UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-05364

American High-Income Trust

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street, 55th Floor

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2023

Becky L. Park

American High-Income Trust

6455 Irvine Center Drive

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

American High-Income Trust® Semi-annual report

for the six months ended

March 31, 2023 |  |

Pursue sustainable

income over time

American High-Income Trust seeks to provide you with a high level of current income. Its secondary investment objective is capital appreciation.

This fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For over 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class F-2 shares. Class A share results are shown at net asset value unless otherwise indicated. If a sales charge (maximum 3.75%) had been deducted from Class A shares, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

Here are the average annual total returns on a $1,000 investment with all distributions reinvested for periods ended March 31, 2023:

| | | 1 year | | 5 years | | 10 years |

| | | | | | | |

| Class F-2 shares | | | –2.92 | % | | | 3.87 | % | | | 3.87 | % |

| Class A shares (reflecting 3.75% maximum sales charge) | | | –6.82 | | | | 2.79 | | | | 3.21 | |

For other share class results, refer to capitalgroup.com and americanfundsretirement.com.

The total annual fund operating expense ratios were 0.40% for Class F-2 shares and 0.69% for Class A shares as of the prospectus dated December 1, 2022.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers and/or expense reimbursements, without which results would have been lower. Refer to capitalgroup.com for more information.

The fund’s 30-day yield as of March 31, 2023, calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula, was 7.54% for Class F-2 shares and 6.98% for Class A shares. The fund’s 12-month distribution rate as of that date was 6.03% for Class F-2 shares and 5.53% for Class A shares. Class A shares reflect the 3.75% maximum sales charge. The SEC yield reflects the rate at which the fund is earning income on its current portfolio of securities while the distribution rate reflects the fund’s past dividends paid to shareholders. Accordingly, the fund’s SEC yield and distribution rate may differ.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. High-yield bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade bonds. Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. Investing in bonds issued outside the U.S. may be subject to additional risks. They include currency fluctuations, political and social instability, differing securities regulations and accounting standards, higher transaction costs, possible changes in taxation, illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Fellow investors:

Results for American High-Income Trust for the periods ended March 31, 2023, are shown in the table below, as well as results of the fund’s benchmark and peer group indexes.

For additional information about the fund, its investment results, holdings and portfolio managers, refer to capitalgroup.com/individual/investments/fund/ahifx. You can also access information about Capital Group’s American Funds and read our insights about the markets, retirement, saving for college, investing fundamentals and more at capitalgroup.com.

Contents

Results at a glance

For periods ended March 31, 2023, with all distributions reinvested

| | | Cumulative total returns | | Average annual total returns |

| | | 6 months | | | 1 year | | | 5 years | | | 10 years | | | Lifetime (since

Class A inception

on 2/19/88) | |

| | | | | | | | | | | | | | | | |

| American High-Income Trust (Class F-2 shares)1 | | | 7.03 | % | | | –2.92 | % | | | 3.87 | % | | | 3.87 | % | | | 7.43 | % |

| American High-Income Trust (Class A shares) | | | 6.87 | | | | –3.20 | | | | 3.58 | | | | 3.61 | | | | 7.19 | |

| Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index2 | | | 7.88 | | | | –3.35 | | | | 3.19 | | | | 4.09 | | | | 7.55 | |

| Lipper High Yield Funds Average3 | | | 7.28 | | | | –3.85 | | | | 2.58 | | | | 3.27 | | | | 6.73 | |

There may have been periods when the results lagged the index(es). The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Past results are not predictive of results in future periods.

| 1 | Class F-2 shares were first offered on August 1, 2008. Class F-2 share results prior to the date of first sale are hypothetical based on the results of the original share class of the fund without a sales charge, adjusted for typical estimated expenses. Refer to capitalgroup.com for more information on specific expense adjustments and the actual dates of first sale. |

| 2 | Source: Bloomberg Index Services Ltd. From February 19, 1988, through December 31, 1992, the Credit Suisse High Yield Index was used because the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index did not yet exist. Since January 1, 1993, the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index has been used. It is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. |

| 3 | Source: Refinitiv Lipper. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper High Yield Funds Index is an equally weighted index of funds that aim at high (relative) current yield from fixed-income securities, have no quality or maturity restrictions and tend to invest in lower grade debt issues. The results of the underlying funds in the index include reinvestment of dividends and capital gain distributions, as well as brokerage commissions paid by the funds for portfolio transactions and other fund expenses, but do not reflect the effect of sales charges, account fees or U.S. federal income taxes. |

| American High-Income Trust | 1 |

| Investment portfolio March 31, 2023 | unaudited |

| | |

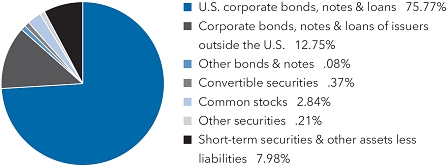

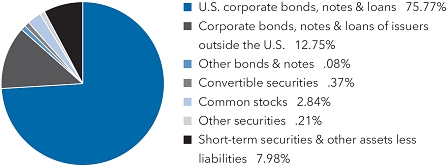

| Portfolio by type of security | Percent of net assets |

| Bonds, notes & other debt instruments 88.60% | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans 88.52% | | | | | | | | |

| Energy 15.27% | | | | | | | | |

| Aethon United BR, LP / Aethon United Finance Corp. 8.25% 2/15/20261 | | USD | 6,600 | | | $ | 6,483 | |

| Antero Midstream Partners, LP 5.375% 6/15/20291 | | | 10,095 | | | | 9,513 | |

| Antero Resources Corp. 7.625% 2/1/20291 | | | 4,356 | | | | 4,458 | |

| Antero Resources Corp. 5.375% 3/1/20301 | | | 5,950 | | | | 5,542 | |

| Apache Corp. 4.625% 11/15/2025 | | | 5,540 | | | | 5,349 | |

| Apache Corp. 6.00% 1/15/2037 | | | 2,910 | | | | 2,710 | |

| Apache Corp. 5.10% 9/1/2040 | | | 17,300 | | | | 14,688 | |

| Apache Corp. 4.75% 4/15/2043 | | | 5,725 | | | | 4,306 | |

| Apache Corp. 4.25% 1/15/2044 | | | 270 | | | | 198 | |

| Apache Corp. 5.35% 7/1/2049 | | | 4,520 | | | | 3,500 | |

| Ascent Resources - Utica, LLC, Term Loan, (3-month USD-LIBOR + 9.00%) 10.00% 11/1/20251,2,3 | | | 4,446 | | | | 4,721 | |

| Ascent Resources Utica Holdings, LLC 7.00% 11/1/20261 | | | 38,410 | | | | 37,165 | |

| Ascent Resources Utica Holdings, LLC 9.00% 11/1/20271 | | | 4,380 | | | | 5,330 | |

| Ascent Resources Utica Holdings, LLC 8.25% 12/31/20281 | | | 4,042 | | | | 3,914 | |

| Ascent Resources Utica Holdings, LLC 5.875% 6/30/20291 | | | 21,835 | | | | 19,291 | |

| BIP-V Chinook Holdco, LLC 5.50% 6/15/20311 | | | 33,080 | | | | 29,773 | |

| Blue Racer Midstream, LLC 7.625% 12/15/20251 | | | 9,754 | | | | 9,665 | |

| Bonanza Creek Energy, Inc. 5.00% 10/15/20261 | | | 17,860 | | | | 16,811 | |

| California Resources Corp. 7.125% 2/1/20261 | | | 6,275 | | | | 6,358 | |

| Callon Petroleum Co. 7.50% 6/15/20301 | | | 29,225 | | | | 27,500 | |

| Cenovus Energy, Inc. 5.375% 7/15/2025 | | | 204 | | | | 205 | |

| Cenovus Energy, Inc. 4.25% 4/15/2027 | | | 390 | | | | 379 | |

| Cenovus Energy, Inc. 5.25% 6/15/2037 | | | 400 | | | | 378 | |

| Cenovus Energy, Inc. 5.40% 6/15/2047 | | | 390 | | | | 363 | |

| Centennial Resource Production, LLC 6.875% 4/1/20271 | | | 6,752 | | | | 6,614 | |

| Cheniere Energy Partners, LP 4.50% 10/1/2029 | | | 19,427 | | | | 18,066 | |

| Cheniere Energy Partners, LP 4.00% 3/1/2031 | | | 8,180 | | | | 7,288 | |

| Cheniere Energy Partners, LP 3.25% 1/31/2032 | | | 12,185 | | | | 10,078 | |

| Cheniere Energy, Inc. 4.625% 10/15/2028 | | | 64,554 | | | | 61,419 | |

| Chesapeake Energy Corp. 4.875% 4/15/20224 | | | 28,871 | | | | 505 | |

| Chesapeake Energy Corp. 5.75% 9/15/20234 | | | 1,730 | | | | 30 | |

| Chesapeake Energy Corp. 5.50% 2/1/20261 | | | 20,225 | | | | 19,923 | |

| Chesapeake Energy Corp. 5.875% 2/1/20291 | | | 37,920 | | | | 36,141 | |

| Chesapeake Energy Corp. 6.75% 4/15/20291 | | | 14,610 | | | | 14,518 | |

| CNX Midstream Partners, LP 4.75% 4/15/20301 | | | 5,745 | | | | 4,948 | |

| CNX Resources Corp. 7.25% 3/14/20271 | | | 23,882 | | | | 23,789 | |

| CNX Resources Corp. 6.00% 1/15/20291 | | | 33,223 | | | | 31,103 | |

| CNX Resources Corp. 7.375% 1/15/20311 | | | 20,279 | | | | 19,998 | |

| Colgate Energy Partners III, LLC 5.875% 7/1/20291 | | | 1,375 | | | | 1,304 | |

| Comstock Resources, Inc. 6.75% 3/1/20291 | | | 19,495 | | | | 17,856 | |

| Comstock Resources, Inc. 5.875% 1/15/20301 | | | 25,605 | | | | 22,022 | |

| Constellation Oil Services Holding SA 13.50% 6/30/20251,5 | | | 5,794 | | | | 5,794 | |

| Constellation Oil Services Holding SA 4.00% PIK 12/31/20266 | | | 46,589 | | | | 27,575 | |

| Continental Resources, Inc. 5.75% 1/15/20311 | | | 7,250 | | | | 6,972 | |

| 2 | American High-Income Trust |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Energy (continued) | | | | | | | | |

| Crescent Energy Finance, LLC 9.25% 2/15/20281 | | USD | 38,527 | | | $ | 36,976 | |

| Crestwood Midstream Partners, LP 5.625% 5/1/20271 | | | 5,000 | | | | 4,823 | |

| Crestwood Midstream Partners, LP 6.00% 2/1/20291 | | | 11,325 | | | | 10,796 | |

| Crestwood Midstream Partners, LP 8.00% 4/1/20291 | | | 33,755 | | | | 34,460 | |

| Crestwood Midstream Partners, LP 7.375% 2/1/20311 | | | 13,462 | | | | 13,475 | |

| Devon Energy Corp. 5.875% 6/15/2028 | | | 2,830 | | | | 2,884 | |

| Devon Energy Corp. 4.50% 1/15/2030 | | | 10,040 | | | | 9,598 | |

| Diamond Foreign Asset Co. 9.00% Cash 4/22/20271,3,6 | | | 2,584 | | | | 2,494 | |

| Diamond Foreign Asset Co. 9.00% Cash 4/22/20276 | | | 2,337 | | | | 2,255 | |

| DT Midstream, Inc. 4.125% 6/15/20291 | | | 28,835 | | | | 25,313 | |

| DT Midstream, Inc. 4.375% 6/15/20311 | | | 16,380 | | | | 14,293 | |

| Encino Acquisition Partners Holdings, LLC 8.50% 5/1/20281 | | | 4,914 | | | | 4,304 | |

| Energean Israel Finance, Ltd. 4.50% 3/30/20241 | | | 8,305 | | | | 8,144 | |

| Energean Israel Finance, Ltd. 4.875% 3/30/20261 | | | 20,000 | | | | 18,575 | |

