Investor Presentation June 2014

Safe Harbor Statement NOTE: This presentation contains certain statements that are not historical facts and that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements in this presentation addressing expectations, assumptions, beliefs, projections, future plans, strategies, and events, developments that we expect or anticipate will occur in the future, and future operating results or financial condition are forward-looking statements. Forward-looking statements in this presentation may include, but are not limited to statements about projected future investment strategies, investment opportunities, financial performance, dividends, leverage ratios, capital raising activities, share issuances and repurchases, the use or impact of NOL carryforwards, and interest rates. The words “will,” “believe,” “expect,” “forecast,” “anticipate,” “intend,” “estimate,” “assume,” “project,” “plan,” “continue,” and similar expressions also identify forward-looking statements. These forward-looking statements reflect our current beliefs, assumptions and expectations based on information currently available to us, and are applicable only as of the date of this presentation. Forward-looking statements are inherently subject to risks, uncertainties, and other factors, some of which cannot be predicted or quantified and any of which could cause the Company’s actual results and timing of certain events to differ materially from those projected in or contemplated by these forward-looking statements. Not all of these risks, uncertainties and other factors are known to us. New risks and uncertainties arise over time, and it is not possible to predict those risks or uncertainties or how they may affect us. The projections, assumptions, expectations or beliefs upon which the forward-looking statements are based can also change as a result of these risks and uncertainties or other factors. If such a risk, uncertainty, or other factor materializes in future periods, our business, financial condition, liquidity and results of operations may differ materially from those expressed or implied in our forward-looking statements. While it is not possible to identify all factors, some of the factors that may cause actual results to differ from historical results or from any results expressed or implied by our forward-looking statements, or that may cause our projections, assumptions, expectations or beliefs to change, include the risks and uncertainties referenced in our Annual Report on Form 10-K for the year ended December 31, 2013 and subsequent filings with the Securities and Exchange Commission, particularly those set forth under the caption “Risk Factors”. 2

3 • Established in 1988, investing across commercial and residential sectors, with a long history of managing businesses across mortgage value chain • Investment philosophy based on conserving capital and managing for the long-term through market cycles • Experienced management team with 100+ years managing assets • Since 2008, delivered a total return of 92%*, an average dividend yield of 10.9%*, and common market capitalization has grown over 4x • Internally managed and high insider ownership aligns interests with shareholders About Dynex *Source: SNL Financial

4 • Mission: Manage a successful public mortgage REIT with a focus on capital preservation and providing risk-adjusted returns reflective of a diversified, leveraged fixed income portfolio. • Objectives and Core Values: Generate dividends for shareholders Manage leverage conservatively Remain owner-operators Maintain a culture of integrity and employ the highest ethical standards Provide a strong risk management culture Focus on long-term shareholder value while preserving capital About Dynex

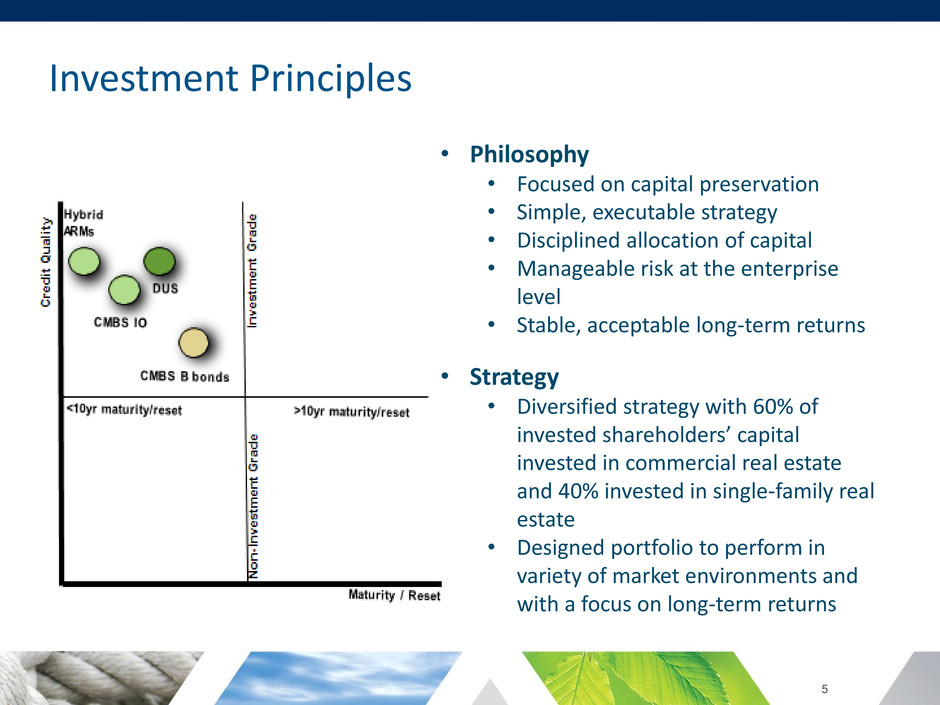

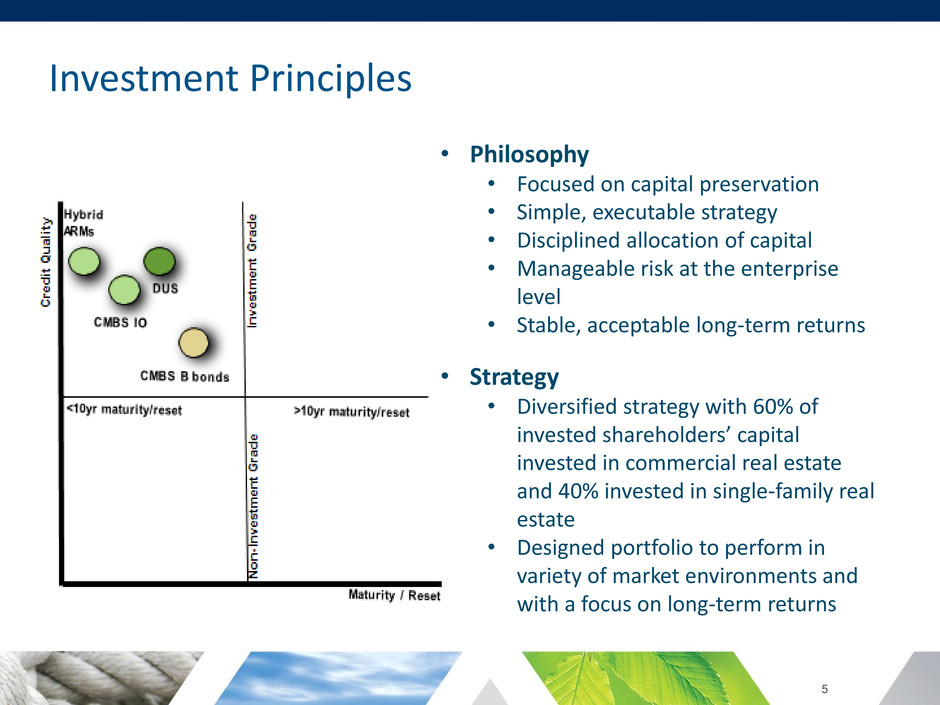

5 Investment Principles • Philosophy • Focused on capital preservation • Simple, executable strategy • Disciplined allocation of capital • Manageable risk at the enterprise level • Stable, acceptable long-term returns • Strategy • Diversified strategy with 60% of invested shareholders’ capital invested in commercial real estate and 40% invested in single-family real estate • Designed portfolio to perform in variety of market environments and with a focus on long-term returns

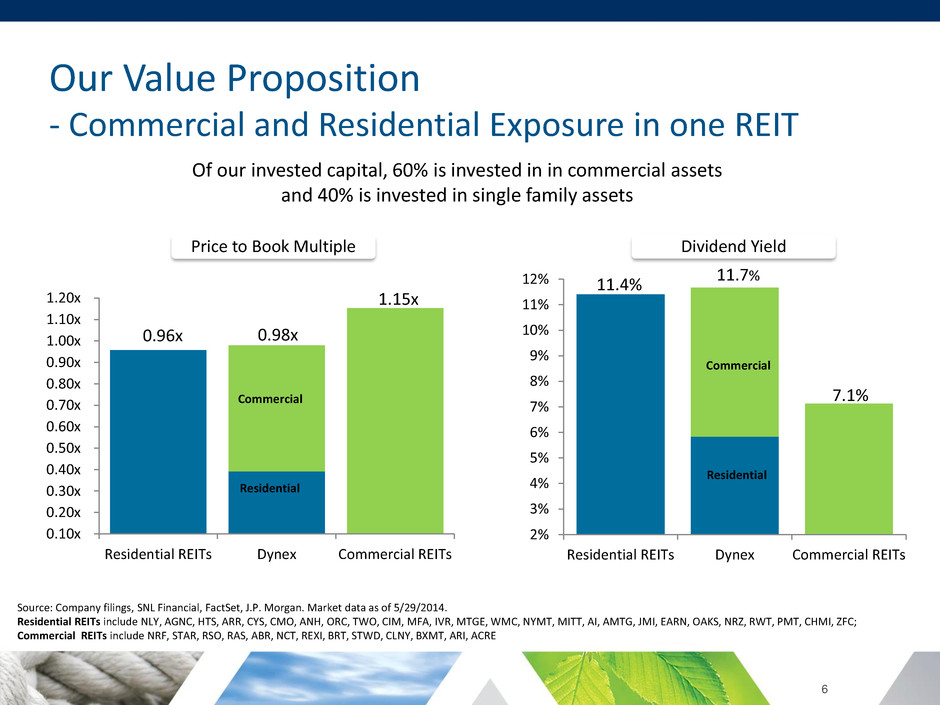

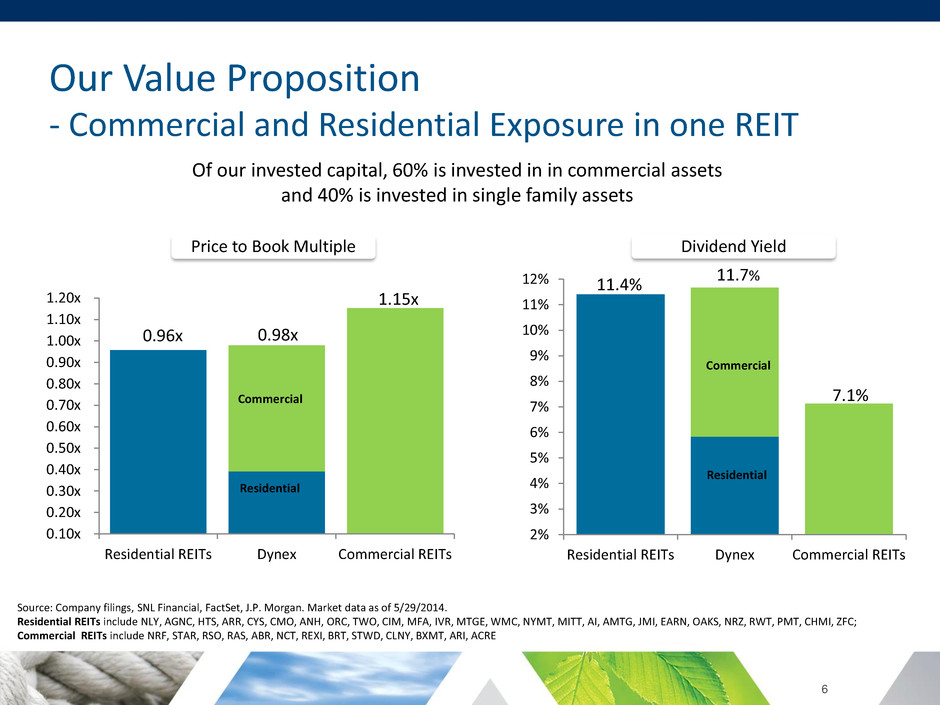

6 Our Value Proposition - Commercial and Residential Exposure in one REIT Of our invested capital, 60% is invested in in commercial assets and 40% is invested in single family assets 11.4% 7.1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% Residential REITs Dynex Commercial REITs Commercial Residential 0.96x 0.98x 1.15x 0.10x 0.20x 0.30x 0.40x 0.50x 0.60x 0.70x 0.80x 0.90x 1.00x 1.10x 1.20x Residential REITs Dynex Commercial REITs Commercial Residential Source: Company filings, SNL Financial, FactSet, J.P. Morgan. Market data as of 5/29/2014. Residential REITs include NLY, AGNC, HTS, ARR, CYS, CMO, ANH, ORC, TWO, CIM, MFA, IVR, MTGE, WMC, NYMT, MITT, AI, AMTG, JMI, EARN, OAKS, NRZ, RWT, PMT, CHMI, ZFC; Commercial REITs include NRF, STAR, RSO, RAS, ABR, NCT, REXI, BRT, STWD, CLNY, BXMT, ARI, ACRE 11.7% Price to Book Multiple Dividend Yield

