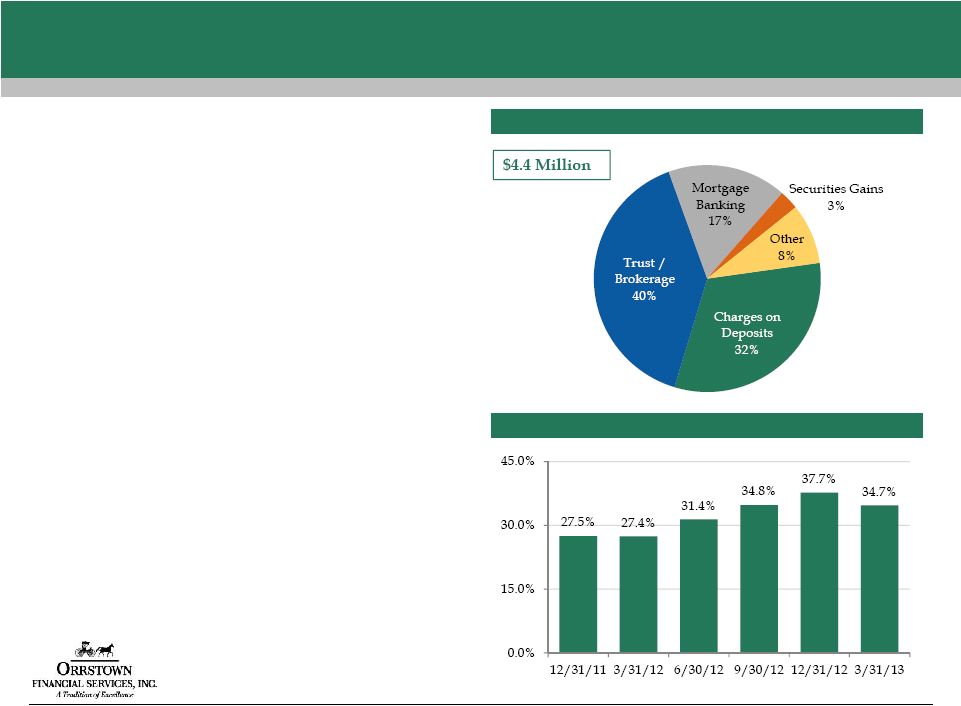

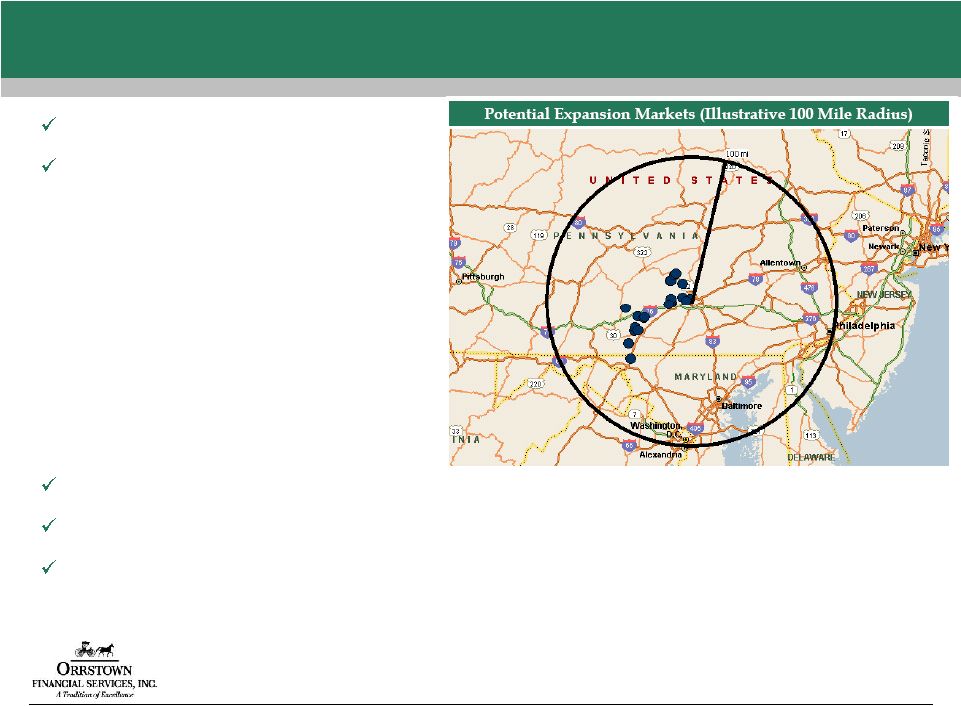

9 Fundamental Operations Net Interest Margin • Use current market opportunities to expand core funding • Convert NPAs to earning assets • Require pricing discipline amid competitors leading with price Loan Growth • Expansion on key lines of business (C&I, medical and professional) • Well positioned near substantial markets allowing for selective loan growth Increasing Fee Income • Target leveraging both deposit and loan customers • Both wealth management lines and transaction fees Efficiency Ratio • Branch optimization and expansion – disciplined return on invested capital approach • Utilize experiences of new management team members • Continual upgrading of employee talent level – driving revenue will lower efficiency ratio • “Operation Bottom Line”: 58% - 62% target efficiency ratio in the next 36 months Earnings Summary 1. Real Estate Owned Expenses include OREO expenses, gains and losses. 2. “Adjusted Earnings” is a non-GAAP-based financial measure calculated using non-GAAP-based amounts, including management’s definition of “non-core” items. 3. The efficiency ratio expresses noninterest expense as a percentage of tax equivalent net interest income and noninterest income, excluding securities gains, goodwill impairment, and other non-recurring items (excludes other litigation expenses for 3/31/13 and 12/31/12). For the Quarter Ended, (Dollars in 000s) 12/31/11 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 Net Interest Income (FTE) $12,265 $11,494 $10,129 $9,574 $8,954 $8,562 Noninterest Income 7,379 6,191 7,027 4,880 5,164 4,432 Noninterest Expense 30,486 10,883 10,733 11,133 10,600 10,949 Pre-Tax/ Pre-Provision Income (FTE) ($10,842) $6,802 $6,423 $3,321 $3,518 $2,045 Non-core Items: (Less) Realized Gain on Securities $3,025 $2,231 $2,595 ($2) - $122 + Goodwill Impair. & Intang. Amt. 19,500 52 52 52 52 52 + Collection and Problem Loan 477 719 579 593 407 182 + Other Litigation Charges - - - - 80 371 + Real Estate Owned Expenses (1) 368 376 100 230 128 43 "Adjusted" Earnings (2) $6,478 $5,718 $4,559 $4,198 $4,185 $2,571 "Adjusted" PTPP Return on Assets 1.76% 1.59% 1.28% 1.29% 1.34% 0.86% Efficiency Ratio (3) 63.9% 67.7% 72.7% 75.1% 73.2% 81.4% Net Interest Margin 3.45% 3.37% 2.96% 3.10% 3.00% 3.07% |