UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

AIM Investment Funds (Invesco Investment Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Glenn Brightman, Principal Executive Officer

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Reports to Stockholders

(a) The Registrant's semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Invesco SteelPath MLP Alpha Fund

Class A: MLPAX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Fund

(Class A) | $426 | 7.99% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $941.80M% |

| Total number of portfolio holdings | $20% |

| Portfolio turnover rate as of the end of the reporting period | $100% |

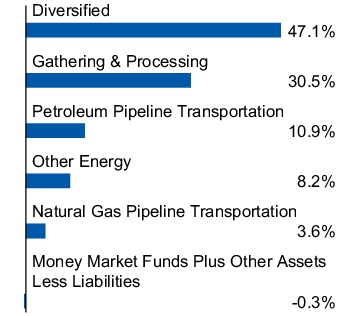

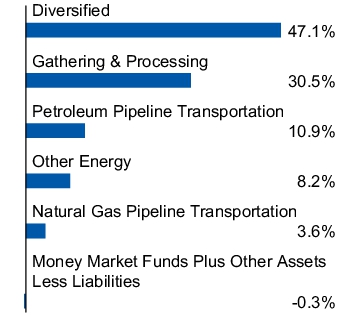

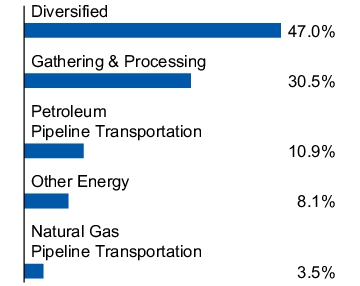

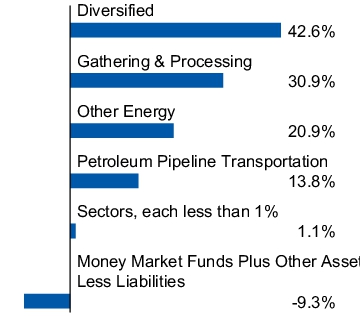

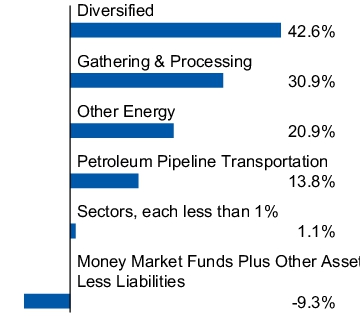

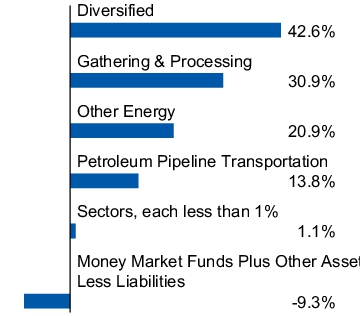

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 13.9% |

| MPLX L.P. | 13.3% |

| Targa Resources Corp. | 13.0% |

| Western Midstream Partners L.P. | 12.9% |

| Enterprise Products Partners L.P. | 9.2% |

| Plains All American Pipeline L.P. | 6.5% |

| ONEOK, Inc. | 6.5% |

| Williams Cos., Inc. | 4.3% |

| Sunoco L.P. | 4.2% |

| Cheniere Energy, Inc. | 2.9% |

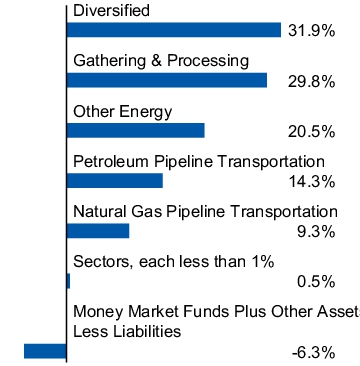

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Fund

Class C: MLPGX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Fund

(Class C) | $465 | 8.74% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $941.80M% |

| Total number of portfolio holdings | $20% |

| Portfolio turnover rate as of the end of the reporting period | $100% |

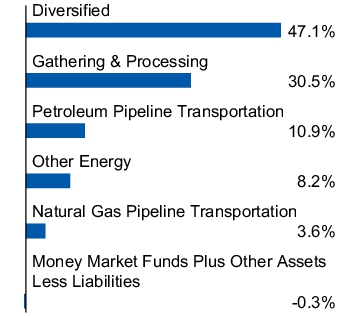

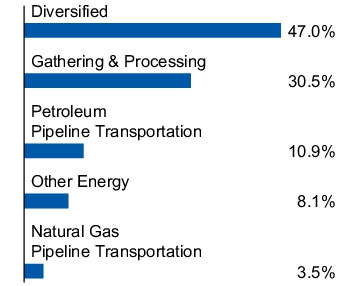

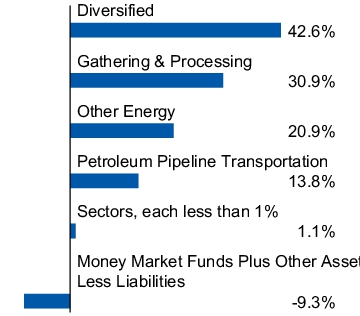

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 13.9% |

| MPLX L.P. | 13.3% |

| Targa Resources Corp. | 13.0% |

| Western Midstream Partners L.P. | 12.9% |

| Enterprise Products Partners L.P. | 9.2% |

| Plains All American Pipeline L.P. | 6.5% |

| ONEOK, Inc. | 6.5% |

| Williams Cos., Inc. | 4.3% |

| Sunoco L.P. | 4.2% |

| Cheniere Energy, Inc. | 2.9% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Fund

