Searchable text section of graphics shown above

[LOGO]

ALLIANCEBERNSTEIN

Research Innovation:

Knowing More...Using Knowledge Better

Prudential CEO Conference Call Series

May 22, 2006

Lewis A. Sanders

Chairman and Chief Executive Officer

AllianceBernstein® and the AB AllianceBernstein logo are trademarks and service marks owned by AllianceBernstein L.P.

AllianceBernstein L.P.

Unusual Breadth by Client Group and Investment Services

$618 Billion

at Mar 31, 2006

By Client Group | By Service |

| |

[CHART] | [CHART] |

AllianceBernstein

AllianceBernstein Research Resources Span the Globe...

[GRAPHIC]

As of December 31, 2005

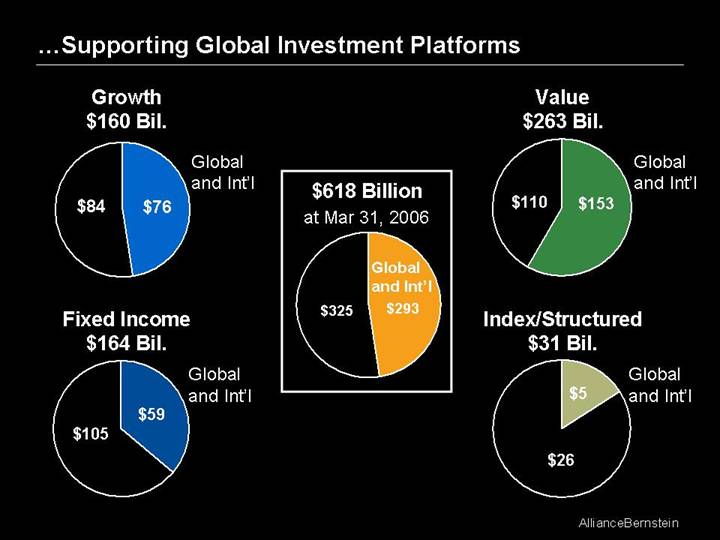

…Supporting Global Investment Platforms

Growth

$160 Bil. | $618 Billion

at Mar 31, 2006

[CHART] | Value

$263 Bil. |

| |

[CHART] | [CHART] |

| |

Fixed Income

$164 Bil. | Index/Structured

$31 Bil. |

| |

[CHART] | [CHART] |

Rapid Growth in Global / International Mandates and

Non-U.S. Client Base

| By Service | | By Client Domicile | |

| | | | |

$618 Billion | [CHART] | +51% | [CHART] | +40% |

at Mar 31, 2006 |

| | | | |

$534 Billion | [CHART] | | [CHART] | |

at Mar 31, 2005 | |

Assets categorized by country domicle of client accounts

Contribution to Growth of Assets Under Management

12 Months ending March 31, 2006*

Growth of AUM

by Service | Contribution to Growth

by Source |

| |

[CHART] | [CHART] |

Past performance does not guarantee future results.

