1 Annual Shareholders Meeting May 3, 2016

2 Forward Looking Statement Certain statements we may make today may constitute “forward looking statements” under the Private Securities Litigation Reform Act of 1995. Orrstown Financial’s actual results may differ significantly from the results discussed in such forward-looking statements. Factors that might cause such a difference include, but are not limited to, economic conditions, competition in the geographic and business areas in which Orrstown Financial conducts its operations, fluctuations in interest rates, credit quality, government regulation and other risks and uncertainties, including those described in the Company’s filings with the Securities and Exchange Commission. The statements we make today are valid only as of today’s date and we disclaim any obligation to update this information.

3 Meeting Agenda • Call to Order • Conduct Meeting Business • Introduce Board of Directors • Management Report • Thomas R. Quinn, Jr., President & CEO Recap of 2015 Achievements • David P. Boyle, EVP/ CFO Financial Review • Benjamin W. Wallace, EVP/ Operations & Technology Monetizing Technology • Thomas R. Quinn, Jr., President & CEO Looking Forward: 2016 & Beyond • Questions from our Shareholders • Conduct Meeting Business • Adjournment

4 Call to Order Joel R. Zullinger, Chairman of the Board

5 Introduction of Board of Directors L-R: Glenn Snoke; Eric Segal; Greg Rosenberry; Dr. Anthony Ceddia; Mark Keller; Cindy Joiner; Jeffrey Coy; Andrea Pugh; Joel Zullinger; Thomas Longenecker; Thomas R. Quinn, Jr.; Floyd Stoner

6 Conduct Meeting Business Joel R. Zullinger, Chairman of the Board

7 Rules of Conduct • In the interest of an orderly Meeting of the Shareholders of Orrstown Financial Services, Inc. (the “Company”), we ask you to honor the following rules of procedure: • Shareholders should not address the Meeting until recognized by the Chairman of the Meeting. Upon recognition by the Chairman, the shareholder will have the floor. Speakers should then state their name and status as a shareholder. We ask that shareholders approach the microphone at the front of the theater. • The business of the Meeting will be taken up as set forth in the Agenda. When an item on the Agenda is before the Meeting for consideration, questions and comments should be confined solely to that item. • Questions or comments not related to an Agenda item will not be entertained at the Meeting. If there are any matters of individual concern to a shareholder, they should be raised after the Meeting with representatives of the Company.

8 Rules of Conduct • Shareholders should confine comments to one subject at a time in order to give other shareholders an opportunity to speak on that subject. Please permit the speaker to conclude his or her remarks without interruption. • A shareholder will be permitted up to two minutes to address the Meeting when recognized by the Chairman. • Derogatory references to personalities or comments that are otherwise in bad taste or any outbursts of demonstration will not be permitted and will be a basis for removal from the Meeting. • No cameras or other recording devices will be permitted at the Meeting. All cell phones, pagers and other electronic communication devices must be turned off.

9 Rules of Conduct • The views, constructive comments and criticisms of the shareholders are welcome, but the purpose of the Meeting will be observed. The Chairman will stop discussions that are: • Irrelevant to the matter under consideration, • Proposals related to the conduct of the Company’s ordinary business operations, • Derogatory or inflammatory, • Related to customers of Orrstown Bank, or • In substance repetitious statements made by other persons.

10 Conduct Meeting Business Joel R. Zullinger, Chairman of the Board

11 Agenda • Management Report • 2015: Year in review • David Boyle, EVP/Chief Financial Officer will review financial results • Ben Wallace, EVP/Operations and Technology will discuss monetizing technology investments • Looking Forward: 2016 & Beyond • Questions from Shareholders

12 Management Report Thomas R. Quinn, Jr. , President & CEO

13 Introduction of the Team • Barbara Brobst: Chief Human Resources Officer • David Boyle: Chief Financial Officer • Robert Coradi: Chief Risk Officer • Philip Fague: Mortgage and Trust Businesses • Zachary Flynn: Commercial Real Estate • Jeffrey Gayman: Retail and C&I Lending • Benjamin Wallace: Operations and Technology

14 A Review of 2015 • Exited all formal enforcement actions on April 1, 2015 • Net income of $7.9 million • 10.9% year-over-year loan growth; + $76.8 million • Annualized loan growth of 11.8% in the first quarter of 2016; +23.0 million • 8.7% year-over-year deposit growth; + $82.5 million • Deposit momentum continued in 1Q16 • 2.0% year-over-year non-interest income growth* *Excludes gains on sale of securities

15 A Review of 2015 • Maintained enterprise risk management culture and asset quality: • 1.34% total non-performing assets to assets • 1.74% allowance for loan losses to total loans • 81.95% allowance for loan losses to non-performing loans • Began the development and execution of five year strategic plan to: • Improve earnings • Take advantage of market dislocation • Enhance shareholder value