| Energean Israel Finance, Ltd. 5.875% 3/30/20311 | | | 1,580 | | | | 1,388 | |

| Energean PLC 6.50% 4/30/20271 | | | 12,805 | | | | 11,763 | |

| EQM Midstream Partners, LP 6.00% 7/1/20251 | | | 4,000 | | | | 3,959 | |

| EQM Midstream Partners, LP 4.125% 12/1/2026 | | | 4,911 | | | | 4,466 | |

| EQM Midstream Partners, LP 7.50% 6/1/20271 | | | 8,031 | | | | 8,071 | |

| EQM Midstream Partners, LP 6.50% 7/1/20271 | | | 42,825 | | | | 41,554 | |

| EQM Midstream Partners, LP 5.50% 7/15/2028 | | | 17,346 | | | | 15,777 | |

| EQM Midstream Partners, LP 4.50% 1/15/20291 | | | 21,410 | | | | 18,226 | |

| EQM Midstream Partners, LP 7.50% 6/1/20301 | | | 21,425 | | | | 20,781 | |

| EQM Midstream Partners, LP 4.75% 1/15/20311 | | | 33,208 | | | | 27,609 | |

| EQM Midstream Partners, LP 6.50% 7/15/2048 | | | 19,603 | | | | 15,170 | |

| EQT Corp. 5.00% 1/15/2029 | | | 5,715 | | | | 5,426 | |

| EQT Corp. 7.25% 2/1/20307 | | | 5,395 | | | | 5,652 | |

| EQT Corp. 3.625% 5/15/20311 | | | 9,080 | | | | 7,879 | |

| Genesis Energy, LP 6.50% 10/1/2025 | | | 32,102 | | | | 31,125 | |

| Genesis Energy, LP 6.25% 5/15/2026 | | | 6,115 | | | | 5,843 | |

| Genesis Energy, LP 8.00% 1/15/2027 | | | 57,399 | | | | 56,814 | |

| Genesis Energy, LP 7.75% 2/1/2028 | | | 7,180 | | | | 6,970 | |

| Genesis Energy, LP 8.875% 4/15/2030 | | | 20,378 | | | | 20,651 | |

| Harbour Energy PLC 5.50% 10/15/20261 | | | 32,030 | | | | 28,068 | |

| Harvest Midstream I, LP 7.50% 9/1/20281 | | | 36,075 | | | | 36,022 | |

| Hess Midstream Operations, LP 4.25% 2/15/20301 | | | 28,875 | | | | 25,823 | |

| Hess Midstream Operations, LP 5.50% 10/15/20301 | | | 12,720 | | | | 11,847 | |

| Hess Midstream Partners, LP 5.125% 6/15/20281 | | | 16,888 | | | | 16,050 | |

| Hilcorp Energy I, LP 6.25% 11/1/20281 | | | 3,515 | | | | 3,340 | |

| Hilcorp Energy I, LP 5.75% 2/1/20291 | | | 19,025 | | | | 17,537 | |

| Hilcorp Energy I, LP 6.00% 4/15/20301 | | | 18,338 | | | | 16,933 | |

| Hilcorp Energy I, LP 6.00% 2/1/20311 | | | 13,382 | | | | 12,372 | |

| Hilcorp Energy I, LP 6.25% 4/15/20321 | | | 16,545 | | | | 15,323 | |

| Holly Energy Partners, LP / Holly Energy Finance Corp. 6.375% 4/15/20271 | | | 4,305 | | | | 4,262 | |

| Howard Midstream Energy Partners, LLC 6.75% 1/15/20271 | | | 2,310 | | | | 2,181 | |

| Independence Energy Finance, LLC 7.25% 5/1/20261 | | | 8,650 | | | | 8,139 | |

| Murphy Oil Corp. 5.75% 8/15/2025 | | | 2,768 | | | | 2,744 | |

| Murphy Oil Corp. 5.625% 5/1/2027 | | | 6,700 | | | | 6,493 | |

| Murphy Oil Corp. 6.375% 7/15/2028 | | | 8,000 | | | | 7,890 | |

| Murphy Oil USA, Inc. 4.75% 9/15/2029 | | | 16,330 | | | | 14,896 | |

| Murphy Oil USA, Inc. 3.75% 2/15/20311 | | | 27,230 | | | | 22,969 | |

| Nabors Industries, Inc. 7.375% 5/15/20271 | | | 30,625 | | | | 30,022 | |

| Nabors Industries, Ltd. 7.25% 1/15/20261 | | | 6,500 | | | | 6,206 | |

| Neptune Energy Group Holdings, Ltd. 6.625% 5/15/20251 | | | 21,325 | | | | 20,693 | |

| New Fortress Energy, Inc. 6.75% 9/15/20251 | | | 30,685 | | | | 29,567 | |

| New Fortress Energy, Inc. 6.50% 9/30/20261 | | | 85,393 | | | | 78,640 | |

| NGL Energy Operating, LLC 7.50% 2/1/20261 | | | 173,599 | | | | 167,659 | |

| NGL Energy Partners, LP 6.125% 3/1/2025 | | | 41,177 | | | | 37,005 | |

| NGL Energy Partners, LP 7.50% 4/15/2026 | | | 14,050 | | | | 12,166 | |

| NGPL PipeCo, LLC 4.875% 8/15/20271 | | | 1,010 | | | | 980 | |

| Northern Oil and Gas, Inc. 8.125% 3/1/20281 | | | 37,565 | | | | 37,296 | |

| NorthRiver Midstream Finance, LP 5.625% 2/15/20261 | | | 10,800 | | | | 10,148 | |

| NuStar Logistics, LP 6.00% 6/1/2026 | | | 6,129 | | | | 6,015 | |

| Oasis Petroleum, Inc. 6.375% 6/1/20261 | | | 19,756 | | | | 19,592 | |

| Occidental Petroleum Corp. 2.90% 8/15/2024 | | | 10,480 | | | | 10,187 | |

| Occidental Petroleum Corp. 5.875% 9/1/2025 | | | 12,395 | | | | 12,503 | |

| Occidental Petroleum Corp. 3.00% 2/15/2027 | | | 500 | | | | 458 | |

| American High-Income Trust | 3 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Energy (continued) | | | | | | | | |

| Occidental Petroleum Corp. 6.375% 9/1/2028 | | USD | 4,575 | | | $ | 4,742 | |

| Occidental Petroleum Corp. 8.875% 7/15/2030 | | | 12,675 | | | | 14,755 | |

| Occidental Petroleum Corp. 6.625% 9/1/2030 | | | 20,235 | | | | 21,329 | |

| Occidental Petroleum Corp. 6.125% 1/1/2031 | | | 11,610 | | | | 12,057 | |

| Occidental Petroleum Corp. 6.45% 9/15/2036 | | | 5,090 | | | | 5,357 | |

| Occidental Petroleum Corp. 6.20% 3/15/2040 | | | 3,495 | | | | 3,519 | |

| Occidental Petroleum Corp. 6.60% 3/15/2046 | | | 7,290 | | | | 7,673 | |

| Occidental Petroleum Corp. 4.20% 3/15/2048 | | | 2,543 | | | | 1,975 | |

| Parkland Corp. 4.625% 5/1/20301 | | | 15,355 | | | | 13,673 | |

| Patterson-UTI Energy, Inc. 5.15% 11/15/2029 | | | 1,595 | | | | 1,471 | |

| PDC Energy, Inc. 5.75% 5/15/2026 | | | 12,000 | | | | 11,698 | |

| Petrobras Global Finance Co. 6.75% 6/3/2050 | | | 5,701 | | | | 5,040 | |

| Petrobras Global Finance Co. 5.50% 6/10/2051 | | | 3,999 | | | | 3,108 | |

| Petróleos Mexicanos 4.875% 1/18/2024 | | | 4,467 | | | | 4,410 | |

| Petróleos Mexicanos 6.875% 10/16/2025 | | | 6,200 | | | | 6,139 | |

| Petróleos Mexicanos 6.875% 8/4/2026 | | | 5,000 | | | | 4,751 | |

| Petróleos Mexicanos 8.75% 6/2/2029 | | | 14,137 | | | | 13,161 | |

| Petrorio Luxembourg SARL 6.125% 6/9/20261 | | | 6,800 | | | | 6,392 | |

| Range Resources Corp. 4.875% 5/15/2025 | | | 5,803 | | | | 5,696 | |

| Range Resources Corp. 8.25% 1/15/2029 | | | 17,375 | | | | 18,330 | |

| Range Resources Corp. 4.75% 2/15/20301 | | | 24,510 | | | | 22,374 | |

| Rockies Express Pipeline, LLC 4.95% 7/15/20291 | | | 11,193 | | | | 9,986 | |

| Sabine Pass Liquefaction, LLC 4.50% 5/15/2030 | | | 4,219 | | | | 4,072 | |

| Sanchez Energy Corp. 7.25% 2/15/20241,4 | | | 22,796 | | | | 199 | |

| SM Energy Co. 5.625% 6/1/2025 | | | 5,270 | | | | 5,116 | |

| SM Energy Co. 6.50% 7/15/2028 | | | 2,910 | | | | 2,780 | |

| Southwestern Energy Co. 5.70% 1/23/20257 | | | 5,630 | | | | 5,638 | |

| Southwestern Energy Co. 8.375% 9/15/2028 | | | 8,875 | | | | 9,339 | |

| Southwestern Energy Co. 5.375% 2/1/2029 | | | 6,470 | | | | 6,105 | |

| Southwestern Energy Co. 5.375% 3/15/2030 | | | 46,000 | | | | 43,301 | |

| Southwestern Energy Co. 4.75% 2/1/2032 | | | 24,695 | | | | 21,842 | |

| Suburban Propane Partners, LP / Suburban Energy Finance Corp. 5.00% 6/1/20311 | | | 4,610 | | | | 4,034 | |

| Sunoco, LP 6.00% 4/15/2027 | | | 12,591 | | | | 12,446 | |

| Sunoco, LP 5.875% 3/15/2028 | | | 4,885 | | | | 4,696 | |

| Sunoco, LP 4.50% 5/15/2029 | | | 38,080 | | | | 35,002 | |

| Sunoco, LP 4.50% 4/30/2030 | | | 31,235 | | | | 28,283 | |

| Superior Plus, LP and Superior General Partner, Inc. 4.50% 3/15/20291 | | | 7,994 | | | | 7,147 | |

| Tallgrass Energy Partners, LP 7.50% 10/1/20251 | | | 2,535 | | | | 2,536 | |

| Targa Resources Partners, LP 6.50% 7/15/2027 | | | 4,322 | | | | 4,410 | |

| Targa Resources Partners, LP 6.875% 1/15/2029 | | | 18,530 | | | | 18,904 | |

| Targa Resources Partners, LP 5.50% 3/1/2030 | | | 16,729 | | | | 16,365 | |

| Targa Resources Partners, LP 4.875% 2/1/2031 | | | 13,835 | | | | 12,960 | |

| Transocean Poseidon, Ltd. 6.875% 2/1/20271 | | | 6,216 | | | | 6,099 | |

| Transocean Titan Financing, Ltd. 8.375% 2/1/20281 | | | 24,931 | | | | 25,679 | |

| Transocean, Inc. 7.25% 11/1/20251 | | | 8,700 | | | | 8,232 | |

| Transocean, Inc. 11.50% 1/30/20271 | | | 5,405 | | | | 5,587 | |

| Transocean, Inc. 8.75% 2/15/20301 | | | 16,384 | | | | 16,726 | |

| Transocean, Inc. 6.80% 3/15/2038 | | | 10,600 | | | | 7,352 | |

| USA Compression Partners, LP 6.875% 4/1/2026 | | | 15,811 | | | | 15,383 | |

| USA Compression Partners, LP 6.875% 9/1/2027 | | | 2,403 | | | | 2,299 | |

| Venture Global Calcasieu Pass, LLC 6.25% 1/15/20301 | | | 11,517 | | | | 11,615 | |

| Venture Global Calcasieu Pass, LLC 4.125% 8/15/20311 | | | 54,765 | | | | 48,171 | |

| Venture Global Calcasieu Pass, LLC 3.875% 11/1/20331 | | | 21,525 | | | | 18,106 | |

| W&T Offshore, Inc. 11.75% 2/1/20261 | | | 7,100 | | | | 6,964 | |

| Weatherford International, Ltd. 11.00% 12/1/20241 | | | 3,050 | | | | 3,133 | |

| Weatherford International, Ltd. 6.50% 9/15/20281 | | | 42,845 | | | | 42,959 | |

| Weatherford International, Ltd. 8.625% 4/30/20301 | | | 75,551 | | | | 77,361 | |

| Western Gas Partners, LP 3.95% 6/1/2025 | | | 1,280 | | | | 1,226 | |

| Western Gas Partners, LP 4.50% 3/1/2028 | | | 15,688 | | | | 14,856 | |

| Western Midstream Operating, LP 3.35% 2/1/20257 | | | 14,110 | | | | 13,488 | |

| Western Midstream Operating, LP 4.75% 8/15/2028 | | | 2,830 | | | | 2,696 | |

| Western Midstream Operating, LP 4.30% 2/1/20307 | | | 9,650 | | | | 8,794 | |

| Western Midstream Operating, LP 6.15% 4/1/2033 | | | 14,175 | | | | 14,385 | |

| Western Midstream Operating, LP 5.50% 2/1/20507 | | | 24,725 | | | | 21,016 | |

| | | | | | | | 2,599,021 | |

| 4 | American High-Income Trust |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Consumer discretionary 12.25% | | | | | | | | |

| Adient Global Holdings, Ltd. 4.875% 8/15/20261 | | USD | 9,660 | | | $ | 9,320 | |