*Excludes dispositions

Investment Performance: Delivering Results for Clients

Net-of-Fee Annualized Performance Premiums

| | | Inception

Date | | Inception–

Mar 2006 | |

Bernstein Value Equities | | | | | |

| U.S. Strategic Value | | Dec 31, 73 | | +2.6 | % |

| U.S. Diversified Value | | Jun 30, 86 | | +1.1 | |

| Global Value | | Sep 30, 95 | | +3.2 | |

| Emerging Markets Value | | Dec 31, 95 | | +3.8 | |

| European Value | | Jun 30, 97 | | +2.8 | |

| Canadian Value | | Dec 31, 97 | | +5.0 | |

| Global Diversified Value | | Mar 31, 98 | | +2.7 | |

| International Value (EAFE) | | Sep 30, 99 | | +6.2 | |

| U.K. Value | | Jun 30, 00 | | +4.4 | |

| International Diversified Value | | Sep 30, 00 | | +5.8 | |

| U.S. Small/Mid Cap Value | | Dec 31, 00 | | +5.7 | |

| International Strategic Value | | Mar 31, 01 | | +8.8 | |

| Global Strategic Value | | Apr 30, 01 | | +9.2 | |

| Japan Strategic Value | | Mar 31, 02 | | +9.1 | |

| Australian Value | | Jun 30, 03 | | +4.9 | |

| | | | | | |

AllianceBernstein Style Blend | | | | | |

| Emerging Markets Style Blend | | Dec 31, 01 | | +5.6 | % |

| International Style Blend | | Dec 31, 01 | | +2.3 | |

| U.S. Style Blend | | Dec 31, 01 | | +0.8 | |

| Global Style Blend | | Jun 30, 03 | | +3.8 | |

| | | | | | |

Alliance Growth Equities | | | | | |

| U.S. Growth | | Dec 31, 70 | | +4.2 | % |

| U.S. Small Cap Growth | | Dec 31, 78 | | +3.3 | |

| U.S. Large Cap Growth | | Dec 31, 77 | | +1.8 | |

| U.S. Disciplined Growth | | Dec 31, 87 | | +3.0 | |

| International Large Cap Growth | | Dec 31, 90 | | +8.9 | |

| Emerging Markets Growth | | Sep 30, 91 | | +2.1 | |

| Japan Growth | | Sep 30, 91 | | +3.7 | |

| Global Research Growth | | Dec 31, 91 | | +6.9 | |

| European Concentrated Growth | | Jun 30, 98 | | -2.1 | |

| U.S. Mid Cap Growth | | Mar 31, 99 | | +5.6 | |

| Australian Growth | | Jun 30, 00 | | -1.4 | |

| | | | | | |

AllianceBernstein Fixed Income | | | | | |

| Global Fixed Income | | Jun 30, 86 | | +0.3 | % |

| U.S. High Yield | | Dec 31, 86 | | -0.7 | |

| U.S. Investment-Grade Corporates | | Dec 31, 91 | | +0.4 | |

| U.S. Short Duration | | Mar 31, 92 | | +0.2 | |

| Emerging-Market Debt | | Jun 30, 94 | | +3.1 | |

| U.S. Core Mortgage | | Dec 31, 94 | | +0.1 | |

| U.S. Low Duration | | Dec 31, 95 | | +0.1 | |

| Europe Core Plus | | Mar 31, 99 | | -1.4 | |

| Japan Credit | | Sep 30, 00 | | +0.0 | |

| Global-Plus Fixed Income | | Jun 30, 01 | | +0.5 | |

| U.S. Strategic Core Plus | | Jun 30, 01 | | +0.6 | |

| Canadian Core Plus Advanced | | Sep 30, 02 | | +4.0 | |

The information in this table is provided solely for use in connection with this presentation and is not directed towards existing or potential investment advisory clients of AllianceBernstein. Past performance is no guarantee of future results. The returns presented above are net of fees.

Source: Bloomberg, Citigroup, FTSE, JPMorgan Chase, Lehman Brothers, Merrill Lynch, MSCI, Nomura, Russell Investment Group, Scotia Capital, S&P, TOPIX, and AllianceBernstein.

Commitment to Fundamental Research

Industry Analysts

Total 209

[CHART]

