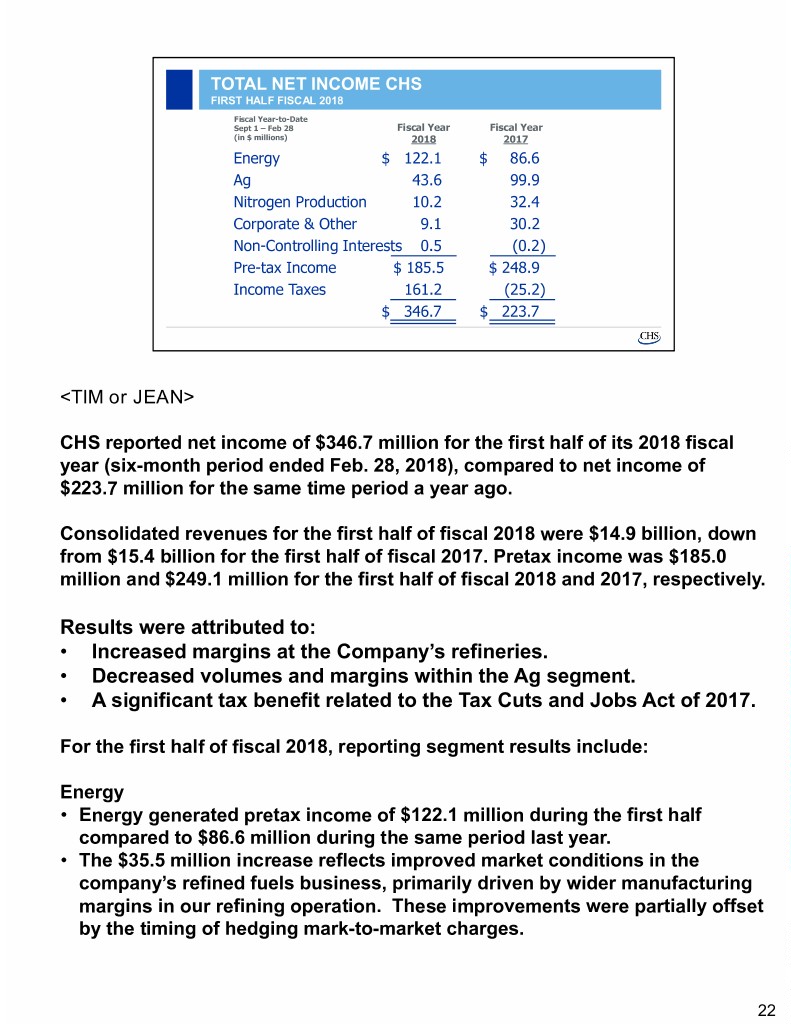

TOTAL NET INCOME CHS FIRST HALF FISCAL 2018 Fiscal Year-to-Date Sept 1 – Feb 28 Fiscal Year Fiscal Year (in $ millions) 2018 2017 Energy $ 122.1 $ 86.6 Ag 43.6 99.9 Nitrogen Production 10.2 32.4 Corporate & Other 9.1 30.2 Non-Controlling Interests 0.5 (0.2) Pre-tax Income $ 185.5 $ 248.9 Income Taxes 161.2 (25.2) $ 346.7 $ 223.7 <TIM or JEAN> CHS reported net income of $346.7 million for the first half of its 2018 fiscal year (six-month period ended Feb. 28, 2018), compared to net income of $223.7 million for the same time period a year ago. Consolidated revenues for the first half of fiscal 2018 were $14.9 billion, down from $15.4 billion for the first half of fiscal 2017. Pretax income was $185.0 million and $249.1 million for the first half of fiscal 2018 and 2017, respectively. Results were attributed to: • Increased margins at the Company’s refineries. • Decreased volumes and margins within the Ag segment. • A significant tax benefit related to the Tax Cuts and Jobs Act of 2017. For the first half of fiscal 2018, reporting segment results include: Energy • Energy generated pretax income of $122.1 million during the first half compared to $86.6 million during the same period last year. • The $35.5 million increase reflects improved market conditions in the company’s refined fuels business, primarily driven by wider manufacturing margins in our refining operation. These improvements were partially offset by the timing of hedging mark-to-market charges. 22