| Affinity Interactive 6.875% 12/15/20271 | | | 13,245 | | | | 11,827 | |

| Allied Universal Holdco, LLC 6.625% 7/15/20261 | | | 8,658 | | | | 8,329 | |

| Allied Universal Holdco, LLC 9.75% 7/15/20271 | | | 17,402 | | | | 15,527 | |

| Allied Universal Holdco, LLC 4.625% 6/1/20281 | | | 14,520 | | | | 12,301 | |

| Allied Universal Holdco, LLC 6.00% 6/1/20291 | | | 55,202 | | | | 41,269 | |

| Asbury Automotive Group, Inc. 4.50% 3/1/2028 | | | 5,000 | | | | 4,557 | |

| Asbury Automotive Group, Inc. 4.625% 11/15/20291 | | | 30,700 | | | | 27,518 | |

| Asbury Automotive Group, Inc. 5.00% 2/15/20321 | | | 27,590 | | | | 24,207 | |

| Atlas LuxCo 4 SARL 4.625% 6/1/20281 | | | 7,925 | | | | 6,661 | |

| AutoNation, Inc. 2.40% 8/1/2031 | | | 12,000 | | | | 9,251 | |

| Bath & Body Works, Inc. 6.625% 10/1/20301 | | | 7,375 | | | | 7,196 | |

| Bath & Body Works, Inc. 6.875% 11/1/2035 | | | 18,693 | | | | 16,868 | |

| Bath & Body Works, Inc. 6.75% 7/1/2036 | | | 13,030 | | | | 11,659 | |

| Beazer Homes USA, Inc. 5.875% 10/15/2027 | | | 10,802 | | | | 9,855 | |

| Boyd Gaming Corp. 4.75% 12/1/2027 | | | 8,389 | | | | 8,053 | |

| Boyd Gaming Corp. 4.75% 6/15/20311 | | | 6,835 | | | | 6,214 | |

| Boyne USA, Inc. 4.75% 5/15/20291 | | | 12,285 | | | | 10,982 | |

| Caesars Entertainment, Inc. 6.25% 7/1/20251 | | | 15,390 | | | | 15,405 | |

| Caesars Entertainment, Inc. 8.125% 7/1/20271 | | | 14,425 | | | | 14,726 | |

| Caesars Entertainment, Inc. 4.625% 10/15/20291 | | | 28,148 | | | | 24,645 | |

| Caesars Entertainment, Inc. 7.00% 2/15/20301 | | | 38,790 | | | | 39,504 | |

| Caesars Entertainment, Inc., Term Loan B, (USD-SOFR + 3.25%) 7.00% 2/1/20291,2,3 | | | 9,479 | | | | 9,445 | |

| Caesars Resort Collection, LLC 5.75% 7/1/20251 | | | 6,965 | | | | 6,973 | |

| Carnival Corp. 10.50% 2/1/20261 | | | 27,520 | | | | 28,699 | |

| Carnival Corp. 7.625% 3/1/20261 | | | 450 | | | | 411 | |

| Carnival Corp. 4.00% 8/1/20281 | | | 55,985 | | | | 48,252 | |

| Carnival Corp. 6.00% 5/1/20291 | | | 7,825 | | | | 6,230 | |

| Carnival Corp. 10.50% 6/1/20301 | | | 2,000 | | | | 1,922 | |

| CDI Escrow Issuer, Inc. 5.75% 4/1/20301 | | | 12,370 | | | | 11,959 | |

| CEC Entertainment, Inc. 6.75% 5/1/20261 | | | 6,500 | | | | 6,181 | |

| Dana, Inc. 4.25% 9/1/2030 | | | 2,150 | | | | 1,726 | |

| Dana, Inc. 4.50% 2/15/2032 | | | 8,510 | | | | 6,726 | |

| Empire Resorts, Inc. 7.75% 11/1/20261 | | | 11,045 | | | | 9,151 | |

| Everi Holdings, Inc. 5.00% 7/15/20291 | | | 3,000 | | | | 2,673 | |

| Fertitta Entertainment, Inc. 4.625% 1/15/20291 | | | 28,070 | | | | 24,669 | |

| Fertitta Entertainment, Inc. 6.75% 1/15/20301 | | | 91,165 | | | | 75,086 | |

| First Student Bidco, Inc. 4.00% 7/31/20291 | | | 21,615 | | | | 18,828 | |

| Ford Motor Co. 2.30% 2/10/2025 | | | 6,625 | | | | 6,149 | |

| Ford Motor Co. 6.10% 8/19/2032 | | | 13,685 | | | | 13,281 | |

| Ford Motor Credit Company, LLC 3.81% 1/9/2024 | | | 3,398 | | | | 3,362 | |

| Ford Motor Credit Company, LLC 5.584% 3/18/2024 | | | 934 | | | | 926 | |

| Ford Motor Credit Company, LLC 3.664% 9/8/2024 | | | 1,438 | | | | 1,382 | |

| Ford Motor Credit Company, LLC 5.125% 6/16/2025 | | | 44,310 | | | | 43,435 | |

| Ford Motor Credit Company, LLC 3.375% 11/13/2025 | | | 11,000 | | | | 10,325 | |

| Ford Motor Credit Company, LLC 4.542% 8/1/2026 | | | 21,795 | | | | 20,694 | |

| Ford Motor Credit Company, LLC 2.70% 8/10/2026 | | | 9,330 | | | | 8,315 | |

| Ford Motor Credit Company, LLC 4.271% 1/9/2027 | | | 4,575 | | | | 4,266 | |

| Ford Motor Credit Company, LLC 4.95% 5/28/2027 | | | 7,420 | | | | 7,088 | |

| Ford Motor Credit Company, LLC 4.125% 8/17/2027 | | | 13,940 | | | | 12,791 | |

| Ford Motor Credit Company, LLC 3.815% 11/2/2027 | | | 16,990 | | | | 15,251 | |

| Ford Motor Credit Company, LLC 2.90% 2/16/2028 | | | 5,850 | | | | 5,037 | |

| Ford Motor Credit Company, LLC 5.113% 5/3/2029 | | | 2,845 | | | | 2,675 | |

| Ford Motor Credit Company, LLC 4.00% 11/13/2030 | | | 11,468 | | | | 9,760 | |

| Group 1 Automotive, Inc. 4.00% 8/15/20281 | | | 7,380 | | | | 6,507 | |

| Hanesbrands, Inc. 4.875% 5/15/20261 | | | 21,712 | | | | 20,599 | |

| Hanesbrands, Inc. 9.00% 2/15/20311 | | | 26,254 | | | | 26,903 | |

| Hanesbrands, Inc., Term Loan B, (1-month USD CME Term SOFR + 3.75%) 8.557% 3/8/20302,3 | | | 12,418 | | | | 12,387 | |

| Hilton Grand Vacations Borrower 5.00% 6/1/20291 | | | 12,490 | | | | 11,107 | |

| Hilton Worldwide Holdings, Inc. 3.75% 5/1/20291 | | | 4,250 | | | | 3,808 | |

| Hilton Worldwide Holdings, Inc. 4.875% 1/15/2030 | | | 8,287 | | | | 7,946 | |

| Hilton Worldwide Holdings, Inc. 4.00% 5/1/20311 | | | 20,465 | | | | 17,940 | |

| International Game Technology PLC 6.50% 2/15/20251 | | | 12,403 | | | | 12,545 | |

| International Game Technology PLC 4.125% 4/15/20261 | | | 18,730 | | | | 18,096 | |

| International Game Technology PLC 5.25% 1/15/20291 | | | 53,932 | | | | 51,694 | |

| Jacobs Entertainment, Inc. 6.75% 2/15/20291 | | | 18,230 | | | | 15,944 | |

| American High-Income Trust | 5 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Consumer discretionary (continued) | | | | | | | | |

| Jacobs Entertainment, Inc. 6.75% 2/15/20291 | | USD | 10,230 | | | $ | 8,947 | |

| KB Home 6.875% 6/15/2027 | | | 6,170 | | | | 6,275 | |

| KB Home 7.25% 7/15/2030 | | | 6,770 | | | | 6,875 | |

| Kontoor Brands, Inc. 4.125% 11/15/20291 | | | 6,770 | | | | 5,819 | |

| LCM Investments Holdings II, LLC 4.875% 5/1/20291 | | | 77,320 | | | | 64,774 | |

| Levi Strauss & Co. 3.50% 3/1/20311 | | | 16,150 | | | | 13,786 | |

| Lindblad Expeditions, LLC 6.75% 2/15/20271 | | | 4,075 | | | | 3,950 | |

| Lithia Motors, Inc. 4.625% 12/15/20271 | | | 7,250 | | | | 6,752 | |

| Lithia Motors, Inc. 3.875% 6/1/20291 | | | 27,860 | | | | 24,134 | |

| Lithia Motors, Inc. 4.375% 1/15/20311 | | | 16,400 | | | | 14,148 | |

| LSF9 Atlantis Holdings, LLC / Victra Finance Corp. 7.75% 2/15/20261 | | | 6,655 | | | | 6,052 | |

| M.D.C. Holdings, Inc. 6.00% 1/15/2043 | | | 11,252 | | | | 9,793 | |

| Macy’s Retail Holdings, LLC 6.125% 3/15/20321 | | | 1,230 | | | | 1,084 | |

| Marriott International, Inc. 4.90% 4/15/2029 | | | 3,407 | | | | 3,379 | |

| Marriott International, Inc. 3.50% 10/15/2032 | | | 9,400 | | | | 8,248 | |

| Marriott International, Inc. 2.75% 10/15/2033 | | | 8,500 | | | | 6,888 | |

| Marriott Ownership Resorts, Inc. 4.75% 1/15/2028 | | | 2,500 | | | | 2,237 | |

| Marriott Ownership Resorts, Inc. 4.50% 6/15/20291 | | | 23,410 | | | | 19,953 | |

| Melco International Development, Ltd. 4.875% 6/6/20251 | | | 16,485 | | | | 15,521 | |

| Melco International Development, Ltd. 5.75% 7/21/20281 | | | 8,910 | | | | 7,716 | |

| Merlin Entertainment 5.75% 6/15/20261 | | | 10,798 | | | | 10,254 | |

| MGM Resorts International 5.50% 4/15/2027 | | | 5,707 | | | | 5,543 | |

| Mohegan Gaming & Entertainment 8.00% 2/1/20261 | | | 620 | | | | 568 | |

| Motel 6 Operating, LP, Term Loan B, (1-month USD-LIBOR + 5.00%) 9.719% 9/9/20262,3 | | | 8,825 | | | | 8,781 | |

| NCL Corp., Ltd. 3.625% 12/15/20241 | | | 6,450 | | | | 6,006 | |

| NCL Corp., Ltd. 5.875% 3/15/20261 | | | 8,100 | | | | 6,902 | |

| NCL Corp., Ltd. 5.875% 2/15/20271 | | | 29,965 | | | | 27,977 | |

| NCL Corp., Ltd. 7.75% 2/15/20291 | | | 7,115 | | | | 6,108 | |

| Neiman Marcus Group, LLC 7.125% 4/1/20261 | | | 35,980 | | | | 33,813 | |

| Panther BF Aggregator 2, LP 6.25% 5/15/20261 | | | 3,667 | | | | 3,662 | |

| Panther BF Aggregator 2, LP 8.50% 5/15/20271 | | | 4,155 | | | | 4,178 | |

| Party City Holdings, Inc. 6.125% 8/15/20231,4 | | | 9,100 | | | | 68 | |

| Party City Holdings, Inc. (6-month USD-LIBOR + 5.00%) 10.13% 7/15/20251,3,4 | | | 4,705 | | | | 659 | |

| Party City Holdings, Inc. 8.75% 2/15/20261,4 | | | 151,988 | | | | 22,988 | |

| Party City Holdings, Inc. 6.625% 8/1/20261,4 | | | 5,000 | | | | 50 | |

| Party City Holdings, Inc., Term Loan DIP, 14.55% 6/18/20232,3 | | | 27,180 | | | | 28,132 | |

| Penske Automotive Group, Inc. 3.75% 6/15/2029 | | | 13,325 | | | | 11,522 | |

| PetSmart, Inc. 4.75% 2/15/20281 | | | 17,050 | | | | 16,021 | |

| PetSmart, Inc. 7.75% 2/15/20291 | | | 23,775 | | | | 23,363 | |

| Premier Entertainment Sub, LLC 5.625% 9/1/20291 | | | 5,300 | | | | 3,919 | |

| QVC, Inc. 4.85% 4/1/2024 | | | 18,375 | | | | 14,723 | |

| Rakuten Group, Inc. 10.25% 11/30/20241 | | | 7,650 | | | | 7,277 | |

| Raptor Acquisition Corp. 4.875% 11/1/20261 | | | 10,725 | | | | 9,986 | |

| Real Hero Merger Sub 2, Inc. 6.25% 2/1/20291 | | | 2,335 | | | | 1,729 | |

| Royal Caribbean Cruises, Ltd. 11.50% 6/1/20251 | | | 47,103 | | | | 50,268 | |

| Royal Caribbean Cruises, Ltd. 4.25% 7/1/20261 | | | 36,740 | | | | 33,015 | |

| Royal Caribbean Cruises, Ltd. 5.50% 8/31/20261 | | | 14,200 | | | | 13,301 | |

| Royal Caribbean Cruises, Ltd. 5.375% 7/15/20271 | | | 28,035 | | | | 25,004 | |