Class R: SPMGX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Fund

(Class R) | $439 | 8.24% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $941.80M% |

| Total number of portfolio holdings | $20% |

| Portfolio turnover rate as of the end of the reporting period | $100% |

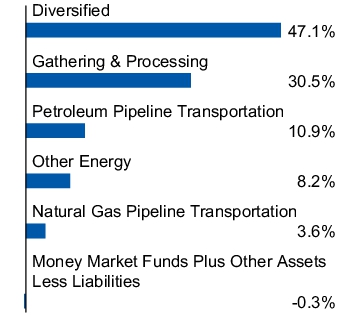

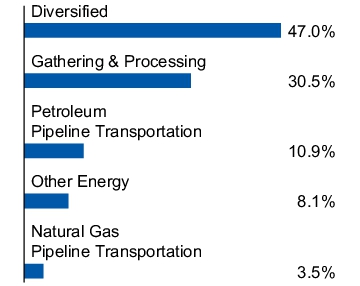

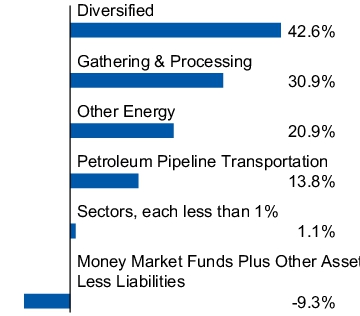

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 13.9% |

| MPLX L.P. | 13.3% |

| Targa Resources Corp. | 13.0% |

| Western Midstream Partners L.P. | 12.9% |

| Enterprise Products Partners L.P. | 9.2% |

| Plains All American Pipeline L.P. | 6.5% |

| ONEOK, Inc. | 6.5% |

| Williams Cos., Inc. | 4.3% |

| Sunoco L.P. | 4.2% |

| Cheniere Energy, Inc. | 2.9% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Fund

Class Y: MLPOX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Fund

(Class Y) | $413 | 7.74% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $941.80M% |

| Total number of portfolio holdings | $20% |

| Portfolio turnover rate as of the end of the reporting period | $100% |

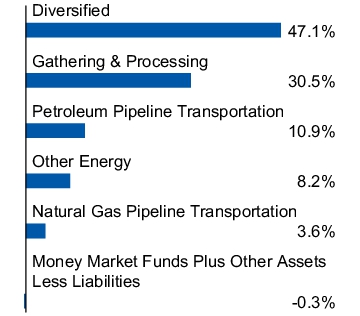

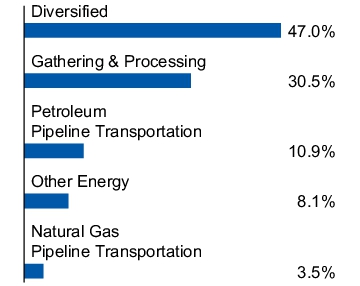

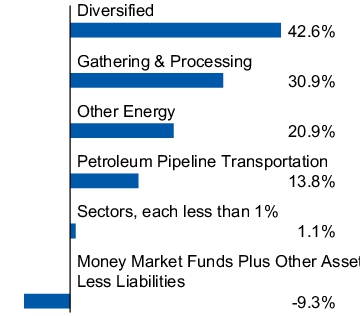

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 13.9% |

| MPLX L.P. | 13.3% |

| Targa Resources Corp. | 13.0% |

| Western Midstream Partners L.P. | 12.9% |

| Enterprise Products Partners L.P. | 9.2% |

| Plains All American Pipeline L.P. | 6.5% |

| ONEOK, Inc. | 6.5% |

| Williams Cos., Inc. | 4.3% |

| Sunoco L.P. | 4.2% |

| Cheniere Energy, Inc. | 2.9% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Fund

Class R5: SPMHX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Fund

(Class R5) | $410 | 7.68% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $941.80M% |

| Total number of portfolio holdings | $20% |

| Portfolio turnover rate as of the end of the reporting period | $100% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 13.9% |

| MPLX L.P. | 13.3% |

| Targa Resources Corp. | 13.0% |

| Western Midstream Partners L.P. | 12.9% |

| Enterprise Products Partners L.P. | 9.2% |

| Plains All American Pipeline L.P. | 6.5% |

| ONEOK, Inc. | 6.5% |

| Williams Cos., Inc. | 4.3% |

| Sunoco L.P. | 4.2% |

| Cheniere Energy, Inc. | 2.9% |

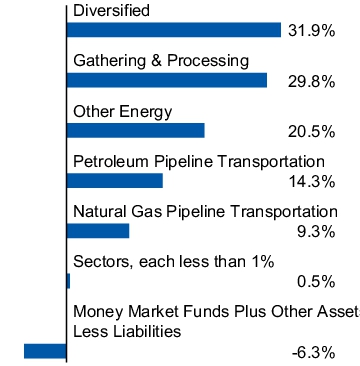

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Fund

Class R6: OSPAX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Fund

(Class R6) | $408 | 7.65% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $941.80M% |

| Total number of portfolio holdings | $20% |

| Portfolio turnover rate as of the end of the reporting period | $100% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 13.9% |

| MPLX L.P. | 13.3% |

| Targa Resources Corp. | 13.0% |

| Western Midstream Partners L.P. | 12.9% |

| Enterprise Products Partners L.P. | 9.2% |

| Plains All American Pipeline L.P. | 6.5% |

| ONEOK, Inc. | 6.5% |

| Williams Cos., Inc. | 4.3% |

| Sunoco L.P. | 4.2% |

| Cheniere Energy, Inc. | 2.9% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Plus Fund

