UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05407

Trust for Credit Unions

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street, 3rd Floor

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jay E. Johnson

Callahan Financial Services, Inc.

1001 Connecticut Avenue NW, Suite 1001

Washington, DC 20036

(Name and address of agent for service)

With Copies To:

Michael P. Malloy

Faegre Drinker Biddle & Reath LLP

One Logan Square, Suite 2000

Philadelphia, PA 19103

Registrant's telephone number, including area code: 1-800-342-5828

Date of fiscal year end: August 31

Date of reporting period: February 28, 2023

Item 1. Reports to Stockholders.

| (a) |

Ultra-Short Duration Portfolio

Short Duration Portfolio

Semi-Annual Report

February 28, 2023

The reports concerning the Trust for Credit Unions (“TCU” or the “Trust”) Ultra-Short Duration Portfolio and Short Duration Portfolio (each a “Portfolio” and together the “Portfolios”) included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the Portfolios in the future. These statements are based on Portfolio management’s predictions and expectations concerning certain future events and their expected impact on the Portfolios, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Portfolios. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

TCU files the complete schedule of portfolio holdings of each Portfolio with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-PORT. The Portfolios’ Forms N-PORT are available on the SEC’s website at http://www.sec.gov.

Information regarding how the Portfolios voted proxies relating to portfolio securities, if any, during the most recent 12-month period ended June 30 is available by August 31 of the relevant year: (i) without charge, upon request, by calling the Trust at 1-800-342-5828; and (ii) on the SEC’s website at http://www.sec.gov.

| An investment in a TCU Portfolio is not a credit union deposit and is not insured or guaranteed by the National Credit Union Share Insurance Fund, the National Credit Union Administration, or any other government agency. |

| The TCU Ultra-Short Duration Portfolio and the TCU Short Duration Portfolio are not money market funds. Investors in these Portfolios should understand that the net asset values of the Portfolios will fluctuate, which may result in a loss of the principal amount invested. The Portfolios’ net asset values and yields are not guaranteed by the U.S. government or by its agencies, instrumentalities or sponsored enterprises. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolios if held to maturity and not to the value of the Portfolios’ shares. The Portfolios’ investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility. |

Holdings and allocations shown may not be representative of current or future investments. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities.

This material is not authorized for distribution unless preceded or accompanied by a current Prospectus. Investors should consider a Portfolio’s objectives, risks, and charges and expenses, and read the Prospectus carefully before investing or sending money. The Prospectus contains this and other information about the Portfolios.

Callahan Financial Services, Inc. is the distributor of the TCU Portfolios.

This report is for the information of the shareholders of the Trust. Its use in connection with any offering of shares of the Trust is authorized only in the case of a concurrent or prior delivery of the Trust’s current Prospectus. |

Dear Credit Union Shareholders,

On March 10th, our credit union shareholders were notified that the Board of Trustees of Trust for Credit Unions (“TCU”) approved a plan of liquidation and termination for the three Portfolios of the TCU mutual funds. The Portfolios discontinued accepting orders for the purchase of their shares on March 17th. On May 9th, any remaining balances in the funds will be liquidated by distributing to investors holding shares in any of the Portfolios their pro rata share of the proceeds in cash and all of the outstanding shares of the Portfolios will be redeemed.

The decision to close the TCU Portfolios was made in response to multiple external factors, including a fundamental shift in how the Ultra-Short Duration and Short Duration Portfolios were utilized by investors that was driven by recent accounting changes requiring mark-to-market treatment through the income statements, the credit union industry’s significantly tightened liquidity profile, declining asset levels in the Portfolios, direct investor feedback, and the overall market and interest rate environments. Similar to the external factors that led to the suspension and closure of TCU’s Government Money Market Portfolio when the Federal Reserve began paying interest on excess reserves, the Trustees recognize that the environment has changed for our bond Portfolios, impacting the value TCU can deliver to credit union investors.

The TCU Board of Trustees and other TCU business partners, including the 37 leading credit unions that comprise Callahan Credit Union Financial Services, LLLP and serve as the Administrator of TCU, as well as the Investment Advisor, ALM First, are proud of the value TCU has provided to its credit union shareholders over the past 35 years. The TCU Portfolios reached an all-time high of over $5 billion in total assets in April 2021, growing by over $1 billion in a single month as it provided competitive investment options to help credit unions manage excess liquidity. As interest rates began to rise in 2022 and credit unions’ liquidity profile tightened, the TCU Portfolios became an attractive source of liquidity relative to bonds held for Available for Sale with unrealized losses. Throughout even highly unusual market cycles such as those experienced in recent years, TCU has continued to perform as it was designed to, providing flexibility and next-day liquidity for credit unions.

TCU has served as a leading example of the innovation and value that can be delivered through collaboration since its launch in 1988. The 20 credit unions that provided the seed funding for TCU enabled hundreds of credit unions to benefit from the investment resources and expertise provided by the Portfolios. As the first, largest, and longest running family of mutual funds created by and for credit unions, TCU’s legacy is one to be celebrated.

I want to thank the members of the Board of Trustees for their guidance and service over the past 35 years. TCU has been fortunate to work with outstanding business partners over the years that have enthusiastically supported this venture and its work with credit unions. I thank them for their contributions to our success.

Most importantly, thank you to our credit union investors for their support of TCU since 1988. Our investors’ commitment to collaboration allowed TCU to deliver greater value to those who participated in the Portfolios.

Sincerely,

Jay E. Johnson

President and Treasurer

Trust for Credit Unions

1

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU ULTRA-SHORT DURATION PORTFOLIO

Investment Objective

The TCU Ultra-Short Duration Portfolio (“USDP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. Under normal circumstances, substantially all of the assets (and at least 80%, measured at the time of purchase) of USDP will be invested in fixed-income securities consisting of the following: (1) securities issued or guaranteed as to principal and interest by the U.S. government or by its agencies, instrumentalities or sponsored enterprises and related custodial receipts; (2) repurchase agreements secured with obligations authorized by the Federal Credit Union Act; and (3) U.S. dollar denominated bank notes issued or guaranteed by banks with total assets exceeding $1 billion with weighted average maturities of less than 5 years, but only to the extent permitted under the Federal Credit Union Act and the rules and regulations thereunder. The Portfolio expects that a substantial portion of these securities will be mortgage-related securities. The Portfolio may also invest in non-U.S. government related securities, including bank notes and repurchase agreements secured by non-U.S. government related collateral. While there will be fluctuations in the net asset value (“NAV”) of the USDP, the Portfolio is expected to have less interest rate risk and asset value fluctuation than funds investing primarily in longer-term mortgage-backed securities paying a fixed rate of interest. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. USDP invests in obligations authorized under the Federal Credit Union Act with a maximum portfolio duration not to exceed that of a One-Year U.S. Treasury Security and a target duration equal to that of its benchmark, the ICE BofAML Three-Month U.S. Treasury Note Index.

Portfolio Management Discussion and Analysis

Below, ALM First Financial Advisors, LLC (“ALM First” or the “Adviser”) discusses the Portfolio’s performance and positioning for the six-month period ended February 28, 2023 (the “Reporting Period”).

Q. How did the Portfolio perform during the Reporting Period?

For the Reporting Period, the cumulative total return of USDP TCU Shares was 0.68% versus a 1.76% cumulative total return of the Portfolio’s benchmark, the ICE BofAML Three-Month U.S. Treasury Bill Index (the “Index”). The NAV per share at the end of the Reporting Period was $9.11, versus $9.21 on August 31, 2022.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

During the six-month period ended February 28, 2023 heavy redemption activity forced the Portfolio to take a more defensive position by increasing cash held in the Portfolio, which hampered performance.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

As discussed above, the Portfolio faced heavy redemption activity as institutions sought liquidity. As a result, the Portfolio was forced to sell securities during a time of illiquidity in the market.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

At the end of the period the Portfolio’s duration was 0.39% compared to 0.24% for the index. The increase in the cash allocation put more of the Portfolio’s duration on the front-end of the curve and closer to that of the index.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

Due to heavy redemption activity the Portfolio’s allocation to cash increased from 4% to 58%.

Q. How was the Portfolio positioned relative to its benchmark index at the end of February 2023?

At the end of the Reporting Period, the Portfolio’s largest allocations was cash, which the Index has no allocation to since the Index is made up only of US Treasury securities.

Past performance does not guarantee future results, which may vary.

There is no guarantee that these objectives will be met.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the Portfolio’s investments. Future investments may or may not be profitable.

