mPhase Technologies Inc.

587 Connecticut Avenue

Norwalk, CT. 06854

Jay Webb, Reviewing Accountant

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.; Mail Stop 5546

Washington, D.C. 20549-5546

RE: mPhase Technologies, Inc.

Form 10K for the FYE June 30, 2008 (Filed Sept 30, 2008; File # 000 30202)

and pending Form 10-K for the FYE June 30, 2009 ( to be filed)

August 26, 2009

Dear Sirs:

We are in receipt of your letter of August 12, 2009, which refers to prior correspondence as well as comments for which we have prepared our response in a format that reiterates your original comments and is followed by the Company’s response.

SEC 1. Please provide us with a copy of “CBIZ Valuations” valuation report that supports the evaluation conclusion discussed in your August 5, 2009 letter.

RESPONSE 1. The “CBIZ valuation” calculations supporting our conclusion discussed in the August 5, 2009 letter were included as attachments in our August 5, correspondence. We are once again enclosing these probability calculations. SEE ATTACHMENT TO RESPONSE 1. Please feel free to contact Mr. Charles Higgins of CBIZ Valuation Group, LLC, Suite 105, 1009 Lenox Drive, Lawrenceville, New Jersey 08648 (telephone 609–895–5314) with respect to any questions you may have concerning such valuation report.

As you will note in our letter of August 5, 2009, the probability calculations of the effect of the $.35 cap were applied to the original calculations, for each period presented.

SEC 2. Please provide us with a clear description of the methodology used to value the derivative instruments, and explain your basis for selecting each significant assumption employed in your revised valuations.

RESPONSE 2. A Hybrid Calculation was used utilizing the Black Sholes model and a weighted adjustment for the probability the “cap” would effect the computation for each period presented. The assumptions are noted in each calculation for each quarter presented. SEE ATTACMENT TO RESPONSE 2.

For the quarter ended March 31, 2008 the CBIZ Valuation report is included as this is the only period that their analysis indicated that the cap had a probability greater than zero.

We reiterate the fact noted in August 5, 2009 letter that the conference call with both the Division of Corporate Finance and the Office of the Chief Accountant– Interpretations identified the potential error was that our original computation gave no weight to effect of the $.35 cap in our agreements.

SEC 3. Specifically, we see your valuations assume that the option term is .05 years or approximately 18 days.

- Please explain why your use of so short an option term is reasonable.

- Tell us if option term of .05 years represents an expected term or the contractual term. In this regard, please note that paragraph A26 of SFAS 123R indicates that the use of an expected term is appropriate only for employee share transactions and is not appropriate for transferable options.

Response 3. There are three factors that were considered the predominant value drivers for the option calculations measuring the value of the derivative instrument under Black Scholes; Volatility, Term and Interest Rate. However if the option strike price is floating based upon any specific look–back period, the full life of the option has no extra value other than the earning (or float) of money.

In the last couple of years, interest rates have been so low that the interest rate component value in the Black Scholes Model has been very small.

By way of a simple example, for a one year Convertible Debenture, assume the price of the issuer’s common stock is $1 on January 1, 2008 and it is then $3 on January 1, 2009. Further assume that such Debenture has a floating conversion feature identical to that of the Company’s first Convertible Debenture with Golden Gate entered into on December 11, 2007 If the holder converts on January 1, 2009 such holder can only look back twenty days on a formula used to compute the conversion price per share into common stock. Depending upon the trading pattern of the issuer’s common stock for such 20 day period, the price of the conversion will be determined by formula. The $1 value on January 1, 2008 is irrelevant to such computation. If the strike price were fixed at $1 then the full one year period would be the appropriate period of time to be used in the Black Scholes calculation.

Similarly, if you value the derivative feature of a 3 year Convertible Debenture with an identical twenty day look back formula computation you are OVERVALUING the derivative if you use the full three year term because the price change in the period has no meaning–only what happens in each twenty day look–back period. Every twenty day trading period is a new 20 day contractual term. As a result the expected volatility of the last twenty days in a valuation period a twenty day life has the most meaning because the expected changes in the stock prices in the twenty day period is where value of the derivative feature is derived.