Class A: MLPLX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Plus Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Plus Fund

(Class A) | $693 | 12.76% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $237.25M% |

| Total number of portfolio holdings | $19% |

| Portfolio turnover rate as of the end of the reporting period | $16% |

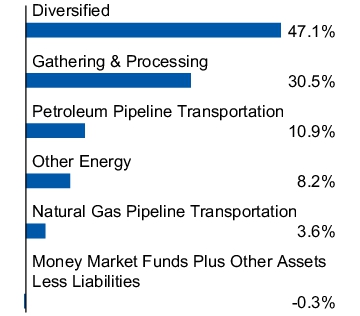

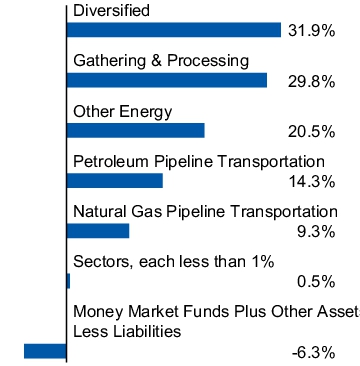

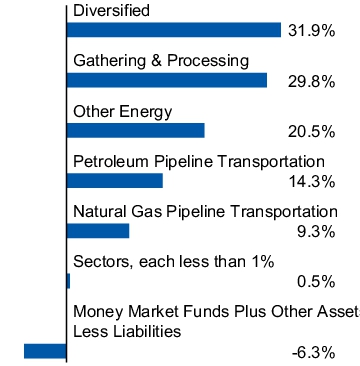

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 19.1% |

| MPLX L.P. | 18.2% |

| Targa Resources Corp. | 17.8% |

| Western Midstream Partners L.P. | 17.7% |

| Enterprise Products Partners L.P. | 12.6% |

| Plains All American Pipeline L.P. | 9.0% |

| ONEOK, Inc. | 8.7% |

| Williams Cos., Inc. | 5.9% |

| Sunoco L.P. | 5.8% |

| Cheniere Energy, Inc. | 4.0% |

Sector Allocation (% of total investments)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Plus Fund

Class C: MLPMX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Plus Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Plus Fund

(Class C) | $733 | 13.51% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $237.25M% |

| Total number of portfolio holdings | $19% |

| Portfolio turnover rate as of the end of the reporting period | $16% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 19.1% |

| MPLX L.P. | 18.2% |

| Targa Resources Corp. | 17.8% |

| Western Midstream Partners L.P. | 17.7% |

| Enterprise Products Partners L.P. | 12.6% |

| Plains All American Pipeline L.P. | 9.0% |

| ONEOK, Inc. | 8.7% |

| Williams Cos., Inc. | 5.9% |

| Sunoco L.P. | 5.8% |

| Cheniere Energy, Inc. | 4.0% |

Sector Allocation (% of total investments)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Plus Fund

Class R: SPMJX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Plus Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Plus Fund

(Class R) | $706 | 13.00% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $237.25M% |

| Total number of portfolio holdings | $19% |

| Portfolio turnover rate as of the end of the reporting period | $16% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 19.1% |

| MPLX L.P. | 18.2% |

| Targa Resources Corp. | 17.8% |

| Western Midstream Partners L.P. | 17.7% |

| Enterprise Products Partners L.P. | 12.6% |

| Plains All American Pipeline L.P. | 9.0% |

| ONEOK, Inc. | 8.7% |

| Williams Cos., Inc. | 5.9% |

| Sunoco L.P. | 5.8% |

| Cheniere Energy, Inc. | 4.0% |

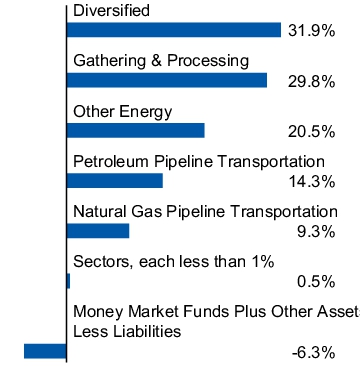

Sector Allocation (% of total investments)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Plus Fund

Class Y: MLPNX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Plus Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Plus Fund

(Class Y) | $680 | 12.50% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $237.25M% |

| Total number of portfolio holdings | $19% |

| Portfolio turnover rate as of the end of the reporting period | $16% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 19.1% |

| MPLX L.P. | 18.2% |

| Targa Resources Corp. | 17.8% |

| Western Midstream Partners L.P. | 17.7% |

| Enterprise Products Partners L.P. | 12.6% |

| Plains All American Pipeline L.P. | 9.0% |

| ONEOK, Inc. | 8.7% |

| Williams Cos., Inc. | 5.9% |

| Sunoco L.P. | 5.8% |

| Cheniere Energy, Inc. | 4.0% |

Sector Allocation (% of total investments)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Plus Fund

Class R5: SPMPX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Plus Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Plus Fund

(Class R5) | $677 | 12.44% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $237.25M% |

| Total number of portfolio holdings | $19% |

| Portfolio turnover rate as of the end of the reporting period | $16% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 19.1% |

| MPLX L.P. | 18.2% |

| Targa Resources Corp. | 17.8% |

| Western Midstream Partners L.P. | 17.7% |

| Enterprise Products Partners L.P. | 12.6% |

| Plains All American Pipeline L.P. | 9.0% |

| ONEOK, Inc. | 8.7% |

| Williams Cos., Inc. | 5.9% |

| Sunoco L.P. | 5.8% |

| Cheniere Energy, Inc. | 4.0% |

Sector Allocation (% of total investments)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Alpha Plus Fund

