Acquisition of Revere Bank September 24, 2019 Daniel J. Schrider President & Chief Executive Officer Philip J. Mantua Executive Vice President & Chief Financial Officer Exhibit 99.1

Disclaimers FORWARD-LOOKING STATEMENTS This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of Sandy Spring Bancorp, Inc. (“Sandy Spring”) and Revere Bank. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of Sandy Spring’s and Revere Bank’s management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “may,” “will,” “would,” “could,” “should” or other similar words and expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and neither Sandy Spring nor Revere Bank undertakes any obligation to update any statement in light of new information or future events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In addition to factors previously disclosed in Sandy Spring’s reports filed with the U.S. Securities and Exchange Commission (the “SEC”), the following factors among others, could cause actual results to differ materially from those in its forward-looking statements: (i) the possibility that any of the anticipated benefits of the proposed transaction between Sandy Spring and Revere Bank will not be realized or will not be realized within the expected time period; (ii) the risk that integration of operations of Revere Bank with those of Sandy Spring will be materially delayed or will be more costly or difficult than expected; (iii) the inability to complete the proposed transaction due to the failure to obtain the required shareholder approvals; (iv) the failure to satisfy other conditions to completion of the proposed transaction, including receipt of required regulatory and other approvals; (v) the failure of the proposed transaction to close for any other reason; (vi) the effect of the announcement of the transaction on customer relationships and operating results; (vii) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (viii) general economic conditions and trends, either nationally or locally; (ix) conditions in the securities markets; (x) changes in interest rates; (xi) changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; (xii) changes in real estate values; (xiii) changes in the quality or composition of Sandy Spring’s or Revere Bank’s loan or investment portfolios; (xiv) changes in competitive pressures among financial institutions or from non-financial institutions; (xv) the ability to retain key members of management; and (xvi) changes in legislation, regulations, and policies. ADDITIONAL INFORMATION ABOUT THE ACQUISITION AND WHERE TO FIND IT In connection with the proposed merger transaction, Sandy Spring will file with the Securities and Exchange Commission a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Sandy Spring and Revere Bank, and a Prospectus of Sandy Spring, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and the Joint Proxy Statement/Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information about Sandy Spring, Revere Bank and the proposed merger. A free copy of the Joint Proxy Statement/Prospectus, as well as other filings containing information about Sandy Spring, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Sandy Spring at www.sandyspringbank.com under the tab “Investor Relations,” and then under the heading “SEC Filings.” Alternatively, these documents, when available, can be obtained free of charge from Sandy Spring upon written request to Sandy Spring Bancorp, Inc., Corporate Secretary, 17801 Georgia Avenue, Olney, Maryland 20832 or by calling (800) 399-5919 or to Revere Bank, Corporate Secretary, 2101 Gaither Road, 6th Floor, Rockville, Maryland or by calling (240) 264-5346. PARTICIPANTS IN THE SOLICITATION Sandy Spring and Revere Bank and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Sandy Spring and Revere Bank in connection with the proposed merger. Information about the directors and executive officers of Sandy Spring is set forth in the proxy statement for Sandy Spring’s 2019 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 13, 2019. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

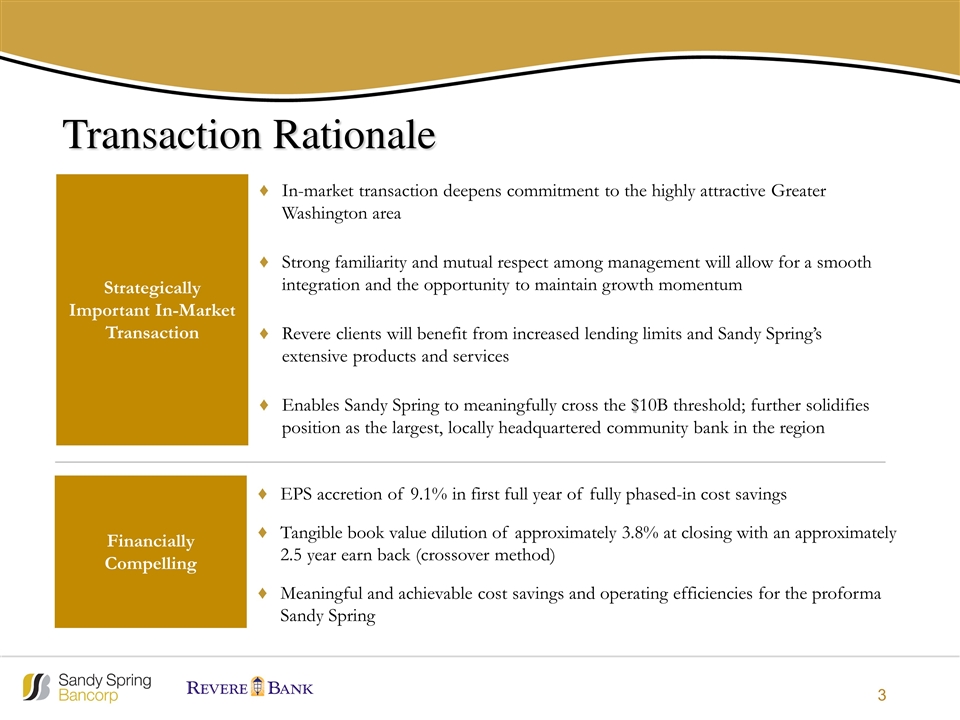

Transaction Rationale Strategically Important In-Market Transaction Financially Compelling In-market transaction deepens commitment to the highly attractive Greater Washington area Strong familiarity and mutual respect among management will allow for a smooth integration and the opportunity to maintain growth momentum Revere clients will benefit from increased lending limits and Sandy Spring’s extensive products and services Enables Sandy Spring to meaningfully cross the $10B threshold; further solidifies position as the largest, locally headquartered community bank in the region EPS accretion of 9.1% in first full year of fully phased-in cost savings Tangible book value dilution of approximately 3.8% at closing with an approximately 2.5 year earn back (crossover method) Meaningful and achievable cost savings and operating efficiencies for the proforma Sandy Spring

