July 31, 2015 Business Update July 2015

July 31, 2015 1 Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10- K, most recent form 10-Q, and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation.

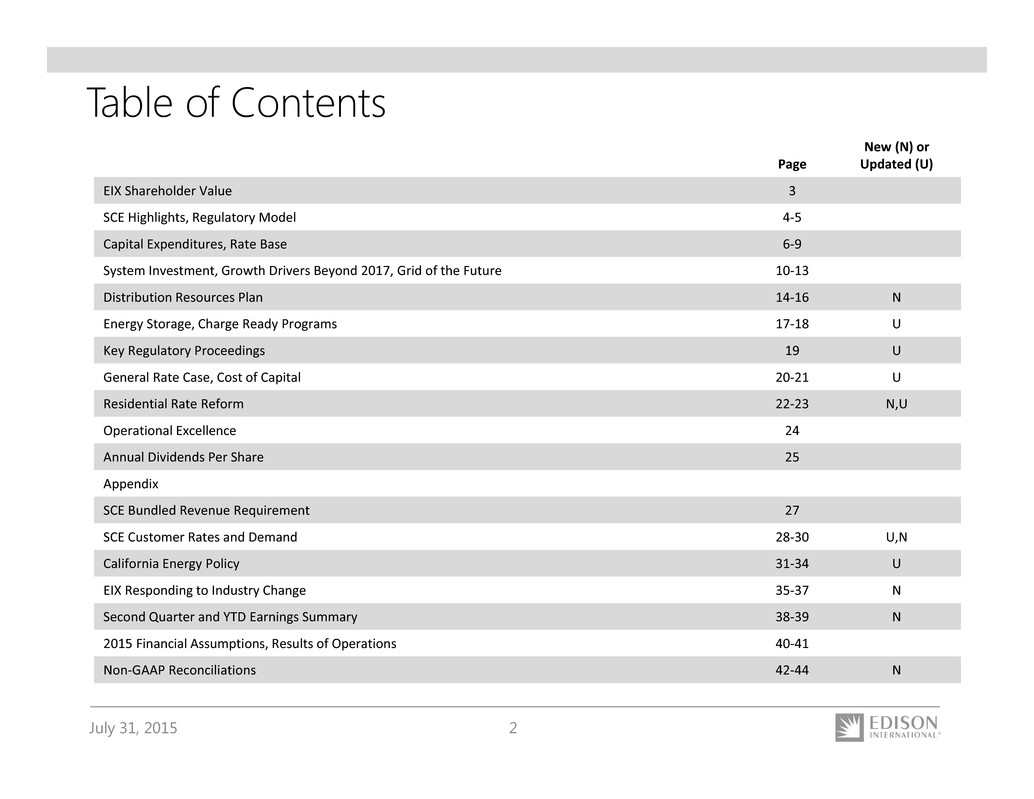

July 31, 2015 2 Table of Contents Page New (N) or Updated (U) EIX Shareholder Value 3 SCE Highlights, Regulatory Model 4‐5 Capital Expenditures, Rate Base 6‐9 System Investment, Growth Drivers Beyond 2017, Grid of the Future 10‐13 Distribution Resources Plan 14‐16 N Energy Storage, Charge Ready Programs 17‐18 U Key Regulatory Proceedings 19 U General Rate Case, Cost of Capital 20‐21 U Residential Rate Reform 22‐23 N,U Operational Excellence 24 Annual Dividends Per Share 25 Appendix SCE Bundled Revenue Requirement 27 SCE Customer Rates and Demand 28‐30 U,N California Energy Policy 31‐34 U EIX Responding to Industry Change 35‐37 N Second Quarter and YTD Earnings Summary 38‐39 N 2015 Financial Assumptions, Results of Operations 40‐41 Non‐GAAP Reconciliations 42‐44 N

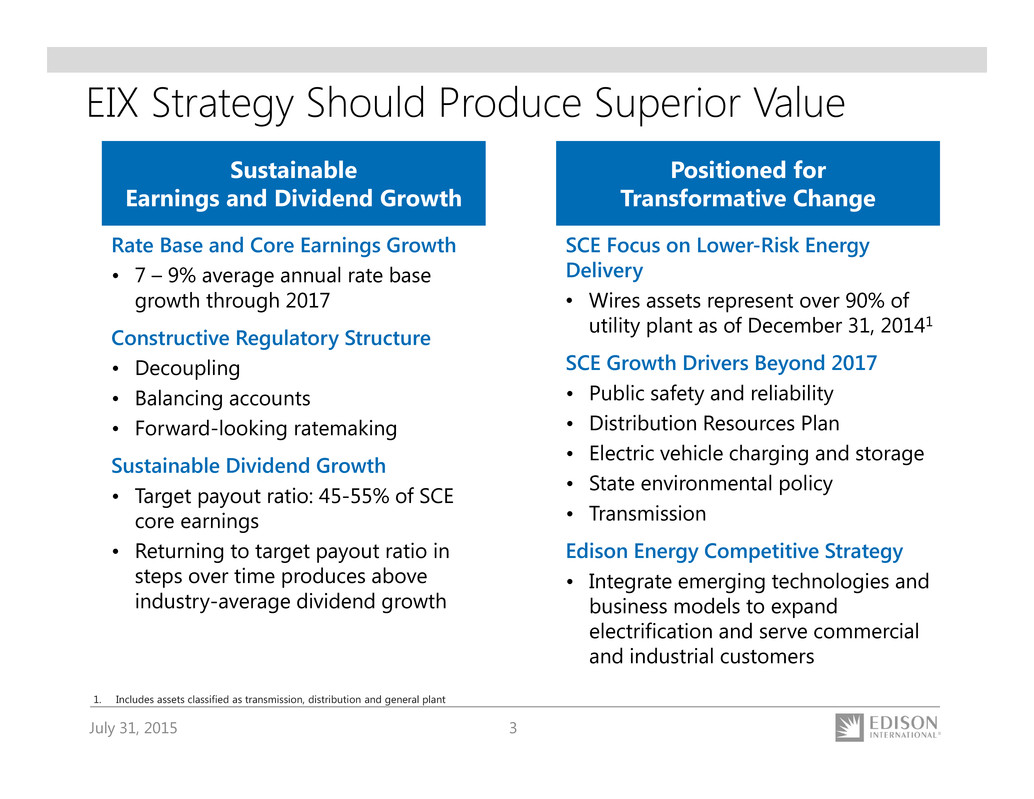

July 31, 2015 3 EIX Strategy Should Produce Superior Value Sustainable Earnings and Dividend Growth Positioned for Transformative Change Rate Base and Core Earnings Growth • 7 – 9% average annual rate base growth through 2017 Constructive Regulatory Structure • Decoupling • Balancing accounts • Forward-looking ratemaking Sustainable Dividend Growth • Target payout ratio: 45-55% of SCE core earnings • Returning to target payout ratio in steps over time produces above industry-average dividend growth SCE Focus on Lower-Risk Energy Delivery • Wires assets represent over 90% of utility plant as of December 31, 20141 SCE Growth Drivers Beyond 2017 • Public safety and reliability • Distribution Resources Plan • Electric vehicle charging and storage • State environmental policy • Transmission Edison Energy Competitive Strategy • Integrate emerging technologies and business models to expand electrification and serve commercial and industrial customers 1. Includes assets classified as transmission, distribution and general plant

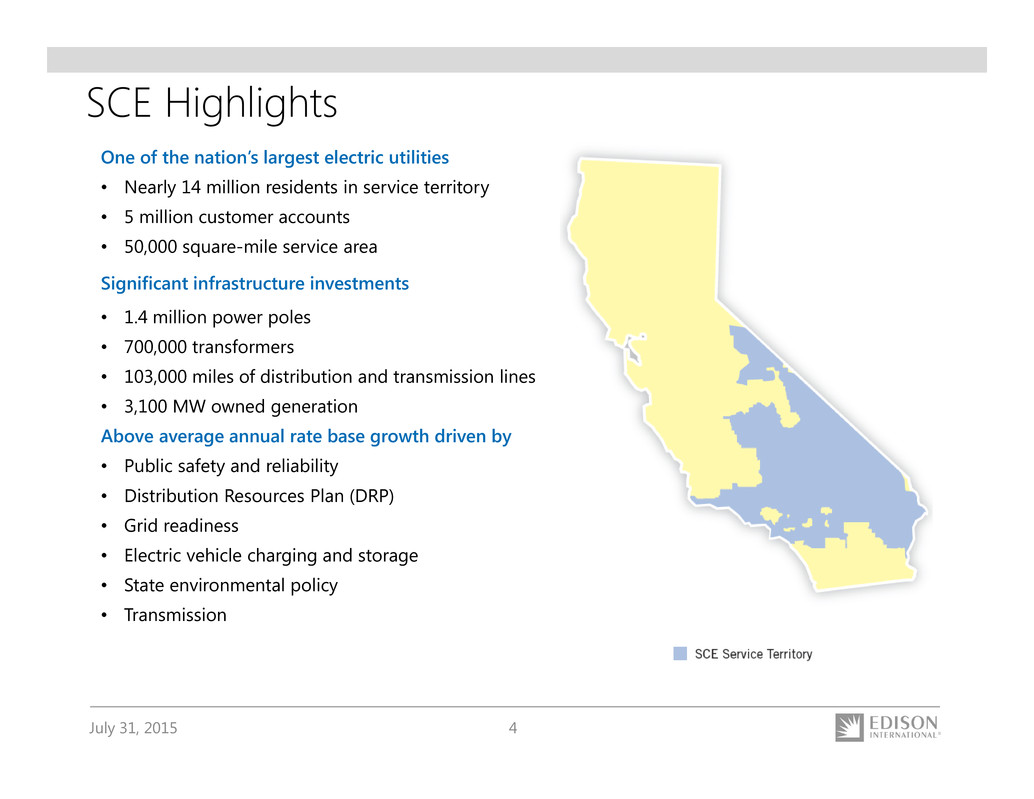

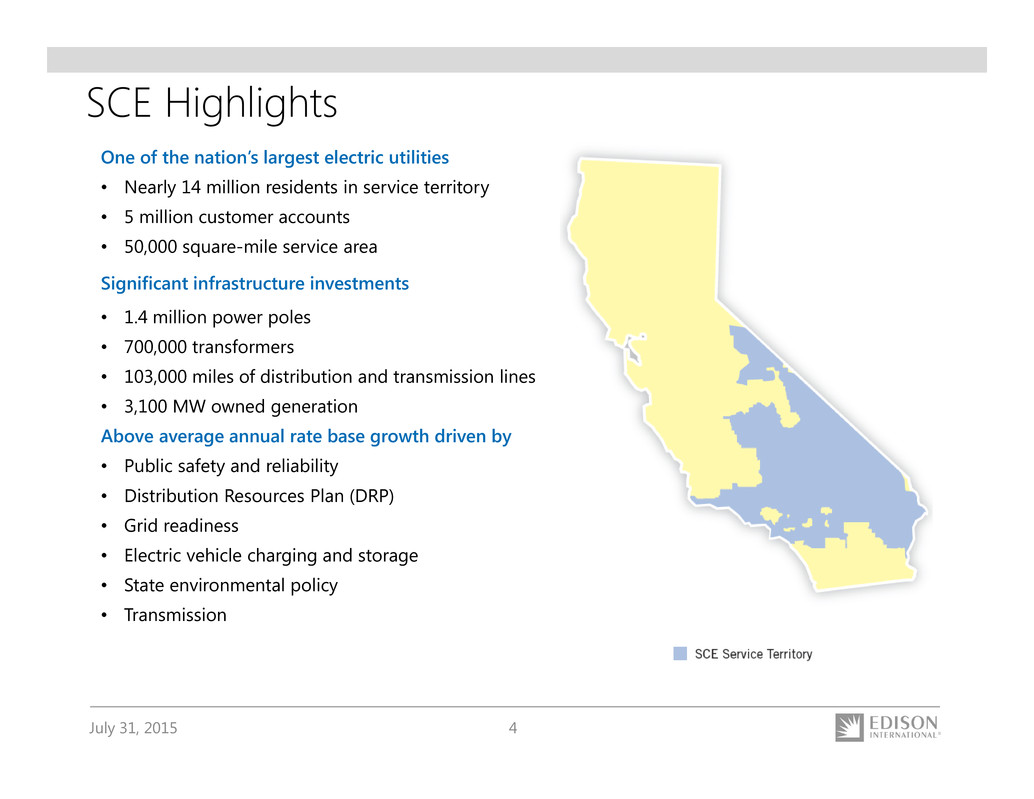

July 31, 2015 4 One of the nation’s largest electric utilities • Nearly 14 million residents in service territory • 5 million customer accounts • 50,000 square-mile service area Significant infrastructure investments • 1.4 million power poles • 700,000 transformers • 103,000 miles of distribution and transmission lines • 3,100 MW owned generation Above average annual rate base growth driven by • Public safety and reliability • Distribution Resources Plan (DRP) • Grid readiness • Electric vehicle charging and storage • State environmental policy • Transmission SCE Highlights

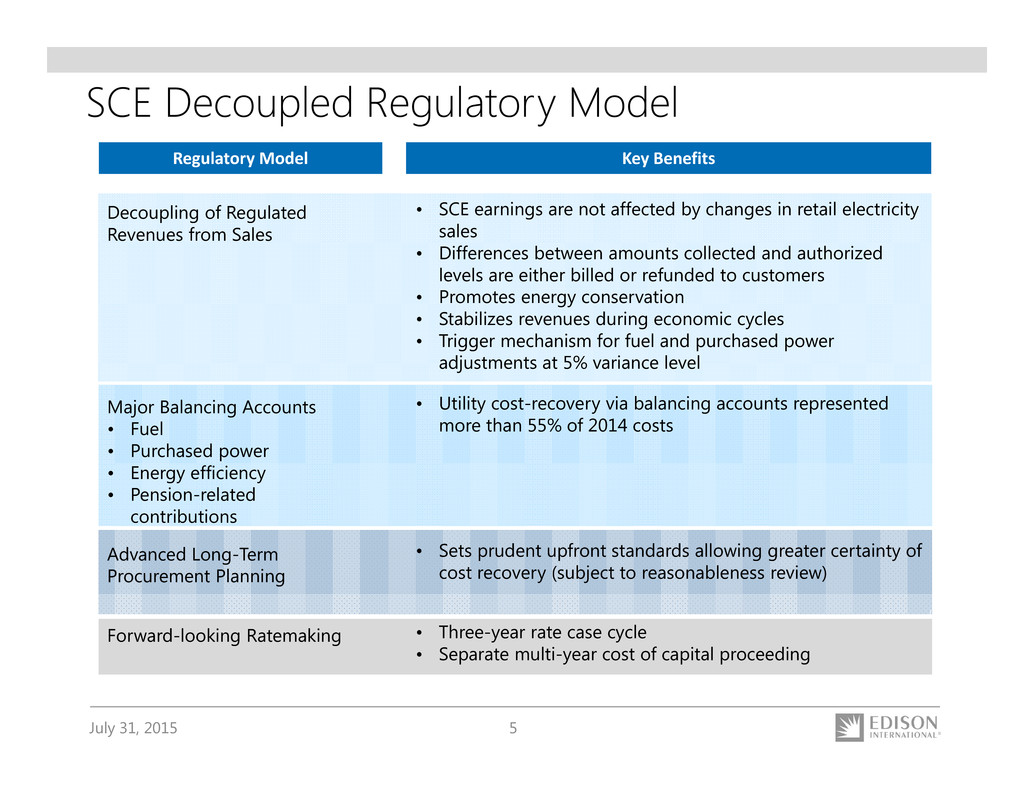

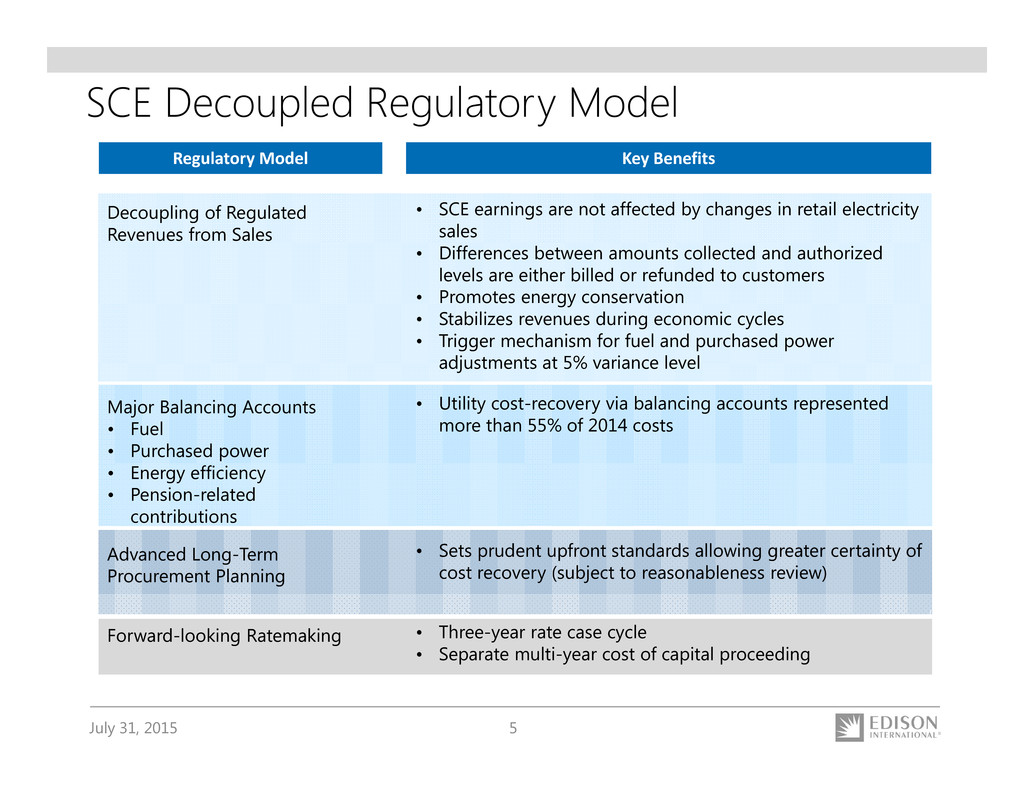

July 31, 2015 5 SCE Decoupled Regulatory Model Decoupling of Regulated Revenues from Sales Major Balancing Accounts • Fuel • Purchased power • Energy efficiency • Pension-related contributions Advanced Long-Term Procurement Planning Forward-looking Ratemaking • SCE earnings are not affected by changes in retail electricity sales • Differences between amounts collected and authorized levels are either billed or refunded to customers • Promotes energy conservation • Stabilizes revenues during economic cycles • Trigger mechanism for fuel and purchased power adjustments at 5% variance level • Utility cost-recovery via balancing accounts represented more than 55% of 2014 costs • Sets prudent upfront standards allowing greater certainty of cost recovery (subject to reasonableness review) • Three-year rate case cycle • Separate multi-year cost of capital proceeding Regulatory Model Key Benefits