Class R6: OSPPX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Alpha Plus Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Alpha Plus Fund

(Class R6) | $675 | 12.41% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $237.25M% |

| Total number of portfolio holdings | $19% |

| Portfolio turnover rate as of the end of the reporting period | $16% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 19.1% |

| MPLX L.P. | 18.2% |

| Targa Resources Corp. | 17.8% |

| Western Midstream Partners L.P. | 17.7% |

| Enterprise Products Partners L.P. | 12.6% |

| Plains All American Pipeline L.P. | 9.0% |

| ONEOK, Inc. | 8.7% |

| Williams Cos., Inc. | 5.9% |

| Sunoco L.P. | 5.8% |

| Cheniere Energy, Inc. | 4.0% |

Sector Allocation (% of total investments)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Income Fund

Class A: MLPDX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Income Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Income Fund

(Class A) | $419 | 7.90% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $3,680.75M% |

| Total number of portfolio holdings | $26% |

| Portfolio turnover rate as of the end of the reporting period | $10% |

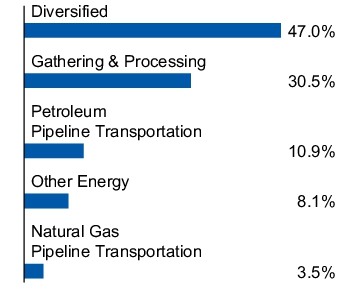

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Western Midstream Partners L.P. | 15.1% |

| Energy Transfer L.P. | 14.8% |

| MPLX L.P. | 14.5% |

| Enterprise Products Partners L.P. | 13.3% |

| Antero Midstream Corp. | 8.8% |

| Plains All American Pipeline L.P. | 7.9% |

| Sunoco L.P. | 7.5% |

| USA Compression Partners L.P. | 6.0% |

| EnLink Midstream LLC | 4.9% |

| Genesis Energy L.P. | 2.7% |

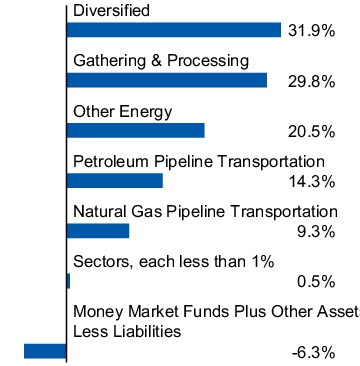

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Income Fund

Class C: MLPRX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Income Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Income Fund

(Class C) | $458 | 8.65% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $3,680.75M% |

| Total number of portfolio holdings | $26% |

| Portfolio turnover rate as of the end of the reporting period | $10% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Western Midstream Partners L.P. | 15.1% |

| Energy Transfer L.P. | 14.8% |

| MPLX L.P. | 14.5% |

| Enterprise Products Partners L.P. | 13.3% |

| Antero Midstream Corp. | 8.8% |

| Plains All American Pipeline L.P. | 7.9% |

| Sunoco L.P. | 7.5% |

| USA Compression Partners L.P. | 6.0% |

| EnLink Midstream LLC | 4.9% |

| Genesis Energy L.P. | 2.7% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Income Fund

Class R: SPNNX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Income Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Income Fund

(Class R) | $432 | 8.15% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $3,680.75M% |

| Total number of portfolio holdings | $26% |

| Portfolio turnover rate as of the end of the reporting period | $10% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Western Midstream Partners L.P. | 15.1% |

| Energy Transfer L.P. | 14.8% |

| MPLX L.P. | 14.5% |

| Enterprise Products Partners L.P. | 13.3% |

| Antero Midstream Corp. | 8.8% |

| Plains All American Pipeline L.P. | 7.9% |

| Sunoco L.P. | 7.5% |

| USA Compression Partners L.P. | 6.0% |

| EnLink Midstream LLC | 4.9% |

| Genesis Energy L.P. | 2.7% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Income Fund

Class Y: MLPZX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Income Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Income Fund

(Class Y) | $406 | 7.65% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $3,680.75M% |

| Total number of portfolio holdings | $26% |

| Portfolio turnover rate as of the end of the reporting period | $10% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Western Midstream Partners L.P. | 15.1% |

| Energy Transfer L.P. | 14.8% |

| MPLX L.P. | 14.5% |

| Enterprise Products Partners L.P. | 13.3% |

| Antero Midstream Corp. | 8.8% |

| Plains All American Pipeline L.P. | 7.9% |

| Sunoco L.P. | 7.5% |

| USA Compression Partners L.P. | 6.0% |

| EnLink Midstream LLC | 4.9% |

| Genesis Energy L.P. | 2.7% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Income Fund

Class R5: SPMQX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Income Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Income Fund

(Class R5) | $404 | 7.62% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $3,680.75M% |

| Total number of portfolio holdings | $26% |

| Portfolio turnover rate as of the end of the reporting period | $10% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Western Midstream Partners L.P. | 15.1% |

| Energy Transfer L.P. | 14.8% |

| MPLX L.P. | 14.5% |

| Enterprise Products Partners L.P. | 13.3% |

| Antero Midstream Corp. | 8.8% |

| Plains All American Pipeline L.P. | 7.9% |

| Sunoco L.P. | 7.5% |

| USA Compression Partners L.P. | 6.0% |

| EnLink Midstream LLC | 4.9% |

| Genesis Energy L.P. | 2.7% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Income Fund