• Excess liquidity from global monetary policy is unprecedented and has led to asset value distortions. Foreign central bank action plans remain uncertain and could cause unexpected results. • The current market environment is complex. Risk premiums have declined as cash seeks to find higher returns – spreads significantly tighter across many risk assets. • In addition, uncertainty around economic growth, regulatory changes, market reaction and global market imbalances require discipline and vigilance. • Our investment strategy and thesis remains intact as we have designed our portfolio to perform in multiple market environments. We continue to generate an above average dividend yield with a conservative profile • Longer term, we see opportunities for investments in both residential and commercial assets and in markets currently dominated by the Fed/GSEs – At the conclusion of QE3, private capital for the first time will need to replace the government as the dominant purchaser of MBS – As the US housing system is reformed, there should be more opportunity to invest in residential credit 7 Current Market View

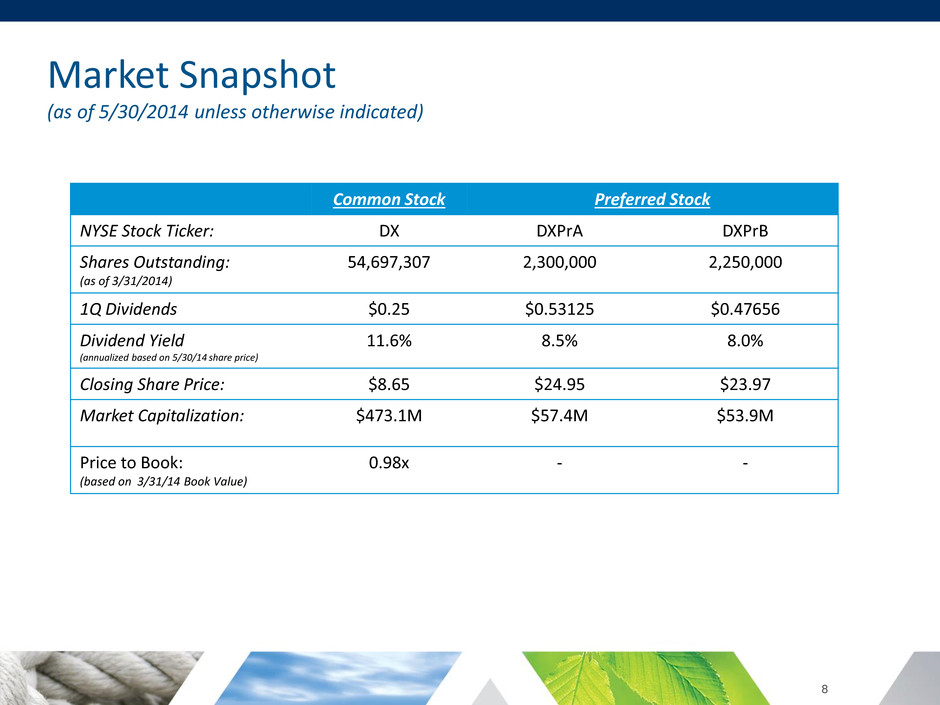

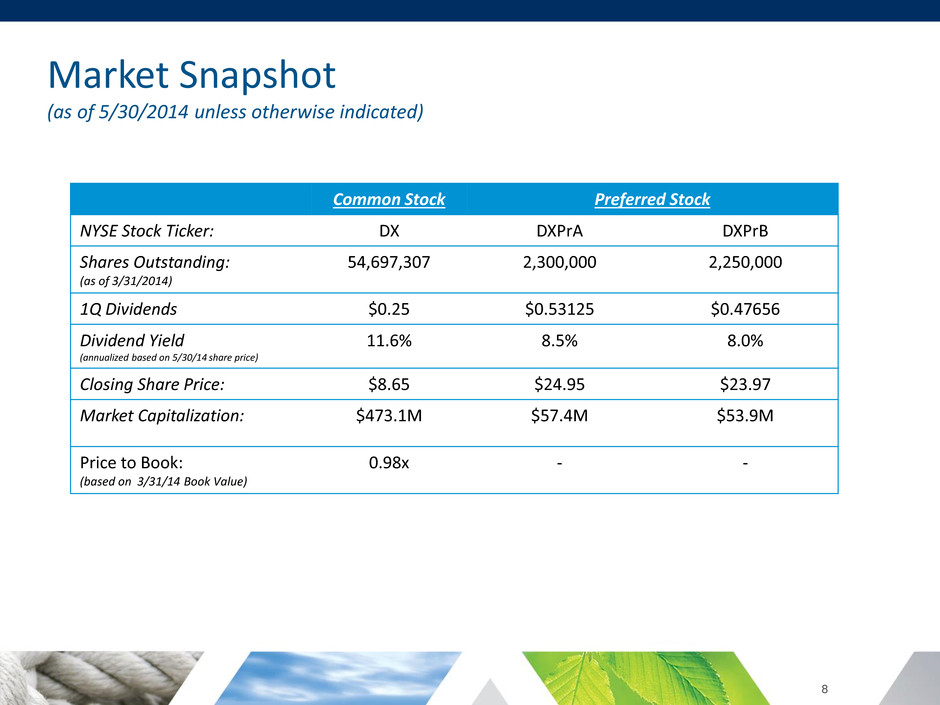

Market Snapshot (as of 5/30/2014 unless otherwise indicated) Common Stock Preferred Stock NYSE Stock Ticker: DX DXPrA DXPrB Shares Outstanding: (as of 3/31/2014) 54,697,307 2,300,000 2,250,000 1Q Dividends $0.25 $0.53125 $0.47656 Dividend Yield (annualized based on 5/30/14 share price) 11.6% 8.5% 8.0% Closing Share Price: $8.65 $24.95 $23.97 Market Capitalization: $473.1M $57.4M $53.9M Price to Book: (based on 3/31/14 Book Value) 0.98x - - 8

APPENDIX 9

CMBS Investment Thesis 10 • CMBS market has rebounded since the crisis with better underwriting, more subordination, and broad investor participation • Fundamentals still positive for Commercial Real Estate, particularly multifamily, given demographic fundamentals and attitude shifts • Market technicals are favorable given deep liquidity, deep investor participation and favorable supply • Market psychology reflects “risk on” view and a flatter credit curve

CMBS Portfolio (as of March 31, 2014) AAA, 73% AA, 6% A, 18% Below A, 3% Other 25% Multifamily 75% 11 Credit Quality Collateral Vintage (by year of origination) Asset Type $ in millions Agency MBS are considered AAA-rated for purposes of this chart. $0 $50 $100 $150 $200 $250 $300 $350 $400 Agency CMBS, $346.2 Agency CMBS IO, $471.2 Non-Agency CMBS, $376.0 Non-Agency CMBS IO, $211.5

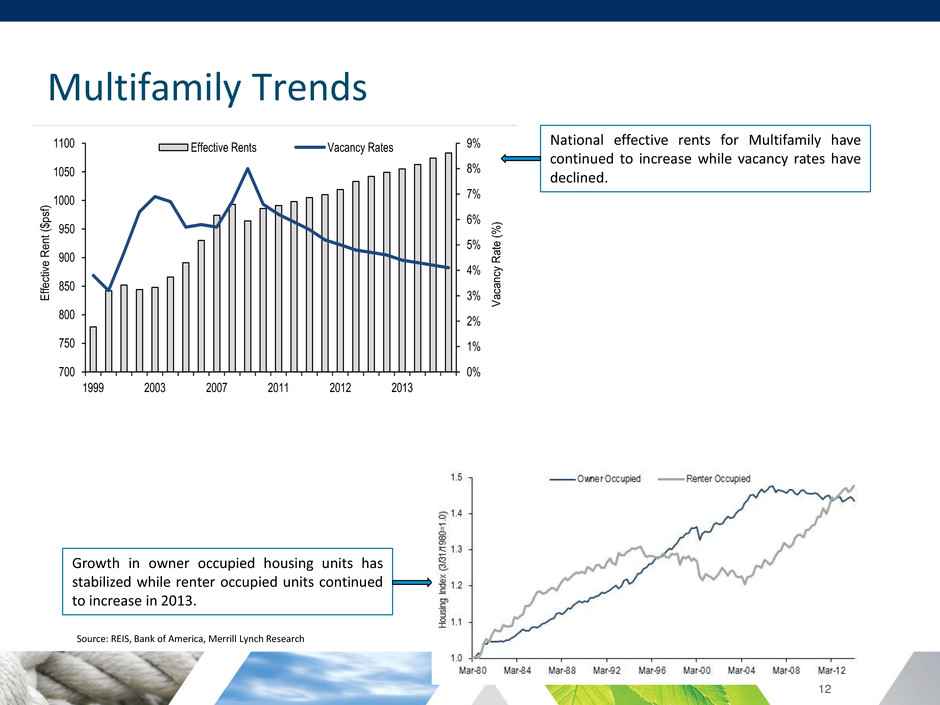

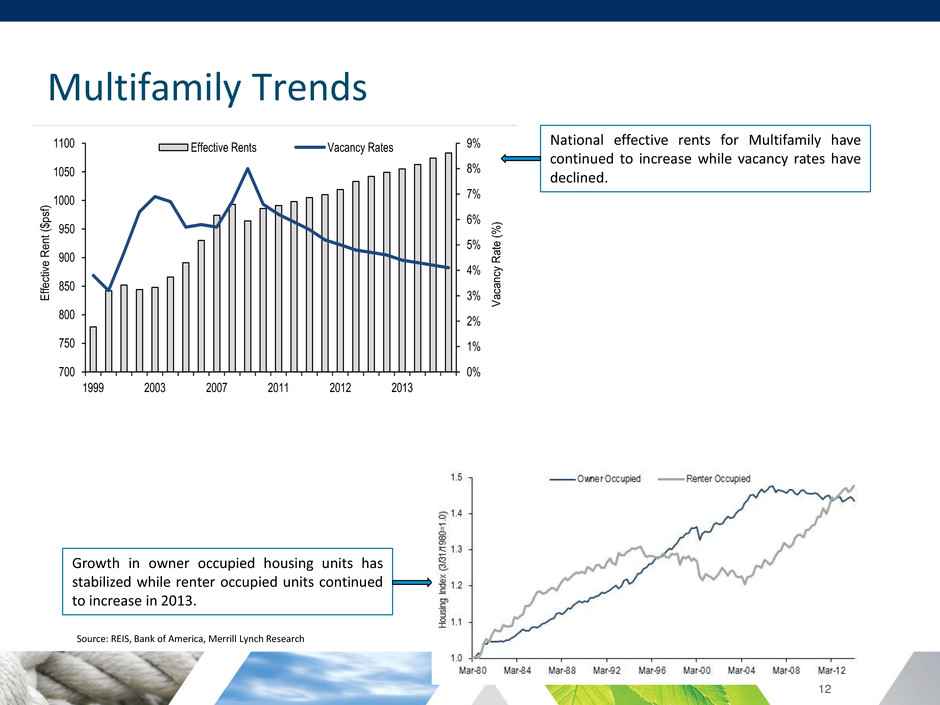

Multifamily Trends 12 The US Fixed Income Week ly 07 February 2014 56 4Q 2013 CRE property sector review Commercial real estate fundamentals continued to improve in the fourth quarter of 2013 as effective rent levels increased and vacancy rates remained stable and even decreased across the majority of property types. Although performance varied depending on an asset’s property type and location, one trend persisted: cities and regions with significant energy, technology and healthcare exposure enjoyed stronger growth than did cities without these industries. As we move through 2014, although we believe fundamental performance will continue to improve, the recovery will remain uneven. As a result, we expect that we will continue to see tiering among assets based on location, property type and quality. The multifamily sector Multifamily fundamentals continued to improve during the fourth quarter of 2013. While vacancy rates ticked only slightly lower to 4.1%, they ended the year at a level that hasn’t been seen since roughly 2000/2001. At the national level, effective rents increased by almost 1% quarter-over-quarter and by more than 3% from Q4 of 2012 to Q4 of 2013 (Chart 57). Chart 57:National effective rents continue to increase for multifamily properties while vacancy rates have slightly ticked lower Source: REIS Across 83 major metro areas in the U.S., three cities with significant exposure to the technology industry – Seattle, San Francisco and San Jose – realized the largest year-over-year changes in effective rents of any city we track (Chart 58). 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 700 750 800 850 900 950 1000 1050 1100 1999 2003 2007 2011 2012 2013 Effective Rents Vacancy Rates Eff ect ive Re nt ($p sf) Va can cy Ra te (% ) National effective rents for Multifamily have continued to increase while vacancy rates have declined. Growth in owner occupied housing units has stabilized while renter occupied units continued to increase in 2013. Source: REIS, Bank of America, Merrill Lynch Research

