Exhibit 99.1

B U D G E T 2 0 1 3 / 1

SUMMARY BUDGET 2013/14

2 / B U D G E T 2 0 1 3

SUMMARY BUDGET

For the Fiscal Year Ending March 31, 2014

With Comparative Data for the year ending March 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | Per Cent Change 2013/14 Budget from |

| | | 2013/14 Budget | | | | | 2012/13 Forecast | | | | | 2012/13 Budget | | | | | 2012/13 Forecast | | | | 2012/13 Budget | | |

| | | (Millions of Dollars) | | | | | | | | | | | |

REVENUE SOURCE | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income Taxes | | | 3,366 | | | | | | 3,291 | | | | | | 3,202 | | | | | 2.3 | | | | 5.1 | | |

Other Taxes | | | 4,015 | | | | | | 3,630 | | | | | | 3,684 | | | | | 10.6 | | | | 9.0 | | |

Fees and Other Revenue | | | 1,987 | | | | | | 2,027 | | | | | | 2,009 | | | | | (2.0) | | | | (1.1) | | |

Federal Transfers | | | 3,849 | | | | | | 3,898 | | | | | | 3,889 | | | | | (1.3) | | | | (1.0) | | |

Net Income of Government Business Enterprises | | | 738 | | | | | | 685 | | | | | | 722 | | | | | 7.7 | | | | 2.2 | | |

Sinking Funds and Other Earnings | | | 227 | | | | | | 233 | | | | | | 241 | | | | | (2.6) | | | | (5.8) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL REVENUE | | | 14,182 | | | | | | 13,764 | | | | | | 13,747 | | | | | 3.0 | | | | 3.2 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

EXPENDITURE SECTORS | | | | | | | | | | | | | | | | | | | | | | | | | | |

Health | | | 5,660 | | | | | | 5,416 | | | | | | 5,547 | | | | | 4.5 | | | | 2.0 | | |

Education | | | 3,807 | | | | | | 3,643 | | | | | | 3,605 | | | | | 4.5 | | | | 5.6 | | |

Family Services | | | 1,133 | | | | | | 1,109 | | | | | | 1,066 | | | | | 2.2 | | | | 6.3 | | |

Community, Economic and Resource Development | | | 2,484 | | | | | | 2,466 | | | | | | 2,447 | | | | | 0.7 | | | | 1.5 | | |

Justice and Other Expenditures | | | 924 | | | | | | 950 | | | | | | 925 | | | | | (2.7) | | | | (0.1) | | |

Debt Servicing Costs | | | 839 | | | | | | 820 | | | | | | 858 | | | | | 2.3 | | | | (2.2) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL EXPENDITURE | | | 14,847 | | | | | | 14,404 | | | | | | 14,448 | | | | | 3.1 | | | | 2.8 | | |

In-Year Adjustments/Lapse | | | (150) | | | | | | (57) | | | | | | (241) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

NET RESULT FOR THE YEAR | | | (515) | | | | | | (583) | | | | | | (460) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

2013 SPRING FLOOD CONTINGENCY | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenditures | | | (30) | | | | | | - | | | | | | - | | | | | | | | | | | |

Recovery from Disaster Financial Assistance | | | 27 | | | | | | - | | | | | | - | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL 2013 SPRING FLOOD CONTINGENCY | | | (3) | | | | | | - | | | | | | - | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

NET INCOME (LOSS) | | | (518) | | | | | | (583) | | | | | | (460) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

NOTES:

| — | | The 2012/13 Budget numbers originally presented in the 2012 Budget Address and the 2012/13 forecast from the Third Quarter Financial Report have been re-stated to be consistent with the current presentation for the GRE. |

| — | | Details of Expenditure and Revenue for Fiscal Year 2013/14, and a reconciliation to the amounts reported for core government are found in Schedules 1 and 2. |

| — | | The 2012/13 expenditure forecast includes reductions related to Program Portfolio Management Reviews. |

| — | | In-Year Adjustments/Lapse could be an increase in revenue and/or decrease in expenditure. |

| — | | The 2012/13 Budget In-Year Adjustments/Lapse includes $128 million for the Program Portfolio Management Reviews. |

| — | | Numbers may not add due to rounding. |

B U D G E T 2 0 1 3 / 3

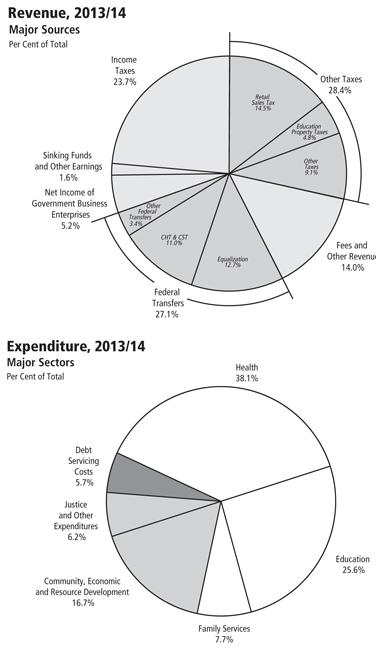

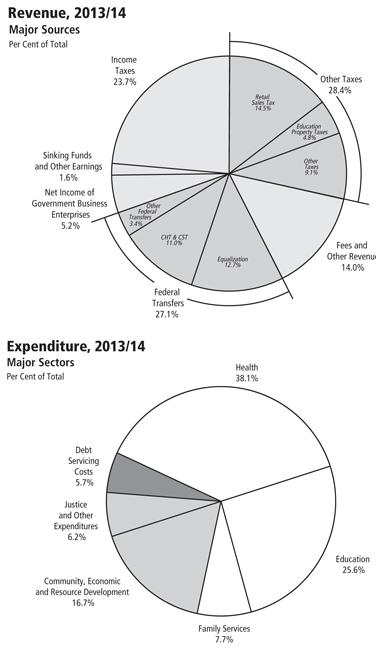

Revenue

Revenue in 2013/14, including new revenue measures, is projected to increase $418 million or 3% from the 2012/13 Forecast.

Income taxes are projected to increase by $75 million, with a $109 million increase in Individual Income Tax offset by a decrease of $34 million in Corporation Income Tax. Budget 2013 projects a $385 million or 10.6%, increase in other taxes, principally reflecting an increase in retail sales tax. Fees and Other Revenue are projected to decline $40 million or 2%. Net Income of Government Business Enterprises (GBEs) is projected to increase $53 million or 7.7%. Federal transfers are projected to decrease $49 million or 1.3%.

Expenditure

Total expenditure is budgeted to increase $443 million or 3.1% from the 2012/13 Forecast.

The growth in Health expenditure is $244 million or 4.5%. Education-related expenditure is increasing by $164 million or 4.5%. Family Services is up $24 million or 2.2%. Community, Economic and Resource Development expenditure will increase by $18 million or 0.7%. Manitoba Justice is increasing by $13 million or 2.6%. Overall, the Justice and Other Expenditures sector will decrease by $26 million or 2.7%. Debt Servicing Costs are expected to increase by $19 million.1

In Budget 2013, services to people represent 76.3% of spending.

Health expenditure makes up 38.1% of total expenditure.

Education accounts for 25.6% of all expenditure; it includes public schools and post-secondary institutions.

Family Services, Justice, and Housing and Community Development represent 12.6% of total expenditure.

| 1 | Debt Servicing Costs are forecast to equal 5.9¢ of every dollar of revenue in 2013/14, down 55.3% from 13.2¢ per dollar in 1999/2000. |

4 / B U D G E T 2 0 1 3

Schedule 1

Summary Revenue Estimate: Details and Reconciliation to Core Government Estimates

Fiscal Year ending March 31, 2014 (in Thousands of Dollars)

| | | | | | | | | | | | | | | |

| | | CORE GOVERNMENT | | CONSOLIDATION IMPACTS | | SUMMARY |

| Source of Revenue | | Revenue

Estimate | | and Revenue of Other

Reporting Entities | | |

| | | |

Income Taxes | | | | | | | | | | | | | | | |

Individual Income Tax | | | | 2,952,400 | | | | | - | | | | | 2,952,400 | |

Corporation Income Tax | | | | 413,200 | | | | | - | | | | | 413,200 | |

| | | | | | | | | | | | | | | |

Subtotal: Income Taxes | | | | 3,365,600 | | | | | - | | | | | 3,365,600 | |

| | | | | | | | | | | | | | | |

Other Taxes | | | | | | | | | | | | | | | |

Corporations Taxes | | | | 227,000 | | | | | - | | | | | 227,000 | |

Fuel Taxes | | | | 312,100 | | | | | 13,700 | | | | | 325,800 | |

Land Transfer Tax | | | | 74,000 | | | | | - | | | | | 74,000 | |

Levy for Health and Education | | | | 433,500 | | | | | (107,472) | | | | | 326,028 | |

Mining Tax | | | | 40,000 | | | | | - | | | | | 40,000 | |

Retail Sales Tax | | | | 2,047,200 | | | | | - | | | | | 2,047,200 | |

Tobacco Tax | | | | 283,000 | | | | | - | | | | | 283,000 | |

Other Taxes | | | | 16,173 | | | | | - | | | | | 16,173 | |

Education Property Taxes | | | | - | | | | | 676,019 | | | | | 676,019 | |

| | | | | | | | | | | | | | | |

Subtotal: Other Taxes | | | | 3,432,973 | | | | | 582,247 | | | | | 4,015,220 | |

| | | | | | | | | | | | | | | |

Fees and Other Revenue | | | | | | | | | | | | | | | |

Fines and Costs and Other Legal | | | | 52,030 | | | | | - | | | | | 52,030 | |

Minerals and Petroleum | | | | 29,074 | | | | | - | | | | | 29,074 | |

Automobile and Motor Carrier Licences and Fees | | | | 140,530 | | | | | - | | | | | 140,530 | |

Parks: Forestry and Other Conservation | | | | 32,446 | | | | | - | | | | | 32,446 | |

Water Power Rentals | | | | 107,700 | | | | | - | | | | | 107,700 | |

Service Fees and Other Miscellaneous Charges | | | | 166,196 | | | | | 1,174,579 | | | | | 1,340,775 | |

Revenue Sharing from SOAs | | | | 16,880 | | | | | - | | | | | 16,880 | |

Tuition Fees | | | | - | | | | | 267,673 | | | | | 267,673 | |

| | | | | | | | | | | | | | | |

Subtotal: Fees and Other Revenue | | | | 544,856 | | | | | 1,442,252 | | | | | 1,987,108 | |

| | | | | | | | | | | | | | | |

Federal Transfers | | | | | | | | | | | | | | | |

Equalization | | | | 1,799,228 | | | | | - | | | | | 1,799,228 | |

Canada Health Transfer | | | | 1,120,800 | | | | | - | | | | | 1,120,800 | |

Canada Social Transfer | | | | 442,753 | | | | | - | | | | | 442,753 | |

Health Funds | | | | 9,062 | | | | | - | | | | | 9,062 | |

Infrastructure Renewal | | | | 22,100 | | | | | - | | | | | 22,100 | |

Shared Cost and Other Transfers | | | | 144,403 | | | | | 310,440 | | | | | 454,843 | |

| | | | | | | | | | | | | | | |

Subtotal: Federal Transfers | | | | 3,538,346 | | | | | 310,440 | | | | | 3,848,786 | |

| | | | | | | | | | | | | | | |

Net Income of Government | | | | | | | | | | | | | | | |

Business Enterprises (GBEs) | | | | | | | | | | | | | | | |

Manitoba Liquor and Lotteries Corporation | | | | 615,055 | | | | | - | | | | | 615,055 | |

