ARC WIRELESS SOLUTIONS, INC.

6330 North Washington Street, Unit #13

Denver, Colorado 80216-1146

VIA EDGAR CORRESPONDENCE

May 29, 2012

U.S. Securities & Exchange Commission

| Attention: | Larry Spirgel, Branch Chief |

| | Celeste M. Murphy, Legal Branch Chief |

| | Ajay Koduri, Staff Attorney |

| | Ivette Leon, Assistant Chief Accountant |

| | Carlos Pacho, Senior Assistant Chief Accountant |

| Re: | ARC Wireless Solutions, Inc. |

| | Preliminary Proxy Statement |

| | Filed April 13, 2012 |

| | File No. 001-33400 |

Ladies and Gentlemen,

This letter is submitted to the U.S. Securities & Exchange Commission (the “SEC”) in response to the comment letter issued by the Staff of the SEC on May 9, 2012 (the “Comment Letter”) in respect of the preliminary proxy statement filed by ARC Wireless Solutions, Inc., (referred to herein as “ARC” and the “Company”) on April 13, 2012 (the “Preliminary Proxy Statement”).

The Company intends to file the amended Preliminary Proxy Statement as soon as possible upon completion of (a) the annual audit of Advanced Forming Technology, Inc. (“AFT”) for its fiscal year ended March 31, 2012; and (b) the unaudited quarterly financial statements for the Quadrant Metals Technologies, Inc. (“QMT”) companies as of March 31, 2012.

We respectfully advise the Staff of the SEC that each of the agreements applicable to the proposed acquisitions of AFT and QMT to be presented for approval by the shareholders of ARC contain provisions for termination of such agreements by the respective sellers if the closings shall not have occurred on or before June 25, 2012.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

In the interim period prior to filing of our amendment to the Preliminary Proxy Statement, we are respectfully filing the comprehensive responses to the Comment Letter in advance of the filing of the amended Preliminary Proxy Statement with a view to resolve all, or substantially all, of the Staff’s comments on the prior Preliminary Proxy Statement so that the definitive proxy statement for the prospective acquisitions may be presented to the shareholders prior to the possible termination of the agreements. Our counsel has spoken with Ms. Celeste M. Murphy on Monday, May 29, 2012 to confirm our proposed course of action regarding resolution of the Staff’s comments. In such regard, all of the responses contained herein will be included in the amended Preliminary Proxy Statement which for purposes of completeness are set forth herein in their entirety.

For convenience, we restate in this response letter each of the Staff’s comments in bold prior to each of our responses set forth below.

General

1. Please note, although our comments may ask for revisions in a certain part of the proxy, to provide fulsome disclosure, you may need to revise other parts. Please revise all applicable parts of your proxy.

We have taken note of the Staff’s comment to make revisions to all applicable parts of the Proxy Statement.We will make conforming changes throughout the amended Preliminary Proxy Statement responsive to all of the Staff’s requests for further details and information in the Comment Letter to which we respond below. Upon filing of the amended Preliminary Proxy Statement we will provide the Staff with a cross-reference index indicating the respective page numbers on which the conforming changes have been made.

Question and Answers, page 1

Q: Why is ARC acquiring QMT and AFT?, page 2

| 2. | We note from page 88 that ARC designs and develops hardware, including antennas, radios, and related accessories, used in broadband and other wireless networks. QMT and AFT, on the other hand, are in the specialty metals business. Please make clear any synergies among ARC’s business and QMT’s and AFT’s business, explain whether the company is pursuing a different business direction, how QMT’s and AFT’s business will affect ARC, and whether the company intends to pursue ARC’s line of business. Please revise the appropriate places of your proxy statement such as ARC’s MD&A. |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

Some of the more significant synergies among ARC, QMT and AFT include the following:

| · | The broad array of technical expertise (materials, processes, technical talent) will allow for sharing and transfer of best practices and technical advancements among the companies; |

| · | The combination of the businesses is anticipated to create economic efficiencies for significant supplier and vendor negotiation advantages among the businesses, thereby providing potential for significant cost savings and the opportunity for overall margin enhancement going forward; |

| · | Economies of scale through a larger organization are also expected to facilitate better per-unit pricing on insurance, employee benefits and similar efficiencies; |

| · | Larger scale revenues and balance sheet assets are anticipated to provide the basis to negotiate better credit terms with suppliers; |

| · | The presence of AFT in Hungary is expected to provide low cost country manufacturing for distribution in Europe and to emerging markets to supplement the U.S. operations; |

| · | We intend to explore using ARC’s existing relationships and supply chain in China for future production of QMT and AFT products; and |

| · | Larger scale revenues to support mainly fixed costs are expected to provide greater cost efficiencies for the Company and its shareholders, including, without limitation, with respect to Nasdaq fees, legal compliance costs, audit fees, transfer agent fees, filing fees, annual meeting costs, investor relations costs, board of directors compensation and similar annual expenditures. |

We also believe that following the QMT and AFT Acquisitions there will be significant opportunities to apply our established management techniques to improve margin and return on invested capital. The Acquisitions are expected to provide a platform for additional acquisitions. The Acquisitions are also expected to deliver accretive earnings and to return enhanced value on invested capital within three to five years.

In addition, the Company intends to continue to continue to design and develop hardware, including antennas, radios, and related accessories, used in broadband and other wireless networks. We supply our antenna products to public and private carriers, wireless infrastructure providers, wireless equipment distributors, value added resellers and other original equipment manufacturers.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

Both the QMT and AFT companies have strong operating platforms and are expected to provide ARC with significant scale and revenue diversity. Company management believes that the combination and synergies of the companies will provide a strong foundation for ARC to become a leading diversified manufacturing company.

Q: Is ARC entering into Financing Arrangements in Connection with the Acquisitions?, page 3

| 3. | We note your financing arrangements. Please specify the portion of the proceeds that will be used to fund the cash portion of the AFT Acquisition. Please also provide more details on the terms of the loans and other material terms applicable to financing arrangements. Also present disclosure on these financing arrangements in the Liquidity section of ARC’s MD&A. |

Subsequent to the date of filing the initial Preliminary Proxy Statement the Company has continued to negotiate the terms and conditions of the credit facility with TD Bank, N.A. (“TD Bank”). As of the date hereof, the terms of the credit facility have been revised. The changes, together with a high level of detail regarding the terms and conditions of the TD Bank credit facility, will be reflected in the amended Preliminary Proxy Statement.

Q: Do any controlling shareholders, executive officers or directors of ARC have interests…, page 3

