Exhibit 99

ORRSTOWN FINANCIAL SERVICES, INC. A Tradition of Excellence Annual Shareholder Meeting April 29, 2014

Forward Looking Statement Certain statements we may make today may constitute “forward looking statements” under the Private Securities Litigation Reform Act of 1995. Orrstown Financial’s actual results may differ significantly from the results discussed in such forward-looking statements. Factors that might cause such a difference include, but are not limited to, economic conditions, competition in the geographic and business areas in which Orrstown Financial conducts its operations, fluctuations in interest rates, credit quality, government regulation and other risks and uncertainties, including those described in the Company’s filings with the Securities and Exchange Commission. The statements we make today are valid only as of today’s date and we disclaim any obligation to update this information.

ORRSTOWN FINANCIAL SERVICES, INC. A Tradition of Excellence Joel Zullinger Chairman of the Board Conduct Meeting Business

|

|

Rules of Conduct In the interest of an orderly Meeting of the Shareholders of Orrstown Financial Services, Inc. (the “Company”), we ask you to honor the following rules of procedure: Shareholders should not address the Meeting until recognized by the Chairman of the Meeting. Upon recognition by the Chairman, the shareholder will have the floor. Speakers should then state their name and status as a shareholder. We ask that shareholders approach the microphone at the front of the theater. The business of the Meeting will be taken up as set forth in the Agenda. When an item on the Agenda is before the Meeting for consideration, questions and comments should be confined solely to that item. Questions or comments not related to an Agenda item will not be entertained at the Meeting. If there are any matters of individual concern to a shareholder, they should be raised after the Meeting with representatives of the Company.

|

|

Rules of Conduct Shareholders should confine comments to one subject at a time in order to give other shareholders an opportunity to speak on that subject. Please permit the speaker to conclude his or her remarks without interruption. A shareholder will be permitted up to two minutes to address the Meeting when recognized by the Chairman. Derogatory references to personalities or comments that are otherwise in bad taste or any outbursts of demonstration will not be permitted and will be a basis for removal from the Meeting. No cameras or other recording devices will be permitted at the Meeting. All cell phones, pagers and other electronic communication devices must be turned off.

|

|

Rules of Conduct The views, constructive comments and criticisms of the shareholders are welcome, but the purpose of the Meeting will be observed. The Chairman will stop discussions that are: Irrelevant to the matter under consideration Proposals related to the conduct of the Company’s ordinary business operations, Derogatory or inflammatory, Related to customers of Orrstown Bank, or In substance repetitious statements made by other persons.

ORRSTOWN FINANCIAL SERVICES, INC. A Tradition of Excellence Joel Zullinger Chairman of the Board Conduct Meeting Business

ORRSTOWN FINANCIAL SERVICES, INC. A Tradition of Excellence Thomas R. Quinn, Jr. President & Chief Executive Officer Management Report

Management Report Agenda 2013: Summary of performance Update on last year’s objectives Financial review Primary focus for 2014 Questions from our shareholders

2013: Summary of Performance Returned to full-year profitability Many regulatory issues resolved Safe and sound footing Poised for growth Will restore dividend as soon as able

2013 Priorities: Status Report Enterprise risk focus Regulatory progress Sustainable earnings quarter over quarter Enhance earnings through loan growth Strategic investments in technology Reinforce the Orrstown Bank brand Enhance shareholder value Expense control Restore dividends Build a diversified and growing balance sheet

1: Enterprise Risk Management

2: Regulatory Progress

3: Earnings Sustainable earnings quarter over quarter

4: Earnings Enhance earnings through loan growth Commercial Lending growth (Q1 2014) Strong year for Retail Banking Another strong year for the Mortgage Unit Another record revenue year for OFA

5: Strategic Investments Technology Operations and infrastructure Support safety and soundness

6: Reinforce the Orrstown Brand More efficient marketing spend (optimize delivery channels) Year over Year reduction of ~$500,000 VIDEO PLAYS: “(0:30) Orrstown Bank TV Commercial, on the spot/retail banking”