As of March 31, 2006

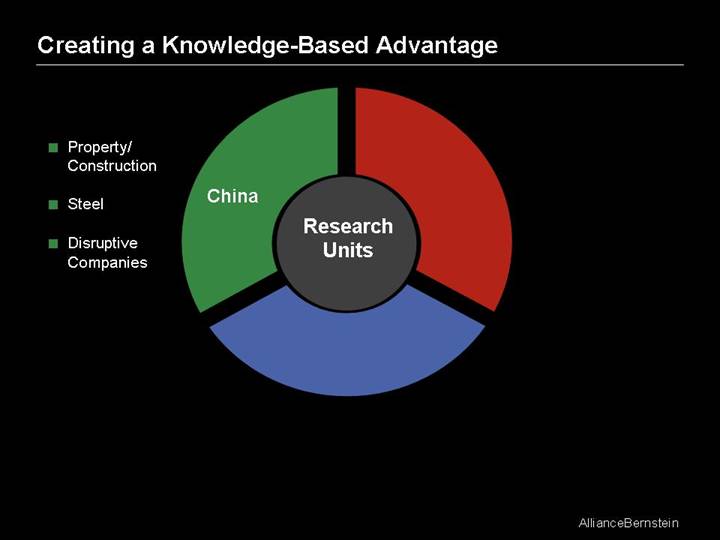

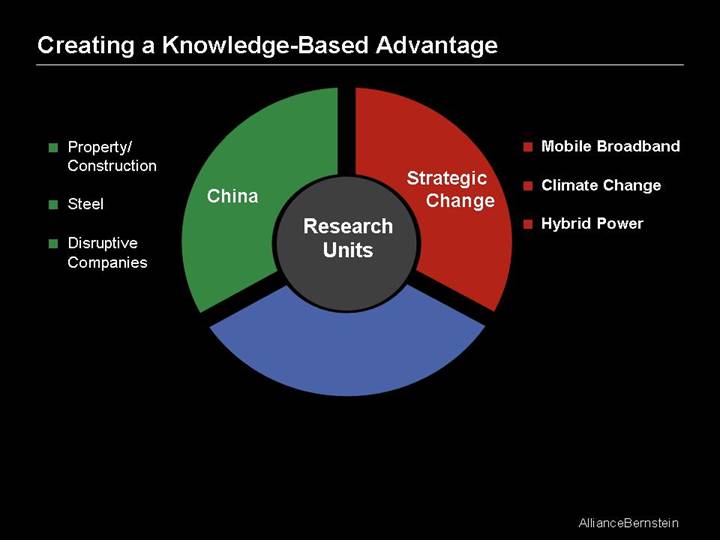

Creating a Knowledge-Based Advantage

Research Units

China

• Property/Construction

• Steel

• Disruptive Companies

Research Units

China

• Property/Construction

• Steel

• Disruptive Companies

Strategic Change

• Mobile Broadband

• Climate Change

• Hybrid Power

Research Units

China

• Property/Construction

• Steel

• Disruptive Companies

Strategic Change

• Mobile Broadband

• Climate Change

• Hybrid Power

Early-Stage Growth

• Pharmacogenomics

• Mobile Media

• High-Energy Batteries

• Alternative Energy

• Open Source Software

Quantitative Methods: Using Knowledge Better

Alpha Generation | Portfolio Optimization |

|

Asset/Liability Modeling |

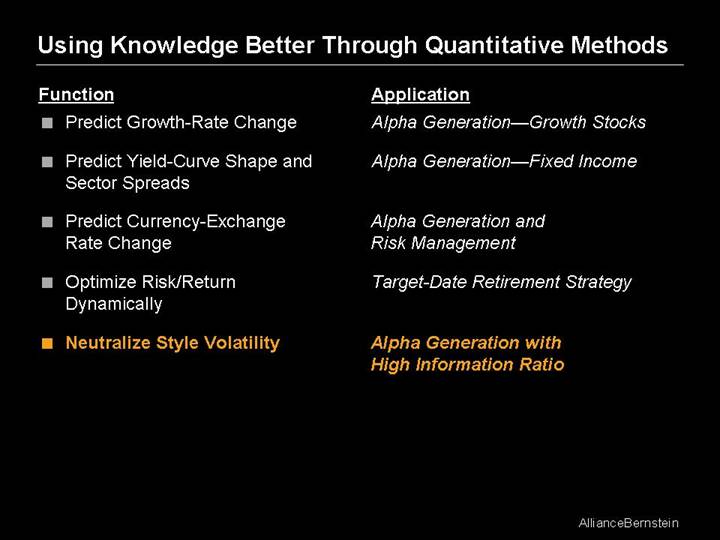

Using Knowledge Better Through Quantitative Methods

Function | Application |

| |

• Predict Growth-Rate Change | Alpha Generation—Growth Stocks |

Using Knowledge Better Through Quantitative Methods

Function | Application |

| |

• Predict Growth-Rate Change | Alpha Generation—Growth Stocks |

| |

• Predict Yield-Curve Shape and Sector Spreads | Alpha Generation—Fixed Income |

Using Knowledge Better Through Quantitative Methods

Function | Application |

| |

• Predict Growth-Rate Change | Alpha Generation—Growth Stocks |

| |

• Predict Yield-Curve Shape and Sector Spreads | Alpha Generation—Fixed Income |

| |

• Predict Currency-Exchange Rate Change | Alpha Generation and Risk Management |

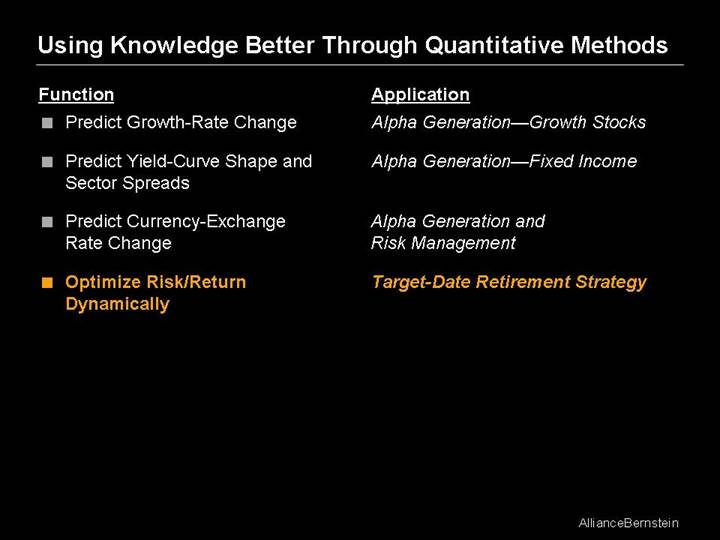

Using Knowledge Better Through Quantitative Methods

Function | Application |

| |

