UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

———————

ýANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2007

or

¨TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from: _____________ to _____________

———————

WEB2 CORP.

(Exact name of registrant as specified in its charter)

———————

| | |

Delaware | 000-29462 | 13-4127624 |

(State or Other Jurisdiction | (Commission | (I.R.S. Employer |

of Incorporation or Organization) | File Number) | Identification No.) |

100 West Lucerne Circle, Suite 601, Orlando, Florida 32801

(Address of Principal Executive Office) (Zip Code)

(407) 540-0452

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

———————

| | |

Securities registered pursuant to Section 12(b) of the Act: None |

| | |

Securities registered pursuant to Section 12(g) of the Act: |

| | |

Common Stock Par Value $.001 |

| (Title of Class) | |

———————

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.¨

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesý No¨

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-KSB or any amendment to this Form 10-KSB.ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Noý

State issuer’s revenues for its most recent fiscal year. $396,412

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold was approximately $358,475 based upon the average bid and asked price of $0.01 as reported by the OTC Bulletin Board as of May 14, 2008.

The Company had 90,772,414 shares of common stock outstanding as of May 14, 2008.

DOCUMENTS INCORPORATED BY REFERENCE

None

Transitional Small Business Disclosure Format (Check one): Yes¨ Noý

PRIVATE SECURITIES LITIGATION REFORM ACT SAFE HARBOR STATEMENT

When used in this Annual Report on Form 10-KSB, the words “may,” “will,” “expect,” “anticipate,” “continue,” “estimate,” “intend,” “plans,” and similar expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 regarding events, conditions and financial trends which may affect the Company's future plans of operations, business strategy, operating results and financial position. Such statements are not guarantees of future performance and are subject to risks and uncertainties and actual results may differ materially from those included within the forward-looking statements as a result of various factors. Such factors include, among others: (i) the Company’s ability to obtain additional sources of capital to fund continuing operations; i n the event it is unable to timely generate revenues (ii) the Company's ability to obtain additional patent protection for its technology; and (iii) other economic, competitive and governmental factors affecting the Company's operations, market, products and services. Additional factors are described in “Risk Factors” below and in the Company’s other public reports and filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publicly release the result of any revision of these forward-looking statements to reflect events or circumstances after the date they are made or to reflect the occurrence of unanticipated events.

ITEM 1. BUSINESS

Overview

Web2 Corp. designs, develops and sells technology products to its customers utilizing both products it has previously developed as well as products it develops or combines to meet customer specific requirements. Its current emphasis is to build technology for specific business entities to facilitate the ease in which the business entity can communicate and conduct transactions with specific groups of users and to facilitate the ability of those users to utilize the internet to communicate with and conduct transactions with the business entity. Web2 Corp. seeks to create and implement internet technology products which reduce the level of user technical skill required and which reduces the time and cost of the process.

The company is headquartered in Orlando, Florida. It is publicly traded on the OTCBB under the symbol WBTO.

Corporate History

We were originally organized as a Colorado corporation and our name was Medical Management Systems, Inc. in 1987. In August 2000, we reincorporated in Delaware and changed our name to Dominix, Inc.

In January 2001 we acquired International Controllers, Inc. (“ICON”). We became a shell corporation as a result of the sale of ICON in April 2002. On December 5, 2003, we completed the acquisition of Jade Entertainment Group, Inc. (“Jade”) by way of merger through the Company's wholly owned subsidiary, Jade Acquisition Corp. by issuing 743,750 shares of common stock and 82,167 shares of its Series B Convertible Preferred Stock, which was converted into 6,834,631 shares of our common stock on June 4, 2004, together representing 36% of the Company. This transaction wasaccounted for as a reverse merger with Jade the acquirer of the Company. The reverse merger was accounted for as a recapitalization and the stockholder's equity was retroactively restated to the inception of Jade, July 5, 2001. On March 30, 2004, Jade entered into a database license agreement with MarketShare Recovery, Inc.

On December 5, 2004, we acquired the database assets of Web1000.com. Pursuant to the Agreement, we acquired a website known as Web1000.com along with the customer list related to that website. The purchase price for the assets was $400,000. On July 12, 2005, we entered into a two-year management services agreement with Global Portals Online, Inc. (formerly known as Personal Portals Online, Inc.) (“Global Portals”), which we subsequently acquired. Under the agreement, Global Portals was given primary responsibility for the management, redesign and redevelopment of our web traffic operations and technology, finance and accounting in exchange for our issuing 200,000 shares of common stock to Global Portals and agreeing to pay a fee of 5% of our net monthly revenues.

On December 22, 2005, we completed the acquisition of Global Portals pursuant to an Agreement and Plan of Share Exchange dated as of December 1, 2005. At the effective time of the share exchange, all of the shares of Global Portals were exchanged for an aggregate of 11,442,446 shares of our common stock on the basis of 2.54 shares of Global Portals for one share of our common stock. The 11,442,446 shares of common stock issued to the Global Portals shareholders represent approximately 85% of our common stock outstanding after the exchange.

In July 2006, we changed our name to Web2 Corp. As a result of the foregoing, our operations are conducted by Web2 Corp., as the parent company, through various subsidiaries, including Global Portals.

When used herein the terms “Company,” “we,” “us” and “our” each refers to the combined business entity of Web2 Corp. and its subsidiaries, unless the context otherwise indicates.

Going Concern

Our financial statements have been prepared on a “going concern” basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Our independent auditor has expressed substantial doubt as to our ability to continue as a going concern. As shown in the financial statements, for the year ended December 31, 2007, we had net sales of $396,412, as compared to net sales of $527,043 for the year ended December 31, 2006. For the year ended December 31, 2007, we incurred a net loss of $3,060,855, as compared to a net loss of $2,617,973 for the year ended December 31, 2006.

At December 31, 2007, we had a stockholders’ deficit of $814,090. At December 31 2007, we had current assets of $4,484 and current liabilities of $1,131,275, resulting in a working capital deficit of $1,126,791.

3

Any shortfall in our cash flow requirements may be met through private placements of our common stock and incurring debt. No assurances can be given that financing will be available or be sufficient to meet our capital needs. During 2007, we were unable to secure any new equity investments of cash in the Company. If we are unable to generate profits or are unable to obtain financing to meet our working capital requirements, then we may be required to modify our operations, including curtailing our business significantly or ceasing operations altogether. The financial statements do not include any adjustments relating to the recoverability and classification of liabilities that might be necessary should we be unable to continue as a going concern. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis, to retain our current financ ing, to obtain additional financing, if necessary, and ultimately to become profitable. Should any of these events not occur, our financial statements will be adversely affected and our business may not survive.