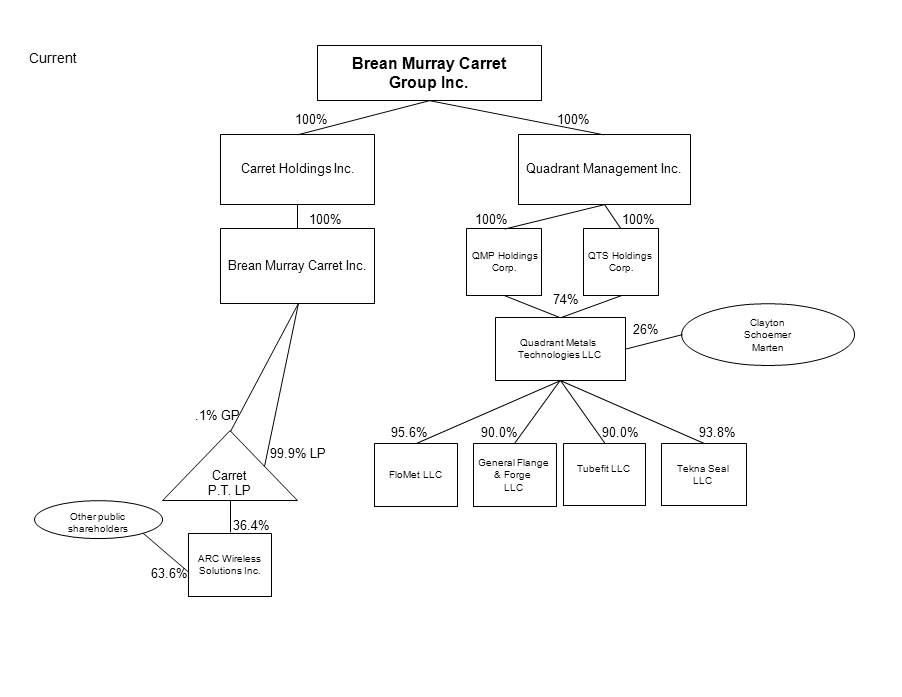

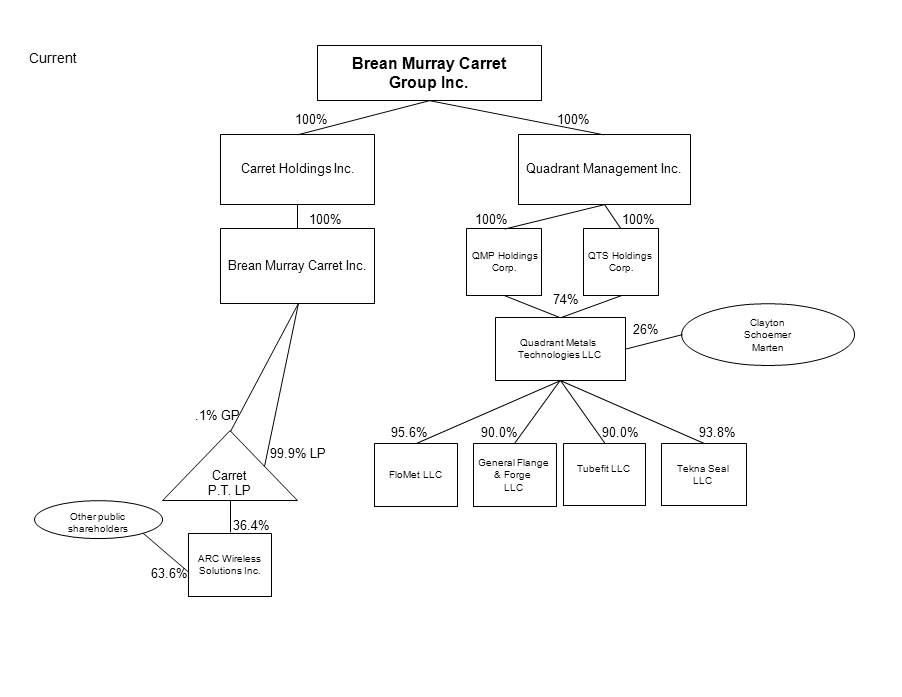

| 4. | You disclose Brean Murray and Quadrant are under common control and, therefore, Brean Murray, Quadrant, ARC, and QMT are affiliates under common control. Please revise to specify how Brean Murray and Quadrant are under common control; disclose the entities and ownership interests that show common control. If it is helpful to explain the relationships, please consider presenting a chart. |

Specifically, Brean Murray controls 100% of the ownership interests of Quadrant as well as, via certain wholly-owned intermediaries, 36.4% of the shares of ARC. Please see the chart set forth below for a detailed description of the relationships, both currently prior to giving effect to the proposed ARC acquisitions of QMT and AFT, as well as the proforma chart giving effect to the ARC acquisitions of QMT and AFT as well as the ancillary transactions discussed herein, between and among Brean Murray, Quadrant, ARC, QMT and other entities, including the proposed name change of ARC.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| 5. | Also please disclose the person to whom Mr. Nemeth is related by marriage and clearly specify the relation. |

Mr. Nemeth is the brother-in-law of Mr. Alan Quasha who serves as the Co-Chairman of Brean Murray and the President of Quadrant Management, Inc.

| 6. | We also note Quadrant has an Advisory Agreement with ARC since November 2008. Please disclose how much has been paid in the aggregate under this Agreement to Quadrant and how much has been paid each year. |

Quadrant has been paid $250,000 per year since 2008 and has received $1,000,000 in fees in the aggregate since inception of the Agreement. To date, Quadrant has been paid $62,500 in fees for the first quarter of 2012.

The ARC Advisory Agreement technically provides Quadrant the right to receive 20% of ARC’s EBITDA, even if such EBITDA is derived from the QMT acquisition and the AFT acquisition. However, Quadrant has granted waivers to certain provisions of the ARC Advisory Agreement, in the form attached as Annex H to the Preliminary Proxy Statement (the “Quadrant Waiver”), such that: (I) in calendar year 2012 Quadrant shall only be paid an annual fee equal to the greater of (i) $250,000; (ii) the product of (a) 20% and (b) the EBITDA of ARC for the twelve months ending December 31, 2012 less the combined EBITDA of QMT and AFT for the twelve months ending February 29, 2012 less the EBITDA of ARC for the twelve months ending December 31, 2011; or (iii) the product of (a) 20% and (b) the reported EBITDA for the financial year of the Company minus the reported EBITDA for QMT and AFT for the twelve months ended February 29, 2012; and (II) in calendar year 2013 Quadrant shall only be paid an annual fee equal to the greater of (i) $250,000; (ii) the product of (a) 20% and (b) the EBITDA of ARC for the twelve months ending December 31, 2013 less the EBITDA of ARC for the twelve months ending December 31, 2012; or (iii) the product of (a) 20% and (b) the reported EBITDA for the financial year of the Company minus the reported EBITDA for QMT and AFT for the twelve months ended February 29, 2012. The ARC Advisory Agreement has been further revised such that it shall no longer extend for additional one-year periods after its expiration on December 31, 2013 in the absence of written termination notice by either party.

Q: What is the role of the Special Committee?, page 4

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| 7. | We note from the first paragraph on page 5 that the QMT Acquisition and Securities Sale will be deemed approved only if a majority of the disinterested shareholders voting on the proposal vote in favor of the QMT Acquisition and Securities Sale. Please revise to explain in more detail who qualifies as “disinterested.” |

The “disinterested shareholders” are shareholders of the Company who do not have any direct or indirect familial, financial, professional, or employment relationship with the Company, QMT or AFT, or any of their respective subsidiaries or affiliates.

| 8. | We also note your disclosure in the second paragraph on page 5. Please disclose whether Quadrant or any one affiliated with QMT has any relationship that would cause a conflict of interest with respect to the AFT acquisition. |

Neither Quadrant nor any persons affiliated with QMT have any relationships that would cause a conflict of interest with respect to the AFT acquisition.

Q: Why is ARC seeking shareholder approval of the Acquisition and issuance of the shares of Common Stock as described in Proposal Nos. 2 and 3?

| 9. | We note your disclosure in the first paragraph on page 7. Please further disclose what claims, if any, shareholders would have after Proposal Nos. 2 and 3 are approved by disinterested shareholders. If shareholders effectively would have no further claims under state law, please disclose as such. |

| | Under Section 16-10a-853 of the Utah Revised Business Corporation Act, a transaction may not be enjoined, set aside, or give rise to an award of damages or other sanctions, in a proceeding by any shareholder or by or in the right of the corporation, solely because the director, or any person with whom or which the director has a personal, economic, or other association, has an interest in the transaction, if the transaction has been approved by a majority of the votes entitled to be cast by disinterested shareholders present in person or by proxy at a meeting properly called for such purpose. As such, if the QMT Acquisition is approved by a majority of disinterested shareholders present and voting at the Annual Meeting in person or by proxy, the shareholders of the Company would thereafter have no basis for further claims under state law in such regard. |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

Summary, page 14

| 10. | We note your disclosure regarding the three individual parties who are the Non- Controlling QMT Investors. Please disclose these persons. |

| | The Non-Controlling QMT Investors are Mr. John Schoemer, Mr. Arlan Clayton and Mr. Robert Marten. Mr. Marten currently serves as CEO of QMT. |

In addition, the Company will include the following table in the amended Preliminary Proxy Statement showing ownership of QMT prior to the transaction, with an explanation that Quadrant is the owner of QTS Holdings Corp. and QMP Holdings Corp., constituting approximately 74% ownership of QMT prior to the acquisition by ARC:

| QMP Holdings Corp. | | | 18,614 | | | | 49.71 | % |

| QTS Holdings Corp. | | | 9,063 | | | | 24.20 | % |

| Arlan Clayton | | | 7,490 | | | | 20.00 | % |

| John Schoemer | | | 1,498 | | | | 4.00 | % |

| Robert Marten | | | 780 | | | | 2.08 | % |

| Total | | | 37,445 | | | | 100.0 | % |

Purchase of ARC Common Stock by Carret P.T., LP, page 15

| 11. | We note your explanation of the reason for the purchase by Carret on page 113. Please also present the disclosure here. |

