1st Quarter 2023 Earnings Presentation April 20, 2023 1

2 Subtitle Copy Sandy Spring Bancorp’s forward-looking statements are subject to significant risks and uncertainties that may cause actual results to differ materially from those in such statements. These risks and uncertainties include, but are not limited to, the risks identified in our quarterly and annual reports and the following: changes in general business and economic conditions nationally or in the markets that we serve; changes in consumer and business confidence, investor sentiment, or consumer spending or savings behavior; changes in the level of inflation; changes in the demand for loans, deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected; the impact of the interest rate environment on our business, financial condition and results of operations; the impact of compliance with changes in laws, regulations and regulatory interpretations, including changes in income taxes; changes in credit ratings assigned to us or our subsidiaries; the ability to realize benefits and cost savings from, and limit any unexpected liabilities associated with, any business combinations; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the impact of changes in accounting policies, including the introduction of new accounting standards; the impact of judicial or regulatory proceedings; the impact of fiscal and governmental policies of the United States federal government; the impact of health emergencies, epidemics or pandemics; the effects of climate change; and the impact of natural disasters, extreme weather events, military conflict, terrorism or other geopolitical events. Sandy Spring Bancorp provides greater detail regarding some of these factors in its Form 10-K for the year ended December 31, 2022, including in the Risk Factors section of that report, and in its other SEC reports. Sandy Spring Bancorp’s forward-looking statements may also be subject to other risks and uncertainties, including those that it may discuss elsewhere in its filings with the SEC, accessible on the SEC’s Web site at www.sec.gov. Forward Looking Statements 2

4 Subtitle Copy 3 Quarterly Highlights Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” 2) Excludes merger, acquisition and disposal expense, amortization of intangible assets, loss on FHLB redemption, contingent payment expense, gain on disposal of assets and investment securities gains (losses) Profitability • Net income of $51.3 million ($1.14 per diluted common share) compared to $43.9 million ($0.96 per diluted common share) for the prior year quarter, and $34.0 million ($0.76 per diluted common share) for the previous quarter. • Core earnings(1)(2) of $52.3 million ($1.16 per diluted common share) compared to $45.1 million ($0.99 per diluted common share) for the prior year quarter, and $35.3 million ($0.79 per diluted common share) for the previous quarter. • GAAP efficiency ratio was 58.55% compared to 50.92% for the prior year quarter, and 53.23% for the previous quarter . The non- GAAP efficiency ratio(1)(2) was 56.87% compared to 49.34% for the prior year quarter, and 51.46% for the previous quarter. Income Statement • Net interest margin of 2.99%, compared to 3.49% for the same quarter of 2022, and 3.26% for the previous quarter. Pre-tax pre- provision net income(1) was $46.9 million compared to $59.9 million for the prior year quarter. • Provision for credit losses was a credit of $21.5 million as compared to a charge of $1.6 million in the prior year quarter. • Non-interest income down 23% from prior year quarter. • Non-interest expense up 7% from prior year quarter. Balance Sheet • Total assets of $14.1 billion, up 2% from the previous quarter. Total assets up 9% year-over-year. • Total loans have remained stable at $11.4 billion compared to the previous quarter and up 12% from the prior year quarter. Total commercial loans grew by $902.1 million or 12% during the past twelve months. • Deposits up 1% from the previous quarter. Noninterest-bearing deposits down 12% and interest-bearing deposits up 8%. Asset Quality • Non-performing loans to total loans of 0.41%, down from 0.46% from prior year quarter. Capital • Risk-based capital ratio of 14.43%, common equity tier 1 risk-based capital ratio of 10.53%, tier 1 risk-based capital ratio of 10.53%, and tier 1 leverage ratio of 9.44%.

6 Subtitle Copy 1st Quarter 2023 Financial Performance 4

8 Subtitle Copy Profitability 5

9 Subtitle Copy Profitability Trends Diluted EPS f Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” 6 Return on Average Assets Return on Average Common Equity Diluted Core EPS(1) $0.96 $1.21 $0.75 $0.76 $1.14 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 $0.99 $0.98 $0.80 $0.79 $1.16 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 1.42% 1.69% 0.99% 0.98% 1.49% 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 11.83% 14.97% 8.96% 9.23% 13.93% 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

10 Subtitle Copy Profitability Trends Net Income Provision (Credit) for Credit Losses Pre-Tax Pre-Provision Net Revenue(1) 7Source: Company documents 1) Net Interest Income plus Non-interest Income less Non-interest Expense • The credit to the provision for credit losses was the driver of the increase in net income from 1Q 2022 to 1Q 2023. The credit to the provision reflects the impact of improvement in the forecasted regional unemployment rate, management's consideration of existing economic versus historical conditions and continued strong credit performance of loan portfolio segments (Dollars in millions) $43.9 $54.8 $33.6 $34.0 $51.3 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 (Dollars in millions) $59.9 $76.2 $64.1 $56.6 $46.9 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 (Dollars in millions) $1.6 $3.0 $18.9 $10.8 $(21.5) 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

11 Subtitle Copy Income Statement 8

Net Interest Income Net Interest Income & Net Interest Margin Source: Company documents 9 • The net interest margin was 2.99% for the current quarter compared to 3.26% for Q4 2022 • Decline in net interest margin due to the higher interest rate on interest-bearing liabilities which outpaced the increase in yield on interest-bearing assets (Dollars in thousands) $101,451 $105,950 $112,960 $106,643 $97,302 3.49% 3.49% 3.53% 3.26% 2.99% Net Interest Income Net Interest Margin 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