2

THIS PAGE LEFT INTENTIONALLY BLANK

3

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited)

February 28, 2023*

August 31, 2022*

4

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU ULTRA-SHORT DURATION PORTFOLIO (Unaudited)

February 28, 2023*

August 31, 2022*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities, including cash. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

5

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU SHORT DURATION PORTFOLIO

Investment Objective

The TCU Short Duration Portfolio (“SDP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with relatively low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. During normal market conditions, SDP intends to invest a substantial portion of its assets in mortgage-related securities, which include mortgage-related securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises. Mortgage-related securities held by SDP may include adjustable rate and fixed rate mortgage pass-through securities, collateralized mortgage obligations and other multi-class mortgage-related securities, as well as other securities that are collateralized by or represent direct or indirect interests in mortgage-related securities or mortgage loans. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. SDP invests in obligations authorized under the Federal Credit Union Act with a target duration that is equal to that of the ICE BofAML Two-Year U.S. Treasury Note Index and its maximum duration is that of a Three-Year U.S. Treasury Security.

Portfolio Management Discussion and Analysis

Below, ALM First discusses the Portfolio’s performance and positioning for the Reporting Period.

Q. How did the Portfolio perform during the Reporting Period?

The Portfolio’s cumulative total return for the Reporting Period was -2.11% for the TCU shares, versus a -0.97% cumulative total return for the ICE BofAML Two-Year U.S. Treasury Note Index (Including Transaction Costs) (the “Index”). The Portfolio’s NAV per share closed the Reporting Period at $8.88, versus $9.22 on August 31, 2022.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

Heavy redemption activity forced the Portfolio to take a more defensive position by selling securities and holding a higher level of cash. These sales came at a time of market illiquidity, generally resulting in sale prices lower than those given by the pricing services. As a result of the repositioning, the Portfolio’s duration fell relative to the benchmark, which benefited relative performance given the impact of higher benchmark yields over the Reporting Period.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

Selling assets and converting most of the Portfolio to cash affected expected returns for the Portfolio relative to the Portfolio strategy.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

In order to meet redemption requests, the Portfolio’s allocation to cash significantly increased and as a result, the duration drifted lower than the benchmark. Benchmark yields were higher over the Reporting Period, which boosted Portfolio performance relative to the benchmark.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

Yes, due to redemptions the Portfolio’s allocation to cash increased from 0% to 75%.

Q. How was the Portfolio positioned at the end of February 2023?

At the end of the Reporting Period, the Portfolio’s largest allocation was cash at 75%, which the Index has no allocation to since the index is made up only of US Treasury securities.

Past performance does not guarantee future results, which may vary.

There is no guarantee that these objectives will be met.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the Portfolio’s investments. Future investments may or may not be profitable.

6

THIS PAGE LEFT INTENTIONALLY BLANK

7

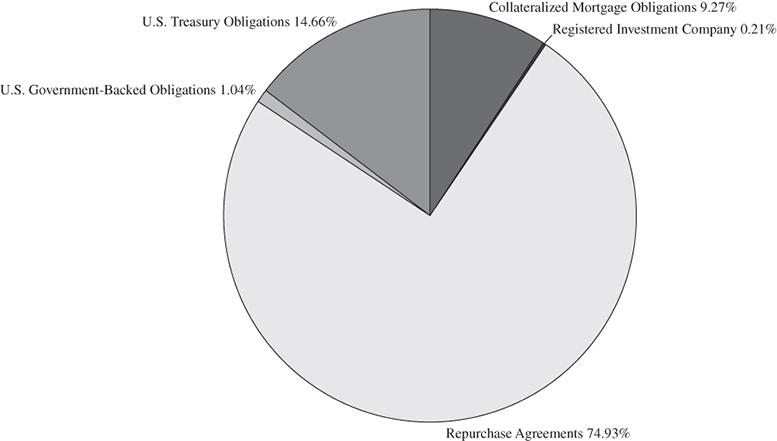

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

February 28, 2023*

August 31, 2022*

8

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

February 28, 2023*

August 31, 2022*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities, including cash. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

9

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments – February 28, 2023 (Unaudited)

| Par Value | Value | ||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS – 40.79% | |||||||

| Federal Home Loan Mortgage | |||||||

| Corporation REMIC – 6.39% | |||||||

$ | 1,540,479 | Series 4566, Class FA | |||||

1 Month LIBOR USD + 0.500% | |||||||

5.088%, 04/15/46 (a) | $ | 1,513,095 | |||||

2,099,653 | Series 4735, Class FB | ||||||

1 Month LIBOR USD + 0.350% | |||||||

4.938%, 12/15/47 (a) | 2,040,222 | ||||||

2,387,629 | Series 4875, Class F | ||||||

1 Month LIBOR USD + 0.450% | |||||||

5.038%, 04/15/49 (a)(b) | 2,338,541 | ||||||

5,718,168 | Series 4980, Class FP | ||||||

1 Month LIBOR USD + 0.400% | |||||||

5.017%, 07/25/49 (a) | 5,566,802 | ||||||

3,036,090 | Series 4906, Class QF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

5.067%, 09/25/49 (a) | 2,964,393 | ||||||

3,104,744 | Series 4982, Class F | ||||||

1 Month LIBOR USD + 0.450% | |||||||

5.067%, 06/25/50 (a)(b) | 3,055,328 | ||||||

1,006,016 | Series 4981, Class GF | ||||||

1 Month LIBOR USD + 0.400% | |||||||

5.017%, 06/25/50 (a) | 981,303 | ||||||

18,459,684 | |||||||

| Federal National Mortgage | |||||||

| Association REMIC – 12.23% | |||||||

1,595,395 | Series 2013-92, Class FA | ||||||

1 Month LIBOR USD + 0.550% | |||||||

5.167%, 09/25/43 (a) | 1,573,708 | ||||||

3,992,895 | Series 2019-25, Class PF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

5.067%, 06/25/49 (a)(b) | 3,910,037 | ||||||

4,143,350 | Series 2019-33, Class CF | ||||||

1 Month LIBOR USD + 0.470% | |||||||

5.087%, 07/25/49 (a) | 4,053,548 | ||||||

1,045,895 | Series 2019-35, Class EF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

5.067%, 07/25/49 (a) | 1,023,884 | ||||||

4,580,828 | Series 2019-50, Class CF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

5.067%, 09/25/49 (a)(b) | 4,472,390 | ||||||

3,195,594 | Series 2019-61, Class F | ||||||

1 Month LIBOR USD + 0.500% | |||||||

5.117%, 11/25/49 (a)(b) | 3,119,247 | ||||||

2,116,317 | Series 2020-17, Class PF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

5.067%, 03/25/50 (a)(b) | 2,058,511 | ||||||

5,557,976 | Series 2020-26, Class GF | ||||||

1 Month LIBOR USD + 0.500% | |||||||

5.117%, 05/25/50 (a)(b) | 5,440,399 | ||||||

7,045,717 | Series 2020-38, Class NF | ||||||

1 Month LIBOR USD + 0.450% | |||||||

5.067%, 06/25/50 (a) | 6,863,367 | ||||||

$ | 2,920,786 | Series 2017-96, Class FA | |||||

1 Month LIBOR USD + 0.400% | |||||||

5.017%, 12/25/57 (a) | 2,821,201 | ||||||

35,336,292 | |||||||

| Government National Mortgage | |||||||

| Association – 22.17% | |||||||

3,456,672 | Series 2019-054, Class HF | ||||||

1 Month SOFR + 0.400% | |||||||

1.785%, 04/20/44 (a) | 3,310,479 | ||||||

2,230,774 | Series 2019-H04, Class FB | ||||||

1 Month LIBOR USD + 0.550% | |||||||

2.248%, 03/20/69 (a) | 2,175,236 | ||||||

2,238,617 | Series 2019-H15, Class NF | ||||||

1 Month LIBOR USD + 0.630% | |||||||

2.923%, 05/20/69 (a) | 2,201,241 | ||||||

2,780,053 | Series 2019-H15, Class EF | ||||||

1 Month LIBOR USD + 0.630% | |||||||

3.583%, 09/20/69 (a) | 2,731,909 | ||||||

3,048,034 | Series 2019-H19, Class FC | ||||||

1 Month LIBOR USD + 0.750% | |||||||

3.560%, 10/20/69 (a) | 2,993,520 | ||||||

3,048,670 | Series 2019-H19, Class FC | ||||||

1 Month LIBOR USD + 0.750% | |||||||

5.142%, 10/20/69 (a) | 2,990,591 | ||||||

5,443,999 | Series 2019-H20, Class AF | ||||||

1 Month LIBOR USD + 0.650% | |||||||

5.042%, 11/20/69 (a) | 5,327,466 | ||||||

3,999,586 | Series 2020-H13, Class FK | ||||||

1 Month LIBOR USD + 0.500% | |||||||

4.412%, 07/20/70 (a) | 3,934,178 | ||||||

2,628,237 | Series 2020-H16, Class LF | ||||||

1 Month LIBOR USD + 1.050% | |||||||

4.493%, 09/20/70 (a) | 2,636,313 | ||||||

8,748,570 | Series 2021-H04, Class FD | ||||||

30-Day Average SOFR + 1.150% | |||||||

4.411%, 12/20/70 (a) | 8,779,485 | ||||||

6,415,487 | Series 2021-H03, Class FJ | ||||||

30-Day Average SOFR + 1.150% | |||||||

3.548%, 02/20/71 (a) | 6,392,450 | ||||||

20,052,799 | Series 2021-H08, Class NF | ||||||

30-Day Average SOFR + 1.500% | |||||||

5.926%, 04/20/71 (a) | 20,563,193 | ||||||

64,036,061 | |||||||

| Total Collateralized | |||||||

| Mortgage Obligations | 117,832,037 | ||||||

(Cost $120,879,362) | |||||||

See accompanying notes to financial statements.

