| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT |

| OF |

| REGISTERED MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number: 811-05379 |

| |

| Name of Registrant: Royce Focus Trust, Inc. |

| |

| Address of Registrant: 745 Fifth Avenue |

| New York, NY 10151 |

| |

| Name and address of agent for service: | | John E. Denneen, Esquire |

| | | 745 Fifth Avenue |

| | | New York, NY 10151 |

| Registrant’s telephone number, including area code: (212) 508-4500 |

| Date of fiscal year end: December 31 |

| Date of reporting period: January 1, 2012 – December 31, 2012 |

| |

Item 1. Reports to Shareholders.

ANNUAL

REVIEW AND REPORT

TO STOCKHOLDERS

| |

Royce Value Trust

Royce Micro-Cap Trust

Royce Focus Trust |

| | | |

| |

| | |

| |

www.roycefunds.com |

|

| A Few Words on Closed-End Funds |

|

Royce & Associates, LLC manages three closed-end funds: Royce Value Trust, the first small-cap value closed-end fund offering; Royce Micro-Cap Trust, the only micro-cap closed-end fund; and Royce Focus Trust, a closed-end fund that invests in a limited number of primarily small-cap companies. |

| |

| A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the Fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange, as with any publicly traded stock. This is in contrast to open-end mutual funds, in which the fund sells and redeems its shares on a continuous basis. |

| A Closed-End Fund Offers Several Distinct Advantages Not Available from an Open-End Fund Structure |

| | |

| • | Since a closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions, as an open-end fund must. |

| | |

| • | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times is ideal for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. |

| | |

| • | A closed-end fund may invest more freely in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is particularly beneficial for Royce-managed closed-end funds, which invest in small- and micro-cap securities. |

| | |

| • | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. |

| | |

| • | Unlike Royce’s open-end funds, our closed-end funds are able to distribute capital gains on a quarterly basis. Each of the Funds has adopted a quarterly distribution policy for its common stock. Please see page 16-18 for more details. |

| | |

| • | We believe that the closed-end fund structure is very suitable for the long-term investor who understands the benefits of a stable pool of capital. |

| Why Dividend Reinvestment Is Important |

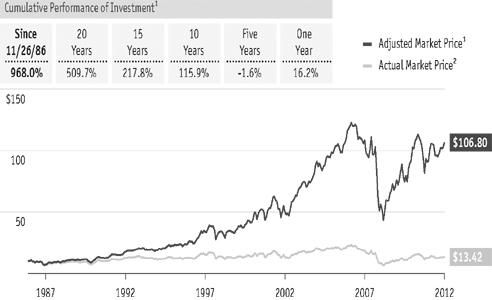

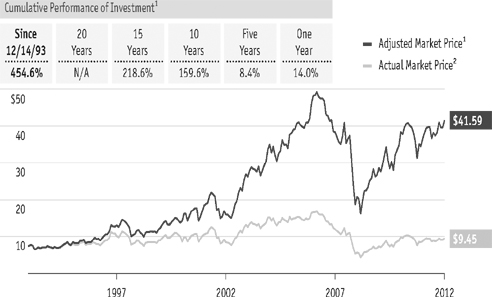

| A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 11, 13, and 15. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 18 or visit our website at www.roycefunds.com. |

| This page is not part of the 2012 Annual Report to Stockholders |

| Table of Contents | |

|

| | |

| Annual Review | |

|

| | |

| Performance Table | 2 |

| | |

| Letter to Our Stockholders | 3 |

| | |

| 2012: In Quotes | 63 |

| | |

| Postscript: The Lessons of 40 years | 64 |

|

| | |

| Annual Report to Stockholders | 9 |

| | |

| | |

| |

| | |

| For 40 years, we have used a value approach to invest in small-cap securities. We focus primarily on the quality of a company’s balance sheet, its ability to generate free cash flow, and other measures of profitability or sound financial condition. We then use these factors to assess the company’s current worth, basing the assessment on either what we believe a knowledgeable buyer might pay to acquire the entire company or what we think the value of the company should be in the stock market. |

| | |

| | |

| | |

|

| This page is not part of the 2012 Annual Report to Stockholders | 1 |

| NAV Average Annual Total Returns | | Through December 31, 2012 |

| | | Royce | | Royce | | Royce | | Russell | | Russell | | Russell |

| | | Value Trust | | Micro-Cap Trust | | Focus Trust | | 2000 Index | | Microcap Index | | 2500 Index |

|

| One-Year | | | 15.41 | % | | | 17.34 | % | | | 11.42 | % | | | 16.35 | % | | | 19.75 | % | | | 17.88 | % |

|

| Five-Year | | | 1.23 | | | | 2.15 | | | | 1.38 | | | | 3.56 | | | | 1.46 | | | | 4.34 | |

|

| 10-Year | | | 9.48 | | | | 10.45 | | | | 12.19 | | | | 9.72 | | | | 8.42 | | | | 10.49 | |

|

| 15-Year | | | 8.14 | | | | 8.60 | | | | 9.17 | | | | 5.89 | | | | n.a. | | | | 7.43 | |

|

| 20-Year | | | 10.06 | | | | n.a. | | | | n.a. | | | | 8.43 | | | | n.a. | | | | 9.89 | |

|

| 25-Year | | | 11.15 | | | | n.a. | | | | n.a. | | | | 9.74 | | | | n.a. | | | | 11.14 | |

|

| Since Inception | | | 10.33 | | | | 10.42 | | | | 10.04 | | | | n.a. | | | | n.a. | | | | n.a. | |

|

| Inception Date | | 11/26/86 | | 12/14/93 | | 11/1/961 | | | n.a. | | | | n.a. | | | | n.a. | |

|

| 1 Date Royce & Associates, LLC assumed investment management responsibility for the Fund. |

Important Performance and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12 for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. All indexes referenced are unmanaged and capitalization-weighted. Each indexes’s returns include net reinvested dividends and/or interest income. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index, along with the next smallest eligible securities as determined by Russell. The Russell 2500 Index is an index of the 2,500 smallest publicly traded U.S. companies in the Russell 3000 Index. |

| 2 | This page is not part of the 2012 Annual Report to Stockholders |

| Letter to Our Stockholders |

|

| |

|

| |

| |

Men can do nothing without the make-believe of a beginning.

– George Eliot |

See a Little Light | | |

When seeing out one year and ushering in another, it is important to remember that the calendar, useful though it may be, provides only one way of tracking time. Some people, for example, choose to look to spring for a new beginning, while others, more habituated to the rhythms of the school year, prefer the arrival of fall. The stock market, in all its caprice and unpredictability, most often eschews 12-month spans in favor of its own irregularly paced seasons. So we find ourselves, as we look back on 2012 and peer ahead to 2013, at one of those curious, familiar junctures when the calendar compels a shift that the market seems to have anticipated months before. From our perspective as active small-cap managers, the recent market cycle change was something of a watershed. In fact, it seems very likely to us that the 2012 small-cap low on June 4 signaled the end of the closely correlated, range-bound cycle of the last few years, a cycle that created ample disappointments for those of us committed to high quality, risk management, and long-term absolute returns. It is not yet clear that this June low will prove as auspicious as it looks to us at this writing. Suffice it to say that major market inflection points seldom do any of us the favor of announcing their arrival. | | From our perspective as active small-

cap managers, the recent market cycle

change was something of a watershed.

In fact, it seems very likely to us that the

2012 small-cap low on June 4 signaled

the end of the closely correlated, range-

bound cycle of the last few years, a cycle

that created ample disappointments for

those of us committed to high quality,

risk management, and long-term

absolute returns. |

| This page is not part of the 2012 Annual Report to Stockholders | 3 |

| |

Charles M. Royce, President

One of the most interesting recent

developments in the equity markets,

particularly in the small-cap space,

has been the persistent disparity

in performance between high- and

low-quality companies. Over longer

periods of time, higher-quality

companies have differentiated

themselves from a performance

standpoint, especially compared

to the lower quality segments of

the market. While the aftermath

of the financial crisis altered this

script, there are signs that the

dynamic is changing.

Historically, lower-quality companies

have tended to demonstrate their

most robust outperformance when

markets are in the initial recovery

phase following a recession or bear

market low. However, once economies

and markets move from recovery to

expansion, the rate of change in these

inputs begins to slow while leadership

tends to rotate back to higher-

quality companies, whose business

fundamentals are more compelling.