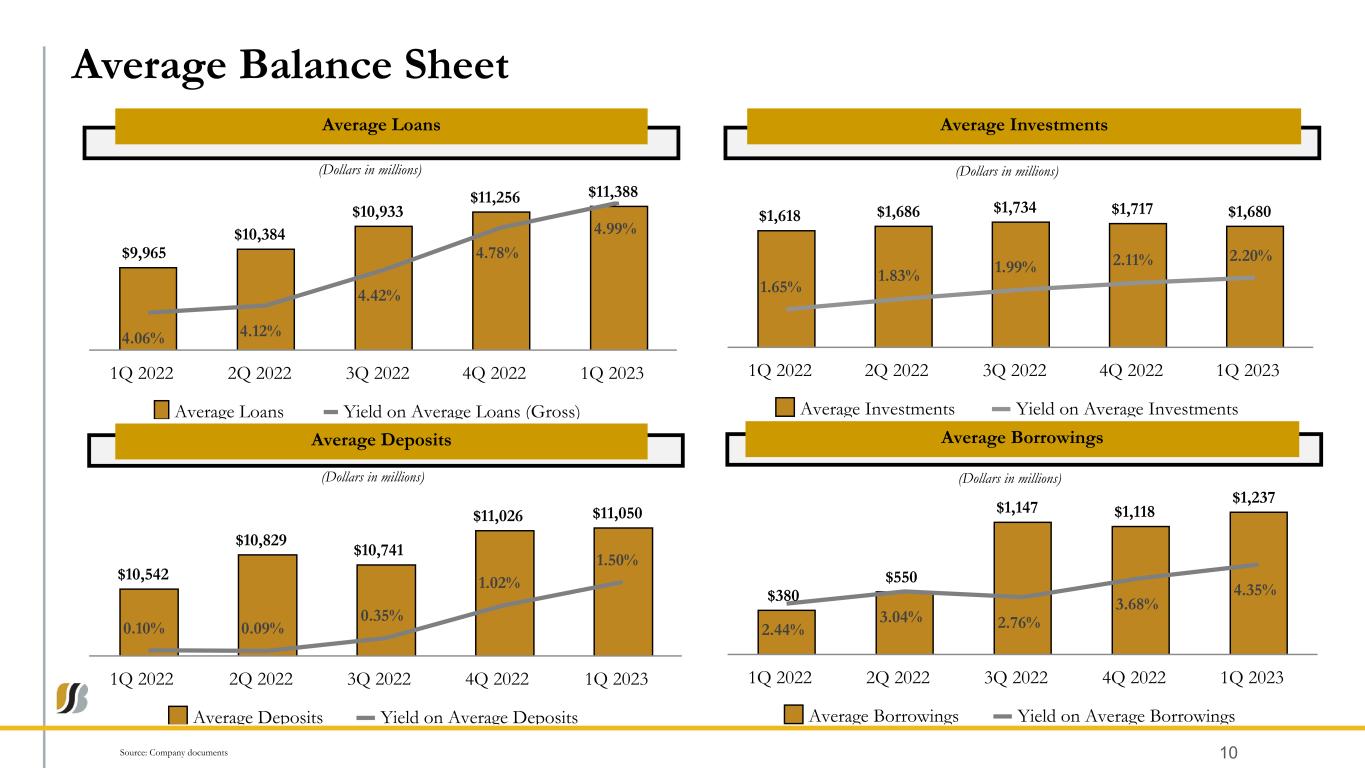

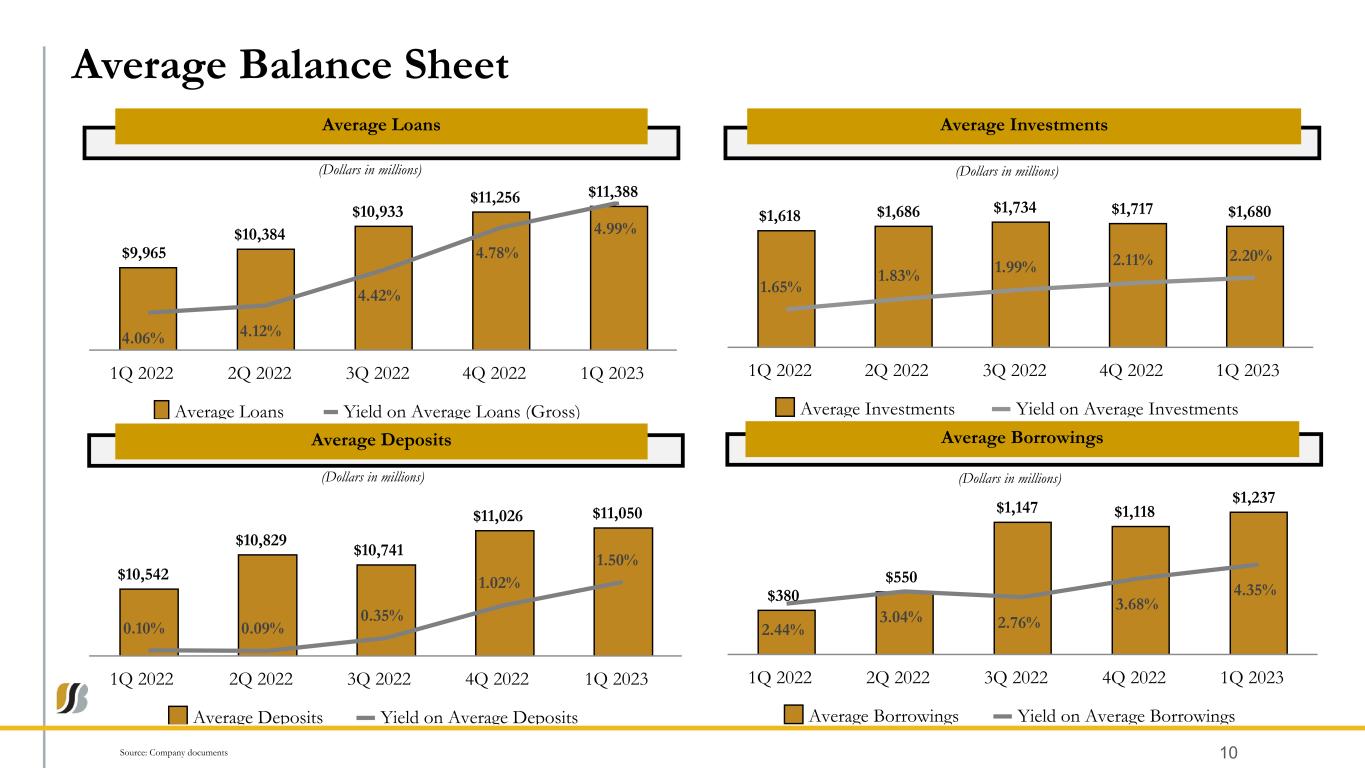

Average Balance Sheet Source: Company documents 10 Average Loans Average Deposits Average Investments Average Borrowings (Dollars in millions) $9,965 $10,384 $10,933 $11,256 $11,388 4.06% 4.12% 4.42% 4.78% 4.99% Average Loans Yield on Average Loans (Gross) 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 (Dollars in millions) $1,618 $1,686 $1,734 $1,717 $1,680 1.65% 1.83% 1.99% 2.11% 2.20% Average Investments Yield on Average Investments 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 (Dollars in millions) $10,542 $10,829 $10,741 $11,026 $11,050 0.10% 0.09% 0.35% 1.02% 1.50% Average Deposits Yield on Average Deposits 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 (Dollars in millions) $380 $550 $1,147 $1,118 $1,237 2.44% 3.04% 2.76% 3.68% 4.35% Average Borrowings Yield on Average Borrowings 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

Source: Company documents 1) YTD March 31, 2023 Revenue Composition Revenue Composition (1) Non-interest Income 11 • Company's insurance business sold in 2Q 2022 • Interchange fee limitation effective 7/1/2022 (Durbin Amendment) • Mortgage banking and wealth management impacted by interest rates and market environment Wealth Management 56% Mortgage Banking 8% Services Charges on Deposits 15% Other 12% Bank Card Revenue 3% BOLI Income 6% (Dollars in thousands) $ Change vs 1Q 2023 4Q 2022 1Q 2022 Investment Securities Gains/ Losses $ — $ 393 $ (8) Service Charges on Deposits 2,388 (31) 62 Mortgage Banking 1,245 462 (1,053) Wealth Management 8,992 520 (345) Insurance Agency Commissions — — (2,115) BOLI Income 907 (43) 112 Bank Card Revenue 418 (45) (1,250) Other Income 2,001 398 (47) Non-interest Income $ 15,951 $ 1,654 $ (4,644) Total: $16.0 Million

