Second Quarter 2024 Earnings Presentation July 23, 2024

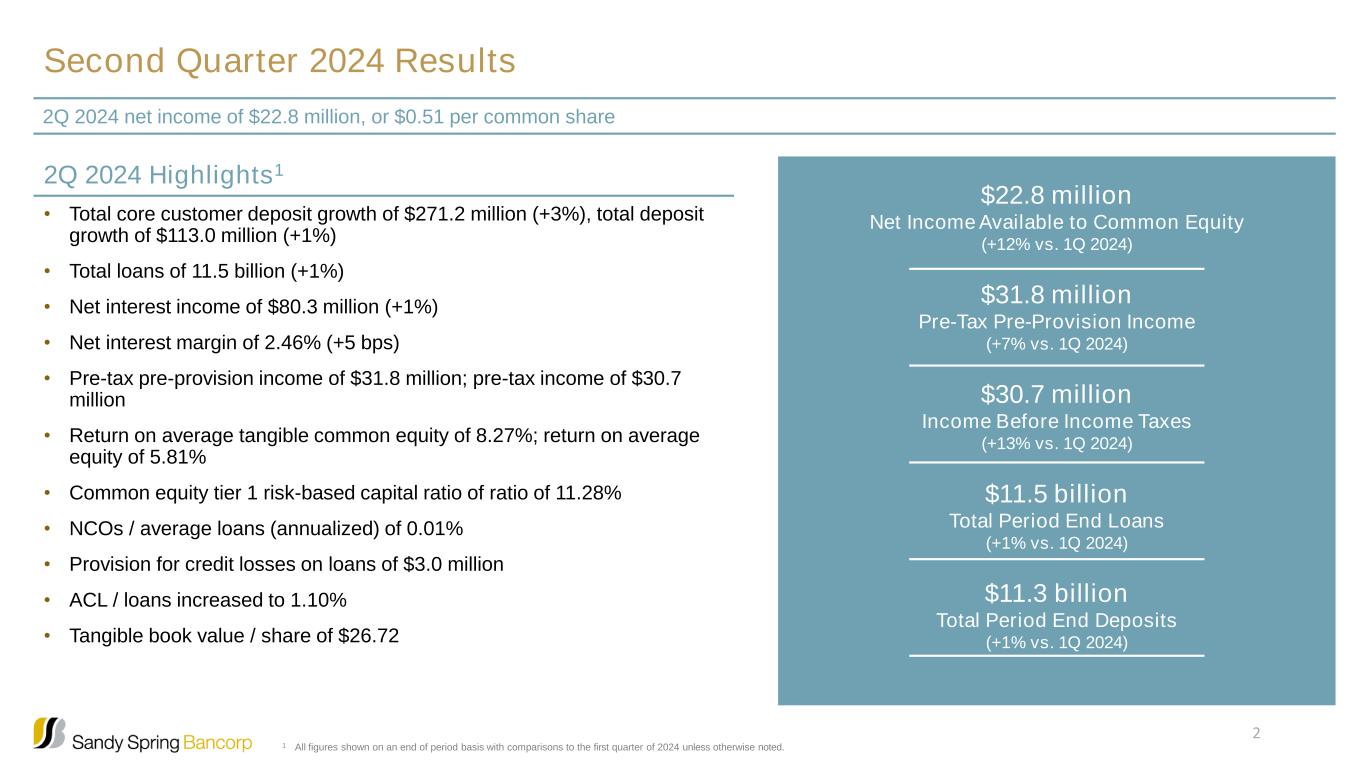

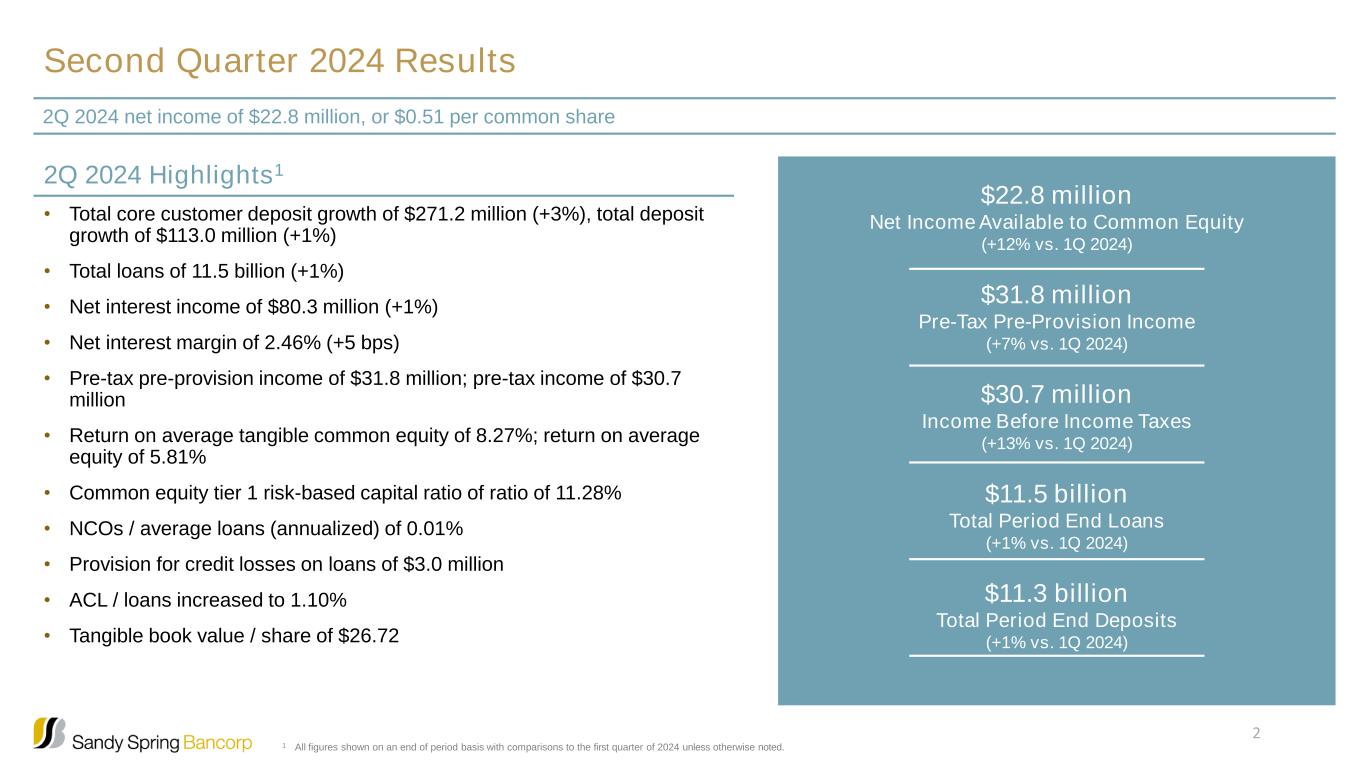

Second Quarter 2024 Results 2Q 2024 Highlights1 • Total core customer deposit growth of $271.2 million (+3%), total deposit growth of $113.0 million (+1%) • Total loans of 11.5 billion (+1%) • Net interest income of $80.3 million (+1%) • Net interest margin of 2.46% (+5 bps) • Pre-tax pre-provision income of $31.8 million; pre-tax income of $30.7 million • Return on average tangible common equity of 8.27%; return on average equity of 5.81% • Common equity tier 1 risk-based capital ratio of ratio of 11.28% • NCOs / average loans (annualized) of 0.01% • Provision for credit losses on loans of $3.0 million • ACL / loans increased to 1.10% • Tangible book value / share of $26.72 2Q 2024 net income of $22.8 million, or $0.51 per common share $22.8 million Net Income Available to Common Equity (+12% vs. 1Q 2024) $31.8 million Pre-Tax Pre-Provision Income (+7% vs. 1Q 2024) $30.7 million Income Before Income Taxes (+13% vs. 1Q 2024) $11.5 billion Total Period End Loans (+1% vs. 1Q 2024) $11.3 billion Total Period End Deposits (+1% vs. 1Q 2024) 1 All figures shown on an end of period basis with comparisons to the first quarter of 2024 unless otherwise noted. 2

$0.55 $0.46 $0.58 $0.45 $0.51 $0.05 $0.16 $0.02 $0.04 $0.03 $0.60 $0.62 $0.60 $0.49 $0.54 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Diluted Earnings Per Share Core Earnings per Share Adjustment¹ Profitability Trends Core Earnings Per Share1 Higher net interest income and non-interest income in combination with lower provision for credit losses contributed to growth in earnings Return on Average Assets2 0.70% 0.58% 0.73% 0.58% 0.66% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Return on Average Common Equity2 6.46% 5.35% 6.70% 5.17% 5.81% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 31 Non-GAAP financial measure. See reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Measures” 2 Annualized metric

Noninterest -bearing demand 26% Interest- bearing demand 13% Money Market 25% Savings 15% Brokered CDs 5% Customer CDs 16% $3,080 $3,014 $2,914 $2,818 $2,931 $1,413 $1,456 $1,464 $1,528 $1,434 $2,918 $2,741 $2,629 $2,680 $2,848 $732 $1,009 $1,275 $1,579 $1,678 $1,210 $1,054 $801 $751 $596 $1,606 $1,877 $1,914 $1,871 $1,853 $10,959 $11,151 $10,997 $11,227 $11,340 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Noninterest-bearing demand Interest-bearing demand Money Market Savings Brokered CDs Customer CDs Quarterly Deposit Trends Quarterly Deposits Total deposits increased $113.0 million or 1% to $11.3 billion. Noninterest-bearing deposits increased 4% ($ in millions) Deposit Composition ▪ The Company reduced its brokered time deposits by $154.7 million during the current quarter. ▪ Total deposits, excluding brokered deposits, increased by $271.2 million or 3% quarter-over-quarter. 4

Insured vs Uninsured Deposits Available unused sources of liquidity are 154% of uninsured deposits Insured $7.2 B 64% Uninsured $4.1 B 36% ▪ Available unused sources of liquidity is $6.3 billion or 154% of uninsured deposits ▪ 38% of uninsured depositors have a lending relationship with the Company. ▪ 80% of uninsured deposits are Business accounts; 15% of uninsured deposits are Trust accounts ▪ Liquidity stress testing is performed quarterly and includes both systemic and idiosyncratic scenarios Deposit Breakdown1 Uninsured Deposits by Type1 $4.1 B $6.3 B Uninsured Deposits Available Unused Sources of Liquidity Source: Company Documents 1 As of June 30, 2024 Retail $0.8 B 20% Commercial $3.3 B 80% $4.1 bn 5

Deposit Overview 57% of core deposit balances are in low-cost transaction and savings accounts ▪ Core deposits represent 94% of total deposits ▪ Average length of relationship is 9.8 years ▪ No commercial client > 2% of total deposits ▪ Well-diversified portfolio; no significant concentration in one industry or with any single client Core Deposit Mix1 Commercial Deposit Portfolio by NAICS2 Non- interest Bearing Checking 27%Money Market 26% Interest Checking 14% Savings 16% Time Deposits 17% $10.7 bn $4.7 bn Source: Company Documents 1 As of June 30, 2024 2 Other Misc includes churches, education, health services education, wholesale and nonresidential lessors Other 25% Real Estate 16% Services 13% Trade Contractors 6% Professional Services 6% Building Contractors 4% Org. Services 4% Engineering & Mgmt 5% Insurance 5% Other Misc. 16% 6