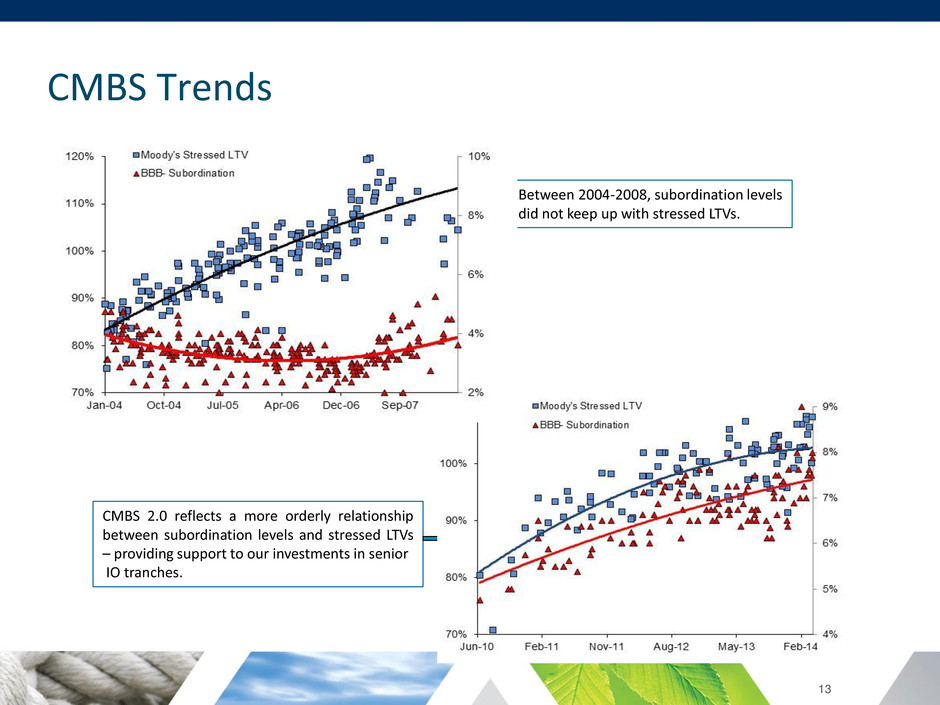

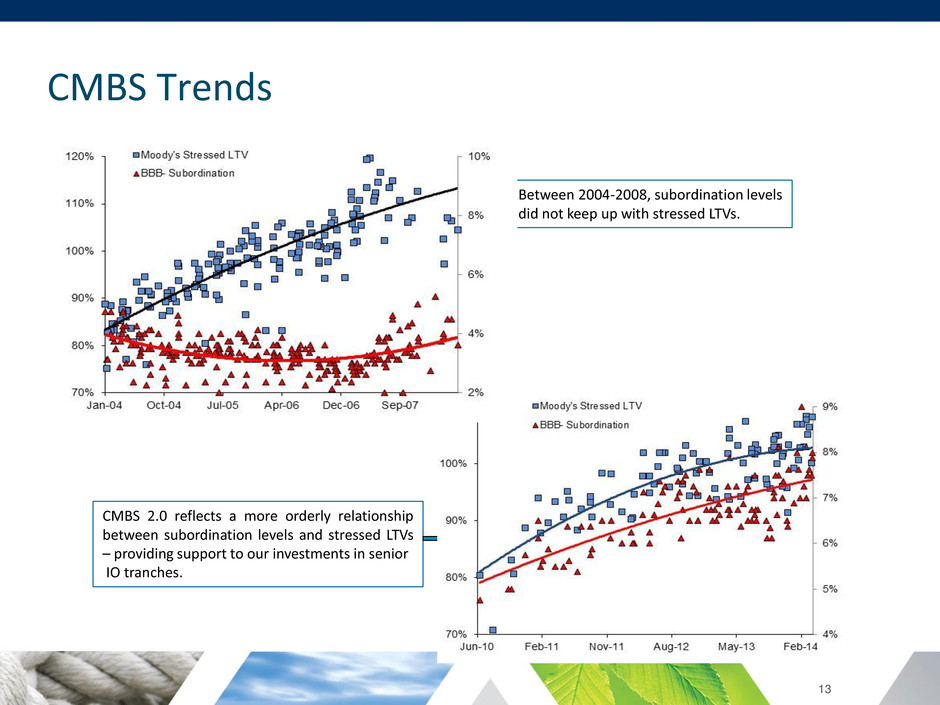

CMBS Trends 13 Between 2004-2008, subordination levels did not keep up with stressed LTVs. CMBS 2.0 reflects a more orderly relationship between subordination levels and stressed LTVs – providing support to our investments in senior IO tranches.

RMBS Investment Thesis • Hybrid ARMs diversified across product type: – Extension risk limited – Agency guarantee – Steep yield curve offers opportunity to roll down 14 • Fundamentals - Slowing trend in prepayments for premium securities - Refinancing activity slowed down as rates rose - Valuations have improved reflecting advantages of shorter duration investments in a rising rate environment and slowing prepayments • Technicals - Net Hybrid ARM supply remains negative - Originator pipelines significantly lower than in 2013 - Strong demand for shorter duration cash flow across investor types - Steep yield curve and rising rates could cause an increase in ARM supply • Psychology - Lower risk profile is attractive - Reduction in large scale asset purchases by Federal Reserve could have spillover effect

RMBS Portfolio (as of March 31, 2014) 15 Credit Quality Weighted Average Loan Age Asset Type Months AAA 99% Not Rated 1% Months Months to Maturity/Reset Agency RMBS 96% Agency CMO 3% Non-Agency RMBS 1% 8% 19% 48% 7% 12% 6% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 23% 9% 29% 3% 36% $- $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 0-12 13-36 37-60 61-84 84-120 $ in millions

Interest Rate Sensitivity (as of March 31, 2014) 16 Parallel Change in Treasury Yields (in basis points) Percentage Change in Projected Market Value of Assets Net of Hedges +100 (1.46)% +50 (0.69)% +25 (0.33)% Curve Shift 2 year Treasury (in basis points) Curve Shift 10 year Treasury (in basis points) Percentage Change in Projected Market Value of Assets Net of Hedges 0 +25 (0.11)% +10 +50 (0.32)% +10 +75 (0.49)% +25 +75 (0.59)% +25 0 (0.20)% +50 0 (0.41)% -10 -50 0.19% Treasury Yields 2Y 0.42% 5Y 1.72% 10Y 2.72% 30Y 3.56% Intermediate curve point shifts are interpolated for non-parallel scenarios

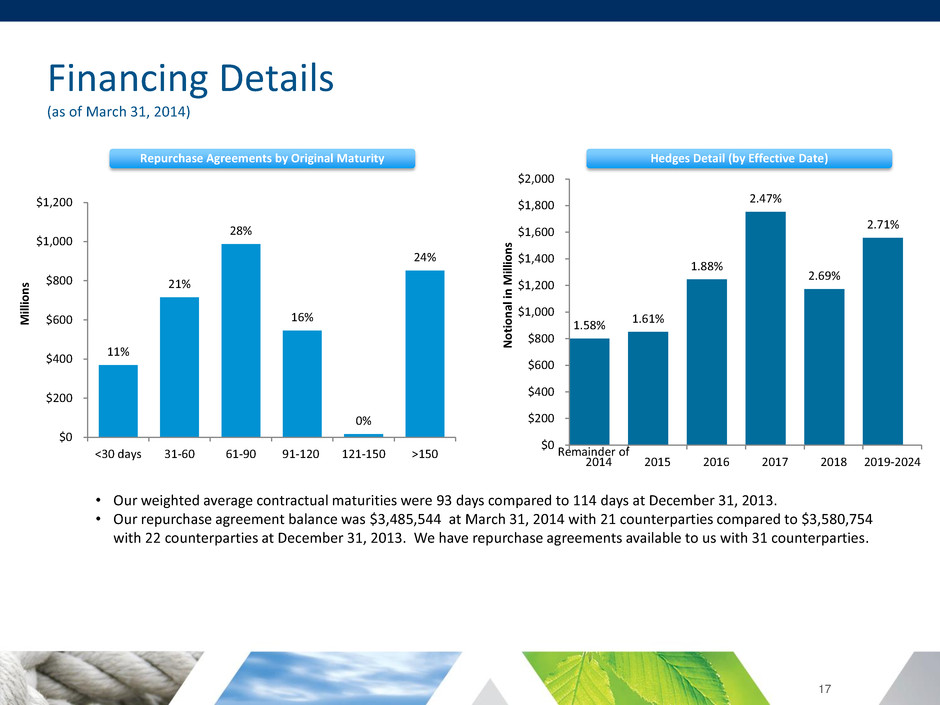

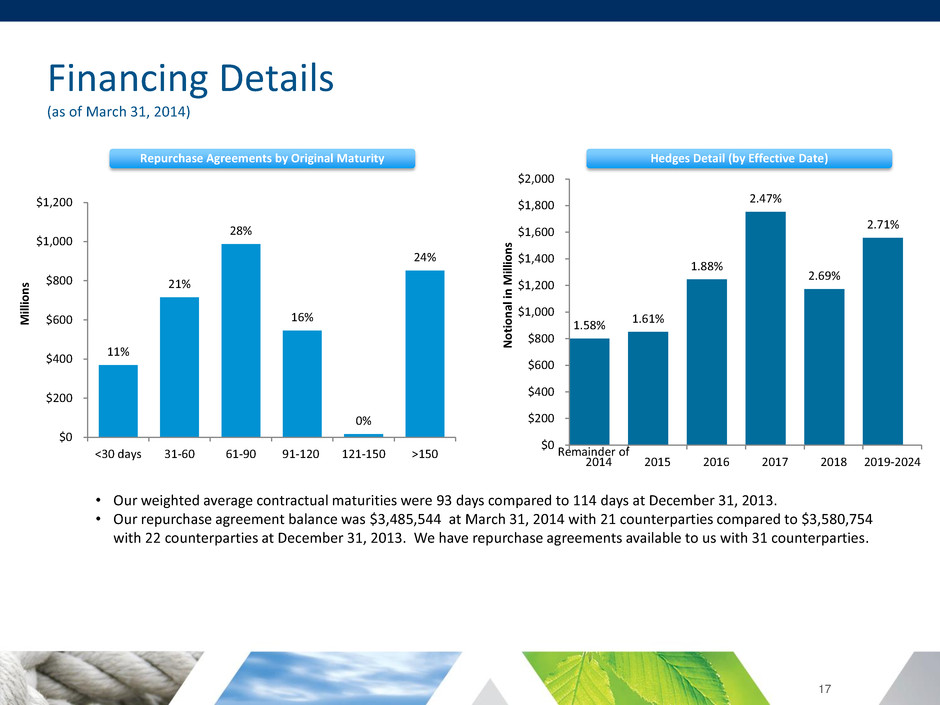

Financing Details (as of March 31, 2014) 17 Repurchase Agreements by Original Maturity 1.58% 1.61% 1.88% 2.47% 2.69% 2.71% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2014 2015 2016 2017 2018 2019-2024 N o tio n al in M ill io n s Remainder of Hedges Detail (by Effective Date) 11% 21% 28% 16% 0% 24% $0 $200 $400 $600 $800 $1,000 $1,200 <30 days 31-60 61-90 91-120 121-150 >150 M ill io n s • Our weighted average contractual maturities were 93 days compared to 114 days at December 31, 2013. • Our repurchase agreement balance was $3,485,544 at March 31, 2014 with 21 counterparties compared to $3,580,754 with 22 counterparties at December 31, 2013. We have repurchase agreements available to us with 31 counterparties.