Again, with respect to the Convertible Debenture issued by the Company, the instrument being valued has a floating conversion price based of the stock for the last 20 trading days or a cap. So regardless of the overall term, anything greater than measuring the twenty day look back period would result in over valuing the derivative.

With respect to paragraph A26 of SFAS 123R expected term is appropriate in our case because these stock rights are not transferable. Additionally SFAS 123R indicates expected term is not appropriate when base upon its contractual term it is rarely advantageous to exercise (paragraphs A3 and A18). In the case of our agreements considering the discounted conversion feature, at all times it is considered economically feasible to exercise and as such the use of expected term is more appropriate. Also note SAB 107 indicates expected life is appropriate in cases where the option feature is not transferable; as is the case with our contractual counterparties.

SEC 4. Refer to prior comment 5 from our letter dated March 30, 2009 as well as “Open Issue II” in your letter dated August 5, 2009 to Stephanie Hunsaker. We see your correspondence to us indicates that mPhase issued warrants to purchase common stock to an investor in order to induce that investor to make an additional investment in the company and also that mPhase has issued many warrants in connection with the private placements of its equity. We also see you do not believe the warrants are derivative securities and you indicate that the warrants have been evaluated by mPhase pursuant to paragraphs 12 – 32 of EITF 00–19 and “no liability associated with the issuance thereon is required as no default or other liability conditions are present”. To help us better understand your conclusions please provide us with the following:

- An analysis – as of date of each quarterly balance sheet and during the quarterly period then ended, beginning with the quarter ended September 30, 2007 – of all non–employee options and warrants issued and outstanding that specifically addresses whether (1) the warrants qualified as a derivative under SFAS 133 and (ii) whether the warrants were required to be classified as a liability under EITF 00–19. Your response should not be general but be specific and address all applicable paragraphs of the referenced literature or other applicable U.S. GAAP literature.

- In particular, provide us with your analysis of how you considered and concluded on each of the factors outlined in each of paragraphs 12 to 32 of EITF 00–19 at the end of each quarter.

- In addition, specially address how you considered the lack of a cap on the number of shares that can be issue upon conversion of your convertible debt in reaching your conclusion that equity classification was appropriate. We note that your debt agreements do not include such a cap and that, as outlined in paragraphs 19–24 of EITF 00–19, a company could be precluded from concluding that it has sufficient shares authorized and unissued to settle its no–employee options and warrants and other convertible instruments as a result of the absence of a gap in one or more of its contracts.

Response 4. Please note an analysis by quarter for warrants and options issued, by quarter, for the periods from September 30, 2007 through March 31, 2009. Please note disposition of each issuance of warrants and options as enumerated with respect to paragraphs 12 to 32 in the analysis. SEE ATTACHMENT TO RESPONSE 4.

Additionally with specific reference to the lack of a lower price cap on the shares issuable upon the conversion of our convertible debt, as outlined in paragraph 19 of EITF 00–19, the Company made a calculation whereby if all options and warrants outstanding were converted, at all times for the periods presented, the convertible debt would be covered by authorized shares if converted at the discounted rate at the cheapest price experienced for each quarter outstanding with sufficient shares available to satisfy such conversion.

Should you have any questions or comments concerning the enclosed please contact myself at 203–831–2242 or Edward Suozzo at 917–324–0354.

