UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05398

AB VARIABLE PRODUCTS SERIES FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: December 31, 2022

Date of reporting period: December 31, 2022

Explanatory Note:

Enclosed for filing you will find an amended Form N-CSR of the registrant’s original 2022 Form N-CSR filing of the referenced period. The purpose of this amended filing is to update Item 11 (b) and Item 13 (which is addressed in exhibits labeled Exhibit 12 (b)(1) and Exhibit 12 (b)(2) in the original filings). Except as set forth above, no other changes have been made to the Form N-CSR, and this amended filing does not amend, update or change any other items or disclosure found in the Form N-CSR.

ITEM 1. REPORTS TO STOCKHOLDERS.

DEC 12.31.22

ANNUAL REPORT

AB VARIABLE PRODUCTS

SERIES FUND, INC.

| + | | BALANCED HEDGED ALLOCATION PORTFOLIO |

Investment Products Offered

| | • | | Are Not Bank Guaranteed |

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| | |

| BALANCED HEDGED ALLOCATION | | |

| |

| PORTFOLIO | | AB Variable Products Series Fund |

LETTER TO INVESTORS

February 14, 2023

The following is an update of AB Variable Products Series Fund—Balanced Hedged Allocation Portfolio (the “Portfolio”) for the annual reporting period ended December 31, 2022. Prior to May 1, 2022, the Portfolio was named Balanced Wealth Strategy Portfolio.

INVESTMENT OBJECTIVE AND POLICIES

The Portfolio’s investment objective is to maximize total return consistent with the Adviser’s determination of reasonable risk.

The Portfolio invests in a balanced portfolio of equity and fixed-income securities (the “Balanced Component”) that is designed as a solution for investors who seek exposure to equity returns but also want the risk diversification offered by fixed-income securities and the broad diversification of their equity risk across styles, capitalization ranges and geographic regions. The Portfolio also utilizes a risk management portfolio intended to enhance the risk-adjusted return of the Portfolio (the “Risk Management Component”). A portfolio’s return is enhanced on a risk-adjusted basis when the portfolio achieves lower volatility with similar returns, or higher returns at similar volatility, compared to its benchmark. Both Components are actively managed by the Adviser as an integrated whole.

With respect to the Balanced Component, the Portfolio typically invests in shares of exchange-traded funds (“ETFs”), most or all of which are passively managed; in exchange-traded derivatives; and directly in securities. ETFs may provide more efficient and economical exposure to the types of companies and geographic locations in which the Portfolio seeks to invest than direct investments. Through its investments, the Portfolio gains exposure to various domestic and foreign markets, regions and countries, including emerging markets. The Portfolio normally invests at least 25% of its assets in equity investments, primarily consisting of but not limited to ETFs. The Portfolio normally invests at least 25% of its assets in US fixed-income investments, primarily consisting of but not limited to US bond ETFs and US government securities, including Treasury Inflation-Protected Securities (“TIPS”). The Portfolio’s fixed-income exposure consists primarily of investment-grade debt and may from time to time include lower-rated debt (“junk bonds”). The Portfolio may also seek exposure to real assets by investing in real estate-related ETFs. The Portfolio uses derivatives to gain access to or adjust its equity and fixed-income exposures.

With respect to the Risk Management Component, the Adviser seeks to enhance the risk-adjusted return of the Portfolio, attempting to enhance market exposure in rising markets and reduce risk in downturns. The Adviser employs a variety of risk management techniques in its strategy, primarily using derivative instruments. The Adviser attempts to stabilize current returns of the Portfolio by using techniques designed to limit the downside exposure of the Portfolio during periods of market declines, to add market exposure to the Portfolio during periods of normal or rising markets, and to reduce the volatility of the Portfolio. The Adviser uses risk management techniques designed to protect the Portfolio’s ability to generate future income. These techniques may use strategies including options (involving the purchase and/or writing of various combinations of call and/or put index options, and also may include options on individual securities) and futures contracts (including futures contracts on stock indices and US Treasuries).

Derivatives may provide more efficient and economical exposure to market segments than direct investments, and may also be a more efficient way to alter the Portfolio’s exposures than making direct investments. The derivative instruments may include “long” and “short” positions in futures, options and swap contracts. The Portfolio may, for example, use credit default, interest rate and total return swaps to establish exposure to the fixed-income markets or particular fixed-income securities and, as noted below, may use currency derivatives to hedge or add foreign currency exposure. The Risk Management Component may also include “long” and “short” positions in US government securities and cash instruments.

The Adviser may employ currency hedging strategies in the Portfolio, including the use of currency-related derivatives, to seek to reduce currency risk in the Portfolio, but it is not required to do so.

The Adviser considers a variety of factors in determining whether to sell a security, including changes in market conditions and changes in prospects for the security.

INVESTMENT RESULTS

The table on page 5 shows the Portfolio’s performance compared with its primary benchmark, the Morgan Stanley Capital International All Country World Index (“MSCI ACWI”) (net), and the Bloomberg US Aggregate Bond Index, for the one-, five- and 10-year periods ended December 31, 2022. The table also includes the previous secondary benchmark, Bloomberg Global Aggregate Bond Index (USD hedged).

For the annual period, all share classes of the Portfolio underperformed the primary benchmark and the

1

| | |

| |

| | | AB Variable Products Series Fund |

Bloomberg US Aggregate Bond Index. The Portfolio’s more diversified approach, which balances exposures to equities, bonds and risk-management techniques, underperformed the all-equity benchmark. During the period, equities, fixed-income assets and equity index options detracted from absolute performance.

During the annual period, the Portfolio used derivatives for hedging and investment purposes in the form of currency forwards, credit default swaps and inflation Consumer Price Index swaps, which added to absolute returns, while futures, interest rate swaps and purchased options detracted.

The Portfolio’s repositioning due to the transition to the new investment strategy was a significant contributor to the Portfolio’s turnover rate of 135%.

MARKET REVIEW AND INVESTMENT STRATEGY

US, international and emerging-market stocks declined during the annual period ended December 31, 2022. In response to persistently high inflation, central banks—led by the US Federal Reserve (the “Fed”)—took a hawkish pivot, which raised concerns that rapidly rising borrowing costs would slow economic growth significantly and tip global economies into recession. Volatility increased and stocks pulled back after the Fed announced its first interest-rate hike in March 2022, which was followed by six additional rate raises, including four consecutive 0.75% increases. Equity markets rebounded briefly at the end of the period, after some early evidence of easing inflationary pressures raised hopes that the Fed and other key central banks would soon slow the pace of rate hikes. Optimism faded and equity markets gave back gains after the Fed downshifted to a 0.50% rate hike but strongly reaffirmed its higher-for-longer conviction. Both value- and growth-oriented stocks declined for the year. Value stocks significantly outperformed growth stocks, as growth stocks have been pressured more by rising interest rates throughout most of the year. Large-cap stocks narrowly outperformed small-cap stocks on a relative basis, but both declined in absolute terms.

Fixed-income government bond market yields rose sharply, and bond prices fell significantly in all major developed markets, as most central banks raised interest rates to combat high and persistent inflation. Lower-than-expected inflation numbers late in the period led to optimism that central bank policy rate increases would moderate. Longer-term bonds fell the most in the UK and eurozone, and by the least in Japan. Securitized assets generally outperformed other credit-risk sectors. Global investment-grade corporate bonds, which typically have longer maturities and are more sensitive to changes in yields than high-yield corporates, underperformed global treasuries—trailing US Treasury bonds in the US while outperforming eurozone treasuries in the euro bloc. Developed-market high-yield corporate bonds modestly outperformed global treasuries, trailing in the US and outperforming in the eurozone relative to respective treasury markets. Emerging-market sovereign bonds trailed as the US dollar gained on the vast majority of currencies. Emerging-market corporate bonds and local-currency bonds also fell sharply. Brent crude oil prices were extremely volatile and rose during the period.

The Portfolio’s Senior Investment Management Team seeks enhanced risk-adjusted returns by utilizing a blend of US, international and emerging-market equities as well as diversifiers in the form of fixed-income, real estate investment trusts (“REITs”) and TIPS. The Portfolio also features a US Treasury futures overlay to benefit from potentially low correlation between Treasuries and equities. The blended equity and fixed-income exposures, combined with the US Treasury overlay and dynamic equity allocation (including equity index options) offer the potential to achieve higher risk-adjusted returns.

