|

Exhibit 99.1

|

Exhibit 99.1

Bipole III, Keeyask and Tie-Line review

September 19, 2016

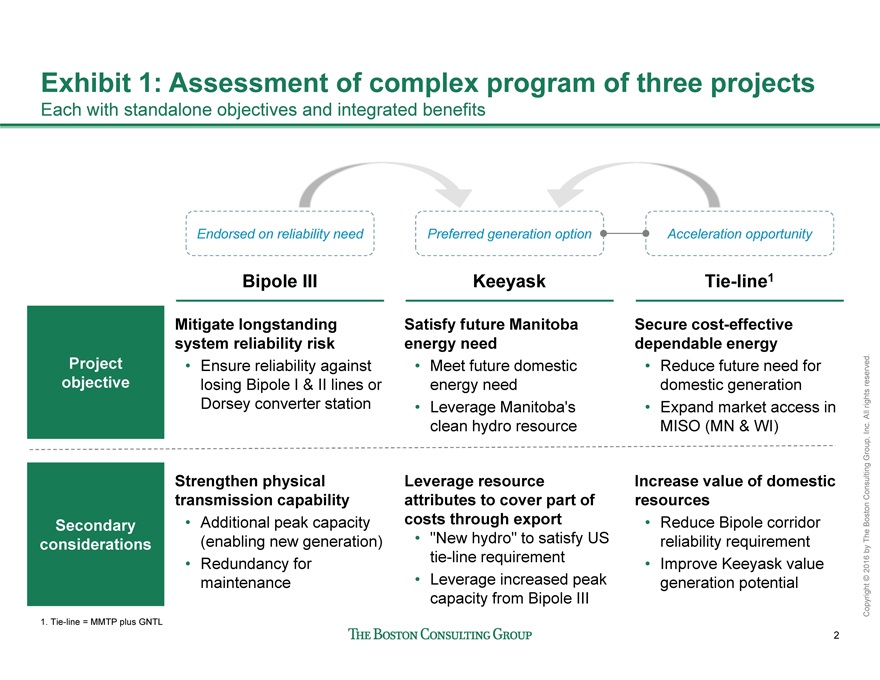

Exhibit 1: Assessment of complex program of three projects

Each with standalone objectives and integrated benefits

Endorsed on reliability need Preferred generation option Acceleration opportunity

Bipole III Keeyask Tie-line1

Mitigate longstanding Satisfy future Manitoba Secure cost-effective system reliability risk energy need dependable energy Project • Ensure reliability against • Meet future domestic • Reduce future need for objective losing Bipole I & II lines or energy need domestic generation Dorsey converter station • Leverage Manitoba’s • Expand market access in clean hydro resource MISO (MN & WI)

Strengthen physical Leverage resource Increase value of domestic transmission capability attributes to cover part of resources Secondary • Additional peak capacity costs through export • Reduce Bipole corridor considerations (enabling new generation) • “New hydro” to satisfy US reliability requirement

• Redundancy for tie-line requirement • Improve Keeyask value maintenance • Leverage increased peak generation potential capacity from Bipole III

1. Tie-line = MMTP plus GNTL

BCG Report.pptx

Copyright © 2016 by The Boston Consulting Group, IncAll. rights reserved.

2

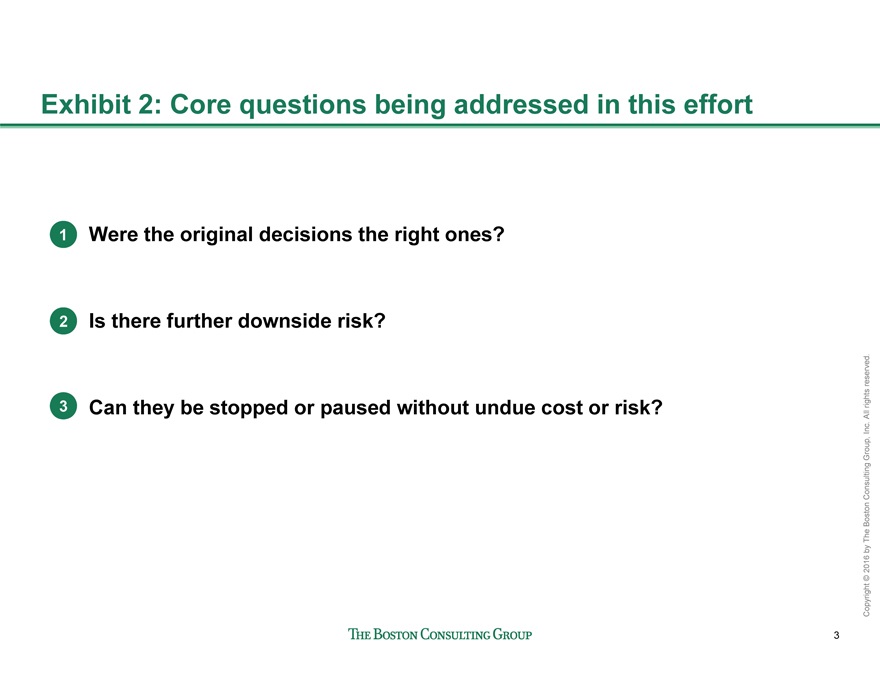

Exhibit 2: Core questions being addressed in this effort

1 Were the original decisions the right ones?

2 Is there further downside risk?

3 Can they be stopped or paused without undue cost or risk?

BCG Report.pptx

Copyright © 2016 by The Boston Consulting Group, IncAll. rights reserved.

3

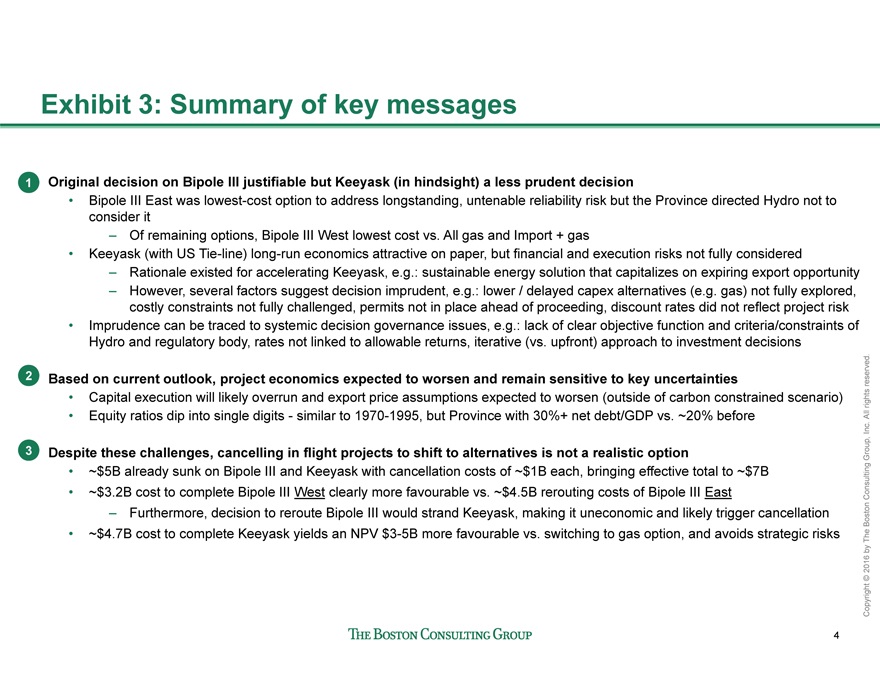

Exhibit 3: Summary of key messages

1 Original decision on Bipole III justifiable but Keeyask (in hindsight) a less prudent decision

• Bipole III East was lowest-cost option to address longstanding, untenable reliability risk but the Province directed Hydro not to consider it

– Of remaining options, Bipole III West lowest cost vs. All gas and Import + gas

• Keeyask (with US Tie-line) long-run economics attractive on paper, but financial and execution risks not fully considered

– Rationale existed for accelerating Keeyask, e.g.: sustainable energy solution that capitalizes on expiring export opportunity

– However, several factors suggest decision imprudent, e.g.: lower / delayed capex alternatives (e.g. gas) not fully explored, costly constraints not fully challenged, permits not in place ahead of proceeding, discount rates did not reflect project risk

• Imprudence can be traced to systemic decision governance issues, e.g.: lack of clear objective function and criteria/constraints of Hydro and regulatory body, rates not linked to allowable returns, iterative (vs. upfront) approach to investment decisions

2 Based on current outlook, project economics expected to worsen and remain sensitive to key uncertainties

• Capital execution will likely overrun and export price assumptions expected to worsen (outside of carbon constrained scenario)

• Equity ratios dip into single digits - similar to 1970-1995, but Province with 30%+ net debt/GDP vs. ~20% before

3 Despite these challenges, cancelling in flight projects to shift to alternatives is not a realistic option

• ~$5B already sunk on Bipole III and Keeyask with cancellation costs of ~$1B each, bringing effective total to ~$7B

• ~$3.2B cost to complete Bipole III West clearly more favourable vs. ~$4.5B rerouting costs of Bipole III East

– Furthermore, decision to reroute Bipole III would strand Keeyask, making it uneconomic and likely trigger cancellation

• ~$4.7B cost to complete Keeyask yields an NPV $3-5B more favourable vs. switching to gas option, and avoids strategic risks

BCG Report.pptx

Copyright © 2016 by The Boston Consulting Group, IncAll. rights reserved.

4

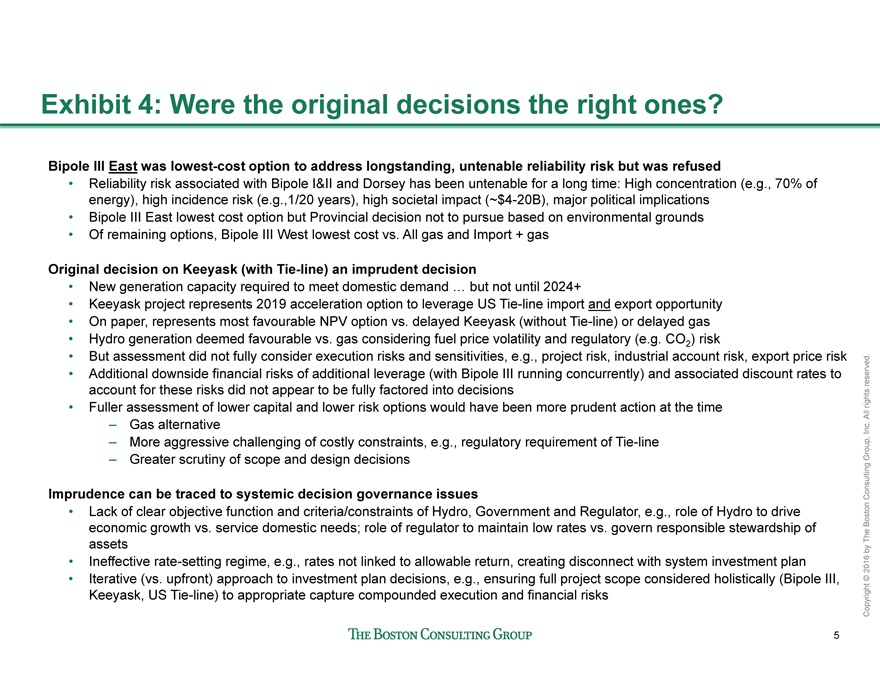

Exhibit 4: Were the original decisions the right ones?

Bipole III East was lowest-cost option to address longstanding, untenable reliability risk but was refused

• Reliability risk associated with Bipole I&II and Dorsey has been untenable for a long time: High concentration (e.g., 70% of energy), high incidence risk (e.g.,1/20 years), high societal impact (~$4-20B), major political implications

• Bipole III East lowest cost option but Provincial decision not to pursue based on environmental grounds

• Of remaining options, Bipole III West lowest cost vs. All gas and Import + gas

Original decision on Keeyask (with Tie-line) an imprudent decision

• New generation capacity required to meet domestic demand … but not until 2024+

• Keeyask project represents 2019 acceleration option to leverage US Tie-line import and export opportunity

• On paper, represents most favourable NPV option vs. delayed Keeyask (without Tie-line) or delayed gas

• Hydro generation deemed favourable vs. gas considering fuel price volatility and regulatory (e.g. CO2) risk

• But assessment did not fully consider execution risks and sensitivities, e.g., project risk, industrial account risk, export price risk

• Additional downside financial risks of additional leverage (with Bipole III running concurrently) and associated discount rates to account for these risks did not appear to be fully factored into decisions

• Fuller assessment of lower capital and lower risk options would have been more prudent action at the time

– Gas alternative

– More aggressive challenging of costly constraints, e.g., regulatory requirement of Tie-line

– Greater scrutiny of scope and design decisions

Imprudence can be traced to systemic decision governance issues

• Lack of clear objective function and criteria/constraints of Hydro, Government and Regulator, e.g., role of Hydro to drive economic growth vs. service domestic needs; role of regulator to maintain low rates vs. govern responsible stewardship of assets

• Ineffective rate-setting regime, e.g., rates not linked to allowable return, creating disconnect with system investment plan

• Iterative (vs. upfront) approach to investment plan decisions, e.g., ensuring full project scope considered holistically (Bipole III, Keeyask, US Tie-line) to appropriate capture compounded execution and financial risks

BCG Report.pptx

Copyright © 2016 by The Boston Consulting Group, IncAll. rights reserved.

5

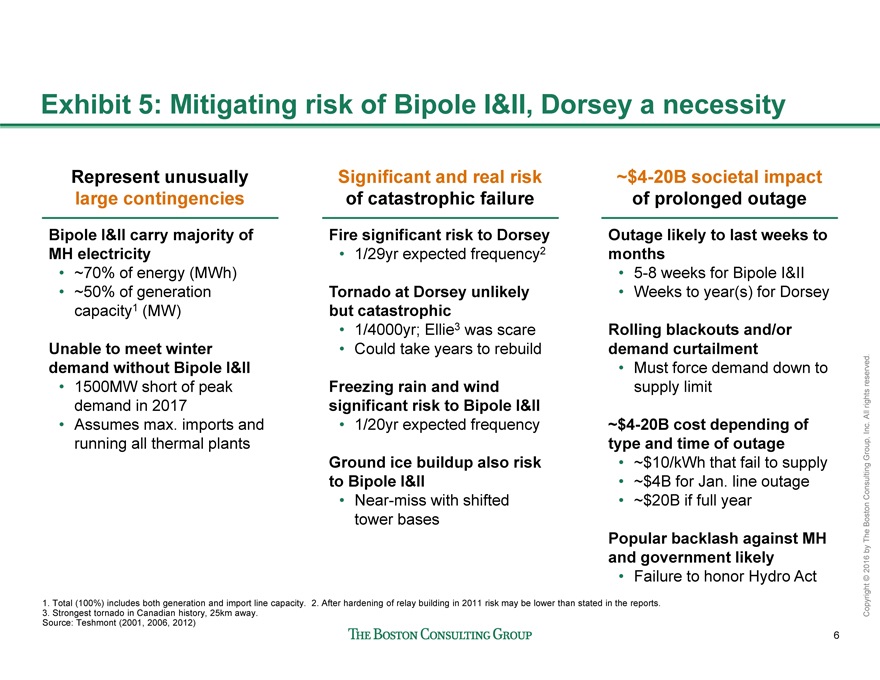

Exhibit 5: Mitigating risk of Bipole I&II, Dorsey a necessity

Represent unusually large contingencies

Bipole I&II carry majority of MH electricity

• ~70% of energy (MWh)

• ~50% of generation capacity1 (MW)

Unable to meet winter demand without Bipole I&II

• 1500MW short of peak demand in 2017

• Assumes max. imports and running all thermal plants

~$4-20B societal impact of prolonged outage

Outage likely to last weeks to months

• 5-8 weeks for Bipole I&II

• Weeks to year(s) for Dorsey

Rolling blackouts and/or demand curtailment

• Must force demand down to supply limit

~$4-20B cost depending of type and time of outage

• ~$10/kWh that fail to supply

• ~$4B for Jan. line outage

• ~$20B if full year

Popular backlash against MH and government likely

• Failure to honor Hydro Act

1. Total (100%) includes both generation and import line capacity. 2. After hardening of relay building in 2011 risk may be lower than stated in the reports.