Our Mission

Our mission is the innovative, rapid adaptation of Internet technologies to solve problems and simplify Internet usage. Our goal is to capitalize on the popular software applications that we have developed by reselling this technology in custom configurations to corporate clients and brand conglomerates with existing niche communities of users and achieve the following:

Target

market gaps and areas of frustration or friction in the marketplace

Simplify

reduce the level of product complexity and the required technical prowess of users

Leverage

the latest technology, imagination and common sense

Integrate

intuitive technologies, functions, features and benefits

Advance

leapfrog established incumbents, deliver desired products/services

Profit

sell products and services that people desire at a solid margin

We believe these provide a straightforward strategic guide for sustaining a strong competitive position.

Our Value to Corporate Clients and their Customers/Users

Web2 Corp. makes the Internet easier to use for a large group of non-technical people. We produce products to overcome the frustrations of average users promoting beneficial value as provided by our corporate client resellers.

Some of the key benefits we offer to our clients’ consumer users include:

Small Business Customers. Web2 Corp makes it easier for small businesses to use the internet. We do this by creating products that are straightforward and easy to use at a low price. Small business users face common problems and challenges that Web2 Corp. products are engineered to solve.

We reduce the technical proficiency required for conducting business on the Internet by packaging pre-engineered solutions that our customers may modify via simple controls to deliver professional results. We believe there is a substantial market of small business owners/operators that tend to have limited technical abilities and available technical resources. Creation of a basic website is beyond the capability of this audience. Few can produce a site with shopping and payment processing capabilities. Small business owners do not generally possess the requisite skills to utilize industry-standard tools to launch and maintain a well-designed site.

We reduce the time required to begin conducting business on the Internet by providing intuitive, easy-to-use tools and simple guided processes that enables immediate productivity. In order to embrace the web, small operators either enter a steep learning curve to learn the technology of the Internet, or they must engage third-party providers. The time to learn graphics design, web design, coding, security, integration of e-commerce payment processing, and web marketing is significant. Web2 Corp. eliminates this requirement to substantially shorten the time for a business to get online.

We produce a quality Internet presence with a variety of options that rival large custom-developed sites. The quality of traditional web development vendors is uneven and resultant product is often poorly designed, technically flawed, and weakly documented. Web2 Corp. provides fully functioning, professionally designed frameworks that are easy for customers to modify and customize to reflect their business. We provide a selection of sophisticated modules with advanced functions that customers can deploy, depending upon their needs, to engage their audience. The ability to maintain integrity of the site, including its look, feel and functionality are simplified and the power is placed in the hands of the business owner who can focus on content rather than coding, mechanics and layout.

4

We integrate marketing tools to help customers attract an online audience. Search engines drive a significant proportion of traffic to websites. In order to tap this resource a business must be proficient at optimizing its web pages to be listed at the top of relevant search results for keywords associated with its products or services. Search engines utilize algorithms that must be monitored and reverse-optimized on a constant basis. Violation of search engine rules can severely penalize a well-intentioned web marketer. Email is also a specialized field that must be mastered to yield results without running afoul of anti-spam rules. Affiliate programs are a powerful tool for creating networks of vendors for a product. These demand research, money and a dedicated devotion of time to generate results. Web2 Corp. integrates the fundamental tools of these promotional arts into its products and offer s advanced features to customers on a paid basis.

We offer timely products that keep our customers trend-right. Internet trends move very fast from early adopters to mainstream audiences. Web2 Corp. believes it can identify market trends early and rapidly develop improved products to present useful solutions to our customers. For non-technical operators, this is a valuable benefit that improves their competitive position on the Internet.

We provide online auction users a migration path to an e-commerce solution they can own at comparable cost. It is our belief that many users of popular online auction systems seek a more flexible, customizable method of conducting Internet commerce that they can own. Our systems enable the operator to tailor their online persona with fewer restrictions on what they can and cannot do to present their products and services. Users are able to directly market via targeted keyword purchases and optimization on search engines to bring prospective customers to their own websites as opposed to bringing them to the online auction site where numerous competitors are readily accessed by consumers.

General Internet Users. We provide tools that simplify the Web for Internet users of all demographic, geographic and social profiles. We do this by aggregating and consolidating a myriad of free services into logical tools that allow them to find relevant information, communicate with their peers, link to their community, generally express themselves to a broad audience, and conduct the transactions of their life.

We simplify web usage by bringing together commonly used tools in one place. It is our observation that most users utilize a fraction of the features provided by competing applications. Many competing products add a glut of features that only serve to complicate processes and frustrate users. Web2 Corp. targets this frustration by bringing the core functionality of multiple competing products into one place with one common set of controls to learn. We provide simpler versions of the most used applications in one easy-to-use product.

We focus on localization of the Internet to improve its relevance in our user’s everyday life. We believe there is a gap in productivity of the Internet as it applies to local markets. The Internet in its first iteration has served to connect the global community. Many products and services have evolved to more efficiently organize a global audience and global information, but few products have successfully levered Internet capabilities to address local markets where people conduct their lives, learning, transactions and communications. Web2 Corp. strives to address this audience by creating localized centers of aggregation and tools that invert the process of trying to locate information. Traditional online search, auctions and other listings try to accumulate the entirety of the universe of information and then let consumers sift it down to their “needle in a haystack.” We reverse the process and start with a local p ile of needles, expanding the scope of the search geographically to reach further into the world if the user so desires. This eliminates the “20 out of 2,347,986 results” that current processes produce which makes us faster and more relevant for the majority of users.

We migrate emerging online services and products from the U.S. to other geographical markets in their local languages. We intend to adapt proven products to meet the social and language needs of these large audiences. This rapid follow-on strategy gives the latest products to online customers in foreign markets and secures an early market position for Web2 Corp.

Corporations and Specialized Organizations. The Internet changes everything for companies, charities, political parties and other cultural organizations. These groups face incremental new challenges in communicating with their customers and constituents in the Internet 2.0 world. Increasingly the online population has a substantial amount of information at their fingertips. They can assess situations, opportunities, products and services for themselves as opposed to relying on “experts” that provided such insight in the past. Companies that fail to acknowledge the new real-time realities of the Internet do so at their own risk. Blogs, online social communities, and negative websites can accelerate dispersion and expansion of sensitive information, irrespective of factual accuracy, to a global audience. Web2 Corp. services this customer base by providing easily implemented, cost effective solutions to actively harness the new community of online consumers.

We provide a new set of tools for companies and organizations to actively embrace their constituents. Proactive companies and groups seek tools such as those offered by Web2 Corp. to try to channel and capitalize on both good and bad communications with customers, supporters, and the public at-large. Each customer touch point is an opportunity to expand sales and the depth of customer relationships. The best run companies utilize this new capability of real-time customer relationships as a competitive advantage to stay abreast of the market and their product position therein.

