Oppenheimer Equity Fund

6803 South Tucson Way, Centennial, Colorado 80112

1.800.225.5677

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 10, 2017

To the Shareholders of Oppenheimer Equity Fund:

Notice is hereby given that a Special Meeting of the Shareholders of Oppenheimer Equity Fund, (the “Target Fund”), a registered open-end management investment company, will be held at the offices of OFI Global Asset Management, Inc. (the “Manager”), 6803 South Tucson Way, Centennial, Colorado 80112 at 1:00PM, Mountain Time, on February 10, 2017, or any adjournments thereof (the “Meeting”). Shareholders will be asked to vote on the following proposals:

| 1. | To approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) between the Target Fund and Oppenheimer Main Street Fund®, a series of Oppenheimer Main Street Funds (the “Acquiring Fund”), and the transactions contemplated thereby, including: (i) the transfer of all of the assets of the Target Fund to the Acquiring Fund solely in exchange for Class A, Class B, Class C, Class R and Class Y shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund, (ii) the distribution of shares of the Acquiring Fund to the corresponding Class A, Class B, Class C, Class R and Class Y shareholders of the Target Fund in complete liquidation of the Target Fund; and (iii) the cancellation of the outstanding shares of the Target Fund (all of the foregoing being referred to as the “Reorganization”); and |

2. To act upon such other matters as may properly come before the Meeting.

Shareholders of record at the close of business on December 5, 2016 are entitled to notice of, and to vote at, the Meeting. The Reorganization is more fully discussed in the Combined Prospectus/Proxy Statement. Please read it carefully before telling us, through your proxy or in person, how you wish your shares to be voted. The Board of Trustees of the Target Fund believes the Reorganization is in the best interests of the Target Fund and the interests of the Target Fund’s existing shareholders would not be diluted as a result of the Reorganization and recommends that you vote “For” the Reorganization.

YOU CAN VOTE ON THE INTERNET, BY TELEPHONE OR BY MAIL.

WE URGE YOU TO VOTE PROMPTLY.

YOUR VOTE IS IMPORTANT

PLEASE VOTE THE ENCLOSED PROXY TODAY.

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.

By Order of the Board of Trustees,

Cynthia Lo Bessette, Secretary

[January 5, 2017]

Oppenheimer Main Street Fund®

6803 South Tucson Way, Centennial, Colorado 80112

1.800.225.5677

COMBINED PROSPECTUS/PROXY STATEMENT

[January 5, 2017]

SPECIAL MEETING OF SHAREHOLDERS OF

Oppenheimer Equity Fund

to be held on February 10, 2017

Acquisition of the Assets of

Oppenheimer Equity Fund

6803 South Tucson Way, Centennial, Colorado 80112

1.800.225.5677

By and in exchange for Class A, Class B, Class C, Class R and Class Y shares of

Oppenheimer Main Street Fund®

This Combined Prospectus/Proxy Statement is furnished to you as a shareholder of Oppenheimer Equity Fund (the “Target Fund”). A special meeting of shareholders of the Target Fund, or any adjournments thereof, (the “Meeting”) will be held at the offices of OFI Global Asset Management, Inc. (the “Manager”) at 6803 South Tucson Way, Centennial, Colorado 80112 on February 10, 2017, at 1:00 p.m., Mountain time, to consider the items that are listed below and discussed in greater detail elsewhere in this Combined Prospectus/Proxy Statement. Shareholders of record of the Target Fund as of the close of business on December 5, 2016 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. This Combined Prospectus/Proxy Statement, proxy card and accompanying Notice of Special Meeting will be sent to shareholders on [January 5, 2017], or as soon as practicable thereafter.

The purposes of the Special Meeting are:

| 1. | To approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) between the Target Fund and Oppenheimer Main Street Fund, a series of Oppenheimer Main Street Funds (the “Acquiring Fund”), and the transactions contemplated thereby, including: (i) the transfer of all of the assets of the Target Fund to the Acquiring Fund solely in exchange for Class A, Class B, Class C, Class R and Class Y shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund, (ii) the distribution of shares of the Acquiring Fund to the corresponding Class A, Class B, Class C, Class R and Class Y shareholders of the Target Fund in complete liquidation of the Target Fund; and (iii) the cancellation of the outstanding shares of the Target Fund (all of the foregoing being referred to as the “Reorganization”); and |

2. To act upon such other matters as may properly come before the Meeting.

At a meeting held on November 11, 2016, the Board of Trustees of the Target Fund and the Acquiring Fund (the “Board”) unanimously approved the Reorganization by which the Target Fund, an open-end investment company, would be acquired by the Acquiring Fund, an open-end investment company. The Target Fund has an investment objective identical to that of the Acquiring Fund, and investment policies and practices that are substantially similar to those of the Acquiring Fund. The investment objective of the Target Fund and the Acquiring Fund is to seek capital appreciation. The Reorganization is intended to consolidate comparable Oppenheimer mutual funds to eliminate redundancies and achieve certain operating efficiencies, including greater benefit from economies of scale for both Funds and decreases in operating expenses for the Target Fund. The Target Fund has been experiencing net outflows for a number of years, which have resulted in certain diseconomies, including fixed costs representing an increasing percentage of a smaller asset base. The Target Fund appears to have limited distribution opportunities and prospects for future asset growth. In contrast, the Acquiring Fund, which has the same investment objective as the Target Fund and substantially similar investment strategies and risks, has demonstrated superior performance relative to peers and appears to provide shareholders greater opportunities for realizing benefits resulting from economies of scale due to asset growth.

The Board requests that shareholders vote their shares by completing and returning the enclosed proxy card or by following one of the other methods for voting specified on the proxy card.

This Combined Prospectus/Proxy Statement constitutes the Prospectus of the Acquiring Fund and the Proxy Statement of the Target Fund filed on Form N-14 with the Securities and Exchange Commission (“SEC”). This Combined Prospectus/Proxy Statement sets forth concisely the information shareholders of the Target Fund should know before voting on the Reorganization and constitutes an offering of the shares of the Acquiring Fund being issued in the Reorganization. Please read it carefully and retain it for future reference. The following documents each have been filed with the SEC, and are incorporated herein by reference into (each legally forms a part of) this Combined Prospectus/Proxy Statement:

| · | A Statement of Additional Information dated [January 5, 2017] (the “Reorganization SAI”), relating to this Combined Prospectus/Proxy Statement; |

| · | The Summary Prospectus of the Acquiring Fund, dated October 28, 2016, as supplemented, a copy of which accompanies this Combined Prospectus/Proxy Statement (the “Acquiring Fund Summary Prospectus”); |

| · | The Prospectus of the Acquiring Fund, dated October 28, 2016, as supplemented (the “Acquiring Fund Prospectus”); |

| · | The Statement of Additional Information of the Acquiring Fund, dated October 28, 2016, as supplemented (the “Acquiring Fund SAI”); |

| · | The Annual Report to shareholders of the Acquiring Fund for the fiscal year ended August 31, 2016 (the “Acquiring Fund Annual Report”); |

| · | The Prospectus of the Target Fund, dated March 28, 2016, as supplemented (the “Target Fund Prospectus”); |

| · | The Statement of Additional Information of the Target Fund, dated March 28, 2016, as supplemented, (the “Target Fund SAI”); |

| · | The Annual Report to shareholders of the Target Fund for the fiscal year ended December 31, 2015 (the “Target Fund Annual Report”); and |

| · | The Semi-Annual Report to shareholders of the Target Fund for the six months ended June 30, 2016 (the “Target Fund Semi-Annual Report”). |

The Target Fund and the Acquiring Fund (each, a “Fund” and together, the “Funds”) are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “Investment Company Act”), and in accordance therewith, file reports and other information, including proxy materials and charter documents, with the SEC.