3. Strongest tornado in Canadian history, 25km away.

Source: Teshmont (2001, 2006, 2012)

BCG Report.pptx

Copyright © 2016 by The Boston Consulting Group, IncAll. rights reserved.

6

7

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

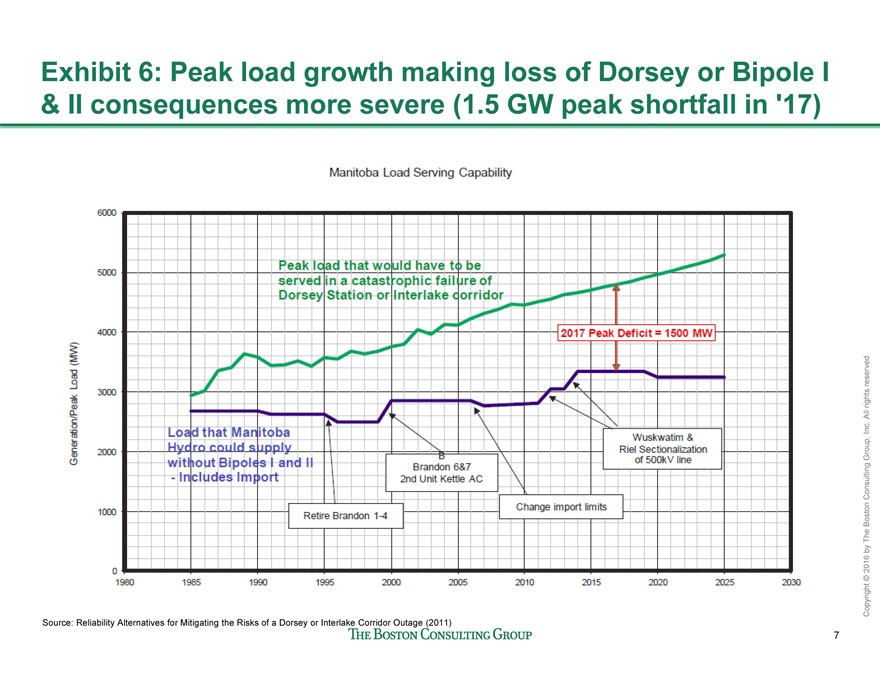

Exhibit 6: Peak load growth making loss of Dorsey or Bipole I

& II consequences more severe (1.5 GW peak shortfall in ‘17)

Source: Reliability Alternatives for Mitigating the Risks of a Dorsey or Interlake Corridor Outage (2011)

8

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

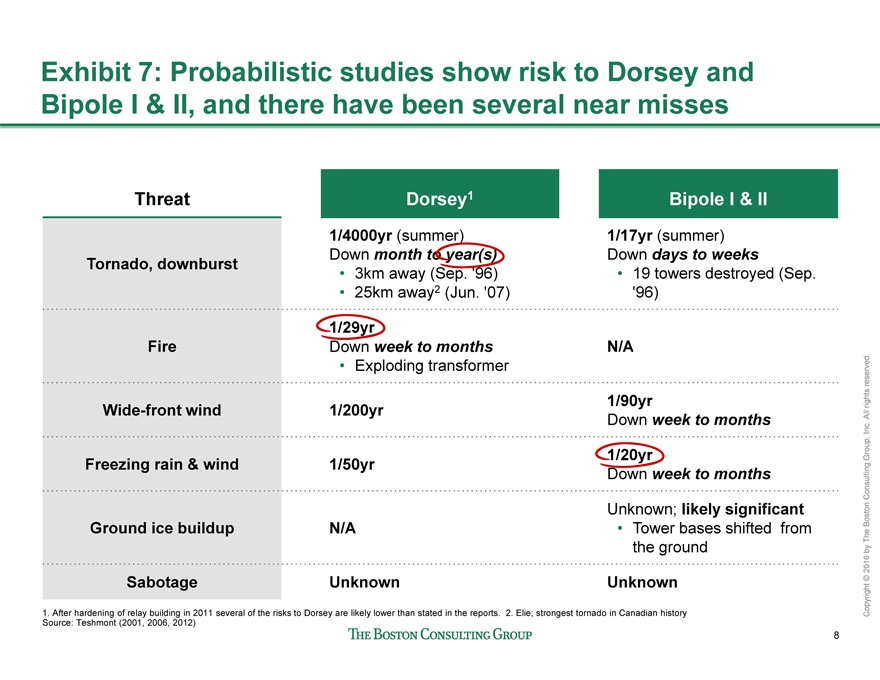

Exhibit 7: Probabilistic studies show risk to Dorsey and

Bipole I & II, and there have been several near misses

1. After hardening of relay building in 2011 several of the risks to Dorsey are likely lower than stated in the reports. 2. Elie; strongest tornado in Canadian history

Source: Teshmont (2001, 2006, 2012)

Threat Dorsey1 Bipole I & II

Tornado, downburst

1/4000yr (summer)

Down month to year(s)

• 3km away (Sep. ‘96)

• 25km away2 (Jun. ‘07)

1/17yr (summer)

Down days to weeks

• 19 towers destroyed (Sep.

‘96)

Fire

1/29yr

Down week to months

• Exploding transformer

N/A

Wide-front wind 1/200yr 1/90yr

Down week to months

Freezing rain & wind 1/50yr 1/20yr

Down week to months

Ground ice buildup N/A

Unknown; likely significant

• Tower bases shifted from

the ground

Sabotage Unknown Unknown

9

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

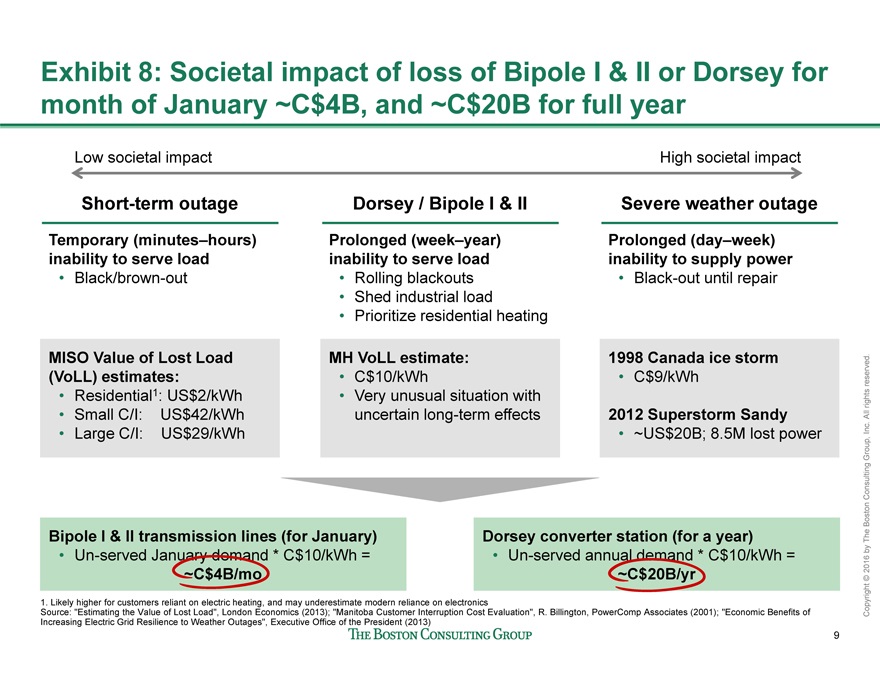

Exhibit 8: Societal impact of loss of Bipole I & II or Dorsey for

month of January ~C$4B, and ~C$20B for full year

Short-term outage

Temporary (minutes–hours)

inability to serve load

• Black/brown-out

Dorsey / Bipole I & II

Prolonged (week–year)

inability to serve load

• Rolling blackouts

• Shed industrial load

• Prioritize residential heating

Severe weather outage

Prolonged (day–week)

inability to supply power

• Black-out until repair

Low societal impact High societal impact

MISO Value of Lost Load

(VoLL) estimates:

• Residential1: US$2/kWh

• Small C/I: US$42/kWh

• Large C/I: US$29/kWh

MH VoLL estimate:

• C$10/kWh

• Very unusual situation with

uncertain long-term effects

1998 Canada ice storm

• C$9/kWh

2012 Superstorm Sandy

• ~US$20B; 8.5M lost power

1. Likely higher for customers reliant on electric heating, and may underestimate modern reliance on electronics

Source: “Estimating the Value of Lost Load”, London Economics (2013); “Manitoba Customer Interruption Cost Evaluation”, R. Billington, PowerComp Associates (2001); “Economic Benefits of

Increasing Electric Grid Resilience to Weather Outages”, Executive Office of the President (2013)

Bipole I & II transmission lines (for January)

• Un-served January demand * C$10/kWh =

~C$4B/mo

Dorsey converter station (for a year)

• Un-served annual demand * C$10/kWh =

~C$20B/yr

10

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

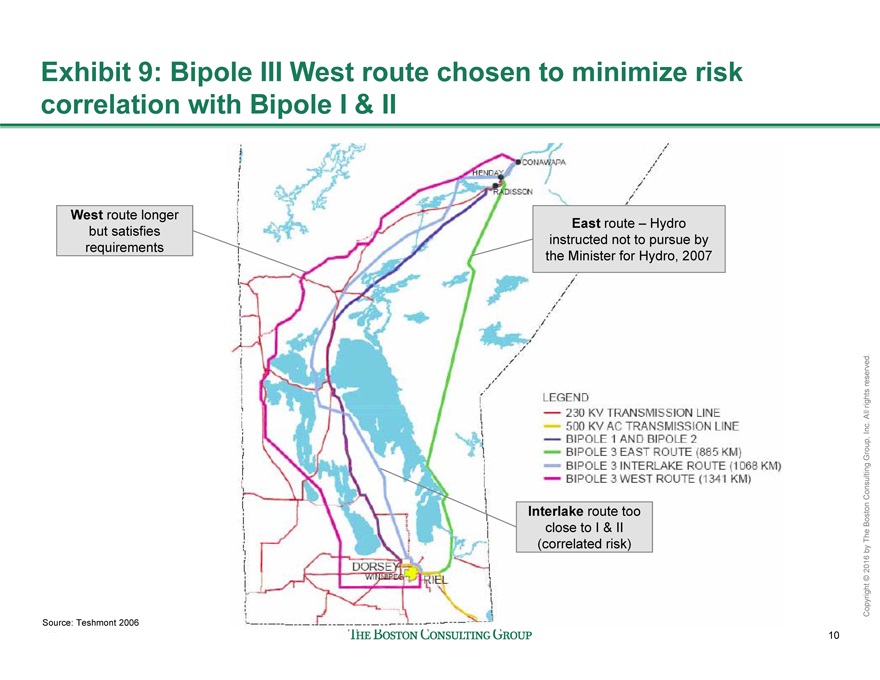

Exhibit 9: Bipole III West route chosen to minimize risk

correlation with Bipole I & II

East route – Hydro

instructed not to pursue by

the Minister for Hydro, 2007

Interlake route too

close to I & II

(correlated risk)

West route longer

but satisfies

requirements

Source: Teshmont 2006

11

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

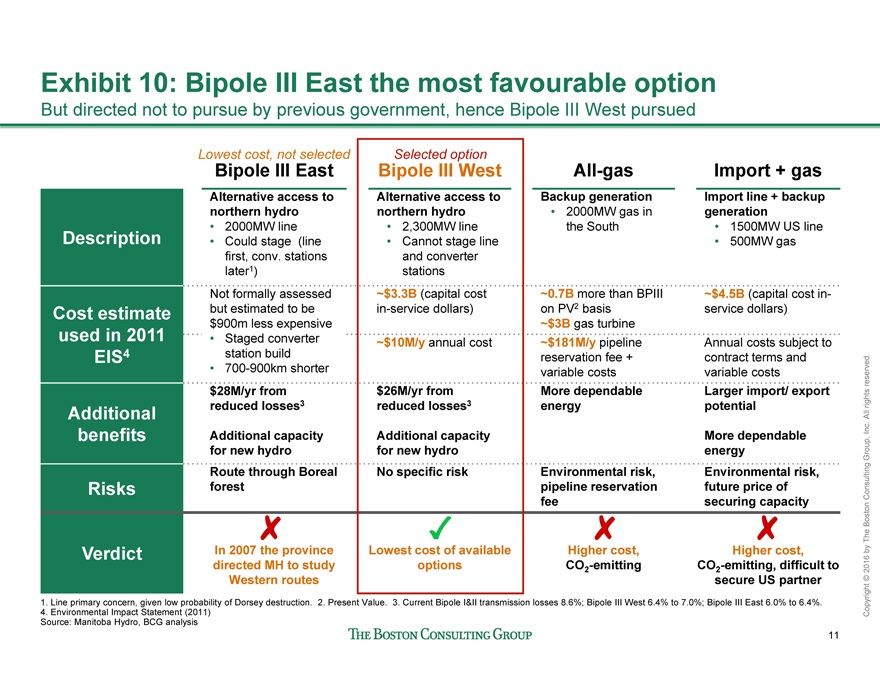

Exhibit 10: Bipole III East the most favourable option

But directed not to pursue by previous government, hence Bipole III West pursued

Bipole III East Bipole III West All-gas Import + gas

Description

Alternative access to

northern hydro

• 2000MW line

• Could stage (line

first, conv. stations

later1)

Alternative access to

northern hydro

• 2,300MW line

• Cannot stage line

and converter

stations

Backup generation

• 2000MW gas in

the South

Import line + backup

generation

• 1500MW US line

• 500MW gas

Cost estimate

used in 2011

EIS4

Not formally assessed

but estimated to be

$900m less expensive

• Staged converter

station build

• 700-900km shorter

~$3.3B (capital cost

in-service dollars)

~0.7B more than BPIII

on PV2 basis

~$3B gas turbine

~$4.5B (capital cost inservice

dollars)

~$10M/y annual cost ~$181M/y pipeline

reservation fee +

variable costs

Annual costs subject to

contract terms and

variable costs

Additional

benefits

$28M/yr from

reduced losses3

Additional capacity

for new hydro

$26M/yr from

reduced losses3

Additional capacity

for new hydro

More dependable

energy

Larger import/ export

potential

More dependable

energy

Risks

Route through Boreal

forest

No specific risk Environmental risk,

pipeline reservation

fee

Environmental risk,

future price of

securing capacity

Verdict In 2007 the province

directed MH to study

Western routes

Lowest cost of available

options

Higher cost,

CO2-emitting

Higher cost,

CO2-emitting, difficult to

secure US partner

1. Line primary concern, given low probability of Dorsey destruction. 2. Present Value. 3. Current Bipole I&II transmission losses 8.6%; Bipole III West 6.4% to 7.0%; Bipole III East 6.0% to 6.4%.