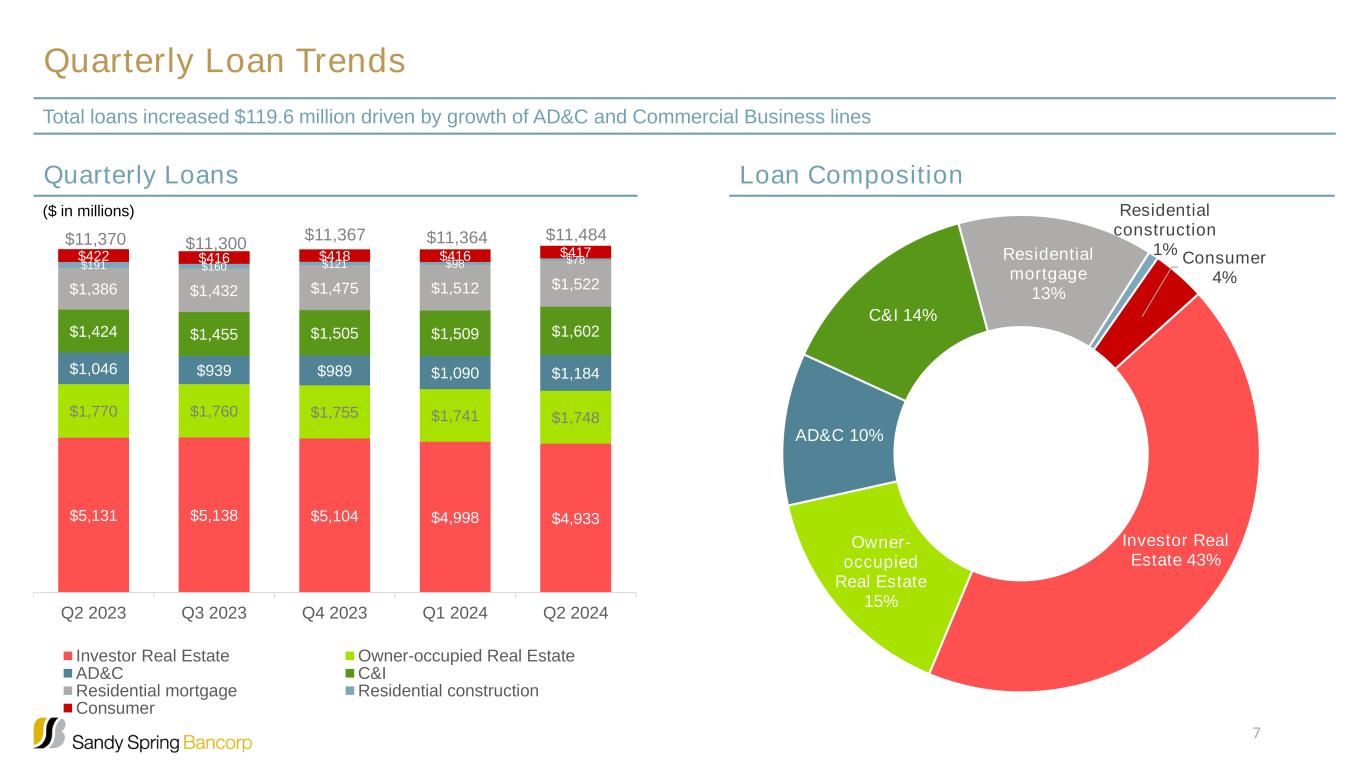

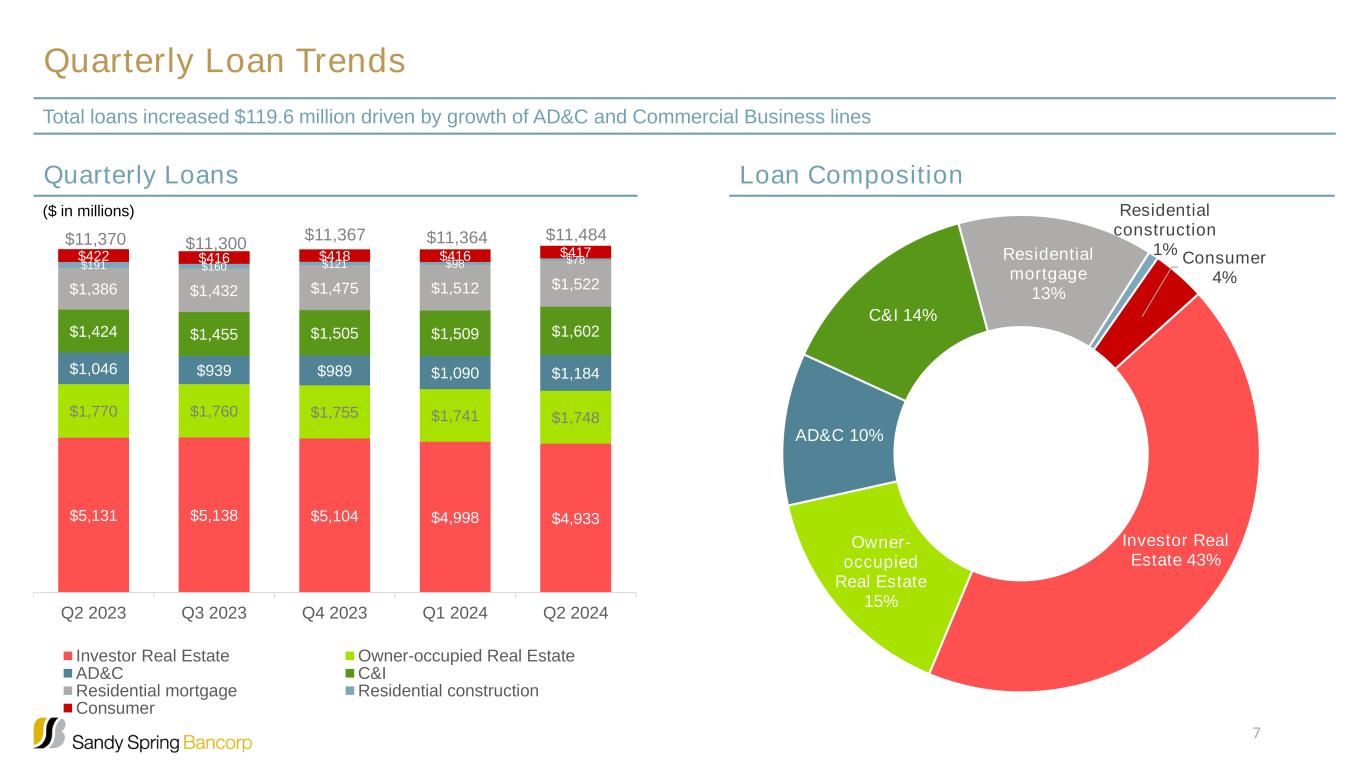

Investor Real Estate 43% Owner- occupied Real Estate 15% AD&C 10% C&I 14% Residential mortgage 13% Residential construction 1% Consumer 4% $5,131 $5,138 $5,104 $4,998 $4,933 $1,770 $1,760 $1,755 $1,741 $1,748 $1,046 $939 $989 $1,090 $1,184 $1,424 $1,455 $1,505 $1,509 $1,602 $1,386 $1,432 $1,475 $1,512 $1,522 $191 $160 $121 $98 $78$422 $416 $418 $416 $417 $11,370 $11,300 $11,367 $11,364 $11,484 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Investor Real Estate Owner-occupied Real Estate AD&C C&I Residential mortgage Residential construction Consumer Quarterly Loan Trends Quarterly Loans Total loans increased $119.6 million driven by growth of AD&C and Commercial Business lines ($ in millions) Loan Composition 7