You may request a free copy of the foregoing documents and any more recent reports filed after the date hereof by writing to OppenheimerFunds Services (the “Transfer Agent”) at P.O. Box 5270, Denver, Colorado 80217, by visiting the OppenheimerFunds Internet website at www.oppenheimerfunds.com or by calling toll-free 1.800.225.5677.

You also may view or obtain these documents from the SEC:

| In Person: | At the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549 |

| By Phone: | (202) 551-8090 |

| By Mail: | Public Reference Section Office of Consumer Affairs and Information Services Securities and Exchange Commission 100 F Street, N.E. Washington, DC 20549 (duplicating fee required) |

| By E-mail: | publicinfo@sec.gov (duplicating fee required) |

| By Internet: | www.sec.gov |

Mutual fund shares are not deposits or obligations of any bank, and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve investment risks including the possible loss of principal.

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Combined Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

This Combined Prospectus/Proxy Statement is dated [January 5, 2017.]

TABLE OF CONTENTS

COMBINED PROSPECTUS/PROXY STATEMENT

| Page | |||

| Synopsis | |||

| The Proposed Reorganization | 1 | ||

| Investment Objectives and Principal Investment Strategies | 3 | ||

| Fees and Expenses | 5 | ||

| Portfolio Turnover | 8 | ||

| Federal Income Tax Consequences of the Reorganization | 8 | ||

| Distribution, Purchase, Exchange, Redemption and Valuation of Shares | 9 | ||

| Comparison of the Funds | |||

| Principal Investment Risks | 9 | ||

| Fundamental Investment Restrictions | 12 | ||

| Performance Information | 12 | ||

| Management of the Funds | 14 | ||

| Investment Advisory Agreements | 15 | ||

| Pending Litigation | 17 | ||

| Distribution Services | 18 | ||

| Payments to Financial Intermediaries and Service Providers | 18 | ||

| Dividends and Distributions | 20 | ||

| Purchase, Exchange, Redemption and Valuation of Shares | 20 | ||

| Fund Service Providers | 22 | ||

| Shareholder Rights | 23 | ||

| Information About the Reorganization | |||

| Terms of the Reorganization Agreement | 24 | ||

| Board Consideration of the Reorganization | 25 | ||

| Expenses of the Reorganization | 26 | ||

| Material U.S. Federal Income Tax Consequences of the Reorganization | 26 | ||

| Voting Information | |||

| Solicitation of Proxies | 29 | ||

| Voting, Quorum Requirement and Adjournments | 31 | ||

| Required Vote | 32 | ||

| How Proxies Will Be Voted | 32 | ||

| Revoking a Proxy | 32 | ||

| Shareholder Proposals | 32 | ||

| Shareholder Communication to the Board | 32 | ||

| Reports to Shareholders and Financial Statements | 33 | ||

| Other Matters | 33 | ||

| Additional Information About the Funds | |||

| Capitalization of the Funds | 33 | ||

| Shareholder Information | 34 | ||

| Financial Highlights | 35 | ||

| Exhibit A: Form of Agreement and Plan of Reorganization | A-1 | ||

| Exhibit B: Principal Shareholders | B-1 | ||

| Exhibit C: Form of Proxy Card | C-1 | ||

Enclosures:

Summary Prospectus of Oppenheimer Main Street Fund dated October 28, 2016

SYNOPSIS

This is only a summary and is qualified in its entirety by the more detailed information contained in or incorporated by reference in this Combined Prospectus/Proxy Statement and by the Reorganization Agreement, which is attached as Exhibit A. Shareholders should carefully review this Combined Prospectus/Proxy Statement and the Reorganization Agreement in their entirety and the Acquiring Fund Summary Prospectus, which accompanies this Combined Prospectus/Proxy Statement and is incorporated herein by reference.

The Proposed Reorganization

If shareholders of the Target Fund vote to approve the Reorganization Agreement and the Reorganization, on the Closing Date (as such term is defined in the Reorganization Agreement attached hereto as Exhibit A), all of the assets of the Target Fund will be transferred to the Acquiring Fund solely in exchange for the assumption of all liabilities and for full and fractional shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of the shareholder’s Target Fund shares as of the Valuation Date (as such term is defined in the Reorganization Agreement) according to the following chart:

| Target Fund – Share Class Exchanged | Acquiring Fund – Share Class Received |

| Class A | Class A |

| Class B | Class B |

| Class C | Class C |

| Class R | Class R |

| Class Y | Class Y |

Immediately thereafter, the Target Fund will distribute these shares of the Acquiring Fund to its shareholders. After distributing these shares, the Target Fund will be terminated. No sales charge will be imposed on the shares of the Acquiring Fund received by Target Fund shareholders in connection with the Reorganization. However, any other purchase or redemption would be subject to any applicable sales charges. After the Reorganization is completed, any contingent deferred sales charge (“CDSC”) on the redemption of shares of the Acquiring Fund would be calculated using the formula set forth in Acquiring Fund Prospectus from the date of original purchase of the Target Fund’s shares.

The Reorganization Agreement is subject to approval by the shareholders of the Target Fund. The Reorganization, if approved by shareholders of the Target Fund, is scheduled to be effective on or about March 17, 2017, or on such later date as the parties may agree (“Closing Date”). As a result of the Reorganization, each shareholder of the Target Fund will become the owner of the number of full and fractional shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of the shareholder’s Target Fund shares as of the close of business on the Valuation Date (hereinafter defined). Class A, Class B, Class C, Class R and Class Y shareholders of the Target Fund will receive the same class of shares of the Acquiring Fund. See “Information About the Reorganization” below.

Approval of the Reorganization of the Target Fund will require the affirmative vote of a majority of the outstanding voting securities of the Target Fund, as defined in the Investment Company Act. A “majority of the outstanding voting securities” is defined in the Investment Company Act as the lesser of (i) 67% or more of the voting power of the voting securities present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Target Fund are present at the Meeting or represented by proxy, or (ii) more than 50% of the voting power of the outstanding voting securities of the Target Fund. See “Voting Information – Quorum and Required Vote” below.

In the absence of sufficient votes to approve the Reorganization, the Meeting shall be adjourned until a quorum shall attend. Additional information on voting and quorum requirements is provided in the section “Voting Information - Quorum and Required Vote.”

The Acquiring Fund, following the completion of the Reorganization, may be referred to as the “Combined Fund” in this Combined Prospectus/Proxy Statement. The Target Fund, the Acquiring Fund, and the Combined Fund may also be generally referred to as a “Fund” or the “Funds.”

OFI Global Asset Management, Inc. (the “Manager”) and OppenheimerFunds, Inc. (the “Sub-Adviser”) serve as the investment adviser and investment sub-adviser, respectively, of each of the Funds. The Manager believes that the shareholders of each Fund generally will benefit more from the potential operating efficiencies and economies of scale that may be achieved by combining the Fund’s assets in the Reorganization, than by continuing to operate the Funds separately. The Manager believes that the Acquiring Fund’s investment objective and strategies make it a compatible fund within the OppenheimerFunds complex for a reorganization with the Target Fund. As a result of the identical investment objectives and substantially similar strategies of the Funds, there is significant overlap in the types of portfolio securities currently owned by the Funds. Shareholders of the Target Fund could also expect to benefit from the superior performance of the Acquiring Fund, and the economies of scale associated with a larger fund as a result of the combined assets realizing a significantly lower management fee rate and lower total operating expenses than Target Fund shareholders currently receive. Consistent with the flexibility permitted by each Fund’s investment strategies, the portfolio management team is generally managing the Target Fund in a similar manner as the portfolio management team of the Acquiring Fund. In particular, as of October 31, 2016, 27% of the Target Fund’s assets were invested in securities that were also held by the Acquiring Fund.