4. Environmental Impact Statement (2011)

Source: Manitoba Hydro, BCG analysis

Lowest cost, not selected Selected option

12

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

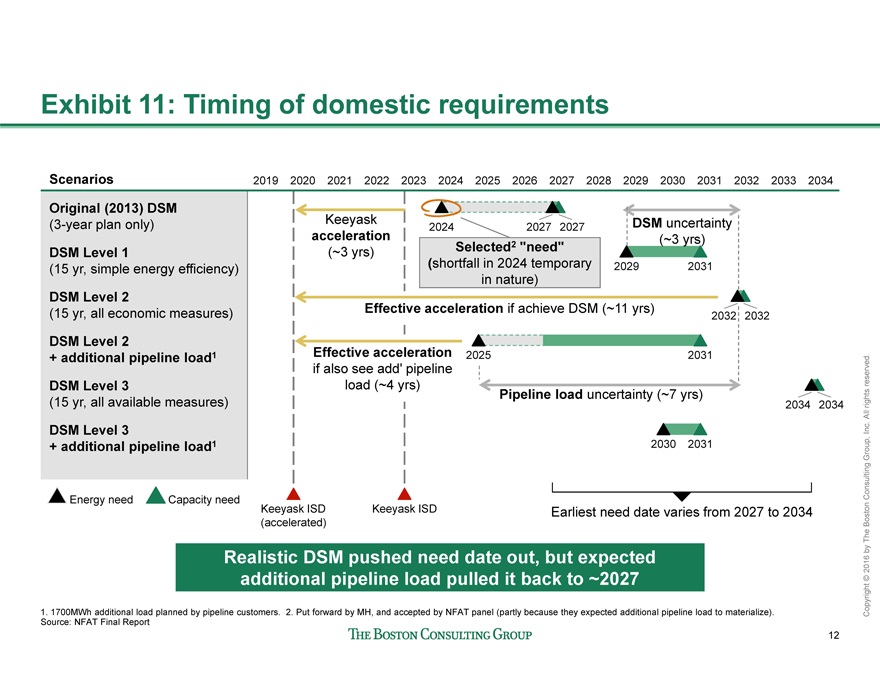

Exhibit 11: Timing of domestic requirements

2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034

DSM Level 2

+ additional pipeline load1 2031

Earliest need date varies from 2027 to 2034

DSM Level 2

(15 yr, all economic measures) 2032 2032

DSM Level 1

(15 yr, simple energy efficiency) 2029 2031

Original (2013) DSM

(3-year plan only) 2027 2027

2025

Keeyask ISD Keeyask ISD

(accelerated)

2034 2034

DSM Level 3

(15 yr, all available measures)

2030 2031

DSM Level 3

+ additional pipeline load1

Scenarios

2024

1. 1700MWh additional load planned by pipeline customers. 2. Put forward by MH, and accepted by NFAT panel (partly because they expected additional pipeline load to materialize).

Source: NFAT Final Report

Energy need Capacity need

Keeyask

acceleration

(~3 yrs)

Effective acceleration if achieve DSM (~11 yrs)

Selected2 “need”

(shortfall in 2024 temporary

in nature)

DSM uncertainty

(~3 yrs)

Pipeline load uncertainty (~7 yrs)

Realistic DSM pushed need date out, but expected

additional pipeline load pulled it back to ~2027

Effective acceleration

if also see add’ pipeline

load (~4 yrs)

13

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

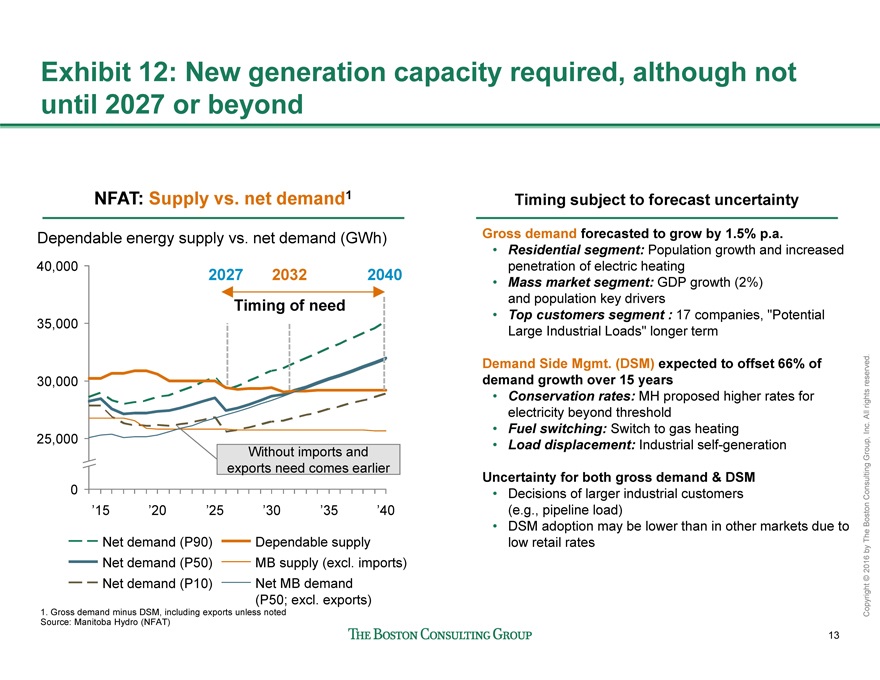

Exhibit 12: New generation capacity required, although not

until 2027 or beyond

1. Gross demand minus DSM, including exports unless noted

Source: Manitoba Hydro (NFAT)

NFAT: Supply vs. net demand1 Timing subject to forecast uncertainty

Gross demand forecasted to grow by 1.5% p.a.

• Residential segment: Population growth and increased

penetration of electric heating

• Mass market segment: GDP growth (2%)

and population key drivers

• Top customers segment : 17 companies, “Potential

Large Industrial Loads” longer term

Demand Side Mgmt. (DSM) expected to offset 66% of

demand growth over 15 years

• Conservation rates: MH proposed higher rates for

electricity beyond threshold

• Fuel switching: Switch to gas heating

• Load displacement: Industrial self-generation

Uncertainty for both gross demand & DSM

• Decisions of larger industrial customers

(e.g., pipeline load)

• DSM adoption may be lower than in other markets due to

low retail rates

40,000

35,000

30,000

25,000

0

Dependable energy supply vs. net demand (GWh)

’15 ’20 ’25 ’30 ’35 ’40

MB supply (excl. imports)

Net demand (P10)

Dependable supply

Net demand (P50)

Net demand (P90)

Net MB demand

(P50; excl. exports)

Without imports and

exports need comes earlier

Timing of need

2027 2032 2040

14

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

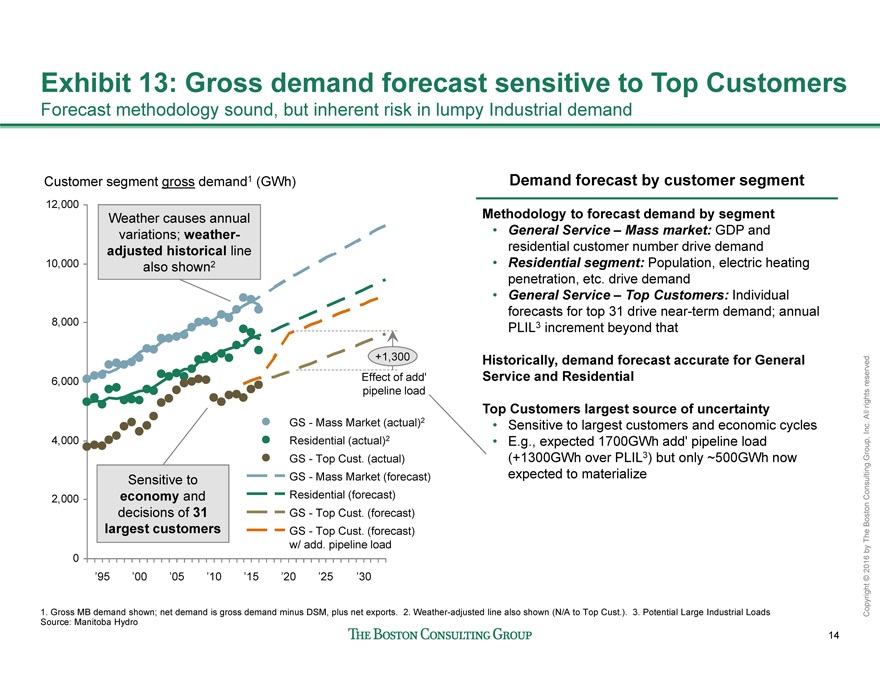

Exhibit 13: Gross demand forecast sensitive to Top Customers

Forecast methodology sound, but inherent risk in lumpy Industrial demand

Demand forecast by customer segment

Methodology to forecast demand by segment

• General Service – Mass market: GDP and

residential customer number drive demand

• Residential segment: Population, electric heating

penetration, etc. drive demand

• General Service – Top Customers: Individual

forecasts for top 31 drive near-term demand; annual

PLIL3 increment beyond that

Historically, demand forecast accurate for General

Service and Residential

Top Customers largest source of uncertainty

• Sensitive to largest customers and economic cycles

• E.g., expected 1700GWh add’ pipeline load

(+1300GWh over PLIL3) but only ~500GWh now

expected to materialize

0

2,000

4,000

6,000

8,000

10,000

12,000

Customer segment gross demand1 (GWh)

+1,300

’95 ’00 ’05 ’10 ’15 ’20 ’25 ’30

GS - Top Cust. (forecast)

w/ add. pipeline load

GS - Top Cust. (forecast)

Residential (forecast)

GS - Mass Market (forecast)

GS - Top Cust. (actual)

Residential (actual)2

GS - Mass Market (actual)2

1. Gross MB demand shown; net demand is gross demand minus DSM, plus net exports. 2. Weather-adjusted line also shown (N/A to Top Cust.). 3. Potential Large Industrial Loads

Source: Manitoba Hydro

Effect of add’

pipeline load

Weather causes annual

variations; weatheradjusted

historical line

also shown2

Sensitive to

economy and

decisions of 31

largest customers

15

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

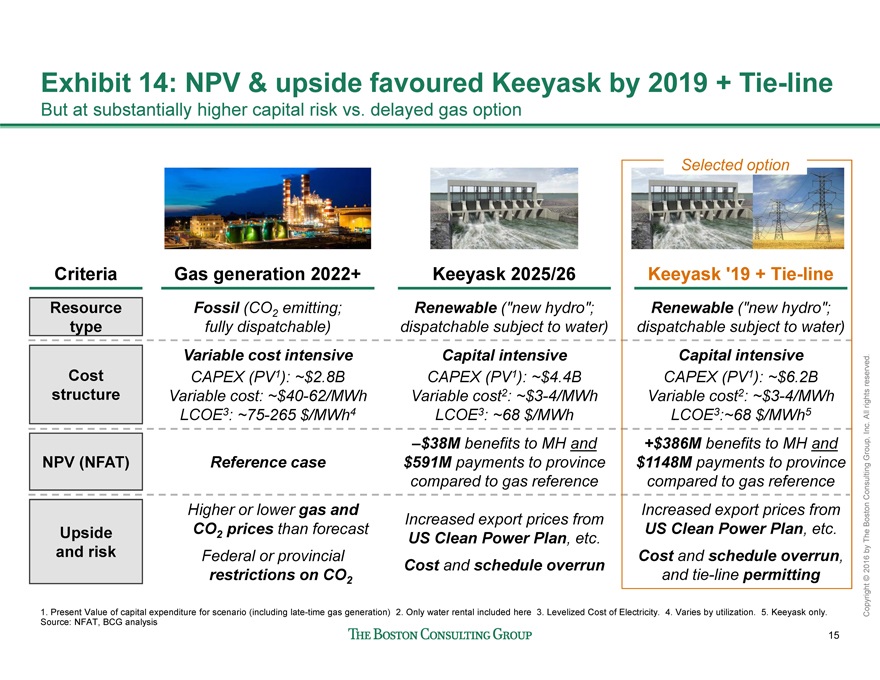

Criteria Gas generation 2022+ Keeyask 2025/26 Keeyask ‘19 + Tie-line

Resource

type

Fossil (CO2 emitting;

fully dispatchable)

Renewable (“new hydro”;

dispatchable subject to water)

Renewable (“new hydro”;

dispatchable subject to water)

Cost

structure

Variable cost intensive

CAPEX (PV1): ~$2.8B

Variable cost: ~$40-62/MWh

LCOE3: ~75-265 $/MWh4

Capital intensive

CAPEX (PV1): ~$4.4B

Variable cost2: ~$3-4/MWh

LCOE3: ~68 $/MWh

Capital intensive

CAPEX (PV1): ~$6.2B

Variable cost2: ~$3-4/MWh

LCOE3:~68 $/MWh5

NPV (NFAT) Reference case

–$38M benefits to MH and

$591M payments to province

compared to gas reference

+$386M benefits to MH and

$1148M payments to province

compared to gas reference

Upside

and risk

Higher or lower gas and

CO2 prices than forecast

Federal or provincial

restrictions on CO2

Increased export prices from

US Clean Power Plan, etc.

Cost and schedule overrun

Increased export prices from

US Clean Power Plan, etc.

Cost and schedule overrun,

and tie-line permitting

Exhibit 14: NPV & upside favoured Keeyask by 2019 + Tie-line

But at substantially higher capital risk vs. delayed gas option

Selected option

1. Present Value of capital expenditure for scenario (including late-time gas generation) 2. Only water rental included here 3. Levelized Cost of Electricity. 4. Varies by utilization. 5. Keeyask only.