7: Enhance Shareholder Value

8: Expense Control

9: Restore Dividends

10: Balance Sheet Build a diversified and growing balance sheet

Orrstown FINANCIAL SERVICES, INC. A Tradition of Excellence David P. Boyle Chief Financial Officer Summary Financial Review

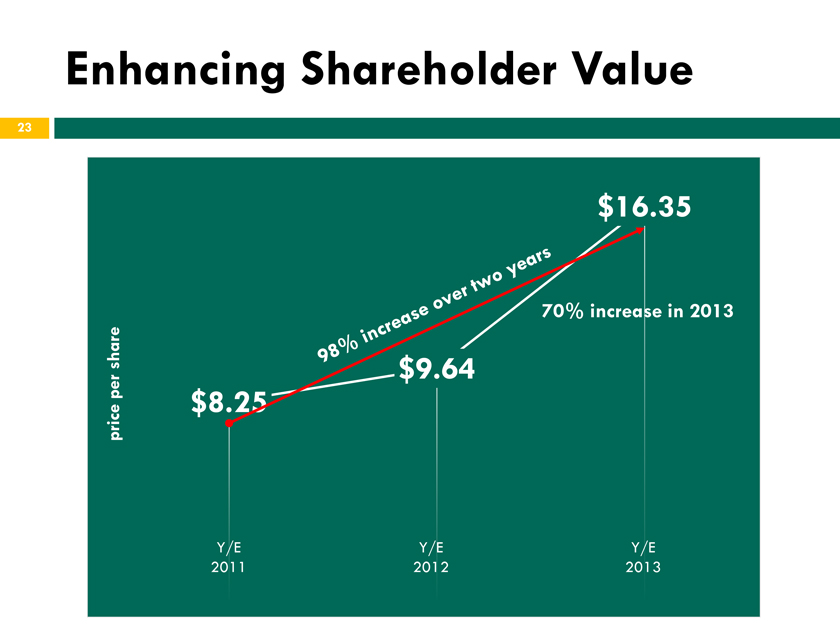

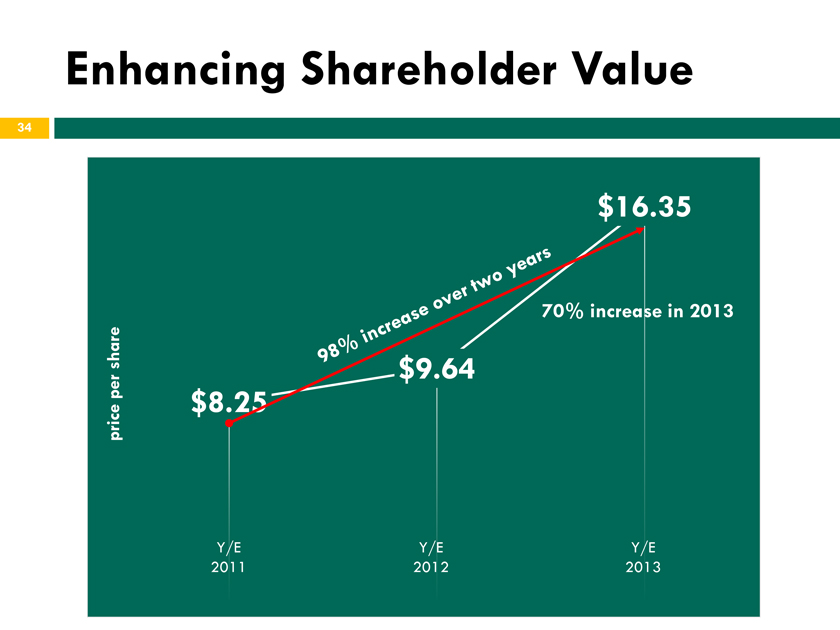

Enhancing Shareholder Value $16.35 price per share 70% increase in 2013 Y/E 2011 Y/E 2012 Y/E 2013 $8.25 $9.64 $98% increase over two years