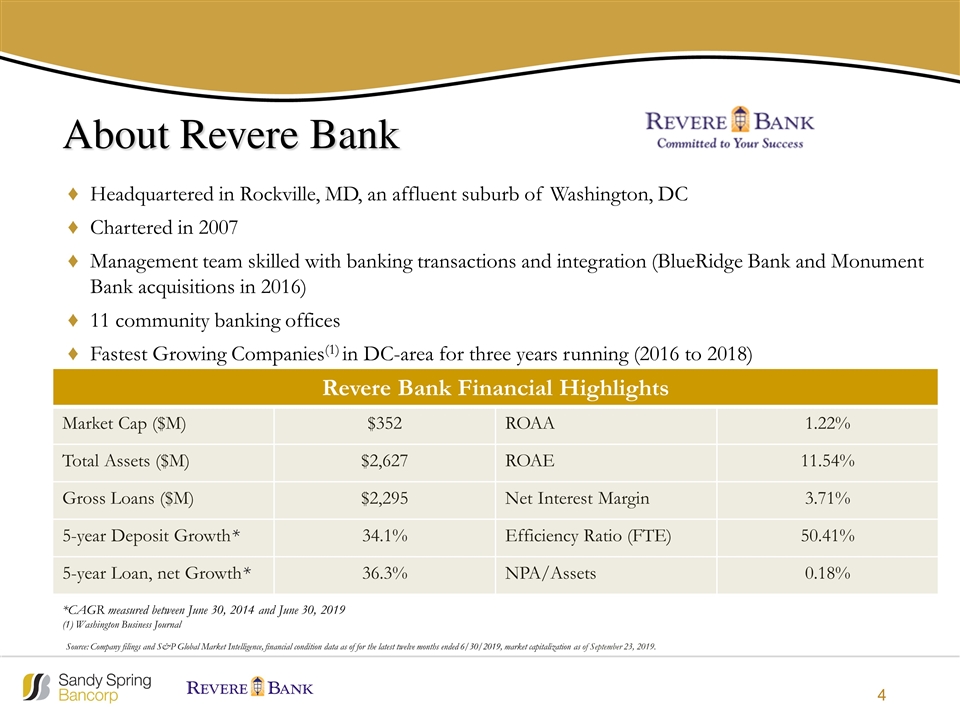

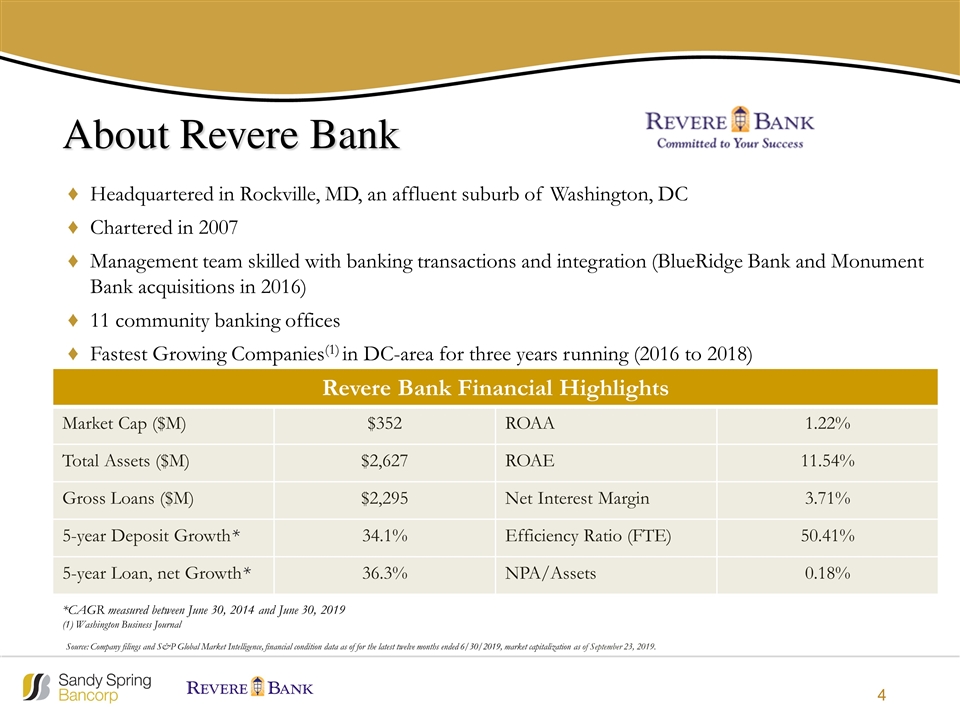

About Revere Bank 4 Source: Company filings and S&P Global Market Intelligence, financial condition data as of for the latest twelve months ended 6/30/2019, market capitalization as of September 23, 2019. Headquartered in Rockville, MD, an affluent suburb of Washington, DC Chartered in 2007 Management team skilled with banking transactions and integration (BlueRidge Bank and Monument Bank acquisitions in 2016) 11 community banking offices Fastest Growing Companies(1) in DC-area for three years running (2016 to 2018) Revere Bank Financial Highlights Market Cap ($M) $352 ROAA 1.22% Total Assets ($M) $2,627 ROAE 11.54% Gross Loans ($M) $2,295 Net Interest Margin 3.71% 5-year Deposit Growth* 34.1% Efficiency Ratio (FTE) 50.41% 5-year Loan, net Growth* 36.3% NPA/Assets 0.18% *CAGR measured between June 30, 2014 and June 30, 2019 (1) Washington Business Journal