| Royal Caribbean Cruises, Ltd. 3.70% 3/15/2028 | | | 40,875 | | | | 33,482 | |

| Royal Caribbean Cruises, Ltd. 5.50% 4/1/20281 | | | 31,350 | | | | 27,713 | |

| Royal Caribbean Cruises, Ltd. 8.25% 1/15/20291 | | | 34,915 | | | | 36,515 | |

| Royal Caribbean Cruises, Ltd. 9.25% 1/15/20291 | | | 19,925 | | | | 21,190 | |

| Royal Caribbean Cruises, Ltd. 7.25% 1/15/20301 | | | 11,562 | | | | 11,645 | |

| Sally Holdings, LLC 5.625% 12/1/2025 | | | 25,859 | | | | 25,483 | |

| Sands China, Ltd. 5.625% 8/8/2025 | | | 6,522 | | | | 6,362 | |

| Sands China, Ltd. 5.90% 8/8/2028 | | | 648 | | | | 616 | |

| Sands China, Ltd. 4.875% 6/18/2030 | | | 2,000 | | | | 1,774 | |

| Sands China, Ltd. 3.75% 8/8/20317 | | | 1,500 | | | | 1,206 | |

| Scientific Games Corp. 8.625% 7/1/20251 | | | 25,415 | | | | 26,043 | |

| Scientific Games Corp. 7.00% 5/15/20281 | | | 20,347 | | | | 20,163 | |

| Scientific Games Corp. 7.25% 11/15/20291 | | | 19,650 | | | | 19,706 | |

| Scientific Games Holdings, LP 6.625% 3/1/20301 | | | 22,515 | | | | 19,918 | |

| Sonic Automotive, Inc. 4.625% 11/15/20291 | | | 28,980 | | | | 24,311 | |

| Sonic Automotive, Inc. 4.875% 11/15/20311 | | | 45,779 | | | | 36,960 | |

| Tempur Sealy International, Inc. 4.00% 4/15/20291 | | | 5,255 | | | | 4,630 | |

| The Gap, Inc. 3.625% 10/1/20291 | | | 3,225 | | | | 2,303 | |

| The Gap, Inc. 3.875% 10/1/20311 | | | 2,148 | | | | 1,492 | |

| 6 | American High-Income Trust |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Consumer discretionary (continued) | | | | | | | | |

| The Home Co., Inc. 7.25% 10/15/20251 | | USD | 7,735 | | | $ | 7,164 | |

| Travel + Leisure Co. 6.00% 4/1/2027 | | | 4,000 | | | | 3,972 | |

| Travel + Leisure Co. 4.50% 12/1/20291 | | | 18,625 | | | | 16,174 | |

| Universal Entertainment Corp. 8.50% 12/11/20241 | | | 58,885 | | | | 55,482 | |

| Vail Resorts, Inc. 6.25% 5/15/20251 | | | 4,090 | | | | 4,103 | |

| VICI Properties, LP / VICI Note Co., Inc. 5.625% 5/1/20241 | | | 9,113 | | | | 9,045 | |

| VICI Properties, LP / VICI Note Co., Inc. 3.75% 2/15/20271 | | | 243 | | | | 225 | |

| WASH Multifamily Acquisition, Inc. 5.75% 4/15/20261 | | | 23,650 | | | | 22,405 | |

| Wheel Pros, Inc., Term Loan, (3-month USD-LIBOR + 4.50%) 9.316% 5/11/20282,3 | | | 16,538 | | | | 11,880 | |

| Wyndham Destinations, Inc. 6.625% 7/31/20261 | | | 8,975 | | | | 9,019 | |

| Wyndham Destinations, Inc. 4.625% 3/1/20301 | | | 5,575 | | | | 4,787 | |

| Wyndham Worldwide Corp. 4.375% 8/15/20281 | | | 19,510 | | | | 17,992 | |

| Wynn Resorts Finance, LLC 5.125% 10/1/20291 | | | 9,225 | | | | 8,390 | |

| Wynn Resorts Finance, LLC 7.125% 2/15/20311 | | | 5,546 | | | | 5,631 | |

| Yahoo Holdings, Inc., Term Loan B, (1-month USD-LIBOR + 5.50%) 10.34% 9/1/20272,3 | | | 10,200 | | | | 9,949 | |

| | | | | | | | 2,084,896 | |

| | | | | | | | | |

| Communication services 10.82% | | | | | | | | |

| Altice France Holding SA 10.50% 5/15/20271 | | | 19,485 | | | | 14,924 | |

| Altice France Holding SA 5.125% 7/15/20291 | | | 33,804 | | | | 25,470 | |

| Brightstar Escrow Corp. 9.75% 10/15/20251 | | | 2,720 | | | | 2,475 | |

| Cablevision Systems Corp. 5.50% 4/15/20271 | | | 2,700 | | | | 2,276 | |

| Cablevision Systems Corp. 5.375% 2/1/20281 | | | 3,775 | | | | 3,096 | |

| CCO Holdings, LLC 5.125% 5/1/20271 | | | 9,878 | | | | 9,347 | |

| CCO Holdings, LLC 5.00% 2/1/20281 | | | 16,374 | | | | 15,125 | |

| CCO Holdings, LLC 6.375% 9/1/20291 | | | 4,400 | | | | 4,206 | |

| CCO Holdings, LLC 4.75% 3/1/20301 | | | 60,731 | | | | 52,684 | |

| CCO Holdings, LLC 4.50% 8/15/20301 | | | 65,679 | | | | 55,573 | |

| CCO Holdings, LLC 4.25% 2/1/20311 | | | 40,930 | | | | 33,515 | |

| CCO Holdings, LLC 4.75% 2/1/20321 | | | 37,601 | | | | 31,627 | |

| CCO Holdings, LLC 4.50% 5/1/2032 | | | 35,527 | | | | 29,093 | |

| CCO Holdings, LLC 4.50% 6/1/20331 | | | 27,049 | | | | 21,809 | |

| CCO Holdings, LLC 4.25% 1/15/20341 | | | 41,875 | | | | 32,796 | |

| CCO Holdings, LLC and CCO Holdings Capital Corp. 5.50% 5/1/20261 | | | 2,094 | | | | 2,039 | |

| CCO Holdings, LLC and CCO Holdings Capital Corp. 5.375% 6/1/20291 | | | 7,126 | | | | 6,551 | |

| CCO Holdings, LLC and CCO Holdings Capital Corp. 2.80% 4/1/2031 | | | 950 | | | | 765 | |

| Centerfield Media Parent, Inc. 6.625% 8/1/20261 | | | 16,900 | | | | 11,006 | |

| Clear Channel Worldwide Holdings, Inc. 7.75% 4/15/20281 | | | 11,000 | | | | 8,260 | |

| Clear Channel Worldwide Holdings, Inc. 7.50% 6/1/20291 | | | 5,000 | | | | 3,558 | |

| Cogent Communications Group, Inc. 3.50% 5/1/20261 | | | 8,445 | | | | 7,883 | |

| Connect Finco SARL 6.75% 10/1/20261 | | | 14,525 | | | | 13,667 | |

| Consolidated Communications, Inc. 5.00% 10/1/20281 | | | 14,350 | | | | 9,762 | |

| CSC Holdings, LLC 6.50% 2/1/20291 | | | 10,000 | | | | 8,314 | |

| CSC Holdings, LLC 3.375% 2/15/20311 | | | 12,700 | | | | 8,797 | |

| Diamond Sports Group, LLC 5.375% 8/15/20261 | | | 9,835 | | | | 553 | |

| Diamond Sports Group, LLC 6.625% 8/15/20271 | | | 18,432 | | | | 253 | |

| DIRECTV Financing, LLC 5.875% 8/15/20271 | | | 48,235 | | | | 43,733 | |

| DIRECTV Financing, LLC, Term Loan, (3-month USD-LIBOR + 5.00%) 9.84% 8/2/20272,3 | | | 29,964 | | | | 28,911 | |

| DISH Network Corp. 11.75% 11/15/20271 | | | 117,385 | | | | 113,987 | |

| Embarq Corp. 7.995% 6/1/2036 | | | 70,126 | | | | 29,554 | |

| Epicor Software Corp., Term Loan, (3-month USD-LIBOR + 7.75%) 12.59% 7/31/20282,3 | | | 7,250 | | | | 7,232 | |

| Frontier Communications Corp. 5.875% 10/15/20271 | | | 30,110 | | | | 27,400 | |

| Frontier Communications Corp. 5.00% 5/1/20281 | | | 81,605 | | | | 70,905 | |

| Frontier Communications Corp. 6.75% 5/1/20291 | | | 33,250 | | | | 26,383 | |

| Frontier Communications Holdings, LLC 5.875% 11/1/2029 | | | 26,207 | | | | 20,010 | |

| Frontier Communications Holdings, LLC 6.00% 1/15/20301 | | | 14,100 | | | | 10,739 | |

| Frontier Communications Holdings, LLC 8.75% 5/15/20301 | | | 18,775 | | | | 18,720 | |

| Gray Escrow II, Inc. 5.375% 11/15/20311 | | | 21,425 | | | | 14,251 | |

| Gray Television, Inc. 5.875% 7/15/20261 | | | 20,065 | | | | 17,377 | |

| Gray Television, Inc. 7.00% 5/15/20271 | | | 17,554 | | | | 14,713 | |

| Gray Television, Inc. 4.75% 10/15/20301 | | | 6,210 | | | | 4,130 | |

| iHeartCommunications, Inc. 6.375% 5/1/2026 | | | 236 | | | | 208 | |

| iHeartCommunications, Inc. 8.375% 5/1/2027 | | | 427 | | | | 311 | |

| iHeartCommunications, Inc. 5.25% 8/15/20271 | | | 30,323 | | | | 24,818 | |

| iHeartCommunications, Inc. 4.75% 1/15/20281 | | | 5,000 | | | | 3,955 | |

| Intelsat Jackson Holding Co. 6.50% 3/15/20301 | | | 35,007 | | | | 32,179 | |

| Kantar Group, LLC, Term Loan B2, (3-month USD-LIBOR + 4.50%) 9.659% 12/4/20262,3 | | | 6,324 | | | | 5,928 | |

| American High-Income Trust | 7 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Communication services (continued) | | | | | | | | |

| Lamar Media Corp. 3.75% 2/15/2028 | | USD | 2,567 | | | $ | 2,377 | |

| Lamar Media Corp. 4.875% 1/15/2029 | | | 3,600 | | | | 3,391 | |

| Lamar Media Corp. 3.625% 1/15/2031 | | | 10,950 | | | | 9,427 | |

| Level 3 Financing, Inc. 3.75% 7/15/20291 | | | 11,500 | | | | 6,146 | |

| Ligado Networks, LLC 15.50% PIK 11/1/20231,6 | | | 49,148 | | | | 15,113 | |

| Live Nation Entertainment, Inc. 4.75% 10/15/20271 | | | 4,910 | | | | 4,547 | |

| Live Nation Entertainment, Inc. 3.75% 1/15/20281 | | | 5,750 | | | | 5,161 | |

| Midas OpCo Holdings, LLC 5.625% 8/15/20291 | | | 53,860 | | | | 47,289 | |

| Netflix, Inc. 4.875% 4/15/2028 | | | 6,190 | | | | 6,165 | |

| Netflix, Inc. 5.375% 11/15/20291 | | | 875 | | | | 890 | |

| Netflix, Inc. 4.875% 6/15/20301 | | | 2,050 | | | | 2,043 | |

| News Corp. 3.875% 5/15/20291 | | | 45,995 | | | | 40,922 | |

| News Corp. 5.125% 2/15/20321 | | | 31,705 | | | | 29,771 | |

| Nexstar Broadcasting, Inc. 4.75% 11/1/20281 | | | 65,616 | | | | 58,434 | |

| Nexstar Escrow Corp. 5.625% 7/15/20271 | | | 11,995 | | | | 11,097 | |

| OUTFRONT Media Capital, LLC 4.625% 3/15/20301 | | | 60 | | | | 50 | |

| Scripps Escrow II, Inc. 3.875% 1/15/20291 | | | 14,018 | | | | 11,017 | |

| Sinclair Television Group, Inc. 4.125% 12/1/20301 | | | 7,700 | | | | 6,217 | |

