3rd Quarter 2022 Earnings Presentation October 20, 2022 1

3 Subtitle Copy Sandy Spring Bancorp’s forward-looking statements are subject to the following principal risks and uncertainties: risks, uncertainties and other factors relating to the COVID-19 pandemic, including the effect of the pandemic on our borrowers and their ability to make payments on their obligations, the effectiveness of vaccination programs, and the effect of remedial actions and stimulus measures adopted by federal, state and local governments; general economic conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of the Company’s loan or investment portfolios; changes in competitive pressures among financial institutions or from non-financial institutions; the Company’s ability to retain key members of management; changes in legislation, regulations, and policies; the possibility that any of the anticipated benefits of acquisitions will not be realized or will not be realized within the expected time period; and a variety of other matters which, by their nature, are subject to significant uncertainties. Sandy Spring Bancorp provides greater detail regarding some of these factors in its Form 10-K for the year ended December 31, 2021, including in the Risk Factors section of that report, and in its other SEC reports. Sandy Spring Bancorp’s forward-looking statements may also be subject to other risks and uncertainties, including those that it may discuss in its filings with the SEC, accessible on the SEC’s Web site at www.sec.gov. Forward Looking Statements 2

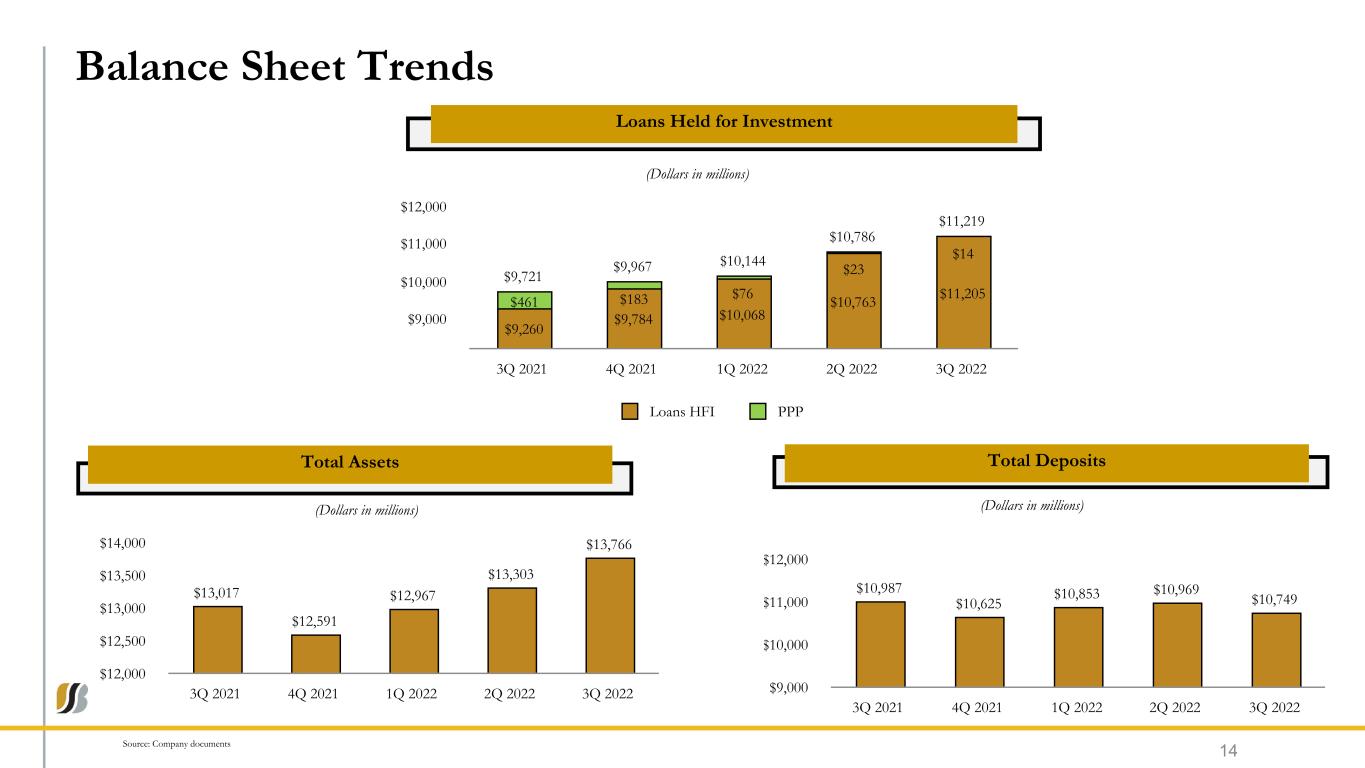

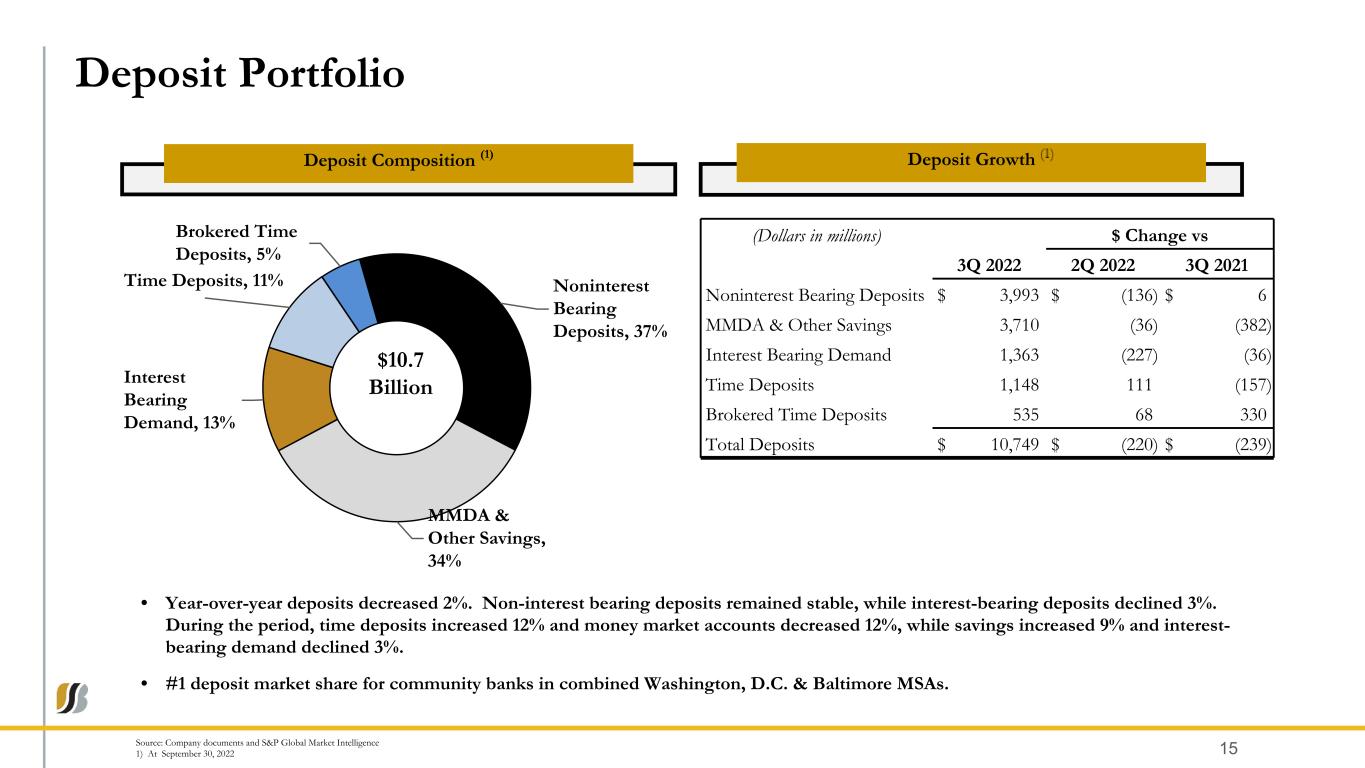

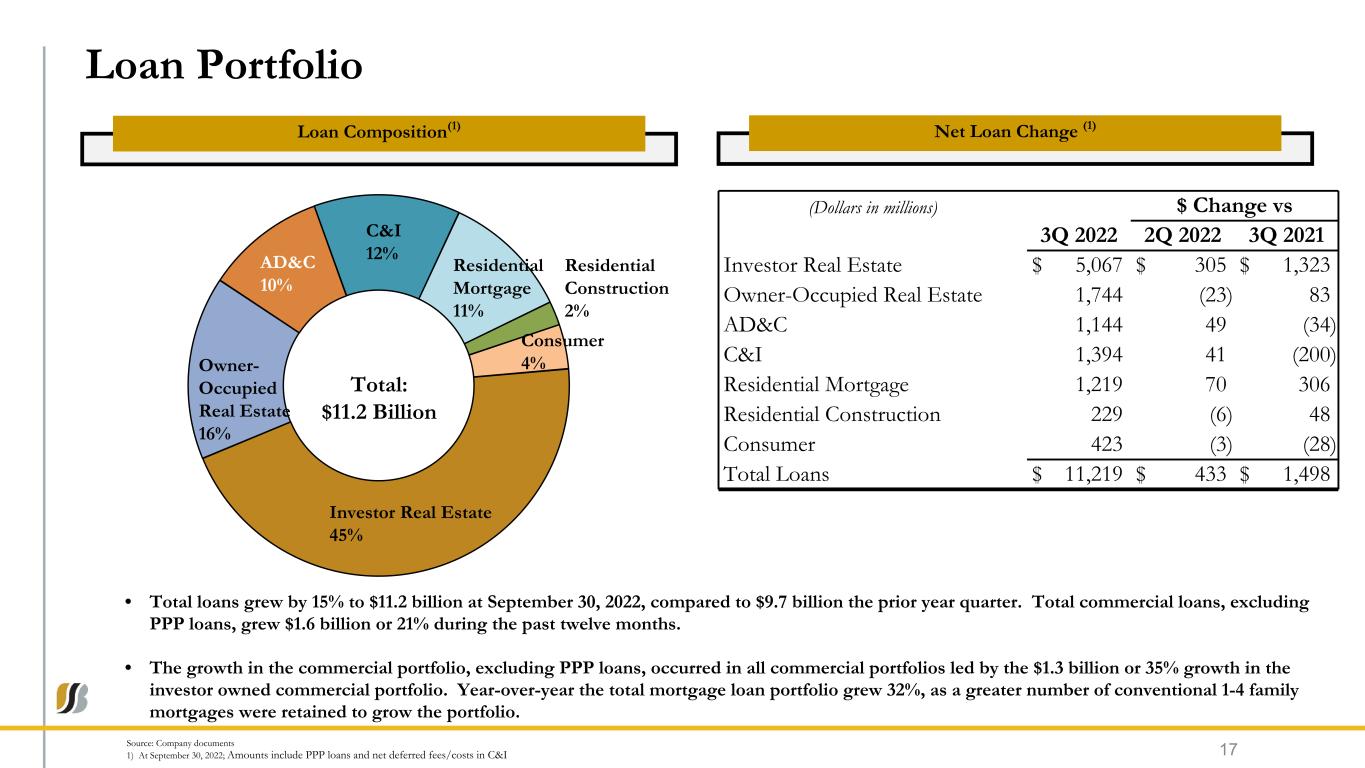

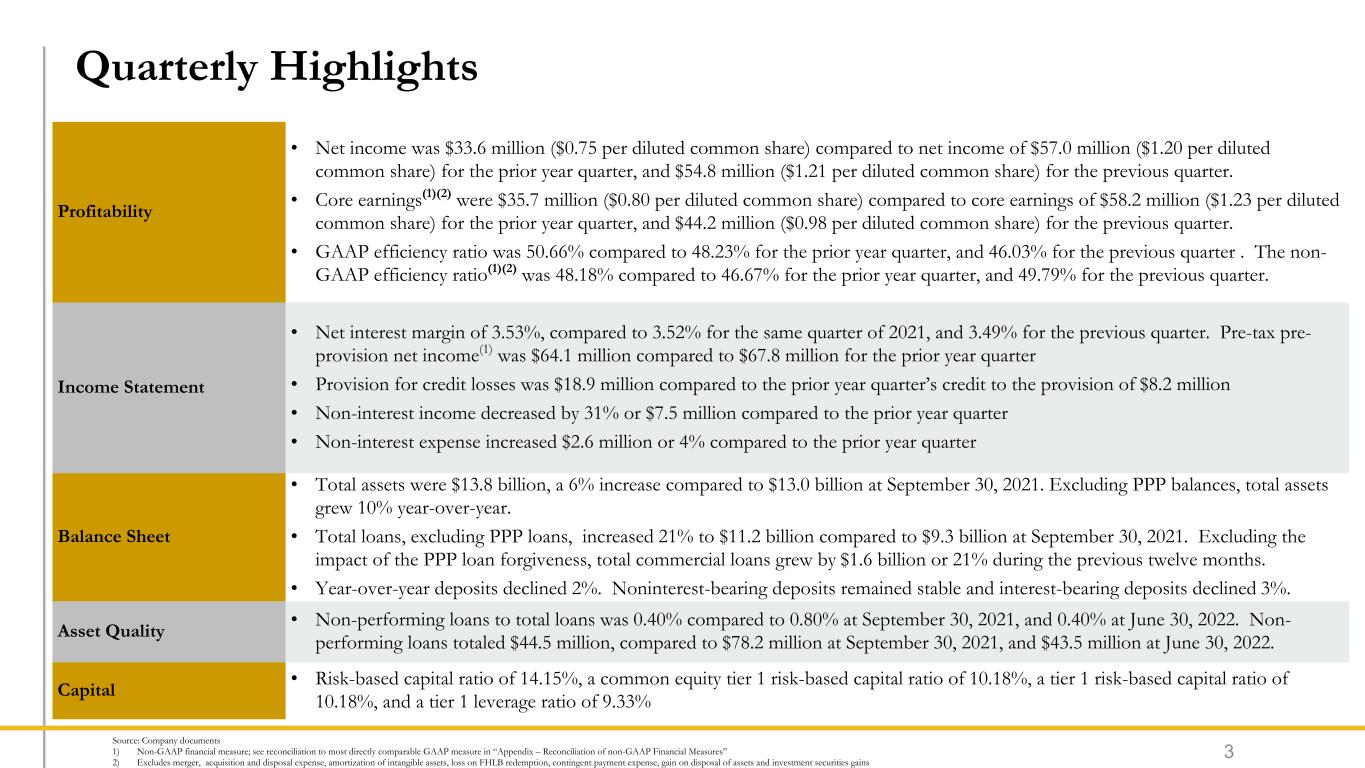

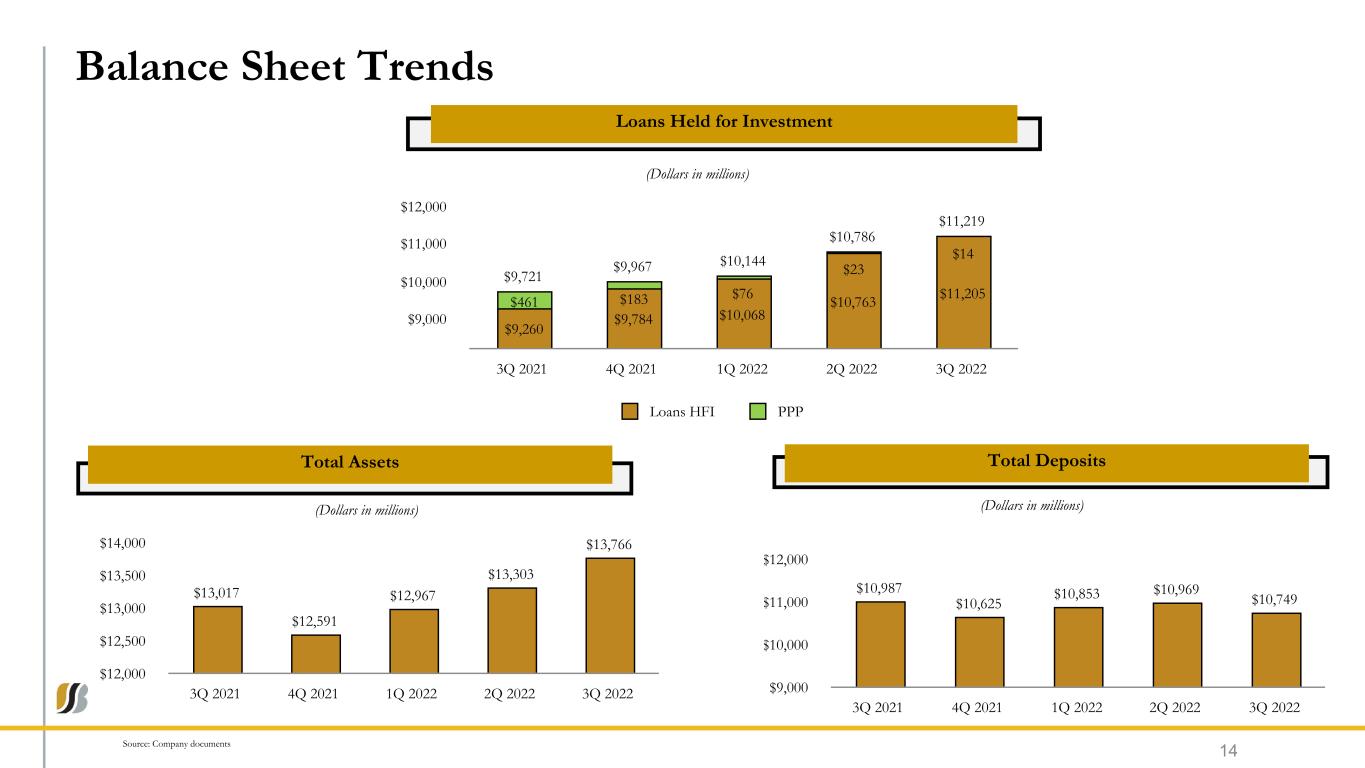

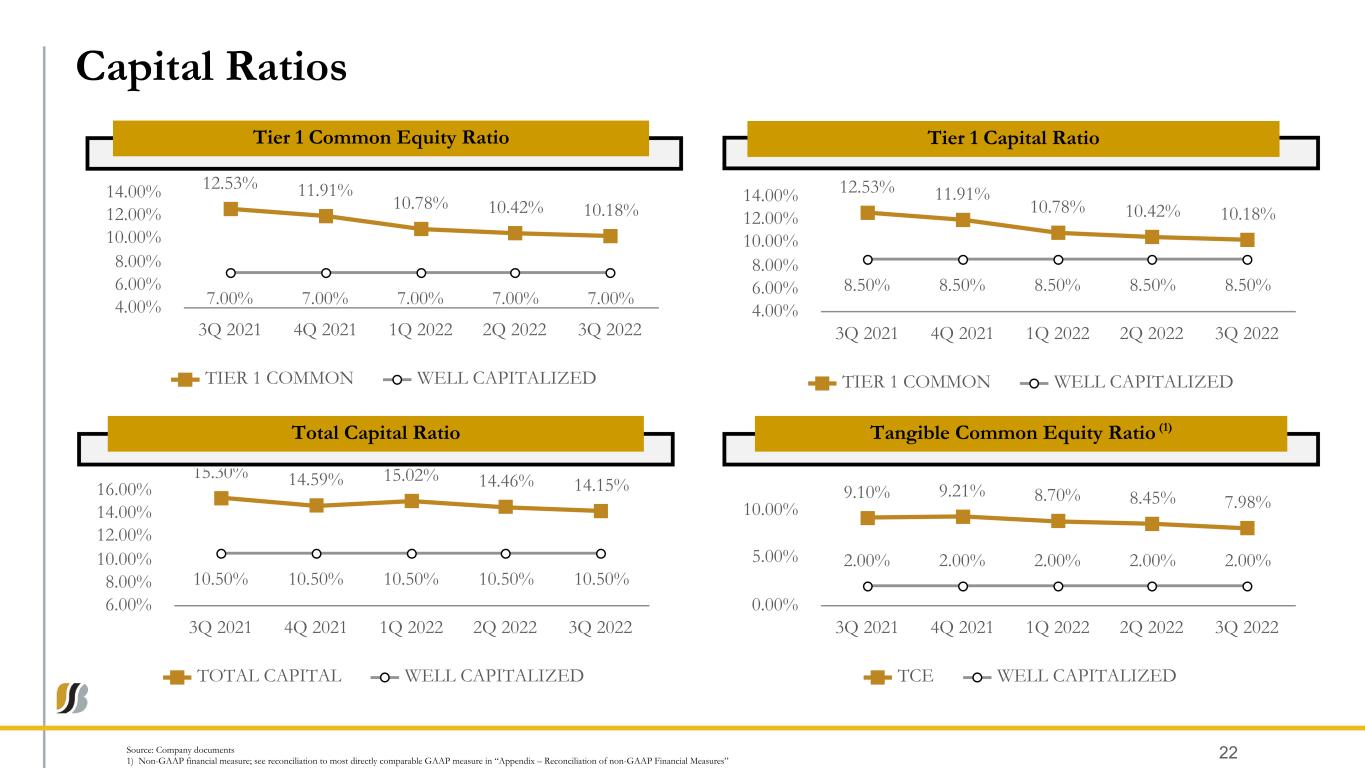

5 Subtitle Copy 3 Quarterly Highlights Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” 2) Excludes merger, acquisition and disposal expense, amortization of intangible assets, loss on FHLB redemption, contingent payment expense, gain on disposal of assets and investment securities gains Profitability • Net income was $33.6 million ($0.75 per diluted common share) compared to net income of $57.0 million ($1.20 per diluted common share) for the prior year quarter, and $54.8 million ($1.21 per diluted common share) for the previous quarter. • Core earnings(1)(2) were $35.7 million ($0.80 per diluted common share) compared to core earnings of $58.2 million ($1.23 per diluted common share) for the prior year quarter, and $44.2 million ($0.98 per diluted common share) for the previous quarter. • GAAP efficiency ratio was 50.66% compared to 48.23% for the prior year quarter, and 46.03% for the previous quarter . The non- GAAP efficiency ratio(1)(2) was 48.18% compared to 46.67% for the prior year quarter, and 49.79% for the previous quarter. Income Statement • Net interest margin of 3.53%, compared to 3.52% for the same quarter of 2021, and 3.49% for the previous quarter. Pre-tax pre- provision net income(1) was $64.1 million compared to $67.8 million for the prior year quarter • Provision for credit losses was $18.9 million compared to the prior year quarter’s credit to the provision of $8.2 million • Non-interest income decreased by 31% or $7.5 million compared to the prior year quarter • Non-interest expense increased $2.6 million or 4% compared to the prior year quarter Balance Sheet • Total assets were $13.8 billion, a 6% increase compared to $13.0 billion at September 30, 2021. Excluding PPP balances, total assets grew 10% year-over-year. • Total loans, excluding PPP loans, increased 21% to $11.2 billion compared to $9.3 billion at September 30, 2021. Excluding the impact of the PPP loan forgiveness, total commercial loans grew by $1.6 billion or 21% during the previous twelve months. • Year-over-year deposits declined 2%. Noninterest-bearing deposits remained stable and interest-bearing deposits declined 3%. Asset Quality • Non-performing loans to total loans was 0.40% compared to 0.80% at September 30, 2021, and 0.40% at June 30, 2022. Non- performing loans totaled $44.5 million, compared to $78.2 million at September 30, 2021, and $43.5 million at June 30, 2022. Capital • Risk-based capital ratio of 14.15%, a common equity tier 1 risk-based capital ratio of 10.18%, a tier 1 risk-based capital ratio of 10.18%, and a tier 1 leverage ratio of 9.33%

7 Subtitle Copy 3rd Quarter 2022 Financial Performance 4

9 Subtitle Copy Profitability 5

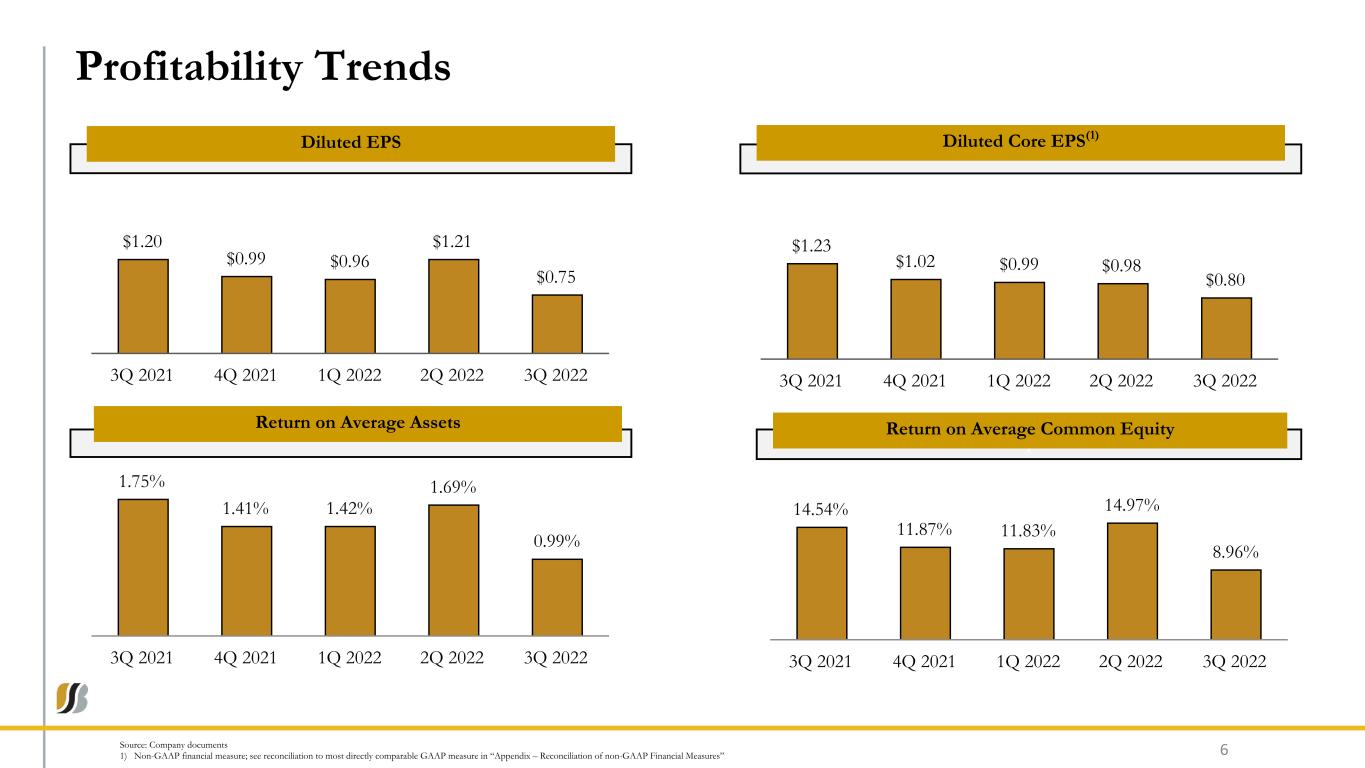

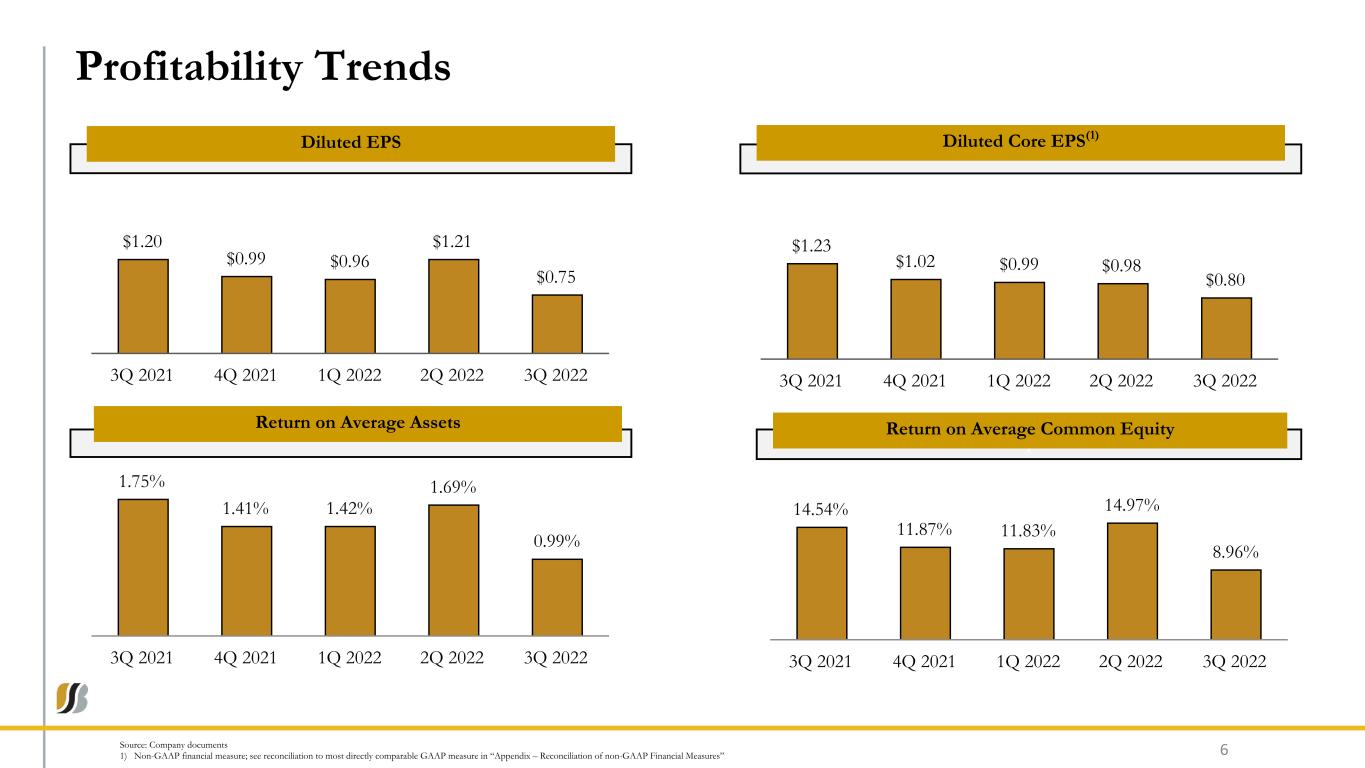

10 Subtitle Copy Profitability Trends Diluted EPS f Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” 6 Return on Average Assets Return on Average Common Equity Diluted Core EPS(1) $1.20 $0.99 $0.96 $1.21 $0.75 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $1.23 $1.02 $0.99 $0.98 $0.80 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 1.75% 1.41% 1.42% 1.69% 0.99% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 14.54% 11.87% 11.83% 14.97% 8.96% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022