10

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Portfolio

Portfolio of Investments (continued) – February 28, 2023 (Unaudited)

| Par Value | Value | ||||||

| AGENCY DEBENTURES – 0.35% | |||||||

| Other Agency Debentures – 0.35% | |||||||

$ | 1,000,000 | Sri Lanka Government AID Bond | |||||

3 Month LIBOR USD + 0.300% | |||||||

5.201%, 11/01/24 (a)(d)(e) | $ | 1,000,000 | |||||

| Total Agency Debentures | 1,000,000 | ||||||

(Cost $1,000,000) | |||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS – 0.71% | |||||||

| FHLMC, Multifamily Structured | |||||||

| Pass Through Certificates – 0.71% | |||||||

370,214 | Series K-F29, Class A | ||||||

1 Month LIBOR USD + 0.360% | |||||||

4.934%, 02/25/24 (a)(c) | 369,501 | ||||||

248,432 | Series K-BF1, Class A | ||||||

1 Month LIBOR USD + 0.390% | |||||||

4.964%, 07/25/24 (a)(c) | 247,859 | ||||||

43,001 | Series K-F30, Class A | ||||||

1 Month LIBOR USD + 0.370% | |||||||

4.944%, 03/25/27 (a)(c) | 42,710 | ||||||

419,986 | Series K-F86, Class AS | ||||||

30-Day Average SOFR + 0.320% | |||||||

4.631%, 08/25/27 (a)(c) | 416,087 | ||||||

984,397 | Series K-F50, Class A | ||||||

1 Month LIBOR USD + 0.400% | |||||||

4.974%, 07/25/28 (a)(c) | 977,210 | ||||||

| Total U.S. Government-Backed | |||||||

| Obligations | 2,053,367 | ||||||

(Cost $2,066,031) | |||||||

| REPURCHASE AGREEMENTS – 58.35% | |||||||

168,500,000 | INT FCStone Financial, Inc., 4.700%, | ||||||

Dated 02/28/2023, matures 03/01/2023, | |||||||

repurchase price $168,521,999 | |||||||

(collateralized by $386,377,630 par amount of | |||||||

Government Agencies, GNMA, FNMA, FHLMC, | |||||||

and United States Treasury securities of 0.000% | |||||||

to 8.000% due 03/25/2023 to 04/20/2071, | |||||||

total market value $171,739,090) | 168,500,000 | ||||||

| Total Repurchase Agreements | 168,500,000 | ||||||

(Cost $168,500,000) | |||||||

| Total Investments – 100.20% | 289,385,404 | ||||||

(Cost $292,445,393) | |||||||

| Net Other Assets | |||||||

| and Liabilities – (0.20)% | (588,032 | ) | |||||

| Net Assets – 100.00% | $ | 288,797,372 | |||||

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at February 28, 2023. Maturity date shown is the date of the next coupon rate reset or actual maturity. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. For those variable rate securities which are based on published reference and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. See also, Explanation of Abbreviations and Acronyms below. |

| (b) | The security has PAC (Planned Amortization Class) collateral. |

| (c) | The security has Structured collateral. |

| (d) | Security has been valued at fair market value as determined in good faith by or under the direction of the Board of Trustees of the Trust. As of February 28, 2023, this security amounted to $1,000,000 or 0.35% of net assets. Investment categorized as a significant unobservable input (Level 3). |

| (e) | Illiquid security. The total market value of this security was $1,000,000, representing 0.35% of net assets. |

Explanation of Abbreviations and Acronyms:

FHLMC | Federal Home Loan Mortgage Corporation |

FNMA | Federal National Mortgage Association |

GNMA | Government National Mortgage Association |

LIBOR | London Interbank Offered Rate |

REMIC | Real Estate Mortgage Investment Conduit |

SOFR | Secured Overnight Financing Rate |

USD | U.S. Dollar |

See accompanying notes to financial statements.

11

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments February 28, 2023 (Unaudited)

| Par Value | Value | ||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS – 9.27% | |||||||

| Government National | |||||||

| Mortgage Association – 9.27% | |||||||

$ | 4,358,981 | Series 2018-H09, Class FC | |||||

12 Month LIBOR USD + 0.150% | |||||||

2.779%, 06/20/68 (a) | $ | 4,249,805 | |||||

5,247,775 | Series 2018-H11, Class FJ | ||||||

12 Month LIBOR USD + 0.080% | |||||||

2.855%, 06/20/68 (a) | 5,141,233 | ||||||

3,212,295 | Series 2020-H09, Class DF | ||||||

1 Month LIBOR USD + 0.640% | |||||||

3.713%, 05/20/70 (a) | 3,172,309 | ||||||

| Total Collateralized | |||||||

| Mortgage Obligations | 12,563,347 | ||||||

(Cost $12,815,840) | |||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS – 1.04% | |||||||

| FHLMC, Multifamily Structured | |||||||

| Pass Through Certificates – 0.88% | |||||||

370,214 | Series K-F29, Class A | ||||||

1 Month LIBOR USD + 0.360% | |||||||

4.934%, 02/25/24 (a)(b) | 369,501 | ||||||

849,892 | Series K-091, Class A1 | ||||||

3.339%, 10/25/28 (b)(c) | 818,949 | ||||||

1,188,450 | |||||||

| FNMA – 0.16% | |||||||

219,974 | Series 2013-M6, Class 2A | ||||||

2.588%, 03/25/23 (a) | 219,243 | ||||||

| Total U.S. Government-Backed | |||||||

| Obligations | 1,407,693 | ||||||

(Cost $1,446,273) | |||||||

| U.S. TREASURY OBLIGATIONS – 14.66% | |||||||

| United States | |||||||

| Treasury Note/Bond – 14.66% | |||||||

20,000,000 | 4.500%, 11/30/24 | 19,853,906 | |||||

| Total U.S. Treasury Obligations | 19,853,906 | ||||||

(Cost $20,086,791) | |||||||

| REPURCHASE AGREEMENTS – 74.93% | |||||||

101,500,000 | INT FCStone Financial, Inc., 4.700%, | ||||||

Dated 02/28/2023, matures 03/01/2023, | |||||||

repurchase price $101,513,251 | |||||||

(collateralized by $195,830,490 par amount of | |||||||

Government Agencies, GNMA, FNMA, and | |||||||

FHLMC securities of 1.500% to 7.000% | |||||||

due 07/25/2023 to 01/20/2073, | |||||||

total market value $103,900,322) | 101,500,000 | ||||||

| Total Repurchase Agreements | 101,500,000 | ||||||

(Cost $101,500,000) | |||||||

| REGISTERED INVESTMENT COMPANY – 0.21% | |||||||

$ | 286,422 | First American Government | |||||

Obligations Fund – Class X | |||||||

4.374%, 12/01/31 (d) | 286,422 | ||||||

| Total Registered | |||||||

| Investment Company | 286,422 | ||||||

(Cost $286,422) | |||||||

| Total Investments – 100.11% | 135,611,368 | ||||||

(Cost $136,135,326) | |||||||

| Net Other Assets | |||||||

| and Liabilities – (0.11)% | (152,103 | ) | |||||

| Net Assets – 100.00% | $ | 135,459,265 | |||||

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at February 28, 2023. Maturity date shown is the date of the next coupon rate reset or actual maturity. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. For those variable rate securities which are based on published reference and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. See also, Explanation of Abbreviations and Acronyms below. |

| (b) | The security has Structured collateral. |

| (c) | The security has Sequential collateral. |

| (d) | Seven day yield as of February 28, 2023. |

Explanation of Abbreviations and Acronyms:

FHLMC | Federal Home Loan Mortgage Corp. |

FNMA | Federal National Mortgage Association |

GNMA | Government National Mortgage Association |

LIBOR | London Interbank Offered Rate |

USD | U.S. Dollar |

See accompanying notes to financial statements.