Class R6: OSPMX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Income Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Income Fund

(Class R6) | $401 | 7.58% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $3,680.75M% |

| Total number of portfolio holdings | $26% |

| Portfolio turnover rate as of the end of the reporting period | $10% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Western Midstream Partners L.P. | 15.1% |

| Energy Transfer L.P. | 14.8% |

| MPLX L.P. | 14.5% |

| Enterprise Products Partners L.P. | 13.3% |

| Antero Midstream Corp. | 8.8% |

| Plains All American Pipeline L.P. | 7.9% |

| Sunoco L.P. | 7.5% |

| USA Compression Partners L.P. | 6.0% |

| EnLink Midstream LLC | 4.9% |

| Genesis Energy L.P. | 2.7% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Select 40 Fund

Class A: MLPFX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Select 40 Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Select 40 Fund

(Class A) | $428 | 8.02% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $1,890.24M% |

| Total number of portfolio holdings | $42% |

| Portfolio turnover rate as of the end of the reporting period | $13% |

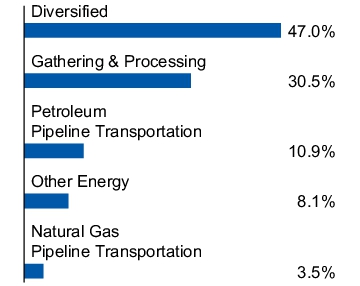

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 8.1% |

| MPLX L.P. | 7.4% |

| Western Midstream Partners L.P. | 6.1% |

| Williams Cos., Inc. | 5.5% |

| Targa Resources Corp. | 5.4% |

| Antero Midstream Corp. | 5.4% |

| Enterprise Products Partners L.P. | 5.3% |

| Genesis Energy L.P. | 5.3% |

| Kinder Morgan, Inc. | 5.2% |

| EnLink Midstream LLC | 5.1% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Select 40 Fund

Class C: MLPEX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Select 40 Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Select 40 Fund

(Class C) | $467 | 8.77% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $1,890.24M% |

| Total number of portfolio holdings | $42% |

| Portfolio turnover rate as of the end of the reporting period | $13% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 8.1% |

| MPLX L.P. | 7.4% |

| Western Midstream Partners L.P. | 6.1% |

| Williams Cos., Inc. | 5.5% |

| Targa Resources Corp. | 5.4% |

| Antero Midstream Corp. | 5.4% |

| Enterprise Products Partners L.P. | 5.3% |

| Genesis Energy L.P. | 5.3% |

| Kinder Morgan, Inc. | 5.2% |

| EnLink Midstream LLC | 5.1% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Select 40 Fund

Class R: SPMWX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Select 40 Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Select 40 Fund

(Class R) | $441 | 8.27% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $1,890.24M% |

| Total number of portfolio holdings | $42% |

| Portfolio turnover rate as of the end of the reporting period | $13% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 8.1% |

| MPLX L.P. | 7.4% |

| Western Midstream Partners L.P. | 6.1% |

| Williams Cos., Inc. | 5.5% |

| Targa Resources Corp. | 5.4% |

| Antero Midstream Corp. | 5.4% |

| Enterprise Products Partners L.P. | 5.3% |

| Genesis Energy L.P. | 5.3% |

| Kinder Morgan, Inc. | 5.2% |

| EnLink Midstream LLC | 5.1% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Select 40 Fund

Class Y: MLPTX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Select 40 Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Select 40 Fund

(Class Y) | $415 | 7.77% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $1,890.24M% |

| Total number of portfolio holdings | $42% |

| Portfolio turnover rate as of the end of the reporting period | $13% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 8.1% |

| MPLX L.P. | 7.4% |

| Western Midstream Partners L.P. | 6.1% |

| Williams Cos., Inc. | 5.5% |

| Targa Resources Corp. | 5.4% |

| Antero Midstream Corp. | 5.4% |

| Enterprise Products Partners L.P. | 5.3% |

| Genesis Energy L.P. | 5.3% |

| Kinder Morgan, Inc. | 5.2% |

| EnLink Midstream LLC | 5.1% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Select 40 Fund

Class R5: SPMVX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Select 40 Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Select 40 Fund

(Class R5) | $414 | 7.74% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $1,890.24M% |

| Total number of portfolio holdings | $42% |

| Portfolio turnover rate as of the end of the reporting period | $13% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 8.1% |

| MPLX L.P. | 7.4% |

| Western Midstream Partners L.P. | 6.1% |

| Williams Cos., Inc. | 5.5% |

| Targa Resources Corp. | 5.4% |

| Antero Midstream Corp. | 5.4% |

| Enterprise Products Partners L.P. | 5.3% |

| Genesis Energy L.P. | 5.3% |

| Kinder Morgan, Inc. | 5.2% |

| EnLink Midstream LLC | 5.1% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco SteelPath MLP Select 40 Fund

Class R6: OSPSX

SEMI-ANNUAL SHAREHOLDER REPORT | May 31, 2024

This semi-annual shareholder report contains important information about Invesco SteelPath MLP Select 40 Fund (the “Fund”) for the period December 1, 2023 to May 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 959-4246.

What Were The Fund Costs For The Last Six Months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

Invesco SteelPath MLP Select 40 Fund

(Class R6) | $413 | 7.74% |

What Are Key Statistics About The Fund?

(as of May 31, 2024)

| Fund net assets | $1,890.24M% |

| Total number of portfolio holdings | $42% |

| Portfolio turnover rate as of the end of the reporting period | $13% |

What Comprised The Fund's Holdings?