2

| | |

|

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| |

| DISCLOSURES AND RISKS | | AB Variable Products Series Fund |

Benchmark Disclosure

All indices are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The MSCI ACWI (net, free float-adjusted, market capitalization weighted) represents the equity market performance of developed and emerging markets. The Bloomberg US Aggregate Bond Index represents the performance of securities within the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities. The Bloomberg Global Aggregate Bond Index (USD hedged) represents the performance of the global investment-grade developed fixed-income markets, hedged to the US dollar. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns reflect the reinvestment of dividends after deduction of non-US withholding tax. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Portfolio.

A Word About Risk

Market Risk: The value of the Portfolio’s assets will fluctuate as the stock or bond market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness) and regional and global conflicts, that affect large portions of the market.

Allocation Risk: The allocation of investments among the different investment styles, such as growth or value, equity or debt securities, or US or non-US securities may have a more significant effect on the Portfolio’s net asset value (“NAV”) when one of these investment strategies is performing more poorly than others.

ETF Risk: ETFs are investment companies and are subject to market and selection risk. When the Portfolio invests in an ETF, the Portfolio bears its share of the ETF’s expenses and runs the risk that the ETF may not achieve its investment objective.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade due to adverse market, economic, political, regulatory or other factors.

Emerging-Market Risk: Investments in emerging-market countries may have more risk because the markets are less developed and less liquid, and because these investments may be subject to increased economic, political, regulatory or other uncertainties.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Portfolio’s investments or reduce the Portfolio’s returns.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations. The Portfolio may be subject to a greater risk of rising interest rates than would normally be the case due to the end of a recent period of historically low rates and the effect of potential central bank monetary policy, and government fiscal policy initiatives and resulting market reactions to those initiatives.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Below Investment-Grade Security Risk: Investments in fixed-income securities with lower ratings (“junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific corporate developments, interest-rate sensitivity and negative perceptions of the junk bond market generally, and may be more difficult to trade than other types of securities.

Capitalization Risk: Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small- and mid-capitalization companies may have additional risks because these companies have limited product lines, markets or financial resources.

(Disclosures, Risks and Note About Historical Performance continued on next page)

3

| | |

|

| DISCLOSURES AND RISKS |

| |

| (continued) | | AB Variable Products Series Fund |

Derivatives Risk: Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Portfolio. A short position in a derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying instrument, which could cause the Portfolio to suffer a (potentially unlimited) loss. Derivatives, especially over-the-counter derivatives, are also subject to counterparty risk, which is the risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable or unwilling to honor its contractual obligations to the Portfolio.

Real Assets Risk: The Portfolio’s investments in securities linked to real assets involve significant risks, including financial, operating, and competitive risks. Investments in securities linked to real assets expose the Portfolio to adverse macroeconomic conditions, such as a rise in interest rates or a downturn in the economy in which the asset is located. Changes in inflation rates or in the market’s inflation expectations may adversely affect the market value of inflation-sensitive equities. The Portfolio’s investments in real estate securities have many of the same risks as direct ownership of real estate, including the risk that the value of real estate could decline due to a variety of factors that affect the real estate market generally. Investments in REITs may have additional risks. REITs are dependent on the capability of their managers, may have limited diversification, and could be significantly affected by changes in tax laws. Some REITs may utilize leverage, which increases investment risk and may potentially increase the Portfolio’s losses.

Management Risk: The Portfolio is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions for the Portfolio, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

These risks are fully discussed in the Variable Products prospectus. As with all investments, you may lose money by investing in the Portfolio.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Portfolio will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. Please contact your financial advisor or insurance agent representative at your financial institution to obtain Portfolio performance information current to the most recent month-end.

Effective May 1, 2022, the Portfolio made certain changes to its principal strategies, including the modification of the strategies to invest in ETFs, most or all of which are passively managed; reduce allocations to international securities; add the Risk Management Component; and eliminate the targets for allocation of investments in natural resource equity securities and inflation-sensitive equity securities. In addition, effective May 1, 2018, the Portfolio amended its principal strategies by eliminating the static targets for allocation of investments among asset classes, changing the securities selection strategies used for the equity portion of the Portfolio, and broadening the types of real asset securities in which the Portfolio invests. In light of these changes, the performance shown for periods prior to May 1, 2022, is based on the Portfolio’s prior principal strategies and may not be representative of the Portfolio’s performance under its current principal strategies.

Investors should consider the investment objectives, risks, charges and expenses of the Portfolio carefully before investing. For additional copies of the Portfolio’s prospectus or summary prospectus, which contains this and other information, call your financial advisor or (800) 227 4618. Please read the prospectus and/or summary prospectus carefully before investing.

All fees and expenses related to the operation of the Portfolio have been deducted, but no adjustment has been made for insurance company separate account or annuity contract charges, which would reduce total return to a contract owner. Performance assumes reinvestment of distributions and does not account for taxes.

There are additional fees and expenses associated with all Variable Products. These fees can include mortality and expense risk charges, administrative charges, and other charges that can significantly reduce investment returns. Those fees and expenses are not reflected in this annual report. You should consult your Variable Products prospectus for a description of those fees and expenses and speak to your insurance agent or financial representative if you have any questions. You should read the prospectus before investing or sending money.

4

| | |

|

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| |

| HISTORICAL PERFORMANCE | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| THE PORTFOLIO VS. ITS BENCHMARKS | | Net Asset Value Returns | |

| PERIODS ENDED DECEMBER 31, 2022 (unaudited) | | 1 Year | | | 5 Years1 | | | 10 Years1 | |

| | | |

| Balanced Hedged Allocation Portfolio Class A2 | | | -18.99% | | | | 2.31% | | | | 5.63% | |

| | | |

| Balanced Hedged Allocation Portfolio Class B2 | | | -19.17% | | | | 2.06% | | | | 5.37% | |

| | | |

| Primary Benchmark: MSCI ACWI (net) | | | -18.36% | | | | 5.23% | | | | 7.98% | |

| | | |

| Bloomberg US Aggregate Bond Index3 | | | -13.01% | | | | 0.02% | | | | 1.06% | |

| | | |

| Bloomberg Global Aggregate Bond Index (USD hedged) | | | -11.22% | | | | 0.36% | | | | 1.70% | |

1 Average annual returns. 2 Includes the impact of proceeds received and credited to the Portfolio resulting from class-action settlements, which enhanced the performance of all share classes of the Portfolio for the annual period ended December 31, 2022, by 0.02%. 3 Effective May 1, 2022, the secondary index used for comparison with the Portfolio’s performance has changed from the Bloomberg Global Aggregate Bond Index (USD hedged) to the Bloomberg US Aggregate Bond Index to show how the Portfolio’s performance compares with the returns of an index of securities similar to those in which the Portfolio invests. | |

| | | | | | | | | | | | |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.67% and 0.92% for Class A and Class B shares, respectively. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