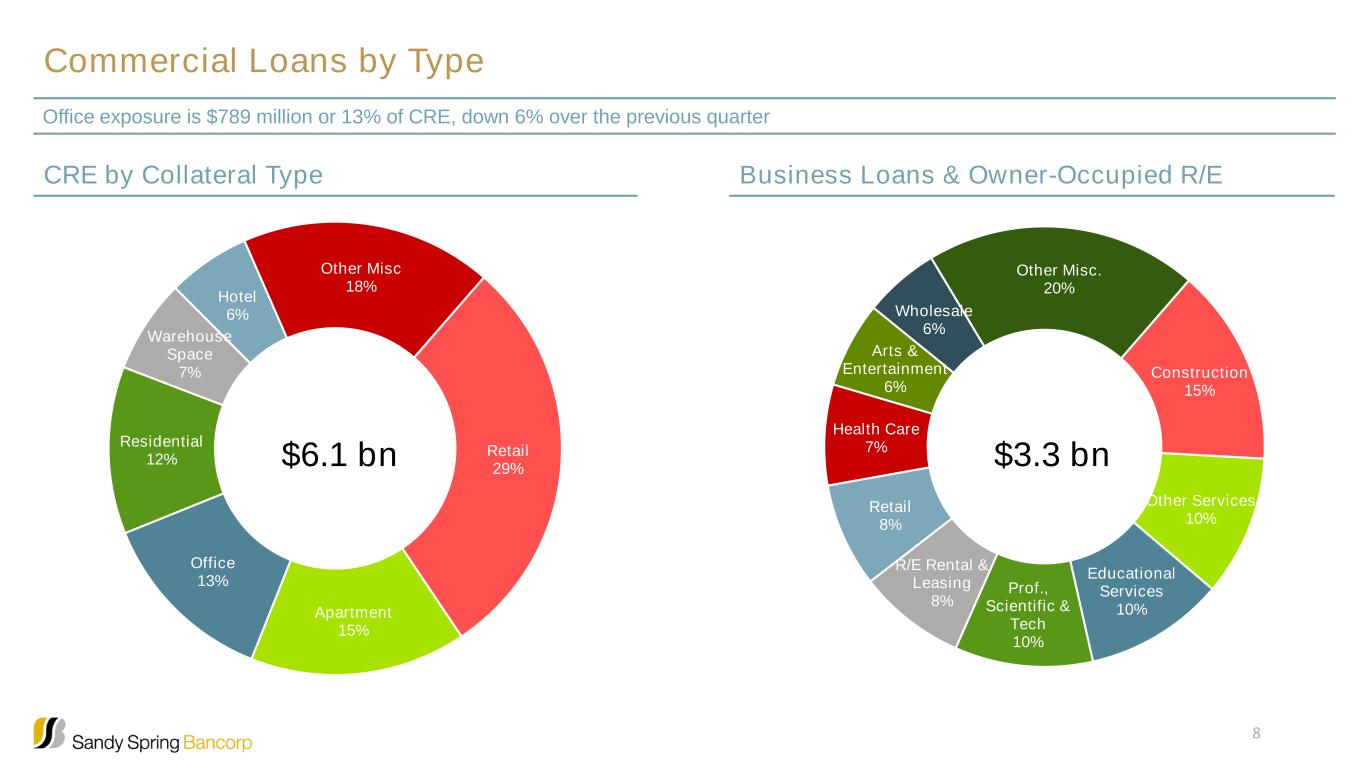

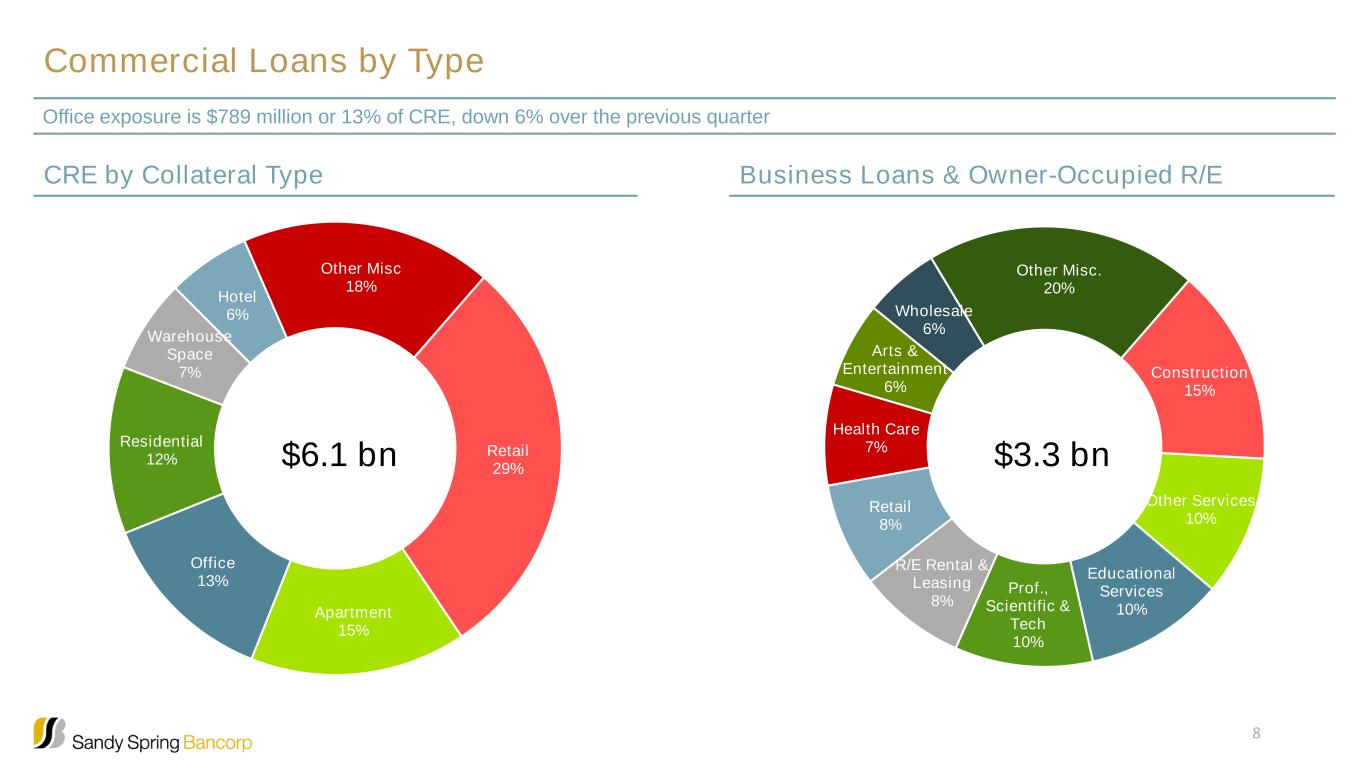

Construction 15% Other Services 10% Educational Services 10% Prof., Scientific & Tech 10% R/E Rental & Leasing 8% Retail 8% Health Care 7% Arts & Entertainment 6% Wholesale 6% Other Misc. 20% Retail 29% Apartment 15% Office 13% Residential 12% Warehouse Space 7% Hotel 6% Other Misc 18% Commercial Loans by Type CRE by Collateral Type Office exposure is $789 million or 13% of CRE, down 6% over the previous quarter Business Loans & Owner-Occupied R/E $6.1 bn $3.3 bn 8

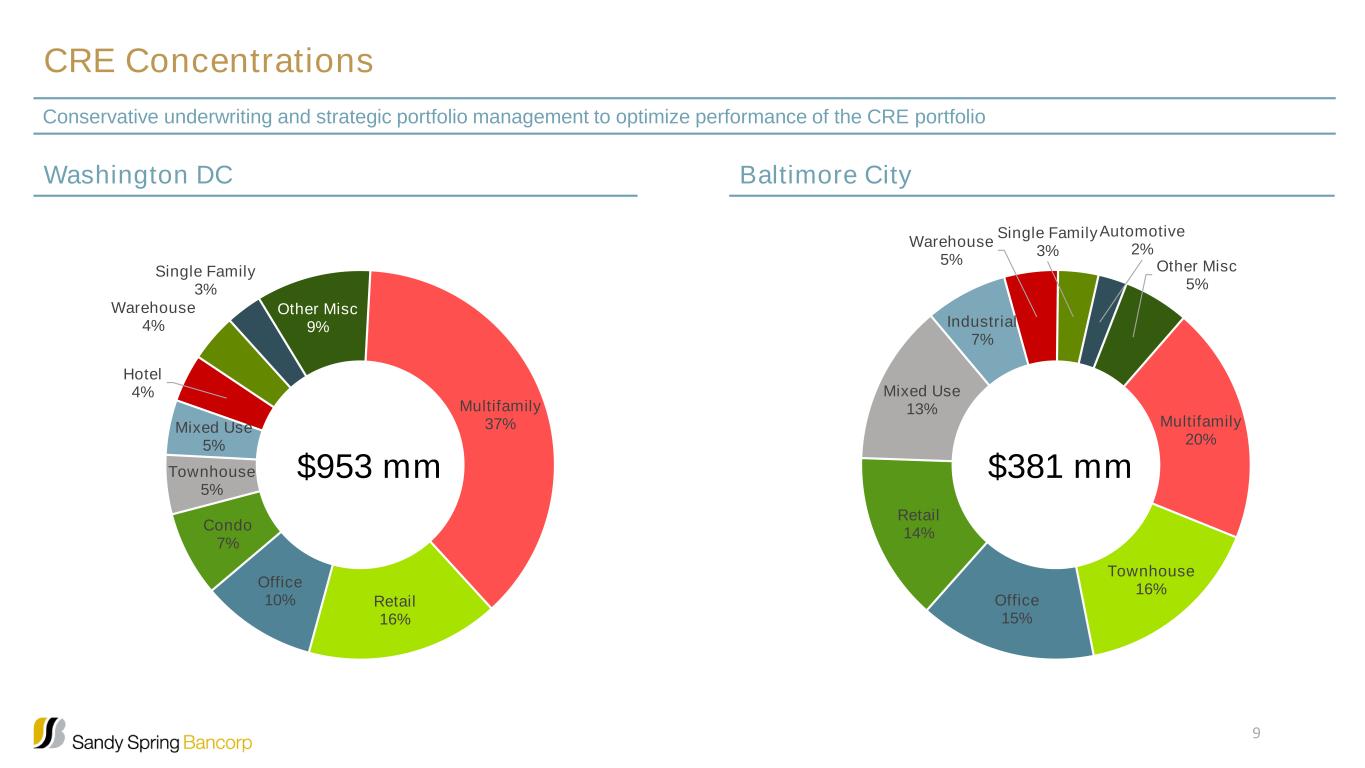

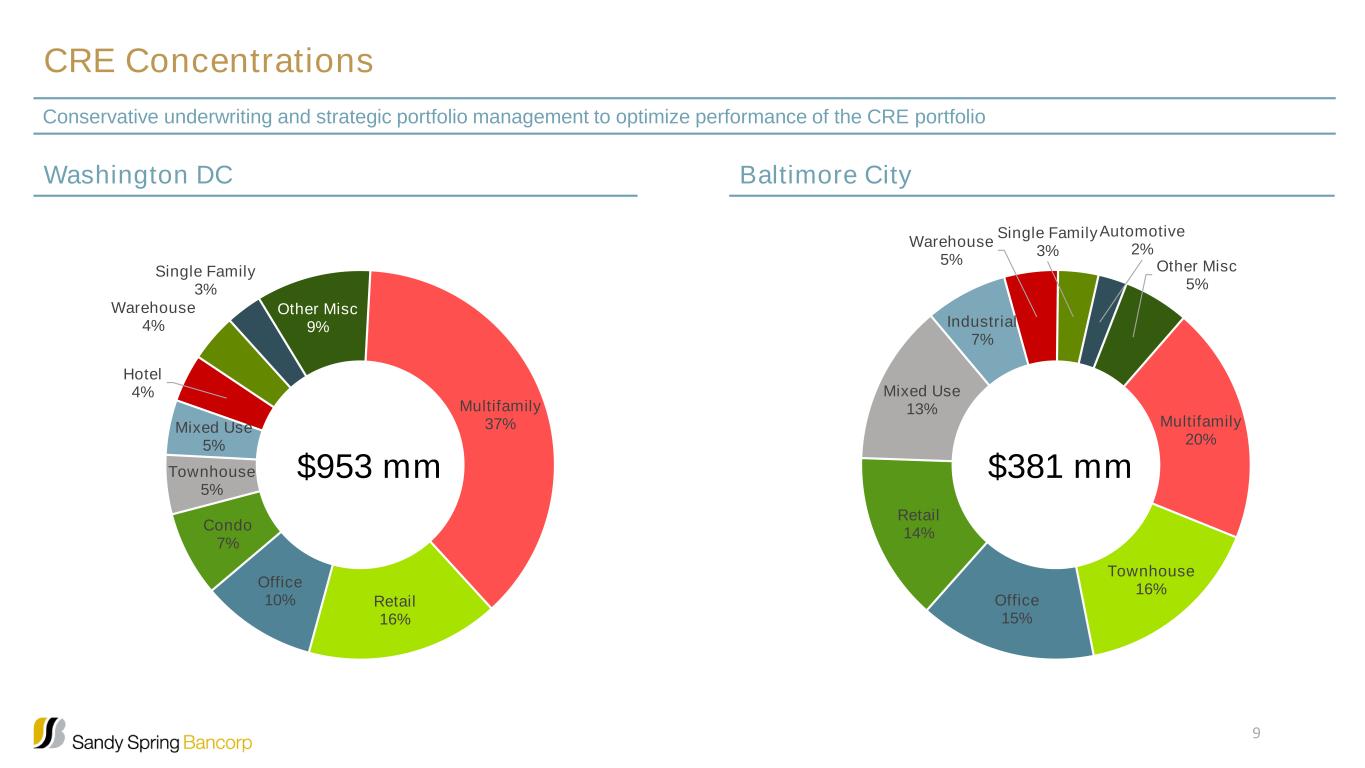

CRE Concentrations Washington DC Conservative underwriting and strategic portfolio management to optimize performance of the CRE portfolio Baltimore City Multifamily 37% Retail 16% Office 10% Condo 7% Townhouse 5% Mixed Use 5% Hotel 4% Warehouse 4% Single Family 3% Other Misc 9% $953 mm Multifamily 20% Townhouse 16% Office 15% Retail 14% Mixed Use 13% Industrial 7% Warehouse 5% Single Family 3% Automotive 2% Other Misc 5% $381 mm 9

$90,471 $85,081 $81,696 $79,343 $80,285 2.73% 2.55% 2.45% 2.41% 2.46% $72,000 $74,000 $76,000 $78,000 $80,000 $82,000 $84,000 $86,000 $88,000 $90,000 $92,000 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Net Interest Income Net interest Margin Net Interest Income and Net Interest Margin Trends Net Interest Income and Margin ($ in thousands) Comments ▪ The net interest margin was 2.46% for the current quarter compared to 2.41% for Q1 2024. ▪ Overall, the net interest margin grew during the quarter due to the rate paid on interest-bearing liabilities decreasing three basis points, while the yield on interest-earning assets rose two basis points ▪ Higher rates paid on interest-bearing liabilities, driven by higher market rates, competition for deposits, and customer movement of excess funds out of noninterest-bearing accounts outpaced the increase in yield on interest-earning assets compared to prior year. ▪ Compared to the prior year quarter, the yield on interest earning assets increased 28 bps and the rate paid on interest bearing liabilities rose 68 bps resulting in margin compression of 27 basis points. 10

