SCHEDULE 14A INFORMATION

(RULE 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

[_] | Preliminary Proxy Statement |

| | |

| [_] | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| | |

| [X] | Definitive Proxy Statement |

| | |

| [_] | Definitive Additional Materials |

| | |

| [_] | Soliciting Material Under Rule 14a-12 |

| AB Variable Products Series Fund, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

| |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| [X] | No fee required. |

| |

| [_] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| |

| (4) | Proposed maximum aggregate value of transaction: |

| |

| |

| (5) | Total fee paid: |

| |

| |

| [_] | Fee paid previously with preliminary materials: |

| |

| |

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

| |

| (1) | Amount previously paid: |

| |

| |

| (2) | Form, Schedule or Registration Statement No.: |

| |

| |

| (3) | Filing Party: |

| |

| |

| (4) | Date Filed: |

| |

| |

| |

AB VARIABLE PRODUCTS SERIES FUND, INC.

1345AvenueoftheAmericas, New York, NewYork 10105

TollFree(800) 221-5672

August 20, 2018

Dear Stockholders:

The Board of Directors (the “Directors”) of AB Variable Products Series Fund, Inc. (the “Company”) is pleased to invite you to the Meeting of Stockholders (the “Meeting”) of the Company and each fund organized as a series of the Company (each, a “Fund” and, collectively, the “Funds”) to be held on October 11, 2018. The accompanying Notice of Meeting of Stockholders and the Proxy Statement present two proposals to be considered at the Meeting.

At the Meeting, stockholders of the Funds will be asked to elect Directors. In addition, stockholders of each Fund will be asked to approve new investment advisory agreements with AllianceBernstein L.P., the investment adviser to the Funds (the “Adviser”). The approval of new advisory agreements is required as a result of certain anticipated changes to the indirect ownership of the Adviser, in connection with a plan by AXA S.A. to divest over time its remaining ownership interest in AXA Equitable Holdings, Inc., the indirect holder of a majority of the partnership interests in the Adviser and the indirect parent of AllianceBernstein Corporation, the general partner of the Adviser. The material terms of the proposed new investment advisory agreements are identical to the material terms of the current investment advisory agreement for the Funds.

The Board has concluded that the proposals are in the best interests of each Fund, and unanimously recommends that you vote "FOR" each of the proposals that apply to each of the Funds in which you hold shares.

We welcome your attendance at the Meeting. Even if you plan to attend, we encourage you to authorize a proxy to vote your shares. Broadridge Financial Solutions, Inc. ("Broadridge"), a proxy solicitation firm, has been selected to assist stockholders in the proxy solicitation process. If we have not received your proxy authorization as the date of the Meeting approaches, you may receive a telephone call from Broadridge reminding you to authorize the proxy holders to cast your votes. No matter how many shares you own, your vote is important.

Sincerely,

| Robert M. Keith | | |

| President | | |

QUESTIONS AND ANSWERS

AB VARIABLE PRODUCTS SERIES FUND, INC.

PROXY

Q. WHY DID YOU SEND ME THIS BOOKLET?

| A. | This booklet contains the Notice of Meeting of Stockholders and the Proxy Statement that provides you with information you should review before voting on the proposals that will be presented at the Meeting of Stockholders (the "Meeting") for AB Variable Products Series Fund, Inc. (the "Company") and each fund organized as a series of the Company (each, a "Fund" and, collectively, the "Funds"). You are receiving these proxy materials because you own shares of capital stock of a Fund. As a stockholder, you have the right to vote on the proposal(s) concerning your investment in a Fund, but only with respect to the Fund or Funds in which you own shares. |

| Q. | WHO IS ASKING FOR MY VOTE? |

| A. | The Board of Directors is asking you to vote at the Meeting on the proposals. Details regarding the proposals are set forth in the Proxy Statement. A summary of the proposals is as follows: |

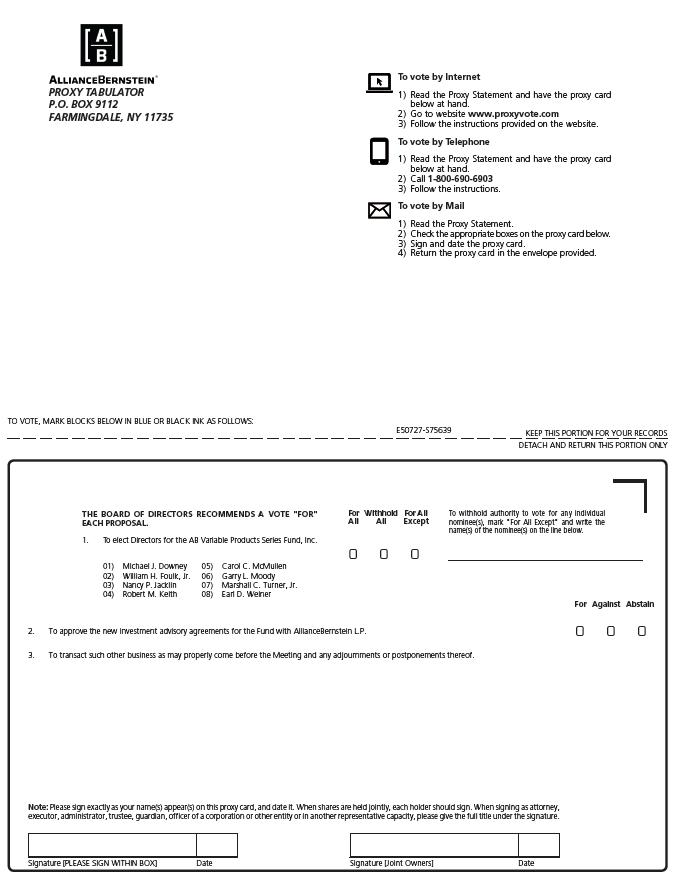

| · | The first proposal is to consider and vote upon the election of Directors. |

| · | The second proposal is to consider and vote upon the approval of new investment advisory agreements for the Funds with AllianceBernstein L.P. (the "Adviser"). |

Each stockholder will be asked to vote on the proposal(s) that applies to the Fund in which the stockholder holds shares.

| Q. | WHY AM I BEING ASKED TO ELECT MEMBERS OF THE BOARD? |

| A. | The members of the Board serve as representatives of stockholders of the Funds they oversee and for which they serve as director. Members of the Board have an obligation to serve the best interests of those Funds. The Investment Company Act of 1940, as amended (the "1940 Act"), requires that a majority of the Directors be elected by stockholders of the Funds for which they serve. In addition, the Board may fill vacancies or elect new Directors only if at least two-thirds of the Directors have been elected by stockholders immediately following their election. |

Having all Directors elected by the stockholders at this time facilitates the election of future Directors by the Board should it become necessary or desirable, as long as two-thirds of the resulting Directors were elected by stockholders. The nominees are all current members of the Board.

The nominees for the Board are Michael J. Downey, William H. Foulk, Jr., Nancy P. Jacklin, Robert M. Keith, Carol C. McMullen, Garry L. Moody, Marshall C. Turner, Jr. and Earl D. Weiner.

| Q. | WHY AM I BEING ASKED TO APPROVE NEW INVESTMENT ADVISORY AGREEMENTS? |

| A. | As required by the 1940 Act, the current investment advisory agreement between the Adviser and the Company on behalf of each Fund automatically terminates in the event of an assignment, which includes a direct or indirect transfer of a controlling block of the voting securities of the Adviser. This provision effectively requires a Fund's stockholders to vote on a new investment advisory agreement if the Adviser experiences a transfer of a controlling block of its voting securities for purposes of the 1940 Act. |

As described in more detail in the Proxy Statement, AXA S.A. plans to sell over time its remaining ownership interest in AXA Equitable Holdings, Inc., the indirect holder of a majority of the partnership interests in the Adviser and the indirect parent of AllianceBernstein Corporation, the general partner of the Adviser (the "Plan"). It is anticipated that one or more of the sales transactions over time conducted pursuant to the Plan may ultimately result in the indirect transfer of a "controlling block" of voting securities of the Adviser and therefore may be deemed an "assignment" causing a termination of the current investment advisory agreement for the Funds. To ensure continuation of the advisory services provided to each Fund, stockholders are being asked to approve a new investment advisory agreement. As part of the same proposal, stockholders are also voting to approve any future advisory agreements in the event there is more than one indirect transfer of a controlling block of the voting securities of the Adviser that occurs in connection with the Plan and a new advisory agreement terminates.