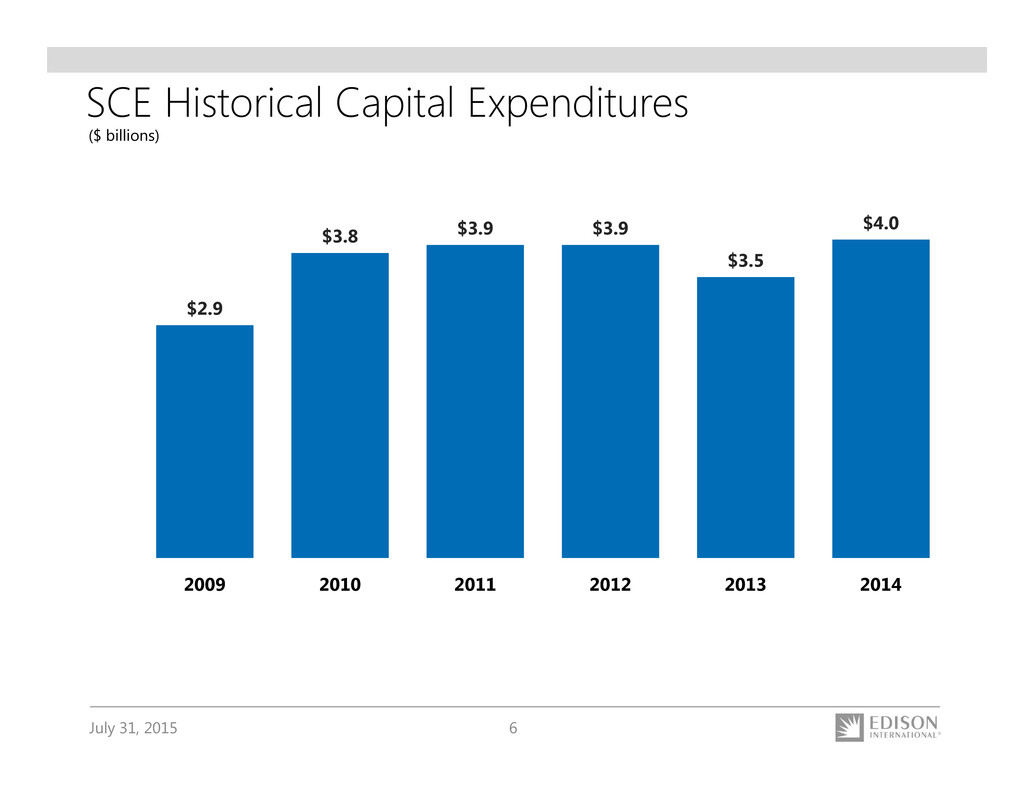

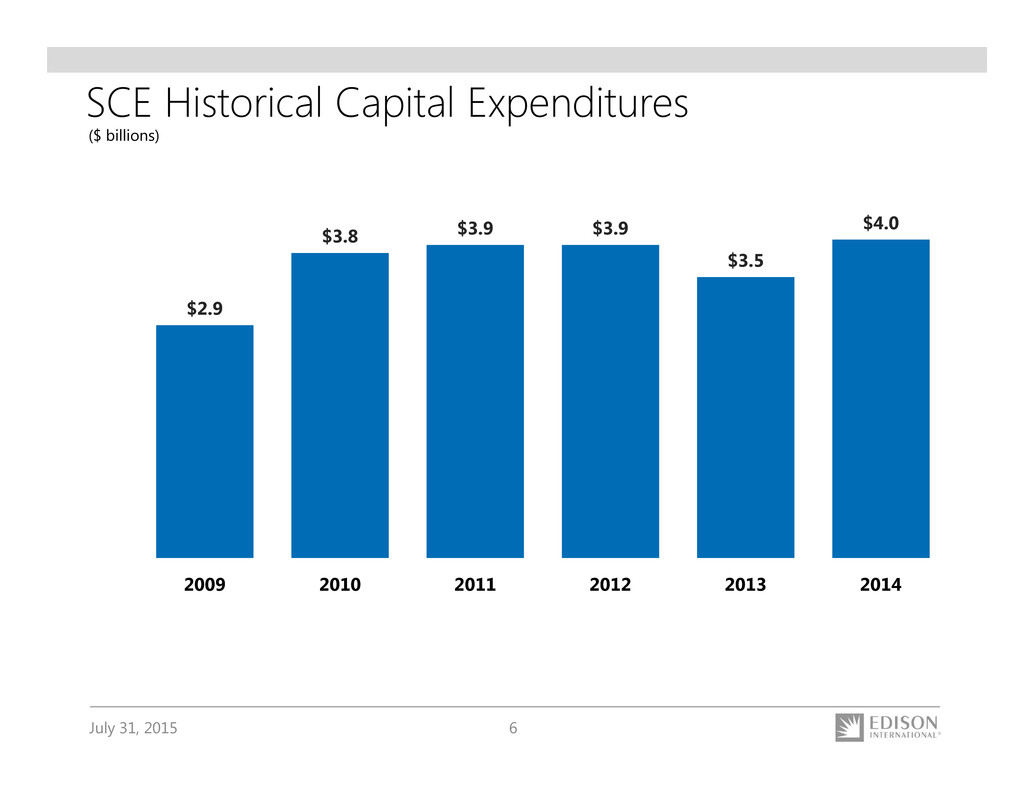

July 31, 2015 6 SCE Historical Capital Expenditures $2.9 $3.8 $3.9 $3.9 $3.5 $4.0 2009 2010 2011 2012 2013 2014 ($ billions)

July 31, 2015 7 $15.0 $16.8 $18.8 $21.0 $21.1 $23.3 2009 2010 2011 2012 2013 2014 SCE Historical Rate Base and Core Earnings Rate Base Core Earnings 9% 12% 2009 – 2014 CAGR Core EPS $4.68$2.68 $3.01 $3.33 $4.10 ($ billions) $3.88 Note: Recorded rate base, year-end basis. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. 2013 and 2014 rate base excludes SONGS

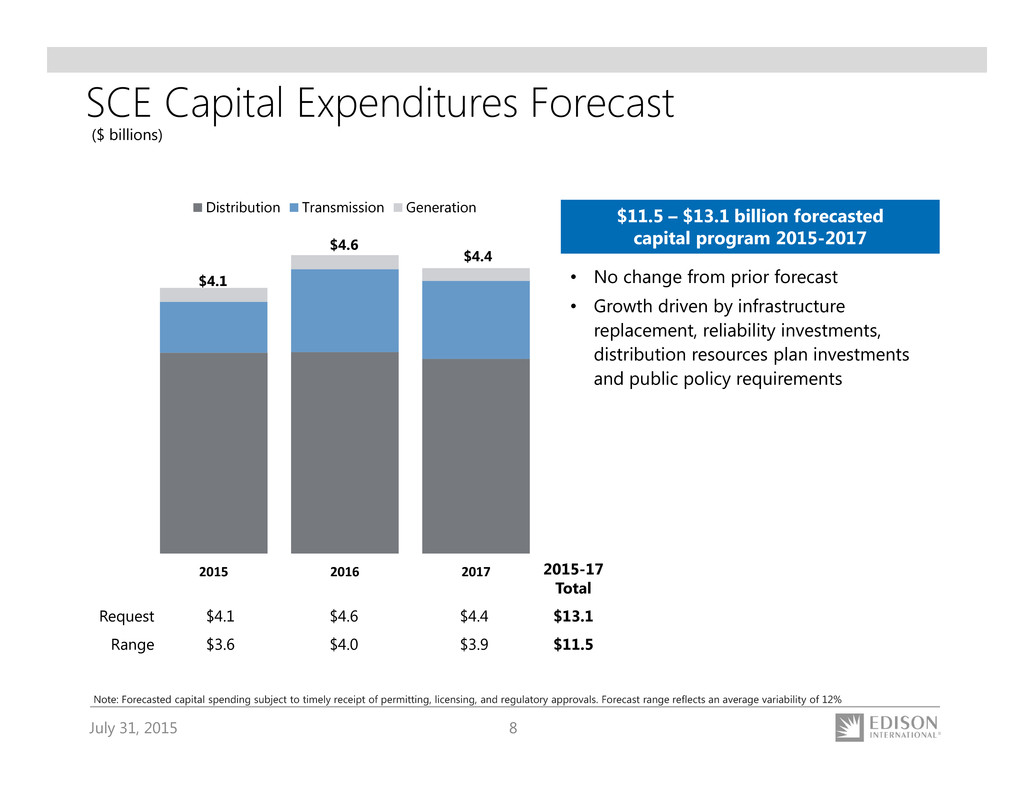

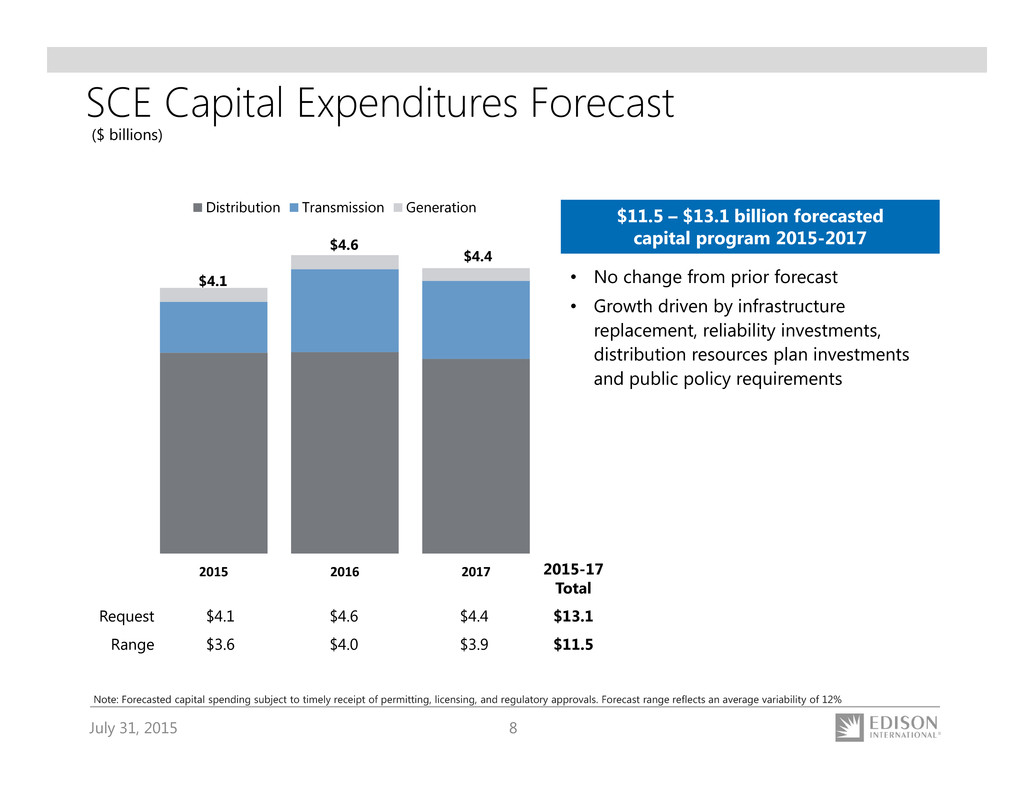

July 31, 2015 8 SCE Capital Expenditures Forecast • No change from prior forecast • Growth driven by infrastructure replacement, reliability investments, distribution resources plan investments and public policy requirements Note: Forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. Forecast range reflects an average variability of 12% ($ billions) 2015-17 Total Request $4.1 $4.6 $4.4 $13.1 Range $3.6 $4.0 $3.9 $11.5 $4.1 $4.6 $4.4 2015 2016 2017 Distribution Transmission Generation $11.5 – $13.1 billion forecasted capital program 2015-2017

July 31, 2015 9 SCE Rate Base Forecast • No change from prior forecast • FERC rate base includes Construction Work in Progress (CWIP) and is approximately 23% of SCE’s rate base forecast by 2017 • Excludes SONGS regulatory asset ($ billions) Request Range $23.1 $25.0 $26.9 $23.6 $26.0 $28.4 2015 2016 2017 Note: Weighted-average year basis, 2015-2017 CPUC rate base requests and consolidation of CWIP projects. Rate base forecast range reflects capital expenditure forecast range 7-9% average annual rate base growth for 2015-2017

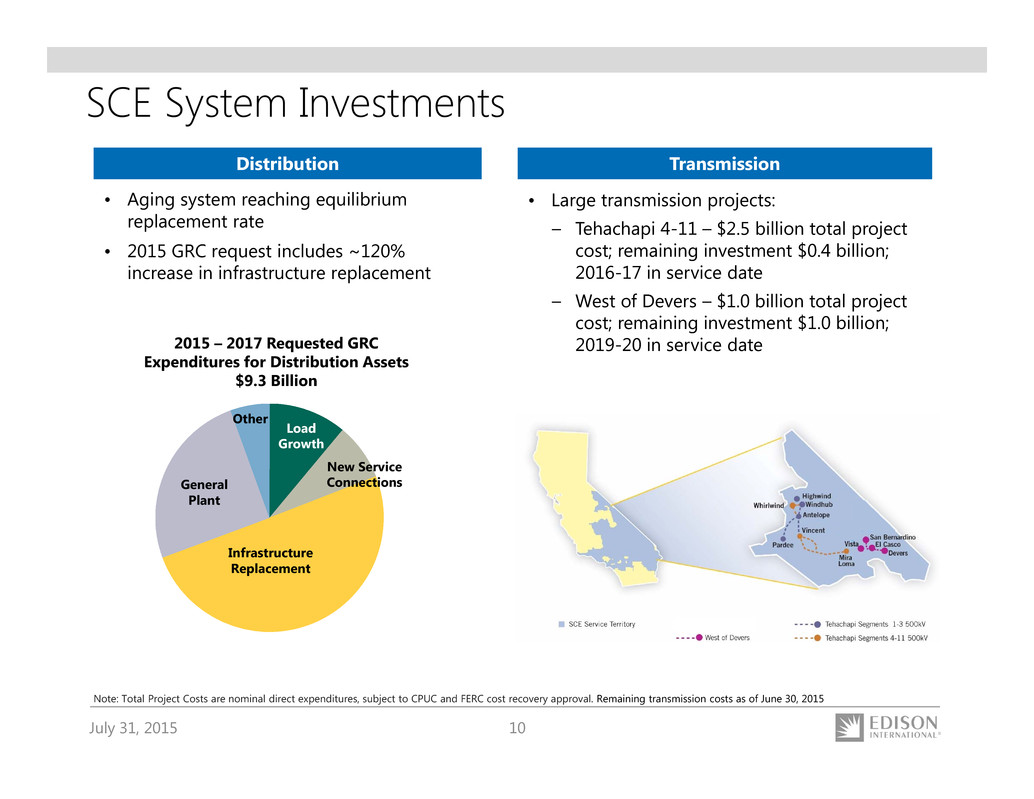

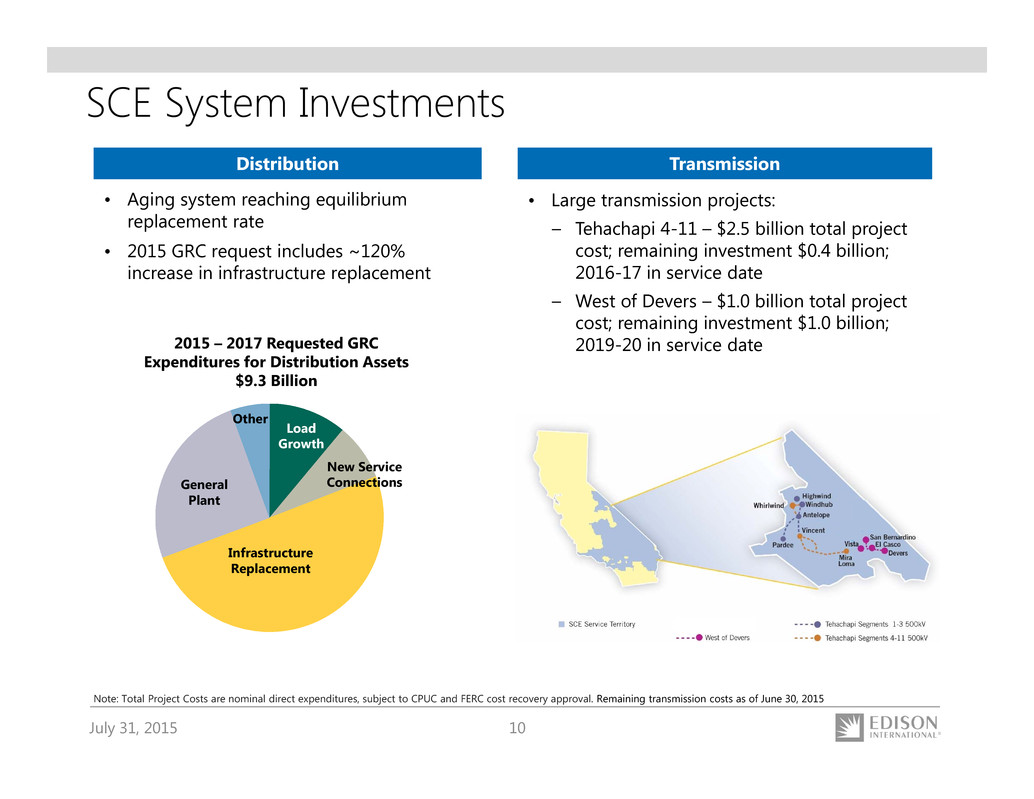

July 31, 2015 10 SCE System Investments Distribution Transmission • Large transmission projects: – Tehachapi 4-11 – $2.5 billion total project cost; remaining investment $0.4 billion; 2016-17 in service date – West of Devers – $1.0 billion total project cost; remaining investment $1.0 billion; 2019-20 in service date • Aging system reaching equilibrium replacement rate • 2015 GRC request includes ~120% increase in infrastructure replacement 2015 – 2017 Requested GRC Expenditures for Distribution Assets $9.3 Billion Load Growth New Service Connections Infrastructure Replacement General Plant Other Note: Total Project Costs are nominal direct expenditures, subject to CPUC and FERC cost recovery approval. Remaining transmission costs as of June 30, 2015