5

These products address any opportunity where groups of people aggregate around common interests. Golf, motorcycles, crafts, charities, political candidates, political issues and a universe of other special interest opportunities exist where a client has already begun to build the audience. Web2 Corp. products simply deepen the level of audience interaction.

Products and Services

Our product development philosophy is built upon rapid and continuous innovation, with frequent releases of early stage products that we seek to improve with every iteration of the development cycle. Our current principal products and services are described below.

Products (“Modules” used individually or in combination to create a Client product)

Social Network Community Module(like: MySpace, Facebook)

Features:

- Fully-featured social network—friends, comments, communication, community and more, all in one package

Friends:

- Find and meet new friends with our Friend Finder tool

- Online Dating optional functionality with picture ratings (HotOrNot), personality profiling, etc.

SocialHub:

- Create and manage interest groups, schedule events, and communicate easily.

- Chat and instant message your friends

Comments and Communications:

- Internal e-mail, instant messaging, shoutbox, comments, and ratings on the Social Network Community Module allows for a complete communication package.

- Dynamic AJAX shoutbox updates live to show all of your visitors what's being discussed on your site right now.

- Users can set their profile to pull e-mails from their Yahoo, Gmail, Hotmail, AOL, and many other e-mail applications in one place, organizing their online communications on your site!

- Online classified listing services lets your community trade or sell items to each other in a trusted environment.

- Complete blogging platform included.

Community:

- Support for thousands of users online simultaneously with the default hosting package gives your site plenty of room to grow.

- Make groups, message boards, forums, events, personal calendars, invitations, and more.

- Search the entire community for groups, people, and events.

- All the features of popular social networks rolled into one powerful site that can be up and running, making it easy for your target audience to meet and form a community instantly.

Video Community Module (like: YouTube, MetaCafe)

Features:

- Rate video, post comments, add to user favorites, or flag video as “featured” or “inappropriate”.

- Upload videos in .avi, .mpeg, .mov, .wmf, or many other video formats

- Adult content flag that requires user verification before continuing.

- META tags

- User groups and private user messaging system

- Member user stats

- Subscription to channels or users

- Every video gets an automatic permalink unique URL

Built-in Audio Community Module: Listen to streaming audio uploads with all of the social networking features of the Video Community Module built in—at no extra cost.

6

Free E-Mail Module (like: Gmail, Hotmail)

Features:

- Multilingual capability (ANSI character set)

- MIME and HTML e-mail

- Attachments, forwarding, address book—all the functionality users are accustomed to from a webmail service.

- Rich Text composing

- Message filters and rules

- Completely customizable interface

Free Website Module (like: Freewebs, Geocities)

Features:

- Customized Do-it-Yourself Website Builder

- Own subdomain

- Search Engine Submission

- Professional 24 x 7 Hosting

- Directory Listing

- Information Design Help Center

- Pre-selected Tools, Forms and Templates

Shopping Cart Module(like: Amazon, EcommerceTemplate.com)

Features:

- Inventory tracking with back order

- Unlimited categories and subcategories

- Automated drop shipping capability

- Integrated shipment tracking

- Product coupons and store-wide discounts

- Related products for cross-selling

- Wish lists

- Cart thumbnails with attribute

- Coupon code tracking

- Search page filters

- Clearance pricing

- Merchant-defined bundles

- Customer service representative order form

Auction Platform Bundle(like: Ebay, Woot.com)

Features:

- Reserve price

- Buy it Now

- Standard, Lot & Dutch auctions

- Item & Auction watch

- Fixed-price sales (gift certificates, etc)

- Support for unlimited numbers of auctions simultaneously

- Embed images into auctions

- Complete admin panel allows administration across different auction sites with one master login

- Easy & customizable user registration

- Bid Retraction

- PayPal Integration

7

Photo Communities Module(like: Flickr, Kodakonline)

Features:

- Re-arrangement of pictures in categories and albums

- Upload pictures with web interface or ftp (and admin can batch-add to database)

- Full multimedia support

- Automatic creation of thumbnails and intermediate size pics

- Search feature, last added, random picture

- User management (private galleries, groups)

- Caption, title, description and user defined fields for each picture (searchable)

- User comments on pictures

- E-card feature

- Slide show viewer

- Template system for customized photo galleries

- User membership in multiple groups

- Upload approval notice for admin

- EXIF/IPTC support

- Image rotation

- Multi-pic upload

- Password-protected albums

- Picture-resize on upload

- Advanced search (boolean operators)

Advertising and Affiliate Network Module(like: Google AdWords, Overture, Commission Junction, DoubleClick)

Features:

-Powerful and simple: easy ad prioritization, click tracking, statistics, and report generation

- Integrated with Google Adsense and Yahoo! Publisher Network

- Click tracking with transparent pixel GIF's and Flash ads

- Easy targeting by site, keyword, or IP address

- In-depth flexible reporting, automatically generated at pre-set times

- Track visitor behavior from click-through to transaction finish

- Flexible, scalable, dynamically changeable advertising programs

Blog Community Module (like: Blogger, Wordpress)

Features:

-Quick and easy registration to comment or start a blog.

- Infinitely customizable. Select from hundreds of templates or design your own!

- Tag posts with META information to make it easier for users to find posts.

- Stat tracking: see who's reading what blogs.

- Spell check option on all blog posts.

- Preview available to make sure that posts look right when they're published.

- Autosave feature to keep users from losing their work

- Embed photos and videos

- Integrated powerful blog comment spam protection from Akismet, the industry leader.

- Privacy options to limit who may read blog posts

- Complete admin tools allows for easy administration of all blogs.

Online Classifieds Module (like: Craigslist)

Features:

-Price setting for different types of classifieds—charge for real estate but not for job postings (or any other category you'd like)

- Personal User account pages to let users keep track of posted ads

- Easy user registration

- User E-mail Notifications—set the classified program to notify users when a particular item is posted on the board.

- Attach photos or video to your ads!

- Admin messaging system—get the word out to users quickly

- Limit listings by geographic area.

8

Private Labeled SearchModule (like: Google, Yahoo, MSN)

Features:

- Fully-featured search module, complete with: Crawler, Link-graph database, HTML, .doc, .pdf, .ppt, .rss, .mp3 and .zip parser

- Supports quotes, nested, wildcard, truncated, and some boolean searches.

- Customize your relevance algorithm to help pull the best results for your searches.

- If you have a large body of information that you need indexed, the Private Labeled Search

- - Module is a quick and easy way to make all that information available to your users.