12

TRUST FOR CREDIT UNIONS

Statements of Assets and Liabilities

February 28, 2023 (Unaudited)

| Ultra-Short | Short | |||||||

| Duration | Duration | |||||||

| Portfolio | Portfolio | |||||||

| ASSETS | ||||||||

| INVESTMENTS: | ||||||||

| Investments and repurchase agreements at cost | $ | 292,445,393 | $ | 136,135,326 | ||||

| Investments at value | $ | 120,885,404 | $ | 34,111,368 | ||||

| Repurchase agreements at value | 168,500,000 | 101,500,000 | ||||||

| Total investments and repurchase agreements at value | 289,385,404 | 135,611,368 | ||||||

| Cash | 332,251 | 99,805 | ||||||

| RECEIVABLES: | ||||||||

| Interest | 153,227 | 252,493 | ||||||

| Other assets | 15,978 | 9,316 | ||||||

| Total Assets | 289,886,860 | 135,972,982 | ||||||

| LIABILITIES: | ||||||||

| PAYABLES: | ||||||||

| Dividends | 902,360 | 396,778 | ||||||

| Advisory fees | 32,551 | 15,422 | ||||||

| Administration fees | 11,965 | 5,508 | ||||||

| Distribution fees | 2,225 | 1,194 | ||||||

| Trustees’ fees | 825 | — | ||||||

| Accrued expenses | 139,562 | 94,815 | ||||||

| Total Liabilities | 1,089,488 | 513,717 | ||||||

| NET ASSETS | $ | 288,797,372 | $ | 135,459,265 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid-in capital | $ | 332,312,356 | $ | 209,087,259 | ||||

| Accumulated deficit | (43,514,984 | ) | (73,627,994 | ) | ||||

| NET ASSETS | $ | 288,797,372 | $ | 135,459,265 | ||||

| TCU Shares: | ||||||||

| Net assets | $ | 192,020,300 | $ | 83,605,335 | ||||

| Total shares outstanding, $0.001 par value (unlimited number of shares authorized) | 21,075,866 | 9,416,370 | ||||||

| Net asset value, offering price and redemption | ||||||||

| price per share (net assets/shares outstanding) | $ | 9.11 | $ | 8.88 | ||||

| Investor Shares: | ||||||||

| Net assets | $ | 96,777,072 | $ | 51,853,930 | ||||

| Total shares outstanding, $0.001 par value (unlimited number of shares authorized) | 10,623,769 | 5,836,775 | ||||||

| Net asset value, offering price and redemption | ||||||||

| price per share (net assets/shares outstanding) | $ | 9.11 | $ | 8.88 | ||||

See accompanying notes to financial statements.

13

TRUST FOR CREDIT UNIONS

Statements of Operations

For the Six Months Ended February 28, 2023 (Unaudited)

| Ultra-Short | Short | |||||||

| Duration | Duration | |||||||

| Portfolio | Portfolio | |||||||

| INVESTMENT INCOME: | ||||||||

| Interest | $ | 6,843,731 | $ | 3,250,629 | ||||

| EXPENSES: | ||||||||

| Advisory fees | 270,732 | 148,123 | ||||||

| Interest expense | 119,803 | 112,238 | ||||||

| Legal fees | 107,798 | 58,257 | ||||||

| Administration fees | 103,077 | 53,763 | ||||||

| Trustees’ fees | 93,419 | 53,091 | ||||||

| Accounting fees | 82,993 | 54,557 | ||||||

| Compliance fees | 40,384 | 21,700 | ||||||

| Transfer agent fees | 31,590 | 26,624 | ||||||

| Custody fees | 16,885 | 12,806 | ||||||

| Distribution and Service (12b-1) Fees on Investor Shares | 14,737 | 8,573 | ||||||

| Audit and tax fees | 12,429 | 12,429 | ||||||

| Registration fees | 8,625 | 7,586 | ||||||

| Printing fees | 2,849 | 1,013 | ||||||

| Other expenses | 61,508 | 28,514 | ||||||

| Net operating expenses | 966,829 | 599,274 | ||||||

| Net Investment Income | 5,876,902 | 2,651,355 | ||||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | ||||||||

| Net realized loss on investment transactions | (12,174,157 | ) | (33,383,569 | ) | ||||

| Net change in unrealized appreciation (depreciation) of: | ||||||||

| Investments | 7,975,618 | 21,674,131 | ||||||

| Net Realized and Unrealized Loss on Investments | (4,198,539 | ) | (11,709,438 | ) | ||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 1,678,363 | $ | (9,058,083 | ) | |||

See accompanying notes to financial statements.

14

TRUST FOR CREDIT UNIONS

Statements of Changes in Net Assets

| Ultra-Short Duration Portfolio | Short Duration Portfolio | |||||||||||||||

| Six Months Ended | Six Months Ended | |||||||||||||||

| February 28, 2023 | Year Ended | February 28, 2023 | Year Ended | |||||||||||||

| (Unaudited) | August 31, 2022 | (Unaudited) | August 31, 2022 | |||||||||||||

| Investment Activities: | ||||||||||||||||

Operations: | ||||||||||||||||

| Net investment income | $ | 5,876,902 | $ | 541,450 | $ | 2,651,355 | $ | 5,165,686 | ||||||||

| Net realized loss on investment transactions | (12,174,157 | ) | (9,669,436 | ) | (33,383,569 | ) | (29,890,222 | ) | ||||||||

| Net change in unrealized | ||||||||||||||||

| appreciation (depreciation) of investments | 7,975,618 | (17,006,407 | ) | 21,674,131 | (29,506,643 | ) | ||||||||||

| Net increase (decrease) in net assets | ||||||||||||||||

| resulting from operations | 1,678,363 | (26,134,393 | ) | (9,058,083 | ) | (54,231,179 | ) | |||||||||

| Distributions to Shareholders: | ||||||||||||||||

Dividends and distributions to shareholders | ||||||||||||||||

| TCU Shares | (5,187,951 | ) | (3,643,894 | ) | (2,277,176 | ) | (5,244,302 | ) | ||||||||

| Investor Shares | (1,721,452 | ) | (2,478,607 | ) | (891,056 | ) | (2,080,511 | ) | ||||||||

| Total distributions | (6,909,403 | ) | (6,122,501 | ) | (3,168,232 | ) | (7,324,813 | ) | ||||||||

| From Shares Transactions: | ||||||||||||||||

| TCU Shares: | ||||||||||||||||

| Proceeds from sale of shares | — | 35,500,000 | — | 283,849,220 | ||||||||||||

| Reinvestment of dividends and distributions | 269,673 | 1,769,335 | 57,874 | 2,436,377 | ||||||||||||

| Cost of shares repurchased | (271,003,952 | ) | (1,031,267,632 | ) | (263,041,568 | ) | (691,021,045 | ) | ||||||||

| Investor Shares: | ||||||||||||||||

| Proceeds from sale of shares | — | 144,591,517 | — | 30,000,000 | ||||||||||||

| Reinvestment of dividends and distributions | 299,475 | 1,395,841 | 141,486 | 879,078 | ||||||||||||

| Cost of shares repurchased | (7,195,343 | ) | (1,893,224,048 | ) | (21,243,723 | ) | (634,667,236 | ) | ||||||||

| Net decrease in net assets | ||||||||||||||||

| resulting from shares transactions | (277,630,147 | ) | (2,741,234,987 | ) | (284,085,931 | ) | (1,008,523,606 | ) | ||||||||

| Net change in net assets | (282,861,187 | ) | (2,773,491,881 | ) | (296,312,246 | ) | (1,070,079,598 | ) | ||||||||

| Net Assets: | ||||||||||||||||

| Beginning of period | 571,658,559 | 3,345,150,440 | 431,771,511 | 1,501,851,109 | ||||||||||||

| End of period | $ | 288,797,372 | $ | 571,658,559 | $ | 135,459,265 | $ | 431,771,511 | ||||||||

| Other Information: | ||||||||||||||||

| Summary of Shares Transactions: | ||||||||||||||||

| TCU Shares: | ||||||||||||||||

| Shares sold | — | 3,765,707 | — | 29,882,023 | ||||||||||||

| Reinvestment of dividends and distributions | 29,599 | 188,484 | 6,489 | 256,933 | ||||||||||||

| Shares repurchased | (29,647,676 | ) | (110,225,827 | ) | (29,203,075 | ) | (73,109,677 | ) | ||||||||

| Total TCU Share Transactions | (29,618,077 | ) | (106,271,636 | ) | (29,196,586 | ) | (42,970,721 | ) | ||||||||

| Investor Shares: | ||||||||||||||||

| Shares sold | — | 15,361,849 | — | 3,058,104 | ||||||||||||

| Reinvestment of dividends and distributions | 32,877 | 148,593 | 15,882 | 90,825 | ||||||||||||

| Shares repurchased | (787,578 | ) | (201,967,137 | ) | (2,368,564 | ) | (66,079,781 | ) | ||||||||

| Total Investor Share Transactions | (754,701 | ) | (186,456,695 | ) | (2,352,682 | ) | (62,930,852 | ) | ||||||||

| Net decrease in shares outstanding | (30,372,778 | ) | (292,728,331 | ) | (31,549,268 | ) | (105,901,573 | ) | ||||||||

See accompanying notes to financial statements.