Continued on page 6...

| | | Letter to Our Stockholders

It is equally important to emphasize that our new-found sanguine attitude is contingent on seeing in 2013 more of what we saw in the second half of 2012, particularly in last year’s closing months. During this period, investors were looking more closely at companies that possess sustainable quality in the form of strong balance sheets, high returns on invested capital, steady earnings, and reasonable dividends while paying a bit less attention to high-yield instruments, copiously leveraged stocks, and explosive growth surprises. We want to stress the extremely cautious nature of our optimism. The resurgence of quality off the June low was not decisive and has been thus far short lived. However, in our view, it did mark a subtle and significant shift that grew more pronounced in the fourth quarter, most notably in October and November when share prices went wobbly from the impact of Hurricane Sandy and the aftermath of the elections, which included periods of recurrent anxiety over the then-looming fiscal cliff.

Quality shone through in this more uncertain period. Throughout most of our first 35 years of managing portfolios, this resilience would have been unexceptional, and hardly worth mentioning, because quality companies have historically defended well. However, since the spring of 2010—and even more dramatically since the April 2011 small-cap high—little of what worked historically has enjoyed success. This has made the last five years—the last three particularly—among the most frustrating periods of our 40 years in business. With retrospective clarity, perhaps we should have suspected that something was amiss, or at least historically aberrant, when stocks rebounded so quickly and dynamically from the March 2009 bottom. Considering that the recession which began in 2007 was made far worse by the global financial crisis in the fall of 2008, the market’s surge may have been too much too soon, welcome though it was.

In any event, investors soon became more than a little wary, shuffling in and out of stocks with little regard for business fundamentals and too much for macro headlines, nearly all of them negative. Unable to establish any clear direction, the market sputtered as it rose and wheezed as it stumbled. It often seemed as though many of the investors who were frantically shoving money in and pulling it out again weeks, days, or hours later were the same people decrying the mercurial nature of asset prices and questioning whether equities were any longer a viable investment option. Along the way, results for passive investment approaches began to outpace those of an ever-larger number of active managers. So it is with a large measure of relief that we bid a tentative and hopeful good-bye to all that as we look ahead to better, more stable days.

The Wall of Worry

An old adage has it that “the market climbs a wall of worry” during those times when stocks behave bullishly in the face of negative news or perceptions. It seems clear to us that in 2012, the market scaled just such a wall. Consider the following: For the most part, the bearish second quarter eroded, but did not undo, the gains achieved in the first. The year’s final six months found many investors still behaving coolly toward equities and a host of large-scale economic and fiscal issues yet to be fully worked through. As the year closed, a fiscal cliff deal had yet to be reached, various European nations continued to flirt with financial peril, and China was still growing |

| |

| |

| | | | |

| 4 | This page is not part of the 2012 Annual Report to Stockholders |

| | |

| | | |

at a slower pace than in previous boom years. In addition, there was a typically contentious presidential election preceded by a disastrous hurricane that swept through the world’s financial capital. Yet the market ultimately shrugged off most of these concerns.

Share prices did not skyrocket following the June 4 small-cap low. July, in fact, saw a downturn for most stocks. But August and September were highly rewarding months that enabled equities to rally decisively enough to post impressive third-quarter results. For the quarter, the small-cap Russell 2000 Index gained 5.3% while the large-cap S&P 500 and Russell 1000 Indexes were up 6.4% and 6.3%, respectively, and the more tech-oriented Nasdaq Composite climbed 6.2%. Following the strong third quarter, equities took a bit of breather in October, before rallying again in November and December, which repeated to some degree the third quarter’s pattern, though with far more modest or slightly negative results. For the fourth quarter, the Russell 2000 was up 1.9%, the Russell 1000 rose 0.1%, the S&P 500 was off 0.4%, and the Nasdaq Composite fell 3.1%.

The end result was a strong calendar year, especially compared to 2011, with each major equity index posting double-digit returns. In 2012, the Russell 2000 gained 16.3%, the S&P 500 rose 16.0%, the Russell 1000 was up 16.4%, and the Nasdaq Composite increased 15.9%. Three-year returns for the major indexes were also strong, with each again posting double-digit average annual total returns. For the three-year period ended December 31, 2012, the Russell 2000 led with a gain of 12.2%. The Russell 2000, Russell 1000, and S&P 500 each finished the year within 2.5% of their respective highs established during 2012’s third quarter, while the Nasdaq Composite remained 40.2% below its peak from March 10, 2000.

Non-U.S. equities also enjoyed a strong second half after starting the year with generally lower gains when stacked against their domestic cousins. The Russell Global ex-U.S. Small Cap Index climbed 8.3% in the third quarter, while the Russell Global ex-U.S. Large Cap Index rose 7.7%. In contrast to the domestic indexes, these strong third-quarter performances were followed by consistently positive results in the fourth quarter. The Russell Global ex-U.S. Small Cap Index was up 4.8% versus a gain of 5.8% for the Russell Global ex-U.S. Large Cap Index. For the full year small-caps were the leaders, with the Russell Global ex-U.S. Small Cap Index gaining 18.8% while the Russell Global ex-U.S. Large Cap Index was up 17.0%. So while the perception persists that non-U.S. markets are a mess—a perception based on the uncertain debt and currency situations in Europe and slower-than-desired growth in developing countries—the reality is that stocks across the globe finished the year with highly attractive results.

Shifting back stateside finds that micro-cap stocks enjoyed a very strong year. After finishing the first half with an enviable 13.0% return, the Russell Microcap Index climbed 5.9% in the third quarter and was essentially flat in the fourth, up 0.04%, which gave the index a 19.7% increase in 2012. Mid-cap stocks also experienced robust results for the calendar year—the Russell Midcap Index was up 17.3% in 2012. | | An old adage has it that “the market

climbs a wall of worry” during those

times when stocks behave bullishly

in the face of negative news or

perceptions. It seems clear to us

that in 2012 the market scaled just

such a wall. |

| This page is not part of the 2012 Annual Report to Stockholders | 5 |

| | However, the four rounds of QE

have created an extended tailwind

for low-quality companies. Highly

levered businesses—a low-quality

attribute from our standpoint—have

benefited from the sharp drop in the

cost of capital that has accompanied

the Fed’s bond buying programs.

Access to capital has simultaneously

improved, allowing weaker companies

to stave off potential financing

challenges. This is particularly

relevant in the smaller company space

where financing is often tenuous.

Interestingly, companies with large

net cash positions have also lagged

as that cash has been viewed as an

unproductive asset that generates

little or no return, even though it

provides a healthy margin of safety

and is often the result of profitability.

Even allowing for strong second-half

results, high-quality small-caps look

highly attractive to us relative to

both their lower-quality counterparts

and their high-quality peers in the

large-cap space.

The drop in market volatility back

to pre-crisis levels, as measured

by the VIX, has contributed to the

relative strength of low-quality

companies. Investors’ appetite for

riskier assets tends to correlate with

sharp moves—both up and down—in

volatility. As the more violent swings

in the market dissipated, investors

were increasingly willing to embrace

the added risk associated with

lower quality enterprises.

Continued on page 8...

| |

| |

| |

| Letter to Our Stockholders |

|

| |

| Good-Bye to All That (We Hope) |

Calendar-year results for our closed-end funds fell a bit short of our expectations on a relative basis, even as all three of the portfolios finished the year with both solid second-half performances and more-than-respectable absolute returns. Certainly some holdings drew a benefit from the market’s suddenly renewed affection for quality characteristics. Results as a whole therefore left us frustrated yet hopeful, for the reasons outlined above.

We have previously discussed the reasons for recent performance disappointments, but they are worth recapping for what we would like to think will be the last time, at least for a while. Beginning with 2007’s recession and moving through the global financial crisis into the early days of June 2012, the markets were highly volatile, closely correlated, and frequently disappointing. This pattern could first be seen emerging in the spring of 2010 and was cast in harder material by the small-cap high on April 29, 2011. So while the one- and three-year numbers for the major domestic indexes were strong through the end of 2012, investors continue to be leery of the market, most probably owing to its lack of a sustainable course, bullish or bearish, especially in the roughly 13-month period between the April 2011 high and the 2012 low in early June. More importantly, this cycle of high correlation often proved difficult for our closed-end portfolios. |

2012 NAV TOTAL RETURNS FOR THE ROYCE FUNDS VS.

RUSSELL 2000, RUSSELL MICROCAP AND THE RUSSELL 2500 as of 12/31/12

|

| 1 | Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12 for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. |

Throughout this time, we remained patient and disciplined, resolutely searching for companies that met our standards for quality and attractive valuation while investors grew more interested in other matters. On the one hand, they sought safety in fixed income instruments, utilities, or high-yielding vehicles such as REITs and MLPs; on the other hand they looked |

| 6 | This page is not part of the 2012 Annual Report to Stockholders |

| | |

| | | |

for fast, dramatic growth, which most often came from highly leveraged companies in which we take no interest. For our part, we continued to see many companies across several sector and industry groups that answered to our preferred combination of quality and value. However, many of the largest company, industry and/or sector weightings in some portfolios have fared poorest, including those in the Energy, Materials, and Information Technology sectors. While all of this has been frustrating, none of it has changed the way in which we invest or construct portfolios. As we said in our Semiannual Review and Report, patience and discipline are not virtues to which we pay lip service. Our investment horizon will remain squarely focused on the long term, as it has for 40 years.

