UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05407

| Trust for Credit Unions | ||||

| (Exact name of registrant as specified in charter) | ||||

4400 Computer Drive Westborough, MA 01581 | ||||

| (Address of principal executive offices) (Zip code) | ||||

Jay Johnson Callahan Financial Services, Inc. 1001 Connecticut Avenue NW, Suite 1001 Washington, DC 20036 | Copies to: Mary Jo Reilly, Esq. Drinker Biddle & Reath LLP One Logan Square, Suite 2000 Philadelphia, PA 19103 | |

| (Name and address of agent for service) | ||

Registrant’s telephone number, including area code: (800) 342-5828

Date of fiscal year end: August 31

Date of reporting period: August 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Annual Report to Unitholders is attached herewith.

Money Market Portfolio

Ultra-Short Duration Government Portfolio

Short Duration Portfolio

Annual Report

August 31, 2012

The reports concerning the Trust for Credit Unions (“TCU” or the “Trust”) Portfolios included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the Portfolios in the future. These statements are based on Portfolio management’s predictions and expectations concerning certain future events and their expected impact on the Portfolios, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Portfolios. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

TCU files the complete schedule of portfolio holdings of each Portfolio with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Portfolios’ Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling I-800-SEC-0330.

An investment in a TCU Portfolio is not a credit union deposit and is not insured or guaranteed by the National Credit Union Share Insurance Fund, the National Credit Union Administration, or any other government agency.

An investment in the TCU Money Market Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio.

The TCU Ultra-Short Duration Government Portfolio and the TCU Short Duration Portfolio are not money market funds. Investors in these Portfolios should understand that the net asset values of the Portfolios will fluctuate, which may result in a loss of the principal amount invested. The Portfolios’ net asset values and yields are not guaranteed by the U.S. government or by its agencies, instrumentalities or sponsored enterprises. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolios if held to maturity and not to the value of the Portfolios’ shares. The Portfolios’ investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

Holdings and allocations shown may not be representative of current or future investments. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities.

This material is not authorized for distribution unless preceded or accompanied by a current Prospectus. Investors should consider a Portfolio’s objectives, risks, and charges and expenses, and read the Prospectus carefully before investing or sending money. The Prospectus contains this and other information about the Portfolios.

Callahan Financial Services, Inc. is the distributor of the TCU Portfolios.

This report is for the information of the shareholders of the Trust. Its use in connection with any offering of shares of the Trust is authorized only in the case of a concurrent or prior delivery of the Trust’s current Prospectus.

Dear Credit Union Shareholders,

Credit unions are posting strong results in 2012. Membership has increased for six consecutive quarters. Core deposits are rising and now account for two-thirds of total share balances. Lending activity is at a record pace through mid-year. Earnings are the highest in seven years. The performance results are an outcome of credit unions’ ongoing success in building member relationships.

While loan growth is picking up, growth in share balances continues to outpace the increase in loans outstanding. As a result, liquidity remains high with a loan to share ratio of 67% at mid-year 2012. The $392 billion investment portfolio is being re-shaped as it grows. Agency securities have become the primary investment vehicle for credit unions, followed by certificates of deposits at banks and S&Ls. Corporate credit unions now account for less than 10% of the industry’s portfolio.

The shift in the investment portfolio underscores the need for credit union designed and led investment options. Trust for Credit Unions’ (“TCU”) 25-year history is a reflection of the relevance of such an alternative to the industry. With the Federal Reserve now expecting to maintain the historically low interest rate environment into 2015, having the capability to respond to changing credit union investment needs is more important than ever. TCU provides such a platform, supported by the credit unions in the Callahan Credit Union Financial Services LLLP partnership.

The three Portfolios in the TCU family of mutual funds complement each other with different objectives and duration targets. Each Portfolio provides daily pricing and same-day or next-day liquidity. By combining the Portfolios to create a duration profile that meets their balance sheet objectives, investors are able to tailor their usage of the TCU Portfolios to their situation. Investors can see the effect of combining the three Portfolios by using the Yield Optimizer tool, available at www.TrustCU.com.

The TCU Money Market Portfolio’s yield reflects the Federal Reserve’s interest rate policies. The standardized 7-day current and effective yields, with fee waivers, on the Money Market Portfolio as of August 31, 2012 are 0.11%.

The Ultra-Short Duration and Short Duration Portfolios are utilized by credit unions looking to hold longer duration investments. The cumulative total return was 0.58% for the Ultra-Short Duration and 1.02% for the Short Duration for the 12-month period ended August 31, 2012.

Please visit our website, www.TrustCU.com, for the most current information on the portfolios, including performance and portfolio holdings. We appreciate your investment in Trust for Credit Unions. Let us know if there are other ways in which we can help complement your credit union’s investment strategy.

Sincerely,

Charles W. Filson

President

Callahan Financial Services, Inc.

and Trust for Credit Unions

1

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU MONEY MARKET PORTFOLIO

Investment Objective

The objective of the TCU Money Market Portfolio (“MMP” or the “Portfolio”) is to maximize current income to the extent consistent with the preservation of capital and the maintenance of liquidity by investing in high quality money market instruments authorized under the Federal Credit Union Act.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Money Market Portfolio Management Team discusses the Portfolio’s performance and positioning for the Reporting Period.

Q. How did the Portfolio perform during the Reporting Period?

For the 12-month period ended August 31, 2012, MMP had a one-year simple average yield of 0.05%. This compared to the 0.06% simple average yield for the iMoneyNet First Tier -Institutional Only Average for the same period.

As of August 31, 2012, the Portfolio had standardized 7-day current and effective yields, with fee waivers, of 0.11%. As of that date, the Portfolio’s standardized 7-day current and effective yields, without fee waivers, would have been -0.30%. The standardized 7-day current and effective yields are calculated in accordance with industry regulations and do not include capital gains. The standardized 7-day current yield may differ slightly from the actual distribution rate because of the exclusion of distributed capital gains, which are non-recurring. The standardized 7-day effective yield assumes reinvestment of all dividends.

The yields represent past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance quoted above. Yields will fluctuate as market conditions change. The yield quotations more closely reflect the current earnings of the Portfolio. Unless otherwise noted, performance reflects fee waivers in effect. In their absence, performance would be reduced.

Q. How did you manage the Portfolio during the Reporting Period?

Given the extremely flat yield curve and our expectation that yields will remain compressed for the foreseeable future, we favored extending the weighted average maturity (“WAM”) through the period, averaging between 35 days and 45 days. Overall, the Portfolio has been engaged in a barbell strategy by holding high levels of liquidity in overnight repurchase agreements and taking duration through one-year U.S. government agency debentures.

Q. How was the Portfolio invested?

During the Reporting Period, the Portfolio had investments in Treasury securities, government agency securities, repurchase agreements, government guaranteed paper and certificates of deposits. A meaningful portion of the Portfolio was invested in overnight repurchase agreements and bills maturing within one week, giving daily liquidity to the Portfolio.

Q. Did you make any changes to the Portfolio during the Reporting Period?

As mentioned earlier, we made adjustments to the Portfolio’s WAM based on then-current market conditions and our near-term view, as well as our anticipated and actual Federal Reserve Board (the “Fed”) monetary policy statements.

Q. What is the Portfolio’s tactical view and strategy for the months ahead?

In the U.S., volatility has been lower because the Fed has committed to holding rates at low levels for an extended period. In June 2012, the Fed furthered its easing bias by engaging in another round of its Maturity Extension Program (“MEP”), more commonly known as “Operation Twist.” We find it difficult to envisage a point where the policy rate will be raised over the next year or more. Looking out over the longer-term, the timing of any rise in rates is very uncertain, but our view is that it is not a likely scenario at any point in the near to intermediate future.

For money market strategies in particular, the Eurozone crisis has been a significant event. Doubts about the solvency of troubled peripheral countries and the expectation of contagion to larger European bond markets have made some government sectors too risky for investors focused on liquidity and capital preservation. As such, investors have shifted more allocations into the government markets with the strongest credit ratings, driving yields close to or below zero for maturities up to a year. In short, the investable universe has become more limited. Against this backdrop, government funds have struggled to find viable investments with a positive yield, and we do not expect to see that situation change any time soon. In fact, continued aggressive accommodation by global central banks could increase the demand for high quality short-term assets in the coming months. As a result, we will continue to focus on an implementation of the barbell strategy in the Portfolio, as it allows for a solid liquidity position while offering duration protection against additional easing actions.

Our philosophy is to aim to deliver liquidity and stability. Because we see the potential for significant volatility, even if the timing is unclear, we have reduced risk more significantly than we would have otherwise. We expect to remain conservatively positioned in the U.S. and our focus is on managing liquidity. Although money market flows have stabilized after some past volatility, we always need to be able to deliver liquidity to our investors. Being further out the curve or higher in the risk spectrum will put pressure on our ability to deliver liquidity, and we do not think there is value in sacrificing liquidity in exchange for modest risk premiums on credit or duration.

Benchmark Definition

iMoneyNet First Tier Institutional Average

iMoneyNet First Tier Institutional Average (the “Average”) is a widely recognized composite of institutional money market funds that invest in securities rated in the highest category by at least two recognized rating agencies. The number of funds in the Average varies.

2

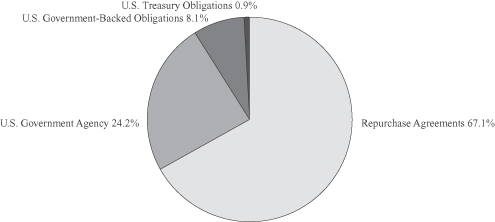

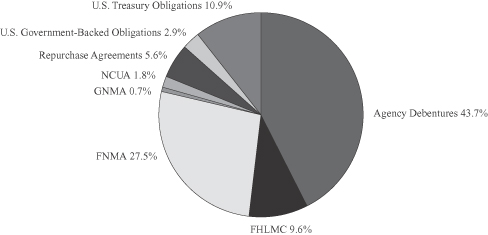

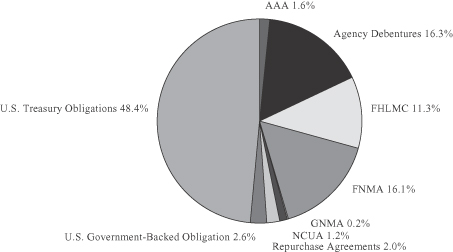

PORTFOLIO COMPOSITION

TCU MONEY MARKET PORTFOLIO (Unaudited)

August 31, 2012*

August 31, 2011*

| * | These percentages reflect portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

3

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO

Investment Objective

The TCU Ultra-Short Duration Government Portfolio (“USDGP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. Under normal circumstances, at least 80% of the net assets (measured at the time of purchase) of USDGP will be invested in securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises. The Portfolio expects that a substantial portion of these securities will be mortgage-related securities. While there will be fluctuations in the net asset value (“NAV”) of the USDGP, the Portfolio is expected to have less interest rate risk and asset value fluctuation than funds investing primarily in longer-term mortgage-backed securities paying a fixed rate of interest. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. USDGP’s maximum duration is equal to that of a Two-Year U.S. Treasury Security, and its target duration is to be no shorter than that of the Six-Month U.S. Treasury Bill Index and no longer than that of the One-Year U.S. Treasury Note Index, each as reported by BofA Merrill Lynch.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Portfolio Management Team discusses the Portfolio’s performance and positioning for the Reporting Period.