Deposit Guarantee Corporation | | | | - | | | | | 21,561 | | | | | 21,561 | |

Manitoba Hydro | | | | - | | | | | 72,000 | | | | | 72,000 | |

Workers Compensation Board | | | | - | | | | | 10,608 | | | | | 10,608 | |

Manitoba Public Insurance Corporation | | | | - | | | | | 18,234 | | | | | 18,234 | |

| | | | | | | | | | | | | | | |

Subtotal: Net Income of GBEs | | | | 615,055 | | | | | 122,403 | | | | | 737,458 | |

| | | | | | | | | | | | | | | |

Sinking Funds and Other Earnings | | | | - | | | | | 227,302 | | | | | 227,302 | |

| | | | | | | | | | | | | | | |

Total Revenue Estimate | | | | 11,496,830 | | | | | 2,684,644 | | | | | 14,181,474 | |

| | | | | | | | | | | | | | | |

NOTE: Legislation to effect the merger of Manitoba Liquor Control Commission and Manitoba Lotteries Corporation will be introduced in the spring session.

B U D G E T 2 0 1 3 / 5

Schedule 2

Summary Expenditure Estimate: Details, Reconciliation to Core Government Estimates and Summary Budget Result

Fiscal Year ending March 31, 2014 (in Thousands of Dollars)

| | | | | | | | | | | | | | | |

| | | CORE GOVERNMENT | | CONSOLIDATION IMPACTS | | SUMMARY |

| Sector/Department | | Expenditure

Estimate | | and Expenditures of Other

Reporting Entities | | |

Health | | | | | | | | | | | | | | | |

Health | | | | 5,230,778 | | | | | 364,592 | | | | | 5,595,370 | |

Healthy Living, Seniors and Consumer Affairs | | | | 55,490 | | | | | 9,112 | | | | | 64,602 | |

| | | | | | | | | | | | | | | |

Total Health | | | | 5,286,268 | | | | | 373,704 | | | | | 5,659,972 | |

| | | | | | | | | | | | | | | |

Education | | | | | | | | | | | | | | | |

Advanced Education and Literacy | | | | 707,662 | | | | | 599,810 | | | | | 1,307,472 | |

Education | | | | 1,681,786 | | | | | 817,971 | | | | | 2,499,757 | |

| | | | | | | | | | | | | | | |

Total Education | | | | 2,389,448 | | | | | 1,417,781 | | | | | 3,807,229 | |

| | | | | | | | | | | | | | | |

Family Services | | | | | | | | | | | | | | | |

Children and Youth Opportunities | | | | 47,910 | | | | | - | | | | | 47,910 | |

Family Services and Labour | | | | 1,097,412 | | | | | (12,034) | | | | | 1,085,378 | |

| | | | | | | | | | | | | | | |

Total Family Services | | | | 1,145,322 | | | | | (12,034) | | | | | 1,133,288 | |

| | | | | | | | | | | | | | | |

Community, Economic and Resource Development | | | | | | | | | | | | | | | |

Aboriginal and Northern Affairs | | | | 34,249 | | | | | 2,902 | | | | | 37,151 | |

Agriculture, Food and Rural Initiatives | | | | 214,643 | | | | | 255,270 | | | | | 469,913 | |

Conservation and Water Stewardship | | | | 146,391 | | | | | (2,155) | | | | | 144,236 | |

Entrepreneurship, Training and Trade | | | | 580,539 | | | | | 22,655 | | | | | 603,194 | |

Housing and Community Development | | | | 82,587 | | | | | 137,178 | | | | | 219,765 | |

Infrastructure and Transportation | | | | 639,203 | | | | | (140,898) | | | | | 498,305 | |

Innovation, Energy and Mines | | | | 85,136 | | | | | 23,277 | | | | | 108,413 | |

Local Government | | | | 398,678 | | | | | 4,663 | | | | | 403,341 | |

| | | | | | | | | | | | | | | |

Total Community, Economic and Resource Development | | | | 2,181,426 | | | | | 302,892 | | | | | 2,484,318 | |

| | | | | | | | | | | | | | | |

Justice and Other Expenditures | | | | | | | | | | | | | | | |

Legislative Assembly | | | | 42,560 | | | | | (1,220) | | | | | 41,340 | |

Executive Council | | | | 2,622 | | | | | (133) | | | | | 2,489 | |

Civil Service Commission | | | | 20,200 | | | | | 468 | | | | | 20,668 | |

Culture, Heritage and Tourism | | | | 60,841 | | | | | 5,872 | | | | | 66,713 | |

Employee Pensions and Other Costs | | | | 18,288 | | | | | 52,000 | | | | | 70,288 | |

Finance | | | | 69,166 | | | | | 4,093 | | | | | 73,259 | |

Immigration and Multiculturalism | | | | 16,892 | | | | | 11,114 | | | | | 28,006 | |

Justice | | | | 507,064 | | | | | 13,965 | | | | | 521,029 | |

Sport | | | | 11,770 | | | | | 869 | | | | | 12,639 | |

Enabling Appropriations | | | | 31,623 | | | | | - | | | | | 31,623 | |

Other Appropriations | | | | 55,393 | | | | | - | | | | | 55,393 | |

| | | | | | | | | | | | | | | |

Total Justice and Other Expenditures | | | | 836,419 | | | | | 87,028 | | | | | 923,447 | |

| | | | | | | | | | | | | | | |

Debt Servicing Costs | | | | 230,000 | | | | | 608,682 | | | | | 838,682 | |

| | | | | | | | | | | | | | | |

Total Expenditure Estimate | | | | 12,068,883 | | | | | 2,778,053 | | | | | 14,846,936 | |

Subtract: Total Revenue Estimate (Schedule 1) | | | | 11,496,830 | | | | | 2,684,644 | | | | | 14,181,474 | |

In-Year Adjustments/Lapse | | | | (70,000) | | | | | (80,000) | | | | | (150,000) | |

| | | | | | | | | | | | | | | |

Net Result for the Year | | | | (502,053) | | | | | (13,409) | | | | | (515,462) | |

2013 Spring Flood Contingency | | | | | | | | | | | | | | | |

Expenditures | | | | (30,000) | | | | | - | | | | | (30,000) | |

Recovery from Disaster Financial Assistance | | | | 27,000 | | | | | - | | | | | 27,000 | |

| | | | | | | | | | | | | | | |

Total 2013 Spring Flood | | | | (3,000) | | | | | - | | | | | (3,000) | |

| | | | | | | | | | | | | | | |

NET INCOME (LOSS) | | | | (505,053) | | | | | (13,409) | | | | | (518,462) | |

| | | | | | | | | | | | | | | |

NOTE: In-Year Adjustments/Lapse could be an increase in revenue and/or decrease in expenditures.

6 / B U D G E T 2 0 1 3

B U D G E T 2 0 1 3 / 7

FINANCIAL MANAGEMENT STRATEGY

8 / B U D G E T 2 0 1 3

| ¢ | | FINANCIAL MANAGEMENT STRATEGY 2013/14 |

Financial Management Priorities

The Financial Management Strategy (FMS) sets out the government’s priorities for financial management. It includes four main priority areas with one or more measurable outcomes. Each measurable outcome includes objectives for the current year and for future years.

For 2013/14, the FMS continues to focus on priority areas identified in prior years and reflects government’s balanced approach to return to surplus.

| | |

FINANCIAL MANAGEMENT PRIORITY | | MEASURABLE OUTCOMES |

| |

| Transparency, Accountability and Fiscal Discipline | | — Summary Budget Outlook |

| |

| | — Maintaining Accountability for Core Government Program Expenditure and Revenue |

| |

| Stable and Affordable Government | | — Credit Ratings |

| |

| | — Expenditures as a Percentage of Gross Domestic Product (GDP) |

| |

| | — Responsible Management of Public Resources |

| |

| Managing Debt | | — Debt Retirement |

| |

| | — Net Debt to GDP Ratio |

| |

| Infrastructure and Capital Asset Renewal | | — Capital Investments |

| ¢ | | PRIORITY AREA – TRANSPARENCY, ACCOUNTABILITY AND FISCAL DISCIPLINE |

Government has implemented a number of measures to ensure financial accountability and maintain fiscal discipline, including:

| — | | implementing GAAP compliant summary financial statements as of March 31, 2005; |

| — | | implementing summary budgeting and reporting in 2007/08 to present comprehensive information on the total cost of providing programs and services to Manitobans and how the GRE operates as a whole; |

| — | | publishing a FMS as part of the annual budget and a report on outcomes within six months of the end of the fiscal year; |

| — | | implementing summary quarterly financial reporting, consistent with GAAP as of 2009/10; |

| — | | establishing a plan to reduce the unfunded pension liabilities; |

| — | | funding the employer’s share of current service pension contributions for all employees; and |

| — | | ensuring all capital investments are amortized and all related costs are included in annual appropriations for core government. |

The commitment to transparency, accountability and fiscal discipline continues in Budget 2013, with an update on the balanced financial strategy for 2013/14 and future years.

B U D G E T 2 0 1 3 / 9

Measurable Outcome – Summary Budget Outlook

With slower than anticipated global economic activity in 2011 and 2012, governments around the world continue to be affected by the fragile recovery from the Great Recession. Due to the sluggish recovery, the International Monetary Fund and other private sector forecasters recently lowered their economic outlook for 2013. While Manitoba’s economy has traditionally been one of the most stable in Canada, economic growth continues to be modest. The current Manitoba Finance survey of forecasters calls for 2.2% GDP growth in 2012, slowing to 1.9% in 2013. With global demand improving, Manitoba’s real GDP is expected to increase by 2.3% in 2014.

Budget 2013 reflects an updated multi-year financial strategy projecting a return to balance in 2016/17. Manitoba continues to be committed to a balanced approach for delivering services, while recognizing the continued uncertainty in global economies. Budget 2013 demonstrates this balanced approach by focusing on:

| — | | supporting economic growth by upgrading needed infrastructure, restoring the damage from past floods and making investments to mitigate the impacts of future floods; |

| — | | investing in vital front-line services by continuing to improve health care, education and training, policing and supports for families; |

| — | | managing government spending strategically to ensure Manitobans’ priorities come first; |

| — | | restoring balance and returning to surplus in Budget 2016; and |

| — | | maintaining affordability to keep Manitoba one of the best places to live, work and raise a family. |

Challenges remain for the Canadian economies as they continue to expand at a subdued pace. Manitoba’s updated strategy to return to surplus in Budget 2016 will keep the economy strong and growing.