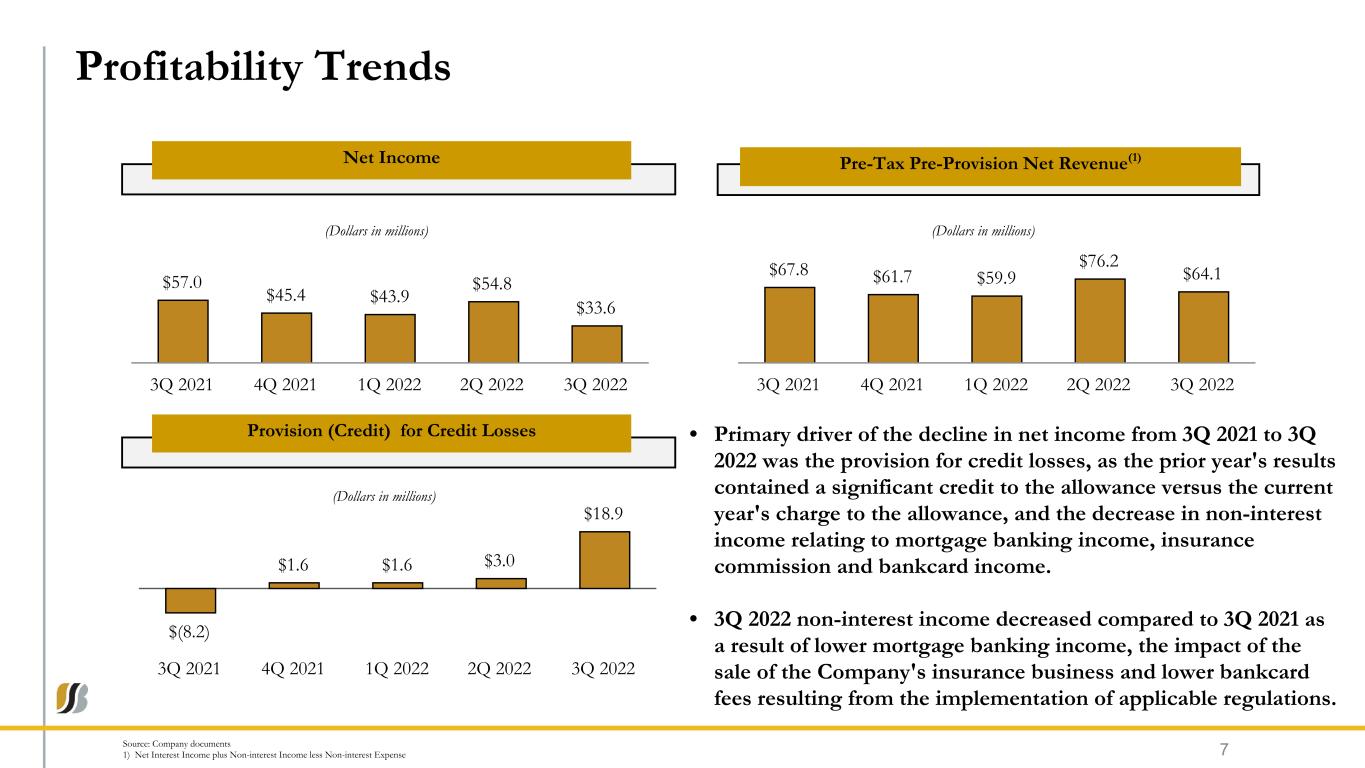

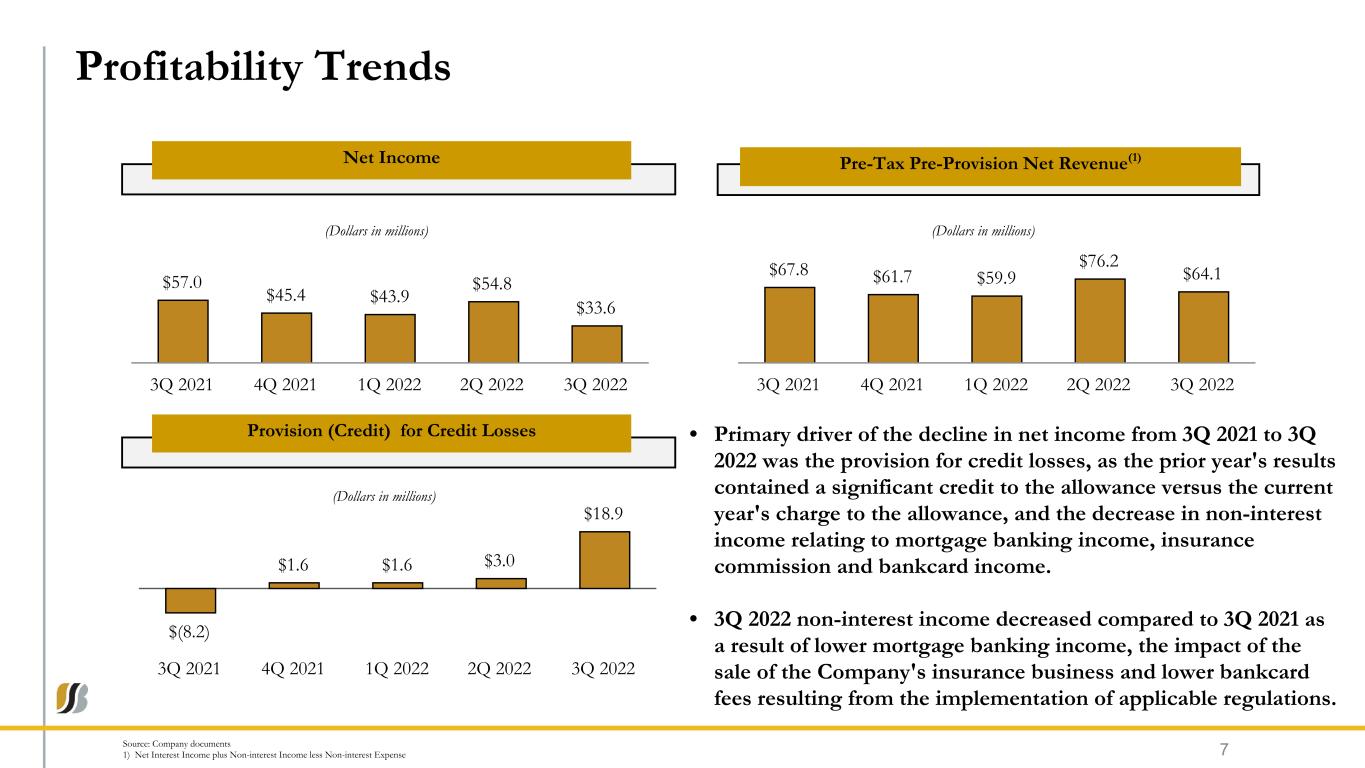

11 Subtitle Copy Profitability Trends Net Income Provision (Credit) for Credit Losses Pre-Tax Pre-Provision Net Revenue(1) 7Source: Company documents 1) Net Interest Income plus Non-interest Income less Non-interest Expense • Primary driver of the decline in net income from 3Q 2021 to 3Q 2022 was the provision for credit losses, as the prior year's results contained a significant credit to the allowance versus the current year's charge to the allowance, and the decrease in non-interest income relating to mortgage banking income, insurance commission and bankcard income. • 3Q 2022 non-interest income decreased compared to 3Q 2021 as a result of lower mortgage banking income, the impact of the sale of the Company's insurance business and lower bankcard fees resulting from the implementation of applicable regulations. (Dollars in millions) $57.0 $45.4 $43.9 $54.8 $33.6 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 (Dollars in millions) $67.8 $61.7 $59.9 $76.2 $64.1 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 (Dollars in millions) $(8.2) $1.6 $1.6 $3.0 $18.9 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022

12 Subtitle Copy Income Statement 8

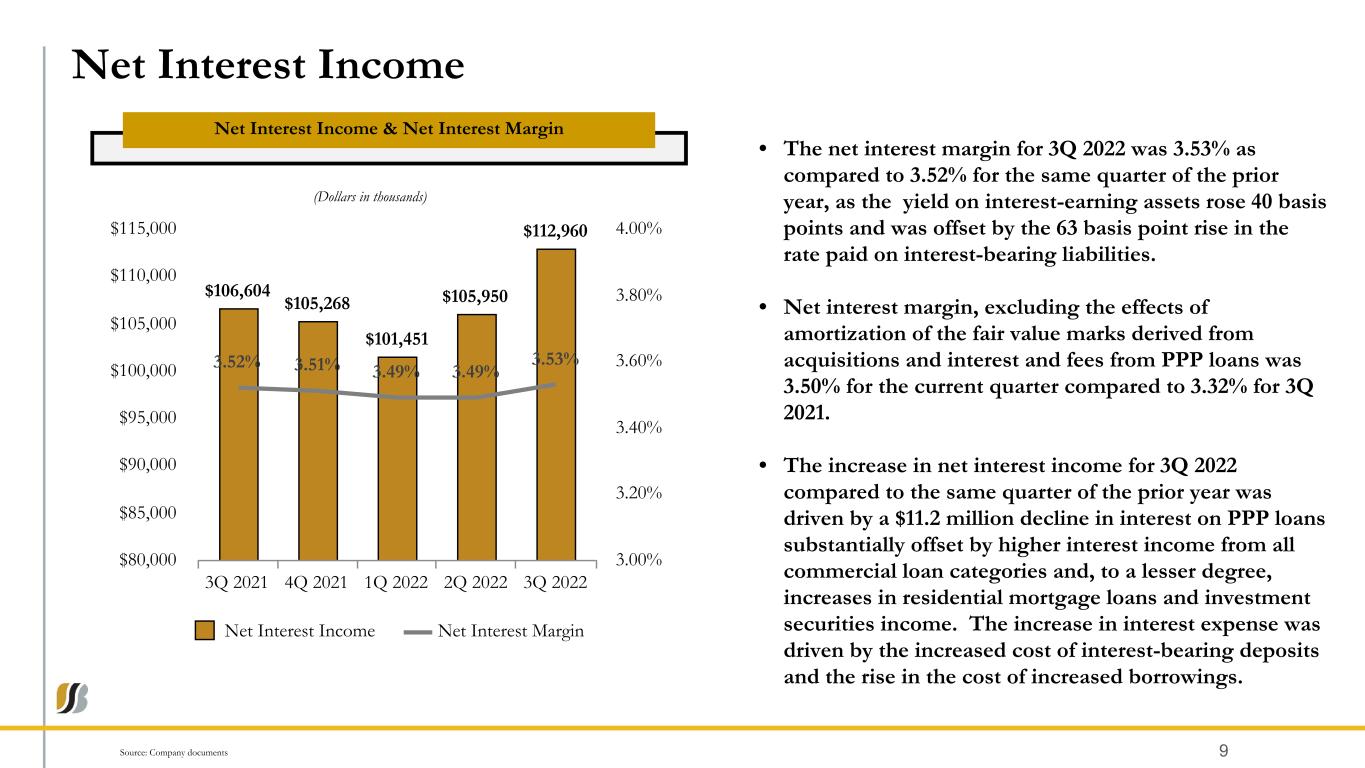

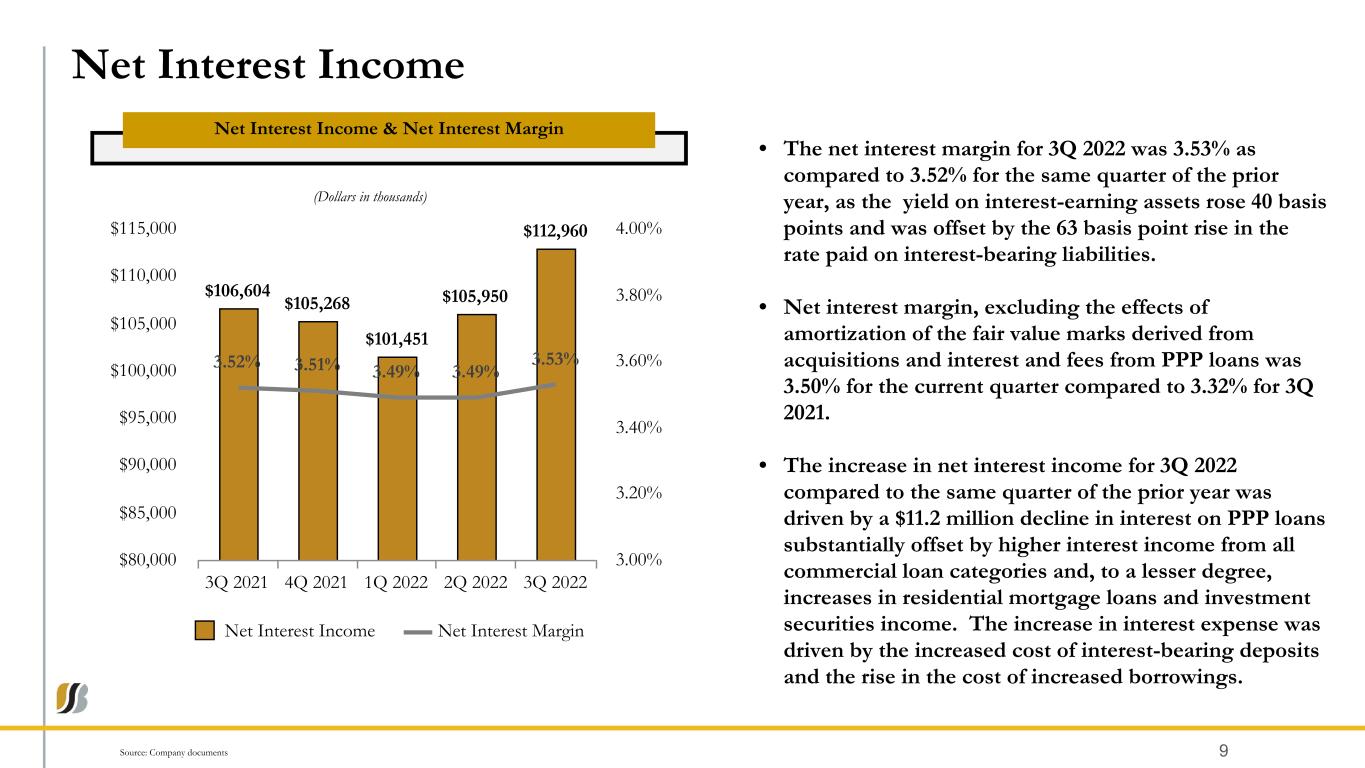

Net Interest Income Net Interest Income & Net Interest Margin Source: Company documents 9 • The net interest margin for 3Q 2022 was 3.53% as compared to 3.52% for the same quarter of the prior year, as the yield on interest-earning assets rose 40 basis points and was offset by the 63 basis point rise in the rate paid on interest-bearing liabilities. • Net interest margin, excluding the effects of amortization of the fair value marks derived from acquisitions and interest and fees from PPP loans was 3.50% for the current quarter compared to 3.32% for 3Q 2021. • The increase in net interest income for 3Q 2022 compared to the same quarter of the prior year was driven by a $11.2 million decline in interest on PPP loans substantially offset by higher interest income from all commercial loan categories and, to a lesser degree, increases in residential mortgage loans and investment securities income. The increase in interest expense was driven by the increased cost of interest-bearing deposits and the rise in the cost of increased borrowings. (Dollars in thousands) $106,604 $105,268 $101,451 $105,950 $112,960 3.52% 3.51% 3.49% 3.49% 3.53% Net Interest Income Net Interest Margin 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $80,000 $85,000 $90,000 $95,000 $100,000 $105,000 $110,000 $115,000 3.00% 3.20% 3.40% 3.60% 3.80% 4.00%

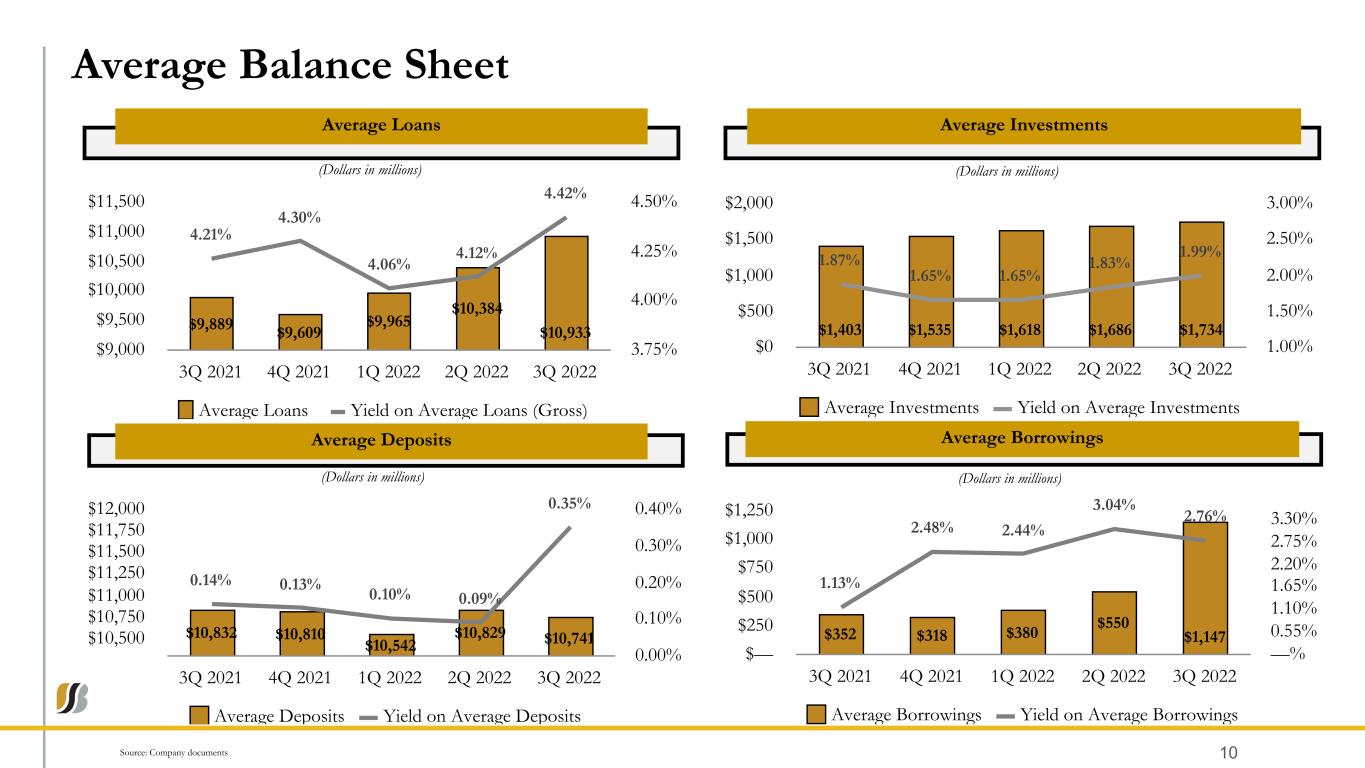

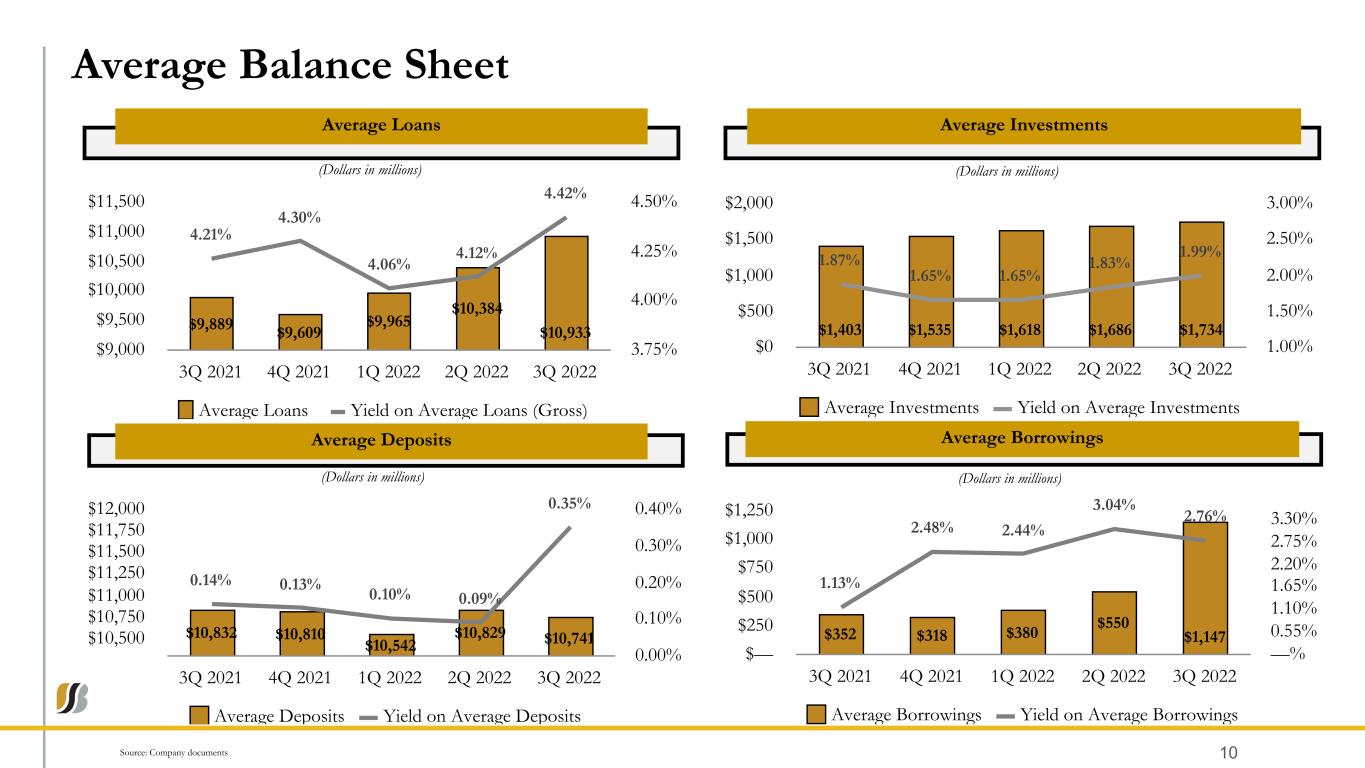

Average Balance Sheet Source: Company documents 10 Average Loans Average Deposits Average Investments Average Borrowings (Dollars in millions) $9,889 $9,609 $9,965 $10,384 $10,933 4.21% 4.30% 4.06% 4.12% 4.42% Average Loans Yield on Average Loans (Gross) 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $9,000 $9,500 $10,000 $10,500 $11,000 $11,500 3.75% 4.00% 4.25% 4.50% (Dollars in millions) $1,403 $1,535 $1,618 $1,686 $1,734 1.87% 1.65% 1.65% 1.83% 1.99% Average Investments Yield on Average Investments 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $0 $500 $1,000 $1,500 $2,000 1.00% 1.50% 2.00% 2.50% 3.00% (Dollars in millions) $10,832 $10,810 $10,542 $10,829 $10,741 0.14% 0.13% 0.10% 0.09% 0.35% Average Deposits Yield on Average Deposits 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $10,500 $10,750 $11,000 $11,250 $11,500 $11,750 $12,000 0.00% 0.10% 0.20% 0.30% 0.40% (Dollars in millions) $352 $318 $380 $550 $1,147 1.13% 2.48% 2.44% 3.04% 2.76% Average Borrowings Yield on Average Borrowings 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $— $250 $500 $750 $1,000 $1,250 —% 0.55% 1.10% 1.65% 2.20% 2.75% 3.30%