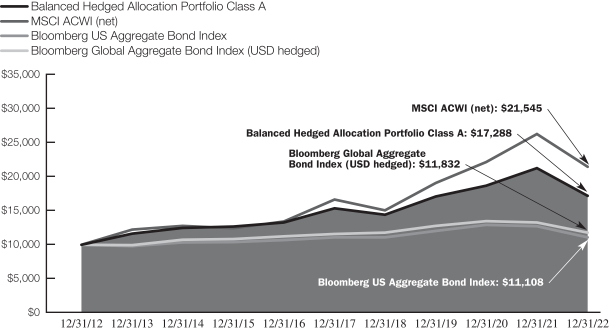

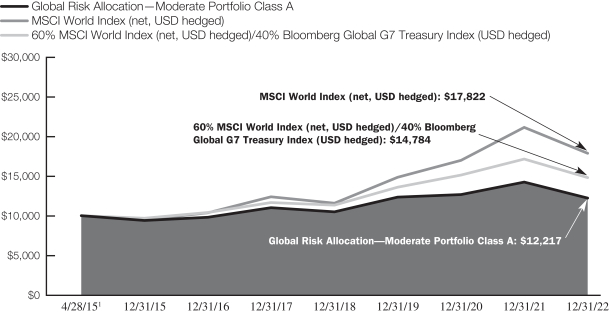

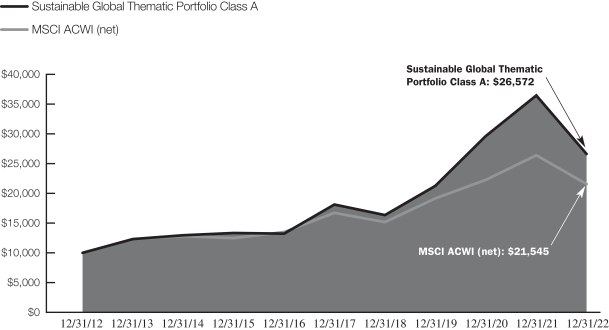

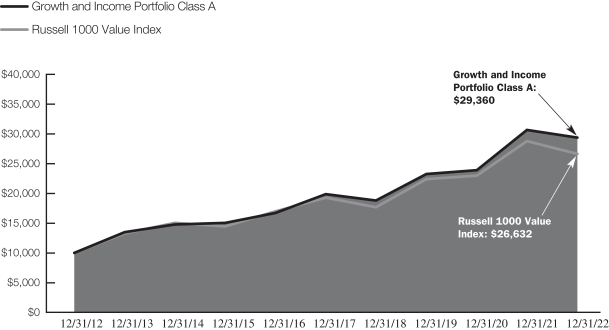

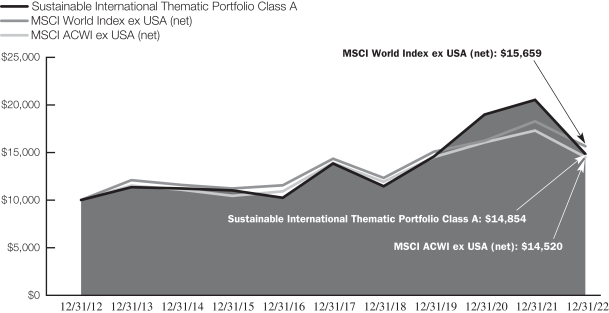

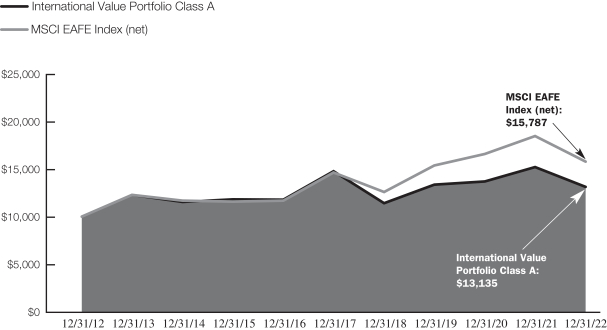

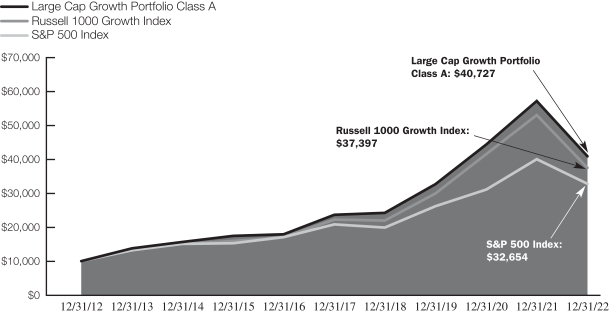

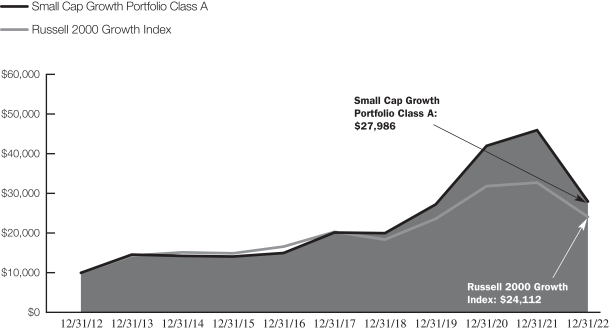

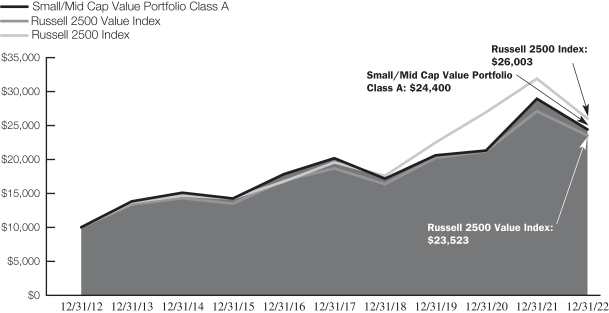

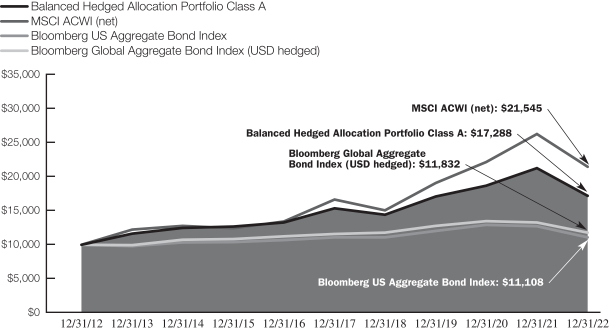

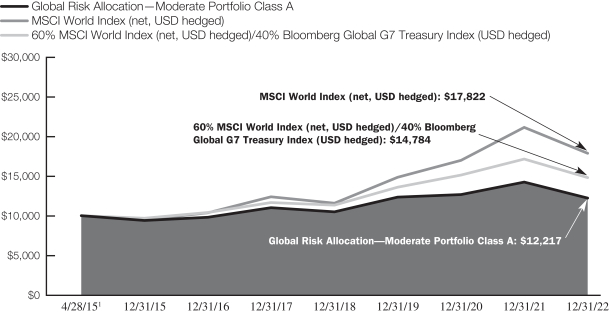

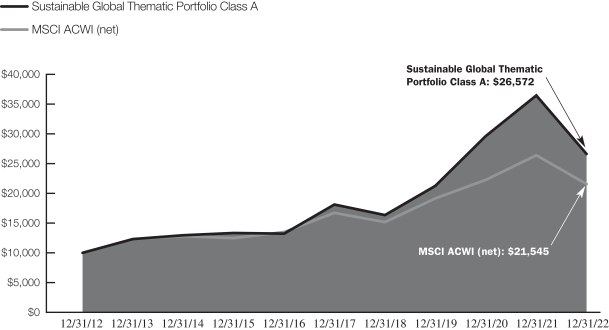

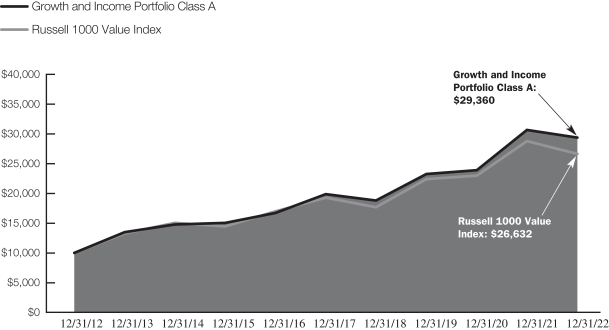

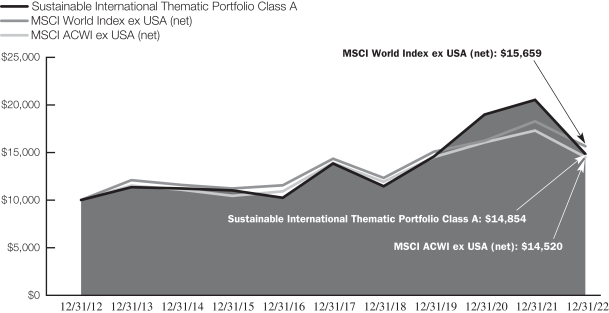

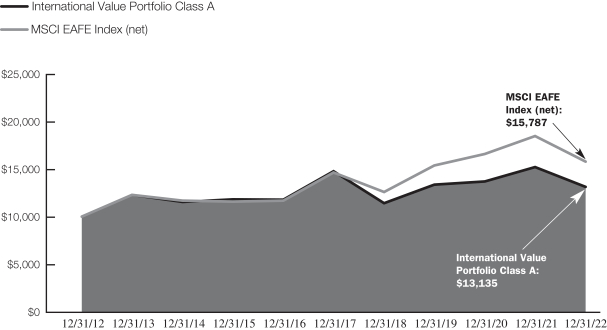

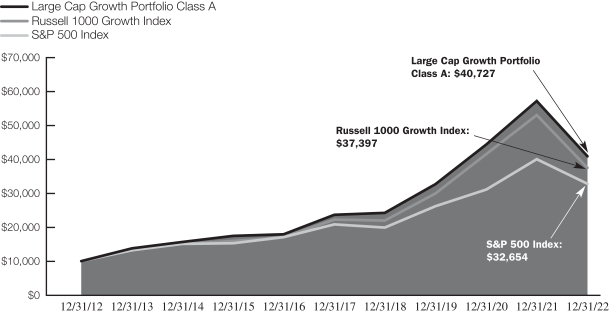

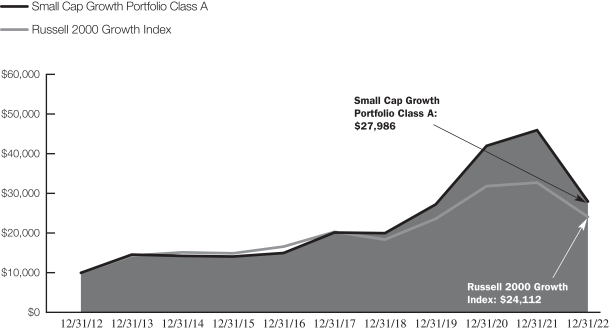

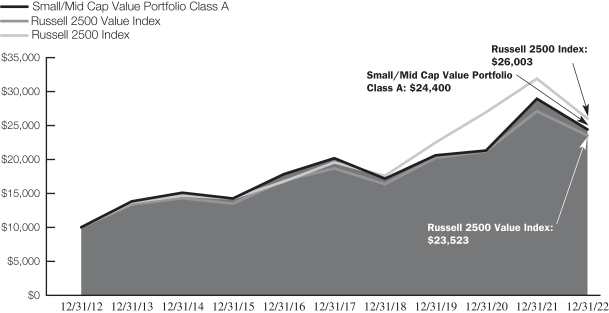

GROWTH OF A $10,000 INVESTMENT

12/31/2012 TO 12/31/2022 (unaudited)

This chart illustrates the total value of an assumed $10,000 investment in Balanced Hedged Allocation Portfolio Class A shares (from 12/31/2012 to 12/31/2022) as compared with the performance of the Portfolio’s current and previous benchmarks. The chart assumes the reinvestment of dividends and capital gains distributions.

See Disclosures, Risks and Note About Historical Performance on pages 3-4.

5

| | |

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| |

| EXPENSE EXAMPLE (unaudited) | | AB Variable Products Series Fund |

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The estimate of expenses does not include fees or other expenses of any variable insurance product. If such expenses were included, the estimate of expenses you paid during the period would be higher and your ending account value would be lower.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The estimate of expenses does not include fees or other expenses of any variable insurance product. If such expenses were included, the estimate of expenses you paid during the period would be higher and your ending account value would be lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of each class’ table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

July 1, 2022 | | | Ending

Account Value

December 31, 2022 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | | | Total

Expenses Paid

During Period+ | | | Total

Annualized

Expense Ratio+ | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 963.50 | | | $ | 3.41 | | | | 0.69 | % | | $ | 3.76 | | | | 0.76 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.73 | | | $ | 3.52 | | | | 0.69 | % | | $ | 3.87 | | | | 0.76 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class B | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 963.00 | | | $ | 4.65 | | | | 0.94 | % | | $ | 5.00 | | | | 1.01 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.47 | | | $ | 4.79 | | | | 0.94 | % | | $ | 5.14 | | | | 1.01 | % |

| * | | Expenses are equal to each classes’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | | Assumes 5% annual return before expenses. |

| + | | In connection with the Portfolio’s investments in affiliated/unaffiliated underlying portfolios, the Portfolio incurs no direct expenses, but bears proportionate shares of the fees and expenses (i.e., operating, administrative and investment advisory fees) of the affiliated/unaffiliated underlying portfolios. The Adviser has contractually agreed to waive its fees from the Portfolio in an amount equal to the Portfolio’s pro rata share of certain acquired fund fees and expenses of the affiliated underlying portfolios. The Portfolio’s total expenses are equal to the classes’ annualized expense ratio plus the Portfolio’s pro rata share of the weighted average expense ratio of the affiliated/unaffiliated underlying portfolios in which it invests, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