The Board of the Target Fund reviewed and discussed the proposed Reorganization with the Manager and the Board’s independent legal counsel. The Board of the Target Fund also considered information with respect to, but not limited to, each Fund’s respective investment objective and policies, management fees, distribution fees and other operating expenses, historical performance and asset size.

Based on the considerations discussed above and the reasons more fully described under “Information About the Reorganization—Board Consideration of the Reorganization,” the Board of the Target Fund, including all of the Board members (each, a “Board Member”) who are not “interested persons” of the Target Fund under the Investment Company Act (the “Independent Board Members”), has unanimously concluded that participation in the Reorganization of the Target Fund is in the best interests of the Target Fund and that the interests of the Target Fund’s existing shareholders would not be diluted as a result of the Reorganization. The Board, therefore, is hereby submitting the Reorganization Agreement to the shareholders of the Target Fund and recommending that shareholders of the Target Fund vote “FOR” the Reorganization Agreement effecting the Reorganization. The Board of the Acquiring Fund has also approved the Reorganization on behalf of the Acquiring Fund. Shareholders of the Acquiring Fund do not vote on the Reorganization.

THE BOARD, INCLUDING ALL OF THE INDEPENDENT BOARD MEMBERS, RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THE REORGANIZATION AGREEMENT

Investment Objectives and Principal Investment Strategies

Investment Objectives. The investment objectives of the Funds are identical. The investment objective of the Target Fund and the Acquiring Fund is to seek capital appreciation. The investment objective of each Fund is non-fundamental, which means it may be changed without the approval of the Fund’s shareholders.

Principal Investment Strategies. The Target Fund and the Acquiring Fund have identical investment objectives, but employ differing investment strategies to achieve their respective objectives. The similarities and differences of the principal investment strategies of the Funds are described in the chart below.

| Target Fund | Acquiring Fund |

| Principal Investment Strategies | |

The Fund invests primarily in equity securities of U.S. companies. Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities (including borrowings for investment purposes). The 80% investment policy is a non-fundamental investment policy and will not be changed without 60 days' advance notice to shareholders. The Fund may also invest in debt securities when the portfolio managers believe it may be advantageous in seeking capital appreciation. The Fund normally invests primarily in medium- and large-capitalization companies that are more established than smaller companies, but may invest in smaller-capitalization companies to the extent that the Fund considers appropriate. The Fund may also invest in companies located outside of the United States.

| The Fund mainly invests in common stocks of U.S. companies of different capitalization ranges. The Fund currently focuses on "larger capitalization" issuers, which are considered to be companies with market capitalizations equal to the companies in the Russell 1000. |

| How Securities are Selected | |

In selecting investments for the Fund's portfolio, the portfolio managers use an investment process that combines both "value" and "growth" investment styles. A value strategy seeks to identify issuers whose securities are undervalued in the marketplace. The portfolio managers consider a number of factors such as the ratio of the stock's price to the company's earnings, the value of its assets and its management strength. A low price/earnings ratio may indicate that a stock is undervalued. A growth style looks for companies whose stock price may increase at a greater rate than the overall market. These issuers may be entering a growth phase, marked by increases in earnings, sales, cash flows, or other factors that suggest that the stock price may increase more rapidly.

With respect to the growth strategy, the portfolio managers construct the portfolio using both a "bottom up" analysis of individual issuers, which includes fundamental analysis of a company's financial statements and management structure and consideration of the company's operations, product development and industry position and a "top down" analysis where overall market, sector and individual trends are considered. The portfolio manager for the value strategy uses a "bottom up" analysis in construction of that portion of the portfolio. The portfolio managers focus on factors that may vary over time and in particular cases. Currently they look for: · Individual stocks that are attractive based on fundamental stock analysis and company characteristics; · Growth stocks of companies that have projected earnings in excess of the average for their sector and industry; · Value stocks with compelling long-term business prospects. The portfolio managers monitor individual issuers for changes in business fundamentals and valuation, which may trigger a decision to sell a security, but does not require such a decision. | The portfolio managers use fundamental research and quantitative models to select securities for the Fund's portfolio, which is comprised of both growth and value stocks. While the process may change over time or vary in particular cases, in general the selection process currently uses: · a fundamental approach in analyzing issuers on factors such as a company's financial performance and prospects, industry position, and business model and management strength. Industry outlook, market trends and general economic conditions may also be considered. · quantitative models to rank securities within each sector to identify potential buy and sell candidates for further fundamental analysis. A number of company-specific factors are analyzed in constructing the models, including valuation, fundamentals and momentum.

The portfolio is constructed and regularly monitored based upon several analytical tools, including quantitative investment models. The Fund aims to maintain a broadly diversified portfolio across major economic sectors by applying investment parameters for both sector and position size. The portfolio managers use the following sell criteria: the stock price is approaching its target, deterioration in the company's competitive position, poor execution by the company's management, or identification of more attractive alternative investment ideas. |

| Who is the Fund Designed For? | |

| The Fund is designed for investors seeking capital appreciation. Those investors should be willing to assume the risks of short-term share price fluctuations that are typical for a moderately aggressive fund that invests primarily in common stocks. Since the Fund's income level will fluctuate, it is not designed for investors needing an assured level of current income. The Fund is not a complete investment program. You should carefully consider your own investment goals and risk tolerance before investing in the Fund. | The Fund is designed primarily for investors seeking capital appreciation. Those investors should be willing to assume the risks of short-term share price fluctuations that are typical for a fund that focuses on stock. The Fund is not designed for investors needing current income. The Fund is not a complete investment program. You should carefully consider your own investment goals and risk tolerance before investing in the Fund.

|

Comparison. As shown in the chart above, each Fund’s investment objective is to seek capital appreciation and each Fund invests primarily in equity securities of U.S. companies. Under normal circumstances, Equity Fund invests at least 80% of its net assets in equity securities (including borrowings for investment purposes), and may invest in debt securities and in foreign securities, while Main Street Fund’s principal investment strategy focuses solely on domestic equity securities. In addition, Equity Fund normally invests primarily in medium- and large-capitalization companies that are more established than smaller companies, but may invest in smaller-capitalization companies. In contrast, Main Street Fund focuses on "larger capitalization" issuers.

Notwithstanding the differences in the investment strategies of the Funds, as noted above, because of the identical investment objectives and substantially similar strategies there is significant overlap in the portfolio securities currently owned by the Funds. Consistent with the flexibility permitted by each Fund’s investment strategies, the portfolio management teams are generally managing the Funds in a similar manner and the Acquiring Fund’s portfolio management team is also expected to manage the Combined Fund after the Reorganization. In particular, as noted above, as of October 31, 2016, 27% of the Target Fund’s assets were invested in securities that were also held by the Acquiring Fund and 47% of the Acquiring Fund’s assets were invested in securities that were also held by the Target Fund. The portfolio managers of the Acquiring Fund have reviewed the portfolio holdings of the Target Fund and do not anticipate disposing of, or requesting the disposition of, any material portion of the assets of the Target Fund in preparation for the applicable Reorganization. Subsequent to the Reorganization, it is expected that the portfolio managers of the Acquiring Fund will dispose of a portion of the assets of the Target Fund, consistent with the Acquiring Fund’s investment objective and strategies and its portfolio managers’ investment processes, which will incur additional transaction costs that will be borne by the Acquiring Fund.