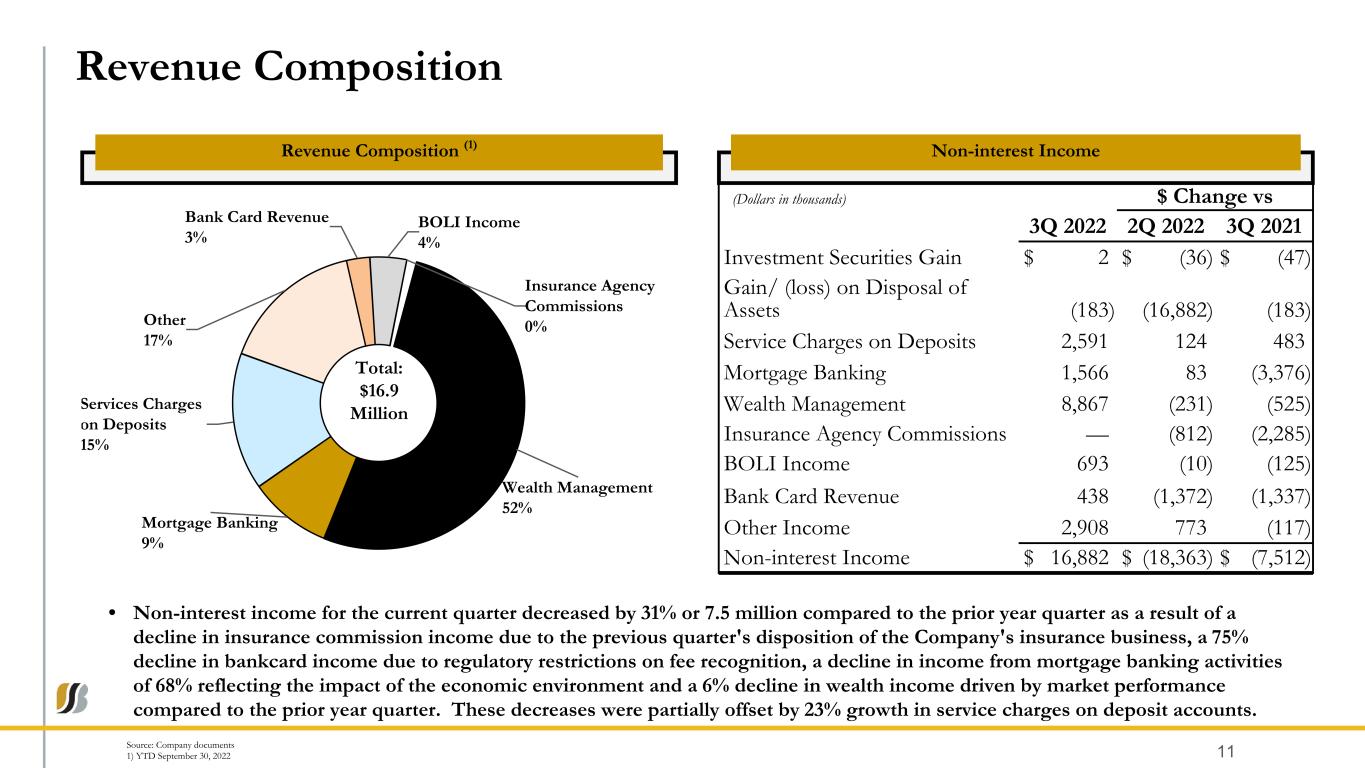

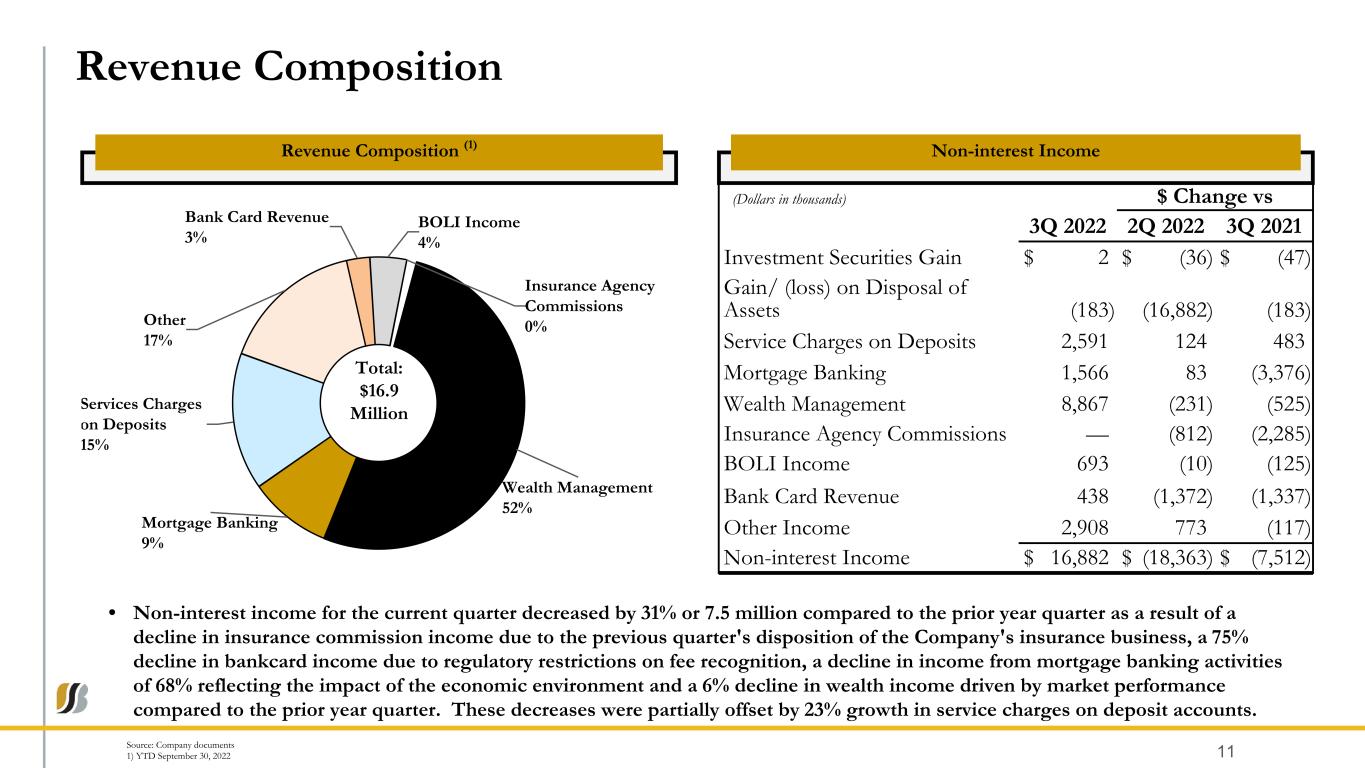

Source: Company documents 1) YTD September 30, 2022 Revenue Composition Revenue Composition (1) Non-interest Income 11 • Non-interest income for the current quarter decreased by 31% or 7.5 million compared to the prior year quarter as a result of a decline in insurance commission income due to the previous quarter's disposition of the Company's insurance business, a 75% decline in bankcard income due to regulatory restrictions on fee recognition, a decline in income from mortgage banking activities of 68% reflecting the impact of the economic environment and a 6% decline in wealth income driven by market performance compared to the prior year quarter. These decreases were partially offset by 23% growth in service charges on deposit accounts. Wealth Management 52% Mortgage Banking 9% Services Charges on Deposits 15% Other 17% Bank Card Revenue 3% BOLI Income 4% Insurance Agency Commissions 0% (Dollars in thousands) $ Change vs 3Q 2022 2Q 2022 3Q 2021 Investment Securities Gain $ 2 $ (36) $ (47) Gain/ (loss) on Disposal of Assets (183) (16,882) (183) Service Charges on Deposits 2,591 124 483 Mortgage Banking 1,566 83 (3,376) Wealth Management 8,867 (231) (525) Insurance Agency Commissions — (812) (2,285) BOLI Income 693 (10) (125) Bank Card Revenue 438 (1,372) (1,337) Other Income 2,908 773 (117) Non-interest Income $ 16,882 $ (18,363) $ (7,512) Total: $16.9 Million

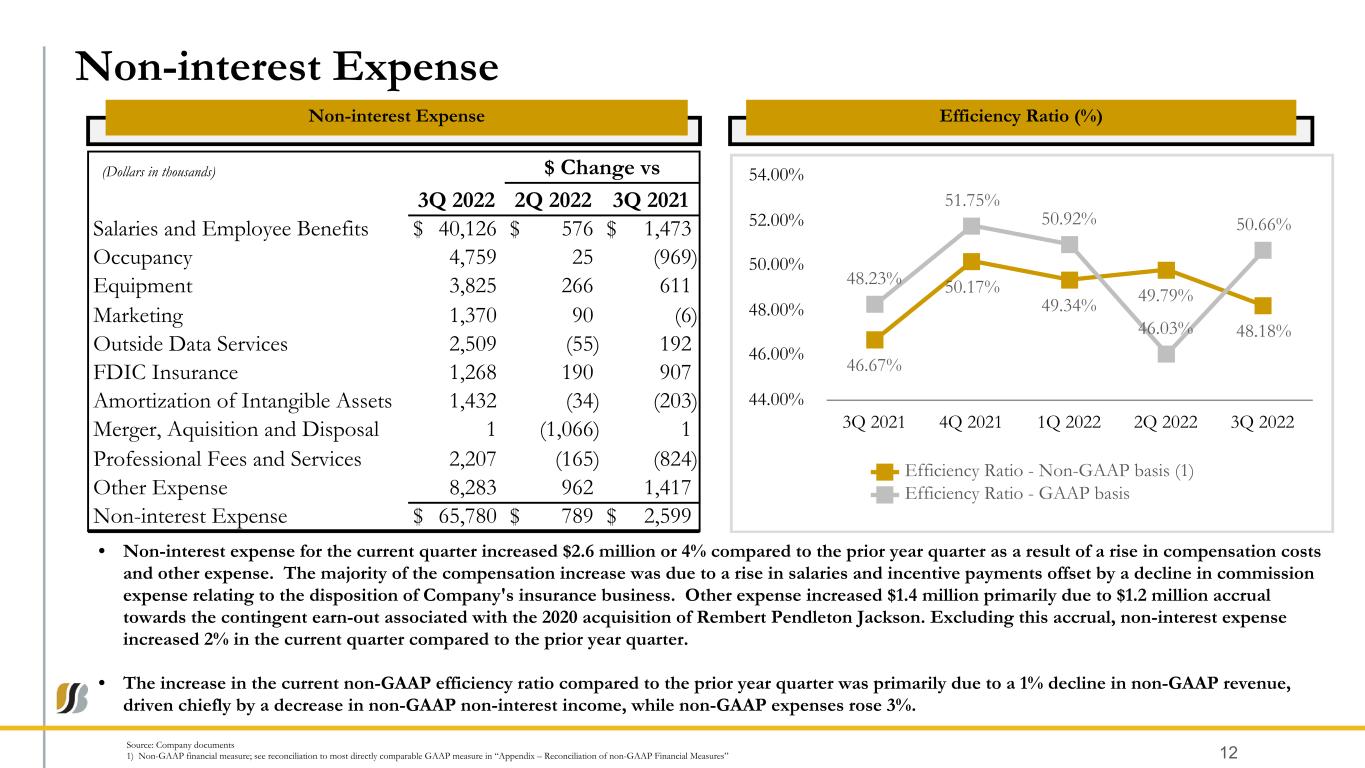

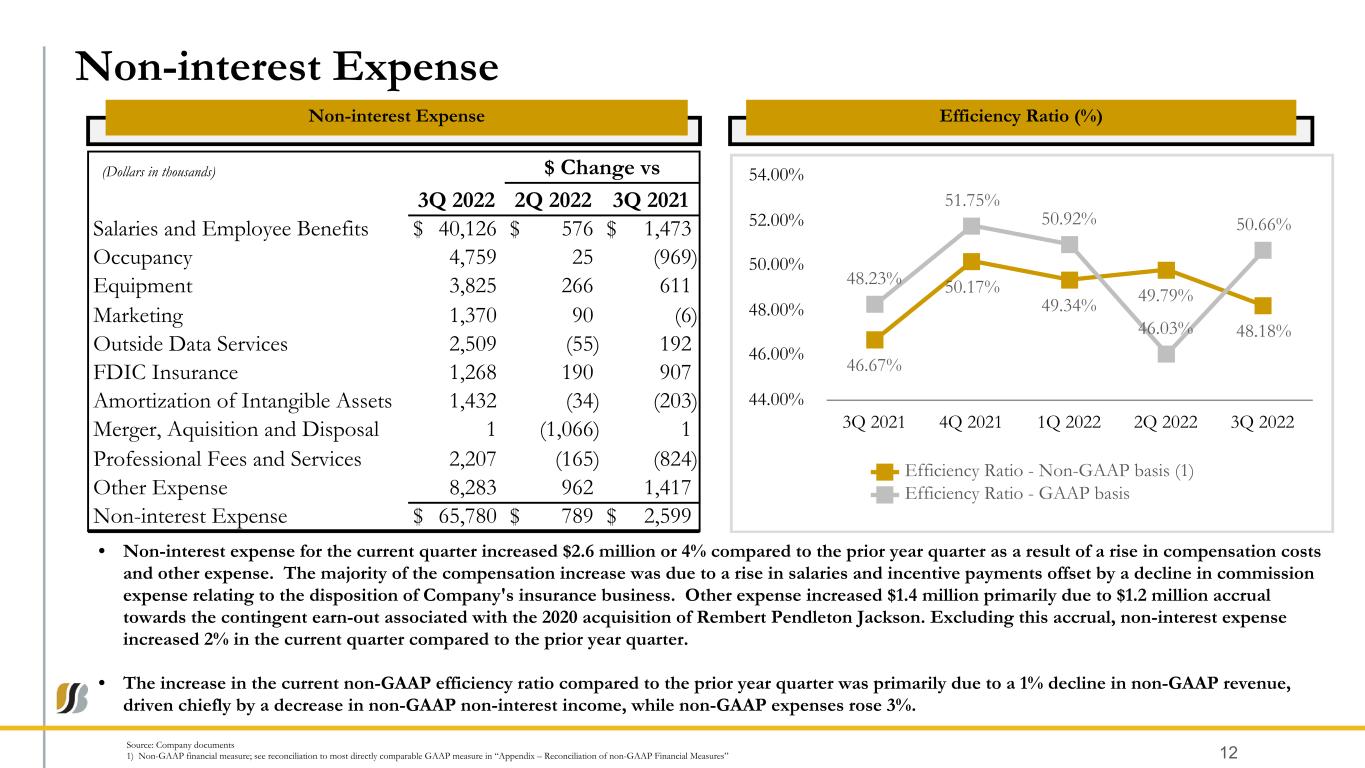

Non-interest Expense Non-interest Expense 12 • Non-interest expense for the current quarter increased $2.6 million or 4% compared to the prior year quarter as a result of a rise in compensation costs and other expense. The majority of the compensation increase was due to a rise in salaries and incentive payments offset by a decline in commission expense relating to the disposition of Company's insurance business. Other expense increased $1.4 million primarily due to $1.2 million accrual towards the contingent earn-out associated with the 2020 acquisition of Rembert Pendleton Jackson. Excluding this accrual, non-interest expense increased 2% in the current quarter compared to the prior year quarter. • The increase in the current non-GAAP efficiency ratio compared to the prior year quarter was primarily due to a 1% decline in non-GAAP revenue, driven chiefly by a decrease in non-GAAP non-interest income, while non-GAAP expenses rose 3%. Efficiency Ratio (%) Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” (Dollars in thousands) $ Change vs 3Q 2022 2Q 2022 3Q 2021 Salaries and Employee Benefits $ 40,126 $ 576 $ 1,473 Occupancy 4,759 25 (969) Equipment 3,825 266 611 Marketing 1,370 90 (6) Outside Data Services 2,509 (55) 192 FDIC Insurance 1,268 190 907 Amortization of Intangible Assets 1,432 (34) (203) Merger, Aquisition and Disposal 1 (1,066) 1 Professional Fees and Services 2,207 (165) (824) Other Expense 8,283 962 1,417 Non-interest Expense $ 65,780 $ 789 $ 2,599 46.67% 50.17% 49.34% 49.79% 48.18% 48.23% 51.75% 50.92% 46.03% 50.66% Efficiency Ratio - Non-GAAP basis (1) Efficiency Ratio - GAAP basis 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 44.00% 46.00% 48.00% 50.00% 52.00% 54.00%