1 0 / B U D G E T 2 0 1 3

Summary Budget Outlook

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2012/13 | | 2013/14 | | 2014/15 | | 2015/16 | | 2016/17 |

| | | | | |

| | | Forecast | | Budget | | Projection | | Projection | | Projection |

| | | (Millions of Dollars) |

| | | | | |

REVENUE | | | | | | | | | | | | | | | | | | | | | | | | | |

Core Government1 | | | | 11,143 | | | | | 11,524 | | | | | 11,977 | | | | | 12,449 | | | | | 12,937 | |

Other Reporting Entities2 | | | | 2,621 | | | | | 2,685 | | | | | 2,575 | | | | | 2,618 | | | | | 2,671 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL REVENUE | | | | 13,764 | | | | | 14,209 | | | | | 14,552 | | | | | 15,067 | | | | | 15,608 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

EXPENDITURE | | | | | | | | | | | | | | | | | | | | | | | | | |

Core Government Programs and Services1 | | | | 11,825 | | | | | 12,099 | | | | | 12,371 | | | | | 12,639 | | | | | 12,912 | |

Other Reporting Entities2 | | | | 2,579 | | | | | 2,778 | | | | | 2,696 | | | | | 2,742 | | | | | 2,797 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL EXPENDITURE | | | | 14,404 | | | | | 14,877 | | | | | 15,067 | | | | | 15,381 | | | | | 15,709 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Re-statement Adjustment | | | | | | | | | | | | | | | | | | | | | | | | | |

In-Year Adjustments/Lapse 3 | | | | (57) | | | | | (150) | | | | | (150) | | | | | (150) | | | | | (150) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

SUMMARY NET INCOME (LOSS) | | | | (583) | | | | | (518) | | | | | (365) | | | | | (164) | | | | | 49 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Includes 2013 Spring Flood Contingency of $30 million in expenditures offset by $27 million in revenue. |

| 2 | Includes Consolidation Impacts. |

| 3 | In-Year Adjustments/Lapse could be an increase in revenue and/or a decrease in expenditure. |

The summary budget outlook assumes GRE revenue will rise by an average of 3.2% annually from 2013/14 to 2016/17, while GRE expenditures are forecast to increase by an annual average of 1.8% during the same period.

Core government revenue is forecast to rise by an average of 3.9% annually, while core government expenditure will grow by an annual average of 2.2% from 2013/14 to 2016/17.

Core government projections reflect the commitment to return to surplus, while protecting the services Manitoba families need. Budget 2013 makes strategic investments in infrastructure and focuses spending growth on key services. External economic factors associated with developments in the global economy present risks to the economic outlooks for Canada and Manitoba. Given the elevated level of global economic uncertainty, private sector forecasters expect Manitoba’s overall economic growth to remain comparatively stable among provinces. The Manitoba government is committed to balancing summary net income over the medium term and Budget 2013 introduces more responsible, innovative ways to reduce the cost of government and to increase efficiency.

| — | | Entrepreneurship Manitoba is being established to provide an integrated suite of programs and innovative service improvements for entrepreneurs and businesses. |

| — | | The operations of the Financial Institutions Regulation Branch have been integrated in the new Manitoba Financial Services Agency (formerly the Manitoba Securities Commission) to gain efficiencies, while acting in the public interest to protect Manitoba investors. |

| — | | Regional office amalgamations in the departments of Agriculture, Food and Rural Initiatives, Conservation and Water Stewardship, Entrepreneurship Training and Trade, and Infrastructure and Transportation will increase efficiency, while providing core government services. |

| — | | Administrative costs will be contained and the civil service will be reduced by 600 over a three-year period. |

B U D G E T 2 0 1 3 / 1 1

| — | | The 20 per cent rollback on salaries for government ministers will continue. |

| — | | The focus on core government program priorities will continue. |

These measures will result in more efficient use of public resources, declining deficits and the return to balance in 2016/17.

As part of the renewal of Manitoba’s Video Lottery Terminal (VLT) program, Manitoba Liquor and Lotteries Corporation will enhance opportunities for VLT siteholders through the replacement of all VLTs across the province, increasing the number of VLTs by up to five machines for selected high-performing commercial sites, and adjusting the commission structure to benefit smaller sites. As well, additional machines will be made available to higher performing First Nations sites.

The deficit to GDP ratio measures a government’s fiscal deficit, or the amount by which budgetary expenditures exceed revenues, in relation to the size of the overall economy. Broadly, it is an indicator of the size of the shortfall relative to all economic activity in the jurisdiction. Comparing this ratio over time permits an eventuation of the trend in the deficit. Manitoba’s deficit as a percentage of GDP in 2013/14 is forecast at (0.8)%, down from the 2012/13 forecast of (1.0)%. This percentage is declining, demonstrating the commitment to achieve improved fiscal balances.

The balanced approach includes amendments to legislation that recognize the challenging economic conditions, while continuing to require a responsible plan to restore balance and provide a sustainable funding source for needed infrastructure. These amendments will:

| — | | maintain the requirement to eliminate the budget shortfall with a return to surplus in 2016/17; |

| — | | keep the legal requirement to have balanced budgets into the future; |

| — | | include the provision for annual debt payments to resume once balance is achieved; |

| — | | continue with the provision to utilize the Fiscal Stabilization Account (FSA) to address the amortization of increases in general purpose debt and related interest expenses; |

| — | | recognize the requirement for immediate and future infrastructure investment; and |

| — | | continue with transparency through the reporting requirements. |

Over the past three years, the government will have transferred $360 million out of the fiscal stabilization account to meet the legislative requirement noted above. Budget 2013 includes a $100 million draw for debt repayment only, in recognition of lower than anticipated interest rates.

The annual FMS and a report on outcomes will continue to be published. In addition, in-year financial reporting will provide updates on the progress made in achieving our balanced financial strategy.

1 2 / B U D G E T 2 0 1 3

Measurable Outcome – Maintaining Accountability for Core

Government Program Expenditure and Revenue

Legislation requires government to include a summary of core government expenditures and projected revenues as part of the FMS. This is consistent with the main estimates of expenditure and revenue for the fiscal year.

While core government expenditure will exceed revenue in Budget 2013, Manitoba’s balanced financial strategy shows declining deficits over the medium term, with a return to balance in Budget 2016.

| | | | | |

| Core Government Expenditure and Revenue, 2013/14 | |

| |

| | | (Millions of Dollars) |

| |

Revenue | | | | 11,497 | |

| |

Expenditure | | | | 12,069 | |

| |

In-Year Adjustments/Lapse | | | | (70) | |

| | | | | |

| | | | (502) | |

| |

2013 Spring Flood Contingency | | | | | |

| |

Flood Fighting Expenditures | | | | (30) | |

| |

Recovery from Disaster Financial Assistance | | | | 27 | |

| | | | | |

| | | | (3) | |

| | | | | |

Net Result | | | | (505) | |

| | | | | |

Year-end information on core government revenue and expenditure for 2013/14 will be provided as part of the FMS report on outcomes, scheduled to be released in the fall of 2014.

| ¢ | | PRIORITY AREA – STABLE AND AFFORDABLE GOVERNMENT |

The Manitoba government continues to be one of the most effective governments in Canada in containing costs. Keeping programs affordable is achieved by continuing to improve the way government operates and delivers services.

Manitoba uses public revenues effectively and efficiently to deliver affordable government programs and services.

As part of the balanced financial strategy, government will continue to carefully manage programs and services to protect the priorities of Manitobans.

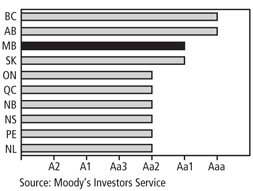

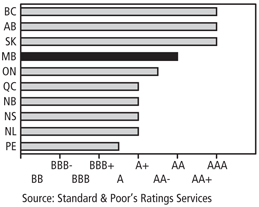

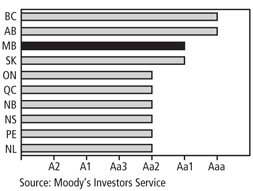

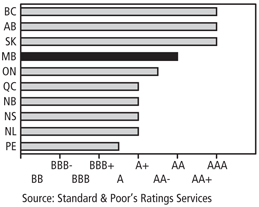

Measurable Outcome – Credit Ratings

Manitoba continues to maintain its reputation for fiscal responsibility. The government’s measured approach to paying down debt and the pension liability, while dealing with the needs in health care and other program areas has been positively acknowledged by credit rating agencies.

This is reflected in the credit rating upgrades Manitoba received from Moody’s Investors Service and by Standard & Poor’s through 2007, and through the re-affirmation of Manitoba’s credit quality by rating agencies in the last five years.

During this period of economic and financial recovery, Manitoba’s stable and diversified economy, strong financial position and commitment to responsible financial management is anticipated to result in a steady credit outlook in 2013. The credit rating agencies are aware of the challenging economic conditions facing all Canadian provinces. Manitoba’s balanced multi-year approach continues to include draws from the fiscal stabilization account to repay debt, while restoring balance.

B U D G E T 2 0 1 3 / 1 3

The Manitoba government remains committed to maintaining fiscal responsibility to achieve stable or improving credit ratings into the future.

| | | | | | | | | | | | | | |

Credit Rating

Agency | | 2007

Actual | | 2008

Actual | | 2009

Actual | | 2010

Actual | | 2011

Actual | | 2012

Actual | | 2013

Actual |

| DBRS | | A(high) | | A(high) | | A(high) | | A(high) | | A(high) | | A(high) | | A(high) |

| Moody’s | | Aa1 | | Aa1 | | Aa1 | | Aa1 | | Aa1 | | Aa1 | | Aa1 |

| Standard & Poor’s | | AA (positive) | | AA | | AA | | AA | | AA | | AA | | AA |

NOTE: As at March 31 (end of fiscal year)

Measurable Outcome – Expenditures as a Percentage of Gross Domestic Production (GDP)

Maintaining stable and affordable government means managing the growth in spending to meet increasing demands for quality services. An effective measure of appropriate spending is the ratio of total expenditures as a percentage of GDP. This ratio has remained relatively stable over the last five years and is budgeted to decline in 2013/14.

Expenditure to GDP ratios are reflected in the following table and as part of Appendix 1, Summary Financial Statistics.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2008/09

Actual | | 2009/10

Actual | | 2010/11

Actual | | 2011/12

Actual | | 2012/13

Forecast | | 2013/14

Budget | | 2014/15

Projection |

| | | | | | | | | (Per Cent) | | | | | | |

| | | | | | | |

Core Program Expenditure | | | | 18.9 | | | | | 20.0 | | | | | 19.6 | | | | | 20.8 | | | | | 19.5 | | | | | 19.1 | | | | | 18.8 | |

| | | | | | | |

Other Reporting Entities Expenditure | | | | 3.3 | | | | | 3.4 | | | | | 3.7 | | | | | 3.8 | | | | | 3.4 | | | | | 3.5 | | | | | 3.2 | |

| | | | | | | |

Debt Servicing Costs | | | | 1.6 | | | | | 1.5 | | | | | 1.4 | | | | | 1.4 | | | | | 1.4 | | | | | 1.4 | | | | | 1.3 | |

| | | | | | | |

Total Expenditure | | | | 23.8 | | | | | 24.9 | | | | | 24.7 | | | | | 26.1 | | | | | 24.2 | | | | | 24.0 | | | | | 23.3 | |

The government’s objective is to maintain a stable or declining ratio over the longer term.