Yours truly,

/s/ Martin Smiley

Martin Smiley, C.F.O.,E.V.P. and General Counsel

Attachment to Response 1

Risk-neutral probability Calculation -that mPhase's Common Stock would equal or exceed $.35

Prepared by Charles Higgins

CBIZ VALUATION GROUP LLC; 1009 Lenox Drive, suite105; Lawrenceville, NJ 08646 tel# 609-895-5314

| mPhase Technologies, Inc. | ||||||||||||||||||

| Derivative Liability | ||||||||||||||||||

| LJ | LJ & GG | LJ & GG | GG | GG | GG | |||||||||||||

| Valuation Date | 31/03/2009 | 31/12/2008 | 30/09/2008 | 30/06/2008 | 31/03/2008 | 31/12/2007 | ||||||||||||

| Stock Price at Valuation Date | $ | 0.0160 | $ | 0.0155 | $ | 0.0360 | $ | 0.0700 | $ | 0.1350 | $ | 0.0500 | ||||||

| Strike Price | $ | 0.3500 | $ | 0.3500 | $ | 0.3500 | $ | 0.3500 | $ | 0.3500 | $ | 0.3500 | ||||||

| Expected Life of Options (years) | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | ||||||||||||

| Risk-Free Interest Rate | 0.17% | 0.11% | 2.28% | 2.89% | 1.79% | 2.89% | ||||||||||||

| Expected Annual Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | ||||||||||||

| Expected Volatility | 69.29% | 100.00% | 79.10% | 77.00% | 210.00% | 9.30% | ||||||||||||

Option Value | $ | 0.0000 | $ | 0.0000 | $ | 0.0000 | $ | 0.0000 | $ | 0.0010 | $ | - | ||||||

D2 | -1910.29% | -1343.30% | -1236.95% | -901.07% | -218.18% | -8932.55% | ||||||||||||

B-S Risk-Neutral Probability N(D2) | 0.000% | 0.000% | 0.000% | 0.000% | 1.456% | 0.000% |

Attachment to Response 2

| mPhase Technologies, Inc. | ||||||||||||||||||

| Derivative Liability-HYBRID CALCULATION | ||||||||||||||||||

| LJ | LJ & GG | LJ & GG | GG | GG | GG | |||||||||||||

| Valuation Date | 31/03/2009 | 31/12/2008 | 30/09/2008 | 30/06/2008 | 31/03/2008 | 31/12/2007 | ||||||||||||

| Original Computation Black Scholes-see attached | ||||||||||||||||||

| probability %-no cap effect | $ | 1,621,798 | $ | 2,599,118 | $ | 1,026,724 | $ | 750,151 | $ | 2,394,313 | $ | 406,404 | ||||||

| Original Computation Black Scholes-see attached | 100 | |||||||||||||||||

$ | 2,394,313 | |||||||||||||||||

| 936,077 | ||||||||||||||||||

| probability %-no cap effect | 100 | 100 | 100 | 100 | 98.5 | 100 | ||||||||||||

| $ | 922,036 | |||||||||||||||||

HYBRID-ORIGINAL PORTION | $ | 1,621,798 | $ | 2,599,118 | $ | 1,026,724 | $ | 750,151 | $ | 3,316,349 | $ | 406,404 | ||||||

| alternative computation-CBIZ VALUATIONS LLC | na | na | na | na | $ | 550,000 | na | |||||||||||

| probability %-cap has effect | 0 | 0 | 0 | 0 | 1.5 | 0 | ||||||||||||

HYBRID-ALTERNATIVE PORTION | 0 | 0 | 0 | 0 | 8,250 | 0 | ||||||||||||

HYBRID VALUATION TOTAL | $ | 1,621,798 | $ | 2,599,118 | $ | 1,026,724 | $ | 750,151 | $ | 3,324,599 | $ | 406,404 | ||||||

FINANCIAL STATEMENT VALUE | $ | 1,621,798 | $ | 2,599,118 | $ | 1,026,724 | $ | 750,151 | $ | 3,330,390 | $ | 406,404 | ||||||

| difference | $ | - | $ | - | $ | - | $ | - | $ | 5,791 | $ | - | ||||||

| immaterial |

Attachment to Response 2

Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

| 12/31/07 | 3/31/08 |

| 6/30/08 |

|

|

| 9/30/08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Liability |

|

|

|

|

|

|

|

|

|

|

|

|

AS REPORTED | 406,404 | 3,330,390 |

| 750,151 |

|

|

| 1,026,725 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumptions |

|

|

|

|

|

|

|

|

|

|

|

|

| Golden Gate | Golden Gate | St. George | Goldent Gate | St. George | JMJ(1) | JMJ(2) | Goldent Gate | JMJ(1) | JMJ(2) | La Jolla | St. George |