Existing Commercial Web Portals Owned and Operated by Web2 Corp

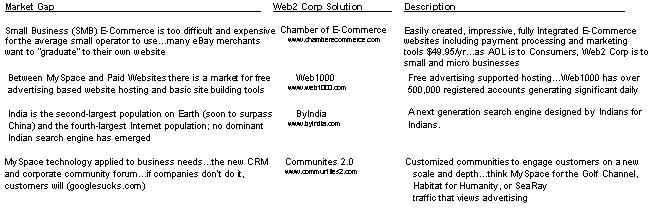

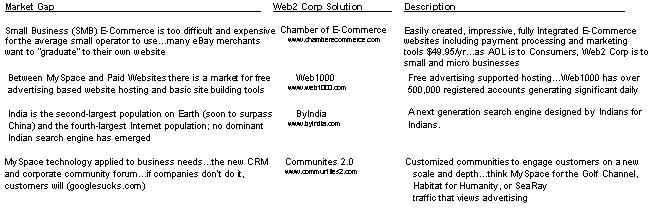

Due to a loss of funding source in 2007, Web2 Corp. revised its business strategy to have an emphasis on building technology for a customer specific requirement. With this change in the business came a fundamental change in our financial and staffing needs. Instead of managing the risk associated with larger investments when developing, marketing, branding, and operating consumer portals, which are very costly to distribute/operate, we reduced our exposure in a conservative manner by offering our innovative software solutions (modules) to corporate clients from whom we can generate income directly. With this transition, came the decision to operate the companies existing web portals at a reduced capacity until they can be sold or partnered. Web2 Corp. has four key products that is still believes are well positioned for success due to known market gaps and are operated in a limited capacity as they are for sale or available for partnering.

Systems Technology

Our business relies on our software and hardware infrastructure, which provides substantial computing resources at low cost. We currently use a combination of off-the-shelf and custom software running on clusters of commodity computers. Our considerable investment in developing this infrastructure has produced several key benefits. It simplifies the storage and processing of large amounts of data, eases the deployment and operation of large-scale global products and services and automates much of the administration of large-scale clusters of computers.

Although most of this infrastructure is not directly visible to our users, we believe it is important for providing a high-quality user experience. We regularly evaluate new hardware alternatives and software techniques and network locations can help to further reduce our operational costs.

Sales and Support

We utilize direct sales, direct response media and third-party channels to promote and sell products to corporate clients. Sales processing channels for these products include Internet orders through multiple owned sites under various brands and operations via a contracted service provider.

Our global support organization, live-websupport.com, provides customer service for all Web2 Corp products. We strive to build products with intuitive user experiences and reliability to reduce customer service and support traffic by design. When the customer still has support needs they have self-help, email, Instant Message, and phone support available in resolving their difficulty.

9

Marketing

Our early marketing efforts focus on creating direct outreach to clients which are identified as “technology needy”, submitting bids and proposals in various publications/sites online and using public relations efforts to accelerate it. Over time we will migrate to broader traditional media to create broad-based client awareness.

Competition

We face well positioned competition in every aspect of our business, and particularly from other companies that seek to connect people with information on the web and provide them with relevant advertising. Currently, we consider our primary competitors to be Google, Microsoft and Yahoo as providers and aggregators of “web services”; however, we are unaware of any one company which provides a majority of the popular web elements in module format to major national companies and/or brands.

We also face competition from other web search providers, including companies that are not yet known to us. We compete with Internet advertising companies, particularly in the areas of pay-for-performance and keyword-targeted Internet advertising. We may compete with companies that sell products and services online because these companies, like us, are trying to attract users to their web products and services. In addition to Internet companies, we face competition from companies that offer traditional media advertising opportunities.

We compete to attract and retain relationships with users, advertisers and web sites. The bases on which we compete differ among the groups.

Users. We compete to attract and retain users of our website builder, search and community products and services. Many of the products and services we offer to users are free. For those that are fee based, we intend to pursue a price leadership strategy to disrupt the value delivered by incumbent competitors to customers. In all cases we target underserved customers, identified pools of Internet user frustration, or opportunities to expand the addressable market for a product category by simplifying and reducing product cost to users.

Advertisers. We compete to attract and retain advertisers. We compete in this area principally on the basis of the return on investment realized by advertisers using our advertising inventory, particularly targeting the underserved local business, or targeted Indian population. We also compete based on the quality of customer service, features and product ease of use.

Website Owners. We compete to attract and retain website owners that utilize our products to build their online presence. We compete by delivering superior ease of use, better resulting sites, and disruptive pricing for value delivered.

We believe that we compete favorably on the factors described above. However, our industry is evolving rapidly and is becoming increasingly competitive. Larger, more established companies than us are increasingly focusing on businesses that directly compete with us.

Intellectual Property

We rely on a combination of trademark, copyright and trade secret laws in the U.S. and other jurisdictions as well as confidentiality procedures and contractual provisions to protect our proprietary technology and our brand. We also enter into confidentiality and invention assignment agreements with our employees and consultants and confidentiality agreements with other third parties, and we rigorously control access to proprietary technology.

Web2 Corp., Chamber of E-Commerce, and ByIndia are trademarks under application in the U.S. Our unregistered trademarks include: Web1000, SickSpot, HotHomePages (protected under common law through first use in commerce since 2000), MyDigitalSpot, WebsiteSuperstore, WebsiteOwner, TemplateSuperstore, and ZeroBrand.

Circumstances outside our control could pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in every country in which our products and services are distributed. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time consuming. Any increase in the unauthorized use of our intellectual property could make it more expensive to do business and harm our operating results.

10

Companies in the Internet, technology and media industries own large numbers of patents, copyrights and trademarks and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition, the possibility of intellectual property claims against us grows. Our technologies may not be able to withstand any third-party claims or rights against their use.

Government Regulation

We are subject to a number of foreign and domestic laws that affect companies conducting business on the Internet. In addition, because of the increasing popularity of the Internet and the growth of online services, laws relating to user privacy, freedom of expression, content, advertising, information security and intellectual property rights are being debated and considered for adoption by many countries throughout the world.

In the U.S., laws relating to the liability of providers of online services for activities of their users are currently being tested by a number of claims, which include actions for defamation, libel, invasion of privacy and other data protection claims, tort, unlawful activity, copyright or trademark infringement, or other theories based on the nature and content of the materials searched and the ads posted or the content generated by users. Likewise, other federal laws could have an impact on our business. For example, the Digital Millennium Copyright Act has provisions that limit, but do not eliminate, our liability for listing or linking to third-party web sites that include materials that infringe copyrights or other rights, so long as we comply with the statutory requirements of this act. The Children’s Online Protection Act and the Children’s Online Privacy Protection Act restrict the distribution of materials considered harmful to children and i mpose additional restrictions on the ability of online services to collect information from minors. In addition, the Protection of Children from Sexual Predators Act of 1998 requires online service providers to report evidence of violations of federal child pornography laws under certain circumstances.