Balance Sheet 13

Balance Sheet Trends Total Assets Loans Held for Investment Total Deposits 14Source: Company documents (Dollars in millions) $13,017 $12,591 $12,967 $13,303 $13,766 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $12,000 $12,500 $13,000 $13,500 $14,000 (Dollars in millions) $10,987 $10,625 $10,853 $10,969 $10,749 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $9,000 $10,000 $11,000 $12,000 (Dollars in millions) $9,721 $9,967 $10,144 $10,786 $11,219 $9,260 $9,784 $10,068 $10,763 $11,205$461 $183 $76 $23 $14 Loans HFI PPP 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $9,000 $10,000 $11,000 $12,000

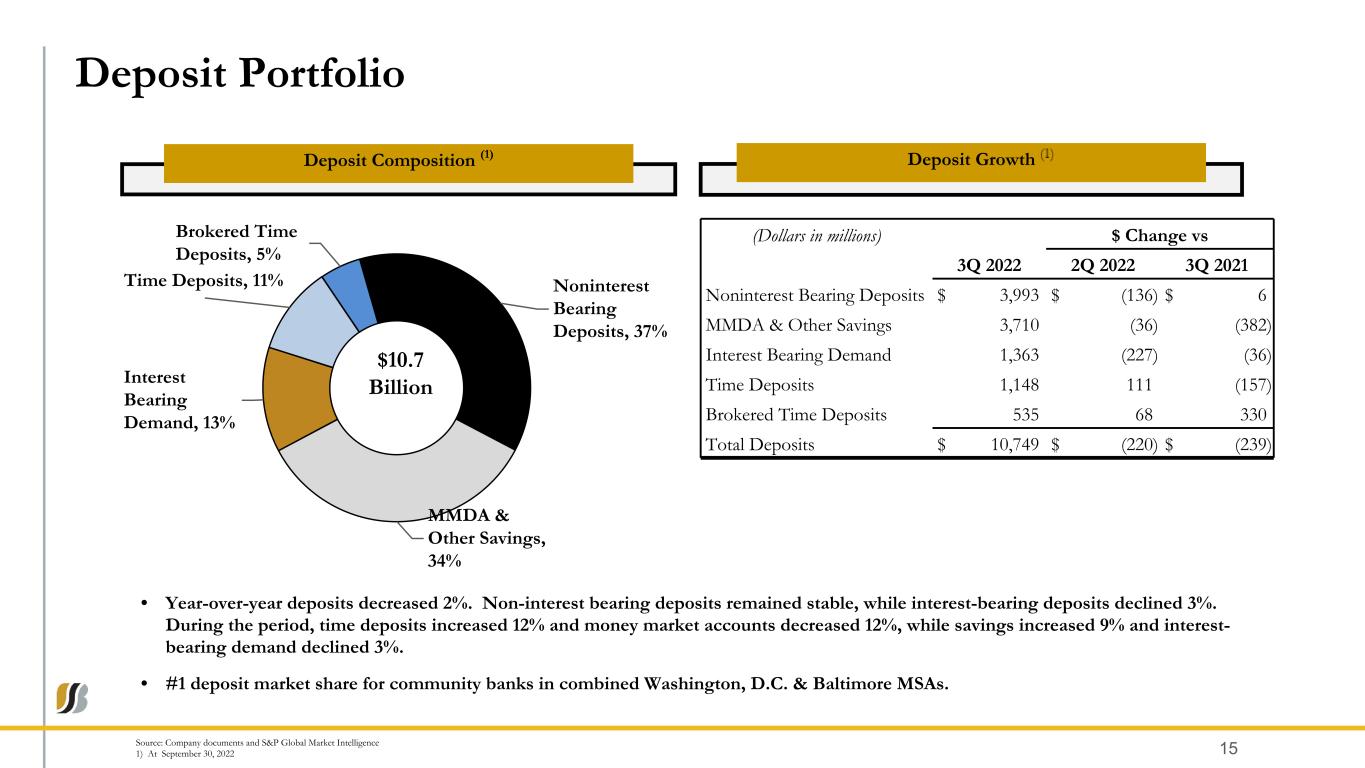

Deposit Portfolio Deposit Composition (1) 15 Deposit Growth • Year-over-year deposits decreased 2%. Non-interest bearing deposits remained stable, while interest-bearing deposits declined 3%. During the period, time deposits increased 12% and money market accounts decreased 12%, while savings increased 9% and interest- bearing demand declined 3%. • #1 deposit market share for community banks in combined Washington, D.C. & Baltimore MSAs. Source: Company documents and S&P Global Market Intelligence 1) At September 30, 2022 Noninterest Bearing Deposits, 37% MMDA & Other Savings, 34% Interest Bearing Demand, 13% Time Deposits, 11% Brokered Time Deposits, 5% $10.7 Billion (Dollars in millions) $ Change vs 3Q 2022 2Q 2022 3Q 2021 Noninterest Bearing Deposits $ 3,993 $ (136) $ 6 MMDA & Other Savings 3,710 (36) (382) Interest Bearing Demand 1,363 (227) (36) Time Deposits 1,148 111 (157) Brokered Time Deposits 535 68 330 Total Deposits $ 10,749 $ (220) $ (239)

Loan Portfolio, Asset Quality & Reserves (CECL) 16

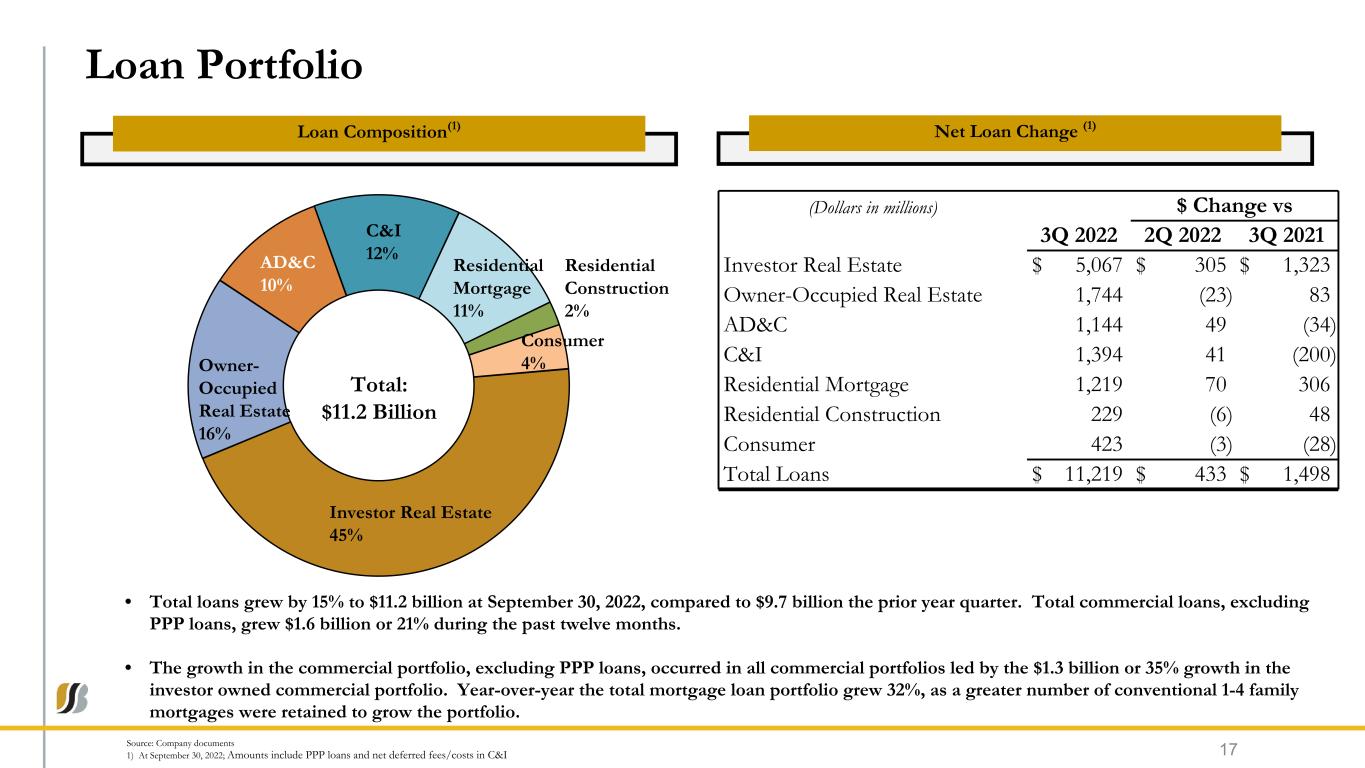

Source: Company documents 1) At September 30, 2022; Amounts include PPP loans and net deferred fees/costs in C&I Loan Portfolio Loan Composition(1) 17 Net Loan Change (1) Investor Real Estate 45% Owner- Occupied Real Estate 16% AD&C 10% C&I 12% Residential Mortgage 11% Residential Construction 2% Consumer 4% Total: $11.2 Billion (Dollars in millions) $ Change vs 3Q 2022 2Q 2022 3Q 2021 Investor Real Estate $ 5,067 $ 305 $ 1,323 Owner-Occupied Real Estate 1,744 (23) 83 AD&C 1,144 49 (34) C&I 1,394 41 (200) Residential Mortgage 1,219 70 306 Residential Construction 229 (6) 48 Consumer 423 (3) (28) Total Loans $ 11,219 $ 433 $ 1,498 • Total loans grew by 15% to $11.2 billion at September 30, 2022, compared to $9.7 billion the prior year quarter. Total commercial loans, excluding PPP loans, grew $1.6 billion or 21% during the past twelve months. • The growth in the commercial portfolio, excluding PPP loans, occurred in all commercial portfolios led by the $1.3 billion or 35% growth in the investor owned commercial portfolio. Year-over-year the total mortgage loan portfolio grew 32%, as a greater number of conventional 1-4 family mortgages were retained to grow the portfolio.

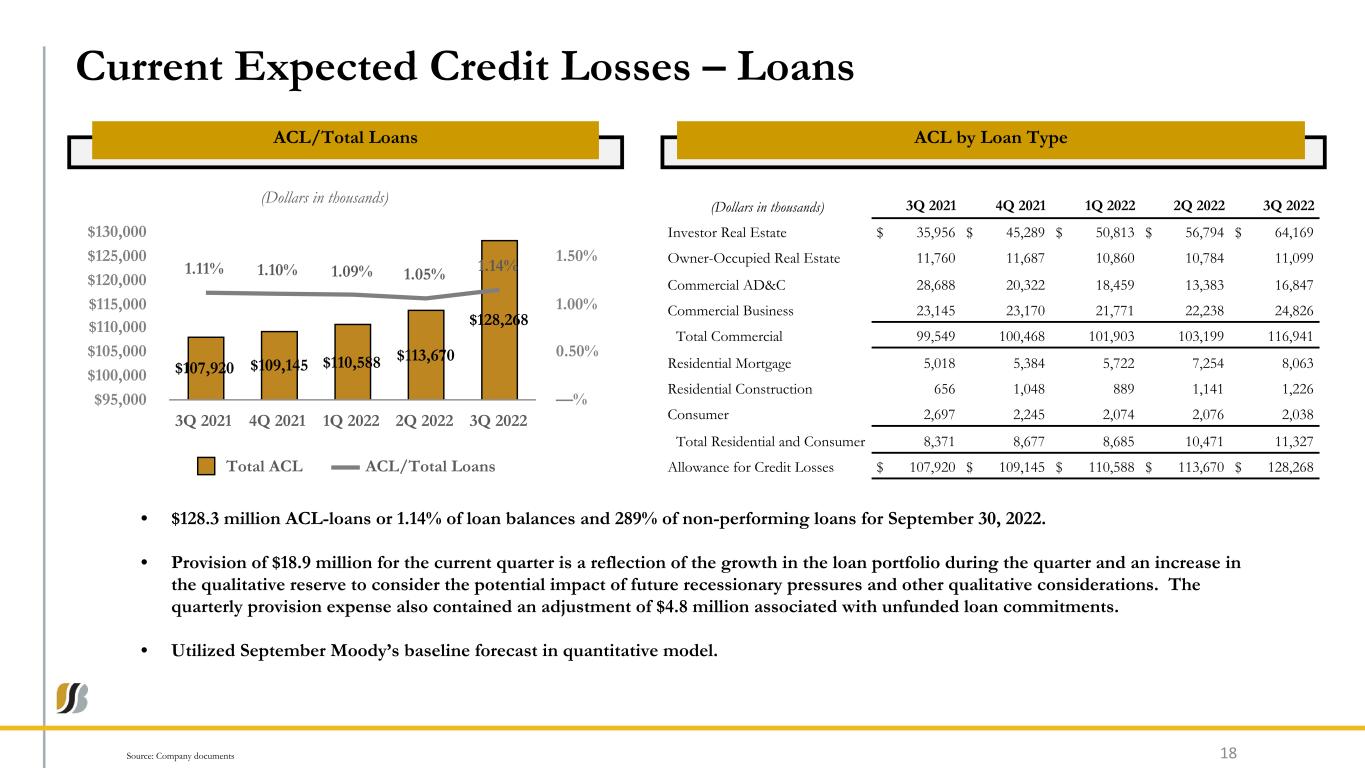

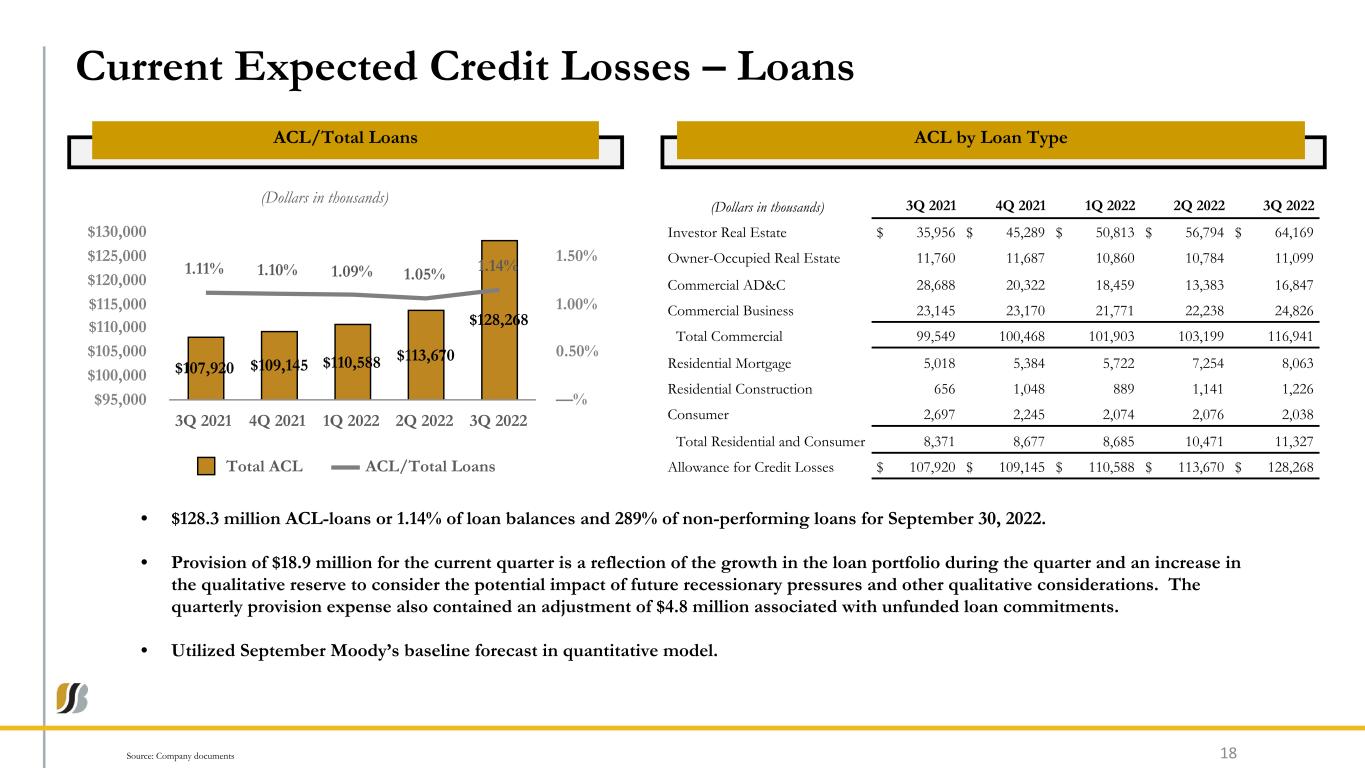

Current Expected Credit Losses – Loans 18 ACL/Total Loans • $128.3 million ACL-loans or 1.14% of loan balances and 289% of non-performing loans for September 30, 2022. • Provision of $18.9 million for the current quarter is a reflection of the growth in the loan portfolio during the quarter and an increase in the qualitative reserve to consider the potential impact of future recessionary pressures and other qualitative considerations. The quarterly provision expense also contained an adjustment of $4.8 million associated with unfunded loan commitments. • Utilized September Moody’s baseline forecast in quantitative model. ACL by Loan Type Source: Company documents (Dollars in thousands) $107,920 $109,145 $110,588 $113,670 $128,268 1.11% 1.10% 1.09% 1.05% 1.14% Total ACL ACL/Total Loans 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 $95,000 $100,000 $105,000 $110,000 $115,000 $120,000 $125,000 $130,000 —% 0.50% 1.00% 1.50% (Dollars in thousands) 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Investor Real Estate $ 35,956 $ 45,289 $ 50,813 $ 56,794 $ 64,169 Owner-Occupied Real Estate 11,760 11,687 10,860 10,784 11,099 Commercial AD&C 28,688 20,322 18,459 13,383 16,847 Commercial Business 23,145 23,170 21,771 22,238 24,826 Total Commercial 99,549 100,468 101,903 103,199 116,941 Residential Mortgage 5,018 5,384 5,722 7,254 8,063 Residential Construction 656 1,048 889 1,141 1,226 Consumer 2,697 2,245 2,074 2,076 2,038 Total Residential and Consumer 8,371 8,677 8,685 10,471 11,327 Allowance for Credit Losses $ 107,920 $ 109,145 $ 110,588 $ 113,670 $ 128,268