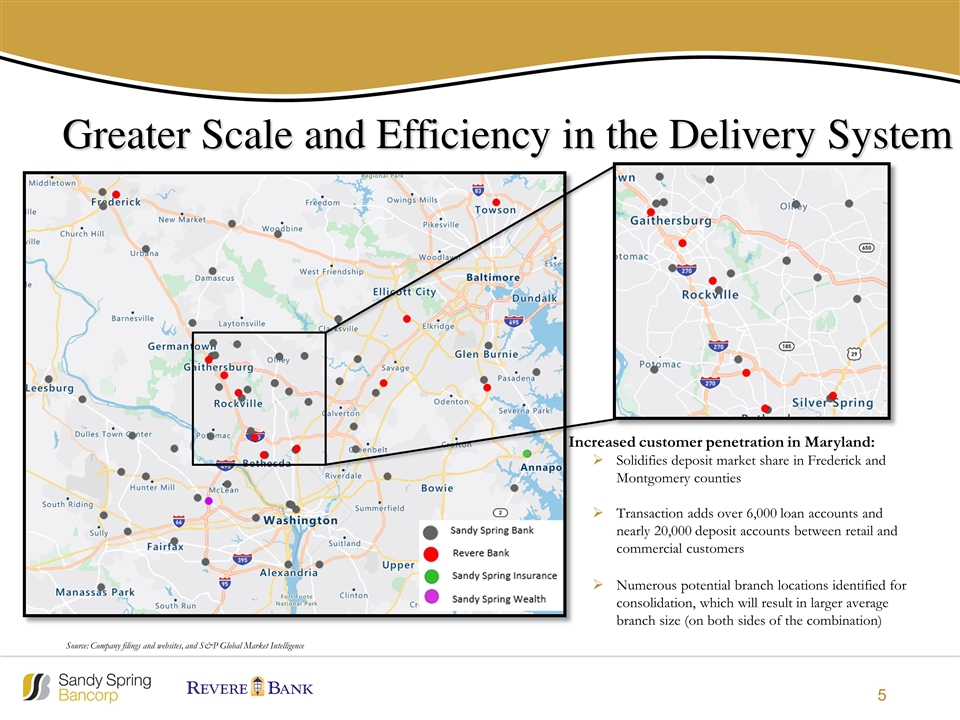

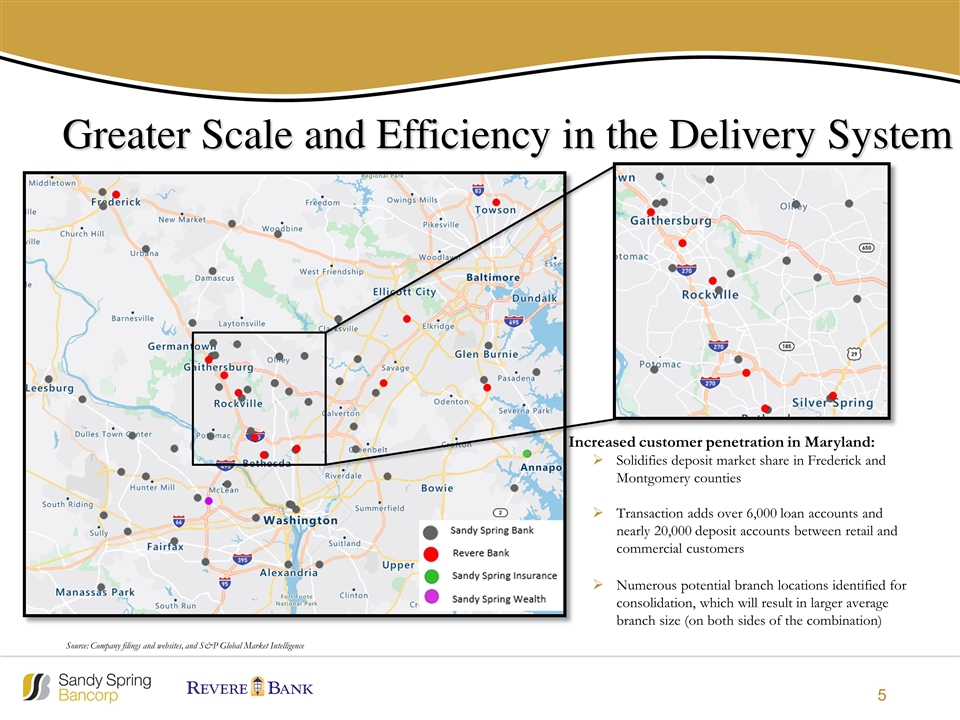

Greater Scale and Efficiency in the Delivery System Increased customer penetration in Maryland: Solidifies deposit market share in Frederick and Montgomery counties Transaction adds over 6,000 loan accounts and nearly 20,000 deposit accounts between retail and commercial customers Numerous potential branch locations identified for consolidation, which will result in larger average branch size (on both sides of the combination) Source: Company filings and websites, and S&P Global Market Intelligence