| Sirius XM Radio, Inc. 3.125% 9/1/20261 | | | 43,930 | | | | 39,671 | |

| Sirius XM Radio, Inc. 4.00% 7/15/20281 | | | 61,990 | | | | 53,311 | |

| Sirius XM Radio, Inc. 4.125% 7/1/20301 | | | 18,625 | | | | 15,247 | |

| Sirius XM Radio, Inc. 3.875% 9/1/20311 | | | 51,380 | | | | 39,999 | |

| Sprint Corp. 7.625% 3/1/2026 | | | 9,450 | | | | 10,002 | |

| Sprint Corp. 6.875% 11/15/2028 | | | 27,744 | | | | 29,839 | |

| Sprint Corp. 8.75% 3/15/2032 | | | 30,459 | | | | 37,116 | |

| TEGNA, Inc. 5.00% 9/15/2029 | | | 8,337 | | | | 7,216 | |

| T-Mobile US, Inc. 2.625% 4/15/2026 | | | 1,350 | | | | 1,261 | |

| T-Mobile US, Inc. 3.375% 4/15/2029 | | | 15,950 | | | | 14,556 | |

| Univision Communications, Inc. 5.125% 2/15/20251 | | | 60,818 | | | | 59,806 | |

| Univision Communications, Inc. 6.625% 6/1/20271 | | | 82,870 | | | | 78,652 | |

| Univision Communications, Inc. 4.50% 5/1/20291 | | | 89,675 | | | | 75,431 | |

| Univision Communications, Inc. 7.375% 6/30/20301 | | | 32,328 | | | | 30,593 | |

| Univision Communications, Inc., Term Loan, (3-month USD CME Term SOFR + 4.25%) 9.148% 6/24/20292,3 | | | 1,237 | | | | 1,231 | |

| UPC Broadband Finco BV 4.875% 7/15/20311 | | | 8,830 | | | | 7,646 | |

| Virgin Media O2 4.25% 1/31/20311 | | | 44,720 | | | | 38,101 | |

| Virgin Media Secured Finance PLC 4.50% 8/15/20301 | | | 14,955 | | | | 12,879 | |

| VZ Secured Financing BV 5.00% 1/15/20321 | | | 21,075 | | | | 17,216 | |

| Warner Music Group 3.75% 12/1/20291 | | | 32,463 | | | | 28,794 | |

| Warner Music Group 3.875% 7/15/20301 | | | 12,507 | | | | 10,994 | |

| Warner Music Group 3.00% 2/15/20311 | | | 4,050 | | | | 3,390 | |

| WarnerMedia Holdings, Inc. 4.279% 3/15/20321 | | | 3,805 | | | | 3,400 | |

| Ziggo Bond Co. BV 5.125% 2/28/20301 | | | 13,368 | | | | 10,765 | |

| Ziggo Bond Finance BV 4.875% 1/15/20301 | | | 28,685 | | | | 24,484 | |

| | | | | | | | 1,842,525 | |

| | | | | | | | | |

| Health care 9.91% | | | | | | | | |

| 1375209 B.C., Ltd. 9.00% 1/30/20281 | | | 14,425 | | | | 14,317 | |

| AdaptHealth, LLC 6.125% 8/1/20281 | | | 8,780 | | | | 8,069 | |

| AdaptHealth, LLC 5.125% 3/1/20301 | | | 20,760 | | | | 17,632 | |

| Avantor Funding, Inc. 4.625% 7/15/20281 | | | 41,175 | | | | 39,051 | |

| Avantor Funding, Inc. 3.875% 11/1/20291 | | | 6,900 | | | | 6,182 | |

| Bausch Health Americas, Inc. 9.25% 4/1/20261 | | | 35,840 | | | | 26,626 | |

| Bausch Health Americas, Inc. 8.50% 1/31/20271 | | | 5,171 | | | | 2,369 | |

| Bausch Health Companies, Inc. 9.00% 12/15/20251 | | | 34,021 | | | | 27,122 | |

| Bausch Health Companies, Inc. 6.125% 2/1/20271 | | | 4,370 | | | | 2,833 | |

| Bausch Health Companies, Inc. 5.75% 8/15/20271 | | | 16,063 | | | | 10,021 | |

| Bausch Health Companies, Inc. 7.00% 1/15/20281 | | | 8,262 | | | | 3,335 | |

| Bausch Health Companies, Inc. 5.00% 1/30/20281 | | | 18,310 | | | | 6,981 | |

| Bausch Health Companies, Inc. 4.875% 6/1/20281 | | | 66,925 | | | | 39,546 | |

| Bausch Health Companies, Inc. 5.00% 2/15/20291 | | | 95 | | | | 37 | |

| Bausch Health Companies, Inc. 7.25% 5/30/20291 | | | 8,112 | | | | 3,114 | |

| Bausch Health Companies, Inc. 5.25% 1/30/20301 | | | 33,642 | | | | 12,595 | |

| Bausch Health Companies, Inc. 14.00% 10/15/20301 | | | 13,950 | | | | 7,923 | |

| Bausch Health Companies, Inc. 5.25% 2/15/20311 | | | 78,304 | | | | 30,343 | |

| Catalent Pharma Solutions, Inc. 5.00% 7/15/20271 | | | 5,859 | | | | 5,727 | |

| Catalent Pharma Solutions, Inc. 3.125% 2/15/20291 | | | 2,975 | | | | 2,618 | |

| 8 | American High-Income Trust |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Health care (continued) | | | | | | | | |

| Catalent Pharma Solutions, Inc. 3.50% 4/1/20301 | | USD | 41,375 | | | $ | 36,399 | |

| Centene Corp. 4.25% 12/15/2027 | | | 20,407 | | | | 19,682 | |

| Centene Corp. 2.45% 7/15/2028 | | | 20,245 | | | | 17,631 | |

| Centene Corp. 4.625% 12/15/2029 | | | 35,635 | | | | 33,537 | |

| Centene Corp. 3.375% 2/15/2030 | | | 8,361 | | | | 7,302 | |

| Centene Corp. 3.00% 10/15/2030 | | | 10,575 | | | | 8,915 | |

| Centene Corp. 2.50% 3/1/2031 | | | 24,825 | | | | 20,126 | |

| Centene Corp. 2.625% 8/1/2031 | | | 17,525 | | | | 14,216 | |

| Charles River Laboratories International, Inc. 4.25% 5/1/20281 | | | 13,673 | | | | 12,813 | |

| Charles River Laboratories International, Inc. 3.75% 3/15/20291 | | | 12,765 | | | | 11,344 | |

| Charles River Laboratories International, Inc. 4.00% 3/15/20311 | | | 7,525 | | | | 6,591 | |

| Community Health Systems, Inc. 8.00% 3/15/20261 | | | 11,500 | | | | 11,126 | |

| Community Health Systems, Inc. 5.625% 3/15/20271 | | | 32,685 | | | | 28,728 | |

| Community Health Systems, Inc. 6.00% 1/15/20291 | | | 9,622 | | | | 8,149 | |

| Community Health Systems, Inc. 6.875% 4/15/20291 | | | 4,500 | | | | 2,791 | |

| Community Health Systems, Inc. 5.25% 5/15/20301 | | | 26,635 | | | | 20,918 | |

| Community Health Systems, Inc. 4.75% 2/15/20311 | | | 1,608 | | | | 1,189 | |

| DaVita, Inc. 4.625% 6/1/20301 | | | 16,310 | | | | 13,937 | |

| Encompass Health Corp. 4.50% 2/1/2028 | | | 7,054 | | | | 6,582 | |

| Encompass Health Corp. 4.75% 2/1/2030 | | | 3,841 | | | | 3,496 | |

| Endo DAC 6.00% 6/30/20281,4 | | | 45,278 | | | | 3,509 | |

| Endo DAC / Endo Finance, LLC / Endo Finco 9.50% 7/31/20271,4 | | | 6,243 | | | | 484 | |

| Endo International PLC 5.875% 10/15/20241 | | | 10,374 | | | | 7,750 | |

| Endo Luxembourg Finance Co. I SARL / Endo U.S., Inc. 6.125% 4/1/20291 | | | 15,320 | | | | 11,346 | |

| Grifols Escrow Issuer SA 4.75% 10/15/20281 | | | 12,075 | | | | 9,914 | |

| HCA, Inc. 5.375% 2/1/2025 | | | 1,000 | | | | 1,001 | |

| HCA, Inc. 5.875% 2/15/2026 | | | 2,902 | | | | 2,947 | |

| HCA, Inc. 4.50% 2/15/2027 | | | 71 | | | | 69 | |

| HCA, Inc. 5.625% 9/1/2028 | | | 22,625 | | | | 22,906 | |

| HCA, Inc. 5.875% 2/1/2029 | | | 2,450 | | | | 2,505 | |

| HCA, Inc. 3.50% 9/1/2030 | | | 24,300 | | | | 21,660 | |

| HCA, Inc. 7.50% 11/15/2095 | | | 5,000 | | | | 5,492 | |

| HealthEquity, Inc. 4.50% 10/1/20291 | | | 15,845 | | | | 14,098 | |

| IMS Health Holdings, Inc. 5.00% 10/15/20261 | | | 24,059 | | | | 23,543 | |

| Jazz Securities DAC 4.375% 1/15/20291 | | | 10,185 | | | | 9,379 | |

| Mallinckrodt PLC 10.00% 4/15/20251 | | | 17,362 | | | | 14,784 | |

| Medline Borrower, LP, Term Loan, (3-month USD-LIBOR + 3.25%) 8.09% 10/23/20282,3 | | | 7,062 | | | | 6,894 | |

| Minerva Merger Sub, Inc. 6.50% 2/15/20301 | | | 13,000 | | | | 10,553 | |

| Molina Healthcare, Inc. 4.375% 6/15/20281 | | | 25,955 | | | | 24,169 | |

| Molina Healthcare, Inc. 3.875% 11/15/20301 | | | 55,775 | | | | 48,715 | |

| Molina Healthcare, Inc. 3.875% 5/15/20321 | | | 45,350 | | | | 38,153 | |

| Mozart Debt Merger Sub, Inc. 3.875% 4/1/20291 | | | 5,000 | | | | 4,343 | |

| Mozart Debt Merger Sub, Inc. 5.25% 10/1/20291 | | | 36,430 | | | | 31,642 | |

| Option Care Health, Inc. 4.375% 10/31/20291 | | | 6,115 | | | | 5,407 | |

| Owens & Minor, Inc. 4.375% 12/15/2024 | | | 25,411 | | | | 24,544 | |

| Owens & Minor, Inc. 4.50% 3/31/20291 | | | 30,970 | | | | 24,198 | |

| Owens & Minor, Inc. 6.625% 4/1/20301 | | | 45,095 | | | | 38,766 | |

| Par Pharmaceutical, Inc. 7.50% 4/1/20271 | | | 106,234 | | | | 79,129 | |

| Radiology Partners, Inc. 9.25% 2/1/20281 | | | 38,699 | | | | 21,435 | |

| Radiology Partners, Inc., Term Loan, (3-month USD-LIBOR + 4.25%) 8.885% 7/9/20252,3 | | | 1,815 | | | | 1,472 | |

| RP Escrow Issuer, LLC 5.25% 12/15/20251 | | | 25,435 | | | | 19,297 | |

| Select Medical Holdings Corp. 6.25% 8/15/20261 | | | 9,039 | | | | 8,777 | |

| Surgery Center Holdings 10.00% 4/15/20271 | | | 4,742 | | | | 4,840 | |

| Syneos Health, Inc. 3.625% 1/15/20291 | | | 5,780 | | | | 4,757 | |

| Team Health Holdings, Inc. 6.375% 2/1/20251 | | | 6,359 | | | | 3,835 | |

| Team Health Holdings, Inc., Term Loan B, (3-month USD CME Term SOFR + 5.25%) 10.057% 3/2/20272,3 | | | 5,467 | | | | 3,818 | |

| Tenet Healthcare Corp. 4.625% 7/15/2024 | | | 4,274 | | | | 4,220 | |

| Tenet Healthcare Corp. 4.875% 1/1/2026 | | | 111,349 | | | | 109,284 | |

| Tenet Healthcare Corp. 6.25% 2/1/2027 | | | 8,995 | | | | 8,856 | |

| Tenet Healthcare Corp. 5.125% 11/1/2027 | | | 3,980 | | | | 3,825 | |

| Tenet Healthcare Corp. 4.625% 6/15/2028 | | | 18,000 | | | | 16,625 | |

| Tenet Healthcare Corp. 6.125% 10/1/2028 | | | 14,815 | | | | 14,213 | |

| Tenet Healthcare Corp. 4.25% 6/1/2029 | | | 20,860 | | | | 18,891 | |

| Tenet Healthcare Corp. 4.375% 1/15/2030 | | | 25,005 | | | | 22,464 | |

| Tenet Healthcare Corp. 6.875% 11/15/2031 | | | 2,000 | | | | 1,912 | |

| Teva Pharmaceutical Finance Co. BV 2.80% 7/21/2023 | | | 8,206 | | | | 8,117 | |