In addition, the application of existing laws regulating or requiring licenses for certain businesses of our advertisers, including, for example, distribution of pharmaceuticals, adult content, financial services, alcohol or firearms, can be unclear. Application of these laws in an unanticipated manner could expose us to substantial liability and restrict our ability to deliver services to our users. For example, some French courts have interpreted French trademark laws in ways that would, if upheld, limit the ability of competitors to advertise on generic keywords.

We also face risks from legislation that could be passed in the future.

We also face risks due to failure to enforce or legislate, particularly in the area of network neutrality, where governments might fail to protect the Internet’s basic neutrality as to the services and sites that users can access through the network. Such a failure could limit our ability to innovate and deliver new features and services, which could harm our business.

We are also subject to international laws associated with data protection in Europe and elsewhere, and the interpretation and application of data protection laws is still uncertain and in flux. In addition, because our services are accessible worldwide, foreign jurisdictions may claim that we are required to comply with their laws.

Culture and Employees

We take great pride in our company culture and embrace it as one of our fundamental strengths. We remain steadfast in our commitment to constantly improve the technology we offer to our users and advertisers and to our website owners. We have assembled what we believe is a highly talented group of employees and dedicated contractors. Our culture encourages the iteration of ideas to address complex technical challenges. In addition, we embrace individual thinking and creativity.

We constantly seek to maintain a small-company feel that promotes interaction and the exchange of ideas among employees. We try to minimize corporate hierarchy to facilitate meaningful communication among employees at all levels and across departments, and we have developed software to help us in this effort. We believe that considering multiple viewpoints is critical to developing effective solutions, and we attempt to build consensus in making decisions. While teamwork is one of our core values, we also significantly reward individual accomplishments that contribute to our overall success. As we grow, we expect to continue to provide compensation structures that are more similar to those offered by start-ups than established companies. We will focus on very significant rewards for individuals and teams that build amazing things that provide significant value to us and our users.

At April 11, 2008, we had three employees and four independent contractors performing services for us.

11

RISK FACTORS

Risks Related to Our Business and Industry

We have a history of losses and we may not become profitable.

For the year ended December 31, 2007, we had net sales of $396,412, as compared to net sales of $527,043 for the year ended December 31, 2006. For the year ended December 31, 2007, we incurred a net loss of $3,060,855, as compared to a net loss of $2,617,973 for the year ended December 31, 2006. At December 31, 2007, we had a stockholders’ deficit of $814,090 and a working capital deficit of $1,126,791. We expect to sustain a loss for 2008.

As a result, we will need to generate significant additional sales in order to become and maintain profitability. We cannot assure our shareholders that we will achieve significant additional sales, or that we will be profitable and, if so, that we can sustain profitability into the future. It is possible that we may encounter unexpected expenses. We need to obtain additional working capital. There can be no assurance that we will be able to successfully complete any such financing arrangements or that the amounts raised would meet our cash flow needs. We cannot assure our shareholders that additional capital will be available to us in the future on favorable terms, or at all. If adequate funds are not available or are not available on acceptable terms, our ability to fund our business activities essential to operate profitably would be significantly limited.

Our available cash is limited. We may need to raise additional capital.

At December 31, 2007, we had a stockholders’ deficit of $814,090. At December 31 2007, we had current assets of $4,484 and current liabilities of $1,131,275, resulting in a working capital deficit of $1,126,791. It is not likely that we will generate sufficient operating capital through operations to meet our debt service requirements and to maintain our business at its present level. If we fail for any reason to repay any of our loans on a timely basis, then we may have to curtail our business sharply or cease our operations altogether.

Similarly, there can be no assurance that sales will continue to increase or even maintain current levels. We will need to obtain capital through equity and/or debt financing. If additional funds are obtained by issuing equity securities and/or debt securities convertible into equity, dilution to existing shareholders will result, and future investors may be granted rights superior to those of existing shareholders. There can be no assurances, however, that additional financing will be available when needed, or if available, on acceptable terms. There are no current agreements, arrangements, or understandings for any equity and/or debt financing. The failure of the Company to obtain any such financing as required or otherwise desired will have a material adverse effect upon the Company, its business and operations.

Our financial statements are subject to a “going concern” qualification.

Our financial statements appearing elsewhere in this report have been prepared on a going concern basis that contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. Management realizes that we must generate capital and revenue resources to enable us to return to profitable operations. The realization of assets and satisfaction of liabilities in the normal course of business is dependent upon our making additional sales and ultimately returning to profitable operations. No assurances can be made that we will be successful in these activities. Should any of these events not occur, our financial statements will be materially and adversely affected.

We face significant competition from Microsoft, Google, Yahoo and other companies.

We face formidable competition in every aspect of our business, and particularly from other companies that seek to connect people with information on the web and provide them with relevant advertising. Currently, we consider our primary competitors to be Microsoft Corporation, Google, Inc. and Yahoo! Inc. Microsoft has announced plans to develop features that make web search a more integrated part of its Windows operating system or other desktop software products. We expect that Microsoft will increasingly use its financial and engineering resources to compete with us. All of these competitors have more employees than we do. All have significantly more cash resources than we do. These companies also have longer operating histories and more established relationships with customers and end users. They can use their experience and resources against us in a variety of competitive ways, including by making acquisitions, investing more aggressiv ely in research and development and competing more aggressively for advertisers and web sites. They also may have a greater ability to attract and retain users than we do because they operate Internet portals with a broad range of content products and services. If they are successful in providing similar or better products compared to ours or leverage their platforms or products to make their products and services easier to access than ours, we could experience a significant decline in user traffic. Any such decline in traffic could negatively affect our revenues.

12

We face competition from other Internet companies, including web search providers, Internet access providers, Internet advertising companies and destination web sites that may also bundle their services with Internet access.

In addition to Microsoft, Google and Yahoo, we face competition from other web search providers, including companies that are not yet known to us. We compete with Internet advertising companies, particularly in the areas of pay-for-performance and keyword-targeted Internet advertising. Also, we may compete with companies that sell products and services online because these companies, like us, are trying to attract users to an array of commercial products and services.