2013: Return to Profitability (net income in millions) $13.37 $16.58 2011 2012 $10.00 2009 2010 2013 $19.0 goodwill $20.2 DTA (yet to be reversed) impairment) -$31.96 -$38.45

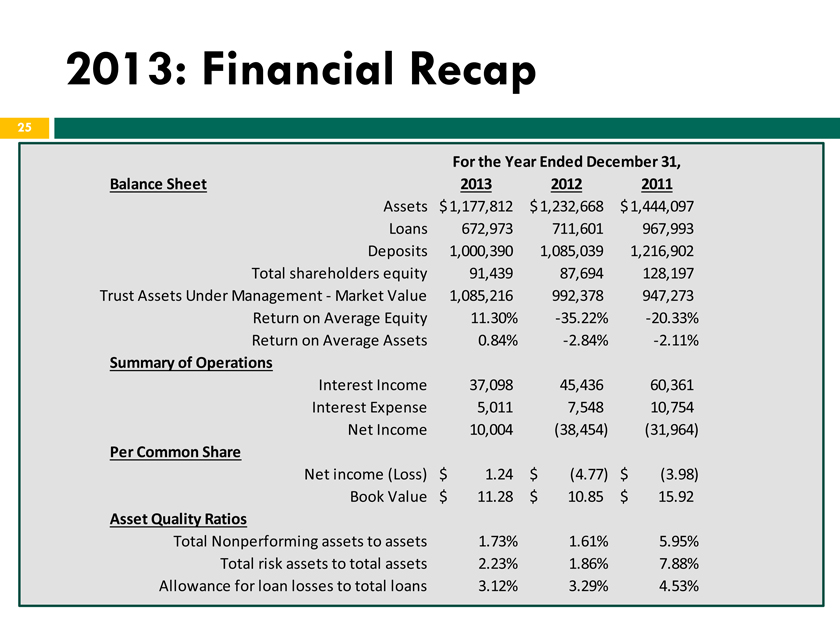

2013: Financial Recap For the Year Ended December 31, Balance Sheet 2013 2012 2011 Assets $ 1,177,812 $ 1,232,668 $ 1,444,097 Loans 672,973 711,601 967,993 Deposits 1,000,390 1,085,039 1,216,902 Total shareholders equity 91,439 87,694 128,197 Trust Assets Under Management—Market Value 1,085,216 992,378 947,273 Return on Average Equity 11.30% -35.22% -20.33% Return on Average Assets 0.84% -2.84% -2.11% Summary of Operations Interest Income 37,098 45,436 60,361 Interest Expense 5,011 7,548 10,754 Net Income 10,004(38,454)(31,964) Per Common Share Net income (Loss) $ 1.24 $ (4.77) $ (3.98) Book Value $ 11.28 $ 10.85 $ 15.92 Asset Quality Ratios Total Nonperforming assets to assets 1.73% 1.61% 5.95% Total risk assets to total assets 2.23% 1.86% 7.88% Allowance for loan losses to total loans 3.12% 3.29% 4.53%