6

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| TEN LARGEST HOLDINGS1 | | |

| |

| December 31, 2022 (unaudited) | | AB Variable Products Series Fund |

| | | | | | | | |

| SECURITY | | U.S. $ VALUE | | | PERCENT OF NET ASSETS | |

iShares Core S&P 500 ETF | | $ | 53,434,774 | | | | 30.1 | % |

iShares Core U.S. Aggregate Bond ETF | | | 28,379,274 | | | | 16.0 | |

Vanguard Total Bond Market ETF | | | 28,362,432 | | | | 16.0 | |

iShares Core MSCI EAFE ETF | | | 21,697,280 | | | | 12.2 | |

iShares Core MSCI Emerging Markets ETF | | | 11,441,500 | | | | 6.4 | |

Vanguard Mid-Cap ETF | | | 5,747,442 | | | | 3.2 | |

U.S. Treasury Notes | | | 4,597,847 | | | | 2.6 | |

Vanguard Small-Cap ETF | | | 4,129,650 | | | | 2.3 | |

Vanguard Real Estate ETF | | | 4,041,520 | | | | 2.3 | |

S&P 500 Index | | | 2,593,500 | | | | 1.5 | |

| | | | | | | | | |

| | | $ | 164,425,219 | | | | 92.6 | % |

SECURITY TYPE BREAKDOWN2

December 31, 2022 (unaudited)

| | | | | | | | |

| SECURITY TYPE | | U.S. $ VALUE | | | PERCENT OF TOTAL INVESTMENTS | |

Investment Companies | | $ | 157,233,872 | | | | 88.4 | % |

Options Purchased—Puts | | | 6,559,555 | | | | 3.7 | |

Inflation-Linked Securities | | | 4,597,847 | | | | 2.6 | |

Options Purchased—Calls | | | 1,588,210 | | | | 0.9 | |

Corporates—Investment Grade | | | 193,998 | | | | 0.1 | |

Short-Term Investments | | | 7,692,198 | | | | 4.3 | |

| | | | | | | | | |

Total Investments | | $ | 177,865,680 | | | | 100.0 | % |

| 2 | | The Portfolio’s security type breakdown is expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Portfolio also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). |

7

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| PORTFOLIO OF INVESTMENTS | | |

| |

| December 31, 2022 | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

INVESTMENT COMPANIES–88.7% | | | | | | | | | | | | |

FUNDS AND INVESTMENT TRUSTS–88.7%(a) | | | | | | | | | | | | |

iShares Core MSCI EAFE ETF | | | | | | | 352,000 | | | $ | 21,697,280 | |

iShares Core MSCI Emerging Markets ETF | | | | | | | 245,000 | | | | 11,441,500 | |

iShares Core S&P 500 ETF | | | | | | | 139,077 | | | | 53,434,774 | |

iShares Core U.S. Aggregate Bond ETF | | | | | | | 292,600 | | | | 28,379,274 | |

Vanguard Mid-Cap ETF(b) | | | | | | | 28,200 | | | | 5,747,442 | |

Vanguard Real Estate ETF(b) | | | | | | | 49,000 | | | | 4,041,520 | |

Vanguard Small-Cap ETF(b) | | | | | | | 22,500 | | | | 4,129,650 | |

Vanguard Total Bond Market ETF | | | | | | | 394,800 | | | | 28,362,432 | |

| | | | | | | | | | | | |

Total Investment Companies

(cost $170,696,688) | | | | | | | | | | | 157,233,872 | |

| | | | | | | | | | | | |

| | | Notional

Amount | | | | |

OPTIONS PURCHASED–PUTS–3.7% | | | | | | | | | | | | |

OPTIONS ON EQUITY INDICES–3.7% | | | | | | | | | | | | |

S&P 500 Index

Expiration: Dec 2024; Contracts: 50; Exercise Price: USD 4,200.00;

Counterparty: Morgan Stanley & Co., Inc.(c) | | | USD | | | | 21,000,000 | | | | 2,593,500 | |

S&P 500 Index

Expiration: Dec 2024; Contracts: 35; Exercise Price: USD 4,100.00;

Counterparty: Morgan Stanley & Co., Inc.(c) | | | USD | | | | 14,350,000 | | | | 1,666,525 | |

S&P 500 Index

Expiration: Dec 2024; Contracts: 27; Exercise Price: USD 4,000.00;

Counterparty: Morgan Stanley & Co., Inc.(c) | | | USD | | | | 10,800,000 | | | | 1,171,530 | |

| | | | | | | | | | | | |

S&P 500 Index

Expiration: Dec 2024; Contracts: 20; Exercise Price: USD 4,300.00;