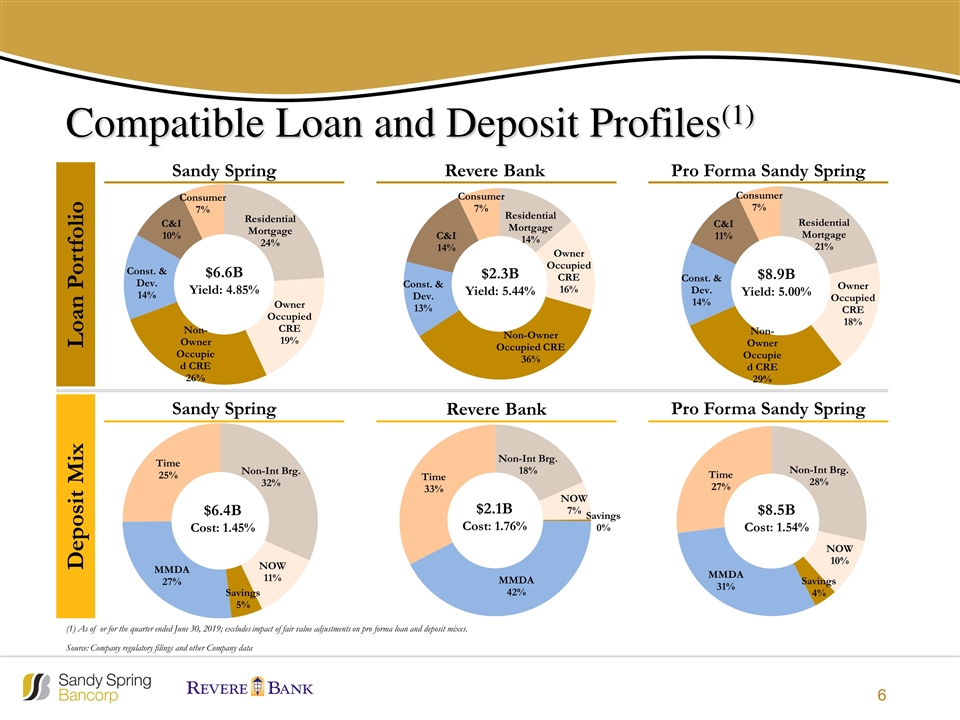

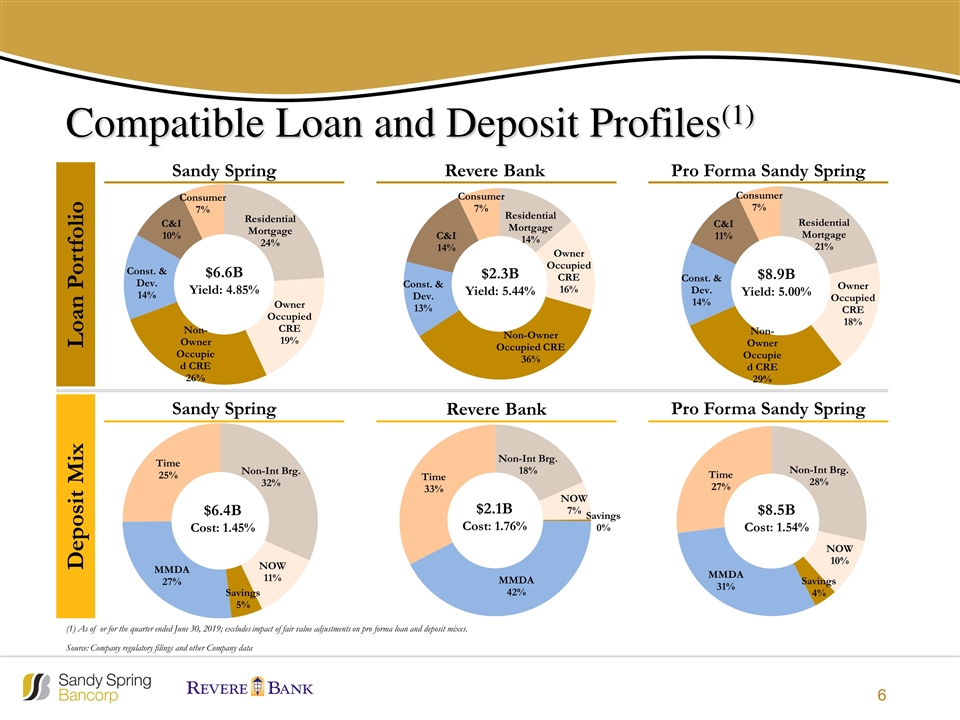

Compatible Loan and Deposit Profiles(1) (1) As of or for the quarter ended June 30, 2019; excludes impact of fair value adjustments on pro forma loan and deposit mixes. Source: Company regulatory filings and other Company data Loan Portfolio Deposit Mix $6.6B Yield: 4.85% Sandy Spring Sandy Spring $2.3B Yield: 5.44% Revere Bank $8.9B Yield: 5.00% Pro Forma Sandy Spring Pro Forma Sandy Spring Revere Bank $6.4B Cost: 1.45% $2.1B Cost: 1.76% $8.5B Cost: 1.54%