Ag • The Ag segment, which includes domestic and global grain marketing and crop nutrients businesses, renewable fuels, local retail operations and processing and food ingredients, generated pretax income of $43.6 million for the six months ending Feb. 28, 2018. That compares to $99.9 million for the same period the previous fiscal year. • The $56.3 million decrease was primarily the result of a decline in grain and oilseed volumes in the grain marketing and country operations businesses and lower margins across the majority of the Ag sub-segments. Nitrogen Production • This segment is comprised of the company’s investment in CF Industries Nitrogen, LLC (CF Nitrogen) and generated pretax income of $10.2 million during the first half of fiscal 2018 compared to $32.4 million during the same time in fiscal 2017. • The $22.2 million decrease in earnings was primarily due to a gain in fiscal 2017 of $29.1 million associated with an embedded derivative asset that did not reoccur in fiscal 2018. This was partially offset by higher urea prices. Corporate and Other • This category is primarily comprised of the company’s wheat milling joint venture (Ardent Mills), our investment in Ventura Foods, LLC (Ventura Foods), which was previously reported as a separate reporting segment and our CHS financing, hedging and insurance operations. Corporate and Other generated pretax income of $9.1 million in the first half of 2018 compared to $30.2 million for the same period of fiscal 2017. • The $21.1 million decrease was due to reduced interest revenue from the company’s financing business, resulting from the sale of loans receivable and lower earnings from our investment in Ventura Foods. 22

2018 PRIORITIES: STRENGTHEN AND GROW SHARPEN RESTORE STRENGTHEN OPERATIONAL FINANCIAL RELATIONSHIPS EXCELLENCE FLEXIBILITY <TIM or JEAN> Jay provided an overview of our priorities. Our finance team has an important role to deliver on these priorities. Let’s dive a little deeper into our restoring financial flexibility priority. 23