New Cycle, New Balance

The recent era of low rates and ample liquidity has not changed our view of the importance of strong balance sheets, high returns on invested capital, cash flow, or dividends. Many small-cap companies that possess any number of these characteristics underperformed the Russell 2000 in 2010, 2011, and the first half of 2012, which definitely hampered the effectiveness of our disciplined approach. This can be seen in the Funds’ three-, five-year, and in the case of Royce Value Trust, even 10-year, results. We did not enjoy watching certain portfolio favorites languish. But not once did we consider changing our core principles. We knew that we were in a highly anomalous market, one that we may not see again for more than a generation. So we stayed patient and consistent while we waited for the cycle to shift.

Our contention is that quality stocks underperformed through much of the recent cycle of correlation owing to both the zero-interest-rate policies that the Fed has implemented over the last few years and the related rounds of quantitative easing. With interest rates so low, companies were finding it very easy to restructure debt or take on more of it. The price companies were paying to do so was miniscule, so investors acted accordingly by rewarding a number of fast-growing, highly leveraged businesses while often ignoring those with strong balance sheets. In an environment where the cost of debt has been virtually nil, low-debt companies lost their traditional advantage. (Our Sidebar, piece provides some more details.) However, we also suspect that we have reached a stage where this advantage is diminishing because rates have been historically low for a few years now and monetary stimulus no longer has the same dramatic impact it had with the first two or three rounds of quantitative easing. In addition to their stalwart second-half returns, we think this is a good sign for high-quality small-cap stocks.

A Quality Cycle?

As correlation continues to abate, we expect to see more opportunities for quality stocks to flourish. This is ultimately why we were not surprised by the market’s strength in the second half, even with ample ongoing uncertainty. We feel confident that the market has entered a cycle | | We did not enjoy watching certain

portfolio favorites languish. But not

once did we consider changing our

core principles. We knew that we

were in a highly anomalous market,

one that we may not see again for

more than a generation. So we stayed

patient and consistent while we

waited for the cycle to shift. |

| This page is not part of the 2012 Annual Report to Stockholders | 7 |

| | The current preference for passive

strategies and ETFs at the expense of

active management has also played

a role. Within small-cap, active

managers, especially those with a

long-term orientation, tend to have

a quality bias in their portfolios,

while passive index vehicles,

especially those meant to replicate

the Russell 2000, have no bias other

than market cap and therefore have

a higher weighting in lower-quality

companies. Persistent redemptions

of actively managed funds combined

with modest inflows to ETFs have

further distorted the low quality/high

performance differential.

The key question, then, is when will

this change? It is our view that it may

already have begun. Interest rates,

while at historic lows, cannot fall

much lower. In fact, each successive

round of quantitative easing is

exerting less and less pressure on

rates while at the same time raising

the specter of increased inflation

down the road. While liquidity should

remain abundant, the rate of change

in the cost of capital has clearly

peaked. By the same token, the rate

of decline in market volatility has

significantly slowed with the VIX now

back to its long-run averages. And

while the global economy continues to

grow, GDP statistics are anything but

robust. Low-quality companies have

had an extended moment in the sun,

but it is our strong belief that we are

entering a new era for quality.

| |

| |

| |

| Letter to Our Stockholders |

|

| |

in which stock picking matters. Our optimism, cautious as it is, is bolstered by the fact that in the years ahead earnings growth can accelerate for small caps and should be robust as the economy continues to improve. While many companies are hesitant about capital expenditures, those issues have more to do with timing. That is, businesses were not willing to start spending until the President and Congress struck a deal. Yet our meetings with management teams have convinced us that there is no question about their willingness to invest.

In this context, it is worth mentioning that the tax and stimulus deal that was struck early in January still left important matters such as infrastructure spending, entitlements, and the next debt ceiling increase unresolved. So there will be opportunities for political intransigence to potentially affect the markets in 2013, and it will be interesting to see how investors respond to additional rounds of fiscal gridlock. Our thought is that greater levels of attention to business fundamentals will remain high. We believe that equities will continue their positive performance into 2013, that quality-oriented companies and active management approaches, especially within the small-cap universe, will continue their resurgence, and that non-U.S. small-caps will continue to surprise on the upside. We are very happy to say that it looks like a new, more historically typical cycle has begun. |

| | | | | | |

| | Sincerely | | | | |

| | | | | | |

| |  | |  | |  |

| | Charles M. Royce | | W. Whitney George | | Jack E. Fockler, Jr. |

| | President | | Vice President | | Vice President |

| | | | | | |

| | January 31, 2013 |

| 8 | This page is not part of the 2012 Annual Report to Stockholders |

| Table of Contents | |

|

| | |

| Annual Report to Stockholders | |

|

| Managers’ Discussions of Fund Performance | |

| | |

| Royce Value Trust | 10 |

| | |

| Royce Micro-Cap Trust | 12 |

| | |

| Royce Focus Trust | 14 |

|

| History Since Inception | 16 |

| | |

| Distribution Reinvestment and Cash Purchase Options | 18 |

| | |

| Schedules of Investments and Other Financial Statements | |

| | |

| Royce Value Trust | 19 |

| | |

| Royce Micro-Cap Trust | 35 |

| | |

| Royce Focus Trust | 50 |

| | |

| Directors and Officers | 60 |

| | |

| Notes to Performance and Other Important Information | 61 |

| | |

| | |

| |

| | |

| The Royce Funds 2012 Annual Report to Stockholders | 9 |

AVERAGE ANNUAL NAV TOTAL RETURNS

Through 12/31/12 |

|

| July-December 20121 | | 10.87 | % | |

|

| One-Year | | | | | 15.41 | | |

|

| Three-Year | | | | | 10.58 | | |

|

| Five-Year | | | | | 1.23 | | |

|

| 10-Year | | | | | 9.48 | | |

|

| 15-Year | | | | | 8.14 | | |

|

| 20-Year | | | | | 10.06 | | |

|

| 25-Year | | | | | 11.15 | | |

|

| Since Inception (11/26/86) | | | | | 10.33 | | |

|

| 1 Not annualized | |

| | | | |

| CALENDAR YEAR NAV TOTAL RETURNS | |

|

| Year | | RVT | | | Year | | | RVT | | |

|

| 2012 | | 15.4 | % | | 2004 | | | 21.4 | % | |

|

| 2011 | | -10.1 | | | 2003 | | | 40.8 | | |

|

| 2010 | | 30.3 | | | 2002 | | | -15.6 | | |

|

| 2009 | | 44.6 | | | 2001 | | | 15.2 | | |

|

| 2008 | | -45.6 | | | 2000 | | | 16.6 | | |

|

| 2007 | | 5.0 | | | 1999 | | | 11.7 | | |

|

| 2006 | | 19.5 | | | 1998 | | | 3.3 | | |

|

| 2005 | | 8.4 | | | 1997 | | | 27.5 | | |

|

| | | | | | | | | | | |

| TOP 10 POSITIONS % of Net Assets | |

|

| HEICO Corporation | | 1.1 | % | |

|

| Carter’s | | 1.0 | | |

|

| Mohawk Industries | | 1.0 | | |

|

| Coherent | | 1.0 | | |

|

| Lincoln Electric Holdings | | 1.0 | | |

|

| Advisory Board (The) | | 1.0 | | |

|

| Nordson Corporation | | 1.0 | | |

|

| Reliance Steel & Aluminum | | 0.9 | | |

|

| PAREXEL International | | 0.9 | | |

|

| E-L Financial | | 0.8 | | |

|

| | | | | | | | | | | |

| PORTFOLIO SECTOR BREAKDOWN % of Net Assets | |

|

| Industrials | | 27.8 | % | |

|

| Information Technology | | 19.6 | | |

|

| Financials | | 17.8 | | |

|

| Consumer Discretionary | | 13.9 | | |

|

| Materials | | 8.1 | | |

|

| Health Care | | 6.5 | | |

|

| Energy | | 5.1 | | |

|

| Consumer Staples | | 2.1 | | |

|

| Telecommunication Services | | 0.7 | | |

|

| Diversified Investment Companies | | 0.4 | | |

|

| Miscellaneous | | 3.8 | | |

|

| Preferred Stock | | 0.1 | | |

|

| Borrowings Under Revolving Credit Agreement Less Cash and Cash Equivalents | | -5.9 | | |

|

| |

| |

| |

|

| |

Manager’s Discussion

Strong results in the final six months of 2012 helped Royce Value Trust (RVT) to enjoy a strong year on an absolute basis even as it came up a bit short on a relative scale. RVT gained 15.4% on an NAV (net asset value) basis and 16.2% on a market price basis in 2012 compared to gains of 16.3% for both of its unleveraged small-cap benchmarks, the Russell 2000 and S&P SmallCap 600 Indexes.