Measurable Outcome – Responsible Management of Public Resources

Responsible management and use of public resources are key to making government more effective. The government continues to explore ways to make sure that public spending remains under control and that tax dollars are used effectively and efficiently.

Budget 2013 continues to move forward on containing core government expenditure growth. The balanced financial strategy projects medium-term expenditure growth at 2.2%, enabling declining deficits, with a return to balance in 2016/17. Meeting government priorities and getting back to a balanced budget will require continuing review and reprioritization of existing funding and streamlining internal operations to find opportunities for lowering costs.

The government supports continuous internal review and reform to provide Manitobans with affordable, innovative and effective public service operations, programs and services. Lean management initiatives will be implemented throughout the year in support of this commitment. This will include continued rationalization of government offices and co-locating departmental staff where appropriate, while ensuring service levels remain constant.

The government will continue to emphasize reforms that improve accountability and transparency and sustainable programs that protect the priorities of Manitobans, including its commitment to reduce the civil service by 600 over three years. Measures have been implemented to meet the commitment.

1 4 / B U D G E T 2 0 1 3

| ¢ | | PRIORITY AREA – MANAGING DEBT |

Over the years, the government has continued to implement specific initiatives to ensure sound fiscal management. These include:

| — | | addressing the unfunded pension liability; |

| — | | funding the employer’s share of current service pension entitlements; |

| — | | ensuring all capital investments are amortized and all related costs are fully reflected in annual appropriations for core government; and |

| — | | establishing a plan to address core government deficits during the economic recovery period. |

Solid debt management consists of a plan to address general purpose debt and the pension liability while making needed investments in Manitoba. The net debt to GDP ratio is one of the key indicators used by credit rating agencies in their analysis of provincial governments because it measures the level of debt relative to a province’s financial capacity. Like all other Canadian jurisdictions, the impact of the economic downturn was an increase in Manitoba’s net debt to GDP ratio. Consistent with the Summary Budget Outlook, this ratio stabilizes in 2014/15 and returns to a downward trend by 2015/16.

Measurable Outcome – Debt Retirement

The government has contributed almost $1 billion to reduce the general purpose debt and meet pension obligations. Direct action to address the unfunded pension liabilities for the Civil Service Superannuation Plan (CSSP) and the Teachers’ Retirement Allowances Fund (TRAF) began in 2007/08 with the government borrowing funds that would be invested by these two pension plans on behalf of the government.

Borrowing funds to pay down the previously unfunded pension liability is a sound fiscal decision, when the cost of borrowing is less than the actuarially determined expected rate of return on the plan assets and the rate of growth in the pension liability.

Since 2000, over $4.1 billion have been directed to pension obligations, including over $615 million of the annual debt retirement payments, $2.6 billion in new investment provided by the government since 2007 and net investment earnings projected to be $911 million by March 31, 2014. In addition, Budget 2013 includes $176 million in core government expenditures for the employer’s share of current service pension obligations.

Tangible Capital Assets –

Net Book Value

The potential benefits from borrowing to pay down pension liability are especially favourable in times like these with historically low interest rates. This is why the government will be assessing the merits of another round of borrowing to pay down some portion of the remaining unfunded liability.

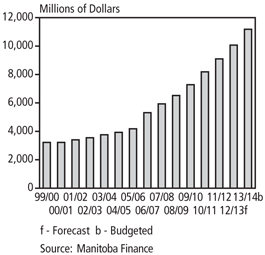

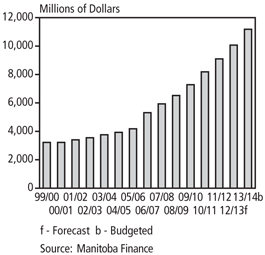

The government continues to recognize capital investment as a priority in order to support economic growth and provide for the services Manitobans need in the future. The cost of these assets is amortized over a set period that represents the useful life of the asset as required by GAAP. The end result is increased infrastructure investment for Manitobans, accompanied by a fixed discipline for paying down the associated debt.

The investment in tangible capital assets has increased steadily over the last decade, and with the $1.7 billion investment in Budget 2013, is projected to total $18.7 billion at March 31, 2014, with $7.5 billion of

B U D G E T 2 0 1 3 / 1 5

related debt retired through accumulated amortization. The net book value of these assets (cost less accumulated amortization) has more than tripled since 1999/2000 to $11.2 billion.

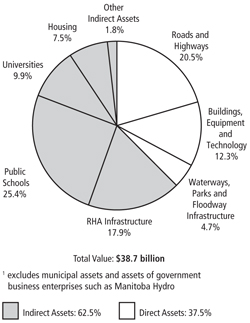

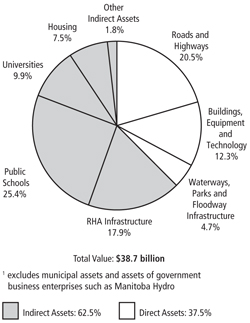

Manitoba’s communities and the economy have benefited over the years from the significant investment in public capital assets such as health facilities, universities, colleges and schools as well as infrastructure assets such as roads, water-control structures and parks. To meet the needs of today’s and future generations, it is necessary to continue to invest in renewal of these assets. The public good provided by these investments is immeasurable. It is estimated that the insured or replacement value of these investments exceeds $38 billion.

Based on projections, core government will have a total of $7.6 billion in capital asset investments at March 31, 2014, and $2.6 billion of related debt will have been retired through accumulated amortization.

A total of $353 million has been included in core government appropriations to retire debt associated with capital investments – $214 million for amortization of department owned assets and $139 million for principal payments for education and health-related assets.

Two thousand and eight saw the onset of the worst global economic downturn in a generation. Throughout the period of economic weakness, the government acted to stimulate the economy, protect jobs and preserve key services. This strategy helped Manitoba fare better than most provinces in weathering the recession. In 2011 and 2012, even as Manitoba’s economic and fiscal recovery was challenged by a historically weak global economic recovery, the government was also forced to confront the devastating effects of flooding. As the government continues to work toward returning to balance, it will benefit from the past key investments in the economy and from the commitment to fiscal prudence – including a healthy FSA that will help mitigate the deficits expected in core government operations.

Replacement Value of Public Assets1

Per Cent of Total

Totals may not add due to rounding.

The government’s balanced financial strategy maintains the legislated requirement to utilize the FSA for the amortization of increases in the general purpose debt, including related interest expenses that are attributable to negative net results incurred during the period of economic recovery. Existing funds in the Debt Retirement Account (DRA) were withdrawn in 2010/11 to repay $145 million of debt and further debt payments of $340 million have been made by withdrawal from the FSA – $90 million in 2010/11, $110 million in 2011/12 and $140 million in 2012/13. Budget 2013 provides for an additional debt payment of $100 million, for a total payment of $585 million. With a return to surplus position in Budget 2016, scheduled debt payments for general purpose debt will resume.

The government has a solid debt management plan which includes addressing the previously unfunded pension liability, budgeting for the employer’s share of current service entitlements for all employees, ensuring all capital investments are amortized and all related costs are fully reflected in annual appropriations, and continuing to make debt repayments to mitigate core government operating deficits.

Strategic decision making has resulted in debt servicing costs as a percentage of revenue remaining constant. Since 1999/2000, the debt servicing cost rate has dropped by 55.3%, from 13.2¢ of every dollar of summary revenue collected to a forecasted level of 5.9¢ in Budget 2013.

Although the lingering financial uncertainty slowed progress, the government remains committed to reducing debt over time with an ultimate goal of eliminating the general purpose debt and the remaining unfunded pension liabilities.

1 6 / B U D G E T 2 0 1 3

Measurable Outcome – Net Debt to GDP Ratio

Summary net debt is financial assets (such as cash or investments) minus total liabilities (such as loans or financing). It is the remaining liability that must be financed by future revenues.

Net debt may grow from time to time, as needed investments in capital assets – like the Red River Floodway, highway infrastructure and economic stimulus investments – are made. These forward-looking investments help support Manitoba’s economy.

Therefore, it is important to measure changes in net debt against the growth of the economy as measured by the nominal GDP.

Manitoba’s net debt to GDP has declined from 32.9% in 1999/2000 to a forecasted 28.7% in Budget 2013.

The government acknowledges that the ratio does need to rise in the short term as it makes needed investments in infrastructure projects, restores the damage from past floods and invests to mitigate impacts of future floods.

The outlook is for a decline in this ratio in 2015/16, demonstrating the government’s commitment to return to a downward trend over the longer term.

| ¢ | | PRIORITY AREA – INFRASTRUCTURE AND CAPITAL ASSET RENEWAL |

Building and upgrading Manitoba’s infrastructure has been a priority for the government since 1999. The government announced a four-year, $4.7 billion economic stimulus investment plan in November 2008 to fund key infrastructure projects across the province. Manitoba has also dedicated revenue raised through fuel taxes to fund infrastructure and in 2011, legislated the equivalent of one-seventh of the provincial sales tax revenue to support investment in municipal infrastructure and public transit. Record levels of investment in roads and bridges, water and wastewater treatment plants, health facilities, and schools, colleges and universities have driven growth and created a wealth of economic opportunities across the province.

Budget 2013 reinforces the commitment to infrastructure funding by continuing to support public service structures and systems that benefit the people of Manitoba. This investment includes projects to restore the damages from past floods and mitigate impacts of future floods.

Measurable Outcome – Capital Investments

Based on principles of sound financial management, the government has been able to increase its assets, while maintaining a sustainable level of debt. Since 2000, the government has invested $11.3 billion in public capital assets, including: $3.8 billion for new or renewed hospitals, universities, colleges and public schools; $4.3 billion to upgrade Manitoba’s roads and highways; and $3.2 billion for the Manitoba Floodway, the modernization and improvement of social housing, improving public service buildings and parks and camping infrastructure.

It is estimated that the insured or replacement value of these investments is more than $38 billion (see chart page 15).

Budget 2013 invests in much needed flood-related and other infrastructure to meet the needs of Manitobans into the future. This includes upgrading roads and highways, wastewater treatment plants, health facilities across the province, building and restoring much needed social housing, and modernizing our schools and post-secondary institutions.