As part of the QMT Acquisition Agreement, simultaneously at closing of the QMT Acquisition Agreement, Carret P.T. LP, an affiliate of Brean Murray, will purchase from ARC, at a purchase price of $4.00 per share ($7.80 per share giving effect to the 1-for-1.95 Reverse Stock Split), 112,648 shares of ARC Common Stock (equal to 57,768 shares of ARC Common Stock after giving effect to the proposed 1:1.95 Reverse Stock Split) for total cash investment of $450,594 by Carret P.T., LP. The reasons for this sale are as follows: following the QMT Acquisition, the former shareholders of QMT will own 71% of the value of ARC. QMI could accomplish the proposed transaction without recognizing taxable gain if the transaction qualifies as a tax-free contribution of the QMT interests to ARC under Section 351 of the Internal Revenue Code of 1986, as amended (the “351 Transaction”). In order to qualify as a tax-free exchange, the 351 Transaction must result in the group of transferors of property to ARC owning at least 80% of the voting power and value of the outstanding stock of the transferee corporation. The Securities Sale is expected to accomplish meeting the conditions required for the 351 Transaction tax treatment. The proceeds of the Securities Sale will be available for general corporate purposes of ARC after closing of the Securities Sale.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| 12. | Also, supplementally, advise us whether the QMT Acquisition would be a taxable transaction to non-affiliated shareholders if the purchase was not made by Carret. |

| | There would be no tax effect on the unaffiliated shareholders of ARC if the purchase is not made by Carret. If Carret does not make the stock purchase, then the sole tax result is that the QMT shareholders would become subject to tax as of the date of exchange of their QMT membership interests for shares of ARC common stock. For purposes of clarity, the shareholders of ARC will not be subject to a taxable transaction in connection with the QMT Acquisition irrespective of whether Carret purchases or does not purchase the new shares of ARC Common Stock. Only the holders of QMT Membership Interests are affected for purposes of tax treatment with respect to the Carret purchase of ARC Common Stock. |

Interests of ARC’s Executive Officers and Directors in the AFT Transaction, page 19

| 13. | You disclose ARC will pay Quadrant transaction fees of about $1,600,000. Please update ARC’s MD&A regarding this known commitment. |

The Company will conform MD&A to add the following disclosures regarding this known commitment:

Pursuant to the original terms of the ARC Advisory Agreement entered into on January 21, 2009, attached as Annex G to the Preliminary Proxy Statement (the “ARC Advisory Agreement”), Quadrant has provided the Company financial advisory and business consulting services, including restructuring services. In consideration for the restructuring services provided by Quadrant since November 2008 and for ongoing services, the Company originally agreed to pay Quadrant the following compensation: (1) an initial cash fee of $250,000 upon signing the ARC Advisory Agreement; (2) an annual fee of the greater of: (i) $250,000, (ii) 20% of any increase in reported earnings before interest, taxes, depreciation and amortization after adjusting for one-time and non-recurring items (“EBITDA”) for the current financial year over preceding year, or (iii) 20% of reported EBITDA for the current financial year; and (3) all reasonable out-of-pocket expenses incurred Quadrant in performing services under the ARC Advisory Agreement.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

The ARC Advisory Agreement technically provides Quadrant the right to receive 20% of ARC’s EBITDA, even if such EBITDA is derived from the QMT acquisition and the AFT acquisition. However, Quadrant has granted waivers to certain provisions of the ARC Advisory Agreement, in the form attached as Annex H to the Preliminary Proxy Statement (the “Quadrant Waiver”), such that: (I) in calendar year 2012 Quadrant shall only be paid an annual fee equal to the greater of (i) $250,000; (ii) the product of (a) 20% and (b) the EBITDA of ARC for the twelve months ending December 31, 2012 less the combined EBITDA of QMT and AFT for the twelve months ending February 29, 2012 less the EBITDA of ARC for the twelve months ending December 31, 2011; or (iii) the product of (a) 20% and (b) the reported EBITDA for the financial year of the Company minus the reported EBITDA for QMT and AFT for the twelve months ended February 29, 2012; and (II) in calendar year 2013 Quadrant shall only be paid an annual fee equal to the greater of (i) $250,000; (ii) the product of (a) 20% and (b) the EBITDA of ARC for the twelve months ending December 31, 2013 less the EBITDA of ARC for the twelve months ending December 31, 2012; or (iii) the product of (a) 20% and (b) the reported EBITDA for the financial year of the Company minus the reported EBITDA for QMT and AFT for the twelve months ended February 29, 2012. The ARC Advisory Agreement has been further revised such that it shall no longer extend for additional one-year periods after its expiration on December 31, 2013 in the absence of written termination notice by either party.

In consideration for granting the foregoing waiver, and in consideration for substantial merger and acquisition support services rendered to ARC over the past several years, Quadrant and ARC will enter into a Letter Agreement in the form of Annex K to the Preliminary Proxy Statement pursuant to which ARC will pay Quadrant transaction fees upon the closing of the QMT and AFT acquisitions, calculated by reference to 2% of the total enterprise value for the QMT Acquisition and AFT Acquisition, which shall result in an estimated fee payment to Quadrant by ARC of approximately $1,600,000. Payment of the fee by ARC is contingent on closing of the QMT Acquisition and AFT Acquisition.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

Risk Factors, page 26

The Acquisitions could result in significant integration costs and any material delays…, page 33

| 14. | Please quantify the integration costs if possible or provide a range. Update ARC’s MD&A as necessary. |

At this time, it is difficult for management to precisely quantify the integration costs associated with these acquisitions as there could be several unknown factors that could potentially drive these costs post-closing. In terms of a broad range, we estimate the total integration costs could be in the range of $300,000 to $500,000. We will update the MD&A section of the amended Preliminary Proxy Statement accordingly.

The Inability of the Company to satisfy National Securities Exchange listing requirements…, page 36

| 15. | We note that you may be required to file a new listing application and may not qualify for listing. Please refer to Rule 13e-3, in specific paragraphs (a)(3)(i) and (ii), and tell us whether the QMT Acquisition and Securities Sale would fall within the parameters of Rule 13e-3. |

The transactions proposed by ARC to its shareholders and its affiliates include actions which are within the scope of Rule 13e-3(a)(i)(A)1 and (C).2 However, the transactions are not within the ambit of Rule 13e-3(a)(ii)3 because, in apposition to Rule 13e-3(a)(ii), Section 7.1(n) of the QMT Purchase Agreement expressly requires as a closing condition that if ARC is required to file an application pertaining to the continuation of listing for trading of ARC’s common stock on a national securities exchange, such application or applications, as the case may be, shall have been approved in writing by the respective securities regulatory organizations having jurisdiction over such application. In addition, ARC’s common stock must remain eligible and qualified for trading on at least one national securities exchange immediately following the Closing Date and must retain such eligibility and qualification immediately following the Closing Date free from any delisting determination, notice of non-compliance with listing criteria or similar proceeding.

_________________________

| 1 | 13e3(a)(i)(A): A purchase of any equity security by the issuer of such security or by an affiliate of such issuer. |

| 2 | 13e3(a)(i) (C) A solicitation subject to Regulation 14A [§§240.14a–1 to 240.14b–1] of any proxy, consent or authorization of, or a distribution subject to Regulation 14C [§§240.14c–1 to 14c–101] of information statements to, any equity security holder by the issuer of the class of securities or by an affiliate of such issuer, in connection with: a merger, consolidation, reclassification, recapitalization, reorganization or similar corporate transaction of an issuer or between an issuer (or its subsidiaries) and its affiliate; a sale of substantially all the assets of an issuer to its affiliate or group of affiliates; or a reverse stock split of any class of equity securities of the issuer involving the purchase of fractional interests. |

| 3 | (A) Causing any class of equity securities of the issuer which is subject to section 12(g) or section 15(d) of the Act to become eligible for termination of registration under Rule 12g–4 (§240.12g–4) or Rule 12h–6 (§240.12h–6), or causing the reporting obligations with respect to such class to become eligible for termination under Rule 12h–6 (§240.12h–6); or suspension under Rule 12h–3 (§240.12h–3) or section 15(d); |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

As such, if the new listing application is not accepted by NASDAQ or other national securities exchange, then the QMT Acquisition would not close and the Company would simply continue trading on NASDAQ under the terms of its prior qualification for listing of its securities, pursuant to which it remains in good standing for such continued trading.