Source: NFAT, BCG analysis

16

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

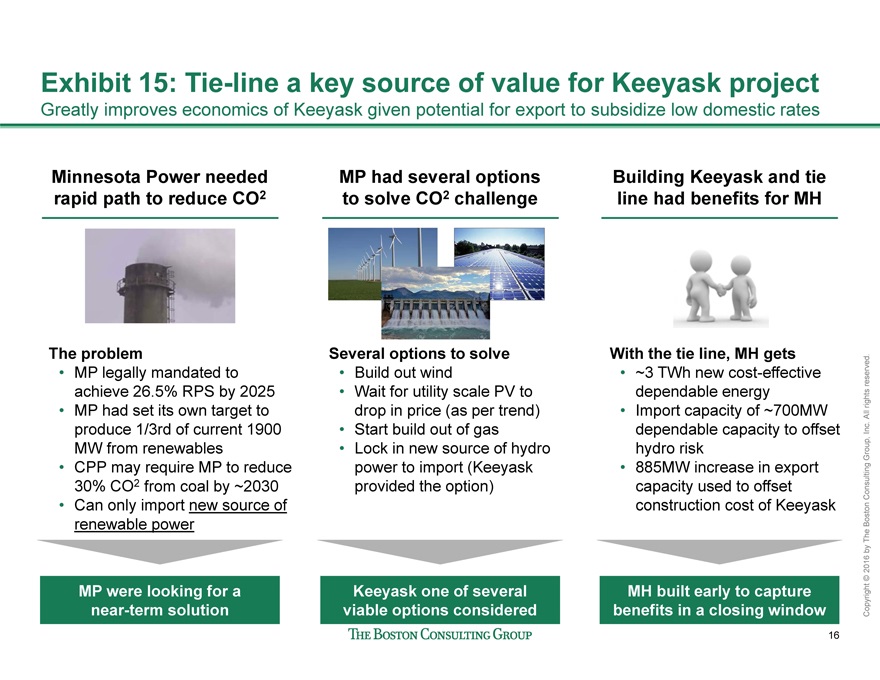

Exhibit 15: Tie-line a key source of value for Keeyask project

Greatly improves economics of Keeyask given potential for export to subsidize low domestic rates

Building Keeyask and tie

line had benefits for MH

With the tie line, MH gets

• ~3 TWh new cost-effective

dependable energy

• Import capacity of ~700MW

dependable capacity to offset

hydro risk

• 885MW increase in export

capacity used to offset

construction cost of Keeyask

Minnesota Power needed

rapid path to reduce CO2

The problem

• MP legally mandated to

achieve 26.5% RPS by 2025

• MP had set its own target to

produce 1/3rd of current 1900

MW from renewables

• CPP may require MP to reduce

30% CO2 from coal by ~2030

• Can only import new source of

renewable power

MP had several options

to solve CO2 challenge

Several options to solve

• Build out wind

• Wait for utility scale PV to

drop in price (as per trend)

• Start build out of gas

• Lock in new source of hydro

power to import (Keeyask

provided the option)

MP were looking for a

near-term solution

Keeyask one of several

viable options considered

MH built early to capture

benefits in a closing window

17

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

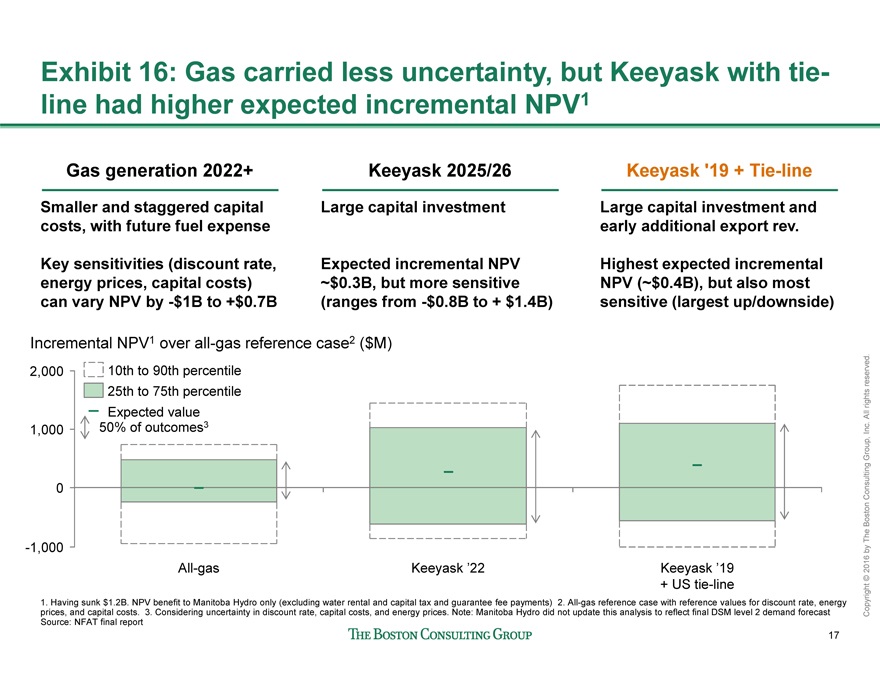

Exhibit 16: Gas carried less uncertainty, but Keeyask with tieline

had higher expected incremental NPV1

1. Having sunk $1.2B. NPV benefit to Manitoba Hydro only (excluding water rental and capital tax and guarantee fee payments) 2. All-gas reference case with reference values for discount rate, energy

prices, and capital costs. 3. Considering uncertainty in discount rate, capital costs, and energy prices. Note: Manitoba Hydro did not update this analysis to reflect final DSM level 2 demand forecast

Source: NFAT final report

2,000

0

1,000

-1,000

Keeyask ’19

+ US tie-line

Incremental NPV1 over all-gas reference case2 ($M)

All-gas Keeyask ’22

Expected value

25th to 75th percentile

10th to 90th percentile

50% of outcomes3

Gas generation 2022+

Smaller and staggered capital

costs, with future fuel expense

Key sensitivities (discount rate,

energy prices, capital costs)

can vary NPV by -$1B to +$0.7B

Keeyask 2025/26

Large capital investment

Expected incremental NPV

~$0.3B, but more sensitive

(ranges from -$0.8B to + $1.4B)

Keeyask ‘19 + Tie-line

Large capital investment and

early additional export rev.

Highest expected incremental

NPV (~$0.4B), but also most

sensitive (largest up/downside)

18

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

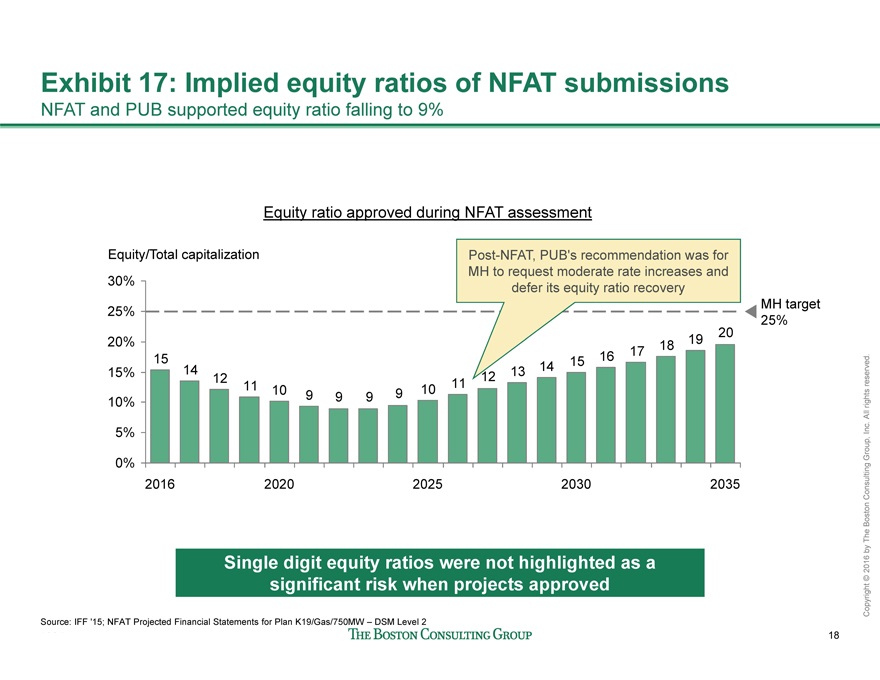

Exhibit 17: Implied equity ratios of NFAT submissions

NFAT and PUB supported equity ratio falling to 9%

19 20 17 18 15 16 13 14 11 12 11 10 9 9 9 9 10 14 12

15

0%

5%

10%

15%

20%

25%

30%

Equity/Total capitalization

2016 2025 2035

MH target

25%

2020 2030

Source: IFF ‘15; NFAT Projected Financial Statements for Plan K19/Gas/750MW – DSM Level 2

Post-NFAT, PUB’s recommendation was for

MH to request moderate rate increases and

defer its equity ratio recovery

Equity ratio approved during NFAT assessment

Single digit equity ratios were not highlighted as a

significant risk when projects approved

19

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

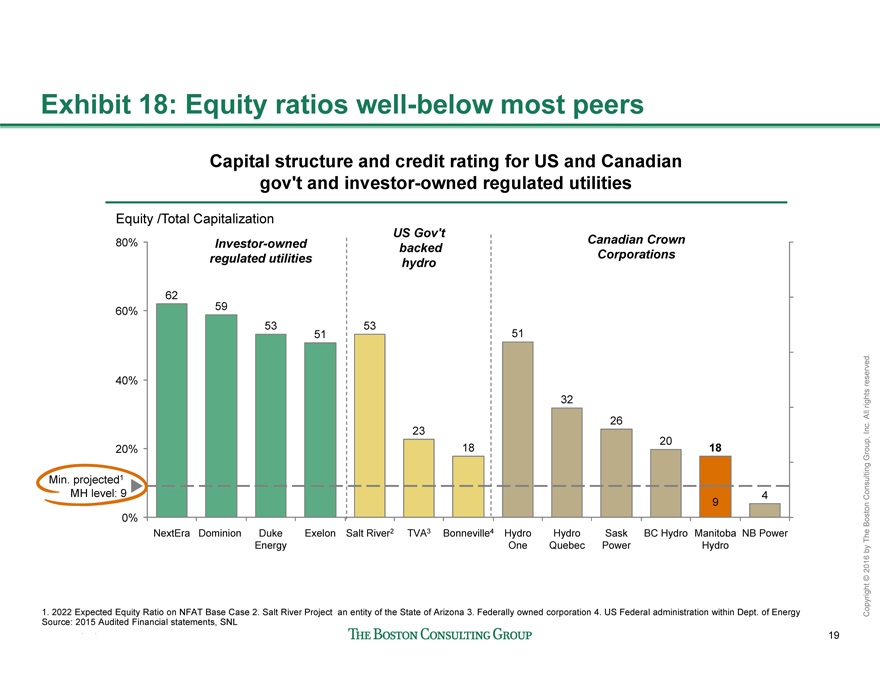

Exhibit 18: Equity ratios well-below most peers

Capital structure and credit rating for US and Canadian

gov’t and investor-owned regulated utilities

1. 2022 Expected Equity Ratio on NFAT Base Case 2. Salt River Project an entity of the State of Arizona 3. Federally owned corporation 4. US Federal administration within Dept. of Energy

Source: 2015 Audited Financial statements, SNL

0%

80%

60%

40%

20%

Equity /Total Capitalization

Hydro

One

51

Min. projected1

MH level: 9

NB Power

4

Manitoba

Hydro

18

9

BC Hydro

20

Sask

Power

26

Hydro

Quebec

32

Bonneville4

18

TVA3

23

Salt River2

53

Exelon

51

Duke

Energy

53

Dominion

59

NextEra

62

Investor-owned

regulated utilities

US Gov’t

backed

hydro

Canadian Crown

Corporations

20

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

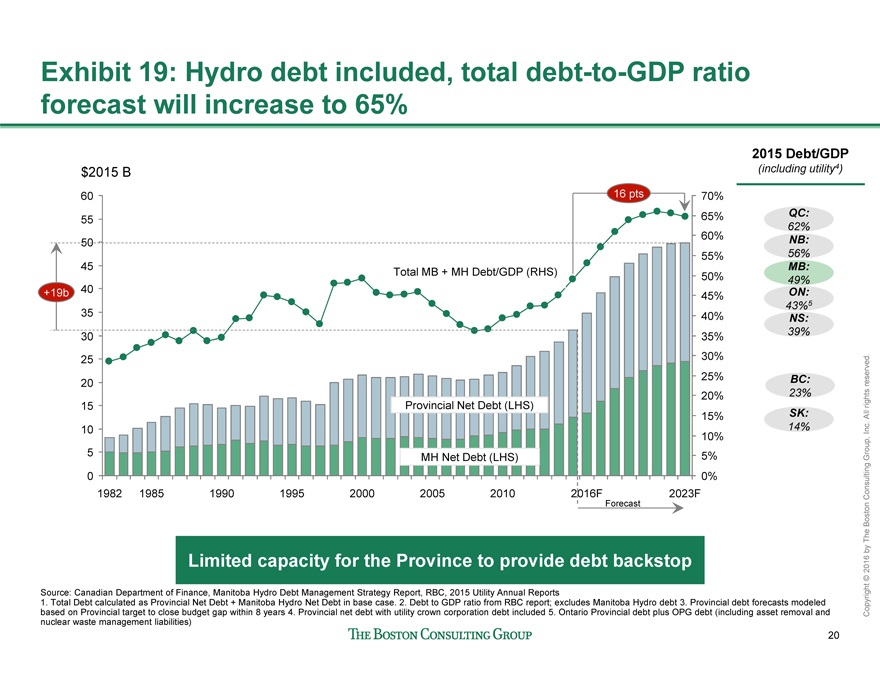

30%

45

50

55

15%

5%

35%

40%

25%

60

60%

20%

10%

55%

65%

0%

45%

50%

70%

0

5

10

15

20

25

30

35

40

16 pts

$2015 B

1982 1985 1990 1995 2000 2005 2010 2023F

+19b

2016F

Total MB + MH Debt/GDP (RHS)

Exhibit 19: Hydro debt included, total debt-to-GDP ratio

forecast will increase to 65%

Source: Canadian Department of Finance, Manitoba Hydro Debt Management Strategy Report, RBC, 2015 Utility Annual Reports

1. Total Debt calculated as Provincial Net Debt + Manitoba Hydro Net Debt in base case. 2. Debt to GDP ratio from RBC report; excludes Manitoba Hydro debt 3. Provincial debt forecasts modeled

based on Provincial target to close budget gap within 8 years 4. Provincial net debt with utility crown corporation debt included 5. Ontario Provincial debt plus OPG debt (including asset removal and

nuclear waste management liabilities)

Provincial Net Debt (LHS)

MH Net Debt (LHS)

Limited capacity for the Province to provide debt backstop

Forecast

2015 Debt/GDP

(including utility4)

SK:

14%

BC:

23%

MB:

49%

NB:

56%

QC:

62%

ON:

43%5

NS:

