EXHIBIT 99.31

Alliance Capital and Alliance Holding

Third Quarter 2002 Review

Bruce W. Calvert | | John D. Carifa | | Lewis A. Sanders |

Chairman and CEO | | President and COO | | Vice Chairman and CIO |

| | | | |

| | | | |

| | | | |

| | October 31, 2002 | | |

Introduction

The SEC adopted Regulation FD in October 2000. In light of Regulation FD, Management will be limited in responding to inquiries from investors or analysts in a non-public forum. You are encouraged to ask all questions of a material nature on this conference call.

Forward-Looking Statements

Certain statements provided by Alliance Capital Management L.P. (“Alliance Capital”) and Alliance Capital Management Holding L.P. (“Alliance Holding”) in this report are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, uncertainties and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The most significant of such factors include, but are not limited to, the following: the performance of financial markets, the investment performance of Alliance Capital’s sponsored investment products and separately managed accounts, general economic conditions, future acquisitions, competitive conditions, and government regulations, including changes in tax rates. Alliance Capital and Alliance Holding caution readers to carefully consider such factors. Further, such forward-looking statements speak only as of the date on which such statements are made; Alliance Capital and Alliance Holding undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Third Quarter Financial Overview

Alliance Capital | | 3Q02 vs. 3Q01 |

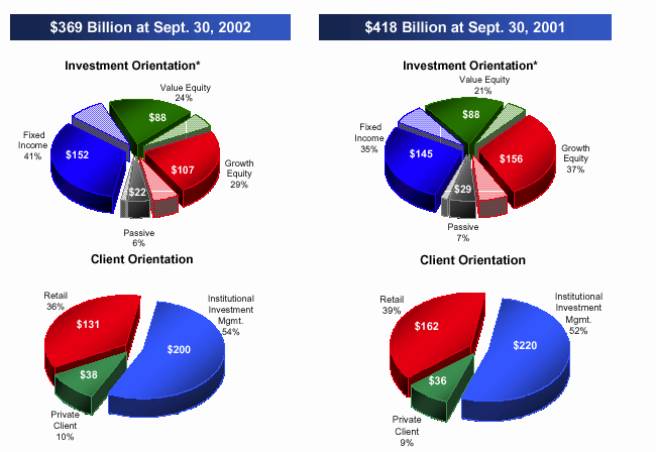

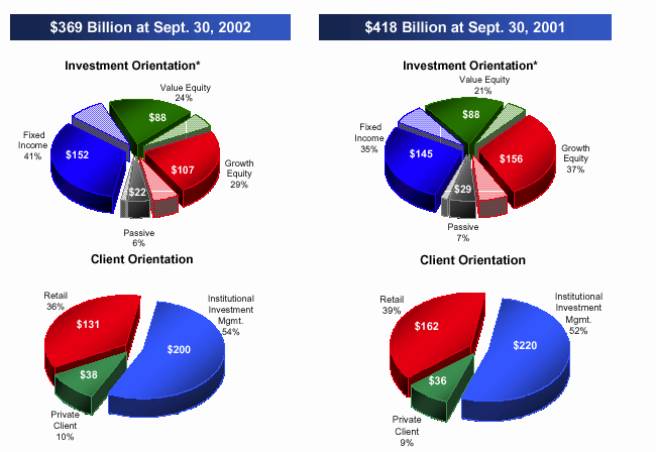

• Sept. 30, 2002 AUM | | $369 bn vs. $418 bn, down 11.8% |

| | |

• Market Environment | | S&P 500 down 20.5% |

(12 Months) | | Russell 1000 Growth down 22.5% |

| | Russell 1000 Value down 17.0% |

| | Lehman Aggr. Bond up 8.6% |

| | |

• Net Asset Outflows | | Net outflows in Retail partially offset by positive |

| | inflows in Institutional and Private Client |

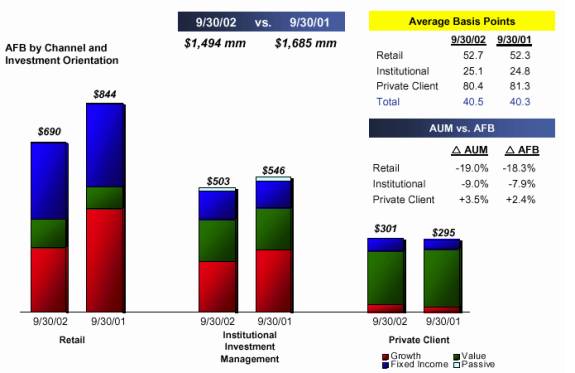

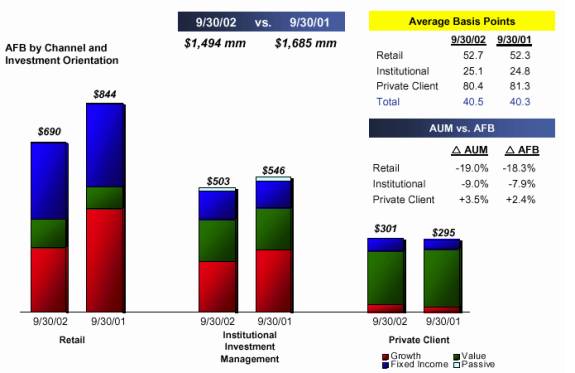

• Annualized Fee Base | | $1,494 mm vs. $1,685 mm, down 11.3% |

| | |

• Average AUM | | $391 bn vs. $446 bn, down 12.3% |

| | |

• Revenues | | $650 mm vs. $725 mm, down 10.4% |

| | |

• Operating Expenses | | $506 mm vs. $521 mm, down 2.9% |

| | |

• Net Operating Earnings | | $137 mm vs. $194 mm, down 29.6% |

Declining Market Values Dominate

Growth Equity & Cash Mgmt. Outflows Partially Offset by Value Equity &

Long-Term Fixed Income Inflows

AUM by Investment Orientation: Three Months Ended Sept. 30, 2002

| | Growth

Equity | | Value

Equity | | Fixed

Income | | Passive | | Total | |

• June 2002 AUM | | $ | 133 | | $ | 104 | | $ | 149 | | $ | 26 | | $ | 412 | |

| | | | | | | | | | | |

• Net Long-Term Flows | | (6 | ) | 2 | | 2 | | – | | (2 | ) |

| | | | | | | | | | | |

• Cash Management, Net | | – | | – | | (2 | ) | – | | (2 | ) |

| | | | | | | | | | | |

• Net New Business/(Outflows) | | (6 | ) | 2 | | – | | – | | (4 | ) |

| | | | | | | | | | | |

• Transfers | | (1 | ) | 1 | | – | | – | | – | |

| | | | | | | | | | | |

• Apprec/(Deprec) | | (19 | ) | (19 | ) | 3 | | (4 | ) | (39 | ) |

| | | | | | | | | | | |

• Sept. 2002 AUM | | $ | 107 | | $ | 88 | | $ | 152 | | $ | 22 | | $ | 369 | |

| | | | | | | | | | | |

• % Change | | -19.5 | % | -15.5 | % | +1.7 | % | -16.1 | % | -10.6 | % |

Net Outflows in Retail Partially Offset by Institutional &

Private Client Inflows

AUM by Channel: Three Months Ended Sept. 30, 2002

| | Retail | | Institutional

Inv Mgmt | | Private

Client | | Total | |

• June 2002 AUM | | $ | 150 | | $ | 222 | | $ | 40 | | $ | 412 | |

| | | | | | | | | |

• Net Long-Term Flows | | (5 | ) | 1 | | 2 | | (2 | ) |

| | | | | | | | | |

• Cash Management, Net | | (2 | ) | – | | – | | (2 | ) |

| | | | | | | | | |

• Net New Business/(Outflows) | | (7 | ) | 1 | | 2 | | (4 | ) |

| | | | | | | | | |

• Apprec/(Deprec) | | (12 | ) | (23 | ) | (4 | ) | (39 | ) |

| | | | | | | | | |

• Sept. 2002 AUM | | $ | 131 | | $ | 200 | | $ | 38 | | $ | 369 | |

| | | | | | | | | |

• % Change | | -12.6 | % | -10.0 | % | -7.1 | % | -10.6 | % |

| | | | | | | | | | | | | | |

About Alliance Capital – AUM by Investment and Client Orientation

Amounts in $ billions. Equity includes balanced portfolios AUM. | |

|

Continued Challenging Market Environment

In Third Quarter, Growth Begins to Outperform Value

| | Cumulative | | | Annualized | |

| | 3Q02 | | YTD | | 1 Yr | | 3 Yr | | 5 Yr | | 3 Yr | | 5 Yr | |

S&P 500 | | -17.3 | % | -28.2 | % | -20.5 | % | -33.9 | % | -7.9 | % | -12.9 | % | -1.6 | % |

| | | | | | | | | | | | | | | |

Russell 1000 Growth | | -15.1 | % | -32.7 | % | -22.5 | % | -48.0 | % | -22.1 | % | -19.6 | % | -4.9 | % |

| | | | | | | | | | | | | | | |

Russell 1000 Value | | -18.8 | % | -22.7 | % | -17.0 | % | -17.6 | % | 1.3 | % | -6.3 | % | 0.3 | % |

| | | | | | | | | | | | | | | |

Lehman Aggr Bond | | 4.6 | % | 8.6 | % | 8.6 | % | 31.2 | % | 45.8 | % | 9.5 | % | 7.8 | % |