AS REPORTED |

|

|

|

|

|

|

|

|

|

|

|

|

Stock Price | 0.0500 | 0.1350 | 0.1350 | 0.0700 | 0.0700 | 0.0700 | 0.0700 | 0.0360 | 0.0360 | 0.0360 | 0.0360 | 0.0360 |

Conversion Price | 0.0406 | 0.0520 | 0.0510 | 0.0550 | 0.0530 | 0.0570 | 0.0540 | 0.0318 | 0.0274 | 0.0292 | 0.0318 | 0.0298 |

Risk Free Rate | 2.8900 | 0.0200 | 0.0200 | 0.0291 | 0.0291 | 0.0291 | 0.0291 | 0.0228 | 0.0228 | 0.0228 | 0.0228 | 0.0228 |

Look Back Period (Days) | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 |

Volatility | 0.0930 | 0.0960 | 0.0960 | 0.7670 | 0.7670 | 0.7670 | 0.7670 | 0.7910 | 0.7910 | 0.7910 | 0.7910 | 0.7910 |

Option Value | 0.0110 | 0.0830 | 0.0868 | 0.0130 | 0.0110 | 0.0110 | 0.0140 | 0.0060 | 0.0090 | 0.0070 | 0.0060 | 0.0070 |

# of Shares | 36,945,813 | 28,846,154 | 10,784,314 | 24,818,182 | 6,603,774 | 19,298,246 | 10,185,185 | 23,584,906 | 12,773,723 | 37,671,233 | 62,893,082 | 18,456,376 |

Derivative Liability | 406,404 | 2,394,313 | 936,077 | 322,636 | 72,642 | 212,281 | 142,593 | 141,509 | 114,964 | 263,699 | 377,358 | 129,195 |

Attachment to Response 2

|

|

|

|

|

|

|

|

|

|

|

| 12/31/08 |

|

|

|

|

| 3/31/09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Liability |

|

|

|

|

|

|

|

|

|

|

AS REPORTED | 2,599,116 |

|

|

|

|

| 1,621,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumptions |

|

|

|

|

|

|

|

|

|

|

| Goldent Gate | JMJ(1) | JMJ(2) | La Jolla | JMJ(3) | St. George | JMJ(1) | La Jolla | JMJ(2) | St. George |

AS REPORTED |

|

|

|

|

|

|

|

|

|

|

Stock Price | 0.0155 | 0.0155 | 0.0155 | 0.0155 | 0.0155 | 0.0155 | 0.0160 | 0.0160 | 0.0160 | 0.0160 |

Conversion Price | 0.0110 | 0.0105 | 0.0098 | 0.0110 | 0.0105 | 0.0105 | 0.0110 | 0.0120 | 0.0110 | 0.0110 |

Risk Free Rate | 0.0011 | 0.0011 | 0.0011 | 0.0011 | 0.0011 | 0.0011 | 0.0017 | 0.0017 | 0.0017 | 0.0017 |

Look Back Period (Days) | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 |

Volatility | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.6929 | 0.6929 | 0.6929 | 0.6929 |

Option Value | 0.0050 | 0.0059 | 0.0065 | 0.0050 | 0.0063 | 0.0048 | 0.0047 | 0.0040 | 0.0048 | 0.0048 |

# of Shares | 23,818,182 | 104,761,905 | 18,163,265 | 181,818,182 | 104,761,905 | 35,628,857 | 94,781,818 | 166,666,667 | 100,000,000 | 6,043,455 |

Derivative Liability | 119,091 | 622,222 | 118,667 | 909,091 | 660,000 | 170,046 | 445,475 | 666,667 | 480,000 | 29,009 |

Attachment to Response 2

MPHASE TECHNOLOGIES, INC.