39%

21

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

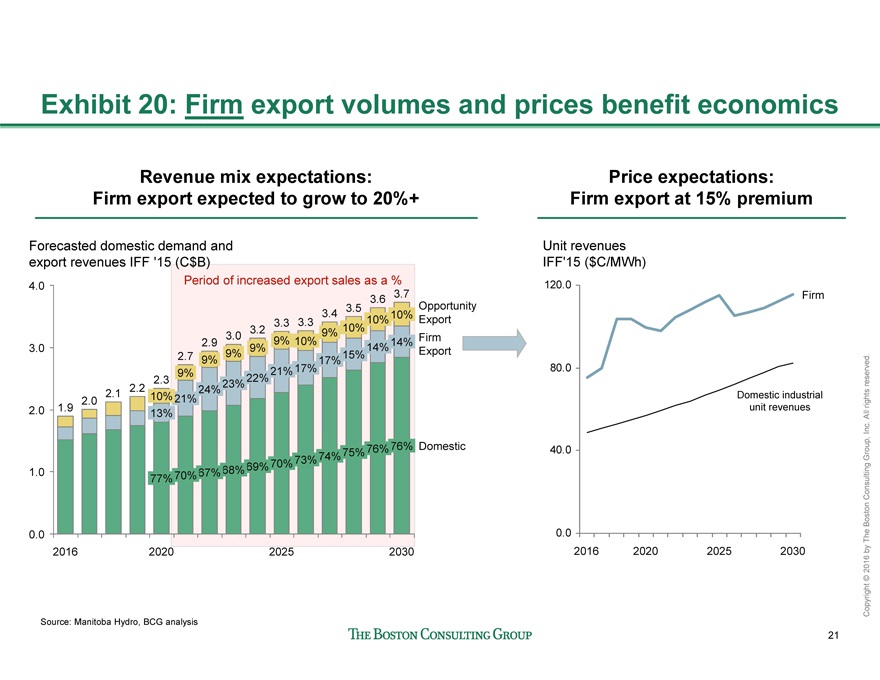

Period of increased export sales as a %

Exhibit 20: Firm export volumes and prices benefit economics

0.0

4.0

3.0

2.0

1.0

Forecasted domestic demand and

export revenues IFF ‘15 (C$B)

Domestic

Firm

Export

Opportunity

Export

2030

3.7

76%

14%

10%

3.6

76%

14%

10%

3.5

75%

15%

10%

3.4

74%

17%

9%

3.3

73%

17%

10%

2025

3.3

70%

21%

9%

3.2

69%

22%

9%

3.0

68%

23%

9%

2.9

67%

24%

2.7 9%

70%

21%

9%

2020

2.3

77%

13%

10%

2.1 2.2 2.0

2016

1.9

0.0

40.0

80.0

120.0

Firm

2016 2020 2025 2030

Unit revenues

IFF’15 ($C/MWh)

Revenue mix expectations:

Firm export expected to grow to 20%+

Price expectations:

Firm export at 15% premium

Source: Manitoba Hydro, BCG analysis

Domestic industrial

unit revenues

22

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

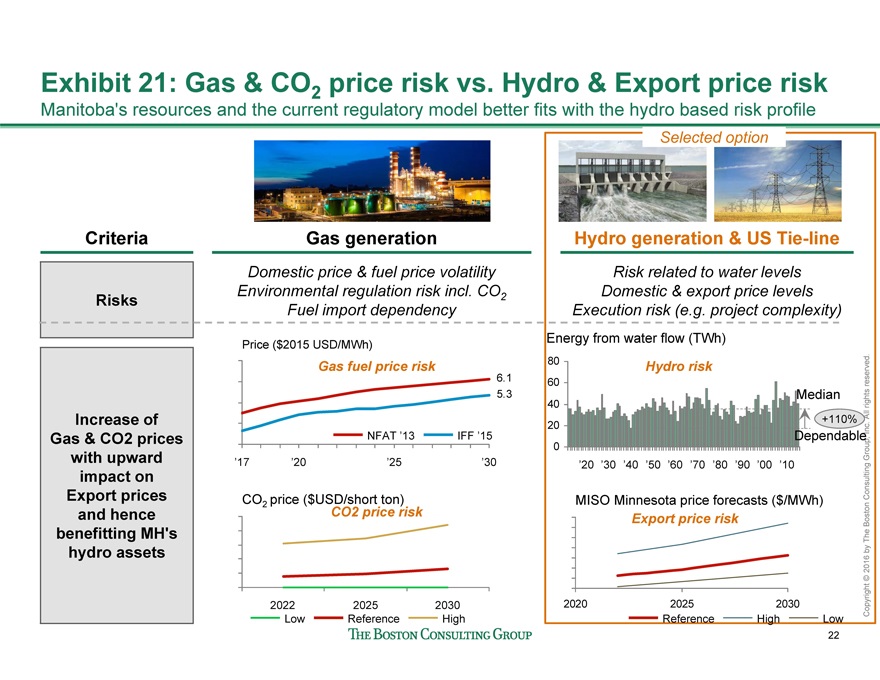

Criteria Gas generation Hydro generation & US Tie-line

Risks

Domestic price & fuel price volatility

Environmental regulation risk incl. CO2

Fuel import dependency

Risk related to water levels

Domestic & export price levels

Execution risk (e.g. project complexity)

Increase of

Gas & CO2 prices

with upward

impact on

Export prices

and hence

benefitting MH’s

hydro assets

Exhibit 21: Gas & CO2 price risk vs. Hydro & Export price risk

Manitoba’s resources and the current regulatory model better fits with the hydro based risk profile

Selected option

0

20

40

60

80

Energy from water flow (TWh)

+110%

’20 ’30 ’40 ’50 ’60 ’70 ’80 ’90 ’00 ’10

Median

Export price risk

Gas fuel price risk

2020 2025 2030

MISO Minnesota price forecasts ($/MWh)

Hydro risk

Dependable

Reference High Low

CO2 price risk

6.1

5.3

Price ($2015 USD/MWh)

’17 ’20 ’25 ’30

NFAT ’13 IFF ’15

2022 2025 2030

CO2 price ($USD/short ton)

Low Reference High

23

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

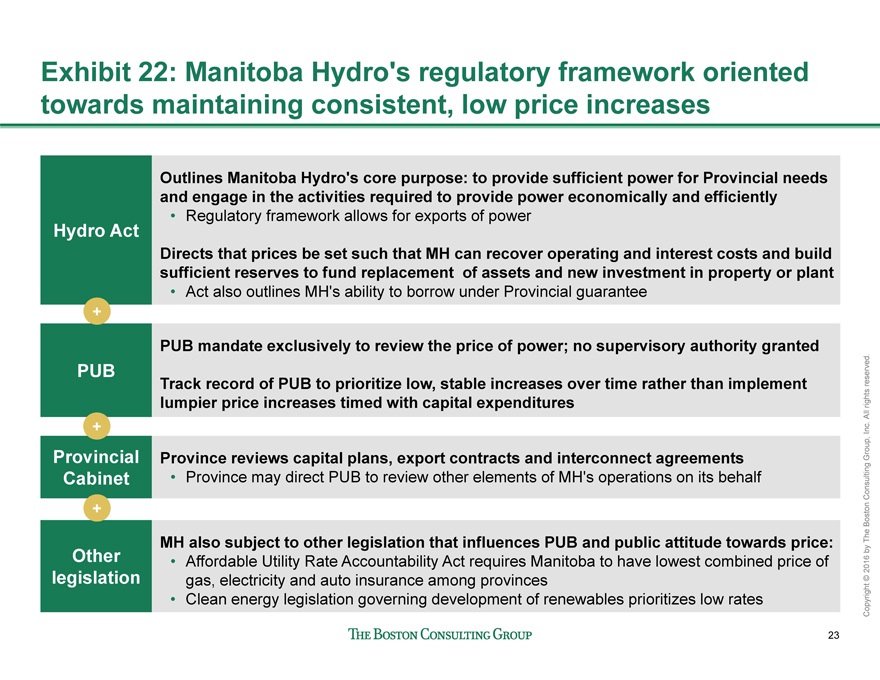

Exhibit 22: Manitoba Hydro’s regulatory framework oriented

towards maintaining consistent, low price increases

Hydro Act

Outlines Manitoba Hydro’s core purpose: to provide sufficient power for Provincial needs

and engage in the activities required to provide power economically and efficiently

• Regulatory framework allows for exports of power

Directs that prices be set such that MH can recover operating and interest costs and build

sufficient reserves to fund replacement of assets and new investment in property or plant

• Act also outlines MH’s ability to borrow under Provincial guarantee

PUB

PUB mandate exclusively to review the price of power; no supervisory authority granted

Track record of PUB to prioritize low, stable increases over time rather than implement

lumpier price increases timed with capital expenditures

Provincial

Cabinet

Province reviews capital plans, export contracts and interconnect agreements

• Province may direct PUB to review other elements of MH’s operations on its behalf

Other

legislation

MH also subject to other legislation that influences PUB and public attitude towards price:

• Affordable Utility Rate Accountability Act requires Manitoba to have lowest combined price of

gas, electricity and auto insurance among provinces

• Clean energy legislation governing development of renewables prioritizes low rates

+

+

+

24

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

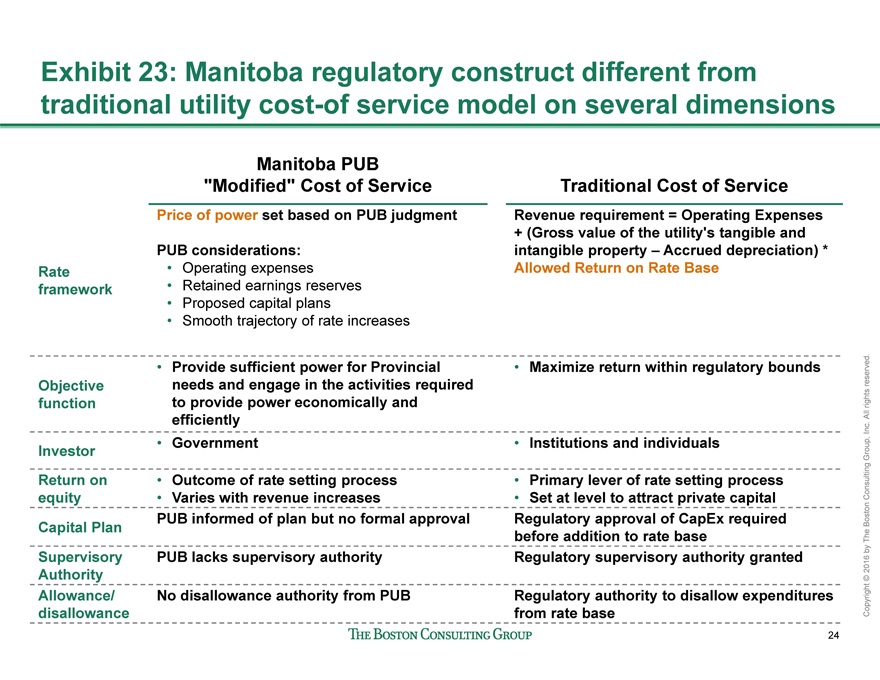

Exhibit 23: Manitoba regulatory construct different from

traditional utility cost-of service model on several dimensions

Manitoba PUB

“Modified” Cost of Service Traditional Cost of Service

Rate

framework

Price of power set based on PUB judgment

PUB considerations:

• Operating expenses

• Retained earnings reserves

• Proposed capital plans

• Smooth trajectory of rate increases

Revenue requirement = Operating Expenses

+ (Gross value of the utility’s tangible and

intangible property – Accrued depreciation) *

Allowed Return on Rate Base

Objective

function

��� Provide sufficient power for Provincial

needs and engage in the activities required

to provide power economically and

efficiently

• Maximize return within regulatory bounds

Investor • Government • Institutions and individuals

Return on

equity

• Outcome of rate setting process

• Varies with revenue increases

• Primary lever of rate setting process

• Set at level to attract private capital

Capital Plan PUB informed of plan but no formal approval Regulatory approval of CapEx required

before addition to rate base

Supervisory

Authority

PUB lacks supervisory authority Regulatory supervisory authority granted

Allowance/

disallowance

No disallowance authority from PUB Regulatory authority to disallow expenditures

from rate base

25

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

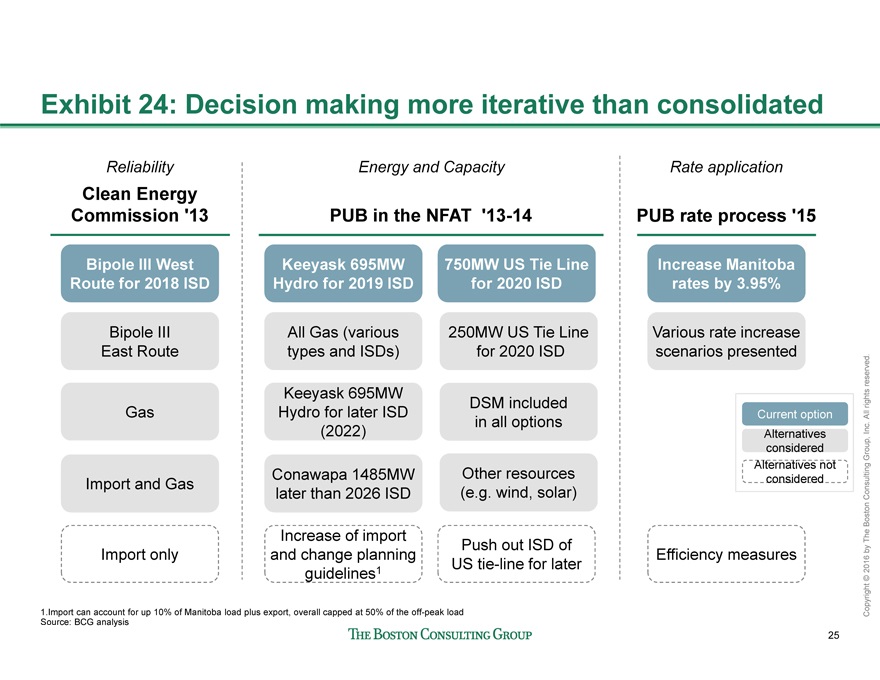

Exhibit 24: Decision making more iterative than consolidated

Current option

Alternatives

considered

Alternatives not

considered

1.Import can account for up 10% of Manitoba load plus export, overall capped at 50% of the off-peak load

Source: BCG analysis

Bipole III West

Route for 2018 ISD

Bipole III

East Route

Gas

Import and Gas

Keeyask 695MW

Hydro for 2019 ISD

750MW US Tie Line

for 2020 ISD

Various rate increase

scenarios presented

Conawapa 1485MW

for later than 2026

ISD

Clean Energy

Commission ‘13 PUB in the NFAT ‘13-14 PUB rate process ‘15

Increase Manitoba

rates by 3.95%

Reliability Energy and Capacity Rate application

Increase of import

and change planning

guidelines1

Import only

Conawapa 1485MW

later than 2026 ISD

All Gas (various

types and ISDs)