The Fund enjoyed full participation in the rally that enlivened the year’s first quarter, up 13.9% on an NAV basis and 14.7% on a market price basis versus 12.4% for the Russell 2000 and 12.0% for the S&P SmallCap 600. This relative advantage was lost, however, once stock prices began to decline following a small-cap high on March 26. Investors once again shifted from bullish to bearish based on a now-familiar set of macro headlines concerning European debt and the pace of global economic growth, particularly in the U.S. and China. RVT fell hard in the second quarter, down 8.6% on an NAV basis and 8.9% on a market price basis versus respective declines of 3.5% and 3.6% for the Russell 2000 and S&P SmallCap 600.

Small-cap stocks reached their low for the year on June 4, 2012, though it would not be until July and August that the presence of a rally began to be felt. Though not as dynamic as the first quarter’s bull run, the third quarter was the year’s second shift into an up phase. The Fund once more did well as share prices climbed, gaining 5.1% on an NAV basis and 6.3% based on market price while the Russell 2000 was up 5.3% and the S&P SmallCap 600 rose 5.4%. For stocks as a whole, the fourth quarter was a more mixed period. Investors did their best to make sense of the effects of Hurricane Sandy, the elections, the looming fiscal cliff, and another round of quantitative easing announced by the Fed in mid-December. This muted the performance of RVT’s benchmarks—the Russell 2000 was up 1.9% in the fourth quarter while the S&P SmallCap 600 rose 2.2%. The Fund handily outpaced each benchmark for the same period, up 5.5% on an NAV basis and 4.6% on a market price basis. This gave the Fund an NAV advantage for the second half and from the 2012 small-cap low on June 4 through the end of December. For this period, RVT gained 17.4% on an NAV basis (+15.6% based on market price) versus respective gains of 16.3% and 15.8% for the Russell 2000 and S&P SmallCap 600.

Longer-term relative results were mixed, with some key pockets of strength. From the small-cap trough on March 9, 2009 through December 31, 2012, RVT was up 187.2% on an NAV basis and 207.0% on a market price basis versus a gain of 160.9% for the Russell 2000 and 174.6% for the S&P SmallCap 600. On an NAV basis, the Fund outperformed both benchmarks for |

GOOD IDEAS THAT WORKED

Top Contributors to 2012 Performance1 |

|

| Nordson Corporation | | 0.45% |

|

| Mohawk Industries | | 0.44 |

|

| MAXIMUS | | 0.36 |

|

| Carter’s | | 0.34 |

|

| PAREXEL International | | 0.31 |

|

| 1 Includes dividends | | |

| | | |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small-and micro-cap companies, which may involve considerably more risk than investing in a more diversified portfolio of larger-cap companies. Regarding the two “Good Ideas” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s performance for 2012. |

| 10 | The Royce Funds 2012 Annual Report to Stockholders |

Performance and Portfolio Review

the 15-, 25-year, and since inception (11/26/86) periods ended December 31, 2012. (The Fund also beat the Russell 2000 on both an NAV and market price basis for the 15-, 20-, 25-year, and since inception periods.) RVT’s NAV average annual total return since inception was 10.3%.

Nordson Corporation, part of the machinery group in the top-performing Industrials sector, was the Fund’s top contributor in 2012. The company has what we think is a highly attractive niche business making customized systems that apply adhesives, sealants, and coatings to consumer and industrial products during the manufacturing process. The company announced a 20% increase in its fiscal fourth quarter dividend in July, which not only excited investors, but also marked the 49th consecutive year in which it increased its dividend. We trimmed our position in August. The recovery in the housing industry spurred the rapidly rising stock price of Mohawk Industries in 2012, which in turn led us to take gains in February, May, November, and December. This conservatively capitalized company produces floor coverings for the residential and commercial markets. In addition to its robust earnings growth, investors seemed to like its aggressive attempts to capture market share by acquiring smaller competitors.

Shares of PMFG, a business we have owned since 1990, fell nearly 80% between its early February high and its 2012 low in late November, driven in large part by issuing a secondary offering priced at a sizable discount to its stock. As a manufacturer of custom products primarily for the natural gas industry, the company was also adversely affected by declining gas prices, increased expenses, and project delays, all of which hurt earnings. Fond of its growing business and attractive valuation, we increased our stake between February and September. Major Drilling Group International provides contract drilling services for the metals industry. Although the firm continued to operate profitably, revenue and earnings were hurt as precious metals miners pared back development projects. This in turn seemed to spark fears of a possible decrease in demand for its services. We added to our stake in 2012 before reducing it somewhat in early January 2013. |

GOOD IDEAS AT THE TIME

Top Detractors from 2012 Performance1 |

|

|

| PMFG | -0.31% |

|

| Major Drilling Group International | -0.19 |

|

| GrafTech International | -0.15 |

|

| ADTRAN | -0.14 |

|

| Sapient Corporation | -0.13 |

|

| 1 Net of dividends |

| |

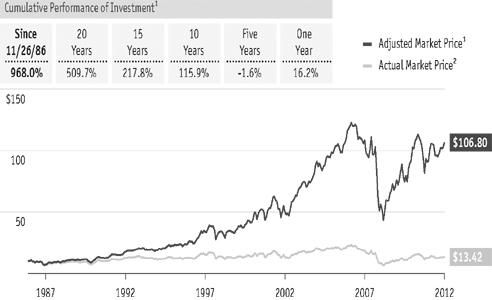

| MARKET PRICE PERFORMANCE HISTORY SINCE INCEPTION (11/26/86) through 12/31/12 |

|

|

1 Reflects the cumulative total return of an investment made by a stockholder who purchased one share at inception ($10.00 IPO), reinvested all annual distributions and fully participated in primary subscriptions of the Fund’s rights offerings. |