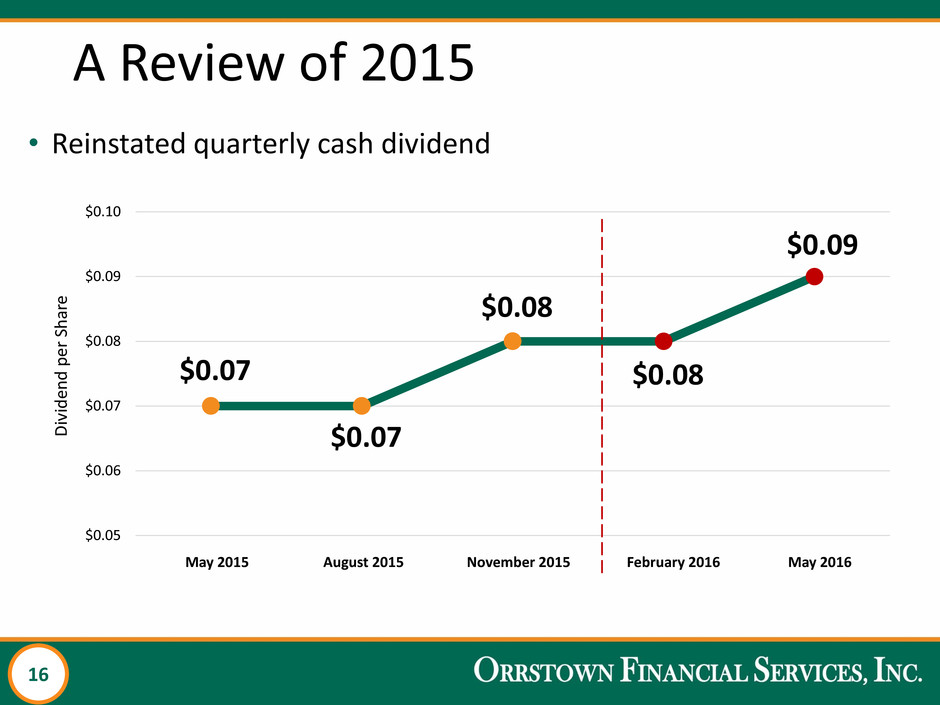

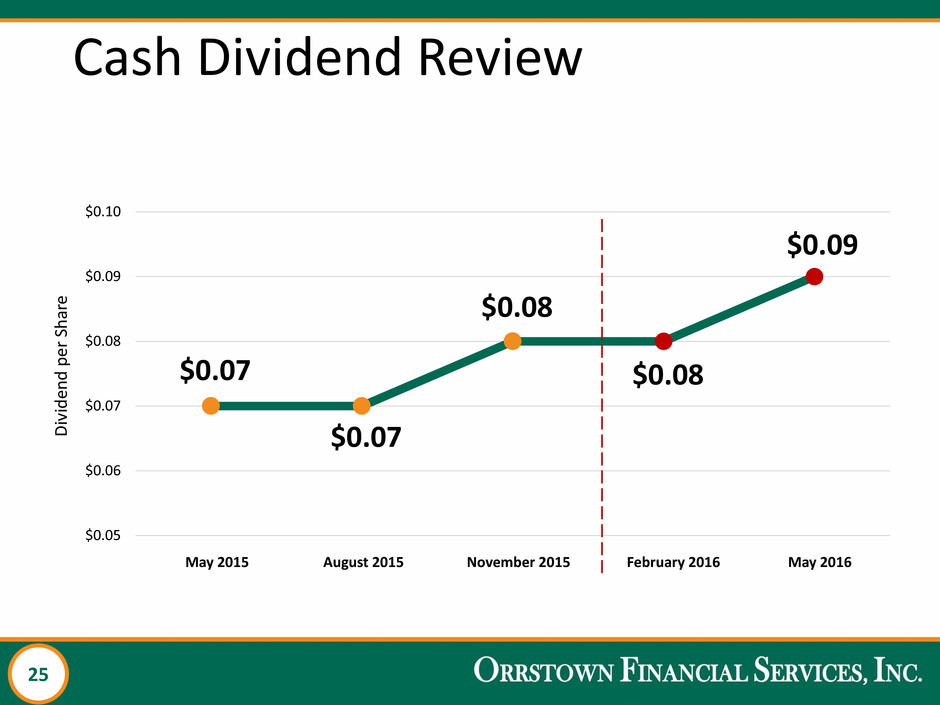

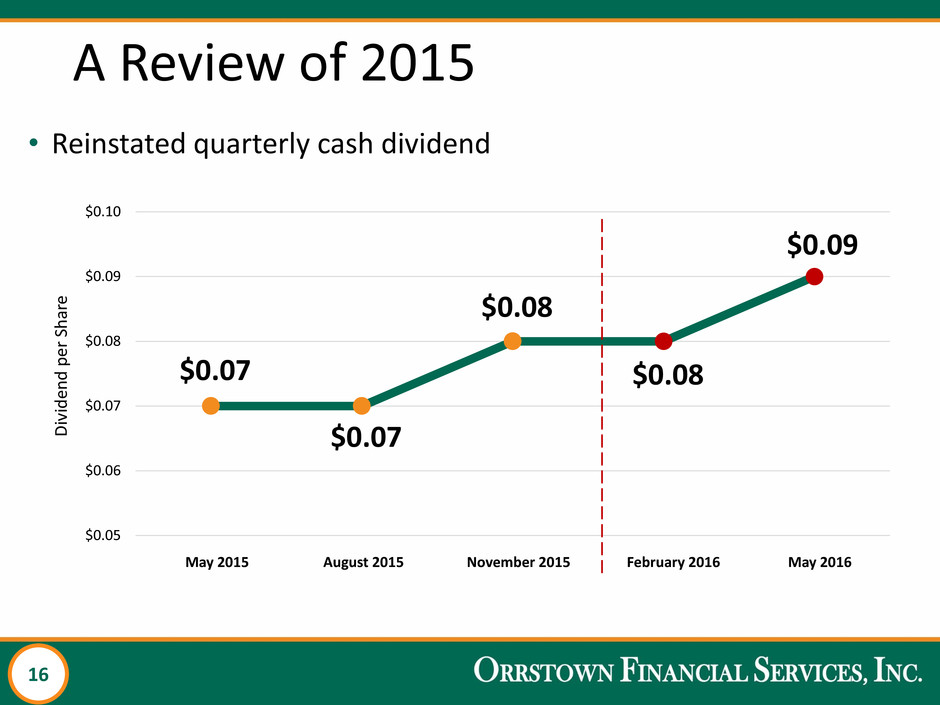

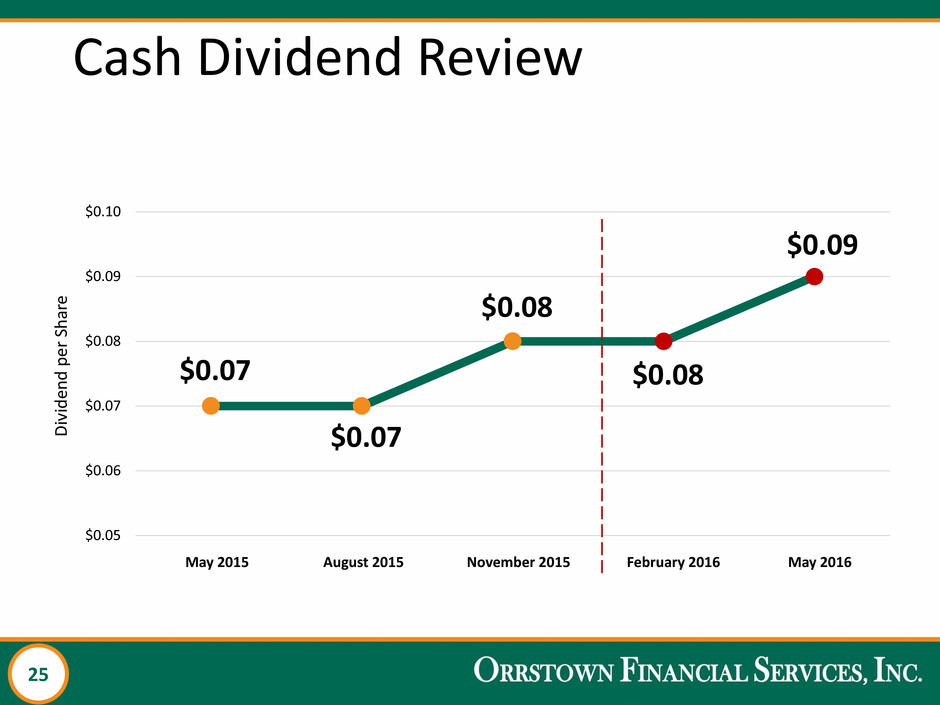

16 A Review of 2015 • Reinstated quarterly cash dividend $0.07 $0.07 $0.08 $0.08 $0.09 $0.05 $0.06 $0.07 $0.08 $0.09 $0.10 May 2015 August 2015 November 2015 February 2016 May 2016 Divide n d p er Sha re

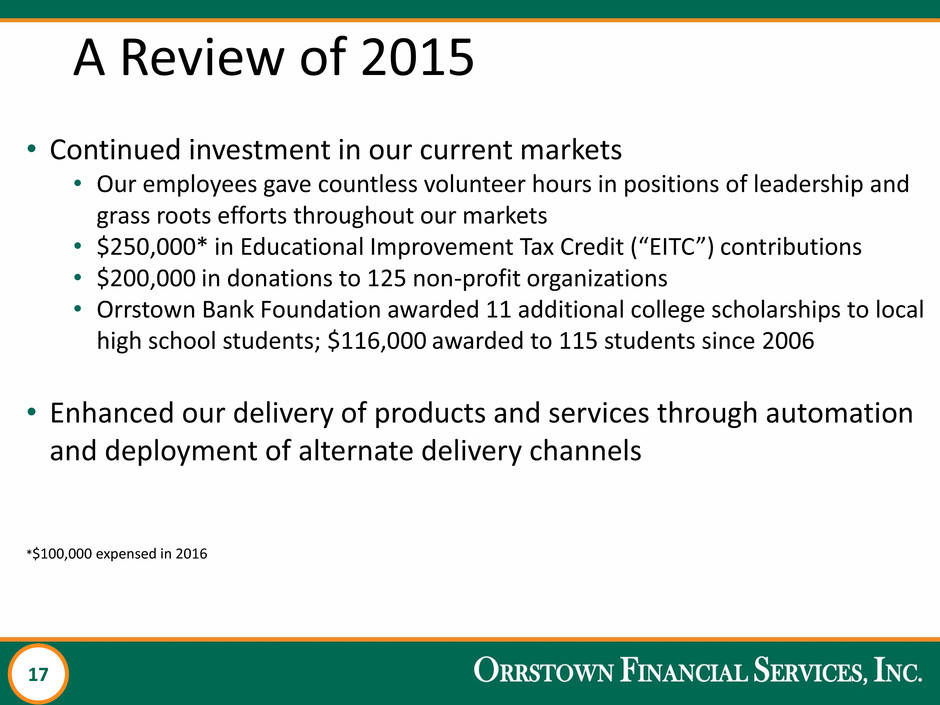

17 A Review of 2015 • Continued investment in our current markets • Our employees gave countless volunteer hours in positions of leadership and grass roots efforts throughout our markets • $250,000* in Educational Improvement Tax Credit (“EITC”) contributions • $200,000 in donations to 125 non-profit organizations • Orrstown Bank Foundation awarded 11 additional college scholarships to local high school students; $116,000 awarded to 115 students since 2006 • Enhanced our delivery of products and services through automation and deployment of alternate delivery channels *$100,000 expensed in 2016

18 Agenda • Management Report • 2015: Year in review • David Boyle, EVP/Chief Financial Officer will review financial results • Ben Wallace, EVP/Operations and Technology will discuss monetizing technology investments • Looking Forward: 2016 & Beyond • Questions from Shareholders