CONVERSION FEATURE CALCULATION

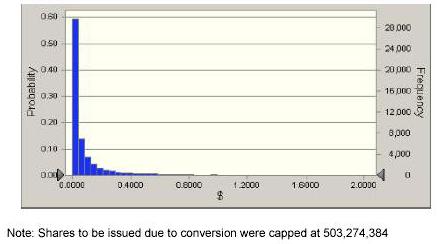

Monte Carlo Simulation Result:

| Trials | 50,000 | |

| Median Value of Conversion Feature | $ | 550,000 |

| Standard Deviation | 2,587,695 | |

| Minimum | 1,000 | |

| Maximum | 158,074,000 | |

| Annual Stock Volatility | 110.0% | |

| Stock Price on 06/30/09 | $ | 0.135 |

| Risk-Free Rate | 1.61% | |

| Maturity Date | 12/11/2010 |

Attachment to Response 2

MPHASE TECHNOLOGIES, INC.

CONVERSION FEATURE CALCULATION

continued

Shares Created:

| Minimum | 4,285,714 |

| Maximum | 503,274,384 |

| Median | 80,541,372 |

Stock Price at Maturity Date

| Minimum | $ | 0.00 |

| Maximum | $ | 38.87 |

| Median | $ | 0.03 |

Attachment to Response 4

EQUITY ELEMENTS

OPTIONS | WARRANTS | AUTH. LIT. | OUTSTANDING | COMMITTED | RESERVED FOR CONVERTIBLE | SHARES | SHARES | |

|

| |||||||

DATE/ISSUANCE/CANCEL | ||||||||

Balance 7/1/2007 | 48,213,000 | 160,983,644 | 387,846,008 | 597,042,652 | - | 900,000,000 | 302,957,348 | |

EXPIRATIONS 08/29/2007 | (2,320,000) | (10,165,399) | ||||||

Balance 09/30/2007 | 45,893,000 | 150,818,245 | 391,736,304 | 588,447,549 | - | 900,000,000 | 311,552,451 | |

ISSUANCE 10/30/2007 | 35,000 | - | expensed SFAS123r | |||||

Balance 12/31/2007 | 45,928,000 | 150,818,245 | 393,378,861 | 590,125,106 | 36,945,813 | 900,000,000 | 272,929,081 | |

ISSUANCE 01/14/2008 | - | 500,000 | private placement of equity | |||||

Balance 03/31/2008 | 45,928,000 | 151,318,245 | 401,356,200 | 598,602,445 | 39,630,468 | 900,000,000 | 261,767,087 | |

ISSUANCE 04/07/2008 | 11,111,112 | expensed-reparations SAS 123R parag 51 | ||||||

ISSUANCE 04/07/2008 | 100,000 | expensed SFAS 123r | ||||||

ISSUANCE 05/21/2008 | 50,000 | - | expensed SFAS 123r | |||||

Balance 06/30/2008 | 45,978,000 | 162,529,357 | 440,395,000 | 648,902,357 | 60,905,387 | 900,000,000 | 190,192,256 | |

ISSUANCE 09/11/2008 | 25,000 | expensed SFAS 123r | ||||||

ISSUANCE 09/16/2008 | 104,950,000 | - | expensed SFAS 123r | ** AUTH SHS INCREASED AUGUST,2008 | ||||

Balance 09/30/2008 | 150,953,000 | 162,529,357 | 526,233,500 | 839,715,857 | 155,379,320 | 2,000,000,000 | 1,004,904,823 | |

Balance 12/31/2008 | 150,978,000 | 162,529,357 | 598,040,300 | 911,547,657 | 468,952,296 | 2,000,000,000 | 619,500,047 | |

EXPIRATIONS 01/14/2009 | (1,280,000) | (7,301,740) | ||||||

Balance 03/31/2009 | 149,698,000 | 155,227,617 | 744,516,390 | 1,049,442,007 | 367,491,940 | 2,000,000,000 | 583,066,053 | |