2 Reflects the actual market price of one share as it traded on the NYSE. |

| |

| FUND INFORMATION AND PORTFOLIO DIAGNOSTICS |

|

| Fund Total Net Assets | $1,082 million |

|

| Number of Holdings | 478 |

|

| Turnover Rate | 25% |

|

| Symbol | |

| Market Price | RVT |

| NAV | XRVTX |

|

| Net Leverage1 | 6% |

|

| Average Market Capitalization2 | $1,430 million |

|

| Weighted Average P/E Ratio3,4 | 15.2x |

|

| Weighted Average P/B Ratio3 | 1.6x |

|

| U.S. Investments (% of Net Assets) | 79.6% |

|

| Non-U.S. Investments (% of Net Assets) | 26.3% |

|

1 Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets. |

2 Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

3 Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

4 The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (10% of portfolio holdings as of 12/31/12). |

| |

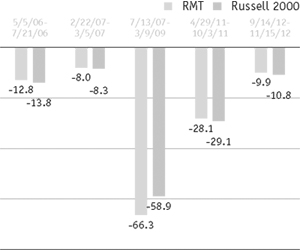

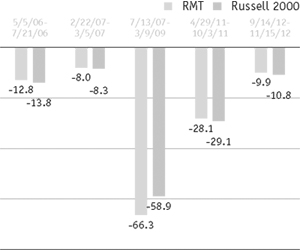

DOWN MARKET PERFORMANCE COMPARISON

All Down Periods of 7.5% or Greater

Over the Last 7 Years, in Percentages (%) |

|

| |

|

| The Royce Funds 2012 Annual Report to Stockholders | 11 |

AVERAGE ANNUAL NAV TOTAL RETURNS

Through 12/31/12 |

|

| July-December 20121 | | 10.20 | % | |

|

| One-Year | | | | | 17.34 | | |

|

| Three-Year | | | | | 11.65 | | |

|

| Five-Year | | | | | 2.15 | | |

|

| 10-Year | | | | | 10.45 | | |

|

| 15-Year | | | | | 8.60 | | |

|

| Since Inception (12/14/93) | | | | | 10.42 | | |

|

| 1 Not annualized | |

| | | | |

| CALENDAR YEAR NAV TOTAL RETURNS | |

|

| Year | | RMT | | | Year | | | RMT | | |

|

| 2012 | | 17.3 | % | | 2004 | | | 18.7 | % | |

|

| 2011 | | -7.7 | | | 2003 | | | 55.5 | | |

|

| 2010 | | 28.5 | | | 2002 | | | -13.8 | | |

|

| 2009 | | 46.5 | | | 2001 | | | 23.4 | | |

|

| 2008 | | -45.5 | | | 2000 | | | 10.9 | | |

|

| 2007 | | 0.6 | | | 1999 | | | 12.7 | | |

|

| 2006 | | 22.5 | | | 1998 | | | -4.1 | | |

|

| 2005 | | 6.8 | | | 1997 | | | 27.1 | | |

|

| | | | | | | | | | | |

| TOP 10 POSITIONS % of Net Assets | |

|

| Kennedy-Wilson Holdings | | 2.0 | % | |

|

| Integrated Electrical Services | | 1.6 | | |

|

| Quaker Chemical | | 1.3 | | |

|

| Virtus Investment Partners | | 1.3 | | |

|

| Seneca Foods | | 1.3 | | |

|

| Tennant Company | | 1.3 | | |

|

| Advisory Board (The) | | 1.2 | | |

|

| America’s Car-Mart | | 1.2 | | |

|

| Flexsteel Industries | | 1.2 | | |

|

| Sapient Corporation | | 1.2 | | |

|

| | | | | | | | | | | |

| PORTFOLIO SECTOR BREAKDOWN % of Net Assets | |

|

| Industrials | | 27.7 | % | |

|

| Information Technology | | 24.6 | | |

|

| Financials | | 17.8 | | |

|

| Consumer Discretionary | | 10.4 | | |

|

| Materials | | 9.2 | | |

|

| Health Care | | 7.7 | | |

|

| Energy | | 4.1 | | |

|

| Consumer Staples | | 3.2 | | |

|

| Utilities | | 0.1 | | |

|

| Miscellaneous | | 4.5 | | |

|

| Preferred Stock | | 0.4 | | |

|

| Borrowings Under Revolving Credit Agreement Less Cash and Cash Equivalents | | -9.7 | | |

|

| |

| |

| |

|

| |

Manager’s Discussion

The strong year for micro-cap stocks was reflected in the calendar-year results for Royce Micro-Cap Trust (RMT). The Fund was up 17.3% on an NAV (net asset value) basis and 14.0% on a market price basis in 2012 compared to 16.3% for its unleveraged small-cap benchmark, the Russell 2000 Index, and 19.8% for the unleveraged Russell Microcap Index.

Stocks as a whole took off fast in 2012, building on a rally that began in early October 2011 and making for a pleasant and bullish opening quarter. The Fund gained 11.4% on an NAV basis and 8.8% on a market price basis compared to a 12.4% increase for its benchmark and a gain of 15.3% for the microcap index. The rally lost steam after small-caps reached a first-half high on March 26, derailed for the third straight year by the same three concerns: sovereign debt in Europe and the pace of economic growth in the U.S. and China. These anxieties drove share prices down through most of the second quarter, with May seeing the largest losses. RMT fell 4.4% on an NAV basis and 3.8% based on its market price in the second quarter. That same period saw the Russell 2000 lose 3.5% while the Russell Microcap lost 2.0%.

Although the third quarter saw a resumption of bullish behavior, it was a more moderately paced run than what the market enjoyed during the first quarter. After reaching a 2012 low on June 4, share prices crept upward. For the third quarter, the Fund rose 6.8% on an NAV basis and 7.3% on a market price basis compared to a 5.3% increase for the Russell 2000 and a gain of 5.9% for the unleveraged Russell Microcap. The fourth quarter was a bit more volatile as investors tried to sort out the ramifications of Hurricane Sandy, the aftermath of the elections, the potential effects of the fiscal cliff, and a fourth round of quantitative easing. The Russell 2000 was up 1.9% and the Russell Microcap gained 0.04% while the Fund climbed 3.2% on an NAV basis and 1.4% based on market price for the year’s final quarter.

The Fund’s strong year helped it to build on previous relative advantages over longer-term time frames. From the small-cap trough on March 9, 2009 through December 31, 2012, RMT gained 197.8% on an NAV basis and 214.7% on a market price basis versus a gain of 160.9% for the Russell 2000 and 160.4% for the Russell Microcap. On both an NAV and market price basis, the Fund was ahead of each index for the 10-year period ended December 31, 2012 while it also outperformed the Russell 2000 for the 15-year and since inception (12/14/93) periods as well. (Data for the Russell Microcap only goes back to 2000.) RMT’s NAV average annual total return since inception was 10.4%.

Eight of the Fund’s nine equity sectors made positive contributions in 2012 while net losses for Energy—the portfolio’s lone detractor—were relatively modest. Financials and Industrials led |

GOOD IDEAS THAT WORKED

Top Contributors to 2012 Performance1 |

|

| Integrated Electrical Services | | 0.91% |

|

| Celsion Corporation | | 0.90 |

|

| Acadia Pharmaceuticals | | 0.78 |

|

| Kennedy-Wilson Holdings | | 0.66 |

|

| Virtus Investment Partners | | 0.59 |

|

| 1 Includes dividends | | |

| | | |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12 for financial reporting purposes, and as a result the net asset value originally calculated on that date and the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund normally invests in micro-cap companies, which may involve considerably more risk than investing in a more diversified portfolio of larger-cap companies. Regarding the two “Good Ideas” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s performance for 2012. |

| 12 | The Royce Funds 2012 Annual Report to Stockholders |

Performance and Portfolio Review

by a sizable margin while Consumer Discretionary, Health Care, and Information Technology also posted notable net gains. In fact, RMT’s underweight in Health Care did not stop the sector from making a meaningful positive impact—two of the Fund’s top three contributors hailed from that sector. Cancer drug developer Celsion Corporation made progress toward FDA approval for its liver cancer treatment ThermoDox, which helped its shares to soar and led us to begin reducing our position in July. During November and December we sold our position in Acadia Pharmaceuticals. Its price shot up late in November after the company announced the success of its drug Pimavanserin in treating psychosis in patients with Parkinson’s disease.

We also trimmed our stake in top contributor Integrated Electrical Services in October as its price rose. The company provides electrical contracting and maintenance services to the commercial, industrial, residential, and power line markets and also offers data communication services that include the installation of wiring for computer networks and fiber optic telecommunications systems. Its ongoing progress back to profitability seemed to attract investors, especially in the second half.

The stock price of PMFG, a business we have owned since 1994 in RMT’s portfolio, fell nearly 80% between its early February high and its 2012 low in late November, driven in large part by issuing a secondary offering priced at a sizable discount to its stock. As a manufacturer of custom products primarily for the natural gas industry, the company was also affected by declining gas prices, increased expenses, and project delays, all of which hurt earnings. Still believing in its niche business and increasingly attractive valuation, we increased our stake between February and June. Tough times for the energy industry, disappointing earnings, and insider selling back in March all helped to drive investors away from Dawson Geophysical. The company acquires and processes three-dimensional seismic data used to analyze subsurface geological conditions for potential oil and natural gas reserves. Its margins remained solid, and it boasts what we think is a highly attractive niche business, so we were happy to hold our shares throughout 2012. |

GOOD IDEAS AT THE TIME

Top Detractors from 2012 Performance1 |

|

|

| PMFG | -0.47% |

|

| Dawson Geophysical | -0.28 |

|

| Chelsea Therapeutics International | -0.25 |

|

| Sapient Corporation | -0.24 |

|

| ChinaCast Education | -0.22 |

|

| 1 Net of dividends |

| |

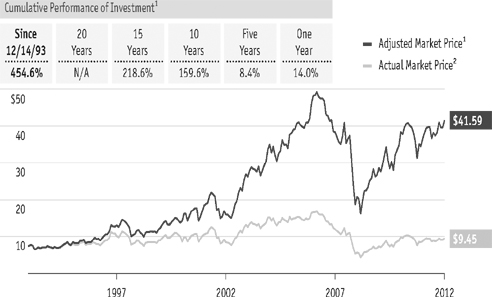

| MARKET PRICE PERFORMANCE HISTORY SINCE INCEPTION (12/14/93) through 12/31/12 |

|

|

1 Reflects the cumulative total return of an investment made by a stockholder who purchased one share at inception ($7.50 IPO), reinvested distributions and fully participated in the primary subscription of the 1994 rights offering. |