The transaction(s) are not expected to result in any changes to the contractual investment advisory fees charged to the Funds, the portfolio management of any Fund or the nature and quality of services provided by the Adviser.

| Q. | WILL THE PROPOSED INVESTMENT ADVISORY AGREEMENT AFFECT THE PORTFOLIO MANAGEMENT OR INVESTMENT STRATEGY OF ANY FUND? |

| A. | No. The investment objectives, principal investment strategies, investment processes and principal risks of the Funds will not change as a result of entering into the proposed new investment advisory agreement with the Adviser. Further, there are no anticipated changes to the portfolio management team of any Fund in connection with the proposed agreement. |

| Q. | DOES THE PROPOSED INVESTMENT ADVISORY AGREEMENT DIFFER FROM THE CURRENT ADVISORY AGREEMENT? |

| A. | No. The proposed new investment advisory agreement is substantially identical to the current investment advisory agreement, except with respect to the effective and termination dates. If the new agreement is approved and becomes effective, the Adviser will continue to provide advisory services to the Funds on the same terms and at the same contractual advisory fee rates as provided under the current investment advisory agreement, subject to any expense limitation. There is no anticipated change in the level, nature or quality of services provided to the Funds by the Adviser. |

| Q. | WHAT HAPPENS IF STOCKHOLDERS OF A FUND DO NOT APPROVE THE PROPOSED INVESTMENT ADVISORY AGREEMENT? |

| A. | If the stockholders of a Fund do not approve the proposed new investment advisory agreement with respect to that Fund and no direct or indirect transfer of a controlling block of the Adviser's voting securities occurs, the Adviser would continue to serve as adviser to the Fund under the current advisory agreement. |

If the stockholders of a Fund do not approve the proposed new investment advisory agreement with respect to that Fund and a direct or indirect transfer of a controlling block of the Adviser's voting securities occurs, the current investment advisory agreement would terminate and the Adviser would not be able to serve as adviser for the Fund to provide for continuity of service. Under these circumstances, the Board would need to consider appropriate action, which could include, among other things, allowing the Fund to operate under an interim advisory agreement with a duration of no more than 150 days (which agreement has been approved by the Board, as discussed in the Proxy Statement), seeking approval of a new investment advisory agreement, liquidation of a Fund, or reorganizing the Fund with and into another investment company in the Fund complex.

| Q. | HOW DOES THE BOARD RECOMMEND I VOTE? |

| A. | The Board recommends that you vote FOR each proposal. |

| Q. | WHO IS ELIGIBLE TO VOTE? |

| A. | Stockholders of record of the Funds at the close of business on August 13, 2018 (the "Record Date") are entitled to vote at the Meeting or any adjournment or postponement of the Meeting. You will be entitled to vote only on those proposals that apply to the Fund or Funds of which you were a stockholder on the Record Date. If you owned shares on the Record Date, you have the right to vote even if you later redeemed the shares. |

| Q. | WHAT ROLE DOES THE BOARD PLAY? |

| A. | The business and affairs of each Fund are overseen by the Board. Each Director has an obligation to act in what he or she believes to be the best interests of the Fund, including approving and recommending the proposals in the Proxy Statement. The background of each nominee for Director is described in the Proxy Statement. |

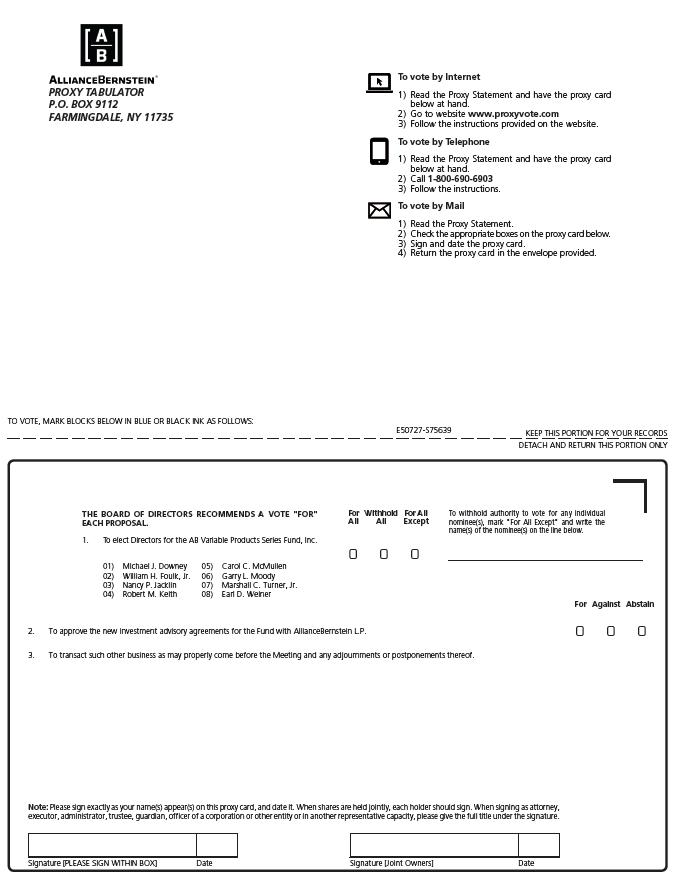

| Q. | HOW CAN I AUTHORIZE PROXIES TO CAST MY VOTE? |

| A. | Please follow the instructions included on the enclosed Proxy Card. |

| Q. | WHAT IF I WANT TO REVOKE MY PROXY? |

| A. | You can revoke your proxy at any time prior to its exercise (i) by giving written notice to the Secretary of AB Variable Products Series Fund, Inc. at 1345 Avenue of the Americas, New York, New York 10105, (ii) by authorizing a later-dated proxy (either by signing and submitting another proxy card or by calling (855) 643-7455 or (iii) by personally voting at the Meeting. Please note that attendance at the Meeting without voting will not be sufficient to revoke a previously authorized proxy. |

| Q. | WHOM DO I CALL IF I HAVE QUESTIONS REGARDING THE PROXY? |

| A. | Please call (855) 643-7455 if you have questions. |

AB VARIABLE PRODUCTS SERIES FUND, INC.

345AvenueoftheAmericas, New York, NewYork 10105 Toll Free (800) 221-5672 |

NOTICE OF MEETING OF STOCKHOLDERS

SCHEDULED FOR OCTOBER 11, 2018

To the Stockholders of the Funds:

Notice is hereby given that a Meeting of Stockholders (the “Meeting”) of AB Variable Products Series Fund, Inc. (the “Company”) and each fund organized as a series of the Company (individually, a “Fund”, and, collectively, the “Funds”) will be held at the offices of the Company, 1345 Avenue of the Americas, 41st Floor, New York, New York 10105, on October 11, 2018, at 11:30 a.m., Eastern Time. The Meeting is designated as the “Annual” stockholder meeting for the Funds.

The Meeting will be held to consider and vote on the following proposals, all of which are more fully described in the accompanying Proxy Statement dated August 20, 2018:

| 1. | To consider and vote upon the election of Directors of the Company, each such Director to serve for a term of indefinite duration and until his or her successor is duly elected and qualifies. |

| 2. | To consider and vote upon the approval of new investment advisory agreements for the Funds with AllianceBernstein L.P. |

| 3. | To transact such other business as may properly come before the Meeting and any adjournments or postponements thereof. |

Any stockholder of record of a Fund at the close of business on August 13, 2018is entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof.The enclosed proxy for each Fund is being solicited on behalf of the Board of Directors of the Company.

| | | By Order of the Board of Directors, Emilie Wrapp Secretary |

New York, New York

August 20, 2018

YOUR VOTE IS IMPORTANT Please indicate your voting instructions on the enclosed Proxy Card, sign and date it, and return it in the envelope provided, which needs no postage if mailed intheUnited States. You may also authorize proxies to cast your vote by telephone or through the Internet. To do so, please follow the instructions on the enclosed proxy card. Your vote is very important no matter howmanyshares you own.Pleasemarkandmail or otherwise authorizeyourproxy promptly in ordertosavetheFundsanyadditional cost of further proxy solicitation and in orderfortheMeetingtobe held as scheduled. |

The [A/B] Logo is a service mark of AllianceBernstein and AllianceBernstein® is a registered trademark used by permission of the owner, AllianceBernstein L.P.