Returns through September 30, 2002

Declining Market Values Swamp Modest Net Flows

Long-Term Value & Fixed Income Inflows Offset Growth Equity & Cash Mgt Outflows

AUM by Investment Orientation: Twelve Months Ended Sept. 30, 2002

| | Growth Equity | | Value Equity | | Fixed Income | | Passive | | Total | |

• Sept. 2001 AUM* | | $ | 156 | | $ | 88 | | $ | 145 | | $ | 29 | | $ | 418 | |

| | | | | | | | | | | |

• Net Long-Term Flows | | (14 | ) | 10 | | 13 | | (3 | ) | 6 | |

| | | | | | | | | | | |

• Cash Management, Net | | – | | – | | (9 | ) | – | | (9 | ) |

| | | | | | | | | | | |

• Net New Business/(Outflows) | | (14 | ) | 10 | | 4 | | (3 | ) | (3 | ) |

| | | | | | | | | | | |

• Transfers | | (4 | ) | 4 | | – | | – | | – | |

| | | | | | | | | | | |

• Apprec/(Deprec) | | (31 | ) | (14 | ) | 3 | | (4 | ) | (46 | ) |

| | | | | | | | | | | |

• Sept. 2002 AUM | | $ | 107 | | $ | 88 | | $ | 152 | | $ | 22 | | $ | 369 | |

| | | | | | | | | | | |

• % Change | | -31.0 | % | -0.3 | % | +4.3 | % | -23.8 | % | -11.8 | % |

* AUM previously reported as of each date prior to March 31, 2002, have been restated to reflect the reclassification of institutional cash management and sub-advised variable annuity accounts from Institutional Investment Management to Retail and certain Private Client accounts to Retail and Institutional Investment Management. AUM now also excludes assets managed by unconsolidated affiliates.

In $ billions.

Market Depreciation & Cash Mgmt. Outflows Overwhelm

Institutional & Private Client Inflows

AUM by Channel: Twelve Months Ended Sept. 30, 2002

| | Retail | | Institutional

Inv Mgmt | | Private

Client | | Total | |

• Sept. 2001 AUM* | | $ | 162 | | $ | 220 | | $ | 36 | | $ | 418 | |

| | | | | | | | | |

• Net Long-Term Flows | | (3 | ) | 5 | | 4 | | 6 | |

| | | | | | | | | |

• Cash Management, Net | | (9 | ) | – | | – | | (9 | ) |

| | | | | | | | | |

• Net New Business/(Outflows) | | (12 | ) | 5 | | 4 | | (3 | ) |

| | | | | | | | | |

• Transfers | | 1 | | (1 | ) | – | | – | |

| | | | | | | | | |

• Apprec/(Deprec) | | (20 | ) | (24 | ) | (2 | ) | (46 | ) |

| | | | | | | | | |

• Sept. 2002 AUM | | $ | 131 | | $ | 200 | | $ | 38 | | $ | 369 | |

| | | | | | | | | |

• % Change | | -19.0 | % | -9.0 | % | +3.5 | % | -11.8 | % |

* AUM previously reported as of each date prior to March 31, 2002, have been restated to reflect the reclassification of institutional cash management and sub-advised variable annuity accounts from Institutional Investment Management to Retail and certain Private Client accounts to Retail and Institutional Investment Management. AUM now also excludes assets managed by unconsolidated affiliates.

In $ billions.

Annualized Fee Base (1)

(1) Annualized Fee Base is defined as period end AUM times contractual annual fee rates; assumes no change in AUM or fee rates for one year. In $ millions

Alliance Capital Third Quarter Financial Overview

| | 3Q02 | | 3Q01 | | % chg |

• Average AUM | | $ | 391 | | $ | 446 | | -12 |

| | | | | | |

• Revenues | | | | | | |

Base Fee & Other | | $ | 530 | | $ | 582 | | -9 |

Performance Fee | | 11 | | 9 | | +27 |

Distribution | | 109 | | 134 | | -19 |

| | 650 | | 725 | | -10 |

• Expenses | | | | | | |

Compensation | | 222 | | 219 | | +1 |

Distribution (1) | | 151 | | 164 | | -8 |

Other (1) | | 140 | | 148 | | -5 |

| | 513 | | 531 | | -3 |

• Net Operating Earnings | | $ | 137 | | $ | 194 | | -30 |

| | | | | | |

• Base Fee Earnings | | $ | 129 | | $ | 187 | | -32 |

• Performance Fee Earnings | | 8 | | 7 | | +23 |

• Net Operating Earnings | | $ | 137 | | $ | 194 | | -30 |

| | | | | | | | | | |

(1) Distribution includes distribution plan payments and amortization of deferred sales commissions. Distribution and other reflects reclassification of revenue sharing payments of $11 mm in 3Q02 and $14 mm in 3Q01 from distribution plan payments to other promotion and servicing expense.

In $ millions, except AUM in $ billions.

Third Quarter Revenues – by Distribution Channel

| | 3Q02 | | 3Q01 | | % chg | | Comments |

• Retail | | $ | 318 | | $ | 390 | | -19 | | • Continued unfavorable environment for equities decreases AUM and base fee revenues |

| | | | | | | | |

• Institutional Inv. Mgmt | | 149 | | 163 | | -9 | | • Revenues decline with average AUM |

| | | | | | | | |

• Private Client | | 103 | | 95 | | +8 | | • Strong new business flows |

| | | | | | | | |

• Institutional Research Svcs. | | 76 | | 64 | | +19 | | • Higher NYSE volume and new business in Europe |

| | | | | | | | |

• Other | | 4 | | 13 | | -66 | | • Lower interest rates |

| | | | | | | | |

• Total | | $ | 650 | | $ | 725 | | -10 | | |

Amounts in $ millions.

Expense Detail

| | 3Q02 | | 3Q01 | | % chg | | Comments |

•Employee Comp. & Benefits | | | | | | | | |

Base Compensation | | $ | 75 | | $ | 80 | | -6 | | •Headcount down 6% |

Incentive Compensation | | | | | | | | |

Cash | | 46 | | 59 | | -23 | | •Lower operating earnings |

Deferred | | 23 | | 8 | | + 198 | | •Second tranche of SCB grant |

Commissions | | 60 | | 51 | | +16 | | •Private Client & Sell-Side |

Other | | 18 | | 21 | | -12 | | offset by lower retail |

| | 222 | | 219 | | +1 | | |

| | | | | | | | |

•Promotion & Servicing | | | | | | | | |

Distribution Plan Pmts (1) | | 95 | | 107 | | -11 | | • |

Amort of Def Sales Comm | | 56 | | 57 | | -2 | | • |

T & E | | 13 | | 16 | | -18 | | • |

Printing/Mailing | | 7 | | 11 | | -33 | | • Continued reductions in

controllable expenses |

Other (1) | | 26 | | 30 | | -12 | | • |

| | 197 | | 221 | | -11 | | • |

| | | | | | | | |

•General & Admin | | | | | | | | |

Office Expense | | 42 | | 38 | | +10 | | •3Q02 sublease charge |

Other | | 42 | | 38 | | +9 | | |

| | 84 | | 76 | | +10 | | |

| | | | | | | | |

•Interest and Taxes | | 10 | | 15 | | -31 | | •Lower debt/pre-tax earnings |

| | | | | | | | |

•Total | | $ | 513 | | $ | 531 | | -3 | | |

(1) Reflects reclassification of revenue sharing payments of $11 mm in 3Q02 and $14 mm in 3Q01 from distribution plan payments to other promotion and servicing expense. Amounts in $ millions.

