- SASR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Sandy Spring Bancorp (SASR) DEF 14ADefinitive proxy

Filed: 6 Apr 22, 8:31am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material pursuant to §240.14a-12 |

SANDY SPRING BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. | |

| ☐ |

Fee paid previously with preliminary materials. | |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| DATE | Wednesday, May 18, 2022

| |

| TIME | 10:00 a.m., Eastern Time

| |

| PLACE | The meeting will be held live via the internet in virtual format only at https://meetnow.global/MMYUPAD

| |

| RECORD DATE | You are eligible to vote if you were a shareholder of record at the close of business on March 9, 2022 |

MEETING AGENDA

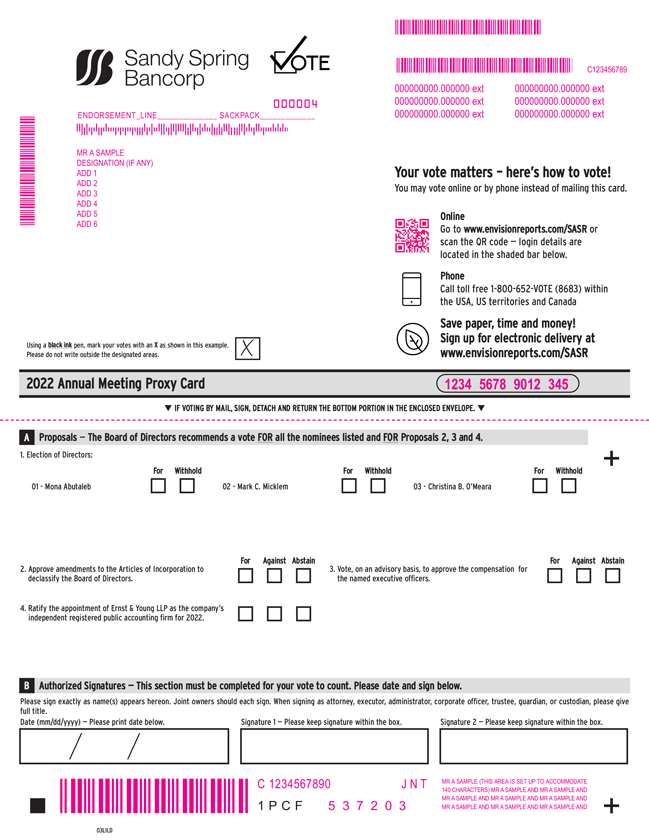

| • | Elect three Class III directors to serve until the 2025 annual meeting |

| • | Approve amendments to the Articles of Incorporation to declassify the Board of Directors |

| • | Vote, on an advisory basis, to approve the compensation for the named executive officers |

| • | Ratify the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm for 2022 |

| • | Transact such other business as may properly come before the meeting |

THERE WILL BE NO PHYSICAL LOCATION FOR THE ANNUAL MEETING

THERE WILL BE NO PHYSICAL LOCATION FOR THE ANNUAL MEETING

In support of the health and safety of our shareholders and employees, we will hold our annual meeting this year solely by means of remote communication via webcast at https://meetnow.global/MMYUPAD. You will be able to attend and participate in the virtual annual meeting online, vote your shares electronically, and submit questions prior to and during the meeting. If you plan to attend the annual meeting virtually, please review the information on attendance procedures on page 59 of this proxy statement.

YOUR VOTE IS VERY IMPORTANT

YOUR VOTE IS VERY IMPORTANT

Please submit your proxy as soon as possible by internet, telephone, or mail. Submitting your proxy by one of these methods will ensure your representation at the annual meeting regardless of whether you attend the meeting. Instructions for voting by internet or telephone can be found on your proxy card or voting instruction form.

By order of the Board of Directors,

Aaron M. Kaslow

General Counsel & Secretary

April 6, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2022 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 18, 2022

This proxy statement and the 2021 Annual Report on Form 10-K are available at www.envisionreports.com/sasr.

| | Notice and Proxy Statement | 2022 |

|

| | Notice and Proxy Statement | 2022 |

|

PROXY SUMMARY |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider in deciding how to vote your shares. Please read the entire proxy statement before voting. For information about our company’s performance, please review our 2021 Annual Report on Form 10-K.

You have received these proxy materials because our Board of Directors is soliciting your proxy to vote your shares during the 2022 annual meeting of shareholders. Notice of our annual meeting and this proxy statement were first sent or made available to shareholders on April 6, 2022.

2022 ANNUAL MEETING INFORMATION

For additional information about our annual meeting, see “Information about the Meeting” on page 59.

| | MEETING DATE: | May 18, 2022

| |

| | MEETING TIME: | 10:00 a.m. (Eastern)

| |

| | RECORD DATE: | March 9, 2022

| |

| | VIRTUAL MEETING LOCATION: | https://meetnow.global/MMYUPAD |

There will be no physical location for the annual meeting. Shareholders may attend, vote and ask questions at the meeting only by logging in at https://meetnow.global/MMYUPAD. Registered shareholders will be required to enter a control number, which can be found on your Notice of Internet Availability, proxy card, electronic notification or voting instructions included with your proxy materials. If you hold your shares through an intermediary, such as a bank or broker, see page 59 for information regarding how to vote your shares during the meeting. If you do not have a control number, you may still attend the meeting as a guest, but you will not be able to vote your shares during the meeting.

VOTING MATTERS AND BOARD RECOMMENDATIONS

Proposal | Board Recommendation | More Information | ||

1) Election of three Class III directors

| ✓ “FOR” all nominees | Page 4 | ||

2) Approval of amendments to the Articles of Incorporation to declassify the Board of Directors

| ✓ “FOR” | Page 53 | ||

3) Advisory vote to approve the compensation for the named executive officers

| ✓ “FOR” | Page 55 | ||

4) The ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm for 2022

| ✓ “FOR” | Page 56 | ||

HOW TO VOTE YOUR SHARES

Your vote is important. You may vote if you were a shareholder on March 9, 2022. Whether or not you plan to attend the virtual annual meeting, please cast your vote as promptly as possible using one of these methods:

|

|

|

| |||

| Online before the meeting | By Phone | By Mail | Online during the meeting | |||

www.envisionreports.com/sasr (record holders) www.proxyvote.com (beneficial owners) | Call the phone number on your proxy card (record holders) or voting instruction form (beneficial owners) | Complete, sign, date and mail your proxy card (record holders) or your voting instruction form (beneficial owners) | Attend our annual meeting virtually by logging into the virtual annual meeting website and vote by following the instructions provided on the website | |||

| | Notice and Proxy Statement | 2022 | 1 |

PROXY SUMMARY |

BOARD OF DIRECTORS

Name | Occupation | Age | Independent | Director Since | Committee Memberships | |||||

Mona Abutaleb | CEO of Medical Technology Solutions, LLC | 59 | ✓ | 2015 |

Compensation Risk

| |||||

Ralph F. Boyd | President and CEO of SOME, Inc. | 65 | ✓ | 2012 |

Compensation (Chair) E&G Nominating

| |||||

Mark E. Friis | Chair (former CEO) of Rogers Consulting, Inc. | 66 | ✓ | 2005 |

E&G Risk (Chair) Nominating

| |||||

Brian J. Lemek | Owner of Lemek, LLC, a franchisee for Panera Bread bakery-cafes. | 58 | ✓ | 2020 |

Audit Compensation

| |||||

Pamela A. Little | CFO of Nathan, Inc. | 68 | ✓ | 2005 |

Audit (Chair) E&G Nominating

| |||||

Walter C. Martz II

|

Managing Member of Walter C. Martz LLC law firm.

|

70

|

✓

|

2020

|

Audit

| |||||

Mark C. Michael

|

Fellow at the Harvard Advanced Leadership Initiative

|

59

|

✓

|

2018

|

Compensation

| |||||

Mark C. Micklem | Retired. Former Managing Director and Head of Financial Services Investment Banking at Robert W. Baird & Co. | 63 | ✓ | 2019 |

Audit Risk

| |||||

Christina B. O’Meara

|

President and founder of O’Meara Properties

|

68

|

✓

|

2020

|

Compensation

| |||||

Robert L. Orndorff, Chair | President and founder of RLO Contractors, Inc. | 65 | ✓ | 1991 |

