November 12, 2019

Dear Shareholder,

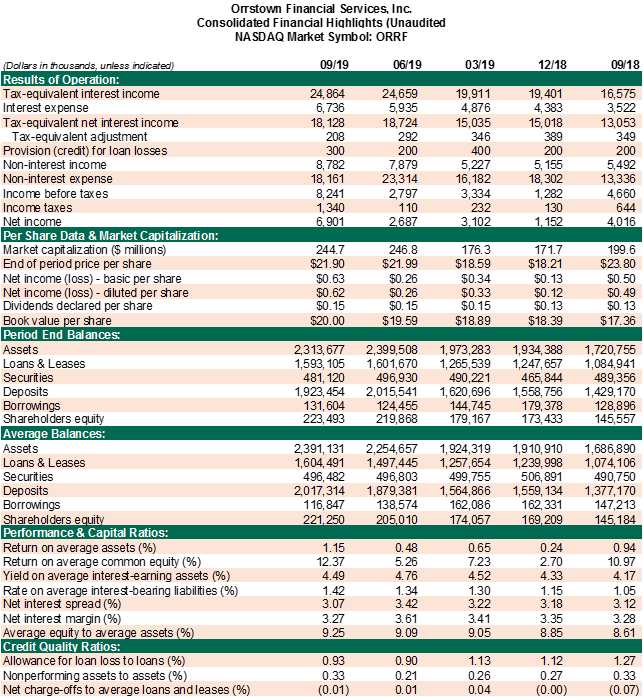

For the third quarter of 2019, your company realized net income, including the impact of merger related expenses, totaling $6.9 million or $0.62 per diluted share, compared with $4.0 million or $0.49 per diluted share for the third quarter of 2018. Net income, including the impact of merger related expenses, for the nine months ended September 30, 2019 totaled $12.7 million or $1.23 per diluted share, compared with $11.7 million or $1.41 per diluted share for the same period in 2018.

Results for the third quarter of 2019 were impacted by the following items: 1) merger-related expenses totaling $471,000, or $0.03 per diluted share, net of tax, 2) securities gains totaling $2.3 million, or $0.17 per diluted share, net of tax, and 3) costs associated with reducing wholesale funding of $223,000, or $0.02 per diluted share.

In October 2019, the Board of Directors declared a cash dividend of $0.15 per common share, which represents a 15.4% increase over the dividend of $0.13 per share declared in October 2018.

During the third quarter of 2019, we continued to execute successfully on our strategic growth plans. Our dedicated team of associates completed the conversion of Hamilton Bank’s systems onto Orrstown Bank’s systems, and all former Hamilton branches are now operating under the Orrstown brand. We hired experienced commercial lenders in both our Maryland and Capital regions. Subsequent to the quarter’s end, we were pleased to announce that Jonathan Ogden, former Baltimore Raven player and Pro Football Hall of Fame inductee, joined the Orrstown team as our brand ambassador for the Maryland Region.

Despite what we view as a favorable outlook for future growth and returns, we are not immune from near-term headwinds. An increase in economic uncertainty and an adverse interest rate environment are challenges to overcome, and we are taking action to assure continued success. Late in the third quarter, we terminated some brokered deposits and borrowings to reduce cash build. Combined with anticipated loan and deposit growth from recent hires, we look for this to favorably shift loan and deposit mix, aiding in defending our margin. We remain focused on growing fee income in mortgage banking, loan swap referral fees, wealth management, and other fee-based business in this low rate environment. We remain attuned to changing client appetites for the delivery of financial services, both at Orrstown and the industry as a whole, and recently announced the consolidation of five branches while serving our clients through an improved online banking platform with increased functionality and enhanced ATMs. Additionally, we are reducing excess office space; though we expect little impact on expenses from this action, it will allow us to focus more on serving our clients than maintaining our physical facilities. We continue to be laser focused on efficiency and automation efforts as we build a scalable organization that is well positioned for future growth and enhanced profitability.