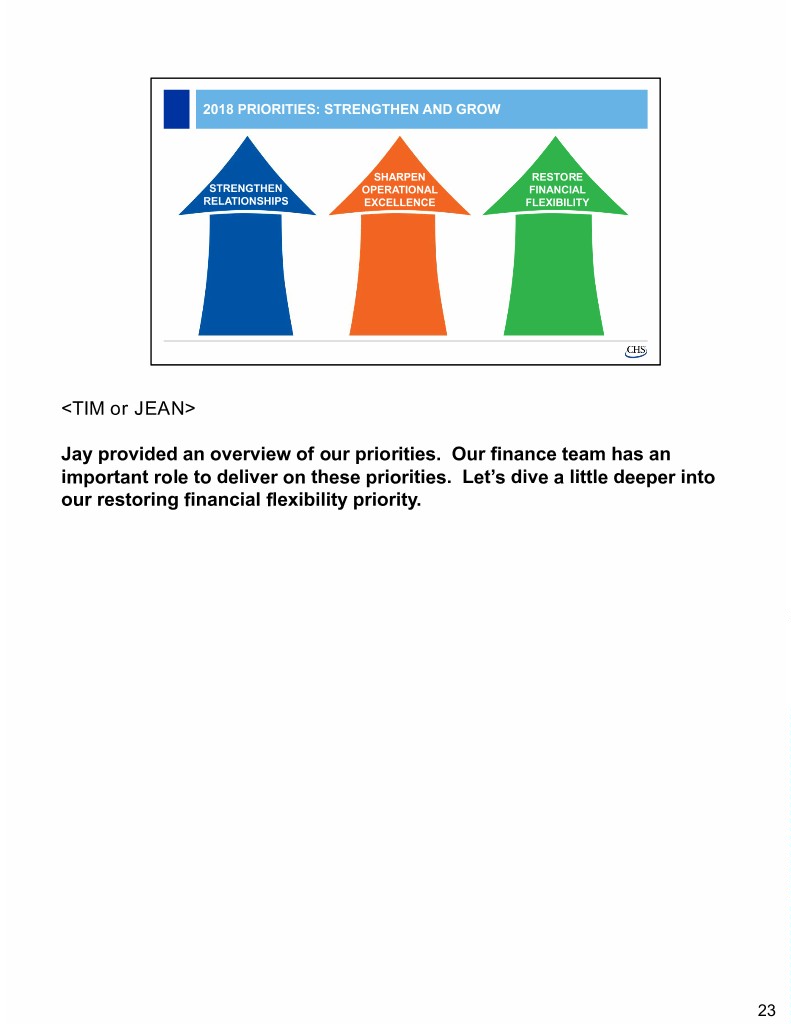

2018 PRIORITIES: STRENGTHEN AND GROW RESTORE FINANCIAL FLEXIBILITY Expense Working Capital CapEx Optimize Assets Equity Management <TIM or JEAN> We have five key focus areas that we believe are essential to restoring financial flexibility: Expenses: We are on our third year of holding overhead expenses flat. We are asking the organization to drive efficiency and continuous improvement to generate the savings needed to ensure our employees are appropriately compensated and that they have the opportunity for learning and development. We look at everything and ask the hard questions to determine what is absolutely necessary. Working Capital: Our businesses require a significant amount of working capital to operate. We continue to work at optimizing our working capital investments. In the past 12 months, we’ve been very focused on strengthening our credit practices by establishing an enterprisewide Credit Center Of Excellence. Better credit management enables lower working capital and disciplined receivables management. In Accounts Payable, we are beginning to leverage SAP to efficiently transact with key vendors. When it comes to inventory, we are well positioned for market moves. Our teams are judicious in managing inventory levels and returns in this carry market. CHS has the liquidity required for today and tomorrow, for what is known and for the unknown. 24

Capex: Until we have holistically restored our financial flexibility, we are constraining capital investment. This year we are limiting capital spending to safety, compliance and maintenance projects. Optimize Assets: Jay has shared with you the list of actions that we’ve taken to optimize our asset portfolio. We have made some difficult decisions and selectively monetized certain assets using the criteria Jay outlined. If business conditions dictate, we will make decisions necessary to keep CHS financially strong. We are proud of our deep supply chain and many of our assets create value through the synergies made possible by interdependence. These interdependencies provide us competitive advantage. We strive to optimize these synergies, which improve margins and asset productivity and drives higher returns. Equity Management: Like we did in FY17, the Board and management are collaborating on key equity management decisions for this year. We appreciate the support our owners have given us related to the tough decisions that were made last year. This work is ongoing and requires a great deal of collaboration and scenario planning. We understand the interest our owners have in CHS’s equity management decisions including 199A pass through, cash patronage and equity retirement. This work is underway and is being led by the Board’s Capital Committee and will culminate with equity management decisions being made by the Board in September. 24