Fees and Expenses

The tables below compare the fees and expenses of each class of shares of the Funds, assuming the Reorganization had taken place on September 30, 2016 and the estimated pro forma fees and expenses attributable to each class of shares of the Combined Fund’s Pro Forma portfolio. Future fees and expenses may be greater or less than those indicated below. For information concerning the net assets of each Fund as of September 30, 2016, see “Additional Information About the Funds—Capitalization of the Funds.” You may qualify for sales charge discounts if you (or you and your spouse) invest, or agree to invest in the future, at least $25,000 in certain funds in the Oppenheimer family of funds. More information about these and other discounts is available from your financial professional and in the section “About Your Account” in the Acquiring Fund Prospectus which is incorporated herein by reference and in the sections “How to Buy Shares” and “Appendix A” of the Acquiring Fund SAI, which is incorporated herein by reference.

Fee Tables of the Target Fund, the Acquiring Fund, and the Combined Fund (as of September 30, 2016 (unaudited))

| Target Fund Class A | Acquiring Fund Class A4 | Acquiring Fund Pro Forma Combined Fund Class A |

| Shareholder Fees (fees paid directly from your investment) | |||

| Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | 5.75% | 5.75% | 5.75% |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds) | None1 | None1 | None1 |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||

| Management Fees | 0.55% | 0.46% | 0.46% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.25% | 0.25% |

| Other Expenses | 0.23% | 0.23% | 0.23% |

| Total Annual Fund Operating Expenses | 1.03% | 0.94% | 0.94% |

| Target Fund Class B | Acquiring Fund Class B4 | Acquiring Fund Pro Forma Combined Fund Class B |

| Shareholder Fees (fees paid directly from your investment) | |||

| Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds) | 5%2 | 5%2 | 5%2 |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||

| Management Fees | 0.55% | 0.46% | 0.46% |

| Distribution and/or Service (12b-1) Fees | 1.00% | 1.00% | 1.00% |

| Other Expenses | 0.24% | 0.24% | 0.24% |

| Total Annual Fund Operating Expenses | 1.79% | 1.70% | 1.70% |

| Target Fund Class C | Acquiring Fund Class C4 | Acquiring Fund Pro Forma Combined Fund Class C |

| Shareholder Fees (fees paid directly from your investment) | |||

| Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds) | 1%3 | 1%3 | 1%3 |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||

| Management Fees | 0.55% | 0.46% | 0.46% |

| Distribution and/or Service (12b-1) Fees | 1.00% | 1.00% | 1.00% |

| Other Expenses | 0.24% | 0.24% | 0.24% |

| Total Annual Fund Operating Expenses | 1.79% | 1.70% | 1.70% |

| Target Fund Class R | Acquiring Fund Class R4 | Acquiring Fund Pro Forma Combined Fund Class R |

| Shareholder Fees (fees paid directly from your investment) | |||

| Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds) | None | None | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||

| Management Fees | 0.55% | 0.46% | 0.46% |

| Distribution and/or Service (12b-1) Fees | 0.50% | 0.50% | 0.50% |

| Other Expenses | 0.24% | 0.23% | 0.23% |

| Total Annual Fund Operating Expenses | 1.29% | 1.19% | 1.19% |

| Target Fund Class Y | Acquiring Fund Class Y4 | Acquiring Fund Pro Forma Combined Fund Class Y |

| Shareholder Fees (fees paid directly from your investment) | |||

| Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of the original offering price or redemption proceeds) | None | None | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||

| Management Fees | 0.55% | 0.46% | 0.46% |

| Distribution and/or Service (12b-1) Fees | None | None | None |

| Other Expenses | 023% | 0.23% | 0.23% |

| Total Annual Fund Operating Expenses | 0.78% | 0.69% | 0.69% |

| 1. | A Class A contingent deferred sales charge may apply to redemptions of investments of $1 million or more in Oppenheimer funds if they are redeemed within an 18-month "holding period" or to certain retirement plan redemptions. |

| 2. | Applies to redemptions in the first year after purchase. The contingent deferred sales charge gradually declines from 5% to 1% during years one through six. Class B shares automatically convert to Class A shares six years (72 months) after purchase. This conversion eliminates the Class B asset-based sales charge, however, the shares will be subject to the ongoing Class A fees and expenses. The conversion is based on the relative net asset value of the two classes, and no sales load or other charge is imposed. When any Class B shares that you hold convert to Class A shares, all other Class B shares that were acquired by reinvesting dividends and distributions on the converted shares will also convert. |

| 3. | Applies to shares redeemed within 12 months of purchase. |

| 4. | Expenses have been restated to reflect current fees. |

Example

This Example is intended to help you compare the cost of investing in the relevant Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in a class of shares of the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Any applicable fee waivers and/or expense reimbursements are reflected in the below examples for the period during which such fee waivers and/or expense reimbursements are in effect. Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows:

| If shares are redeemed1: | 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund Class A | $675 | $886 | $1,114 | $1,768 |

| Acquiring Fund Class A | $666 | $859 | $1,067 | $1,668 |

| Acquiring Fund Pro Forma Combined Fund Class A | $666 | $859 | $1,067 | $1,668 |

| If shares are not redeemed2: | ||||

| Target Fund Class A | $675 | $886 | $1,114 | $1,768 |

| Acquiring Fund Class A | $666 | $859 | $1,067 | $1,668 |

| Acquiring Fund Pro Forma Combined Fund Class A | $666 | $859 | $1,067 | $1,668 |

| If shares are redeemed1: | 1 Year | 3 Years | 5 Years | 10 Years3 |

| Target Fund Class B | $683 | $868 | $1,178 | $1,735 |

| Acquiring Fund Class B | $674 | $840 | $1,131 | $1,633 |

| Acquiring Fund Pro Forma Combined Fund Class B | $674 | $840 | $1,131 | $1,633 |

| If shares are not redeemed2: | ||||

| Target Fund Class B | $183 | $568 | $978 | $1,735 |

| Acquiring Fund Class B | $174 | $540 | $931 | $1,633 |

| Acquiring Fund Pro Forma Combined Fund Class B | $174 | $540 | $931 | $1,633 |

| If shares are redeemed1: | 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund Class C | $283 | $568 | $978 | $2,124 |

| Acquiring Fund Class C | $274 | $540 | $931 | $2,025 |

| Acquiring Fund Pro Forma Combined Fund Class C | $274 | $540 | 931$ | $2,025 |

| If shares are not redeemed2: | ||||

| Target Fund Class C | $183 | $568 | $978 | $2,124 |

| Acquiring Fund Class C | $174 | $540 | $931 | $2,025 |

| Acquiring Fund Pro Forma Combined Fund Class C | $174 | $540 | $931 | $2,025 |

| If shares are redeemed: | 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund Class R | $132 | $412 | $712 | $1,566 |

| Acquiring Fund Class R | $122 | $380 | $658 | $1,452 |

| Acquiring Fund Pro Forma Combined Fund Class R | $122 | $380 | $658 | $1,452 |

| If shares are not redeemed: | ||||

| Target Fund Class R | $132 | $412 | $712 | $1,566 |

| Acquiring Fund Class R | $122 | $380 | $658 | $1,452 |

| Acquiring Fund Pro Forma Combined Fund Class R | $122 | $380 | $658 | $1,452 |

| If shares are redeemed: | 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund Class Y | $80 | $250 | $435 | $970 |

| Acquiring Fund Class Y | $71 | $221 | $385 | $861 |

| Acquiring Fund Pro Forma Combined Fund Class Y | $71 | $221 | $385 | $861 |

| If shares are not redeemed: | ||||

| Target Fund Class Y | $80 | $250 | $435 | $970 |

| Acquiring Fund Class Y | $71 | $221 | $385 | $861 |

| Acquiring Fund Pro Forma Combined Fund Class Y | $71 | $221 | $385 | $861 |

| 1. | In the “If shares are redeemed” examples, expenses include the initial sales charge for Class A and the applicable Class B, and Class C contingent deferred sales charges. |

| 2. | In the “If shares are not redeemed” examples, the Class A expenses include the initial sales charge, but Class B and Class C expenses do not include the contingent deferred sales charges. |

| 3. | Class B expenses for years 7 through 10 are based on Class A expenses, since Class B shares automatically convert to Class A shares 72 months after purchase. |

Portfolio Turnover.