Counterparty: Morgan Stanley & Co., Inc.(c) | | | USD | | | | 8,600,000 | | | | 1,128,000 | |

| | | | | | | | | | | | |

Total Options Purchased–Puts

(premiums paid $7,009,410) | | | | | | | | | | | 6,559,555 | |

| | | | | | | | | | | | |

| | | Principal

Amount

(000) | | | | |

INFLATION-LINKED SECURITIES–2.6% | | | | | | | | | | | | |

UNITED STATES–2.6% | | | | | | | | | | | | |

U.S. Treasury Notes

0.125%, 01/15/2032

(cost $5,268,986) | | | U.S.$ | | | | 5,239 | | | | 4,597,847 | |

| | | | | | | | | | | | |

| | | Notional

Amount | | | | |

OPTIONS PURCHASED–CALLS–0.9% | | | | | | | | | | | | |

OPTIONS ON EQUITY INDICES–0.9% | | | | | | | | | | | | |

S&P 500 Index

Expiration: Dec 2024; Contracts: 15; Exercise Price: USD 4,200.00;

Counterparty: Morgan Stanley & Co., Inc.(c) | | | USD | | | | 6,300,000 | | | | 613,950 | |

S&P 500 Index

Expiration: Dec 2024; Contracts: 12; Exercise Price: USD 4,000.00;

Counterparty: Morgan Stanley & Co., Inc.(c) | | | USD | | | | 4,800,000 | | | | 611,160 | |

S&P 500 Index

Expiration: Dec 2024; Contracts: 10; Exercise Price: USD 4,300.00;

Counterparty: Morgan Stanley & Co., Inc.(c) | | | USD | | | | 4,300,000 | | | | 363,100 | |

| | | | | | | | | | | | |

Total Options Purchased–Calls

(premiums paid $1,955,535) | | | | | | | | | | | 1,588,210 | |

| | | | | | | | | | | | |

8

| | |

| |

| | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

| | |

Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

CORPORATES–INVESTMENT GRADE–0.1% | | | | | | | | | | | | |

INDUSTRIAL–0.1% | | | | | | | | | | | | |

SERVICES–0.1% | | | | | | | | | | | | |

Chicago Parking Meters

4.93%, 12/30/2025(d)

(cost $200,000) | | | U.S.$ | | | | 200 | | | $ | 193,998 | |

| | | | | | | | | | | | |

| | | Shares | | | | |

COMMON STOCKS–0.0% | | | | | | | | | | | | |

ENERGY – 0.0% | | | | | | | | | | | | |

OIL, GAS & CONSUMABLE FUELS–0.0% | | | | | | | | | | | | |

Gazprom PJSC(d)(e) | | | | | | | 31,460 | | | | –0 | – |

LUKOIL PJSC(d)(e) | | | | | | | 790 | | | | –0 | – |

| | | | | | | | | | | | |

| | | | | | | | | | | –0 | – |

| | | | | | | | | | | | |

MATERIALS–0.0% | | | | | | | | | | | | |

METALS & MINING–0.0% | | | | | | | | | | | | |

MMC Norilsk Nickel PJSC (ADR)(c)(d)(e) | | | | | | | 2,540 | | | | –0 | – |

| | | | | | | | | | | | |

Total Common Stocks

(cost $272,623) | | | | | | | | | | | –0 | – |

| | | | | | | | | | | | |

SHORT-TERM INVESTMENTS–4.3% | | | | | | | | | | | | |

INVESTMENT COMPANIES – 4.3% | | | | | | | | | | | | |

AB Fixed Income Shares, Inc.–Government Money Market Portfolio–Class AB, 4.12%(a)(f)(g)

(cost $7,692,198) | | | | | | | 7,692,198 | | | | 7,692,198 | |

| | | | | | | | | | | | |

Total Investments Before Security Lending Collateral for Securities Loaned–100.3%

(cost $193,095,440) | | | | | | | | | | | 177,865,680 | |

| | | | | | | | | | | | |

| | | | | |

Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

INVESTMENTS OF CASH COLLATERAL FOR SECURITIES LOANED–1.1% | | | | | | | | | | | | |

INVESTMENT COMPANIES–1.1% | | | | | | | | | | | | |

AB Fixed Income Shares, Inc.–Government Money Market Portfolio–Class AB,

4.12%(a)(f)(g)

(cost $1,978,425) | | | | | | | 1,978,425 | | | $ | 1,978,425 | |

| | | | | | | | | | | | |

TOTAL INVESTMENTS–101.4% (cost $195,073,865) | | | | | | | | | | | 179,844,105 | |

Other assets less liabilities–(1.4)% | | | | | | | | | | | (2,453,679 | ) |

| | | | | | | | | | | | |

NET ASSETS–100.0% | | | | | | | | | | $ | 177,390,426 | |

| | | | | | | | | | | | |

9

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| PORTFOLIO OF INVESTMENTS | | |

| |

| (continued) | | AB Variable Products Series Fund |

FUTURES (see Note D)

| | | | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | | Expiration

Month | | | Current

Notional | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Purchased Contracts | |

E-Mini Russell 2000 Futures | | | 2 | | | | March 2023 | | | $ | 177,090 | | | $ | (11,464 | ) |

MSCI EAFE Futures | | | 7 | | | | March 2023 | | | | 682,290 | | | | (29,837 | ) |

MSCI Emerging Markets Futures | | | 5 | | | | March 2023 | | | | 239,850 | | | | (8,702 | ) |

S&P 500 E-Mini Futures | | | 93 | | | | March 2023 | | | | 17,953,650 | | | | (659,084 | ) |

S&P Mid 400 E-Mini Futures | | | 2 | | | | March 2023 | | | | 488,520 | | | | (19,780 | ) |

U.S. Long Bond (CBT) Futures | | | 50 | | | | March 2023 | | | | 6,267,188 | | | | (57,315 | ) |

U.S. T-Note 10 Yr (CBT) Futures | | | 536 | | | | March 2023 | | | | 60,191,125 | | | | (408,778 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | (1,194,960 | ) |

| | | | | | | | | | | | | | | | |

| (a) | | To obtain a copy of the fund’s shareholder report, please go to the Securities and Exchange Commission’s website at www.sec.gov, or call AB at (800) 227-4618. |

| (b) | | Represents entire or partial securities out on loan. See Note E for securities lending information. |

| (c) | | Non-income producing security. |

| (d) | | Fair valued by the Adviser. |

| (e) | | Security in which significant unobservable inputs (Level 3) were used in determining fair value. |

| (f) | | Affiliated investments. |

| (g) | | The rate shown represents the 7-day yield as of period end. |

Currency Abbreviations:

USD—United States Dollar

Glossary:

ADR—American Depositary Receipt

CBT—Chicago Board of Trade

EAFE—Europe, Australia, and Far East

ETF—Exchange Traded Fund

MSCI—Morgan Stanley Capital International

PJSC—Public Joint Stock Company

See notes to financial statements.

10

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| STATEMENT OF ASSETS & LIABILITIES | | |

| |

| December 31, 2022 | | AB Variable Products Series Fund |

| | | | |

ASSETS | |

Investments in securities, at value | | | | |

Unaffiliated issuers (cost $185,403,242) | | $ | 170,173,482 | (a) |

Affiliated issuers (cost $9,670,623—including investment of cash collateral for securities loaned of $1,978,425) | | | 9,670,623 | |

Cash | | | 2,471 | |

Foreign currencies, at value (cost $11) | | | 12 | |

Affiliated dividends receivable | | | 28,549 | |

Receivable for capital stock sold | | | 27,145 | |

Unaffiliated dividends and interest receivable | | | 26,087 | |

Receivable for investment securities sold | | | 5 | |

| | | | |

Total assets | | | 179,928,374 | |

| | | | |

LIABILITIES | |

Payable for collateral received on securities loaned | | | 1,978,425 | |

Payable for variation margin on futures | | | 147,296 | |

Advisory fee payable | | | 68,958 | |

Payable for capital stock redeemed | | | 39,600 | |

Distribution fee payable | | | 35,301 | |

Administrative fee payable | | | 23,956 | |

Foreign capital gains tax payable | | | 13,800 | |

Transfer Agent fee payable | | | 150 | |

Accrued expenses | | | 230,462 | |

| | | | |

Total liabilities | | | 2,537,948 | |

| | | | |

NET ASSETS | | $ | 177,390,426 | |

| | | | |

COMPOSITION OF NET ASSETS | |

Capital stock, at par | | $ | 21,739 | |

Additional paid-in capital | | | 182,087,411 | |

Accumulated loss | | | (4,718,724 | ) |

| | | | |

NET ASSETS | | $ | 177,390,426 | |

| | | | |

Net Asset Value Per Share—1 billion shares of capital stock authorized, $.001 par value

| | | | | | | | | | | | |

| Class | | Net Assets | | | Shares

Outstanding | | | Net Asset

Value | |

| | | |

| A | | $ | 16,241,235 | | | | 1,961,152 | | | $ | 8.28 | |

| | | |

| B | | $ | 161,149,191 | | | | 19,778,053 | | | $ | 8.15 | |

| (a) | | Includes securities on loan with a value of $8,441,350 (see Note E). |

See notes to financial statements.