|

|

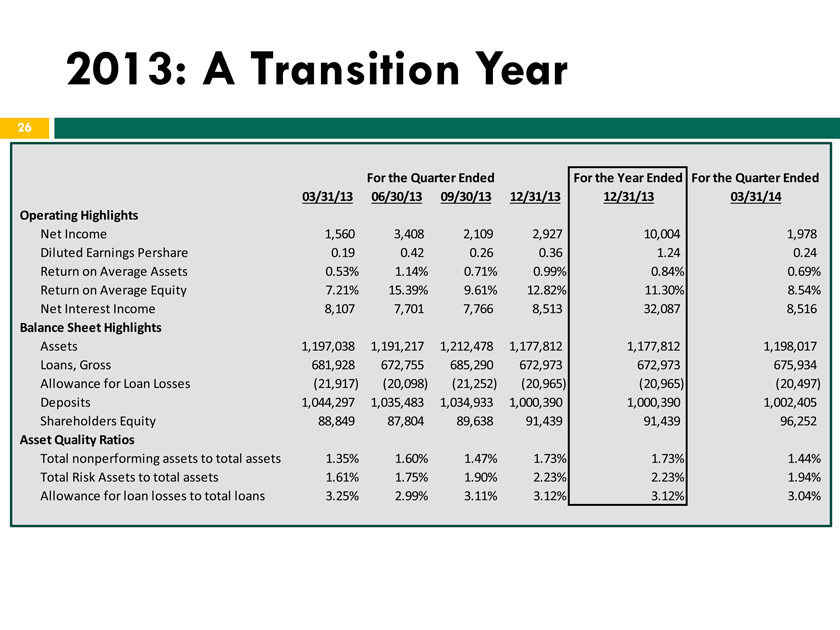

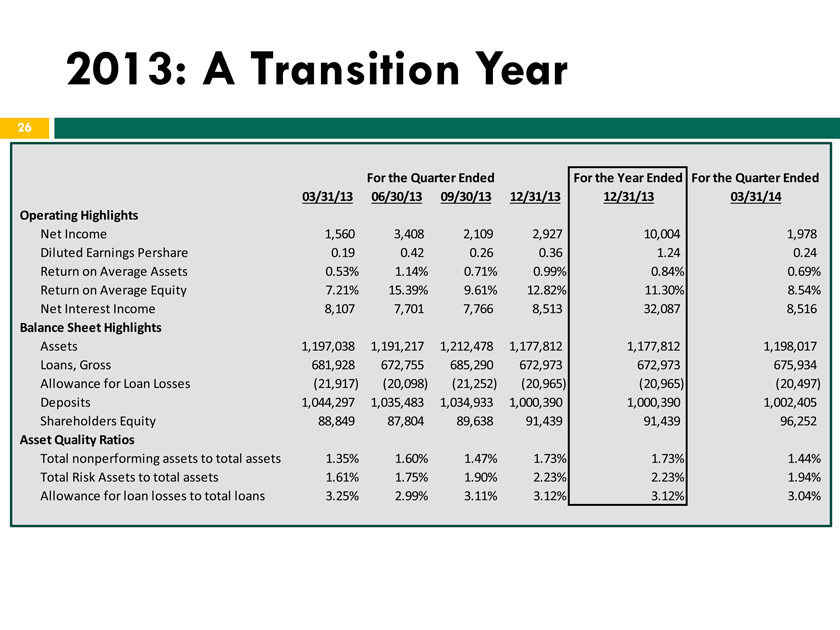

2013: A Transition Year For the Quarter Ended For the Year Ended For the Quarter Ended 03/31/13 06/30/13 09/30/13 12/31/13 12/31/13 03/31/14 Operating Highlights Net Income 1,560 3,408 2,109 2,927 10,004 1,978 Diluted Earnings Pershare 0.19 0.42 0.26 0.36 1.24 0.24 Return on Average Assets 0.53°% 1.14% 0.71% 0.99% 0.84% 0.69% Return on Average Equity 7.21% 15.39% 9.61% 12.82% 11.30% 8.54% Net Interest Income 8,107 7,701 7,766 8,513 32,087 8,516 Balance Sheet Highlights Assets 1,197,038 1,191,217 1,212,478 1,177,812 1,177,812 1,198,017 Loans, Gross 681,928 672,755 685,290 672,973 672,973 675,934 Allowance for Loan Losses (21,917) (20,098) (21,252) (20,965) (20,965) (20,497) Deposits 1,044,297 1,035,483 1,034,933 1,000,390 1,000,390 1,002,405 Shareholders Equity 88,849 87,804 89,638 91,439 91,439 96,252 Asset Quality Ratios Total nonperforming assets to total assets 1.35% 1.60% 1.47% 1.73% 1.73% 1.44% Total Risk Assets to total assets 1.61% 1.75% 1.90% 2.23% 2.23% 1.94% Allowance for loan losses to total loans 3.25% 2.99% 3.11% 3.12% 3.12% 3.04%