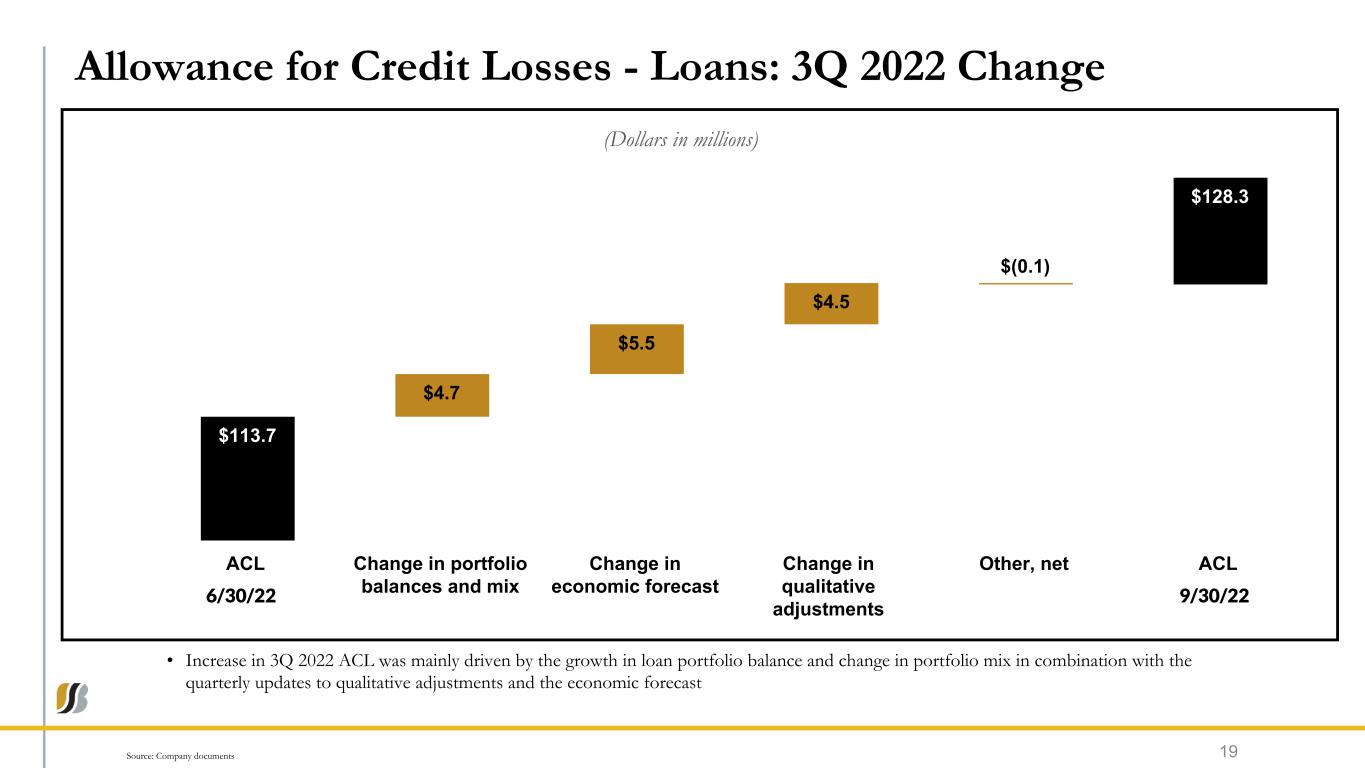

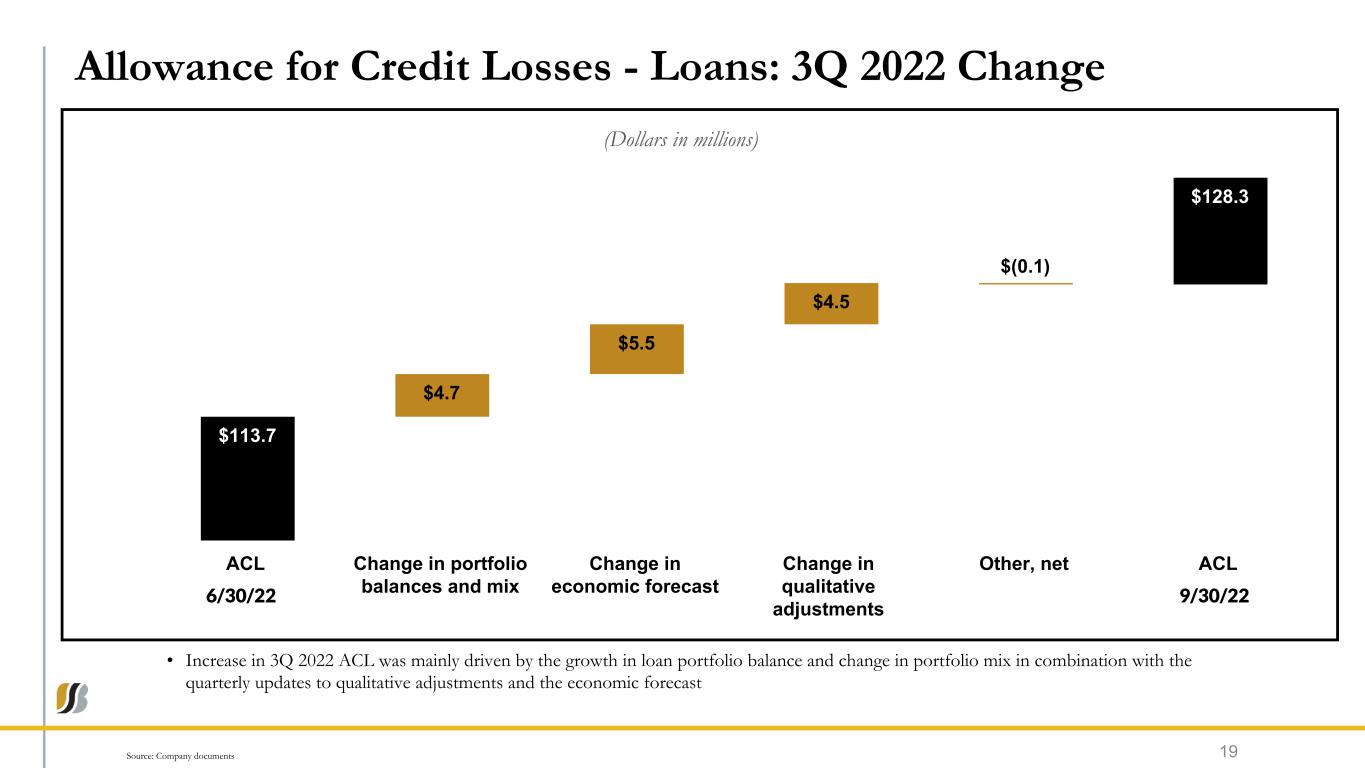

Allowance for Credit Losses - Loans: 3Q 2022 Change 19 • Increase in 3Q 2022 ACL was mainly driven by the growth in loan portfolio balance and change in portfolio mix in combination with the quarterly updates to qualitative adjustments and the economic forecast Source: Company documents (Dollars in millions) $113.7 $4.7 $5.5 $4.5 $(0.1) $128.3 ACL Change in portfolio balances and mix Change in economic forecast Change in qualitative adjustments Other, net ACL 9/30/226/30/22

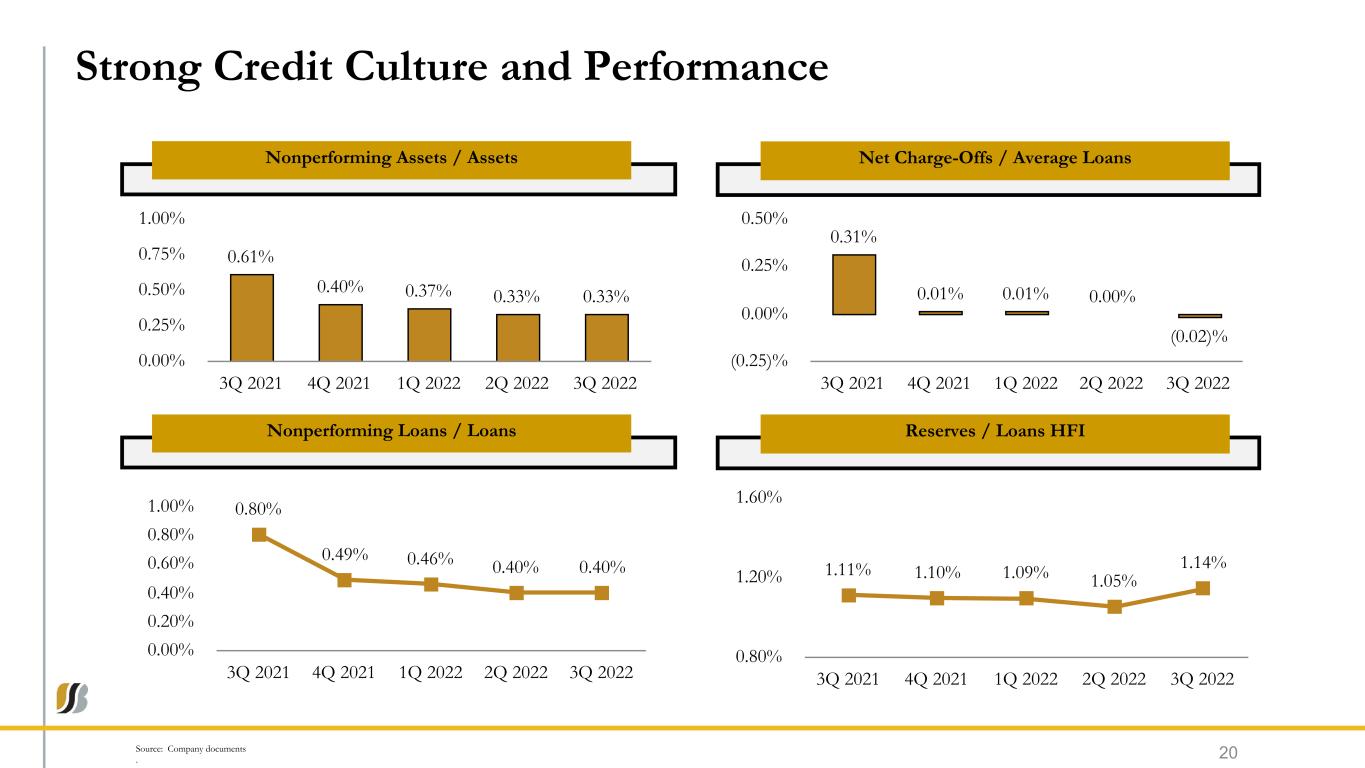

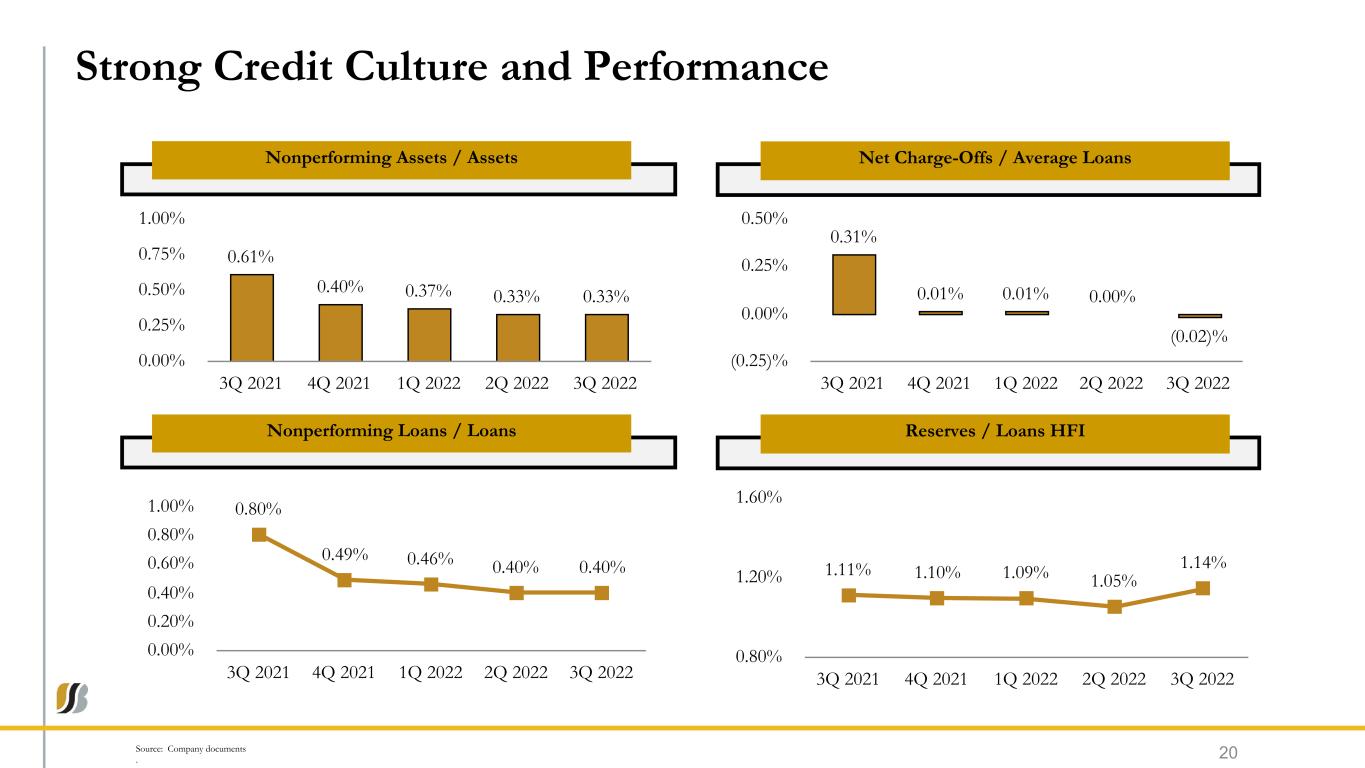

Source: Company documents . Strong Credit Culture and Performance Nonperforming Assets / Assets Net Charge-Offs / Average Loans Nonperforming Loans / Loans Reserves / Loans HFI 20 0.61% 0.40% 0.37% 0.33% 0.33% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 0.00% 0.25% 0.50% 0.75% 1.00% 0.31% 0.01% 0.01% 0.00% (0.02)% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 (0.25)% 0.00% 0.25% 0.50% 0.80% 0.49% 0.46% 0.40% 0.40% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.11% 1.10% 1.09% 1.05% 1.14% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 0.80% 1.20% 1.60%

Capital 21

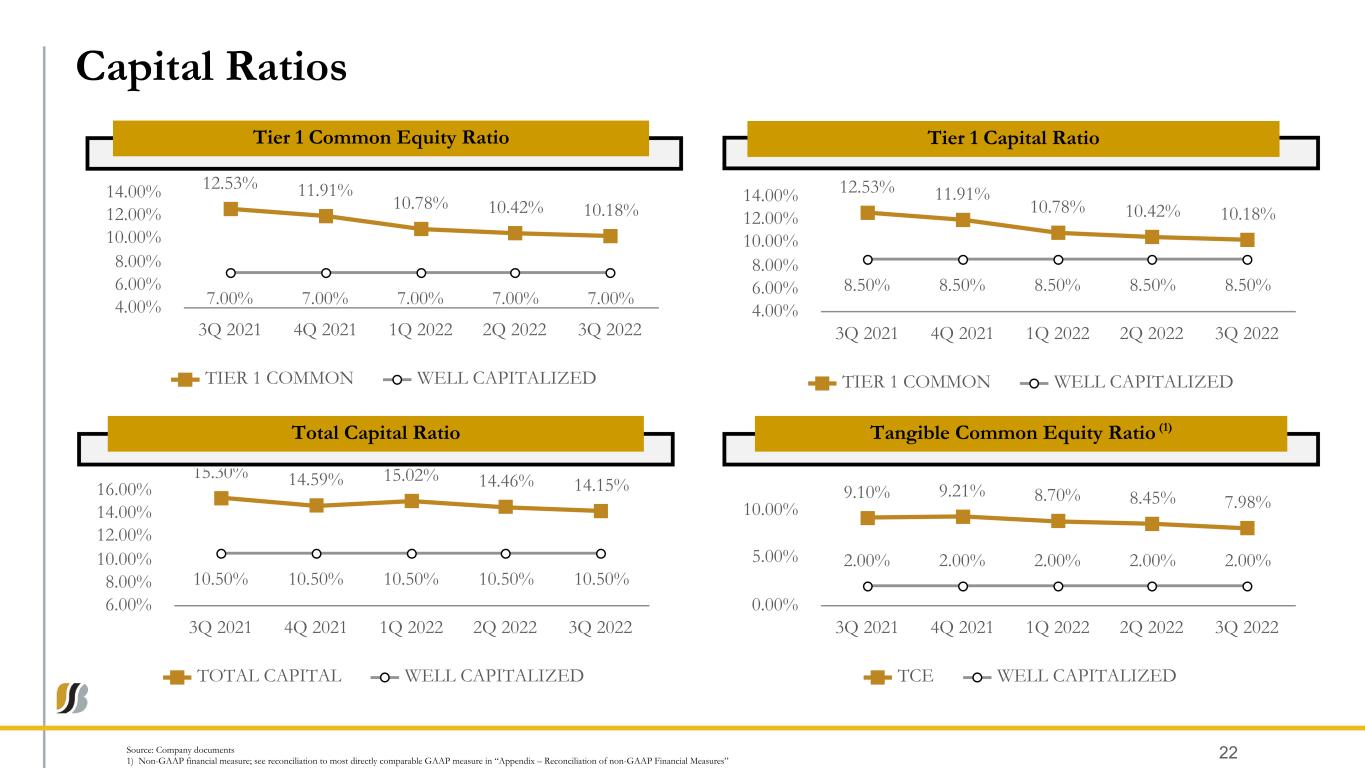

Capital Ratios Tier 1 Common Equity Ratio 22 Tier 1 Capital Ratio Tangible Common Equity Ratio (1)Total Capital Ratio Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” 12.53% 11.91% 10.78% 10.42% 10.18% 7.00% 7.00% 7.00% 7.00% 7.00% TIER 1 COMMON WELL CAPITALIZED 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 12.53% 11.91% 10.78% 10.42% 10.18% 8.50% 8.50% 8.50% 8.50% 8.50% TIER 1 COMMON WELL CAPITALIZED 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 15.30% 14.59% 15.02% 14.46% 14.15% 10.50% 10.50% 10.50% 10.50% 10.50% TOTAL CAPITAL WELL CAPITALIZED 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 9.10% 9.21% 8.70% 8.45% 7.98% 2.00% 2.00% 2.00% 2.00% 2.00% TCE WELL CAPITALIZED 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 0.00% 5.00% 10.00%