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect each Fund’s performance. During its most recent fiscal year, each Fund had the following portfolio turnover rate:

| Fund | Fiscal Year End | Rate |

| Target Fund | 12/31/15 | 57% |

| Acquiring Fund | 8/31/16 | 39% |

Federal Income Tax Consequences of the Reorganization

The Reorganization is expected to be a tax-free reorganization for federal income tax purposes. Accordingly, it is expected that Target Fund shareholders will not and the Target Fund generally will not recognize gain or loss as a result of the Reorganization, and that the aggregate tax basis of the Acquiring Fund shares received by each Target Fund shareholder will be the same as the aggregate tax basis of the shareholder’s Target Fund shares. You should, however, consult your tax advisor regarding the effect on you, if any, of the Reorganization in light of your individual circumstances. You should also consult your tax advisor about state and local tax consequences.

A portion of the Target Fund’s portfolio securities may be disposed of in connection with the Reorganization. The actual tax effect of such disposition will depend on the difference between the price at which such portfolio assets are sold and the tax basis of the Target Fund in such assets. Any capital gains recognized in any such sales on a net basis, after reduction by any capital losses, will be distributed to shareholders as capital gain dividends (to the extent of net realized long-term capital gains over net realized long-term capital losses) during or with respect to the year of sale, and such distributions will be taxable to shareholders. The Target Fund does not expect to dispose of a material portion of its assets in connection with the Reorganization.

Because the Reorganization will end the Target Fund’s tax year, it may accelerate distributions to shareholders from the Target Fund for its short tax year ending on the date of the Reorganization. Those tax year-end distributions will be taxable and will include any capital gains resulting from portfolio turnover before the consummation of the Reorganization that were not previously distributed.

At any time prior to the consummation of the Reorganization, a shareholder may redeem shares of the Target Fund, likely resulting in recognition of gain or loss to such shareholder for U.S. federal and state income tax purposes. For further information about the tax consequences of the Reorganization, please see the section titled “Information About the Reorganization – Material U.S. Federal Income Tax Consequences of the Reorganization.”

Distribution, Purchase, Exchange, Redemption and Valuation of Shares

Procedures for the distribution, purchase, exchange, redemption and valuation of shares of the Target Fund and the Acquiring Fund are identical. For more information about these procedures, see below under “Comparison of the Funds – Distribution Services.” and “Comparison of the Funds – Purchase, Exchange, Redemption and Valuation of Shares.”

Comparison of the funds

Principal Investment Risks

As a result of their similar investment objectives and investment strategies, the Target Fund and the Acquiring Fund are subject to similar principal investment risks associated with an investment in the relevant Fund. The following comparison shows the principal risks that apply to both Funds and the principal risks that are unique to each Fund.

The principal risks that apply to each Fund are set out below:

Risks of Investing in Stocks. The value of the Fund’s portfolio may be affected by changes in the stock markets. Stock markets may experience significant short-term volatility and may fall sharply at times. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments. Different stock markets may behave differently from each other and U.S. stock markets may move in the opposite direction from one or more foreign stock markets.

The prices of individual stocks generally do not all move in the same direction at the same time. For example, “growth” stocks may perform well under circumstances in which “value” stocks in general have fallen. A variety of factors can affect the price of a particular company’s stock. These factors may include, but are not limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry. To the extent that securities of a particular type are emphasized (for example foreign stocks, stocks of small- or mid-cap companies, growth or value stocks, or stocks of companies in a particular industry), fund share values may fluctuate more in response to events affecting the market for those types of securities.

Industry and Sector Focus. At times the Fund may increase the relative emphasis of its investments in a particular industry or sector. The prices of stocks of issuers in a particular industry or sector may go up and down in response to changes in economic conditions, government regulations, availability of basic resources or supplies, or other events that affect that industry or sector more than others. To the extent that the Fund increases the relative emphasis of its investments in a particular industry or sector, its share values may fluctuate in response to events affecting that industry or sector. To some extent that risk may be limited by the Fund’s policy of not concentrating its investments in any one industry.

The Target Fund also has the following additional principal risks:

Risks of Mid-Cap Companies. Mid-cap companies generally involve greater risk of loss than larger companies. The prices of securities issued by mid-sized companies may be more volatile and their securities may be less liquid and more difficult to sell than those of larger companies. They may have less established markets, fewer customers and product lines, less management depth and more limited access to financial resources. Mid-cap companies may not pay dividends for some time, if at all.

Risks of Growth Investing. If a growth company's earnings or stock price fails to increase as anticipated, or if its business plans do not produce the expected results, its securities may decline sharply. Growth companies may be newer or smaller companies that may experience greater stock price fluctuations and risks of loss than larger, more established companies. Newer growth companies tend to retain a large part of their earnings for research, development or investments in capital assets. Therefore, they may not pay any dividends for some time. Growth investing has gone in and out of favor during past market cycles and is likely to continue to do so. During periods when growth investing is out of favor or when markets are unstable, it may be more difficult to sell growth company securities at an acceptable price. Growth stocks may also be more volatile than other securities because of investor speculation.

Risks of Value Investing. Value investing entails the risk that if the market does not recognize that a fund's securities are undervalued, the prices of those securities might not appreciate as anticipated. A value approach could also result in fewer investments that increase rapidly during times of market gains and could cause a fund to underperform funds that use a growth or non-value approach to investing. Value investing has gone in and out of favor during past market cycles and when value investing is out of favor or when markets are unstable, the securities of "value" companies may underperform the securities of "growth" companies.

Risks of Foreign Investing. Foreign securities are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company's operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of investments denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those investments. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company's assets, or other political and economic factors. In addition, due to the inter-relationship of global economies and financial markets, changes in political and economic factors in one country or region could adversely affect conditions in another country or region. Investments in foreign securities may also expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. As a result, the value of the Fund's net assets may change on days when you will not be able to purchase or redeem the Fund's shares. At times, the Fund may emphasize investments in a particular country or region and may be subject to greater risks from adverse events that occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to only limited or no regulatory oversight.

The Acquiring Fund also has the following additional principal risks, which would apply to the Combined Fund:

Risks of Small- and Mid-Cap Companies. Small-cap companies may be either established or newer companies, including "unseasoned" companies that have been in operation for less than three years. Mid-cap companies are generally companies that have completed their initial start-up cycle, and in many cases have established markets and developed seasoned market teams. While smaller companies might offer greater opportunities for gain than larger companies, they also may involve greater risk of loss. They may be more sensitive to changes in a company's earnings expectations and may experience more abrupt and erratic price movements. Small- and mid-cap companies' securities may trade in lower volumes and it might be harder for the Fund to dispose of its holdings at an acceptable price when it wants to sell them. Small- and mid-cap companies may not have established markets for their products or services and may have fewer customers and product lines. They may have more limited access to financial resources and may not have the financial strength to sustain them through business downturns or adverse market conditions. Since small- and mid-cap companies typically reinvest a high proportion of their earnings in their business, they may not pay dividends for some time, particularly if they are newer companies. Small- and mid-cap companies may have unseasoned management or less depth in management skill than larger, more established companies. They may be more reliant on the efforts of particular members of their management team and management changes may pose a greater risk to the success of the business. It may take a substantial period of time before the Fund realizes a gain on an investment in a small- or mid-cap company, if it realizes any gain at all.

