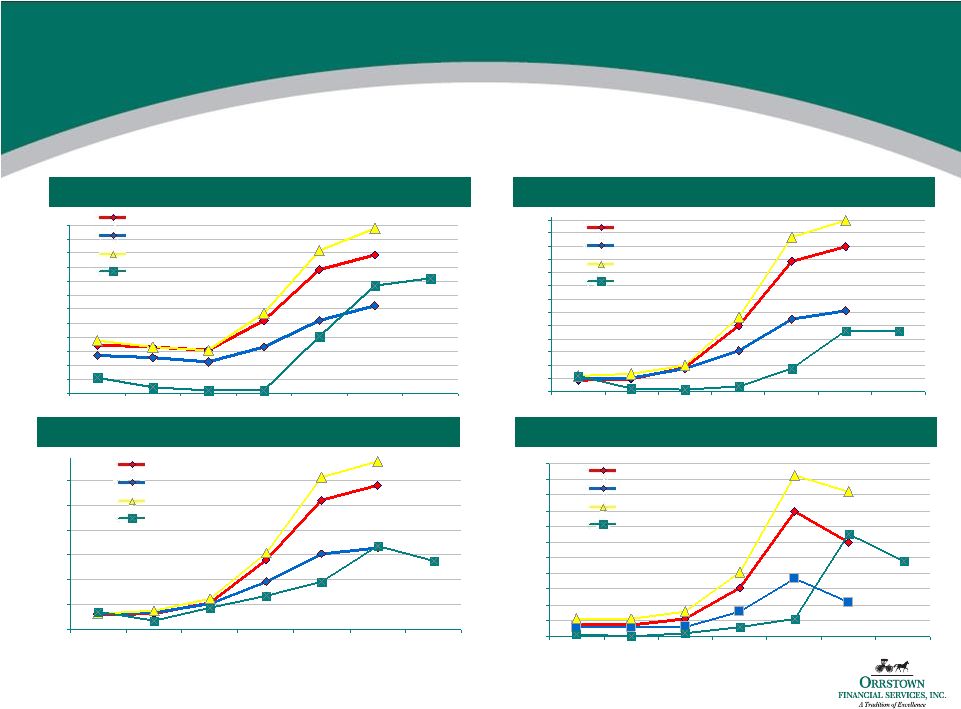

28 Regional Peer Analysis (1) See note in appendix regarding non-GAAP financial measures Note: Includes publicly-traded commercial banks with assets between $1bn and $2bn headquartered in the Mid Atlantic Financial data as of June 30, 2010; Market data as of October 19, 2010 Source: Company Documents as of 9/30/10; SNL Financial Balance Sheet Non- Total Int. Inc./ Res./ NCOs/ NPAs/ Total Total Gross TCE / RBC Eff. Total Gross Res./ Ave Total Market Dividend Assets Deposits Loans TA (1) Ratio ROAA ROAE NIM Ratio Rev. Loans NPAs Loans Assets Cap. Yield Company St. Ticker ($mm) ($mm) ($mm) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) ($mm) (%) Arrow Financial Corporation NY AROW 1,846 1,439 1,145 7.4 15.5 1.20 15.19 3.72 56.74 20.66 1.26 446.58 0.06 0.18 291.2 3.99 Eagle Bancorp, Inc. MD EGBN 1,937 1,578 1,529 8.8 12.9 0.74 7.08 4.01 62.55 6.70 1.42 67.90 0.37 1.65 230.5 0.00 Suffolk Bancorp NY SUBK 1,703 1,455 1,159 8.4 12.3 0.73 9.13 4.98 53.13 11.73 1.80 45.71 0.57 2.68 256.9 3.41 First United Corporation MD FUNC 1,776 1,374 1,082 3.1 12.0 (0.68) (12.00) 2.95 71.24 22.81 2.20 34.17 0.63 3.70 26.1 0.96 First of Long Island Corporation NY FLIC 1,598 1,273 864 8.0 16.8 1.18 15.77 3.83 54.39 10.38 1.38 484.58 0.00 0.15 215.9 3.53 State Bancorp, Inc. NY STBC 1,615 1,389 1,101 7.2 13.3 0.57 6.15 4.29 63.94 5.05 2.84 399.94 0.93 0.48 157.4 2.21 Canandaigua National Corporation NY CNND 1,624 1,432 1,188 6.5 14.0 1.11 15.68 4.25 60.06 30.34 1.26 57.69 0.39 1.59 149.0 3.64 Peapack-Gladstone Financial Corporation NJ PGC 1,477 1,311 959 6.4 13.3 0.52 6.79 3.66 65.98 22.49 1.44 44.43 0.92 2.11 106.6 1.67 Tower Bancorp, Inc. PA TOBC 1,588 1,322 1,231 9.6 14.5 0.40 3.74 3.65 71.45 15.16 0.94 102.12 0.24 0.72 156.0 5.18 Alliance Financial Corporation NY ALNC 1,457 1,118 916 6.4 13.9 0.80 9.28 3.58 65.35 29.84 1.12 95.18 0.29 0.73 144.6 4.00 First Mariner Bancorp MD FMAR 1,342 1,116 974 3.2 9.4 (1.17) (44.46) 2.76 111.25 37.83 1.23 14.81 1.30 6.00 12.5 0.00 Royal Bancshares of Pennsylvania, Inc. PA RBPAA 1,183 792 635 6.1 16.7 (0.80) (9.30) 2.87 94.49 14.51 3.58 19.94 4.13 8.89 26.8 0.00 Citizens & Northern Corporation PA CZNC 1,339 969 724 9.3 19.1 1.39 11.91 NA 54.12 24.01 1.17 91.37 0.02 0.69 165.3 3.29 VIST Financial Corp. PA VIST 1,289 1,006 899 5.4 13.0 0.48 5.05 3.39 69.42 35.11 1.43 38.07 0.72 2.61 46.3 2.86 Bryn Mawr Bank Corporation PA BMTC 1,281 953 904 9.7 15.0 0.76 8.26 3.90 66.58 33.71 1.09 77.03 1.05 1.02 207.0 3.31 Center Bancorp, Inc. NJ CNBC 1,196 802 723 6.9 12.3 0.39 4.36 3.37 64.04 7.00 1.19 92.23 0.51 0.78 111.5 1.59 CNB Financial Corporation PA CCNE 1,325 1,095 723 7.6 15.9 0.85 13.32 3.69 60.23 18.71 1.41 95.18 0.31 0.80 166.4 4.78 Shore Bancshares, Inc. MD SHBI 1,129 972 905 9.4 12.9 (0.20) (1.76) 3.95 62.52 30.95 1.47 30.48 2.22 3.86 80.0 2.50 High 1,937 1,578 1,529 9.7 19.1 1.39 15.77 4.98 111.25 37.83 3.58 484.58 4.13 8.89 291.2 5.18 Low 1,129 792 635 3.1 9.4 (1.17) (44.46) 2.76 53.13 5.05 0.94 14.81 0.00 0.15 12.5 0.00 Mean 1,484 1,189 981 7.2 14.0 0.46 3.57 3.70 67.08 20.94 1.57 124.30 0.81 2.15 141.7 2.61 Median 1,467 1,196 938 7.3 13.6 0.65 6.94 3.69 63.99 21.57 1.40 72.47 0.54 1.31 152.5 3.08 Orrstown Financial Services, Inc. PA ORRF 1,359 1,090 898 10.3 15.3 1.15 11.04 3.77 53.25 30.93 1.62 92.53 0.65 1.16 194.3 3.53 Asset Quality Profitability Valuation |