|

|

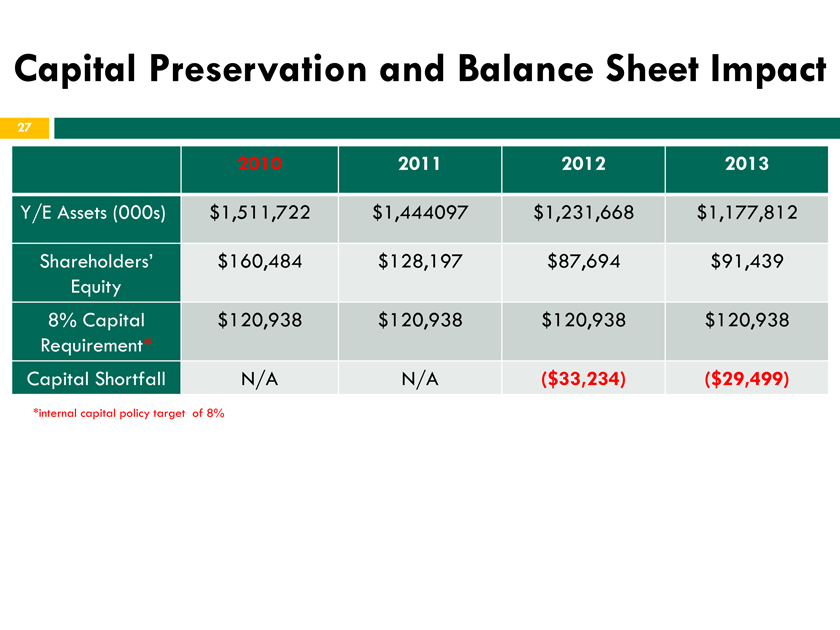

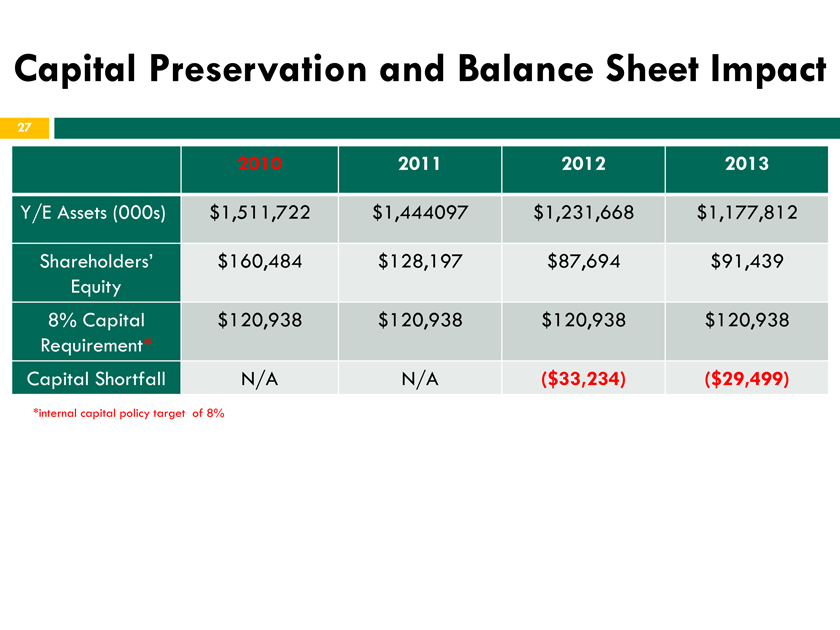

Capital Preservation and Balance Sheet Impact 2011 2012 2013 Y/E Assets (000s) $1,511,722 $1,444097 $1,231,668 $1,177,812 Shareholders’ Equity $160,484 $128,197 $87,694 $91,439 8% Capital Requirement $120,938 $120,938 $120,938 $120,938 Capital Shortfall N/A N/A ($33,234) ($29,499) *internal capital policy target of 8%