2 Reflects the actual market price of one share as it traded on the NYSE and, prior to 12/1/03, on the Nasdaq. |

| |

| FUND INFORMATION AND PORTFOLIO DIAGNOSTICS |

|

| Fund Total Net Assets | $319 million |

|

| Number of Holdings | 332 |

|

| Turnover Rate | 28% |

|

| Symbol | |

| Market Price | RMT |

| NAV | XOTCX |

|

| Net Leverage1 | 10% |

|

| Average Market Capitalization2 | $350 million |

|

| Weighted Average P/E Ratio3,4 | 15.6 |

|

| Weighted Average P/B Ratio3 | 1.4x |

|

| U.S. Investments (% of Net Assets) | 96.6% |

|

| Non-U.S. Investments (% of Net Assets) | 13.1% |

|

1 Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets. |

2 Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

3 Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

4 The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (25% of portfolio holdings as of 12/31/12). |

| |

DOWN MARKET PERFORMANCE COMPARISON

All Down Periods of 7.5% or Greater

Over the Last 7 Years, in Percentages (%) |

|

| |

|

| The Royce Funds 2012 Annual Report to Stockholders | 13 |

AVERAGE ANNUAL NAV TOTAL RETURNS

Through 12/31/12 |

|

| July-December 20121 | | 11.50 | % | |

|

| One-Year | | | | | 11.42 | | |

|

| Three-Year | | | | | 6.69 | | |

|

| Five-Year | | | | | 1.38 | | |

|

| 10-Year | | | | | 12.19 | | |

|

| 15-Year | | | | | 9.17 | | |

|

| Since Inception (11/1/96)2 | | | | | 10.04 | | |

|

| 1 Not annualized | |

2 Royce & Associates assumed investment management responsibility for the Fund on 11/1/96. |

| | | | |

| CALENDAR YEAR NAV TOTAL RETURNS | |

|

| Year | | FUND | | | Year | | | FUND | | |

|

| 2012 | | 11.4 | % | | 2004 | | | 29.3 | % | |

|

| 2011 | | -10.5 | | | 2003 | | | 54.3 | | |

|

| 2010 | | 21.8 | | | 2002 | | | -12.5 | | |

|

| 2009 | | 54.0 | | | 2001 | | | 10.0 | | |

|

| 2008 | | -42.7 | | | 2000 | | | 20.9 | | |

|

| 2007 | | 12.2 | | | 1999 | | | 8.7 | | |

|

| 2006 | | 15.8 | | | 1998 | | | -6.8 | | |

|

| 2005 | | 13.3 | | | 1997 | | | 20.5 | | |

|

| | | | | | | | | | | |

| TOP 10 POSITIONS % of Net Assets | |

|

| Western Digital | | 3.9 | % | |

|

| Analog Devices | | 3.3 | | |

|

| Berkshire Hathaway Cl. B | | 3.3 | | |

|

| Microsoft Corporation | | 3.3 | | |

|

| Mosaic Company (The) | | 3.1 | | |

|

| Franklin Resources | | 3.1 | | |

|

| Helmerich & Payne | | 2.9 | | |

|

| Exxon Mobil | | 2.9 | | |

|

| Buckle (The) | | 2.7 | | |

|

| Apple | | 2.6 | | |

|

| | | | | | | | | | | |

| PORTFOLIO SECTOR BREAKDOWN % of Net Assets | |

|

| Materials | | 29.6 | % | |

|

| Information Technology | | 18.1 | | |

|

| Financials | | 15.9 | | |

|

| Energy | | 13.1 | | |

|

| Consumer Discretionary | | 7.5 | | |

|

| Industrials | | 7.0 | | |

|

| Consumer Staples | | 4.9 | | |

|

| Health Care | | 2.0 | | |

|

| Cash and Cash Equivalents | | 1.9 | | |

|

| |

| |

| |

|

| |

Manager’s Discussion

We were very pleased with the strong second half turned in by Royce Focus Trust (FUND), even if it was not quite strong enough to give the Fund an advantage over its new benchmark for the calendar year. In 2012, FUND rose 11.4% on an NAV (net asset value) basis and 12.1% on a market price basis versus 17.9% for its new unleveraged benchmark, the Russell 2500 Index, and 16.3% for the similarly unleveraged Russell 2000 Index.

The year began on a positive note by extending the rally that began off the October 3, 2011 small-cap low. In the bullish first quarter of 2012, the Fund rose 11.0% on an NAV basis and 12.0% on a market price basis. While by each measure these were strong absolute showings, the Fund lagged both the Russell 2500, which was up 13.0%, and the Russell 2000, which rose 12.4%. Any hopes that the nearly six-month bull phase might keep running based on the slowly improving U.S. economy were dashed following an early small-cap high on March 26, 2012. Driving investors away from stocks was another round of macro worries, including anxiety over European debt and currency issues and the strength of the U.S. and Chinese economies. The effect on stock prices was predictably negative, hitting many of the Fund’s most heavily weighted, economically sensitive sectors hardest. The Fund fell 10.0% on an NAV basis and 8.3% on a market price basis in the second quarter, while for the same period the Russell 2500 lost 4.1% and the Russell 2000 fell 3.5%.

Following the June 4, 2012 small-cap low, the market shook loose of the bear. The Fund’s relative results also began to improve substantially. For the third quarter, FUND climbed 10.1% on an NAV basis and 8.4% on a market price basis, in both cases beating the Russell 2500 (+5.6%) and the Russell 2000 (+5.3%). For most small-cap and mid-cap stocks the fourth quarter was slightly rockier, particularly from mid-September through mid-November. The Fund gave up some ground to both indexes in the fourth quarter, gaining 1.3% in NAV and 0.7% in market price while the Russell 2500 rose 3.1% and the Russell 2000 was up 1.9%. Yet FUND outpaced both indexes for the second half of 2012 on both an NAV (+11.5%) and market price (+9.2%) basis. The Russell 2500 was up 8.8% during this same period, while the Russell 2000 increased 7.2%.

During the most recent full market cycle period that ran from the previous small-cap peak on July 13, 2007 through the small-cap peak on April 29, 2011, the Fund increased 10.2% on an NAV basis versus 9.2% for its new benchmark and 6.6% for the Russell 2000. On an NAV and market price basis, FUND beat both indexes for the 10-year, 15-year, and |

GOOD IDEAS THAT WORKED

Top Contributors to 2012 Performance1 |

|

| Westlake Chemical | | 1.68% |

|

| Western Digital | | 1.25 |

|

| Franklin Resources | | 1.02 |

|

| Stella-Jones | | 0.85 |

|

| Analog Devices | | 0.76 |

|

| 1 Includes dividends | | |

| | | |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund normally invests primarily in small-cap companies, which may involve considerably more risk than investing in a more diversified portfolio of larger-cap companies. Regarding the two “Good Ideas” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s performance for 2012. |

| 14 | The Royce Funds 2012 Annual Report to Stockholders |

Performance and Portfolio Review

since inception of Royce’s management (11/1/96) periods ended December 31, 2012. The Fund’s average annual NAV total return for the since inception of our management period was 10.0%.

Westlake Chemical manufactures basic chemicals, vinyls, polymers, fabricated building products, plastics, and high-end plastic films used to wrap food. Natural gas is a feedstock for much of what it produces, which gave it a huge cost advantage thanks to slumping gas prices. A founder-controlled business with conservative and intelligent management, we think its ongoing prospects remain very strong, especially in light of the fact that it has yet to see much benefit from the reviving housing industry. We did, however, take gains in August as its stock price was climbing. Top holding Western Digital makes hard drives and related products. Its stock was quite volatile in 2012, though it was relatively more stable in the second half. After announcing in April that its disk prices were lower than they had been at the beginning of the year, its shares tumbled. The company bought back shares in the aftermath, which is nearly always a positive sign to us. The firm’s earnings then surprised on the upside for the next two quarters, giving a boost to its stock price. Liking its ongoing prospects as a leader in its field, we were happy to hold a large position at the end of 2012.

