Canadian Outlook

Canada’s economic growth moderated in the first half of 2022, expanding by 0.8 per cent in the first quarter and 0.8 per cent in the second quarter. The moderation in growth in the second quarter was due to a large surge in imports (+6.9 per cent), as well as a decline in gross fixed capital formation (-2.3 per cent) under higher interest rates.

The Canadian economy is struggling with many of the same challenges as the Manitoba economy. Pandemic-related supply chain issues are creating troubles for Canada’s manufacturing sector, notably the automotive industry where there is a global shortage in semiconductor chips. Labour shortages are disrupting business operations and investment plans. Canadian consumer inflation reached 8.1 per cent in June 2022, the highest rate since January 1983.

In March 2022, the Bank of Canada (BoC) began lifting interest rates to curtail soaring inflation. So far, in 2022 the BoC has raised the overnight rate by 300 basis points, including a 100-basis point hike in July and 75-point hike in September. The overnight rate is currently set at 3.25 per cent, slightly above the bank’s neutral rate, which is the estimated rate that neither stimulates nor hampers economic growth. There are two additional scheduled rate announcements remaining in 2022. The BoC Governing Council expects the need to raise rates further.

Elevated inflation is expected to decelerate household spending, as higher prices erode consumer purchasing power. Consumers will also experience the impacts of higher interest rates that will increase debt-servicing costs and further weigh on spending and investment.

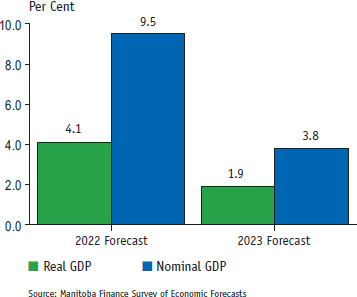

Manitoba’s 2022/23 First Quarter Report expects Canada’s economy to expand by 3.7 per cent in 2022, followed by

1.8 per cent in 2023.

U.S. and International Outlook

The United States of America (U.S.) experienced two consecutive quarters of declines in the first half of 2022 (-1.6 per cent in the first quarter and -0.9 per cent in the second quarter). The economic declines were due to decreases in investment, as well as government spending.

After peaking at 9.1 per cent in June 2022, year-over-year inflation in the U.S. dipped slightly to 8.5 per cent in July as gasoline prices across the country pulled back. Given Manitoba imports over $17 billion of goods from the United States annually, escalating prices in the U.S. are a concern because price pressures migrate across borders, creating inflationary pressure domestically. Year-to-date Manitoba imports from the U.S. are up 25.9 per cent as of June 2022.

The U.S. Federal Reserve is tightening monetary policy with several incremental rate hikes that began in March 2022, including two consecutive 75-basis point hikes in June and July. The Federal Reserve interest rate is currently set at 2.25 – 2.50 per cent. Continued rate hikes could see the Canadian dollar depreciate, which could help to stimulate Manitoba and Canadian exports.

The International Monetary Fund (IMF) revised its U.S. economic forecast downwards by 1.4 and 1.3 percentage points in 2022 and 2023 to reflect the weaker economic growth in the first half of 2022 and the more aggressive rate hikes expected. The IMF projects that U.S. economy to expand by 2.3 per cent in 2022 and 1.0 per cent in 2023.

The IMF also downgraded economic growth projections for Manitoba’s other key trading partners due to the ongoing conflict in the Ukraine, tighter global financial conditions, as well as an economic slowdown in China as the country continues to adopt a zero-COVID policy. The Japanese economy is projected to expand by 1.7 per cent in 2022 and 2023. Mexico’s economy is expected to increase by 2.4 per cent in 2022 and 1.2 per cent in 2023. The Chinese economy is expected to expand by 3.3 per cent in 2022 and 4.6 per cent in 2023. Euro Area economies are projected to grow by 2.6 per cent in 2022 and 1.2 per cent in 2023.