Q. How did the Portfolio perform during the Reporting Period?

For the 12-month period ended August 31, 2012, the cumulative total return of USDGP was 0.58% versus a 0.18% cumulative total return of the Portfolio’s blended benchmark, the 9-Month U.S. Treasury Index (weighted average return of the Six-Month U.S. Treasury Bill Index (50%) and the One-Year U.S. Treasury Note Index (50%), as reported by BofA Merrill Lynch). The cumulative total returns for the Six-Month U.S. Treasury Bill Index and the One-Year U.S. Treasury Note Index were 0.14% and 0.22%, respectively. The Portfolio’s NAV per share at the end of the Reporting Period was $9.64, versus $9.62 on August 31, 2011.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

The Portfolio’s performance was driven primarily by individual security selection strategies, particularly within government/agency bonds. The Portfolio’s cross-sector positioning further added to excess returns, while the Portfolio’s duration and term structure positioning had a minimal impact on performance during the Reporting Period.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

The Portfolio’s sector positioning relative to the benchmark made a positive contribution to performance during the Reporting Period. Our overweight exposure to agency mortgage-backed securities (“MBS”) contributed to returns, as a positive contribution during the last three months of the Reporting Period offset a negative contribution during the first

three months of the Reporting Period. Security selection strategies within the MBS space, specifically the selection of adjustable-rate mortgages, also positively contributed to performance. Agency mortgage-backed securities performed well late in 2011 and through the first six months of 2012, as the market priced in soft economic data and comments by Federal Reserve Board (“Fed”) officials have raised expectations for another round of quantitative easing (“QE3”).

Within the agency mortgage-backed space, Ginnie Mae (“GNMA”) mortgages generally underperformed Fannie Mae (“FNMA”) and Freddie Mac (“FHLMC”) MBS due to expensive valuations and increasing prepayment risk. Furthermore, positioning in lower coupon MBS, in order to protect the Portfolio from faster prepayment speeds in higher coupons, has been a key contributor to performance. Lower coupon MBS have significantly outperformed higher coupons throughout 2012. The Portfolio’s overweight to agency debentures added to performance over the Reporting Period, particularly in the first quarter of 2012, as spreads tightened.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

The Portfolio’s duration and term structure positioning made a minimal positive contribution to performance. Specifically, long positions in the intermediate and long ends of the yield curve added to returns, as rates fell across the curve due to political uncertainty and weak economic data. The US 10-year yield ended the Reporting Period 68 basis points lower at 1.55%, after hitting all-time lows earlier in July. With respect to the portion of the yield curve one year and in, yields were largely range-bound, as the Fed’s policy statement indicated extraordinarily low rates through mid-2015.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

Over the Reporting Period, the largest changes in the Portfolio’s allocation were decreases in its U.S. Treasury and cash positions. Corresponding increases in allocation were concentrated in agency non-government guaranteed securities and agency mortgage-backed securities.

Q. How was the Portfolio positioned at the end of August 2012?

At the end of the Reporting Period, the Portfolio’s largest allocations were in agency non-government guaranteed securities, U.S. Treasuries, agency adjustable-rate mortgage securities and agency collateralized mortgage obligations.

Benchmark Definitions

9-Month U.S. Treasury Index

The 9-Month Treasury Index is an equal weight (50%) blend of the BofA Merrill Lynch Six-Month U.S. Treasury Bill Index and the BofA Merrill Lynch One-Year U.S. Treasury Note Index.

4

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO

Six-Month U.S. Treasury Bill Index and One-Year U.S. Treasury Note Index

The BofA Merrill Lynch Six-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not beyond, six months from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

The BofA Merrill Lynch One-year U.S. Treasury Note Index is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding two-year Treasury note that matures closest to, but not beyond, one year from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

5

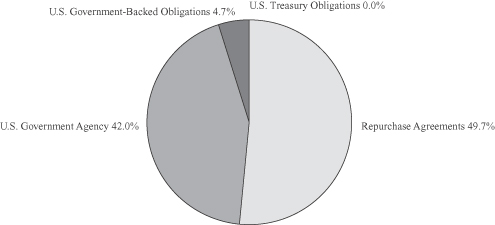

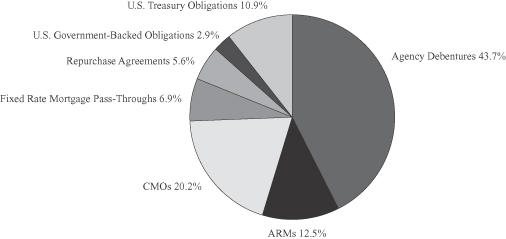

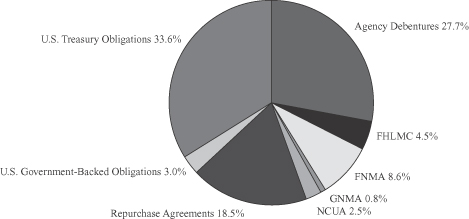

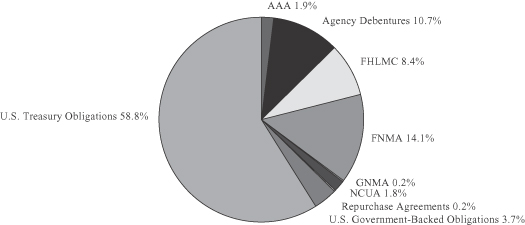

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO (Unaudited)

August 31, 2012*

August 31, 2011*

6

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO (Unaudited)

August 31, 2012*

August 31, 2011*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

7

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU SHORT DURATION PORTFOLIO

Investment Objective

The TCU Short Duration Portfolio (“SDP” or the “Portfolio”) seeks to achieve a high level of current income, consistent with relatively low volatility of principal, by investing in obligations authorized under the Federal Credit Union Act. During normal market conditions, SDP intends to invest a substantial portion of its assets in mortgage-related securities, which include privately-issued mortgage-related securities rated, at the time of purchase, in one of the two highest rating categories by a Nationally Recognized Statistical Rating Organization (“NRSRO”) and mortgage-related securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises. Mortgage-related securities held by SDP may include adjustable rate and fixed rate mortgage pass-through securities, collateralized mortgage obligations and other multi-class mortgage-related securities, as well as other securities that are collateralized by or represent direct or indirect interests in mortgage-related securities or mortgage loans. An investment in the Portfolio is neither insured nor guaranteed by the U.S. government. SDP invests in obligations authorized under the Federal Credit Union Act with a maximum portfolio duration not to exceed that of a Three-Year U.S. Treasury Security and a target duration equal to that of its benchmark, the BofA Merrill Lynch Two-Year U.S. Treasury Note Index.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs U.S. Fixed Income Portfolio Management Team discusses the Portfolio’s performance and positioning for the Reporting Period.

Q. How did the Portfolio perform during the Reporting Period?

The Portfolio’s cumulative total return for the 12-month period ended August 31, 2012, was 1.02%, versus a 0.22% cumulative total return for the BofA Merrill Lynch Two-Year U.S. Treasury Note Index. The Portfolio’s net asset value per share closed the Reporting Period at $9.82, versus $9.79 on August 31, 2011.

Q. What key factors were responsible for the Portfolio’s performance during the Reporting Period?

The Portfolio’s performance was driven primarily by individual security selection strategies, with the majority of outperformance coming from collateralized and government selection strategies. Additionally, the Portfolio’s cross-sector positioning, as well as duration and term structure positioning, further added to excess returns. With respect to security selection strategies, the Portfolio’s adjustable-rate mortgages, mortgage-backed security (“MBS”) pass-through securities, agency debentures and U.S. Treasuries were all positive contributors to performance.

Q. Which fixed income market sectors most significantly affected Portfolio performance?

The Portfolio’s sector positioning relative to the benchmark made a positive contribution to performance. In particular, a positive contribution throughout the second half of the Reporting Period offset a negative contribution during the first three months of the Reporting Period. Our overweight exposure in the

agency MBS sector contributed positively to returns, particularly late in the Reporting Period. Agency MBS were well supported, as the Federal Reserve Board (“Fed”) extended “Operation Twist” until year end, along with the current practice of reinvesting paydowns into agency MBS. Additionally, the Portfolio’s exposures to non-agency MBS and agency debentures were beneficial. Security selection strategies, specifically the Portfolio’s agency and non-agency adjustable-rate mortgages and MBS pass-through securities, also significantly added to performance. Agency MBS performed well late in 2011 and through the first six months of 2012, as the market priced in soft economic data and comments by Fed officials have raised expectations for another round of quantitative easing (“QE3”).

Within the agency mortgage-backed space, Ginnie Mae (“GNMA”) mortgages generally underperformed Fannie Mae (“FNMA”) and Freddie Mac (“FHLMC”) MBS due to expensive valuations and increasing prepayment risk. Furthermore, positioning in lower coupon MBS, in order to protect the Portfolio from faster prepayment speeds in higher coupons, has been a key contributor to performance. Lower coupon MBS have significantly outperformed higher coupons throughout 2012. Elsewhere, the Portfolio’s selection of government/agency securities added to performance, specifically in Treasuries. Additionally, selection of agency debentures added to performance, as our focus on short maturities had a positive impact.

Q. Did the Portfolio’s duration and yield curve positioning strategy help or hurt its results during the Reporting Period?