Major Drilling Group International provides contract drilling services for the metals industry. Although the firm continued to operate profitably, revenue and earnings were hurt as precious metals miners pared back development projects. This in turn seemed to spark fears of a possible decrease in demand for its services. This looked to us like a case of guilt by association, so we built our position in June, August, and September. We have owned shares of steel and scrap metal recycler Schnitzer Steel Industries since 2004. Demand for recycled metals slackened amid the slow pace of growth in the U.S. Excess capacity, lower-than-normal spring scrap flows, and margins compressed from increases in raw materials and transport costs have all driven investors to keep selling while we continued to hold our shares in anticipation of a rebound in global industrial activity that we think will spark demand. |

GOOD IDEAS AT THE TIME

Top Detractors from 2012 Performance1 |

|

|

| Major Drilling Group International | -0.75% |

|

| Schnitzer Steel Industries Cl. A | -0.60 |

|

| Sprott | -0.55 |

|

| Trican Well Service | -0.53 |

|

| Newmont Mining | -0.48 |

|

| 1 Net of dividends |

| |

| MARKET PRICE PERFORMANCE HISTORY SINCE INCEPTION (11/1/96)3 through 12/31/12 |

|

|

1 Reflects the cumulative total return experience of a continuous common stockholder who reinvested all distributions and fully participated in the primary subscription of the 2005 rights offering. |

2 Reflects the actual market price of one share as it traded on Nasdaq. |

3 Royce & Associates assumed investment management responsibility for the Fund on 11/1/96. |

| |

| FUND INFORMATION AND PORTFOLIO DIAGNOSTICS |

|

| Fund Total Net Assets | $164 million |

|

| Number of Holdings | 52 |

|

| Turnover Rate | 16% |

|

| Symbol | |

| Market Price | FUND |

| NAV | XFUNX |

|

| Average Market Capitalization1 | $5,492 million |

|

| Weighted Average P/E Ratio2,3 | 14.1x |

|

| Weighted Average P/B Ratio2 | 1.8x |

|

| U.S. Investments (% of Net Assets) | 71.4% |

|

| Non-U.S. Investments (% of Net Assets) | 26.7% |

|

1 Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

2 Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings, or book value, as the case may be, of its underlying stocks. |

3 The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (8% of portfolio holdings as of 12/31/12). |

| |

DOWN MARKET PERFORMANCE COMPARISON

All Down Periods of 7.5% or Greater

Over the Last 7 Years, in Percentages(%) |

|

| |

|

| The Royce Funds 2012 Annual Report to Stockholders | 15 |

History Since Inception

The following table details the share accumulations by an initial investor in the Funds who reinvested all distributions and participated fully in primary subscriptions for each of the rights offerings. Full participation in distribution reinvestments and rights offerings can maximize the returns available to a long-term investor. This table should be read in conjunction with the Performance and Portfolio Reviews of the Funds. |

| | | | Amount | | | Purchase | | | | | | NAV | | | Market |

History | | | Invested | | | Price1 | | | Shares | | | Value2 | | | Value2 |

| Royce Value Trust |

| 11/26/86 | | | Initial Purchase | | | $ | 10,000 | | | $ | 10.000 | | | | 1,000 | | | $ | 9,280 | | | $ | 10,000 |

| 10/15/87 | | | Distribution $0.30 | | | | | | | | 7.000 | | | | 42 | | | | | | | | |

| 12/31/87 | | | Distribution $0.22 | | | | | | | | 7.125 | | | | 32 | | | | 8,578 | | | | 7,250 |

| 12/27/88 | | | Distribution $0.51 | | | | | | | | 8.625 | | | | 63 | | | | 10,529 | | | | 9,238 |

| 9/22/89 | | | Rights Offering | | | | 405 | | | | 9.000 | | | | 45 | | | | | | | | |

| 12/29/89 | | | Distribution $0.52 | | | | | | | | 9.125 | | | | 67 | | | | 12,942 | | | | 11,866 |

| 9/24/90 | | | Rights Offering | | | | 457 | | | | 7.375 | | | | 62 | | | | | | | | |

| 12/31/90 | | | Distribution $0.32 | | | | | | | | 8.000 | | | | 52 | | | | 11,713 | | | | 11,074 |

| 9/23/91 | | | Rights Offering | | | | 638 | | | | 9.375 | | | | 68 | | | | | | | | |

| 12/31/91 | | | Distribution $0.61 | | | | | | | | 10.625 | | | | 82 | | | | 17,919 | | | | 15,697 |

| 9/25/92 | | | Rights Offering | | | | 825 | | | | 11.000 | | | | 75 | | | | | | | | |

| 12/31/92 | | | Distribution $0.90 | | | | | | | | 12.500 | | | | 114 | | | | 21,999 | | | | 20,874 |

| 9/27/93 | | | Rights Offering | | | | 1,469 | | | | 13.000 | | | | 113 | | | | | | | | |

| 12/31/93 | | | Distribution $1.15 | | | | | | | | 13.000 | | | | 160 | | | | 26,603 | | | | 25,428 |

| 10/28/94 | | | Rights Offering | | | | 1,103 | | | | 11.250 | | | | 98 | | | | | | | | |

| 12/19/94 | | | Distribution $1.05 | | | | | | | | 11.375 | | | | 191 | | | | 27,939 | | | | 24,905 |

| 11/3/95 | | | Rights Offering | | | | 1,425 | | | | 12.500 | | | | 114 | | | | | | | | |

| 12/7/95 | | | Distribution $1.29 | | | | | | | | 12.125 | | | | 253 | | | | 35,676 | | | | 31,243 |

| 12/6/96 | | | Distribution $1.15 | | | | | | | | 12.250 | | | | 247 | | | | 41,213 | | | | 36,335 |

| 1997 | | | Annual distribution total $1.21 | | | | | | | | 15.374 | | | | 230 | | | | 52,556 | | | | 46,814 |

| 1998 | | | Annual distribution total $1.54 | | | | | | | | 14.311 | | | | 347 | | | | 54,313 | | | | 47,506 |

| 1999 | | | Annual distribution total $1.37 | | | | | | | | 12.616 | | | | 391 | | | | 60,653 | | | | 50,239 |

| 2000 | | | Annual distribution total $1.48 | | | | | | | | 13.972 | | | | 424 | | | | 70,711 | | | | 61,648 |

| 2001 | | | Annual distribution total $1.49 | | | | | | | | 15.072 | | | | 437 | | | | 81,478 | | | | 73,994 |

| 2002 | | | Annual distribution total $1.51 | | | | | | | | 14.903 | | | | 494 | | | | 68,770 | | | | 68,927 |

| 1/28/03 | | | Rights Offering | | | | 5,600 | | | | 10.770 | | | | 520 | | | | | | | | |

| 2003 | | | Annual distribution total $1.30 | | | | | | | | 14.582 | | | | 516 | | | | 106,216 | | | | 107,339 |

| 2004 | | | Annual distribution total $1.55 | | | | | | | | 17.604 | | | | 568 | | | | 128,955 | | | | 139,094 |

| 2005 | | | Annual distribution total $1.61 | | | | | | | | 18.739 | | | | 604 | | | | 139,808 | | | | 148,773 |

| 2006 | | | Annual distribution total $1.78 | | | | | | | | 19.696 | | | | 693 | | | | 167,063 | | | | 179,945 |

| 2007 | | | Annual distribution total $1.85 | | | | | | | | 19.687 | | | | 787 | | | | 175,469 | | | | 165,158 |

| 2008 | | | Annual distribution total $1.723 | | | | | | | | 12.307 | | | | 1,294 | | | | 95,415 | | | | 85,435 |

| 3/11/09 | | | Distribution $0.323 | | | | | | | | 6.071 | | | | 537 | | | | 137,966 | | | | 115,669 |

| 12/2/10 | | | Distribution $0.03 | | | | | | | | 13.850 | | | | 23 | | | | 179,730 | | | | 156,203 |

| 2011 | | | Annual distribution total $0.783 | | | | | | | | 13.043 | | | | 656 | | | | 161,638 | | | | 139,866 |

| 2012 | | | Annual distribution total $0.80 | | | | | | | | 13.063 | | | | 714 | | | | | | | | |

| |

| 12/31/12 | | | | | | $ | 21,922 | | | | | | | | 12,113 | | | $ | 186,540 | | | $ | 162,556 |

| |

|

1 The purchase price used for annual distribution totals is a weighted average of the distribution reinvestment prices for the year. | 2 Other than for initial purchase, values are stated as of December 31 of the year indicated, after reinvestment of distributions. |

3 Includes a return of capital. |

| 16 | The Royce Funds 2012 Annual Report to Stockholders |

The following table details the share accumulations by an initial investor in the Funds who reinvested all distributions and participated fully in primary subscriptions for each of the rights offerings. Full participation in distribution reinvestments and rights offerings can maximize the returns available to a long-term investor. This table should be read in conjunction with the Performance and Portfolio Reviews of the Funds. |

| | | | Amount | | | Purchase | | | | | | NAV | | | Market |

History | | | Invested | | | Price1 | | | Shares | | | Value2 | | | Value2 |

| Royce Micro-Cap Trust |

| 12/14/93 | | | Initial Purchase | | | $ | 7,500 | | | $ | 7.500 | | | | 1,000 | | | $ | 7,250 | | | $ | 7,500 |

| 10/28/94 | | | Rights Offering | | | | 1,400 | | | | 7.000 | | | | 200 | | | | | | | | |

| 12/19/94 | | | Distribution $0.05 | | | | | | | | 6.750 | | | | 9 | | | | 9,163 | | | | 8,462 |

| 12/7/95 | | | Distribution $0.36 | | | | | | | | 7.500 | | | | 58 | | | | 11,264 | | | | 10,136 |

| 12/6/96 | | | Distribution $0.80 | | | | | | | | 7.625 | | | | 133 | | | | 13,132 | | | | 11,550 |