Audit Compensation E&G (Chair) Risk Nominating

| |||||

Craig A. Ruppert | President and CEO of The Ruppert Companies | 68 | ✓ | 2002 |

E&G Nominating (Chair)

| |||||

Daniel J. Schrider, Vice Chair | President and CEO Sandy Spring Bancorp, Inc. and Sandy Spring Bank | 57 |

| 2009 |

E&G Risk

| |||||

Ages as of 03/09/2022 E&G = Executive and Governance

2 |

|

| | Notice and Proxy Statement | 2022 |

|

PROXY SUMMARY |

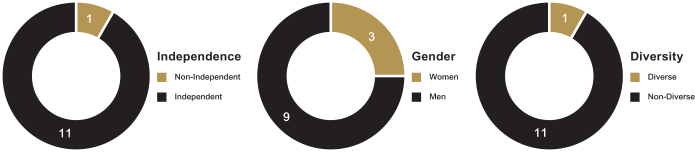

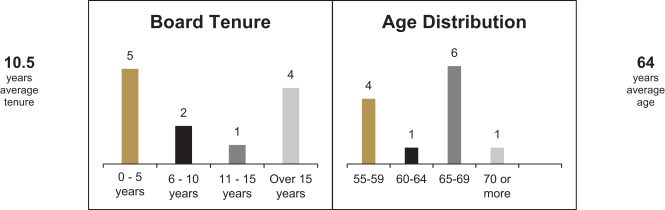

BOARD COMPOSITION

GOVERNANCE HIGHLIGHTS

Independent chair | ✓ | Continuing director education program | ✓ | |||

Mandatory director retirement age of 72 | ✓ | Stock ownership guidelines for directors and executive officers | ✓ | |||

Independent directors meet regularly in executive session | ✓ | Anti-hedging policy | ✓ | |||

Audit, Compensation and Nominating Committees consist solely of independent directors | ✓ | Clawback policy | ✓ | |||

Audit Committee meets with auditor in executive session | ✓ | Code of Ethics and Business conduct available on website | ✓ | |||

Oversight of enterprise risk through Board Risk Committee | ✓ | Corporate governance policies available on website | ✓ | |||

Plurality plus resignation in uncontested director elections | ✓ | One share, one vote structure | ✓ | |||

Annual board evaluations | ✓ | No shareholder rights plan | ✓ | |||

| | Notice and Proxy Statement | 2022 | 3 |

PROPOSAL 1: ELECTION OF DIRECTORS |

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently has 12 members. Under our Articles of Incorporation and Bylaws, the Board is authorized to fix the number of directors, up to a maximum of 15. The Board currently is divided into three classes, with only one class of directors being elected each year and each class serving a three-year term. The Board has approved amendments to our Articles of Incorporation to declassify the Board so that directors are elected annually by shareholders. If these amendments are approved by shareholders (see Proposal 2 on page 53), nominees will be elected for a one-year term beginning in 2023.

The Board has nominated three Class III directors for election for a three-year term expiring in 2025. They are Mona Abutaleb, Mark C. Micklem, and Christina B. O’Meara. All Class III director-nominees are currently directors who have been elected previously by the shareholders. Each nominee has consented to be nominated and has agreed to serve, if elected. If any person nominated by the Board is unable to stand for election for any reason, the shares represented at our annual meeting may be voted for the election of another candidate as the present Board may designate, or our Board may choose to reduce its size. |

In Memoriam

GARY G. NAKAMOTO 1964 - 2021

Gary G. Nakamoto served as an independent director of our company since 2011. Mr. Nakamoto was the principal of The Nakamoto Group, LLC, a consulting firm based in Great Falls, Virginia. We remember Gary for his warmth and humor and his unwavering support for our company.

|

Our Board values diversity (inclusive of gender, race and ethnicity) and seeks to include directors with a broad range of backgrounds, professional experience, perspectives and skills. In compliance with Nasdaq Listing Rules, the following chart shows the diversity of the Board:

| Board Diversity Matrix as of March 9, 2022 | ||||||||

Total Number of Directors | 12 | |||||||

| Female | Male | Non-Binary | Did not Disclose | |||||

Part I: Gender Identity |

|

|

|

| ||||

Directors | 3 | 9 | 0 | 0 | ||||

Part II: Demographic Background |

|

|

|

| ||||

African American or Black |

| 1 |

|

| ||||

Alaskan Native or Native American |

|

|

|

| ||||

Asian |

|

|

|

| ||||

Hispanic or Latinx |

|

|

|

| ||||

Native Hawaiian or Pacific Islander |

|

|

|

| ||||

White | 11 |

|

|

| ||||

Two or More Races or Ethnicities |

|

|

|

| ||||

LGBTQ+ | 0 | |||||||

Did Not Disclose Demographic Background | 0 | |||||||

4 |

|

| | Notice and Proxy Statement | 2022 |

|

PROPOSAL 1: ELECTION OF DIRECTORS |

Our directors bring a balance of skills, qualifications and experience to their oversight of our company, as shown in the matrix below. The matrix identifies certain skills, qualifications and experience that the Board believes are relevant to our business. A director may possess other skills, qualifications and experience not indicated in the matrix that may be relevant and valuable to their service on our Board.

| Abutaleb | Boyd | Friis | Lemek | Little | Martz | Michael | Micklem | O’Meara | Orndorff | Ruppert | Schrider | |||||||||||||||||||||||||||||||||||||||

SKILL/EXPERIENCE | Executive Leadership Experience in an executive leadership position provides the perspective required to understand and direct business operations, analyze risk, manage human capital, oversee implementation of organizational change, and develop and execute strategic plans. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||

Consumer Business and Financial Services Experience with consumer products and services or the financial services industry provides insight that assists the Board in overseeing the operation of our business and implementation of our strategic plan. | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ● | ¡ | ¡ | ¡ | ● | ||||||||||||||||||||||||||||||||||||||

Financial Reporting and Accounting Knowledge of or experience in accounting, financial reporting or auditing processes and standards assists the Board in overseeing our financial position and condition and ensuring accuracy and transparency in reporting. | ● | ¡ | ¡ | ¡ | ● | ¡ | ● | ● | ¡ | ● | ● | |||||||||||||||||||||||||||||||||||||||

Legal and Regulatory Understanding legal risks and obligations and experience with regulated businesses, regulatory requirements and relationships with regulators is important because we operate in a regulated industry. | ¡ | ● | ¡ | ¡ | ● | ¡ | ¡ | ¡ | ● | |||||||||||||||||||||||||||||||||||||||||

Risk Management Risk is inherent in the operation of our business. Having directors with experience and expertise in risk management allows the Board to provide guidance in its independent oversight of the design and implementation of our risk management framework. | ● | ¡ | ¡ | ● | ● | ¡ | ● | ¡ | ¡ | ● | ● | |||||||||||||||||||||||||||||||||||||||

Technology/Information Security/Cybersecurity Experience with and understanding of technology, information systems and/or cybersecurity is important in overseeing our ongoing investment in and development of critical technology, as well as the security of our operations, assets and systems. | ● | ¡ | ● | ● | ● | ¡ | ¡ | ¡ | ● | |||||||||||||||||||||||||||||||||||||||||

Human Capital Management Directors with an understanding of human capital management and compensation help the Board to effectively oversee our efforts to recruit, retain and develop key talent and provide valuable insight in determining compensation of the CEO and other executive officers. | ● | ¡ | ● | ● | ● | ● | ● | ¡ | ¡ | ¡ | ● | |||||||||||||||||||||||||||||||||||||||

Commercial Real Estate/Market Knowledge Directors with experience in commercial real estate in our service area provide insight into our strategic planning, risk management, our market area and the needs of the local communities we serve. | ● | ● | ● | ● | ¡ | ¡ | ¡ | ¡ | ● | ¡ | ● | ● | ||||||||||||||||||||||||||||||||||||||

Public Company Governance Knowledge of public company governance practices and policies assists the Board in considering and adopting corporate governance practices, interacting with stakeholders and understanding the impact of various policies on our business. | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||

| ● |

Technical or Managerial Expertise – derived from direct and hands-on experience or director managerial experience with the subject matter during his/her career. | |

| ¡ | Working Knowledge – derived through Board or relevant committee membership at Sandy Spring or another company, executive leadership of a company in the relevant industry, consulting, investment banking, or private equity investing. | |

| | Notice and Proxy Statement | 2022 | 5 |

PROPOSAL 1: ELECTION OF DIRECTORS |

The Nominating Committee is responsible for identifying, evaluating, and recommending to the Board a slate of nominees for election at each annual meeting of shareholders. All director nominees are expected to exhibit high standards of integrity and independence of thought and judgment, participate in a constructive and collegial manner, and be willing to devote sufficient time to carrying out the duties and responsibilities of a director.