| American High-Income Trust | 9 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Health care (continued) | | | | | | | | |

| Teva Pharmaceutical Finance Co. BV 6.00% 4/15/2024 | | USD | 46,824 | | | $ | 46,875 | |

| Teva Pharmaceutical Finance Co. BV 3.15% 10/1/2026 | | | 65,186 | | | | 59,057 | |

| Teva Pharmaceutical Finance Co. BV 4.75% 5/9/2027 | | | 24,040 | | | | 22,470 | |

| Teva Pharmaceutical Finance Co. BV 6.75% 3/1/2028 | | | 24,371 | | | | 24,403 | |

| Teva Pharmaceutical Finance Co. BV 5.125% 5/9/2029 | | | 110,110 | | | | 99,848 | |

| Teva Pharmaceutical Finance Co. BV 7.875% 9/15/2029 | | | 15,340 | | | | 16,069 | |

| Teva Pharmaceutical Finance Co. BV 8.125% 9/15/2031 | | | 21,537 | | | | 22,634 | |

| Teva Pharmaceutical Finance Co. BV 4.10% 10/1/2046 | | | 16,337 | | | | 10,901 | |

| Valeant Pharmaceuticals International, Inc. 5.50% 11/1/20251 | | | 83,325 | | | | 68,602 | |

| | | | | | | | 1,687,310 | |

| | | | | | | | | |

| Materials 9.51% | | | | | | | | |

| Alcoa Nederland Holding BV 5.50% 12/15/20271 | | | 10,760 | | | | 10,640 | |

| Alcoa Nederland Holding BV 4.125% 3/31/20291 | | | 6,250 | | | | 5,570 | |

| Allegheny Technologies, Inc. 4.875% 10/1/2029 | | | 21,320 | | | | 19,435 | |

| Allegheny Technologies, Inc. 5.125% 10/1/2031 | | | 22,140 | | | | 20,180 | |

| ArcelorMittal 4.25% 7/16/2029 | | | 940 | | | | 892 | |

| ArcelorMittal 7.00% 10/15/2039 | | | 10,104 | | | | 10,636 | |

| ArcelorMittal 6.75% 3/1/2041 | | | 15,173 | | | | 15,408 | |

| Ardagh Group SA 6.50% Cash 6/30/20271,6 | | | 8,809 | | | | 6,749 | |

| Ardagh Metal Packaging Finance USA, LLC 6.00% 6/15/20271 | | | 1,500 | | | | 1,489 | |

| Ardagh Metal Packaging Finance USA, LLC 3.25% 9/1/20281 | | | 5,000 | | | | 4,309 | |

| Ardagh Metal Packaging Finance USA, LLC 4.00% 9/1/20291 | | | 16,970 | | | | 13,295 | |

| Ardagh Packaging Finance PLC 5.25% 4/30/20251 | | | 570 | | | | 562 | |

| Ardagh Packaging Finance PLC 4.125% 8/15/20261 | | | 11,435 | | | | 10,679 | |

| Ardagh Packaging Finance PLC 5.25% 8/15/20271 | | | 10,000 | | | | 7,894 | |

| Avient Corp. 7.125% 8/1/20301 | | | 6,750 | | | | 6,968 | |

| Axalta Coating Systems, LLC 4.75% 6/15/20271 | | | 6,495 | | | | 6,179 | |

| Ball Corp. 6.875% 3/15/2028 | | | 21,175 | | | | 21,938 | |

| Ball Corp. 2.875% 8/15/2030 | | | 3,250 | | | | 2,710 | |

| Ball Corp. 3.125% 9/15/2031 | | | 26,280 | | | | 21,772 | |

| Braskem Idesa SAPI 6.99% 2/20/20321 | | | 1,370 | | | | 1,035 | |

| CAN-PACK SA 3.875% 11/15/20291 | | | 26,795 | | | | 21,725 | |

| Cleveland-Cliffs, Inc. 6.75% 3/15/20261 | | | 9,823 | | | | 10,010 | |

| Cleveland-Cliffs, Inc. 7.00% 3/15/2027 | | | 3,853 | | | | 3,776 | |

| Cleveland-Cliffs, Inc. 5.875% 6/1/2027 | | | 63,955 | | | | 63,392 | |

| Cleveland-Cliffs, Inc. 4.625% 3/1/20291 | | | 39,643 | | | | 36,416 | |

| Cleveland-Cliffs, Inc. 4.875% 3/1/20311 | | | 43,344 | | | | 39,452 | |

| Consolidated Energy Finance SA 6.50% 5/15/20261 | | | 2,013 | | | | 1,897 | |

| Consolidated Energy Finance SA 5.625% 10/15/20281 | | | 3,680 | | | | 3,169 | |

| CROWN Americas, LLC 5.25% 4/1/2030 | | | 2,775 | | | | 2,675 | |

| Crown Holdings, Inc. 7.375% 12/15/2026 | | | 2,000 | | | | 2,115 | |

| CVR Partners, LP 6.125% 6/15/20281 | | | 22,525 | | | | 19,993 | |

| Element Solutions, Inc. 3.875% 9/1/20281 | | | 8,300 | | | | 7,294 | |

| First Quantum Minerals, Ltd. 7.50% 4/1/20251 | | | 76,007 | | | | 76,021 | |

| First Quantum Minerals, Ltd. 6.875% 3/1/20261 | | | 55,328 | | | | 53,722 | |

| First Quantum Minerals, Ltd. 6.875% 10/15/20271 | | | 141,914 | | | | 136,940 | |

| Freeport-McMoRan, Inc. 4.25% 3/1/2030 | | | 303 | | | | 281 | |

| Freeport-McMoRan, Inc. 4.625% 8/1/2030 | | | 900 | | | | 851 | |

| Freeport-McMoRan, Inc. 5.40% 11/14/2034 | | | 4,288 | | | | 4,207 | |

| Freeport-McMoRan, Inc. 5.45% 3/15/2043 | | | 8,393 | | | | 7,860 | |

| FXI Holdings, Inc. 7.875% 11/1/20241 | | | 135,382 | | | | 126,437 | |

| FXI Holdings, Inc. 12.25% 11/15/20261 | | | 158,184 | | | | 140,784 | |

| Graphic Packaging International, LLC 3.75% 2/1/20301 | | | 10,000 | | | | 8,688 | |

| Hexion, Inc., Term Loan, (3-month USD CME Term SOFR + 4.50%) 9.454% 3/15/20292,3 | | | 11,195 | | | | 10,090 | |

| INEOS Finance PLC 6.75% 5/15/20281 | | | 10,200 | | | | 9,858 | |

| Kaiser Aluminum Corp. 4.625% 3/1/20281 | | | 12,698 | | | | 11,318 | |

| LABL, Inc. 5.875% 11/1/20281 | | | 14,600 | | | | 13,000 | |

| LABL, Inc. 9.50% 11/1/20281 | | | 3,277 | | | | 3,310 | |

| LABL, Inc. 8.25% 11/1/20291 | | | 15,215 | | | | 13,003 | |

| LSB Industries, Inc. 6.25% 10/15/20281 | | | 49,875 | | | | 44,437 | |

| LSF11 A5 HoldCo, LLC 6.625% 10/15/20291 | | | 1,425 | | | | 1,200 | |

| Mauser Packaging Solutions Holding Co. 7.875% 8/15/20261 | | | 21,143 | | | | 21,162 | |

| Mauser Packaging Solutions Holding Co. 9.25% 4/15/20271 | | | 12,500 | | | | 11,562 | |

| Methanex Corp. 5.125% 10/15/2027 | | | 73,490 | | | | 69,341 | |

| Methanex Corp. 5.25% 12/15/2029 | | | 12,718 | | | | 11,905 | |

| Methanex Corp. 5.65% 12/1/2044 | | | 9,445 | | | | 7,787 | |

| 10 | American High-Income Trust |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Materials (continued) | | | | | | | | |

| Mineral Resources, Ltd. 8.00% 11/1/20271 | | USD | 25,450 | | | $ | 26,201 | |

| Mineral Resources, Ltd. 8.50% 5/1/20301 | | | 25,920 | | | | 26,628 | |

| Nova Chemicals Corp. 4.875% 6/1/20241 | | | 15,785 | | | | 15,592 | |

| Nova Chemicals Corp. 5.25% 6/1/20271 | | | 31,493 | | | | 28,750 | |

| Nova Chemicals Corp. 4.25% 5/15/20291 | | | 36,067 | | | | 29,524 | |

| Novelis Corp. 3.25% 11/15/20261 | | | 16,285 | | | | 14,897 | |

| Novelis Corp. 4.75% 1/30/20301 | | | 11,093 | | | | 10,206 | |

| Novelis Corp. 3.875% 8/15/20311 | | | 22,344 | | | | 18,852 | |

| Olin Corp. 5.625% 8/1/2029 | | | 5,700 | | | | 5,500 | |

| Olin Corp. 5.00% 2/1/2030 | | | 3,365 | | | | 3,158 | |

| Owens-Illinois, Inc. 5.875% 8/15/20231 | | | 4,082 | | | | 4,080 | |

| Owens-Illinois, Inc. 6.375% 8/15/20251 | | | 5,341 | | | | 5,349 | |

| SCIH Salt Holdings, Inc. 4.875% 5/1/20281 | | | 41,413 | | | | 36,970 | |

| SCIH Salt Holdings, Inc. 6.625% 5/1/20291 | | | 18,600 | | | | 15,415 | |

| Scotts Miracle-Gro Co. 4.50% 10/15/2029 | | | 7,776 | | | | 6,695 | |

| Scotts Miracle-Gro Co. 4.375% 2/1/2032 | | | 7,620 | | | | 6,132 | |

| Sealed Air Corp. 4.00% 12/1/20271 | | | 7,559 | | | | 7,061 | |

| Sealed Air Corp. 6.125% 2/1/20281 | | | 15,912 | | | | 16,106 | |

| Sealed Air Corp. 5.00% 4/15/20291 | | | 13,750 | | | | 12,938 | |

| SPCM SA 3.375% 3/15/20301 | | | 10,732 | | | | 8,866 | |

| Summit Materials, LLC 6.50% 3/15/20271 | | | 5,478 | | | | 5,438 | |

| Summit Materials, LLC 5.25% 1/15/20291 | | | 15,015 | | | | 14,211 | |

| Trivium Packaging BV 5.50% 8/15/20261 | | | 6,445 | | | | 6,182 | |

| Trivium Packaging BV 8.50% 8/15/20271 | | | 19,352 | | | | 17,629 | |

| Tronox, Ltd. 4.625% 3/15/20291 | | | 14,155 | | | | 11,870 | |

| Valvoline, Inc. 4.25% 2/15/20301 | | | 3,691 | | | | 3,623 | |

| Valvoline, Inc. 3.625% 6/15/20311 | | | 8,405 | | | | 7,147 | |

| Venator Finance SARL 9.50% 7/1/20251 | | | 33,482 | | | | 20,926 | |

| Venator Finance SARL 5.75% 7/15/20251 | | | 70,528 | | | | 10,253 | |

| Venator Finance SARL, Term Loan, (3-month USD-LIBOR + 3.00%) 8.159% 8/8/20242,3 | | | 9,064 | | | | 6,007 | |

| W. R. Grace Holdings, LLC 5.625% 8/15/20291 | | | 6,495 | | | | 5,521 | |

| Warrior Met Coal, Inc. 7.875% 12/1/20281 | | | 26,880 | | | | 27,058 | |

| | | | | | | | 1,618,803 | |

| | | | | | | | | |

| Industrials 8.67% | | | | | | | | |

| AAdvantage Loyalty IP, Ltd. 5.50% 4/20/20261 | | | 15,095 | | | | 14,874 | |

| ADT Security Corp. 4.125% 8/1/20291 | | | 4,815 | | | | 4,300 | |

| Allison Transmission Holdings, Inc. 3.75% 1/30/20311 | | | 24,820 | | | | 21,203 | |

| Ashtead Capital, Inc. 5.50% 8/11/20321 | | | 10,743 | | | | 10,574 | |

| Atkore, Inc. 4.25% 6/1/20311 | | | 6,650 | | | | 5,827 | |

| Atlantic Aviation FBO, Inc., Term Loan, (3-month USD-LIBOR + 5.75%) 10.385% 9/21/20292,3 | | | 67,254 | | | | 66,127 | |