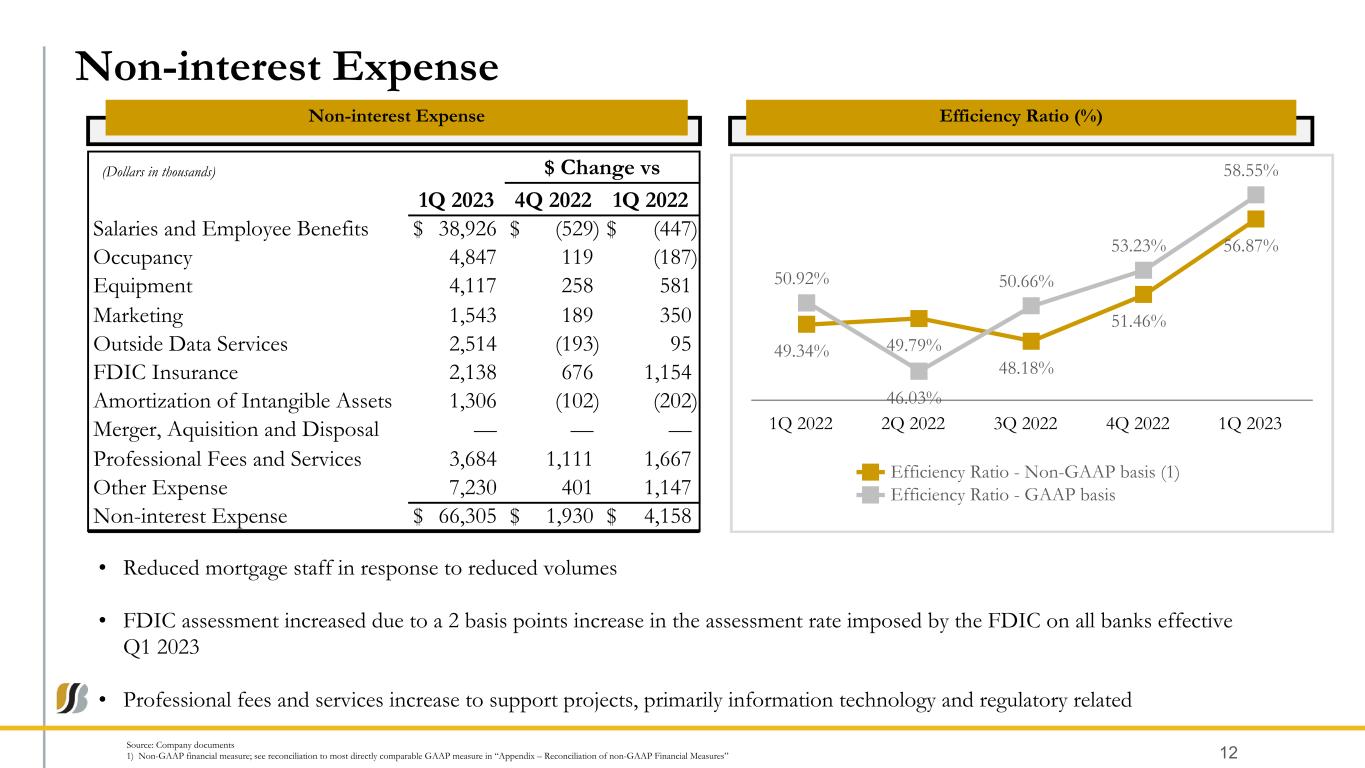

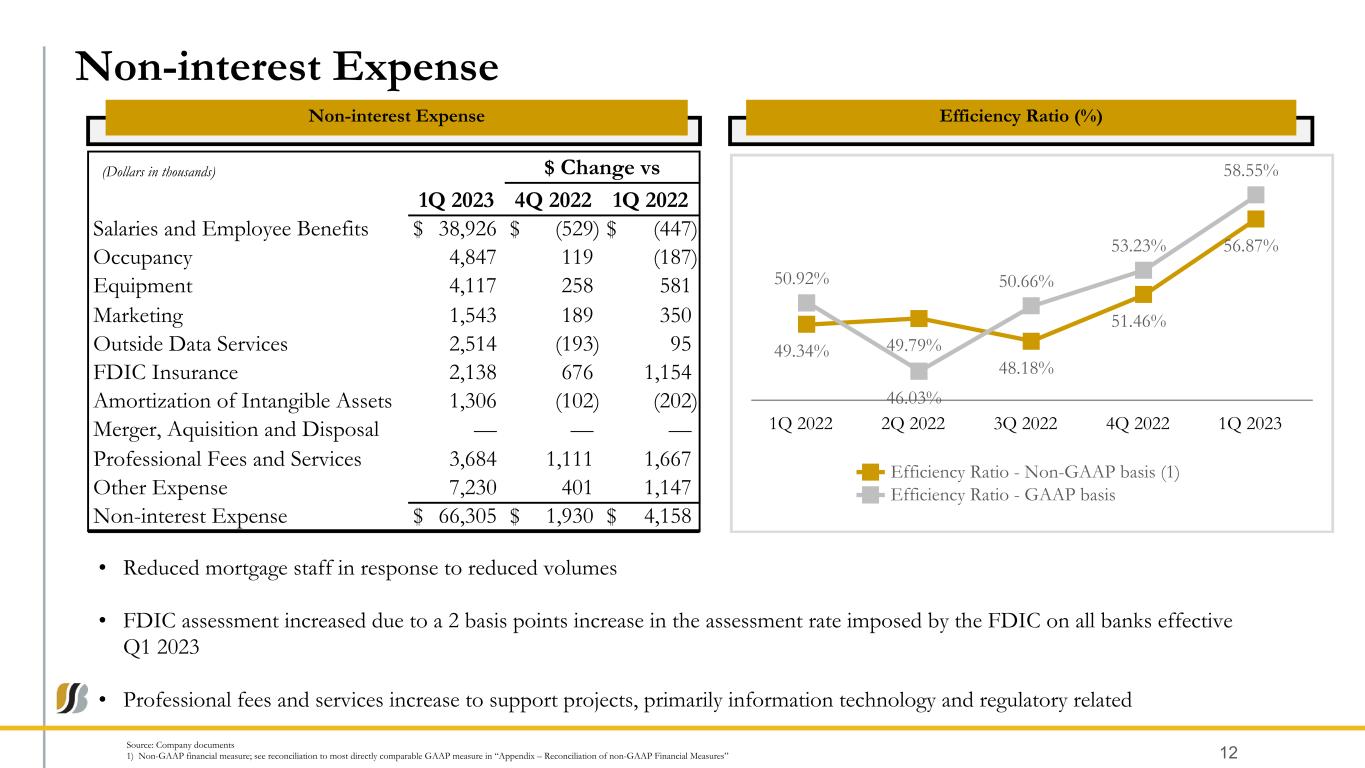

Non-interest Expense Non-interest Expense 12 • Reduced mortgage staff in response to reduced volumes • FDIC assessment increased due to a 2 basis points increase in the assessment rate imposed by the FDIC on all banks effective Q1 2023 • Professional fees and services increase to support projects, primarily information technology and regulatory related Efficiency Ratio (%) Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” (Dollars in thousands) $ Change vs 1Q 2023 4Q 2022 1Q 2022 Salaries and Employee Benefits $ 38,926 $ (529) $ (447) Occupancy 4,847 119 (187) Equipment 4,117 258 581 Marketing 1,543 189 350 Outside Data Services 2,514 (193) 95 FDIC Insurance 2,138 676 1,154 Amortization of Intangible Assets 1,306 (102) (202) Merger, Aquisition and Disposal — — — Professional Fees and Services 3,684 1,111 1,667 Other Expense 7,230 401 1,147 Non-interest Expense $ 66,305 $ 1,930 $ 4,158 49.34% 49.79% 48.18% 51.46% 56.87% 50.92% 46.03% 50.66% 53.23% 58.55% Efficiency Ratio - Non-GAAP basis (1) Efficiency Ratio - GAAP basis 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

Balance Sheet 13

Balance Sheet Trends Total Assets Loans Held for Investment Total Deposits 14 Source: Company documents (Dollars in millions) $12,967 $13,303 $13,766 $13,833 $14,129 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 (Dollars in millions) $10,853 $10,969 $10,749 $10,953 $11,076 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 (Dollars in millions) $10,144 $10,786 $11,219 $11,397 $11,395 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

Deposit Portfolio Deposit Composition (1) 15 Deposit Growth • #1 deposit market share for community banks in combined Washington, D.C. & Baltimore MSAs. Source: Company documents and S&P Global Market Intelligence 1) At March 31, 2023 Noninterest- Bearing Deposits, 29% MMDA & Other Savings, 34% Interest Bearing Demand, 13% Time Deposits, 12% Brokered Time Deposits, 12% $11.1 Billion (Dollars in millions) $ Change vs 1Q 2023 4Q 2022 1Q 2022 Noninterest-Bearing Deposits $ 3,229 $ (444) $ (811) MMDA & Other Savings 3,729 3 (311) Interest Bearing Demand 1,472 37 62 Time Deposits 1,335 136 208 Brokered Time Deposits 1,311 391 1,074 Total Deposits $ 11,076 $ 123 $ 223

Insured vs Uninsured Deposits Deposit Breakdown (1) 16 Uninsured Deposits by Type • 40% of uninsured depositors have a lending relationship with the Company • 79% of uninsured deposits are Business accounts; 46% of which have a lending relationship; 15% of uninsured deposits are Trust accounts, 23% of which have a lending relationship , Source: Company documents and S&P Global Market Intelligence 1) At March 31, 2023 $3.8, 35% $7.3, 65% Uninsured Insured $3.0, 79% $0.8, 21% Commercial Retail Dollars in Billions Dollars in Billions

Commercial Customers Core Deposit Mix Source: Company documents 17 • 61% of total core deposits are business accounts • Average length of relationship 9 years • 79% of uninsured deposits were commercial as of 1Q 2023 • No commercial client > 2% of total deposits • Well-diversified portfolio; no significant concentration in one industry or with any single client Time Deposits, 5% Non-interest Bearing Checking, 49% Money Market, 35% Interest Checking, 9% Savings, 2% Total: $6.0 Billion