The table and chart below show the investment makeup of the Fund as of May 31, 2024.

Top Ten Holdings (% of net assets)

| Energy Transfer L.P. | 8.1% |

| MPLX L.P. | 7.4% |

| Western Midstream Partners L.P. | 6.1% |

| Williams Cos., Inc. | 5.5% |

| Targa Resources Corp. | 5.4% |

| Antero Midstream Corp. | 5.4% |

| Enterprise Products Partners L.P. | 5.3% |

| Genesis Energy L.P. | 5.3% |

| Kinder Morgan, Inc. | 5.2% |

| EnLink Midstream LLC | 5.1% |

Sector Allocation (% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at (800) 959-4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Not applicable for a semi-annual report.

Item 3. Audit Committee Financial Expert

Item 4. Principal Accountant Fees and Services

Not applicable.

Item 5. Audit Committee of Listed Registrants

Investments in securities of unaffiliated issuers is filed under Item 7 of this Form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

| | | | |

| Semi-Annual Financial Statements and Other Information | | | May 31, 2024 | |

| | | | |

| Invesco SteelPath MLP Alpha Fund | |

| |

| | | | |

| Nasdaq: | |

| A: MLPAX ∎ C: MLPGX ∎ R: SPMGX ∎ Y: MLPOX ∎ R5: SPMHX ∎ R6: OSPAX | |

| | |

| 2 | | Schedule of Investments |

| 3 | | Financial Statements |

| 6 | | Financial Highlights |

| 12 | | Notes to Financial Statements |

| 18 | | Other Information Required in Shareholder Reports |

Schedule of Investments

May 31, 2024

(Unaudited)

| | | | | | | | |

| | | Units | | | Value | |

Master Limited Partnerships And Related

Entities–99.24% | |

| Diversified–47.14% | |

Energy Transfer L.P. | | | 8,342,403 | | | $ | 130,725,461 | |

Enterprise Products Partners L.P. | | | 3,029,145 | | | | 86,330,632 | |

MPLX L.P. | | | 3,077,850 | | | | 125,206,938 | |

ONEOK, Inc. | | | 752,414 | | | | 60,945,534 | |

Williams Cos., Inc. | | | 981,651 | | | | 40,748,333 | |

| | | | | | | | 443,956,898 | |

| Gathering & Processing–30.50% | |

EnLink Midstream LLC | | | 1,874,145 | | | | 23,782,900 | |

Hess Midstream L.P., Class A | | | 573,651 | | | | 19,934,372 | |

Targa Resources Corp. | | | 1,035,762 | | | | 122,458,142 | |

Western Midstream Partners L.P. | | | 3,243,978 | | | | 121,065,255 | |

| | | | | | | | 287,240,669 | |

| Natural Gas Pipeline Transportation–2.58% | |

DT Midstream, Inc. | | | 153,311 | | | | 10,284,102 | |

Enbridge, Inc.(a) | | | 382,134 | | | | 13,978,462 | |

| | | | | | | | 24,262,564 | |

| Other Energy–8.16% | |

Cheniere Energy Partners LP | | | 192,568 | | | | 9,276,000 | |

Cheniere Energy, Inc. | | | 175,054 | | | | 27,621,771 | |

Sunoco L.P. | | | 782,510 | | | | 39,908,010 | |

| | | | | | | | 76,805,781 | |

| | | | | | | | |

| | | Units | | | Value | |

| Petroleum Pipeline Transportation–10.86% | |

Delek Logistics Partners L.P. | | | 168,514 | | | $ | 6,676,525 | |

Genesis Energy L.P. | | | 1,273,104 | | | | 15,939,262 | |

Plains All American Pipeline L.P. | | | 3,622,140 | | | | 61,612,601 | |

Plains GP Holdings L.P., Class A | | | 1,004,599 | | | | 18,092,828 | |

| | | | | | | | 102,321,216 | |

Total Master Limited Partnerships And Related Entities (Cost $903,436,709) | | | | 934,587,128 | |

| | |

| | | Shares | | | | |

Common Stocks–1.03% | |

| Natural Gas Pipeline Transportation–1.03% | |

Kinetik Holdings, Inc.

(Cost $8,016,469) | | | 237,525 | | | | 9,736,150 | |

Money Market Funds–2.45% | |

Fidelity Treasury Portfolio, Institutional Class, 5.19%

(Cost $23,100,451)(b) | | | 23,100,451 | | | | 23,100,451 | |

TOTAL INVESTMENTS IN SECURITIES–102.72%

(Cost $934,553,629) | | | | 967,423,729 | |

OTHER ASSETS LESS LIABILITIES–(2.72)% | | | | (25,623,524 | ) |

NET ASSETS–100% | | | | | | $ | 941,800,205 | |

Notes to Schedule of Investments:

| (a) | Foreign security denominated in U.S. dollars. |

| (b) | The rate shown is the 7-day SEC standardized yield as of May 31, 2024. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

2 Invesco SteelPath MLP Alpha Fund

Statement of Assets and Liabilities

May 31, 2024

(Unaudited)

| | | | |

Assets: | | | | |

Investments in unaffiliated securities, at value (Cost $934,553,629) | | $ | 967,423,729 | |

Receivable for: | | | | |

Investments sold | | | 12,677,267 | |

Fund shares sold | | | 284,562 | |

Dividends | | | 301,348 | |

Investment for trustee deferred compensation and retirement plans | | | 95,585 | |