B U D G E T 2 0 1 3 / 1 7

Budget 2013 includes capital investment of $1.8 billion to support continued economic growth, reduce the maintenance burden and provide for the services Manitobans need in the future as outlined in the table below.

| | | | | |

| | | 2013/14 |

| | | (Millions of Dollars) |

| |

Roads and Highways (including preservation and winter roads) | | | | 622 | |

| |

Universities, Colleges and Public Schools | | | | 228 | |

| |

Health Facilities | | | | 350 | |

| |

Manitoba Floodway and Water-Related Infrastructure | | | | 48 | |

| |

Housing (including third-party contributions) | | | | 333 | |

| |

Assistance to Third Parties | | | | 123 | |

| |

Public Service Buildings | | | | 71 | |

| |

Parks and Camping Infrastructure | | | | 24 | |

| |

| | | | | |

| | | | 1,799 | |

| | | | | |

The government’s commitment to infrastructure investments and renewal of existing assets, while maintaining a fiscally responsible approach to budgeting and debt management, will continue to deliver benefits to Manitobans.

1 8 / B U D G E T 2 0 1 3

B U D G E T 2 0 1 3 / 1 9

APPENDIX 1

MANITOBA SUMMARY FINANCIAL STATISTICS

2 0 / B U D G E T 2 0 1 3

Manitoba Summary Financial Statistics

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013/14 Budget | | | 2012/13 Forecast | | | 2011/12 Actual | | | 2010/11 Actual | | | 2009/10 Actual | | | 2008/09 Actual | |

| SUMMARY FINANCIAL STATEMENTS | | (Millions of Dollars) | |

| | | | | | |

Revenue | | | | | | | | | | | | | | | | | | | | | | | | |

Income Taxes | | | 3,366 | | | | 3,291 | | | | 3,124 | | | | 2,922 | | | | 2,659 | | | | 2,841 | |

Other Taxes | | | 4,015 | | | | 3,630 | | | | 3,531 | | | | 3,406 | | | | 3,281 | | | | 3,276 | |

Fees and Other Revenue | | | 1,987 | | | | 2,027 | | | | 1,906 | | | | 1,828 | | | | 1,792 | | | | 1,722 | |

Federal Transfers | | | 3,849 | | | | 3,898 | | | | 4,332 | | | | 4,047 | | | | 3,924 | | | | 3,866 | |

Net Income of Government Business Enterprises | | | 738 | | | | 685 | | | | 713 | | | | 807 | | | | 789 | | | | 764 | |

Sinking Funds and Other Earnings | | | 227 | | | | 233 | | | | 249 | | | | 230 | | | | 220 | | | | 296 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Revenue | | | 14,182 | | | | 13,764 | | | | 13,855 | | | | 13,240 | | | | 12,665 | | | | 12,765 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenditure | | | | | | | | | | | | | | | | | | | | | | | | |

Health | | | 5,660 | | | | 5,416 | | | | 5,328 | | | | 5,044 | | | | 4,831 | | | | 4,590 | |

Education | | | 3,807 | | | | 3,643 | | | | 3,489 | | | | 3,330 | | | | 3,227 | | | | 3,091 | |

Family Services | | | 1,133 | | | | 1,109 | | | | 1,013 | | | | 978 | | | | 1,295 | | | | 1,192 | |

Community, Economic and Resource Development | | | 2,484 | | | | 2,466 | | | | 2,771 | | | | 2,400 | | | | 1,813 | | | | 1,729 | |

Justice and Other Expenditures | | | 924 | | | | 950 | | | | 1,438 | | | | 894 | | | | 926 | | | | 882 | |

Debt Servicing Costs | | | 839 | | | | 820 | | | | 815 | | | | 773 | | | | 756 | | | | 830 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Expenditure | | | 14,847 | | | | 14,404 | | | | 14,854 | | | | 13,419 | | | | 12,848 | | | | 12,314 | |

| | | | | | |

In-Year Adjustments/Lapse | | | (150) | | | | (57) | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Result for the Year | | | (515) | | | | (583) | | | | (999) | | | | (179) | | | | (183) | | | | 451 | |

| | | | | | |

2013 Spring Flood Contingency | | | | | | | | | | | | | | | | | | | | | | | | |

Expenditures | | | (30) | | | | - | | | | - | | | | - | | | | - | | | | - | |

Recovery from Disaster Financial Assistance | | | 27 | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total 2013 Spring Flood Contingency | | | (3) | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Income (Loss) | | | (518) | | | | (583) | | | | (999) | | | | (179) | | | | (183) | | | | 451 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Provincial Borrowings, Guarantees & Obligations | | | | | | | | | | | | | | | | | | | | | | | | |

General Government Programs | | | 8,659 | | | | 8,254 | | | | 7,803 | | | | 6,955 | | | | 6,863 | | | | 6,400 | |

General Government Programs - Federal Flood Relief | | | - | | | | 276 | | | | 326 | | | | - | | | | - | | | | - | |

General Government Programs - Pension Liability | | | 2,595 | | | | 2,595 | | | | 2,595 | | | | 2,355 | | | | 2,175 | | | | 1,850 | |

The Manitoba Hydro-Electric Board | | | 11,046 | | | | 9,608 | | | | 8,999 | | | | 8,362 | | | | 7,730 | | | | 7,499 | |

Other Crown Organizations | | | 2,397 | | | | 2,247 | | | | 1,926 | | | | 1,641 | | | | 1,478 | | | | 1,341 | |

Health Facilities | | | 1,314 | | | | 1,162 | | | | 1,094 | | | | 1,015 | | | | 949 | | | | 831 | |

Other | | | 17 | | | | 27 | | | | 37 | | | | 51 | | | | 65 | | | | 78 | |

Capital Investments | | | 4,089 | | | | 3,668 | | | | 3,195 | | | | 2,546 | | | | 1,846 | | | | 1,411 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal | | | 30,117 | | | | 27,837 | | | | 25,975 | | | | 22,925 | | | | 21,106 | | | | 19,410 | |

| | | | | | |

Other Obligations | | | | | | | | | | | | | | | | | | | | | | | | |

Pension Liability | | | 7,264 | | | | 6,892 | | | | 6,697 | | | | 6,545 | | | | 6,392 | | | | 6,152 | |

Pension Asset Fund | | | (5,266) | | | | (5,083) | | | | (5,063) | | | | (4,814) | | | | (4,624) | | | | (4,161) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Pension Liability | | | 1,998 | | | | 1,809 | | | | 1,634 | | | | 1,731 | | | | 1,768 | | | | 1,991 | |

Debt incurred for and repayable by the Manitoba Hydro-Electric Board | | | (10,698) | | | | (9,445) | | | | (8,742) | | | | (8,199) | | | | (7,479) | | | | (7,177) | |

Education and Health Debt held by Government Enterprises | | | 535 | | | | 505 | | | | 505 | | | | 471 | | | | 443 | | | | 406 | |

Other Debt of Crown Organizations | | | 266 | | | | 266 | | | | 266 | | | | 263 | | | | 255 | | | | 262 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal | | | (7,899) | | | | (6,865) | | | | (6,337) | | | | (5,734) | | | | (5,013) | | | | (4,518) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Summary Borrowings, Guarantees & Obligations | | | 22,218 | | | | 20,972 | | | | 19,638 | | | | 17,191 | | | | 16,093 | | | | 14,892 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Adjustments to arrive at Summary Net Debt | | | | | | | | | | | | | | | | | | | | | | | | |

Guarantees | | | (351) | | | | (166) | | | | (257) | | | | (165) | | | | (255) | | | | (326) | |

Net Financial Assets | | | (4,113) | | | | (4,687) | | | | (4,870) | | | | (4,501) | | | | (4,231) | | | | (3,086) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Summary Net Debt | | | 17,754 | | | | 16,119 | | | | 14,511 | | | | 12,525 | | | | 11,607 | | | | 11,480 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

NOTES:

| — | | The 2012/13 Budget numbers originally presented in the 2012 Budget Address and the 2012/13 forecast from the Third Quarter Financial Report have been re-stated to be consistent with the current presentation for the GRE. |

| — | | Details of Expenditure and Revenue for Fiscal Year 2013/14, and a reconciliation to the amounts reported for core government are found in Schedules 1 and 2. |

| — | | In-Year Adjustments/Lapse could be an increase in revenue and/or decrease in expenditures. |

| — | | Numbers may not add due to rounding. |

B U D G E T 2 0 1 3 / 2 1

Manitoba Summary Financial Statistics

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013/14 Budget | | | 2012/13 Forecast | | | 2011/12 Actual | | | 2010/11 Actual | | | 2009/10 Actual | | | 2008/09 Actual | |

| |

| | | (Percentage Change) | |

Annual Change | | | | | | | | | | | | | | | | | | | | | | | | |

Income Taxes | | | 2.3 | | | | 5.3 | | | | 6.9 | | | | 9.9 | | | | (6.4) | | | | 7.1 | |

Other Taxes | | | 10.6 | | | | 2.8 | | | | 3.7 | | | | 3.8 | | | | 0.2 | | | | (0.4) | |

Fees and Other Revenue | | | (2.0) | | | | 6.3 | | | | 4.3 | | | | 2.0 | | | | 4.1 | | | | 5.8 | |

Federal Transfers | | | (1.3) | | | | (10.0) | | | | 7.0 | | | | 3.1 | | | | 1.5 | | | | 7.5 | |

Total Revenue | | | 3.0 | | | | (0.7) | | | | 4.6 | | | | 4.5 | | | | (0.8) | | | | 2.2 | |

Health | | | 4.5 | | | | 1.7 | | | | 5.6 | | | | 4.4 | | | | 5.3 | | | | 8.5 | |

Education | | | 4.5 | | | | 4.4 | | | | 4.8 | | | | 3.2 | | | | 4.4 | | | | (4.1) | |

Debt Servicing Costs | | | 2.3 | | | | 0.6 | | | | 5.4 | | | | 2.2 | | | | (8.9) | | | | (3.9) | |

Total Expenditure | | | 3.1 | | | | (3.0) | | | | 10.7 | | | | 4.4 | | | | 4.3 | | | | 3.1 | |

Summary Net Debt | | | 10.1 | | | | 11.1 | | | | 15.9 | | | | 7.9 | | | | 1.1 | | | | 8.7 | |

| |

| | | (Per Cent) | |

Per Cent of GDP | | | | | | | | | | | | | | | | | | | | | | | | |

Income Taxes | | | 5.4 | | | | 5.5 | | | | 5.5 | | | | 5.4 | | | | 5.2 | | | | 5.5 | |

Other Taxes | | | 6.5 | | | | 6.1 | | | | 6.2 | | | | 6.3 | | | | 6.4 | | | | 6.3 | |

Fees and Other Revenue | | | 3.2 | | | | 3.4 | | | | 3.3 | | | | 3.4 | | | | 3.5 | | | | 3.3 | |

Federal Transfers | | | 6.2 | | | | 6.6 | | | | 7.6 | | | | 7.5 | | | | 7.6 | | | | 7.5 | |

Total Revenue | | | 22.9 | | | | 23.2 | | | | 24.3 | | | | 24.4 | | | | 24.6 | | | | 24.7 | |