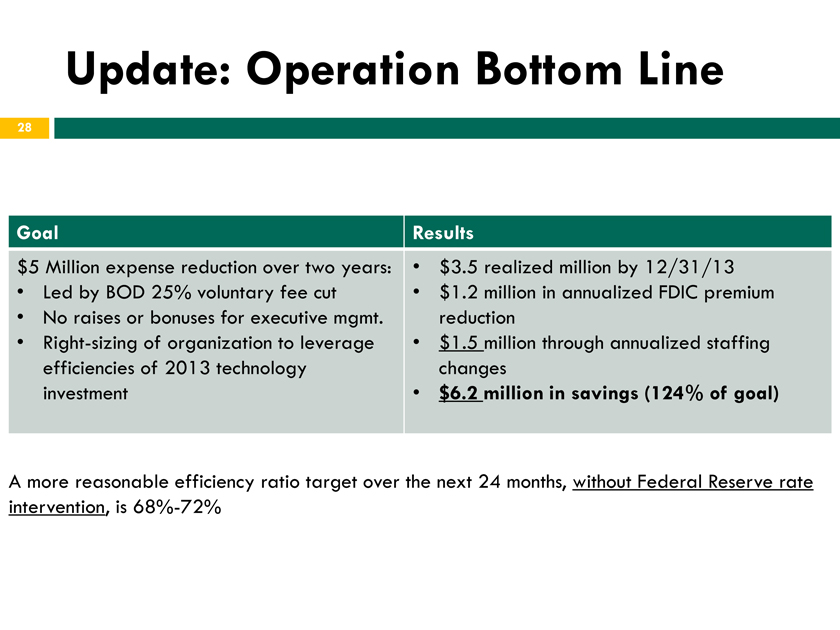

Update: Operation Bottom Line Goal Results $5 Million expense reduction over two years: • Led by BOD 25% voluntary fee cut • No raises or bonuses for executive mgmt. • Right-sizing of organization to leverage efficiencies of 2013 technology investment • $3.5 realized million by 12/31/13 • $1.2 million in annualized FDIC premium reduction • $1.5 million through annualized staffing changes • $6.2 million in savings (124% of goal) A more reasonable efficiency ratio target over the next 24 months, without Federal Reserve rate intervention, is 68%-72%

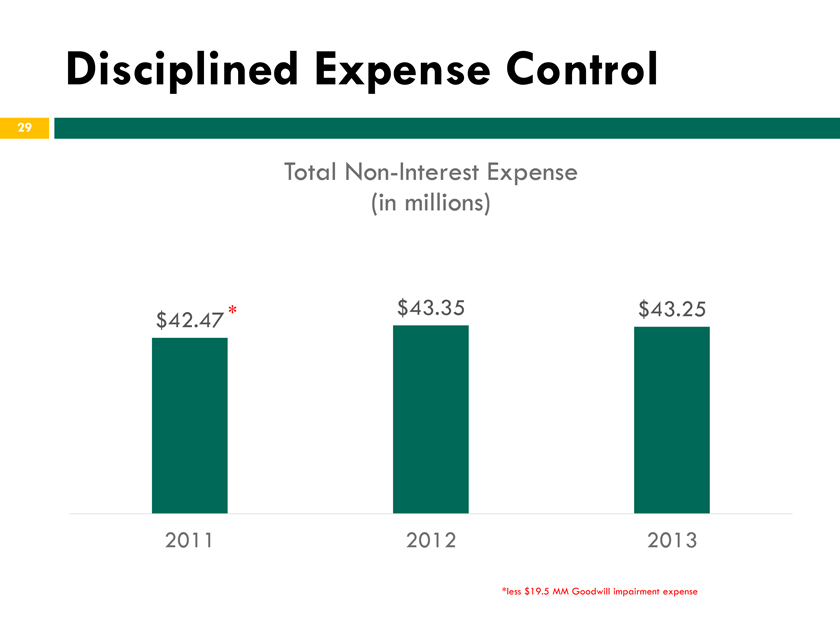

Disciplined Expense Control *less $19.5 MM Goodwill impairment expense Total Non-Interest Expense (in millions) $42.47* $43.35 $43.25 2011 2012 2013