PROXYSTATEMENT

AB VARIABLE PRODUCTS SERIES FUND, INC.

AB Balanced Wealth Strategy Portfolio

AB Dynamic Asset Allocation Portfolio

AB Global Thematic Growth Portfolio

AB Growth Portfolio

AB Growth and Income Portfolio

AB Intermediate Bond Portfolio

AB International Growth Portfolio

AB International Value Portfolio

AB Large Cap Growth Portfolio

AB Real Estate Investment Portfolio

AB Small Cap Growth Portfolio

AB Small/Mid Cap Value Portfolio

AB Value Portfolio

AB Global Risk Allocation—Moderate Portfolio

1345 Avenue of the Americas

New York, New York 10105

MEETING OF STOCKHOLDERS

October 11, 2018

INTRODUCTION

This is a Proxy Statement for AB Variable Products Series Fund, Inc. ("AVP" or the "Company") and each fund organized as a series of the Company listed above (each a "Fund", and collectively, the "Funds"). The Board of Directors (the "Board") is soliciting proxies for a Meeting of Stockholders (the "Meeting") to consider and vote on proposals that are being recommended by the Board.

The Company is sending you this Proxy Statement to ask for your vote on the proposals affecting your Fund. The Meeting will be held at the offices of the Company, 1345 Avenue of the Americas, 41st Floor, New York, New York 10105, on October 11, 2018 at 11:30 a.m., Eastern Time.The solicitation will be made primarily by mail and may also be made by telephone or through the Internet.It is expected that AllianceBernstein L.P., the investment adviser to the Funds (the "Adviser"), will bear the expenses of the printing and mailing of the proxy statements relating to the transactions arising from the Plan (as defined below), including the proxy solicitation costs, as well as the legal costs of Fund counsel relating thereto. The Notice of Meeting of Stockholders, Proxy Statement, and Proxy Card are beingmailed to stockholders on or about August 31, 2018.

Any stockholder who owned shares of a Fund at the close of business on August 13, 2018 (the "Record Date") is entitled to notice of, and to vote at, the Meeting and any postponement or adjournment thereof. Each share is entitled to one vote, and each fractional share is entitled to a proportionate fractional vote.Appendix A sets forth the number of shares of each Fund issued and outstanding as of the Record Date. The Meeting is designated as the "Annual" stockholder meeting for the Funds.

Important Notice Regarding Availability of Proxy Materials for the Stockholders' Meeting to be Held on Thursday, October 11, 2018. This Proxy Statement is available on the Internet atwww.alliancebernstein.com/abfundsproxy.

PROPOSAL ONE:

ELECTION OF DIRECTORS

At the Meeting, stockholders of each Fund will vote on the election of Directors of the Company. Unless otherwise noted herein, each Director elected at the Meeting will serve for a term of indefinite duration and until his or her successor is duly elected and qualifies.

The individuals identified below have been nominated for election as Directors as indicated below. The nominees are all current members of the Board.

Section 16 of the Investment Company Act of 1940, as amended (the “1940 Act”), requires that fund directors must be elected by the holders of outstanding securities of a fund, with the exception that vacancies occurring between meetings may be filled in any otherwise legal manner so long as, immediately after a vacancy is filled, at least two-thirds of the directors were elected by security holders. In order to provide the Board with the maximum flexibility to fill vacancies on the Board without the administrative burden and expense of calling a special meeting of stockholders, the Board believes it is appropriate for all current Directors to be submitted to stockholders for election.

Each nominee was recommended for nomination by the Fund's Governance and Nominating Committee. The Committee, which, among other things, considers recommendations on nominations for Directors, reviewed the qualifications, experience, and background of the nominees. Based upon this review, the Committee recommended each nominee as a candidate for nomination as a Director. At meetings of Directors held on July 31-August 2, 2018, after discussion and further consideration of the matter, the Directors voted to nominate the nominees for election by stockholders.

Unless contrary instructions are received, it is the intention of the persons named as proxies in the accompanying Proxy Card to vote in favor of the nominees named below for election as Directors.

| |

Independent Director Nominees: Michael J. Downey |

| William H. Foulk, Jr. |

| Nancy P. Jacklin |

| Carol C. McMullen |

| Garry L. Moody |

| Marshall C. Turner, Jr. |

Earl D. Weiner |

| Interested Director Nominee: |

| Robert M. Keith |

| |

Each nominee has consented to serve as a Director. The Board knows of no reason why any of the nominees would be unable to serve, but in the event any nominee is unable to serve or for good cause will not serve, the proxies received indicating a vote in favor of such nominee will be voted for a substitute nominee as the Board may determine, in its sole and absolute discretion.

Certain information concerningthe nominees for Director is set forth below (nominees are referred to as Directors in the charts below).

NAME, ADDRESS,*

AGE AND (YEAR FIRST ELECTED**) | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS AND OTHERINFORMATION | PORTFOLIOS IN AB FUND COMPLEX OVERSEEN BYDIRECTOR | OTHER PUBLIC COMPANY DIRECTORSHIPS CURRENTLY HELD BY DIRECTOR |

| | | | |

INDEPENDENT DIRECTORS | | | |

Marshall C. Turner, Jr.,# Chairman of the Board 76 (1992) | Private Investor since prior to 2013. Former Chairman and CEO of Dupont Photomasks, Inc. (components of semi-conductor manufacturing). He has extensive operating leadership and venture capital investing experience, including five interim or full-time CEO roles, and prior service as general partner of institutional venture capital partnerships. He also has extensive non-profit board leadership experience, and currently serves on the boards of two education and science-related non-profit organizations. He has served as a director of one AB Fund since 1992, and director or trustee of multiple AB Funds since 2005. He has been Chairman of the AB Funds since January 2014, and the Chairman of the Independent Directors Committees of such AB Funds since February 2014. | 94 | Xilinx, Inc. (programmable logic semi-conductors) since 2007 |

| | | | |

Michael J. Downey,#

74 (2005) | Private Investor since prior to 2013. Formerly, managing partner of Lexington Capital, LLC (investment advisory firm) from December 1997 until December 2003. He served as a Director of Prospect Acquisition Corp. (financial services) from 2007 until 2009. From 1987 until 1993, Chairman and CEO of Prudential Mutual Fund Management, director of the Prudential mutual funds, and member of the Executive Committee of Prudential Securities Inc. He has served as a director or trustee of the AB Funds since 2005 and is a director and Chairman of one other registered investment company. | 94 | The Asia Pacific Fund, Inc. (registered investment company) since prior to 2013 |

NAME, ADDRESS,*

AGE AND (YEAR FIRST ELECTED**) | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS AND OTHERINFORMATION | PORTFOLIOS IN AB FUND COMPLEX OVERSEEN BYDIRECTOR | OTHER PUBLIC COMPANY DIRECTORSHIPS CURRENTLY HELD BY DIRECTOR |

| | | | |

William H. Foulk, Jr.,# 85 (1990) | Investment Adviser and an Independent Consultant since prior to 2013. Previously, he was Senior Manager of Barrett Associates, Inc., a registered investment adviser. He was formerly Deputy Comptroller and Chief Investment Officer of the State of New York and, prior thereto, Chief Investment Officer of the New York Bank for Savings. He has served as a director or trustee of various AB Funds since 1983, and was Chairman of the Independent Directors Committees of the AB Funds from 2003 to early February 2014. He served as Chairman of such AB Funds from 2003 through December 2013. He is also active in a number of mutual fund related organizations and committees. | 94 | None |

Nancy P. Jacklin,# 70 (2006) | Private Investor since prior to 2013. Professorial Lecturer at the Johns Hopkins School of Advanced International Studies (2008-2015). U.S. Executive Director of the International Monetary Fund (which is responsible for ensuring the stability of the international monetary system), (December 2002-May 2006); Partner, Clifford Chance (1992-2002); Sector Counsel, International Banking and Finance, and Associate General Counsel, Citicorp (1985-1992); Assistant General Counsel (International), Federal Reserve Board of Governors (1982-1985); and Attorney Advisor, U.S. Department of the Treasury (1973-1982). Member of the Bar of the District of Columbia and of New York; and member of the Council on Foreign Relations. She has served as a director or trustee of the AB Funds since 2006 and has been Chairman of the Governance and Nominating Committees of the AB Funds since August 2014. | 94 | None |