Health | | | 9.2 | | | | 9.1 | | | | 9.4 | | | | 9.3 | | | | 9.4 | | | | 8.9 | |

Education | | | 6.2 | | | | 6.1 | | | | 6.1 | | | | 6.1 | | | | 6.3 | | | | 6.0 | |

Debt Servicing Costs | | | 1.4 | | | | 1.4 | | | | 1.4 | | | | 1.4 | | | | 1.5 | | | | 1.6 | |

Total Expenditure | | | 24.0 | | | | 24.2 | | | | 26.1 | | | | 24.7 | | | | 24.9 | | | | 23.8 | |

Summary Net Debt | | | 28.7 | | | | 27.1 | | | | 25.5 | | | | 23.1 | | | | 22.5 | | | | 22.2 | |

| | | | | | |

Per Cent of Revenue | | | | | | | | | | | | | | | | | | | | | | | | |

Income Taxes | | | 23.7 | | | | 23.9 | | | | 22.5 | | | | 22.1 | | | | 21.0 | | | | 22.3 | |

Other Taxes | | | 28.3 | | | | 26.4 | | | | 25.5 | | | | 25.7 | | | | 25.9 | | | | 25.7 | |

Fees and Other Revenue | | | 14.0 | | | | 14.7 | | | | 13.8 | | | | 13.8 | | | | 14.1 | | | | 13.5 | |

Federal Transfers | | | 27.1 | | | | 28.3 | | | | 31.3 | | | | 30.6 | | | | 31.0 | | | | 30.3 | |

Net Income of Government Business Enterprises | | | 5.2 | | | | 5.0 | | | | 5.1 | | | | 6.1 | | | | 6.2 | | | | 6.0 | |

Sinking Funds and Other Earnings | | | 1.6 | | | | 1.7 | | | | 1.8 | | | | 1.7 | | | | 1.7 | | | | 2.3 | |

| |

| | | (Dollars) | |

| | | | | | |

Dollars Per Capita | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total Revenue | | | 11,063 | | | | 10,863 | | | | 11,069 | | | | 10,715 | | | | 10,382 | | | | 10,587 | |

Total Expenditure | | | 11,582 | | | | 11,369 | | | | 11,867 | | | | 10,859 | | | | 10,532 | | | | 10,213 | |

Debt Servicing Costs | | | 654 | | | | 647 | | | | 651 | | | | 626 | | | | 620 | | | | 688 | |

Summary Net Debt | | | 13,850 | | | | 12,722 | | | | 11,593 | | | | 10,136 | | | | 9,515 | | | | 9,521 | |

| | | | | | |

Memorandum Items | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Population (000’s) * | | | 1,281.9f | | | | 1,267.0 | | | | 1,251.7 | | | | 1,235.7 | | | | 1,219.9 | | | | 1,205.7 | |

GDP at Market Prices ($M) | | | 61,850f | | | | 59,405f | | | | 56,947 | | | | 54,275 | | | | 51,554 | | | | 51,676 | |

Source: Manitoba Finance

* official population July 1

f - Forecast

2 2 / B U D G E T 2 0 1 3

Budget Paper B

SUPPLEMENTARY

FINANCIAL INFORMATION

| | | | |

Available in alternate formats upon request. | | | |  |

SUPPLEMENTARY FINANCIAL INFORMATION

| | | | |

CONTENTS | | | | |

| |

SPECIAL ACCOUNTS | | | 1 | |

Fiscal Stabilization Account | | | 1 | |

Pension Assets Fund | | | 2 | |

| |

CAPITAL INVESTMENT | | | 4 | |

| |

CAPITAL INVESTMENT – CORE GOVERNMENT | | | 5 | |

| |

LOAN REQUIREMENTS | | | 6 | |

| |

BORROWING REQUIREMENTS | | | 8 | |

| |

SUMMARY NET DEBT | | | 9 | |

| |

INTERPROVINCIAL COMPARISONS | | | 9 | |

B U D G E T 2 0 1 3 S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n / B 1

Fiscal Stabilization Account

The Fiscal Stabilization Account (FSA) is projected to have a balance of $375 million as at March 31, 2013, after a draw of $8 million for wait-time reduction and other health-related programming, $4 million related to ecoTrust and $140 million to retire a portion of the borrowings incurred during the period of economic recovery to support core government programs.

The budgeted draw in 2013/14 of $100 million is to retire a portion of the borrowings for core government.

Fiscal Stabilization Account

Revenue, Expenditure and Balance

Projection as at March 31, 2014 and March 31, 2013

| | | | | | | | | | |

| | | 2013/14 Budget | | | | | 2012/13 Forecast | |

| | | | | | (Millions of Dollars) | | | |

| | | |

Total Account Balance, Beginning of Year | | | 375 | | | | | | 527 | |

| | | | | | | | | | |

Health Programs | | | | | | | | | | |

Balance, Beginning of Year | | | - | | | | | | 8 | |

Transfers to the Core Government | | | | | | | | | | |

Wait-Time Reduction Programming and | | | | | | | | | | |

Other Health-Related Programming | | | - | | | | | | (8) | |

| | | | | | | | | | |

| | | |

Balance, End of Year | | | - | | | | | | - | |

| | | | | | | | | | |

| | | |

General Programs | | | | | | | | | | |

Balance, Beginning of Year | | | 375 | | | | | | 519 | |

Transfers to the Core Government | | | | | | | | | | |

Debt Repayment | | | (100) | | | | | | (140) | |

ecoTrust | | | - | | | | | | (4) | |

| | | | | | | | | | |

| | | |

Balance, End of Year | | | 275 | | | | | | 375 | |

| | | | | | | | | | |

| | | |

Total Account Balance, End of Year | | | 275 | | | | | | 375 | |

| | | | | | | | | | |

B 2 / S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n B U D G E T 2 0 1 3

Pension Assets Fund

The government continues its commitment to fund its unfunded pension liabilities. As part of this commitment, the government has changed the trust conditions of the funds held in the Pension Assets Fund to clarify that these funds are irrevocably restricted for pension purposes only. Net investment earnings of pension assets include the expected rate of return during the year as well as adjustments to market-related value. Market fluctuations of pension assets are not recorded in the year in which they occur but are recognized over the employee average remaining service life.

The fund is expected to have a balance of $3,439 million by the end of the 2013/14 fiscal year.

Pension Assets Fund

Projection as at March 31, 2014 and March 31, 2013

| | | | | | | | | | |

| | | 2013/14 Budget | | | | | 2012/13 Forecast | |

| | | | | | (Millions of Dollars) | | | |

Balance, Beginning of Year | | | 3,347 | | | | | | 3,324 | |

| | | | | | | | | | |

| | | |

Contributions and Revenue | | | | | | | | | | |

Net Investment Earnings | | | 209 | | | | | | 152 | |

Departments and Crown Corporations | | | 172 | | | | | | 153 | |

| | | | | | | | | | |

| | | |

| | | 381 | | | | | | 305 | |

| | | | | | | | | | |

| | | |

Transfers | | | | | | | | | | |

TRAF and CSSP Payments | | | (289) | | | | | | (282) | |

| | | | | | | | | | |

| | | |

Balance, End of Year | | | 3,439 | | | | | | 3,347 | |

| | | | | | | | | | |

B U D G E T 2 0 1 3 S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n / B 3

SUMMARY OF ACCOUNT/FUND ACTIVITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 13/14 Budget | | | 12/13 Forecast | | | 11/12 Actual | | | 10/11 Actual | | | 09/10 Actual | | | 08/09 Actual | | | 07/08 Actual | | | 06/07 Actual | | | 05/06 Actual | | | 04/05 Actual | | | 03/04 Actual | | | 02/03 Actual | | | 01/02 Actual | | | 00/01 Actual | | | 99/00 Actual | |

| | | (Millions of Dollars) | |

| | | | | | | | | | | | | | | |

Fiscal Stabilization Account | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Transfers to Account | | | - | | | | - | | | | - | | | | - | | | | - | | | | 30 | | | | 128 | | | | 110 | | | | 31 | | | | 405 | | | | 13 | | | | 4 | | | | 63 | | | | 40 | | | | 11 | |

| | | | | | | | | | | | | | | |

Transfers from Account | | | (100 | ) | | | (152 | ) | | | (155 | ) | | | (125 | ) | | | (57 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (171 | ) | | | (22 | ) | | | (150 | ) | | | - | | | | (185 | ) |

| | | | | | | | | | | | | | | |

Investment Revenue | | | - | | | | - | | | | - | | | | - | | | | - | | | | 16 | | | | 27 | | | | 21 | | | | 15 | | | | 2 | | | | 1 | | | | 7 | | | | 14 | | | | 15 | | | | 12 | |

| | | | | | | | | | | | | | | |

Balance, End of Year | | | 275 | | | | 375 | | | | 527 | | | | 682 | | | | 807 | | | | 864 | | | | 818 | | | | 663 | | | | 532 | | | | 486 | | | | 79 | | | | 236 | | | | 247 | | | | 320 | | | | 265 | |

| | | | | | | | | | | | | | | |

Debt Retirement Account | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Contribution | | | - | | | | - | | | | - | | | | - | | | | 20 | | | | 110 | | | | 110 | | | | 110 | | | | 110 | | | | 99 | | | | 96 | | | | 96 | | | | 96 | | | | 96 | | | | 75 | |

| | | | | | | | | | | | | | | |

Interest Earnings | | | - | | | | - | | | | - | | | | - | | | | 1 | | | | 1 | | | | 2 | | | | 1 | | | | - | | | | 2 | | | | 7 | | | | 3 | | | | 5 | | | | - | | | | - | |

| | | | | | | | | | | | | | | |

Transfers to Pension Assets Fund | | | - | | | | - | | | | - | | | | - | | | | (10 | ) | | | (55 | ) | | | (85 | ) | | | (85 | ) | | | (85 | ) | | | (79 | ) | | | (75 | ) | | | (48 | ) | | | (75 | ) | | | (21 | ) | | | - | |

| | | | | | | | | | | | | | | |

Transfers for General Purpose Debt Reduction | | | - | | | | - | | | | - | | | | (145 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (202 | ) | | | - | | | | - | | | | - | | | | - | | | | (305 | ) |

| | | | | | | | | | | | | | | |

Balance, End of Year | | | - | | | | - | | | | - | | | | - | | | | 145 | | | | 134 | | | | 78 | | | | 51 | | | | 25 | | | | - | | | | 180 | | | | 152 | | | | 101 | | | | 75 | | | | - | |

| | | | | | | | | | | | | | | |

Pension Assets Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Transfers from Debt Retirement Account | | | - | | | | - | | | | - | | | | - | | | | 10 | | | | 55 | | | | 85 | | | | 85 | | | | 85 | | | | 79 | | | | 75 | | | | 48 | | | | 75 | | | | 21 | | | | - | |

| | | | | | | | | | | | | | | |

Net Investment Earnings | | | 209 | | | | 152 | | | | 40 | | | | 100 | | | | 160 | | | | 41 | | | | 16 | | | | 67 | | | | 61 | | | | 31 | | | | 38 | | | | (6 | ) | | | 2 | | | | - | | | | - | |

| | | | | | | | | | | | | | | |

Net Current Service Contributions | | | (117 | ) | | | (129 | ) | | | (130 | ) | | | (114 | ) | | | (100 | ) | | | (80 | ) | | | (60 | ) | | | 10 | | | | 8 | | | | 6 | | | | 3 | | | | 2 | | | | 9 | | | | - | | | | - | |

| | | | | | | | | | | | | | | |

TRAF/CSSP Funding | | | - | | | | - | | | | 240 | | | | 180 | | | | 330 | | | | 350 | | | | 1,502 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | |

Balance, End of Year | | | 3,439 | | | | 3,347 | | | | 3,324 | | | | 3,174 | | | | 3,008 | | | | 2,608 | | | | 2,242 | | | | 699 | | | | 537 | | | | 383 | | | | 267 | | | | 151 | | | | 107 | | | | 21 | | | | - | |

B 4 / S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n B U D G E T 2 0 1 3

Capital investment continues to be a priority for the government, with the cost of these assets amortized over a set period that represents the useful life of the asset as required by GAAP. These set periods result in regular repayment of debt. The end result is increased infrastructure investment for Manitobans, while spreading the cost of those assets over their useful life, a strategy which includes a plan to pay the debt. The net book value of these assets (cost less accumulated amortization) has more than tripled since 1999/2000 and is a major asset of the government in providing services to Manitobans into the future.