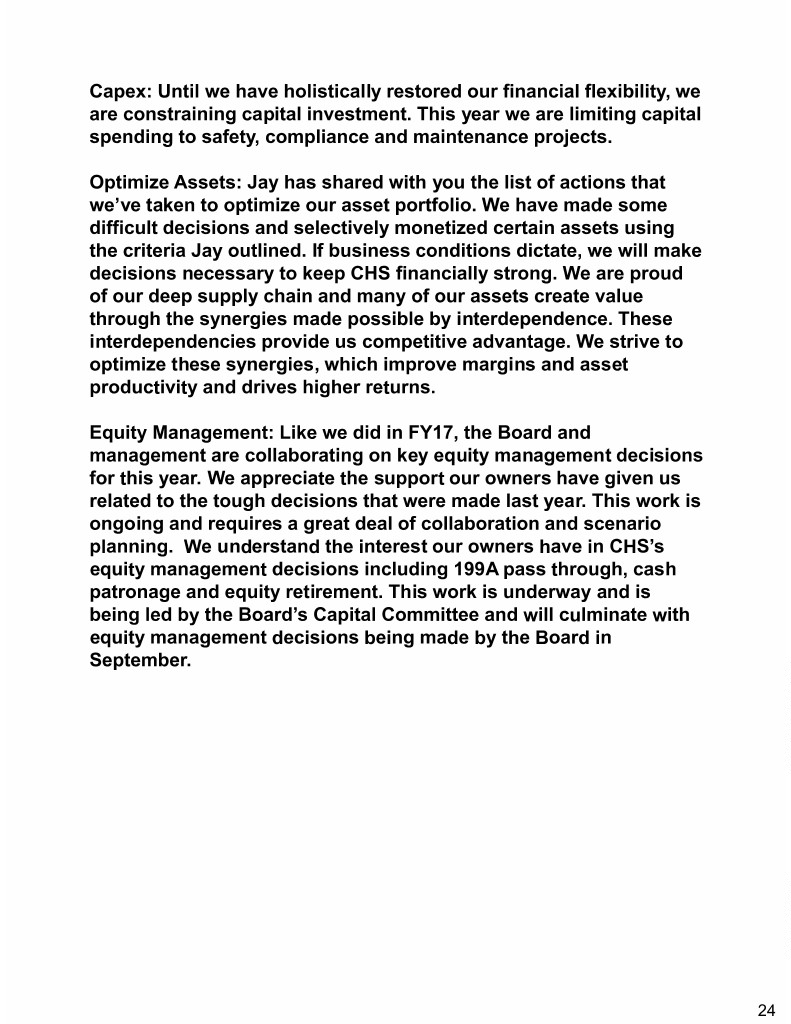

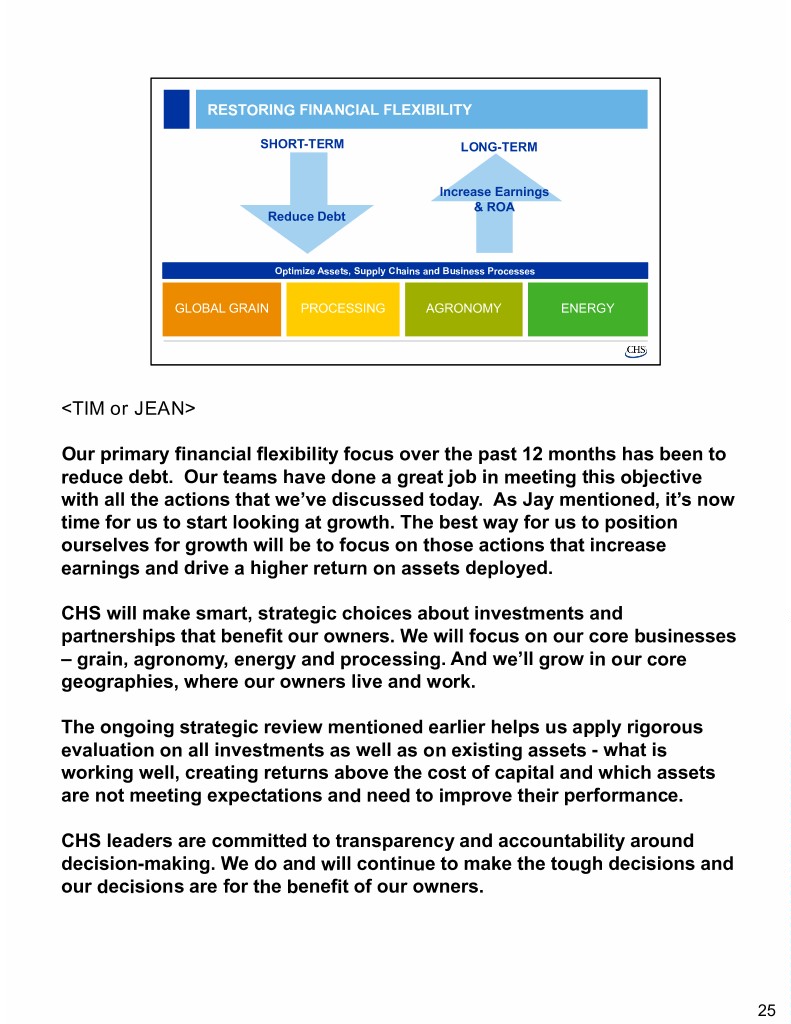

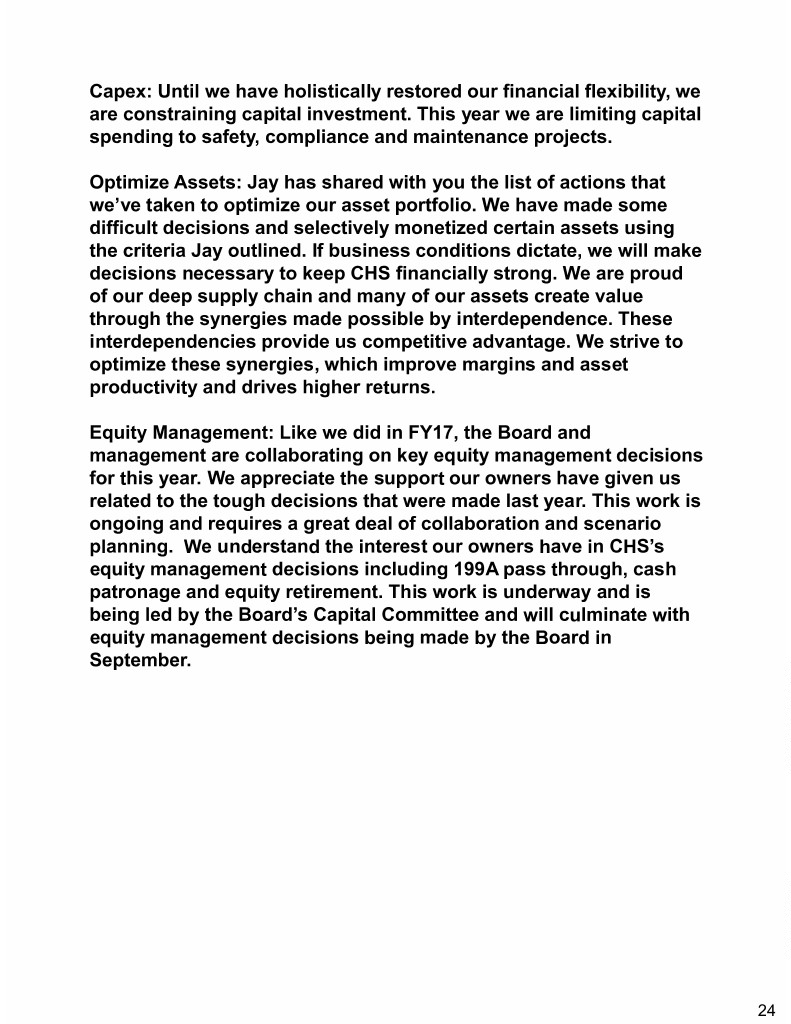

RESTORING FINANCIAL FLEXIBILITY SHORT-TERM LONG-TERM Increase Earnings & ROA Reduce Debt Optimize Assets, Supply Chains and Business Processes GLOBAL GRAIN PROCESSING AGRONOMY ENERGY <TIM or JEAN> Our primary financial flexibility focus over the past 12 months has been to reduce debt. Our teams have done a great job in meeting this objective with all the actions that we’ve discussed today. As Jay mentioned, it’s now time for us to start looking at growth. The best way for us to position ourselves for growth will be to focus on those actions that increase earnings and drive a higher return on assets deployed. CHS will make smart, strategic choices about investments and partnerships that benefit our owners. We will focus on our core businesses – grain, agronomy, energy and processing. And we’ll grow in our core geographies, where our owners live and work. The ongoing strategic review mentioned earlier helps us apply rigorous evaluation on all investments as well as on existing assets - what is working well, creating returns above the cost of capital and which assets are not meeting expectations and need to improve their performance. CHS leaders are committed to transparency and accountability around decision-making. We do and will continue to make the tough decisions and our decisions are for the benefit of our owners. 25