NAME, ADDRESS,*

AGE AND (YEAR FIRST ELECTED**) | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS AND OTHERINFORMATION | PORTFOLIOS IN AB FUND COMPLEX OVERSEEN BYDIRECTOR | OTHER PUBLIC COMPANY DIRECTORSHIPS CURRENTLY HELD BY DIRECTOR |

| | | | |

Carol C. McMullen,# 63 (2016) | Managing Director of Slalom Consulting (consulting) since 2014, private investor and member of the Partners Healthcare Investment Committee. Formerly, Director of Norfolk & Dedham Group (mutual property and casualty insurance) from 2011 until November 2016; Director of Partners Community Physicians Organization (healthcare) from 2014 until December 2016; and Managing Director of The Crossland Group (consulting) from 2012 until 2013. She has held a number of senior positions in the asset and wealth management industries, including at Eastern Bank (where her roles included President of Eastern Wealth Management), Thomson Financial (Global Head of Sales for Investment Management), and Putnam Investments (where her roles included Head of Global Investment Research). She has served on a number of private company and non-profit boards, and as a director or trustee of the AB Funds since June 2016. | 94 | None |

Garry L. Moody,# 66 (2007) | Independent Consultant. Formerly, Partner, Deloitte & Touche LLP (1995-2008) where he held a number of senior positions, including Vice Chairman, and U.S. and Global Investment Management Practice Managing Partner; President, Fidelity Accounting and Custody Services Company (1993-1995), where he was responsible for accounting, pricing, custody and reporting for the Fidelity mutual funds; and Partner, Ernst & Young LLP (1975-1993), where he served as the National Director of Mutual Fund Tax Services and Managing Partner of its Chicago Office Tax department. He is a member of the Trustee Advisory Board of BoardIQ, a biweekly publication focused on issues and news affecting directors of mutual funds. He has served as a director or trustee, and as Chairman of the Audit Committees, of the AB Funds since 2008. | 94 | None |

NAME, ADDRESS,*

AGE AND (YEAR FIRST ELECTED**) | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS AND OTHERINFORMATION | PORTFOLIOS IN AB FUND COMPLEX OVERSEEN BYDIRECTOR | OTHER PUBLIC COMPANY DIRECTORSHIPS CURRENTLY HELD BY DIRECTOR |

| | | | |

Earl D. Weiner,# 78 (2007) | Of Counsel, and Partner prior to January 2007, of the law firm Sullivan & Cromwell LLP and is a former member of the ABA Federal Regulation of Securities Committee Task Force to draft editions of the Fund Director's Guidebook. He also serves as a director or trustee of various non-profit organizations and has served as Chairman or Vice Chairman of a number of them. He has served as a director or trustee of the AB Funds since 2007 and served as Chairman of the Governance and Nominating Committees of the AB Funds from 2007 until August 2014. | 94 | None |

| INTERESTED DIRECTOR | | | |

Robert M. Keith,+ 58 (2009) | Senior Vice President of the Adviser++ and the head of AllianceBernstein Investments, Inc. ("ABI")++ since July 2008; Director of ABI and President of the AB Mutual Funds. Previously, he served as Executive Managing Director of ABI from December 2006 to June 2008. Prior to joining ABI in 2006, Executive Managing Director of Bernstein Global Wealth Management, and prior thereto, Senior Managing Director and Global Head of Client Service and Sales of the Adviser's institutional investment management business since 2004. Prior thereto, he was Managing Director and Head of North American Client Service and Sales in the Adviser's institutional investment management business, with which he had been associated since prior to 2004. | 94 | None |

| ___________________________________________________ | |

| * | The address for each of the Fund's Directors is c/o AllianceBernstein L.P., Attention: Legal & Compliance Department – Mutual Fund Legal, 1345 Avenue of the Americas, New York, NY 10105. |

| ** | There is no stated term of office for the Directors. Mr. Foulk will retire from the Board effective December 31, 2018. |

| # | Member of the Audit Committee, the Governance and Nominating Committee and the Independent Directors Committee. |

| + | Mr. Keith is an "interested person", as defined in Section 2(a)(19) of the 1940 Act, of the Funds because of his affiliation with the Adviser. |

| ++ | The Adviser and ABI are affiliates of the Funds. |

In addition to the public company directorships currently held by the Directors, set forth in the table above, Mr. Turner was a director of SunEdison, Inc. (solar materials and power plants) since prior to 2013 until July 2014, Mr. Downey was a director of The Merger Fund (a registered investment company) from 1995 until 2013, and Mr. Moody was a director of Greenbacker Renewable Energy Company LLC (renewable energy and energy efficiency projects) from August 2013 until January 2014.

Directors who are not "interested persons" of the Fund as defined in the 1940 Act, are referred to as "Independent Directors", and Directors who are "interested persons" of the Fund are referred to as "Interested Directors".

Experience, Skills, Attributes, and Qualifications of the Directors. The Governance and Nominating Committee of the Board, which is composed of Independent Directors, reviews the experience, qualifications, attributes and skills of potential candidates for nomination or election by the Board, and conducts a similar review in connection with the proposed nomination of current Directors for re-election by stockholders at any annual or special meeting of stockholders. In evaluating a candidate for nomination or election as a Director, the Governance and Nominating Committee takes into account the contribution that the candidate would be expected to make to the diverse mix of experience, qualifications, attributes and skills that the Governance and Nominating Committee believes contributes to good governance for the Company. Additional information concerning the Governance and Nominating Committee's consideration of nominees appears in the description of the Committee below.

The Board believes that, collectively, the Directors have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the Company and protecting the interests of stockholders. The Board has concluded that, based on each Director's experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Directors, each Director is qualified and should continue to serve as such.

In determining that a particular Director was and continues to be qualified to serve as a Director, the Board has considered a variety of criteria, none of which, in isolation, was controlling. In addition, the Board has taken into account the actual service and commitment of each Director during his or her tenure (including the Director's commitment and participation in Board and committee meetings, as well as his or her current and prior leadership of standing and ad hoc committees) in concluding that each should continue to serve. Additional information about the specific experience, skills, attributes and qualifications of each Director, which in each case led to the Board's conclusion that the Director should serve (or continue to serve) as director of the Company, is provided in the table above and in the next paragraph.

Among other attributes and qualifications common to all Directors are their ability to review critically, evaluate, question and discuss information provided to them (including information requested by the Directors), to interact effectively with the Adviser, other service providers, counsel and the Funds' independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties as Directors. In addition to his or her service as a Director of the Company and other AB Funds as noted in the table above: Mr. Downey has experience in the investment advisory business including as Chairman and Chief Executive Officer of a large fund complex and as director of a number of non-AB funds and as Chairman of a non-AB closed-end fund; Mr. Foulk has experience in the investment advisory and securities businesses, including as Deputy Comptroller and Chief Investment Officer of the State of New York (where his responsibilities included bond issuances, cash management and oversight of the New York Common Retirement Fund), has served as Chairman of the Independent Directors Committees from 2003 until early February 2014, served as Chairman of the AB Funds from 2003 through December 2013, and is active in a number of mutual fund related organizations and

committees; Ms. Jacklin has experience as a financial services regulator as U.S. Executive Director of the International Monetary Fund (which is responsible for ensuring the stability of the international monetary system), and as a financial services lawyer in private practice and has served as Chair of the Governance and Nominating Committees of the AB Funds since August 2014; Mr. Keith has experience as an executive of the Adviser with responsibility for, among other things, the AB Funds; Ms. McMullen has experience as a management consultant and as a director of various private companies and non-profit organizations, as well as extensive asset management experience at a number of companies, including as an executive in the areas of portfolio management, research, and sales and marketing; Mr. Moody has experience as a certified public accountant including experience as Vice Chairman and U.S. and Global Investment Management Practice Partner for a major accounting firm, is a member of the Trustee Advisory Board of BoardIQ, a biweekly publication focused on issues and news affecting directors of mutual funds, and has served as a director or trustee and Chairman of the Audit Committees of the AB Funds since 2008; Mr. Turner has experience as a director (including Chairman and Chief Executive Officer of a number of companies) and as a venture capital investor including prior service as general partner of three institutional venture capital partnerships, and has served as Chairman of the AB Funds since January 2014 and Chairman of the Independent Directors Committees of such AB Funds since February 2014; and Mr. Weiner has experience as a securities lawyer whose practice includes registered investment companies and as director or trustee of various non-profit organizations and served as Chairman or Vice Chairman of a number of them, and served as Chairman of the Governance and Nominating Committees of the AB Funds from 2007 until August 2014. The disclosure herein of a director's experience, qualifications, attributes and skills does not impose on such director any duties, obligations, or liability that are greater than the duties, obligations and liability imposed on such director as a member of the Board and any committee thereof in the absence of such experience, qualifications, attributes and skills.