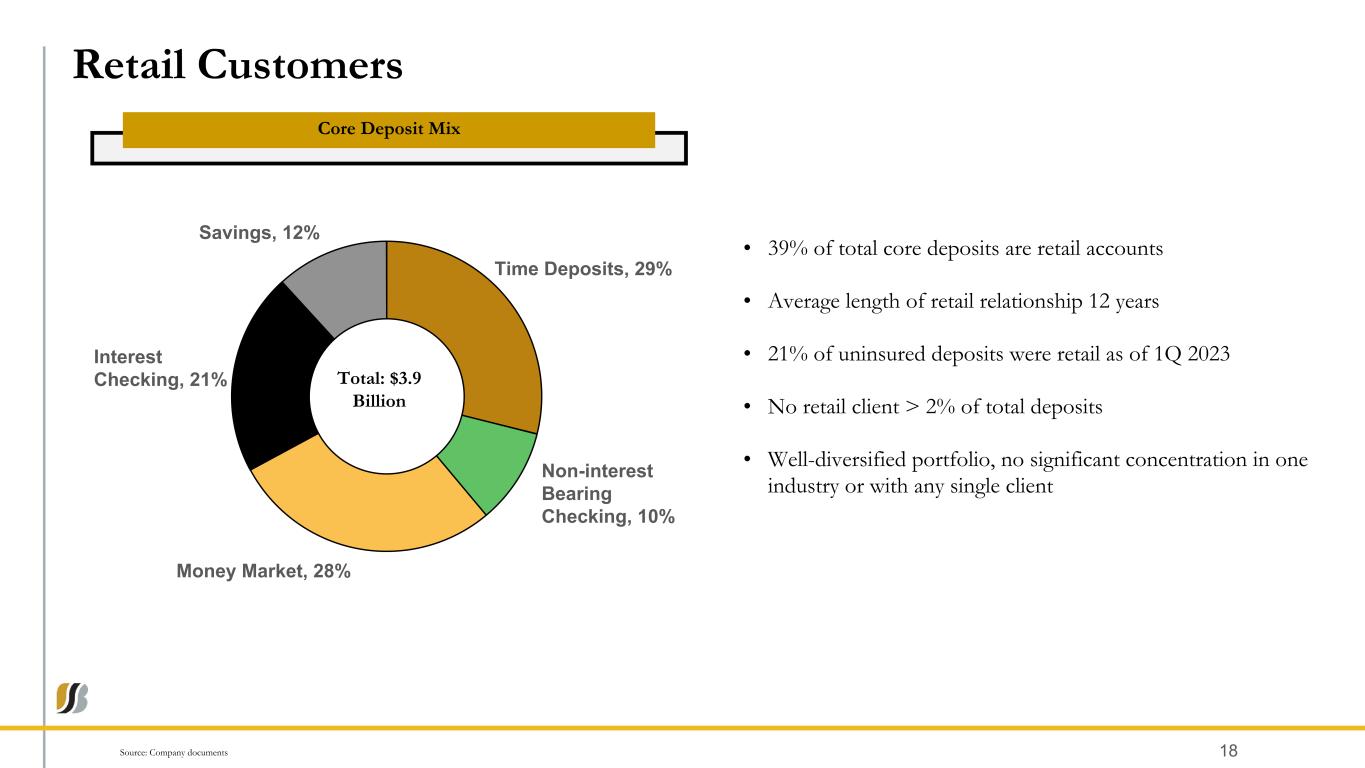

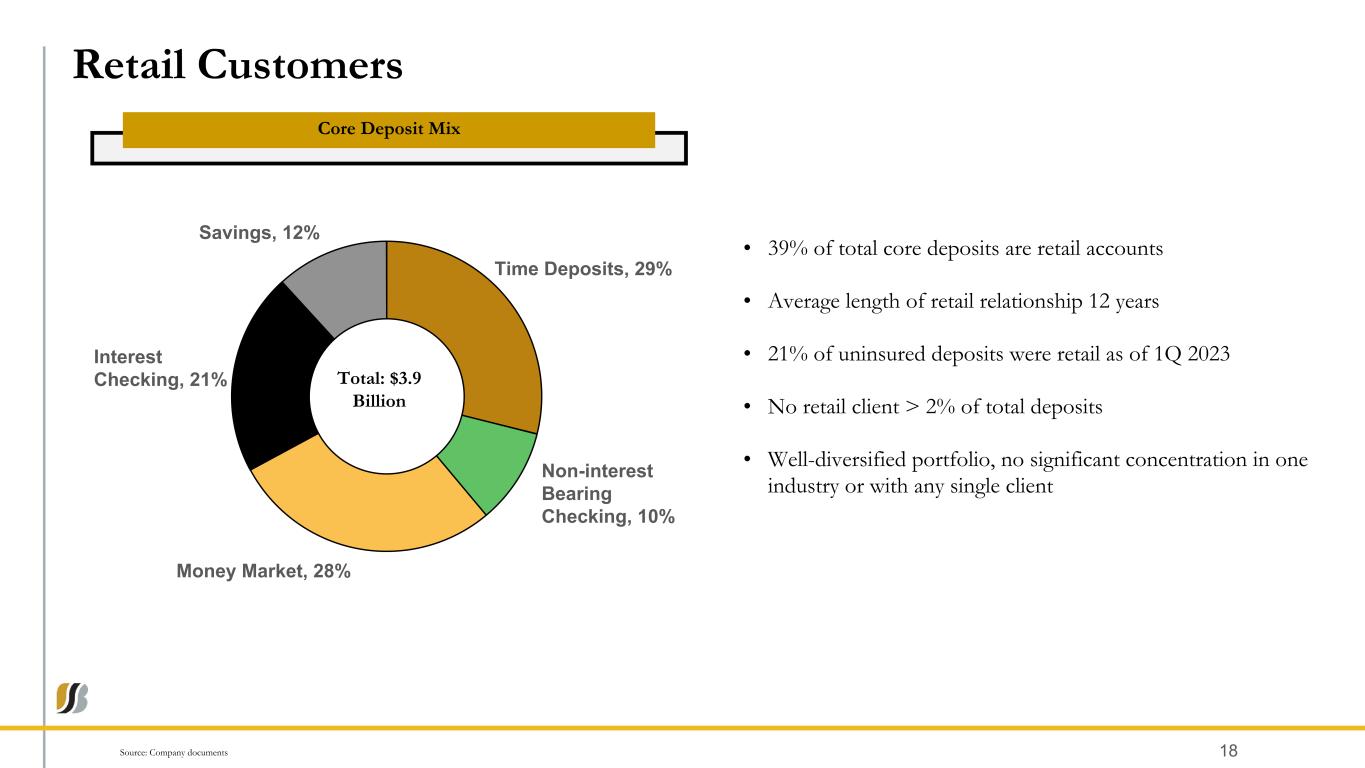

Retail Customers Core Deposit Mix Source: Company documents 18 • 39% of total core deposits are retail accounts • Average length of retail relationship 12 years • 21% of uninsured deposits were retail as of 1Q 2023 • No retail client > 2% of total deposits • Well-diversified portfolio, no significant concentration in one industry or with any single client Time Deposits, 29% Non-interest Bearing Checking, 10% Money Market, 28% Interest Checking, 21% Savings, 12% Total: $3.9 Billion

• Core deposits equaled 73.3% of total interest-earning assets at March 31, 2023 • Stress testing is performed quarterly and includes both systemic and idiosyncratic scenarios • Testing completed at the end of the first quarter demonstrates a strong liquidity position with sufficient liquidity in the most severe scenarios Source: Company documents Contingent Liquidity to Uninsured Deposits 19 Liquidity Position

Loan Portfolio, Asset Quality & Reserves (CECL) 20

Source: Company documents 1) At March 31, 2023; Amounts include PPP loans and net deferred fees/costs in C&I Loan Portfolio Loan Composition(1) 21 Net Loan Change (1) Investor Real Estate 45% Owner- Occupied Real Estate 15% AD&C 9% C&I 13% Residential Mortgage 12% Residential Construction 2% Consumer 4%Total: $11.4 Billion (Dollars in millions) $ Change vs 1Q 2023 4Q 2022 1Q 2022 Investor Real Estate $ 5,167 $ 37 $ 779 Owner-Occupied Real Estate 1,770 (5) 78 AD&C 1,047 (43) (42) C&I 1,437 (19) 87 Residential Mortgage 1,329 41 328 Residential Construction 223 (2) 19 Consumer 422 (11) 2 Total Loans $ 11,395 $ (2) $ 1,251 • New commercial loan production of $422.9 million in 2023, of which $155.8 million was funded (37% utilization) • A greater number of conventional 1-4 family mortgages and ARM loans were retained to grow the mortgage portfolio which resulted in 33% growth year-over- year. Greater number of loans converting out of the construction portfolio were retained in the loan portfolio • Reduced loan demand and lower payoff activity resulted in minimal loan growth compared to the prior quarter

Source: Company documents 1) At March 31, 2023; Business Loan Portfolio by NAICS Business Loans By Industry (1) 22 Real Estate 14% Services 8% Trade Contractors 6% Wholesale 5% Engineering & Management 5% Insurance 5% Professional Services 5% Education 5% Organizational Services 5% Building Contractors 5% Other 37% Total: $5.2 Billion

Source: Company documents 1) At March 31, 2023 Commercial Loans by Type (1) CRE by Collateral Type Business Loans & Owner Occupied R/E 23 Retail 30% Office 14% Residential 12% Apartment Building (5+ units) 15% Hotel 6% Warehouse Space 6% Residential Lot 3% Mixed Use (res. & comm.) 3% Flex (office/warehouse) 3% Industrial Space 2% Automotive Facilities 1% Unimproved Commercial Property 1% Other Misc 4% Construction 13% Other Services 11% Real Estate Rental & Leasing 10% Professional, Scientific & Technical Services 10% Health Care & Social Assistance 7% Educational Services 10% Retail 9% Accommodation & Food Services 5% Wholesale 6% Arts, Entertainment & Recreation 6% Manufacturing 4% Administrative & Support 3% Other Misc 6% Total: $6.2 Billion Total: $3.2 Billion (1)

Source: Company documents 1) At March 31, 2023 CRE Concentrations (1) Washington DC Baltimore City 24 Apartment Building (5+ units) 37% Retail Space 16% Office Building 9% Condo Structure 8% Mixed Use (res. & comm.) 5% Townhouse Structure 5% Warehouse Space 4% Single Family Structure 4% Hotel 4% Other Misc 8% Apartment Building (5+ units) 18% Townhouse Structure 16% Retail Space 14% Mixed Use (res. & comm.) 14% Office Building Industrial Space 8% Single Family Structure 5% Warehouse Space 4% Automotive Facilities 3% Other Misc 5% Total: $1.1 Billion Total: $385.6 Million (1)