Net Distribution Expense

| | 3Q02 | | 3Q01 | | % chg | |

•Distribution Revenues | | $ | 109 | | $ | 134 | | -19 | |

| | | | | | | |

•Distribution Expenses | | | | | | | |

Distribution Plan Payments (1) | | 95 | | 107 | | -11 | |

Amort. of Deferred Sales Comm. | | 56 | | 57 | | -2 | |

| | 151 | | 164 | | -8 | |

| | | | | | | |

•Net Distribution Expense | | $ | 42 | | $ | 30 | | +40 | |

· Lower average retail AUM in growth equity and technology products led decline in distribution revenues

(1) Reflects reclassification of revenue sharing payments of $11 mm in 3Q02 and $14 mm in 3Q01 from distribution plan payments to other promotion and servicing expense.

Amounts in $ millions.

Alliance Capital Pre-tax Operating Margin

| | 3Q02 | | % of Rev (1) | | 3Q01 | | % of Rev (1) | |

•Base Fee Earnings, Net | | $ | 168 | | 31.0 | % | $ | 221 | | 37.3 | % |

| | | | | | | | | |

•Distribution Expense, Net (2) | | (33 | ) | -6.1 | | (24 | ) | -4.0 | |

| | | | | | | | | |

•Performance Fee Earnings, Net | | 8 | | 1.6 | | 7 | | 1.2 | |

| | | | | | | | | |

•Pre-tax Operating Earnings | | $ | 143 | | 26.5 | % | $ | 204 | | 34.5 | % |

· Decline in margins due to lower base fees and higher net distribution, principally from declining markets, and higher deferred compensation and a one-time office space charge related to SCB acquisition

(1) Excludes distribution revenues.

(2) Net distribution expense and net performance fee earnings include allocations of incentive compensation.

Alliance Holding Third Quarter Financial Overview

| | 3Q02 | | 3Q01 | | % chg | |

•Diluted Net Income | | $ | 0.45 | | $ | 0.51 | | -12 | % |

| | | | | | | |

•Amortization of Intangibles & Goodwill | | 0.02 | | 0.17 | | -88 | |

| | | | | | | |

•Net Operating Earnings | | $ | 0.47 | | $ | 0.68 | | -31 | % |

| | | | | | | |

•Base Fee Earnings | | $ | 0.44 | | $ | 0.66 | | -33 | % |

| | | | | | | |

•Performance Fee Earnings | | 0.03 | | 0.02 | | +50 | |

| | | | | | | |

•Net Operating Earnings | | $ | 0.47 | | $ | 0.68 | | -31 | % |

| | | | | | | |

•Distribution | | $ | 0.46 | | $ | 0.67 | | -31 | % |

Per Unit amounts

Deferred Sales Commissions

• Payments made to financial intermediaries from the sale of back-end load shares are capitalized as Deferred Sales Commissions (DSC)

• DSC asset is recovered through future incremental 12b-1 fees paid by funds and contingent deferred sales charge (“CDSC”) paid by investors at time of redemption

• Future fees and CDSC are contingent upon future market levels and redemption rates

• Amortized over the estimated recovery period of 5.5 years

DSC Asset Impairment

• Management evaluates asset for impairment on a periodic basis

• Estimates of future fees and CDSC are based on a range of management assumptions of market levels and redemption rates during the recovery period

• If future fees and CDSC are less than the DSC asset and management estimates the amount is not fully recoverable, an impairment loss is recognized for the difference between the DSC asset and its estimated fair value

• Estimated fair value is determined using discounted future fees and CDSC

• An impairment loss decreases current period earnings but increases future period earnings in an equal amount over the next 3-5 years

DSC Asset Status

• No impairment at September 30, 2002

• Although markets have improved in October, a return to declining market levels and higher redemption rates will increase the risk of impairment

FAS 123: Accounting for Stock-Based Compensation

• Alliance Capital intends to voluntarily adopt the fair value method of recording expenses relating to employee Unit options in the fourth quarter of 2002, as permitted by FASB Statement No. 123, Accounting for Stock-Based Compensation

• Change will apply to all employee Unit options awarded subsequent to December 31, 2001

• Not expected to have a material impact on net income or net operating earnings of Alliance Capital or Alliance Holding for full year 2002 or 2003

Retail 3Q02 Overview

• Net long-term outflows of $4.4 billion primarily in growth equity funds

• $1.1 billion in outflows attributed to liquidation of EPTA Italy portfolio

• $2.1 billion in cash management net outflows

• Positive net flows in AllianceBernstein and Luxembourg funds

• Equity portfolios performance generally mixed

• 529 CollegeBoundfundSM savings plan remains largest in the country with $2.2 billion in AUM

• Number of accounts increased by 9%; currently over 300,000 accounts

Initiatives for 2003:

• Continued focus on performance and delivering value to customers

• Continue to emphasize CollegeBoundfundSM for educational savings

• Continue to develop style-balanced and alternative growth products

• Continue to control expenses

Retail Net Outflows

| | 3Q02 | | Comments | |

• U.S. | | $ | (1,329 | ) | • Increased US redemptions in growth products | |

| | | | | |

• Luxembourg | | 55 | | • Continued strength in non-US funds | |

| | | | | |

• Other Non-U.S. | | (1,098 | ) | • $1.1 Billion in outflows from liquidation of remaining EPTA Italy portfolio | |

| | | | | |

• Variable/Sub-Advised | | (1,424 | ) | | |

| | | | | |

• Managed Accounts | | (619 | ) | | |

| | | | | |

• Net Long-term Outflows | | (4,415 | ) | | |

| | | | | |

• Cash Management | | (2,097 | ) | • Cash mgmt outflows attributed to industry consolidation | |

| | | | | |

• Total Net Outflows | | $ | (6,512 | ) | | |

In $ millions.

Relative Performance – Retail Growth Equity

Retail Mutual Funds vs. Lipper Averages |

| | Premier Growth (1) | | Growth (2) | | Tech (3) | | Health-

Care (4) | | Int’l

Premier (5) | | Global

Gr Trd (6) | |

QTR | | +0.2 | | +3.0 | | -1.5 | | +2.0 | | -1.5 | | -1.9 | |

| | | | | | | | | | | | | |

YTD | | -2.2 | | +3.4 | | +1.6 | | +14.4 | | -4.2 | | -2.0 | |

| | | | | | | | | | | | | |

1yr | | -4.7 | | +3.4 | | +2.1 | | +10.6 | | -0.7 | | -1.5 | |

| | | | | | | | | | | | | |

3yr | | -3.9 | | -1.6 | | +4.9 | | -4.6 | | -3.5 | | +5.7 | |

| | | | | | | | | | | | | |

5yr | | -1.0 | | -2.4 | | +0.5 | | – | | – | | +5.8 | |

| | | | | | | | | | | | | |

10yr | | +1.6 | | +0.7 | | +2.3 | | – | | – | | +7.0 | |

(1) vs. Large Cap Growth average (2) vs. Multi Cap Growth average (3) vs. Science and Technology average (4) vs. Health/Biotechnology average (5) vs. International average (6) vs. Global Growth average

Source: Alliance Capital and Lipper

Mutual fund performance and Lipper data through 9/30/02.