Prepaid state income tax | | | 280,256 | |

Other assets | | | 88,736 | |

Total assets | | | 981,151,483 | |

| |

| | | | |

Liabilities: | | | | |

Payable for: | | | | |

Fund shares reacquired | | | 540,744 | |

Accrued fees to affiliates | | | 1,304,137 | |

Accrued interest expense | | | 587 | |

Accrued trustees’ and officers’ fees and benefits | | | 2,722 | |

Accrued other operating expenses | | | 28,649 | |

Current tax expense | | | 36,910,748 | |

Deferred tax liability, net | | | 468,106 | |

Trustee deferred compensation and retirement plans | | | 95,585 | |

Total liabilities | | | 39,351,278 | |

Net assets applicable to shares outstanding | | $ | 941,800,205 | |

| |

| | | | |

Net assets consist of: | | | | |

Shares of beneficial interest | | $ | 1,640,360,732 | |

Distributable earnings (loss), net of taxes | | | (698,560,527 | ) |

| | | $ | 941,800,205 | |

| | | | |

Net Assets: | | | | |

Class A | | $ | 443,581,505 | |

Class C | | $ | 90,181,708 | |

Class R | | $ | 1,998,916 | |

Class Y | | $ | 384,891,183 | |

Class R5 | | $ | 83,507 | |

Class R6 | | $ | 21,063,386 | |

| |

| | | | |

Shares outstanding, no par value, with an unlimited number of shares authorized: | |

Class A | | | 61,121,682 | |

Class C | | | 14,586,905 | |

Class R | | | 280,613 | |

Class Y | | | 49,680,760 | |

Class R5 | | | 11,333 | |

Class R6 | | | 2,685,170 | |

Class A: | | | | |

Net asset value per share | | $ | 7.26 | |

Maximum offering price per share

(net asset value $7.28 ÷ 94.50%) | | $ | 7.68 | |

Class C: | | | | |

Net asset value and offering price per share | | $ | 6.18 | |

Class R: | | | | |

Net asset value and offering price per share | | $ | 7.12 | |

Class Y: | | | | |

Net asset value and offering price per share | | $ | 7.75 | |

Class R5: | | | | |

Net asset value and offering price per share | | $ | 7.37 | |

Class R6: | | | | |

Net asset value and offering price per share | | $ | 7.84 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

3 Invesco SteelPath MLP Alpha Fund

Statement of Operations

For the six months ended May 31, 2024

(Unaudited)

| | | | |

Investment income: | | | | |

Distributions and dividends (net of return of capital distributions of $23,835,407) | | $ | 6,836,838 | |

Less: return of capital on distributions and dividends in excess of cost basis | | | (363,876 | ) |

Total investment income | | | 6,472,962 | |

| |

| | | | |

Expenses: | | | | |

Advisory fees | | | 4,967,454 | |

Administrative services fees | | | 149,186 | |

Custodian fees | | | 17,989 | |

Distribution fees: | | | | |

Class A | | | 527,773 | |

Class C | | | 465,809 | |

Class R | | | 4,355 | |

Transfer agent fees — A, C, R and Y | | | 541,589 | |

Transfer agent fees — R5 | | | 11 | |

Transfer agent fees — R6 | | | 2,743 | |

Interest, facilities and maintenance fees | | | 88,102 | |

State income tax expense | | | 6,888 | |

Trustees’ and officers’ fees and benefits | | | 12,630 | |

Registration and filing fees | | | 56,360 | |

Reports to shareholders | | | 108,489 | |

Professional services fees | | | 78,361 | |

Other | | | 9,568 | |

Total expenses, before waivers and deferred taxes | | | 7,037,307 | |

Less: Expenses reimbursed | | | (228,796 | ) |

Net expenses, before deferred taxes | | | 6,808,511 | |

Net investment income (loss), before deferred taxes | | | (335,549 | ) |

Net deferred tax benefit | | | 37,266,724 | |

Current tax (expense)/benefit | | | (36,910,748 | ) |

Net investment income (loss), net of deferred taxes | | | 20,427 | |

| |

| | | | |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from: | | | | |

Unaffiliated investment securities (includes net gain from securities sold to affiliates of $1,501,973) | | | 453,498,527 | |

Net deferred tax (expense) benefit | | | (105,358,306 | ) |

Net realized gain, net of deferred taxes | | | 348,140,221 | |

Change in net unrealized appreciation (depreciation) of: | | | | |

Unaffiliated investment securities | | | (310,352,068 | ) |

Net deferred tax (expense) benefit | | | 75,879,676 | |

Net change in net unrealized appreciation (depreciation) of investment securities, net of deferred taxes | | | (234,472,392 | ) |

Net realized and unrealized gain, net of deferred taxes | | | 113,667,829 | |

Net increase in net assets resulting from operations | | $ | 113,688,256 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

4 Invesco SteelPath MLP Alpha Fund

Statement of Changes in Net Assets

For the six months ended May 31, 2024 and the year ended November 30, 2023

(Unaudited)

| | | | | | | | |

| | | May 31, 2024 | | | November 30,

2023 | |

Operations: | | | | | | | | |

Net investment income (loss), net of deferred taxes | | $ | 20,427 | | | $ | (1,875,548 | ) |

Net realized gain, net of deferred taxes | | | 348,140,221 | | | | 134,154,119 | |

Change in net unrealized appreciation (depreciation), net of deferred taxes | | | (234,472,392 | ) | | | 14,332,373 | |