15

TRUST FOR CREDIT UNIONS

Financial Highlights

SELECTED DATA FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD

| Ultra-Short Duration Portfolio – TCU Shares | ||||||||||||||||||||||||

| Six Months | ||||||||||||||||||||||||

| Ended | ||||||||||||||||||||||||

| February 28, | ||||||||||||||||||||||||

| 2023 | Years Ended August 31, | |||||||||||||||||||||||

| (Unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 | |||||||||||||||||||

| Net Asset Value, | ||||||||||||||||||||||||

| Beginning of period | $ | 9.21 | $ | 9.43 | $ | 9.42 | $ | 9.38 | $ | 9.40 | $ | 9.47 | ||||||||||||

Income from Investment Operations: | ||||||||||||||||||||||||

Net investment income(a)(b) | 0.13 | 0.00 | (c) | 0.02 | 0.13 | 0.22 | 0.14 | |||||||||||||||||

| Net realized and unrealized gain | ||||||||||||||||||||||||

| (loss) on investment transactions | (0.07 | ) | (0.18 | ) | 0.02 | 0.05 | (0.01 | ) | (0.06 | ) | ||||||||||||||

| Total income from | ||||||||||||||||||||||||

| investment operations | 0.06 | (0.18 | ) | 0.04 | 0.18 | 0.21 | 0.08 | |||||||||||||||||

| Less Distributions from: | ||||||||||||||||||||||||

Investment income(b) | (0.16 | ) | (0.04 | ) | (0.03 | ) | (0.14 | ) | (0.23 | ) | (0.15 | ) | ||||||||||||

| Total Distributions | (0.16 | ) | (0.04 | ) | (0.03 | ) | (0.14 | ) | (0.23 | ) | (0.15 | ) | ||||||||||||

| Net Asset Value, | ||||||||||||||||||||||||

| End of period | $ | 9.11 | $ | 9.21 | $ | 9.43 | $ | 9.42 | $ | 9.38 | $ | 9.40 | ||||||||||||

Total Return(d) | 0.68 | %(e) | -1.93 | % | 0.44 | % | 1.99 | % | 2.22 | % | 0.89 | % | ||||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||||||

Net assets at the | ||||||||||||||||||||||||

end of period (in thousands) | $ | 192,020 | $ | 466,894 | $ | 1,479,989 | $ | 748,181 | $ | 427,038 | $ | 360,130 | ||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||

| Expenses net of expense reductions | 0.46 | %(f) | 0.20 | % | 0.20 | % | 0.26 | %(g) | 0.32 | %(g) | 0.40 | %(g) | ||||||||||||

| Expenses before expense reductions | 0.46 | %(f) | 0.20 | % | 0.20 | % | 0.26 | % | 0.33 | % | 0.41 | % | ||||||||||||

| Net investment income net | ||||||||||||||||||||||||

| of expense reductions | 2.81 | %(f) | 0.04 | % | 0.26 | % | 1.39 | %(g) | 2.37 | %(g) | 1.52 | %(g) | ||||||||||||

| Net investment income | ||||||||||||||||||||||||

| before expense reductions | 2.81 | %(f) | 0.04 | % | 0.26 | % | 1.39 | % | 2.36 | % | 1.51 | % | ||||||||||||

| Portfolio Turnover Rate | 0 | %(e) | 3 | % | 26 | % | 25 | % | 60 | % | 157 | % | ||||||||||||

______________________

| (a) | Calculated based on average shares outstanding. |

| (b) | Net investment income per share differs from Distributions to Shareholders from net investment income primarily due to book/tax differences on treatment of paydown gains and losses, market discounts and market premiums. |

| (c) | Amount is between $(0.005) and 0.005. |

| (d) | Assumes investment at the net asset value at the beginning of the period, reinvestment of all distributions and a complete redemption of the investment at the net asset value at the end of the period. |

| (e) | Not Annualized. |

| (f) | Annualized. |

| (g) | During the year, certain fees were waived (see Note 3). |

See accompanying notes to financial statements.

16

TRUST FOR CREDIT UNIONS

Financial Highlights

SELECTED DATA FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD

| Ultra-Short Duration Portfolio – Investor Shares | ||||||||||||||||||||||||

| Six Months | ||||||||||||||||||||||||

| Ended | ||||||||||||||||||||||||

| February 28, | ||||||||||||||||||||||||

| 2023 | Years Ended August 31, | |||||||||||||||||||||||

| (Unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 | |||||||||||||||||||

| Net Asset Value, | ||||||||||||||||||||||||

| Beginning of period | $ | 9.21 | $ | 9.43 | $ | 9.42 | $ | 9.38 | $ | 9.40 | $ | 9.47 | ||||||||||||

Income from Investment Operations: | ||||||||||||||||||||||||

Net investment income(a)(b) | 0.14 | 0.00 | (c) | 0.02 | 0.09 | 0.22 | 0.14 | |||||||||||||||||

| Net realized and unrealized gain | ||||||||||||||||||||||||

| (loss) on investment transactions | (0.08 | ) | (0.18 | ) | 0.02 | 0.09 | (0.02 | ) | (0.06 | ) | ||||||||||||||

| Total income from | ||||||||||||||||||||||||

| investment operations | 0.06 | (0.18 | ) | �� | 0.04 | 0.18 | 0.20 | 0.08 | ||||||||||||||||

| Less Distributions from: | ||||||||||||||||||||||||

Investment income(b) | (0.16 | ) | (0.04 | ) | (0.03 | ) | (0.14 | ) | (0.22 | ) | (0.15 | ) | ||||||||||||

| Total Distributions | (0.16 | ) | (0.04 | ) | (0.03 | ) | (0.14 | ) | (0.22 | ) | (0.15 | ) | ||||||||||||

| Net Asset Value, | ||||||||||||||||||||||||

| End of period | $ | 9.11 | $ | 9.21 | $ | 9.43 | $ | 9.42 | $ | 9.38 | $ | 9.40 | ||||||||||||

Total Return(d) | 0.66 | %(e) | -1.96 | % | 0.41 | % | 1.96 | % | 2.19 | % | 0.86 | % | ||||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||||||

Net assets at the | ||||||||||||||||||||||||

end of period (in thousands) | $ | 96,777 | $ | 104,765 | $ | 1,865,162 | $ | 889,240 | $ | 54,160 | $ | 14,192 | ||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||

| Expenses net of expense reductions | 0.49 | %(f) | 0.23 | % | 0.23 | % | 0.28 | %(g) | 0.34 | %(g) | 0.43 | %(g) | ||||||||||||

| Expenses before expense reductions | 0.49 | %(f) | 0.23 | % | 0.23 | % | 0.28 | % | 0.35 | % | 0.44 | % | ||||||||||||

| Net investment income net | ||||||||||||||||||||||||

| of expense reductions | 2.99 | %(f) | 0.01 | % | 0.23 | % | 0.94 | %(g) | 2.40 | %(g) | 1.48 | %(g) | ||||||||||||

| Net investment income | ||||||||||||||||||||||||

| before expense reductions | 2.99 | %(f) | 0.01 | % | 0.23 | % | 0.94 | % | 2.39 | % | 1.47 | % | ||||||||||||

| Portfolio Turnover Rate | 0 | %(e) | 3 | % | 26 | % | 25 | % | 60 | % | 157 | % | ||||||||||||

______________________

| (a) | Calculated based on average shares outstanding. |

| (b) | Net investment income per share differs from Distributions to Shareholders from net investment income primarily due to book/tax differences on treatment of paydown gains and losses, market discounts and market premiums. |

| (c) | Amount is between $(0.005) and 0.005. |

| (d) | Assumes investment at the net asset value at the beginning of the period, reinvestment of all distributions and a complete redemption of the investment at the net asset value at the end of the period. |

| (e) | Not Annualized. |

| (f) | Annualized. |

| (g) | During the year, certain fees were waived (see Note 3). |

See accompanying notes to financial statements.