The Nominating Committee assesses the skill areas currently represented on the Board, as well as those skill areas represented by directors expected to retire from the Board in the near future, against the skills matrix described above. The committee also considers recommendations from members of the Board regarding skills that could improve the overall ability of the Board to carry out its function. Based on this analysis, the committee targets specific skill areas or experience as the focus of consideration for new directors to join the Board.

The Nominating Committee also considers whether the candidate would enhance the diversity of the Board in terms of gender, ethnicity, race, experience and skills.

The Nominating Committee may retain an independent search firm to assist with identifying director candidates, and individual Board members are encouraged to submit potential nominees to the Chair of the Nominating Committee. The Nominating Committee has the sole authority to retain and terminate any search firm used to identify director candidates, including sole authority to approve its fees and the other terms of its engagement. Shareholders may also submit suggestions for qualified director candidates to the Corporate Secretary at Sandy Spring Bancorp, Inc., 17801 Georgia Avenue, Olney, Maryland 20832. Submissions should include information regarding a candidate’s background, qualifications, experience and willingness to serve as a director. The Nominating Committee has not adopted any specific procedures for considering the recommendation of director nominees by shareholders, but will consider shareholder nominees on the same basis as other nominees. Please see “Proposals for the 2023 Annual Meeting of Shareholders” on page 61 for important information for shareholders who intend to submit a director nomination for the 2023 annual meeting of shareholders.

VOTING STANDARD FOR UNCONTESTED ELECTIONS

With respect to the election of directors, a plurality of all the votes cast at the annual meeting will be sufficient to elect a nominee as a director. In an uncontested election, an incumbent director-nominee who receives a greater number of votes “withheld” than votes “for” will promptly tender his or her resignation following certification of the shareholder vote. The Nominating Committee will consider the resignation, taking into consideration any information it deems to be appropriate and relevant, and make a recommendation to the Board.

6 |

|

| | Notice and Proxy Statement | 2022 |

|

PROPOSAL 1: ELECTION OF DIRECTORS |

NOMINEES FOR ELECTION AND CONTINUING DIRECTORS

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW AS A DIRECTOR. |

CLASS III DIRECTOR-NOMINEES – FOR TERMS EXPIRING AT THE 2025 ANNUAL MEETING

MONA ABUTALEB | About

Ms. Abutaleb has been the Chief Executive Officer of Medical Technology Solutions, LLC, a provider of technology solutions for the healthcare industry, since December 2019. From 2013 to 2018, Ms. Abutaleb was the Chief Executive Officer of mindSHIFT Technologies, Inc., an IT outsourcing/managed services and cloud services provider, which was acquired by Ricoh Company, Ltd. in 2014. From 2006 to 2013, Ms. Abutaleb served as President and Chief Operating Officer of mindSHIFT. Ms. Abutaleb also served as Senior Vice President, Ricoh USA from 2015 to 2017 and Executive Vice President of Ricoh Global Services from 2017 to 2018. Ms. Abutaleb is also on the board of directors of Pentair plc (NYSE: PNR). | |

|

MARK C. MICKLEM | About

Mr. Micklem retired from Robert W. Baird & Co. Incorporated, in 2018 where he was a Managing Director and Head of Financial Services Investment Banking for 12 years. While at Baird, Mr. Micklem focused on providing capital financing and merger and acquisition advisory services to banks and other financial services companies. Prior to joining Baird, Mr. Micklem was head of the Financial Services Investment Banking Group at Legg Mason for 10 of his 21 years there. During his career, Mr. Micklem completed more than 250 financing and M&A advisory engagements for financial services companies. | |

|

| | Notice and Proxy Statement | 2022 | 7 |

PROPOSAL 1: ELECTION OF DIRECTORS |

CHRISTINA B. O’MEARA | About

Ms. O’Meara is president and founder of O’Meara Properties, a real estate brokerage, development, and management firm. She has extensive experience with commercial property and is a licensed real estate broker. Ms. O’Meara is an owner of Reliable Contracting Company and an officer of related companies. She is a former Legislation Committee chair for the Anne Arundel County Association of Realtors and a past land use chair for the Anne Arundel Trade Council. Ms. O’Meara is active in the global community to support education and basic needs for children. She currently serves as a director of Kaleidoscope Child Foundation. | |

|

INCUMBENT CLASS I DIRECTORS – TERMS EXPIRING AT THE 2024 ANNUAL MEETING

RALPH F. BOYD | About

Mr. Boyd is the President and Chief Executive Officer for SOME, Inc. a Washington D.C. based inter-faith non-profit that provides emergency services, health care, substance abuse treatment and counseling, remedial education and employment training, and affordable housing with supportive services for vulnerable individuals and families in our nation’s capital. Formerly, Mr. Boyd was Sr. Resident Fellow for Leadership and Strategy at the Urban Land Institute (ULI) from 2018-2020, and was CEO of ULI Americas from 2017-2018. Prior to that Mr. Boyd was CEO of the Massachusetts Region of The American Red Cross from 2014-2017. He is a Harvard Law School graduate and previously served as Assistant Attorney General for Civil Rights under President Bush. From 2005 to 2012, Mr. Boyd also served variously as Chair, President and CEO of the Freddie Mac Foundation, Inc. Among other distinctions, Mr. Boyd currently serves as chair of the NHP Foundation, a national nonprofit developer and owner of multi-family affordable housing with resident services. | |

|

8 |

|

| | Notice and Proxy Statement | 2022 |

|

PROPOSAL 1: ELECTION OF DIRECTORS |

WALTER C. MARTZ II | About

Mr. Martz has practiced law for over 42 years and is currently the Managing Member of Walter C. Martz LLC, in Frederick, Md., a general law practice encompassing a broad spectrum of legal matters ranging from corporate matters and estate administration to complex real estate and commercial banking transactions. Mr. Martz has also served on the Maryland Tax Court located in Baltimore since 1980 and is currently the Chief Judge. Mr. Martz was a co-founder, director and vice chair of the board of BlueRidge Bank, which merged with Revere Bank in 2016. | |

|

MARK C. MICHAEL | About

In 2021, Mr. Michael became a Fellow at the Harvard Advanced Leadership Initiative located in Cambridge, Massachusetts. He is the co-founder of Occasions Caterers Inc., located in Washington, D.C. where he was CEO from 1986 to 2020 and remains a senior advisor. He also founded Protocol Staffing Services LLC, as well as Menus Catering, Inc. Mr. Michael was formerly on the President’s Council for Higher Achievement Program, and also served on the board of directors of DC Central Kitchen. He is a member of the US Chamber of Commerce, the Greater Washington Board of Trade, the Washington Convention and Visitors Bureau, and the International Society of Event Specialists. | |

|

| | Notice and Proxy Statement | 2022 | 9 |

PROPOSAL 1: ELECTION OF DIRECTORS |

ROBERT L. ORNDORFF | About

Mr. Orndorff is the founder and President of RLO Contractors, Inc., a leading residential and commercial excavating and grading company in central Maryland established in 1976. In 2002, RLO expanded to include a products division that provides aggregate, mulch, and specialized soil mixes including locally finished compost products. Mr. Orndorff’s experience in building a highly successful business with a strong reputation for quality, teamwork, and integrity is a testament to his leadership ability that is also strongly aligned with our culture and values. | |

|

DANIEL J. SCHRIDER | About

Mr. Schrider has been part of Sandy Spring Bank for more than 30 years. He joined our company in 1989 as a commercial lender, he become an executive and Sandy Spring Bank’s Chief Credit Officer in 2003, and he was named President and Chief Executive Officer in 2009. Mr. Schrider holds a bachelor’s degree from the University of Maryland and an MBA from Mount St. Mary’s University. Mr. Schrider is also a graduate of the American Bankers Association Stonier Graduate School of Banking. A leader among community bankers, Mr. Schrider has served previously as a director of the American Bankers Association, the chair of the Maryland Bankers Association, and a chair of the Stonier Graduate School of Banking Advisory Board. | |