Relative Performance – Retail Value Equity

Retail Mutual Funds vs. Lipper Averages |

| | AB

Value (1) | | Growth &

Income (2) | | Small Cap

Value (3) | | RE Inv (4) | | Intl

Value (5) | | Global

Value (6) | | Balanced (7) |

QTR | | -0.3 | | -1.2 | | -2.4 | | +0.1 | | -1.4 | | -3.0 | | +1.2 |

| | | | | | | | | | | | | | |

YTD | | +2.9 | | -6.8 | | +2.6 | | -0.1 | | +7.5 | | +0.7 | | 0.0 |

| | | | | | | | | | | | | | |

1yr | | +0.7 | | -5.9 | | +4.2 | | -0.3 | | +11.2 | | -2.0 | | -0.2 |

| | | | | | | | | | | | | | |

3yr | | – | | +1.0 | | – | | -0.4 | | – | | – | | +4.5 |

| | | | | | | | | | | | | | |

5yr | | – | | +3.1 | | – | | -1.3 | | – | | – | | +3.2 |

| | | | | | | | | | | | | | |

10yr | | – | | +1.3 | | – | | – | | – | | – | | +1.0 |

(1) vs. Multi Cap Value average (2) vs. Large Cap Value average (3) vs. Mid Cap Value average (4) vs. Real Estate average (5) vs. International average (6) vs. Global average (7) vs. Balanced average

Source: Alliance Capital and Lipper

Mutual fund performance and Lipper data through 9/30/02.

AllianceBernstein Institutional Investment Mgmt

3Q02 Overview

• Net inflows of $1.0 billion

• 70 new account wins representing $4.8 billion in AUM across a broad range of disciplines

• Seeing benefits of Alliance Bernstein combination; year-to-date new accounts balanced among growth, value and fixed income products

• Non-U.S. business strong, particularly in Canada, UK, Japan and Australia

• Relative performance in growth products generally improved while value products remained mixed for the quarter; long-term results remain competitive

Initiatives for 2003:

• Continued focus on performance, business development and maintaining high level of client service

• Focus on international markets, especially Japan, UK, Europe and Australia

• Continue to pursue cross-selling opportunities to existing clients

Institutional Investment Management Net New Business

| | 3Q02 | | Comments |

• Growth | | $ | (2,145 | ) | • Continuing shift out of growth portfolios |

| | | | |

• Value | | 1,761 | | • |

| | | | Global value and fixed income flows particularly |

• Fixed Income | | 1,155 | | • strong, especially in non-US markets |

| | | | |

• Passive | | 180 | | |

| | | | |

• Total Net New Business | | $ | 951 | | |

In $ millions.

Relative Performance (1) – Institutional Growth Equity

Institutional Equity Composites vs. Benchmarks

| | Large Cap Growth (2) | | Disciplined Growth (2) | | Multi Cap Growth (3) | | Small Cap Growth (4) | | Intl Lg Cap Growth (5) | | Emerging Market

Growth (6) |

QTR | | +0.9 | | +0.2 | | +2.8 | | +1.3 | | -1.7 | | +2.7 |

| | | | | | | | | | | | |

YTD | | +1.1 | | -2.0 | | +4.6 | | +1.7 | | -1.8 | | +6.0 |

| | | | | | | | | | | | |

1yr | | 0.0 | | -1.8 | | +6.7 | | +1.3 | | +0.9 | | +10.5 |

| | | | | | | | | | | | |

3yr | | +2.4 | | -0.5 | | +3.0 | | +11.9 | | +5.0 | | +6.3 |

| | | | | | | | | | | | |

5yr | | +3.3 | | -0.1 | | +1.2 | | +6.0 | | +4.1 | | +4.5 |

| | | | | | | | | | | | |

10yr | | +2.9 | | +0.9 | | +2.2 | | +7.3 | | +3.7 | | +2.9 |

(1) Investment performance of composites are after investment management fees.

(2) vs. Russell 1000 Growth (3) vs. Russell 3000 Growth (4) vs. Russell 2000 Growth (5) vs. MSCI EAFE Growth (6) vs. MSCI Emerging Markets Free

Composite and benchmark data through 9/30/02.

See Performance Disclosure

Relative Performance (1) – Institutional Value Equity

Institutional Equity Composites vs. Benchmarks

| | Strategic Value (2) | | Diversified Value (3) | | Relative

Value (2) | | Small- Mid Cap Value (4) | | International Value (5)* | | Emerging Market

Value (6)* | |

QTR | | -1.6 | | -0.8 | | +1.1 | | -2.9 | | +1.2 | | +3.6 | |

| | | | | | | | | | | | | |

YTD | | -3.1 | | +4.7 | | -6.1 | | -1.3 | | +6.1 | | +10.3 | |

| | | | | | | | | | | | | |

1yr | | -0.2 | | +4.2 | | -3.5 | | -0.3 | | +8.3 | | +3.2 | |

| | | | | | | | | | | | | |

3yr | | +3.1 | | +8.2 | | +1.5 | | – | | +4.5 | | +3.6 | |

| | | | | | | | | | | | | |

5yr | | -0.7 | | +2.3 | | +1.4 | | – | | +2.4 | | +3.1 | |

| | | | | | | | | | | | | |

10yr | | +1.6 | | +1.7 | | – | | – | | +2.1 | | – | |

(1) Investment performance of composites are after investment management fees.

(2) vs. Russell 1000 Value (3) vs. S&P 500 (4) vs. Russell 2500 Value (5) vs. MSCI EAFE Value (6) vs. MSCI Emerging Markets Free

* Preliminary returns

Composite and benchmark data through 9/30/02.

See Performance Disclosure

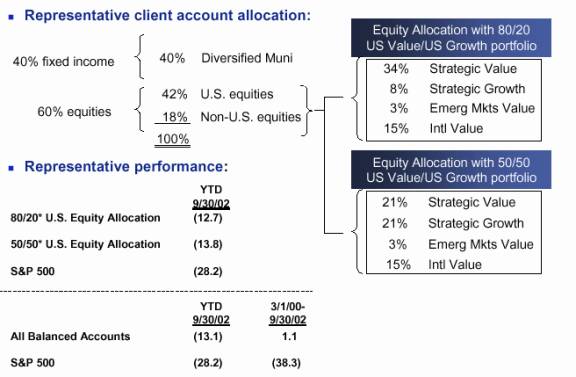

Private Client 3Q02 Overview

Bernstein Investment Research & Management

• One of the strongest quarters of net new business totaling $1.3 billion; on track for record year

• 600 new client relationships; over 19,000 in total

• Competitive relative performance; clients remain in balanced portfolios, continuing to retain their wealth

Initiatives for 2003

• Capitalize on resource commitments made over last two years

• Increase fee realization through enhanced product profile

• Plan to launch new Global Equity Hedge fund in early 2003 building on success in 2002

Relative Performance (1) – Private Client

Private Client Composites vs. Benchmarks

| | Strategic

Value (2) | | Strategic Growth (3) | | International Value (4)* | | Emerging Market Value (5)* | | Intermediate Muni (6) | |

QTR | | -2.9 | | +3.7 | | +1.2 | | +3.6 | | -0.5 | |

| | | | | | | | | | | |

YTD | | +1.8 | | -5.3 | | +6.1 | | +10.3 | | -1.4 | |

| | | | | | | | | | | |

1yr | | +2.0 | | -4.9 | | +8.3 | | +3.2 | | -1.1 | |

| | | | | | | | | | | |

3yr | | +8.7 | | -5.6 | | +4.5 | | +3.6 | | -0.5 | |

| | | | | | | | | | | |

5yr | | +0.5 | | -0.9 | | +2.4 | | +3.1 | | – | |

| | | | | | | | | | | |

10yr | | +2.0 | | 0.0 | | +2.1 | | – | | – | |

(1) Investment performance of composites are after investment management fees.

(2) vs. S&P 500 (3) vs. S&P 500; Large Cap Growth composite through 2000, then Strategic Growth (4) vs. MSCI EAFE Value (5) vs. MSCI Emerging Markets Free (6) vs. Lehman 1-10 Year Muni

* Preliminary returns

Composite and benchmark data through 9/30/02.

See Performance Disclosure

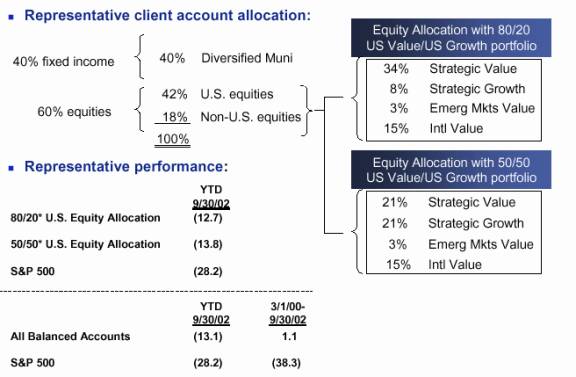

Private Client Portfolio Performance

* Allocation of U.S. equity portion of portfolio. Results are simulated.