17

TRUST FOR CREDIT UNIONS

Financial Highlights

SELECTED DATA FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD

| Short Duration Portfolio – TCU Shares | ||||||||||||||||||||||||

| Six Months | ||||||||||||||||||||||||

| Ended | ||||||||||||||||||||||||

| February 28, | ||||||||||||||||||||||||

| 2023 | Years Ended August 31, | |||||||||||||||||||||||

| (Unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 | |||||||||||||||||||

| Net Asset Value, | ||||||||||||||||||||||||

| Beginning of period | $ | 9.22 | $ | 9.83 | $ | 9.91 | $ | 9.75 | $ | 9.51 | $ | 9.67 | ||||||||||||

Income from Investment Operations: | ||||||||||||||||||||||||

Net investment income(a)(b) | 0.11 | 0.05 | 0.03 | 0.17 | 0.23 | 0.16 | ||||||||||||||||||

| Net realized and unrealized gain | ||||||||||||||||||||||||

| (loss) on investment transactions | (0.30 | ) | (0.58 | ) | (0.04 | ) | 0.19 | 0.25 | (0.15 | ) | ||||||||||||||

| Total income from | ||||||||||||||||||||||||

| investment operations | (0.19 | ) | (0.53 | ) | (0.01 | ) | 0.36 | 0.48 | 0.01 | |||||||||||||||

| Less Distributions from: | ||||||||||||||||||||||||

Investment income(b) | (0.15 | ) | (0.08 | ) | (0.07 | ) | (0.20 | ) | (0.24 | ) | (0.17 | ) | ||||||||||||

| Total Distributions | (0.15 | ) | (0.08 | ) | (0.07 | ) | (0.20 | ) | (0.24 | ) | (0.17 | ) | ||||||||||||

| Net Asset Value, | ||||||||||||||||||||||||

| End of period | $ | 8.88 | $ | 9.22 | $ | 9.83 | $ | 9.91 | $ | 9.75 | $ | 9.51 | ||||||||||||

Total Return(c) | -2.11 | %(d) | -5.40 | % | -0.13 | % | 3.76 | % | 5.15 | % | 0.06 | % | ||||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||||||

Net assets at the | ||||||||||||||||||||||||

end of period (in thousands) | $ | 83,605 | $ | 356,187 | $ | 802,363 | $ | 590,322 | $ | 400,537 | $ | 380,063 | ||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||

| Expenses net of expense reductions | 0.54 | %(e) | 0.23 | % | 0.21 | % | 0.27 | %(f) | 0.32 | %(f) | 0.39 | %(f) | ||||||||||||

| Expenses before expense reductions | 0.54 | %(e) | 0.23 | % | 0.21 | % | 0.27 | % | 0.33 | % | 0.40 | % | ||||||||||||

| Net investment income net | ||||||||||||||||||||||||

| of expense reductions | 2.42 | %(e) | 0.50 | % | 0.34 | % | 1.71 | %(f) | 2.42 | %(f) | 1.65 | %(f) | ||||||||||||

| Net investment income | ||||||||||||||||||||||||

| before expense reductions | 2.42 | %(e) | 0.50 | % | 0.34 | % | 1.71 | % | 2.41 | % | 1.64 | % | ||||||||||||

| Portfolio Turnover Rate | 57 | %(d) | 266 | % | 311 | % | 112 | % | 80 | % | 196 | % | ||||||||||||

______________________

| (a) | Calculated based on average shares outstanding. |

| (b) | Net investment income per share differs from Distributions to Shareholders from net investment income primarily due to book/tax differences on treatment of paydown gains and losses, market discounts and market premiums. |

| (c) | Assumes investment at the net asset value at the beginning of the period, reinvestment of all distributions and a complete redemption of the investment at the net asset value at the end of the period. |

| (d) | Not Annualized. |

| (e) | Annualized. |

| (f) | During the year, certain fees were waived (see Note 3). |

See accompanying notes to financial statements.

18

TRUST FOR CREDIT UNIONS

Financial Highlights

SELECTED DATA FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD

| Short Duration Portfolio – Investor Shares | ||||||||||||||||||||||||

| Six Months | ||||||||||||||||||||||||

| Ended | ||||||||||||||||||||||||

| February 28, | ||||||||||||||||||||||||

| 2023 | Years Ended August 31, | |||||||||||||||||||||||

| (Unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 | |||||||||||||||||||

| Net Asset Value, | ||||||||||||||||||||||||

| Beginning of period | $ | 9.23 | $ | 9.84 | $ | 9.91 | $ | 9.75 | $ | 9.51 | $ | 9.67 | ||||||||||||

Income from Investment Operations: | ||||||||||||||||||||||||

Net investment income(a)(b) | 0.11 | 0.04 | 0.03 | 0.12 | 0.22 | 0.15 | ||||||||||||||||||

| Net realized and unrealized gain | ||||||||||||||||||||||||

| (loss) on investment transactions | (0.32 | ) | (0.57 | ) | (0.04 | ) | 0.24 | 0.26 | (0.15 | ) | ||||||||||||||

| Total income from | ||||||||||||||||||||||||

| investment operations | (0.21 | ) | (0.53 | ) | (0.01 | ) | 0.36 | 0.48 | 0.00 | |||||||||||||||

| Less Distributions from: | ||||||||||||||||||||||||

Investment income(b) | (0.14 | ) | (0.08 | ) | (0.06 | ) | (0.20 | ) | (0.24 | ) | (0.16 | ) | ||||||||||||

| Total Distributions | (0.14 | ) | (0.08 | ) | (0.06 | ) | (0.20 | ) | (0.24 | ) | (0.16 | ) | ||||||||||||

| Net Asset Value, | ||||||||||||||||||||||||

| End of period | $ | 8.88 | $ | 9.23 | $ | 9.84 | $ | 9.91 | $ | 9.75 | $ | 9.51 | ||||||||||||

Total Return(c) | -2.23 | %(d) | -5.42 | % | -0.06 | % | 3.73 | % | 5.12 | % | 0.03 | % | ||||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||||||

Net assets at the | ||||||||||||||||||||||||

end of period (in thousands) | $ | 51,854 | $ | 75,584 | $ | 699,488 | $ | 260,351 | $ | 1,792 | $ | 22,082 | ||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||

| Expenses net of expense reductions | 0.60 | %(e) | 0.26 | % | 0.24 | % | 0.28 | %(f) | 0.35 | %(f) | 0.42 | %(f) | ||||||||||||

| Expenses before expense reductions | 0.60 | %(e) | 0.26 | % | 0.24 | % | 0.28 | % | 0.36 | % | 0.43 | % | ||||||||||||

| Net investment income net | ||||||||||||||||||||||||

| of expense reductions | 2.59 | %(e) | 0.47 | % | 0.27 | % | 1.23 | %(f) | 2.27 | %(f) | 1.62 | %(f) | ||||||||||||

| Net investment income | ||||||||||||||||||||||||

| before expense reductions | 2.59 | %(e) | 0.47 | % | 0.27 | % | 1.23 | % | 2.26 | % | 1.61 | % | ||||||||||||

| Portfolio Turnover Rate | 57 | %(d) | 266 | % | 311 | % | 112 | % | 80 | % | 196 | % | ||||||||||||

______________________

| (a) | Calculated based on average shares outstanding. |

| (b) | Net investment income per share differs from Distributions to Shareholders from net investment income primarily due to book/tax differences on treatment of paydown gains and losses, market discounts and market premiums. |

| (c) | Assumes investment at the net asset value at the beginning of the period, reinvestment of all distributions and a complete redemption of the investment at the net asset value at the end of the period. |

| (d) | Not Annualized. |

| (e) | Annualized. |

| (f) | During the year, certain fees were waived (see Note 3). |

See accompanying notes to financial statements.

19

TRUST FOR CREDIT UNIONS

Notes to Financial Statements

Six Months Ended February 28, 2023 (Unaudited)

Note 1. Organization

Trust for Credit Unions (the “Trust”) is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company currently consisting of three diversified portfolios. This shareholder report relates to the Trust’s Ultra-Short Duration Portfolio and Short Duration Portfolio (together, the “Portfolios” or individually, a “Portfolio”). Shares of the Portfolios are offered for sale solely to state and federally chartered credit unions. The Trust previously offered shares of another portfolio, the Money Market Portfolio, which suspended operations as of the close of business on May 30, 2014.

On October 1, 2012, the Trust began offering a second class of shares, known as Investor Shares, in each of the Portfolios and the existing shares in each Portfolio were redesignated as TCU Shares. Investor Shares and TCU Shares of each Portfolio should have returns that are substantially the same because they represent interests in the same Portfolio and differ only to the extent that they have different class specific expenses. Effective October 1, 2012, TCU Shares of each Portfolio are only available to those shareholders that had open accounts in the particular Portfolio as of such date. The Investor Shares of each Portfolio commenced operations on November 30, 2012.