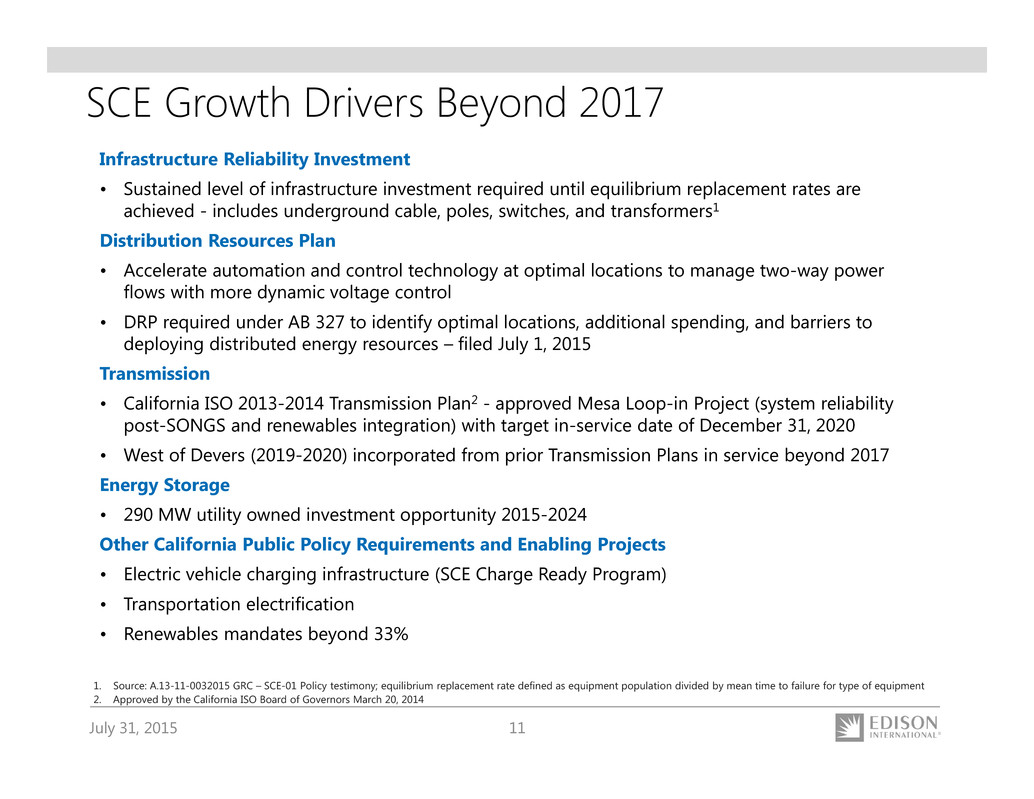

July 31, 2015 11 SCE Growth Drivers Beyond 2017 Infrastructure Reliability Investment • Sustained level of infrastructure investment required until equilibrium replacement rates are achieved - includes underground cable, poles, switches, and transformers1 Distribution Resources Plan • Accelerate automation and control technology at optimal locations to manage two-way power flows with more dynamic voltage control • DRP required under AB 327 to identify optimal locations, additional spending, and barriers to deploying distributed energy resources – filed July 1, 2015 Transmission • California ISO 2013-2014 Transmission Plan2 - approved Mesa Loop-in Project (system reliability post-SONGS and renewables integration) with target in-service date of December 31, 2020 • West of Devers (2019-2020) incorporated from prior Transmission Plans in service beyond 2017 Energy Storage • 290 MW utility owned investment opportunity 2015-2024 Other California Public Policy Requirements and Enabling Projects • Electric vehicle charging infrastructure (SCE Charge Ready Program) • Transportation electrification • Renewables mandates beyond 33% 1. Source: A.13-11-0032015 GRC – SCE-01 Policy testimony; equilibrium replacement rate defined as equipment population divided by mean time to failure for type of equipment 2. Approved by the California ISO Board of Governors March 20, 2014

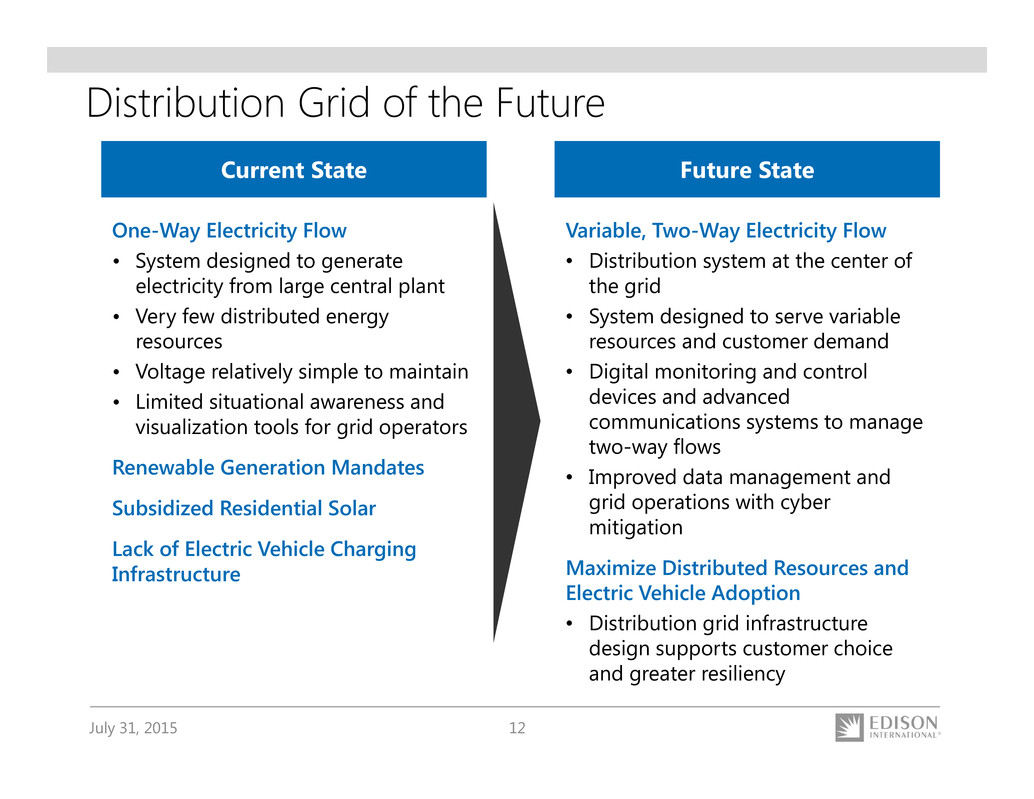

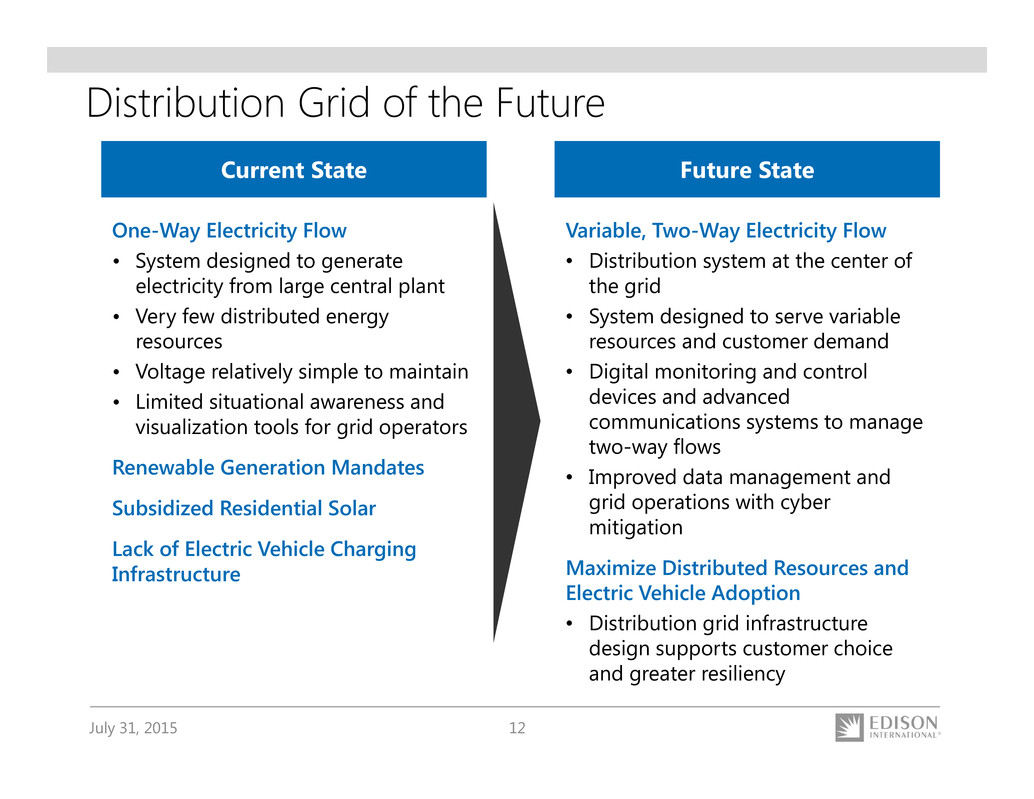

July 31, 2015 12 Distribution Grid of the Future One-Way Electricity Flow • System designed to generate electricity from large central plant • Very few distributed energy resources • Voltage relatively simple to maintain • Limited situational awareness and visualization tools for grid operators Renewable Generation Mandates Subsidized Residential Solar Lack of Electric Vehicle Charging Infrastructure Variable, Two-Way Electricity Flow • Distribution system at the center of the grid • System designed to serve variable resources and customer demand • Digital monitoring and control devices and advanced communications systems to manage two-way flows • Improved data management and grid operations with cyber mitigation Maximize Distributed Resources and Electric Vehicle Adoption • Distribution grid infrastructure design supports customer choice and greater resiliency Current State Future State

July 31, 2015 13 New Technology Grid Impacts 2 1 3 1 1 1 2 2 Future state based on evolving energy landscape More automated and digital, with more sophisticated voltage control and protection schemes Facilitates increasing renewables & two- way power flow Cyber mitigation must be included 1 2 3 1

July 31, 2015 14 AB 327 required IOU submissions of Distribution Resources Plans (DRP) on July 1, 2015 to integrate increasing penetration of Distributed Energy Resources (DERs). Key provisions of the DRP filing include: • Methodology/Tools for identifying optimal locations for DERs (includes distributed generation, energy storage, electric vehicle charging, energy efficiency and demand response) • Enhance the electric system’s capability to integrate more DERs at the distribution level through modernization of system planning tools, design and operations • Technology recommendations (information technology, communications, system planning, voltage and frequency controls, etc.) SCE’s DRP includes a conceptual capital plan • Estimated scope of work, technology roadmap, timeline, and capital and expense cost estimates • Incremental to traditional general rate case expenditures; implementation recommendations proposed to be integrated into future general rate cases beginning with the 2018 filing • Overall capital spending expected to be at least in the range of current forecast levels, although could result in higher spending pending CPUC approval in future GRCs SCE Distribution Resources Plan

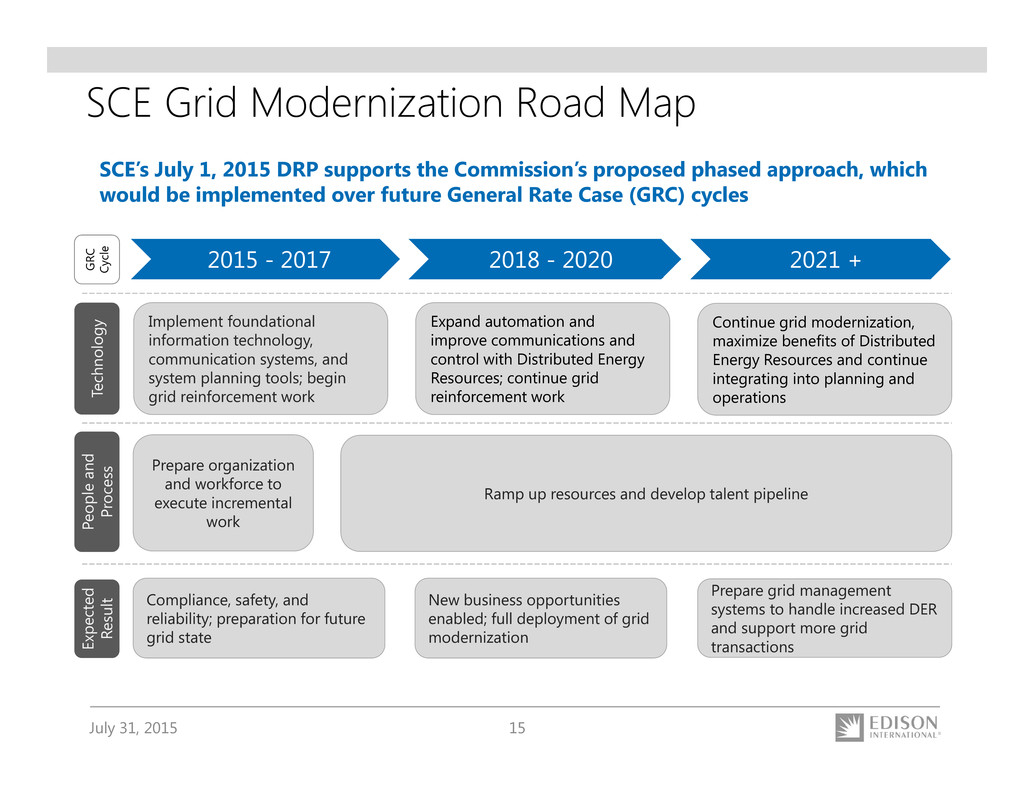

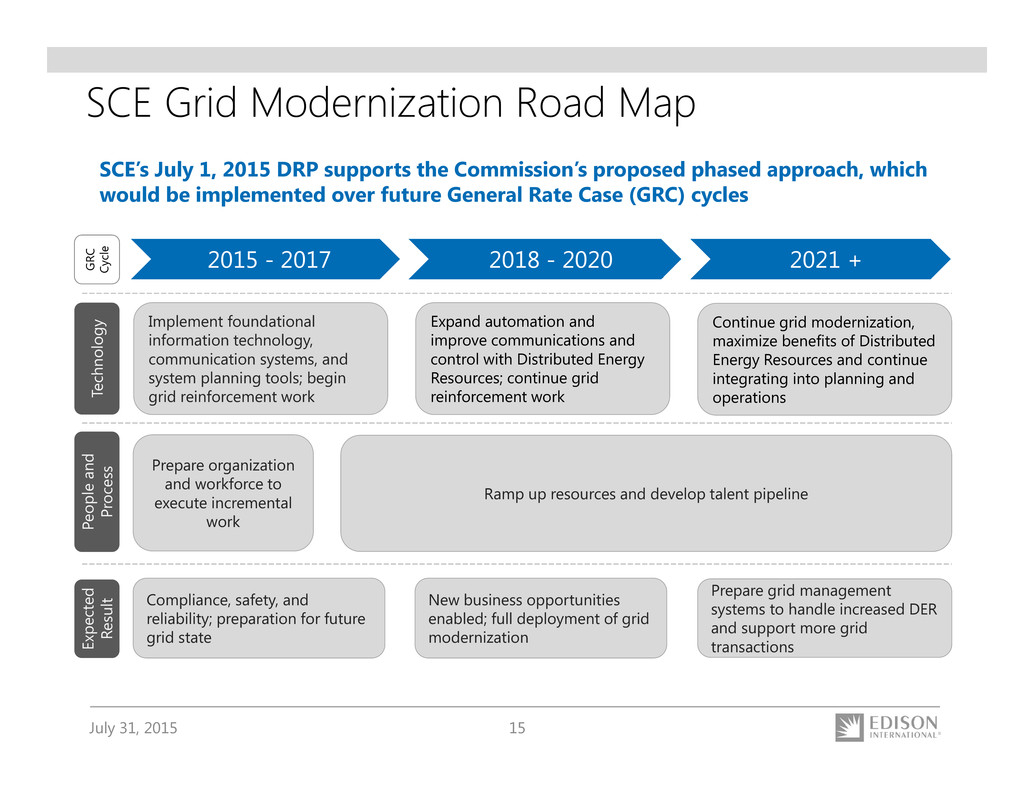

July 31, 2015 15 2015 - 2017 2018 - 2020 2021 + Implement foundational information technology, communication systems, and system planning tools; begin grid reinforcement work Expand automation and improve communications and control with Distributed Energy Resources; continue grid reinforcement work Continue grid modernization, maximize benefits of Distributed Energy Resources and continue integrating into planning and operationsT e c h n o l o g y E x p e c t e d R e s u l t G R C C y c l e Prepare organization and workforce to execute incremental work Ramp up resources and develop talent pipeline Compliance, safety, and reliability; preparation for future grid state New business opportunities enabled; full deployment of grid modernization Prepare grid management systems to handle increased DER and support more grid transactions P e o p l e a n d P r oces s SCE’s July 1, 2015 DRP supports the Commission’s proposed phased approach, which would be implemented over future General Rate Case (GRC) cycles SCE Grid Modernization Road Map

