Third Quarter 2007 Review

In light of Regulation FD, management will be limited in responding to inquiries from investors or analysts in a non-public forum.

Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from future

results expressed or implied by such forward-looking statements. The most significant of these factors include, but are not limited to, the following:

the performance of financial markets, the investment performance we achieve for our clients, general economic conditions, future acquisitions,

competitive conditions, and government regulations, including changes in tax rates. We caution readers to carefully consider our forward-looking

statements in light of these factors. Further, these forward-looking statements speak only as of the date on which such statements ar

e made; we

undertake no obligation to update any forward-looking statements to reflect subsequent events or circumstances. For further information regarding

these forward-looking statements and the factors that could cause actual results to differ, see “Risk Factors” in Item 1A of Form 10-K for the year

ended December 31, 2006 and in Part II, Item 1A of Form 10-Q for the quarter ended June 30, 2007. Any or all of the forward-looking statements

that we make in Form 10-K, Form 10-Q, this presentation, or any other public statements we issue may turn out to be wrong. Of course, factors other

than those listed in “Risk Factors” and those listed below could also adversely affect our revenues, financial condition, results of operations, and

business prospects.

The forward-looking statements we make in this presentation include estimated earnings guidance and related assumptions provided for full year

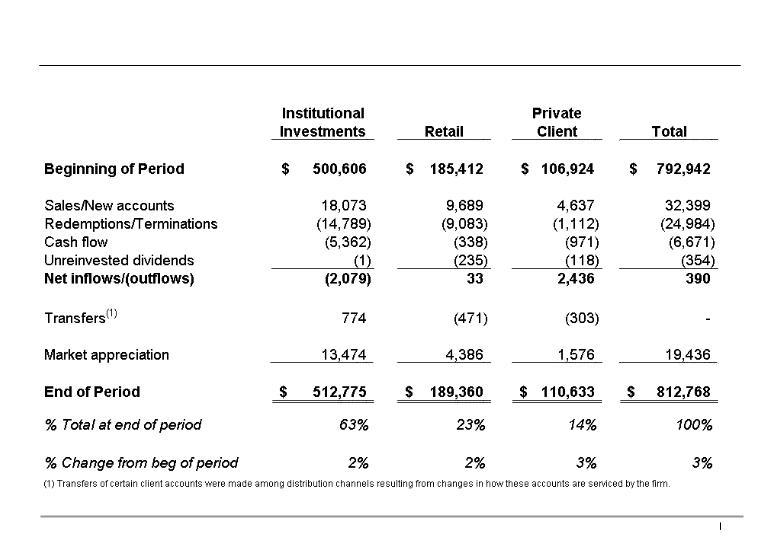

2007. The earnings guidance is based on a number of assumptions, including, but not limited to, the following: net asset inflows continuing after

September 30, 2007 at levels similar to the third quarter of 2007 (adjusted to exclude the above mentioned index terminations) and assumes equity

and fixed income market returns at annual rates of 8% and 5%, respectively, for the fourth quarter. Net inflows of client assets are subject to

domestic and international securities market conditions, competitive factors, and relative performance, each of which may have a negative effect on

net inflows; capital market performance is inherently unpredictable. In view of these factors, and particularly given the volatility of capital markets

(and

the effect of such volatility on performance fees and the value of investments in respect of incentive compensation) and the difficulty of

predicting client asset inflows and outflows, our earnings estimates should not be relied on as predictions of actual performance, but only as

estimates based on assumptions that may or may not be correct. There can be no assurance that we will be able to meet the investment and service

goals and needs of our clients or that, even if we do, it will have a positive effect on the company’s financial performance.

The forward-looking statements we make in this presentation also include our anticipation that the level of net asset flows into our institutional

channel will improve in 2008 due to our growing momentum in the defined contribution market, that robust growth will continue in our private client

channel, and that we are optimistic about the long-term outlook for our retail business. The market for defined contribution plan investment services

is highly competitive and we may not be successful in winning new mandates. Also, before they are funded, institutional mandates do not represent

legally binding commitments to fund and, accordingly, the possibility exists that not all mandates will be funded in the amounts and at the times we

currently anticipate. Growth in the private client and retail channels may be impaired by changes in competitive and securities market conditions a

nd

relative performance. The actual performance of the capital markets and other factors beyond our control will affect our investment success for

clients and asset inflows.

Cautions regarding Forward-Looking Statements

Propriety - For AllianceBernstein L.P. use only