Personal Measures

Basic Personal Amount

2024/25 fiscal impact: $3.5-million

The Basic Personal Amount (BPA) is a non-refundable tax credit Manitoba residents claim on their personal income tax return. The BPA has been indexed since 2017 and will total $15,780 for 2024 and is currently projected at $16,206 for 2025. The value of the credit (i.e., the reduction in tax liability) is the BPA multiplied by the lowest Manitoba tax bracket rate of 10.8 per cent.

Beginning with the 2025 tax year, Manitoba will phase out the BPA over a net income range of $200,000 to $400,000.

For more information, please visit: Location A, page 128

Renters Tax Credit

2024/25 fiscal impact: -$2.2-million

Until 2020, renters in Manitoba received a tax credit of up to $700 a year and low-income seniors who rented received a top-up of up to $400. In 2021, the renters credit was reduced to $525 and the seniors top-up was reduced to $300.

For tax year 2025, an increased Renters Tax Credit of up to $575 will be provided, and the seniors top-up will be increased to a maximum $328. Both amounts will be increased each year of the current mandate.

The following table shows the maximum credit available for renters in 2024 versus 2025.

| | |

| 2024 | | 2025 |

Renters Tax Credit (+ seniors top-up) | | Renters Tax Credit (+ seniors top-up) |

| |

max $525 (+ up to $300) | | max $575 (+ up to $328) |

For more information, please visit: Location A, page 128

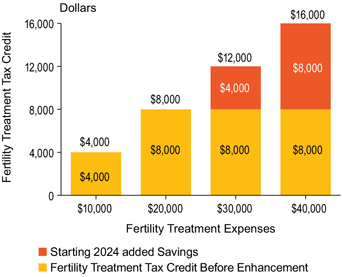

Fertility Treatment Tax Credit

2024/25 fiscal impact: -$1.3-million

The Fertility Treatment Tax Credit is a refundable personal income tax credit equal to 40 per cent of fertility treatment fees paid to a Manitoba licensed medical practitioner or fertility treatment clinic, and for related prescription drugs, net of any reimbursements such as private health care coverage. There is no limit on the number of treatments eligible Manitobans can claim. However, only $20,000 can be claimed in eligible annual costs for a maximum annual credit of $8,000 (40 per cent of $20,000).

For the 2024 tax year, the maximum annual eligible expense amount under the Fertility Treatment Tax Credit is doubled from $20,000 to $40,000, which doubles the available annual credit amount from $8,000 to $16,000. This improves benefits under the program for those facing greater fertility treatment costs.

This enhancement aligns with recent federal changes to eligibility for the medical expense tax credit.

For more information, please visit: Location A, page 128

Retail Sales Tax Measures

Sales Tax Registration Threshold

2024/25 fiscal impact: -$2.0-million

Effective January 1, 2024, the sales tax registration threshold will be increased for taxable sales from $10,000 to $30,000, consistent with the federal government’s $30,000 GST/HST registration threshold.

Manitoba’s sales tax registration threshold of $10,000 was introduced in 2007, with businesses under the threshold not required to register and collect sales tax in Manitoba.

This increase will reduce red tape and administration for an estimated 3,300 small businesses with taxable sales between $10,000 and $30,000.

For more information, please visit: Location C, page 128