The Company has initiated a new listing application on NASDAQ. The Company has been advised by NASDAQ that if the QMT and AFT Acquisitions do not close, the current listing and trading status of the Company would simply remain in effect subject to the continued listing standards, for which the Company currently remains fully qualified to continue trading.

The conclusion with respect to the rule 13e-3 analysis is that the Company will under any set of circumstances remain a publicly traded company on a national exchange during the foreseeable future. The conditions of Rule 13e-3(a)(ii) are therefore not obtained. In addition, the Company has no plans to “go private” or de-list the Company’s securities at any time during the foreseeable future.

AFT has particularly concentrated customers, page 37

| 16. | Please name your 5 largest customers. Further, we note similar disclosure under the risk factors titled “Of the QMT Group, Flomet has particularly concentrated customers,” and “GF&F, like other QMT Group, has a small number of customers who dominate sales” on pages 38 and 41, respectively. Please also name your customers in these risk factors. |

The five largest customers of ARC include X-Concepts Solutions Electronics Trading, LLC, Streakwave Wireless, Inc., DoubleRadius, Inc., GOIP Global Services Private Limited, and Titan Wireless, LLC.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

The five largest customers of AFT include Black & Decker, Inc., CompX Security Products Inc., Smith & Wesson Corp., and Sturm, Ruger & Co., Poslovni System Cimos.

The five largest customers of the QMT Group of companies as a whole, include Medventure Technology Corp., Ormco Corporation, Covidien Medical Products, Goodrich Sensor Systems, and Starkey Laboratories Inc.

We respectfully note to the Staff that, notwithstanding the disclosures regarding the dependence on a limited number of customers in certain segments, except as set forth above, there are not any other customers of QMT in one or more segments to whom sales in the aggregate amount equal 10% or more of QMT’s consolidated revenues where the loss of such customer would have a material adverse effect on QMT and its subsidiaries taken as a whole, that would otherwise be required to be disclosed under §229.101(c)(vii) of Regulation S-K. As such, the Company believes that it is not required to disclose the names of additional customers of the QMT Group companies. The Company will conform the respective disclosures in the amended Preliminary Proxy Statement regarding these matters.

QMT Transaction Structure, page 43

| 17. | We note from the first paragraph on page 154 that you will acquire QMT for $31,432,000. The financial analyses under the fairness opinion provide significantly higher values for QMT: under Public Company Trading Analysis ($59 to $65 million); under Discount Cash Flow ($56 to 64 million); and under Equity Value ($53 to $61 million and $48 to $55 million, as adjusted). With a view towards revised disclosure, please explain the difference in the acquisition price and valuations. |

The difference between the acquisition price of QMT and the independent valuation is attributable to the vigorous negotiation by the Special Committee on behalf of the disinterested public ARC shareholders. The Special Committee strongly believed, and Quadrant ultimately conceded, that first priority should be given to the protection of the interests of the disinterested ARC shareholders.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

Background to the QMT Acquisition, page 43

| 18. | Please improve the quality of your background discussion. In specific: |

18.1 Disclose how the parties negotiated on price and consideration.

The acquisition price of QMT was negotiated by the Special Committee on behalf of the disinterested public ARC shareholders and by Quadrant on behalf of the owners of QMT. The price of QMT was calculated based on an Enterprise Value of seven (7) times QMT’s EBITDA for the twelve month period ending February 29, 2012. The parties to the negotiation believed that this multiple was favorable to the disinterested ARC shareholders both on its own merit and because QMT was forecasting significant EBITDA growth for the coming months. The subsequent analysis by Aranca confirmed the favorable nature of this price for the disinterested ARC shareholders.

| | 18.2. Disclose the substance of the conversations between Messrs. Marten and Young in October and November 2011. |

Mr. Young initiated informal discussions with Mr. Marten regarding a potential transaction between QMT and ARC in October 2011. Mr. Young indicated that ARC is continuously evaluating potential acquisition targets that could provide ARC a strong combined foundation for organic growth and/or establish strong platforms to provide scale and revenue diversity. In that regard, Mr. Young discussed with Mr. Marten the possibility of QMT being a potential acquisition target for ARC; as the Managing Director of Quadrant, the largest single interest holder of QMT, Mr. Young was already familiar with the business, operations and management of QMT and its subsidiaries. They discussed the benefits of combining the businesses, in particular how QMT could potentially be a value-creating acquisition adding growth platforms to provide ARC with the scale and revenue diversity it has been seeking for the past several years. Furthermore, Mr. Marten discussed with Mr. Young potentially combining the two businesses of AFT and QMT under the ARC public umbrella. Mr. Marten further discussed how QMT and AFT were both leading players in their key markets and offered attractive synergies, including cross fertilization of product/customer applications, expanded R&D capabilities, and operational synergies, among others. In light of a number of strategic advantages expected from the proposed combination of ARC, QMT and AFT, Mr. Young requested that Mr. Deinard conduct preliminary analysis on combined QMT and AFT acquisitions. After a favorable preliminary assessment, Mr. Young negotiated the non-binding letter of intent between QMT and AFT that was signed on November 22, 2011. ARC and QMT subsequently negotiated and executed a non-binding term sheet and QMT assigned its non-binding rights under the AFT letter of intent to ARC.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| | 18.3. Explain in more detail how Mr. Marten knew AFT through his business dealings. |

AFT is a leading manufacturer of precision, miniature Metal Injection Molding (“MIM”) components and a direct competitor of FloMet, one of the QMT Group companies. Due to the competing nature of the two businesses, FloMet routinely competes with AFT for new business and often finds them as a competing bidder on customer quotes. As the CEO and President of FloMet, Mr. Marten is very familiar with AFT and its MIM operations.

| | 18.4. Disclose the material terms of the favorable assessment conducted by Mr. Deinard, |

The response to this item is included as part of response to item 18.2 above, which is incorporated herein by reference thereto.

| | 18.5 Disclose the material terms of the non-binding letter of intent signed on November; 22, 2011 and the non-binding term sheet—explain how the preliminary terms were negotiated over to arrive at the final terms. |

18.5(A) The material terms of the non-binding letter of intent signed on November; 22, 2011 between QMT and Precision Castparts Corp. (“PCC”), included the following:

QMT proposed to acquire 100% of the stock of Advanced Forming Technology, Inc., a Colorado corporation, from PCC, which would have divested its Thixoforming division prior to the closing, and 100% of the assets of AFT-Europe (collectively, the “Business”), free and clear of any liens, charges, restrictions or encumbrances. AFT would be delivered free of any debt or debt-like items and with a normalized level of working capital, including a normalized level of cash traditionally used in the day to day operations of the Business.

The purchase price for the Business would be $43 million (the “Purchase Price”) to be paid as follows: $25.4 million of the Purchase Price to be paid in cash from existing QMT resources, not subject to financing contingencies; and $17.6 million of the Purchase Price would be in the form of subordinated convertible note (the “Convertible Note”) of ARC. At closing would make a Section 338(h)(10) election with respect to sale of the stock which would result in $16 million of goodwill as well as an additional $1.2 million in machinery & equipment book value as of closing.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

The closing of the acquisition of the Business would be concurrent with the acquisitions of QMT and its current subsidiaries (FloMet LLC, Tekna Seal LLC, General Flange & Forge LLC, and TubeFit LLC) into ARC.

The terms for the Convertible Note would be the following: Maturity date on the fifth anniversary of the date of issuance (subject to acceleration on certain events), interest would be at a rate equivalent to 5-year U.S. T-bill Rates, to be reset on each annual anniversary from the date of issuance. Interest would be paid quarterly in cash in arrears. No dividends would be paid on ARC common stock or preferred stock nor any share repurchases be made while any principal or interest on the Convertible Note remains outstanding. If the Convertible Note is in default, the interest rate would be increased to 12% per annum during the continuation of the default condition. The Convertible Note would be subject to acceleration of repayment in the event of a change in control of ARC, including a sale of a majority of its equity, the sale of a majority of ARC’s assets, a bankruptcy, liquidation or dissolution of ARC, failure to pay interest or principal on any debt when due, or any default by ARC under the terms of the Convertible Note. The Convertible Note may be prepaid in whole or part prior to the Maturity Date upon 5 business days’ notice without penalty.