Yield and Cost Trends Selected Yields (%) Asset & Liability Yield / Rate Trends Asset yields continue to reprice at higher rates while interest-bearing liabilities yields decreased QoQ 4.75% 4.83% 4.92% 5.01% 5.03% 2.93% 3.29% 3.54% 3.64% 3.61% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Total interest-earning assets Total interest-bearing liabilities 4.00% 4.50% 5.00% 5.50% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 P e rc e n t Commercial investor real estate loans Total commercial loans Total residential and consumer loans Total loans Total interest-earning assets 11

Service Charges on Deposits 15% Mortgage Banking 8% Wealth Management 54% BOLI Income 9% Bank Card Revenue 2% Other Income 12% Non-interest Income Revenue Composition Stronger market conditions and client acquisition drive higher wealth management fees $19.6 mm ▪ Wealth management income increased compared to the prior quarter due to a 1% increase in assets under management and the overall favorable market performance. ▪ Higher income from mortgage banking activities and BOLI mortality- related income, due to receipt of death proceeds. 12 ($ in thousands) Q2 2024 Q1 2024 Q2 2023 Service Charges on Deposits 2,939 122 333 Mortgage Banking 1,621 247 (196) Wealth Management 10,455 497 1,424 BOLI Income 1,816 656 565 Bank Card Revenue 445 32 (2) Other Income 2,311 (334) 287 Total 19,587$ 1,220$ 2,411$ $ Change vs

Non-interest Expense Non-interest Expense Trends Increase due to higher personnel and marketing expense; offset by lower general operating expense ($ in thousands) Non-interest Expense Detail Fully Tax-Equivalent Efficiency Ratio1 Source: Company documents 1) Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” 64.2% 70.7% 68.3% 69.6% 68.2% 60.7% 60.9% 66.2% 66.7% 65.3% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Efficiency Ratio (GAAP) Efficiency Ratio (Non-GAAP) $40,931 $36,696 $35,482 $36,698 $37,821 $12,667 $11,870 $14,487 $14,546 $13,378 $8,524 $8,420 $8,545 $8,779 $8,673 $2,853 $2,819 $3,000 $3,103 $3,286 $4,161 $4,509 $5,628 $4,880 $4,946 $8,157 $69,136 $72,471 $67,142 $68,006 $68,104 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Personal Expense Other expenses Occupancy & Equipment Expense Outside data services Professional Expense Pension Settlement Expense 13 ($ in thousands) Q2 2024 Q1 2024 Q2 2023 Salaries and employee benefits 37,821 1,123 (3,110)$ Occupancy expense of premises 4,805 (11) 41 Equipment expenses 3,868 (95) 108 Marketing 1,288 546 (301) Outside data services 3,286 183 433 FDIC insurance 2,951 40 576 Amortization of intangible assets 2,135 66 866 Professional fees and services 4,946 66 785 Other expenses 7,004 (1,820) (430) Total 68,104$ 98$ (1,032)$ $ Change vs

Current Expected Credit Losses - Loans ACL increased due to loan portfolio growth coupled with higher individual reserves ACL by Loan TypeACL / Total Loans $120,287 $123,360 $120,865 $123,096 $125,863 1.06% 1.09% 1.06% 1.08% 1.10% $117,000 $118,000 $119,000 $120,000 $121,000 $122,000 $123,000 $124,000 $125,000 $126,000 $127,000 0.30% 0.50% 0.70% 0.90% 1.10% 1.30% 1.50% 1.70% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Total ACL ACL/Total Loans ($ in thousands) ▪ ACL of $125.9 million or 1.10% of outstanding loans equals 135% of non-performing loans at June 30, 2024 ▪ The increase in the provision during the current quarter was a product of higher individual reserves on collateral-dependent loans along with overall growth of the loan portfolio, partially offset by lower qualitative adjustments due to reduction of the commercial investor real estate segment. In addition, during the current quarter, the reserve for unfunded commitments decreased by $1.9 million as a result of higher utilization rates on lines of credit. ▪ Utilized June 2024 Moody’s baseline forecast in quantitative model 14 ($ thousands) 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Investor Real Estate 61,087$ 63,192$ 61,439$ 64,299$ 63,898$ Owner-Occupied Real Estate 9,230 8,961 7,536 6,907 6,877 Commercial AD&C 10,200 9,100 8,287 10,845 12,436 Commercial Business 27,914 30,720 31,932 29,037 30,200 Total Commercial 108,431 111,973 109,194 111,088 113,411 Residential Mortgage 9,161 8,499 8,890 9,091 9,488 Residential Construction 850 672 729 423 362 Consumer 1,845 2,216 2,052 2,494 2,602 Total Residential and Consumer 11,856 11,387 11,671 12,008 12,452 Allowance for Credit Losses 120,287$ 123,360$ 120,865$ 123,096$ 125,863$

Strong Credit Culture and Performance Increase this quarter in non-performing loans related to several loans within the owner-occupied commercial real estate segment 0.36% 0.37% 0.65% 0.63% 0.68% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Non-performing Assets / Total Assets 0.06% --% --% 0.04% 0.01% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Ann. Net Charge-offs (Recoveries) / Average Loans Non-performing Loans / Loans Reserves / Loans HFI 0.44% 0.46% 0.81% 0.74% 0.81% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 1.06% 1.09% 1.06% 1.08% 1.10% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 15