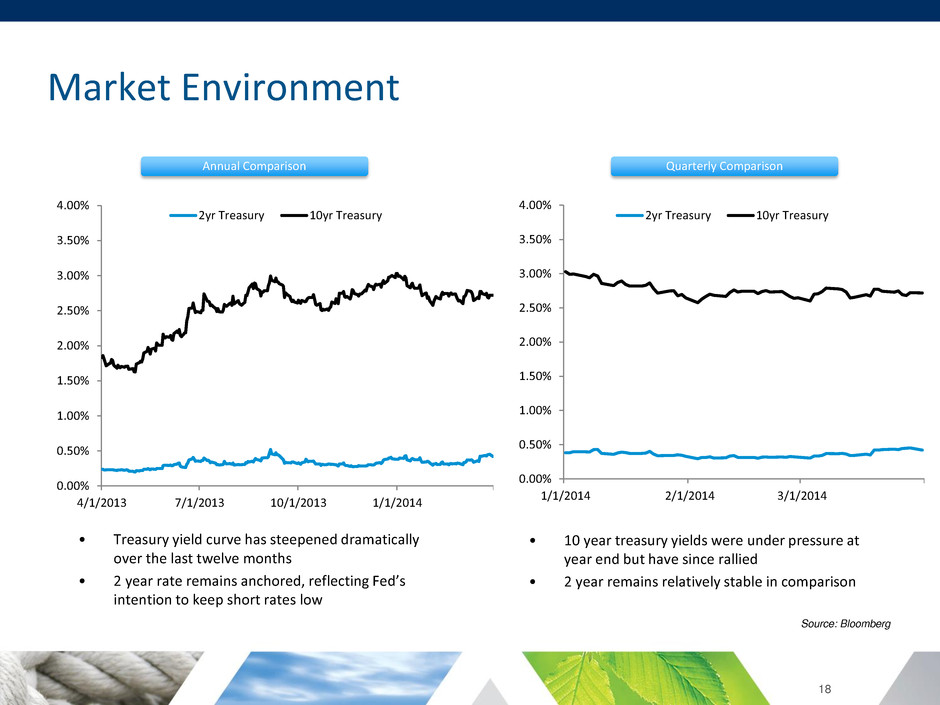

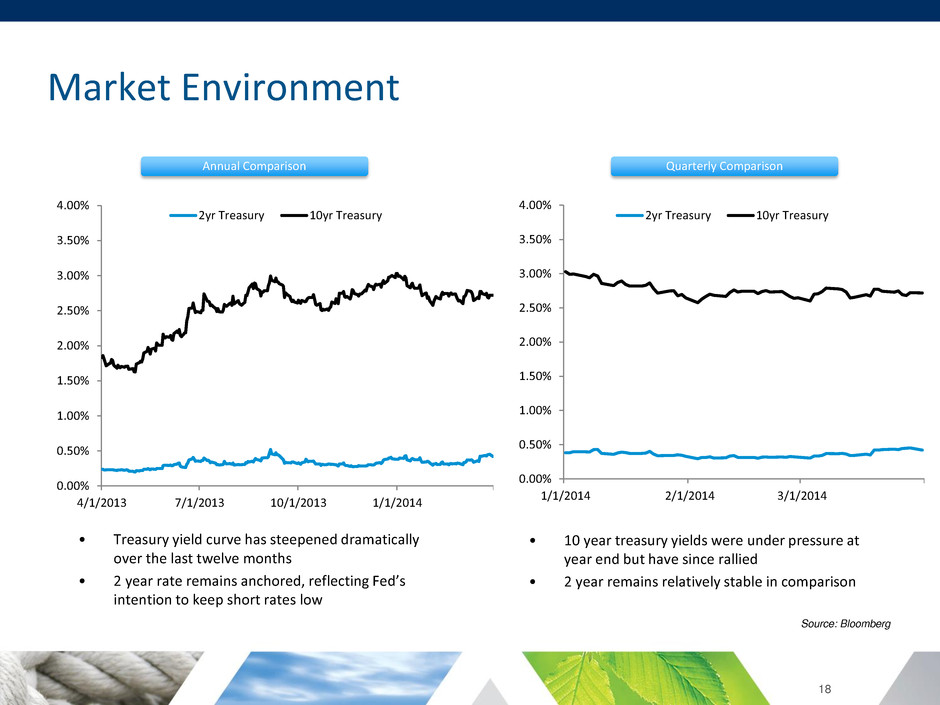

Market Environment • Treasury yield curve has steepened dramatically over the last twelve months • 2 year rate remains anchored, reflecting Fed’s intention to keep short rates low 18 Annual Comparison Quarterly Comparison • 10 year treasury yields were under pressure at year end but have since rallied • 2 year remains relatively stable in comparison Source: Bloomberg 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 1/1/2014 2/1/2014 3/1/2014 2yr Treasury 10yr Treasury 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4/1/2013 7/1/2013 10/1/2013 1/1/2014 2yr Treasury 10yr Treasury

19 Market Environment Homeownership Rates 59.0% 60.0% 61.0% 62.0% 63.0% 64.0% 65.0% 66.0% 67.0% 68.0% 69.0% 70.0% 64.8% 69.2% Source: U.S. Census Bureau

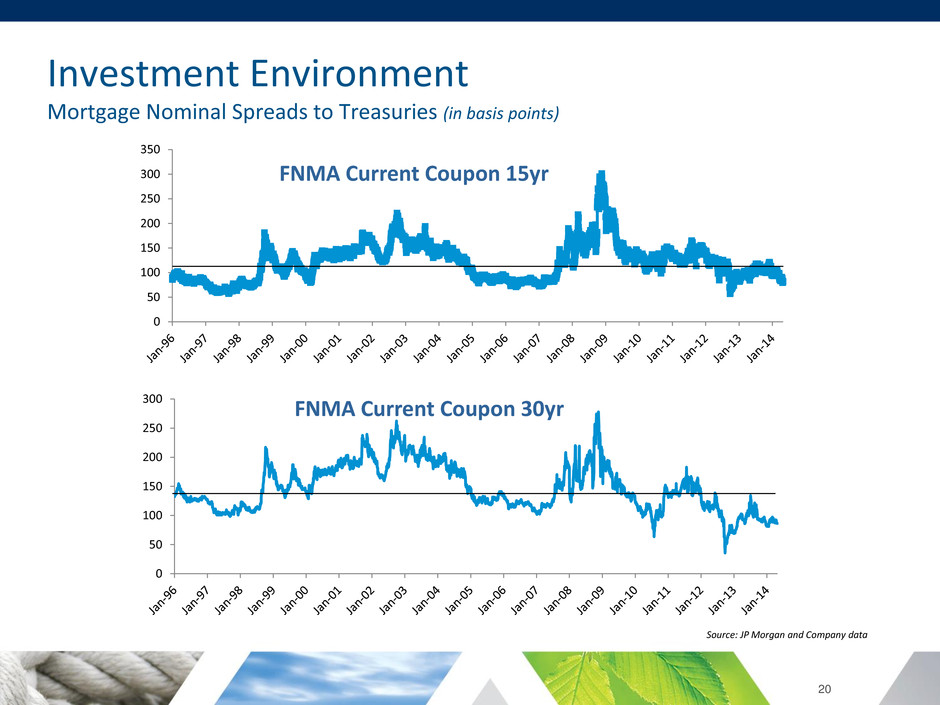

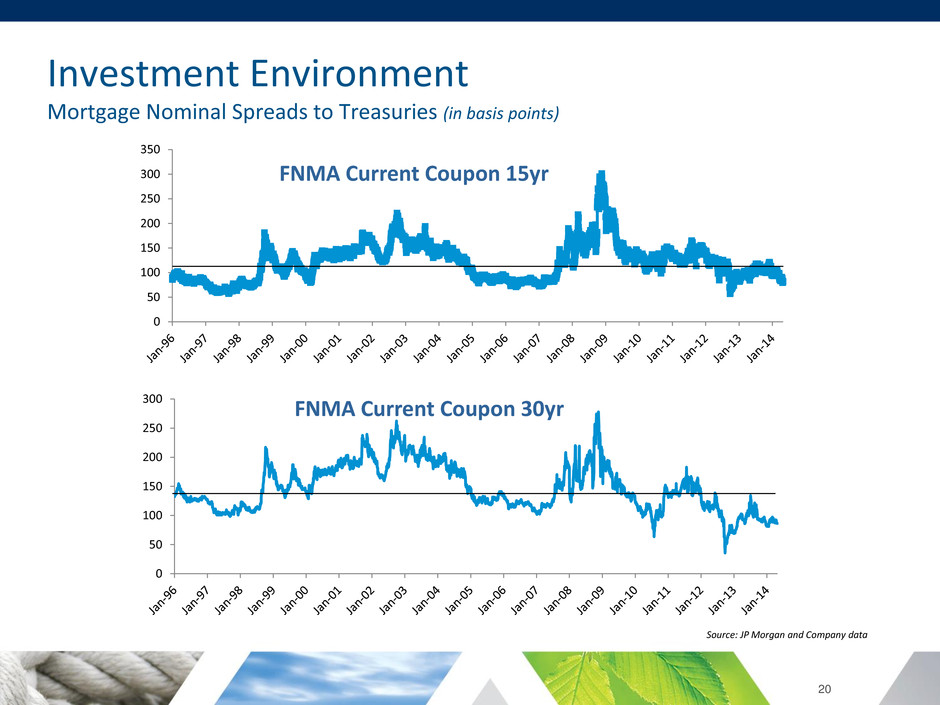

20 Investment Environment Mortgage Nominal Spreads to Treasuries (in basis points) 0 50 100 150 200 250 300 FNMA Current Coupon 30yr 0 50 100 150 200 250 300 350 FNMA Current Coupon 15yr Source: JP Morgan and Company data

Investment Environment Non-Mortgage Spreads to Treasuries (in basis points) 21 0 100 200 300 400 500 600 700 800 Investment Grade Composite High Yield Composite Emerging Market Composite Source: Bloomberg Composite Indexes