|

10 |

|

| | Notice and Proxy Statement | 2022 |

|

PROPOSAL 1: ELECTION OF DIRECTORS |

INCUMBENT CLASS II DIRECTORS – TERMS EXPIRING AT THE 2023 ANNUAL MEETING

MARK E. FRIIS | About

Mr. Friis is currently the chair of Rodgers Consulting, Inc., having previously served as the firm’s President and CEO from 2001-2016. Headquartered in Germantown, Maryland, Rodgers Consulting is a land development planning and engineering firm; specializing in town planning, urban design, development entitlements, site engineering and natural resource management for developers, builders, institutions and corporations in the suburban Maryland region. Mr. Friis is a member of the Urban Land Institute, the Maryland Building Industry Association, and the American Planning Association. He holds an undergraduate degree from the University of Maryland and a graduate degree from Hood College, where he currently serves on the Board of Trustees. | |

|

BRIAN J. LEMEK | About

Mr. Lemek is the founder and owner of Lemek, LLC, the franchisee for Panera Bread bakery-cafes in the state of Maryland. Lemek, LLC currently owns and operates over 50 locations. In 2010, Mr. Lemek founded Lemek Slower Lower LLC, which owns six Panera Bread Cafes in Southern New Jersey and Delaware. Mr. Lemek currently serves on the board of trustees of his alma mater, Saint Ambrose University in Davenport, Iowa, where he chairs the Building & Grounds Committee. | |

|

| | Notice and Proxy Statement | 2022 | 11 |

PROPOSAL 1: ELECTION OF DIRECTORS |

PAMELA A. LITTLE | About

Ms. Little is the Chief Financial Officer of Nathan, Inc., a private international economic and analytics consulting firm that works with government and commercial clients around the globe. From 2014 to 2018, she was the Executive Vice President and Chief Financial Officer of Modern Technology Solutions Inc., an employee-owned government contractor, for which she remains on the board of directors. Ms. Little has over 35 years of experience working with companies ranging from privately held start-up firms to large, publicly traded government contracting firms. Ms. Little also serves on the board of Excella, a management and technology consulting firm in Northern Virginia. | |

|

CRAIG A. RUPPERT | About

Mr. Ruppert is the founder, President and CEO of The Ruppert Companies, which is comprised of Ruppert Landscape, Inc., one of the largest commercial landscape construction and management companies in the US, located in seven states and the District of Columbia; Ruppert Nurseries, Inc., a premier large-caliper wholesale tree growing and moving operation in the eastern US; and Ruppert Properties, LLC, an industrial and office property development and management company in the Washington/Baltimore metropolitan region. A noted entrepreneur and philanthropist, Mr. Ruppert was inducted into the Washington Business Hall of Fame in 2021. | |

|

12 |

|

| | Notice and Proxy Statement | 2022 |

|

CORPORATE GOVERNANCE |

We are committed to strong corporate governance practices that promote the long-term interests of our shareholders and strengthen the accountability of our Board and management.

Our governance framework is set forth in our Corporate Governance Policy, committee charters and other key governance documents, which we review and modify on a regular basis to reflect best practices, recent developments, and legal and regulatory requirements. Our Corporate Governance Policy, committee charters and other key governance documents are available on our website at www.sandyspringbank.com by selecting “Investor Relations” at the top of the page, then “Governance Documents” under “Governance Information.”

Nasdaq Listing Rules require that a majority of our directors and each member of our Audit Committee, Compensation Committee and Nominating Committee be independent. In addition, our Corporate Governance Policy requires that not more than two of our directors be non-independent. A director may be determined to be independent only if the Board has determined that he or she has no relationship with the company that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Nominating Committee advises and makes recommendations to the full Board regarding director independence. After considering the committee’s recommendation, the Board affirmatively determined that all current members of the Board, other than Mr. Schrider, are independent directors and independent for purposes of the committees on which they serve in accordance with applicable Nasdaq and Securities and Exchange Commission (SEC) independence rules and requirements. The Board determined that Mr. Schrider is not independent because he is the President and Chief Executive Officer of the company.

To determine the independence of the directors, the Board considered certain transactions, relationships, or arrangements between those directors, their immediate family members, or their affiliated entities, on the one hand, and the company, on the other hand. Certain directors, their respective immediate family members, and/or affiliated entities have deposit or credit relationships with, or received investment or wealth management services from, Sandy Spring Bank or one of its subsidiaries in the ordinary course of business. The Board determined that all of these transactions, relationships, or arrangements were made in the ordinary course of business, were made on terms comparable to those that could be obtained in arms’ length dealings with an unrelated third party, were not criticized or classified, non-accrual, past due, restructured or a potential problem, complied with applicable banking laws, and did not otherwise impair any director’s independence.

Our Board is led by the Chair. Under our Bylaws, the Chair is elected annually by the Board from among the directors and presides over each Board meeting and performs such other duties as may be incident to the office of the Chair. The Chair also chairs the Executive and Governance Committee (see Executive and Governance Committee description below), which is empowered to act on behalf of the Board between regular Board meetings.

Under our Corporate Governance Policy, we separate the roles of Chair and Chief Executive Officer. Separation of the Chair and Chief Executive Officer roles facilitates effective oversight and evaluation of the Chief Executive Officer’s performance and supports the Board’s independent oversight of the company’s performance.

| | Notice and Proxy Statement | 2022 | 13 |

CORPORATE GOVERNANCE |

The Board has five standing committees: Audit, Compensation, Executive and Governance, Nominating, and Risk. Each committee operates under a written charter, which may be found on our investor relations website at www.sandyspringbank.com.

| AUDIT COMMITTEE

|

The primary responsibility of the Audit Committee is to assist the Board in fulfilling its oversight responsibility for:

• the integrity of the company’s accounting and financial statements and reporting processes;

• the qualifications, independence, and performance of the independent auditors; and

• the qualifications and performance of the company’s internal audit function.

The Audit Committee is also responsible for:

• the appointment, compensation, retention and oversight of the company’s independent auditors;

• pre-approval of all audit and permissible non-audit services to be performed by the company’s independent auditors;

• reviewing all major financial reports in advance of filing or distribution, including the company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and quarterly earnings press releases; and

• reviewing the effectiveness of the company’s system of internal controls.

All members are financially literate as required by the Nasdaq listing rules.

All members are independent and meet additional Nasdaq and SEC independence standards for audit committee members.

The Board has determined that Pamela A. Little and Mark C. Micklem are each an audit committee financial expert as defined by the SEC. | |

Committee Chair: Pamela A. Little

| ||

| ||

Other Committee Members

| ||

Brian J. Lemek Walter C. Martz, II Mark C. Micklem Robert L. Orndorff

| ||

Meetings in 2021: 8

|

| COMPENSATION COMMITTEE

|

The responsibilities of the Compensation Committee include:

• developing our executive compensation philosophy and reviewing and approving compensation and benefit programs applicable to the company’s executive officers, including base salary, incentive compensation, equity awards, and retirement benefits.

• reviewing and recommending to the Board the compensation of the company’s non-employee directors;

• assessing whether the company’s compensation programs generally are designed in a manner that does not encourage or reward unnecessary or excessive risk-taking;

• administering the company’s equity compensation plans;

• oversight of the company’s human capital management strategy including initiatives on diversity, equity and inclusion, employee well-being and engagement; and

• retaining and overseeing an independent compensation consultant to support the committee, approving related fees and engagement terms, and determining that the consultant’s work raises no conflicts of interest.

All members are independent and meet additional Nasdaq and SEC independence standards for compensation committee members. | |

Committee Chair: Ralph F. Boyd

| ||

| ||

Other Committee Members

| ||

Mona Abutaleb Brian J. Lemek Mark C. Michael Christina B. O’Meara Robert L. Orndorff

| ||

Meetings in 2021: 6

|

14 |

|

| | Notice and Proxy Statement | 2022 |

|

CORPORATE GOVERNANCE |

| EXECUTIVE AND GOVERNANCE COMMITTEE

|

The Executive and Governance Committee is authorized to exercise the authority of the Board between regular meetings, except to the extent limited by law or the company’s charter documents. The Executive and Governance Committee also oversees the company’s governance structure and practices.

The responsibilities of the Executive and Governance Committee include:

• reviewing the company’s Corporate Governance Policy at least annually and making recommendations for updates;

• reviewing the qualifications and independence of the directors as well as the composition of the Board and each committee’s membership;

• oversight of the annual evaluation of the CEO and executive succession planning;

• managing the Board’s process of annual evaluation;

• oversight of ethics and business conduct; and

• oversight of the company’s policies and practices on significant issues of corporate social responsibility including environmental, social, and corporate governance (ESG) and sustainability.