We also compete with destination web sites that seek to increase their product and revenue base. These destination web sites may include those operated by Internet access providers, such as cable and DSL service providers. Because our users need to access our services through Internet access providers, they have direct relationships with these providers. If an access provider or a computer or computing device manufacturer offers online services that compete with ours, the user may find it more convenient to use the services of the access provider or manufacturer. In addition, the access provider or manufacturer may make it hard to access our services by not listing them in the access provider’s or manufacturer’s own menu of offerings, or may charge users to access our websites or the websites of our customers. Also, because the access provider gathers information from the user in connection with the establishment of a billing relationship, t he access provider may be more effective than we are in tailoring services and advertisements to the specific tastes of the user.

There has been a trend toward industry consolidation among our competitors, and so smaller competitors today may become larger competitors in the future. If our competitors are more successful than we are at generating a customer base, our revenues may decline.

We face competition from traditional media companies, and we may not be included in the advertising budgets of large advertisers, which could harm our operating results.

In addition to Internet companies, we face competition from companies that offer traditional media advertising opportunities. Most large advertisers have set advertising budgets, a very small portion of which is allocated to Internet advertising. We expect that large advertisers will continue to focus most of their advertising efforts on traditional media. If we fail to convince these companies to spend a portion of their advertising budgets with us, or if our existing advertisers reduce the amount they spend on our programs, our operating results would be harmed.

Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our operating results may fluctuate as a result of a number of factors, many of which are outside of our control. For these reasons, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly and annual expenses as a percentage of our revenues may be significantly different from our historical or projected rates. Our operating results in future quarters may fall below expectations. Any of these events could cause our stock price to fall. Each of the risk factors listed and the following factors, may affect our operating results:

Our ability to continue to attract users to ours / client’s web sites and products.

Our ability to monetize or generate revenue from through our product offerings.

Our ability to attract advertisers to ours / client’s web sites and products.

The mix in our revenues between our various products and services.

The amount and timing of operating costs and capital expenditures related to the maintenance and expansion of our businesses, operations and infrastructure.

Our focus on long term goals over short term results.

The results of our investments in risky projects.

Payments made in connection with the resolution of litigation matters.

General economic conditions and those economic conditions specific to the Internet and Internet advertising.

13

Our ability to keep our web sites operational at a reasonable cost and without service interruptions.

Our ability to forecast revenue from agreements under which we guarantee minimum payments.

Geopolitical events such as war, threat of war or terrorist actions.

Because our business is changing and evolving, our historical operating results may not be useful to you in predicting our future operating results. In addition, advertising spending has historically been cyclical in nature, reflecting overall economic conditions as well as budgeting and buying patterns. For example, in 1999, advertisers spent heavily on Internet advertising. This was followed by a lengthy downturn in ad spending on the web. Also, user traffic tends to be seasonal. Our rapid growth may mask the cyclicality and seasonality of our business. As our growth rate has slows, the cyclicality and seasonality in our business may become more pronounced and may cause our operating results to fluctuate.

If we do not continue to innovate and provide products and services that are useful to users, we may not remain competitive, and our revenues and operating results could suffer.

Our success depends on providing products and services that people use for a high quality Internet experience. Our competitors are constantly developing innovations in web search, online advertising and providing information to people. As a result, we must continue to invest significant resources in research and development in order to enhance our web search technology and our existing products and services and introduce new high-quality products and services that people can easily and effectively use. If we are unable to ensure that our users and customers have a high quality experience with our products and services, then they may become dissatisfied and move to competitors’ products and services. In addition, if we are unable to predict user preferences or industry changes, or if we are unable to modify our products and services on a timely basis, we may lose users, advertisers and website builder customers. Our operating results would a lso suffer if our innovations are not responsive to the needs of our users, advertisers and website builder customers are not appropriately timed with market opportunity or are not effectively brought to market. As search technology continues to develop, our competitors may be able to offer products that are, or that are perceived to be, substantially similar or better than those offered by Web2. This may force us to compete in different ways with our competitors and to expend significant resources in order to remain competitive.

Our business and operations may experience rapid growth. If we fail to effectively manage our growth, our business and operating results could be harmed and we may have to incur significant expenditures to address the additional operational and control requirements of this growth.

We may experience rapid growth in our headcount and operations, which has placed, and will continue to place, significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, the quality of our products and services could suffer, which could negatively affect our brand and operating results. Our expansion and growth in international markets heightens these risks as a result of the particular challenges of supporting a rapidly growing business in an environment of multiple languages, cultures, customs, legal systems, alternative dispute systems, regulatory systems and commercial infrastructures. To effectively manage this growth, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. These systems enhancements and improvements will require significant capital expenditures and allocation of valuable management resou rces. If the improvements are not implemented successfully, our ability to manage our growth will be impaired and we may have to make significant additional expenditures to address these issues, which could harm our financial position. The required improvements include:

Enhancing our information and communication systems to ensure that our offices around the world are well coordinated and that we can effectively communicate with our growing base of users, advertisers and business products customers.

Enhancing systems of internal controls to ensure timely and accurate reporting of all of our operations.

Ensuring enhancements to our systems of internal controls are scalable to our anticipated growth in headcount and operations.

Standardizing systems of internal controls and ensuring they are consistently applied at each of our operations around the world.

Improving our information technology infrastructure to maintain the effectiveness of our marketing, sales and customer fulfillment functions.

14

Proprietary document formats may limit the effectiveness of our search technology by preventing our technology from accessing the content of documents in such formats which could limit the effectiveness of our products and services.

A large amount of information on the Internet is provided in proprietary document formats such as Microsoft Word. The providers of the software application used to create these documents could engineer the document format to prevent or interfere with our ability to access the document contents with our search technology. This would mean that the document contents would not be included in our search results even if the contents were directly relevant to a search. These types of activities could assist our competitors or diminish the value of our search results. The software providers may also seek to require us to pay them royalties in exchange for giving us the ability to search documents in their format. If the software provider also competes with us in the search business, they may give their search technology a preferential ability to search documents in their proprietary format. Any of these results could harm our brand and our operating results.

New technologies could block our ads, which would harm our business.

Technologies may be developed that can block the display of our ads. Much of our revenue is derived from fees paid to us by advertisers in connection with the display of ads on web pages. As a result, ad-blocking technology could, in the future, adversely affect our operating results.

Our corporate culture has contributed to our success, and if we cannot maintain this culture as we grow, we could lose the innovation, creativity and teamwork fostered by our culture, and our business may be harmed.

We believe that a critical contributor to our success has been our corporate culture, which we believe fosters innovation, creativity and teamwork. As our organization grows, and we are required to implement more complex organizational management structures, we may find it increasingly difficult to maintain the beneficial aspects of our entrepreneurial culture. This could negatively impact our future success. In addition, equity ownership in our company may create disparities in wealth among employees, which may adversely impact relations among employees and our corporate culture in general.