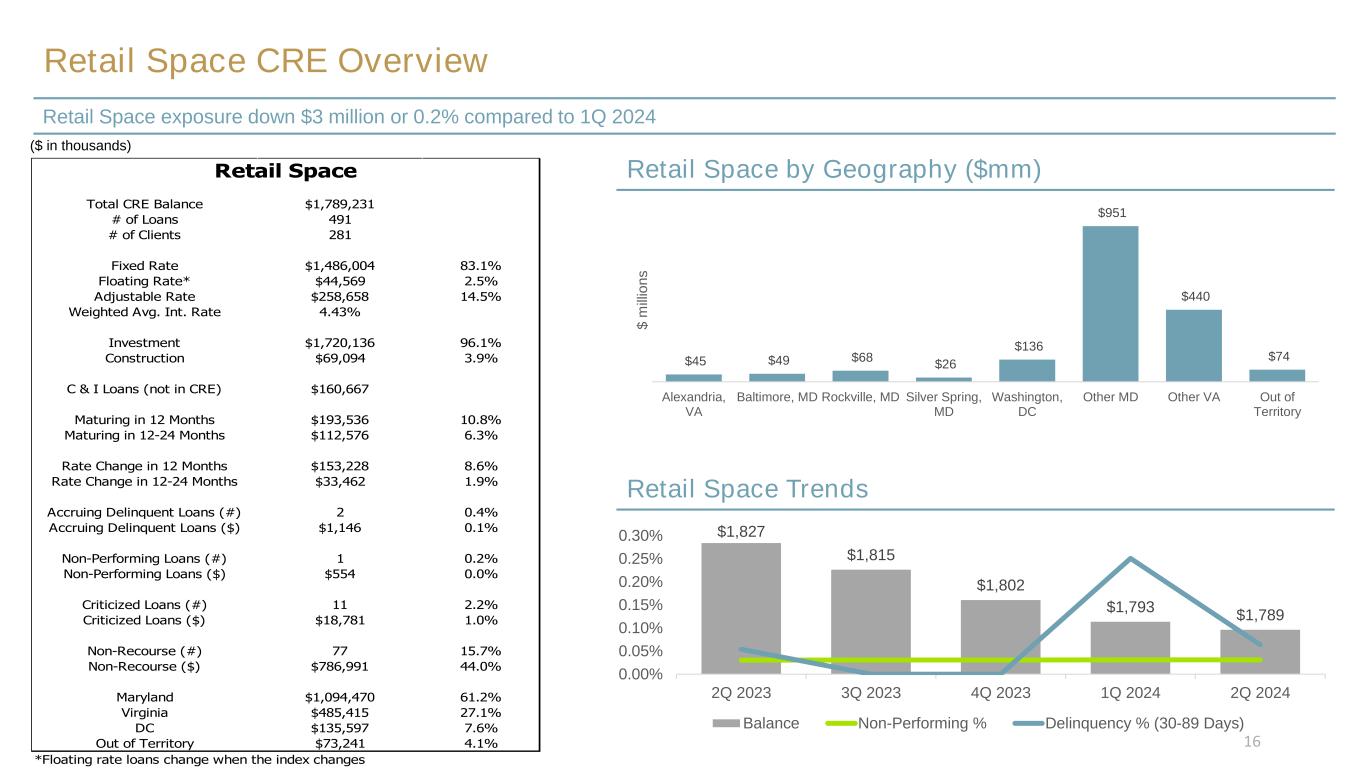

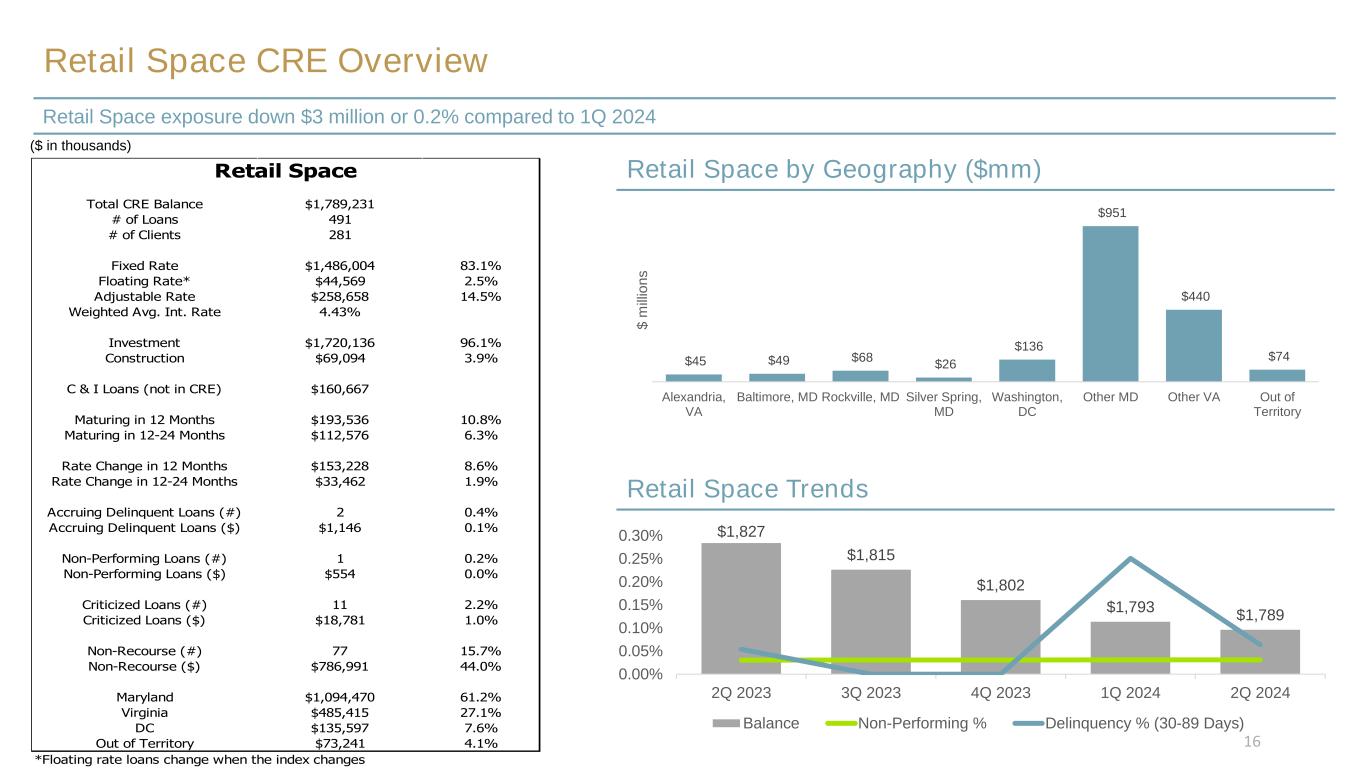

Retail Space CRE Overview Retail Space exposure down $3 million or 0.2% compared to 1Q 2024 $1,827 $1,815 $1,802 $1,793 $1,789 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 $1,770,000 $1,780,000 $1,790,000 $1,800,000 $1,810,000 $1,820,000 $1,830,000 Balance Non-Performing % Delinquency % (30-89 Days) Retail Space Trends Retail Space by Geography ($mm) $45 $49 $68 $26 $136 $951 $440 $74 Alexandria, VA Baltimore, MD Rockville, MD Silver Spring, MD Washington, DC Other MD Other VA Out of Territory $ m ill io n s 16 Total CRE Balance $1,789,231 # of Loans 491 # of Clients 281 Fixed Rate $1,486,004 83.1% Floating Rate* $44,569 2.5% Adjustable Rate $258,658 14.5% Weighted Avg. Int. Rate 4.43% Investment $1,720,136 96.1% Construction $69,094 3.9% C & I Loans (not in CRE) $160,667 Maturing in 12 Months $193,536 10.8% Maturing in 12-24 Months $112,576 6.3% Rate Change in 12 Months $153,228 8.6% Rate Change in 12-24 Months $33,462 1.9% Accruing Delinquent Loans (#) 2 0.4% Accruing Delinquent Loans ($) $1,146 0.1% Non-Performing Loans (#) 1 0.2% Non-Performing Loans ($) $554 0.0% Criticized Loans (#) 11 2.2% Criticized Loans ($) $18,781 1.0% Non-Recourse (#) 77 15.7% Non-Recourse ($) $786,991 44.0% Maryland $1,094,470 61.2% Virginia $485,415 27.1% DC $135,597 7.6% Out of Territory $73,241 4.1% *Floating rate loans change when the index changes Retail Space ($ in thousands)

Multifamily CRE Overview Multi-family exposure up $70 million, or 7% compared to 1Q 2024 Multi-family Trends Multi-family by Geography $954 $965 $885 $989 $1,060 0.00% 1.00% 2.00% 3.00% 4.00% 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 $750,000 $800,000 $850,000 $900,000 $950,000 $1,000,000 $1,050,000 $1,100,000 Balance Non-Performing % Delinquency % (30-89 Days) $6 $153 $10 $357 $238 $128 $154 Alexandria, VA Baltimore, MD Silver Spring, MD Washington, DC Other MD Other VA Out of Territory $ m ill io n s ($ in thousands) 17 Total CRE Balance $1,059,856 # of Loans 252 # of Clients 164 Apartment Building $961,799 90.7% Mixed Use (res. & comm.) $44,766 4.2% Other $53,291 5.0% Fixed Rate $596,064 56.2% Floating Rate* $118,605 11.2% Adjustable Rate $345,187 32.6% Weighted Avg. Int. Rate 5.64% Investment $786,893 74.2% Construction $241,573 22.8% C & I Loans (not in CRE) $2,823 Maturing in 12 Months $246,068 23.2% Maturing in 12-24 Months $109,618 10.3% Rate Change in 12 Months $294,513 27.8% Rate Change in 12-24 Months $24,287 2.3% Accruing Delinquent Loans (#) 1 0.4% Accruing Delinquent Loans ($) $1,434 0.1% Non-Performing Loans (#) 5 2.0% Non-Performing Loans ($) $31,249 2.9% Criticized Loans (#) 20 7.9% Criticized Loans ($) $115,225 10.9% Non-Recourse (#) 19 7.5% Non-Recourse ($) $238,778 22.5% Maryland $400,222 37.8% Virginia $133,659 12.6% DC $371,526 35.1% Out of Territory $153,877 14.5% *Floating rate loans change when the index changes Multi-Family