The Convertible Note would be subordinated to (i) the first priority security interest on assets of credit line creditor securing indebtedness outstanding and (ii) the security interest on assets of any commercial bank, provided that the additional indebtedness (net of cash), at the time it is incurred, does not cause the total indebtedness (net of cash) to ARC’s secured lenders, excluding PCC’s Convertible Note, to exceed three times the trailing, adjusted, pro-forma 12 months EBITDA of ARC.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

At any time prior to the Maturity Date, the outstanding principal balance and accrued but unpaid interest, if any, of the Convertible Note may be converted into common stock of ARC (“Common Stock”) as follows: (i) At the option of PCC at any time on the basis of the 30-day average trading value of the Common Stock immediately preceding conversion (the “Conversion Rate”), provided that the Convertible Note may be converted under this provision only if it converts into less than 10% of the common ownership of ARC and the equity value of ARC is not less than $176 million; (ii) At the option of PCC at any time in connection with a sale of ARC, in which case the conversion ratio would be determined on the basis of the lower of the 30-day average trading value of the Common Stock immediately preceding announcement of the sale transaction and the 30-day average trading value of the Common Stock immediately preceding the closing of the sale transaction; (iii) At the option of PCC at any time at the Conversion Rate if ARC is then in default under the terms of the Convertible Note. (iv) at the option of ARC, any portion of the principal amount of the Convertible Note, provided that the entire amount of such acquired common stock may be sold by PCC under SEC Rule 144 in a single three-month period. Provided that the sale of the Common Stock is completed within five business days of the conversion, ARC would reduce the portion of the principal amount of the Convertible Note by the proceeds of PCC’s sale of the Common Stock.

Regarding rights of PPC in the event of default of the Convertible Note, in addition to all remedies otherwise available to PCC upon a default, ARC would agree that during any period in which interest payments are past due, or if the Convertible Note is not fully repaid at the Maturity Date, ARC must obtain the consent of PCC to incur additional indebtedness, or take other actions outside the ordinary course of business, increase compensation payable to executives or pay bonuses to executives, or make capital expenditure in excess of $50,000.

Conditions to closing provided that a definitive proposal would not be subject to material conditions or contingencies beyond the completion of the following: (i) Confirmatory due diligence, including calls or visits with the top customers; (ii) QMT being satisfied that AFT’s major customers and suppliers would continue to trade with QMT/ARC on substantially the same terms as currently, following an acquisition; and (iii) No material adverse change in AFT’s business.

The proposal would not be conditioned on the availability of debt financing as we are capable of providing the funding required in cash to expeditiously consummate a transaction, if needed.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

The consummation of any transaction would be conditioned upon the QMT and ARC having received approvals from their boards, as well as any regulatory, government or other approvals which would be necessary or desirable.

Acknowledgment by ARC that the draft Purchase Agreement provided to QMT by PCC, to be qualified by disclosure schedules, together with the modifications and clarifications described above, represented the material terms to close a transaction upon; provided that, in part based on QMT continued due diligence, QMT would continue to negotiate the agreement to reach commercially reasonable agreement on (1) representations and warranties regarding environmental matters (2) the cap on recovery for indemnifiable claims and (3) customary transaction terms that are less material in nature.

The letter of intent included confidentiality provisions and exclusivity provision whereby QMT would have exclusive rights to complete negotiation of the proposed transaction for the period of 60 days from the date of the execution of this letter, so long as QMT negotiated in good faith to expeditiously execute a definitive agreement in accordance with the terms of the letter. The letter of intent was non-binding, except for the provisions regarding confidentiality and exclusivity.

The preliminary terms were negotiated to the definitive documentation over the course of several months between counsel of ARC and counsel of PCC, who negotiated on behalf of their respective clients, together with direct discussions on business points between officers of ARC and authorized employees of PCC. The main points of negotiation included the scope of representations and warranties, the extent of covenants to be performed by PCC and AFT between signing and closing of the transaction, the closing condition requirements, the coverage, operation and limitations of the indemnification provisions, and the negotiation of the terms of the Convertible Note.

18.5(B) The material terms of the non-binding term sheet between ARC and QMT included the following (Note some of terms originally contemplated in the term sheet were revised during the course of negotiations of the definitive documentation):

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

For ARC to acquire 100% of the outstanding equity securities of QMT in exchange for newly issued common stock (the “Common Stock”) of ARC (the “Transaction”) and for QMT to become a direct subsidiary of ARC, and each of QMT’s direct subsidiaries, FloMet LLC, Tekna Seal LLC, General Flange & Forge LLC and TubeFit LLC (collectively with QMT, “QMT”), to become indirect subsidiaries of ARC.

The aggregate value of consideration to be provided by ARC to the QMT Members (the “Base Price”) in the Transaction would be determined in negotiation between a Special Committee of the Board of Directors of ARC (the “Special Committee”) and the QMT Members following completion by the Special Committee of due diligence on QMT, including, without limitation, the receipt of an independent professional valuation of QMT.

At the closing of the Transaction (the “Closing”), for all of the outstanding membership interests of QMT to be exchanged for a number of shares (the “Exchange Shares”) of Common Stock equal to (i) the Base Price divided by (ii) $4.00 (the “Exchange Price”). Notwithstanding the foregoing, if the Exchange Shares have an aggregate Closing Value (defined below) greater than a specific price per share (the “Cap Price”) to be agreed upon by the Special Committee and QMT, then the Exchange Price would be increased to equal the Cap Price. For purposes of the Term Sheet, the “Closing Value” would be defined to mean the average closing price per share of the common stock for the 10-day period ending 5 days prior to the Closing.

The Closing of the Transaction would be subject to customary closing conditions, and the following special closing conditions which could not be waived by ARC, other than by action of the Special Committee:

| · | Regulatory approvals including Hart-Scott-Rodino (HSR) approval, if required; |

| · | Approval of the Transaction by a majority of the ARC shares held by the disinterested shareholders entitled to vote thereon and present in person or by proxy; |

| · | Completion by ARC of the acquisition of 100% of the stock of Advanced Forming Technology, Inc. and 100% of the assets of AFT-Europe (collectively, “AFT”); and |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| · | Amendment of the Financial Advisory Agreement, dated as of January 23, 2009, between Quadrant Management, Inc. and ARC on terms reasonably acceptable to the parties, including the Special Committee. |

The ARC-QMT Term Sheet also addressed fiduciary matters, whereby ARC would not be restricted from soliciting or engaging in discussions regarding alternative proposals prior to the Closing; and ARC, acting through its Special Committee, would have the right to change its recommendation to the ARC shareholders and/or terminate the Transaction if it determined that a recommendation change is required by its fiduciary duties as a result of the receipt of a “Superior Proposal” or otherwise. The governing law of the Term Sheet was agreed to be the laws of New York.

The ARC-QMT Term Sheet included provisions that the Company would use commercially reasonable efforts to cause a registration statement covering the resale of the Exchange Shares to be filed and declared effective by the Securities and Exchange Commission as soon as reasonably practicable; and the Company would use commercially reasonable efforts to maintain the effectiveness of such registration statement until such time as the Exchange Shares may be sold without restriction under Rule 144 promulgated under the Securities Act of 1933, as amended, or otherwise.

Key executives of QMT would continue their respective employment agreements and noncompetition agreements with QMT and not enter into new employment agreements, subject to further discussion among the parties.

The Term Sheet provided that the Definitive Agreement would contain covenants, representations and warranties of QMT and the QMT Members (collectively, the “Sellers”) customary for transactions of this nature and that the parties would maintain confidentiality regarding the transaction until the definitive agreement was signed (the “Confidentiality Provision”) and that the parties would each pay for their own respective costs and expenses (the “Expenses Provision”).