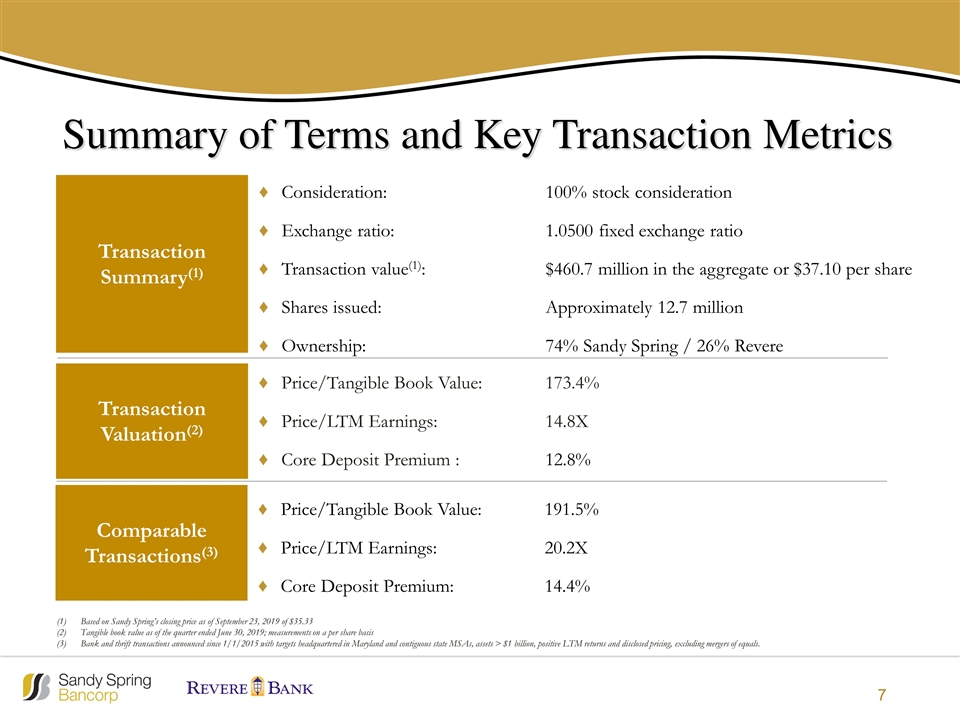

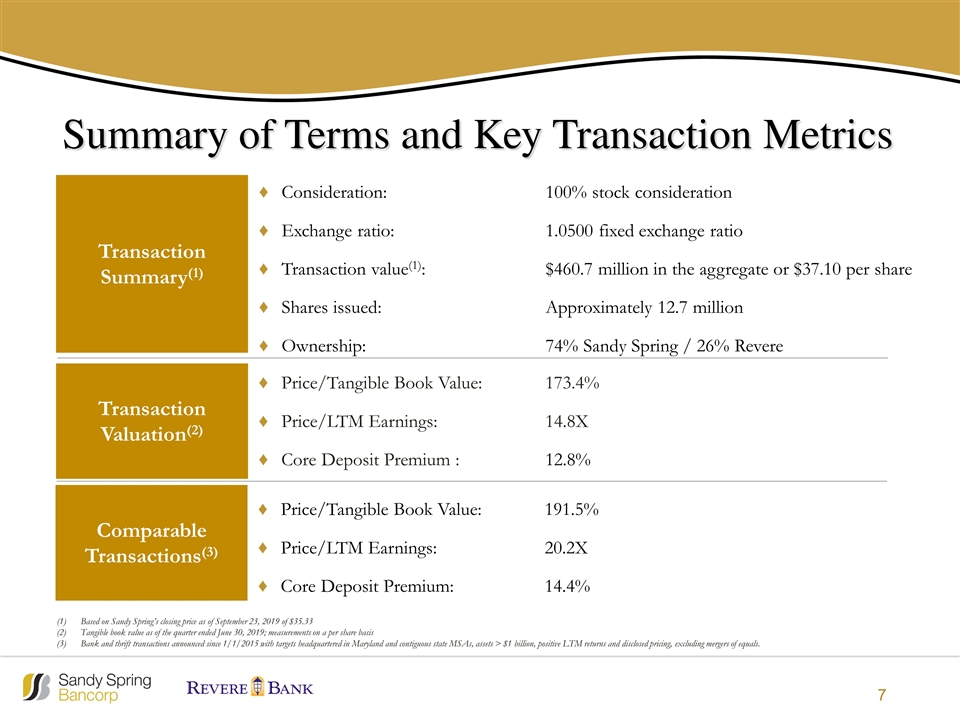

Summary of Terms and Key Transaction Metrics Transaction Summary(1) Transaction Valuation(2) Consideration:100% stock consideration Exchange ratio:1.0500 fixed exchange ratio Transaction value(1): $460.7 million in the aggregate or $37.10 per share Shares issued:Approximately 12.7 million Ownership:74% Sandy Spring / 26% Revere Price/Tangible Book Value: 173.4% Price/LTM Earnings: 14.8X Core Deposit Premium :12.8% Based on Sandy Spring’s closing price as of September 23, 2019 of $35.33 Tangible book value as of the quarter ended June 30, 2019; measurements on a per share basis Bank and thrift transactions announced since 1/1/2015 with targets headquartered in Maryland and contiguous state MSAs, assets > $1 billion, positive LTM returns and disclosed pricing, excluding mergers of equals. Comparable Transactions(3) Price/Tangible Book Value: 191.5% Price/LTM Earnings: 20.2X Core Deposit Premium:14.4%