• Predict Growth-Rate Change | Alpha Generation—Growth Stocks |

| |

• Predict Yield-Curve Shape and Sector Spreads | Alpha Generation—Fixed Income |

| |

• Predict Currency-Exchange Rate Change | Alpha Generation and Risk Management |

| |

• Optimize Risk/Return Dynamically | Target-Date Retirement Strategy |

Using Knowledge Better Through Quantitative Methods

Function | Application |

| |

• Predict Growth-Rate Change | Alpha Generation—Growth Stocks |

| |

• Predict Yield-Curve Shape and Sector Spreads | Alpha Generation—Fixed Income |

| |

• Predict Currency-Exchange Rate Change | Alpha Generation and Risk Management |

| |

• Optimize Risk/Return Dynamically | Target-Date Retirement Strategy |

| |

• Neutralize Style Volatility | Alpha Generation with High Information Ratio |

Style-Blend Services of Increasing Significance

$618 Billion

at Mar 31, 2006

[CHART]

*Excludes $4 billion of Blend Fixed Income AUM

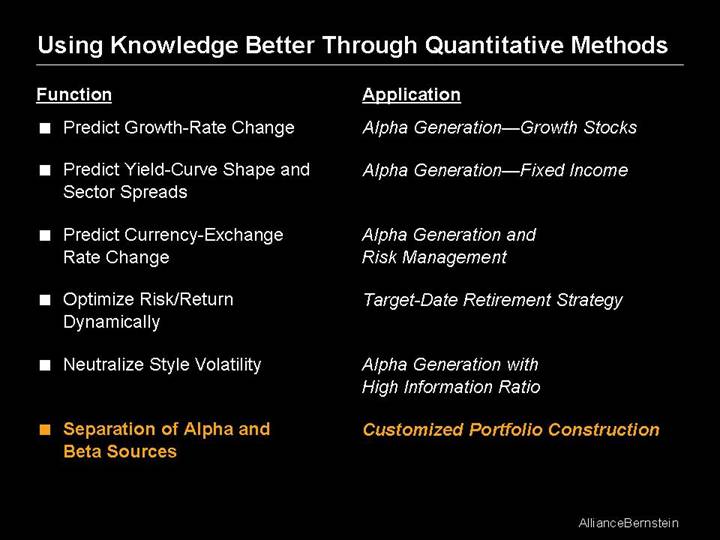

Using Knowledge Better Through Quantitative Methods

Function | Application |

| |

• Predict Growth-Rate Change | Alpha Generation—Growth Stocks |

| |

• Predict Yield-Curve Shape and Sector Spreads | Alpha Generation—Fixed Income |

| |

• Predict Currency-Exchange Rate Change | Alpha Generation and Risk Management |

| |

• Optimize Risk/Return Dynamically | Target-Date Retirement Strategy |

| |

• Neutralize Style Volatility | Alpha Generation with High Information Ratio |

| |

• Separation of Alpha and Beta Sources | Customized Portfolio Construction |

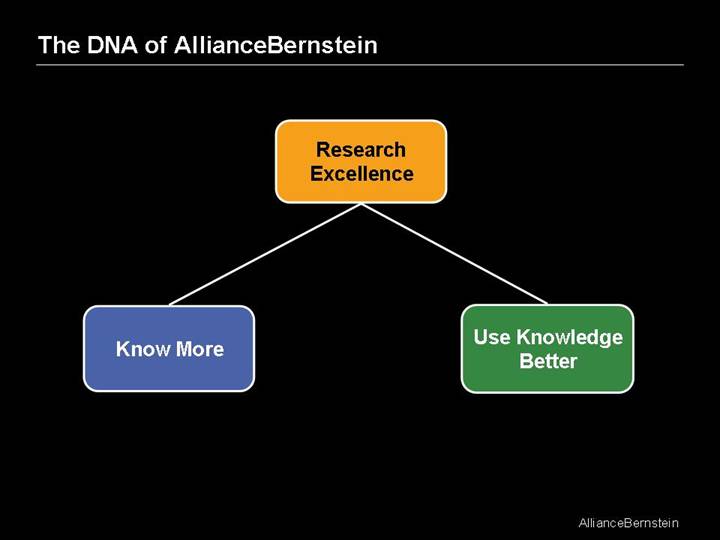

The DNA of AllianceBernstein

Research Excellence |

|

|

Know More | Use Knowledge Better |