The Portfolios seek to achieve a high level of current income, consistent with low volatility of principal (in the case of the Ultra-Short Duration Portfolio) and relatively low volatility of principal (in the case of the Short Duration Portfolio) by investing in obligations authorized under the Federal Credit Union Act.

The Portfolios are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 “Financial Services – Investment Companies”.

Note 2. Summary of Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Portfolios. The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that may affect the reported amounts. Actual results could differ from those estimates.

A. Investment Valuation

Investments in mortgage-backed, asset-backed (to the extent that obligations authorized under the Federal Credit Union Act are categorized as asset-backed obligations), and U.S. Treasury obligations for which accurate market quotations are readily available are valued on the basis of quotations furnished by a pricing service or provided by dealers in such securities. The pricing services may use valuation models or matrix pricing, which considers yield or price with respect to comparable bonds, quotations from bond dealers or by reference to other securities that are considered comparable in such characteristics as rating, interest rate and maturity date, to determine current value. Short-term debt obligations maturing in sixty days or less are valued at amortized cost, which approximates market value. Portfolio securities for which accurate market quotations are not readily available due to, among other factors, current market trading activity, credit quality and default rates, are valued based on yield equivalents, pricing matrices or other sources, under valuation procedures established by the Board of Trustees of the Trust (the “Board”).

The Portfolios are subject to fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the measurement date. The three levels of the fair value hierarchy are as follows:

| Level 1 – | quoted prices in active markets for identical securities | |

| Level 2 – | significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) | |

| Level 3 – | significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments) |

At the end of each calendar quarter, management evaluates the Level 2 and Level 3 assets and liabilities, if any, for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates Level 1 and Level 2 assets and liabilities, if any, on a quarterly basis for changes in listings or delistings on national exchanges. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Portfolios’ investments may fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Portfolios may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less liquid than publicly traded securities.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

20

TRUST FOR CREDIT UNIONS

Notes to Financial Statements

Six Months Ended February 28, 2023 (Unaudited) (continued)

The summary of inputs used to value each Portfolio’s net assets as of February 28, 2023 is as follows:

| Ultra-Short Duration Portfolio | ||||||||||||||||

| Total | Level 2 | Level 3 | ||||||||||||||

| Market | Level 1 | Significant | Significant | |||||||||||||

| Value at | Quoted | Observable | Unobservable | |||||||||||||

| 2/28/2023 | Price | Inputs | Inputs | |||||||||||||

| Assets: | ||||||||||||||||

| Collateralized | ||||||||||||||||

| Mortgage | ||||||||||||||||

| Obligations | $ | 117,832,037 | $ | — | $ | 117,832,037 | $ | — | ||||||||

| Agency | ||||||||||||||||

| Debentures | 1,000,000 | — | — | 1,000,000 | ||||||||||||

| U.S. Government- | ||||||||||||||||

| Backed | ||||||||||||||||

| Obligations | 2,053,367 | — | 2,053,367 | — | ||||||||||||

| Repurchase | ||||||||||||||||

| Agreements | 168,500,000 | — | 168,500,000 | — | ||||||||||||

$ | 289,385,404 | $ | — | $ | 288,385,404 | $ | 1,000,000 | |||||||||

| Short Duration Portfolio | ||||||||||||||||

| Total | Level 2 | Level 3 | ||||||||||||||

| Market | Level 1 | Significant | Significant | |||||||||||||

| Value at | Quoted | Observable | Unobservable | |||||||||||||

| 2/28/2023 | Price | Inputs | Inputs | |||||||||||||

| Assets: | ||||||||||||||||

| Collateralized | ||||||||||||||||

| Mortgage | ||||||||||||||||

| Obligations | $ | 12,563,347 | $ | — | $ | 12,563,347 | $ | — | ||||||||

| U.S. Government- | ||||||||||||||||

| Backed | ||||||||||||||||

| Obligations | 1,407,693 | — | 1,407,693 | — | ||||||||||||

| U.S. Treasury | ||||||||||||||||

| Obligations | 19,853,906 | — | 19,853,906 | — | ||||||||||||

| Repurchase | ||||||||||||||||

| Agreements | 101,500,000 | — | 101,500,000 | — | ||||||||||||

| Registered | ||||||||||||||||

| Investment | ||||||||||||||||

| Company | 286,422 | 286,422 | — | — | ||||||||||||

$ | 135,611,368 | $ | 286,422 | $ | 135,324,946 | $ | — | |||||||||

The following is a reconciliation of Level 3 holdings for which significant unobservable inputs were used in determining fair value as of February 28, 2023:

| Ultra-Short | ||||

| Duration Portfolio | ||||

| Fair Value, as of | ||||

| August 31, 2022 | $ | 1,250,000 | ||

| Gross sales | (250,000 | ) | ||

| Fair Value, as of | ||||

| February 28, 2023 | $ | 1,000,000 | ||

Factors considered in determining the fair value of investments designated as Level 3 include anticipated cash flows and credit characteristics.

B. Security Transactions and Investment Income

Security transactions are reflected for financial reporting purposes as of the trade date. Realized gains and losses on sales of portfolio securities are calculated using the identified cost basis. Interest income is recorded on the basis of interest accrued, premium amortized and discount accreted.

All paydown gains and losses are classified as interest income in the accompanying Statements of Operations in accordance with U.S. GAAP. Market discounts, original issue discounts and market premiums on debt securities are accreted/amortized to interest income over the life of the security with a corresponding increase/decrease in the cost basis of that security using the yield to maturity method, or where applicable, the first call date of the security.

C. Distribution to Shareholders

Each Portfolio intends to distribute to its shareholders substantially all of its investment income and capital gains. The Portfolios declare dividends from net investment income daily and pay such dividends monthly. Each Portfolio makes distributions of net realized capital gains, if any, at least annually. Income distributions and capital gain distributions are determined in accordance with income tax regulations.

D. Allocations

Net investment income earned, other than class-specific expenses, realized capital gains and losses, and unrealized appreciation and depreciation for a Portfolio are allocated daily to each class of shares based upon the relative net asset value of settled shares of each class at the beginning of the day (after adjusting for the current day’s settled capital share activity of the respective class). Class-specific expenses are charged directly to the class incurring the expense. Expenses not directly charged to a Portfolio are allocated proportionally among all the Portfolios in the Trust, daily in relation to the net assets of each Portfolio or another reasonable measure.

E. Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reported period. Actual results could differ from those estimates.

21

TRUST FOR CREDIT UNIONS

Notes to Financial Statements

Six Months Ended February 28, 2023 (Unaudited) (continued)

F. LIBOR Transition

The Portfolios invest in financial instruments with payment obligations, financing terms, hedging strategies or investment values based on floating rates, such as London Interbank Offered Rate (“LIBOR”). LIBOR is the offered rate for short-term Eurodollar deposits between major international banks.

ICE Benchmark Administration, the administrator of LIBOR, ceased publication of most LIBOR settings on a representative basis at the end of 2021 and is expected to cease publication of a majority of U.S. dollar LIBOR settings on a representative basis after June 30, 2023. In addition, global regulators have announced that, with limited exceptions, no new LIBOR-based contracts should be entered into after 2021. The transition away from LIBOR poses a number of other risks, including changed values of LIBOR-related investments, which may adversely affect the Portfolios’ performance.

G. Federal Taxes

It is each Portfolio’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, (the “Code”) applicable to regulated investment companies and to distribute each year substantially all of its investment company taxable income and capital gains to its shareholders. Accordingly, no federal tax provisions are required. Income distributions to shareholders are recorded on the ex-dividend date, declared daily and paid monthly by the Portfolios. Net capital losses are carried forward to future years and may be used to the extent allowed by the Code to offset any future capital gains. Utilization of capital loss carryforwards may reduce the requirement of future capital gain distributions.

The characterization of distributions to shareholders is determined in accordance with U.S. federal income tax rules, which may differ from U.S. GAAP. Therefore, the source of each Portfolio’s distributions may be shown in the accompanying financial statements as either from net investment income, net realized gains or as a tax return of capital.

Generally, paydown gains and losses are recorded as increases (paydown gains) or decreases (paydown losses) against capital gains for tax purposes. The Portfolios have elected to accrete and amortize market discounts and premiums on portfolio securities for tax purposes based on the securities’ yield to maturity. For the current year, net amortization is reducing ordinary income available for distribution.