SECTION 199A •Reinstate tax benefits of the previous domestic production activities deduction (DPAD) to CHS •Allow eligible patrons to receive a DPAD pass through from CHS •Includes some individual 199A benefits •Appropriate levels of FY18 DPAD will be passed through before Dec. 31, 2018 <TIM or JEAN> We know many of you have been watching the discussion around 199A closely. Well, here’s where everything landed: • Reinstate tax benefits of the previous domestic production activities deduction, or DPAD, to CHS. • Allow eligible patrons to receive an appropriate DPAD pass-through from CHS. • Includes some individual patron 199A benefits. • The Capital Committee will work with management to determine an appropriate level of FY18 DPAD to pass through before Dec. 31, 2018. We recommend you connect with your tax advisor to understand what all of this means for you and your operation. 26

QUESTIONS? <TIM or JEAN> Answer questions from audience. 27

2018 MARKET INSIGHTS panel <JAY> 28

What are you seeing today? <JAY> So, let’s get started. Please start off by sharing what you’re seeing in terms of trends in each of your areas? Each leader answers the question and then turns it back over to Jay. The following outlines the topics that each leader will cover (NOTE: Not all leaders will be present at each meeting, making it likely that only portions of the information outlined on slides 31, 33 and 35 will be shared at each event). 29