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products, services and brand.

Our trademarks, trade secrets, copyrights and all of our other intellectual property rights are important assets for us. There are events that are outside of our control that pose a threat to our intellectual property rights as well as to our products and services. For example, effective intellectual property protection may not be available in every country in which our products and services are distributed or made available through the Internet. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time consuming. Any increase in the unauthorized use of our intellectual property could make it more expensive to do business and harm our operating results.

Although we may seek to obtain patent protection for our innovations, it is possible we may not be able to protect some of these innovations. In addition, given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important. Furthermore, there is always the possibility, despite our efforts, that the scope of the protection gained will be insufficient or that an issued patent may be deemed invalid or unenforceable. Finally, third parties increasingly have and will continue to allege that our products and services infringe their patent rights.

We also face risks associated with our trademarks. Third parties may infringe on our trademarks and frequently enter into litigation based on allegations of infringement or other violations of trademark rights. As we face increasing competition and become increasingly high profile, the possibility of intellectual property rights claims against us grows. Our trademarks may not be able to withstand any third-party claims or rights against their use. Any intellectual property claims, with or without merit, could be time-consuming, expensive to litigate or settle and could divert resources and attention. An adverse determination also could prevent us from offering our products and services to customers under identities we have carefully fostered and may require that we procure substitute trademarks for our businesses at great expense.

We are, and may in the future be, subject to intellectual property rights claims, which are costly to defend, could require us to pay damages and could limit our ability to use certain technologies in the future.

15

Companies in the Internet, technology and media industries own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition and become increasingly high profile, the possibility of intellectual property rights claims against us grows. Our technologies may not be able to withstand any third-party claims or rights against their use. Any intellectual property claims, with or without merit, could be time-consuming, expensive to litigate or settle and could divert resources and attention. An adverse determination also could prevent us from offering our products and services to others and may require that we procure substitute products or services for these members.

With respect to any intellectual property rights claim, we may have to pay damages or discontinue the practices found to be in violation of a third party’s rights. We may have to seek a license to continue such practices, which may not be available on reasonable terms and may significantly increase our operating expenses. A license to continue such practices may not be available to us at all. As a result, we may also be required to develop alternative non-infringing technology or practices or discontinue the practices. The development of alternative non-infringing technology or practices could require significant effort and expense. If we cannot obtain a license to continue such practices or develop alternative technology or practices for the infringing aspects of our business, we may be forced to limit our product and service offerings and may be unable to compete effectively. Any of these results could harm our brand and opera ting results.

From time to time, we receive notice letters from patent holders alleging that certain of our products and services infringe their patent rights. Some of these may result in litigation against us. Companies may also file trademark infringement and related claims against us over the display of ads in response to user queries that include trademark terms.

Our business may be adversely affected by malicious third-party applications that interfere with, or exploit security flaws in, our products and services.

Our business may be adversely affected by malicious applications that make changes to our users’ computers and interferes with our product experiences. These applications may attempt, to change our users’ Internet experience, including hijacking queries to our sites, altering or replacing search results, or otherwise interfering with our ability to connect with our users. The interference often occurs without disclosure to or consent from users, resulting in a negative experience that users may associate with our brands. These applications may be difficult or impossible to uninstall or disable, may reinstall themselves and may circumvent other applications’ efforts to block or remove them. In addition, we offer a number of products and services that our users download to their computers or that they rely on to store information and transmit information to others over the Internet. These products and services are subject to a ttack by viruses, worms and other malicious software programs, which could jeopardize the security of information stored in a user’s computer or in our computer systems and networks. The ability to reach users and provide them with a superior experience is critical to our success. If our efforts to combat these malicious applications are unsuccessful, or if our products and services have actual or perceived vulnerabilities, our reputation may be harmed and our user traffic could decline, which would damage our business.

Index spammers could harm the integrity of our web search results, which could damage our reputation and cause our users to be dissatisfied with our products and services.

There is an ongoing and increasing effort by “index spammers” to develop ways to manipulate our web search results. For example, because our web search technology ranks a web page’s relevance based in part on the importance of the web sites that link to it, people have attempted to link a group of web sites together to manipulate web search results. We take this problem very seriously because providing relevant information to users is critical to our success. If our efforts to combat these and other types of index spamming are unsuccessful, our reputation for delivering relevant information could be diminished. This could result in a decline in user traffic, which would damage our business.

Privacy concerns relating to our technology could damage our reputation and deter current and potential users from using our products and services.

From time to time, concerns may be expressed about whether our products and services compromise the privacy of users and others. Concerns about our practices with regard to the collection, use, disclosure or security of personal information or other privacy-related matters, even if unfounded, could damage our reputation and operating results. While we strive to comply with all applicable data protection laws and regulations, as well as our own posted privacy policies, any failure or perceived failure to comply may result in proceedings or actions against us by government entities or others, which could potentially have an adverse affect on our business. Laws related to data protection continue to evolve. It is possible that certain jurisdictions may enact laws or regulations that impact our ability to offer our products and services in those jurisdictions, which could harm our business.

16

Our business is subject to a variety of U.S. and foreign laws that could subject us to claims or other remedies based on the nature and content of the information searched or displayed by our products and services, and could limit our ability to provide information regarding regulated industries and products.

The laws relating to the liability of providers of online services for activities of their users are currently unsettled both within the U.S. and abroad. It is possible that we could be held liable for misinformation provided over the web when that information appears in our web search results. If one of these complaints results in liability to us, it could be potentially costly, encourage similar lawsuits, distract management and harm our reputation and possibly our business. In addition, increased attention focused on these issues and legislative proposals could harm our reputation or otherwise affect the growth of our business.

The application to us of existing laws regulating or requiring licenses for certain businesses of our advertisers, including, for example, distribution of pharmaceuticals, adult content, financial services, alcohol or firearms, can be unclear. Existing or new legislation could expose us to substantial liability, restrict our ability to deliver services to our users, limit our ability to grow and cause us to incur significant expenses in order to comply with such laws and regulations.

Several other federal laws could have an impact on our business. Compliance with these laws and regulations is complex and may impose significant additional costs on us. For example, the Digital Millennium Copyright Act has provisions that limit, but do not eliminate, our liability for listing or linking to third-party web sites that include materials that infringe copyrights or other rights, so long as we comply with the statutory requirements of this act. The Children’s Online Protection Act and the Children’s Online Privacy Protection Act restrict the distribution of materials considered harmful to children and impose additional restrictions on the ability of online services to collect information from minors. In addition, the Protection of Children from Sexual Predators Act of 1998 requires online service providers to report evidence of violations of federal child pornography laws under certain circumstances. Any failure on our part to comply with these regulations may subject us to additional liabilities.