If you do not currently participate in our Dividend Reinvestment and Stock Purchase Plan (DRSPP), and wish to learn more, please contact the DRSPP administrator, Continental Stock Transfer & Trust, at 212-509-4000 or drp@continentalstock.com, for a prospectus.

On behalf of the Board of Directors, our Leadership Team, and all who serve our clients on a daily basis, thank you for your support and continued long-term investment in Orrstown Financial Services, Inc. As we work on your behalf, we look forward to hearing from you. Should you have any questions or concerns please feel free to contact me, at 717-530-2602 or tquinn@orrstown.com or Matthew Schultheis, CFA, Director of Investor Relations at 717-586-0561 or mschultheis@orrstown.com.

Sincerely,

/s/ Thomas R. Quinn, Jr.

Thomas R. Quinn, Jr.

President and Chief Executive Officer

Stock Transfer Agent:

Continental Stock Transfer & Trust 212-509-4000

(www.continentalstock.com)

Shareholder inquires:

Thomas R. Quinn, Jr. Matthew Schultheis, CFA

President and Chief Executive Officer Director Investor Relations

Tel: 717-530-2602 Tel: 717-530-2602

tquinn@orrstown.com mschultheis@orrstown.com

About the Company

With over $2.3 billion in assets, Orrstown Financial Services, Inc. and its wholly-owned subsidiaries, Orrstown Bank and Wheatland Advisors, Inc., provide a wide range of consumer and business financial services through banking and financial advisory offices in Berks, Cumberland, Dauphin, Franklin, Lancaster, Perry, and York Counties, Pennsylvania and Anne Arundel, Baltimore, Howard, and Washington Counties, Maryland, as well as Baltimore City, Maryland. Orrstown Bank is an Equal Housing Lender and its deposits are insured up to the legal maximum by the FDIC. Orrstown Financial Services, Inc.’s common stock is traded on Nasdaq (ORRF). For more information about Orrstown Financial Services, Inc. and Orrstown Bank, visit www.orrstown.com. For more information about Wheatland Advisors, Inc., visit www.wheatlandadvisors.com.

Cautionary Note Regarding Forward-looking Statements:

This letter contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements reflect the current views of the Company's management with respect to, among other things, future events and the Company's financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about the Company's industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company's control. Accordingly, the Company cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements and there can be no assurances that the Company will be able to continue to successfully execute on our strategic growth plan into Dauphin, Lancaster, York and Berks counties, Pennsylvania, and the greater Baltimore market in Maryland, with newer markets continuing to be receptive to our community banking model; to take advantage of market disruption; and to experience sustained growth in loans and deposits or maintain the momentum experienced to date from these actions. Factors which could cause the actual results of the Company's operations to differ materially from expectations include, but are not limited to: ineffectiveness of the Company's strategic growth plan due to changes in current or future market conditions; the effects of competition and how it may impact our community banking model, including industry consolidation and development of competing financial products and services; the integration of the Company's strategic acquisitions; the inability to fully achieve expected savings, efficiencies or synergies from mergers and acquisitions, or taking longer than estimated for such savings, efficiencies and synergies to be realized; changes in laws and regulations; interest rate movements; changes in credit quality; inability to raise capital, if necessary, under favorable conditions; volatilities in the securities markets; deteriorating economic conditions; expenses associated with pending litigation and legal proceedings; and other risks and uncertainties, including those set forth under the heading "Risk Factors" in the Company's 2018 Annual Report on Form 10-K and subsequent filings. The foregoing list of factors is not exhaustive.

If one or more events related to these or other risks or uncertainties materialize, or if the Company's underlying assumptions prove to be incorrect, actual results may differ materially from what the Company anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and the Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for the Company to predict those events or how they may affect it. In addition, the Company cannot assess the impact of each factor on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that the Company or persons acting on the Company's behalf may issue.

###