The Portfolio’s duration and term structure positioning positively contributed to performance over the Reporting Period. Specifically, our overweight positioning in the short/intermediate portion of the curve (particularly the 1-, 3-, 5- and 7-year segments) added to performance as yields fell over the Reporting Period, with the 10-year U.S. Treasury yield falling by 68 basis points. Rates fell across the curve, supported by concerns over global economic slowdown and fears of European contagion. This offset a negative contribution from an underweight position in the two-year portion of the curve, as front-end rates fell. Late in the Reporting Period, the Fed announced the extension of its program “Operation Twist” and left the door open to additional quantitative easing, likely focusing on agency MBS purchases. Furthermore, at their August meeting, the Federal Open Market Committee (“FOMC)” stated they “will provide accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in the context of price stability.” The meeting minutes and Chairman Bernanke’s Jackson Hole speech reinforced the accommodative posture of FOMC, strengthening our view that it will take action in September.

Q. Were there any notable changes in the Portfolio’s weightings during the Reporting Period?

Modest decreases in domestic sovereign securities were offset by increased allocations to agency collateralized mortgage obligations and agency non-government guaranteed securities.

8

INVESTMENT ADVISER’S DISCUSSION AND ANALYSIS

TCU SHORT DURATION PORTFOLIO

Q. How was the Portfolio positioned relative to its benchmark index at the end of August 2012?

At the end of the Reporting Period, the Portfolio’s largest allocations were in domestic sovereign securities, agency non-government guaranteed securities, agency adjustable-rate mortgage securities and agency collateralized mortgage obligations.

Benchmark Definition

Two-Year U.S. Treasury Note Index

The BofA Merrill Lynch Two-Year U.S. Treasury Note Index is a one-security index comprised of the most recently issued two-year U.S. Treasury note. The index is rebalanced monthly. In order to qualify for inclusion, a two-year note must be auctioned on or before the third business day before the last business day of the month.

9

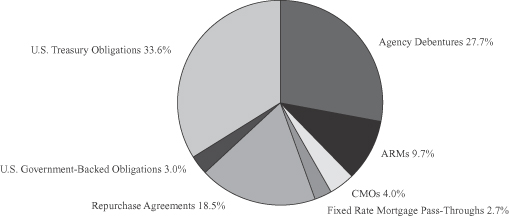

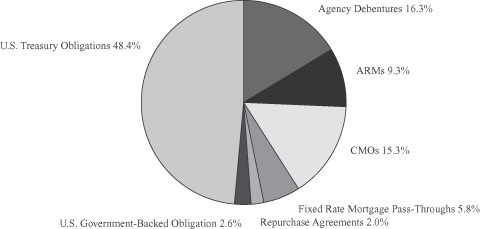

PORTFOLIO COMPOSITION—SECTOR ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2012*

August 31, 2011*

10

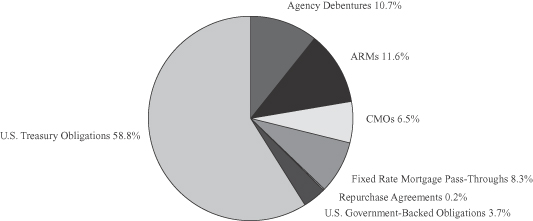

PORTFOLIO COMPOSITION—ISSUER ALLOCATION

TCU SHORT DURATION PORTFOLIO (Unaudited)

August 31, 2012*

August 31, 2011*

| * | These percentages reflect Portfolio holdings as a percentage of net assets. Figures in the above charts may not sum to 100% due to the exclusion of other assets and liabilities. Holdings and allocations may not be representative of current or future investments. Holdings and allocations may not include the Portfolio’s entire investment portfolio, which may change at any time. Portfolio holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. |

11

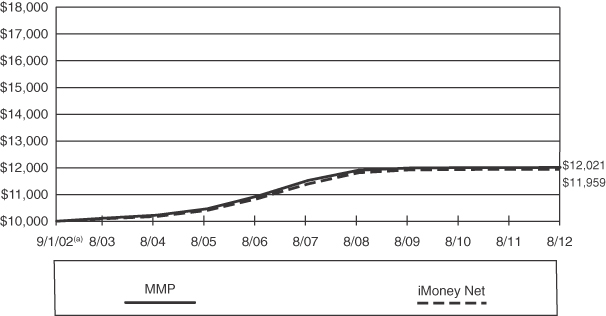

PERFORMANCE COMPARISON

TCU MONEY MARKET PORTFOLIO (Unaudited)

The following data for the Money Market Portfolio is supplied for the period ended August 31, 2012. The Portfolio is compared to its benchmark assuming the following initial investment:

Portfolio | Initial | Compare to: | ||

Money Market (“MMP”) | $10,000 | iMoney Net First Tier Institutional Only (“iMoney Net”) |

Money Market Portfolio’s 10 Year Performance

| Average Annual Total Return | ||||||

| One Year | Five Year | Ten Year | Since Inception(b) | |||

0.05% | 0.83% | 1.86% | 3.98% | |||

| (a) | For comparative purposes, the initial investment is assumed to have been made on September 1, 2002. |

| (b) | The Money Market Portfolio commenced operations on May 17, 1988. |

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. Investments in the TCU Money Market Portfolio are not insured or guaranteed by the National Credit Union Administration, the Federal Deposit Insurance Corporation, or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio. The chart and table above assume reinvestment of dividends and distributions. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

12

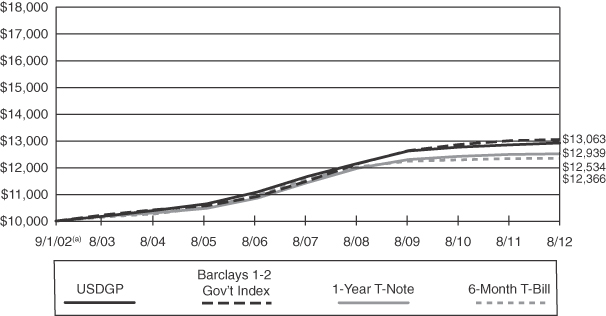

PERFORMANCE COMPARISON

TCU ULTRA-SHORT DURATION GOVERNMENT PORTFOLIO (Unaudited)

In accordance with the requirements of the Securities and Exchange Commission, the following data for the Ultra-Short Duration Government Portfolio is supplied for the period ended August 31, 2012. The Portfolio is compared to its benchmarks assuming the following initial investment:

Portfolio | Initial | Compare to: | ||

Ultra-Short Duration Government (“USDGP”) | $10,000 | Barclays Capital Mutual Fund Short (1-2 year) Government Index (“Barclays 1-2 Gov’t Index”); BofA Merrill Lynch One-Year U.S. Treasury Note Index (“1-year T-Note”); BofA Merrill Lynch 6-Month U.S. Treasury Bill Index (“6-month T-Bill”). |

Ultra-Short Duration Government Portfolio’s 10 Year Performance

| Average Annual Total Return | ||||||

| One Year | Five Year | Ten Year | Since Inception(b) | |||

0.58% | 2.06% | 2.61% | 3.37% | |||

| (a) | For comparative purposes, the initial investment is assumed to have been made on September 1, 2002. |

| (b) | The Ultra-Short Duration Government Portfolio commenced operations on July 10, 1991. |

The BofA Merrill Lynch Six-Month U.S. Treasury Bill Index and the BofA Merrill Lynch One-Year U.S. Treasury Note Index do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The TCU Ultra-Short Duration Government Portfolio is not a money market fund. Investors in this Portfolio should understand that the net asset value of the Portfolio will fluctuate, which may result in a loss of the principal amount invested. The Portfolio’s net asset value and yield are not guaranteed by the U.S. government, the National Credit Union Administration, or any other U.S. government agency, instrumentality or sponsored enterprise. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio’s investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. The investment return and principal value of an investment will fluctuate with changes in market conditions so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The chart and table above assume reinvestment of dividends and distributions. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

13

PERFORMANCE COMPARISON

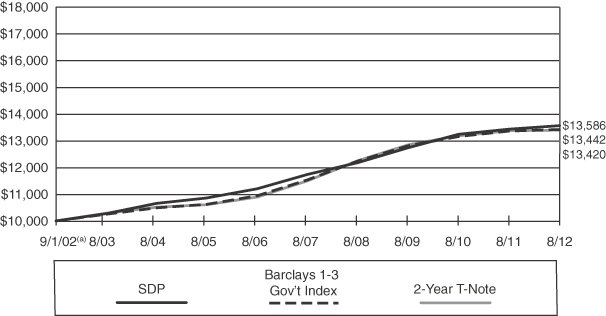

TCU SHORT DURATION PORTFOLIO (Unaudited)

In accordance with the requirements of the Securities and Exchange Commission, the following data for the Short Duration Portfolio is supplied for the period ended August 31, 2012. The Portfolio is compared to its benchmarks assuming the following initial investment:

Portfolio | Initial | Compare to: | ||

Short Duration (“SDP”) | $10,000 | Barclays Capital Mutual Fund Short (1-3 year) Government Index (“Barclays 1-3 Gov’t Index”); BofA Merrill Lynch 2-Year U.S. Treasury Note Index (“2-year T-Note”). |

Short Duration Portfolio’s 10 Year Performance

| Average Annual Total Return | ||||||

| One Year | Five Year | Ten Year | Since Inception(b) | |||

1.02% | 2.95% | 3.11% | 4.14% | |||

| (a) | For comparative purposes, the initial investment is assumed to have been made on September 1, 2002. |

| (b) | The Short Duration Portfolio commenced operations on October 9, 1992. |

The BofA Merrill Lynch Two-Year U.S. Treasury Note Index does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The TCU Short Duration Portfolio is not a money market fund. Investors in this Portfolio should understand that the net asset value of the Portfolio will fluctuate, which may result in a loss of the principal amount invested. The Portfolio’s net asset value and yield are not guaranteed by the U.S. government, the National Credit Union Administration, or any other U.S. government agency, instrumentality or sponsored enterprise. Investments in fixed income securities are subject to the risks associated with debt securities including credit and interest rate risk. The guarantee on U.S. government securities applies only to the underlying securities of the Portfolio if held to maturity and not to the value of the Portfolio’s shares. The Portfolio’s investments in mortgage-backed securities are subject to prepayment risks. These risks may result in greater share price volatility.