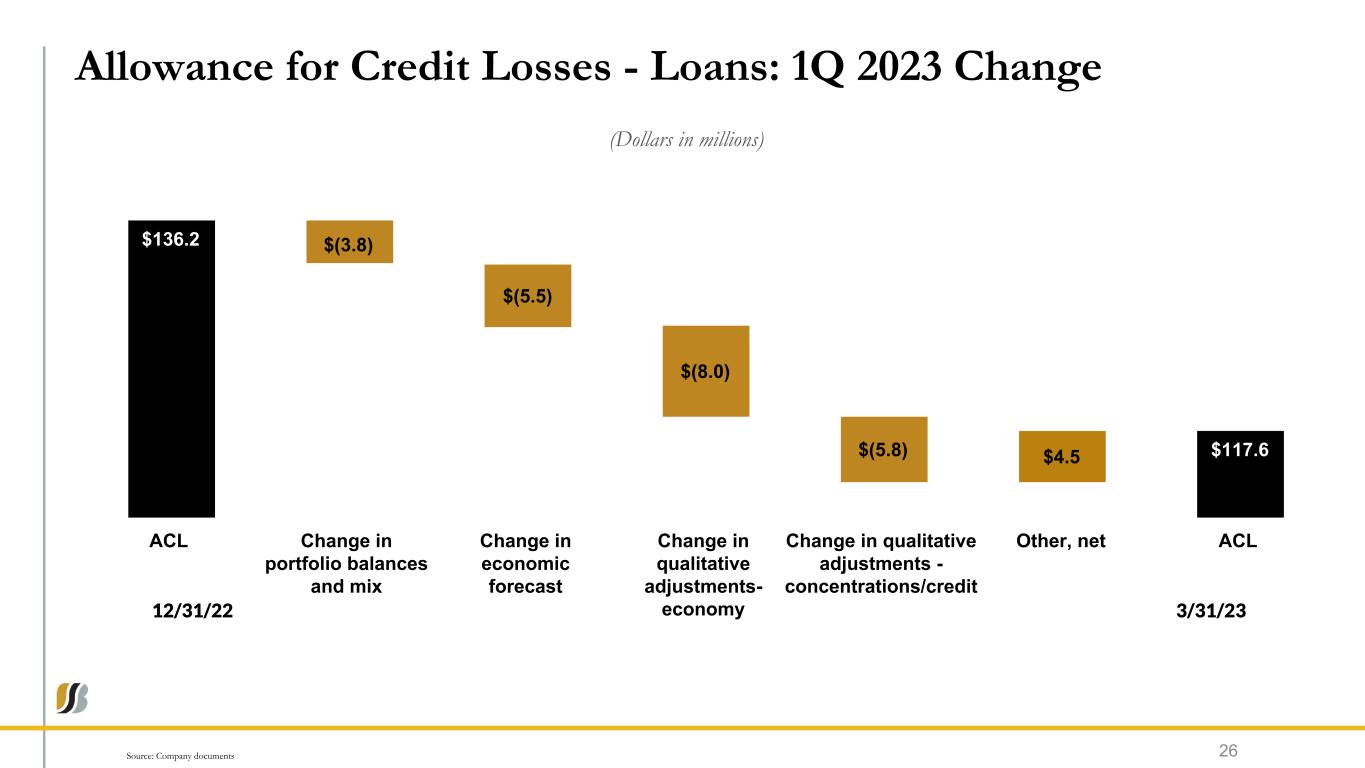

Current Expected Credit Losses – Loans 25 ACL/Total Loans • ACL of $117.6 million or 1.03% of outstanding loans equals 249% of non-performing loans at March 31, 2023 • Credit to the provision of $21.5 million includes $18.9 million directly attributable to the funded loan portfolio and $2.6 million for unfunded loan commitments. Resulting credit to the provision for the current quarter is driven by improved forecasts of the regional unemployment rate coupled with the stable credit quality • Utilized March 2023 Moody’s baseline forecast in quantitative model ACL by Loan Type Source: Company documents (Dollars in thousands) $110,588 $113,670 $128,268 $136,242 $117,610 1.09% 1.05% 1.14% 1.20% 1.03% Total ACL ACL/Total Loans 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 (Dollars in thousands) 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Investor Real Estate $ 50,813 $ 56,794 $ 64,169 $ 64,737 $ 56,962 Owner-Occupied Real Estate 10,860 10,784 11,099 11,646 9,876 Commercial AD&C 18,459 13,383 16,847 18,646 11,953 Commercial Business 21,771 22,238 24,826 28,027 25,900 Total Commercial 101,903 103,199 116,941 123,056 104,691 Residential Mortgage 5,722 7,254 8,063 9,424 9,753 Residential Construction 889 1,141 1,226 1,337 1,104 Consumer 2,074 2,076 2,038 2,425 2,065 Total Residential and Consumer 8,685 10,471 11,327 13,186 12,922 Allowance for Credit Losses $ 110,588 $ 113,670 $ 128,268 $ 136,242 $ 117,613

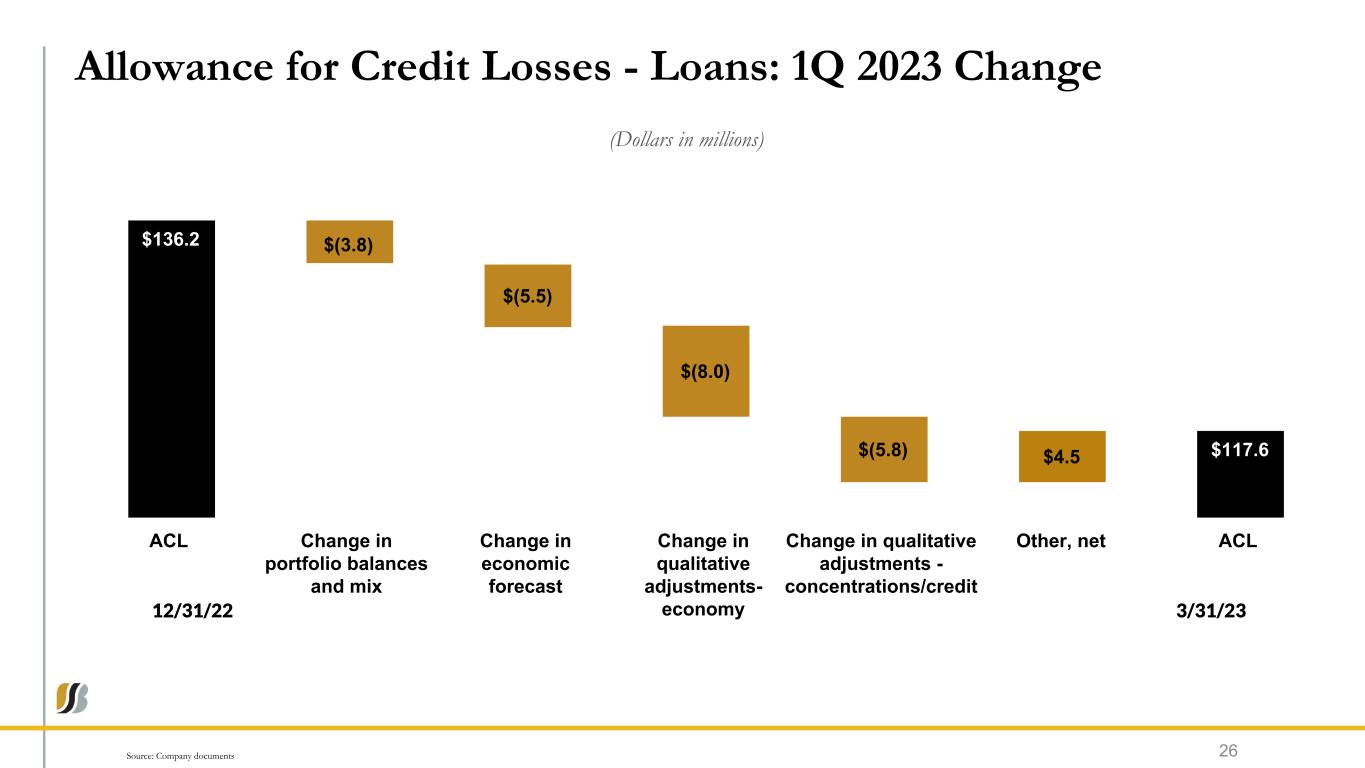

Allowance for Credit Losses - Loans: 1Q 2023 Change 26Source: Company documents (Dollars in millions) $136.2 $(3.8) $(5.5) $(8.0) $(5.8) $4.5 $117.6 ACL Change in portfolio balances and mix Change in economic forecast Change in qualitative adjustments- economy Change in qualitative adjustments - concentrations/credit Other, net ACL 3/31/2312/31/22