All members are independent, except for Mr. Schrider. | |

Committee Chair: Robert L. Orndorff

| ||

| ||

Other Committee Members

| ||

Ralph F. Boyd Mark E. Friis Pamela A. Little Craig A. Ruppert Daniel J. Schrider

| ||

Meetings in 2021: 4

|

| NOMINATING COMMITTEE

|

The responsibilities of the Nominating Committee include:

• reviewing the composition of the Board at least annually to ensure the Board reflects the desired skills, experience, diversity, and other qualifications as well as affirming whether each director qualifies as “independent” as defined by Nasdaq Listing Rules;

• recommending the appropriate size of the Board;

• overseeing the Company’s policies and processes for identifying and reviewing director candidates;

• engaging an outside search firm, as needed, to source qualified candidates;

• identifying, screening and reviewing individuals qualified to serve as directors, consistent with the criteria developed and approved by the Board; and

• recommending to the Board for approval the candidates for nomination for election or re-election by the shareholders.

All members are independent. | |

Committee Chair: Craig A. Ruppert

| ||

| ||

Other Committee Members

| ||

Ralph F. Boyd Mark E. Friis Pamela A. Little Robert L. Orndorff

| ||

Meetings in 2021: 2

|

| | Notice and Proxy Statement | 2022 | 15 |

CORPORATE GOVERNANCE |

| RISK COMMITTEE

|

The Risk Committee assists the Board in its oversight of the company’s enterprise risk management.

The responsibilities of the Risk Committee include:

• monitoring the direction and trend of major risks relative to the our business operations and strategies;

• reviewing and recommending to the Board updates to our enterprise risk management structure and risk appetite statement at least annually;

• reviewing and approving significant risk management policies and controls that reflect our risk management philosophy, principles, and limits consistent with the risk appetite statement; and

• receiving comprehensive reports on enterprise level risk exposures and measurements, including relevant forecast information, and risk management programs including cybersecurity, business continuity, vendor management, and regulatory compliance.

All members are independent, except for Mr. Schrider. | |

Committee Chair: Mark E. Friis

| ||

| ||

Other Committee Members

| ||

Mona Abutaleb Mark C. Micklem Robert L. Orndorff Daniel J. Schrider

| ||

Meetings in 2021: 6

|

We believe that a strong risk management culture is vital to the success of our business. To mitigate the risks inherent in our business, we foster a culture that makes managing risk everyone’s responsibility at all levels of the company.

We have implemented a formal risk management framework that establishes the program by which we identify, assess, measure, monitor, report and control risks across the company. The risk management framework is designed to link risk appetite, and related risk monitoring and reporting, with our business strategy and capital plans. The risk management framework describes our risk management approach, including the adoption of the three lines of defense risk model, and outlines our risk management governance structure, including the roles of the Board, management, lines of business and internal audit. The Risk Committee reviews the risk management framework at least annually, or more often as needed to address changes in the company’s risk profile or risk management best practices.

We have also adopted a risk appetite statement that identifies the level of risk we are willing to accept in pursuit of our strategic objectives. The company’s risk appetite is articulated through qualitative statements and quantitative metrics that cover the broad array of risks relevant to the company, including credit, market, liquidity, capital, operational, strategic and reputational risks. The Board reviews and approves our risk appetite statement annually. On a quarterly basis, we evaluate the risks facing the company and our risk appetite metrics against the risk appetite statement to ensure that the operations of the company align with the company’s risk appetite.

16 |

|

| | Notice and Proxy Statement | 2022 |

|

CORPORATE GOVERNANCE |

The Board is responsible for overseeing the company’s risk management processes by informing itself about our material risks and evaluating whether management has reasonable risk management and control processes in place to address those risks. The Board oversees risk management through the actions of the full Board, including approval and oversight of the company’s risk appetite statement, strategic plan, capital plan and financial plan, and the activities of its committees, principally the Risk Committee, Audit Committee and Compensation Committee.

| Board of Directors | ||||

Risk Committee | The Risk Committee has primary responsibility for overseeing our risk management framework. The committee reviews and approves the company’s risk appetite statement, key risk management policies and the charter of the Executive Risk Committee, monitors compliance with the risk management framework and risk limits, and oversees the work of the company’s risk management function. The committee oversees credit risk, including lending and credit policies and asset quality, financial risk, including interest rate risk, liquidity risk, capital risk and market risk, and operational risk, including compliance risk, business continuity planning, information and cyber security risk, and third-party risk. The committee receives a quarterly enterprise risk report as well as regular updates on key and emerging risks. The Risk Committee reports regularly to the Board regarding material matters discussed at meetings of the Risk Committee, as well as the current status of risk and action items. | |||

Audit Committee | The Audit Committee plays a significant role in the Board’s exercise of its risk oversight responsibilities. This committee has primary oversight of risks arising from the company’s financial reporting, internal control processes and public disclosure. The Audit Committee reviews management’s assessment of the company’s internal control over financial reporting, meets regularly with the company’s independent auditors to discuss the results of their quarterly reviews and annual audit, and receives internal audit reports that enable it to monitor operational risk throughout the company. To ensure candid reporting, the Audit Committee meets in separate executive sessions with the company’s independent auditors and Chief Internal Auditor. The committee coordinates any substantive or systemic findings with the Risk Committee through a liaison member who serves on both committees. The Audit Committee regularly reports to the full Board on its risk management activities. | |||

Compensation Committee | The Compensation Committee has primary oversight of risks arising from the company’s incentive compensation plans and programs. On an annual basis, the committee receives a risk assessment that enables the committee to determine whether our incentive compensation plans and programs create risks that are likely to have a material adverse effect or would encourage excessive risk-taking. | |||

Board Oversight of Cybersecurity Risk

Our Board recognizes the company’s responsibility to protect the data provided by its clients and employees, understands how cyber risks could disrupt the company’s operations, and is cognizant of the increasing risks and threats associated with the use of digital technology. Through the efforts of the Risk Committee, the Board oversees the company’s continuing efforts to strengthen its information security infrastructure and staffing and enhance its technology controls and cybersecurity defenses.

As part of its oversight of operational risk, the Risk Committee is responsible for the oversight of information security and cybersecurity risk management. Our Chief Information Security Officer regularly reports to the Risk Committee on security events, testing, training, audits, new system assessments and vendor performance. These reports address topics such as the threat environment and vulnerability assessments, results of penetration testing, results of key cyber risk indicators and performance metrics, and the company’s efforts to detect, prevent and respond to internal and external critical threats. The Risk Committee receives periodic updates on information security risk, the maturity of the company’s information security program, and updates on related investments and results. On an annual basis, the Risk Committee reviews and approves our information security program and information security policy.

| | Notice and Proxy Statement | 2022 | 17 |

CORPORATE GOVERNANCE |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

Strengthening our communities through our products and services, investing in our communities and serving our neighbors and friends has always been at the heart of our mission as a community financial institution. As investors and the business community coalesce around the importance of environmental, social and governance issues (ESG), we are developing an approach to corporate and environmental sustainability that aligns with the nature of our business and the evolution of ESG principles in the financial services industry. In 2021, we published our inaugural Corporate Responsibility Report, which summarizes our efforts and performance on ESG matters that we and our stakeholders view as among the most important to our business.

The Board has responsibility for overseeing policies, programs and strategies related to ESG matters and receives updates, at least annually, from management on ESG matters, including investor sentiment, our Corporate Responsibility Report, and ESG initiatives. Board committees also play an important role in oversight of ESG matters. The Executive and Governance Committee oversees the company’s policies and practices on significant issues of corporate social responsibility and sustainability. The Compensation Committee assists the Board in the oversight of the company’s human capital management strategy, including strategies and initiatives on diversity, equity, and inclusion, employee well-being and engagement.