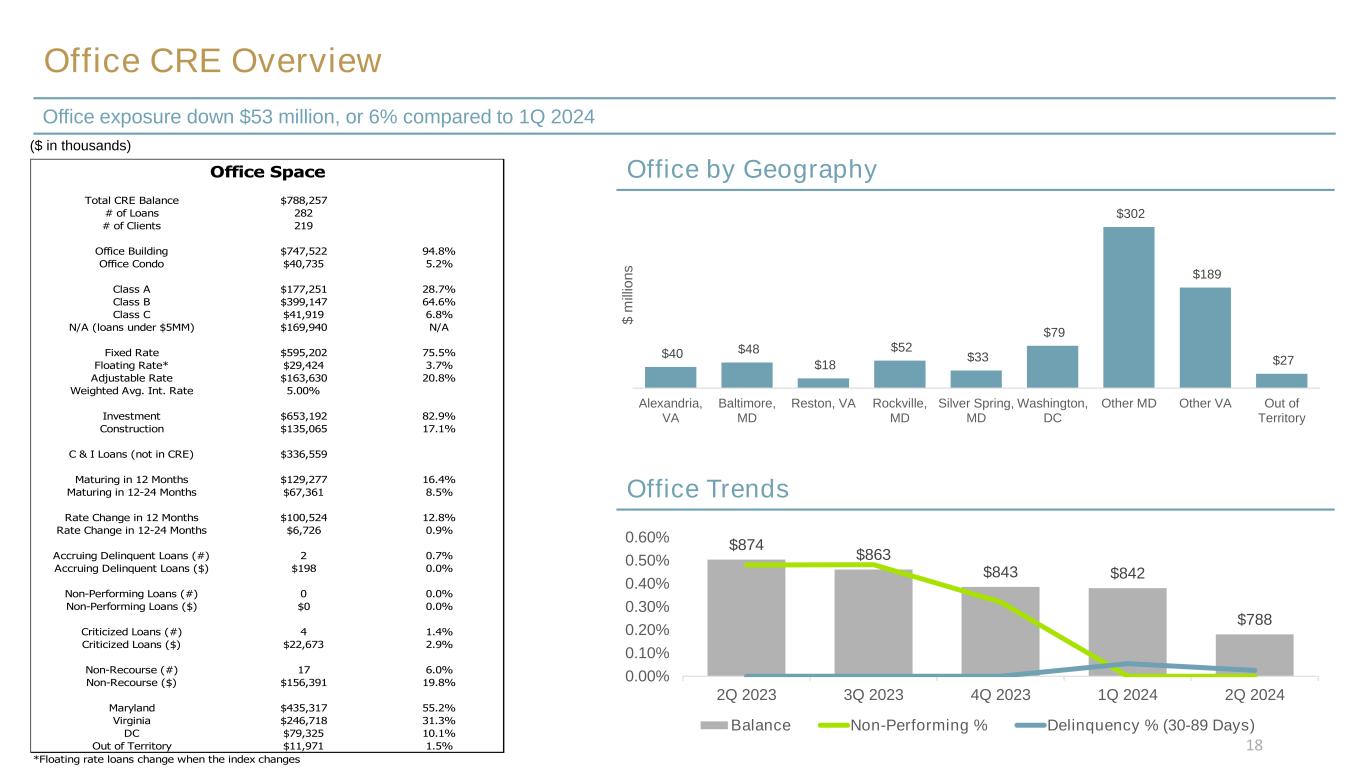

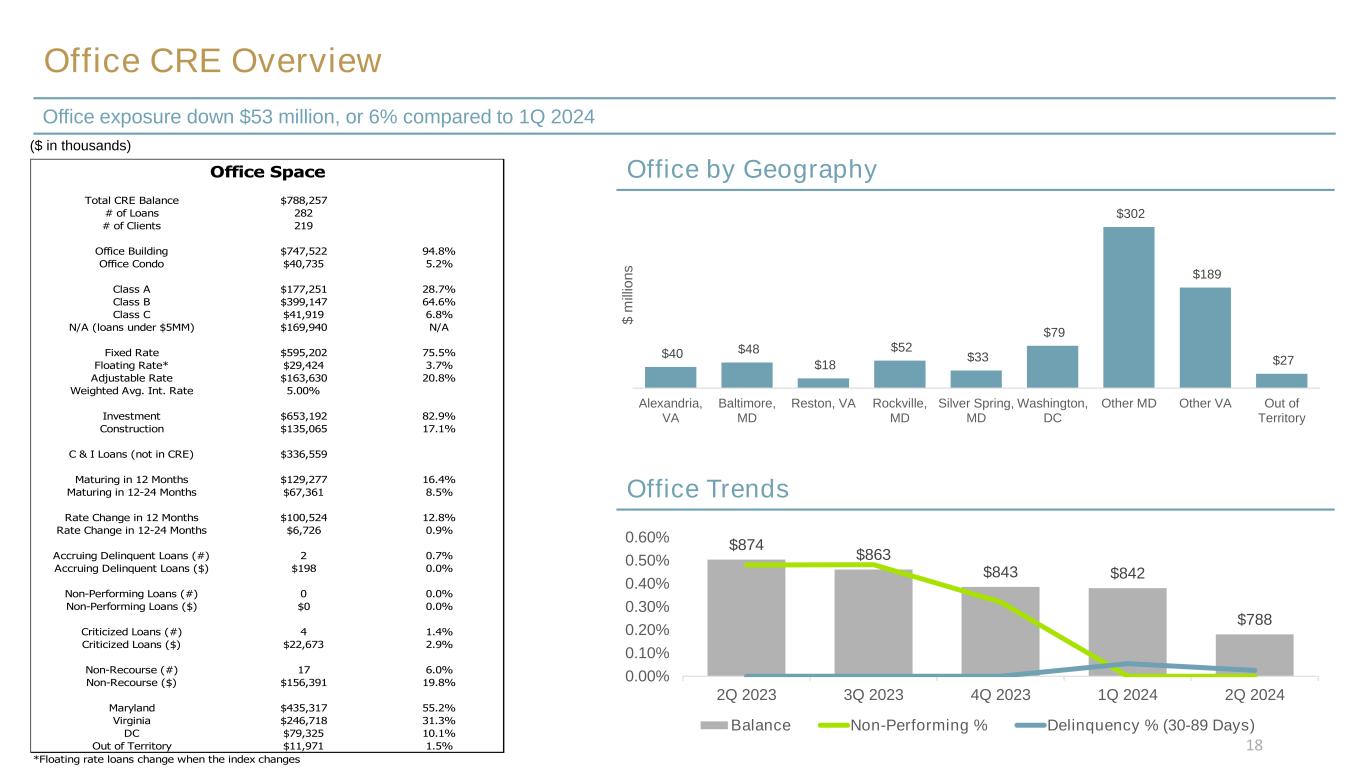

Office CRE Overview Office exposure down $53 million, or 6% compared to 1Q 2024 Office Trends Office by Geography $874 $863 $843 $842 $788 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 $740,000 $760,000 $780,000 $800,000 $820,000 $840,000 $860,000 $880,000 $900,000 Balance Non-Performing % Delinquency % (30-89 Days) $40 $48 $18 $52 $33 $79 $302 $189 $27 Alexandria, VA Baltimore, MD Reston, VA Rockville, MD Silver Spring, MD Washington, DC Other MD Other VA Out of Territory $ m ill io n s ($ in thousands) 18 Total CRE Balance $788,257 # of Loans 282 # of Clients 219 Office Building $747,522 94.8% Office Condo $40,735 5.2% Class A $177,251 28.7% Class B $399,147 64.6% Class C $41,919 6.8% N/A (loans under $5MM) $169,940 N/A Fixed Rate $595,202 75.5% Floating Rate* $29,424 3.7% Adjustable Rate $163,630 20.8% Weighted Avg. Int. Rate 5.00% Investment $653,192 82.9% Construction $135,065 17.1% C & I Loans (not in CRE) $336,559 Maturing in 12 Months $129,277 16.4% Maturing in 12-24 Months $67,361 8.5% Rate Change in 12 Months $100,524 12.8% Rate Change in 12-24 Months $6,726 0.9% Accruing Delinquent Loans (#) 2 0.7% Accruing Delinquent Loans ($) $198 0.0% Non-Performing Loans (#) 0 0.0% Non-Performing Loans ($) $0 0.0% Criticized Loans (#) 4 1.4% Criticized Loans ($) $22,673 2.9% Non-Recourse (#) 17 6.0% Non-Recourse ($) $156,391 19.8% Maryland $435,317 55.2% Virginia $246,718 31.3% DC $79,325 10.1% Out of Territory $11,971 1.5% *Floating rate loans change when the index changes Office Space

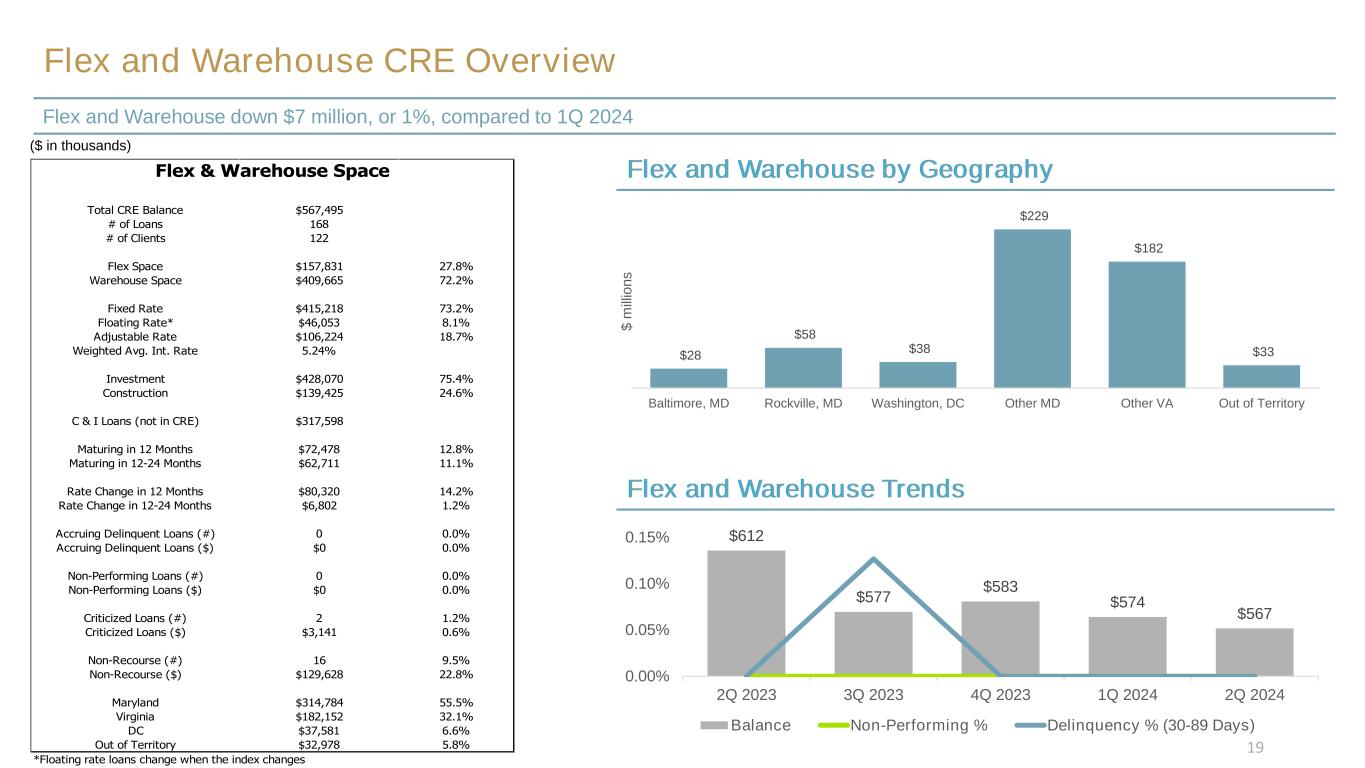

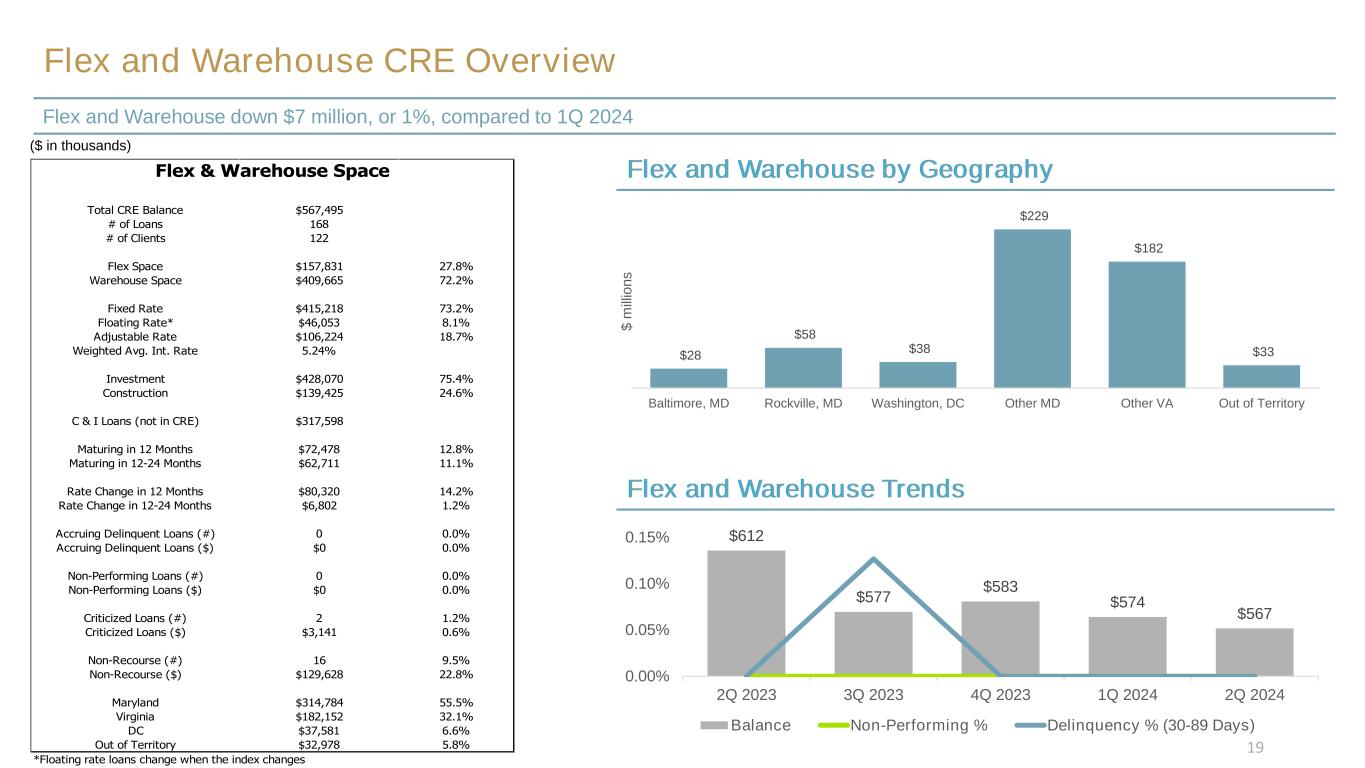

Flex and Warehouse CRE Overview Flex and Warehouse down $7 million, or 1%, compared to 1Q 2024 Flex and Warehouse Trends Flex and Warehouse by Geography $612 $577 $583 $574 $567 0.00% 0.05% 0.10% 0.15% 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 $540,000 $550,000 $560,000 $570,000 $580,000 $590,000 $600,000 $610,000 $620,000 Balance Non-Performing % Delinquency % (30-89 Days) $28 $58 $38 $229 $182 $33 Baltimore, MD Rockville, MD Washington, DC Other MD Other VA Out of Territory $ m ill io n s ($ in thousands) 19 Total CRE Balance $567,495 # of Loans 168 # of Clients 122 Flex Space $157,831 27.8% Warehouse Space $409,665 72.2% Fixed Rate $415,218 73.2% Floating Rate* $46,053 8.1% Adjustable Rate $106,224 18.7% Weighted Avg. Int. Rate 5.24% Investment $428,070 75.4% Construction $139,425 24.6% C & I Loans (not in CRE) $317,598 Maturing in 12 Months $72,478 12.8% Maturing in 12-24 Months $62,711 11.1% Rate Change in 12 Months $80,320 14.2% Rate Change in 12-24 Months $6,802 1.2% Accruing Delinquent Loans (#) 0 0.0% Accruing Delinquent Loans ($) $0 0.0% Non-Performing Loans (#) 0 0.0% Non-Performing Loans ($) $0 0.0% Criticized Loans (#) 2 1.2% Criticized Loans ($) $3,141 0.6% Non-Recourse (#) 16 9.5% Non-Recourse ($) $129,628 22.8% Maryland $314,784 55.5% Virginia $182,152 32.1% DC $37,581 6.6% Out of Territory $32,978 5.8% *Floating rate loans change when the index changes Flex & Warehouse Space