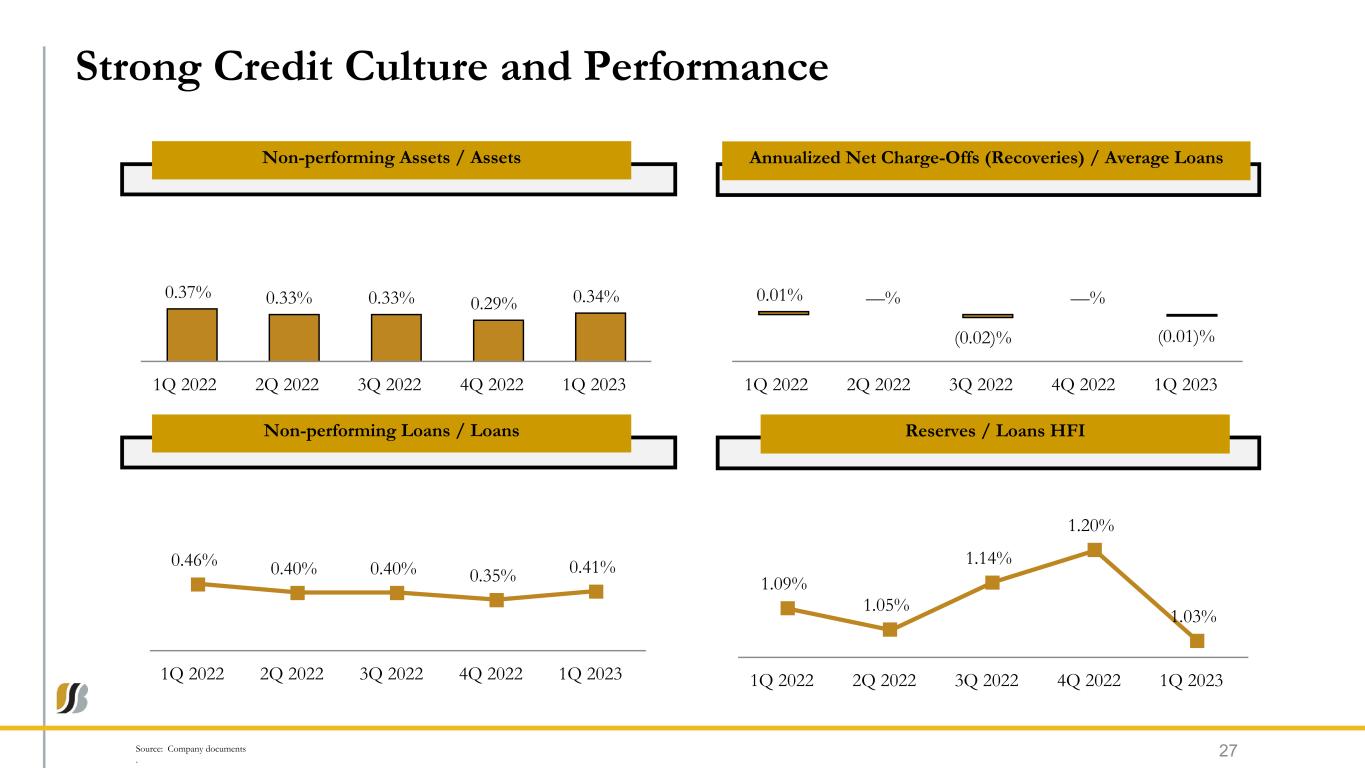

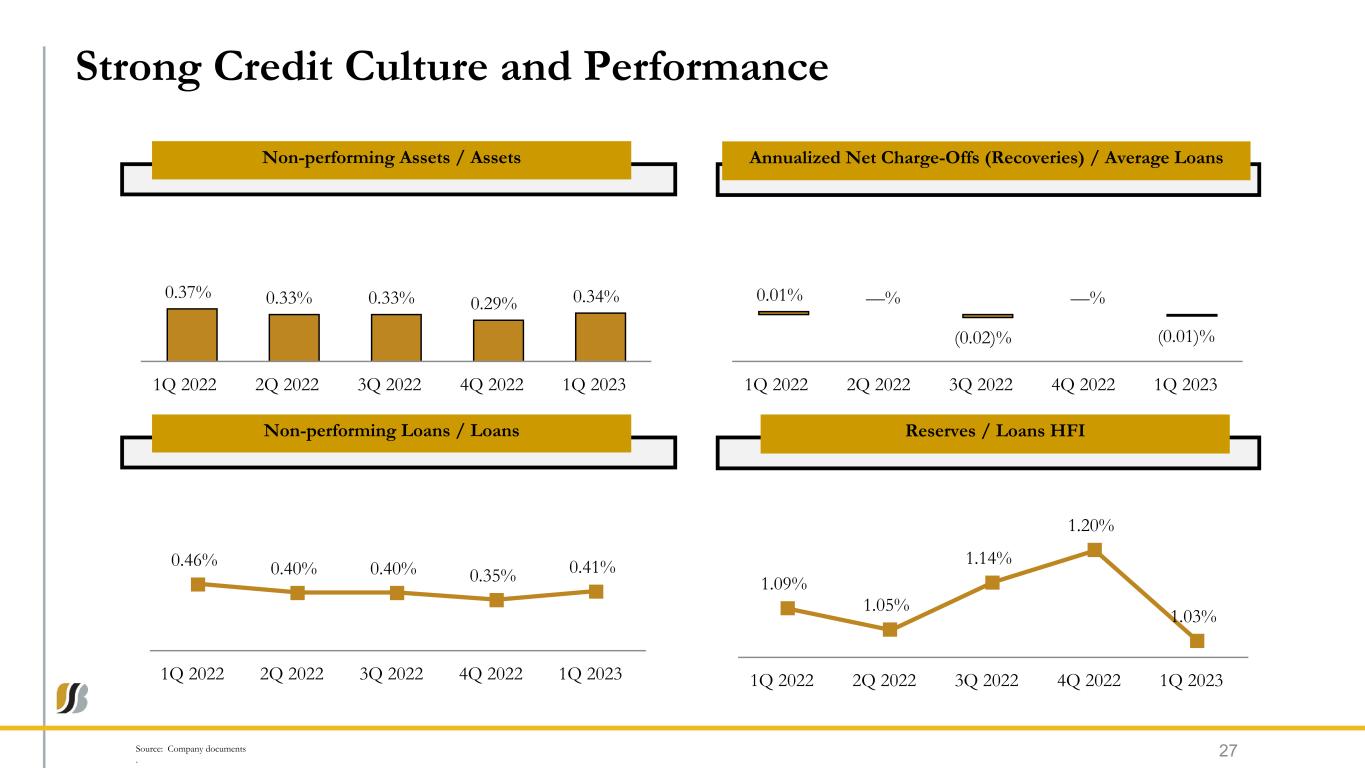

Source: Company documents . Strong Credit Culture and Performance Non-performing Assets / Assets Annualized Net Charge-Offs (Recoveries) / Average Loans Non-performing Loans / Loans Reserves / Loans HFI 27 0.37% 0.33% 0.33% 0.29% 0.34% 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 0.01% —% (0.02)% —% (0.01)% 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 0.46% 0.40% 0.40% 0.35% 0.41% 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 1.09% 1.05% 1.14% 1.20% 1.03% 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

Capital 28

Capital Ratios Tier 1 Common Equity Ratio 29 Tier 1 Capital Ratio Tangible Common Equity Ratio (1)Total Capital Ratio Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” 10.78% 10.42% 10.18% 10.23% 10.53% 7.00% 7.00% 7.00% 7.00% 7.00% Tier 1 Common Well Capitalized 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 10.78% 10.42% 10.18% 10.23% 10.53% 8.50% 8.50% 8.50% 8.50% 8.50% Tier 1 Common Well Capitalized 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 15.02% 14.46% 14.15% 14.20% 14.43% 10.50% 10.50% 10.50% 10.50% 10.50% Total Capital Well Capitalized 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 8.70% 8.45% 7.98% 8.18% 8.40% 2.00% 2.00% 2.00% 2.00% 2.00% TCE Well Capitalized 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