Keeyask 695MW

Hydro for later ISD

(2022)

Efficiency measures

250MW US Tie Line

for 2020 ISD

DSM included

in all options

Other resources

(e.g. wind, solar)

Push out ISD of

US tie-line for later

26

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

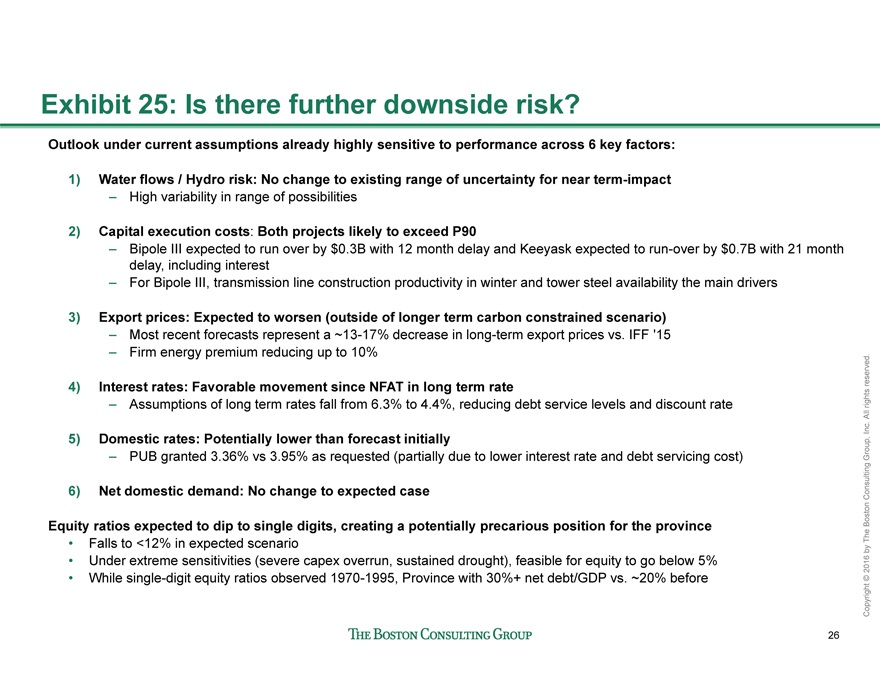

Exhibit 25: Is there further downside risk?

Outlook under current assumptions already highly sensitive to performance across 6 key factors:

1) Water flows / Hydro risk: No change to existing range of uncertainty for near term-impact

– High variability in range of possibilities

2) Capital execution costs: Both projects likely to exceed P90

– Bipole III expected to run over by $0.3B with 12 month delay and Keeyask expected to run-over by $0.7B with 21 month

delay, including interest

– For Bipole III, transmission line construction productivity in winter and tower steel availability the main drivers

3) Export prices: Expected to worsen (outside of longer term carbon constrained scenario)

– Most recent forecasts represent a ~13-17% decrease in long-term export prices vs. IFF ‘15

– Firm energy premium reducing up to 10%

4) Interest rates: Favorable movement since NFAT in long term rate

– Assumptions of long term rates fall from 6.3% to 4.4%, reducing debt service levels and discount rate

5) Domestic rates: Potentially lower than forecast initially

– PUB granted 3.36% vs 3.95% as requested (partially due to lower interest rate and debt servicing cost)

6) Net domestic demand: No change to expected case

Equity ratios expected to dip to single digits, creating a potentially precarious position for the province

• Falls to <12% in expected scenario

• Under extreme sensitivities (severe capex overrun, sustained drought), feasible for equity to go below 5%

• While single-digit equity ratios observed 1970-1995, Province with 30%+ net debt/GDP vs. ~20% before

27

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

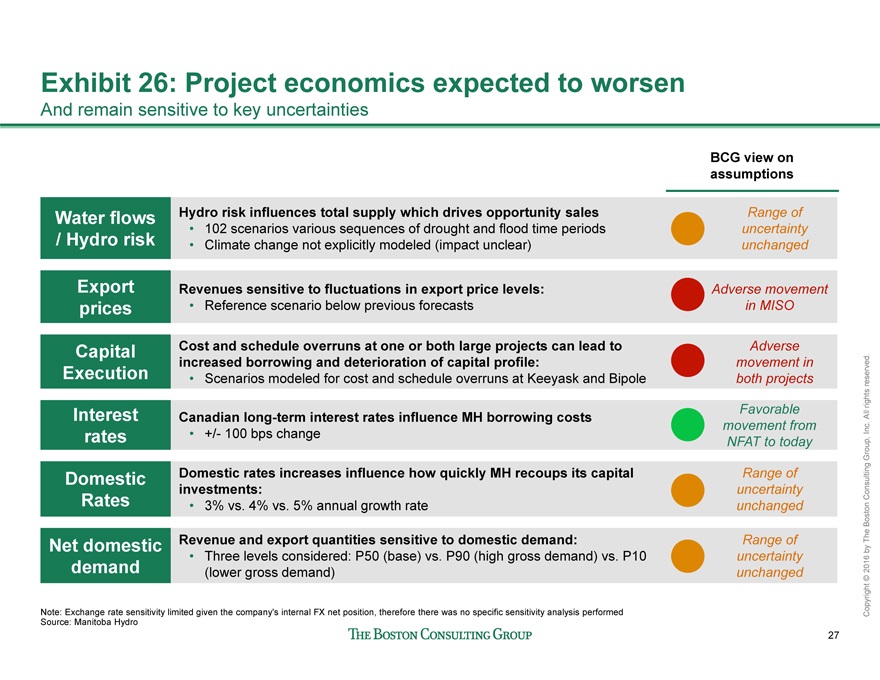

Water flows

/ Hydro risk

Hydro risk influences total supply which drives opportunity sales

• 102 scenarios various sequences of drought and flood time periods

• Climate change not explicitly modeled (impact unclear)

Range of

uncertainty

unchanged

Export

prices

Revenues sensitive to fluctuations in export price levels:

• Reference scenario below previous forecasts

Adverse movement

in MISO

Capital

Execution

Cost and schedule overruns at one or both large projects can lead to

increased borrowing and deterioration of capital profile:

• Scenarios modeled for cost and schedule overruns at Keeyask and Bipole

Adverse

movement in

both projects

Interest

rates

Canadian long-term interest rates influence MH borrowing costs

• +/- 100 bps change

Favorable

movement from

NFAT to today

Domestic

Rates

Domestic rates increases influence how quickly MH recoups its capital

investments:

• 3% vs. 4% vs. 5% annual growth rate

Range of

uncertainty

unchanged

Net domestic

demand

Revenue and export quantities sensitive to domestic demand:

• Three levels considered: P50 (base) vs. P90 (high gross demand) vs. P10

(lower gross demand)

Range of

uncertainty

unchanged

Exhibit 26: Project economics expected to worsen

And remain sensitive to key uncertainties

Note: Exchange rate sensitivity limited given the company’s internal FX net position, therefore there was no specific sensitivity analysis performed

Source: Manitoba Hydro

BCG view on

assumptions

28

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

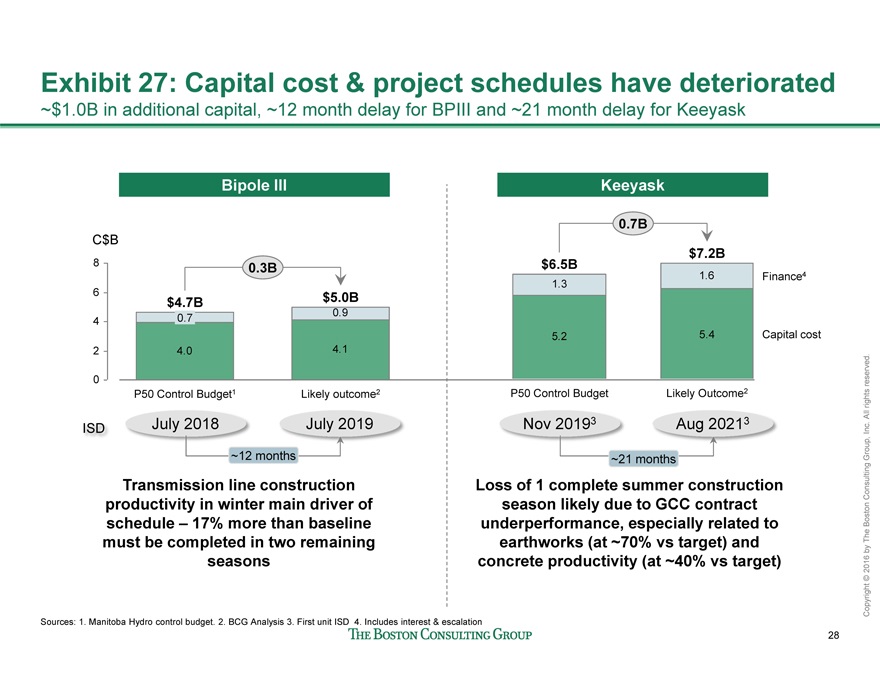

Exhibit 27: Capital cost & project schedules have deteriorated

~$1.0B in additional capital, ~12 month delay for BPIII and ~21 month delay for Keeyask

Sources: 1. Manitoba Hydro control budget. 2. BCG Analysis 3. First unit ISD 4. Includes interest & escalation

4.0 4.1

0.9

0

2

4

6

8

C$B

Likely outcome2

0.3B

$5.0B

P50 Control Budget1

$4.7B

0.7

ISD July 2018 July 2019

1.3

1.6

5.2

$6.5B

P50 Control Budget

5.4

$7.2B

Likely Outcome2

Finance4

Capital cost

0.7B

Nov 20193 Aug 20213

Bipole III Keeyask

Transmission line construction

productivity in winter main driver of

schedule – 17% more than baseline

must be completed in two remaining

seasons

Loss of 1 complete summer construction

season likely due to GCC contract

underperformance, especially related to

earthworks (at ~70% vs target) and

concrete productivity (at ~40% vs target)

~12 months ~21 months

29

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

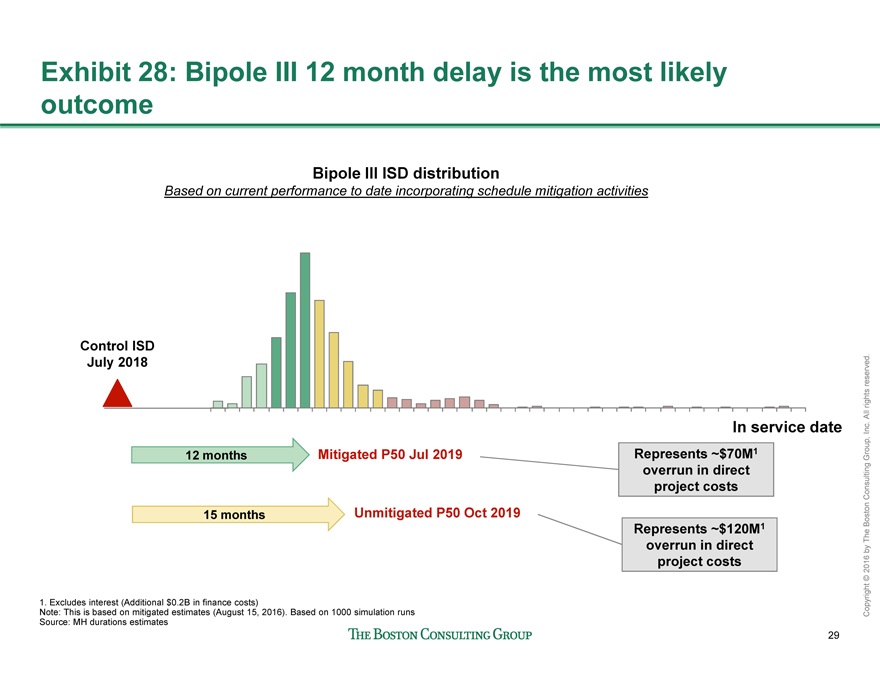

Exhibit 28: Bipole III 12 month delay is the most likely

outcome

Unmitigated P50 Oct 2019

Mitigated P50 Jul 2019

Control ISD

July 2018

12 months

In service date

1. Excludes interest (Additional $0.2B in finance costs)

Note: This is based on mitigated estimates (August 15, 2016). Based on 1000 simulation runs

Source: MH durations estimates

Bipole III ISD distribution

Based on current performance to date incorporating schedule mitigation activities

15 months

Represents ~$70M1

overrun in direct

project costs

Represents ~$120M1

overrun in direct

project costs

30

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

Exhibit 29: Mitigated project delay expected to be ~21 months

Estimated in-service cost equal to ~$7.2B

1. Excludes interest (Additional $0.3B in finance costs) 2. Excludes interest (Additional $0.7B in finance costs)

Note: Activity durations and mitigation plans determined in conjunction with Manitoba Hydro. Based on 10000 simulation runs on 12-Aug-2016

Source: MH durations estimates. BCG analysis

Control ISD

Unit 1: Nov 2019

This image cannot currently be displayed.

Mitigated P50 Aug 2021

Represents ~$0.4B1

overrun in direct

project costs

21 months

32 months Unmitigated P50 Jul 2022

Keeyask schedule distribution

Represents ~$0.6B2

overrun in direct

project costs

31

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

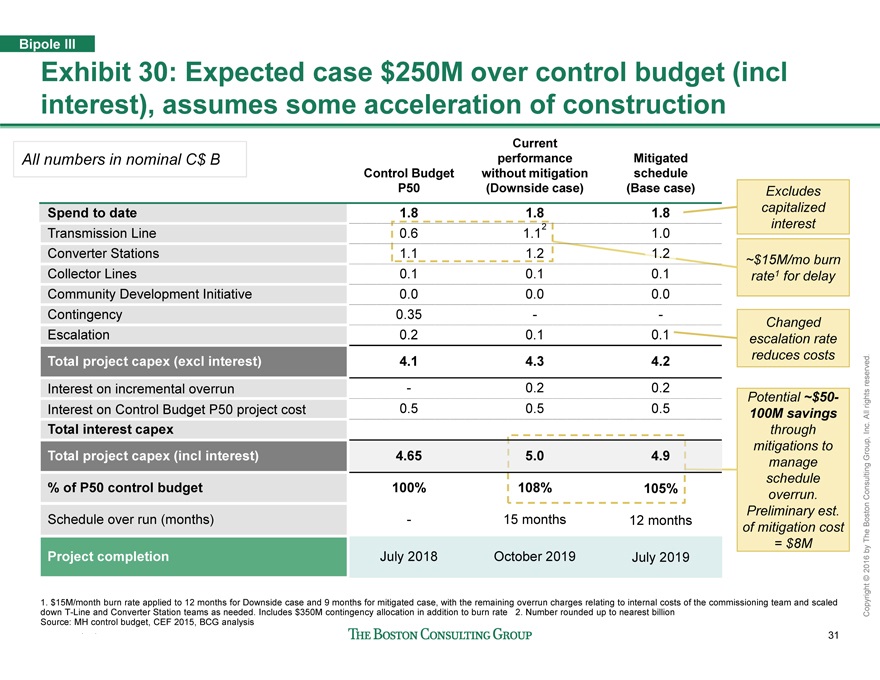

Exhibit 30: Expected case $250M over control budget (incl

interest), assumes some acceleration of construction

Bipole III

All numbers in nominal C$ B

~$15M/mo burn

rate1 for delay

Potential ~$50-

100M savings

through

mitigations to

manage

schedule

overrun.