The investment in tangible capital assets is projected to be $18.7 billion as at March 31, 2014, with $7.5 billion of related debt having been retired through accumulated amortization. Core government will have a total of $7.6 billion in capital asset investments as at March 31, 2014 and $2.6 billion of related debt will have been retired through accumulated amortization.

Tangible Capital Assets – Net Book Value

B U D G E T 2 0 1 3 S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n / B 5

| ¢ | | CAPITAL INVESTMENT – CORE GOVERNMENT |

Government owned capital assets such as highways, waterways, buildings, machinery and computer systems are amortized over their useful life based on established guidelines for amortization (see Appendix B of the 2013/14 Estimates of Expenditure). The amortization and interest costs are borne by departments that are responsible for each asset and are reflected as annual costs related to capital assets. In total, costs related to capital assets are estimated at $413 million in 2013/14, an increase of $31 million from 2012/13. In 2013/14, departmental appropriations include $214 million for amortization and $199 million for allocation of interest.

Authority for the annual cost to acquire government owned assets is reflected as Part B – Capital Investment which totals $696 million in 2013/14, a decrease of $55 million from 2012/13.

Capital Investment, 2013/14

(Thousands of Dollars)

| | | | | | | | | | |

| | | 2013/14 Budget | | 2012/13 Budget |

General Assets | | | | | | | | | | |

Government Services Capital Projects | | | | 112,000 | | | | | 128,346 | |

Transportation Equipment and Aircraft | | | | 16,920 | | | | | 42,164 | |

Information Technology Projects | | | | | | | | | | |

Corporate Information Technology Projects | | | | 21,904 | | | | | 21,558 | |

Advanced Education and Literacy | | | | 100 | | | | | 500 | |

Conservation and Water Stewardship | | | | 405 | | | | | - | |

Finance | | | | 500 | | | | | 500 | |

Health | | | | 665 | | | | | 928 | |

Justice | | | | 325 | | | | | 413 | |

Other Equipment and Buildings | | | | 19,427 | | | | | 51,056 | |

| | | | | | | | | | |

| | | | 172,246 | | | | | 245,465 | |

| | | | | | | | | | |

| | |

Infrastructure Assets | | | | | | | | | | |

Provincial Roads, Highways and Airport Infrastructure | | | | 470,510 | | | | | 427,045 | |

Water Related Infrastructure | | | | 37,100 | | | | | 52,800 | |

Parks, Cottage and Camping Projects | | | | 15,839 | | | | | 25,600 | |

| | | | | | | | | | |

| | | | 523,449 | | | | | 505,445 | |

| | | | | | | | | | |

Total Capital Investment | | | | 695,695 | | | | | 750,910 | |

| | | | | | | | | | |

B 6 / S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n B U D G E T 2 0 1 3

The Loan Act 2013 provides borrowing and expenditure authority and, in some cases, guarantee authority for the government and its agencies to undertake self-sustaining programs, where self-sustaining means having the ability for repayment. This authority is in addition to that voted in the printed estimates review.

Incremental Capital Authority Requirements for Non-Budgetary Programs, 2013/14

(Thousands of Dollars)

| | | | |

| The Loan Act, 2013 | | | |

The Manitoba Hydro-Electric Board | | | $2,070,000 | |

Manitoba Housing and Renewal Corporation | | | 408,733 | |

Manitoba Agricultural Services Corporation | | | 173,130 | |

Manitoba Liquor and Lotteries Corporation | | | 108,000 | |

Health Capital Program | | | 92,800 | |

Business Support | | | 32,238 | |

Manitoba Student Aid Program | | | 29,476 | |

Diagnostic Services Manitoba | | | 14,683 | |

Special Operating Agencies Financing Authority - Vehicles and Equipment Management Agency | | | 8,000 | |

Communities Economic Development Fund | | | 6,800 | |

Special Operating Agencies Financing Authority - Crown Lands and Property Agency | | | 5,000 | |

Post-Secondary Institutions | | | 2,678 | |

Leaf Rapids Town Properties Ltd. | | | 500 | |

Manitoba Film Guarantee Program | | | 257 | |

Special Operating Agencies Financing Authority - Vital Statistics | | | 200 | |

| | | | |

| |

| | | $2,952,495 | |

| | | | |

B U D G E T 2 0 1 3 S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n / B 7

Non-Budgetary Capital Program, 2013/14

(Thousands of Dollars)

| | | | |

The Manitoba Hydro-Electric Board | | | $2,158,000 | |

Manitoba Housing and Renewal Corporation | | | 341,743 | |

Manitoba Agricultural Services Corporation | | | 240,895 | |

Manitoba Liquor and Lotteries Corporation | | | 215,400 | |

Health Capital Program | | | 167,478 | |

Post-Secondary Institutions | | | 82,802 | |

Business Support (including Manitoba Industrial Opportunities Program) | | | 76,871 | |

Manitoba Opportunities Fund | | | 58,848 | |

Manitoba Student Aid Program | | | 36,796 | |

Diagnostic Services Manitoba | | | 34,641 | |

Special Operating Agencies Financing Authority - Vehicles and Equipment Management Agency | | | 30,400 | |

The Manitoba Water Services Board | | | 27,876 | |

Northern Affairs Communities | | | 11,880 | |

Communities Economic Development Fund | | | 9,000 | |

Cottage Lots Development | | | 6,971 | |

Special Operating Agencies Financing Authority - Crown Lands and Property Agency | | | 5,000 | |

Miscellaneous Corporations, Agencies and Other Programs | | | 9,322 | |

| | | | |

| | | $3,513,923 | |

| | | | |

B 8 / S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n B U D G E T 2 0 1 3

Manitoba’s borrowing requirements with respect to both general and self sustaining borrowings is estimated to total $4.8 billion in 2013/14, of which $2.2 billion is required for refinancing purposes. New cash requirements, net of estimated repayments, are $2.6 billion, which includes requirements for general government purposes, capital investments by departments and The Manitoba Hydro-Electric Board. Estimated repayments are for general purpose borrowings, capital investment assets and health facilities. The Loan Act, 2013, will provide incremental capital authority of $3 billion. To date, approximately $0.6 billion of Manitoba’s borrowing requirements have been funded.

Borrowing Requirements 2013/14

(Thousands of Dollars)

| | | | | | | | | | | | | | | | | | | | |

| | | Refinancing | | New Cash Requirements | | Estimated Repayments | | Borrowing Requirements |

Government Business Enterprises | | | | | | | | | | | | | | | | | | | | |

The Manitoba Hydro-Electric Board | | | | 728,800 | | | | | 1,584,800 | | | | | - | | | | | 2,313,600 | |

Manitoba Liquor and Lotteries Corporation | | | | - | | | | | 75,000 | | | | | 24,786 | | | | | 50,214 | |

| | | | | | | | | | | | | | | | | | | | |

Subtotal | | | | 728,800 | | | | | 1,659,800 | | | | | 24,786 | | | | | 2,363,814 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Other Borrowings | | | | | | | | | | | | | | | | | | | | |

General Purpose Borrowings | | | | 760,208 | | | | | 505,053 | | | | | 100,000 | | | | | 1,165,261 | |

Capital Investment Assets | | | | 158,567 | | | | | 635,001 | | | | | 214,862 | | | | | 578,706 | |

Health Facilities | | | | 384,000 | | | | | 100,000 | | | | | 88,600 | | | | | 395,400 | |

Other Crowns and Organizations | | | | 150,000 | | | | | 100,000 | | | | | - | | | | | 250,000 | |

| | | | | | | | | | | | | | | | | | | | |

Subtotal | | | | 1,452,775 | | | | | 1,340,054 | | | | | 403,462 | | | | | 2,389,367 | |

| | | | | | | | | | | | | | | | | | | | |

Total Borrowing Requirements | | | | 2,181,575 | | | | | 2,999,854 | | | | | 428,248 | | | | | 4,753,181 | |

| | | | | | | | | | | | | | | | | | | | |

B U D G E T 2 0 1 3 S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n / B 9

Changes in Summary Net Debt

(Millions of Dollars)

| | | | |

2012/13 Summary Net Debt (Forecast) | | | 16,119 | |

| |

Net Investment in Tangible Capital Assets | | | | |

| |

Core Government | | | 481 | |

| |

Other Reporting Entities | | | 636 | |

| | | | |

| | | 1,117 | |

| | | | |

Plus: Projected (Income) Loss for the Year | | | | |

| |

Core Government | | | 505 | |

| |

Other Reporting Entities | | | 13 | |

| | | | |

| | | 518 | |

| | | | |

Change in Net Debt | | | 1,635 | |

| | | | |

| |

2013/14 Summary Net Debt (Budget) | | | 17,754 | |

| | | | |

In Budget 2013, the net debt to GDP ratio is forecast to be 28.7%. Net debt is an important indicator of a government’s financial position as this highlights the affordability of future government service. Summary net debt represents the difference between the GREs’ total liabilities, such as borrowing and financing, less its financial assets* – it reflects the residual liability that must be financed by future revenues. Net debt may grow in absolute terms from time to time, as needed investments in capital assets are made. These investments underpin and support Manitoba’s economic performance. It is important to measure changes in net debt against the growth of the economy, as measured by the nominal GDP.

* Financial assets are liquid assets such as cash, investments, loans and accounts receivable that could be readily converted to cash.