ENVIRONMENT | We recognize that we all have a role to play in environmental sustainability and combatting climate change. We foster sustainability by:

• embracing digital tools to reduce paper usage and reliance on paper intensive processes

• reducing waste and energy and resource usage in our facilities

• financing clean energy and energy efficiency projects | |

SOCIAL | We believe that all members of our communities should have the opportunity to enjoy prosperous and fulfilling lives and that our success should enrich all stakeholders. We help lift up our clients and our communities by:

• making financial products and services accessible and affordable

• supporting area non-profit organizations that promote affordable housing, financial literacy, education, and health and wellness

• volunteering with organizations across our footprint | |

PEOPLE | Attracting, retaining and developing a diverse, highly skilled workforce where employees feel included, respected and valued is key to our ability to deliver a remarkable client experience. We create a great place to work by:

• building a diverse and inclusive workplace where all backgrounds, experience, interests and skills are respected, appreciated and encouraged

• providing employees with opportunities to advance and grow their careers with our company through systematic talent management, career development and succession planning

• delivering competitive compensation and benefits that exceed expectations | |

GOVERNANCE | We believe in strong governance and a culture of ethics and integrity in all that we do. We live these principles by:

• adopting a Corporate Governance Policy that promotes sound and effective governance

• adhering to a Code of Ethics and Business Conduct that sets expectations aligned with our core values

• creating a culture of risk management in which managing risk is everyone’s responsibility at all levels of the company | |

18 |

|

| | Notice and Proxy Statement | 2022 |

|

CORPORATE GOVERNANCE |

2021 ESG HIGHLIGHTS

| $494K donated to 110 local nonprofits |

Financing clean energy through Montgomery County Green Bank and DC Green Bank

| |||

over 6,000

employee volunteer hours

| Lent $307M to first-time home buyers | |||

59%

women in workforce |

Launched formalized mentor program for diverse leaders |

Paid over

$475K

in COVID-19 leave benefits

| ||

38%

people of color in workforce |

| $1.6B Paycheck Protection Program Loans | ||

|

$15 minimum wage | |||

For more detailed information, please see our Corporate Responsibility Report, which is available on our website at www.sandyspringbank.com. Information on our website is not incorporated by reference into this proxy statement. Additional disclosures about human capital management can be found in our 2021 Annual Report on Form 10-K filed with the SEC.

The Board has established an annual self-assessment process that evaluates a different aspect of the Board’s effectiveness each year. On a rotating basis, the directors evaluate the Board as a whole, the Board committees, and individual director performance. The self-assessment process, which is managed by the Executive and Governance Committee, involves completion of annual surveys, review and discussion of the results of the surveys by both the committee and the full Board, as well as with individual directors in the case of peer evaluations, and communication of feedback to management to improve policies, processes and procedures to support Board and committee effectiveness. In 2021, the Board completed an evaluation of the Board as a whole.

We believe that continuing director education is essential to the ability of directors to fulfill their roles. We provide both internal and external educational opportunities and association memberships for our directors. We encourage directors to participate in external continuing director education programs, and we reimburse directors for their expenses associated with such activities. Continuing director education also is provided during Board meetings and as stand-alone information sessions outside of meetings. Our Board hears from management as well as from subject matter experts on corporate governance and other matters relevant to Board service, including matters related to the financial services industry.

BOARD AND COMMITTEE MEETING ATTENDANCE

During 2021, the Board held nine regular meetings and one special meeting. Directors are expected to attend at least 80% of Board meetings and meetings of the committees upon which they serve. In 2021, directors attended 99% of total Board and committee meetings, and each of the directors attended at least 75% of the total meetings of the Board and the committees on which he or she served in 2021.

| | Notice and Proxy Statement | 2022 | 19 |

CORPORATE GOVERNANCE |

Directors are expected to attend the company’s annual meeting of shareholders. All of our directors serving at the time of the 2021 annual meeting attended the 2021 virtual annual meeting via teleconference.

CODE OF ETHICS AND BUSINESS CONDUCT

Our Board has adopted a Code of Ethics and Business Conduct (the Code) applicable to all directors, officers, and employees of the company. The Code of Ethics and Business Conduct may be found on our investor relations website at www.sandyspringbank.com. If we make any substantive amendments to the Code or grant any waiver from a provision of the Code that is required to be disclosed under the applicable rules of the SEC, we will disclose the nature of such amendments or waiver on our website or in a current report on Form 8-K.

STOCK OWNERSHIP REQUIREMENTS FOR DIRECTORS

Our Corporate Governance Policy requires that directors own the lesser of 5,000 shares of company stock or company stock with a market value of $175,000 by January 1 following the director’s fifth anniversary of service. Unvested shares of restricted stock and restricted stock units count towards the satisfaction of the ownership requirement. Directors are expected to retain the shares of company stock they receive pursuant to their service as a Board member for so long as they serve as a director. All of the directors exceed the minimum ownership requirements of the policy.

PROHIBITION ON HEDGING AND PLEDGING

Under our Insider Trading Policy, our directors, officers and employees may not at any time buy or sell options on company securities or other derivative securities that reference company securities and may not enter into hedging or similar transactions that are designed to offset any decrease in the market value of company securities. In addition, our directors and executive officers are prohibited from trading company securities on margin, borrowing against any account in which company securities are held, or pledging company securities as collateral for any loan. Our policy also prohibits directors and executive officers from engaging in short sales of company stock.

20 |

|

| | Notice and Proxy Statement | 2022 |

|

DIRECTOR COMPENSATION |

Our director compensation program is designed to attract and retain highly qualified directors and align their interests with those of our shareholders. We compensate our non-employee directors with a combination of cash and equity awards. Directors who are employees of our company do not receive additional compensation for their service as Board members.

The Compensation Committee periodically reviews the director compensation program and recommends changes for approval by the Board. The Compensation Committee did not recommend any changes to our director compensation program for 2021.

CASH COMPENSATION

Non-employee directors received cash compensation in 2021 as follows:

Annual cash retainer per director | $ | 30,000 |

|

|

| |||

Additional cash annual retainer for Board and committee chairs |

|

|

|

|

|

| ||

Chair of Board | $ | 40,000 |

|

|

| |||

Audit Committee | $ | 15,000 |

|

|

| |||

All other committees | $ | 10,000 |

|

|

| |||

Board meeting attendance fee (per meeting) | $ | 1,200 |

|

|

| |||

Attending an in-person Board meeting by phone | $ | 500 |

|

|

| |||

Committee meeting attendance fee (per meeting) | $ | 1,000 |

|

|

| |||

Directors are not paid for limited-purpose teleconference meetings, and members of the Nominating Committee are not paid when the Executive and Governance Committee meets on the same day. All directors of our company also serve as directors of Sandy Spring Bank, for which they do not receive any additional compensation.

EQUITY COMPENSATION

On April 28, 2021, each director received a grant of restricted stock units valued at approximately $35,000. The restricted stock units will vest over three years in equal increments, and vesting accelerates upon the permanent departure from the Board other than removal for just cause.

DEFERRED FEE ARRANGEMENTS

Directors are eligible to defer all or a portion of their fees under the Director Deferred Fee Plan. The amounts deferred accrue interest at 120% of the long-term Applicable Federal Rate, which is not considered “above market” or preferential. Except in the case of financial emergency, deferred fees and accrued interest are payable only following termination of a director’s service, at which time the director’s deferral account balance will be paid in a lump sum. Mr. Orndorff is a party to a Directors’ Fee Deferral Agreement, under which deferrals ceased in 2004, pursuant to which his beneficiary would receive a death benefit equal to the greater of the projected retirement benefit or the combined deferral account balance under the two fee deferral arrangements should his death occur while actively serving as a member of the Board.

| | Notice and Proxy Statement | 2022 | 21 |

DIRECTOR COMPENSATION |

2021 NON-EMPLOYEE DIRECTOR COMPENSATION

The following table shows the compensation received during 2021 by our non-employee directors.

Name | Fees Earned or ($) | Stock Awards(2) ($) | All Other ($) | Total ($) | ||||||||||||||||

Mona Abutaleb | 51,800 | 35,043 | 2,616 | 89,459 |

|

|

| |||||||||||||

Ralph F. Boyd | 58,800 | 35,043 | 2,616 | 96,459 |

|

|

| |||||||||||||

Mark E. Friis | 61,800 | 35,043 | 5,016 | 101,859 |

|

|

| |||||||||||||

Brian J. Lemek | 47,800 | 35,043 | 2,223 | 85,066 |

|

|

| |||||||||||||

Pamela A. Little | 63,800 | 35,043 | 2,616 | 101,459 |

|

|

| |||||||||||||

James J. Maiwurm(4) | 5,400 | — | 708 | 6,108 |

|

|

| |||||||||||||

Walter C. Martz, II | 44,100 | 35,043 | 3,423 | 82,566 |

|

|

| |||||||||||||

Mark C. Michael | 44,800 | 35,043 | 2,616 | 82,459 |

|

|

| |||||||||||||

Mark C. Micklem | 50,800 | 35,043 | 2,813 | 88,656 |

|

|

| |||||||||||||

Gary G. Nakamoto(5) | 38,800 | 35,043 | 1,485 | 75,328 |

|

|

| |||||||||||||

Christina B. O’Meara | 44,800 | 35,043 | 2,223 | 82,066 |

|

|

| |||||||||||||

Robert L. Orndorff | 108,800 | 35,043 | 2,616 | 146,459 |

|

|

| |||||||||||||

Craig A. Ruppert | 54,800 | 35,043 | 2,616 | 92,459 |

|

|

| |||||||||||||

| (1) | All or a portion of the reported cash compensation may be deferred under the Director Fee Deferral Plan. |