Board Structure and Oversight Function. The Board is responsible for oversight of the Funds. Each Fund has engaged the Adviser to manage the Fund on a day-to-day basis. The Board is responsible for overseeing the Adviser and the Fund's other service providers in the operations of the Fund in accordance with the Fund's investment objective and policies and otherwise in accordance with its prospectus, the requirements of the 1940 Act and other applicable Federal, state and other securities and other laws, and the Fund's charter and bylaws. The Board typically meets in-person at regularly scheduled meetings four times throughout the year. In addition, the Directors may meet in person or by telephone at special meetings or on an informal basis at other times. The Independent Directors also regularly meet without the presence of any representatives of management. As described below, the Board has established three standing committees – the Audit, Governance and Nominating, and Independent Directors Committees – and may establish ad hoc committees or working groups from time to time, to assist the Board in fulfilling its oversight responsibilities. Each committee is composed exclusively of Independent Directors. The responsibilities of each committee, including its oversight responsibilities, are described further below. The Independent Directors have also engaged independent legal counsel, and may from time to time engage consultants and other advisors, to assist them in performing their oversight responsibilities.

An Independent Director serves as Chairman of the Board. The Chairman's duties include setting the agenda for each Board meeting in consultation with management, presiding at each Board meeting, meeting with management between Board meetings, and facilitating communication and coordination between the Independent Directors and management. The Directors have determined that a Board's leadership by an Independent Director and its committees composed exclusively of Independent Directors is appropriate because they believe it sets the proper tone to the relationships between the Funds, on the one hand, and the Adviser and other service providers, on the other, and facilitates the exercise of the Board's independent judgment in evaluating and managing the relationships. In addition, each Company is required to have an Independent Director as Chairman pursuant to certain 2003 regulatory settlements involving the Adviser.

Risk Oversight. Each Fund is subject to a number of risks, including investment, compliance and operational risks, including cyber risks. Day-to-day risk management with respect to a Fund resides with the Adviser or other service providers (depending on the nature of the risk), subject to supervision by the Adviser. The Board has charged the Adviser and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrable and material adverse effects on the Fund; (ii) to the extent appropriate, reasonable or practicable, implementing processes and controls reasonably designed to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously, and to revise as appropriate, the processes and controls described in (i) and (ii) above.

Risk oversight forms part of a Board's general oversight of the Fund's investment program and operations and is addressed as part of various regular Board and committee activities. The Fund's investment management and business affairs are carried out by or through the Adviser and other service providers. Each of these persons has an independent interest in risk management but the policies and the methods by which one or more risk management functions are carried out may differ from the Fund's and each other's in the setting of priorities, the resources available or the effectiveness of relevant controls. Oversight of risk management is provided by the Board and the Audit Committee. The Directors regularly receive reports from, among others, management (including the Chief Risk Officer of the Adviser), the Fund's Chief Compliance Officer, the Fund's independent registered public accounting firm, the Adviser's internal legal counsel, the Adviser's Chief Compliance Officer and internal auditors for the Adviser, as appropriate, regarding risks faced by a Fund and the Adviser's risk management programs. In addition, the Directors receive regular updates on cyber security matters from the Adviser.

Not all risks that may affect a Fund can be identified, nor can controls be developed to eliminate or mitigate their occurrence or effects. It may not be practical or cost-effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of the Fund or the Adviser, its affiliates or other service providers. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve a Fund's goals. As a result of the foregoing and other factors a Fund's ability to manage risk is subject to substantial limitations.

Board Committees. The Board has three standing committees – an Audit Committee, a Governance and Nominating Committee and an Independent Directors Committee. The members of the Audit, Governance and Nominating and Independent Directors Committees are identified above.

The function of the Audit Committee is to assist the Board in its oversight of each Fund's accounting and financial reporting policies and practices. The Audit Committee of the Board met three times during each Fund's most recently completed fiscal year.

The function of the Governance and Nominating Committee includes the nomination of persons to fill any vacancies or newly created positions on the Board. The Governance and Nominating Committee of the Board met three times during each Fund's most recently completed fiscal year.

The Board has adopted a charter for its Governance and Nominating Committee. Pursuant to the charter, the Committee assists the Board in carrying out its responsibilities with respect to governance of the Funds and identifies, evaluates, selects and nominates candidates for the Board. The Committee may also set standards or qualifications for Directors and reviews at least annually the performance of each Director, taking into account factors such as attendance at meetings, adherence to Board policies, preparation for and participation at meetings, commitment and contribution to the overall work of the Board and its committees, and whether there are health or other reasons that might affect the Director's ability to perform his or her duties. The Committee may consider candidates as Directors submitted by the current Directors, officers, the Adviser, stockholders and other appropriate sources.

Pursuant to the Charter, the Governance and Nominating Committee will consider candidates for nomination as a director submitted by a stockholder or group of stockholders who have beneficially owned at least 5% of the Fund's common stock or shares of beneficial interest for at least two years at the time of submission and who timely provide specified information about the candidates and the nominating stockholder or group. To be timely for consideration by the Governance and Nominating Committee, the submission, including all required information, must be submitted in writing to the attention of the Secretary at the principal executive offices of the Funds not less than 120 days before the date of the proxy statement for the previous year's annual meeting of stockholders. If the Funds did not hold an annual meeting of stockholders in the previous year, the submission must be delivered or mailed and received within a reasonable amount of time before the Funds begin to print and mail its proxy materials. Public notice of such upcoming annual meeting of stockholders may be given in a stockholder report or other mailing to stockholders or by other means deemed by the Governance and Nominating Committee or the Board to be reasonably calculated to inform stockholders.

Stockholders submitting a candidate for consideration by the Governance and Nominating Committee must provide the following information to the Governance and Nominating Committee: (i) a statement in writing setting forth (A) the name, date of birth, business address and residence address of the candidate; (B) any position or business relationship of the candidate, currently or within the preceding five years, with the stockholder or an associated person of the stockholder as defined below; (C) the class or series and number of all shares of a Fund owned of record or beneficially by the candidate; (D) any other information regarding the candidate that is required to be disclosed about a nominee in a proxy statement or other filing required to be made in connection with the solicitation of proxies for election of Directors pursuant to Section 20 of the 1940 Act and the rules and regulations promulgated thereunder; (E) whether the stockholder believes that the candidate is or will be an "interested person" of the Funds (as defined in the 1940 Act) and, if believed not to be an "interested person", information regarding the candidate that will be sufficient for the Funds to make such determination; and (F) information as to the candidate's knowledge of the investment company industry, experience as a director or senior officer of public companies, directorships on the boards of other registered investment companies and educational background; (ii) the written and signed consent of the candidate to be named as a nominee and to serve as a Director if elected; (iii) the written and signed agreement of the candidate to complete a directors' and officers' questionnaire if elected; (iv) the stockholder's consent to be named as such by the Funds; (v) the class or series and number of all shares of a Fund owned beneficially and of record by the stockholder and any associated person of the stockholder and the dates on which such shares were acquired, specifying the number of shares owned beneficially but not of record by each, and stating the names of each as they appear on the Funds' record books and the names of any nominee holders for each; and (vi) a description of all arrangements or understandings between the stockholder, the candidate and/or any other person or persons (including their names) pursuant to which the recommendation is being made by the stockholder. "Associated person of the stockholder" means any person who is required to be identified under clause (vi) of this paragraph and any other person controlling, controlled by or under common control with, directly or indirectly, (a) the stockholder or (b) the associated person of the stockholder.