We also face risks associated with international data protection. The interpretation and application of data protection laws in Europe and elsewhere are still uncertain and in flux. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with our data practices. If so, in addition to the possibility of fines, this could result in an order requiring that we change our data practices, which in turn could have a material effect on our business.

We also face risks from legislation that could be passed in the future.

We also face risks due to failure to enforce or legislate, particularly in the area of network neutrality, where governments might fail to protect the Internet’s basic neutrality as to the services and sites that users can access through the network. Such a failure could limit Web2 Corp.’s ability to innovate and deliver new features and services, which could harm our business.

If we were to lose the services of our senior management team, we may not be able to execute our business strategy.

Our future success depends in a large part upon the continued service of key members of our senior management team. In particular, our Chairman and Chief Executive Officer, William A. Mobley, Jr., and our President and Chief Operating Officer, Andre L. Forde, are critical to the overall management of Web2 Corp., as well as the development of our technology, our culture and our strategic direction. All of our executive officers and key employees are at-will employees, and we do not maintain any key-person life insurance policies. The loss of any of our management or key personnel could seriously harm our business.

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our performance is largely dependent on the talents and efforts of highly skilled individuals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Competition in our industry for qualified employees is intense, and we are aware that certain of our competitors have directly targeted our employees. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees.

As we grow, our hiring process may prevent us from hiring the personnel we need in a timely manner. In addition, as we become a more mature company, we may find our recruiting efforts more challenging. The incentives to attract, retain and motivate employees provided by our option grants may not be as effective as in the past and our current and future compensation arrangements, which include cash bonuses, may not be successful in attracting new employees and retaining and motivating our existing employees. If we do not succeed in attracting excellent personnel or retaining or motivating existing personnel, we may be unable to grow effectively.

17

We have a short operating history and a relatively new business model in an emerging and rapidly evolving market. This makes it difficult to evaluate our future prospects and may increase the risk that we will not continue to be successful.

We have very little operating history for you to evaluate in assessing our future prospects. Also, we derive nearly all of our revenues from online advertising website building products, and sale of other Internet services, which are immature industries that have undergone rapid and dramatic changes in its short history. You must consider our business and prospects in light of the risks and difficulties we will encounter as an early-stage company in a new and rapidly evolving market. We may not be able to successfully address these risks and difficulties, which could materially harm our business and operating results.

We may have difficulty scaling and adapting our existing architecture to accommodate increased traffic and technology advances or changing business requirements, which could lead to the loss of users, advertisers and business product customers, and cause us to incur expenses to make architectural changes.

To be successful, our network infrastructure has to perform well and be reliable. The greater the user traffic and the greater the complexity of our products and services, the more computing power we will need. We expect spending to continue as we purchase or lease data centers and equipment and upgrade our technology and network infrastructure to handle increased traffic on our web sites and to roll out new products and services. This expansion is expensive and complex and could result in inefficiencies or operational failures. If we do not implement this expansion successfully, or if we experience inefficiencies and operational failures during the implementation, the quality of our products and services and our users’ experience could decline. This could damage our reputation and lead us to lose current and potential customers and advertisers. The costs associated with these adjustments to our architecture could harm our operating r esults. Cost increases, loss of traffic or failure to accommodate new technologies or changing business requirements could harm our operating results and financial condition.

We rely on bandwidth providers, data centers or other third parties for key aspects of the process of providing products and services to our users, and any failure or interruption in the services and products provided by these third parties could harm our ability to operate our business and damage our reputation.

We rely on third-party vendors, including data center and bandwidth providers. Any disruption in the network access or co-location services provided by these third-party providers or any failure of these third-party providers to handle current or higher volumes of use could significantly harm our business. Any financial or other difficulties our providers face may have negative effects on our business, the nature and extent of which we cannot predict. We exercise little control over these third-party vendors, which increases our vulnerability to problems with the services they provide. We license technology and related databases from third parties to facilitate aspects of our data center and connectivity operations including, among others, Internet traffic management services. We have experienced and expect to continue to experience interruptions and delays in service and availability for such elements. Any errors, failures, interrup tions or delays experienced in connection with these third-party technologies and information services could negatively impact our relationship with users and adversely affect our brand and our business and could expose us to liabilities to third parties.

Our systems are also heavily reliant on the availability of electricity, which also comes from third-party providers. If we were to experience a major power outage, we would have to rely on back-up generators. These back-up generators may not operate properly through a major power outage and their fuel supply could also be inadequate during a major power outage. This could result in a disruption of our business.

Interruption or failure of our information technology and communications systems could impair our ability to effectively provide our products and services, which could damage our reputation and harm our operating results.

Our provision of our products and services depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could result in interruptions in our service. Interruptions in our service could reduce our revenues and profits, and our brand could be damaged if people believe our system is unreliable. Our systems are vulnerable to damage or interruption from earthquakes, terrorist attacks, floods, fires, power loss, telecommunications failures, computer viruses, computer denial of service attacks or other attempts to harm our systems, and similar events. Some of our data centers are located in areas with a high risk of major earthquakes. Our data centers are also subject to break-ins, sabotage and intentional acts of vandalism, and to potential disruptions if the operators of these facilities have financial difficulties. Some of our systems are not fully redundant, and our disa ster recovery planning cannot account for all eventualities. The occurrence of a natural disaster, a decision to close a facility we are using without adequate notice for financial reasons or other unanticipated problems at our data centers could result in lengthy interruptions in our service.

18

Any unscheduled interruption in our service puts a burden on our entire organization and would result in an immediate loss of revenue. If we experience frequent or persistent system failures on our web sites, our reputation and brand could be permanently harmed. The steps we have taken to increase the reliability and redundancy of our systems are expensive, reduce our operating margin and may not be successful in reducing the frequency or duration of unscheduled downtime.

More individuals are using non-PC devices to access the Internet, and versions of our web search technology developed for these devices may not be widely adopted by users of these devices.

The number of people who access the Internet through devices other than personal computers, including mobile telephones, hand-held calendaring and email assistants, and television set-top devices, has increased dramatically in the past few years. The lower resolution, functionality and memory associated with alternative devices make the use of our products and services through such devices difficult. If we are unable to attract and retain a substantial number of alternative device users to our web search services or if we are slow to develop products and technologies that are more compatible with non-PC communications devices, we will fail to capture a significant share of an increasingly important portion of the market for online services.

We rely on insurance to mitigate some risks and, to the extent the cost of insurance increases or we are unable or choose not to maintain sufficient insurance to mitigate the risks facing our business, our operating results may be diminished.