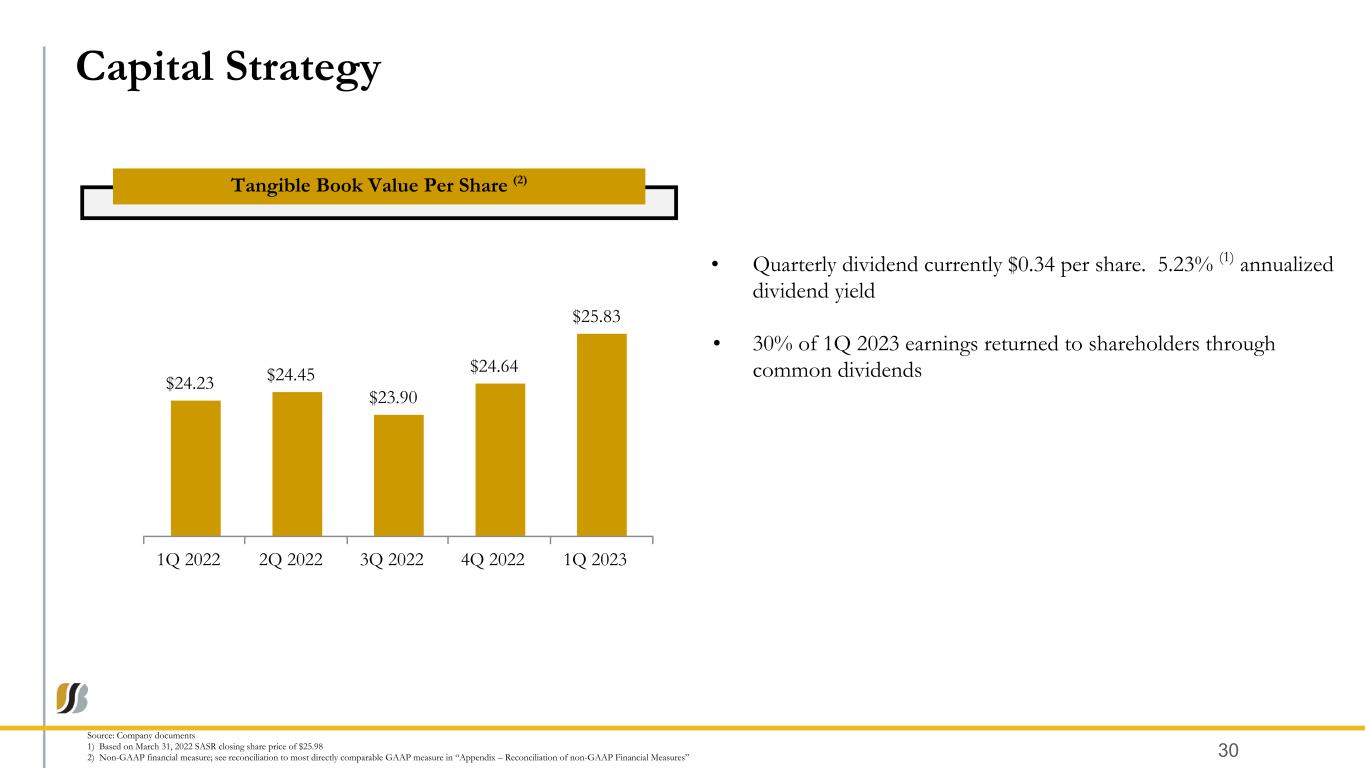

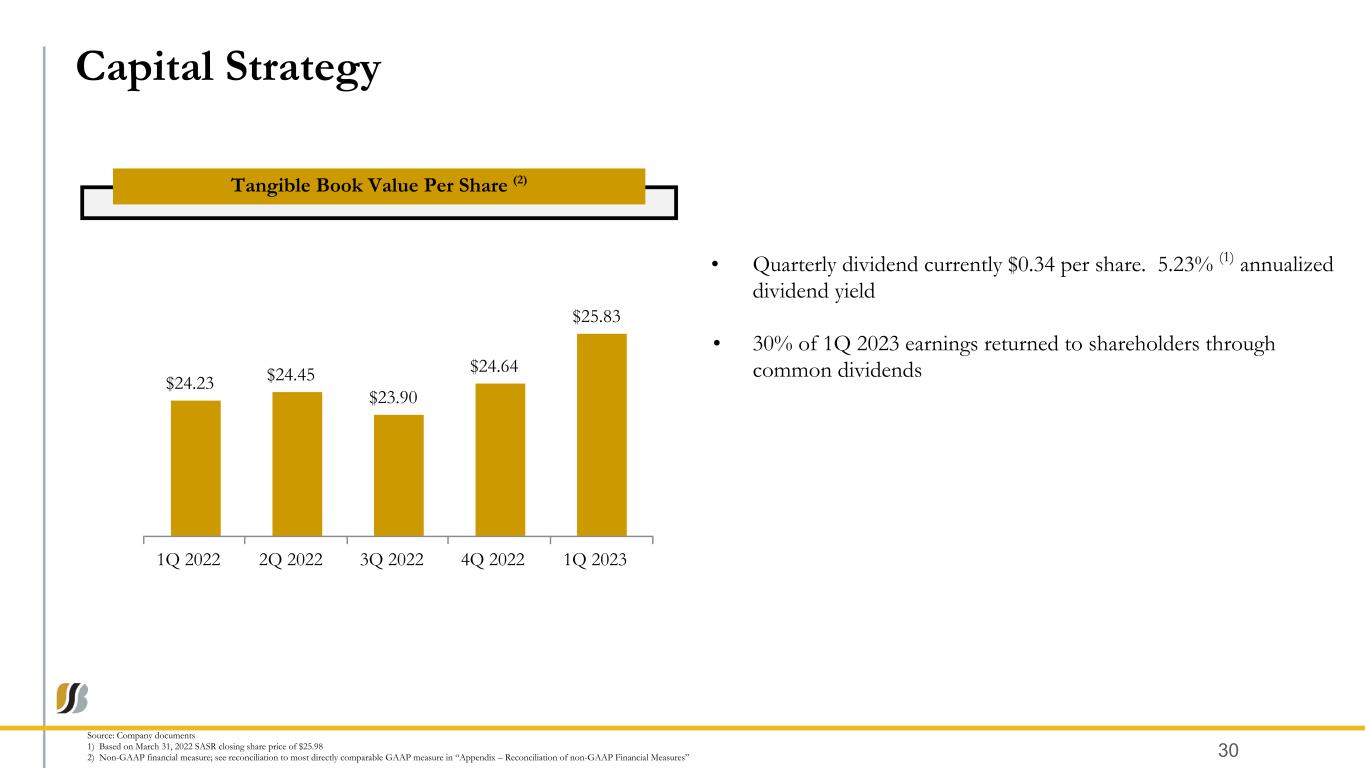

Source: Company documents 1) Based on March 31, 2022 SASR closing share price of $25.98 2) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” Capital Strategy Tangible Book Value Per Share (2) 30 • Quarterly dividend currently $0.34 per share. 5.23% (1) annualized dividend yield • 30% of 1Q 2023 earnings returned to shareholders through common dividends $24.23 $24.45 $23.90 $24.64 $25.83 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023

Proforma for AFS and HTM Sale Proforma 31Source: Company documents

Topics of the Quarter 32

Response to Silicon Valley Bank / Signature Bank Failures 33 • Bankers reached out to the top 1,000 deposit customers to address any customer questions and concerns • Mitigated deposit outflows by providing reciprocal deposit options which provide FDIC deposit insurance for accounts that would otherwise exceed deposit insurance limits • Began daily regulatory updates (FRB, FDIC, MD) and daily Board situational updates led by CEO • Out of an abundance of caution, initiated the Contingency Funding Plan and accessed additional sources ($900 million) from FHLB on 3/14/2023. A large portion of these additional resources were paid back by the end of the quarter • As of 1Q 2023, contingent liquidity amounted to $3.8 billion or 101% of uninsured deposits; additional $1.5 billion available in federal funds to provide total coverage of 158% of uninsured deposits

Appendix 34

Non-GAAP Reconciliation This presentation contains financial information and performance measures determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). Sandy Spring Bancorp’s management believes that the supplemental non-GAAP information provides a better comparison of period-to-period operating performance. Additionally, Sandy Spring Bancorp believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. Non-GAAP measures used in this presentation consist of the following: • efficiency ratio • tangible common equity • core earnings Efficiency Ratio. Management views the GAAP efficiency ratio as an important financial measure of expense performance and cost management. The ratio expresses the level of non-interest expenses as a percentage of total revenue (net interest income plus total non-interest income). Lower ratios indicate improved productivity. In general, the efficiency ratio is non-interest expenses as a percentage of net interest income plus non-interest income. Non- interest expenses used in the calculation of the non-GAAP efficiency ratio excludes intangible asset amortization, loss on FHLB redemption, contingent payment expense, and merger, acquisition, and disposal expense from non-interest expense, and securities gains and gain on asset sales from non-interest income and adds the tax- equivalent adjustment to net interest income. The measure is different from the GAAP efficiency ratio, which also is presented in this document. The GAAP measure is calculated using non-interest expense and income amounts as shown on the face of the Consolidated Statements of Income. The GAAP and non-GAAP efficiency ratios are reconciled and provided in the following table. Tangible Common Equity. Tangible equity, tangible assets and tangible book value per share are non-GAAP financial measures calculated using GAAP amounts. Tangible common equity and tangible assets exclude the balances of goodwill and other intangible assets from stockholder’s equity and total assets, respectively. Management believes that this non-GAAP financial measure provides information to investors that may be useful in understanding our financial condition. Because not all companies use the same calculation of tangible equity and tangible assets, this presentation may not be comparable to other similarly titled measures calculated by other companies. Core Earnings. Core earnings is a non-GAAP financial measure calculated using GAAP amounts. Core earnings reflect net income for the period exclusive of merger, acquisition and disposal expense, amortization of intangible assets, loss on FHLB redemption, contingent payment expense, investment securities gains,and gain on asset sales, in each case net of tax. Management believes that this non-GAAP financial measure provides helpful information to investors in understanding the Company’s core operating earnings and provides a better comparison of period-to-period operating performance of the Company. 35

Reconciliation of Non-GAAP Financial Measures-QTD Source: Company documents 36 (Dollars in thousands) 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Pre-tax pre-provision income (Non-GAAP) . Pre-tax pre-provision income: $ 43,935 $ 54,800 $ 33,584 $ 33,980 $ 51,253 Net income Plus/(less) non-GAAP adjustments: Income taxes 14,329 18,358 11,588 11,784 17,231 Provision/(credit) for credit losses 1,635 3,046 18,890 10,801 (21,536) Pre-tax pre-provision net income $ 59,899 $ 76,204 $ 64,062 $ 56,565 $ 46,948 Efficiency ratio - GAAP basis . Non-interest expenses $ 62,147 $ 64,991 $ 65,780 $ 64,375 $ 66,305 Net interest income plus non-interest income 122,046 141,195 129,842 120,940 113,253 Efficiency ratio - GAAP basis 50.92 % 46.03 % 50.66 % 53.23 % 58.55 % Efficiency ratio - Non-GAAP basis Non-interest expenses $ 62,147 $ 64,991 $ 65,780 $ 64,375 $ 66,305 Less non-GAAP adjustments: Amortization of intangible assets 1,508 1,466 1,432 1,408 1,306 Merger, acquisition and disposal expense — 1,067 1 — — Contingent payment expense — — 1,247 — 36 Non-interest expenses - as adjusted $ 60,639 $ 62,458 $ 63,100 $ 62,967 $ 64,963 Net interest income plus non-interest income $ 122,046 $ 141,195 $ 129,842 $ 120,940 $ 113,253 Plus non-GAAP adjustment: Tax-equivalent income 866 992 951 1,032 970 Less non-GAAP adjustments: Investment securities gains/(losses) 8 38 2 (393) — Gain/(loss) on disposal of assets — 16,699 (183) — — Net interest income plus non-interest income - as adjusted $ 122,904 $ 125,450 $ 130,974 $ 122,365 $ 114,223 Efficiency ratio - Non-GAAP basis 49.34 % 49.79 % 48.18 % 51.46 % 56.87 %