The Governance and Nominating Committee may require the stockholder to furnish such other information as it may reasonably require or deem necessary to verify any information furnished pursuant to the nominating procedures described above or to determine the qualifications and eligibility of the candidate proposed by the stockholder to serve on the Board. If the stockholder fails to provide such other information in writing within seven days of receipt of written request from the Governance and Nominating Committee, the recommendation of such candidate as a nominee will be deemed not properly submitted for consideration, and will not be considered, by the Committee.

The Governance and Nominating Committee will consider only one candidate submitted by such a stockholder or group for nomination for election at an annual meeting of stockholders. The Governance and Nominating Committee will not consider self-nominated candidates. The Governance and Nominating Committee will consider and evaluate candidates submitted by stockholders on the basis of the same criteria as those used to consider and evaluate candidates submitted from other sources. These criteria include the candidate's relevant knowledge, experience, and expertise, the candidate's ability to carry out his or her duties in the best interests of the Funds, and the candidate's ability to qualify as an Independent Director. When assessing a candidate for nomination, the Committee considers whether the individual's background, skills, and experience will complement the background, skills, and experience of other nominees and will contribute to the diversity of the Board.

The function of the Independent Directors Committee is to consider and take action on matters that the Board or Committee believes should be addressed in executive session of the Independent Directors, such as review and approval of the Advisory and Distribution Services Agreements. The Independent Directors Committee of the Board met seven times during each Fund's most recently completed fiscal year.

Other Information

Additional information on Proposal One, including information on the principal officers of the Company, nominee ownership of Fund shares and Board compensation, is included inAppendix B (Additional Information on Proposal One) andAppendix C (Independent Registered Public Accounting Firm).

The Board unanimously recommends thatthestockholders vote "FOR"each of the nominees to serve as a Director. The election of each nominee requires the affirmative vote of a plurality of the votes cast for the Company.

PROPOSAL TWO:

APPROVAL OF Investment Advisory AgreementS

Background

AXA S.A. ("AXA") is asociete anonyme organized under the laws of France and the holding company for an international group of insurance and related financial services companies. AXA Equitable Holdings, Inc., a Delaware corporation ("AXA Equitable"), is a majority-owned subsidiary of AXA and an indirect parent of AllianceBernstein Corporation, the general partner of the Adviser. AXA Equitable also indirectly holds a majority of the outstanding partnership interests of the Adviser.

AXA formerly owned all of the outstanding shares of common stock of AXA Equitable. On May 10, 2017, AXA announced its intention to sell a minority stake of AXA Equitable, an entity through which AXA owns its indirect interest in the Adviser, via an initial public offering ("IPO") and listing of AXA Equitable's shares of common stock on the New York Stock Exchange. On November 13, 2017, AXA Equitable filed a Form S-1 with the Securities and Exchange Commission (the “SEC”), confirming the May 2017 announcement. On May 10, 2018, the shares of common stock of AXA Equitable were listed and commenced trading (NYSE: EQH), and on May 14, 2018, AXA sold approximately 24.5% of the outstanding shares of AXA Equitable at $20.00 per share. Contemporaneously with the IPO, AXA sold $862.5 million aggregate principal amount of its 7.25% mandatorily exchangeable notes (the "MxB Notes") due May 15, 2021 and exchangeable into up to 43,125,000 shares of common stock (or approximately 7% of the outstanding shares of common stock of AXA Equitable). AXA retains ownership (including voting rights) of such shares of common stock until the MxB Notes are exchanged, which may be on a date that is earlier than the maturity date at AXA's option upon the occurrence of certain events. If, for example, there were no further sales by AXA Equitable or AXA of shares of common stock of AXA Equitable, upon exchange of the MxB Notes, AXA would continue to own approximately 64% of the shares of common stock of AXA Equitable ("Shares"). AXA has publicly announced, however, its plans to divest its remaining ownership interest in AXA Equitable over time in one or more transactions, subject to market conditions (the "Plan").

Currently, the Adviser and its affiliates do not anticipate that the Plan will have a material impact on the Adviser or any affiliates of the Adviser that provides services to the Funds, including with respect to the following: operations, personnel, organizational structure; capitalization, or financial and other resources. The Adviser's current leadership and key investment teams are expected to stay in place, and no change in senior management's strategy for the Adviser is anticipated as a result of the implementation of the Plan. Notwithstanding the foregoing, it is possible that the completion of the Plan, whether implemented through public offerings or other means, could create the potential for disruption to the businesses of AXA Equitable and its subsidiaries. AXA Equitable, today and in the future as a stand-alone entity, is a publicly held U.S. company subject to the reporting requirements of the Securities Exchange Act of 1934 as well as other U.S. government and state regulations applicable to public companies that it was not subject to prior to the IPO. The Plan may be implemented in phases. During the time that AXA retains a controlling interest in AXA Equitable, circumstances affecting AXA, including restrictions or requirements imposed on AXA by European and other authorities, may also affect AXA Equitable. A failure to implement the Plan could create uncertainty about the nature of the relationship between AXA Equitable and AXA, and could adversely affect AXA Equitable and its subsidiaries including the Adviser.

Completion of the Plan is subject to certain regulatory approvals, including the registration of shares to be sold publicly as well as the listing of those shares on the New York Stock Exchange, and other conditions, including market conditions prevailing at the time of its implementation. If the Plan is completed, AXA Equitable will no longer be a subsidiary of AXA. AXA Equitable is expected to remain the indirect parent of AllianceBernstein Corporation, the general partner of the Adviser.

This planned divestment gives rise to the proposal.

The Funds are subject to Section 15 of the 1940 Act. Section 15 provides that any investment advisory agreement with a registered investment company such as a Fund must terminate automatically upon its "assignment," which includes any transfer of a controlling block of outstanding voting securities of an investment adviser or the parent company of an investment adviser. Such transfer is often referred to as a "Change of Control Event."

Whether or not a particular sale of Shares by AXA results in a Change of Control Event depends on the facts and circumstances of the sale, and the law is not clear as to whether an assignment would ever occur in the case of implementation of the Plan. Also, a Change of Control Event may not occur if AXA continues to hold more than 25% of the Shares and if no single person or group acting together gains "control" (as defined in the 1940 Act) of AXA Equitable.

It is anticipated that one or more of the transactions contemplated by the Plan could be deemed a Change of Control Event resulting in the automatic termination of the investment advisory agreement (“Current Agreement”). In order to ensure that the existing investment advisory services can continue uninterrupted, the Board has approved a new investment advisory agreement with the Adviser in connection with the Plan. Stockholders are being asked to approve the new investment advisory agreement with the Adviser approved by the Board (“Proposed Agreement”), which would be effective after the first Change of Control Event that occurs after stockholder approval. This agreement is described below.

As part of Proposal Two, stockholders are also voting to approve any future advisory agreements ("Future Agreements") if there are subsequent Change of Control Events arising from completion of the Plan that terminate the advisory agreement after the first Change of Control Event. Stockholder approval will be deemed to apply to Future Agreements only if: (1) no single person or group acting together gains "control" (as defined in the 1940 Act) of AXA Equitable; (2) the Board approves the Future Agreements; and (3) the Future Agreements would not be materially different from the Proposed Agreement that is described in this Proxy Statement. The Future Agreements would be deemed effective upon the closing of the subsequent transaction that constitutes a Change of Control Event.

Stockholders are asked to vote on approval of Future Agreements as part of the same vote on the Proposed Agreement, which Proposed Agreement has been authorized and approved by the Board and which is described later in this Proxy Statement. This is because the first Change of Control Event and subsequent Change of Control Events will be incremental related steps that are part of the same Plan that would lead to the full divestiture of Shares by AXA. Under the circumstances described above, seeking a single stockholder vote for the Proposed Agreement and Future Agreements will allow the Funds to maintain the uninterrupted services of the Adviser without the need for additional stockholder approval and additional proxy statements, which would describe the same or substantially similar facts as this Proxy Statement.

If there is a change from the facts described in this Proxy Statement that is material to stockholders of the Funds in the context of a vote on an advisory agreement, any stockholder approval received at the Meeting would no longer be valid to approve Future Agreements that would otherwise be approved in the event of subsequent Change of Control Events. This judgment will be made by the Adviser in consultation with Fund counsel and reviewed by the Board. If the advisory agreement were to terminate without valid stockholder approval, the Board and the stockholders of each Fund may be asked to approve a new advisory agreement to permit the Adviser to continue to provide services to the Funds.