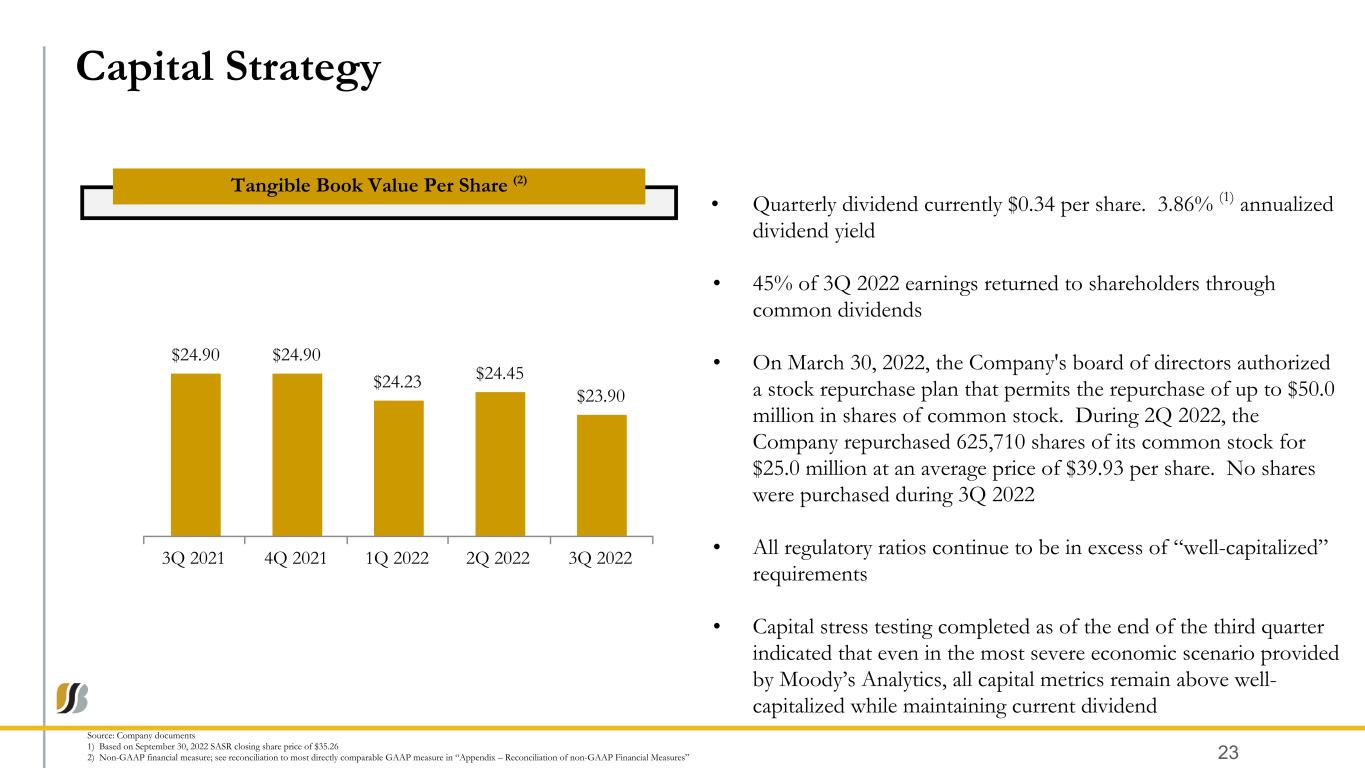

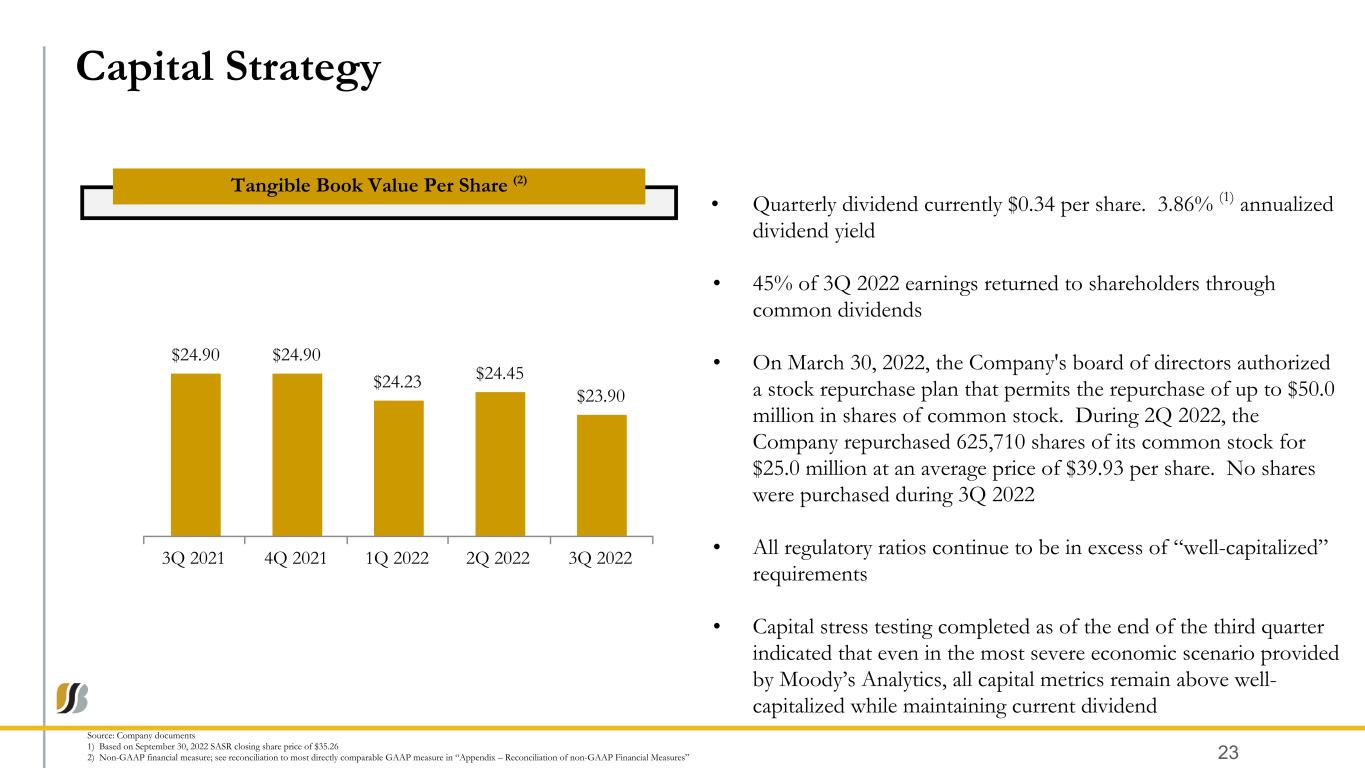

Source: Company documents 1) Based on September 30, 2022 SASR closing share price of $35.26 2) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” Capital Strategy Tangible Book Value Per Share (2) 23 • Quarterly dividend currently $0.34 per share. 3.86% (1) annualized dividend yield • 45% of 3Q 2022 earnings returned to shareholders through common dividends • On March 30, 2022, the Company's board of directors authorized a stock repurchase plan that permits the repurchase of up to $50.0 million in shares of common stock. During 2Q 2022, the Company repurchased 625,710 shares of its common stock for $25.0 million at an average price of $39.93 per share. No shares were purchased during 3Q 2022 • All regulatory ratios continue to be in excess of “well-capitalized” requirements • Capital stress testing completed as of the end of the third quarter indicated that even in the most severe economic scenario provided by Moody’s Analytics, all capital metrics remain above well- capitalized while maintaining current dividend $24.90 $24.90 $24.23 $24.45 $23.90 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022

Appendix 24

Non-GAAP Reconciliation This presentation contains financial information and performance measures determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). Sandy Spring Bancorp’s management believes that the supplemental non-GAAP information provides a better comparison of period-to-period operating performance. Additionally, Sandy Spring Bancorp believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. Non-GAAP measures used in this presentation consist of the following: • efficiency ratio • tangible common equity • core earnings Efficiency Ratio. Management views the GAAP efficiency ratio as an important financial measure of expense performance and cost management. The ratio expresses the level of non-interest expenses as a percentage of total revenue (net interest income plus total non-interest income). Lower ratios indicate improved productivity. In general, the efficiency ratio is non-interest expenses as a percentage of net interest income plus non-interest income. Non- interest expenses used in the calculation of the non-GAAP efficiency ratio excludes intangible asset amortization, loss on FHLB redemption, contingent payment expense, and merger, acquisition, and disposal expense from non-interest expense, and securities gains and gain on asset sales from non-interest income and adds the tax- equivalent adjustment to net interest income. The measure is different from the GAAP efficiency ratio, which also is presented in this document. The GAAP measure is calculated using non-interest expense and income amounts as shown on the face of the Consolidated Statements of Income. The GAAP and non-GAAP efficiency ratios are reconciled and provided in the following table. Tangible Common Equity. Tangible equity, tangible assets and tangible book value per share are non-GAAP financial measures calculated using GAAP amounts. Tangible common equity and tangible assets exclude the balances of goodwill and other intangible assets from stockholder’s equity and total assets, respectively. Management believes that this non-GAAP financial measure provides information to investors that may be useful in understanding our financial condition. Because not all companies use the same calculation of tangible equity and tangible assets, this presentation may not be comparable to other similarly titled measures calculated by other companies. Core Earnings. Core earnings is a non-GAAP financial measure calculated using GAAP amounts. Core earnings reflect net income for the period exclusive of merger, acquisition and disposal expense, amortization of intangible assets, loss on FHLB redemption, contingent payment expense, investment securities gains,and gain on asset sales, in each case net of tax. Management believes that this non-GAAP financial measure provides helpful information to investors in understanding the Company’s core operating earnings and provides a better comparison of period-to-period operating performance of the Company. 25

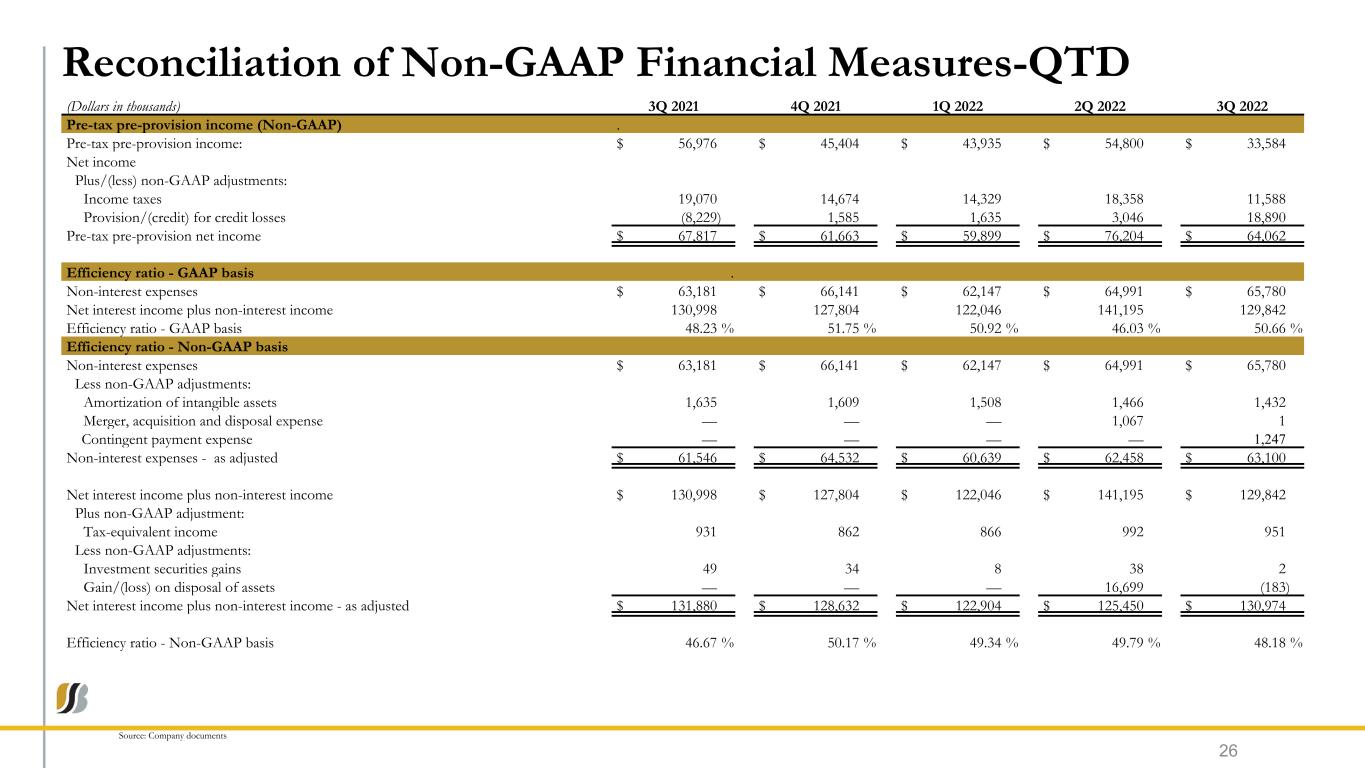

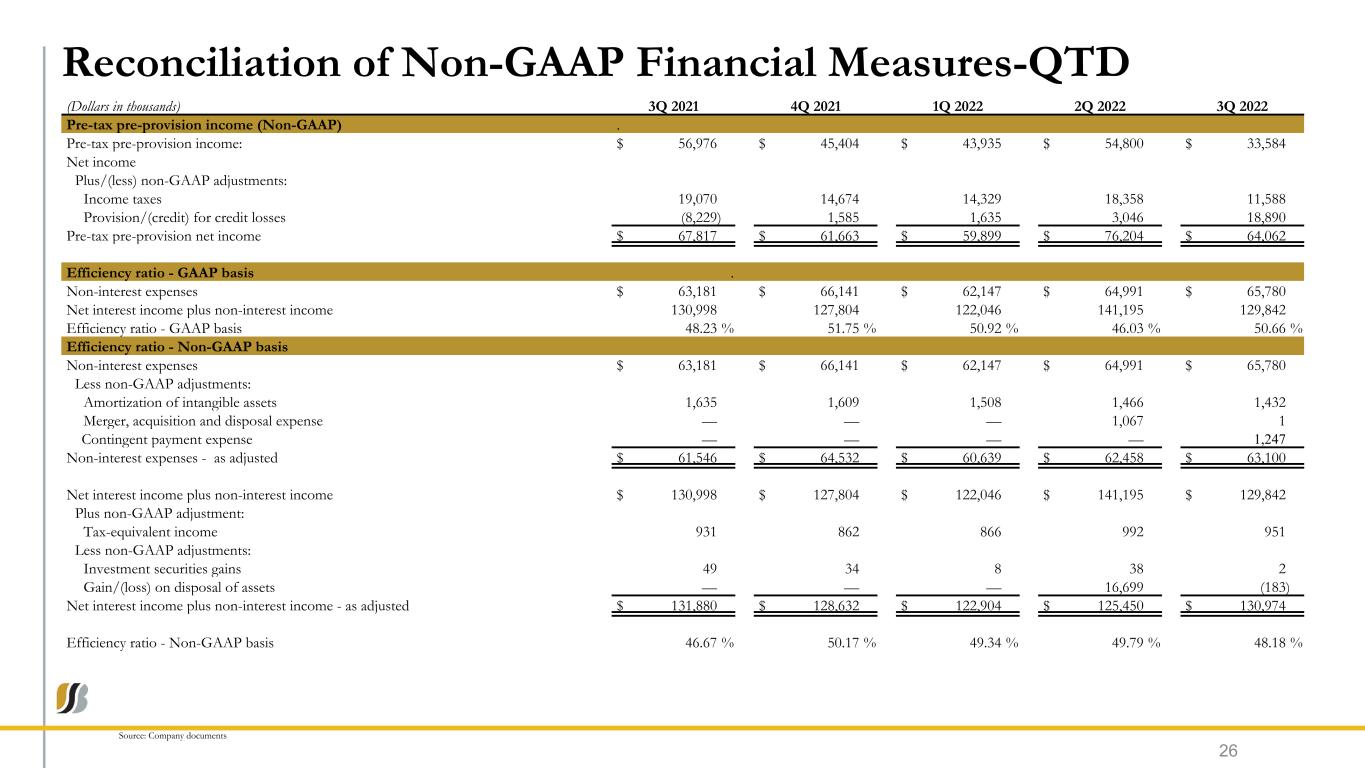

Reconciliation of Non-GAAP Financial Measures-QTD Source: Company documents 26 (Dollars in thousands) 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Pre-tax pre-provision income (Non-GAAP) . Pre-tax pre-provision income: $ 56,976 $ 45,404 $ 43,935 $ 54,800 $ 33,584 Net income Plus/(less) non-GAAP adjustments: Income taxes 19,070 14,674 14,329 18,358 11,588 Provision/(credit) for credit losses (8,229) 1,585 1,635 3,046 18,890 Pre-tax pre-provision net income $ 67,817 $ 61,663 $ 59,899 $ 76,204 $ 64,062 Efficiency ratio - GAAP basis . Non-interest expenses $ 63,181 $ 66,141 $ 62,147 $ 64,991 $ 65,780 Net interest income plus non-interest income 130,998 127,804 122,046 141,195 129,842 Efficiency ratio - GAAP basis 48.23 % 51.75 % 50.92 % 46.03 % 50.66 % Efficiency ratio - Non-GAAP basis Non-interest expenses $ 63,181 $ 66,141 $ 62,147 $ 64,991 $ 65,780 Less non-GAAP adjustments: Amortization of intangible assets 1,635 1,609 1,508 1,466 1,432 Merger, acquisition and disposal expense — — — 1,067 1 Contingent payment expense — — — — 1,247 Non-interest expenses - as adjusted $ 61,546 $ 64,532 $ 60,639 $ 62,458 $ 63,100 Net interest income plus non-interest income $ 130,998 $ 127,804 $ 122,046 $ 141,195 $ 129,842 Plus non-GAAP adjustment: Tax-equivalent income 931 862 866 992 951 Less non-GAAP adjustments: Investment securities gains 49 34 8 38 2 Gain/(loss) on disposal of assets — — — 16,699 (183) Net interest income plus non-interest income - as adjusted $ 131,880 $ 128,632 $ 122,904 $ 125,450 $ 130,974 Efficiency ratio - Non-GAAP basis 46.67 % 50.17 % 49.34 % 49.79 % 48.18 %