19 Summary Financial Review David P. Boyle, EVP/Chief Financial Officer

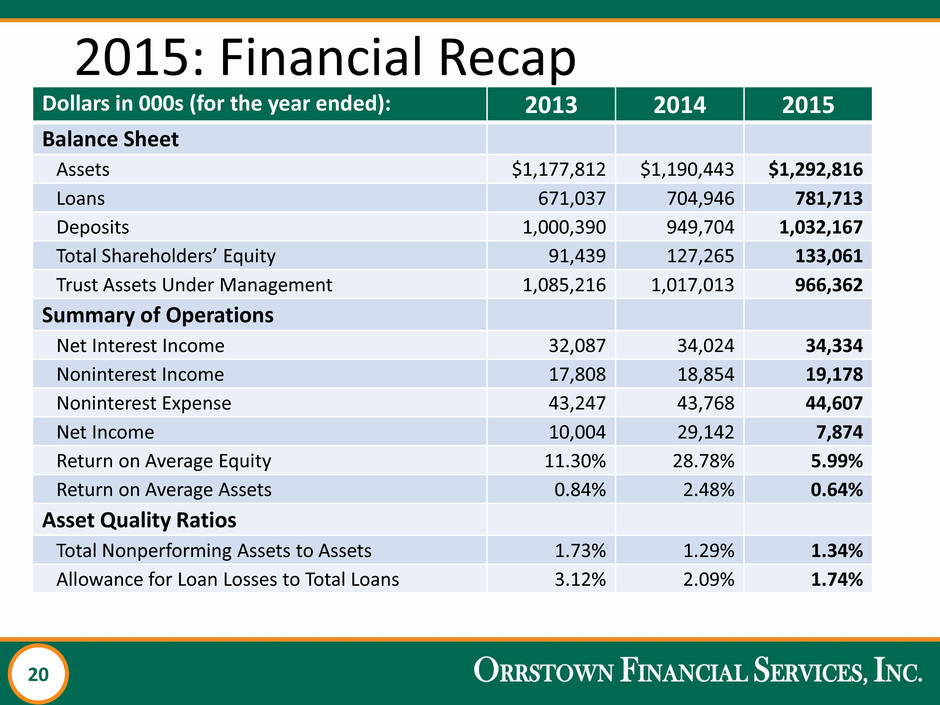

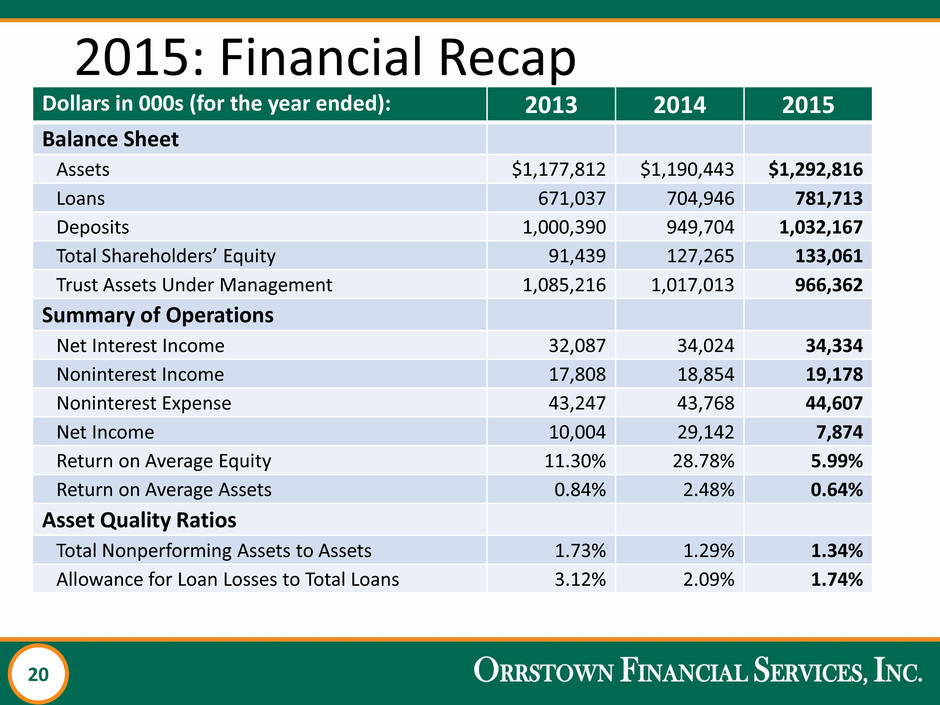

20 2015: Financial Recap Dollars in 000s (for the year ended): 2013 2014 2015 Balance Sheet Assets $1,177,812 $1,190,443 $1,292,816 Loans 671,037 704,946 781,713 Deposits 1,000,390 949,704 1,032,167 Total Shareholders’ Equity 91,439 127,265 133,061 Trust Assets Under Management 1,085,216 1,017,013 966,362 Summary of Operations Net Interest Income 32,087 34,024 34,334 Noninterest Income 17,808 18,854 19,178 Noninterest Expense 43,247 43,768 44,607 Net Income 10,004 29,142 7,874 Return on Average Equity 11.30% 28.78% 5.99% Return on Average Assets 0.84% 2.48% 0.64% Asset Quality Ratios Total Nonperforming Assets to Assets 1.73% 1.29% 1.34% Allowance for Loan Losses to Total Loans 3.12% 2.09% 1.74%

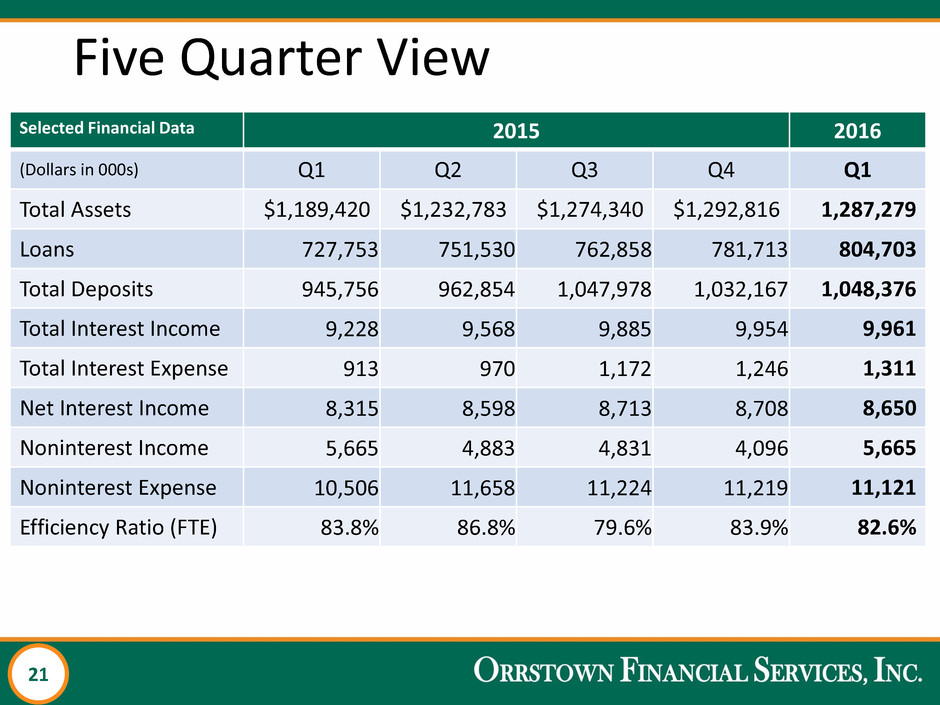

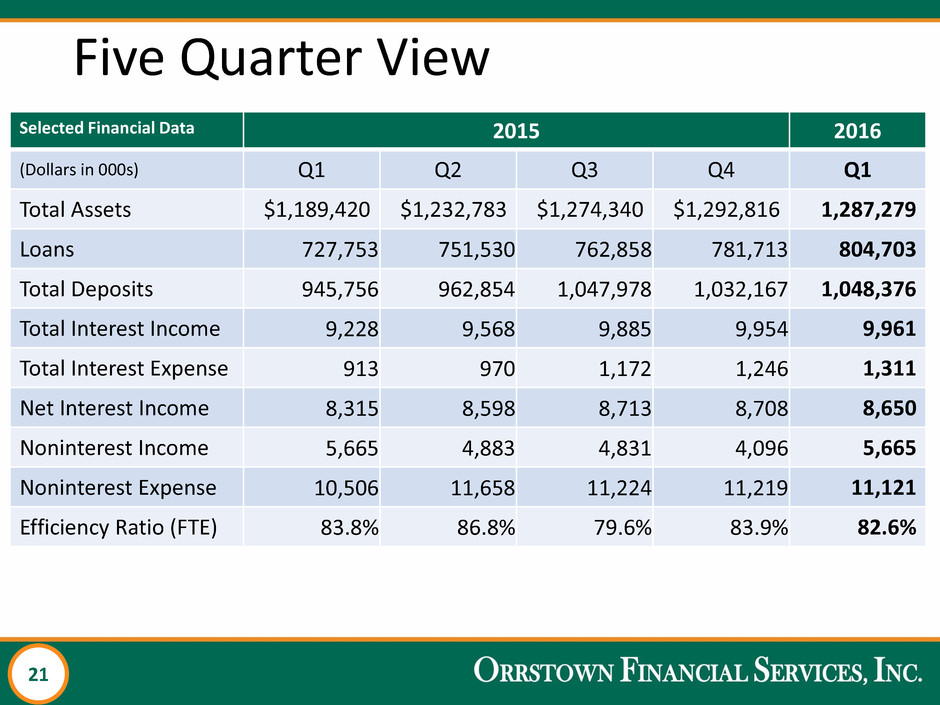

21 Five Quarter View Selected Financial Data 2015 2016 (Dollars in 000s) Q1 Q2 Q3 Q4 Q1 Total Assets $1,189,420 $1,232,783 $1,274,340 $1,292,816 1,287,279 Loans 727,753 751,530 762,858 781,713 804,703 Total Deposits 945,756 962,854 1,047,978 1,032,167 1,048,376 Total Interest Income 9,228 9,568 9,885 9,954 9,961 Total Interest Expense 913 970 1,172 1,246 1,311 Net Interest Income 8,315 8,598 8,713 8,708 8,650 Noninterest Income 5,665 4,883 4,831 4,096 5,665 Noninterest Expense 10,506 11,658 11,224 11,219 11,121 Efficiency Ratio (FTE) 83.8% 86.8% 79.6% 83.9% 82.6%