The Adviser anticipates that the conditions of Section 15(f) will be complied with in connection with offerings of the Shares pursuant to the Plan. Section 15(f) provides, in pertinent part, that affiliated persons of an adviser may receive any amount or benefit in connection with a sale of securities of, or a sale of any other interest in, such an adviser which results in an assignment of an investment advisory agreement if, for a period of three years after the time of such a transaction, at least 75% of the members of the board of any investment company which it oversees are not "interested persons" (as defined in the 1940 Act) of the new or old investment adviser; and, if, for a two-year period, there is no "unfair burden" imposed on any such investment company as a result of the transaction. The Board currently satisfies the 75% requirement of Section 15(f) and the Adviser has represented to the Board that it will use its best efforts to ensure its and its affiliates' compliance with the unfair burden condition for so long as the requirements of Section 15(f) apply.

Discussion

At the Meeting, stockholders of each Fund will be asked to approve a new investment advisory agreement between the Adviser and the Company with respect to that Fund (the “Proposed Agreement”) to ensure that existing investment advisory services can continue uninterrupted through the implementation of the Plan. A general description of the Proposed Agreement is included below.

As discussed above in the section entitled “Background,” the Plan may result in one or more Change of Control Events, each of which would result in the automatic termination of the advisory agreement for the Funds with the Adviser. Therefore, in addition to the Proposed Agreement, as part of this Proposal Two, stockholders are also voting to approve any future advisory agreement (“Future Agreement”) if, as a result of future Change of Control Events that occur in connection with the Plan, the then-current investment advisory agreement terminates. Stockholder approval will be deemed to apply to Future Agreements only if: (1) no single person or group acting together gains “control” (as defined in the 1940 Act) of AXA Equitable; (2) the Board approves the Future Agreements; and (3) the Future Agreements are not materially different from the Agreements that are described in this Proxy Statement. These Future Agreements would be deemed effective upon the closing of a transaction that constitutes a Change of Control Event.

At in-person Board meetings (the “Board Meeting”) held on July 31-August 2, 2018, the Adviserpresented its recommendation that the Board consider and approve the Proposed Agreement and approve for submission to stockholders the Future Agreements for the Funds. The Board approved the Proposed Agreement for the Funds at the Board Meeting, and recommended that stockholders of the Funds vote to approve the Proposed Agreement and the Future Agreements at the Meeting. The factors that the Board considered in approving the Proposed Agreement are set forth below under “Board Consideration of the Proposed Agreement” and inAppendix G to this Proxy Statement. Accordingly, the Board recommended approval of the Proposed Agreement by stockholders of the Funds, as discussed in this Proxy Statement.

The Adviser

The Adviser is a Delaware limited partnership with principal offices at 1345 Avenue of the Americas, New York, New York 10105. The Adviser is a leading international investment adviser supervising client accounts with assets as of June 30, 2018 totaling approximately $540 billion (of which approximately $110 billion represented assets of registered investment companies). As of June 30, 2018, the Adviser managed retirement assets for many of the largest public and private employee benefit plans in the United States (including 15 of the nation's FORTUNE 100 companies), for public employee retirement funds across 29 of the 50 states, for investment companies, and for foundations, endowments, banks and insurance companies worldwide. The 29 registered investment companies managed by the Adviser, comprising approximately 112 separate investment portfolios, had as of June 30, 2018 approximately 2.4 million stockholder accounts.

As of June 30, 2018, the direct ownership structure of the Adviser, expressed as a percentage of general and limited partnership interests, was as follows:

| AXA Equitable Holdings and its subsidiaries | 63.3% |

| AllianceBernstein Holding L.P. | 35.9% |

| Unaffiliated holders | 0.8% |

| | 100.0% |

As of June 30, 2018, AXA Equitable owns approximately 3.8% of the issued and outstanding units representing assignments of beneficial ownership of limited partnership interests in AllianceBernstein Holding L.P. ("AB Holding") ("AB Holding Units"). AllianceBernstein Corporation (an indirect wholly-owned subsidiary of AXA Equitable, "GP") is the general partner of both AB Holding and the Adviser. The GP owns 100,000 general partnership units in AB Holding and a 1% general partnership interest in the Adviser.

Including both the general partnership and limited partnership interests in AB Holding and the Adviser, AXA Equitable and its subsidiaries have an approximate 64.7% economic interest in the Adviser as of June 30, 2018.

The names and principal occupations of the Adviser's chief executive officer (also a director) and directors are set forth below. Unless otherwise indicated, the business address of each person listed below is 1345 Avenue of the Americas, New York, NY 10105.

| NAME | PRINCIPAL OCCUPATION |

| Seth Bernstein | President and Chief Executive Officer of the Adviser and Director of the General Partner of the Adviser. |

| | |

| Robert Zoellick | Chairman of the Board of the General Partner of the Adviser. |

| | |

| Paul Audet | Founding and Managing Member of Symmetrical Ventures, LLC, a venture capital firm specializing in growth capital investments in the technology sector. Director of the General Partner of the Adviser. |

| | |

| Ramon de Oliveira | Director of the General Partner of the Adviser. |

| | |

| Denis Duverne | Director of the General Partner of the Adviser. Chairman of the Board of AXA. |

| | |

| Barbara Fallon-Walsh | Director of the General Partner of the Adviser. |

| | |

| Daniel Kaye | Director of the General Partner of the Adviser. |

| | |

| Shelley Leibowitz | Director of the General Partner of the Adviser. Founder of SL Advisory, which advises senior executives and boards of directors in the areas of technology oversight and cybersecurity best practices. |

| | |

| Anders Malmstrom | Director of the General Partner of the Adviser. Chief Financial Officer of AXA Equitable. |

| | |

| Das Narayandas | Director of the General Partner of the Adviser. Edsel Bryant Ford Professor of Business Administration at Harvard Business School. |

| | |

| Mark Pearson | Director of the General Partner of the Adviser. President and Chief Executive Officer of AXA Equitable. |

Description of the Proposed Agreement and Future Agreements

The description of the Proposed Agreement that follows is qualified entirely by reference to the form of Proposed Agreement included inAppendix D to this Proxy Statement. For purposes of this subsection, references to the Proposed Agreement of the Funds include the Future Agreement. The Proposed Agreement is identical in all material respects to the applicable Current Agreement, except that it reflects new effective and termination dates, as the Proposed Agreement would become effective after the first Change of Control Event that occurs after stockholder approval, except that in the case of a Future Agreement, the Agreement would become effective upon a subsequent Change of Control Event. The material terms of the Proposed Agreement are discussed in more detail below.

Contractual Management Fees

No change in the contractual management fees for the Funds is proposed in connection with Proposal Two.Appendix E includes the fee schedules for each Fund and provides information on the fees paid to the Adviser by each registered investment company with an investment objective similar to the investment objectives of the Funds.

Services

No change to the advisory services provisions of the Current Agreement is proposed in connection with Proposal Two.

The Proposed Agreement provides that the Adviser will, subject to the oversight of the Directors and in accordance with the Fund's prospectus, manage the investment and reinvestment of the assets of the Fund and administer its affairs. In this regard, it is the responsibility of the Adviser to make investment and reinvestment decisions for each Fund and to place the purchase and sale orders for each Fund. The Adviser provides research and advice, continuously supervises the investment portfolio of each Fund and pays the costs of certain clerical and administrative services involved in portfolio management.

Reimbursement of Administrative Expenses

No change to the expense reimbursement provision of the Current Agreement is proposed in connection with Proposal Two.

The Proposed Agreement for the Funds includes a provision for the reimbursement to the Adviser of the costs of certain administrative services, including clerical, accounting, legal and other services, that the Adviser provides to the Funds at the request of the Funds.

Appendix F includes information on the amounts paid by the Funds to the Adviser with respect to the administrative services described above during the most recent fiscal year of each Fund, as applicable.

Other Expenses

No change to the "Other Expense" provision of the Current Agreement is proposed in connection with Proposal Two.