| 12/5/97 | | | Distribution $1.00 | | | | | | | | 10.000 | | | | 140 | | | | 16,694 | | | | 15,593 |

| 12/7/98 | | | Distribution $0.29 | | | | | | | | 8.625 | | | | 52 | | | | 16,016 | | | | 14,129 |

| 12/6/99 | | | Distribution $0.27 | | | | | | | | 8.781 | | | | 49 | | | | 18,051 | | | | 14,769 |

| 12/6/00 | | | Distribution $1.72 | | | | | | | | 8.469 | | | | 333 | | | | 20,016 | | | | 17,026 |

| 12/6/01 | | | Distribution $0.57 | | | | | | | | 9.880 | | | | 114 | | | | 24,701 | | | | 21,924 |

| 2002 | | | Annual distribution total $0.80 | | | | | | | | 9.518 | | | | 180 | | | | 21,297 | | | | 19,142 |

| 2003 | | | Annual distribution total $0.92 | | | | | | | | 10.004 | | | | 217 | | | | 33,125 | | | | 31,311 |

| 2004 | | | Annual distribution total $1.33 | | | | | | | | 13.350 | | | | 257 | | | | 39,320 | | | | 41,788 |

| 2005 | | | Annual distribution total $1.85 | | | | | | | | 13.848 | | | | 383 | | | | 41,969 | | | | 45,500 |

| 2006 | | | Annual distribution total $1.55 | | | | | | | | 14.246 | | | | 354 | | | | 51,385 | | | | 57,647 |

| 2007 | | | Annual distribution total $1.35 | | | | | | | | 13.584 | | | | 357 | | | | 51,709 | | | | 45,802 |

| 2008 | | | Annual distribution total $1.193 | | | | | | | | 8.237 | | | | 578 | | | | 28,205 | | | | 24,807 |

| 3/11/09 | | | Distribution $0.223 | | | | | | | | 4.260 | | | | 228 | | | | 41,314 | | | | 34,212 |

| 12/2/10 | | | Distribution $0.08 | | | | | | | | 9.400 | | | | 40 | | | | 53,094 | | | | 45,884 |

| 2011 | | | Annual distribution total $0.533 | | | | | | | | 8.773 | | | | 289 | | | | 49,014 | | | | 43,596 |

| 2012 | | | Annual distribution total $0.51 | | | | | | | | 9.084 | | | | 285 | | | | | | | | |

| |

|

| 12/31/12 | | | | | | $ | 8,900 | | | | | | | | 5,256 | | | $ | 57,501 | | | $ | 49,669 |

| |

|

| Royce Focus Trust |

| 10/31/96 | | | Initial Purchase | | | $ | 4,375 | | | $ | 4.375 | | | | 1,000 | | | $ | 5,280 | | | $ | 4,375 |

| 12/31/96 | | | | | | | | | | | | | | | | | | | 5,520 | | | | 4,594 |

| 12/5/97 | | | Distribution $0.53 | | | | | | | | 5.250 | | | | 101 | | | | 6,650 | | | | 5,574 |

| 12/31/98 | | | | | | | | | | | | | | | | | | | 6,199 | | | | 5,367 |

| 12/6/99 | | | Distribution $0.145 | | | | | | | | 4.750 | | | | 34 | | | | 6,742 | | | | 5,356 |

| 12/6/00 | | | Distribution $0.34 | | | | | | | | 5.563 | | | | 69 | | | | 8,151 | | | | 6,848 |

| 12/6/01 | | | Distribution $0.14 | | | | | | | | 6.010 | | | | 28 | | | | 8,969 | | | | 8,193 |

| 12/6/02 | | | Distribution $0.09 | | | | | | | | 5.640 | | | | 19 | | | | 7,844 | | | | 6,956 |

| 12/8/03 | | | Distribution $0.62 | | | | | | | | 8.250 | | | | 94 | | | | 12,105 | | | | 11,406 |

| 2004 | | | Annual distribution total $1.74 | | | | | | | | 9.325 | | | | 259 | | | | 15,639 | | | | 16,794 |

| 5/6/05 | | | Rights offering | | | | 2,669 | | | | 8.340 | | | | 320 | | | | | | | | |

| 2005 | | | Annual distribution total $1.21 | | | | | | | | 9.470 | | | | 249 | | | | 21,208 | | | | 20,709 |

| 2006 | | | Annual distribution total $1.57 | | | | | | | | 9.860 | | | | 357 | | | | 24,668 | | | | 27,020 |

| 2007 | | | Annual distribution total $2.01 | | | | | | | | 9.159 | | | | 573 | | | | 27,679 | | | | 27,834 |

| 2008 | | | Annual distribution total $0.473 | | | | | | | | 6.535 | | | | 228 | | | | 15,856 | | | | 15,323 |

| 3/11/09 | | | Distribution $0.093 | | | | | | | | 3.830 | | | | 78 | | | | 24,408 | | | | 21,579 |

| 12/31/10 | | | | | | | | | | | | | | | | | | | 29,726 | | | | 25,806 |

| 2011 | | | Annual distribution total $0.413 | | | | | | | | 6.894 | | | | 207 | | | | 26,614 | | | | 22,784 |

| 2012 | | | Annual distribution total $0.46 | | | | | | | | 6.686 | | | | 255 | | | | | | | | |

| |

|

| 12/31/12 | | | | | | $ | 7,044 | | | | | | | | 3,871 | | | $ | 29,652 | | | $ | 25,549 |

| |

|

1 The purchase price used for annual distribution totals is a weighted average of the distribution reinvestment prices for the year. | 2 Other than for initial purchase, values are stated as of December 31 of the year indicated, after reinvestment of distributions. |

3 Includes a return of capital. |

| The Royce Funds 2012 Annual Report to Stockholders | 17 |

Distribution Reinvestment and Cash Purchase Options

Why should I reinvest my distributions?

By reinvesting distributions, a stockholder can maintain an undiluted investment in the Fund. The regular reinvestment of distributions has a significant impact on stockholder returns. In contrast, the stockholder who takes distributions in cash is penalized when shares are issued below net asset value to other stockholders.

How does the reinvestment of distributions from the Royce closed-end funds work?

The Funds automatically issue shares in payment of distributions unless you indicate otherwise. The shares are generally issued at the lower of the market price or net asset value on the valuation date.

How does this apply to registered stockholders?

If your shares are registered directly with a Fund, your distributions are automatically reinvested unless you have otherwise instructed the Funds’ transfer agent, Computershare, in writing. A registered stockholder also has the option to receive the distribution in the form of a stock certificate or in cash if Computershare is properly notified.

What if my shares are held by a brokerage firm or a bank?

If your shares are held by a brokerage firm, bank, or other intermediary as the stockholder of record, you should contact your brokerage firm or bank to be certain that it is automatically reinvesting distributions on your behalf. If they are unable to reinvest distributions on your behalf, you should have your shares registered in your name in order to participate.

What other features are available for registered stockholders?

The Distribution Reinvestment and Cash Purchase Plans also allow registered stockholders to make optional cash purchases of shares of a Fund’s common stock directly through Computershare on a monthly basis, and to deposit certificates representing your Fund shares with Computershare for safekeeping. The Funds’ investment adviser is absorbing all commissions on optional cash purchases under the Plans through December 31, 2012.

How do the Plans work for registered stockholders?

Computershare maintains the accounts for registered stockholders in the Plans and sends written confirmation of all transactions in the account. Shares in the account of each participant will be held by Computershare in non-certificated form in the name of the participant, and each participant will be able to vote those shares at a stockholder meeting or by proxy. A participant may also send other stock certificates held by them to Computershare to be held in non-certificated form. There is no service fee charged to participants for reinvesting distributions. If a participant elects to sell shares from a Plan account, Computershare will deduct a $2.50 fee plus brokerage commissions from the sale transaction. If a nominee is the registered owner of your shares, the nominee will maintain the accounts on your behalf.

How can I get more information on the Plans?

You can call an Investor Services Representative at (800) 221-4268 or you can request a copy of the Plan for your Fund from Computershare. All correspondence (including notifications) should be directed to: [Name of Fund] Distribution Reinvestment and Cash Purchase Plan, c/o Computershare, PO Box 43010, Providence, RI 02940-3010, telephone (800) 426-5523.

|

| 18 | The Royce Funds 2012 Annual Report to Stockholders |

| Royce Value Trust | December 31, 2012 |

|

| |

| Schedule of Investments |

| | | SHARES | | | VALUE |

| | | | | | | |

COMMON STOCKS – 105.8% | | | | | | |

| | | | | | | |

Consumer Discretionary – 13.9% | | | | | | |

Auto Components - 0.4% | | | | | | |