July 31, 2015 16 SCE DRP Capital Expenditure Estimates Time Period Capital Expenditures CPUC Approval Mechanism 2015-2017 Distribution Automation $40-70 million • Proposed memorandum account to record associated revenue requirement until expenditures are authorized by CPUC Substation Automation $30-60 million Communications Systems $7-15 million Technology Platforms and Applications $130-200 million Grid Reinforcement $140-215 million Total $347-560 million 2018-2020 Distribution Automation $185-320 million • Request recovery in 2018 GRCSubstation Automation $185-320 million Communications Systems $270-470 million Technology Platforms and Applications $215-375 million Grid Reinforcement $550-1,100 million Total $1,405-2,585 million SCE anticipates capital spending to continue at least in the range of current forecast levels, although could result in higher spending pending CPUC approval in future GRCs

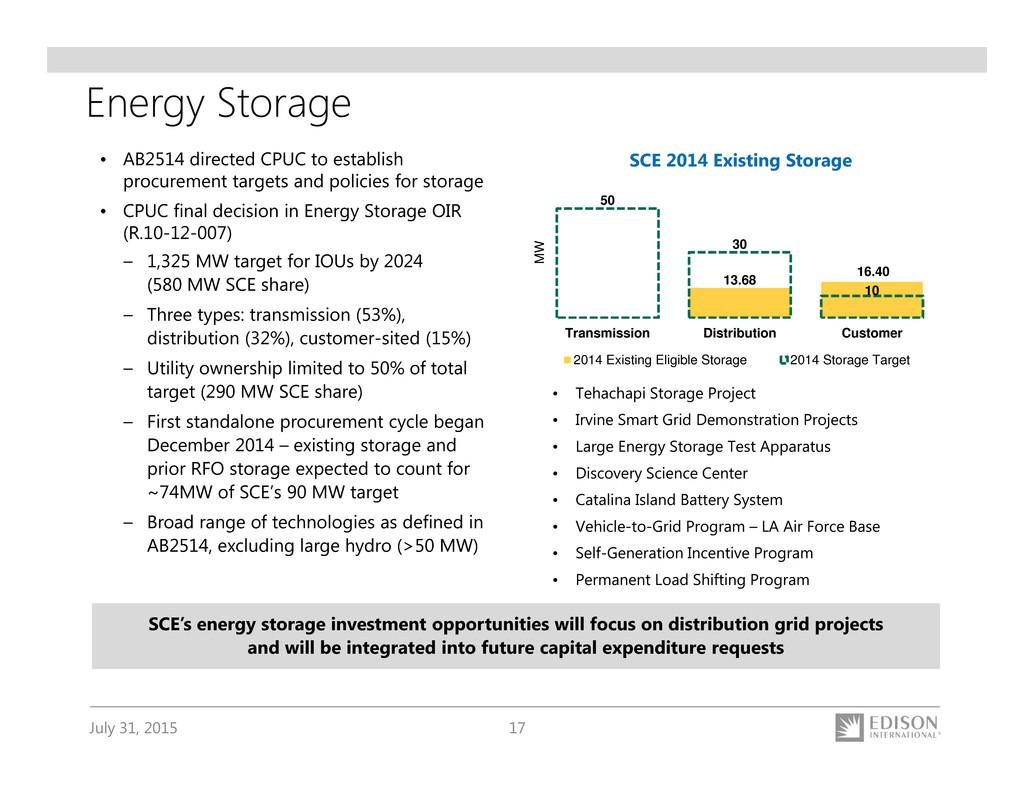

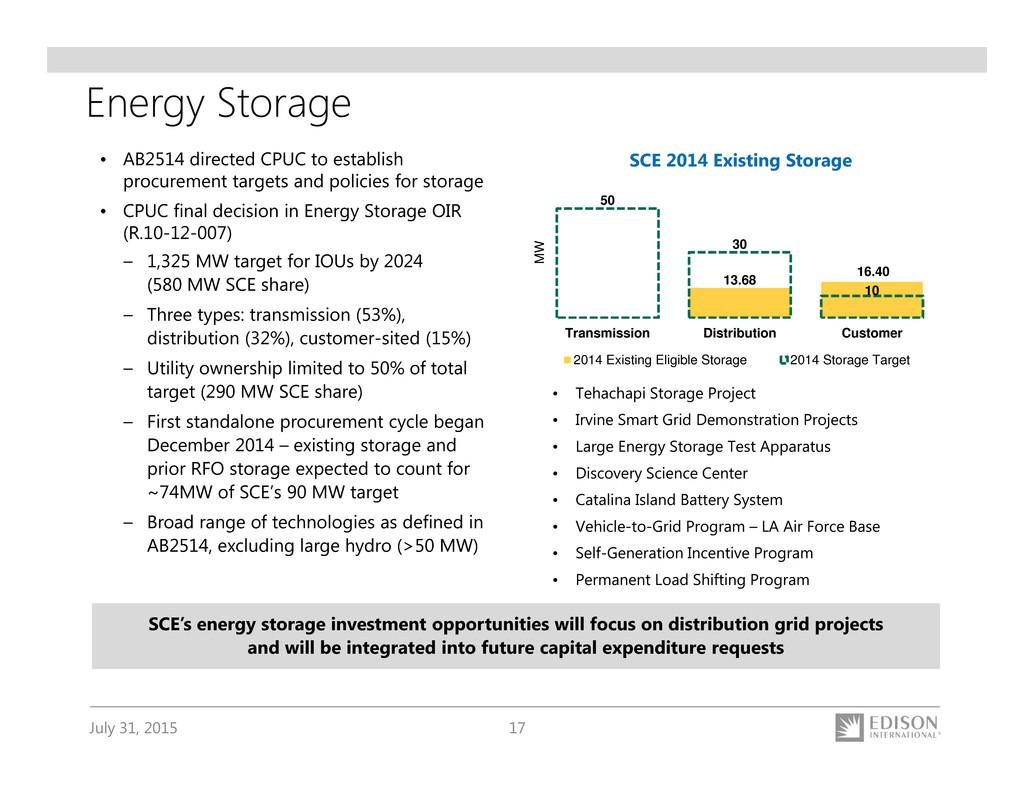

July 31, 2015 17 Energy Storage • AB2514 directed CPUC to establish procurement targets and policies for storage • CPUC final decision in Energy Storage OIR (R.10-12-007) – 1,325 MW target for IOUs by 2024 (580 MW SCE share) – Three types: transmission (53%), distribution (32%), customer-sited (15%) – Utility ownership limited to 50% of total target (290 MW SCE share) – First standalone procurement cycle began December 2014 – existing storage and prior RFO storage expected to count for ~74MW of SCE’s 90 MW target – Broad range of technologies as defined in AB2514, excluding large hydro (>50 MW) SCE 2014 Existing Storage SCE’s energy storage investment opportunities will focus on distribution grid projects and will be integrated into future capital expenditure requests • Tehachapi Storage Project • Irvine Smart Grid Demonstration Projects • Large Energy Storage Test Apparatus • Discovery Science Center • Catalina Island Battery System • Vehicle-to-Grid Program – LA Air Force Base • Self-Generation Incentive Program • Permanent Load Shifting Program 13.68 16.40 50 30 10 Transmission Distribution Customer M W 2014 Existing Eligible Storage 2014 Storage Target

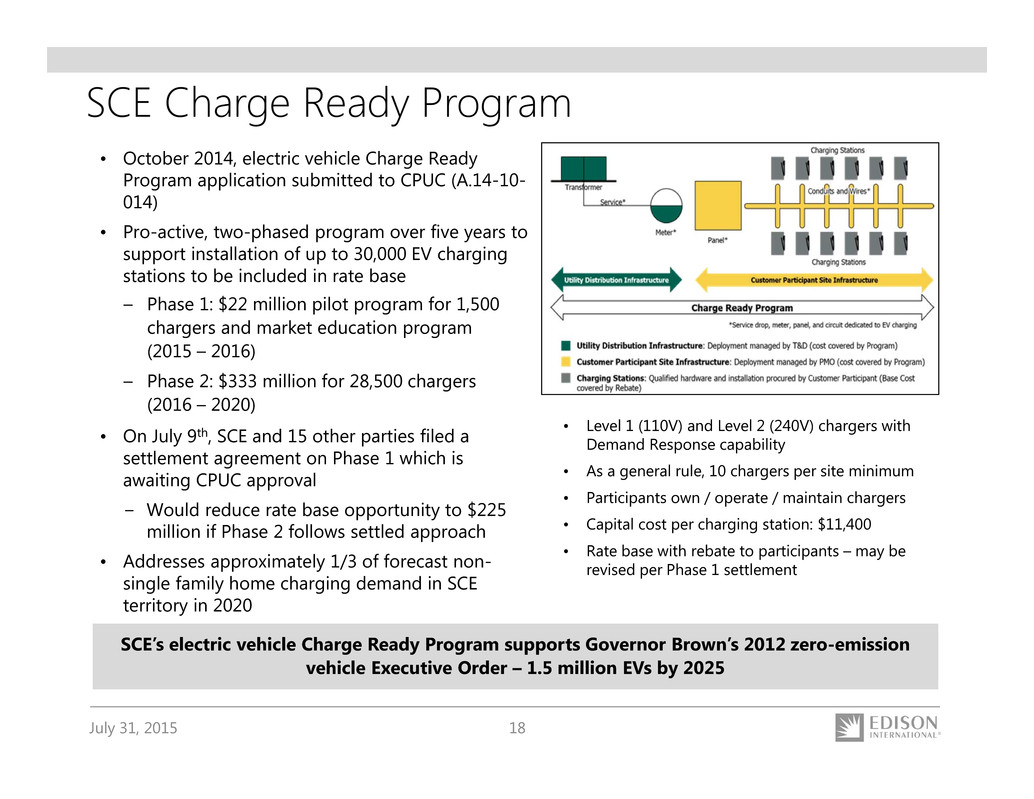

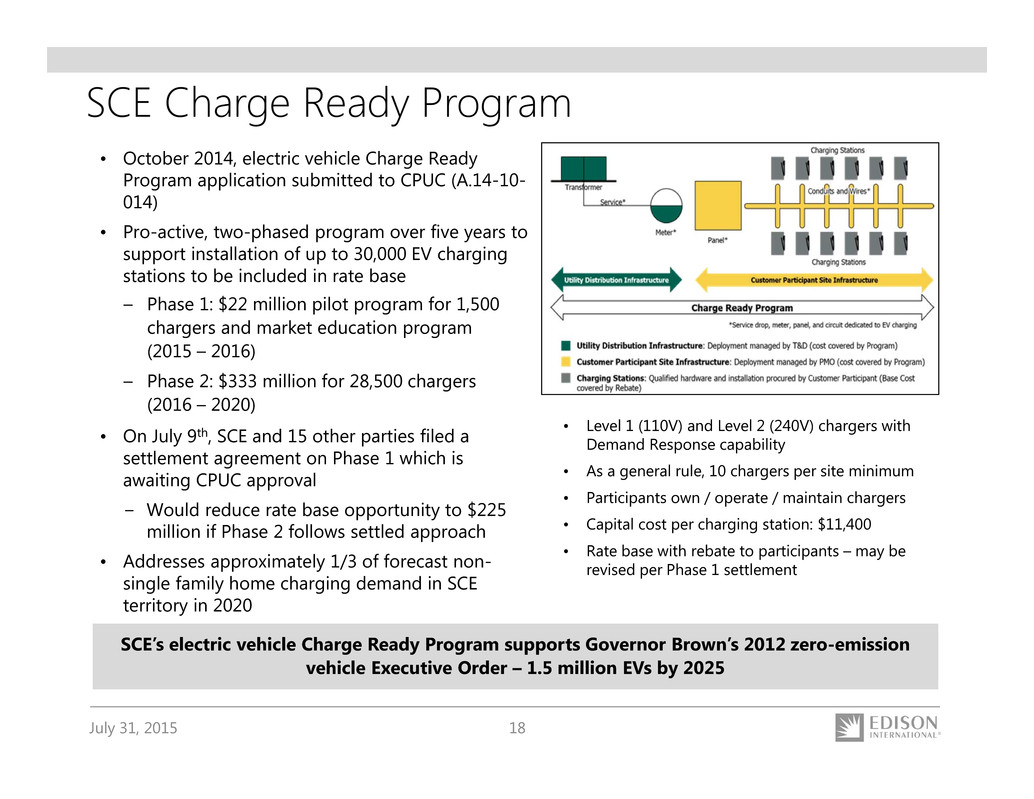

July 31, 2015 18 SCE Charge Ready Program • October 2014, electric vehicle Charge Ready Program application submitted to CPUC (A.14-10- 014) • Pro-active, two-phased program over five years to support installation of up to 30,000 EV charging stations to be included in rate base – Phase 1: $22 million pilot program for 1,500 chargers and market education program (2015 – 2016) – Phase 2: $333 million for 28,500 chargers (2016 – 2020) • On July 9th, SCE and 15 other parties filed a settlement agreement on Phase 1 which is awaiting CPUC approval − Would reduce rate base opportunity to $225 million if Phase 2 follows settled approach • Addresses approximately 1/3 of forecast non- single family home charging demand in SCE territory in 2020 SCE’s electric vehicle Charge Ready Program supports Governor Brown’s 2012 zero-emission vehicle Executive Order – 1.5 million EVs by 2025 • Level 1 (110V) and Level 2 (240V) chargers with Demand Response capability • As a general rule, 10 chargers per site minimum • Participants own / operate / maintain chargers • Capital cost per charging station: $11,400 • Rate base with rebate to participants – may be revised per Phase 1 settlement