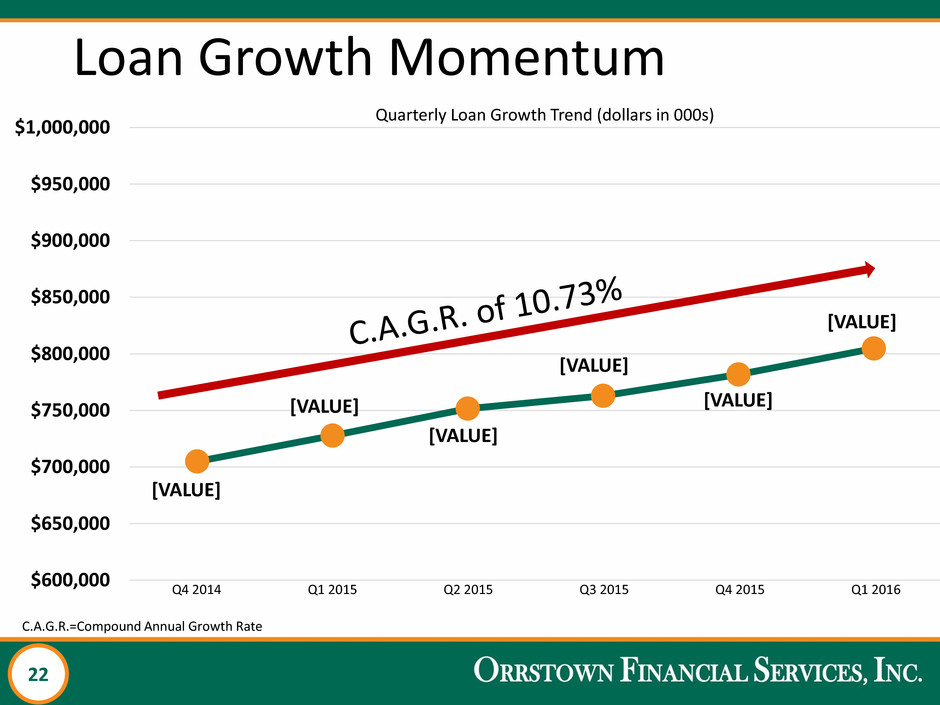

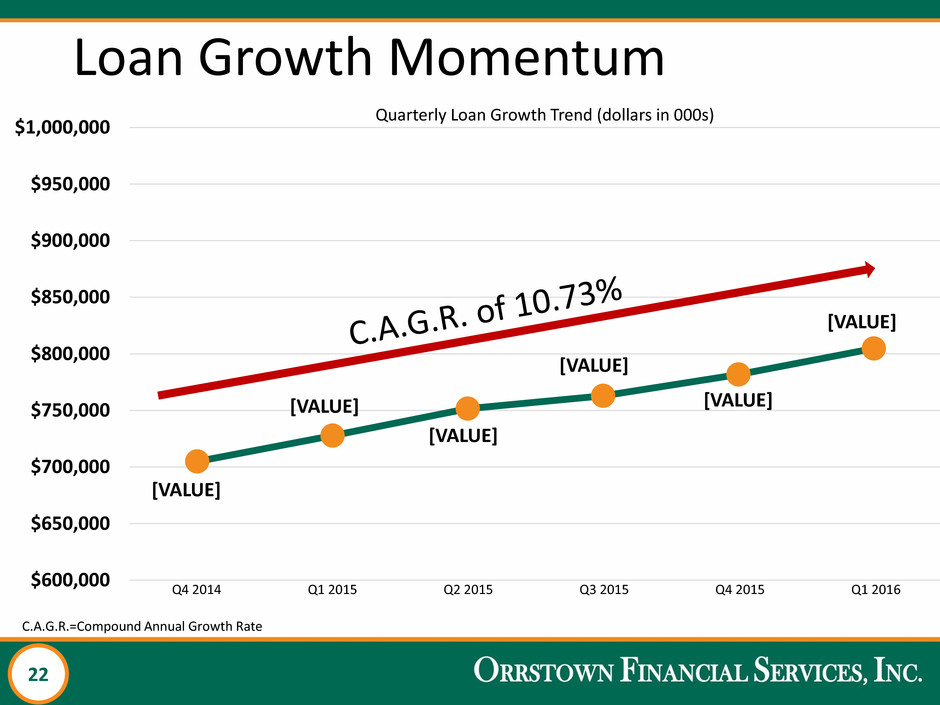

22 Loan Growth Momentum C.A.G.R.=Compound Annual Growth Rate [VALUE] [VALUE] [VALUE] [VALUE] [VALUE] [VALUE] $600,000 $650,000 $700,000 $750,000 $800,000 $850,000 $900,000 $950,000 $1,000,000 Quarterly Loan Growth Trend (dollars in 000s) Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q4 2014

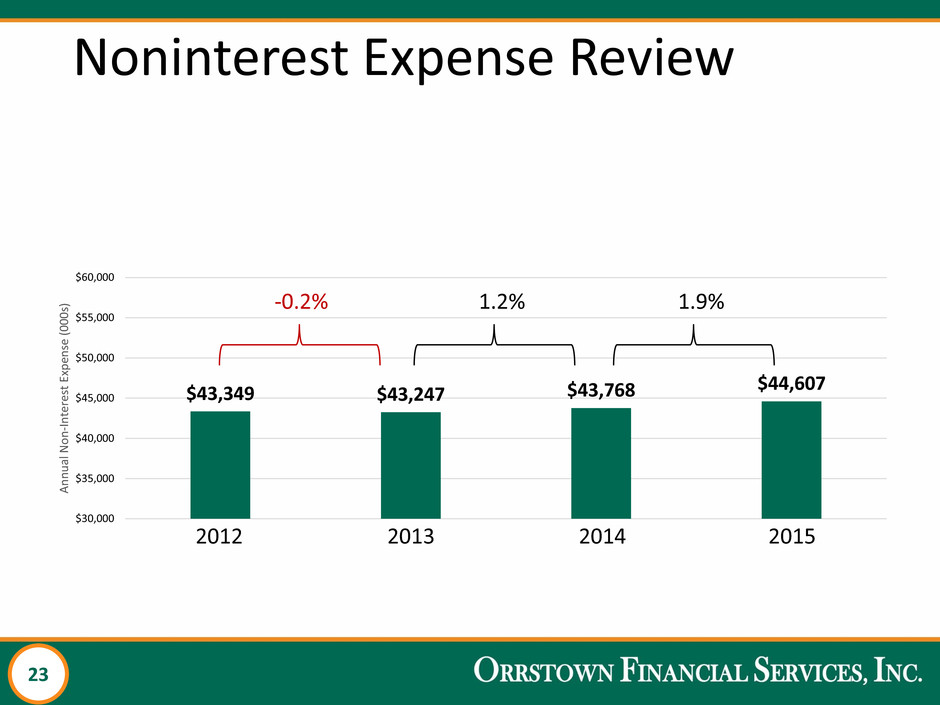

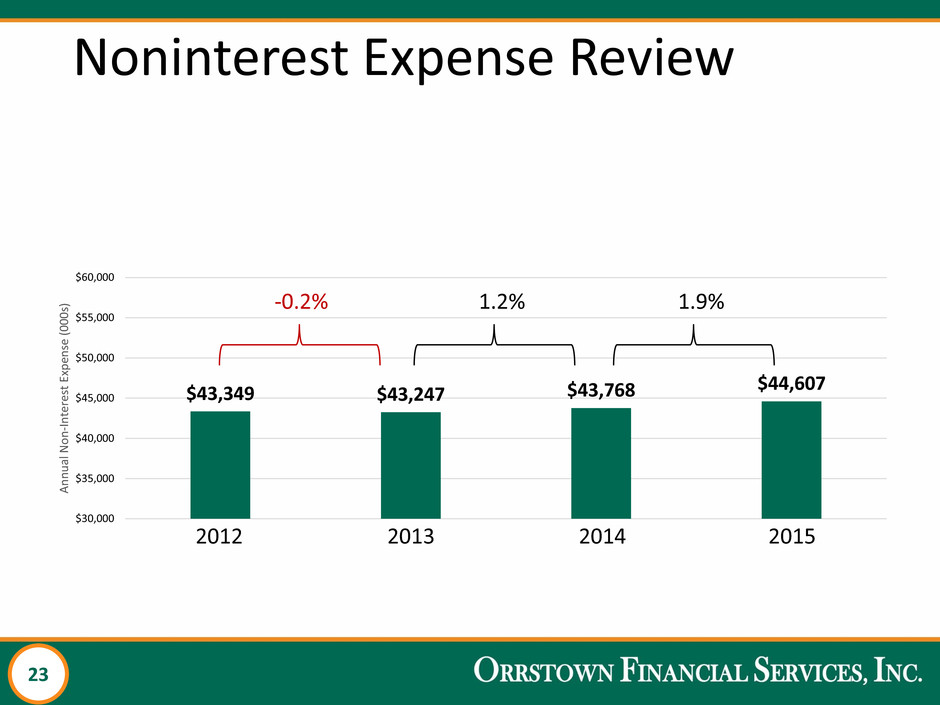

23 2013 2014 2015 2012 $43,349 $43,247 $43,768 $44,607 $30,000 $35,000 $40,000 $45,000 $50,000 $55,000 $60,000 A n n u al N o n -I n ter es t Ex p en se (0 0 0 s) Noninterest Expense Review 1.2% 1.9% -0.2%