Prior to the Closing, the Sellers would cause QMT and each of its subsidiaries to maintain their respective assets and capital and operate their respective businesses only in the ordinary course of business.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

The QMT Members agreed to indemnify ARC for losses arising from breaches of representations, warranties and covenants included in the Definitive Agreement. Other than in circumstances of fraud and intentional misrepresentation or for breaches of covenants and fundamental warranties, the Sellers’ collective liability would be limited to the Base Price.

ARC would file a proxy statement with the SEC whereby ARC would seek consent of its shareholders for (i) the increase in authorized capital; (ii) change of corporate name to Arc Consolidated, Inc.; (iii) approval of the QMT acquisition; and (iv) approval of the AFT acquisition.

QMT and QMT Members would not entertain, solicit or encourage any inquiry or proposal from any third party concerning the acquisition of all or a substantial portion of the business or equity securities of QMT; and

Mutual acknowledgement that the Term Sheet did not contain all matters upon which an agreement must be reached in order for the Transaction to be consummated, and, that except with respect to the provisions for “Confidentiality,” “Expenses,” and “Governing Law,” the Term Sheet would not be binding nor would it create any obligation, fiduciary relationship or joint venture between the parties.

The preliminary terms regarding the Term Sheet were negotiated in the context of the discussions and negotiations between Messrs. Marten and Young.

The definitive terms of Agreement between QMT and ARC were negotiated over the course of several months between counsel of ARC and special counsel to the Special Committee, together with direct discussions on business points between officers of ARC and members of the Special Committee. The main points of negotiation included the scope of representations and warranties, the extent of covenants to be performed by QMT, the nature of amendments and waivers to be provided by Quadrant with respect to its contractual agreements with ARC, the scope of the Superior Offer rights of ARC, the valuation and purchase price terms and conditions for issuance of ARC shares in exchange for acquiring QMT, closing condition requirements, and the coverage, operation and limitations of the indemnification provisions.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

October and November 2011

| | 6. Explain whether Messrs. Young and Deinard addressed how QMT’s and AFT’s lines of business would fit in with ARC’s business in the December 2011 meetings with the board, |

In the course of discussions with the Board, Messrs. Young and Deinard covered many of the same issues which had been discussed with Mr. Marten regarding a potential transaction between QMT and ARC related to the course of ARC continuously evaluating potential acquisition targets that could provide ARC a strong combined foundation for organic growth and/or establish strong platforms to provide scale and revenue diversity. Messrs. Young and Deinard discussed the possibility of QMT being a potential acquisition target for ARC and disclosed to the Board; as Managing Directors of Quadrant, the largest single interest holder of QMT, Messrs. Young and Deinard were already familiar with the business, operations and management of QMT and its subsidiaries. They discussed the benefits of combining the businesses, in particular how QMT could potentially be a value-creating acquisition adding growth platforms to provide ARC with the scale and revenue diversity it has been seeking for the past several years. Messrs. Young and Deinard disclosed Mr. Marten’s proposal to potentially combine the two businesses of AFT and QMT under the ARC public umbrella, and conveyed to the Board Mr. Marten’s observations regarding how QMT and AFT were both leading players in their respective key markets and offered attractive synergies, including cross fertilization of product/customer applications, expanded R&D capabilities, and operational synergies, among others. Messrs. Young and Deinard discussed with the Board their preliminary due diligence assessment and analysis regarding undertaking the combined QMT and AFT Acquisitions.

| | 7. Disclose the Special Committee’s legal counsel and financial consultant. |

The New York City office of the law firm of Garvey Schubert Barer was engaged as independent legal counsel to the Special Committee of the Board of Directors. The financial consultant assisting the Special Committee was the firm of Piton Advisors, LLC, based in New York City.

| | 8. Disclose whether the Special Committee considered any alternatives as disclosed in the second paragraph on page 44 . |

The Special Committee was given authority to explore alternative transactions. The Special Committee did not consider any alternative transactions through the date of the signing of the QMT Acquisition Agreement. The Special Committee has continuing authority until closing of the QMT Acquisition to assess superior proposals and maychange its recommendation to the ARC shareholders and/or terminate the Transaction if it determines that a recommendation change is required by its fiduciary duties as a result of the receipt of a “Superior Proposal” or otherwise.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

Conflicts of Interest, page 44

| 19. | We note from the disclosure at the top of page 44 that Quadrant provides advisory services to QMT. Please disclose the total amount of fees earned under this agreement and the amount of fees per year. |

In accordance with the financial advisory agreement between QMT and Quadrant, in consideration for services provided by Quadrant, on January 1, 2012 QMT commenced paying an annual cash fee to Quadrant of $250,000 to be paid in quarterly installments. To date, Quadrant has been paid $62,500 in fees for the first quarter of 2012. Annual fees through the maturity date of December 31, 2013 shall be $250,000 per year.

Summary of Opinion, page 46

| 20. | We note from the bullets on page 46 that you provided financial information, forecasts, and other data to Aranca. Please confirm whether all of this information is disclosed in Aranca’s opinion that is attached as Annex F. Aranca certificate; |

All information provided to Aranca for has been included in their opinion unless deemed not material by Aranca for purposes of their opinion.

Management’s Discussion and Analysis of Financial Condition and Results of Operations of QMT, page 73

| 21. | We note QMT began consolidating in June 2011. With a view towards revised disclosure, please tell us whether QMT acquired controlling interests of FloMet, GF&F, Tekna Seal, and TubeFit in June 2011. We note your disclosure on page 165. Please tell us when Quadrant or QMT began its involvement in the metal component fabrication industry. If their involvement is recent, please provide appropriate risk factor disclosure and update other applicable parts of the proxy statement. |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

QMT was formed in April 2011, to function as a holding company for a group of diversified manufacturing and distribution companies, and therefore the first set of consolidated audited financial statements available for QMT is for the period ending June 30, 2011. Upon formation, QMT acquired controlling interests in Tekna Seal as of May 1, 2011 and in Flomet as of June 30, 2011. In addition, QMT acquired GF&F as of April 14, 2011 and has held controlling interests in GF&F since that date. Furthermore, TubeFit was formed on November 1, 2011 and QMT has held controlling interests in TubeFit since that date.

While QMT was only recently formed in 2011 as a holding company, Quadrant has held controlling interests in FloMet and Tekna Seal for over 20 years, and therefore we believe that it is not material to make a special risk factor disclosure regarding recent involvement of QMT in the in the metal component fabrication industry. The other two companies, namely GF&F and TubeFit, which operate in the Pipe Fittings and Flanges industry, were acquired by QMT in 2011.

For purposes of clarity, the following disclosure will be added to the business section of the amended Preliminary Proxy Statement:

QMT acquired controlling interests in GF&F as of April 14, 2011. GF&F has been in business since 1972. GF&F is a domestic manufacturer of flanges in carbon steel, stainless steel and the alloys. GF&F also manufactures metric flanges, orifice unions, galvanized flanges, long weld necks, pad flanges/studding outlets, special facings and custom flanges. Since 1972, GF&F has been manufacturing domestic flanges in carbon steel, stainless steel and alloys. GF&F also maintains a large inventory of galvanized flanges and orifice unions. The QMT believes that GF&F can handle any substantially custom machining requirements and special flange facings.

In addition, the following risk factor will be added to the amended Preliminary Proxy Statement:

TubeFit has only recently commenced its involvement in the metal component fabrication industry. The uncertainty and costs associated with our support of the growth and development of TubeFit in the metal component fabrication industry and its continued integration into QMT could adversely affect our overall results of operations.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

TubeFit was formed on November 1, 2011. TubeFit has had limited involvement in the metal component fabrication industry. In addition, although we believe the management and personnel for TubeFit are experienced in the metal component fabrication industry, we cannot assure you that we will be able to successfully grow, develop and integrate TubeFit as a meaningful contributor into the overall QMT business. In particular, the significant risks associated with TubeFit regarding its recent involvement in the metal component fabrication industry include the following:

| · | our ability to attract new customers to TubeFit and retain existing customers; |

| | | |

| · | diversion of management’s time and focus from operating our business to address TubeFit integration challenges; |

| | | |

| · | cultural and logistical challenges associated with integrating new TubeFit employees; |

| | | |

| · | our ability to integrate the combined products, services and technology with TubeFit; |

| | | |

| · | the integration and migration to TubeFit of the QMT technology platforms; |

| | | |

| · | our ability to cross-sell TubeFit products to new and existing clients; |

| | | |

| · | our ability to realize expected synergies with TubeFit; |

| | | |

| · | the need to implement into TubeFit internal controls, procedures and policies appropriate for the public company, including, but not limited to, processes required for the effective and timely reporting of the financial condition and results of operations of the newly acquired business, both for historical periods prior to the acquisition and on a forward-looking basis following the acquisition; |

| | | |

| · | possible write-offs or impairment charges that result from TubeFit; |

| | | |

| · | unanticipated or unknown liabilities that may arise in connection with the TubeFit businesses; |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| · | the need to fully integrate the QMT accounting, management information, human resources, and other administrative systems to permit effective management at TubeFit; and |

| | | |

| · | any change in one of the many complex federal or state laws or regulations that govern any aspect of the financial or business operations of TubeFit, and the interface of the businesses with QMT as a whole. |

If the actual outcomes of one or more of the risks discussed above are detrimental to TubeFit, our overall business could be adversely affected.