| (2) | On April 28, 2021, each director serving at the time was granted 769 restricted stock units. The value reported represents the grant date fair value of the award computed in accordance with FASB ASC Topic 718, and based on a grant date stock price of $45.57 per share. On December 31, 2021, each non-employee director had 334 shares of restricted stock and 1654 restricted stock units with the exception of Mr. Micklem who had 2,154 restricted stock units, and Ms. O’Meara, Mr. Lemek, and Mr. Martz who had 1800 restricted stock units. |

| (3) | Amounts in this column represent dividends paid on restricted stock, dividend equivalents paid on restricted stock units and meeting fees for attendance at advisory board meetings. |

| (4) | Mr. Maiwurm retired from the Board effective April 28, 2021 at which time his outstanding restricted stock vested. |

| (5) | Mr. Nakamoto died on June 22, 2021. |

22 |

|

| | Notice and Proxy Statement | 2022 |

|

TRANSACTIONS WITH RELATED PERSONS |

TRANSACTIONS WITH RELATED PERSONS

The Board has adopted a written policy and procedures for the review, approval or ratification of transactions that could potentially be required to be reported under the SEC rules for disclosure of transactions in which related persons have a direct or indirect material interest. Related persons include directors and executive officers of the company and members of their immediate families. To help identify related person transactions and relationships, each director and executive officer completes a questionnaire that requires the disclosure of any transaction or relationship that the person, or any member of his or her immediate family, has or is proposed to have with the company. The policy applies to any transaction in which our company is a participant, any related party has a direct or indirect material interest, and the amount involved exceeds $120,000, but excludes any transaction that does not require disclosure under Item 404(a) of SEC Regulation S-K, including banking, insurance, trust and wealth management services provided to related parties on substantially the same terms for comparable services provided to unrelated third parties. In addition, loans to related parties are excluded from the policy, but only if the loan (i) is made in the ordinary course of business, (ii) is on market terms or terms that are no more favorable than those offered to unrelated third parties, (iii) when made does not involve more than the normal risk of collectability or present other unfavorable features, (iv) would not be disclosed as nonaccrual, past due, restructured or a potential problem loan, and (v) complies with applicable law.

The Audit Committee, with assistance from our General Counsel, is responsible for reviewing and, where appropriate, approving or ratifying any related person transaction involving our company or its subsidiaries and related parties.

As required by federal regulations, extensions of credit by Sandy Spring Bank to directors and executive officers are subject to the procedural and financial requirements of Regulation O of the Board of Governors of the Federal Reserve System, which generally require advance approval of such transactions by disinterested directors. Extensions of credit to our directors or officers are subject to approval by the disinterested members of the Board per the terms of Regulation O and our policy.

| | Notice and Proxy Statement | 2022 | 23 |

STOCK OWNERSHIP INFORMATION |

5% OWNERS OF COMPANY STOCK

The following table provides information about those holders known to us to be the beneficial owners of 5% or more of our outstanding shares of common stock as of December 31, 2021.

Name and Address | Number of Shares | Percentage of Common Stock Outstanding | ||||||||||

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | 4,352,382(1) | 9.6% |

|

|

| |||||||

T. Rowe Price Associates, Inc. 100 E. Pratt Street, Baltimore, MD 21202 | 2,910,314(2) | 6.4% |

|

|

| |||||||

The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | 2,480,515(3) | 5.5% |

|

|

| |||||||

Dimensional Fund Advisors LP 6300 Bee Cave Road, Austin, TX 78746 | 2,425,462(4) | 5.3% |

|

|

| |||||||

| (1) | According to the Schedule 13G/A filed by Blackrock, Inc., with the SEC on February 1, 2022, BlackRock, Inc., had sole voting power with respect to 4,037,072 shares and sole dispositive power with respect to 4,352,382 shares. |

| (2) | According to the Schedule 13G/A filed by T. Rowe Price Associates, Inc., with the SEC on February 14, 2022, T. Rowe Price Associates, Inc. had sole voting power with respect to 760,162 shares, and sole dispositive power with respect to 2,910,314. |

| (3) | According to the Schedule 13G/A filed by The Vanguard Group, with the SEC on February 10, 2022, The Vanguard Group had shared power to vote 42,321 shares, sole dispositive power with respect to 2,398,093, and shared dispositive power with regard to 82,422 shares. |

| (4) | According to the Schedule 13G/A filed by Dimensional Fund Advisors LP on February 8, 2022, Dimensional Fund Advisors had sole voting power with respect to 2,372,470 shares and sole dispositive power with respect to 2,425,462 shares. Dimensional Fund Advisors LP, an investment adviser registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). In certain cases, subsidiaries of Dimensional Fund Advisors LP may act as an adviser or sub-adviser to certain Funds. In its role as investment advisor, sub-adviser and/or manager, Dimensional Fund Advisors LP or its subsidiaries may possess voting and/or investment power over the securities that are owned by the Funds, and may be deemed to be the beneficial owner of the shares held by the Funds. However, all securities reported are owned by the Funds. Dimensional Fund Advisors LP disclaims beneficial ownership of such securities. |

24 |

|

| | Notice and Proxy Statement | 2022 |

|

STOCK OWNERSHIP INFORMATION |

BENEFICIAL OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information as of February 16, 2022, with respect to the shares of common stock beneficially owned by each director and director-nominee, by the 2021 named executive officers, and by all directors and executive officers as a group. No individual holds more than 1% of the total outstanding shares of common stock. All directors and executive officers as a group beneficially own 3.2% of our outstanding common stock.

Name | Shares Owned(1)(2) | Restricted Stock Awards(3) | Right to Acquire(4) | Total Beneficial Ownership | Additional Stock Units(5) | Total | ||||||||||||||||||||||||||

Mona Abutaleb | 4,538 | 334 | 442 | 5,314 |

|

|

|

|

|

| 1,212 | 6,526 | ||||||||||||||||||||

Ralph F. Boyd | 7,500 | 334 | 442 | 8,276 |

|

|

|

|

|

| 1,212 | 9,488 | ||||||||||||||||||||

Mark E. Friis(6) | 44,477 | 334 | 442 | 45,253 |

|

|

|

|

|

| 1,212 | 46,465 | ||||||||||||||||||||

Brian J. Lemek | 252,072 | — | 515 | 252,587 |

|

|

|

|

|

| 1,285 | 253,872 | ||||||||||||||||||||

Pamela A. Little | 26,578 | 334 | 442 | 27,354 |

|

|

|

|

|

| 1,212 | 28,566 | ||||||||||||||||||||

Walter C. Martz II(7) | 30,427 | — | 515 | 30,942 |

|

|

|

|

|

| 1,285 | 32,227 | ||||||||||||||||||||

Mark C. Michael | 23,670 | 334 | 442 | 24,446 |

|

|

|

|

|

| 1,212 | 25,658 | ||||||||||||||||||||

Mark C. Micklem | 12,963 | — | 942 | 13,905 |

|

|

|

|

|

| 1,212 | 15,117 | ||||||||||||||||||||

Christina B. O’Meara(8) | 44,954 | 334 | 515 | 45,469 |

|

|

|

|

|

| 1,285 | 46,754 | ||||||||||||||||||||

Robert L. Orndorff(9) | 168,011 | 334 | 442 | 168,787 |

|

|

|

|

|

| 1,212 | 169,999 | ||||||||||||||||||||

Craig A. Ruppert | 106,618 | 334 | 442 | 107,394 |

|

|

|

|

|

| 1,212 | 108,606 | ||||||||||||||||||||

Daniel J. Schrider (10) | 99,496 | 24,410 | — | 123,906 |

|

|

|

|

|

| 21,914 | 145,820 | ||||||||||||||||||||

Philip J. Mantua(11) | 55,330 | 9,389 | — | 64,719 |

|

|

|

|

|

| 8,396 | 73,115 | ||||||||||||||||||||

Joseph J. O’Brien, Jr.(12) | 51,748 | 12,021 | — | 63,769 |

|

|

|

|

|

| 11,075 | 74,844 | ||||||||||||||||||||

Kenneth C. Cook (13) | 216,514 | 6,264 | 109,027 | 331,805 |

|

|

|

|

|

| 7,829 | 339,634 | ||||||||||||||||||||

R. Louis Caceres | 36,556 | 8,673 | — | 45,229 |

|

|

|

|

|

| 7,554 | 52,783 | ||||||||||||||||||||

All directors and all executive officers as a group (21 persons) | 1,237,642 | 91,369 | 115,419 | 1,444,430 |