11

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| STATEMENT OF OPERATIONS | | |

| |

| Year Ended December 31, 2022 | | AB Variable Products Series Fund |

| | | | |

INVESTMENT INCOME | | | | |

Dividends | | | | |

Unaffiliated issuers (net of foreign taxes withheld of $27,846) | | $ | 3,460,506 | |

Affiliated issuers | | | 139,426 | |

Interest (net of foreign taxes withheld of $143) | | | 721,069 | |

Securities lending income | | | 12,841 | |

| | | | |

| | | 4,333,842 | |

| | | | |

EXPENSES | | | | |

Advisory fee (see Note B) | | | 995,302 | |

Distribution fee—Class B | | | 465,033 | |

Transfer agency—Class A | | | 460 | |

Transfer agency—Class B | | | 4,661 | |

Custody and accounting | | | 120,024 | |

Audit and tax | | | 107,406 | |

Administrative | | | 92,509 | |

Legal | | | 69,114 | |

Directors’ fees | | | 20,109 | |

Printing | | | 15,325 | |

Miscellaneous | | | 23,233 | |

| | | | |

Total expenses | | | 1,913,176 | |

Less: expenses waived and reimbursed by the Adviser (see Notes B & E) | | | (155,733 | ) |

| | | | |

Net expenses | | | 1,757,443 | |

| | | | |

Net investment income | | | 2,576,399 | |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENT AND FOREIGN CURRENCY TRANSACTIONS | | | | |

Net realized gain (loss) on: | | | | |

Affiliated Underlying Portfolios | | | (3,685,980 | ) |

Investment transactions(a) | | | 22,135,291 | |

Forward currency exchange contracts | | | 2,260,394 | |

Futures | | | (8,073,709 | ) |

Swaps | | | 264,013 | |

Foreign currency transactions | | | (2,605,361 | ) |

Net change in unrealized appreciation (depreciation) of: | | | | |

Affiliated Underlying Portfolios | | | (4,266,342 | ) |

Investments(b) | | | (52,375,945 | ) |

Forward currency exchange contracts | | | (491,430 | ) |

Futures | | | (1,220,824 | ) |

Swaps | | | 49,082 | |

Foreign currency denominated assets and liabilities | | | (5,038 | ) |

| | | | |

Net loss on investment and foreign currency transactions | | | (48,015,849 | ) |

| | | | |

Contributions from Affiliates (see Note B) | | | 2,636 | |

| | | | |

NET DECREASE IN NET ASSETS FROM OPERATIONS | | $ | (45,436,814 | ) |

| | | | |

| (a) | | Net of foreign realized capital gains taxes of $6,888. |

| (b) | | Net of decrease in accrued foreign capital gains taxes on unrealized gains of $1,429. |

See notes to financial statements.

12

| | |

| |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| |

| STATEMENT OF CHANGES IN NET ASSETS | | AB Variable Products Series Fund |

| | | | | | | | |

| | | Year Ended

December 31,

2022 | | | Year Ended

December 31,

2021 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | |

Net investment income | | $ | 2,576,399 | | | $ | 3,030,763 | |

Net realized gain on investment and foreign currency transactions | | | 10,294,648 | | | | 20,060,382 | |

Net realized gain distributions from Underlying Portfolios | | | –0 | – | | | 2,321,524 | |

Net change in unrealized appreciation (depreciation) of investments and foreign currency denominated assets and liabilities | | | (58,310,497 | ) | | | 5,781,625 | |

Contributions from Affiliates (see Note B) | | | 2,636 | | | | 72 | |

| | | | | | | | |

Net increase (decrease) in net assets from operations | | | (45,436,814 | ) | | | 31,194,366 | |

Distributions to Shareholders | |

Class A | | | (2,419,129 | ) | | | (615,351 | ) |

Class B | | | (24,164,652 | ) | | | (5,621,797 | ) |

CAPITAL STOCK TRANSACTIONS | |

Net increase (decrease) | | | 3,638,903 | | | | (22,864,424 | ) |

| | | | | | | | |

Total increase (decrease) | | | (68,381,692 | ) | | | 2,092,794 | |

NET ASSETS | |

Beginning of period | | | 245,772,118 | | | | 243,679,324 | |

| | | | | | | | |

End of period | | $ | 177,390,426 | | | $ | 245,772,118 | |

| | | | | | | | |

See notes to financial statements.

13

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| NOTES TO FINANCIAL STATEMENTS | | |

| |

| December 31, 2022 | | AB Variable Products Series Fund |

NOTE A: Significant Accounting Policies

The AB Balanced Hedged Allocation Portfolio (the “Portfolio”) (formerly known as AB Balanced Wealth Strategy Portfolio) is a series of AB Variable Products Series Fund, Inc. (the “Fund”). The Portfolio’s investment objective is to maximize total return consistent with the determination of AllianceBernstein L.P. (the “Adviser”) of reasonable risk. The Portfolio is diversified as defined under the Investment Company Act of 1940. The Fund was incorporated in the State of Maryland as an open-end series investment company. The Fund offers 10 separately managed pools of assets which have differing investment objectives and policies. The Portfolio offers Class A and Class B shares. Both classes of shares have identical voting, dividend, liquidating and other rights, except that Class B shares bear a distribution expense and have exclusive voting rights with respect to the Class B distribution plan.

The Portfolio offers and sells its shares only to separate accounts of certain life insurance companies for the purpose of funding variable annuity contracts and variable life insurance policies. Sales are made without a sales charge at the Portfolio’s net asset value per share.

The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Portfolio is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Portfolio.

1. Security Valuation

Portfolio securities are valued at market value determined on the basis of market quotations or, if market quotations are not readily available or are unreliable, at “fair value” as determined in accordance with procedures approved by and under the oversight of the Fund’s Board of Directors (the “Board”). Pursuant to these procedures, the Adviser serves as the Portfolio’s valuation designee pursuant to Rule 2a-5 of the 1940 Act. In this capacity, the Adviser is responsible, among other things, for making all fair value determinations relating to the Portfolio’s portfolio investments, subject to the Board’s oversight.

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, the Adviser will have discretion to determine the best valuation (e.g., last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; U.S. Government securities and any other debt instruments having 60 days or less remaining until maturity are generally valued at market by an independent pricing vendor, if a market price is available. If a market price is not available, the securities are valued at amortized cost. This methodology is commonly used for short term securities that have an original maturity of 60 days or less, as well as short term securities that had an original term to maturity that exceeded 60 days. In instances when amortized cost is utilized, the Valuation Committee (the “Committee”) must reasonably conclude that the utilization of amortized cost is approximately the same as the fair value of the security. Factors the Committee will consider include, but are not limited to, an impairment of the creditworthiness of the issuer or material changes in interest rates. Fixed-income securities, including mortgage-backed and asset-backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker-dealers. In cases where broker-dealer quotes are obtained, the Adviser may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security. Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Open-end mutual funds are valued at the closing net asset value per share, while exchange traded funds are valued at the closing market price per share.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value as deemed appropriate by the Adviser. Factors considered in making this determination may include, but

14

| | |

| |

| | | AB Variable Products Series Fund |

are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Portfolio may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Portfolio values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities. To account for this, the Portfolio generally values many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Portfolio would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability (including those valued based on their market values as described in Note A.1 above). Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Portfolio. Unobservable inputs reflect the Portfolio’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments) |

The fair value of debt instruments, such as bonds, and over-the-counter derivatives is generally based on market price quotations, recently executed market transactions (where observable) or industry recognized modeling techniques and are generally classified as Level 2. Pricing vendor inputs to Level 2 valuations may include quoted prices for similar investments in active markets, interest rate curves, coupon rates, currency rates, yield curves, option adjusted spreads, default rates, credit spreads and other unique security features in order to estimate the relevant cash flows which are then discounted to calculate fair values. If these inputs are unobservable and significant to the fair value, these investments will be classified as Level 3.