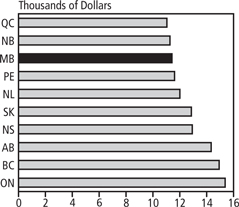

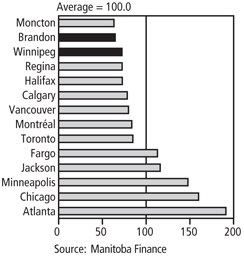

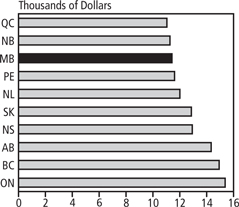

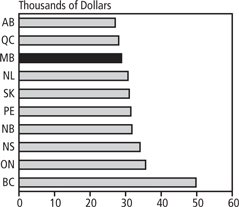

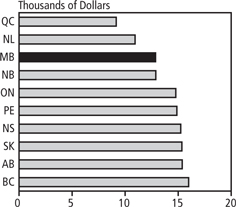

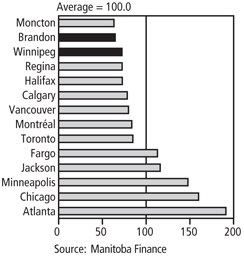

| ¢ | | INTERPROVINCIAL COMPARISONS |

Moody’s Credit Ratings

S&P Credit Ratings

B 1 0 / S u p p l e m e n t a r y F i n a n c i a l I n f o r m a t i o n B U D G E T 2 0 1 3

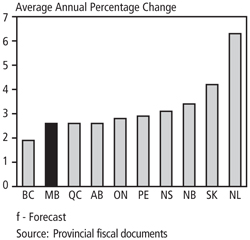

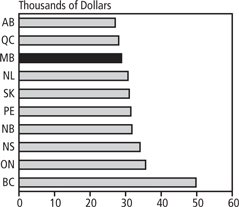

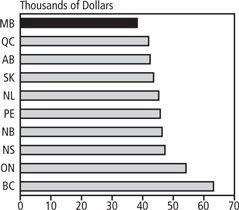

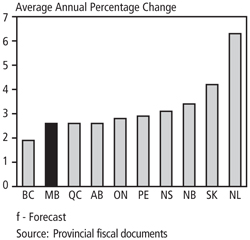

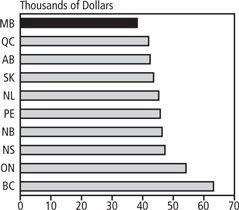

Provincial Expenditure

Per Capita Increase,

2007/08 to 2012/13f

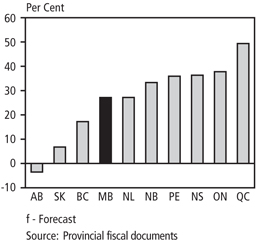

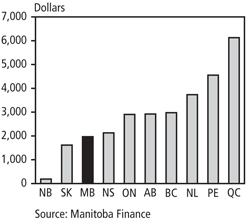

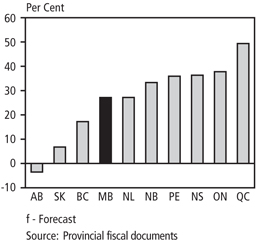

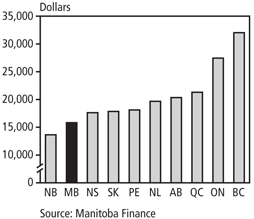

Net Debt to GDP Ratio,

2012/13f

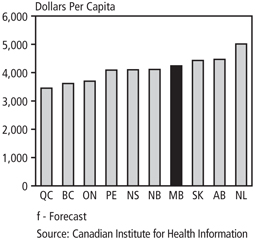

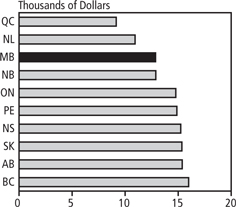

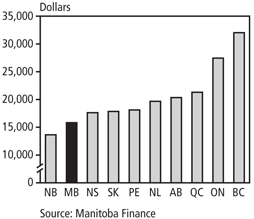

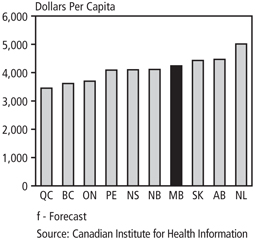

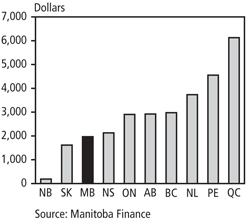

Provincial Government Expenditure

on Health, 2011/12f

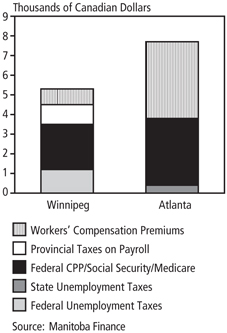

Major Federal Cash Transfers,

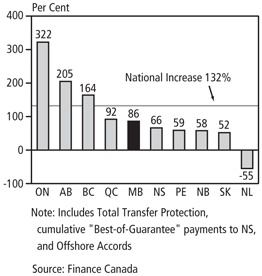

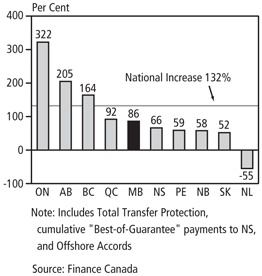

Change from 1999/00 to 2013/14

Budget Paper C

TAXATION ADJUSTMENTS

| | | | |

Available in alternate formats upon request. | | | |  |

TAXATION ADJUSTMENTS

| | | | |

CONTENTS | | | | |

| |

SUMMARY OF 2013 TAX MEASURES | | | 1 | |

| |

PERSONAL MEASURES | | | 2 | |

Seniors’ School Tax Rebate | | | 2 | |

Dividend Tax Credit | | | 2 | |

| |

HEALTH AND ENVIRONMENTAL MEASURES | | | 2 | |

Tobacco Tax | | | 2 | |

Natural Gas Fuel Tax | | | 2 | |

Odour Control Tax Credit | | | 3 | |

| |

BUSINESS AND FARM MEASURES | | | 3 | |

Data Processing Investment Tax Credit | | | 3 | |

Rental Housing Construction Tax Credit | | | 3 | |

Research and Development Tax Credit | | | 4 | |

Manufacturing Investment Tax Credit | | | 4 | |

Small Business Income Limit | | | 5 | |

Film and Video Production Tax Credit | | | 5 | |

Interactive Digital Media Tax Credit | | | 5 | |

Small Business Venture Capital Tax Credit | | | 6 | |

Farmland School Tax Rebate | | | 6 | |

Corporation Capital Tax on Financial Institutions | | | 7 | |

| |

SALES TAX MEASURES | | | 7 | |

Sales Tax Rate | | | 7 | |

Exemptions | | | 7 | |

| |

TECHNICAL AND ADMINISTRATIVE AMENDMENTS | | | 8 | |

| |

GOODS AND SERVICES NOT TAXABLE UNDER MANITOBA SALES TAX | | | 9 | |

| |

CONTACTS FOR FURTHER INFORMATION | | | 10 | |

| |

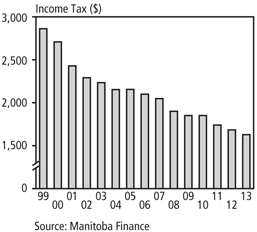

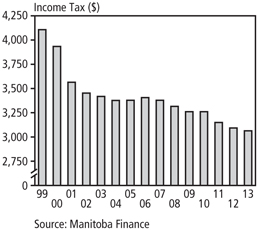

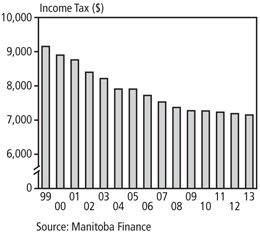

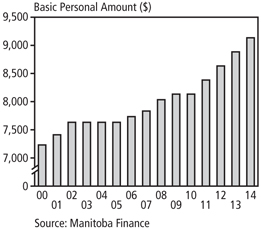

PERSONAL TAX SAVINGS SINCE 1999 | | | 12 | |

| |

MANITOBA INCOME TAX SAVINGS FOR TYPICAL TAXPAYERS | | | 14 | |

| |

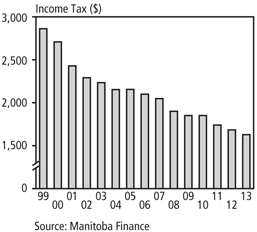

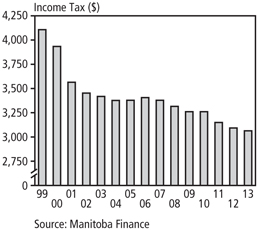

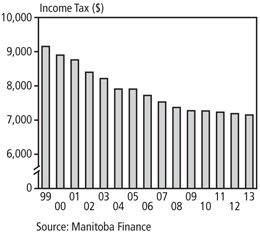

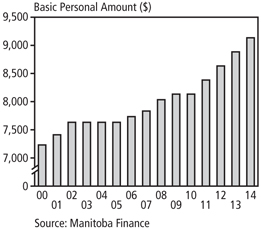

MANITOBA INCOME TAX SINCE 1999 | | | 15 | |

| |

2013 INTERPROVINCIAL COMPARISON OF TAX RATES | | | 16 | |

| |

FEDERAL AND MANITOBA INCOME TAX RATES, 2013 | | | 16 | |

| |

Appendix 1: MANITOBA TAX EXPENDITURES, 2012/13 | | | 18 | |

| |

Appendix 2: THE MANITOBA ADVANTAGE | | | 23 | |

| |

Appendix 3: MANITOBA’S COMPETITIVE ENVIRONMENT FOR MANUFACTURING | | | 34 | |

B U D G E T 2 0 1 3 T a x a t i o n A d j u s t m e n t s / C 1

| ¢ | | SUMMARY OF 2013 TAX MEASURES |

A negative amount represents a tax reduction.

| | | | | | | | | | |

| | | 2013/14 | | Full Year |

| |

| | | | | |

| | | (Millions of Dollars) |

| | |

Ongoing Reductions1 | | | | | | | | | | |

Personal Tax reductions | | | | -25.0 | | | | | -41.3 | |

Business Tax reductions | | | | -4.8 | | | | | -11.8 | |

| | |

| | | | | | | | | | |

| | | | -29.8 | | | | | -53.1 | |

| | |

Personal Measures | | | | | | | | | | |

Seniors’ School Tax Rebate introduced | | | | -6.5 | | | | | -50.0 | |

Dividend Tax Credit changed | | | | - | | | | | - | |

| | |

| | | | | | | | | | |

| | | | -6.5 | | | | | -50.0 | |

| | |

Health and Environmental Measures | | | | | | | | | | |

Tobacco Tax increased | | | | 16.4 | | | | | 17.2 | |

Natural Gas Fuel Tax introduced | | | | - | | | | | - | |

Odour Control Tax Credit enhanced | | | | - | | | | | - | |

| | |

| | | | | | | | | | |

| | | | 16.4 | | | | | 17.2 | |

| | |

Business and Farm Measures | | | | | | | | | | |