All performance data shown represents past performance and should not be considered indicative of future performance, which will fluctuate as market conditions change. The investment return and principal value of an investment will fluctuate with changes in market conditions so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The chart and table above assume reinvestment of dividends and distributions. In addition to the investment adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting a portfolio. Please call 1-800-342-5828 or 1-800-CFS-5678 for the most recent month-end returns.

14

TRUST FOR CREDIT UNIONS

Money Market Portfolio

Portfolio of Investments – August 31, 2012

Par Value | Value | |||||||

| U.S. GOVERNMENT AGENCY SECURITIES - 24.22% |

| ||||||

Federal Farm Credit Bank - 0.29% |

| |||||||

| $ | 500,000 | 0.612%, 12/14/12 (a) | $ | 500,000 | ||||

|

| |||||||

Federal Home Loan Bank - 12.03% |

| |||||||

| 1,000,000 | 0.220%, 10/24/12 | 999,951 | ||||||

| 6,000,000 | 0.190%, 10/26/12 | 5,999,878 | ||||||

| 2,000,000 | 0.230%, 10/26/12 | 1,999,928 | ||||||

| 4,890,000 | 4.500%, 11/15/12 | 4,932,994 | ||||||

| 800,000 | 0.210%, 12/10/12 | 799,904 | ||||||

| 2,000,000 | 0.200%, 04/30/13 | 1,999,362 | ||||||

| 300,000 | 0.210%, 05/17/13 | 299,909 | ||||||

| 350,000 | 0.200%, 05/22/13 | 349,867 | ||||||

| 200,000 | 0.230%, 05/23/13 | 199,966 | ||||||

| 15,000 | 0.230%, 05/24/13 | 14,997 | ||||||

| 700,000 | 0.230%, 05/29/13 | 699,880 | ||||||

| 100,000 | 0.230%, 06/07/13 | 99,982 | ||||||

| 50,000 | 0.280%, 06/10/13 | 50,000 | ||||||

| 200,000 | 0.350%, 06/10/13 | 200,148 | ||||||

| 300,000 | 0.230%, 06/12/13 | 299,946 | ||||||

| 300,000 | 0.230%, 06/18/13 | 299,944 | ||||||

| 500,000 | 0.420%, 06/21/13 | 500,665 | ||||||

| 100,000 | 1.875%, 06/21/13 | 101,297 | ||||||

| 300,000 | 0.125%, 06/28/13 | 299,659 | ||||||

| 500,000 | 0.240%, 06/28/13 | 499,930 | ||||||

| 300,000 | 0.290%, 07/01/13 | 300,000 | ||||||

|

| |||||||

| 20,948,207 | ||||||||

|

| |||||||

Federal Home Loan Mortgage Corporation - 2.87% |

| |||||||

| 5,000,000 | 0.197%, 03/21/13 (a) | 4,999,169 | ||||||

|

| |||||||

Federal National Mortgage Association - 9.03% |

| |||||||

| 3,545,000 | 6.260%, 11/26/12 | 3,595,327 | ||||||

| 6,000,000 | 0.428%, 12/20/12 (a) | 6,000,038 | ||||||

| 1,500,000 | 0.345%, 05/17/13 (a) | 1,499,673 | ||||||

| 3,000,000 | 1.500%, 06/26/13 | 3,030,241 | ||||||

| 1,600,000 | 0.500%, 08/09/13 | 1,603,526 | ||||||

|

| |||||||

| 15,728,805 | ||||||||

|

| |||||||

Total U.S. Government Agency Securities | 42,176,181 | |||||||

|

| |||||||

(Cost $42,176,181) | ||||||||

| U.S. TREASURY OBLIGATION - 0.94% |

| ||||||

United States Treasury Notes & Bonds - 0.94% |

| |||||||

| 1,600,000 | 3.375%, 06/30/13 | 1,641,374 | ||||||

|

| |||||||

Total U.S. Treasury Obligations | 1,641,374 | |||||||

|

| |||||||

(Cost $1,641,374) | ||||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS - 8.05% |

| ||||||

| Citigroup Funding | ||||||||

| 4,000,000 | 1.875%, 10/22/12 (b) | 4,009,285 | ||||||

| General Electric Capital Corp | ||||||||

| 5,000,000 | 0.468%, 09/21/12 (a) (b) | 5,000,893 | ||||||

| JPMorgan Chase Bank N.A. (a) | ||||||||

| 5,000,000 | 0.357%, 11/21/12 | 5,000,000 | ||||||

|

| |||||||

Total U.S. Government-Backed Obligations | 14,010,178 | |||||||

|

| |||||||

(Cost $14,010,178) | ||||||||

| Par Value | Value | |||||||

| REPURCHASE AGREEMENTS - 67.08% |

| ||||||

| $ | 40,000,000 | BNP Paribas, 0.200%, Dated 08/31/12, matures 09/04/12, repurchase price $40,000,889 (collateralized by U.S. Government Obligations with an interest rate of 4.500% due 04/01/31 to 09/15/39, total market value $40,800,001) | $ | 40,000,000 | ||||

| 36,800,000 | Deutsche Bank, 0.210%, Dated 08/31/12, matures 09/04/12, repurchase price $36,800,859 (collateralized by a U.S. Government Obligation with an interest rate of 3.500% due 05/15/42, total market value $37,536,001) | 36,800,000 | ||||||

| 40,000,000 | UBS, 0.200%, Dated 08/31/12, matures 09/04/12, repurchase price $40,000,889 (collateralized by U.S. Government Obligations with an interest rate of 4.500%, due 09/01/40 to 02/01/41, total market value $40,800,000) | 40,000,000 | ||||||

|

| |||||||

Total Repurchase Agreements | 116,800,000 | |||||||

|

| |||||||

(Cost $116,800,000) | ||||||||

Total Investments - 100.29% | 174,627,733 | |||||||

|

| |||||||

(Cost $174,627,733 ) (c) | ||||||||

Net Other Assets and | (505,535 | ) | ||||||

|

| |||||||

Net Assets - 100.00% | $ | 174,122,198 | ||||||

|

| |||||||

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at August 31, 2012. Maturity date shown is the date of the next coupon rate reset or actual maturity. |

| (b) | Guaranteed under the Federal Deposit Insurance Corporation's ("FDIC") Temporary Liquidity Guarantee Program and backed by the full faith and credit of the United States government. The expiration date of the FDIC's guarantee is the earlier of the maturity date of the debt or December 31, 2012. Total market value of these securities amounts to $9,010,178, which represents approximately 5.17% of net assets as of August 31, 2012. |

| (c) | At August 31, 2012, cost is identical for book and federal income tax purposes. |

See accompanying notes to financial statements.

15

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Government Portfolio

Portfolio of Investments – August 31, 2012

Par Value | Value | |||||||

| ASSET-BACKED SECURITIES - 0.23% | |||||||

Federal National Mortgage Association - 0.23% |

| |||||||

| $ | 162,278 | Series 2001-W4, Class AV1 0.516%, 02/25/32 (a) | $ | 151,904 | ||||

| 275,055 | Series 2002-W2, Class AV1 0.496%, 06/25/32 (a) | 274,378 | ||||||

| 1,133,791 | Series 2002-T7, Class A1 0.456%, 07/25/32 (a) | 1,027,583 | ||||||

|

| |||||||

Total Asset-Backed Securities | 1,453,865 | |||||||

|

| |||||||

(Cost $1,571,276) | ||||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS - 20.19% | |||||||

Federal Home Loan Mortgage Corporation REMIC - 5.41% |

| |||||||

| 21,808 | Series 1009, Class D 0.850%, 10/15/20 (a) | 21,997 | ||||||

| 64,043 | Series 1066, Class P 1.150%, 04/15/21 (a) | 64,821 | ||||||

| 93,444 | Series 1222, Class P 1.140%, 03/15/22 (a) (b) | 95,050 | ||||||

| 219,719 | Series 1250, Class J 7.000%, 05/15/22 (b) | 245,533 | ||||||

| 100,626 | Series 1448, Class F 1.650%, 12/15/22 (a) (d) | 103,065 | ||||||

| 1,831,287 | Series 3084, Class FN 0.740%, 12/15/34 (a) (d) | 1,838,258 | ||||||

| 7,921,030 | Series 3033, Class CI 5.500%, 01/15/35 (b) | 8,475,787 | ||||||

| 9,624,131 | Series 3208, Class FH 0.640%, 08/15/36 (a) | 9,641,211 | ||||||

| 856,275 | Series 3231, Class FB 0.590%, 10/15/36 (a) | 857,702 | ||||||

| 813,567 | Series 3314, Class FC 0.640%, 12/15/36 (a) | 815,543 | ||||||

| 1,774,420 | Series 3545, Class FA 1.090%, 06/15/39 (a) | 1,790,705 | ||||||

| 1,468,863 | Series 3830, Class FD 0.600%, 03/15/41 (a) | 1,474,549 | ||||||

| 1,476,986 | Series 3827, Class KF 0.610%, 03/15/41 (a) | 1,482,682 | ||||||

| 767,908 | Series 3868, Class FA 0.640%, 05/15/41 (a) | 769,656 | ||||||

| 6,379,290 | Series 4039, Class FA 0.740%, 05/15/42 (a) | 6,401,429 | ||||||

|

| |||||||

| 34,077,988 | ||||||||

|

| |||||||

Federal National Mortgage Association REMIC - 13.01% |

| |||||||

| 285,549 | Series 1993-225, Class WC 6.500%, 12/25/13 (b) | 293,310 | ||||||

| 2,500,000 | Series 2009-M2, Class A2 3.334%, 01/25/19 (d) | 2,679,408 | ||||||

| 413,076 | Series 1990-145, Class A 1.091%, 12/25/20 (a) | 416,824 | ||||||

| 576,534 | Series 1991-67, Class J 7.500%, 08/25/21 (b) | 657,638 | ||||||

| 476,451 | Series 1992-137, Class F 1.250%, 08/25/22 (a) | 483,896 | ||||||

| 511,850 | Series 1993-27, Class F 1.400%, 02/25/23 (a) (c) | 521,126 | ||||||

| 260,035 | Series 1998-21, Class F 0.540%, 03/25/28 (a) | 259,770 | ||||||

Par Value | Value | |||||||

Federal National Mortgage Association REMIC - (continued) |

| |||||||

| $ | 5,864,993 | Series 2011-137, Class A 4.000%, 06/25/29 (d) | $ | 6,131,903 | ||||