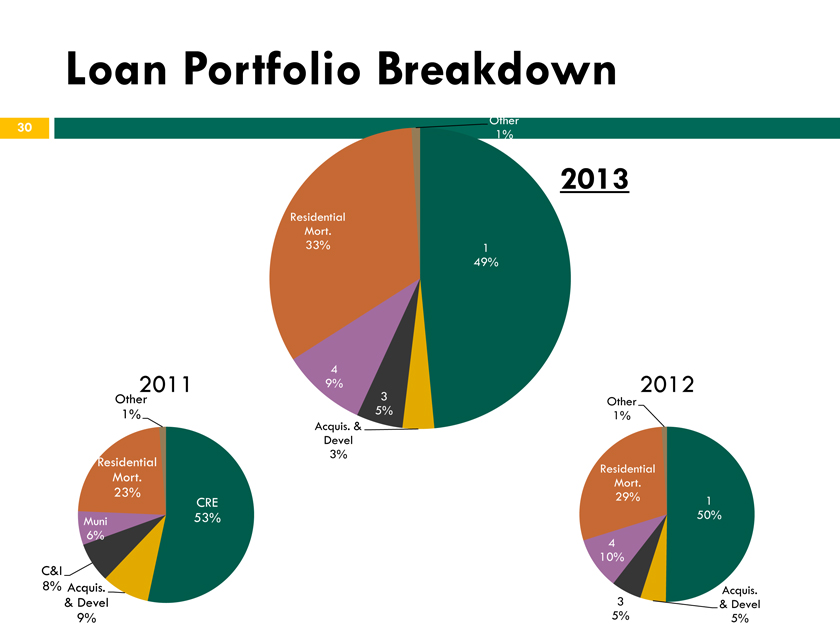

Loan Portfolio Breakdown 50% Acquis. & Devel 5% 3 5% 4 10% Residential Mort. 29% Other 1% 2012 1 49% Acquis. & Devel 3% 3 5% 4 9% Residential Mort. 33% 2011 Residential Mort. 23% CRE 53% Muni 6% 2011 2013 1 Other 1%

Funding Composition 3 7% 4 20% 5 9% Brokered Money 11% Noninterest bearing 11% 2 44% 3 8% 4 18% 5 8% (12/31/11) A Core Funded Franchise 2 42% Brokered Money 11% Noninterest bearing 11% 2 42% 3 6% 4 20% 5 12% Brokered Money 11% Noninterest bearing 11%