Where readily available market prices or relevant bid prices are not available for certain equity investments, such investments may be valued based on similar publicly traded investments, movements in relevant indices since last available prices or based upon underlying company fundamentals and comparable company data (such as multiples to earnings or other multiples to equity). Where an investment is valued using an observable input, such as another publicly traded security, the investment will be classified as Level 2. If management determines that an adjustment is appropriate based on restrictions on resale, illiquidity or uncertainty, and such adjustment is a significant component of the valuation, the investment will be classified as Level 3. An investment will also be classified as Level 3 where management uses company fundamentals and other significant inputs to determine the valuation.

Options are valued using market-based inputs to models, broker or dealer quotations, or alternative pricing sources with reasonable levels of price transparency, where such inputs and models are available. Alternatively, the values may be obtained through unobservable management determined inputs and/or management’s proprietary models. Where models are used, the selection of a particular model to value an option depends upon the contractual terms of, and specific risks inherent in, the option as well as the availability of pricing information in the market. Valuation models require a variety of inputs, including contractual terms, market prices, measures of volatility and correlations of such inputs. Exchange traded options generally will be classified as Level 2. For options that do not trade on an exchange but trade in liquid markets, inputs can generally be verified and model selection does not involve significant management judgment. Options are classified within Level 2 on the fair value hierarchy when all of the significant inputs can be corroborated to market evidence. Otherwise such instruments are classified as Level 3.

15

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| NOTES TO FINANCIAL STATEMENTS | | |

| |

| (continued) | | AB Variable Products Series Fund |

Valuations of mortgage-backed or other asset-backed securities, by pricing vendors, are based on both proprietary and industry recognized models and discounted cash flow techniques. Significant inputs to the valuation of these instruments are value of the collateral, the rates and timing of delinquencies, the rates and timing of prepayments, and default and loss expectations, which are driven in part by housing prices for residential mortgages. Significant inputs are determined based on relative value analyses, which incorporate comparisons to instruments with similar collateral and risk profiles, including relevant indices. Mortgage and asset-backed securities for which management has collected current observable data through pricing services are generally categorized within Level 2. Those investments for which current observable data has not been provided are classified as Level 3.

Other fixed income investments, including non-U.S. government and corporate debt, are generally valued using quoted market prices, if available, which are typically impacted by current interest rates, maturity dates and any perceived credit risk of the issuer. Additionally, in the absence of quoted market prices, these inputs are used by pricing vendors to derive a valuation based upon industry or proprietary models which incorporate issuer specific data with relevant yield/spread comparisons with more widely quoted bonds with similar key characteristics. Those investments for which there are observable inputs are classified as Level 2. Where the inputs are not observable, the investments are classified as Level 3.

The following table summarizes the valuation of the Portfolio’s investments by the above fair value hierarchy levels as of December 31, 2022:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities: | | | | | | | | | | | | | | | | |

Assets: | |

Investment Companies | | $ | 157,233,872 | | | $ | –0 | – | | $ | –0 | – | | $ | 157,233,872 | |

Options Purchased—Puts | | | –0 | – | | | 6,559,555 | | | | –0 | – | | | 6,559,555 | |

Inflation-Linked Securities | | | –0 | – | | | 4,597,847 | | | | –0 | – | | | 4,597,847 | |

Options Purchased—Calls | | | –0 | – | | | 1,588,210 | | | | –0 | – | | | 1,588,210 | |

Corporates—Investment Grade | | | –0 | – | | | 193,998 | | | | –0 | – | | | 193,998 | |

Common Stocks: | | | | | | | | | | | | | | | | |

Energy | | | –0 | – | | | –0 | – | | | 0 | (a) | | | –0 | – |

Materials | | | –0 | – | | | –0 | – | | | 0 | (a) | | | –0 | – |

Short-Term Investments | | | 7,692,198 | | | | –0 | – | | | –0 | – | | | 7,692,198 | |

Investments of Cash Collateral for Securities Loaned in Affiliated Money Market Fund | | | 1,978,425 | | | | –0 | – | | | –0 | – | | | 1,978,425 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 166,904,495 | | | | 12,939,610 | | | | 0 | (a) | | | 179,844,105 | |

Other Financial Instruments(b): | | | | | | | | | | | | | | | | |

Assets | | | –0 | – | | | –0 | – | | | –0 | – | | | –0 | – |

Liabilities: | |

Futures | | | (1,194,960 | ) | | | –0 | – | | | –0 | – | | | (1,194,960 | )(c) |

| | | | | | | | | | | | | | | | |

Total | | $ | 165,709,535 | | | $ | 12,939,610 | | | $ | 0 | (a) | | $ | 178,649,145 | |

| | | | | | | | | | | | | | | | |

| (a) | | The Portfolio held securities with zero market value at period end. |

| (b) | | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation (depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, written options and written swaptions which are valued at market value. |

| (c) | | Only variation margin receivable (payable) at period end is reported within the statement of assets and liabilities. This amount reflects cumulative unrealized appreciation (depreciation) on futures and centrally cleared swaps as reported in the portfolio of investments. Where applicable, centrally cleared swaps with upfront premiums are presented here at market value. |

3. Currency Translation

Assets and liabilities denominated in foreign currencies and commitments under forward currency exchange contracts are translated into U.S. dollars at the mean of the quoted bid and ask prices of such currencies against the U.S. dollar. Purchases and sales of portfolio securities are translated into U.S. dollars at the rates of exchange prevailing when such securities were acquired or sold. Income and expenses are translated into U.S. dollars at rates of exchange prevailing when accrued.

16

| | |

| |

| | | AB Variable Products Series Fund |

Net realized gain or loss on foreign currency transactions represents foreign exchange gains and losses from sales and maturities of foreign fixed income investments, holding of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign investment transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Portfolio’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation or depreciation of foreign currency denominated assets and liabilities.

4. Taxes

It is the Portfolio’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required. The Portfolio may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and net unrealized appreciation/depreciation as such income and/or gains are earned.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Portfolio’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Portfolio’s financial statements.

5. Investment Income and Investment Transactions

Dividend income is recorded on the ex-dividend date or as soon as the Portfolio is informed of the dividend. Interest income is accrued daily. Investment transactions are accounted for on the date the securities are purchased or sold. Investment gains or losses are determined on the identified cost basis. Non-cash dividends, if any, are recorded on the ex-dividend date at the fair value of the securities received. The Portfolio amortizes premiums and accretes discounts as adjustments to interest income. The Portfolio accounts for distributions received from REIT investments or from regulated investment companies as dividend income, realized gain, or return of capital based on information provided by the REIT or the investment company.

6. Class Allocations

All income earned and expenses incurred by the Portfolio are borne on a pro-rata basis by each outstanding class of shares, based on the proportionate interest in the Portfolio represented by the net assets of such class, except for class specific expenses which are allocated to the respective class. Expenses of the Fund are charged proportionately to each portfolio or based on other appropriate methods. Realized and unrealized gains and losses are allocated among the various share classes based on respective net assets.

7. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

NOTE B: Advisory Fee and Other Transactions with Affiliates

Under the terms of the investment advisory agreement, the Portfolio pays the Adviser an advisory fee at an annual rate of .45% of the first $2.5 billion, .425% of the next $2.5 billion and .40% in excess of $5 billion, of the Portfolio’s average daily net assets. The fee is accrued daily and paid monthly. Prior to May 2, 2022, the Portfolio paid the Adviser an advisory fee at an annual rate of .55% of the first $2.5 billion, .45% of the next $2.5 billion and .40% in excess of $5 billion, of the Portfolio’s average daily net assets. The Adviser has agreed to waive its fees and bear certain expenses to the extent necessary to limit total operating expenses on an annual basis (the “Expense Caps”) to .75% and 1.00% of daily average net assets for Class A and Class B shares, respectively. For the year ended December 31, 2022, there was no such reimbursement. This fee waiver and/or expense reimbursement agreement extends through May 1, 2023 and then may be extended by the Adviser for additional one-year terms.

Pursuant to the investment advisory agreement, the Portfolio may reimburse the Adviser for certain legal and accounting services provided to the Portfolio by the Adviser. For the year ended December 31, 2022, the reimbursement for such services amounted to $92,509.

17

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| NOTES TO FINANCIAL STATEMENTS | | |

| |

| (continued) | | AB Variable Products Series Fund |

The Portfolio compensates AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Adviser, under a Transfer Agency Agreement for providing personnel and facilities to perform transfer agency services for the Portfolio. Such compensation retained by ABIS amounted to $1,773 for the year ended December 31, 2022.