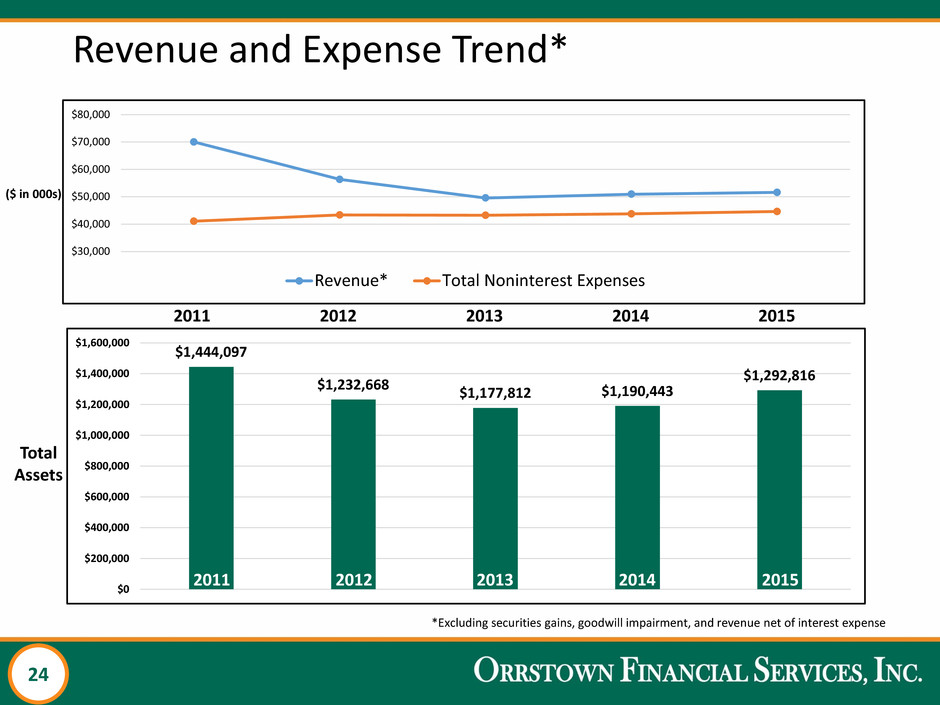

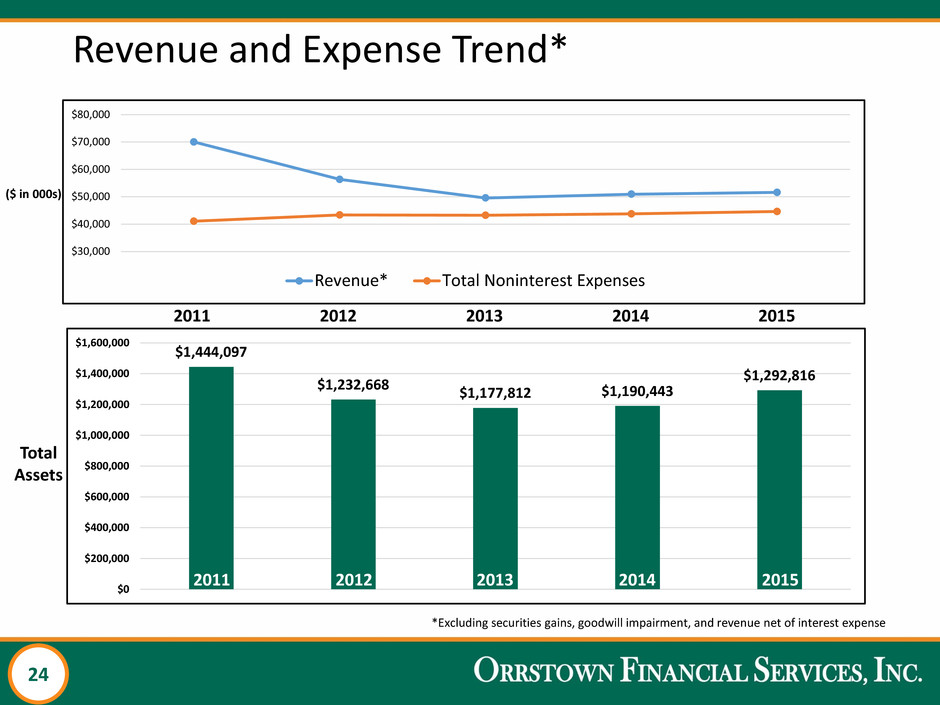

24 Revenue and Expense Trend* Total Assets 2013 2012 2014 2015 ($ in 000s) $1,444,097 $1,232,668 $1,177,812 $1,190,443 $1,292,816 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 2011 2013 2012 2014 2015 2011 *Excluding securities gains, goodwill impairment, and revenue net of interest expense $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 Revenue* Total Noninterest Expenses

25 Cash Dividend Review $0.07 $0.07 $0.08 $0.08 $0.09 $0.05 $0.06 $0.07 $0.08 $0.09 $0.10 May 2015 August 2015 November 2015 February 2016 May 2016 Divide n d p er Sha re

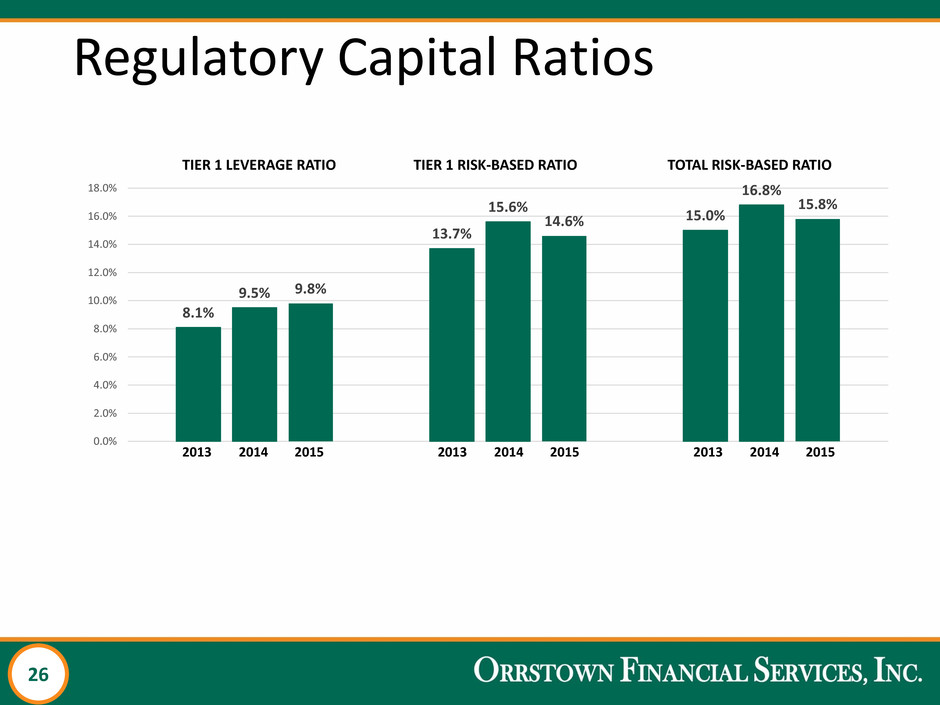

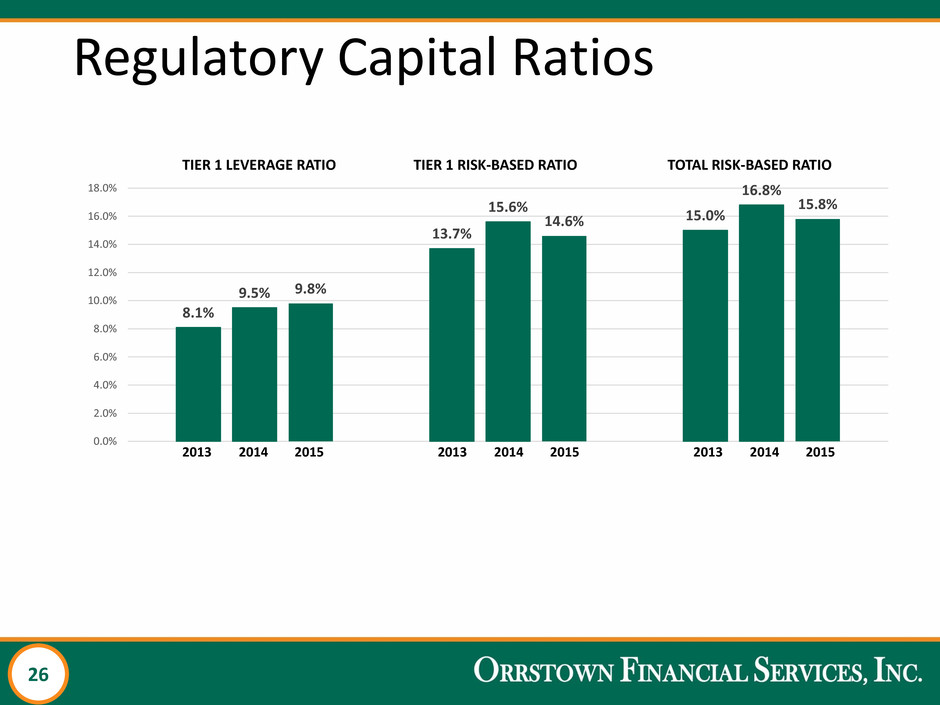

26 8.1% 13.7% 15.0% 9.5% 15.6% 16.8% 9.8% 14.6% 15.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% Regulatory Capital Ratios 2013 2014 2015 2013 2014 2015 2013 2014 2015 TIER 1 LEVERAGE RATIO TIER 1 RISK-BASED RATIO TOTAL RISK-BASED RATIO