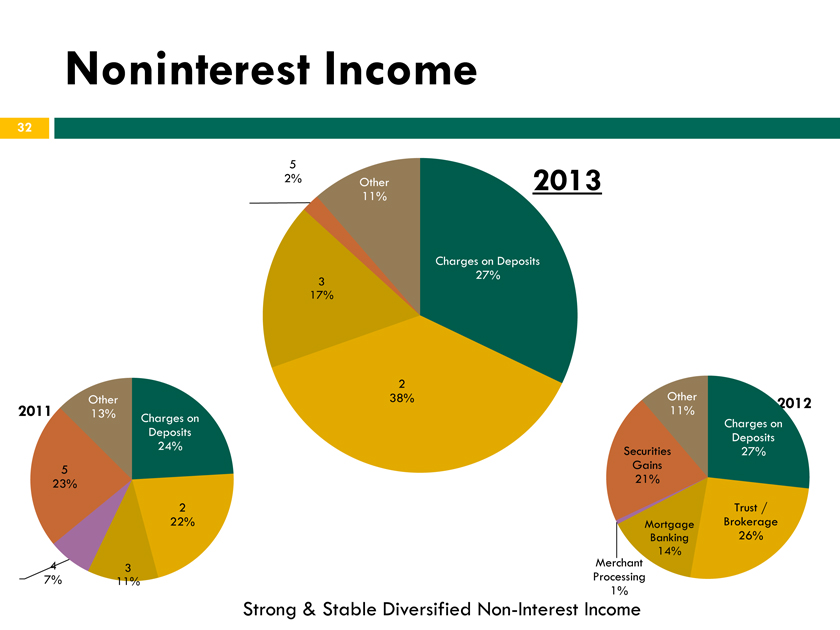

Noninterest Income 26% Mortgage Banking 14% Merchant Processing 1% Securities Gains 21% Other 11% Charges on Deposits 24% 2 22% 3 11% 4 7% 5 23% Other 13% Strong & Stable Diversified Non-Interest Income Charges on Deposits 27% 2 38% 3 17% 5 2% Other 11%2013 2012 Charges on Deposits 27% Trust / Brokerage 2011

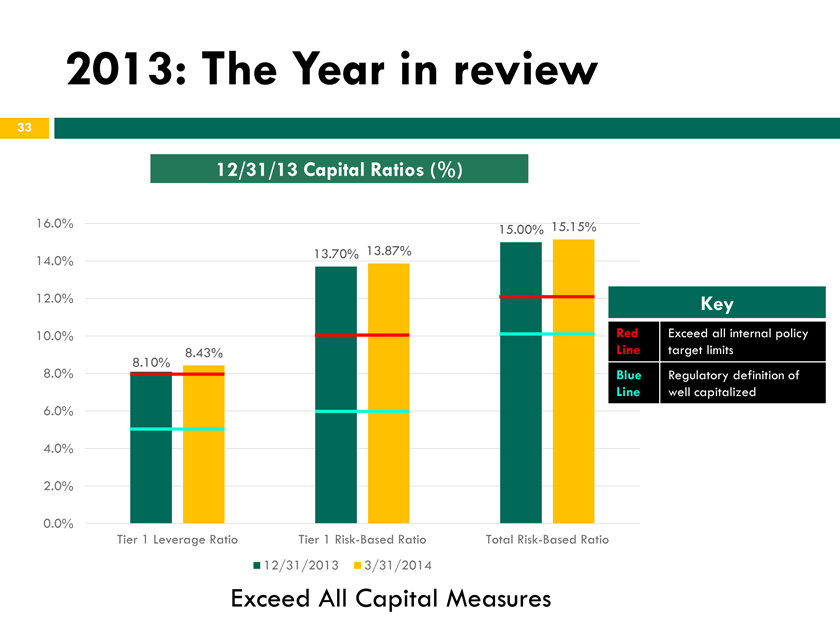

2013: The Year in review 12/31/13 Capital Ratios (%) 16.0% 14.0% 1 2.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% 13.70% 13.87% Key Red Line Exceed all internal policy target limits Blue Line Regulatory definition of well capitalized Tier 1 Leverage Ratio Total Risk-Based Ratio Tier 1 Risk-Based Ratio 12/31/2013 3/31/2014 Exceed All Capital Measures 8.10% 8.43% 15.00% 15.15%

Enhancing Shareholder Value $16.35 price per share 70% increase in 2013 Y/E 2011 Y/E 2012 Y/E 2013 $8.25 $9.64 $16.35 98% increase over two years

Orrstown FINANCIAL SERVICES, INC. A Tradition of Excellence Thomas R. Quinn, Jr. President & Chief Executive Officer Management Report

2014 Priorities Continue to Work with Primary Regulators to Remediate few remaining matters Build a Diversified and Growing Balance Sheet Revenue Growth Improve our Efficiency Ratio Orrstown

2014 Priorities Leverage Data and Technology Retail enhancements New delivery channels Simplified product line Focus on fee income generation Obtain greater share of customers’ business Restore dividends

Orrstown FINANCIAL SERVICES, INC A Tradition of Excellence Joel Zullinger Chairman of the Board Conduct Meeting Business

Orrstown FINANCIAL SERVICES, INC A Tradition of Excellence The Floor is Open for Questions

Orrstown FINANCIAL SERVICES, INC. A Tradition of Excellence Annual Shareholder Meeting Thank You

VIDEO PLAYS: (2:54) closing video-Orrstown Bank “on the spot” employee montage