Management’s Discussion and Analysis of Financial Condition and Results of Operations of ARC, page 73

| 22. | We note your disclosure in the last paragraph on page 88. Please revise to update for the pending QMT and AFT acquisitions or advise. |

The Company has noted the Staff’s comment and will update the disclosures in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of ARC accordingly.

Introduction to unaudited pro forma consolidated financial statements, page 150

| 23. | Based on the disclosures in the second paragraph on page 150 it appears that you concluded that the registrant is the accounting acquirer in each of the acquisitions of AFT and QMT. However with respect to the acquisition of QMT we note that you will issue 7,857,899 common shares to the shareholders of QMT representing approximately 71% of the company issued and outstanding shares. Please tell us how you considered each of the indicators in paragraphs 805-10-55-12 to 55-14 in determining the accounting acquirer. .. Also provide us with a table showing the shareholders of ARC before and after the acquisition of QMT with their respective ownership interest. |

Under the FASB Accounting Standards Board (FASB) Accounting Standards Codification (ASC), paragraph 5512, in a business combination effected primarily by exchanging equity interests, the acquirer usually is the entity that issues its equity interests. However, in some business combinations, commonly called reverse acquisitions, the issuing entity is the acquiree. Subtopic 805-40: provides guidance on accounting for reverse acquisitions. Other pertinent facts and circumstances are also considered in identifying the acquirer in a business combination effected by exchanging equity interests, including the following, as to which we have identified the distinguishing factors which weigh against “reverse acquisition” treatment:

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

a. The relative voting rights in the combined entity after the business combination. The acquirer usually is the combining entity whose owners as a group retain or receive the largest portion of the voting rights in the combined entity. In determining which group of owners retains or receives the largest portion of the voting rights, an entity shall consider the existence of any unusual or special voting arrangements and options, warrants, or convertible securities.

b. The existence of a large minority voting interest in the combined entity if no other owner or organized group of owners has a significant voting interest. The acquirer usually is the combining entity whose single owner or organized group of owners holds the largest minority voting interest in the combined entity.

c. The composition of the governing body of the combined entity. The acquirer usually is the combining entity whose owners have the ability to elect or appoint or to remove a majority of the members of the governing body of the combined entity.

d. The composition of the senior management of the combined entity. The acquirer usually is the combining entity whose former management dominates the management of the combined entity. Again, similar with (c) above, if ARC remains as the main Board composition and decision makers on a global basis, it provides support that it is the acquiring entity and it is not a reverse merger.

e. The terms of the exchange of equity interests. The acquirer usually is the combining entity that pays a premium over the pre-combination fair value of the equity interests of the other combining entity or entities.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

Prior to the QMT Acquisition, Brean Murray Carret Group, Inc. (“Brean Murray”) and its affiliates own approximately 36.44% of ARC. Brean Murray is an affiliate of Quadrant Management Inc. (“QMI”). Carret P.T., LP (“Carret PT”) is also an affiliate of Brean Murray. After giving effect to the issuance of shares to QMI in the QMT Acquisition and the purchase of shares by Carret PT, Brean Murray and its affiliates will own approximately 61.7% of the shares of ARC. Prior to the QMT Acquisition and after the QMT Acquisition, all officers serving ARC consist of Brean Murray affiliates. Prior to and after the QMT Acquisition, all non-independent directors consist of Brean Murray affiliates. At all prior meetings of shareholders of ARC since inception of the QMI Advisory Agreement with ARC in November 2008, the majority of all shares voting for the election of directors in all shareholder meetings consisted of the Brean Murray shareholdings. As such, the control of Brean Murray over the policies and management of the Company both prior to and after the QMT Acquisition will have been controlled by Brean Murray and its affiliates. In addition ARC is paying a premium for the acquisition of QMT in the form of shares of common stock of ARC which have a higher deemed value than the market value of the Company’s common stock.

The table showing the shareholders of ARC before and after the acquisition of QMT with respective ownership interest is set forth in the Proxy Statement under the captions “SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT- Beneficial Ownership Prior to the Annual Meeting” and “- Pro-Forma Beneficial Ownership Assuming Approval of the QMT Acquisition by the Disinterested Shareholdersand Effectiveness of 1:1.95 Reverse Stock Split.”

Our conclusions of ARC on the basis of analysis pursuant to guidance from ASC 55-12 are therefore the following:

| (a). | Brean Murray and its affiliates will retain the largest portion voting rights of the voting rights in the combined entity, thus indicating ARC is the accounting acquirer; |

| (c) | Brean Murray and its affiliates, as the continuing owners of ARC, will continue to have the ability to elect or appoint or to remove a majority of the members of the governing body of the combined entity, thus indicating ARC is the accounting acquirer; |

| (d) | The former management of ARC will dominate the management of the combined entity, thus indicating ARC is the accounting acquirer; and |

| (e) | ARC is paying a premium over the pre-combination fair value of the equity interests of the other combining entity or entities, thus indicating ARC is the accounting acquirer. |

The weight of ASC 55-12 clearly indicates that ARC is the accounting acquirer and the QMT Acquisition is not a reverse merger.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

55-13 The acquirer usually is the combining entity whose relative size (measured in, for example, assets, revenues, or earnings) is significantly larger than that of the other combining entity or entities. While ARC does not alone have a relative size which is significantly larger than QMT, conversely, QMT measured against ARC and AFT taken together does not have a size which is significantly larger than the other combining entity or entities. As such, we believe that ASC 55-13 is not dispositive with respect to an indication of the identification of the acquirer.

55-14 In a business combination involving more than two entities, determining the acquirer shall include a consideration of, among other things, which of the combining entities initiated the combination, as well as the relative size of the combining entities, as discussed in the preceding paragraph.

The ARC acquisitions of QMT and AFT involve more than two entities, however, the QMT acquisition was initiated by Mr. Jason Young, chairman of ARC with Mr. Robert Marten, CEO of QMT. Mr. Marten suggested to Mr. Young that ARC simultaneously purchase AFT together with QMT, however, it was again Mr. Young who took the lead in initiating the proposal to AFT, as evidenced by the letter of intent negotiated by Mr. Young. As such, we believe that ASC 55-14, taken together with the relative sizes of the three companies as discussed above, indicates that ARC is the acquirer.