Preliminary est.

of mitigation cost

= $8M

Excludes

capitalized

interest

1. $15M/month burn rate applied to 12 months for Downside case and 9 months for mitigated case, with the remaining overrun charges relating to internal costs of the commissioning team and scaled

down T-Line and Converter Station teams as needed. Includes $350M contingency allocation in addition to burn rate 2. Number rounded up to nearest billion

Source: MH control budget, CEF 2015, BCG analysis

Changed

escalation rate

reduces costs

Control Budget

P50

Current

performance

without mitigation

(Downside case)

Mitigated

schedule

(Base case)

Spend to date 1.8 1.8 1.8

Transmission Line 0.6 1.12 1.0

Converter Stations 1.1 1.2 1.2

Collector Lines 0.1 0.1 0.1

Community Development Initiative 0.0 0.0 0.0

Contingency 0.35 - -

Escalation 0.2 0.1 0.1

Total project capex (excl interest) 4.1 4.3 4.2

Interest on incremental overrun - 0.2 0.2

Interest on Control Budget P50 project cost 0.5 0.5 0.5

Total interest capex

Total project capex (incl interest) 4.65 5.0 4.9

% of P50 control budget 100% 108% 105%

Schedule over run (months) - 15 months 12 months

Project completion July 2018 October 2019 July 2019

32

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

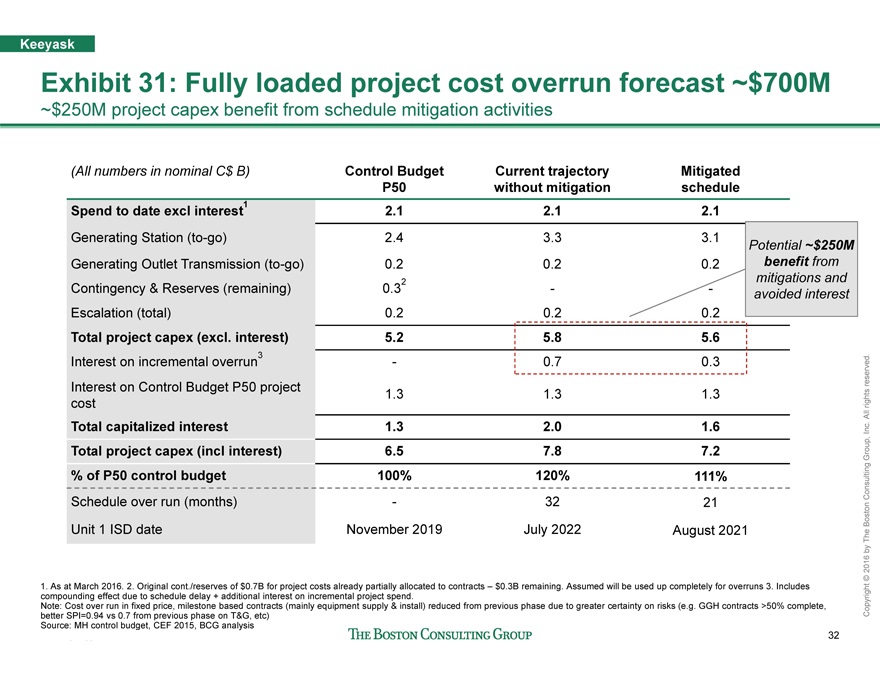

Exhibit 31: Fully loaded project cost overrun forecast ~$700M

~$250M project capex benefit from schedule mitigation activities

Keeyask

(All numbers in nominal C$ B) Control Budget

P50

Current trajectory

without mitigation

Mitigated

schedule

Spend to date excl interest1 2.1 2.1 2.1

Generating Station (to-go) 2.4 3.3 3.1

Generating Outlet Transmission (to-go) 0.2 0.2 0.2

Contingency & Reserves (remaining) 0.32 - -

Escalation (total) 0.2 0.2 0.2

Total project capex (excl. interest) 5.2 5.8 5.6

Interest on incremental overrun3 - 0.7 0.3

Interest on Control Budget P50 project

cost

1.3 1.3 1.3

Total capitalized interest 1.3 2.0 1.6

Total project capex (incl interest) 6.5 7.8 7.2

% of P50 control budget 100% 120% 111%

Schedule over run (months) - 32 21

Unit 1 ISD date November 2019 July 2022 August 2021

1. As at March 2016. 2. Original cont./reserves of $0.7B for project costs already partially allocated to contracts – $0.3B remaining. Assumed will be used up completely for overruns 3. Includes

compounding effect due to schedule delay + additional interest on incremental project spend.

Note: Cost over run in fixed price, milestone based contracts (mainly equipment supply & install) reduced from previous phase due to greater certainty on risks (e.g. GGH contracts >50% complete,

better SPI=0.94 vs 0.7 from previous phase on T&G, etc)

Source: MH control budget, CEF 2015, BCG analysis

Potential ~$250M

benefit from

mitigations and

avoided interest

33

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

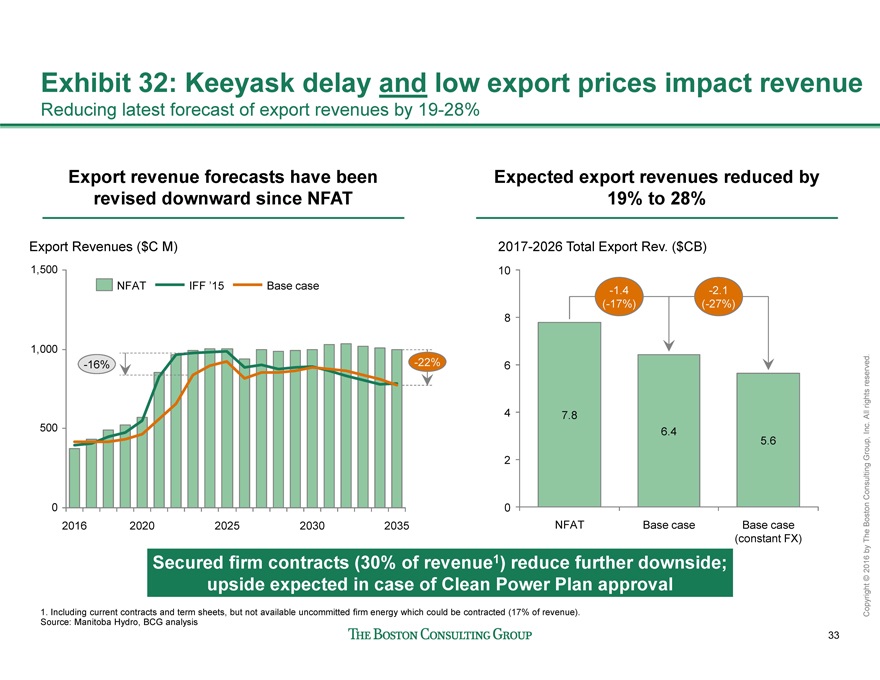

Exhibit 32: Keeyask delay and low export prices impact revenue

Reducing latest forecast of export revenues by 19-28%

Export revenue forecasts have been

revised downward since NFAT

Expected export revenues reduced by

19% to 28%

0

500

1,000

1,500

2025 2030 2035

Export Revenues ($C M)

2016 2020

-16% -22% 6

8

10

4

2

0

2017-2026 Total Export Rev. ($CB)

Base case

5.6

-1.4

(-17%)

Base case

(constant FX)

-2.1

(-27%)

6.4

7.8

NFAT

NFAT IFF ’15 Base case

1. Including current contracts and term sheets, but not available uncommitted firm energy which could be contracted (17% of revenue).

Source: Manitoba Hydro, BCG analysis

Secured firm contracts (30% of revenue1) reduce further downside;

upside expected in case of Clean Power Plan approval

34

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

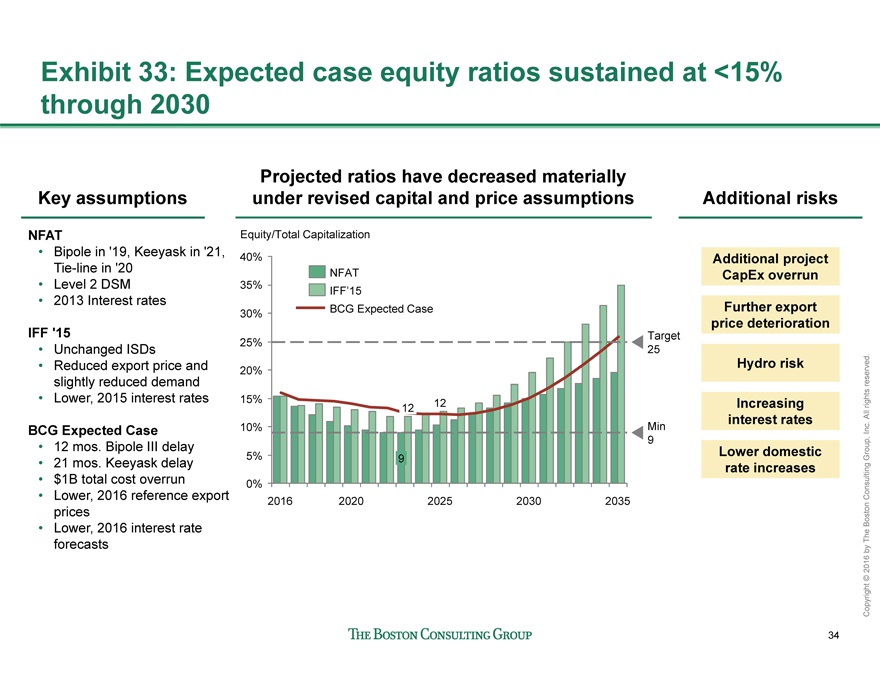

Exhibit 33: Expected case equity ratios sustained at <15%

through 2030

35%

40%

0%

5%

10%

20%

15%

25%

30%

Equity/Total Capitalization

Target

25

Min

9

12

2025 2030 2035

9

2016

12

2020

Projected ratios have decreased materially

under revised capital and price assumptions

IFF’15

NFAT

BCG Expected Case

Key assumptions Additional risks

NFAT

• Bipole in ‘19, Keeyask in ‘21,

Tie-line in ‘20

• Level 2 DSM

• 2013 Interest rates

IFF ‘15

• Unchanged ISDs

• Reduced export price and

slightly reduced demand

• Lower, 2015 interest rates

BCG Expected Case

• 12 mos. Bipole III delay

• 21 mos. Keeyask delay

• $1B total cost overrun

• Lower, 2016 reference export

prices

• Lower, 2016 interest rate

forecasts

Additional project

CapEx overrun

Increasing

interest rates

Lower domestic

rate increases

Hydro risk

Further export

price deterioration

35

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

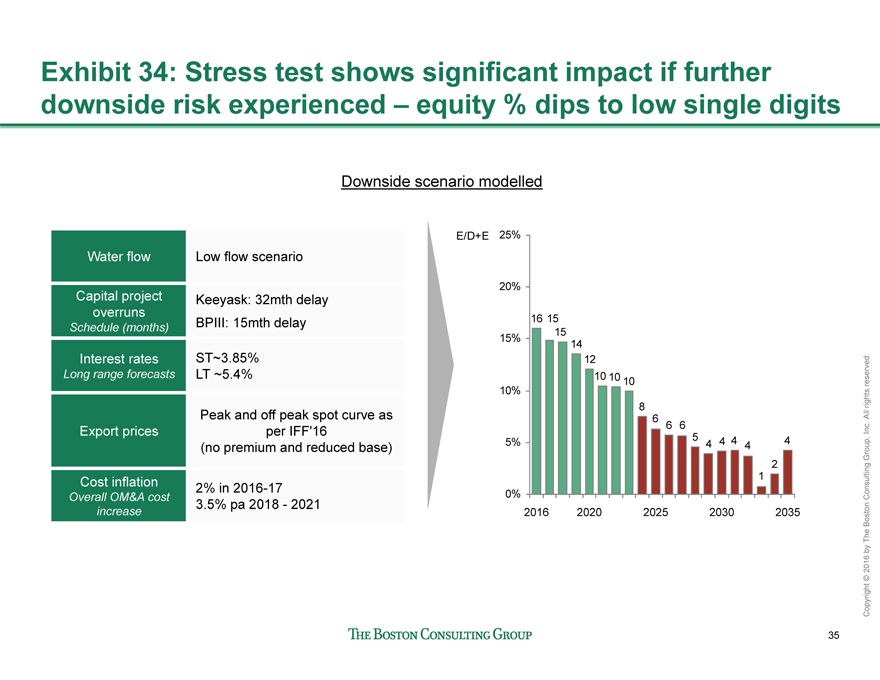

Exhibit 34: Stress test shows significant impact if further

downside risk experienced – equity % dips to low single digits

4

2

1

4 4 4 4 5

6 6 6

8

10 10 10

12

14

15

16 15

0%

5%

10%

15%

20%

E/D+E 25%

2016 2020 2025 2030 2035

Downside scenario modelled

Water flow Low flow scenario

Capital project

overruns

Schedule (months)

Keeyask: 32mth delay

BPIII: 15mth delay

Interest rates

Long range forecasts

ST~3.85%

LT ~5.4%

Export prices

Peak and off peak spot curve as

per IFF’16

(no premium and reduced base)

Cost inflation

Overall OM&A cost

increase

2% in 2016-17

3.5% pa 2018 – 2021

36

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

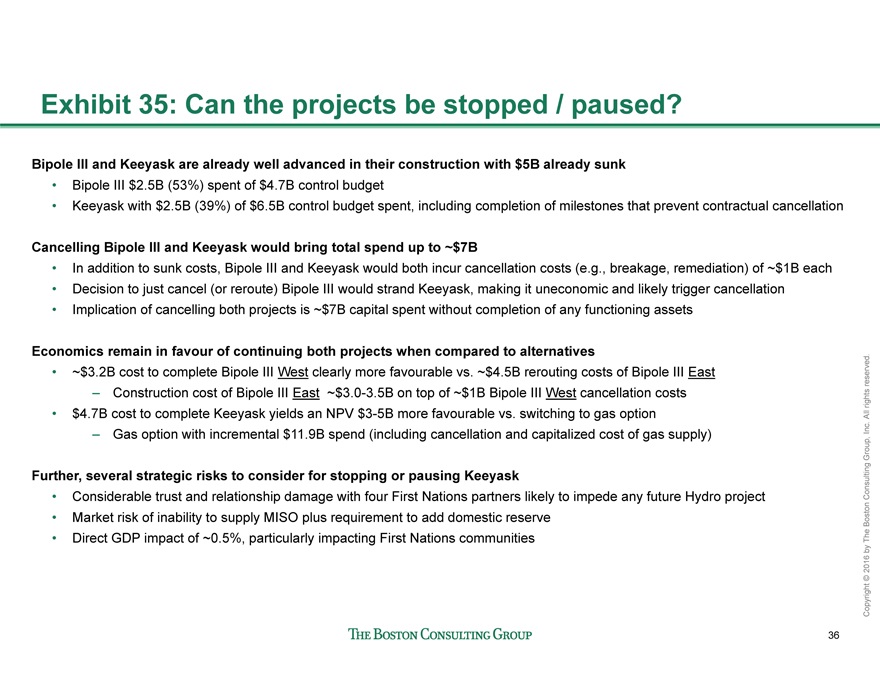

Exhibit 35: Can the projects be stopped / paused?