The risks described above form the expected overall risk profile, respectively, of each Fund and can affect the value of a Fund's investments, its investment performance and the price of its shares. The price of a Fund’s shares can go up and down substantially. The value of a Fund's investments may change because of broad changes in the markets in which the Fund invests or because of poor investment selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that a Fund will achieve its investment objective. When you redeem your shares, they may be worth more or less than what you paid for them. These risks mean that you can lose money by investing in a Fund.

Fundamental Investment Restrictions

Both the Target Fund and the Acquiring Fund have certain additional fundamental investment restrictions that can only be changed with shareholder approval. These investment restrictions are identical between the Funds. Please see the Statements of Additional Information for each Fund for descriptions of the current fundamental investment restrictions, which are incorporated by reference into this Combined Prospectus/Proxy Statements and the Reorganization SAI.

Performance Information

The bar charts and tables below provide some indication of the risks of investing in each Fund by showing changes in the Fund's performance from year to year and by showing how each Fund's average annual returns for the one-year, five-year and ten-year periods compare with those of a broad measure of market performance. A Fund's past investment performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. More recent performance information is available by calling the toll-free number on the back of a Fund’s prospectus and on the Funds’ website: https://www.oppenheimerfunds.com

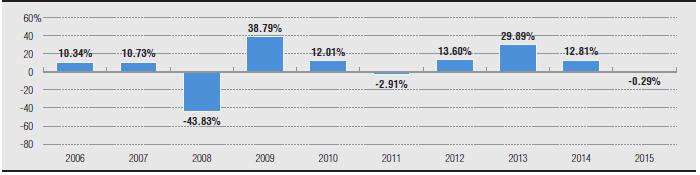

Annual Total Returns for the Target Fund (Class A) as of 12/31 each year

Sales charges and taxes are not included and the returns would be lower if they were. During the period shown, the highest return for a calendar quarter was 19.35% (2nd Qtr 09) and the lowest return was -27.29% (4th Qtr 08).

The following table shows the average annual total returns for each class of the Fund's shares. After-tax returns are calculated using the highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Your actual after-tax returns, depending on your individual tax situation, may differ from those shown and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for only one class and after-tax returns for other classes will vary.

| Target Fund | |||

| Average Annual Total Returns for the periods ended December 31, 2015 | 1 Year | 5 Years | 10 Years |

Class A (inception 10/02/47) Return Before Taxes Return After Taxes on Distributions Return After Taxes on Distributions and Sale of Fund Shares |

(6.02%) (8.08%)

(1.71%) |

8.72% 8.11%

6.89% |

4.95% 4.19%

3.91% |

| Class B (inception 05/03/93) | (5.55%) | 8.76% | 4.99% |

| Class C (inception 08/29/95) | (1.96%) | 9.08% | 4.65% |

| Class R (inception 03/01/01) | (0.53%) | 9.64% | 5.16% |

| Class Y (inception 06/01/94) | (0.09%) | 10.22% | 5.74% |

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) | 1.38% | 12.57% | 7.31% |

| Russell 1000 Index (reflects no deduction for fees, expenses or taxes) | 0.92% | 12.44% | 7.40% |

Annual Total Returns for the Acquiring Fund (Class A) as of 12/31 each year

Sales charges and taxes are not included and the returns would be lower if they were. During the period shown, the highest return for a calendar quarter was 18.65% (2nd Qtr 09) and the lowest return was -22.27 (4th Qtr 08). For the period from January 1, 2016 to September 30, 2016 the cumulative return (not annualized) before sales charges and taxes was 6.96%.

The following table shows the average annual total returns for each class of the Fund's shares. After-tax returns are calculated using the highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Your actual after-tax returns, depending on your individual tax situation, may differ from those shown and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for only one class and after-tax returns for other classes will vary.

| Acquiring Fund | |||

| Average Annual Total Returns for the periods ended December 31, 2015 | 1 Year | 5 Years | 10 Years |

Class A (inception 2/3/88) Return Before Taxes Return After Taxes on Distributions Return After Taxes on Distributions and Sale of Fund Shares |

(2.81)% (5.77%)

0.56% |

10.43% 9.11%

8.25% |

6.03% 4.96%

4.75% |

| Class B (inception 10/3/94) | (2.19%) | 10.53% | 6.15% |

| Class C (inception 12/1/93) | 1.45% | 10.91% | 5.87% |

| Class R (inception 03/01/01) | 2.86% | 11.46% | 6.38% |

| Class Y (inception 11/01/96) | 3.37% | 12.10% | 7.08% |

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) | 1.38%

| 12.57% 15.35%1 | 7.31%

|

1. As of 12/31/2011.

The accounting survivor of the Reorganization will be the Acquiring Fund. As a result, the Combined Fund will continue the performance history of the Acquiring Fund after the closing of the Reorganization.

Management of the Funds

OFI Global Asset Management, Inc., the Manager, is a wholly-owned subsidiary of OppenheimerFunds, Inc., the Sub-Adviser. The Sub-Adviser is wholly-owned by Oppenheimer Acquisition Corp., a holding company primarily owned by Massachusetts Mutual Life Insurance Company, a global, diversified insurance and financial services company. The Manager oversees the Fund's investments and its business operations. The Sub-Adviser chooses the Fund's investments and provides related advisory services. The Manager carries out its duties, subject to the policies established by each Fund's Board, under an investment advisory agreement that states the Manager's responsibilities. The agreement sets the fees each Fund pays to the Manager and describes the expenses that each Fund is responsible to pay to conduct its business. The Sub-Adviser has a sub-advisory agreement with the Manager and is paid by the Manager. The Manager has been an investment adviser since 2012. The Sub-Adviser has been an investment adviser since 1960. The Manager and the Sub-Adviser are located at 225 Liberty Street, New York, New York 10281-1008.

Each Fund is governed by its Board, which is responsible for overseeing the Fund. For a listing of the members comprising each Fund’s Board, please refer to the Statement of Additional Information for the relevant Fund.

The Target Fund is managed by Laton Spahr, CFA, and Paul Larson, who are primarily responsible for the day-to-day management of the Fund’s investments. Mr. Spahr has been a portfolio manager and Vice President of the Fund since March 2013 and Mr. Larson has been a portfolio manager of the Fund since October 2016.

The Acquiring Fund is managed by Manind (“Mani”) Govil, CFA, Benjamin Ram and Paul Larson, who are primarily responsible for the day-to-day management of the Fund’s investments. Mr. Govil has been a Vice President and lead portfolio manager of the Fund and Mr. Ram has been a Vice President and co-portfolio manager of the Fund since May 2009. Mr. Larson has been a Vice President and a co-portfolio manager of the Fund since February 2014. The portfolio management team of the Acquiring Fund is expected to manage the Combined Fund after the Reorganization.

Mr. Spahr has been a Senior Vice President of the Sub-Adviser since March 2013. Prior to joining the Sub-Adviser, he was a senior portfolio manager from 2003 to 2013 and an equity analyst from 2001 to 2002 for Columbia Management Investment Advisers, LLC. Mr. Spahr is a portfolio manager of other portfolios in the OppenheimerFunds complex.

Mr. Larson has been a Vice President of the Sub-Adviser since January 2013. Prior to joining the Sub-Adviser, he was a portfolio manager and Chief Equity Strategist at Morningstar, during which time he was also an editor of Morningstar’s StockInvestor newsletter, which tracked Mr. Larson’s recommendations. He was previously an analyst at Morningstar covering the energy sector and oversaw the firm’s natural resources analysts. During his tenure at Morningstar, Mr. Larson also contributed to the ongoing development of Morningstar’s moat methodology and their initiation of the moat trend methodology. Prior to joining Morningstar in 2002, Mr. Larson was an analyst with The Motley Fool. Mr. Larson is a portfolio manager and officer of other portfolios in the OppenheimerFunds complex.