In summary, the overall weight of ASC paragraphs 805-10-55-12 to 55-14 indicates that ARC is the acquirer and the transaction is not a reverse merger.

| 24. | It is unclear to us whether these acquisitions, if approved by the shareholders, will be completed simultaneously or whether you will have different scenarios. If they will not be completed simultaneously, it appears that you should revise or expand the pro formas to show the different scenarios. |

| | The acquisitions, if approved by the shareholders, will be completed simultaneously. |

Pro forma adjustments to the consolidated balance sheet and consolidated statement of operations, page 154

| 25. | Refer to adjustment A and tell us why you use $4.00 to value the shares to be issued to QMT shareholders. It appears to us that you should use the most recent stock price at the time of filing the proxy. In addition, the notes to the pro forma balance sheet should include a disclosure of the date at which the stock price was determined and a sensitivity analysis for the range of possible outcomes based upon percentage increases and decreases in the recent stock price. Also tell us how you reflected the 7,857,899 shares valued at $4.00 in the stockholders’ equity section. |

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

| | The $4.00 per share valuation of ARC was the result of negotiations between the Special Committee and Quadrant and was determined on the date of the execution of the QMT purchase agreement. Notwithstanding the fact that ARC’s publicly determined stock price had for many years implied a negative Enterprise Value of ARC’s business, the Special Committee argued that ARC’s business deserved a positive Enterprise Value. Quadrant conceded the point out of desire to protect the disinterested ARC public shareholders. The $4.00 per share price implies an Enterprise Value of $1,317,400 which Quadrant felt was more than fair for ARC’s disinterested shareholders for a business that had not generated positive EBITDA or Net Income for several years. The subsequent evaluation by Aranca confirmed this valuation. |

| | We have updated the pro forma balance sheet responsive to the Staff’s comments which will be included in the amended Preliminary Proxy Statement. See Exhibit A attached hereto. |

| 26. | Refer to adjustment D. It is unclear why you state that you paid cash for the acquisition of QMT in view of your disclosures throughout the document that you will issue shares to acquire QMT. Please clarify this inconsistency. |

We have updated the pro forma balance sheet responsive to the Staff’s comments which will be included in the amended Preliminary Proxy Statement. See Exhibit A attached hereto.

| 27. | Provide us a breakdown of the ($12,052) net adjustment to cash and cash equivalents. |

We have updated the pro forma balance sheet responsive to the Staff’s comments which will be included in the amended Preliminary Proxy Statement. See Exhibit A attached hereto.

| 28. | We note that QMT’s auditor makes reference to the work of other auditors with reference to the financial statements of QMT’s majority owned subsidiaries. Revise to include the reports of the other auditors. Refer to Rule 2-05 of Regulation S-X. |

We will include the reports of the other auditors in the amended Preliminary Proxy Statement.

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

Notes to financial statements, page 165

Significant Business Acquisitions, page 165

| 29. | We note that QMT was organized in March 2011. We also note that QMT acquired General Flange & Forge LLC, Tekna Seal LLC and FloMet LLC during the three months ended June 30, 2011. We also note that the operations of these entities were reflected in the financial statements of QMT for the full fiscal year ended June 30, 2011 and that the auditor’s opinion is on the year then ended. In this regard, tell us how QMT accounted for the acquisitions of these entities. If the acquisitions were accounted for as acquisitions of entities under common control, tell us how these entities were under common control with QMT at the time they were acquired. |

The QMT auditor has prepared a revised report regarding its audit of Quadrant Metals TechnologiesLLCand subsidiariesas ofJune30, 2011 which sets forth how QMT accounted for the acquisitions of General Flange & Forge LLC, Tekna Seal LLC and FloMet LLC. We will file the revised reportwith the amended Preliminary Proxy Statement.

[Acknowledgment and Signature Page Follow]

| U.S. Securities & Exchange Commission | Arc Wireless Solutions, Inc. |

| Preliminary Proxy Statement – Comment Responses | May 29, 2012 |

The Company respectfully acknowledges to the SEC the following statements:

| · | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please do not hesitate to contact the undersigned or our counsel in connection with the foregoing responses to the Comment Letter.

We look forward to hearing from the Staff as soon as reasonably possible regarding whether the responses provided herein and in the amended Preliminary Proxy Statement are satisfactory and whether the Company may file its Definitive Proxy Statement so that the Company may proceed with presenting the matters for action to the shareholders. Thank you very much.

Sincerely yours,

/s/ Theodore Deinard

Theodore Deinard, Interim CEO

| cc: | Wuersch & Gering LLP |

| | Attention: Travis L. Gering |

INTRODUCTION TO UNAUDITED PRO FORMA

CONSOLIDATED FINANCIAL STATEMENTS

The Unaudited Pro Forma Consolidated Balance Sheet combines the historical consolidated balance sheet of ARC Wireless Solutions, Inc. (ARC) as of December 31, 2011 and the historical consolidated balance sheet of Quadrant Metal Technologies LLC (QMT) as of December 31, 2011, and the historical combined balance sheet of Advanced Forming Technology (AFT) as of December 31, 2011, giving effect to the acquisition as if it had occurred January 1, 2011. The Unaudited Pro Forma Consolidated Statement of Operations for the year ended December 31, 2011 combines the historical consolidated statement of operations of ARC for the year ended December 31, 2011, QMT and AFT for the twelve months ended December 31, 2011 as if the merger had occurred on January 1, 2011. Adjustments have been made to conform QMT and AFT’s balance sheet and statement of operations to ARC fiscal year end. No pro forma effects have been given to any operational or other synergies that may be realized from the acquisitions.

The unaudited pro forma consolidated financial information is based on the estimates and assumptions described in the notes to the unaudited pro forma consolidated financial statements. The unaudited pro forma consolidated financial information has been prepared using the purchase method of accounting in which the total cost of the QMT and AFT acquisitions are allocated to the tangible and intangible assets acquired and liabilities assumed based on their estimated fair values at the date of the acquisitions. This allocation has been done on a preliminary basis and is subject to change pending final determination of fair values for the acquired assets and assumed liabilities and a final analysis of the total purchase price paid, including direct costs of the acquisitions. The adjustments included in the unaudited pro forma consolidated financial information represent the preliminary determination of such adjustments based upon currently available information. Accordingly, the actual fair value of the assets acquired, liabilities assumed and the related adjustments may differ from those reflected in this Proxy Statement. ARC expects to finalize the purchase price allocations within one year of the date of the QMT and AFT acquisitions.

The unaudited pro forma consolidated financial information is presented for illustrative purposes only and is not necessarily indicative of the operating results or financial position that might have been achieved had the transaction occurred as of an earlier date, and they are not necessarily indicative of future operating results or financial position. These pro forma amounts do not, therefore, project ARC’s financial position or results of operations for any future date or period. The accompanying unaudited pro forma consolidated financial information should be read in conjunction with the historical financial statements and the related notes thereto of ARC, which are included in its Annual Report on Form 10-K, as well as other financial information included elsewhere in this Proxy.

ARC WIRELESS SOLUTIONS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONSOLIDATED BALANCE SHEET

DECEMBER 31, 2011

(in thousands)

| | | ARC

Wireless Solutions,

Inc. | | | Quadrant Metals Technologies LLC | | | Advanced

Forming

Technology | | | Pro Forma

Adjustments | | | | | | ARC Wireless Solutions, Inc.

Pro Forma | |

| | | (Historical) | | | (Historical) | | | (Historical) | | | | | | | | | | |

| ASSETS | | | | | | | | | | | | | | | | | | |

| Current Assets: | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 11,048 | | | $ | 2,589 | | | $ | 681 | | | $ | (12,052 | ) | | | D,E,F | | | $ | 2,266 | |

| Accounts receivable, net | | | 740 | | | | 4,275 | | | | 4,987 | | | | – | | | | | | | | 10,002 | |

| Inventories, net | | | 185 | | | | 3,776 | | | | 5,535 | | | | – | | | | | | | | 9,496 | |

| Deferred income taxes | | | – | | | | – | | | | 189 | | | | (189 | ) | | | F | | | | – | |

| Due from related party | | | – | | | | 196 | | | | – | | | | – | | | | | | | | 196 | |

| Prepaid and other current assets | | | 17 | | | | 745 | | | | 510 | | | | | | | | | | | | 1,272 | |

| Total current assets | | | 11,990 | | | | 11,581 | | | | 11,902 | | | | (12,241 | ) | | | | | | | 23,232 | |

| Property and Equipment, net | | | 227 | | | | 4,668 | | | | 20,467 | | | | – | | | | | | | | 25,362 | |

| Long-Term Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Goodwill | | | – | | | | 6,964 | | | | 12,387 | | | | 24,916 | | | | E,F | | | | 44,267 | |

| Intangible assets | | | 116 | | | | – | | | | 12 | | | | – | | | | | | | | 128 | |

| Due from related party | | | – | | | | 305 | | | | 26,286 | | | | (26,286 | ) | | | F | | | | 305 | |

| Other | | | 7 | | | | 302 | | | | – | | | | – | | | | | | | | 309 | |

| Total long-term assets | | | 123 | | | | 7,571 | | | | 38,685 | | | | (1,370 | ) | | | | | | | 45,009 | |