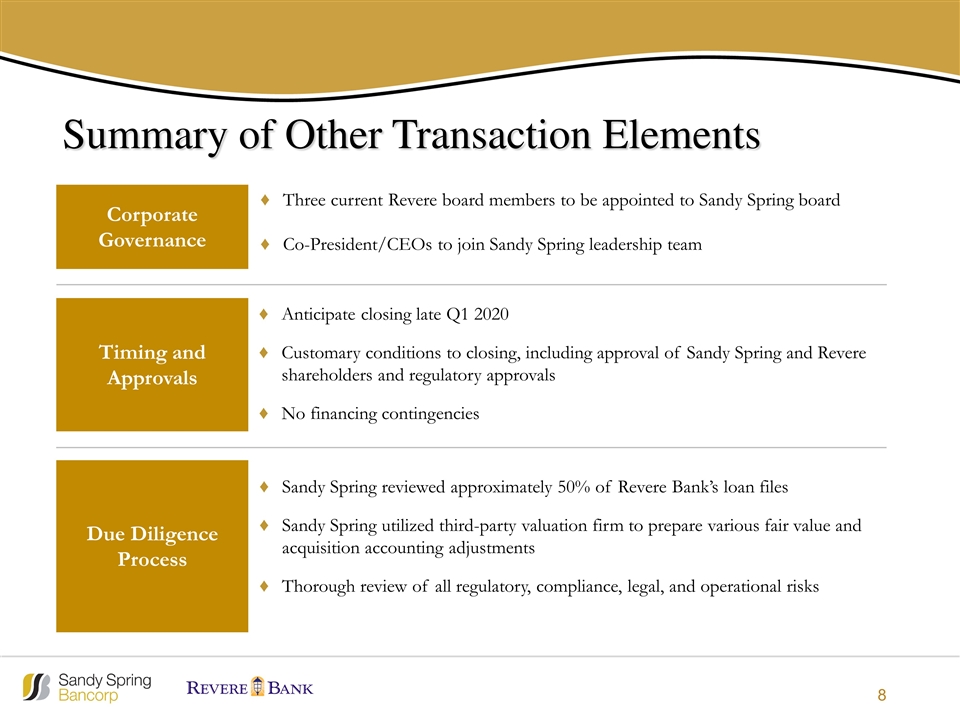

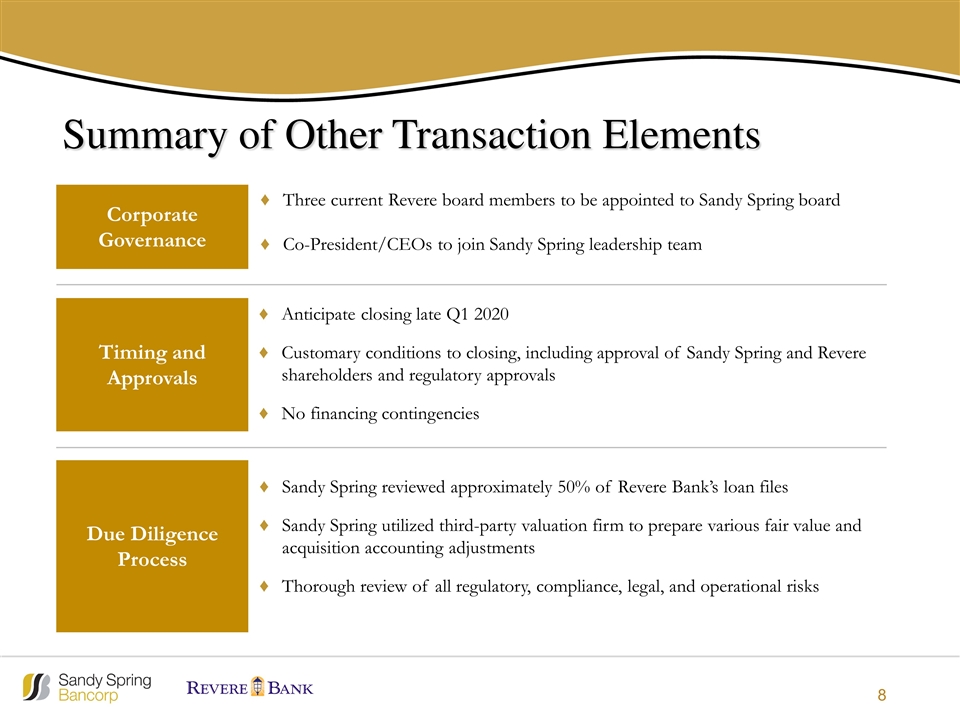

Summary of Other Transaction Elements Timing and Approvals Anticipate closing late Q1 2020 Customary conditions to closing, including approval of Sandy Spring and Revere shareholders and regulatory approvals No financing contingencies Corporate Governance Three current Revere board members to be appointed to Sandy Spring board Co-President/CEOs to join Sandy Spring leadership team Sandy Spring reviewed approximately 50% of Revere Bank’s loan files Sandy Spring utilized third-party valuation firm to prepare various fair value and acquisition accounting adjustments Thorough review of all regulatory, compliance, legal, and operational risks Due Diligence Process

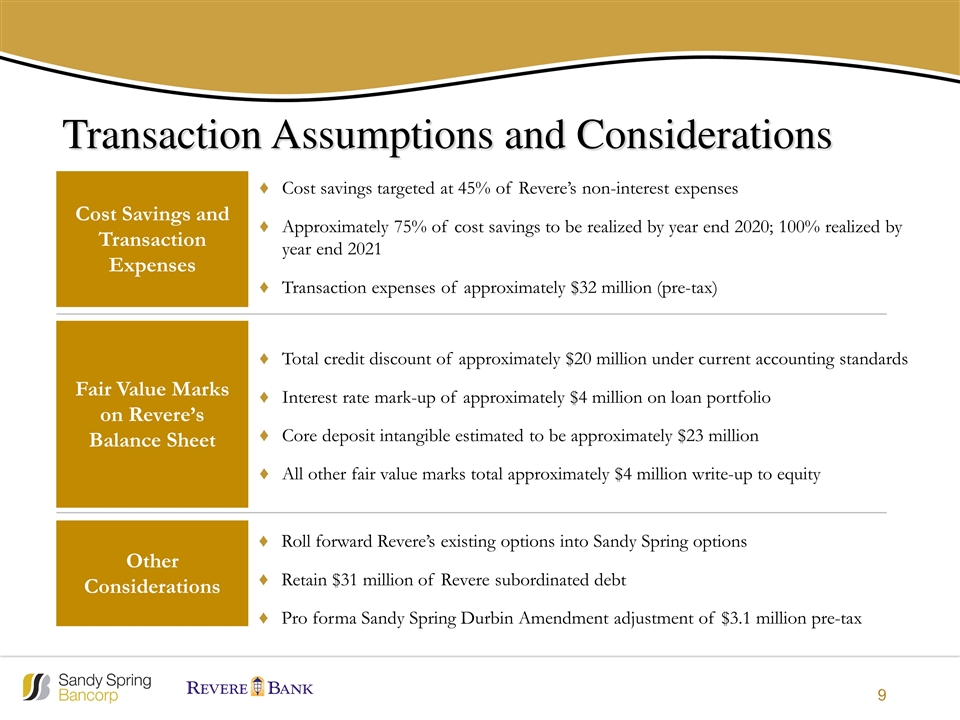

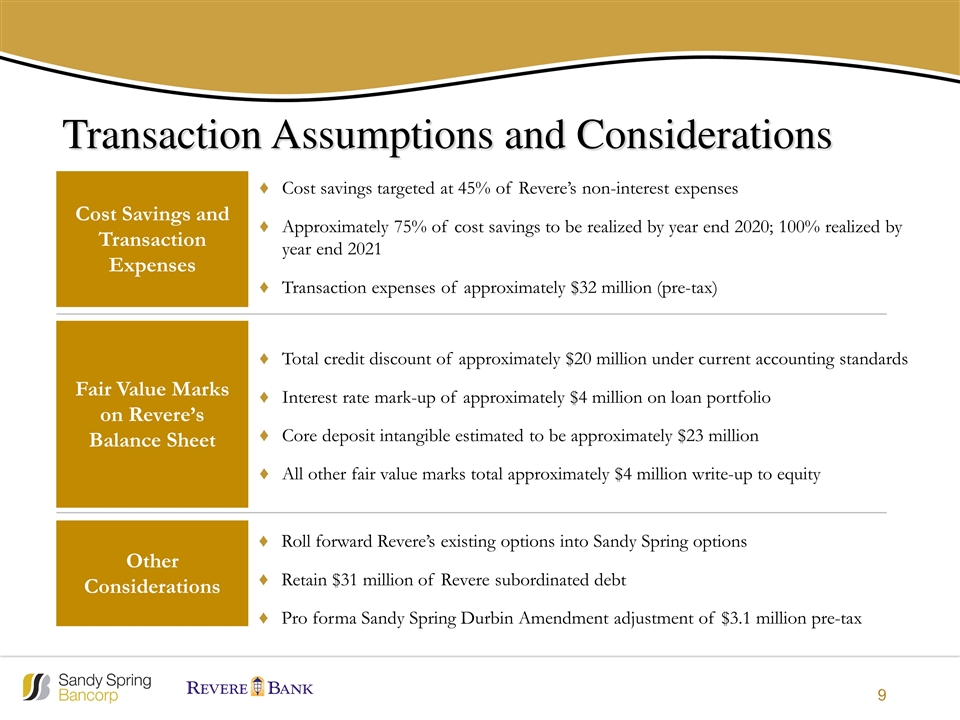

Transaction Assumptions and Considerations Cost Savings and Transaction Expenses Fair Value Marks on Revere’s Balance Sheet Other Considerations Cost savings targeted at 45% of Revere’s non-interest expenses Approximately 75% of cost savings to be realized by year end 2020; 100% realized by year end 2021 Transaction expenses of approximately $32 million (pre-tax) Total credit discount of approximately $20 million under current accounting standards Interest rate mark-up of approximately $4 million on loan portfolio Core deposit intangible estimated to be approximately $23 million All other fair value marks total approximately $4 million write-up to equity Roll forward Revere’s existing options into Sandy Spring options Retain $31 million of Revere subordinated debt Pro forma Sandy Spring Durbin Amendment adjustment of $3.1 million pre-tax