Performance after fees. See Performance Disclosure.

Institutional Research Services 3Q02 Overview

• Revenue growth driven by year-over-year increase in market share and strong European research and trading; continued pricing pressures in the US partially offset by pricing strength in the UK

• Investments made over last few years, combined with industry focus on independent research, increases interest in Bernstein research

• Appointed new Chairman & CEO to lead business unit in continuing expansion of global operations and hired new head of global trading in October

• Became a Nasdaq market maker in July

Initiatives for 2003:

• Continue to capitalize on substantial investments over the last two years

• Complete research coverage launches

• Further expand sales breadth in US and Europe

• Further broaden trading capabilities

Positioned For Growth

• Worldwide research and investment capabilities

• Unique with strengths in both growth and value investing

• Broad array of fixed income services

• Generally competitive investment results

• Highly regarded marketing and client service teams

• Well-positioned in retail, institutional and private client channels

• Highly valued independent sell-side research and institutional trading

• Strong financials

• Cogent strategy

Performance Disclosure – Growth Composites: Net of Fee

Alliance Capital Management L.P. (“ACMLP”), is a registered investment advisor. ACMLP had $369.0 billion in assets under management as of September 30, 2002. US$38 billion in assets are managed by our private-client services group, which does not present its performance composites in strict accordance with AIMR standards.

1) TOTAL RETURN METHODOLOGY AND FEE STRUCTURE – Performance figures in this report have been presented net of investment management fees. Net performance figures have been calculated by deducting the highest fee charged to an account in the composite from inception of the composite to December 2000. The annual fees used were: 0.90% for Large Cap Growth Composite from January 2000 to December 31, 2000 and 0.75% from inception to December 31, 1999, 0.90% for Disciplined Growth Composite from January 2000 to December 31, 2000 and 0.75% from inception to December 31, 1999, 0.75% for Relative Value Composite, 1.00% for Small Cap Composite, 1.00% for Multi Capitalization Growth Composite, 0.90% for International Large Cap Growth Equity Composite from October 2000 to December 31, 2000 and 0.75% from inception to September 30, 2000, and 1.00% for Emerging Markets Growth Composite. From January 2001 forward, the Composites’ net of fee returns are based upon a weighted average of the actual fee rates charged to each account in the Composites. The average fees applied were: 0.34% for Large Cap Growth Composite; 0.34% for Disciplined Growth Composite; 0.23% for Relative Value Composite; 0.88% for Small Cap Composite; 0.64% for Multi Capitalization Growth Composite; 0.36% for International Large Cap Growth Equity Composite; and 0.58% for Emerging Markets Growth Composite. Both fee structures exclude accounts with performance-based fee arrangements. Net-of-fee performance figures reflect the compounding effect of such fees.

2) RATE OF RETURN – No representation is made that the performance shown in this presentation is indicative of future performance. A portfolio could suffer losses as well as gains. Performance figures for each account are calculated monthly on a trade-date basis using an internal rate-of-return calculation. Monthly market values include income accruals and reflect the daily weighting of cash flows. The composite results are asset-weighted on a monthly basis. Quarterly and annual composite performance figures are computed by linking monthly returns, resulting in a “time-weighted” rate of return. Performance results include the reinvestment of dividends and other earnings. Returns are calculated in US Dollars.

3) COMPOSITE STRUCTURE – As of September 30, 2002, the Composites include fee-paying discretionary accounts with assets over US$10 million, which are not subject to significant investment restrictions imposed by clients. As of September 30, 2002, Emerging Markets Growth Composite had 4.6% of its assets in countries or regions outside of the benchmark, MSCI Emerging Market Free International. Large Cap Growth Equity Composite had 6.03% of its assets invested in countries or regions outside of the benchmark, MSCI EAFE

The number of accounts in each composite, the market value, and percentage of composite assets in relation to the total assets under management are included in the following table.

| | Number of Accounts | | Asset Value

($ in millions) | | % of Total Firm Assets | |

Large Cap Growth Composite | | 253 | | 20,088 | | 6 | |

Disciplined Growth Composite | | 87 | | 5,265 | | 2 | |

Relative Value Composite | | 18 | | 1914 | | <1 | |

Small Cap Composite | | 13 | | 523 | | <1 | |

Multi Capitalization Growth Composite | | 9 | | 487 | | <1 | |

International Large Cap Growth Equity | | 6 | | 1,147 | | <1 | |

Emerging Markets Growth Composite | | 5 | | 602 | | <1 | |

Performance Disclosure – Growth Composites: Net of Fee

The Large Cap and Disciplined Growth Composites include the equity segment of balanced accounts. In these portfolios, the asset allocation mix is generally determined by client guidelines and cash flows are allocated in accordance with these guidelines. The primary portfolio manager responsible for managing the Small Cap Strategy, who had been in place since June of 1994, left the firm in January of 1999. A new team responsible for managing the Small Cap Strategy was put in place during January of 1999. The Relative Value Composite has been restated to reflect a material change in the investment process during the fourth quarter of 1994. The nature of the restatement has resulted in a change in the inception of the composite from January 1, 1992 to January 1, 1995. No other changes occurred as a result of this restatement.

The withholding tax basis of the Global Composites is consistent with the benchmark, which is Luxembourg. The Creation dates of the composites are as follows: MultiCap Growth: December 2000; The Large Cap Growth, Disciplined Growth, International Large Cap Growth, Small Cap Growth, and Relative Value Composites were created prior to December 1992, the first year that these Composites were AIMR verified. The Emerging Growth Composite was created prior to December 1994, the first year that this Composite was AIMR verified.

4) DISPERSION – The dispersion of annual returns was calculated based on the asset-weighted standard deviation. Dispersion of performance for the Composites is as follows: Large Cap Growth Composite: 1993: 1.61; 1994: 1.22; 1995: 1.86; 1996: 1.29; 1997: 4.96; 1998: 2.43; 1999: 3.23; 2000: 2.11; 2001: 3.56; 2002 (YTD): 1.47;

Disciplined Growth Composite: 1993: 1.10; 1994: 0.68; 1995: 1.05; 1996: 1.09; 1997: 1.64; 1998: 0.88; 1999: 1.36; 2000: 1.68; 2001: 1.75; 2002 (YTD): 1.04;

Relative Value Composite: 1994(Q4): 0.53; 1995: 2.72; 1996: 0.39; 1997: 0.23; 1998: 0.54; 1999: 0.76; 2000: 0.24; 2001: 0.50; 2002 (YTD): 0.93;

Small Cap Composite: 1994(Q2-Q4): 1.65; 1995: 0.19; 1996: 0.09; 1997: 0.14; 1998: 0.29; 1999: 0.55; 2000: 0.79; 2001: 0.29; 2002 (YTD): 0.21;

Multi Capitalization Growth Composite: 1993: 1.64; 1994: 0.41; 1995: 0.36; 1996: 0.94; 1997: 0.69; 1998: 0.26; 1999: 1.14; 2000: 0.28; 2001: 0.24; 2002 (YTD): 0.55;

International Large Cap Growth Equity Co: 1993: 2.22; 1994: 0.49; 1995: 1.18; 1996: 0.24; 1997: 0.90; 1998: 3.06; 1999: 5.77; 2000: 2.58; 2001: 0.69; 2002 (YTD): 0.76;

Emerging Markets Growth Composite: 1993: N/M*; 1994: 2.56; 1995: 1.00; 1996: 0.57; 1997: 0.31; 1998: 0.04; 1999: N/M*; 2000: N/M*; 2001: N/M*; 2002 (YTD): 0.42.

Alliance Capital has prepared and presented this report in compliance with the Performance Presentation Standards of the Association for Investment Management and Research (AIMR-PPS®), the US and Canadian versions of the Global Investment Performance Standards (GIPS®). AIMR has not been involved in the preparation or review of this report. Alliance Capital received Level 1 and 2 AIMR Verification from KPMG LLP for 1992, 1993, 1994, 1995, 1996, 1997, 1998, 1999 and 2000. KPMG LLP is currently auditing 2001. This verification is available upon request.

*N/M represents not meaningful. N/M coding indicates that only one account, or no accounts, are in the Composite for the full year. Dispersion is only shown for accounts included in each quarter of each year presented.