| 447,703 | Series 2000-16, Class ZG 8.500%, 06/25/30 (d) | 517,624 | ||||||

| 542,707 | Series 2000-32, Class Z 7.500%, 10/18/30 | 645,291 | ||||||

| 2,630,172 | Series 2005-102, Class DF 0.536%, 11/25/35 (a) | 2,631,685 | ||||||

| 1,142,165 | Series 2006-45, Class TF 0.636%, 06/25/36 (a) | 1,145,687 | ||||||

| 1,149,334 | Series 2006-76, Class QF 0.636%, 08/25/36 (a) (b) | 1,154,851 | ||||||

| 1,490,160 | Series 2006-79, Class PF 0.636%, 08/25/36 (a) (b) | 1,497,791 | ||||||

| 2,397,039 | Series 2006-111, Class FA 0.616%, 11/25/36 (a) | 2,403,507 | ||||||

| 1,028,878 | Series 2007-75, Class VF 0.686%, 08/25/37 (a) | 1,033,133 | ||||||

| 2,310,898 | Series 2007-85, Class FC 0.776%, 09/25/37 (a) | 2,324,363 | ||||||

| 1,748,719 | Series 2007-86, Class FC 0.806%, 09/25/37 (a) | 1,759,012 | ||||||

| 1,698,052 | Series 2007-92, Class OF 0.806%, 09/25/37 (a) | 1,707,346 | ||||||

| 1,968,158 | Series 2007-99, Class FD 0.836%, 10/25/37 (a) | 1,979,747 | ||||||

| 3,286,793 | Series 2010-89, Class CF 0.686%, 02/25/38 (a) | 3,300,204 | ||||||

| 3,762,202 | Series 2012-63, Class FE 0.636%, 06/25/38 (a) (d) | 3,768,229 | ||||||

| 6,202,381 | Series 2012-56, Class FG 0.736%, 03/25/39 (a) (d) | 6,214,737 | ||||||

| 1,425,000 | Series 2012-93, Class KF 0.650%, 05/25/39 (a) (d) | 1,425,361 | ||||||

| 667,160 | Series 2009-84, Class WF 1.336%, 10/25/39 (a) | 676,414 | ||||||

| 3,700,000 | Series 2012-103, Class GF 0.647%, 02/25/40 (a) | 3,700,941 | ||||||

| 3,703,162 | Series 2010-123, Class FL 0.666%, 11/25/40 (a) | 3,705,523 | ||||||

| 6,009,624 | Series 2011-110, Class FE 0.636%, 04/25/41 (a) (b) | 6,042,102 | ||||||

| 1,875,955 | Series 2011-59, Class FW 0.596%, 07/25/41 (a) | 1,880,312 | ||||||

| 2,469,898 | Series 2011-63, Class FG 0.686%, 07/25/41 (a) | 2,481,890 | ||||||

| 800,459 | Series 2011-86, Class DF 0.736%, 09/25/41 (a) | 804,781 | ||||||

| 3,910,757 | Series 2012-65, Class FB 0.756%, 06/25/42 (a) | 3,920,022 | ||||||

| 5,133,873 | Series 2012-71, Class FL 0.736%, 07/25/42 (a) | 5,146,148 | ||||||

| 8,697,550 | Series 2012-82, Class FA 0.666%, 08/25/42 (a) | 8,711,414 | ||||||

|

| |||||||

| 82,021,990 | ||||||||

|

| |||||||

National Credit Union Administration - 1.77% |

| |||||||

| 1,143,963 | Series 2010-R2, Class 1A 0.614%, 11/06/17 (a) | 1,146,287 | ||||||

| 822,145 | Series 2011-R1, Class 1A 0.694%, 01/08/20 (a) | 823,719 | ||||||

See accompanying notes to financial statements.

16

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Government Portfolio

Portfolio of Investments (continued) – August 31, 2012

Par Value | Value | |||||||

National Credit Union Administration - (continued) |

| |||||||

| $ | 2,700,650 | Series 2011-R2, Class 1A 0.644%, 02/06/20 (a) | $ | 2,704,131 | ||||