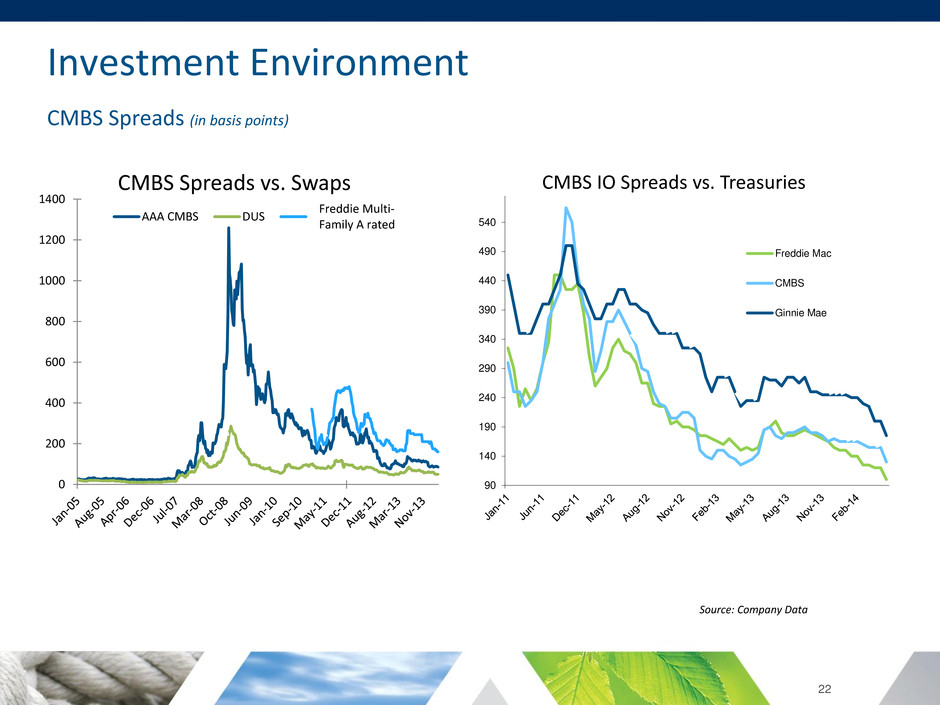

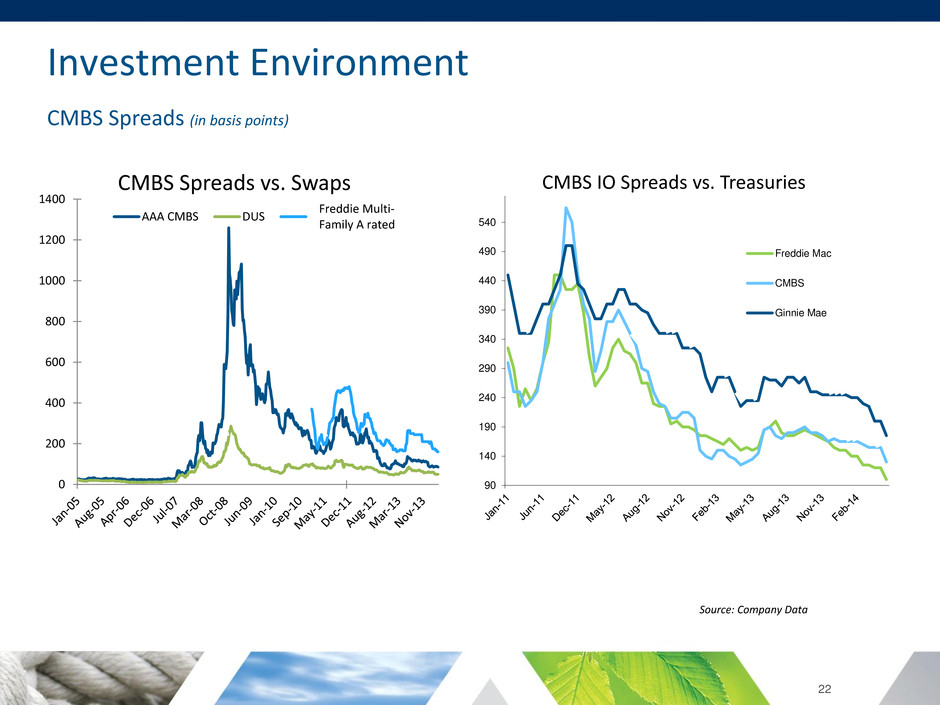

Investment Environment CMBS Spreads (in basis points) 22 Source: Company Data 0 200 400 600 800 1000 1200 1400 CMBS Spreads vs. Swaps AAA CMBS DUS Freddie Credit 90 140 190 240 290 340 390 440 490 540 Freddie Mac CMBS Ginnie Mae CMBS IO Spreads vs. Treasuries Freddie Multi- Family A rated

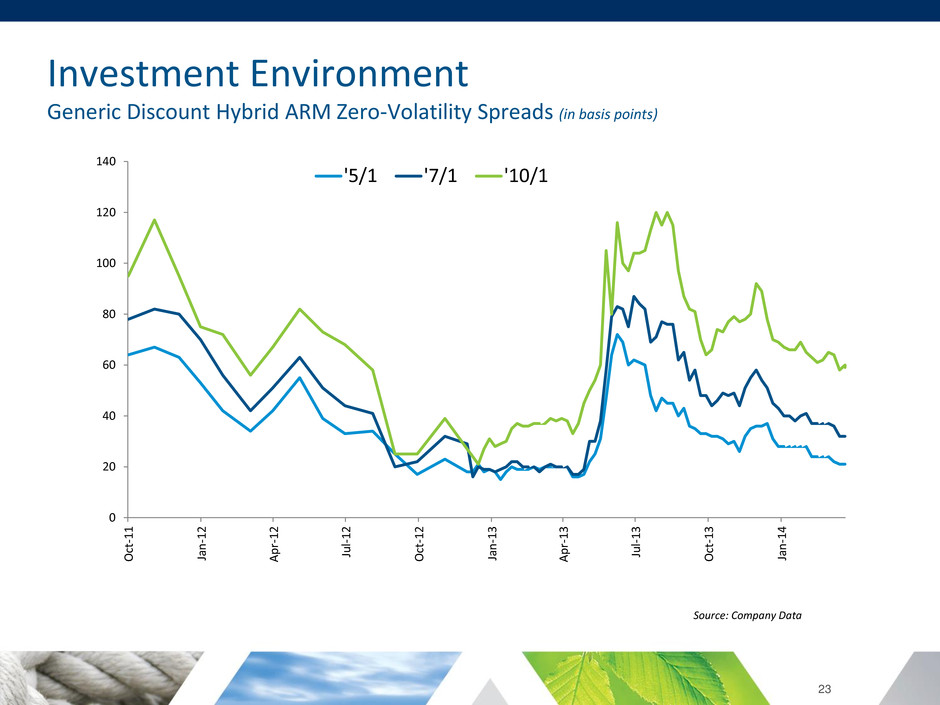

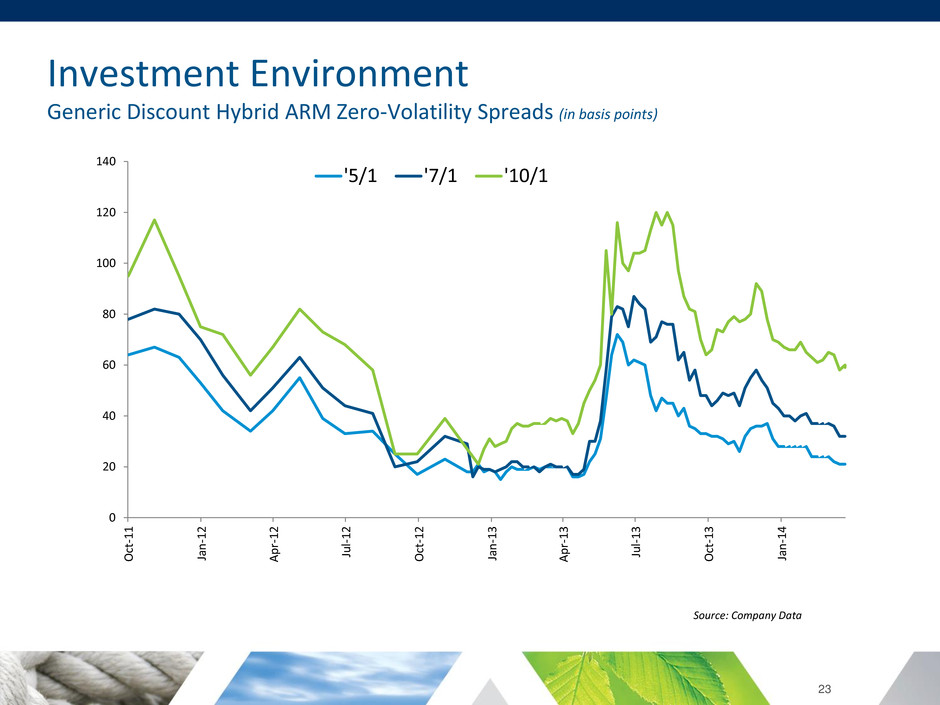

23 0 20 40 60 80 100 120 140 Oct -1 1 Ja n -1 2 A p r- 1 2 Ju l- 1 2 Oct -1 2 Ja n -1 3 A p r- 1 3 Ju l- 1 3 Oct -1 3 Ja n -1 4 '5/1 '7/1 '10/1 Investment Environment Generic Discount Hybrid ARM Zero-Volatility Spreads (in basis points) Source: Company Data

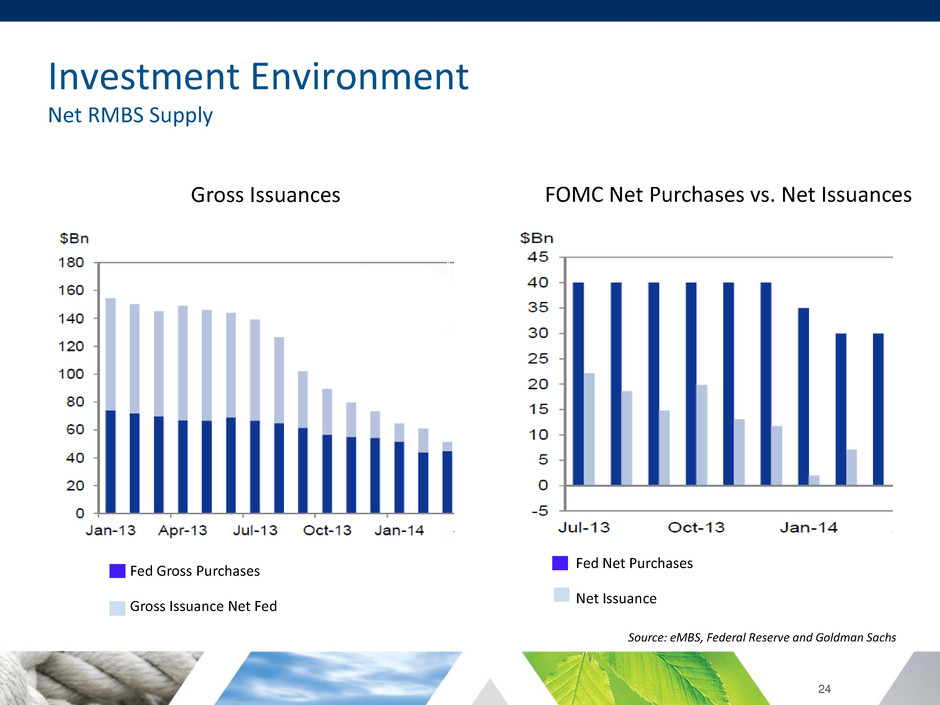

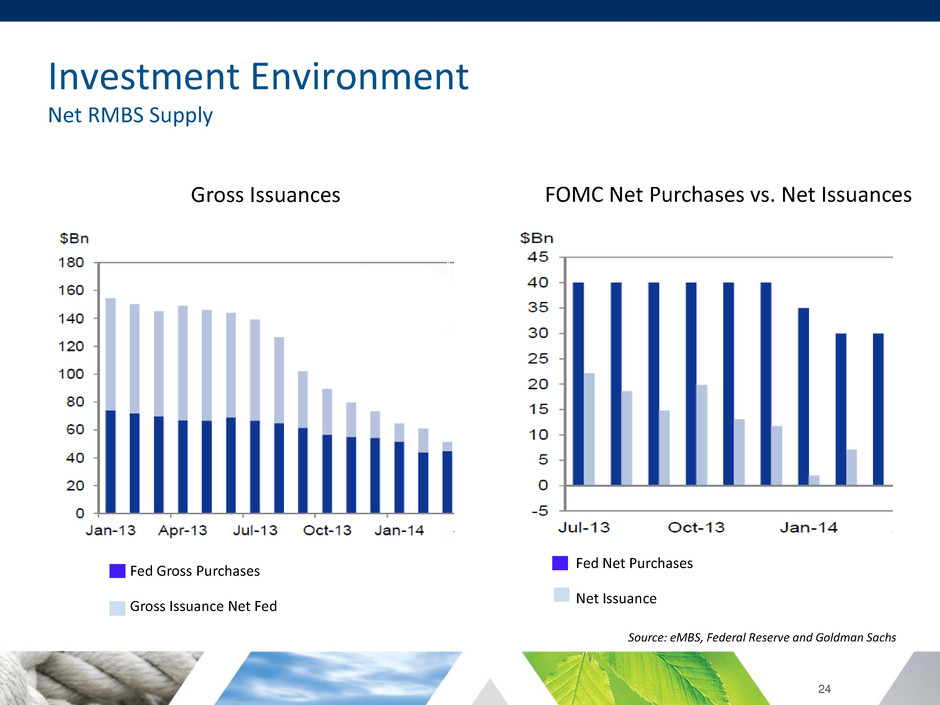

24 Investment Environment Net RMBS Supply FOMC Net Purchases vs. Net Issuances Gross Issuances Source: eMBS, Federal Reserve and Goldman Sachs Fed Gross Purchases Gross Issuance Net Fed Fed Net Purchases Net Issuance

