ECONOMIC UPDATE

| | | | | | | | | | | | | | | | |

| | | | |

| Manitoba Economic Outlook at a Glance | | | | | | | | | | | | |

| | | | |

| | | Budget 24 2024F | | | Update 2024F | | | Budget 24 2025F | | | Update 2025F | |

| | | | |

Gross Domestic Product Growth | | | | | | | | | | | | | | | | |

| | | | |

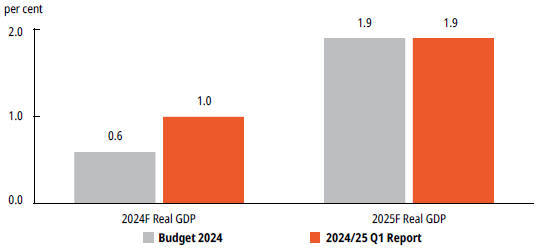

Real | | | 0.6 | | | | 1.0 | | | | 1.9 | | | | 1.9 | |

| | | | |

Nominal | | | 2.9 | | | | 3.7 | | | | 3.1 | | | | 3.4 | |

| | | | |

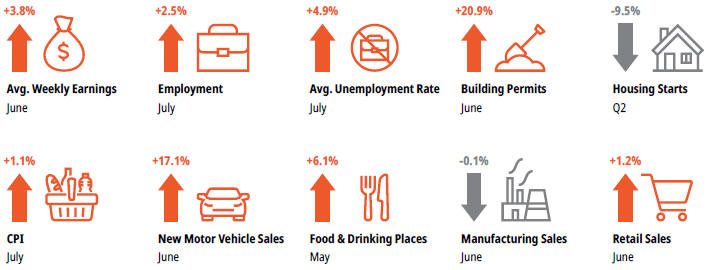

Consumer Price Inflation | | | 2.5 | | | | 1.5 | | | | 1.9 | | | | 2.1 | |

| | | | |

Employment growth | | | 1.2 | | | | 2.0 | | | | 1.5 | | | | 1.5 | |

| | | | |

Unemployment Rate | | | 5.7 | | | | 5.1 | | | | 5.7 | | | | 5.3 | |

| | | | |

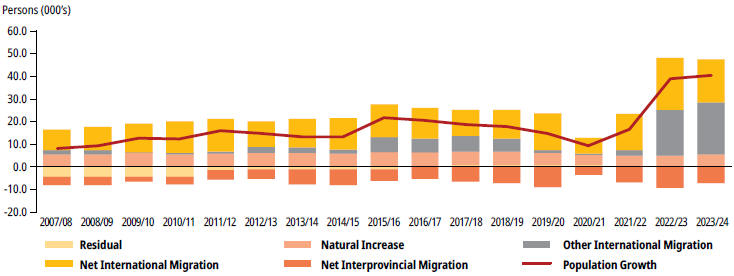

Population growth | | | 1.0 | | | | 1.6 | | | | 1.0 | | | | 1.3 | |

per cent change unless otherwise noted

Source: Manitoba Finance Survey of Economic Forecasts

With two years of rapidly rising inflation and interest rates, the 2024/25 First Quarter Economic Update projects real gross domestic product (GDP) to grow by 1.0 per cent in 2024, compared to 1.3 per cent in 2023/24 and 3.3 per cent in 2022/23. The forecast is up slightly from the forecasted 0.6 per cent at the time of Budget 2024. Real GDP growth is expected to pick up in 2025 to 1.9 per cent, unchanged from the 1.9 per cent forecasted at Budget.

Nominal GDP growth, which acts as a proxy for tax revenue growth, is expected to increase 3.7 per cent in 2024, and slow to 3.4 per cent in 2025, compared to 2.9 per cent for 2024 and 3.1 per cent for 2025 expected in Budget 2024.

There is some uncertainty in the economic forecast, especially for 2024. After enacting a series of steep interest rate hikes from 2022 to mid-2023, the Bank of Canada (BoC) began its cutting cycle in June 2024 with a 25-basis point cut to the target rate, followed by similar cuts in July and September lowering its policy rate from 5.0 to 4.25 per cent.

Ongoing conflicts in Ukraine and in the Middle East, lingering supply chain disruptions, and climate risks, are downside risk factors that could slow down projected economic growth. On the other hand, lower inflation levels and falling interest rates relative to previous years should bolster overall purchasing power for households and businesses in Manitoba.