The Proposed Agreement for the Funds provides that each Fund is responsible for the payment of various expenses, including: (a) custody, transfer and dividend disbursing expenses; (b) fees of Directors who are not affiliated persons of the Adviser; (c) legal and auditing expenses; (d) clerical, accounting and other office costs; (e) the cost of certain personnel, who may be employees of the Adviser or its affiliates, that provide clerical, accounting and other services to such Fund; (f) costs of printing prospectuses and stockholder reports; (g) the cost of maintenance of corporate existence; (h) interest charges, taxes, brokerage fees and commissions; (i) costs of stationary and supplies; (j) expenses and fees related to registration and filing with the SEC and with state regulatory authorities; and (k) promotional expenses paid pursuant to any Rule 12b-1 Plan.

Exculpatory Provisions

No change to the exculpatory and limitations of liabilities provisions of the Current Agreement is proposed in connection with Proposal Two.

The Proposed Agreement provides that the Adviser shall not be liable thereunder for any mistake of judgment or in any event whatsoever, except for lack of good faith, provided that nothing in the Proposed Agreement shall be deemed to protect, or purport to protect, the Adviser against any liability to the particular Fund or to its stockholders to which the Adviser would otherwise be subject by reason of willful misfeasance, bad faith or gross negligence in the performance of the Adviser's duties thereunder, or by reason of the Adviser's reckless disregard of its obligations and duties thereunder.

Term and Continuance

No change to the term and continuance provisions of the Current Agreement is proposed in connection with Proposal Two. The Proposed Agreement would differ only to the extent of its effective and termination dates.

If approved by stockholders, the Proposed Agreement will be effective after the first Change of Control Event that occurs after stockholder approval or any subsequent Change of Control Event in the case of a Future Agreement. The Proposed Agreement would continue in effect for one year from its effective date and thereafter from year-to-year provided that its continuance is specifically approved at least annually by a vote of a majority of the Fund’s outstanding voting securities or by the Board, and in either case, by a majority of the Directors who are not parties to the Agreement or “interested persons” of any such party at a meeting called for the purpose of voting on such matter.

Termination

No change to the termination provision of the Current Agreement is proposed in connection with Proposal Two. The Proposed Agreement automatically terminates upon assignment and is terminable with respect to a Fund at any time without penalty by vote of the holders of a majority of the outstanding voting securities of the Fund or by vote of the directors of the Fund, in either case on 60 days’ written notice to the Adviser, or by the Adviser on 60 days’ written notice to the Fund.

For more information on when the Current Agreement was last approved by stockholders, seeAppendix E.

Board Consideration of the Proposed Agreement

As described above, the Plan contemplates one or more transactions that may result ultimately in one or more indirect Change of Control Events for the Adviser, which in turn would result in the automatic termination of the Current Agreement or the then-current investment advisory agreement. At the Board Meeting, the Adviser presented its recommendation that the Board consider and approve the Proposed Agreement. Following review and discussion with the Adviser, the Board, including a majority of the Directors who are not interested persons of the Funds (the “Independent Directors”) as defined in the 1940 Act, approved at the Board Meeting the Proposed Agreement with the Adviser. The Board, including the Independent Directors, also considered and approved an interim advisory agreement with the Adviser (the “Interim Advisory Agreement”) at the Board Meeting, to be effective only in the event that stockholder approval of the Proposed Agreement had not been obtained as of the date of a Change of Control Event resulting in the automatic termination of the investment advisory agreement.

The decision by the Board, including a majority of the Independent Directors, to approve the Proposed Agreement and Interim Advisory Agreement and to recommend approval of the Proposed Agreement and the Future Agreements by stockholders of the Funds was based on a determination by the Board that it would be in the best interests of the Funds for the Adviser to continue providing investment advisory and related services for the Funds, without interruption, as consummation of the Plan proceeds.

The Board was aware that the Plan may not result immediately in a Change of Control Event, but also recognized that the Plan contemplates a series of transactions that could result in one or more Change of Control Events in the future. The Board concluded that approval by stockholders at this time of the Proposed Agreement and the Future Agreements that may become effective for the Funds upon the Change of Control Events in the future will permit the Funds to benefit from the continuation of services by the Adviser and its affiliates throughout the implementation of the Plan without the need for multiple stockholder meetings. The Board also noted that they would have the opportunity to review and further consider any Future Agreement at the time of the Change of Control Event that resulted in a termination of a prior investment advisory agreement.

The Board, including the Independent Directors, recommends approval of the Proposed Agreement for the Funds by stockholders of the Funds.

Prior to their approval of the Proposed Agreement and Interim Advisory Agreement, the Directors had requested information from the Adviser, and had received and evaluated, extensive materials.

The Board reviewed detailed information on the Plan, including the ownership and control structure of the Adviser and its affiliated entities both before and after the series of transactions that are expected to result in a change of control of the Adviser. The Board reviewed information about the potential impact of the transactions contemplated by the Plan on the Adviser and each of the Adviser’s affiliates that provides services to the Funds, including with respect to the following areas: operations; personnel; organizational and governance structure; technology infrastructure; insurance coverage; capitalization; and financial and other resources. The Board considered the Adviser’s statement that it does not anticipate that the Plan will have a material impact on the Adviser or any affiliates of the Adviser with respect to operations, personnel, organizational structure, or capitalization, financial and other resources.

The Board further noted the Adviser's representation that the Adviser anticipates that the conditions of Section 15(f) of the 1940 Act will be complied with in connection with offerings of the Shares pursuant to the Plan, including that it will use its best efforts to ensure its and its affiliates' compliance with the unfair burden condition for so long as the requirements of Section 15(f) apply.

The Board reviewed the Proposed Agreement and Interim Advisory Agreement with the Adviser and with experienced counsel who are independent of the Adviser, who advised on the relevant legal standards. The Independent Directors also discussed the proposed approvals in private sessions with their counsel.

A further description of the process followed by the Board in approving the Proposed Agreement for the Funds, including information reviewed, certain material factors considered, and certain related conclusions reached, is set forth inAppendix G.

Approval of Proposal Two requires the affirmative vote of the holders of a "majority of the outstanding voting securities," of each Fund, as defined in the 1940 Act, which means the lesser of (i) 67% or more of the voting securities of the Fund present or represented by proxy if the holders of more than 50% of the Fund's outstanding voting securities are present or represented by proxy, or (ii) more than 50% of the outstanding voting securities of the Fund ("1940 Act Majority Vote").

The Board, including the Independent Directors, unanimously recommends that the stockholders of the Funds vote FOR Proposal Two.

PROXY VOTING AND STOCKHOLDER MEETINGS

All properly executed and timely received proxies will be exercised at the Meeting in accordance with the instructions marked thereon or otherwise provided therein. Accordingly, unless instructions to the contrary are marked on the proxies, the votes entitled to be cast by the stockholder will be cast (i) "FOR" the election of each of the nominees as a Director (Proposal One) and (ii) "FOR" the approval of the investment advisory agreements (Proposal Two).If no specification is made on a properly executed and timely received proxy, it will be voted for the matters specified on the Proxy Card.

Those stockholders who hold shares directly and not through a broker or nominee (that is, a stockholder of record) may authorize their proxies to cast their votes by completing a Proxy Card and returning it by mail in the enclosed postage-paid envelope as well as by telephoning toll free (855) 643-7455 or by authorizing a proxy through the Internet at www.proxyvote.com and following the directions on the proxy card. Owners of shares held through a broker or nominee (who is the stockholder of record for those shares) should follow directions provided to the stockholder by the broker or nominee to submit voting instructions. Instructions to be followed by a stockholder of record to authorize a proxy via telephone or through the Internet, including use of the Control Number on the stockholder's Proxy Card, are designed to verify stockholder identities, to allow stockholders to give voting instructions and to confirm that stockholder instructions have been recorded properly. Stockholders who authorize proxies by telephone or through the Internet should not also return a Proxy Card. A stockholder of record may revoke the stockholder's proxy at any time prior to exercise thereof by giving written notice to the Secretary of the Company at 1345 Avenue of the Americas, New York, New York 10105, by authorizing a later-dated proxy (either by signing and mailing another Proxy Card or by telephone or through the Internet, as indicated above), or by personally attending and voting at the Meeting. Attendance alone is not sufficient to revoke a previously authorized proxy.

Properly executed proxies may be returned with instructions to abstain from voting or to withhold authority to vote (an "abstention") or represent a broker "non-vote" (which is a proxy from a broker or nominee indicating that the broker or nominee has not received instructions from the beneficial owner or other person entitled to vote shares on a particular matter with respect to which the broker or nominee does not have discretionary power to vote).