38 / Economic Review and Outlook BUDGET 2019

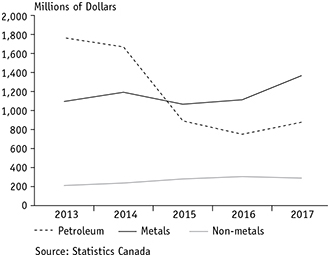

were recorded in the exports of chemicals, zinc, agriculture machinery, processed food products, transportation equipment and crude oil.

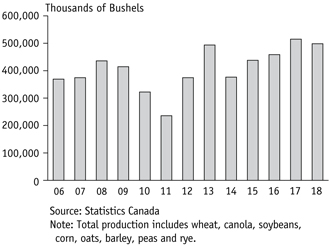

On the other hand, total exports to non-U.S. destinations fell by 6.9% during the same period. The decline in exports to non-U.S. destinations was mainly due to a 15.4% fall in exports to China, which was primarily attributed to one commodity, soybeans. After surging significantly by 171.1% in 2017, soybean sales fell by 92.9%. However, with the exclusion of soybeans, exports to China actually increased by 7.3%.

Overall, the outlook for Manitoba’s exports remains positive. On September 30, 2018, the U.S., Mexico and Canada announced the completion of negotiations pertaining to the USMCA. The new agreement largely preserves the benefits of free and secure access for Manitoba exports enjoyed under the North American Free Trade Agreement, and modernizes it in many areas. Ratification of the USMCA is expected to remove any uncertainty that may have hindered investment in Manitoba, particularly in the North American context. However, a number of issues remain outstanding between the U.S. and Canada, including the steel and aluminum tariffs imposed by the U.S. in June 2018.

On September 21, 2017, 90% of the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) came into force, reducing most tariffs and non-tariff barriers, providing access to government procurement obligations at the European Union and member state levels, and temporary entry commitments. However, full implementation can only take effect after the ratification by the national parliaments of member states.

The CPTPP was ratified by Canada and came into force in January 2019 in six countries. The CPTPP will eliminate tariffs on almost all of Manitoba’s key exports and provide access to new opportunities in the Asia-Pacific region. Manitoba’s agri-food and mineral resource sectors in particular will benefit from the significant reduction in tariffs in high value markets, especially Japan.

MANITOBA OUTLOOK

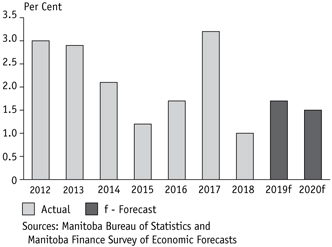

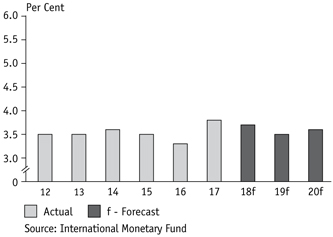

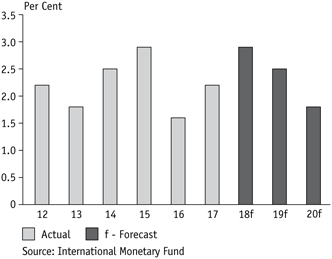

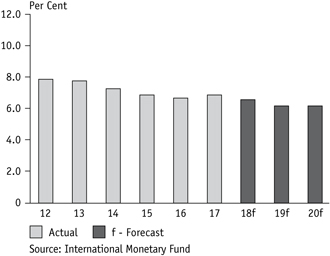

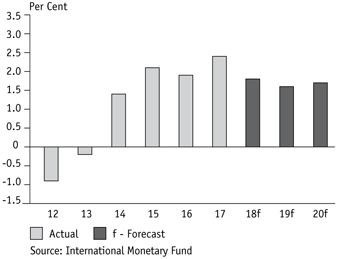

Early last year, global growth was projected to pick-up in 2018 and maintain the same momentum in 2019. This was based on the introduction of the biggest overhaul of taxes in the U.S. since 1987 and increasing growth in the Eurozone and other countries. However, as a number of countries started reporting weaker than expected quarterly growth in 2018, and more tariff barriers were erected among countries, the assessment of economic growth, going forward, was lowered.

According to a World Trade Organization report, between May 16, 2018, and October 15, 2018, 40 new trade-restrictive measures were applied by G20 economies, including tariff increases, import bans and export duties. This is equal to an average of eight restrictive measures per month.

In their latest forecast for global growth, IMF, BoC and the OECD have all lowered the outlook for 2019 compared to a year ago. Citing growth in international trade barriers, monetary tightening, geopolitical tension, rising protectionist sentiment and uncertain demand growth, the risks to the global outlook are moving to the downside and currently prolonging financial, commodity and equity market volatility.

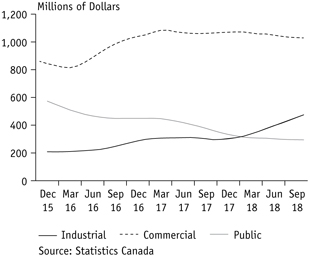

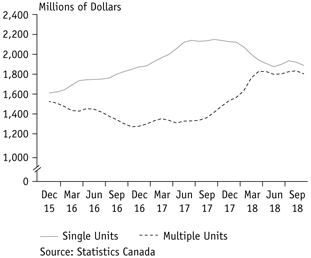

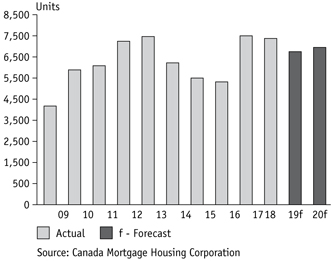

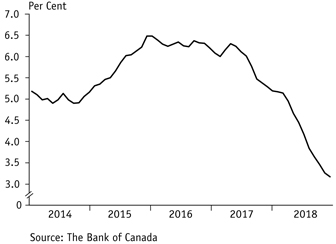

Since Manitoba greatly benefits from international and inter-provincial trade, these external risks tend to undermine its outlook. However, continued strength in population growth and industrial weekly wages is supporting a robust pace in residential and non-residential construction in buildings. But, with stringent federal mortgage rules still in