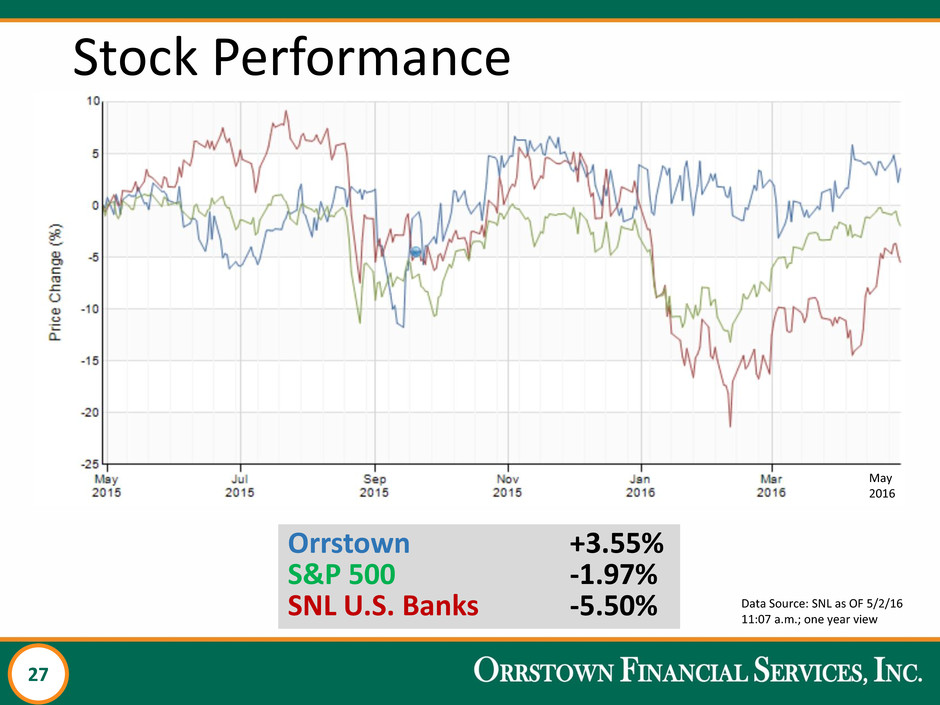

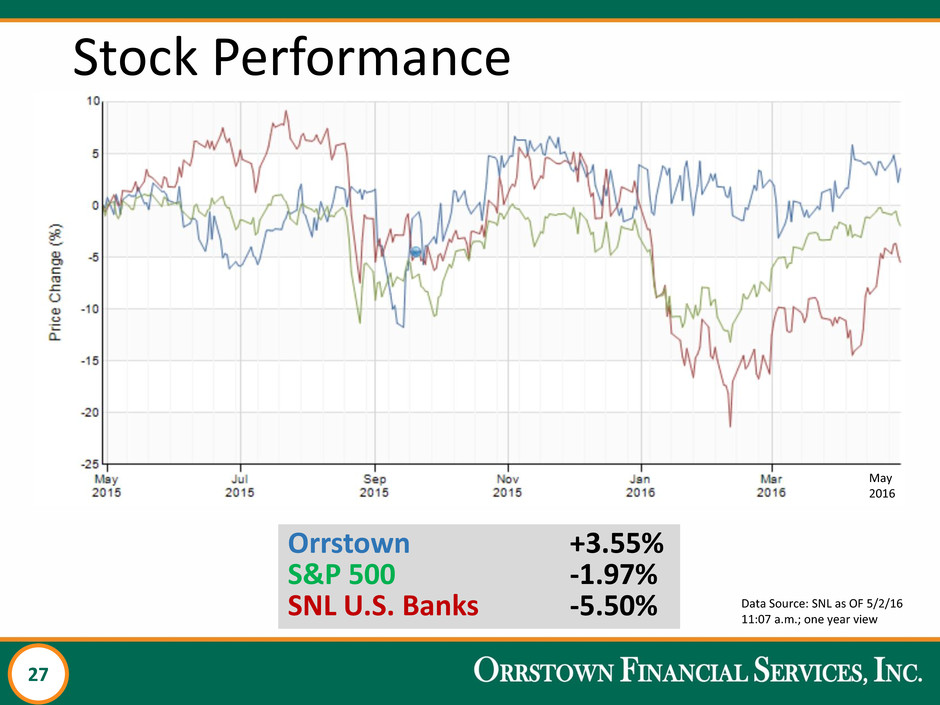

27 Stock Performance Data Source: SNL as OF 5/2/16 11:07 a.m.; one year view Orrstown +3.55% S&P 500 -1.97% SNL U.S. Banks -5.50% May 2016

28 Agenda • Management Report • 2015: Year in review • David Boyle, EVP/Chief Financial Officer will review financial results • Ben Wallace, EVP/Operations and Technology will discuss monetizing technology investments • Looking Forward: 2016 & Beyond • Questions from Shareholders

29 Management Report Ben Wallace, EVP/Operations and Technology

30 Monetizing Technology 30 • Foundational investments since 2013 have been significant • Improving the customer experience continues to be at the center of these investments • As a result: • +100% year-over-year growth in Mobile adoption • ~10% of overall check deposits now using Mobile or ATM technologies • 8% of our customer service engagements are now conducted through non- traditional channels (Chat, SMS, Email, Online Portals) • Strong engagement with our Lending Portals – including our marketing leading Mortgage Center • Orrstown has aligned our digital monetization efforts into a distinct internal business unit

31 Using Technology to Deepen Relationships 31 Relationships Enabling more sophisticated offerings Expansion of Products & Services – Relationship Focused 2 0 1 4 2 0 1 5 2 0 1 6 Simplification of Products – Centered around products that reinforce and reward clients for engaging deeper with the Bank. Continued expansion of our Commercial Cash Management offerings – supporting larger more sophisticated regional clients Addition of digital products to enable deeper engagement - Remote Deposit, Person to Person Money Transfer, Bill Pay, Richer IVR Platforms, 2-Way SMS Developing a Relationship Platform directed at helping us shape conversations with customers and engage more effectively to understand their needs 2 0 1 4 2 0 1 5 2 0 1 6

32 Strategic Priorities Related to Digital • With our digital “backbone” established – we have opened entirely new ways for our customers to interact and engage • Our leadership teams are focused on: • Ensuring a consistent and positive customer experience across our digital channels • Optimizing how we market, sell, and engage customers • This business will underpin many of the traditional retail branch changes that will emerge – providing more options for our customers to engage with us within the branch using richer technologies Top 10 Technology Projects 2013, 2014 & 2015 Finovate Spring 2016

33 Maturing Customer Acquisition - Online • Significant work has been completed on aligning our Brand more actively in our markets over the last 18 months • With the expansion of our Online capabilities, we believe we are well positioned to increase customer acquisition – across the millennial demographic and those markets with historically few Orrstown Branch footprints • Optimizing our advertising spend against these opportunities remains a focus as we look to increase the percentage of business sourced online

34 Managing Technology as a Strategic Asset Offering customers richer experiences within the Online, Mobile, and Branch network requires continuous investment. To support this investment and our growth, Orrstown has focused on automation and efficiency efforts across the firm: • Implemented numerous back-office automation frameworks – allowing us to optimize human capital across our operational teams • Investments continue in the platforms that support the credit underwriting and portfolio management of the Bank • Continue to lead industry efforts across Cyber Security within the region and across the State – protecting our clients assets and trust remains paramount • Overall, our strategy and investment focus is not yet shared by many of our peers – providing Orrstown a unique opportunity in the years ahead

35 Agenda • Management Report • 2015: Year in review • David Boyle, EVP/Chief Financial Officer will review financial results • Ben Wallace, EVP/Operations and Technology will discuss monetizing technology investments • Looking Forward: 2016 & Beyond • Questions from Shareholders

36 Management Report Thomas R. Quinn, Jr. , President & CEO

37 Looking Forward: 2016 & Beyond 37 • Strategic plan: defining the market opportunities • Integrate the teams joining the company in 2016-2017 and their valued relationships • Optimize our delivery channels to attract the growing millennial demographic that will be 50% of the work force in 10 years • Continue to explore opportunities to expand our fee income business lines (Orrstown Financial Advisors, Mortgage, Telesales, Digital Channels)