<PANELISTS> Speak to area of expertise, some of the following may be shared: • Energy • Strong and competitive United States production makes us an exporter to the world in crude oil, refined fuels products and propane. • Agronomy • Increased United States/North American fertilizer production is changing trade flows, method of delivery, competitive behaviors and asset values. • Compressed season, more domestic/MW production and truck shortage resulting from United States Department of Transportation’s electronic logging devices (with fertilizer not classified as an agricultural product). • Faster spreaders, bigger planters. • Not enough trucks or retail/on-farm storage. 30

• Processing • Increasing feed demand driven by livestock expansions along with kill capacity. • Large bean carryout creating wider-than-average Midwest bean basis which leads to decent crush margins. • Increase in regional crush capacity with AGP and MNSP; some built by non-traditional companies. • Global grain • Potential trade wars with China and other countries (NAFTA, TPP, South Korea etc.). • Larger carry outs – bigger carries in the market: lower prices, tighter margins, more global competition. • Retail • Our competition (including NEW competition) is evolving and creating deeper connections to customers. And they are developing integrated, efficient supply chains. 30

What trends are you watching? <JAY> What trends are you watching? 31

<PANELISTS> Speak to area of expertise, some of the following may be shared: Energy • Flat to slightly declining domestic demand for refined fuels going forward. Specifically, we’re seeing: • Ag diesel demand decline due to technology advances and farming practices. • Stagnant gasoline demand in the short-term buoyed by big trucks and SUVs and potential decline in the long-term due to improved vehicle mileage and growth in alternative fuels. • Changing consumer preferences impact on retail. • Agronomy • Continued evolution to a consolidated, vertically-integrated supply chain. • Socio-environmental concerns over safety, sustainability and transparency/traceability. • Online agronomy inputs – the price may be right, but can they deliver in a market that’s moving from volume to value (beyond the ton). 32

• Processing • Growing world demand of protein and vegetable oil. • FSMA and feed regulation continue and could impact global supply chain. • Truck freight rate increases and electronic logs. • Industrial uses of soy and canola oil. • Global grain • Foreign market entrants into United States: consolidation of market place. • Growth in domestic consumption demand, protein demand, renewable fuels. 32

What excites you about the future? <JAY> Great discussion. Now, let’s talk about what excites you about the future? 33

<PANELISTS> Speak to area of expertise, some of the following may be shared: • Energy • The quality and position of assets to win in the future - Laurel and McPherson provide excellent access to cost-advantaged crude supply and great access to markets to serve our owners really well. • Products- Cenex® Ruby Fieldmaster® continues to be the gold standard in high-performing premium diesel fuel at a time when diesel engine technology is more demanding than ever. • The passion of our people to serve our owners’ energy needs. • Agronomy • Our strategic advantage, including nitrogen production, deep water port, river, rail and truck-served facilities and strong retail partnerships to serve our grower owners across the country. • Digitization of agriculture with farm planning and management platforms complementing precision ag technology to help growers make better agronomic and economic decisions and provide new and better ways for us to serve our customers and owners. 34

• Processing • Growth in our soymeal export presence. • Growth in the high-oleic oil market. • Proprietary sunflower seed and pasteurization plant for flax, millet and buckwheat. • Global grain • Acreage shifts globally to maximize profitability: Population growth, protein consumption, global renewable fuels consumption. • Connecting our capabilities to customer needs (contract production partnerships, growth in containers and emerging country markets): Use of technology to better connect to our owners, risk management programs, build out of additional supply chains. • Retail • CHS priority is a heavier engagement with our customers – co-ops and farmers alike. We are hard at work positioning CHS to be the industry leader as the most efficient, seamless supply chain. Our efforts will be put toward making that a differentiator that no one can touch. Those efforts will be multi-faceted and could include organic growth, expansion through investment and/or partner or tightening up the current internal process for greater efficiency and a better customer experience. 34

Questions? <JAY> Field questions and direct them to a panelists. 35

SAVE THE DATE CHS ANNUAL MEETING DECEMBER 6-7, 2018 <JAY> I’d like to talk more about our future with all of you. If you can share some of your time this December, please consider attending the CHS Annual Meeting. It’s a great chance for you to connect with other producers, leaders and folks at CHS. We always love the opportunity to connect in person at this annual event. 36

Reporting progress 2018 CHS OwnerExchanging Forums ideas Growing stronger together <JAY> Share wrap-up comments. 37

Thank you <JAY> 38

39