|

|

|

|

|

| 91,184 | 1,535,614 | ||||||||||||||||||||

| (1) | Under the rules of the SEC, an individual is considered to “beneficially own” any share of common stock which he or she, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise, has or shares: (a) voting power, which includes the power to vote, or to direct the voting of, such security; and/or (b) investment power, which includes the power to dispose, or to direct the disposition, of such security. |

| (2) | Only whole shares appear in the table. Fractional shares that may arise from reinvested dividends are not shown. |

| (3) | Includes restricted stock awards as to which the holder has voting power. |

| (4) | Includes shares that the named individual or group has the right to acquire through the exercise of vested stock options and shares that the named individual or group has the right to acquire through the vesting of restricted stock units within 60 days of February 16, 2022. |

| (5) | Includes restricted stock units and performance-based restricted stock units, reported at target levels, as to which no voting or investment power exists. |

| (6) | Includes 30,782 shares owned by Mr. Friis’ Living Trust for which Mr. Friis and his spouse share investing and voting power. |

| (7) | Includes 2,183 shares held in three trusts for which Mr. Martz is trustee. Mr. Martz has no pecuniary interest these holdings. |

| (8) | Includes 7,343 shares owned by Ms. O’Meara’s spouse |

| (9) | Includes 156,348 shares owned by trusts for which Mr. Orndorff and his spouse, as co-trustees, share investment and voting power. |

| (10) | Includes 6,671 shares held through employee benefit plans and 56 shares owned by Mr. Schrider’s son. |

| (11) | Includes 11,330 shares held through employee benefit plans. |

| (12) | Includes 5,491 shares held through employee benefit plans. |

| (13) | Includes 2,256 shares held through employee benefit plans. |

| | Notice and Proxy Statement | 2022 | 25 |

STOCK OWNERSHIP INFORMATION |

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers, and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership of our common stock with the SEC. Specific dates for such filings have been established by the SEC, and we are required to report in this proxy statement any failure to file reports in a timely manner in 2021.

Based solely on the review of the copies of forms we have received and written representations from each person, all the executive officers and directors have complied with filing requirements applicable to them with respect to transactions during 2021 with the single exception of a Form 4 for Gary J. Fernandes reporting the withholding of shares upon the vesting of restricted stock awards that was filed late due to delay in receiving EDGAR access codes from the SEC.

26 |

|

| | Notice and Proxy Statement | 2022 |

|

COMPENSATION DISCUSSION AND ANALYSIS |

COMPENSATION DISCUSSION AND ANALYSIS

This section describes our executive compensation philosophy, the material components of our compensation program, and the factors used for determining compensation earned by the following persons who were our named executive officers, or “NEOs,” in 2021:

Daniel J. Schrider President and Chief Executive Officer

Philip J. Mantua Executive Vice President and Chief Financial Officer

Joseph J. O’Brien, Jr. Executive Vice President and Chief Banking Officer

Kenneth C. Cook Executive Vice President and President of Commercial Banking

R. Louis Caceres Executive Vice President and Chief Wealth Officer

Each of our NEOs is a member of our Executive Leadership Team, which includes other key members of our senior management.

This discussion should be read in conjunction with the compensation tables and accompanying narrative starting on page 42.

|

| |||||||||

| | | 1. EXECUTIVE SUMMARY |

| 28 |

| ||||||

| 28 |

| ||||||||

| Executive Compensation Philosophy | 28 | |||||||||

| 2021 Compensation Highlights | 29 | |||||||||

| Target Compensation Mix | 29 | |||||||||

| “Say on Pay” Results | 29 | |||||||||

| Compensation and Governance Practices | 30 | |||||||||

| | |

|

| 31 |

| ||||||

| Executive Compensation Program Elements | 31 | |||||||||

| | |

|

| 31 |

| ||||||

| Executive Compensation Process | 31 | |||||||||

| Peer Group | 32 | |||||||||

| | |

|

| 33 |

| ||||||

| Base Salary | 33 | |||||||||

| 2021 Target Award Opportunities | 33 | |||||||||

| Annual Incentive Compensation | 33 | |||||||||

| Long-term Incentive Compensation | 37 | |||||||||

| Executive Incentive Retirement Plan | 38 | |||||||||

| | |

|

| 39 |

| ||||||

| Other Compensation Elements | 39 | |||||||||

| Employment and Change in Control Agreements | 40 | |||||||||

| Executive Compensation Policies | 40 | |||||||||

| Compensation Risk Assessment | 40 | |||||||||

| Tax Considerations | 40 | |||||||||

| | Notice and Proxy Statement | 2022 | 27 |

COMPENSATION DISCUSSION AND ANALYSIS |

2021 was a year of strong financial performance in a challenging operating environment. We began the year by supporting our clients with an additional $469 million of Paycheck Protection Program (PPP) loans, bringing our total PPP loan originations to over $1.6 billion. As the year progressed and COVID-19 vaccines became widely available, the economy rebounded and loan demand returned. We reopened our branch lobbies – which had been operating on an appointment only basis – in June and began phasing in our return to office plans in early July, with a full return to office as of November 1. Despite the challenges of the operating environment, we generated strong return metrics while making significant strides in our technology and digital investments.

Core Earnings* $212M Core earnings, which exclude provision expense and non-recurring and non-cash items, increased 12% over 2020. | Loans $10.0B Excluding PPP loans, loans grew 5% in 2021 as loan demand surged in the second half of the year. | Deposits $10.6B Deposits grew 6% in 2021, | ||||||

Non-GAAP Efficiency* 46.17% Our non-GAAP efficiency ratio improved from 46.53% in 2020 and was in the top quartile of our peers. | Core ROATCE* 18.93% Our core return on average tangible | Core ROAA* 1.65% Our core return on average | ||||||

Tangible Book Value* $24.90/share Tangible book value per share grew 10% in 2021. | Core EPS* $4.52/share Core earnings per share | Dividends $1.28/share We increased our dividend | ||||||

| * | Non-GAAP financial measure. See our 2021 Annual Report on Form 10-K for additional information and a reconciliation to the most directly comparable GAAP financial measure. |

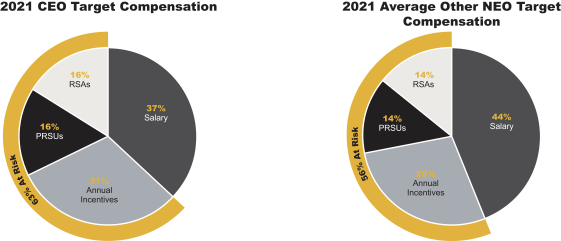

EXECUTIVE COMPENSATION PHILOSOPHY

EXECUTIVE COMPENSATION PHILOSOPHY

Our Compensation Committee is committed to rewarding executive management for the company’s performance achieved through planning and execution. We achieve our objectives through an executive compensation program that is aligned, balanced, and rewarding.

Aligned – Executive compensation must be aligned with the company’s strategic objectives, which state that the company will earn independence by creating franchise and shareholder value. In order to align compensation to this strategy, a significant portion of total compensation is tied to company performance, both absolute and relative.

Compensation must also be aligned with the competitive markets in order to attract and retain the talent, skills, and experience needed in executive management. The committee works with an independent compensation consultant to receive periodic analyses that benchmark compensation with market trends and practices.

Finally, compensation must align the interests of executives with those of shareholders to ensure that management will be rewarded for increasing shareholder value. To accomplish this, a significant portion of total compensation is in the form of equity.

Balanced – Executive compensation must balance a number of factors. Compensation should have a proper mix of fixed and variable elements, compensation arrangements should use multiple performance measures for balanced achievement, awards should balance short and long-term results with short and long-term career objectives, including retirement, and compensation must always balance risk with reward so as not to encourage excessive risk-taking.

Rewarding – Executive compensation must provide the means to attract, motivate, and retain the caliber of talent and leadership needed to support the company’s long record of growth and profitability. Compensation arrangements should motivate executives to work collaboratively and creatively to generate a high-level of synergistic performance by and among the officers and employees.

28 |

|

| | Notice and Proxy Statement | 2022 |

|