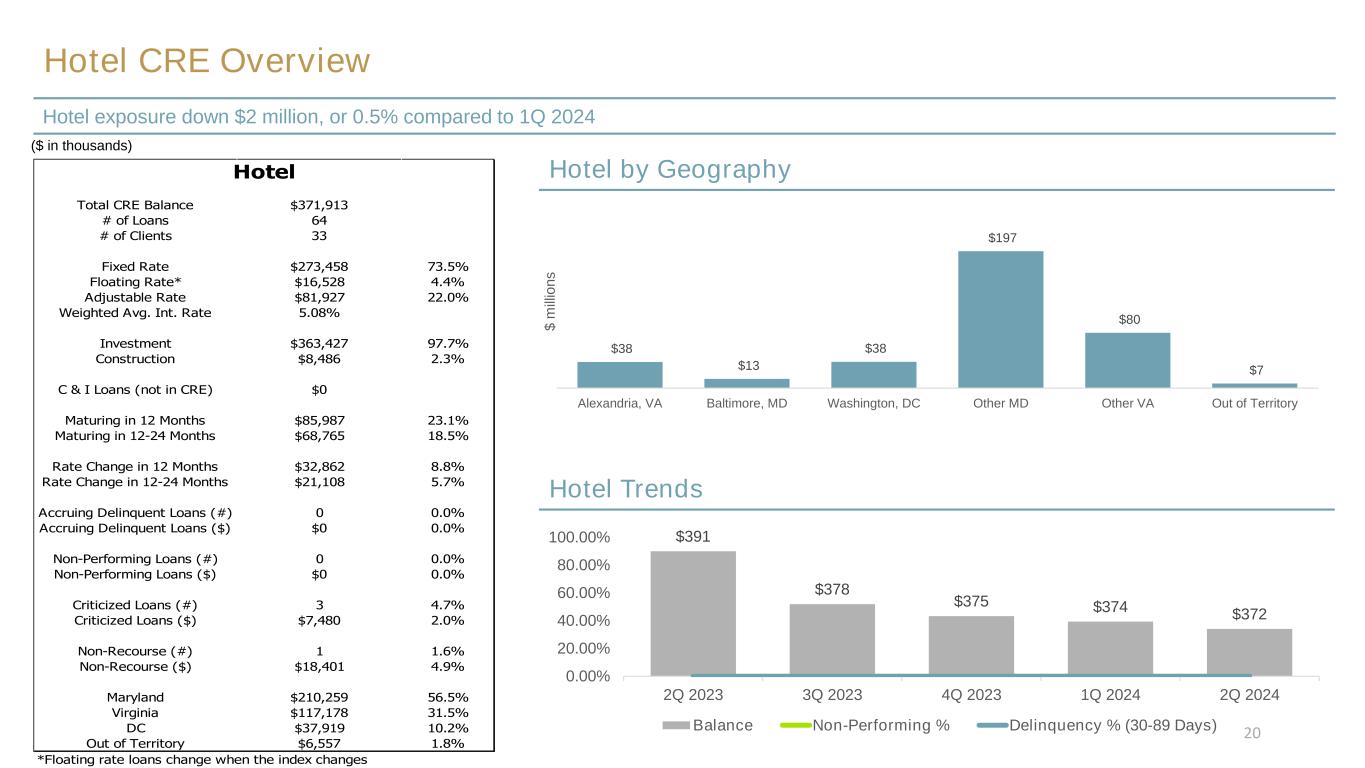

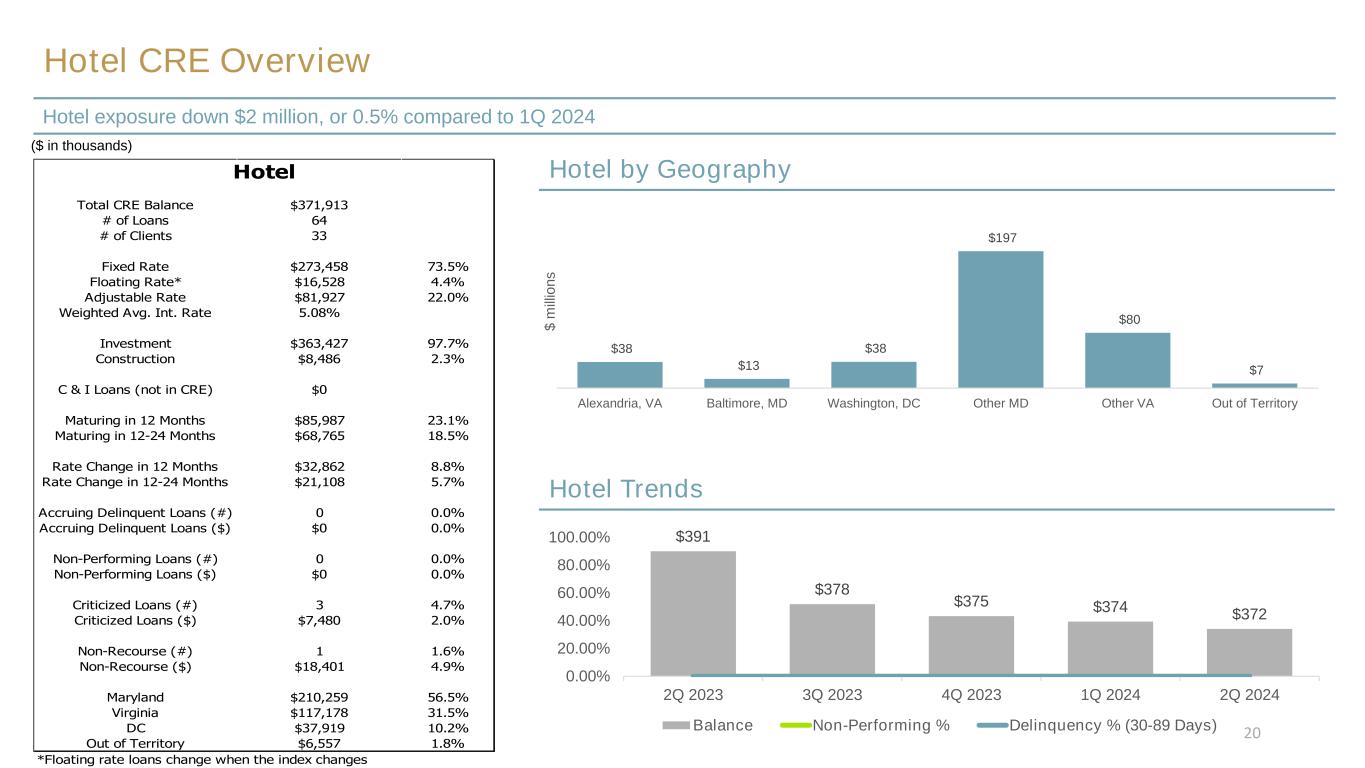

Hotel CRE Overview Hotel exposure down $2 million, or 0.5% compared to 1Q 2024 Hotel Trends Hotel by Geography $391 $378 $375 $374 $372 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 $360,000 $365,000 $370,000 $375,000 $380,000 $385,000 $390,000 $395,000 Balance Non-Performing % Delinquency % (30-89 Days) $38 $13 $38 $197 $80 $7 Alexandria, VA Baltimore, MD Washington, DC Other MD Other VA Out of Territory $ m ill io n s ($ in thousands) 20 Total CRE Balance $371,913 # of Loans 64 # of Clients 33 Fixed Rate $273,458 73.5% Floating Rate* $16,528 4.4% Adjustable Rate $81,927 22.0% Weighted Avg. Int. Rate 5.08% Investment $363,427 97.7% Construction $8,486 2.3% C & I Loans (not in CRE) $0 Maturing in 12 Months $85,987 23.1% Maturing in 12-24 Months $68,765 18.5% Rate Change in 12 Months $32,862 8.8% Rate Change in 12-24 Months $21,108 5.7% Accruing Delinquent Loans (#) 0 0.0% Accruing Delinquent Loans ($) $0 0.0% Non-Performing Loans (#) 0 0.0% Non-Performing Loans ($) $0 0.0% Criticized Loans (#) 3 4.7% Criticized Loans ($) $7,480 2.0% Non-Recourse (#) 1 1.6% Non-Recourse ($) $18,401 4.9% Maryland $210,259 56.5% Virginia $117,178 31.5% DC $37,919 10.2% Out of Territory $6,557 1.8% *Floating rate loans change when the index changes Hotel

Capital Ratios 2Q 2024 Capital Ratios Comments ▪ Quarterly dividend currently $0.34 per share. Annualized dividend yield 5.58%1 ▪ 69% of 2Q 2024 earnings returned to shareholders through common dividends. All capital ratios are in excess of “well-capitalized” regulatory risk-based capital thresholds Tangible Book Value Per Share2 $25.82 $25.80 $26.64 $26.61 $26.72 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 1 Based on June 28, 2024 SASR closing share price of $24.36 2 Non-GAAP financial measure; see reconciliation to most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Financial Measures” 9.42% 10.65% 10.65% 14.60% 9.70% 11.28% 11.28% 15.49% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% Tier 1 Leverage Ratio Tier 1 Common Equity Ratio Tier 1 Capital Ratio Total Capital Ratio 2Q 2023 2Q 2024 21

2024 Management Outlook Outlook for full-year 2024 Balance Sheet Loan Growth Deposit Growth(1) Net Interest Margin Low/Mid-single digits Mid/High-single digits Financial Targets Efficiency Ratio Fee Income Growth Expenses Mid 60% area High-single digits $68MM - $70MM per quarter Operating Assumptions CET1 TCE / TA Tax Rate Low 11% area High 8% to low 9% area 24% - 26% area ▪ The Federal Reserve Bank cuts the fed funds rate by 25 bps one time in December 2024 ▪ Increased likelihood of soft landing with relatively stable economy in the Washington DC / Baltimore CSA ▪ Net interest margin stabilized in 2Q 2024 with potential modest expansion of 2-4 bps per quarter anticipated through year end 2024 subject to interest rate, loan growth, and funding trends Key Economic and Operating Assumptions Credit ACL / Loans: 1.10% area NCO / Loans: 5- 15 basis points 2.45% - 2.55% 22 1 Excludes brokered deposits

Appendix 23

Non-GAAP Reconciliation This presentation contains financial information and performance measures determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). Sandy Spring Bancorp’s management believes that the supplemental non-GAAP information provides a better comparison of period-to-period operating performance. Additionally, Sandy Spring Bancorp believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. Non-GAAP measures used in this presentation consist of the following: • efficiency ratio • tangible common equity • core earnings Efficiency Ratio. Management views the GAAP efficiency ratio as an important financial measure of expense performance and cost management. The ratio expresses the level of non-interest expenses as a percentage of total revenue (net interest income plus total non-interest income). Lower ratios indicate improved productivity. In general, the efficiency ratio is non-interest expenses as a percentage of net interest income plus non-interest income. Noninterest expenses used in the calculation of the non-GAAP efficiency ratio excludes intangible asset amortization and non-recurring or extraordinary items. Non-interest income is adjusted to exclude securities gains and losses and nonrecurring or extraordinary items, and net interest income is adjusted to include tax-equivalent income. The measure is different from the GAAP efficiency ratio, which also is presented in this document. The GAAP measure is calculated using non-interest expense and income amounts as shown on the face of the Consolidated Statements of Income. The GAAP and non-GAAP efficiency ratios are reconciled and provided in the following table. Tangible Common Equity. Tangible equity, tangible assets and tangible book value per share are non-GAAP financial measures calculated using GAAP amounts. Tangible common equity and tangible assets exclude the balances of goodwill and other intangible assets from stockholder’s equity and total assets, respectively. Management believes that this non-GAAP financial measure provides information to investors that may be useful in understanding our financial condition. Because not all companies use the same calculation of tangible equity and tangible assets, this presentation may not be comparable to other similarly titled measures calculated by other companies. Core Earnings. Core earnings is a non-GAAP financial measure calculated using GAAP amounts. Core earnings reflect net income for the period exclusive of merger, acquisition and disposal expense, amortization of intangible assets, and other nonrecurring or extraordinary items, in each case net of tax. Management believes that this non-GAAP financial measure provides helpful information to investors in understanding the Company’s core operating earnings and provides a better comparison of period-to-period operating performance of the Company. 24