| 1,316,865 | Series 2011-R4, Class 1A 0.624%, 03/06/20 (a) | 1,317,277 | ||||||

| 1,316,348 | Series 2011-R3, Class 1A 0.649%, 03/11/20 (a) | 1,317,890 | ||||||

| 1,252,609 | Series 2011-R5, Class 1A 0.624%, 04/06/20 (a) | 1,254,175 | ||||||

| 1,168,150 | Series 2011-R6, Class 1A 0.624%, 05/07/20 (a) | 1,169,565 | ||||||

| 628,165 | Series 2010-R1, Class 1A 0.694%, 10/07/20 (a) | 629,269 | ||||||

| 192,195 | Series 2010-R1, Class 2A 1.840%, 10/07/20 (d) | 195,198 | ||||||

| 575,823 | Series 2010-A1, Class A 0.591%, 12/07/20 (a) (c) | 576,129 | ||||||

|

| |||||||

| 11,133,640 | ||||||||

|

| |||||||

Total Collateralized Mortgage Obligations | 127,233,618 | |||||||

|

| |||||||

(Cost $126,979,139) | ||||||||

| MORTGAGE-BACKED OBLIGATIONS - 19.21% |

| ||||||

Federal Home Loan Mortgage Corporation - 3.96% |

| |||||||

| 130,947 | 1.422%, 02/01/18 (a) | 131,951 | ||||||

| 247,095 | 2.917%, 11/01/18 (a) | 255,838 | ||||||

| 1,190,829 | 6.876%, 11/01/19 (a) | 1,279,824 | ||||||

| 71,366 | 1.910%, 11/01/22 (a) | 73,230 | ||||||

| 169,142 | 2.140%, 11/01/22 (a) | 174,408 | ||||||

| 109,664 | 2.652%, 10/01/24 (a) | 115,174 | ||||||

| 169,963 | 3.376%, 10/01/25 (a) | 176,952 | ||||||

| 597,784 | 3.802%, 08/01/28 (a) | 639,789 | ||||||

| 77,321 | 1.798%, 07/01/29 (a) | 79,828 | ||||||

| 378,965 | 2.692%, 05/01/31 (a) | 404,160 | ||||||

| 11,029,977 | 2.375%, 03/01/35 (a) | 11,778,378 | ||||||

| 3,846,413 | 2.370%, 04/01/35 (a) | 4,115,566 | ||||||

| 5,338,014 | 2.733%, 06/01/37 (a) | 5,715,116 | ||||||

|

| |||||||

| 24,940,214 | ||||||||

|

| |||||||

Federal Home Loan Mortgage Corporation Gold - 0.24% |

| |||||||

| 30,791 | 6.500%, 09/01/13 | 31,144 | ||||||

| 43,555 | 6.500%, 10/01/13 | 44,440 | ||||||

| 16,053 | 6.500%, 05/01/14 | 16,377 | ||||||

| 33,110 | 6.500%, 06/01/14 | 34,520 | ||||||

| 106,120 | 6.000%, 12/01/14 | 108,638 | ||||||

| 129,958 | 8.000%, 12/01/15 | 139,020 | ||||||

| 134,941 | 6.000%, 03/01/16 | 143,653 | ||||||

| 24,289 | 6.500%, 07/01/16 | 24,779 | ||||||

| 306,697 | 5.000%, 10/01/17 | 331,346 | ||||||

| 364,567 | 5.000%, 11/01/17 | 392,274 | ||||||

| 233,000 | 5.500%, 01/01/20 | 255,377 | ||||||

| 7,841 | 4.500%, 07/01/23 | 8,433 | ||||||

|

| |||||||

| 1,530,001 | ||||||||

|

| |||||||

Federal National Mortgage Association - 14.33% |

| |||||||

| 4,858 | 5.066%, 10/01/13 (a) | 4,914 | ||||||

| 110,792 | 8.500%, 04/01/16 | 119,598 | ||||||

| 80,522 | 4.004%, 07/01/17 (a) | 85,931 | ||||||

| 46,768 | 1.640%, 11/01/17 (a) | 47,168 | ||||||

| 117,224 | 2.147%, 11/01/17 (a) | 119,050 | ||||||

| 58,945 | 2.397%, 11/01/17 (a) | 60,138 | ||||||

| 167,600 | 2.130%, 03/01/18 (a) | 170,220 | ||||||

| 2,140,352 | 2.800%, 03/01/18 | 2,298,414 | ||||||

Par Value | Value | |||||||

Federal National Mortgage Association - (continued) |

| |||||||

| $ | 4,513,193 | 3.620%, 03/01/18 | $ | 5,038,652 | ||||

| 29,698 | 1.880%, 05/01/18 (a) | 30,222 | ||||||

| 950,000 | 3.840%, 05/01/18 | 1,076,409 | ||||||

| 64,280 | 2.068%, 06/01/18 (a) | 65,801 | ||||||

| 910,431 | 2.744%, 10/01/18 (a) | 935,510 | ||||||

| 38,173 | 2.650%, 02/01/19 (a) | 39,230 | ||||||

| 48,191 | 1.875%, 05/01/19 (a) | 49,099 | ||||||

| 122,699 | 6.864%, 12/01/19 (a) | 132,455 | ||||||

| 133,107 | 1.837%, 01/01/20 (a) | 134,672 | ||||||

| 16,239 | 5.000%, 01/01/20 | 17,692 | ||||||

| 82,345 | 1.960%, 05/01/20 (a) | 83,327 | ||||||

| 262,472 | 5.786%, 05/01/20 (a) | 282,006 | ||||||

| 1,076,161 | 3.416%, 10/01/20 | 1,191,094 | ||||||

| 881,095 | 3.632%, 12/01/20 | 985,994 | ||||||

| 1,800,000 | 4.375%, 06/01/21 | 2,087,974 | ||||||

| 438,892 | 6.592%, 02/01/22 (a) | 471,692 | ||||||

| 55,382 | 3.020%, 01/01/23 (a) | 57,496 | ||||||

| 150,949 | 3.040%, 03/01/24 (a) | 154,392 | ||||||

| 32,615 | 2.860%, 04/01/25 (a) | 34,935 | ||||||

| 142,021 | 5.887%, 10/01/25 (a) | 152,590 | ||||||

| 425,651 | 3.164%, 02/01/27 (a) | 440,538 | ||||||

| 149,249 | 2.028%, 07/01/27 (a) | 153,080 | ||||||

| 219,464 | 2.477%, 07/01/27 (a) | 226,028 | ||||||

| 259,073 | 4.658%, 01/01/29 (a) | 282,105 | ||||||

| 63,429 | 4.650%, 02/01/29 (a) | 69,068 | ||||||

| 3,962,973 | 2.873%, 08/01/29 (a) | 4,068,980 | ||||||

| 94,948 | 2.263%, 07/01/31 (a) | 100,832 | ||||||

| 94,398 | 2.380%, 07/01/32 (a) | 100,577 | ||||||

| 65,078 | 2.880%, 07/01/32 (a) | 69,800 | ||||||

| 290,218 | 2.751%, 09/01/32 (a) | 311,907 | ||||||

| 523,190 | 2.348%, 01/01/33 (a) | 555,903 | ||||||

| 117,723 | 2.333%, 06/01/33 (a) | 125,310 | ||||||

| 1,634,701 | 4.611%, 08/01/33 (a) | 1,780,028 | ||||||

| 924,082 | 2.198%, 04/01/34 (a) | 978,841 | ||||||

| 546,766 | 2.368%, 07/01/34 (a) | 573,165 | ||||||

| 553,932 | 2.368%, 08/01/34 (a) | 580,746 | ||||||

| 5,878,156 | 2.331%, 10/01/34 (a) | 6,252,728 | ||||||

| 6,145,877 | 2.381%, 11/01/34 (a) | 6,539,805 | ||||||

| 2,348,026 | 2.320%, 06/01/35 (a) | 2,500,471 | ||||||

| 2,629,478 | 2.650%, 12/01/36 (a) | 2,803,479 | ||||||

| 1,480,262 | 2.863%, 07/01/37 (a) | 1,586,003 | ||||||

| 6,181,287 | 2.778%, 09/01/37 (a) | 6,591,483 | ||||||

| 549,194 | 6.500%, 11/01/37 | 618,398 | ||||||

| 3,507,966 | 2.596%, 01/01/38 (a) | 3,751,436 | ||||||

| 3,685,583 | 2.315%, 05/01/39 (a) | 3,937,298 | ||||||

| 398,715 | 4.500%, 02/01/40 | 431,462 | ||||||

| 393,030 | 4.500%, 05/01/40 | 426,538 | ||||||

| 1,783,596 | 4.500%, 08/01/40 | 1,929,791 | ||||||

| 6,464,910 | 4.500%, 07/01/41 | 7,028,211 | ||||||

| 17,000,000 | 5.000%, 09/01/42 TBA (g) | 18,564,530 | ||||||

| 933,664 | 2.368%, 08/01/44 (a) | 979,256 | ||||||

|

| |||||||

| 90,284,472 | ||||||||

|

| |||||||

Government National Mortgage Association - 0.68% |

| |||||||

| 68,328 | 7.000%, 04/15/26 | 81,466 | ||||||

| 457,069 | 2.250%, 04/20/34 (a) | 486,165 | ||||||

| 1,953,149 | 1.750%, 06/20/34 (a) | 2,030,723 | ||||||

| 1,616,688 | 1.625%, 08/20/34 (a) | 1,680,225 | ||||||

|

| |||||||

| 4,278,579 | ||||||||

|

| |||||||

Total Mortgage-Backed Obligations | 121,033,266 | |||||||

|

| |||||||

(Cost $118,271,681) |

| |||||||

See accompanying notes to financial statements.

17

TRUST FOR CREDIT UNIONS

Ultra-Short Duration Government Portfolio

Portfolio of Investments (continued) – August 31, 2012

Par Value | Value | |||||||

| AGENCY DEBENTURES - 43.69% |

| ||||||

| Federal Farm Credit Bank | ||||||||

| $ | 45,000,000 | 0.206%, 10/28/13 (a) | $ | 44,995,455 | ||||

| Federal Farm Credit Bank | ||||||||

| 25,000,000 | 0.216%, 10/28/13 (a) | 25,000,375 | ||||||

| Federal Home Loan Bank | ||||||||

| 9,000,000 | 0.240%, 09/28/12 | 9,000,603 | ||||||

| Federal Home Loan Bank | ||||||||

| 3,700,000 | 0.210%, 01/04/13 | 3,700,862 | ||||||

| Federal Home Loan Bank | ||||||||

| 8,300,000 | 0.500%, 02/13/15 | 8,300,448 | ||||||

| Federal Home Loan Mortgage Corp | ||||||||

| 26,000,000 | 0.195%, 06/03/13 (a) | 25,998,960 | ||||||

| Federal Home Loan Mortgage Corp | ||||||||

| 16,500,000 | 0.188%, 06/17/13 (a) | 16,511,715 | ||||||

| Federal Home Loan Mortgage Corp | ||||||||

| 18,200,000 | 0.500%, 10/18/13 | 18,205,205 | ||||||

| Federal Home Loan Mortgage Corp | ||||||||

| 1,700,000 | 0.375%, 11/27/13 | 1,703,043 | ||||||

| Federal Home Loan Mortgage Corp | ||||||||

| 9,000,000 | 0.500%, 01/24/14 | 9,010,062 | ||||||

| Federal Home Loan Mortgage Corp | ||||||||

| 30,400,000 | 3.000%, 07/31/19 | 31,122,122 | ||||||

| Federal National Mortgage Association | ||||||||

| 33,900,000 | 0.345%, 05/17/13 (a) | 33,918,713 | ||||||

| Federal National Mortgage Association | ||||||||

| 5,400,000 | 0.600%, 10/25/13 | 5,401,939 | ||||||

| Federal National Mortgage Association | ||||||||

| 35,000,000 | 0.600%, 11/14/13 | 35,019,005 | ||||||

| Federal National Mortgage Association | ||||||||

| 1,200,000 | 0.375%, 03/16/15 | 1,200,686 | ||||||

| Small Business Administration | ||||||||

| 71,512 | 1.075%, 03/25/14 (a) | 71,466 | ||||||

| Sri Lanka Government Aid Bond | ||||||||

| 6,250,000 | 0.723%, 11/01/24 (a) (e) | 6,218,750 | ||||||

|

| |||||||

Total Agency Debentures | 275,379,409 | |||||||

|

| |||||||

(Cost $275,289,381) | ||||||||

| U.S. TREASURY OBLIGATIONS - 10.92% |

| ||||||

United States Treasury Notes & Bonds - 10.92% |

| |||||||

| 7,100,000 | 0.125%, 09/30/13 | 7,094,732 | ||||||

| 6,000,000 | 0.500%, 10/15/13 | 6,019,686 | ||||||

| 11,400,000 | 2.750%, 10/31/13 | 11,733,986 | ||||||

| 6,200,000 | 0.500%, 11/15/13 | 6,222,283 | ||||||

| 3,000,000 | 0.750%, 12/15/13 | 3,020,742 | ||||||

| 3,000,000 | 0.125%, 12/31/13 | 2,996,718 | ||||||

| 12,200,000 | 1.500%, 12/31/13 | 12,407,778 | ||||||

| 19,300,000 | 0.250%, 01/31/14 | 19,311,310 | ||||||

| 68,807,235 | ||||||||

|

| |||||||

Total U.S. Treasury Obligations | 68,807,235 | |||||||

|

| |||||||

(Cost $68,773,149) | ||||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS - 2.92% |

| ||||||

| FDIC Structured Sale Guaranteed Notes | ||||||||

| 2,240,222 | Series 2010-S1, Class 1A 0.796%, 02/25/48 (a) | 2,242,089 | ||||||

| Federal Home Loan Mortgage Corp, | ||||||||

| Multifamily Structured Pass Through Certificates | ||||||||

| 1,866,487 | Series K501, Class A1 1.337%, 06/25/16 (d) | 1,900,308 | ||||||

Par Value | Value | |||||||

| Federal Home Loan Mortgage Corp, | ||||||||

Multifamily Structured Pass Through Certificates | ||||||||

| $ | 5,300,000 | Series K501, Class A2 1.655%, 11/25/16 (d) | $ | 5,447,617 | ||||

| Federal Home Loan Mortgage Corp, Multifamily Structured Pass Through Certificates | ||||||||

| 1,700,000 | Series K703, Class A2 2.699%, 05/25/18 (d) | 1,820,908 | ||||||

| National Credit Union Administration | ||||||||

Guaranteed Notes | ||||||||

| 7,000,000 | Series 2011-A1 0.259%, 06/12/13 (a) | 7,000,000 | ||||||

|

| |||||||

Total U.S. Government-Backed Obligations | 18,410,922 | |||||||

|

| |||||||

(Cost $18,155,396) | ||||||||

| REPURCHASE AGREEMENT - 5.55% |

| ||||||

| 35,000,000 | Merrill Lynch, 0.180%, Dated 08/31/12, matures 09/04/12, repurchase price $35,000,700 (collateralized by a U.S. Treasury Note with an interest rate of 0.750% due 06/30/17, total market value $35,700,050) | 35,000,000 | ||||||

|

| |||||||

Total Repurchase Agreement | 35,000,000 | |||||||

|

| |||||||

(Cost $35,000,000) | ||||||||

Total Investments - 102.71% | 647,318,315 | |||||||

|

| |||||||

(Cost $644,040,022) (f) | ||||||||

| TBA SALE COMMITMENTS - (2.60)% |

| ||||||

| (15,000,000 | ) | Federal National Mortgage Association 5.000%, 10/01/42 (g) | (16,368,164 | ) | ||||

|

| |||||||

Total TBA Sale Commitments - (2.60)% | (16,368,164 | ) | ||||||

|

| |||||||

(Proceeds $16,323,125) | ||||||||

Net Other Assets and Liabilities - (0.11)% | (703,773 | ) | ||||||

|

| |||||||

Net Assets - 100.00% | $ | 630,246,378 | ||||||

|

| |||||||

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at August 31, 2012. Maturity date shown is the date of the next coupon rate reset or actual maturity. |

| (b) | The security has PAC (Planned Amortization Class) collateral. |

| (c) | The security has Support collateral. |

| (d) | This security has Sequential collateral. |

| (e) | Security has been valued at fair market value as determined in good faith by or under the direction of the Board of Trustees of the Trust. As of August 31, 2012, this security amounted to $6,218,750 or 1.0% of net assets. |

| (f) | Cost for U.S. federal income tax purposes is $644,164,633. As of August 31, 2012, the aggregate gross unrealized appreciation for all securites in which there was an excess of value over tax cost was $4,111,316 and the aggregate gross unrealized depreciation for all securities in which was an excess of tax cost over value was $957,634. Net unrealized appreciation was $3,153,682. |

| (g) | Represents or includes a TBA transaction. Unsettled TBA transactions as of August 31, 2012 were as follows: |

Counterparty | Value | Unrealized | ||||

| Credit Suisse Securities (USA) LLC | $2,196,366 | $ | 10,429 | |||

See accompanying notes to financial statements.