Performance Disclosure – Value Composites: Net of Fee

1) Performance Statistics Are Not Financial Statements – There are various methods of compiling or reporting performance statistics. The standards of performance measurement used in compiling this data are in accordance with the methods set forth below. Past performance statistics are not indicative of future results.

2) Total Return – Performance results of accounts and comparisons are made on a total-return basis, which includes all dividends, interest and accrued interest, and realized and unrealized gains or losses. Securities are included in accounts on a trade-date basis. Performance results are after deductions of all transaction charges and fees.

3) Rate of Return – Investment results are computed on a “time-weighted” rate-of-return basis. Assuming dividends and interest are reinvested, the growth in dollars of an investment in a period can be computed using these rates of return. In computing the time-weighted rate of return, if an account’s net monthly cash flow exceeds 10% of its beginning market value, the cash flows are weighted on a daily basis. When an account’s net monthly cash flows are less than 10% of its beginning market value, the cash flows are weighted by the “end-of-the-month” assumption. Beginning 2001, all cash flows are daily-weighted using the Modified Dietz Method.

4) Preparation of Data – Investment results for Strategic Value accounts for the entire quarter were added together and the sum divided by the total number of accounts in each quarter through 1992; beginning in 1993, and since inception for all the other cited composites, quarterly performance was for all accounts weighted by their market value. These quarterly performance figures were then linked to produce a continuous-performance index. The continuous-performance index from inception was used to create point-to-point comparisons. Closed accounts are included for each full quarter prior to their closing. From inception, returns for Diversified Value optimized against the Russell 1000 Value Index exclude certain accounts with special restrictions imposed by clients. Strategic Value returns include all accounts offered from 1974-1982 and, from 1983, all Strategic Value accounts with $5 million or more in assets. Beginning January 1, 2000, results exclude accounts with a client-directed margin balance of 20% or more of market value at any month end. From July 1993 quarterly results were those of GDP-weighted, half-hedged International Value accounts separately managed in US dollars. The minimum account size for Emerging Market Value accounts (including commingled accounts) included in performance is $5 million or more in assets.

5) Dispersion – The dispersion factor is a measure around the average account performance. The dispersion factor is calculated as the standard deviation of the equal-weighted returns from the asset-weighted mean. Specifically, it is the standard deviation around the performance for accounts managed during each period and indicates the range from average performance of approximately two-thirds of the accounts included in each period. Dispersion of performance for accounts under management are: Diversified Value (Russell 1000 Value) - 1999: 2Q-4Q: 1.8; 2000: 1.9; 2001: 1.0; 2002: N/A; Strategic Value - 1974: 29.1; 1975: 26.5; 1976: 17.6; 1977: 8.3; 1978: 11.5; 1979: 9.0; 1980: 8.7; 1981: 5.6; 1982: 5.5; 1983: 2.9; 1984: 1.6; 1985: 1.6; 1986: 1.1; 1987: 1.7; 1988: 1.7; 1989: 1.4; 1990: 1.2; 1991: 2.0; 1992: 1.4; 1993: 1.2; 1994: 1.2; 1995: 1.3; 1996: 1.3; 1997: 1.6; 1998: 2.5; 1999: 2.5; 2000: 2.6; 2001: 2.1; 2002: N/A. Dispersion of performance for Small & Mid-Cap Value composite is currently not available. International Value (GDP-weighted, half-hedged) - 1993:2H: 0.5; 1994: 0.9; 1995: 1.1; 1996: 1.0; 1997: 1.3; 1998: 1.6; 1999: 1.8; 2000: 1.6; 2001: 0.9; 2002: N/A; Emerging Markets Value - 1996: 0.0; 1997: 3.8; 1998: 2.7; 1999: 2.8; 2000: 2.0; 2001: 2.1; 2002: N/A.

Performance Disclosure – Value Composites and Private Client Simulation: Net of Fee

6) Financial Securities Environment – Various indices are used to indicate the type of investment environment existing during the time periods shown. Composites used for reporting purposes represent the following:

Strategy | | Number of Accounts | | Assets ($mm) | | % of Total Firm Assets | |

Strategic Value (accts. over $5 million) | | 228 | | 10,684 | | 3 | % |

Diversified Value (opt to S&P 500) | | 283 | | 6,899 | | 2 | |

Small-Mid Cap Value | | 3 | | 127 | | <1 | |

International Value (half-hedged, GDP wtd) | | 24 | | 1,547 | | <1 | |

Emerging Markets Value | | 6 | | 1,209 | | <1 | |

All Balanced Accounts Composite Methodology

Investment results on a quarterly basis for All Balanced Accounts for the entire quarter were added together and the sum divided by the total number of accounts in each quarter to produce a series of average quarterly performance figures. All Balanced Accounts include those with any combination of equity and fixed income (U.S. or non-U.S.), in any percentage mix. When an account’s net monthly cash flows were less than 10% of its beginning market value, the cash flows were assumed to have occurred on the last day of the month. Beginning in 2001, all cash flows are daily weighted using the modified Dietz method.

Private Client Portfolio Performance – Simulation

The private client portfolio representative performance does not represent actual account performance but is a simulation constructed using the following products in the asset allocation shown below:

For 50/50 U.S. Equity/Asset Allocation Blend:

21% Bernstein “Strategic Value” composite (after all costs); 21% Bernstein “Strategic Growth” composite (after all costs); 15% Bernstein “Tax-Managed International Value Fund” (after all costs); 3% Bernstein “Emerging Markets Value Fund” (after expenses but before 2% purchase & 2% redemption fees); 40% Bernstein “Intermediate Diversified Municipal Bond Fund” (after all costs)

For 80/20 U.S. Equity/Asset Allocation Blend:

34% Bernstein “Strategic Value” composite (after all costs); 8% Bernstein “Strategic Growth” composite (after all costs); 15% Bernstein “Tax-Managed International Value Fund” (after all costs); 3% Bernstein “Emerging Markets Value Fund” (after expenses but before 2% purchase & 2% redemption fees); 40% Bernstein “Intermediate Diversified Municipal Bond Fund” (after all costs)

The simulated returns were calculated on a monthly basis; each product’s actual monthly return was multiplied by its weight within the blend then summed together. These monthly returns were then geometrically linked to calculate year-to-date 6/30/02 returns. This methodology assumes the portfolio is rebalanced monthly to the allocation described above but does not account for the costs of rebalancing.

Performance Disclosure – Private Client: Net of Fee

Strategic Value (All) / Strategic Growth

1. Preparation of Data – Investment results for the Strategic Value (All) composite discretionary accounts are added together and the sum divided by the total number of accounts to produce a series of average quarterly performance figures. Strategic Value (All) composite returns include all accounts from 1974-1999 that are not subject to significant investment restrictions imposed by clients. Beginning January 1, 2000, results exclude accounts with a client-directed margin balance of 20% or more of market value at any month end. Prior to 2001, in computing the time-weighted rate of return, if an account’s net monthly cash flow was equal to or exceeded 10% of its beginning market value, the modified Dietz method was used to daily weight the cash flows. When an account’s net monthly cash flows were less than 10% of its beginning market value, the cash flows were assumed to have occurred on the last day of the month. Beginning 2001, all cash flows are daily weighted using the modified Dietz method.

The performance results of the Strategic Growth composite are calculated by linking the asset-weighted quarterly returns of the Alliance Large Cap Growth composite for the period 1979 through 2000 with those of Strategic Growth thereafter. The quarterly asset-weighted returns are geometrically linked to calculate cumulative and/or annualized rates of return for various periods. Alliance Large Cap Growth differs from Strategic Growth, which is offered exclusively to clients of the Bernstein Investment Research and Management unit of Alliance Capital Management L.P., in that, among other things, Strategic Growth offers tax management and may contain fewer stocks.

Alliance Large Cap Growth Composite Methodology (1979-2000) – Monthly market values include income accruals and reflect the daily weighting of cash flows. The Alliance Large Cap Growth composite results are asset-weighted on a monthly basis. The quarterly composite performance figures are computed by linking the monthly returns, resulting in a time-weighted rate of return. The composite includes fee-paying discretionary tax-exempt accounts with assets over $10 million not subject to significant investment restrictions imposed by clients. The composite includes the equity segment of balanced accounts. In these equity portfolios, the asset-allocation mix is generally determined by client guidelines and cash flows are allocated in accordance with these guidelines. Fee structures exclude accounts with performance-based fee arrangements. Net-of-fee performance figures reflect the compounding effect of such fees.