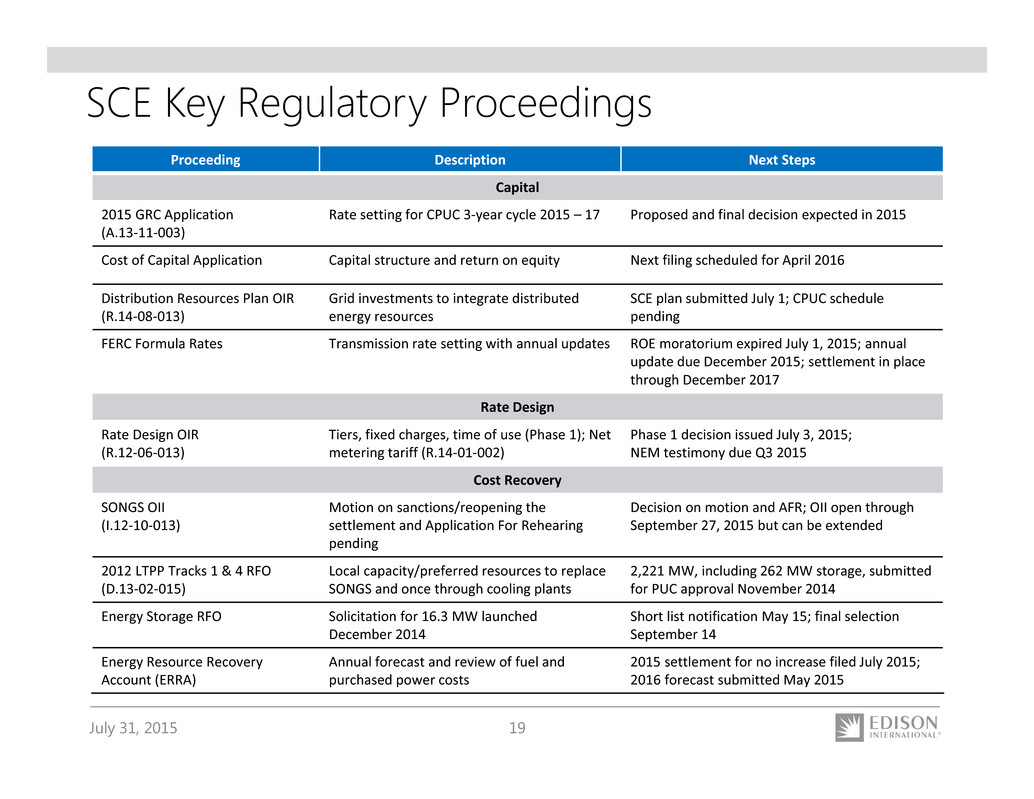

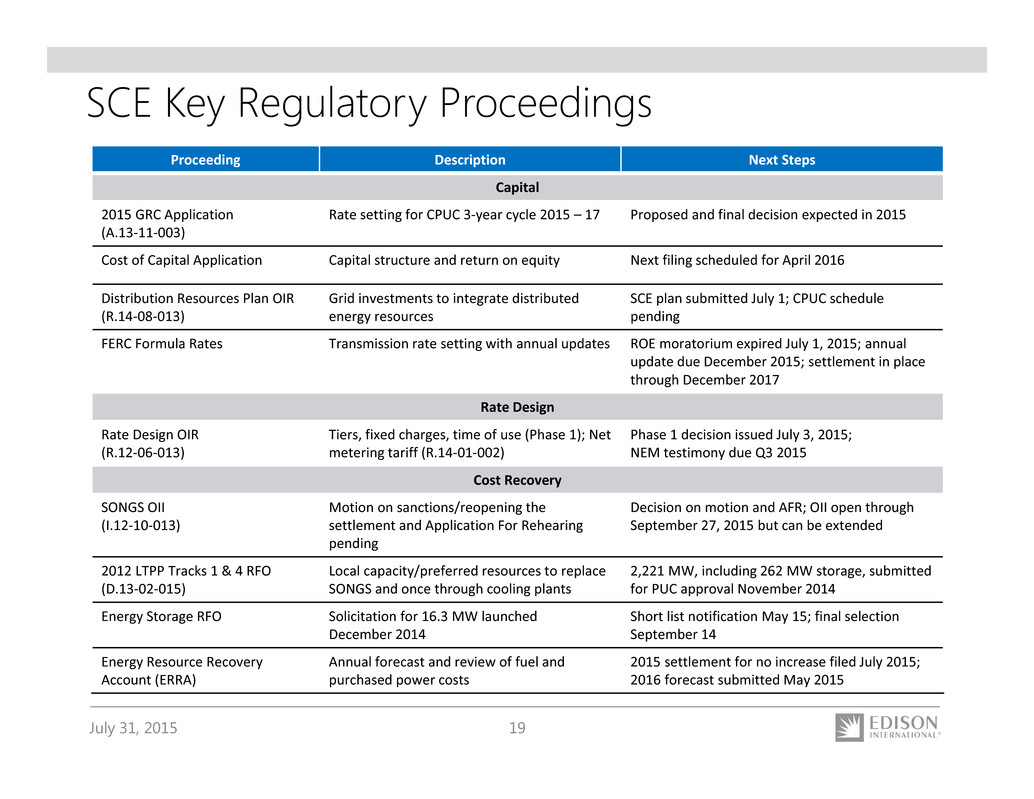

July 31, 2015 19 SCE Key Regulatory Proceedings Proceeding Description Next Steps Capital 2015 GRC Application (A.13‐11‐003) Rate setting for CPUC 3‐year cycle 2015 – 17 Proposed and final decision expected in 2015 Cost of Capital Application Capital structure and return on equity Next filing scheduled for April 2016 Distribution Resources Plan OIR (R.14‐08‐013) Grid investments to integrate distributed energy resources SCE plan submitted July 1; CPUC schedule pending FERC Formula Rates Transmission rate setting with annual updates ROE moratorium expired July 1, 2015; annual update due December 2015; settlement in place through December 2017 Rate Design Rate Design OIR (R.12‐06‐013) Tiers, fixed charges, time of use (Phase 1); Net metering tariff (R.14‐01‐002) Phase 1 decision issued July 3, 2015; NEM testimony due Q3 2015 Cost Recovery SONGS OII (I.12‐10‐013) Motion on sanctions/reopening the settlement and Application For Rehearing pending Decision on motion and AFR; OII open through September 27, 2015 but can be extended 2012 LTPP Tracks 1 & 4 RFO (D.13‐02‐015) Local capacity/preferred resources to replace SONGS and once through cooling plants 2,221 MW, including 262 MW storage, submitted for PUC approval November 2014 Energy Storage RFO Solicitation for 16.3 MW launched December 2014 Short list notification May 15; final selection September 14 Energy Resource Recovery Account (ERRA) Annual forecast and review of fuel and purchased power costs 2015 settlement for no increase filed July 2015; 2016 forecast submitted May 2015

July 31, 2015 20 SCE 2015 CPUC General Rate Case November 2013, 2015 GRC Application A.13-11-003 sets 2015 – 2017 base revenue requirement • Includes operating costs and CPUC jurisdictional capital • Excludes fuel and purchased power (and other utility cost-recovery activities), cost of capital, and FERC jurisdictional transmission 2015 revenue requirement request of $5.512 billion • $121 million decrease from presently authorized base rates based on May 11th update filing • Post test year requested year-over-year increase of $236 million in 2016 and additional increase of $320 million in 2017 Request consistent with SCE strategy to ramp up infrastructure investment consistent with capital plan while mitigating customer rate impacts through productivity and lower operating costs Current CPUC schedule does not specify a proposed decision timeframe Nov 12 GRC Application Aug 18 Intervener Testimony Sept 29 Evidentiary Hearings 2013 2014 Feb 11 Prehearing Conference Jan 13 Update Hearing 2015 Aug 4 ORA Testimony Nov 25 Opening Briefs Dec 11 Reply Briefs Final Decision Expected May 11 Update Filing

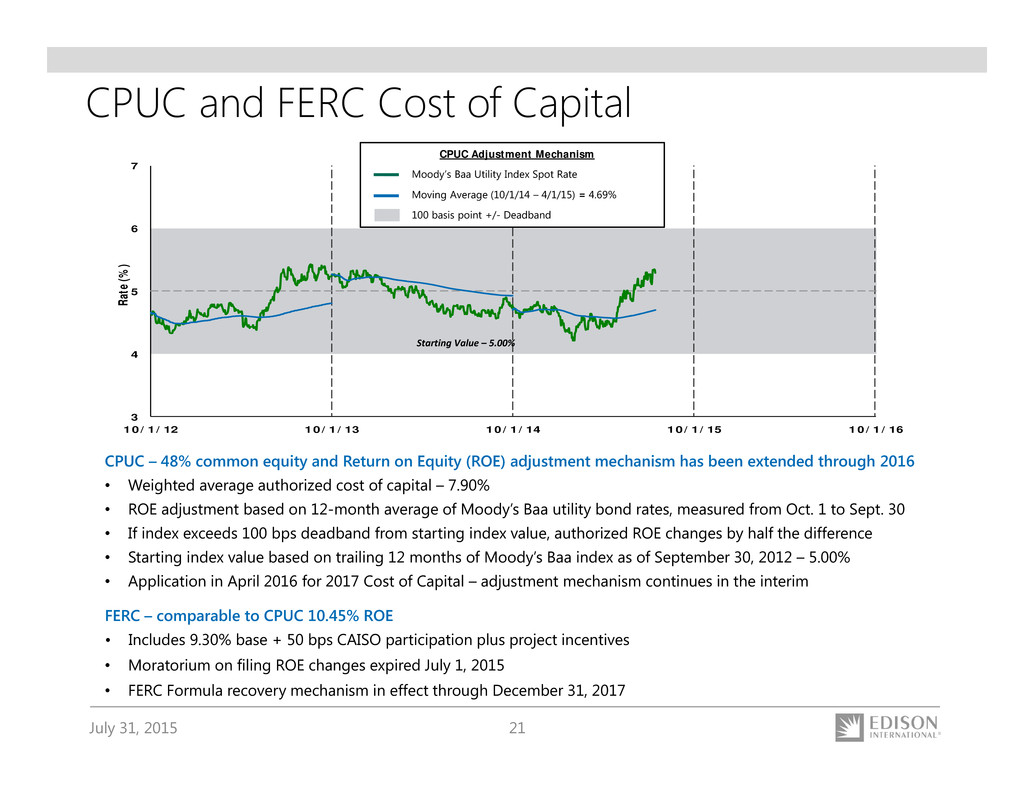

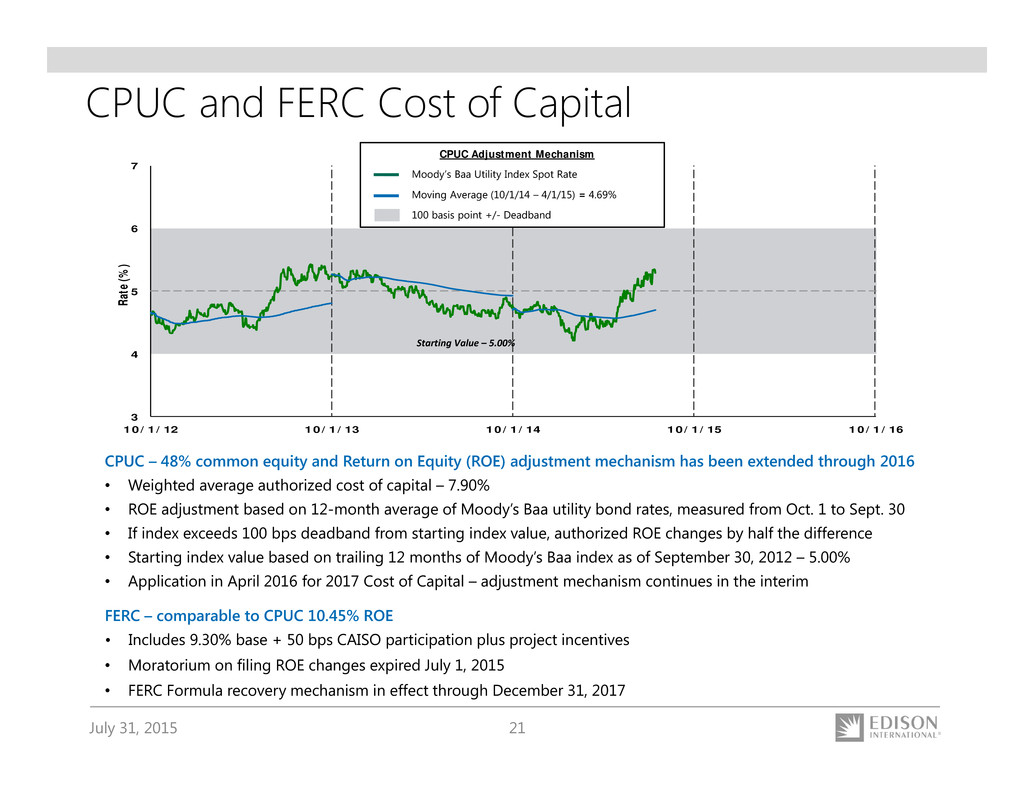

July 31, 2015 21 CPUC and FERC Cost of Capital 3 4 5 6 7 10/1/12 10/1/13 10/1/14 10/1/15 10/1/16 R a t e ( % ) CPUC Adjustment Mechanism Moody’s Baa Utility Index Spot Rate Moving Average (10/1/14 – 4/1/15) = 4.69% 100 basis point +/- Deadband Starting Value – 5.00% CPUC – 48% common equity and Return on Equity (ROE) adjustment mechanism has been extended through 2016 • Weighted average authorized cost of capital – 7.90% • ROE adjustment based on 12-month average of Moody’s Baa utility bond rates, measured from Oct. 1 to Sept. 30 • If index exceeds 100 bps deadband from starting index value, authorized ROE changes by half the difference • Starting index value based on trailing 12 months of Moody’s Baa index as of September 30, 2012 – 5.00% • Application in April 2016 for 2017 Cost of Capital – adjustment mechanism continues in the interim FERC – comparable to CPUC 10.45% ROE • Includes 9.30% base + 50 bps CAISO participation plus project incentives • Moratorium on filing ROE changes expired July 1, 2015 • FERC Formula recovery mechanism in effect through December 31, 2017

July 31, 2015 22 Residential Rate Design OIR • CPUC Order Instituting Ratemaking R.12-06-013 includes comprehensive review of residential rate structure including a future transition to time of use rates • July 2015 CPUC Decision includes: - Transition to 2 tiered rates by 2019 - “Super User Electric Surcharge” for usage 400% above baseline (~4% of current residential load) - Continue fixed charge at $0.94/month; allows for consideration of increased fixed charges in future - Minimum bills up to $10/month which applies to delivery revenue only • Net Energy Metering (R.14-07-002): successor tariff due Q4 2015 Current Rates – July 2015 17.8¢ 39.9¢ 100% 101‐400% >400% 22.8¢ Usage Level (% of Baseline) ¢ / k W h Future Rates - 2019 Usage Level (% of Baseline) 14.9¢ 25.4¢ 30.9¢ 100% 101‐ 130% 131‐ 200% 200‐400% >400% 19.3¢ ¢ / k W h Fixed Charge: $0.94/month Minimum Bill: $1.79/month Fixed Charge: $0.94/month Minimum Bill: $10.00/month Note: Graphs not to scale. 2019 rate levels are based on current revenue requirements

July 31, 2015 23 SCE Residential Net Metering Rate Structure 7¢ 24¢17¢ 0 5 10 15 20 25 30 ¢ / k W h Solar Subsidies (Illustrative) Avoided Generation Subsidy Paid by Other Ratepayers Equivalent Solar Offset Current rate design results in residential solar customers receiving a subsidy funded by all other non-solar customers SCE’s Rate Developments: • Residential solar customer generation offsets total retail rate via Net Energy Metering (NEM) structure • Through tiered rate flattening, Residential Rate OIR decision will reduce subsidy paid by non-solar customers by about 20% • 20-year NEM grandfathering at retail rate for installations up to 5% cap (2,240 MW for SCE) interconnected before July 2017 • On August 3rd, SCE (and other parties) will file rate proposals with the CPUC that are more reflective of distributed energy systems’ total costs and benefits SCE 2014 Net Energy Metering Statistics: • 103,900 combined residential and non-residential projects – 880 MW installed (of 2,240 MW cap) – 99.5% solar – 100,300 residential – 500 MW – 3,600 non-residential – 380 MW • Approximately 1,270,000 kWh / year generated

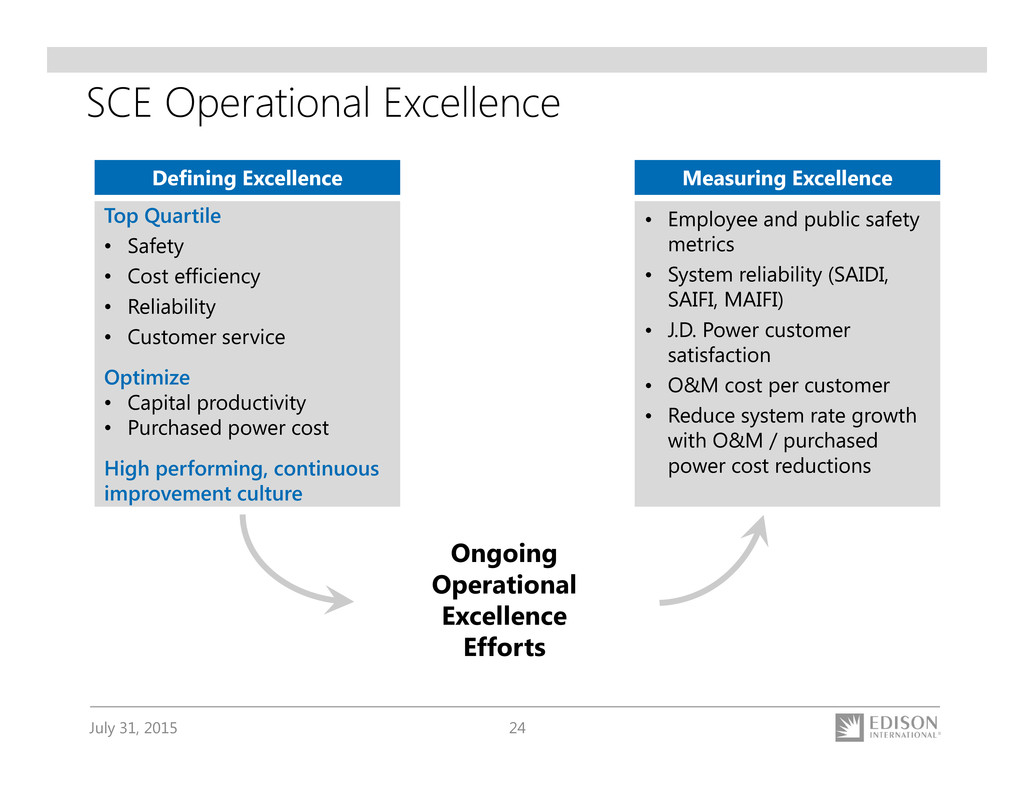

July 31, 2015 24 SCE Operational Excellence Top Quartile • Safety • Cost efficiency • Reliability • Customer service Optimize • Capital productivity • Purchased power cost High performing, continuous improvement culture Defining Excellence Measuring Excellence • Employee and public safety metrics • System reliability (SAIDI, SAIFI, MAIFI) • J.D. Power customer satisfaction • O&M cost per customer • Reduce system rate growth with O&M / purchased power cost reductions Ongoing Operational Excellence Efforts