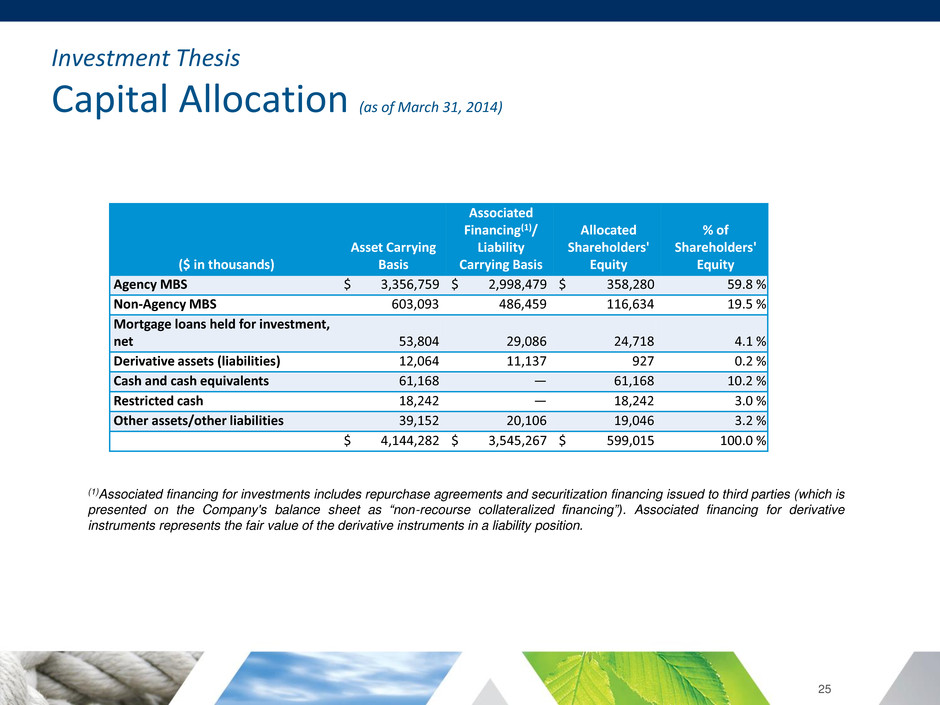

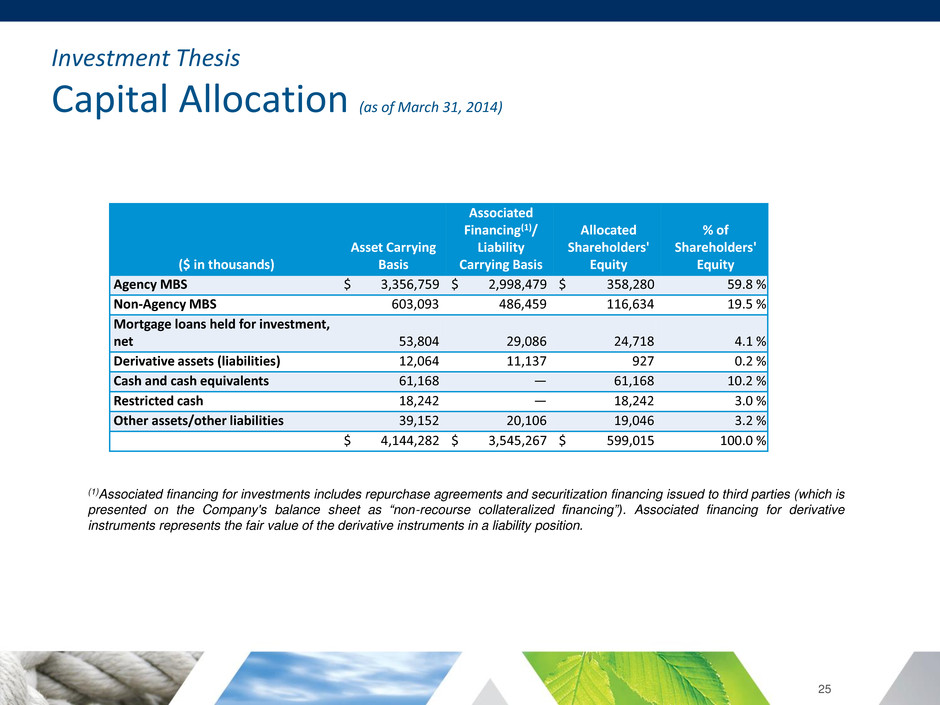

25 Investment Thesis Capital Allocation (as of March 31, 2014) (1)Associated financing for investments includes repurchase agreements and securitization financing issued to third parties (which is presented on the Company's balance sheet as “non-recourse collateralized financing”). Associated financing for derivative instruments represents the fair value of the derivative instruments in a liability position. ($ in thousands) Asset Carrying Basis Associated Financing(1)/ Liability Carrying Basis Allocated Shareholders' Equity % of Shareholders' Equity Agency MBS $ 3,356,759 $ 2,998,479 $ 358,280 59.8 % Non-Agency MBS 603,093 486,459 116,634 19.5 % Mortgage loans held for investment, net 53,804 29,086 24,718 4.1 % Derivative assets (liabilities) 12,064 11,137 927 0.2 % Cash and cash equivalents 61,168 — 61,168 10.2 % Restricted cash 18,242 — 18,242 3.0 % Other assets/other liabilities 39,152 20,106 19,046 3.2 % $ 4,144,282 $ 3,545,267 $ 599,015 100.0 %

Drivers of EPS Investment Premium Allocation 26 (as of end of period) -$100 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2009 2010 2011 2012 2013 Q12014 M ill ion s Premium (Discount), net - CMBS and loans Premium, net - RMBS and loans

Drivers of EPS ARM Prepayment Speeds vs MBA Refinancing Index 27 Source : MBA REFI Index (Bloomberg) M B A R ef i I n d ex V al u e 0 1000 2000 3000 4000 5000 6000 7000 0 5 10 15 20 25 30 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 DX Hybrid ARMs/ARMs DX Total Agency DX Total Portfolio MBA Refi Index P re p ay me n t Sp ee d s (C PR )

Drivers of Book Value Spread Risk • An asset’s “spread” is the market premium above a benchmark rate that reflects the relative riskiness of the asset versus the benchmark. • Spread risk is the uncertainty in pricing resulting from the expansion and contraction of the risk premium over the benchmark. • Spreads (and therefore prices) are impacted by the following factors: – Fundamentals: Probability of default, cash flow uncertainty – Technicals: Supply and demand for various assets – Psychology: Reflects the risk appetite of the market and the perceived riskiness of specific assets • Most mortgage REIT business models are inherently exposed to spread risk. At Dynex, we focus on all three aspects of spread risk. However, changes in pricing due to technicals and psychology are very difficult to predict. We manage spread risk over the long-term through portfolio construction. 28

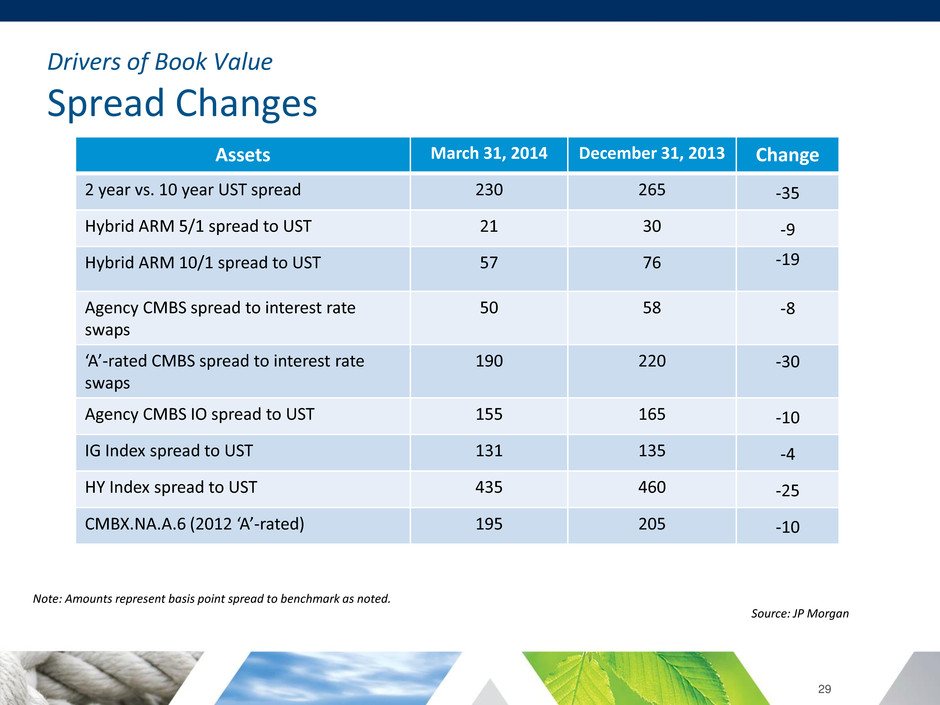

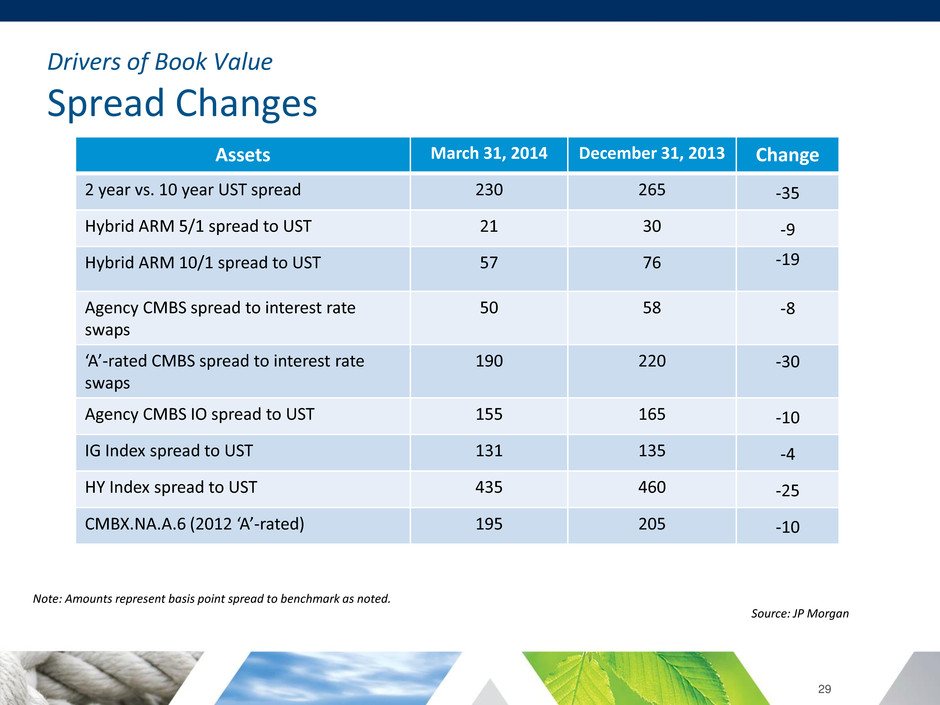

Drivers of Book Value Spread Changes 29 Assets March 31, 2014 December 31, 2013 Change 2 year vs. 10 year UST spread 230 265 -35 Hybrid ARM 5/1 spread to UST 21 30 -9 Hybrid ARM 10/1 spread to UST 57 76 -19 Agency CMBS spread to interest rate swaps 50 58 -8 ‘A’-rated CMBS spread to interest rate swaps 190 220 -30 Agency CMBS IO spread to UST 155 165 -10 IG Index spread to UST 131 135 -4 HY Index spread to UST 435 460 -25 CMBX.NA.A.6 (2012 ‘A’-rated) 195 205 -10 Note: Amounts represent basis point spread to benchmark as noted. Source: JP Morgan