Bipole III and Keeyask are already well advanced in their construction with $5B already sunk

• Bipole III $2.5B (53%) spent of $4.7B control budget

• Keeyask with $2.5B (39%) of $6.5B control budget spent, including completion of milestones that prevent contractual cancellation

Cancelling Bipole III and Keeyask would bring total spend up to ~$7B

• In addition to sunk costs, Bipole III and Keeyask would both incur cancellation costs (e.g., breakage, remediation) of ~$1B each

• Decision to just cancel (or reroute) Bipole III would strand Keeyask, making it uneconomic and likely trigger cancellation

• Implication of cancelling both projects is ~$7B capital spent without completion of any functioning assets

Economics remain in favour of continuing both projects when compared to alternatives

• ~$3.2B cost to complete Bipole III West clearly more favourable vs. ~$4.5B rerouting costs of Bipole III East

– Construction cost of Bipole III East ~$3.0-3.5B on top of ~$1B Bipole III West cancellation costs

• $4.7B cost to complete Keeyask yields an NPV $3-5B more favourable vs. switching to gas option

– Gas option with incremental $11.9B spend (including cancellation and capitalized cost of gas supply)

Further, several strategic risks to consider for stopping or pausing Keeyask

• Considerable trust and relationship damage with four First Nations partners likely to impede any future Hydro project

• Market risk of inability to supply MISO plus requirement to add domestic reserve

• Direct GDP impact of ~0.5%, particularly impacting First Nations communities

37

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

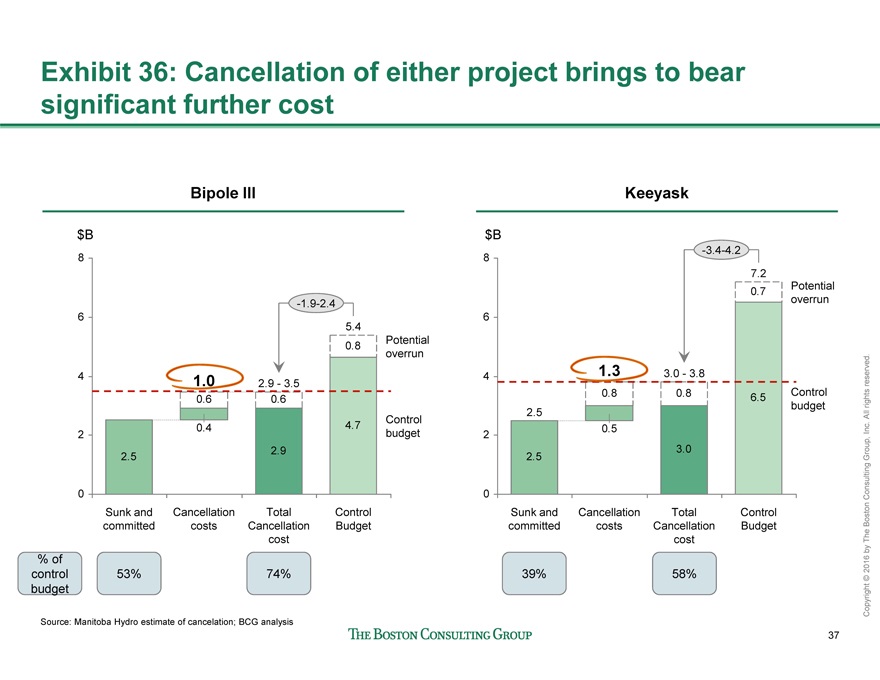

2.5 2.9

4.7

0.6 0.6

0.8

0.4

0

2

4

6

8

$B

-1.9-2.4

Control

budget

Potential

overrun

Control

Budget

5.4

Total

Cancellation

cost

2.9 - 3.5

Cancellation

costs

1.0

Sunk and

committed

$B

Source: Manitoba Hydro estimate of cancelation; BCG analysis

Bipole III Keeyask

Exhibit 36: Cancellation of either project brings to bear

significant further cost

53% 74% 39% 58%

% of

control

budget

2.5

3.0

0.8 0.8 6.5

0.7

0.5

0

2

4

6

8 -3.4-4.2

Control

budget

Potential

overrun

Control

Budget

7.2

Total

Cancellation

cost

3.0 - 3.8

Cancellation

costs

1.3

Sunk and

committed

2.5

38

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

Source: Manitoba Hydro estimate of cancelation; BCG analysis

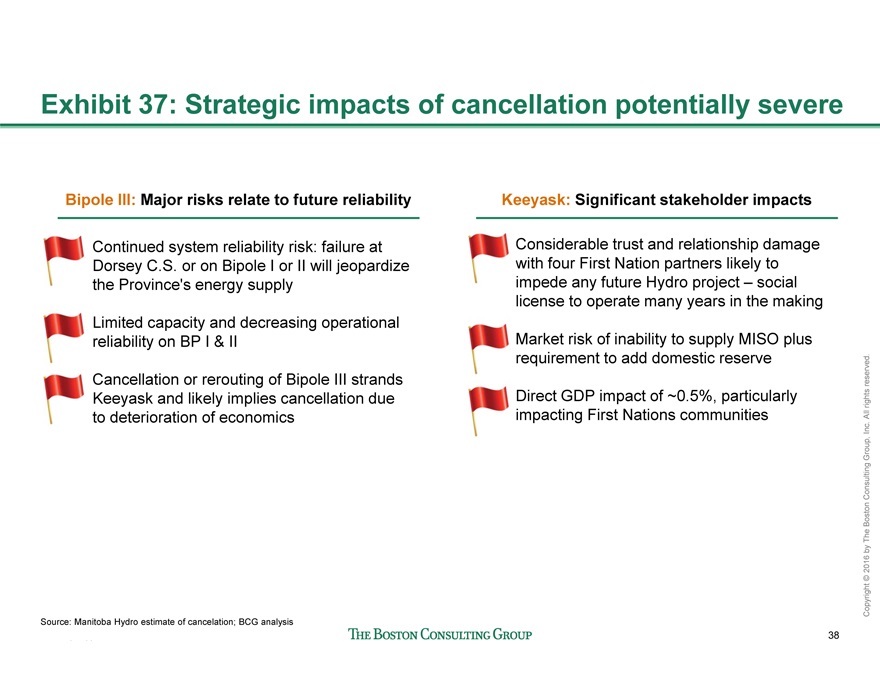

Bipole III: Major risks relate to future reliability Keeyask: Significant stakeholder impacts

• Continued system reliability risk: failure at

Dorsey C.S. or on Bipole I or II will jeopardize

the Province’s energy supply

• Limited capacity and decreasing operational

reliability on BP I & II

• Cancellation or rerouting of Bipole III strands

Keeyask and likely implies cancellation due

to deterioration of economics

• Considerable trust and relationship damage

with four First Nation partners likely to

impede any future Hydro project – social

license to operate many years in the making

• Market risk of inability to supply MISO plus

requirement to add domestic reserve

• Direct GDP impact of ~0.5%, particularly

impacting First Nations communities

Exhibit 37: Strategic impacts of cancellation potentially severe

39

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

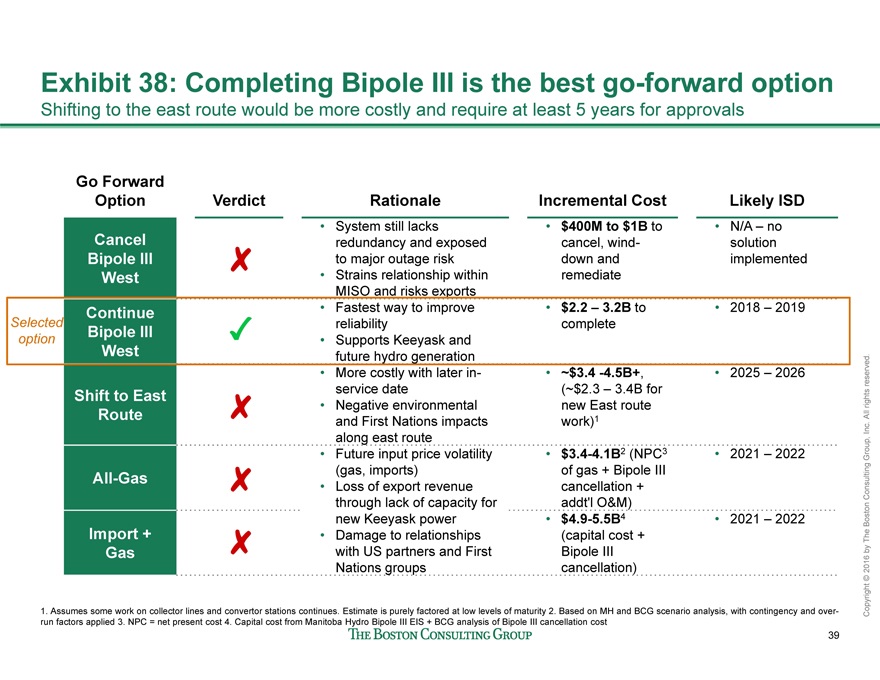

Exhibit 38: Completing Bipole III is the best go-forward option

Shifting to the east route would be more costly and require at least 5 years for approvals

Go Forward

Option Verdict Rationale Incremental Cost Likely ISD

Cancel

Bipole III

West

• System still lacks

redundancy and exposed

to major outage risk

• Strains relationship within

MISO and risks exports

• $400M to $1B to

cancel, winddown

and

remediate

• N/A – no

solution

implemented

Continue

Bipole III

West

• Fastest way to improve

reliability

• Supports Keeyask and

future hydro generation

• $2.2 – 3.2B to

complete

• 2018 – 2019

Shift to East

Route

• More costly with later inservice

date

• Negative environmental

and First Nations impacts

along east route

• ~$3.4 -4.5B+,

(~$2.3 – 3.4B for

new East route

work)1

• 2025 – 2026

All-Gas

• Future input price volatility

(gas, imports)

• Loss of export revenue

through lack of capacity for

new Keeyask power

• Damage to relationships

with US partners and First

Nations groups

• $3.4-4.1B2 (NPC3

of gas + Bipole III

cancellation +

addt’l O&M)

• 2021 – 2022

Import +

Gas

• $4.9-5.5B4

(capital cost +

Bipole III

cancellation)

• 2021 – 2022

Selected

option

1. Assumes some work on collector lines and convertor stations continues. Estimate is purely factored at low levels of maturity 2. Based on MH and BCG scenario analysis, with contingency and overrun

factors applied 3. NPC = net present cost 4. Capital cost from Manitoba Hydro Bipole III EIS + BCG analysis of Bipole III cancellation cost

40

Copyright © 2016 by The Boston Consulting Group, Inc. All rights reserved.

6

-1

3

1

5

4

2

0

0.0

5.3

4.5

0.4

0.4

0.0

Low

export

price w

revised

capex

2.5

1.7

0.4

0.4

Reference

export

price w

revised

capex

3.7

2.8

0.4

0.4

High

export

price w

revised

capex

1.3

1.8

$B

0.3

0.3

Low

export

price w

revised

capex

0.5

0.3

0.3

0.3 1.0

High

export

price w

revised

capex

Reference

export

price w

revised

capex

0.3

0.5

Cancel

Keeyask

and

replace

with gas

(reference)

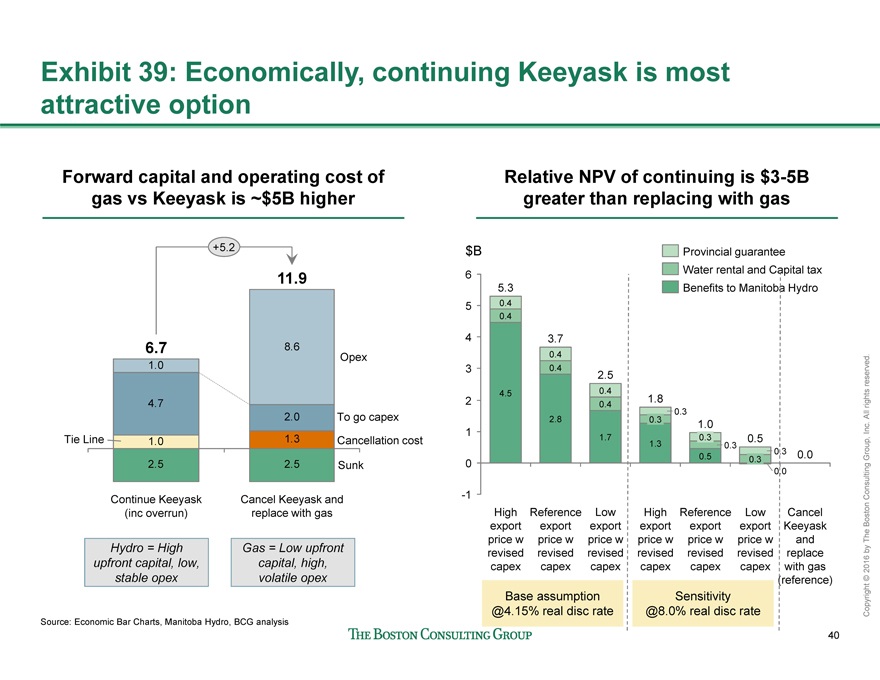

Exhibit 39: Economically, continuing Keeyask is most

attractive option

2.5 2.5

4.7

2.0

1.0

8.6

1.0 1.3

Continue Keeyask

(inc overrun)

6.7

+5.2

Cancel Keeyask and

replace with gas

11.9

Forward capital and operating cost of

gas vs Keeyask is ~$5B higher

Relative NPV of continuing is $3-5B

greater than replacing with gas

Benefits to Manitoba Hydro

Water rental and Capital tax

Provincial guarantee

Source: Economic Bar Charts, Manitoba Hydro, BCG analysis

Opex

To go capex

Sunk

Tie Line Cancellation cost

Hydro = High

upfront capital, low,

stable opex

Gas = Low upfront

capital, high,

volatile opex

Base assumption

@4.15% real disc rate

Sensitivity

@8.0% real disc rate