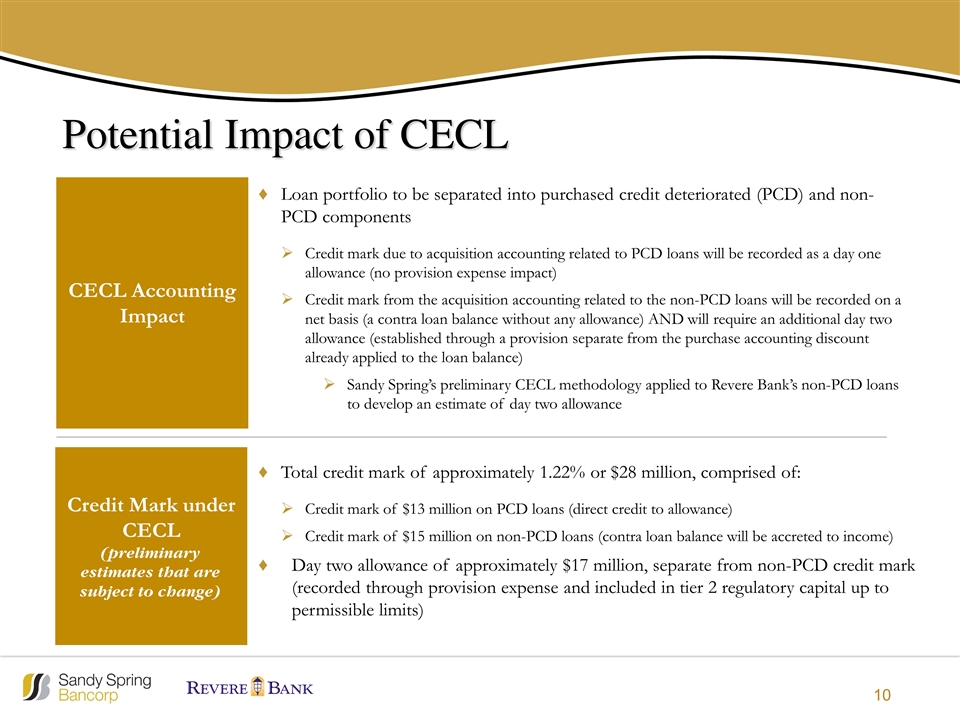

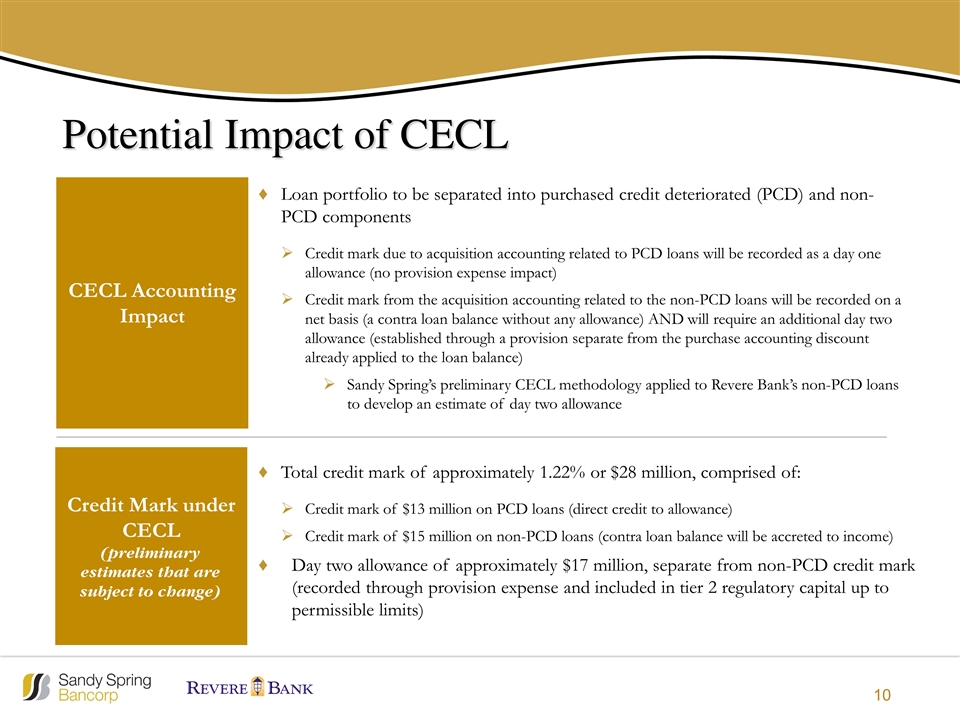

Potential Impact of CECL CECL Accounting Impact Credit Mark under CECL (preliminary estimates that are subject to change) Total credit mark of approximately 1.22% or $28 million, comprised of: Credit mark of $13 million on PCD loans (direct credit to allowance) Credit mark of $15 million on non-PCD loans (contra loan balance will be accreted to income) Day two allowance of approximately $17 million, separate from non-PCD credit mark (recorded through provision expense and included in tier 2 regulatory capital up to permissible limits) Loan portfolio to be separated into purchased credit deteriorated (PCD) and non-PCD components Credit mark due to acquisition accounting related to PCD loans will be recorded as a day one allowance (no provision expense impact) Credit mark from the acquisition accounting related to the non-PCD loans will be recorded on a net basis (a contra loan balance without any allowance) AND will require an additional day two allowance (established through a provision separate from the purchase accounting discount already applied to the loan balance) Sandy Spring’s preliminary CECL methodology applied to Revere Bank’s non-PCD loans to develop an estimate of day two allowance