| Avis Budget Car Rental, LLC 5.75% 7/15/20271 | | | 18,910 | | | | 17,736 | |

| Avis Budget Group, Inc. 4.75% 4/1/20281 | | | 1,000 | | | | 911 | |

| Avis Budget Group, Inc. 5.375% 3/1/20291 | | | 23,995 | | | | 22,309 | |

| Avolon Holdings Funding, Ltd. 5.25% 5/15/20241 | | | 17,340 | | | | 17,176 | |

| Avolon Holdings Funding, Ltd. 2.528% 11/18/20271 | | | 36,710 | | | | 31,096 | |

| BlueLinx Holdings, Inc. 6.00% 11/15/20291 | | | 6,795 | | | | 5,618 | |

| Boeing Company 3.90% 5/1/2049 | | | 540 | | | | 409 | |

| Bohai Financial Investment Holding Co., Ltd. 5.50% 2/15/20241 | | | 1,258 | | | | 1,247 | |

| Bombardier, Inc. 7.50% 3/15/20251 | | | 5,102 | | | | 5,107 | |

| Bombardier, Inc. 7.125% 6/15/20261 | | | 67,460 | | | | 67,764 | |

| Bombardier, Inc. 7.875% 4/15/20271 | | | 41,960 | | | | 42,518 | |

| Bombardier, Inc. 6.00% 2/15/20281 | | | 25,648 | | | | 25,007 | |

| Bombardier, Inc. 7.50% 2/1/20291 | | | 13,681 | | | | 13,989 | |

| Bombardier, Inc. 7.45% 5/1/20341 | | | 1,850 | | | | 2,081 | |

| BWX Technologies, Inc. 4.125% 6/30/20281 | | | 15,932 | | | | 14,365 | |

| BWX Technologies, Inc. 4.125% 4/15/20291 | | | 18,130 | | | | 16,099 | |

| Chart Industries, Inc. 7.50% 1/1/20301 | | | 10,389 | | | | 10,747 | |

| Clarivate Science Holdings Corp. 3.875% 7/1/20281 | | | 31,755 | | | | 28,375 | |

| Clarivate Science Holdings Corp. 4.875% 7/1/20291 | | | 18,675 | | | | 16,907 | |

| Clean Harbors, Inc. 4.875% 7/15/20271 | | | 12,014 | | | | 11,600 | |

| Clean Harbors, Inc. 5.125% 7/15/20291 | | | 5,000 | | | | 4,773 | |

| Clean Harbors, Inc. 6.375% 2/1/20311 | | | 17,247 | | | | 17,614 | |

| CoreLogic, Inc. 4.50% 5/1/20281 | | | 75,882 | | | | 57,646 | |

| CoreLogic, Inc., Term Loan, (3-month USD-LIBOR + 6.50%) 11.375% 6/4/20292,3 | | | 22,275 | | | | 16,637 | |

| Covanta Holding Corp. 4.875% 12/1/20291 | | | 18,260 | | | | 16,266 | |

| | | | | | | | | |

| American High-Income Trust | 11 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Industrials (continued) | | | | | | | | |

| Covanta Holding Corp. 5.00% 9/1/2030 | | USD | 28,240 | | | $ | 24,353 | |

| Dun & Bradstreet Corp. 5.00% 12/15/20291 | | | 24,367 | | | | 21,126 | |

| Garda World Security Corp. 6.00% 6/1/20291 | | | 3,200 | | | | 2,548 | |

| GFL Environmental, Inc. 3.50% 9/1/20281 | | | 10,000 | | | | 9,059 | |

| Harsco Corp. 5.75% 7/31/20271 | | | 7,265 | | | | 5,712 | |

| Herc Holdings, Inc. 5.50% 7/15/20271 | | | 3,200 | | | | 3,092 | |

| Howmet Aerospace, Inc. 6.875% 5/1/2025 | | | 1,510 | | | | 1,569 | |

| Howmet Aerospace, Inc. 5.95% 2/1/2037 | | | 9,125 | | | | 9,204 | |

| Icahn Enterprises Finance Corp. 4.75% 9/15/2024 | | | 24,105 | | | | 23,544 | |

| Icahn Enterprises, LP 5.25% 5/15/2027 | | | 5,503 | | | | 5,170 | |

| Icahn Enterprises, LP 4.375% 2/1/2029 | | | 9,175 | | | | 7,903 | |

| LABL Escrow Issuer, LLC 6.75% 7/15/20261 | | | 560 | | | | 541 | |

| LABL Escrow Issuer, LLC 10.50% 7/15/20271 | | | 36,018 | | | | 33,355 | |

| LSC Communications, Inc. 8.75% 10/15/20231,4,5 | | | 114,646 | | | | 346 | |

| LSC Communications, Inc., Term Loan B, (3-month USD-LIBOR + 4.50%) 7.75% 9/30/20222,3,4,5 | | | 8,059 | | | | 24 | |

| Masonite International Corp. 3.50% 2/15/20301 | | | 11,831 | | | | 9,825 | |

| MasTec, Inc. 4.50% 8/15/20281 | | | 9,375 | | | | 8,674 | |

| Mileage Plus Holdings, LLC 6.50% 6/20/20271 | | | 68,387 | | | | 68,234 | |

| Mueller Water Products, Inc. 4.00% 6/15/20291 | | | 5,115 | | | | 4,574 | |

| Park River Holdings, Inc. 5.625% 2/1/20291 | | | 17,205 | | | | 11,750 | |

| PGT Innovations, Inc. 4.375% 10/1/20291 | | | 22,759 | | | | 20,597 | |

| Pitney Bowes, Inc. 6.875% 3/15/20271 | | | 11,500 | | | | 9,118 | |

| PM General Purchaser, LLC 9.50% 10/1/20281 | | | 50,749 | | | | 46,540 | |

| Prime Security Services Borrower, LLC 3.375% 8/31/20271 | | | 8,100 | | | | 7,269 | |

| Prime Security Services Borrower, LLC 6.25% 1/15/20281 | | | 11,833 | | | | 11,075 | |

| R.R. Donnelley & Sons Co. 6.125% 11/1/20261 | | | 12,125 | | | | 12,174 | |

| Regal Rexnord Corp. 6.40% 4/15/20331 | | | 19,125 | | | | 19,160 | |

| Ritchie Bros. Holdings, Inc. 6.75% 3/15/20281 | | | 13,643 | | | | 14,067 | |

| Ritchie Bros. Holdings, Inc. 7.75% 3/15/20311 | | | 46,887 | | | | 49,197 | |

| Roller Bearing Company of America, Inc. 4.375% 10/15/20291 | | | 3,325 | | | | 2,973 | |

| Rolls-Royce PLC 5.75% 10/15/20271 | | | 9,915 | | | | 9,886 | |

| Sabre GLBL, Inc. 7.375% 9/1/20251 | | | 3,617 | | | | 3,235 | |

| Sabre GLBL, Inc. 11.25% 12/15/20271 | | | 17,689 | | | | 16,494 | |

| Sabre Holdings Corp. 9.25% 4/15/20251 | | | 16,754 | | | | 15,798 | |

| Sensata Technologies Holding BV 4.00% 4/15/20291 | | | 3,225 | | | | 2,917 | |

| Sensata Technologies, Inc. 3.75% 2/15/20311 | | | 8,800 | | | | 7,708 | |

| SkyMiles IP, Ltd. 4.75% 10/20/20281 | | | 19,430 | | | | 18,766 | |

| Spirit AeroSystems, Inc. 7.50% 4/15/20251 | | | 3,425 | | | | 3,428 | |

| Spirit AeroSystems, Inc. 4.60% 6/15/2028 | | | 31,555 | | | | 26,780 | |

| Spirit AeroSystems, Inc. 9.375% 11/30/20291 | | | 21,688 | | | | 23,694 | |

| Spirit AeroSystems, Inc., Term Loan, (3-month CME Term SOFR + 4.50%) 9.176% 1/15/20272,3 | | | 7,663 | | | | 7,677 | |

| SRS Distribution, Inc. 4.625% 7/1/20281 | | | 10,080 | | | | 8,966 | |

| SRS Distribution, Inc. 6.125% 7/1/20291 | | | 615 | | | | 520 | |

| Stericycle, Inc. 5.375% 7/15/20241 | | | 20,884 | | | | 20,746 | |

| Stericycle, Inc. 3.875% 1/15/20291 | | | 16,235 | | | | 14,193 | |

| The Brink’s Co. 4.625% 10/15/20271 | | | 10,371 | | | | 9,785 | |

| The Hertz Corp. 5.00% 12/1/20291 | | | 7,500 | | | | 6,220 | |

| Titan International, Inc. 7.00% 4/30/2028 | | | 11,500 | | | | 10,372 | |

| TK Elevator Holdco GmbH 7.625% 7/15/20281 | | | 1,375 | | | | 1,190 | |

| TransDigm, Inc. 6.25% 3/15/20261 | | | 32,470 | | | | 32,533 | |

| TransDigm, Inc. 6.875% 5/15/2026 | | | 12,740 | | | | 12,561 | |

| TransDigm, Inc. 6.375% 6/15/2026 | | | 5,560 | | | | 5,441 | |

| TransDigm, Inc. 7.50% 3/15/2027 | | | 770 | | | | 769 | |

| TransDigm, Inc. 5.50% 11/15/2027 | | | 19,810 | | | | 18,701 | |

| TransDigm, Inc. 6.75% 8/15/20281 | | | 14,070 | | | | 14,228 | |

| TransDigm, Inc. 4.625% 1/15/2029 | | | 2,971 | | | | 2,644 | |

| TransDigm, Inc. 4.875% 5/1/2029 | | | 4,180 | | | | 3,704 | |

| Triumph Group, Inc. 7.75% 8/15/2025 | | | 21,075 | | | | 19,365 | |

| Triumph Group, Inc. 9.00% 3/15/20281 | | | 31,249 | | | | 31,321 | |

| Uber Technologies, Inc. 8.00% 11/1/20261 | | | 10,000 | | | | 10,262 | |

| United Airlines, Inc. 4.375% 4/15/20261 | | | 5,125 | | | | 4,909 | |

| United Airlines, Inc. 4.625% 4/15/20291 | | | 10,100 | | | | 9,149 | |

| United Rentals, Inc. 5.25% 1/15/2030 | | | 5,484 | | | | 5,284 | |

| United Rentals, Inc. 3.875% 2/15/2031 | | | 9,450 | | | | 8,350 | |

| United Rentals, Inc. 3.75% 1/15/2032 | | | 8,360 | | | | 7,209 | |

| | |

| 12 | American High-Income Trust |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Industrials (continued) | | | | | | | | |

| Vertical U.S. Newco, Inc. 5.25% 7/15/20271 | | USD | 29,545 | | | $ | 27,932 | |

| WESCO Distribution, Inc. 7.125% 6/15/20251 | | | 11,475 | | | | 11,675 | |

| WESCO Distribution, Inc. 7.25% 6/15/20281 | | | 10,900 | | | | 11,203 | |

| | | | | | | | 1,475,290 | |

| | | | | | | | | |

| Financials 7.20% | | | | | | | | |

| Advisor Group Holdings, LLC 6.25% 3/1/20281 | | | 41,998 | | | | 37,874 | |

| AG Merger Sub II, Inc. 10.75% 8/1/20271 | | | 76,600 | | | | 77,818 | |

| AG TTMT Escrow Issuer, LLC 8.625% 9/30/20271 | | | 21,016 | | | | 21,174 | |

| Alliant Holdings Intermediate, LLC 4.25% 10/15/20271 | | | 14,020 | | | | 12,574 | |

| Alliant Holdings Intermediate, LLC 6.75% 10/15/20271 | | | 33,300 | | | | 30,917 | |

| Alliant Holdings Intermediate, LLC 6.75% 4/15/20281 | | | 7,130 | | | | 7,057 | |

| Alliant Holdings Intermediate, LLC 5.875% 11/1/20291 | | | 31,605 | | | | 26,709 | |

| AmWINS Group, Inc. 4.875% 6/30/20291 | | | 27,142 | | | | 24,056 | |

| Aretec Escrow Issuer, Inc. 7.50% 4/1/20291 | | | 57,872 | | | | 47,387 | |

| Ascensus, Inc., Term Loan, (3-month USD-LIBOR + 6.50%) 11.313% 8/2/20292,3 | | | 22,600 | | | | 20,340 | |

| AssuredPartners, Inc. 7.00% 8/15/20251 | | | 226 | | | | 220 | |

| AssuredPartners, Inc. 8.00% 5/15/20271 | | | 8,409 | | | | 8,035 | |

| AssuredPartners, Inc. 5.625% 1/15/20291 | | | 4,895 | | | | 4,236 | |

| Blackstone Private Credit Fund 7.05% 9/29/20251 | | | 12,730 | | | | 12,568 | |

| Block, Inc. 2.75% 6/1/2026 | | | 28,750 | | | | 26,248 | |

| Block, Inc. 3.50% 6/1/2031 | | | 31,175 | | | | 25,633 | |

| BroadStreet Partners, Inc. 5.875% 4/15/20291 | | | 9,950 | | | | 8,426 | |

| Castlelake Aviation Finance DAC 5.00% 4/15/20271 | | | 17,105 | | | | 15,185 | |