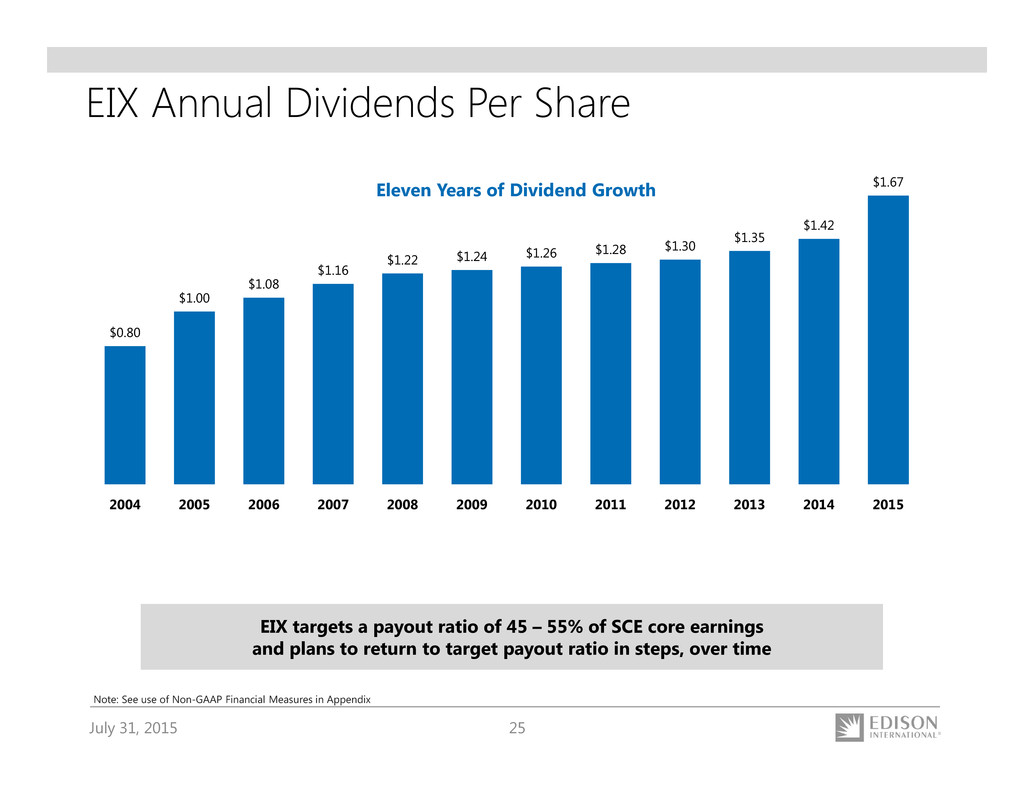

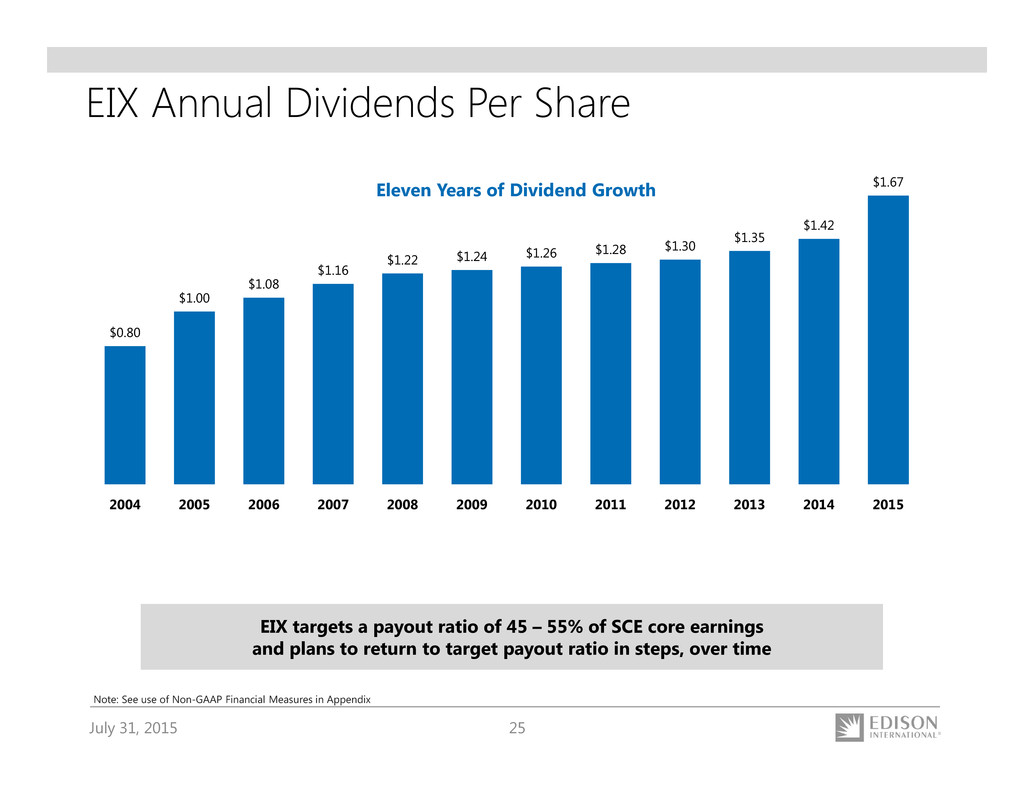

July 31, 2015 25 EIX Annual Dividends Per Share $0.80 $1.00 $1.08 $1.16 $1.22 $1.24 $1.26 $1.28 $1.30 $1.35 $1.42 $1.67 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Note: See use of Non-GAAP Financial Measures in Appendix Eleven Years of Dividend Growth EIX targets a payout ratio of 45 – 55% of SCE core earnings and plans to return to target payout ratio in steps, over time

July 31, 2015 26 Appendix

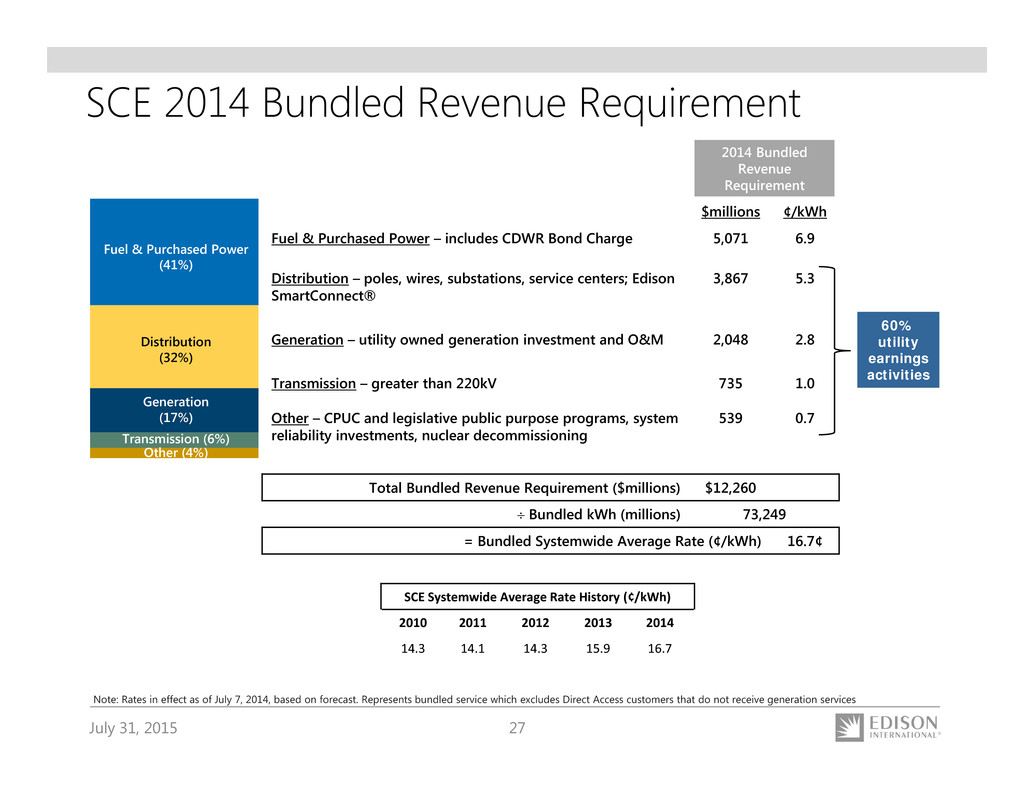

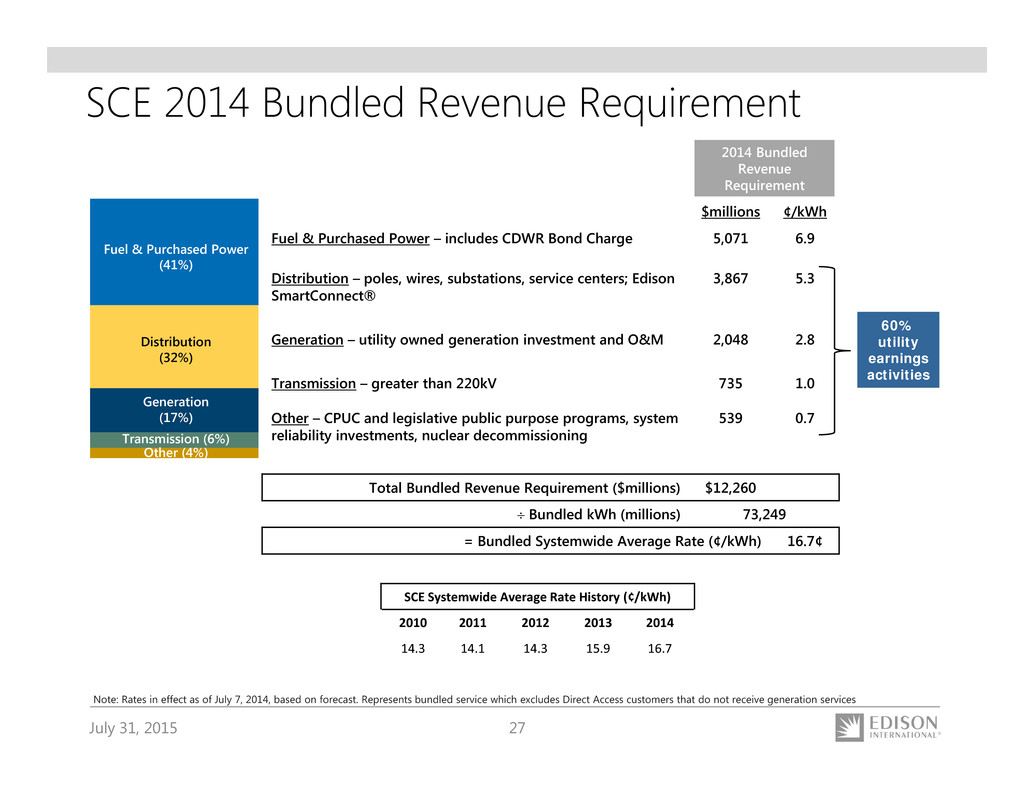

July 31, 2015 27 SCE 2014 Bundled Revenue Requirement Note: Rates in effect as of July 7, 2014, based on forecast. Represents bundled service which excludes Direct Access customers that do not receive generation services 60% utility earnings activities SCE Systemwide Average Rate History (¢/kWh) 2010 2011 2012 2013 2014 14.3 14.1 14.3 15.9 16.7 Fuel & Purchased Power (41%) Distribution (32%) Transmission (6%) Generation (17%) Other (4%) 2014 Bundled Revenue Requirement $millions ¢/kWh Fuel & Purchased Power – includes CDWR Bond Charge 5,071 6.9 Distribution – poles, wires, substations, service centers; Edison SmartConnect® 3,867 5.3 Generation – utility owned generation investment and O&M 2,048 2.8 Transmission – greater than 220kV 735 1.0 Other – CPUC and legislative public purpose programs, system reliability investments, nuclear decommissioning 539 0.7 Total Bundled Revenue Requirement ($millions) $12,260 Bundled kWh (millions) 73,249 = Bundled Systemwide Average Rate (¢/kWh) 16.7¢

July 31, 2015 28 SCE Rates and Bills Comparison 12.9 16.4 US Average SCE 27% Higher • SCE’s residential rates are above national average due, in part, to a cleaner fuel mix – cost for renewables are higher than high carbon sources • Average monthly residential bills are lower than national average – higher rate levels offset by lower usage – 42% lower SCE residential customer usage than national average, from mild climate and higher energy efficiency building standards • Public policy mandates (33% RPS, AB32 GHG, Once-through Cooling) and electric system requirements will drive rates and bills higher 2014 Average Residential Rates (¢/kWh) 2014 Average Residential Bills ($ per Month) Key Factors ¢ ¢ SCE’s average residential rates are above national average, but residential bills are below national average due to lower energy usage $127 $94 US Average SCE 26% Lower Source: EIA's Form 826 Data Monthly Electric Utility Sales and Revenue Data for 2014

July 31, 2015 29 SCE Customer Demand Trends Kilowatt-Hour Sales (millions of kWh) Residential Commercial Industrial Public authorities Agricultural and other Subtotal Resale Total Kilowatt-Hour Sales Customers Residential Commercial Industrial Public authorities Agricultural Railroads and railways Interdepartmental Total Number of Customers Number of New Connections Area Peak Demand (MW) 2012 30,563 40,541 8,504 5,196 1,676 86,480 1,735 88,215 4,321,171 549,855 10,922 46,493 21,917 83 24 4,950,465 22,866 21,996 2011 29,631 39,622 8,490 5,206 1,318 84,267 3,071 87,338 4,301,969 546,936 11,370 46,684 22,086 82 22 4,929,149 19,829 22,443 2013 29,889 40,649 8,472 5,012 1,885 85,907 1,490 87,397 4,344,429 554,592 10,584 46,323 21,679 99 23 4,977,729 27,370 22,534 Note: See 2014 Edison International Financial and Statistical Reports for further information 2014 30,115 42,127 8,417 4,990 2,025 87,674 1,312 88,986 4,368,897 557,957 10,782 46,234 21,404 105 22 5,005,401 29,879 23,055 YTD 2015 12,782 20,104 3,792 2,264 864 39,806 414 40,220 4,381,124 559,594 10,893 46,343 21,401 118 22 5,019,495 12,626 N/A

July 31, 2015 30 (Southern California) Source: Energy Information Administration, July 2015. Data is for SP-15 Nodes Wholesale Electricity Prices, May 2014-June 2015

July 31, 2015 31 The Future of California Energy Policy January 2015, Governor Brown’s inauguration speech outlined environmental objectives for 2030 which are currently being considered by the legislature (SB 350) • Increase renewables (RPS) to 50% • Reduce petroleum use in cars by 50% • Double efficiency of existing buildings Renewables Electric Vehicles Energy Efficiency Legislative action, regulation, grid investment • Renewable Portfolio Standard (RPS) – mandate, currently 33% by 2020 • Clean Energy Standard (CES) – emissions targets met through optimization of renewables, transportation, energy efficiency Utility participation through infrastructure investment • SCE Charge Ready application • Distribution grid investments to meet EV impact Continuation of utility programs and earnings incentive mechanism • SCE 2015 program budget: $333 million • $0.05 per share 2015 earnings potential Utility Role

July 31, 2015 32 • Assembly Bill 32 (2006) – reduces State greenhouse gas (GHG) emissions to 1990 levels by 2020 (~16% reduction) • Cap and trade program basics: – State-wide cap in 2013 – decreases over time – Compliance met through allowances, offsets, or emissions reductions – Excess allowances sold, or “banked” for future use – January 2014 – merger with Quebec cap and trade program • SCE received 32.3 million 2013 allowances vs. a financial exposure to only 21.9 million metric tons of GHG emissions that same year • Allowances sold into quarterly auction and bought back for compliance – SB 1018 (2012) – auction revenues used for rate relief for residential (~93%), small business, and large industrial customers AB32 Emissions Reduction Programs Cap & Trade 22% Other 23% Low Carbon Fuel Standard 19% RPS 14% Energy Efficiency 15% High GWP Gases 7% California Cap and Trade Program