18

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments – August 31, 2012

Par Value | Value | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS - 15.33% |

| ||||||

Federal Home Loan Mortgage Corporation REMIC - 7.11% |

| |||||||

| $ | 234,793 | Series 1448, Class F 1.650%, 12/15/22 (a) (c) | $ | 240,486 | ||||

| 485,548 | Series 1980, Class Z 7.000%, 07/15/27 (c) | 555,802 | ||||||

| 2,935,453 | Series 2236, Class Z 8.500%, 06/15/30 (c) | 3,599,302 | ||||||

| 14,494,173 | Series 3208, Class FA 0.640%, 08/15/36 | 14,529,277 | ||||||

| 3,722,339 | Series 3367, Class YF 0.790%, 09/15/37 | 3,743,607 | ||||||

| 6,362,627 | Series 3371 class FA 0.840%, 09/15/37 (a) | 6,400,222 | ||||||

| 3,672,162 | Series 4097, Class AF 0.650%, 07/15/39 | 3,672,162 | ||||||

| 1,205,221 | Series 3830, Class FD 0.600%, 03/15/41 (a) | 1,209,886 | ||||||

| 1,211,886 | Series 3827, Class KF 0.610%, 03/15/41 (a) | 1,216,559 | ||||||

| 3,597,344 | Series 4039, Class FA 0.740%, 05/15/42 | 3,609,828 | ||||||

|

| |||||||

| 38,777,131 | ||||||||

|

| |||||||

Federal National Mortgage Association REMIC - 5.41% |

| |||||||

| 126,909 | Series 2001-42, Class HG 10.000%, 09/25/16 | 138,730 | ||||||

| 88,562 | Series 1988-12, Class A 3.750%, 02/25/18 (a) | 93,585 | ||||||

| 487,784 | Series G92-44, Class Z 8.000%, 07/25/22 | 538,484 | ||||||

| 1,051,994 | Series 2006-45, Class TF 0.636%, 06/25/36 (a) | 1,055,238 | ||||||

| 1,060,923 | Series 2006-76, Class QF 0.636%, 08/25/36 (a) (b) | 1,066,016 | ||||||

| 841,809 | Series 2007-75, Class VF 0.686%, 08/25/37 (a) | 845,291 | ||||||

| 6,546,983 | Series 2007-91, Class FB 0.836%, 10/25/37 (a) | 6,617,267 | ||||||

| 2,128,615 | Series 2012-63, Class FE 0.636%, 06/25/38 (a) (c) | 2,132,024 | ||||||

| 1,225,000 | Series 2012-93, Class KF 0.650%, 05/25/39 | 1,225,310 | ||||||

| 3,175,000 | Series 2012-103, Class GF 0.647%, 02/25/40 | 3,175,808 | ||||||

| 2,097,850 | Series 2010-123, Class FL 0.666%, 11/25/40 | 2,099,188 | ||||||

| 3,397,749 | Series 2011-110, Class FE 0.636%, 04/25/41 | 3,416,111 | ||||||

| 1,730,250 | Series 2011-59, Class FW 0.596%, 07/25/41 (a) | 1,734,268 | ||||||

| 731,848 | Series 2011-86, Class DF 0.736%, 09/25/41 (a) | 735,800 | ||||||

| 2,204,245 | Series 2012-65, Class FB 0.756%, 06/25/42 | 2,209,467 | ||||||

| 2,421,638 | Series 2012-71, Class FL 0.736%, 07/25/42 | 2,427,428 | ||||||

|

| |||||||

| 29,510,015 | ||||||||

|

| |||||||

National Credit Union Administration - 1.20% |

| |||||||

| 1,309,406 | Series 2011-R2, Class 1A 0.644%, 02/06/20 (a) | 1,311,094 | ||||||

Par Value | Value | |||||||

National Credit Union Administration - (continued) |

| |||||||

| $ | 1,316,865 | Series 2011-R4, Class 1A 0.624%, 03/06/20 (a) | $ | 1,317,277 | ||||

| 1,471,212 | Series 2011-R3, Class 1A 0.649%, 03/11/20 (a) | 1,472,936 | ||||||

| 1,252,609 | Series 2011-R5, Class 1A 0.624%, 04/06/20 (a) | 1,254,175 | ||||||

| 1,168,151 | Series 2011-R6, Class 1A 0.624%, 05/07/20 (a) | 1,169,565 | ||||||

|

| |||||||

| 6,525,047 | ||||||||

|

| |||||||

Private - 1.61% | ||||||||

| Adjustable Rate Mortgage Trust | ||||||||

| 728,530 | Series 2004-4, Class 1A1 2.725%, 03/25/35 (a) | 670,653 | ||||||

| Banc of America Mortgage Securities | ||||||||

| 61,694 | Series 2004-D, Class 1A1 2.998%, 05/25/34 (a) | 56,268 | ||||||

| Countrywide Home Loans | ||||||||

| 27,877 | Series 2003-37, Class 1A1 3.253%, 08/25/33 (a) | 23,644 | ||||||

| Indymac Index Mortgage Loan Trust | ||||||||

| 510,048 | Series 2004-AR4, Class 1A 2.656%, 08/25/34 (a) | 368,827 | ||||||

| Merrill Lynch Mortgage Investors, Inc. | ||||||||

| 62,882 | Series 2003-A4, Class 1A 2.730%, 07/25/33 (a) | 60,343 | ||||||

| Salomon Brothers Mortgage Securities VII, Inc. | ||||||||

| 58,676 | Series 1994-20, Class A 2.982%, 12/25/24 (a) | 56,983 | ||||||

| Structured Adjustable Rate Mortgage Loan | ||||||||

| 122,476 | Series 2004-2, Class 2A 2.919%, 03/25/34 (a) | 106,470 | ||||||

| 266,398 | Series 2004-5, Class 1A 2.925%, 05/25/34 (a) (c) | 229,560 | ||||||

| Structured Asset Securities Corp. | ||||||||

| 944,733 | Series 2003-34A, Class 3A3 2.804%, 11/25/33 (a) | 916,077 | ||||||

| Washington Mutual Mortgage Pass-Through Certificates | ||||||||

| 431,713 | Series 2003-AR6, Class A1 2.444%, 06/25/33 (a) | 423,801 | ||||||

| 3,005,827 | Series 2005-AR12, Class 1A8 2.466%, 10/25/35 (a) | 2,652,112 | ||||||

| Wells Fargo Mortgage Backed Securities Trust | ||||||||

| 3,405,909 | Series 2005-AR4, Class 2A2 2.686%, 04/25/35 (a) | 3,197,323 | ||||||

|

| |||||||

| 8,762,061 | ||||||||

|

| |||||||

Total Collateralized Mortgage Obligations | 83,574,254 | |||||||

|

| |||||||

(Cost $83,960,138) | ||||||||

| MORTGAGE-BACKED OBLIGATIONS - 15.02% |

| ||||||

Federal Home Loan Mortgage Corporation - 1.73% |

| |||||||

| 709,406 | 2.645%, 01/01/34 (a) | 749,927 | ||||||

| 183,851 | 2.724%, 11/01/34 (a) | 195,019 | ||||||

| 4,771,500 | 2.370%, 04/01/35 (a) | 5,105,386 | ||||||

| 1,780,328 | 2.375%, 08/01/35 (a) | 1,900,314 | ||||||

| 1,362,603 | 2.877%, 05/01/36 (a) | 1,464,009 | ||||||

|

| |||||||

| 9,414,655 | ||||||||

|

| |||||||

See accompanying notes to financial statements.