The Portfolio may invest in AB Government Money Market Portfolio (the “Government Money Market Portfolio”) which has a contractual annual advisory fee rate of .20% of the portfolio’s average daily net assets and bears its own expenses. The Adviser has contractually agreed to waive .10% of the advisory fee of Government Money Market Portfolio (resulting in a net advisory fee of .10%) until August 31, 2023. In connection with the investment by the Portfolio in Government Money Market Portfolio, the Adviser has contractually agreed to waive its advisory fee from the Portfolio in an amount equal to the Portfolio’s pro rata share of the effective advisory fee of Government Money Market Portfolio, as borne indirectly by the Portfolio as an acquired fund fee and expense. For the year ended December 31, 2022, such waiver amounted to $8,111.

In connection with the Portfolio’s investments in other AB mutual funds, the Adviser has contractually agreed to waive fees and/or reimburse the expenses payable to the Adviser by the Portfolio in an amount equal to the Portfolio’s pro rata share of the effective advisory fees of AB mutual funds, as paid by the Portfolio as an acquired fund fee and expense. These fee waivers and/or expense reimbursements will remain in effect until May 1, 2023. For the year ended December 31, 2022, such waivers and/or reimbursements amounted to $147,074.

A summary of the Portfolio’s transactions in AB mutual funds for the year ended December 31, 2022 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | Distributions | |

Fund | | Market Value

12/31/21

(000) | | | Purchases

at Cost

(000) | | | Sales

Proceeds

(000) | | | Realized

Gain (Loss)

(000) | | | Change in

Unrealized

Appr. (Depr.)

(000) | | | Market Value

12/31/22

(000) | | | Dividend

Income

(000) | | | Realized

Gains

(000) | |

Government Money Market Portfolio | | $ | 1,525 | | | $ | 126,581 | | | $ | 120,414 | | | $ | –0 | – | | $ | –0 | – | | $ | 7,692 | | | $ | 139 | | | $ | –0 | – |

AB Discovery Growth Fund, Inc. | | | 3,174 | | | | –0 | – | | | 2,346 | | | | (400 | ) | | | (428 | ) | | | –0 | – | | | –0 | – | | | –0 | – |

AB Trust—AB Discovery Value Fund | | | 3,246 | | | | –0 | – | | | 2,923 | | | | 7 | | | | (330 | ) | | | –0 | – | | | –0 | – | | | –0 | – |

Bernstein Fund, Inc.: International Small Cap Portfolio | | | 8,146 | | | | –0 | – | | | 7,073 | | | | (658 | ) | | | (415 | ) | | | –0 | – | | | –0 | – | | | –0 | – |

International Strategic Equities Portfolio | | | 42,838 | | | | –0 | – | | | 37,952 | | | | (2,434 | ) | | | (2,452 | ) | | | –0 | – | | | –0 | – | | | –0 | – |

Small Cap Core Portfolio | | | 3,267 | | | | –0 | – | | | 2,808 | | | | 122 | | | | (581 | ) | | | –0 | – | | | –0 | – | | | –0 | – |

Sanford C. Bernstein Fund, Inc.—Emerging Markets Portfolio | | | 3,784 | | | | –0 | – | | | 3,401 | | | | (323 | ) | | | (60 | ) | | | –0 | – | | | –0 | – | | | –0 | – |

Government Money Market Portfolio* | | | 214 | | | | 101,216 | | | | 99,452 | | | | –0 | – | | | –0 | – | | | 1,978 | | | | 1 | | | | –0 | – |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | $ | (3,686 | ) | | $ | (4,266 | ) | | $ | 9,670 | | | $ | 140 | | | $ | –0 | – |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | | Investments of cash collateral for securities lending transactions (see Note E). |

During the year ended December 31, 2022 and the year ended December 31, 2021, the Adviser reimbursed the Portfolio $2,636 and $72, respectively, for trading losses incurred due to a trade entry error.

NOTE C: Distribution Plan

The Portfolio has adopted a Distribution Plan (the “Plan”) for Class B shares pursuant to Rule 12b-1 under the Investment Company Act of 1940. Under the Plan, the Portfolio pays distribution and servicing fees to AllianceBernstein Investments, Inc. (the “Distributor”), a wholly-owned subsidiary of the Adviser, at an annual rate of up to .50% of the Portfolio’s average daily net assets attributable to Class B shares. The fees are accrued daily and paid monthly. The Board currently limits

18

| | |

| |

| | | AB Variable Products Series Fund |

payments under the Plan to .25% of the Portfolio’s average daily net assets attributable to Class B shares. The Plan provides that the Distributor will use such payments in their entirety for distribution assistance and promotional activities.

The Portfolio is not obligated under the Plan to pay any distribution and servicing fees in excess of the amounts set forth above. The purpose of the payments to the Distributor under the Plan is to compensate the Distributor for its distribution services with respect to the sale of the Portfolio’s Class B shares. Since the Distributor’s compensation is not directly tied to its expenses, the amount of compensation received by it under the Plan during any year may be more or less than its actual expenses. For this reason, the Plan is characterized by the staff of the Securities and Exchange Commission as being of the “compensation” variety.

In the event that the Plan is terminated or not continued, no distribution or servicing fees (other than current amounts accrued but not yet paid) would be owed by the Portfolio to the Distributor.

The Plan also provides that the Adviser may use its own resources to finance the distribution of the Portfolio’s shares.

NOTE D: Investment Transactions

Purchases and sales of investment securities (excluding short-term investments) for the year ended December 31, 2022 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities (excluding U.S. government securities) | | $ | 230,108,845 | | | $ | 249,830,577 | |

U.S. government securities | | | 28,459,925 | | | | 37,665,252 | |

The cost of investments for federal income tax purposes, gross unrealized appreciation and unrealized depreciation are as follows:

| | | | |

Cost | | $ | 195,073,865 | |

| | | | |

Gross unrealized appreciation | | $ | 1,225,640 | |

Gross unrealized depreciation | | | (16,455,400 | ) |

| | | | |

Net unrealized depreciation | | $ | (15,229,760 | ) |

| | | | |

1. Derivative Financial Instruments

The Portfolio may use derivatives in an effort to earn income and enhance returns, to replace more traditional direct investments, to obtain exposure to otherwise inaccessible markets (collectively, “investment purposes”), or to hedge or adjust the risk profile of its portfolio.

The principal types of derivatives utilized by the Portfolio, as well as the methods in which they may be used are:

The Portfolio may buy or sell futures for investment purposes or for the purpose of hedging its portfolio against adverse effects of potential movements in the market. The Portfolio bears the market risk that arises from changes in the value of these instruments and the imperfect correlation between movements in the price of the futures and movements in the price of the assets, reference rates or indices which they are designed to track. Among other things, the Portfolio may purchase or sell futures for foreign currencies or options thereon for non-hedging purposes as a means of making direct investment in foreign currencies, as described below under “Currency Transactions”.

At the time the Portfolio enters into futures, the Portfolio deposits and maintains as collateral an initial margin with the broker, as required by the exchange on which the transaction is effected. Such amount is shown as cash collateral due from broker on the statement of assets and liabilities. Pursuant to the contract, the Portfolio agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments are known as variation margin and are recorded by the Portfolio as unrealized gains or losses. Risks may arise from the potential inability of a counterparty to meet the terms of the contract. The credit/counterparty risk for exchange-traded futures is generally less than privately negotiated futures, since the clearinghouse, which is the issuer or counterparty to each exchange-traded future, has robust risk mitigation standards, including the requirement to provide initial and variation margin. When the contract is closed, the Portfolio records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the time it was closed.

19

| | |

| BALANCED HEDGED ALLOCATION PORTFOLIO |

| NOTES TO FINANCIAL STATEMENTS | | |

| |

| (continued) | | AB Variable Products Series Fund |

Use of long futures subjects the Portfolio to risk of loss in excess of the amounts shown on the statement of assets and liabilities, up to the notional value of the futures. Use of short futures subjects the Portfolio to unlimited risk of loss. Under some circumstances, futures exchanges may establish daily limits on the amount that the price of futures can vary from the previous day’s settlement price, which could effectively prevent liquidation of unfavorable positions.

During the year ended December 31, 2022, the Portfolio held futures for hedging and non-hedging purposes.

| | • | | Forward Currency Exchange Contracts |

The Portfolio may enter into forward currency exchange contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to hedge certain firm purchase and sale commitments denominated in foreign currencies and for non-hedging purposes as a means of making direct investments in foreign currencies, as described below under “Currency Transactions”.