Reconciliation of Non-GAAP Financial Measures - QTD 25 (Dollars in thousands) 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Pre-tax pre-provision income (Non-GAAP) . Pre-tax pre-provision income: $ 24,745 $ 20,746 $ 26,100 $ 20,372 $ 22,807 Net income Plus/(less) non-GAAP adjustments: Income taxes 8,711 6,890 8,459 6,944 7,941 Provision/(credit) for credit losses 5,055 2,365 (3,445) 2,388 1,020 Pre-tax pre-provision net income $ 38,511 $ 30,001 $ 31,114 $ 29,704 $ 31,768 Efficiency ratio - GAAP basis . Non-interest expenses $ 69,136 $ 72,471 $ 67,142 $ 68,006 $ 68,104 Net interest income plus non-interest income 107,647 102,472 98,256 97,710 99,872 Efficiency ratio - GAAP basis 64.22 % 70.72 % 68.33 % 69.60 % 68.19 % Efficiency ratio - Non-GAAP basis Non-interest expenses $ 69,136 $ 72,471 $ 67,142 $ 68,006 $ 68,104 Less non-GAAP adjustments: Amortization of intangible assets 1,269 1,245 1,403 2,069 2,135 Severance expense 1,939 — — — — Pension settlement expense — 8,157 — — — Non-interest expenses - as adjusted $ 65,928 $ 63,069 $ 65,739 $ 65,937 $ 65,969 Net interest income plus non-interest income $ 107,647 $ 102,472 $ 98,256 $ 97,710 $ 99,872 Plus non-GAAP adjustment: Tax-equivalent income 1,006 1,068 1,113 1,099 1,139 Less non-GAAP adjustments: Investment securities gains/(losses) — — — — — Net interest income plus non-interest income - as adjusted $ 108,653 $ 103,540 $ 99,369 $ 98,809 $ 101,011 Efficiency ratio - Non-GAAP basis 60.68 % 60.91 % 66.16 % 66.73 % 65.31 %

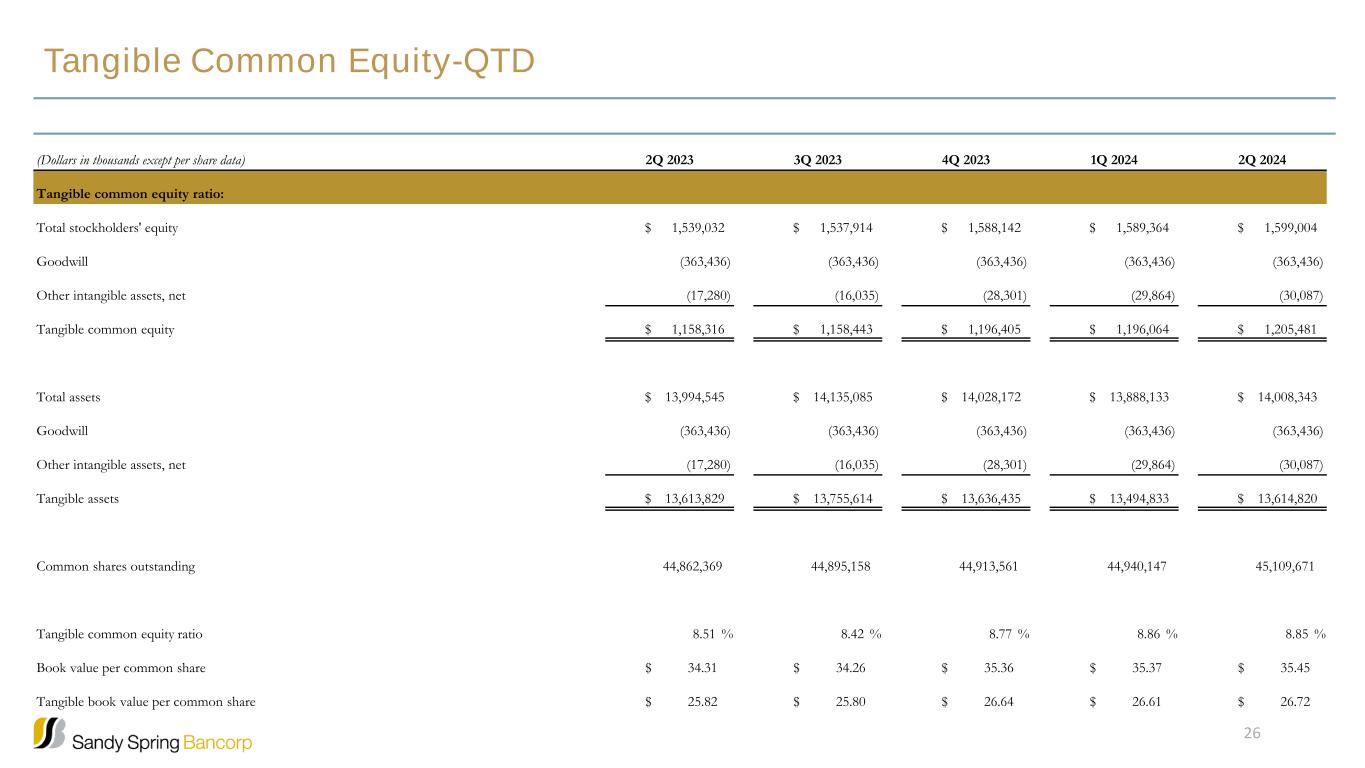

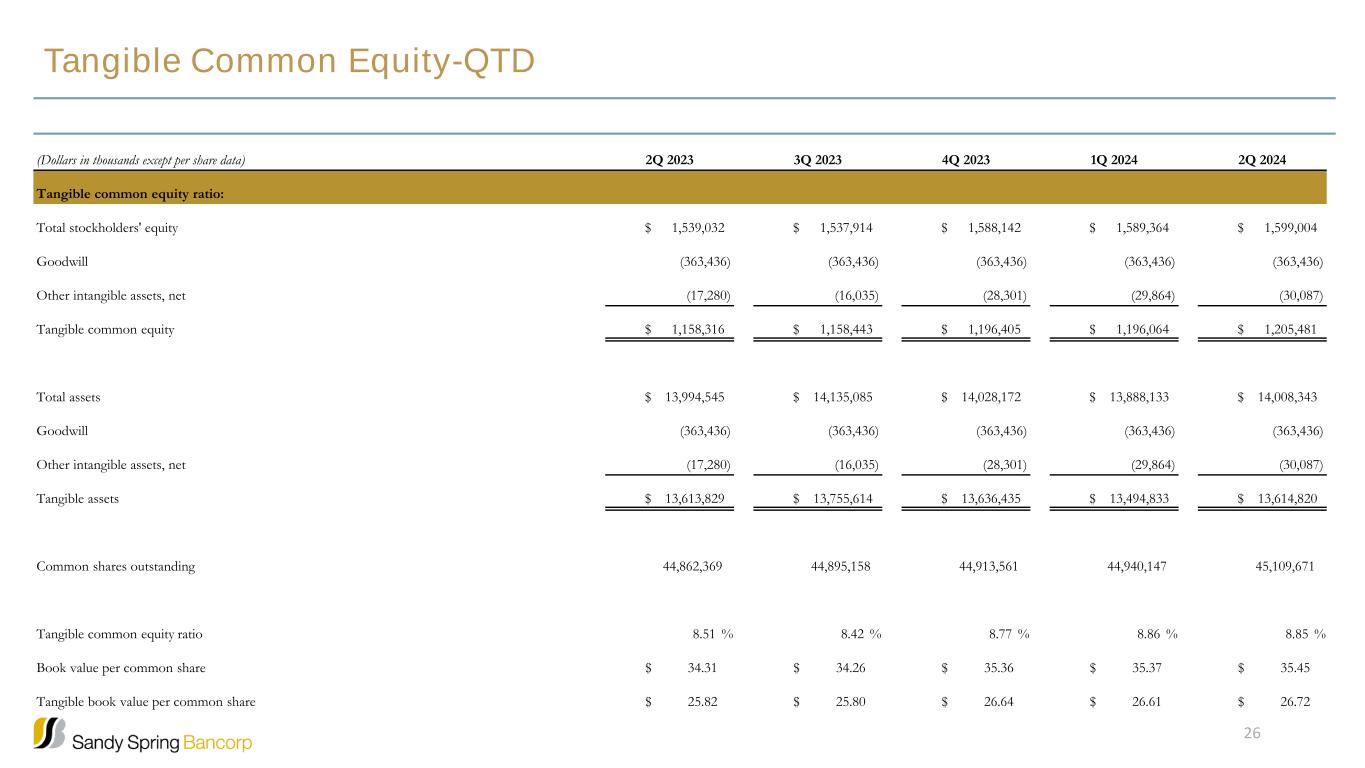

Tangible Common Equity-QTD 26 (Dollars in thousands except per share data) 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Tangible common equity ratio: Total stockholders' equity $ 1,539,032 $ 1,537,914 $ 1,588,142 $ 1,589,364 $ 1,599,004 Goodwill (363,436) (363,436) (363,436) (363,436) (363,436) Other intangible assets, net (17,280) (16,035) (28,301) (29,864) (30,087) Tangible common equity $ 1,158,316 $ 1,158,443 $ 1,196,405 $ 1,196,064 $ 1,205,481 Total assets $ 13,994,545 $ 14,135,085 $ 14,028,172 $ 13,888,133 $ 14,008,343 Goodwill (363,436) (363,436) (363,436) (363,436) (363,436) Other intangible assets, net (17,280) (16,035) (28,301) (29,864) (30,087) Tangible assets $ 13,613,829 $ 13,755,614 $ 13,636,435 $ 13,494,833 $ 13,614,820 Common shares outstanding 44,862,369 44,895,158 44,913,561 44,940,147 45,109,671 Tangible common equity ratio 8.51 % 8.42 % 8.77 % 8.86 % 8.85 % Book value per common share $ 34.31 $ 34.26 $ 35.36 $ 35.37 $ 35.45 Tangible book value per common share $ 25.82 $ 25.80 $ 26.64 $ 26.61 $ 26.72

Core Earnings - QTD 27 (Dollars in thousands except per share data) 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 Core Earnings: Net income(GAAP) $ 24,745 $ 20,746 $ 26,100 $ 20,372 $ 22,807 Plus/(less) non-GAAP adjustments (net of tax): Amortization of intangible assets 946 932 1,047 1,544 1,593 Severance Expense 1,445 — — — — Pension settlement expense — 6,088 — — — Core earnings (non-GAAP) $ 27,136 $ 27,766 $ 27,147 $ 21,916 $ 24,400 Core return on average assets (non-GAAP) Average assets (GAAP) $14,094,653 $14,086,342 $14,090,423 $14,061,935 $13,956,261 Return on average assets (GAAP) 0.70 % 0.58 % 0.73 % 0.58 % 0.66 % Core return on average assets (non-GAAP) 0.77 % 0.78 % 0.76 % 0.63 % 0.70 % Weighted average common shares outstanding - diluted (GAAP) 44,888,759 44,960,455 45,009,574 45,086,471 45,145,214 Earning per diluted common share (GAAP) $ 0.55 $ 0.46 $ 0.58 $ 0.45 $ 0.51 Core earnings per diluted common share (non-GAAP) $ 0.60 $ 0.62 $ 0.60 $ 0.49 $ 0.54