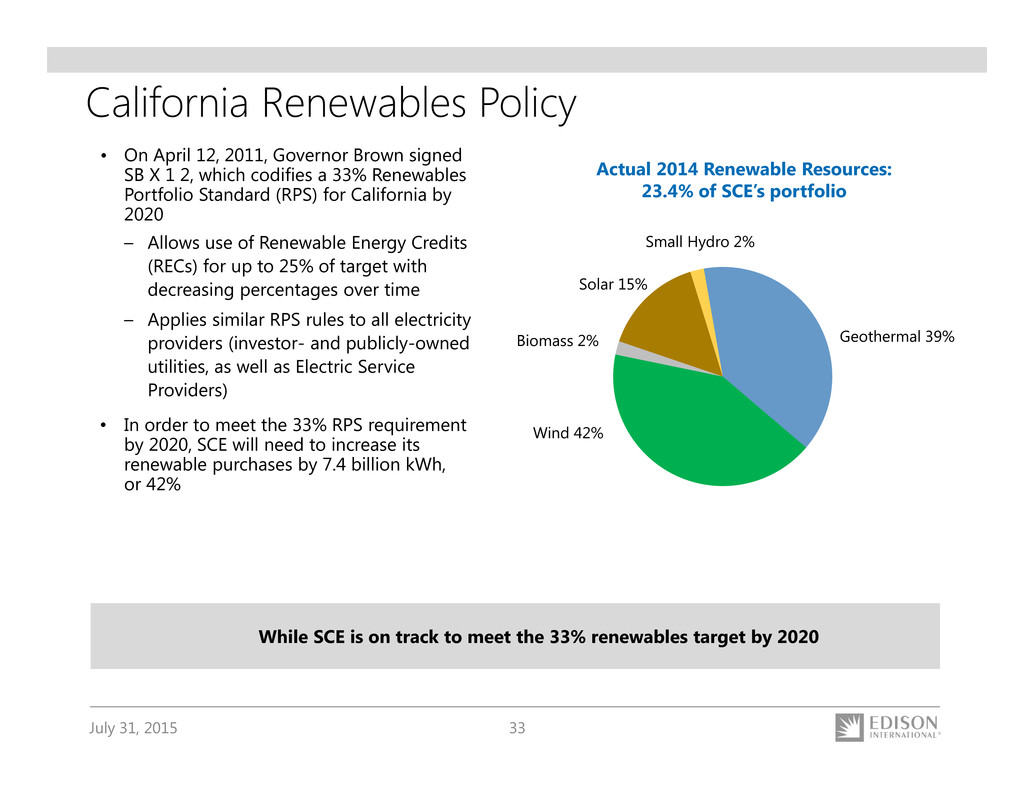

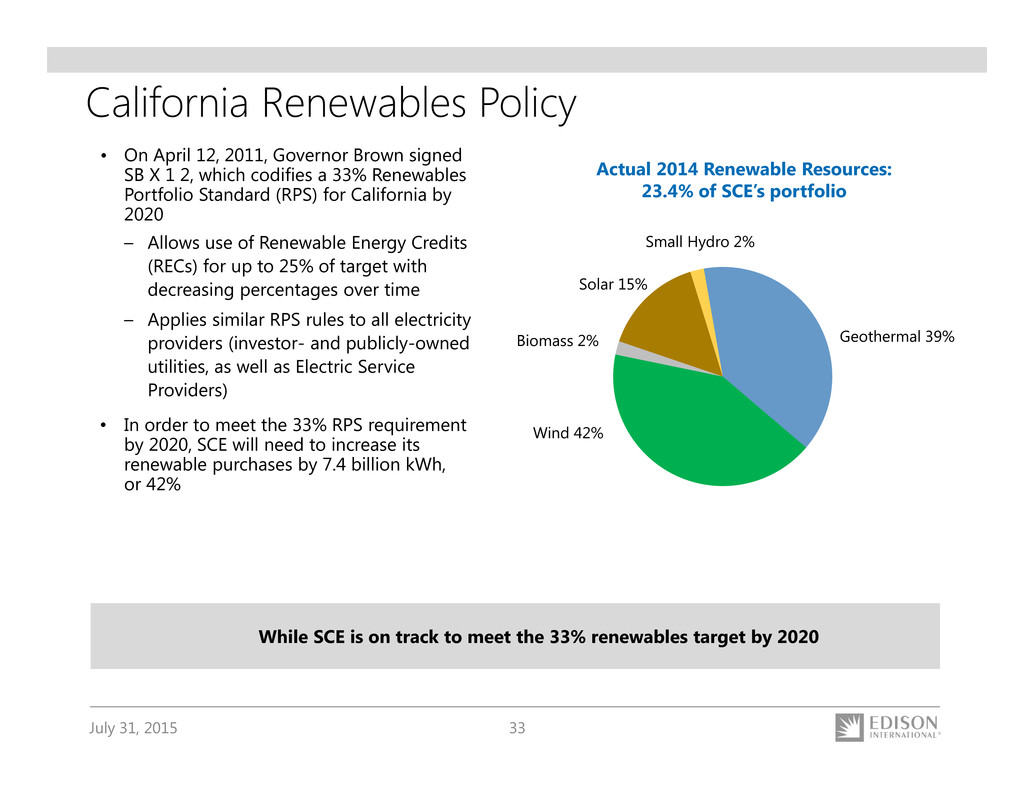

July 31, 2015 33 California Renewables Policy • On April 12, 2011, Governor Brown signed SB X 1 2, which codifies a 33% Renewables Portfolio Standard (RPS) for California by 2020 – Allows use of Renewable Energy Credits (RECs) for up to 25% of target with decreasing percentages over time – Applies similar RPS rules to all electricity providers (investor- and publicly-owned utilities, as well as Electric Service Providers) • In order to meet the 33% RPS requirement by 2020, SCE will need to increase its renewable purchases by 7.4 billion kWh, or 42% While SCE is on track to meet the 33% renewables target by 2020 Solar 15% Small Hydro 2% Geothermal 39%Biomass 2% Wind 42% Actual 2014 Renewable Resources: 23.4% of SCE’s portfolio

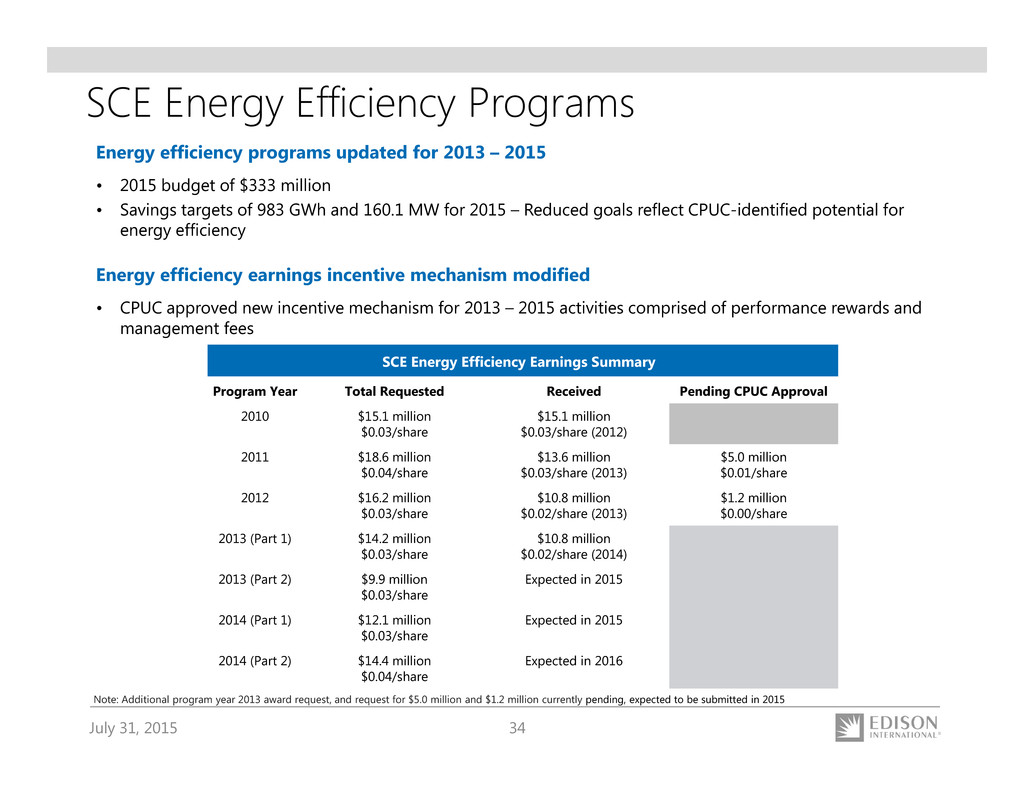

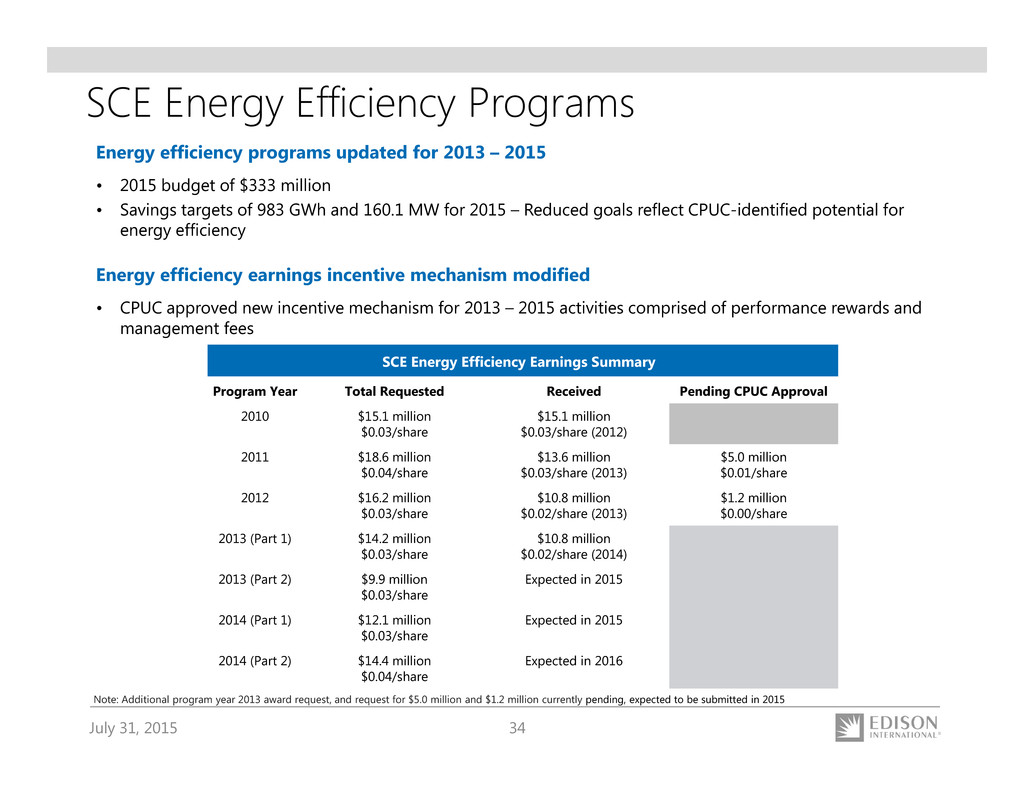

July 31, 2015 34 SCE Energy Efficiency Earnings Summary Program Year Total Requested Received Pending CPUC Approval 2010 $15.1 million $0.03/share $15.1 million $0.03/share (2012) 2011 $18.6 million $0.04/share $13.6 million $0.03/share (2013) $5.0 million $0.01/share 2012 $16.2 million $0.03/share $10.8 million $0.02/share (2013) $1.2 million $0.00/share 2013 (Part 1) $14.2 million $0.03/share $10.8 million $0.02/share (2014) 2013 (Part 2) $9.9 million $0.03/share Expected in 2015 2014 (Part 1) $12.1 million $0.03/share Expected in 2015 2014 (Part 2) $14.4 million $0.04/share Expected in 2016 SCE Energy Efficiency Programs Energy efficiency programs updated for 2013 – 2015 • 2015 budget of $333 million • Savings targets of 983 GWh and 160.1 MW for 2015 – Reduced goals reflect CPUC-identified potential for energy efficiency Energy efficiency earnings incentive mechanism modified • CPUC approved new incentive mechanism for 2013 – 2015 activities comprised of performance rewards and management fees Note: Additional program year 2013 award request, and request for $5.0 million and $1.2 million currently pending, expected to be submitted in 2015

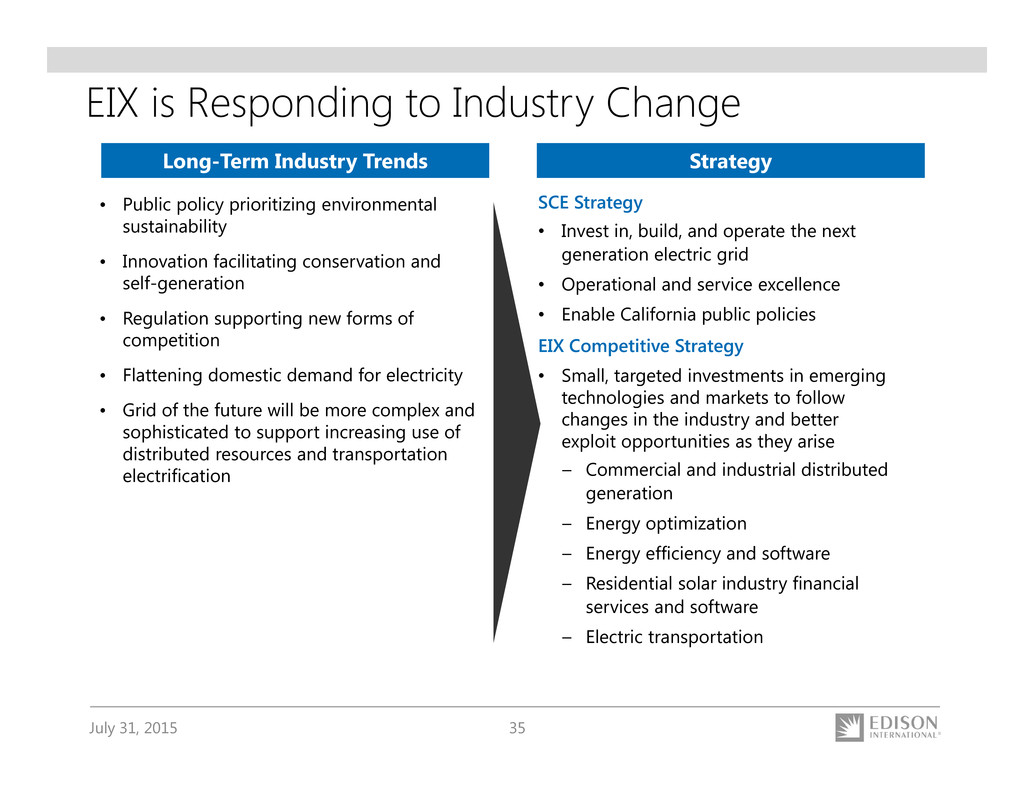

July 31, 2015 35 EIX is Responding to Industry Change • Public policy prioritizing environmental sustainability • Innovation facilitating conservation and self-generation • Regulation supporting new forms of competition • Flattening domestic demand for electricity • Grid of the future will be more complex and sophisticated to support increasing use of distributed resources and transportation electrification SCE Strategy • Invest in, build, and operate the next generation electric grid • Operational and service excellence • Enable California public policies EIX Competitive Strategy • Small, targeted investments in emerging technologies and markets to follow changes in the industry and better exploit opportunities as they arise – Commercial and industrial distributed generation – Energy optimization – Energy efficiency and software – Residential solar industry financial services and software – Electric transportation Long-Term Industry Trends Strategy

July 31, 2015 36 • Create energy services that help simplify and optimize energy needs for commercial & industrial customers: – Help customers better value energy optimization, paving the way for greater third party energy services – Help customers manage through potential technological / regulatory changes Changing Customer Needs Evolving customer needs and uncertainty around changing technologies and regulation create a business opportunity for a trusted advisor role The Opportunity: Trusted Advisor Edison Energy Focus: Commercial & Industrial

July 31, 2015 37 On June 10th, eight electric utilities and energy companies announced a MOU to pursue the development of Grid Assurance, a limited liability company that plans to offer subscribers cost- effective solutions for enhancing grid resiliency and protecting customers from prolonged transmission outages • Grid Assurance is intended to address potential high impact events on the bulk transmission systems: - Entity will own critical equipment with long manufacturing lead times to account for risk beyond what is covered by “operational spares” (e.g., BES transformers, breakers, etc.) - Entity will provide secure, off-site storage in strategic locations, and support the delivery of equipment transportation and logistics services - Subscribers will pay a cost-of-service based subscription fee for access to inventory and will have rights to call upon inventory following a “Qualifying Event” such as physical attacks, electromagnetic pulses, solar storms, cyberattacks, earthquakes and severe weather events - Regulatory construct will provide cost certainty and cost recovery similar to FERC formula rates for transmission assets - Subscription to the sparing service will be available to all transmission owning entities • Contingent on regulatory approvals, Grid Assurance is expected to begin accepting subscribers and identifying inventory in 2016 Grid Assurance™ Overview Edison Transmission is one of the eight companies pursuing Grid Assurance