19

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2012

Par Value | Value | |||||||

Federal Home Loan Mortgage Corporation Gold - 2.43% |

| |||||||

| $ | 1,349 | 7.000%, 12/01/12 | $ | 1,350 | ||||

| 4,482 | 8.000%, 07/01/14 | 4,496 | ||||||

| 2,045 | 7.000%, 03/01/15 | 2,141 | ||||||

| 596 | 8.000%, 09/01/17 | 596 | ||||||

| 323,736 | 5.000%, 10/01/17 | 349,755 | ||||||

| 384,820 | 5.000%, 11/01/17 | 414,067 | ||||||

| 315,861 | 8.000%, 11/01/17 | 349,841 | ||||||

| 298,030 | 5.500%, 03/01/18 | 321,615 | ||||||

| 160,980 | 5.500%, 04/01/18 | 173,632 | ||||||

| 163,987 | 6.500%, 05/01/18 | 183,682 | ||||||

| 20,139 | 6.000%, 10/01/18 | 22,110 | ||||||

| 6,747 | 6.000%, 11/01/18 | 7,407 | ||||||

| 1,345,815 | 5.500%, 02/01/19 | 1,460,597 | ||||||

| 246,706 | 5.500%, 01/01/20 | 270,399 | ||||||

| 4,179,138 | 5.000%, 04/01/20 | 4,534,068 | ||||||

| 4,874,348 | 3.500%, 08/01/20 | 5,170,316 | ||||||

|

| |||||||

| 13,266,072 | ||||||||

|

| |||||||

Federal National Mortgage Association - 10.70% |

| |||||||

| 76,232 | 5.500%, 01/01/13 | 76,872 | ||||||

| 224 | 8.000%, 01/01/13 | 225 | ||||||

| 3,461 | 6.000%, 02/01/18 | 3,814 | ||||||

| 1,264,754 | 2.800%, 03/01/18 | 1,358,154 | ||||||

| 950,000 | 3.840%, 05/01/18 | 1,076,409 | ||||||

| 1,122,478 | 5.500%, 05/01/18 | 1,218,283 | ||||||

| 54,633 | 6.000%, 05/01/18 | 60,198 | ||||||

| 355,417 | 5.500%, 06/01/18 | 385,753 | ||||||

| 2,972 | 6.000%, 08/01/18 | 3,275 | ||||||

| 3,551 | 6.000%, 09/01/18 | 3,913 | ||||||

| 328,147 | 5.500%, 10/01/18 | 356,210 | ||||||

| 389,354 | 5.500%, 11/01/18 | 422,586 | ||||||

| 325,174 | 6.000%, 11/01/18 | 358,296 | ||||||

| 28,997 | 5.500%, 12/01/18 | 31,510 | ||||||

| 554,536 | 6.000%, 12/01/18 | 611,019 | ||||||

| 468,707 | 6.000%, 01/01/19 | 516,449 | ||||||

| 3,250,000 | 3.334%, 01/25/19 (c) | 3,483,231 | ||||||

| 7,374 | 6.000%, 02/01/19 | 8,125 | ||||||

| 155,936 | 6.000%, 04/01/19 | 171,819 | ||||||

| 38,332 | 6.000%, 05/01/19 | 42,237 | ||||||

| 782,662 | 3.416%, 10/01/20 | 866,250 | ||||||

| 587,397 | 3.632%, 12/01/20 | 657,329 | ||||||

| 1,571,189 | 4.301%, 01/01/21 | 1,823,180 | ||||||

| 1,500,000 | 4.375%, 06/01/21 | 1,739,978 | ||||||

| 99,475 | 6.000%, 10/01/23 | 110,800 | ||||||

| 317,778 | 7.000%, 08/01/28 | 371,924 | ||||||

| 700,033 | 7.000%, 11/01/28 | 834,109 | ||||||

| 52,738 | 7.000%, 02/01/32 | 60,026 | ||||||

| 53,233 | 4.185%, 05/01/32 (a) | 56,554 | ||||||

| 178,868 | 7.000%, 05/01/32 | 213,932 | ||||||

| 298,036 | 2.751%, 09/01/32 (a) | 320,310 | ||||||

| 152,231 | 7.000%, 09/01/32 | 171,426 | ||||||

| 1,256,607 | 2.340%, 07/01/33 (a) | 1,338,055 | ||||||

| 582,110 | 2.349%, 11/01/33 (a) | 612,917 | ||||||

| 1,838,145 | 2.340%, 12/01/33 (a) | 1,965,029 | ||||||

| 471,641 | 2.623%, 03/01/34 (a) | 498,552 | ||||||

| 812,090 | 2.617%, 04/01/34 (a) | 865,148 | ||||||

| 270,083 | 2.310%, 08/01/34 (a) | 285,138 | ||||||

| 1,621,446 | 2.337%, 10/01/34 (a) | 1,730,086 | ||||||

| 536,944 | 2.462%, 10/01/34 (a) | 576,904 | ||||||

| 4,901,732 | 2.291%, 01/01/35 (a) | 5,224,831 | ||||||

Par Value | Value | |||||||

Federal National Mortgage Association - (continued) |

| |||||||

| $ | 459,684 | 2.763%, 03/01/35 (a) | $ | 492,078 | ||||

| 1,827,432 | 2.845%, 04/01/35 (a) | 1,961,991 | ||||||

| 1,202,619 | 2.437%, 05/01/35 (a) | 1,287,830 | ||||||

| 1,168,429 | 2.525%, 05/01/35 (a) | 1,239,711 | ||||||

| 736,754 | 2.569%, 05/01/35 (a) | 784,139 | ||||||

| 749,996 | 2.164%, 06/01/35 (a) | 787,851 | ||||||

| 2,582,829 | 2.320%, 06/01/35 (a) | 2,750,518 | ||||||

| 1,175,004 | 2.264%, 08/01/35 (a) | 1,236,766 | ||||||

| 1,943,529 | 2.820%, 08/01/35 (a) | 2,088,168 | ||||||

| 2,694,147 | 2.586%, 09/01/35 (a) | 2,899,190 | ||||||

| 1,281,549 | 3.369%, 09/01/35 (a) | 1,376,923 | ||||||

| 552,891 | 2.210%, 10/01/35 (a) | 591,405 | ||||||

| 1,690,359 | 2.862%, 03/01/36 (a) | 1,816,157 | ||||||

| 1,099,091 | 2.621%, 04/01/36 (a) | 1,151,682 | ||||||

| 2,740,542 | 2.596%, 01/01/38 (a) | 2,930,749 | ||||||

| 3,135,635 | 2.315%, 05/01/39 (a) | 3,349,790 | ||||||

| 1,008,642 | 4.000%, 09/01/41 | 1,082,964 | ||||||

|

| |||||||

| 58,338,768 | ||||||||

|

| |||||||

Government National Mortgage Association - 0.16% |

| |||||||

| 823,390 | 1.625%, 12/20/34 (a) | 855,685 | ||||||

|

| |||||||

Total Mortgage-Backed Obligations | 81,875,180 | |||||||

|

| |||||||

(Cost $78,158,025) | ||||||||

| AGENCY DEBENTURES - 16.29% |

| ||||||

Federal Home Loan Bank - 1.45% | ||||||||

| 7,900,000 | 0.500%, 02/13/15 | 7,900,427 | ||||||

|

| |||||||

Federal Home Loan Mortgage Corporation - 8.98% |

| |||||||

| 5,000,000 | 4.580%, 11/19/13 | 5,268,705 | ||||||

| 4,500,000 | 0.500%, 01/24/14 | 4,505,031 | ||||||

| 9,700,000 | 1.000%, 07/30/14 | 9,829,039 | ||||||

| 2,200,000 | 1.000%, 08/20/14 | 2,228,087 | ||||||

| 26,500,000 | 3.000%, 07/31/19 | 27,129,481 | ||||||

|

| |||||||

| 48,960,343 | ||||||||

|

| |||||||

Federal National Mortgage Association - 5.86% |

| |||||||

| 17,000,000 | 0.600%, 11/14/13 | 17,009,231 | ||||||

| 4,800,000 | 0.625%, 10/30/14 | 4,832,165 | ||||||

| 1,100,000 | 0.750%, 12/19/14 | 1,110,489 | ||||||

| 9,000,000 | 0.375%, 03/16/15 | 9,005,148 | ||||||

|

| |||||||

| 31,957,033 | ||||||||

|

| |||||||

Total Agency Debentures | 88,817,803 | |||||||

|

| |||||||

(Cost $88,553,558) | ||||||||

| U.S. TREASURY OBLIGATIONS - 48.37% |

| ||||||

United States Treasury Notes & Bonds - 48.37% |

| |||||||

| 13,000,000 | 0.125%, 12/31/13 | 12,985,778 | ||||||

| 12,600,000 | 0.250%, 01/31/14 | 12,607,384 | ||||||

| 68,100,000 | 0.250%, 02/28/14 | 68,137,251 | ||||||

| 7,100,000 | 1.875%, 02/28/14 | 7,274,724 | ||||||

| 95,500,000 | 0.250%, 05/31/14 | 95,541,065 | ||||||

| 44,800,000 | 0.125%, 07/31/14 | 44,712,506 | ||||||

| 2,900,000 | 0.500%, 10/15/14 | 2,915,860 | ||||||

| 10,200,000 | 4.000%, 02/15/15 | 11,128,363 | ||||||

| 8,200,000 | 1.250%, 09/30/15 | 8,435,110 | ||||||

|

| |||||||

Total U.S. Treasury Obligations | 263,738,041 | |||||||

|

| |||||||

(Cost $263,339,313) | ||||||||

See accompanying notes to financial statements.

20

TRUST FOR CREDIT UNIONS

Short Duration Portfolio

Portfolio of Investments (continued) – August 31, 2012

Par Value | Value | |||||||

| U.S. GOVERNMENT-BACKED OBLIGATIONS - 2.65% |

| ||||||

Federal Home Loan Mortgage Corp, Multifamily Structured Pass Thru Certificates |

| |||||||

| $ | 1,866,487 | Series K501, Class A1 1.337%, 06/25/16 (c) | $ | 1,900,308 | ||||

Federal Home Loan Mortgage Corp, Multifamily Structured Pass Thru Certificates |

| |||||||

| 5,200,000 | Series K501, Class A2 1.655%, 11/25/16 (c) | 5,344,832 | ||||||

Federal Home Loan Mortgage Corp, Multifamily Structured Pass Thru Certificates |

| |||||||

| 1,500,000 | Series K703, Class A2 2.699%, 05/25/18 (c) | 1,606,683 | ||||||

| National Credit Union Administration | ||||||||

| 3,100,000 | 0.259%, 06/12/13 (a) | 3,100,000 | ||||||

| National Credit Union Administration | ||||||||

| 2,300,000 | 3.000%, 06/12/19 | 2,491,866 | ||||||

|

| |||||||

Total U.S. Government-Backed Obligations | 14,443,689 | |||||||

|

| |||||||

(Cost $14,005,261) | ||||||||

| REPURCHASE AGREEMENT - 2.00% |

| ||||||

| 10,900,000 | UBS, 0.190%, Dated 08/31/12, matures 09/04/12, repurchase price $10,900,230 (collateralized by a U.S. Treasury Note with an interest rate of 1.875% due 07/15/19, total market value $11,118,028) | 10,900,000 | ||||||

|

| |||||||

Total Repurchase Agreement | 10,900,000 | |||||||

|

| |||||||

(Cost $10,900,000) | ||||||||

Total Investments - 99.66% | 543,348,967 | |||||||

|

| |||||||

(Cost $538,916,295) (d) | ||||||||

Net Other Assets and Liabilities - 0.34% | 1,827,473 | |||||||

|

| |||||||

Net Assets - 100.00% | $ | 545,176,440 | ||||||

|

| |||||||

| (a) | Variable rate securities. Interest rates disclosed are those which are in effect at August 31, 2012. Maturity date shown is the date of the next coupon rate reset or actual maturity. |

| (b) | The security has PAC (Planned Amortization Class) collateral. |

| (c) | This security has Sequential collateral. |

| (d) | Cost for U.S. federal income tax purposes is $539,103,450. As of August 31, 2012, the aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost was $5,208,854 and the aggregate gross unrealized depreciation for all securities in which was an excess of tax cost over value was $963,337. Net unrealized appreciation was $4,245,517. |