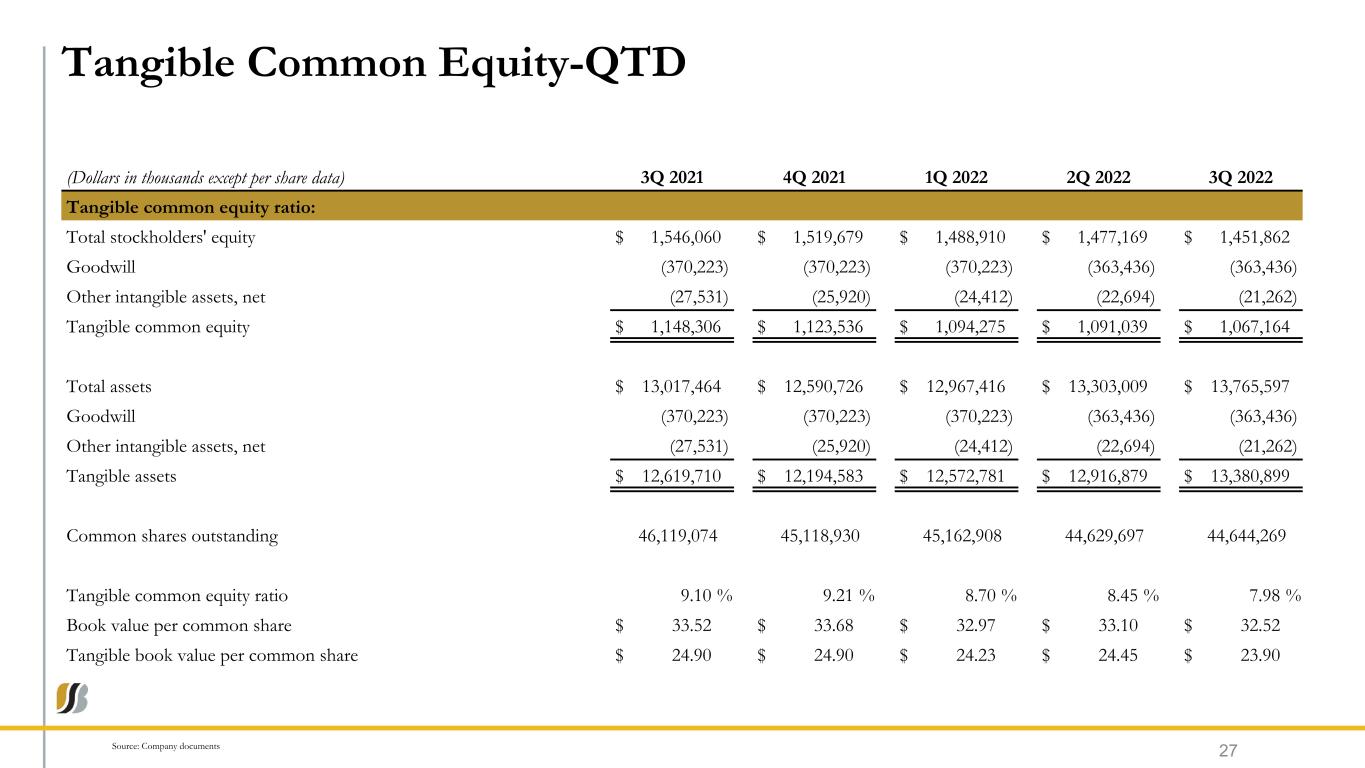

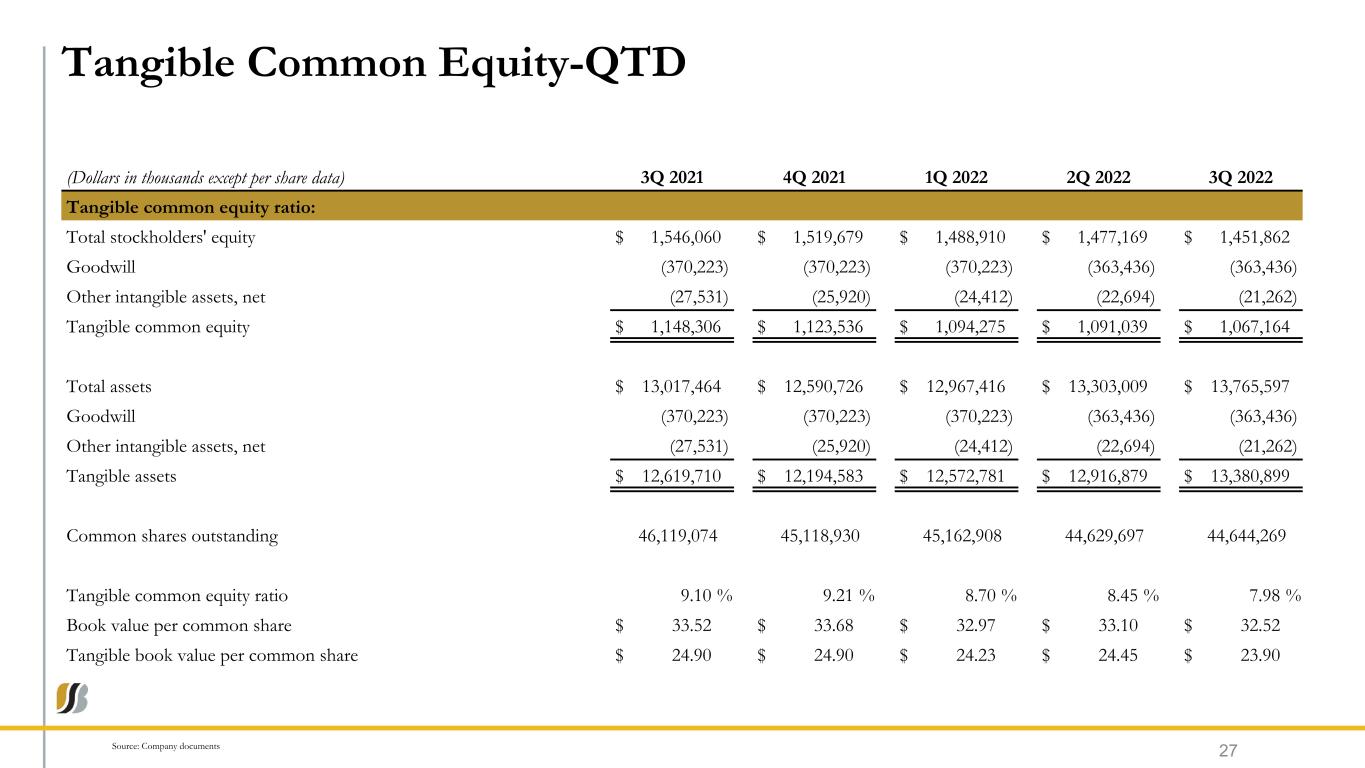

Tangible Common Equity-QTD Source: Company documents 27 (Dollars in thousands except per share data) 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Tangible common equity ratio: Total stockholders' equity $ 1,546,060 $ 1,519,679 $ 1,488,910 $ 1,477,169 $ 1,451,862 Goodwill (370,223) (370,223) (370,223) (363,436) (363,436) Other intangible assets, net (27,531) (25,920) (24,412) (22,694) (21,262) Tangible common equity $ 1,148,306 $ 1,123,536 $ 1,094,275 $ 1,091,039 $ 1,067,164 Total assets $ 13,017,464 $ 12,590,726 $ 12,967,416 $ 13,303,009 $ 13,765,597 Goodwill (370,223) (370,223) (370,223) (363,436) (363,436) Other intangible assets, net (27,531) (25,920) (24,412) (22,694) (21,262) Tangible assets $ 12,619,710 $ 12,194,583 $ 12,572,781 $ 12,916,879 $ 13,380,899 Common shares outstanding 46,119,074 45,118,930 45,162,908 44,629,697 44,644,269 Tangible common equity ratio 9.10 % 9.21 % 8.70 % 8.45 % 7.98 % Book value per common share $ 33.52 $ 33.68 $ 32.97 $ 33.10 $ 32.52 Tangible book value per common share $ 24.90 $ 24.90 $ 24.23 $ 24.45 $ 23.90

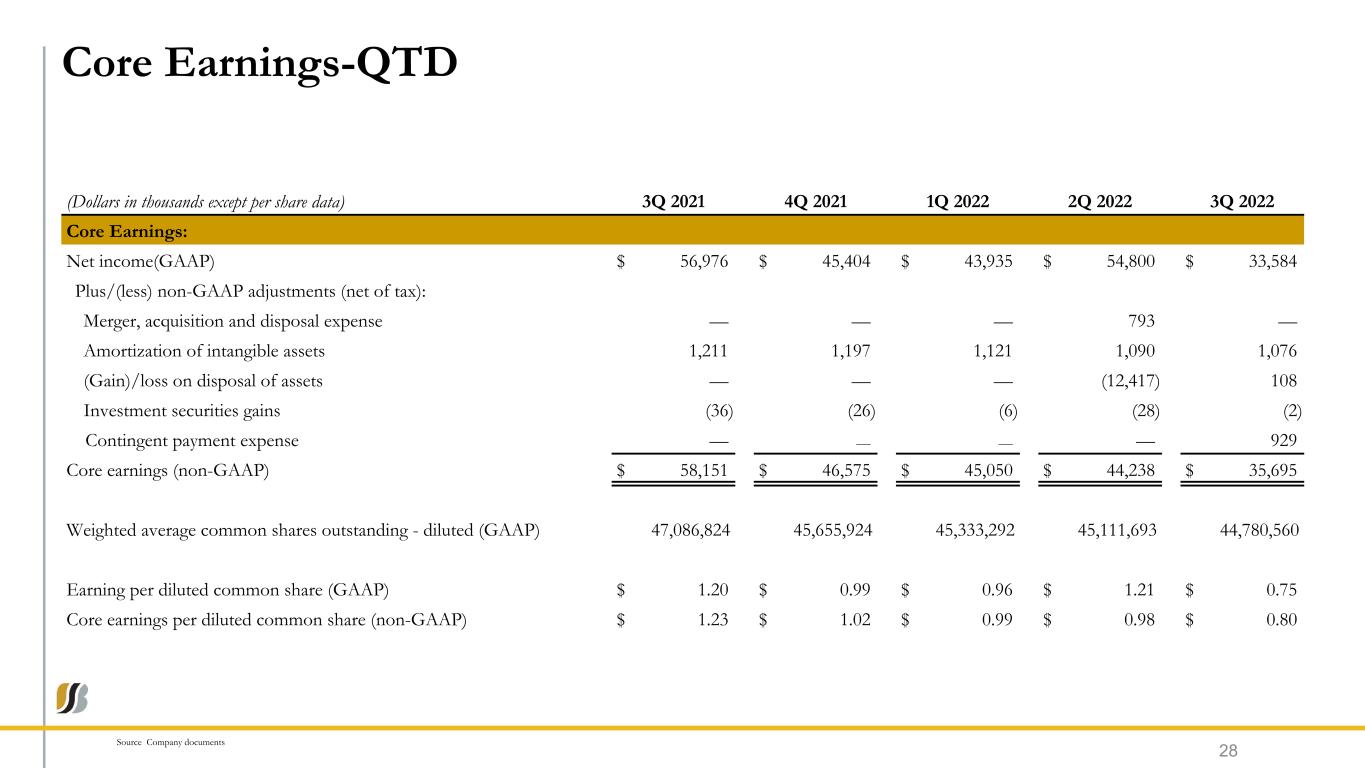

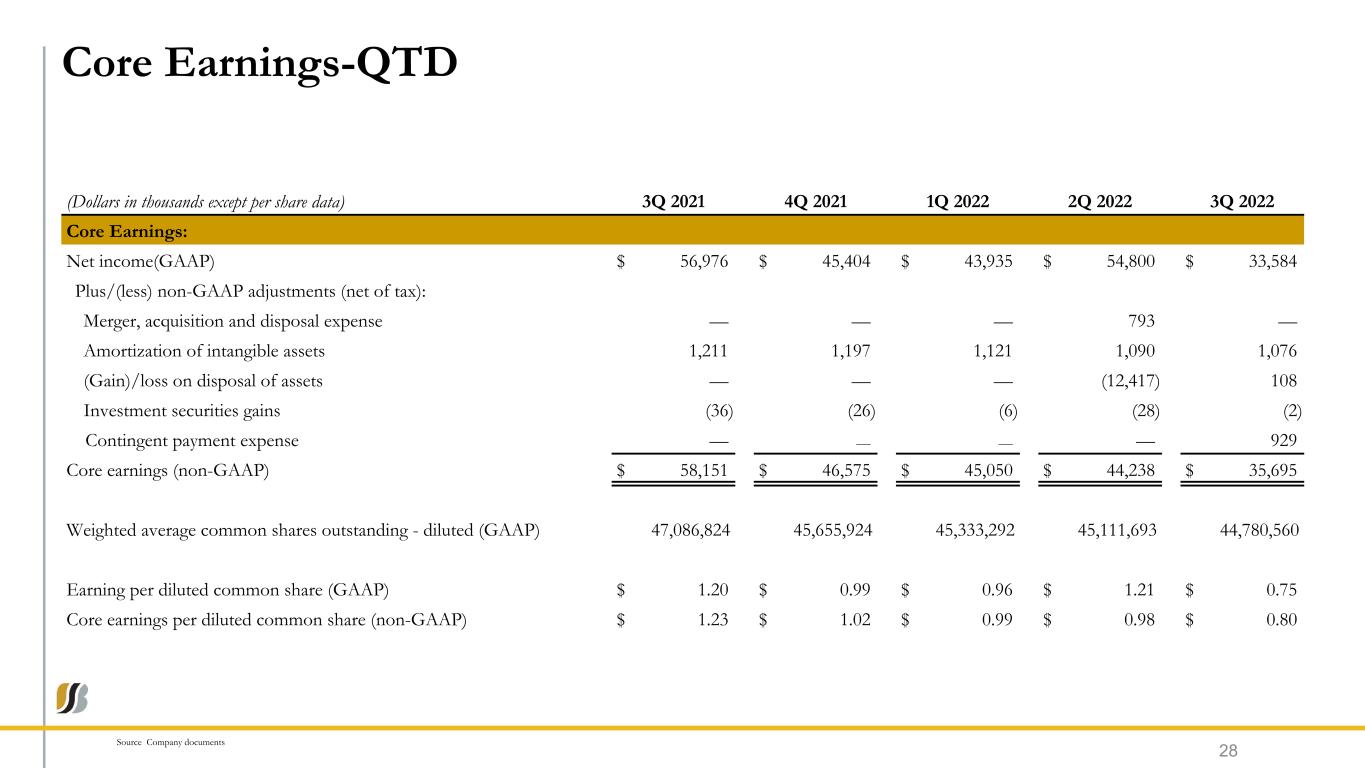

Core Earnings-QTD Source Company documents 28 (Dollars in thousands except per share data) 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Core Earnings: Net income(GAAP) $ 56,976 $ 45,404 $ 43,935 $ 54,800 $ 33,584 Plus/(less) non-GAAP adjustments (net of tax): Merger, acquisition and disposal expense — — — 793 — Amortization of intangible assets 1,211 1,197 1,121 1,090 1,076 (Gain)/loss on disposal of assets — — — (12,417) 108 Investment securities gains (36) (26) (6) (28) (2) Contingent payment expense — — — — 929 Core earnings (non-GAAP) $ 58,151 $ 46,575 $ 45,050 $ 44,238 $ 35,695 Weighted average common shares outstanding - diluted (GAAP) 47,086,824 45,655,924 45,333,292 45,111,693 44,780,560 Earning per diluted common share (GAAP) $ 1.20 $ 0.99 $ 0.96 $ 1.21 $ 0.75 Core earnings per diluted common share (non-GAAP) $ 1.23 $ 1.02 $ 0.99 $ 0.98 $ 0.80