| Coinbase Global, Inc. 3.375% 10/1/20281 | | | 26,075 | | | | 16,128 | |

| Coinbase Global, Inc. 3.625% 10/1/20311 | | | 30,431 | | | | 17,074 | |

| Compass Diversified Holdings 5.25% 4/15/20291 | | | 90,012 | | | | 79,365 | |

| Compass Diversified Holdings 5.00% 1/15/20321 | | | 21,655 | | | | 17,583 | |

| Credit Acceptance Corp. 5.125% 12/31/20241 | | | 7,030 | | | | 6,689 | |

| Credit Suisse Group AG 7.50% junior subordinated perpetual bonds (USD Semi Annual 30/360 (vs. 3-month USD-LIBOR) + 4.60% on 7/17/2023)1,4,7 | | | 2,295 | | | | 132 | |

| FS Energy and Power Fund 7.50% 8/15/20231 | | | 54,954 | | | | 54,919 | |

| Hightower Holding, LLC 6.75% 4/15/20291 | | | 18,130 | | | | 15,448 | |

| HUB International, Ltd. 7.00% 5/1/20261 | | | 35,178 | | | | 34,607 | |

| HUB International, Ltd. 5.625% 12/1/20291 | | | 3,745 | | | | 3,268 | |

| Iron Mountain Information Management Services, Inc. 5.00% 7/15/20321 | | | 18,510 | | | | 15,913 | |

| JPMorgan Chase & Co. 2.956% 5/13/2031 (USD-SOFR + 2.515% on 5/13/2030)7 | | | 3,100 | | | | 2,682 | |

| Ladenburg Thalmann Financial Services, Inc. 6.50% 11/30/2027 | | | 80 | | | | 1,285 | |

| LPL Holdings, Inc. 4.625% 11/15/20271 | | | 29,103 | | | | 27,529 | |

| LPL Holdings, Inc. 4.00% 3/15/20291 | | | 48,520 | | | | 43,716 | |

| LPL Holdings, Inc. 4.375% 5/15/20311 | | | 23,445 | | | | 20,754 | |

| MGIC Investment Corp. 5.25% 8/15/2028 | | | 7,625 | | | | 7,256 | |

| MSCI, Inc. 4.00% 11/15/20291 | | | 15,793 | | | | 14,427 | |

| MSCI, Inc. 3.625% 9/1/20301 | | | 5,559 | | | | 4,837 | |

| MSCI, Inc. 3.875% 2/15/20311 | | | 31,490 | | | | 28,058 | |

| MSCI, Inc. 3.625% 11/1/20311 | | | 46,121 | | | | 39,542 | |

| MSCI, Inc. 3.25% 8/15/20331 | | | 25,004 | | | | 20,499 | |

| National Financial Partners Corp. 6.875% 8/15/20281 | | | 11,239 | | | | 9,655 | |

| Navient Corp. 6.125% 3/25/2024 | | | 21,112 | | | | 20,850 | |

| Navient Corp. 5.875% 10/25/2024 | | | 25,680 | | | | 24,977 | |

| Navient Corp. 6.75% 6/25/2025 | | | 11,000 | | | | 10,702 | |

| Navient Corp. 6.75% 6/15/2026 | | | 12,310 | | | | 12,017 | |

| Navient Corp. 5.00% 3/15/2027 | | | 53,762 | | | | 47,423 | |

| Navient Corp. 4.875% 3/15/2028 | | | 5,570 | | | | 4,691 | |

| Navient Corp. 5.50% 3/15/2029 | | | 45,671 | | | | 38,651 | |

| Navient Corp. 5.625% 8/1/2033 | | | 27,712 | | | | 20,593 | |

| OneMain Finance Corp. 3.875% 9/15/2028 | | | 3,989 | | | | 3,167 | |

| OneMain Holdings, Inc. 7.125% 3/15/2026 | | | 24,220 | | | | 23,307 | |

| Owl Rock Capital Corp. 4.00% 3/30/2025 | | | 449 | | | | 419 | |

| Owl Rock Capital Corp. 3.75% 7/22/2025 | | | 12,093 | | | | 11,041 | |

| Owl Rock Capital Corp. 3.40% 7/15/2026 | | | 5,685 | | | | 5,028 | |

| Owl Rock Capital Corp. 2.625% 1/15/2027 | | | 400 | | | | 339 | |

| Owl Rock Capital Corp. II 4.625% 11/26/20241 | | | 9,835 | | | | 9,442 | |

| Owl Rock Capital Corp. III 3.125% 4/13/2027 | | | 11,350 | | | | 9,549 | |

| Owl Rock Core Income Corp. 4.70% 2/8/2027 | | | 15,700 | | | | 14,205 | |

| Oxford Finance, LLC 6.375% 2/1/20271 | | | 38,985 | | | | 36,499 | |

| Quicken Loans, LLC 3.625% 3/1/20291 | | | 6,605 | | | | 5,680 | |

| | |

| American High-Income Trust | 13 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Financials (continued) | | | | | | | | |

| Rocket Mortgage, LLC 2.875% 10/15/20261 | | USD | 9,410 | | | $ | 8,432 | |

| Ryan Specialty Group, LLC 4.375% 2/1/20301 | | | 12,050 | | | | 10,551 | |

| Springleaf Finance Corp. 6.125% 3/15/2024 | | | 3,700 | | | | 3,608 | |

| Starwood Property Trust, Inc. 5.50% 11/1/20231 | | | 7,195 | | | | 7,216 | |

| Starwood Property Trust, Inc. 4.375% 1/15/20271 | | | 11,835 | | | | 9,795 | |

| | | | | | | | 1,226,005 | |

| | | | | | | | | |

| Information technology 4.30% | | | | | | | | |

| Almonde, Inc., Term Loan B, (3-month USD-LIBOR + 3.50%) 8.325% 6/13/20242,3 | | | 15,848 | | | | 14,913 | |

| Almonde, Inc., Term Loan, (3-month USD-LIBOR + 7.25%) 12.075% 6/13/20252,3 | | | 81,669 | | | | 66,152 | |

| Black Knight, Inc. 3.625% 9/1/20281 | | | 8,470 | | | | 7,718 | |

| BMC Software, Inc. 7.125% 10/2/20251 | | | 3,545 | | | | 3,532 | |

| BMC Software, Inc. 9.125% 3/1/20261 | | | 4,290 | | | | 4,176 | |

| BMC Software, Inc., Term Loan, (3-month USD-LIBOR + 5.50%) 10.34% 2/27/20262,3 | | | 23,325 | | | | 22,679 | |

| Booz Allen Hamilton, Inc. 3.875% 9/1/20281 | | | 9,362 | | | | 8,552 | |

| Booz Allen Hamilton, Inc. 4.00% 7/1/20291 | | | 5,633 | | | | 5,088 | |

| CA Magnum Holdings 5.375% 10/31/20261 | | | 1,075 | | | | 944 | |

| CDK Global, Inc. 7.25% 6/15/20291 | | | 11,650 | | | | 11,461 | |

| CommScope Finance, LLC 6.00% 3/1/20261 | | | 16,030 | | | | 15,488 | |

| CommScope Finance, LLC 8.25% 3/1/20271 | | | 24,731 | | | | 20,279 | |

| CommScope Technologies, LLC 6.00% 6/15/20251 | | | 41,921 | | | | 39,520 | |

| CommScope Technologies, LLC 5.00% 3/15/20271 | | | 13,025 | | | | 9,540 | |

| CommScope, Inc. 7.125% 7/1/20281 | | | 9,869 | | | | 7,291 | |

| Condor Merger Sub, Inc. 7.375% 2/15/20301 | | | 8,000 | | | | 6,715 | |

| Diebold Nixdorf Dutch Holding BV 9.00% 7/15/2025 | | EUR | 25,040 | | | | 13,985 | |

| Diebold Nixdorf, Inc. 9.375% 7/15/20251 | | USD | 151,093 | | | | 77,435 | |

| Diebold Nixdorf, Inc., units, 8.50% PIK or 8.50% Cash 10/15/20261,6 | | | 53,944 | | | | 13,773 | |

| Diebold Nixdorf, Inc., Term Loan, (3-month USD CME Term SOFR + 7.00%) 14.75% 6/5/20232,3 | | | 15,141 | | | | 15,141 | |

| Diebold Nixdorf, Inc., Term Loan, (3-month USD CME Term SOFR + 5.25%) 10.479% 7/15/20252,3 | | | 53,938 | | | | 27,509 | |

| Diebold Nixdorf, Inc., Term Loan, (3-month USD CME Term SOFR + 6.50%) 11.629% 7/15/20252,3 | | | 47,768 | | | | 50,156 | |

| Entegris Escrow Corp. 4.75% 4/15/20291 | | | 7,610 | | | | 7,201 | |

| Fair Isaac Corp. 4.00% 6/15/20281 | | | 18,315 | | | | 17,004 | |

| Finastra, Ltd., Term Loan B, (3-month EUR-EURIBOR + 3.00%) 5.492% 6/13/20242,3 | | EUR | 19,007 | | | | 18,623 | |

| Gartner, Inc. 4.50% 7/1/20281 | | USD | 37,332 | | | | 35,472 | |

| Gartner, Inc. 3.625% 6/15/20291 | | | 3,657 | | | | 3,266 | |

| Gartner, Inc. 3.75% 10/1/20301 | | | 20,136 | | | | 18,093 | |

| GoDaddy Operating Co. 5.25% 12/1/20271 | | | 7,725 | | | | 7,525 | |

| GoDaddy Operating Co. 3.50% 3/1/20291 | | | 10,575 | | | | 9,153 | |

| Imola Merger Corp. 4.75% 5/15/20291 | | | 5,000 | | | | 4,479 | |

| J2 Global, Inc. 4.625% 10/15/20301 | | | 339 | | | | 293 | |

| MicroStrategy, Inc. 6.125% 6/15/20281 | | | 6,425 | | | | 5,710 | |

| MoneyGram International, Inc. 5.375% 8/1/20261 | | | 18,775 | | | | 18,839 | |

| NCR Corp. 5.125% 4/15/20291 | | | 35,955 | | | | 31,146 | |

| NCR Corp. 6.125% 9/1/20291 | | | 9,550 | | | | 9,428 | |

| Open Text Corp., Term Loan B, (3-month USD CME Term SOFR + 3.50%) 8.407% 1/31/20302,3 | | | 7,000 | | | | 6,989 | |

| Rocket Software, Inc. 6.50% 2/15/20291 | | | 9,075 | | | | 7,156 | |

| Synaptics, Inc. 4.00% 6/15/20291 | | | 5,225 | | | | 4,508 | |

| Tibco Software, Inc., Term Loan A, (3-month USD CME Term SOFR + 4.50%) 9.498% 9/29/20282,3 | | | 25,785 | | | | 23,432 | |

| UKG, Inc., Term Loan B, (3-month USD-LIBOR + 3.25%) 8.032% 5/4/20262,3 | | | 8,815 | | | | 8,601 | |

| UKG, Inc., Term Loan, (3-month USD-LIBOR + 5.25%) 10.032% 5/3/20272,3 | | | 26,300 | | | | 25,379 | |

| Unisys Corp. 6.875% 11/1/20271 | | | 19,140 | | | | 12,227 | |

| VeriSign, Inc. 5.25% 4/1/2025 | | | 3,068 | | | | 3,067 | |

| Viavi Solutions, Inc. 3.75% 10/1/20291 | | | 3,750 | | | | 3,211 | |

| Xerox Corp. 5.50% 8/15/20281 | | | 11,000 | | | | 9,532 | |

| | | | | | | | 732,381 | |

| | | | | | | | | |

| Consumer staples 4.11% | | | | | | | | |

| Albertsons Companies, Inc. 4.625% 1/15/20271 | | | 7,215 | | | | 6,985 | |

| Albertsons Companies, Inc. 3.50% 3/15/20291 | | | 68,823 | | | | 59,947 | |

| Albertsons Companies, Inc. 4.875% 2/15/20301 | | | 11,915 | | | | 11,134 | |

| B&G Foods, Inc. 5.25% 4/1/2025 | | | 26,687 | | | | 24,881 | |

| B&G Foods, Inc. 5.25% 9/15/2027 | | | 41,606 | | | | 35,718 | |

| | |

| 14 | American High-Income Trust |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Consumer staples (continued) | | | | | | | | |

| BJ’s Wholesale Club, Term Loan, (3-month USD CME Term SOFR + 2.75%) 7.448% 2/3/20272,3 | | USD | 4,985 | | | $ | 4,997 | |

| Central Garden & Pet Co. 4.125% 10/15/2030 | | | 14,556 | | | | 12,875 | |