Strategic Growth Composite Methodology (2001- present) – The Strategic Growth composite returns are calculated on a quarterly basis with each account’s return weighted by its prior quarter-end market value. All cash flows are daily weighted using the modified Deitz method. Results exclude accounts with a client-directed margin balance of 20% or more of market value at any month end.

2. Net-of-fee performance figures have been calculated as follows:

Strategic Value (All) composite:

a. Prior to 1983, management fees were not charged; instead, the accounts incurred transaction costs.

b. From 1983 forward, the composite’s net-of-fee return is the equal-weighted average of the actual after-fee returns of Strategic Value accounts in the composite.

Strategic Growth composite:

a. From 1979-1982, 0.75%, the highest annual fee charged to an Alliance Large Cap Growth account for that period (excluding accounts with performance-based fee arrangements) was deducted from the composite’s gross-of-fee returns.

b. From 1983 through 2000, the actual average quarterly fee charged by Bernstein for the Strategic Value (All) service was deducted from the Alliance Large Cap Growth composite gross-of-fee returns.

c. From January 2001 forward, the composite’s net-of-fee return is the asset-weighted average of the actual after-fee returns of Strategic Growth accounts in the composite.

3. Dispersion: Dispersion is calculated on the gross-of-fee returns. Dispersion, or standard deviation, measures the variability of account returns within a composite. In a normal distribution, approximately two-thirds of the account returns will fall within the range of one standard deviation above and below the equal-weighted mean return.

Dispersion of returns for Strategic Value (All) is as follows: 1974: 26.0; 1975: 20.3; 1976: 14.3; 1977: 8.3; 1978: 10.9; 1979: 8.5; 1980: 7.8; 1981: 5.5; 1982: 5.6; 1983: 3.7; 1984: 2.8; 1985: 2.4; 1986: 2.1; 1987: 3.3; 1988: 2.1; 1989: 1.7; 1990: 2.1; 1991: 2.4; 1992: 2.1; 1993: 1.6; 1994: 1.4; 1995: 1.6; 1996: 1.4; 1997: 1.9; 1998: 2.9; 1999: 3.1; 2000: 3.0; 2001: 2.2; 2002: N/A.

Dispersion of returns for accounts within the Alliance Large Cap Growth from 1979-2000 is as follows 1979: 4.7; 1980: 1.4; 1981: 2.4; 1982: 3.1; 1983: 2.4; 1984: 2.1; 1985: 2.6; 1986: 5.3; 1987: 3.9; 1988: 2.9; 1989: 5.4; 1990: 1.5; 1991: 3.3; 1992: 3.1; 1993: 1.6; 1994: 1.2; 1995: 1.9; 1996: 1.3; 1997: 5.0; 1998: 2.4; 1999: 3.2; 2000: 2.1. Dispersion of returns for Strategic Growth is as follows: 2001: 2.2; 2002: N/A.

Year 2001 data are preliminary, pending completion of internal audit.

Performance of Private Client International Value, Emerging Markets Value and Intermediate Muni are the returns of portfolios of the Sanford C. Bernstein Fund, Inc. Past performance is not necessarily indicative of future results. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Portfolio returns are expressed after all fees. Annualized total returns for periods ending 9/30/02 were as follows: Intermediate Duration - 1 yr: 6.69%; 5 yrs: 5.49%; 10 yrs: 5.67%; since inception (1/17/89): 6.71%.

Diverse Group of Clients

Wholesale | | Direct Sales | |

Retail | | Institutional Investment

Mgmt | | Private Client | | Institutional Research Services | |

• 7.5 million accounts | | • 2,300+ client | | • 19,000 client | | • 1,000 client | |

| | relationships* | | relationships | | relationships | |

• 53 U.S. mutual funds | | | | | | | |

| | • 43 of Fortune 100 | | • 12 client offices in | | • 51 senior analysts | |

• 18 non-U.S. mutual | | companies | | U.S. | | | |

funds | | | | | | | |

| | • Public pension funds | | • Referral network of | | • Independent | |

| | across 44 states | | 8,000 lawyers and | | research | |

| | | | accountants | | | |

| | | | | | | | | |

As of September 30, 2002.

Changes in AUM by Investment Orientation

Three Months Ended September 30, 2002

| | Growth | | Value | | Fixed | | | | | |

| | Equity | | Equity | | Income | | Passive | | Total | |

Beginning of Period | | $ | 133,386 | | $ | 104,213 | | $ | 149,068 | | $ | 25,828 | | $ | 412,495 | |

| | | | | | | | | | | |

Sales/New accounts | | 3,883 | | 4,245 | | 4,011 | | 284 | | 12,423 | |

Redemptions/Terminations | | (7,315 | ) | (1,921 | ) | (3,603 | ) | (237 | ) | (13,076 | ) |

Net cash management sales | | – | | – | | (2,097 | ) | – | | (2,097 | ) |

Cash flow | | (2,726 | ) | (785 | ) | 2,197 | | 82 | | (1,232 | ) |

Unreinvested dividends | | – | | (26 | ) | (255 | ) | – | | (281 | ) |

Net new business/(Outflows) | | (6,158 | ) | 1,513 | | 253 | | 129 | | (4,263 | ) |

| | | | | | | | | | | |

Transfer | | (1,142 | ) | 1,142 | | – | | – | | – | |

| | | | | | | | | | | |

Market appreciation/(depreciation) | | (18,776 | ) | (18,764 | ) | 2,244 | | (4,282 | ) | (39,578 | ) |

| | | | | | | | | | | |

End Of Period | | $ | 107,310 | | $ | 88,104 | | $ | 151,565 | | $ | 21,675 | | $ | 368,654 | |

| | | | | | | | | | | | | | | | | |

Amounts in $ millions.

Changes in AUM by Investment Orientation

Twelve Months Ended September 30, 2002

| | Growth Equity | | Value Equity | | Fixed Income | | Passive | | Total | |

Beginning of Period | | $ | 155,616 | | $ | 88,390 | | $ | 145,336 | | $ | 28,460 | | $ | 417,802 | |

| | | | | | | | | | | |

Sales/New accounts | | 18,939 | | 16,220 | | 20,962 | | 1,373 | | 57,494 | |

Redemptions/Terminations | | (29,135 | ) | (6,934 | ) | (12,483 | ) | (1,510 | ) | (50,062 | ) |

Net cash management sales | | – | | – | | (9,061 | ) | – | | (9,061 | ) |

Cash flow | | (3,780 | ) | 1,567 | | 4,953 | | (2,494 | ) | 246 | |

Unreinvested dividends | | (10 | ) | (101 | ) | (999 | ) | – | | (1,110 | ) |

Net new business/(Outflows) | | (13,986 | ) | 10,752 | | 3,372 | | (2,631 | ) | (2,493 | ) |

| | | | | | | | | | | |

Transfer | | (3,742 | ) | 3,742 | | – | | – | | – | |

| | | | | | | | | | | |

Market appreciation/(depreciation) | | (30,578 | ) | (14,780 | ) | 2,857 | | (4,154 | ) | (46,655 | ) |

| | | | | | | | | | | |

End Of Period | | $ | 107,310 | | $ | 88,104 | | $ | 151,565 | | $ | 21,675 | | $ | 368,654 | |

* AUM previously reported as of each date prior to March 31, 2002, have been restated to reflect the reclassification of institutional cash management and sub-advised variable annuity accounts from Institutional Investment Management to Retail and certain Private Client accounts to Retail and Institutional Investment Management. AUM now also excludes assets managed by unconsolidated affiliates.

In $ millions.