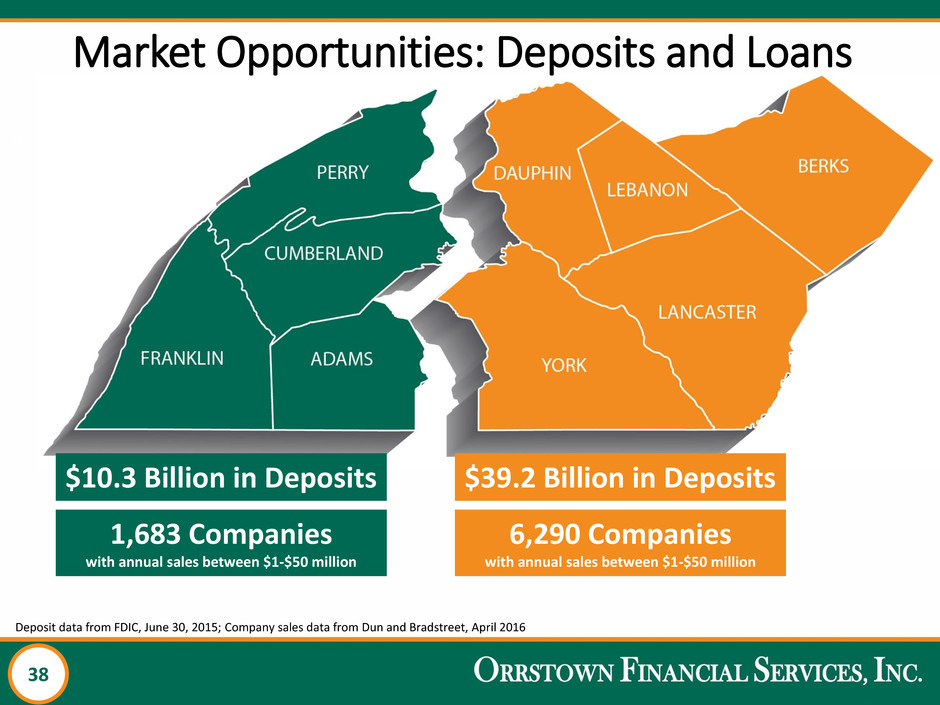

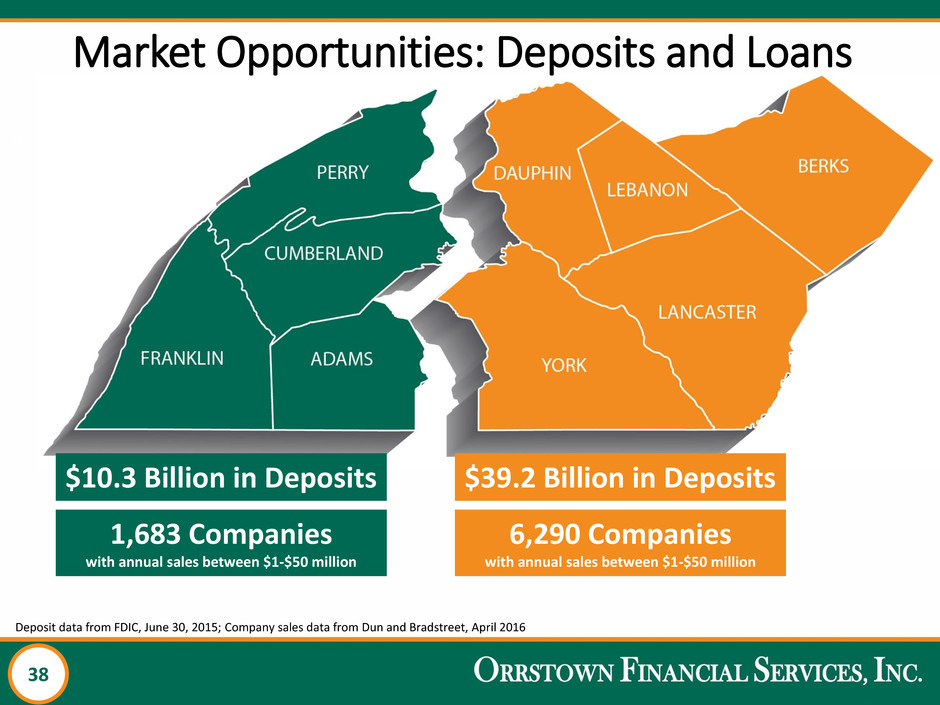

38 38 $10.3 Billion in Deposits $39.2 Billion in Deposits 1,683 Companies with annual sales between $1-$50 million 6,290 Companies with annual sales between $1-$50 million Market Opportunities: Deposits and Loans Deposit data from FDIC, June 30, 2015; Company sales data from Dun and Bradstreet, April 2016