Net increase in net assets resulting from operations | | | 113,688,256 | | | | 146,610,944 | |

| | |

| | | | | | | | |

Distributions to shareholders from distributable earnings: | | | | | | | | |

Class A | | | (10,149,433 | ) | | | (23,476,914 | ) |

Class C | | | (2,597,955 | ) | | | (7,237,564 | ) |

Class R | | | (42,235 | ) | | | (68,912 | ) |

Class Y | | | (8,273,985 | ) | | | (19,352,650 | ) |

Class R5 | | | (1,761 | ) | | | (1,137 | ) |

Class R6 | | | (421,695 | ) | | | (984,124 | ) |

Total distributions from distributable earnings | | | (21,487,064 | ) | | | (51,121,301 | ) |

| | |

| | | | | | | | |

Share transactions–net: | | | | | | | | |

Class A | | | (1,120,989 | ) | | | (8,534,434 | ) |

Class C | | | (14,972,271 | ) | | | (25,710,731 | ) |

Class R | | | 291,508 | | | | 662,738 | |

Class Y | | | (5,952,723 | ) | | | (10,554,146 | ) |

Class R5 | | | 6,556 | | | | 56,685 | |

Class R6 | | | 1,457,388 | | | | (1,101,370 | ) |

Net increase (decrease) in net assets resulting from share transactions | | | (20,290,531 | ) | | | (45,181,258 | ) |

Net increase in net assets | | | 71,910,661 | | | | 50,308,385 | |

| | |

| | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 869,889,544 | | | | 819,581,159 | |

End of period | | $ | 941,800,205 | | | $ | 869,889,544 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

5 Invesco SteelPath MLP Alpha Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

May 31, 2024

(Unaudited) | | | Years Ended November 30, | |

| Class A | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

Per share operating data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 6.56 | | | $ | 5.84 | | | $ | 4.56 | | | $ | 3.58 | | | $ | 5.28 | | | $ | 6.56 | |

Net investment income (loss)(a) | | | (0.00 | ) | | | (0.01 | ) | | | (0.02 | ) | | | (0.11 | ) | | | (0.06 | ) | | | (0.03 | ) |

Return of capital(a) | | | 0.15 | | | | 0.28 | | | | 0.25 | | | | 0.24 | | | | 0.29 | | | | 0.34 | |

Net realized and unrealized gain (loss) | | | 0.72 | | | | 0.83 | | | | 1.42 | | | | 1.22 | | | | (1.42 | ) | | | (0.93 | ) |

Total from investment operations | | | 0.87 | | | | 1.10 | | | | 1.65 | | | | 1.35 | | | | (1.19 | ) | | | (0.62 | ) |

Less: | | | | | | | | | | | | | | | | | | | | | | | | |

Return of capital | | | — | | | | — | | | | — | | | | (0.37 | ) | | | (0.51 | ) | | | (0.62 | ) |

Dividends from net investment income | | | (0.17 | ) | | | (0.38 | ) | | | (0.37 | ) | | | — | | | | — | | | | (0.04 | ) |

Total distributions | | | (0.17 | ) | | | (0.38 | ) | | | (0.37 | ) | | | (0.37 | ) | | | (0.51 | ) | | | (0.66 | ) |

Net asset value, end of period | | $ | 7.26 | | | $ | 6.56 | | | $ | 5.84 | | | $ | 4.56 | | | $ | 3.58 | | | $ | 5.28 | |

Total return(b) | | | 13.35 | % | | | 19.67 | % | | | 37.02 | % | | | 38.26 | % | | | (22.24 | )% | | | (10.69 | )% |

Net assets, end of period (000’s omitted) | | $ | 443,582 | | | $ | 401,811 | | | $ | 366,201 | | | $ | 274,904 | | | $ | 203,978 | | | $ | 321,237 | |

Portfolio turnover rate | | | 100 | % | | | 32 | % | | | 25 | % | | | 31 | % | | | 88 | % | | | 32 | % |

| | | |

Ratios/supplemental data based on average net assets: | | | | | | | | | | | | | |

Ratio of expenses: | | | | | | | | | | | | | | | | | | | | |

Without fee waivers and/or expense reimbursements, before taxes | | | 1.60 | %(c) | | | 1.60 | % | | | 1.62 | % | | | 1.65 | % | | | 1.87 | % | | | 1.67 | % |

Expense (waivers) | | | (0.05 | )%(c) | | | (0.06 | )% | | | (0.08 | )% | | | (0.10 | )% | | | (0.13 | )% | | | (0.08 | )% |

With fee waivers and/or expense reimbursements, before taxes(d) | | | 1.55 | %(c) | | | 1.54 | % | | | 1.54 | % | | | 1.55 | % | | | 1.74 | % | | | 1.59 | % |

Deferred/current tax expense (benefit)(e) | | | 6.44 | %(c) | | | 1.52 | % | | | 0.85 | % | | | 1.28 | % | | | 0.77 | % | | | — | % |

With fee waivers and/or expense reimbursements, after taxes | | | 7.99 | %(c) | | | 3.06 | % | | | 2.39 | % | | | 2.83 | % | | | 2.51 | % | | | 1.59 | % |

| |

Ratio of investment income (loss): | | | | | |

Ratio of net investment income (loss), before taxes | | | (0.16 | )%(c) | | | (0.61 | )% | | | (0.88 | )% | | | (0.92 | )% | | | (1.57 | )% | | | (0.56 | )% |

Net of expense (waivers) and before deferred tax benefit (expense) | | | (0.11 | )%(c) | | | (0.55 | )% | | | (0.80 | )% | | | (0.82 | )% | | | (1.44 | )% | | | (0.48 | )% |