Mr. Govil has been a Senior Vice President, the Main Street Team Leader and a portfolio manager of the Sub-Adviser since May 2009. Prior to joining the Sub-Adviser, Mr. Govil was a portfolio manager with RS Investment Management Co. LLC from October 2006 until March 2009. He served as the head of equity investments at The Guardian Life Insurance Company of America from August 2005 to October 2006 when Guardian Life Insurance acquired an interest in RS Investment Management Co. LLC. He served as the lead portfolio manager - large cap blend/core equity, co-head of equities and head of equity research, from 2001 to July 2005, and was lead portfolio manager - core equity, from April 1996 to July 2005, at Mercantile Capital Advisers, Inc. Mr. Govil is a portfolio manager and officer of other portfolios in the OppenheimerFunds complex.

Mr. Ram has been a Vice President and portfolio manager of the Sub-Adviser since May 2009. Prior to joining the Sub-Adviser, Mr. Ram was sector manager for financial investments and a co-portfolio manager for mid-cap portfolios with the RS Core Equity Team of RS Investment Management Co. LLC from October 2006 to May 2009. He served as Portfolio Manager Mid Cap Strategies, Sector Manager Financials at The Guardian Life Insurance Company of America from January 2006 to October 2006 when Guardian Life Insurance acquired an interest in RS Investment Management Co. LLC. He was a financial analyst, from 2003 to 2005, and co-portfolio manager, from 2005 to 2006, at Mercantile Capital Advisers, Inc. Mr. Ram was a bank analyst at Legg Mason Securities from 2000 to 2003 and was a senior financial analyst at the CitiFinancial division of Citigroup, Inc. from 1997 to 2000. Mr. Ram is a portfolio manager and officer of other portfolios in the OppenheimerFunds complex.

The Statement of Additional Information of each Fund provides additional information about portfolio manager compensation, other accounts managed and ownership of each Fund’s shares.

Investment Advisory Agreements

The day-to-day management of the business and affairs of each Fund is the responsibility of the Manager. Pursuant to each Fund’s investment advisory agreement, the Manager acts as the investment adviser for the Fund. With respect to each Fund, the Sub-Adviser has a sub-advisory agreement with the Manager and is paid by the Manager. The Sub-Adviser employs each Fund’s portfolio managers, who are primarily responsible for the day-to-day management of each Fund's investments.

The table below shows the current contractual management fee schedule for each of the Funds. As shown in the table, the effective management fee as of September 30, 2016 is 0.55% for the Target Fund and 0.46% for the Acquiring Fund. The Acquiring Fund’s management fee schedule would be the fee schedule for the Combined Fund upon successful completion of the Reorganization. Each Fund’s management fee and other annual operating expenses may vary in future years.

As of September 30, 2016, the Acquiring Fund had net assets of approximately $7.6 billion. As of the same date, the Target Fund had net assets of only approximately $1.5 billion and therefore has not benefitted from the additional breakpoints in its fee schedule on net assets of more than $5 billion. Although the management fees would be reduced at certain higher asset levels, the Manager does not believe the Target Fund will grow to those asset levels so the Target Fund is not expected to reach those breakpoints.

The contractual management fee schedule of the Acquiring Fund is lower than the fee schedule of the Target Fund across all asset levels.

A comparison at each management fee level is set forth in the chart below:

| Target Fund | Acquiring Fund | ||

| Assets (in $ millions of average annual net assets) | Fee | Assets (in $ millions of average annual net assets) | Fee |

| First 100 | 0.75% | First 200 | 0.65% |

| Next 100 | 0.70% | Next 150 | 0.60% |

| Next 100 | 0.65% | Next 150 | 0.55% |

| Next 100 | 0.60% | Next 9,500 | 0.45% |

| Next 100 | 0.55% | Over 10,000 | 0.43% |

| Next 4,500 | 0.50% | ||

| Over 5,000 | 0.48% | ||

| Effective management fee as of September 30, 2016 | 0.55% | 0.46% | |

The pro forma effective management fee after the Reorganization is estimated to be about 0.46%, a decrease for the Target Fund. The Fund’s combined assets after the Reorganization would be approximately $9.1 billion, which would mean that the management fee on additional assets would be at a 0.45% annual rate.

As shown in the current and pro forma fee tables above, total (gross) fund operating expenses across all share classes for shareholders of the Target Fund are expected to decrease significantly as a result of the Reorganization.

Both Funds obtain investment management services from the Manager according to the terms of advisory agreements that are substantially similar. The advisory agreements require the Manager, at its expense, to provide each Fund with adequate office space, facilities and equipment. The agreements also require the Manager to provide and supervise the activities of all administrative and clerical personnel required to provide effective administration for the Funds. Those responsibilities include the compilation and maintenance of records with respect to their operations, the preparation and filing of specified reports, and composition of proxy materials and registration statements for the continuous public sale of shares of the Funds.

Each Fund pays expenses not expressly assumed by the Manager under the advisory agreement. The advisory agreements list examples of expenses paid by each Fund. The major categories relate to interest, taxes, brokerage commissions, fees to Independent Trustees, legal and audit expenses, custodian bank and transfer agent expenses, share issuance costs, certain printing and registration costs, and non-recurring expenses, including litigation costs.

Each investment advisory agreement states that in the absence of willful misfeasance, bad faith, gross negligence in the performance of its duties or reckless disregard of its obligations and duties under the investment advisory agreements, the Manager is not liable for any loss sustained by reason of good faith errors or omissions in connection with any matters to which the agreement relates.

Pending Litigation

In 2009, several putative class action lawsuits were filed and later consolidated before the U.S. District Court for the District of Colorado in connection with the investment performance of Oppenheimer Rochester California Municipal Fund (the "California Fund"), a fund advised by the Sub-Adviser and distributed by OppenheimerFunds Distributor, Inc. (the “Distributor”). The plaintiffs asserted claims against the Sub-Adviser, the Distributor and certain present and former trustees and officers of the California Fund under the federal securities laws, alleging, among other things, that the disclosure documents of the California Fund contained misrepresentations and omissions and the investment policies of the California Fund were not followed. An amended complaint and a motion to dismiss were filed, and in 2011, the court issued an order which granted in part and denied in part the defendants’ motion to dismiss. In October 2015, following a successful appeal by defendants and a subsequent hearing, the court granted plaintiffs’ motion for class certification and appointed class representatives and class counsel.

The Sub-Adviser and the Distributor believe the suit is without merit; that it is premature to render any opinion as to the likelihood of an outcome unfavorable to them in the suit; and that no estimate can yet be made as to the amount or range of any potential loss. Furthermore, the Sub-Adviser believes that the suit should not impair the ability of the Sub-Adviser or the Distributor to perform their respective duties to the Fund and that the outcome of the suit should not have any material effect on the operations of any of the Oppenheimer funds.

Distribution Services

OppenheimerFunds Distributor, Inc. (the “Distributor”) acts as the principal underwriter in a continuous public offering of shares of the Funds, but is not obligated to sell a specific number of shares. Each Fund has adopted a service plan for Class A shares that reimburses the Distributor for a portion of the costs of maintaining accounts and providing services to Class A shareholders. Reimbursement is made periodically at an annual rate of up to 0.25% of the Class A shares daily net assets. The Distributor currently uses all of those fees to pay brokers, dealers, banks and other financial intermediaries for providing personal service and maintaining the accounts of their customers that hold Class A shares. For Class A purchases with no front-end sales charge imposed due to the qualifying breakpoint, the Distributor normally pays intermediaries the service fee in advance for the first year after shares are purchased and then pays that fee periodically. Any unreimbursed expenses the Distributor incurs with respect to Class A shares in any fiscal year cannot be recovered in subsequent periods. Because the service fee is paid out of the Fund’s assets on an ongoing basis, over time it will increase the cost of your investment.