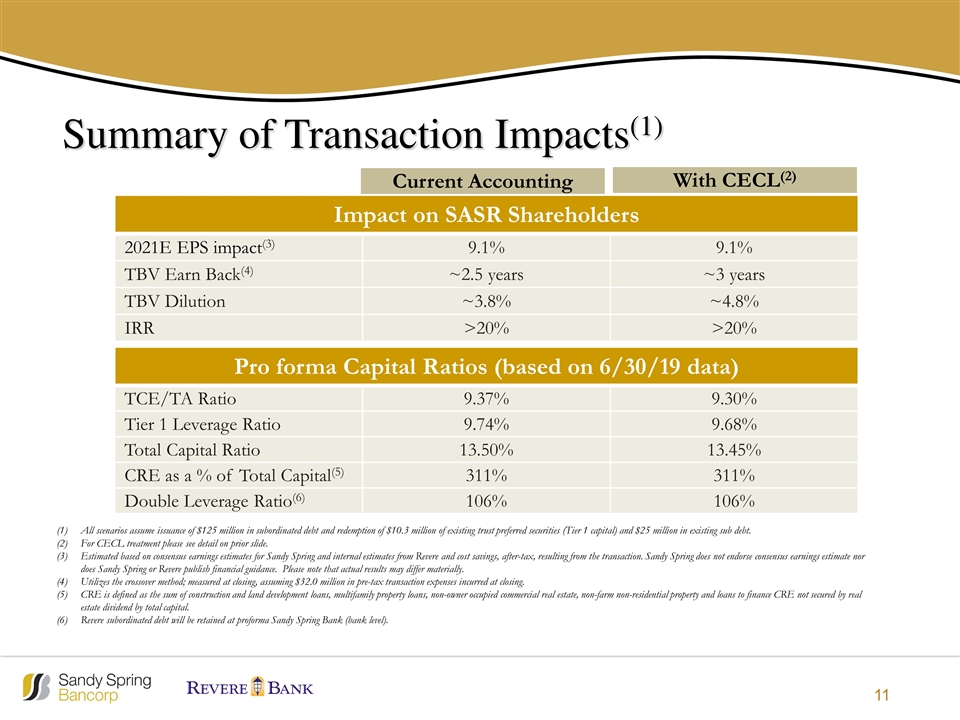

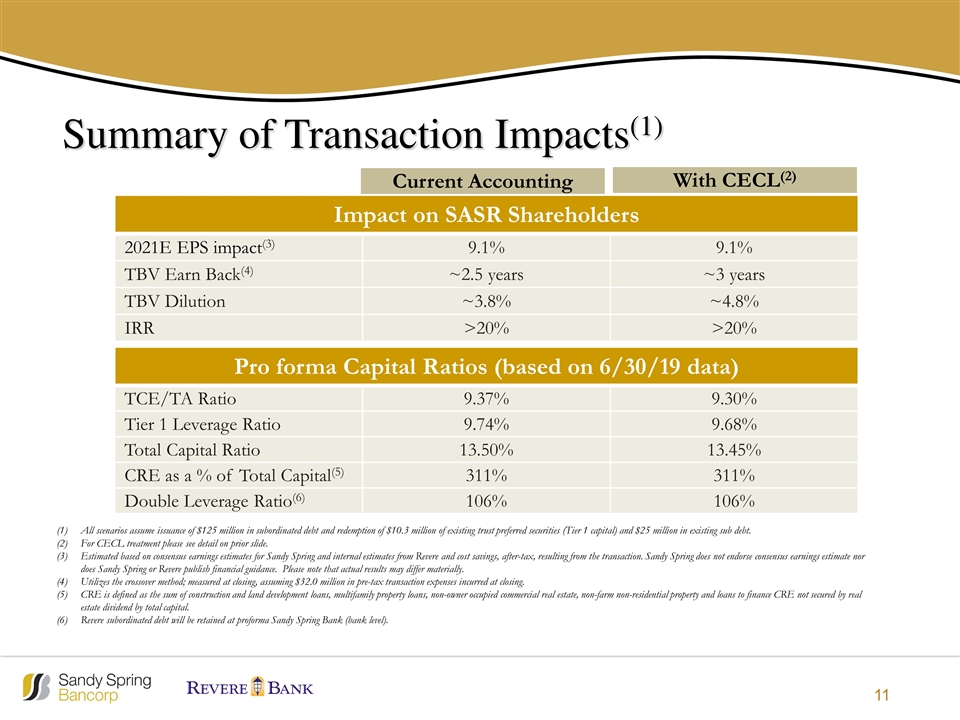

Summary of Transaction Impacts(1) All scenarios assume issuance of $125 million in subordinated debt and redemption of $10.3 million of existing trust preferred securities (Tier 1 capital) and $25 million in existing sub debt. For CECL treatment please see detail on prior slide. Estimated based on consensus earnings estimates for Sandy Spring and internal estimates from Revere and cost savings, after-tax, resulting from the transaction. Sandy Spring does not endorse consensus earnings estimate nor does Sandy Spring or Revere publish financial guidance. Please note that actual results may differ materially. Utilizes the crossover method; measured at closing, assuming $32.0 million in pre-tax transaction expenses incurred at closing. CRE is defined as the sum of construction and land development loans, multifamily property loans, non-owner occupied commercial real estate, non-farm non-residential property and loans to finance CRE not secured by real estate dividend by total capital. Revere subordinated debt will be retained at proforma Sandy Spring Bank (bank level). Impact on SASR Shareholders 2021E EPS impact(3) 9.1% 9.1% TBV Earn Back(4) ~2.5 years ~3 years TBV Dilution ~3.8% ~4.8% IRR >20% >20% Pro forma Capital Ratios (based on 6/30/19 data) TCE/TA Ratio 9.37% 9.30% Tier 1 Leverage Ratio 9.74% 9.68% Total Capital Ratio 13.50% 13.45% CRE as a % of Total Capital(5) 311% 311% Double Leverage Ratio(6) 106% 106% With CECL(2) Current Accounting

Q&A