Changes in Retail AUM by Investment Orientation

Three Months Ended September 30, 2002

| | Growth Equity | | Value Equity | | Fixed Income | | Cash Mgmt | | Total | |

Beginning Of Period | | $ | 56,357 | | $ | 24,714 | | $ | 31,177 | | $ | 37,407 | | $ | 149,655 | |

| | | | | | | | | | | |

Sales | | 2,278 | | 1,207 | | 2,299 | | – | | 5,784 | |

Redemptions | | (5,116 | ) | (1,382 | ) | (2,218 | ) | – | | (8,716 | ) |

Net cash management sales | | – | | – | | – | | (2,097 | ) | (2,097 | ) |

Cash flow | | (2,811 | ) | 789 | | 742 | | 32 | | (1,248 | ) |

Unreinvested dividends | | – | | (26 | ) | (209 | ) | – | | (235 | ) |

Net new business/(Outflows) | | (5,649 | ) | 588 | | 614 | | (2,065 | ) | (6,512 | ) |

| | | | | | | | | | | |

Transfers | | 176 | | (249 | ) | (33 | ) | (32 | ) | (138 | ) |

| | | | | | | | | | | |

Market appreciation/(depreciation) | | (8,892 | ) | (4,440 | ) | 1,175 | | 2 | | (12,155 | ) |

| | | | | | | | | | | |

End Of Period | | $ | 41,992 | | $ | 20,613 | | $ | 32,933 | | $ | 35,312 | | $ | 130,850 | |

Amounts in $ millions.

Changes in Retail AUM by Product

Three Months Ended September 30, 2002

| | U.S. Funds | | Non-U.S. Funds | | Variable Annuity | | Managed Accounts | | Total | |

Beginning Of Period | | $ | 84,026 | | $ | 19,651 | | $ | 37,473 | | $ | 8,505 | | $ | 149,655 | |

| | | | | | | | | | | |

Sales | | 1,950 | | 1,931 | | 1,478 | | 425 | | 5,784 | |

Redemptions | | (3,059 | ) | (2,944 | ) | (1,668 | ) | (1,045 | ) | (8,716 | ) |

Net cash management sales | | (2,097 | ) | – | | – | | – | | (2,097 | ) |

Cash flow | | (47 | ) | 34 | | (1,235 | ) | – | | (1,248 | ) |

Unreinvested dividends | | (172 | ) | (63 | ) | – | | – | | (235 | ) |

Net new business/(Outflows) | | (3,425 | ) | (1,042 | ) | (1,425 | ) | (620 | ) | (6,512 | ) |

| | | | | | | | | | | |

Transfer | | – | | (361 | ) | 223 | | – | | (138 | ) |

| | | | | | | | | | | |

Market depreciation | | (4,782 | ) | (1,090 | ) | (5,193 | ) | (1,090 | ) | (12,155 | ) |

| | | | | | | | | | | |

End Of Period | | $ | 75,819 | | $ | 17,158 | | $ | 31,078 | | $ | 6,795 | | $ | 130,850 | |

Amounts in $ millions.

Changes in Institutional Investment Management AUM by Investment Orientation

Three Months Ended September 30, 2002

| | Growth Equity | | Value Equity | | Fixed Income | | Passive | | Total | |

Beginning Of Period | | $ | 76,811 | | $ | 52,651 | | $ | 70,253 | | $ | 22,759 | | $ | 222,474 | |

| | | | | | | | | | | |

Sales/New accounts | | 1,579 | | 2,381 | | 780 | | 67 | | 4,807 | |

Redemptions/Terminations | | (2,369 | ) | (340 | ) | (1,287 | ) | – | | (3,996 | ) |

Cash management sales, net | | – | | – | | – | | – | | – | |

Cash flow | | (1,355 | ) | (280 | ) | 1,663 | | 113 | | 141 | |

Unreinvested dividends | | – | | – | | (1 | ) | – | | (1 | ) |

Net new business/(Outflows) | | (2,145 | ) | 1,761 | | 1,155 | | 180 | | 951 | |

| | | | | | | | | | | |

Transfer | | (176 | ) | 249 | | 33 | | 32 | | 138 | |

| | | | | | | | | | | |

Market appreciation/(depreciation) | | (9,970 | ) | (10,308 | ) | 775 | | (3,747 | ) | (23,250 | ) |

| | | | | | | | | | | |

End Of Period | | $ | 64,520 | | $ | 44,353 | | $ | 72,216 | | $ | 19,224 | | $ | 200,313 | |

| | | | | | | | | | | | | | | | | |

Amounts in $ millions.

Alliance Capital (The Operating Partnership)

Consolidated Balance Sheet

| | 9/30/02 | | 12/31/01 | |

Assets | | | | | |

Cash and investments | | $ | 506,429 | | $ | 501,845 | |

Cash and securities, segregated | | 1,147,943 | | 1,415,158 | |

Receivables | | 1,423,998 | | 1,954,582 | |

Goodwill, net | | 2,876,657 | | 2,876,657 | |

Intangible assets, net | | 372,600 | | 388,125 | |

Deferred sales commissions, net | | 544,019 | | 648,244 | |

Other | | 395,632 | | 390,782 | |

Total Assets | | $ | 7,267,278 | | $ | 8,175,393 | |

| | | | | |

Liabilities and Partners’ Capital | | | | | |

Liabilites: | | | | | |

Payables | | $ | 2,239,652 | | $ | 3,029,983 | |

Accounts payable and accrued expenses | | 179,295 | | 194,538 | |

Accrued compensation and benefits | | 474,521 | | 328,077 | |

Debt | | 433,806 | | 627,609 | |

Other | | 7,798 | | 7,026 | |

Total Liabilities | | 3,335,072 | | 4,187,233 | |

| | | | | |

Partners’ Capital | | 3,932,206 | | 3,988,160 | |

Total Liabilities and Partners’ Capital | | $ | 7,267,278 | | $ | 8,175,393 | |

Amounts in $ thousands. Unaudited

Alliance Capital (The Operating Partnership)

Consolidated Cash Flow

| | Nine Months Ended | |

| | 9/30/02 | | 9/30/01 | |

Cash Flows From Operating Activities: | | | | | |

Net income | | $ | 464,261 | | $ | 463,832 | |

Non-cash items: | | | | | |

Amortization and depreciation | | 225,848 | | 334,394 | |

Other, net | | 74,365 | | 45,632 | |

Changes in assets and liabilities | | 51,109 | | 162,880 | |

Net cash provided from operating activities | | 815,583 | | 1,006,738 | |

| | | | | |

Cash Flows From Investing Activities: | | | | | |

Purchase of investments, net | | (77,360 | ) | (164,234 | ) |

Additions to furniture, equipment and leaseholds, net | | (43,246 | ) | (63,322 | ) |

Other | | – | | (6,779 | ) |

Net cash (used in) investing actvities | | (120,606 | ) | (234,335 | ) |

| | | | | |

Cash Flows From Financing Activities: | | | | | |

Increase (decrease) in debt, net | | (195,956 | ) | (222,621 | ) |

Cash distributions to General Partner and Alliance Capital Unitholders | | (520,469 | ) | (597,620 | ) |

Other | | (54,916 | ) | 8,427 | |

Net cash (used in) financing activities | | (771,341 | ) | (811,814 | ) |

` | | | | | |

Effect of exchange rate change on cash | | 4,275 | | (433 | ) |

| | | | | |

Net (decrease) in cash | | (72,089 | ) | (39,844 | ) |

Cash at the beginning of period | | 220,127 | | 216,251 | |

Cash at the end of period | | $ | 148,038 | | $ | 176,407 | |

Amounts in $ thousands. Unaudited

Alliance Capital Investment Management Services

Alliance Capital provides diversified investment management and related services globally to a broad range of clients:

1. Retail Services consists of investment management products and services distributed to individual investors through financial intermediaries, such as brokers and financial planners by means of:

• mutual funds sponsored by Alliance Capital and consolidated joint venture companies,

• cash management products such as money market funds and deposit accounts,

• mutual fund sub-advisory relationships resulting from the efforts of the mutual fund marketing department, and

• managed account products;

2. Institutional Investment Management Services consists of investment management services to unaffiliated parties such as corporate and public employee pension funds, endowment funds, domestic and foreign institutions and governments, and affiliates such as AXA and its insurance company subsidiaries by means of:

• separate accounts,

• mutual fund shares sold exclusively to institutional investors and high net worth individuals,

• sub-advisory relationships resulting from the efforts of the institutional marketing department,

• hedge funds,

• structured products, and

• group trusts;

3. Private Client Services consists of investment management services provided to high net worth individuals, trusts and estates, charitable foundations, partnerships, private and family corporations and other entities by means of:

• separate accounts,

• hedge funds and

• certain other vehicles; and

4. Institutional Research Services provided to institutional clients by means of:

• in-depth research,

• portfolio strategy,

• trading and

• brokerage-related services.