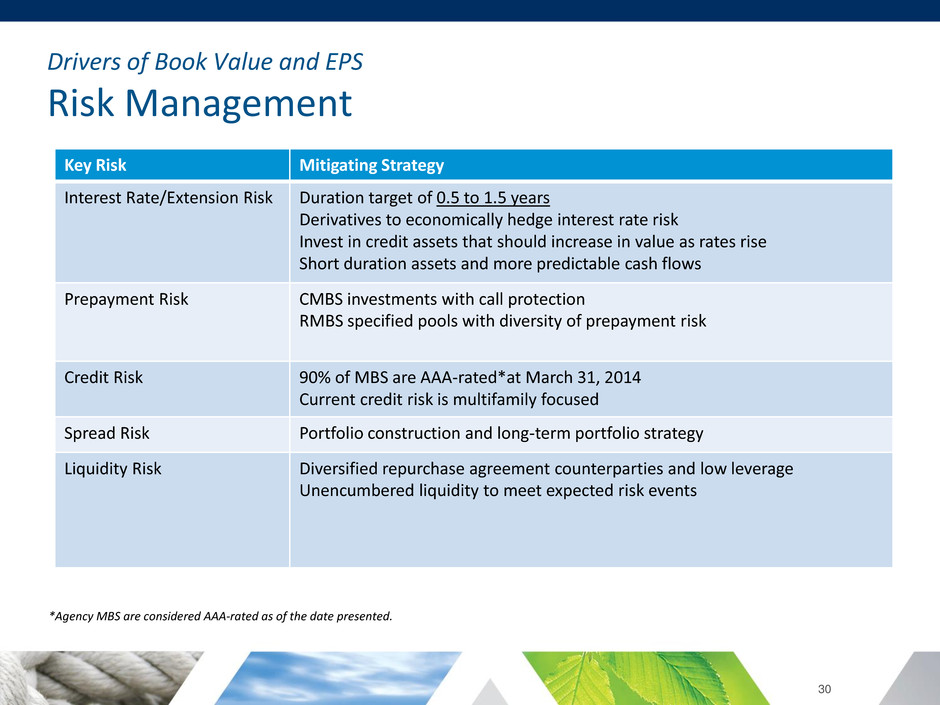

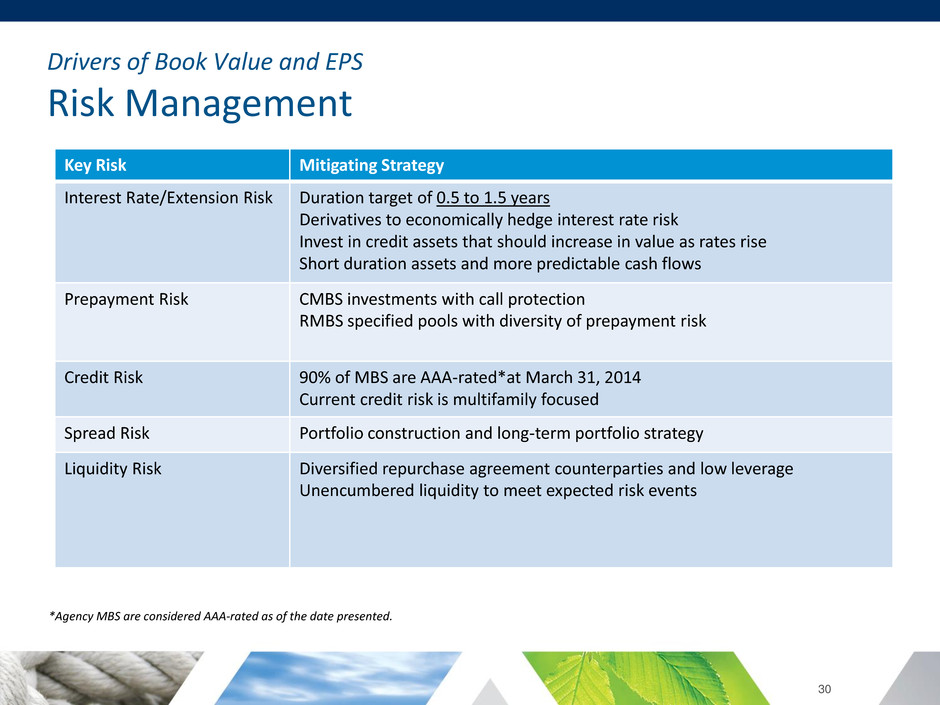

Drivers of Book Value and EPS Risk Management 30 Key Risk Mitigating Strategy Interest Rate/Extension Risk Duration target of 0.5 to 1.5 years Derivatives to economically hedge interest rate risk Invest in credit assets that should increase in value as rates rise Short duration assets and more predictable cash flows Prepayment Risk CMBS investments with call protection RMBS specified pools with diversity of prepayment risk Credit Risk 90% of MBS are AAA-rated*at March 31, 2014 Current credit risk is multifamily focused Spread Risk Portfolio construction and long-term portfolio strategy Liquidity Risk Diversified repurchase agreement counterparties and low leverage Unencumbered liquidity to meet expected risk events *Agency MBS are considered AAA-rated as of the date presented.

Drivers of Book Value Extension Risk (as of April 30, 2014) 0 2 4 6 8 10 12 14 16 FN 30 year FNCI 15 year FN 5/1 ARM 15 CPR/CPB 2 CPR/CPB Price Coupon WAC Speed Average Life Average Life Extension FN 30yr $101-13 3.50% 4.01% 15 CPR 2 CPR 5.36 years 14.31 years ~9 years FNCI 15yr $103-5 3.0% 3.48% 15 CPR 2 CPR 4.07 years 7.19 years ~3 years FN 5/1 ARM $103-10 2.78% 3.42% 15 CPB 2 CPB 3.33 years 4.53 years ~1 year 31 Average Life (years)

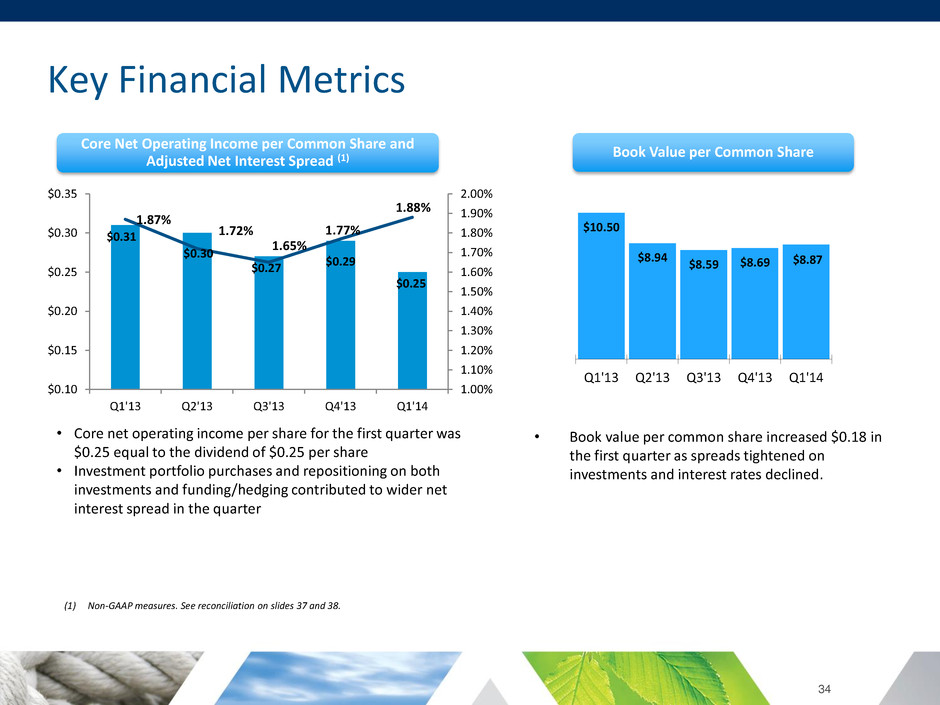

• GAAP net loss of $0.06 per common share and a return on common equity of (2.5)%, reflecting change in fair value of derivatives over the quarter • Core net operating income(1) of $0.25 and an adjusted return on common equity(1) of 11.3% • Common dividend declared of $0.25 per share, for an annualized 11.7% yield based on $8.54 closing stock price on May 6, 2014 • GAAP net interest spread of 1.87% and adjusted net interest spread(1) of 1.88% • Increase in book value per common share of 2.1% to $8.87 from $8.69 at December 31, 2013 • Decline during the quarter in overall leverage to 5.9x from 6.2x • Continued decline in portfolio CPR to 10.3% from 11.7% in the fourth quarter of 2013 32 First Quarter 2014 Highlights (1) Non-GAAP measures. See reconciliations on slides 37 and 38.

Portfolio Update (as of March 31, 2014) AAA 90% AA 2% A 6% Below A 2% 33 Commercial Securities with IO 47.2% Residential Securities 32.1% Legacy Investments 4.1% Other assets, net 6.4% Cash 10.2% $192.2 $282.7 $38.2 $61.2 $24.7 Residential 17% Commercial 83% $140.2 ($ in millions) MBS Credit Quality 14.9% 9.2% 26.7% 10.4% 35.5% 3.3% 0% 5% 10% 15% 20% 25% 30% 35% 40% Months to Maturity/Reset Equity Capital Allocation Net Premium by Asset Type MBS Expected Maturity/Reset Distribution $673.0 0-12 13-36 37-60 61-84 85-120 >120 Agency MBS are considered AAA-rated for purposes of this chart.

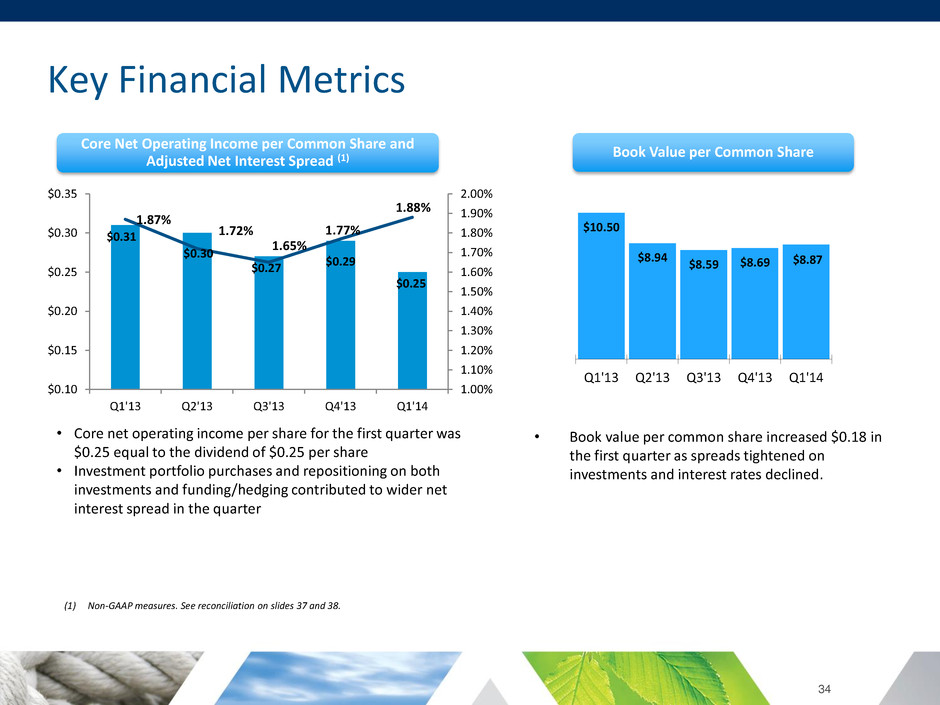

Key Financial Metrics 34 • Core net operating income per share for the first quarter was $0.25 equal to the dividend of $0.25 per share • Investment portfolio purchases and repositioning on both investments and funding/hedging contributed to wider net interest spread in the quarter Core Net Operating Income per Common Share and Adjusted Net Interest Spread (1) (1) Non-GAAP measures. See reconciliation on slides 37 and 38. Book Value per Common Share • Book value per common share increased $0.18 in the first quarter as spreads tightened on investments and interest rates declined. $10.50 $8.94 $8.59 $8.69 $8.87 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 $$10.50 $0.31 $0.30 $0.27 $0.29 $0.25 1.87% 1.72% 1.65% 1.77% 1.88% 1.00% 1.10% 1.20% 1.30% 1.40% 1.50% 1.60% 1.70% 1.80% 1.90% 2.00% $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14