Tangible Common Equity-QTD Source: Company documents 37 (Dollars in thousands except per share data) 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Tangible common equity ratio: Total stockholders' equity $ 1,488,910 $ 1,477,169 $ 1,451,862 $ 1,483,768 $ 1,536,865 Goodwill (370,223) (363,436) (363,436) (363,436) (363,436) Other intangible assets, net (24,412) (22,694) (21,262) (19,855) (18,549) Tangible common equity $ 1,094,275 $ 1,091,039 $ 1,067,164 $ 1,100,477 $ 1,154,880 Total assets $ 12,967,416 $ 13,303,009 $ 13,765,597 $ 13,833,119 $ 14,129,007 Goodwill (370,223) (363,436) (363,436) (363,436) (363,436) Other intangible assets, net (24,412) (22,694) (21,262) (19,855) (18,549) Tangible assets $ 12,572,781 $ 12,916,879 $ 13,380,899 $ 13,449,828 $ 13,747,022 Common shares outstanding 45,162,908 44,629,697 44,644,269 44,657,054 44,712,497 Tangible common equity ratio 8.70 % 8.45 % 7.98 % 8.18 % 8.40 % Book value per common share $ 32.97 $ 33.10 $ 32.52 $ 33.23 $ 34.37 Tangible book value per common share $ 24.23 $ 24.45 $ 23.90 $ 24.64 $ 25.83

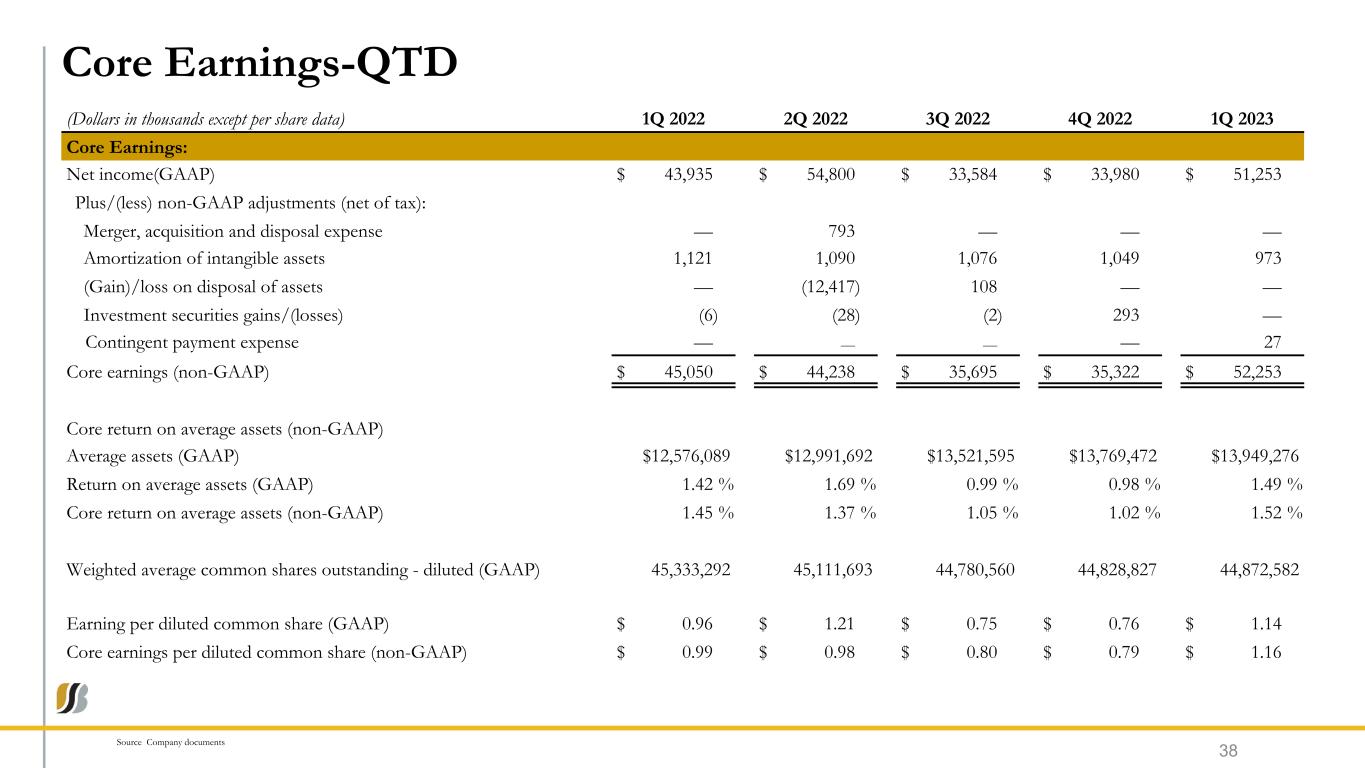

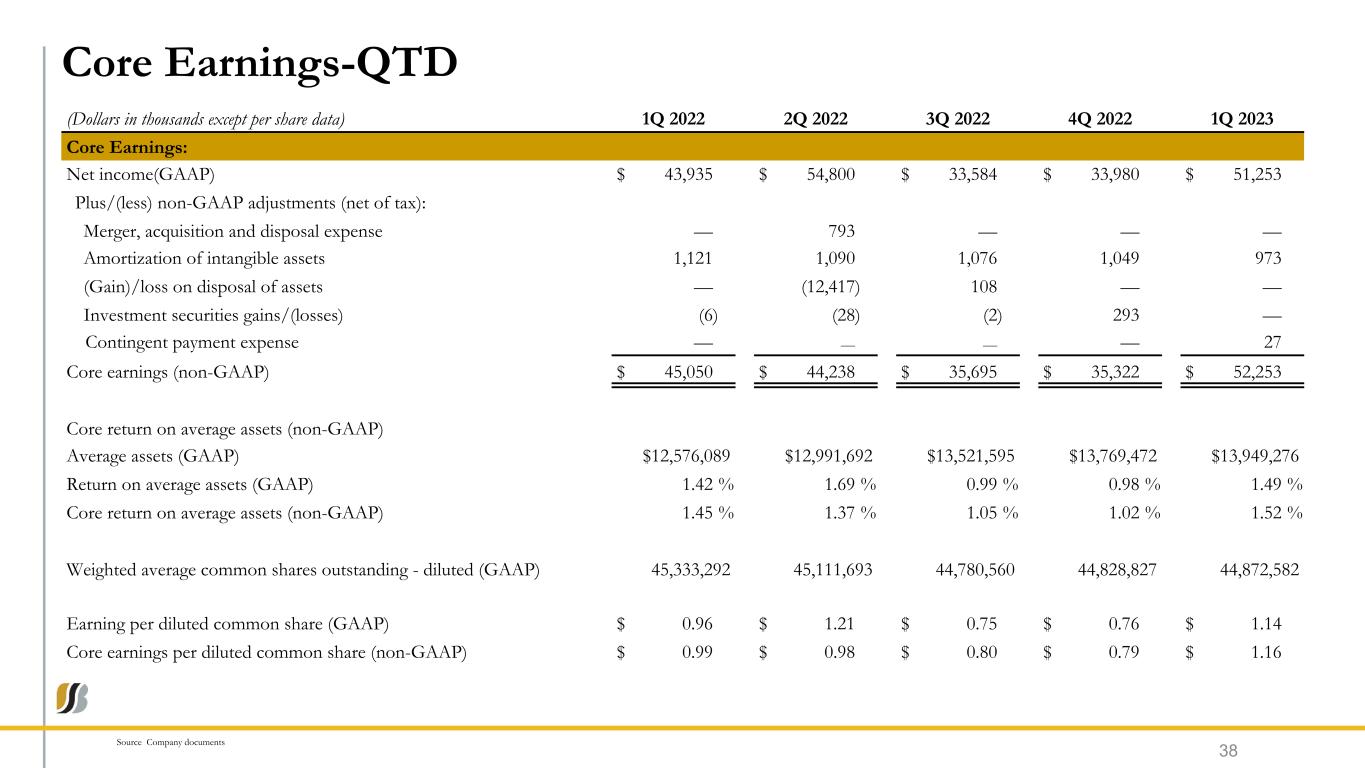

Core Earnings-QTD Source Company documents 38 (Dollars in thousands except per share data) 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 Core Earnings: Net income(GAAP) $ 43,935 $ 54,800 $ 33,584 $ 33,980 $ 51,253 Plus/(less) non-GAAP adjustments (net of tax): Merger, acquisition and disposal expense — 793 — — — Amortization of intangible assets 1,121 1,090 1,076 1,049 973 (Gain)/loss on disposal of assets — (12,417) 108 — — Investment securities gains/(losses) (6) (28) (2) 293 — Contingent payment expense — — — — 27 Core earnings (non-GAAP) $ 45,050 $ 44,238 $ 35,695 $ 35,322 $ 52,253 Core return on average assets (non-GAAP) Average assets (GAAP) $12,576,089 $12,991,692 $13,521,595 $13,769,472 $13,949,276 Return on average assets (GAAP) 1.42 % 1.69 % 0.99 % 0.98 % 1.49 % Core return on average assets (non-GAAP) 1.45 % 1.37 % 1.05 % 1.02 % 1.52 % Weighted average common shares outstanding - diluted (GAAP) 45,333,292 45,111,693 44,780,560 44,828,827 44,872,582 Earning per diluted common share (GAAP) $ 0.96 $ 1.21 $ 0.75 $ 0.76 $ 1.14 Core earnings per diluted common share (non-GAAP) $ 0.99 $ 0.98 $ 0.80 $ 0.79 $ 1.16