Management has analyzed the Portfolios’ tax positions taken on federal income tax returns for all open tax years (current and prior three tax years), and has concluded that no provision for federal income tax is required in the Portfolios’ financial statements. The Portfolios’ federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

The aggregate cost of investments and the composition of unrealized appreciation and depreciation on investments for Federal income tax purposes as of August 31, 2022, were as follows:

| Ultra-Short | Short | |||||||

| Duration | Duration | |||||||

| Portfolio | Portfolio | |||||||

| Total Cost of Investments | ||||||||

| on Tax Basis | $ | 582,630,399 | $ | 519,283,373 | ||||

| Gross Unrealized | ||||||||

| Appreciation on | ||||||||

| Investments | $ | 90,472 | $ | 660,081 | ||||

| Gross Unrealized | ||||||||

| Depreciation on | ||||||||

| Investments | (11,139,532 | ) | (22,876,593 | ) | ||||

| Net Unrealized | ||||||||

| Appreciation (Depreciation) | ||||||||

| on Investments | $ | (11,049,060 | ) | $ | (22,216,512 | ) | ||

H. Expenses

Expenses incurred by the Portfolios that do not specifically relate to an individual Portfolio are generally allocated to the Portfolios based on each Portfolio’s relative average net assets for the period or in such other manner as the Board deems fair or equitable depending upon the nature of the expenses. In addition, expenses incurred by a Portfolio that do not specifically relate to a particular class of shares of the Portfolio are generally allocated to the appropriate classes based on each class’ relative average net assets or in such other manner as the Board deems fair and equitable. Expenses that specifically relate to a particular class of shares of a Portfolio are allocated to that class.

The Portfolios pay compensation to the independent Trustees of the Trust in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The Portfolios do not pay compensation to Trustees or officers of the Trust who are also officers of the Trust’s investment adviser or administrator.

I. Repurchase Agreements and Reverse Repurchase Agreements

Repurchase agreements involve the purchase of securities subject to the seller’s agreement to repurchase the securities at a mutually agreed upon date and price. During the term of a repurchase agreement, the value of the underlying securities held as collateral on behalf of the Portfolios, including accrued interest, is required to exceed the value of the repurchase agreement, including accrued

22

TRUST FOR CREDIT UNIONS

Notes to Financial Statements

Six Months Ended February 28, 2023 (Unaudited) (continued)

interest. If the seller defaults or becomes insolvent, realization of the collateral by the Portfolios may be delayed or limited and there may be a decline in the value of the collateral during the period while the Portfolios seek to assert their rights. The underlying securities for all repurchase agreements are held in safekeeping at the Portfolios’ regular custodian or at a custodian specifically designated for purposes of the repurchase agreement under triparty repurchase agreements.

A repurchase agreement may permit a Portfolio, under certain circumstances, including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the repurchase agreement with collateral held and/or posted to the counterparty and create one single net payment due to or from the Portfolio. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of the repurchase agreement counterparty’s bankruptcy or insolvency. Pursuant to the terms of the repurchase agreement, a Portfolio receives or posts securities as collateral with a market value in excess of the repurchase price to be paid or received by the Portfolio upon the maturity of the transaction. Upon a bankruptcy or insolvency of the repurchase agreement counterparty, the Portfolio would recognize a liability with respect to such excess collateral to reflect the Portfolio’s obligation under bankruptcy law to return the excess to the counterparty.

Master Repurchase Agreements (“MRAs”) permit the Portfolio, under certain circumstances, including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the MRA with collateral held and/or posted to the counterparty and create one single net payment due to or from the Portfolio. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of the MRA counterparty’s bankruptcy or insolvency. Pursuant to the terms of the MRA, the Portfolio receives or posts securities as collateral with a market value in excess of the repurchase price to be paid or received by the Portfolio upon the maturity of the transaction. Upon a bankruptcy or insolvency of the MRA counterparty, the Portfolio would recognize a liability with respect to such excess collateral to reflect the Portfolio’s obligation under bankruptcy law to return the excess to the counterparty.

The Portfolios had investments in repurchase agreements at February 28, 2023. The gross value and related collateral received for these investments are presented in each Portfolio of Investments and the value of these investments is also presented in the Statements of Assets and Liabilities. The value of the related collateral held by each Portfolio exceeded the value of its respective repurchase agreements as of February 28, 2023.

The Portfolios may also engage in reverse repurchase transactions in which a Portfolio sells its securities and simultaneously agrees to repurchase the securities at a specified time and price. Reverse repurchase transactions are considered to be borrowings by a Portfolio. The Portfolios did not engage in reverse repurchase transactions during the six months ended February 28, 2023.

J. When-Issued Securities

Consistent with National Credit Union Administration (“NCUA”) rules and regulations, the Portfolios may purchase or sell when-issued securities, including TBA (“To Be Announced”) securities that have been authorized but not yet issued in the market. The value of a when-issued security sale is recorded as an asset and a liability on the Portfolios’ records with the difference between its market value and expected cash proceeds recorded as an unrealized gain or loss. Gains or losses are realized upon delivery of the security sold. Losses may arise due to changes in the market value of the security or from the inability of counterparties to meet the terms of the transaction. All settlements in connection with purchases and sales of when-issued securities must be by regular way (i.e., the normal security settlement time, which may vary according to security type). Effective August 19, 2022, certain when-issued securities held by the Portfolios will be subject to the SEC’s regulations governing the use of derivatives by registered investment companies (“Rule 18f-4”). Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, eliminates the asset segregation framework previously used by funds to comply with Section 18 of the 1940 Act, and requires funds whose use of derivatives is greater than a limited specified amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager.

K. Mortgage Dollar Rolls

The Portfolios may enter into mortgage ‘‘dollar rolls’’ in which the Portfolios sell securities in the current month for delivery and simultaneously contract with the same counterparty to repurchase similar (same type, coupon and maturity) but not identical securities on a specified future date. For financial reporting and tax reporting purposes, the Portfolios treat mortgage dollar rolls as two separate transactions; one involving the purchase of a security and a separate transaction involving a sale. During the settlement period between the sale and repurchase, the Portfolios will not be entitled to accrue interest and/or receive principal payments on the securities sold. Dollar roll transactions involve the risk that the market value of

23

TRUST FOR CREDIT UNIONS

Notes to Financial Statements

Six Months Ended February 28, 2023 (Unaudited) (continued)

the securities sold by the Portfolios may decline below the repurchase price of those securities. In the event the buyer of the securities under a dollar roll transaction files for bankruptcy or becomes insolvent, the Portfolios’ use of proceeds of the transaction may be restricted pending a determination by, or with respect to, the other party.

Note 3. Agreements and 12b-1 Plan

A. Advisory Agreement

ALM First Financial Advisors, LLC (“ALM First” or the “Adviser”) serves as investment adviser pursuant to an amended and restated advisory agreement (the “Advisory Agreement”) that was approved by the Board and shareholders of each Portfolio and took effect on January 31, 2021. Under the Advisory Agreement, ALM First manages the Portfolios, subject to the general supervision of the Board.

As compensation for its services and its assumption of certain expenses, the Adviser is entitled to the following fees, computed daily and payable monthly, at the annual rates listed below (as a percentage of each Portfolio’s average daily net assets):

Portfolio(s) | Contractual Rate* |

Ultra-Short | 0.14% on the first $250 million; |

Duration | 0.12% between $250 million and $500 million; |

0.08% between $500 million and $1 billion; | |

0.06% assets above $1 billion | |

Short | 0.14% on the first $250 million; |

Duration | 0.12% between $250 million and $500 million; |

0.08% between $500 million and $1 billion; | |

0.06% assets above $1 billion |

| * | Contractual rate effective January 31, 2021 is based on the average daily net assets of each Portfolio. |

B. Administration Agreement

Callahan Credit Union Financial Services Limited Liability Limited Partnership (“CUFSLP”) serves as the Portfolios’ administrator pursuant to an Administration Agreement. Callahan Financial Services, Inc. (“CFS”) serves as a general partner to CUFSLP, which includes 37 major credit unions that are limited partners. As compensation for services rendered pursuant to such Agreement, CUFSLP is entitled to fees, computed daily and payable by the Portfolios monthly, at the following annual rates as a percentage of each respective Portfolio’s average daily net assets:

Portfolio | CUFSLP Fee |

| Ultra-Short Duration | 0.05% |

| Short Duration | 0.05% |

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”), an indirect wholly-owned subsidiary of U.S. Bancorp, provides additional administrative services to the Portfolios pursuant to a Fund Administration Servicing Agreement dated June 7, 2018 and is entitled to the following fees, computed daily and payable by the Portfolios monthly, at the following annual rates as a percentage of the aggregate average net assets.

Asset Level | Contractual Rate(1) |

| up to $300 million | 0.030% |

| from $300 to $600 million | 0.025% |

| from $600 million to $2 billion | 0.020% |

| in excess of $2 billion | 0.0175% |

________

| (1) | Each Portfolio is subject to a minimum annual base fee of $75,000. |

C. Other Agreements