35 Accounting Disclosure Selected Financial Highlights (as of and for the quarter ended) (1) Core net operating income to common shareholders (including on a per share basis), adjusted return on average common equity and adjusted net interest spread are non-GAAP financial measures. Reconciliations of these non-GAAP financial measures are provided on slides 37 and 38. ($ in thousands, except per share amounts) 1Q2014 4Q2013 1Q2013 Net interest income $ 20,007 $ 20,186 $ 22,526 (Loss) gain on derivative instruments, net (13,422) 2,607 (17 Net (loss) income to common shareholders (3,028) 19,266 18,381 Net (loss) income per common share (0.06) 0.35 0.34 Comprehensive income to common shareholders 26,532 19,813 27,427 Comprehensive income per common share $ 0.49 $ 0.36 $ 0.51 Core net operating income to common shareholders (1) 13,746 15,544 16,973 Core net operating income per common share (1) $ 0.25 $ 0.29 $ 0.31 Return on average common equity (annualized) (2.5)% 16.1% 13.0% Adjusted return on average common equity (annualized) (1) 11.3% 13.0% 12.0% Dividends per common share $ 0.25 $ 0.27 $ 0.29 Book value per common share, end of period $ 8.87 $ 8.69 $ 10.50 Interest earning assets, end of period $ 4,013,656 $ 4,073,584 $ 4,531,342 Average interest earning assets $ 4,002,555 $ 4,123,224 $ 4,098,681 Average interest bearing liabilities $ 3,509,889 $ 3,620,795 $ 3,641,654 Weighted average effective yield 2.74% 2.72% 3.04% Annualized cost of funds 0.87% 0.90% 1.15% Net interest spread 1.87% 1.82% 1.89% Adjusted net interest spread (1) 1.88% 1.77% 1.87% Portfolio CPR 10.3% 11.7% 19.3% Debt to shareholders' equity ratio, end of period 5.9x 6.2x 6.3x

Accounting Disclosure Book Value Reconciliation 36 Book Value ($ in thousands) Book Value Per Common Share Shareholders' equity, December 31, 2013 $ 585,876 $ 8.69 GAAP net loss to common shareholders: Core net operating income 13,746 0.25 Amortization of de-designated cash flow hedges (2,288 ) (0.04 ) Change in fair value of derivative instruments, net (11,211 ) (0.21 ) Loss on sale of investments, net (3,307 ) (0.06 ) Fair value adjustments, net 32 — Other comprehensive income 29,560 0.54 Common dividends declared (13,674 ) (0.25 ) Balance before capital transactions 598,734 8.92 Restricted stock amortization 672 0.01 Stock issued, including incentive stock issued to employees, net of forfeitures and issuance costs (391 ) (0.06 ) Shareholders' equity, March 31, 2014 $ 599,015 $ 8.87 Common Shares outstanding March 31, 2014 54,697,307

37 ($ in thousands except per share data) Quarter Ended 3/31/2014 12/31/2013 9/30/2013 6/30/2013 3/31/2013 Net (loss) income to common shareholders $ (3,028) $ 19,266 $ (6,921) $ 29,442 $ 18,381 Adjustments: Amortization of de-designated cash flow hedges (1) 2,288 2,609 2,583 — — Change in fair value on derivatives instruments, net 11,211 (5,636) 18,548 (11,626) (157) Loss (gain) on sale of investments, net 3,307 (757) 825 (2,031) (1,391) Fair value adjustments, net (32) 62 (150) 600 140 Core net operating income to common shareholders $ 13,746 $ 15,544 $ 14,885 $ 16,385 $ 16,973 Core net operating income per share $ 0.25 $ 0.29 $ 0.27 $ 0.30 $ 0.31 ROAE based on annualized net (loss) income to common shareholders (2.5)% 16.1 % (5.7)% 21.0 % 13.0 % Amortization of de-designated cash flow hedges 1.9% 2.2 % 2.1 % —% —% Change in fair value on derivatives instruments, net 9.2% (4.7)% 15.3 % (8.3)% (0.1)% Loss (gain) on sale of investments 2.7% (0.6)% 0.7 % (1.4)% (1.0)% Fair value adjustments, net -% 0.1 % (0.1)% 0.4 % 0.1 % Adjusted ROAE, based on annualized core net operating income 11.3% 13.0 % 12.3 % 11.7 % 12.0 % Average common equity during the period $ 485,044 $ 477,432 $ 484,356 $ 560,449 $ 567,489 (1) Amount recorded as a portion of "interest expense" in accordance with GAAP related to the amortization of the balance remaining in accumulated other comprehensive loss as of June 30, 2013 as a result of the Company's discontinuation of hedge accounting. Accounting Disclosure Reconciliation of GAAP Measures to Non-GAAP Measures

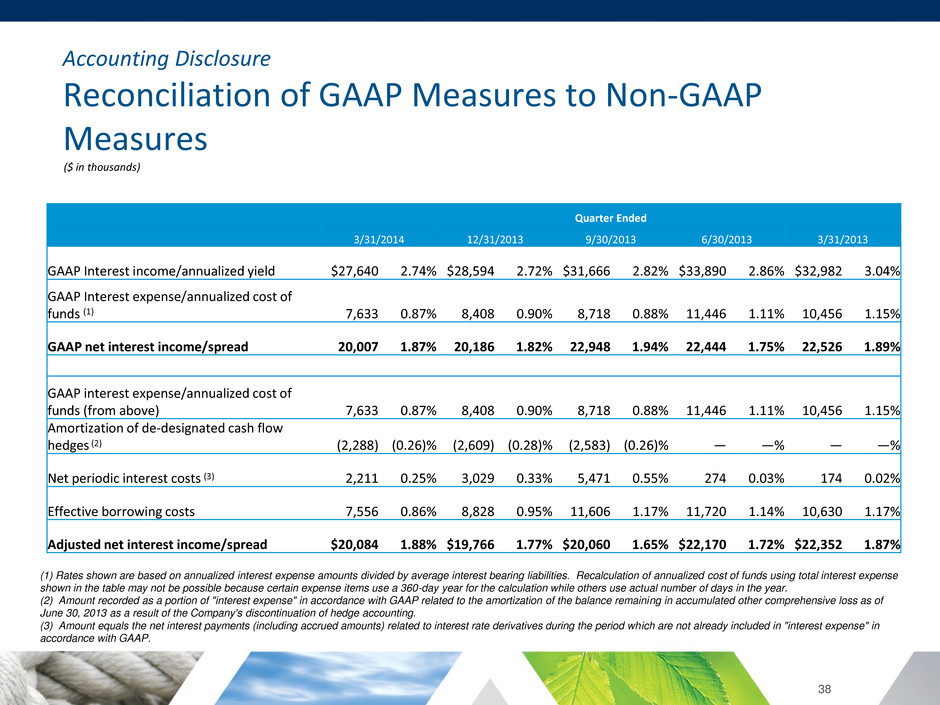

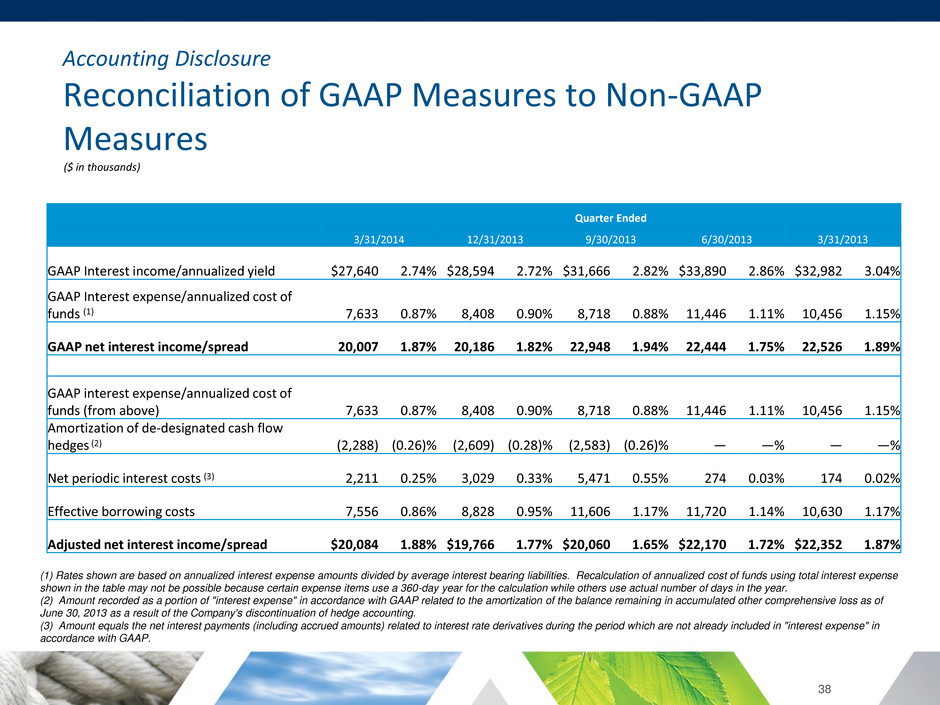

Accounting Disclosure Reconciliation of GAAP Measures to Non-GAAP Measures 38 (1) Rates shown are based on annualized interest expense amounts divided by average interest bearing liabilities. Recalculation of annualized cost of funds using total interest expense shown in the table may not be possible because certain expense items use a 360-day year for the calculation while others use actual number of days in the year. (2) Amount recorded as a portion of "interest expense" in accordance with GAAP related to the amortization of the balance remaining in accumulated other comprehensive loss as of June 30, 2013 as a result of the Company's discontinuation of hedge accounting. (3) Amount equals the net interest payments (including accrued amounts) related to interest rate derivatives during the period which are not already included in "interest expense" in accordance with GAAP. Quarter Ended 3/31/2014 12/31/2013 9/30/2013 6/30/2013 3/31/2013 GAAP Interest income/annualized yield $27,640 2.74% $28,594 2.72% $31,666 2.82% $33,890 2.86% $32,982 3.04% GAAP Interest expense/annualized cost of funds (1) 7,633 0.87% 8,408 0.90% 8,718 0.88% 11,446 1.11% 10,456 1.15% GAAP net interest income/spread 20,007 1.87% 20,186 1.82% 22,948 1.94% 22,444 1.75% 22,526 1.89% GAAP interest expense/annualized cost of funds (from above) 7,633 0.87% 8,408 0.90% 8,718 0.88% 11,446 1.11% 10,456 1.15% Amortization of de-designated cash flow hedges (2) (2,288) (0.26)% (2,609) (0.28)% (2,583) (0.26)% — —% — —% Net periodic interest costs (3) 2,211 0.25% 3,029 0.33% 5,471 0.55% 274 0.03% 174 0.02% Effective borrowing costs 7,556 0.86% 8,828 0.95% 11,606 1.17% 11,720 1.14% 10,630 1.17% Adjusted net interest income/spread $20,084 1.88% $19,766 1.77% $20,060 1.65% $22,170 1.72% $22,352 1.87% ($ in thousands)