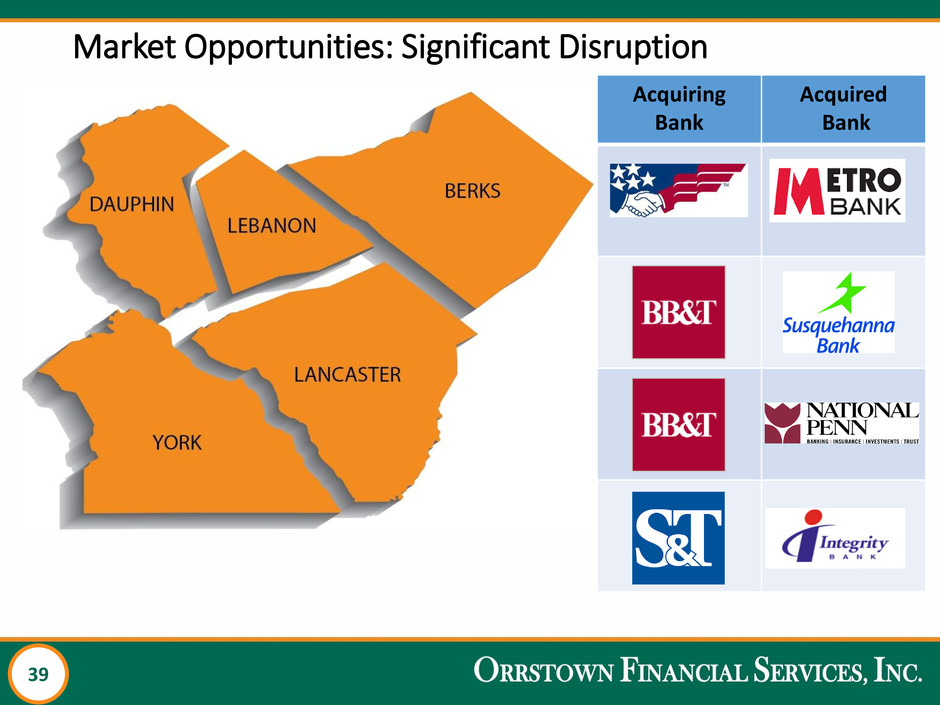

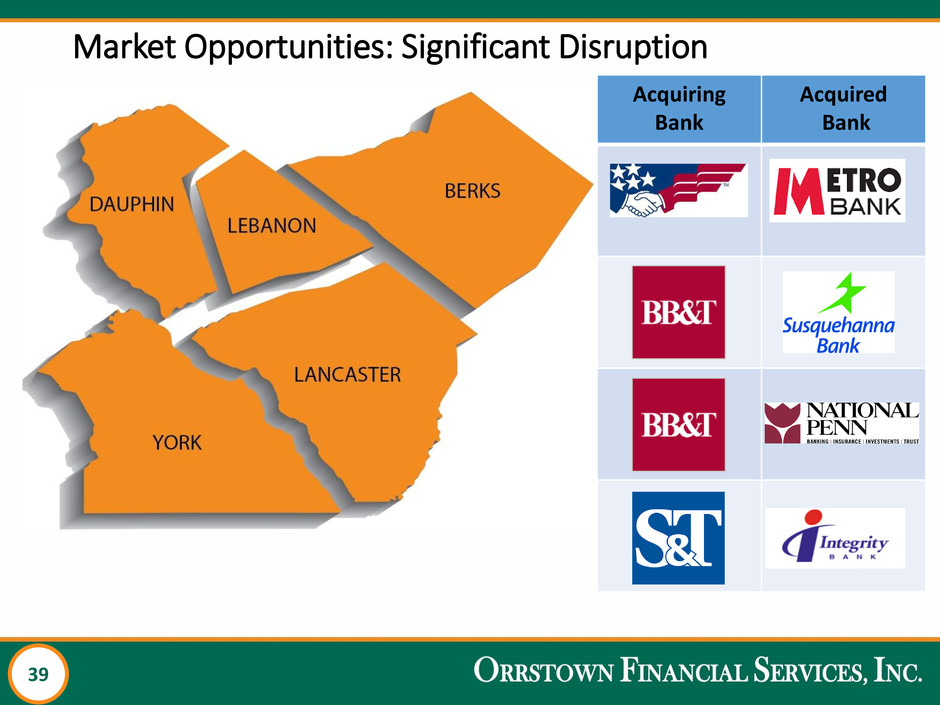

39 39 Market Opportunities: Significant Disruption Acquiring Bank Acquired Bank

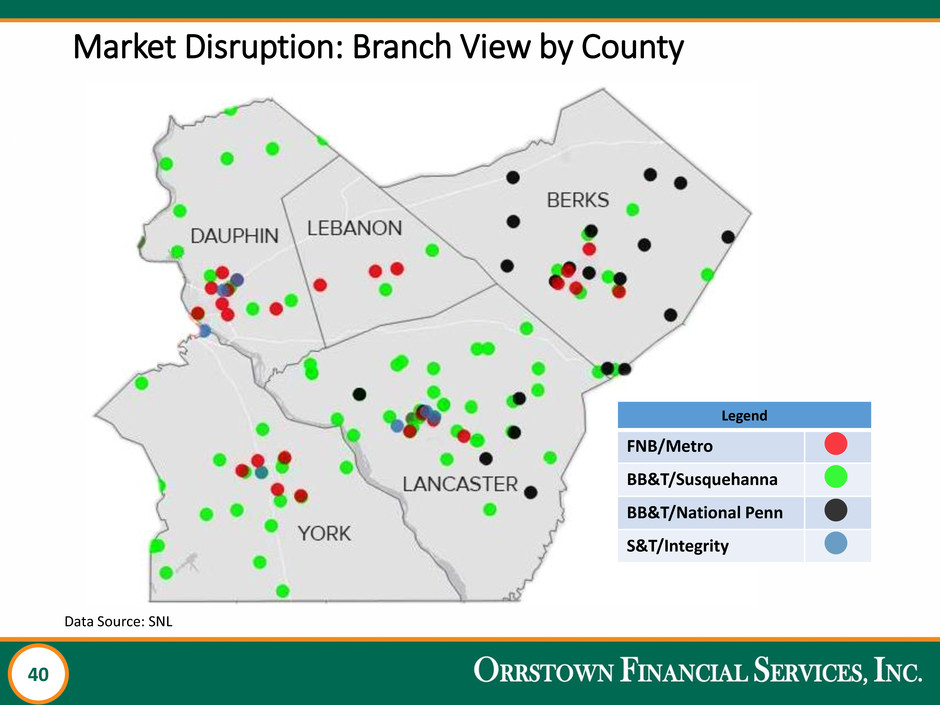

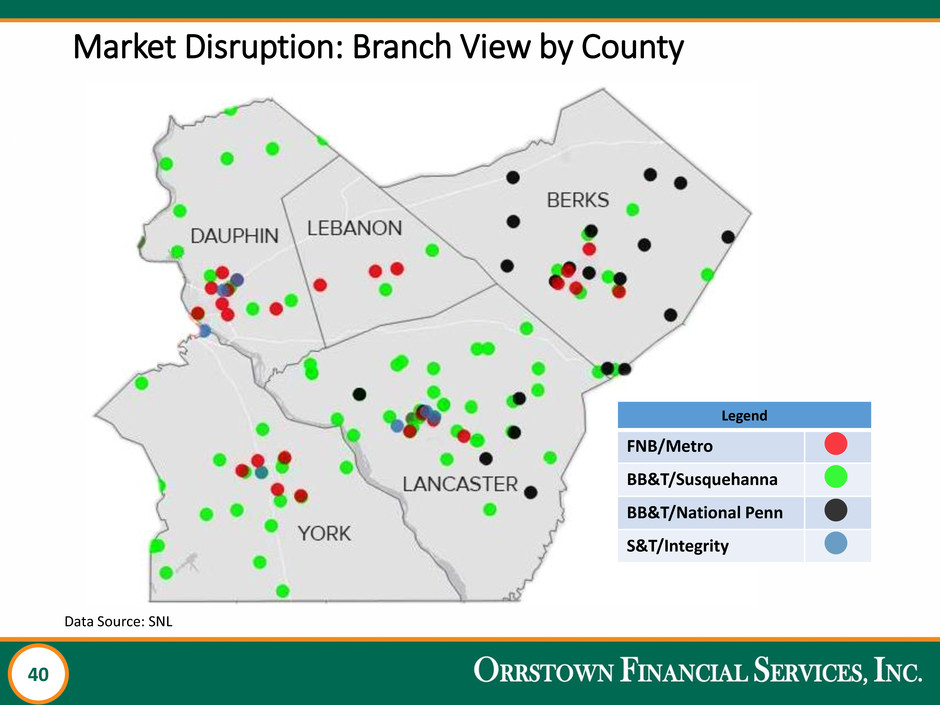

40 40 Market Disruption: Branch View by County Legend FNB/Metro BB&T/Susquehanna BB&T/National Penn S&T/Integrity Data Source: SNL

41 41 FNB, Integrity, Metro, Susquehanna 23 Branches - $1.41 billion Integrity, Metro, Susquehanna, FNB 26 Branches - $1.30 billion B of A, FNB, Metro, Nat Penn, Susquehanna 33 Branches - $1.72 billion B of A, Integrity, Metro, Nat Penn, Susquehanna 44 Branches - $3.68 billion FNB Fredericksburg, Metro, Susquehanna 9 Branches - $318.5 million 135 Branches and $8.43 billion in deposits FDIC Data as of June 30, 2015 Market Disruption: Quantified

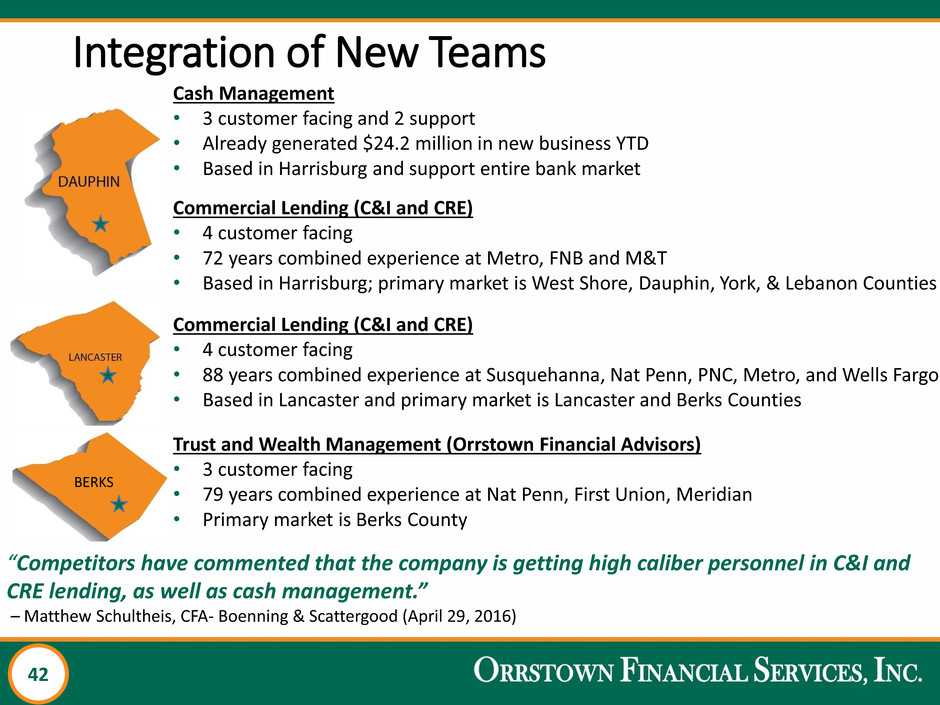

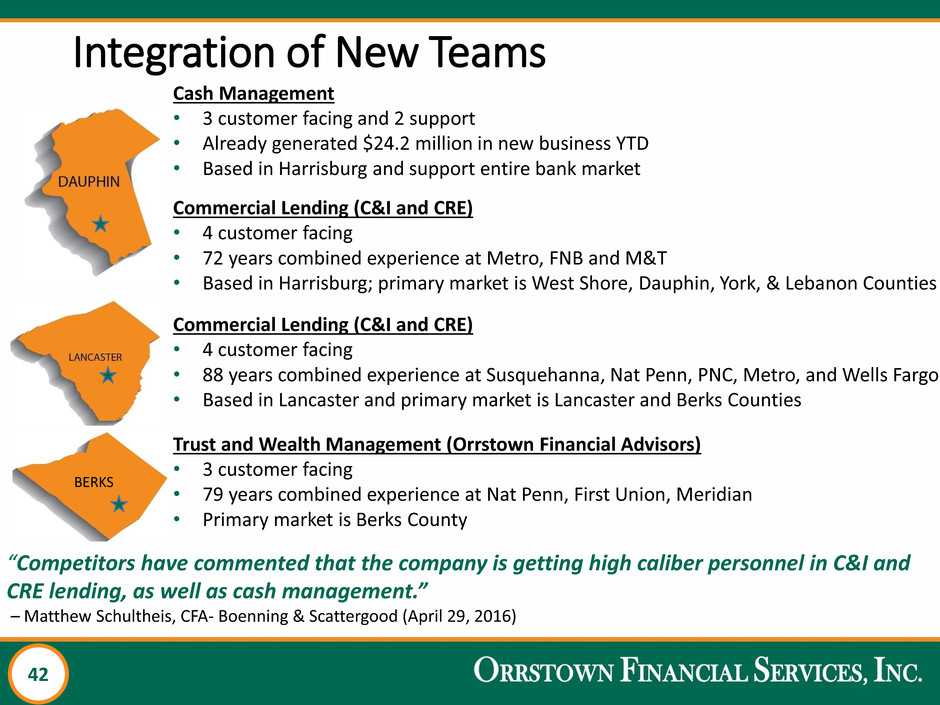

42 42 Integration of New Teams Cash Management • 3 customer facing and 2 support • Already generated $24.2 million in new business YTD • Based in Harrisburg and support entire bank market Commercial Lending (C&I and CRE) • 4 customer facing • 72 years combined experience at Metro, FNB and M&T • Based in Harrisburg; primary market is West Shore, Dauphin, York, & Lebanon Counties Commercial Lending (C&I and CRE) • 4 customer facing • 88 years combined experience at Susquehanna, Nat Penn, PNC, Metro, and Wells Fargo • Based in Lancaster and primary market is Lancaster and Berks Counties Trust and Wealth Management (Orrstown Financial Advisors) • 3 customer facing • 79 years combined experience at Nat Penn, First Union, Meridian • Primary market is Berks County BERKS “Competitors have commented that the company is getting high caliber personnel in C&I and CRE lending, as well as cash management.” – Matthew Schultheis, CFA- Boenning & Scattergood (April 29, 2016)

43 43 Integration of New Teams • We recently added regional facilities in Dauphin and Lancaster Counties • Our strategic plan also anticipates deployment of tech-centric branches in new markets utilizing “hub and spoke” model 4750 Lindle Rd., Harrisburg 1800 Fruitville Pk., Lancaster

44 44 Optimize Delivery Channels for Millennials • 50% of the work force in ~10 years • Demand convenience, including a “tech-centric” branch network • Integration of technology and a “data-rich” experience is critical • Future beneficiaries of a sizeable transfer of wealth

45 45 Summary • One year removed from enforcement actions • Consistent loan growth, deposit growth, and fee income growth • Integration of experienced bankers into our culture • Execution of expanded delivery channel strategy to broaden appeal to all demographic groups • Opportunistic and disciplined approach to franchise expansion • Long-term strategic plan to enhance shareholder value

46 Agenda • Management Report • 2015: Year in review • David Boyle, EVP/Chief Financial Officer will review financial results • Ben Wallace, EVP/Operations and Technology will discuss monetizing technology investments • Looking Forward: 2016 & Beyond • Questions from Shareholders

47 Shareholder Questions

48 Conduct Meeting Business Joel R. Zullinger, Chairman of the Board

49 Adjournment Thank you