Each Fund has adopted Distribution and Service Plans for Class B, Class C and Class R shares to pay the Distributor for distributing those share classes, maintaining accounts and providing shareholder services. Under the plans, the Fund pays the Distributor an asset-based sales charge for Class B and Class C shares calculated at an annual rate of 0.75% of the daily net assets of those classes and for Class R shares calculated at 0.25% of the daily net assets of that class. The Fund also pays a service fee under the plans at an annual rate of 0.25% of the daily net assets of Class B, Class C and Class R shares. Altogether, these fees increase the Class B and Class C shares annual expenses by 1.00% and increase the Class R shares annual expenses by 0.50%, calculated on the daily net assets of the applicable class. Because these fees are paid out of the Fund’s assets on an ongoing basis, over time they will increase the cost of your investment and may cost you more than other types of sales charges.

Use of Plan Fees: The Distributor uses the service fees to compensate brokers, dealers, banks and other financial intermediaries for maintaining accounts and providing personal services to Class B, Class C or Class R shareholders in the applicable share class. The Distributor normally pays intermediaries the 0.25% service fee in advance for the first year after shares are purchased and then pays that fee periodically.

Class C Shares: At the time of a Class C share purchase, the Distributor generally pays financial intermediaries a sales concession of 0.75% of the purchase price from its own resources. Therefore, the total amount, including the advance of the service fee that the Distributor pays the intermediary at the time of a Class C share purchase is 1.00% of the purchase price. The Distributor normally retains the asset-based sales charge on Class C share purchases during the first year and then pays that fee to the intermediary as an ongoing concession. For Class C share purchases in certain omnibus group retirement plans, the Distributor pays the intermediary the asset-based sales charge during the first year instead of paying a sales concession at the time of purchase. The Distributor pays the service fees it receives on those shares to the intermediary for providing shareholder services to those accounts. See the Fund’s Statement of Additional Information for exceptions to these arrangements.

Class R Shares (formerly Class N Shares): For all new purchases of Class R shares, the Distributor pays intermediaries a 0.25% service fee and a 0.25% asset based sales charge on an ongoing basis. For certain Class R shares of Oppenheimer funds purchased prior to July 1, 2014, the Distributor paid financial intermediaries 1.00% of the purchase price at the time of sale. For those shares, the Distributor retained the service fee for the first year, paying intermediates the service fee thereafter, and retains the asset-based sales charge on Class R shares on an ongoing basis.

Payments to Financial Intermediaries and Service Providers

The Sub-Adviser and/or the Distributor, Transfer Agent and/or Sub-Transfer Agent, at their discretion, may also make payments to broker-dealers, other financial intermediaries or to service providers for some or all of the following services: distribution, promotional and marketing support, operational and recordkeeping, sub-accounting, networking and administrative services.

The types of financial intermediaries that may receive compensation for providing such services include, but are not limited to, broker-dealers, financial advisors, registered investment advisers, sponsors of fund “supermarkets,” sponsors of fee-based advisory or wrap fee-based programs, sponsors of college and retirement savings programs, banks, trust companies, retirement plan or qualified tuition program administrators, third party administrators, financial intermediaries that offer products that hold Fund shares, and insurance companies that offer variable annuity or variable life insurance products.

Payments for distribution or promotional and marketing support are made out of the Sub-Adviser's and/or the Distributor's own resources and/or assets, including from the revenues or profits derived from the management fees the Sub-Adviser receives from the Manager for sub-advisory services on behalf of the Fund. Such payments, which may be substantial, are paid to financial intermediaries who perform services for the Sub-Adviser, and/or the Distributor, and are in addition to payments made pursuant to an applicable 12b-1 plan. Such payments are separate from any commissions the Distributor pays to financial intermediaries out of the sales charges paid by investors.

Payments for distribution-related expenses and asset retention items, paid by the Sub-Adviser or the Distributor, such as marketing or promotional expenses, are often referred to as "revenue sharing." Revenue sharing payments may be made on the basis of the sales of shares attributable to that financial intermediary, the average net assets of the Fund and other Oppenheimer funds attributable to the accounts of that financial intermediary and its clients, negotiated lump sum payments for distribution services provided, or similar fees. In some circumstances, revenue sharing payments may create an incentive for a financial intermediary or its representatives to recommend or offer shares of the Fund or other Oppenheimer funds to its customers. These payments also may give a financial intermediary an incentive to cooperate with the Distributor's marketing efforts. A revenue sharing payment may, for example, qualify the Fund for preferred status with the financial intermediary receiving the payment or provide representatives of the Distributor with access to representatives of the financial intermediary's sales force, in some cases on a preferential basis over funds of competitors. Additionally, as firm support, the Sub-Adviser or Distributor may reimburse expenses, including, but not limited to, educational seminars and "due diligence" or training meetings (to the extent permitted by applicable laws or the rules of the Financial Industry Regulatory Authority ("FINRA")) designed to increase sales representatives' awareness about Oppenheimer funds, including travel and lodging expenditures. However, the Sub-Adviser or Distributor does not consider a financial intermediary's sale of shares of the Fund or other Oppenheimer funds when selecting brokers or dealers to effect portfolio transactions for the funds.

Various factors are used to determine whether to make revenue sharing payments. Possible considerations include, without limitation, the types of services provided by the financial intermediary, sales of Fund shares, the redemption rates on accounts of clients of the financial intermediary or overall asset levels of Oppenheimer funds held for or by clients of the financial intermediary, the willingness of the financial intermediary to allow the Distributor to provide educational and training support for the financial intermediary's sales personnel relating to the Oppenheimer funds, the availability of the Oppenheimer funds on the financial intermediary's sales system, as well as the overall quality of the services provided by the financial intermediary. The Sub-Adviser and Distributor have adopted guidelines for assessing and implementing each prospective revenue sharing arrangement. To the extent that financial intermediaries receiving distribution-related payments from the Sub-Adviser or Distributor sell more shares of the Oppenheimer funds or retain more shares of the funds in their client accounts, the Sub-Adviser and Distributor benefit from the incremental management and other fees they receive with respect to those assets.

Payments may be made by the Transfer Agent or Sub-Transfer Agent to financial intermediaries to compensate or reimburse them for services provided, such as sub-transfer agency services for shareholders or retirement plan participants, omnibus accounting or sub-accounting, participation in networking arrangements, operational and recordkeeping and other administrative services. These payments are made out of the Transfer Agent’s or Sub-Transfer Agent’s own resources and/or assets, including from the revenues or profits derived from the transfer agency fees the Transfer Agent receives from the Fund. Financial intermediaries that may receive these fees for providing services may include, but are not limited to, retirement plan administrators, qualified tuition program sponsors, banks and trust companies, broker-dealers, and insurance companies that offer variable annuity or variable life insurance products, and other financial intermediaries. These fees may be used by the financial intermediary to offset or reduce fees that would otherwise be paid directly to them by certain account holders, such as retirement plans.

Payments made by the Sub-Adviser, and/or the Distributor, the Transfer Agent and Sub-Transfer Agent are not reflected in the tables in the “Fees and Expenses” section above because they are not paid by the Fund.

Each Fund's Statement of Additional Information contains more information about revenue sharing and service payments made by the Sub-Adviser and/or Distributor and operational and recordkeeping, networking and sub-accounting payments made by the Transfer Agent and/or Sub-Transfer Agent. Your broker-dealer or other financial intermediary may charge may charge you fees or commissions in addition to those disclosed in this Combined Prospectus/Proxy Statement. You should ask your financial intermediary for details about any such payments it receives from the Sub-Adviser, Distributor, Transfer Agent or Sub-Transfer Agent, or any other fees or expenses it charges.

Dividends and Distributions