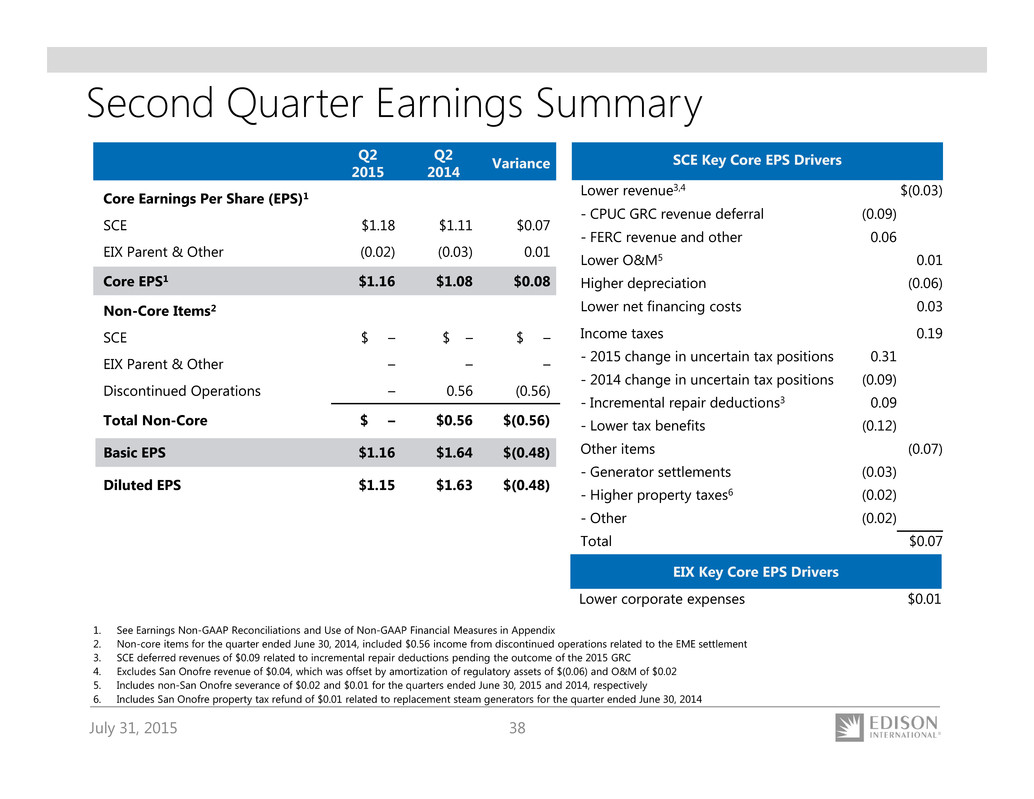

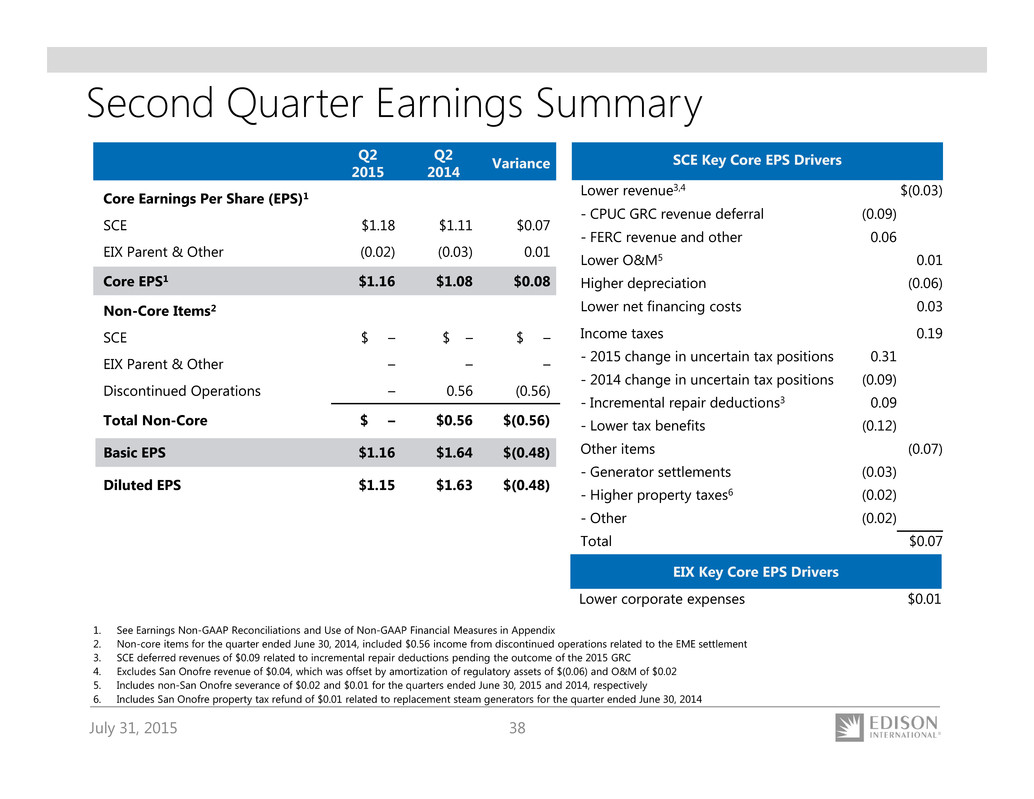

July 31, 2015 38 Q2 2015 Q2 2014 Variance Core Earnings Per Share (EPS)1 SCE $1.18 $1.11 $0.07 EIX Parent & Other (0.02) (0.03) 0.01 Core EPS1 $1.16 $1.08 $0.08 Non-Core Items2 SCE $ – $ – $ – EIX Parent & Other – – – Discontinued Operations – 0.56 (0.56) Total Non-Core $ – $0.56 $(0.56) Basic EPS $1.16 $1.64 $(0.48) Diluted EPS $1.15 $1.63 $(0.48) Second Quarter Earnings Summary 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Non-core items for the quarter ended June 30, 2014, included $0.56 income from discontinued operations related to the EME settlement 3. SCE deferred revenues of $0.09 related to incremental repair deductions pending the outcome of the 2015 GRC 4. Excludes San Onofre revenue of $0.04, which was offset by amortization of regulatory assets of $(0.06) and O&M of $0.02 5. Includes non-San Onofre severance of $0.02 and $0.01 for the quarters ended June 30, 2015 and 2014, respectively 6. Includes San Onofre property tax refund of $0.01 related to replacement steam generators for the quarter ended June 30, 2014 EIX Key Core EPS Drivers Lower corporate expenses $0.01 SCE Key Core EPS Drivers Lower revenue3,4 $(0.03) - CPUC GRC revenue deferral (0.09) - FERC revenue and other 0.06 Lower O&M5 0.01 Higher depreciation (0.06) Lower net financing costs 0.03 Income taxes 0.19 - 2015 change in uncertain tax positions 0.31 - 2014 change in uncertain tax positions (0.09) - Incremental repair deductions3 0.09 - Lower tax benefits (0.12) Other items (0.07) - Generator settlements (0.03) - Higher property taxes6 (0.02) - Other (0.02) Total $0.07

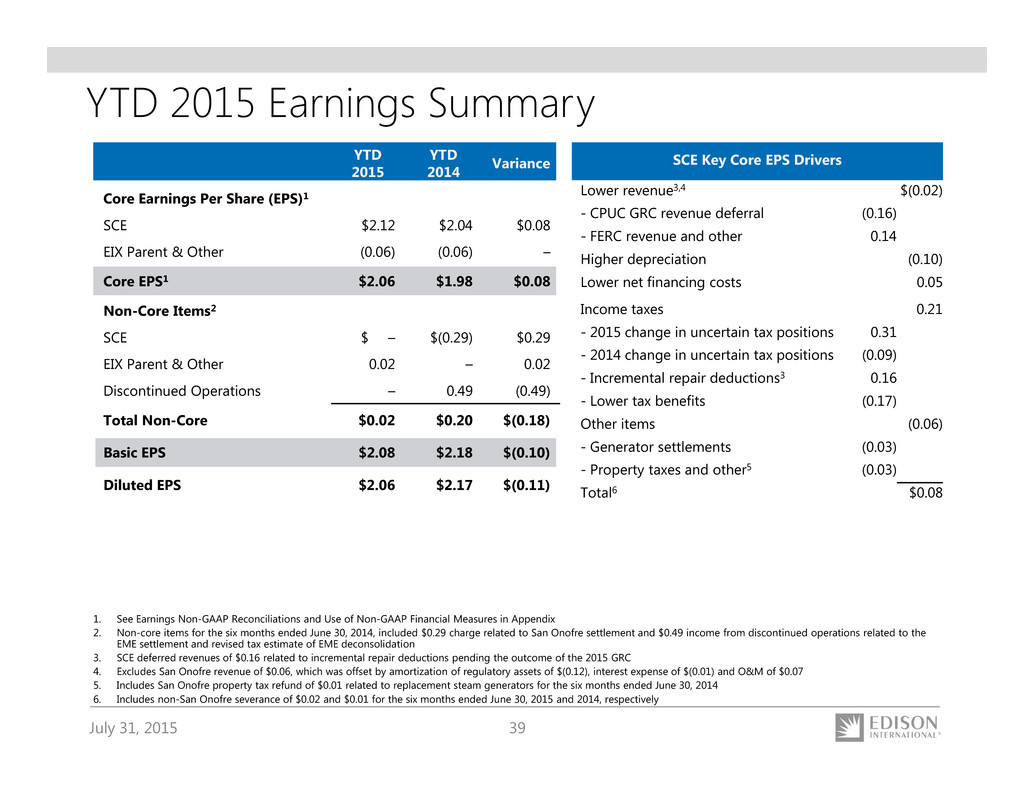

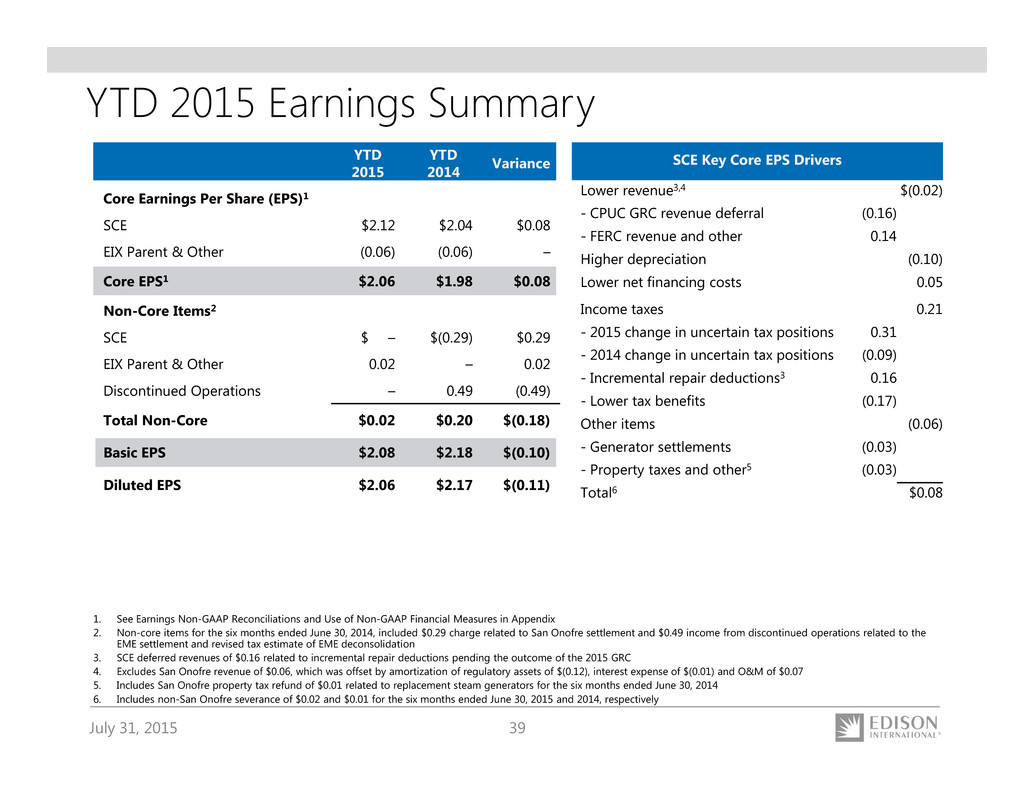

July 31, 2015 39 YTD 2015 YTD 2014 Variance Core Earnings Per Share (EPS)1 SCE $2.12 $2.04 $0.08 EIX Parent & Other (0.06) (0.06) – Core EPS1 $2.06 $1.98 $0.08 Non-Core Items2 SCE $ – $(0.29) $0.29 EIX Parent & Other 0.02 – 0.02 Discontinued Operations – 0.49 (0.49) Total Non-Core $0.02 $0.20 $(0.18) Basic EPS $2.08 $2.18 $(0.10) Diluted EPS $2.06 $2.17 $(0.11) YTD 2015 Earnings Summary 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Non-core items for the six months ended June 30, 2014, included $0.29 charge related to San Onofre settlement and $0.49 income from discontinued operations related to the EME settlement and revised tax estimate of EME deconsolidation 3. SCE deferred revenues of $0.16 related to incremental repair deductions pending the outcome of the 2015 GRC 4. Excludes San Onofre revenue of $0.06, which was offset by amortization of regulatory assets of $(0.12), interest expense of $(0.01) and O&M of $0.07 5. Includes San Onofre property tax refund of $0.01 related to replacement steam generators for the six months ended June 30, 2014 6. Includes non-San Onofre severance of $0.02 and $0.01 for the six months ended June 30, 2015 and 2014, respectively SCE Key Core EPS Drivers Lower revenue3,4 $(0.02) - CPUC GRC revenue deferral (0.16) - FERC revenue and other 0.14 Higher depreciation (0.10) Lower net financing costs 0.05 Income taxes 0.21 - 2015 change in uncertain tax positions 0.31 - 2014 change in uncertain tax positions (0.09) - Incremental repair deductions3 0.16 - Lower tax benefits (0.17) Other items (0.06) - Generator settlements (0.03) - Property taxes and other5 (0.03) Total6 $0.08

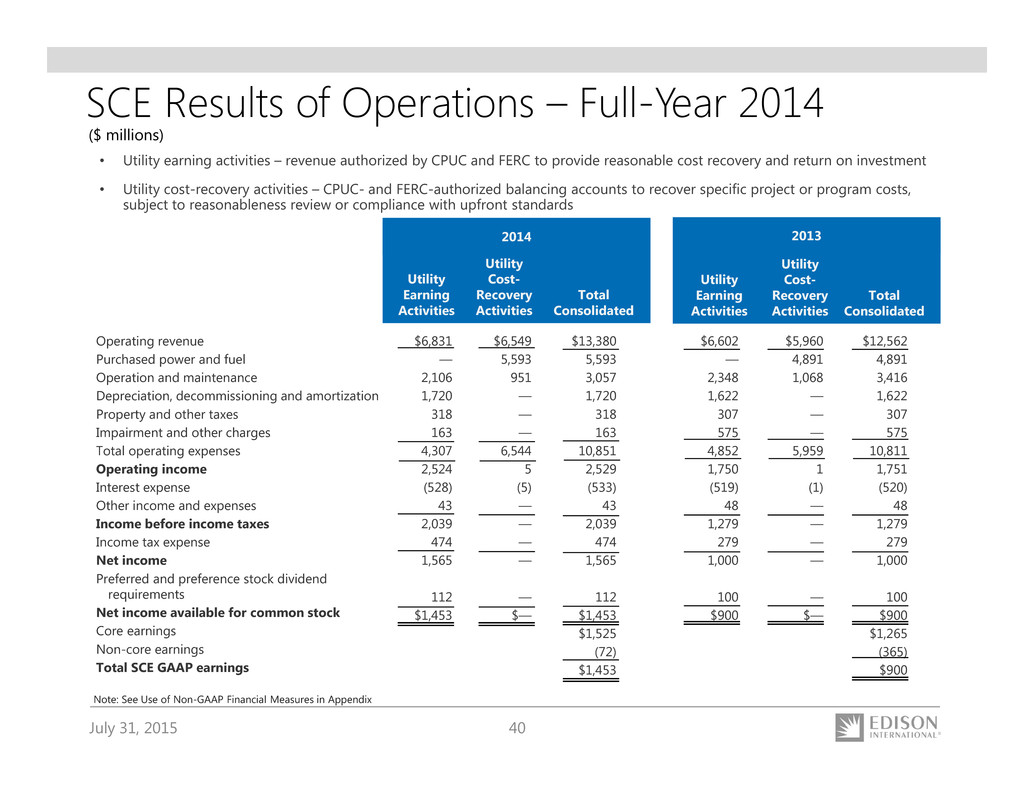

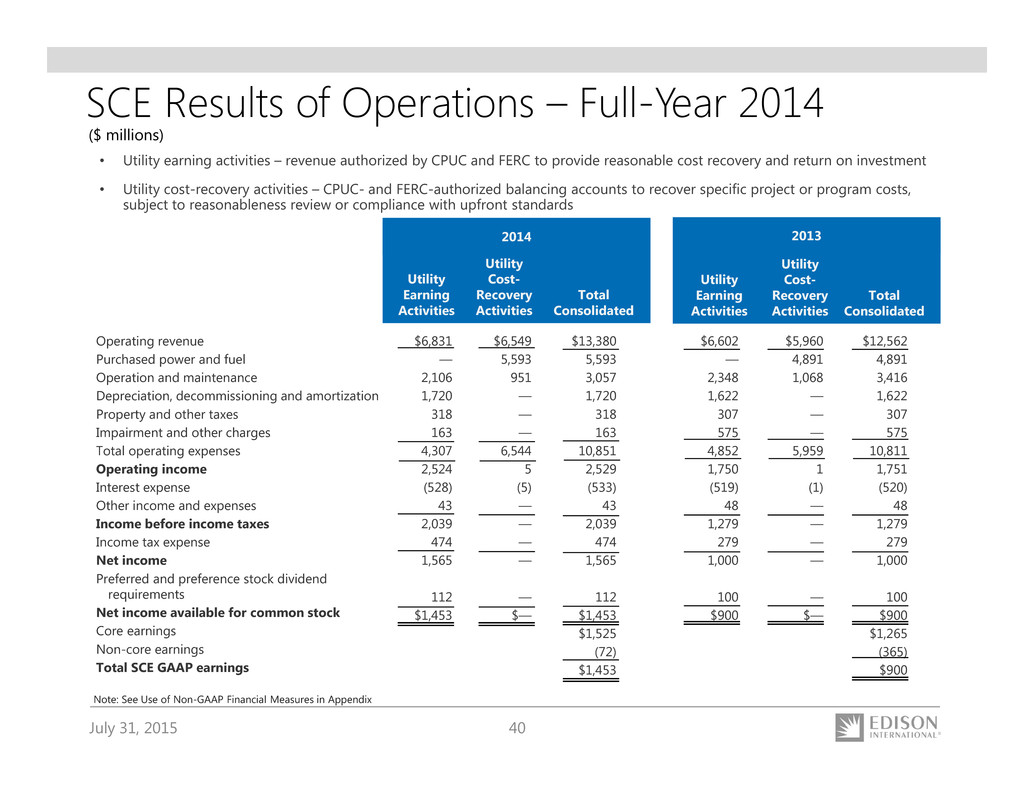

July 31, 2015 40 $6,602 — 2,348 1,622 307 575 4,852 1,750 (519) 48 1,279 279 1,000 100 $900 $5,960 4,891 1,068 — — — 5,959 1 (1) — — — — — $— $6,831 — 2,106 1,720 318 163 4,307 2,524 (528) 43 2,039 474 1,565 112 $1,453 $6,549 5,593 951 — — — 6,544 5 (5) — — — — — $— $13,380 5,593 3,057 1,720 318 163 10,851 2,529 (533) 43 2,039 474 1,565 112 $1,453 $1,525 (72) $1,453 $12,562 4,891 3,416 1,622 307 575 10,811 1,751 (520) 48 1,279 279 1,000 100 $900 $1,265 (365) $900 SCE Results of Operations – Full-Year 2014 • Utility earning activities – revenue authorized by CPUC and FERC to provide reasonable cost recovery and return on investment • Utility cost-recovery activities – CPUC- and FERC-authorized balancing accounts to recover specific project or program costs, subject to reasonableness review or compliance with upfront standards Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2014 Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2013 Operating revenue Purchased power and fuel Operation and maintenance Depreciation, decommissioning and amortization Property and other taxes Impairment and other charges Total operating expenses Operating income Interest expense Other income and expenses Income before income taxes Income tax expense Net income Preferred and preference stock dividend requirements Net income available for common stock Core earnings Non-core earnings Total SCE GAAP earnings Note: See Use of Non-GAAP Financial Measures in Appendix ($ millions)

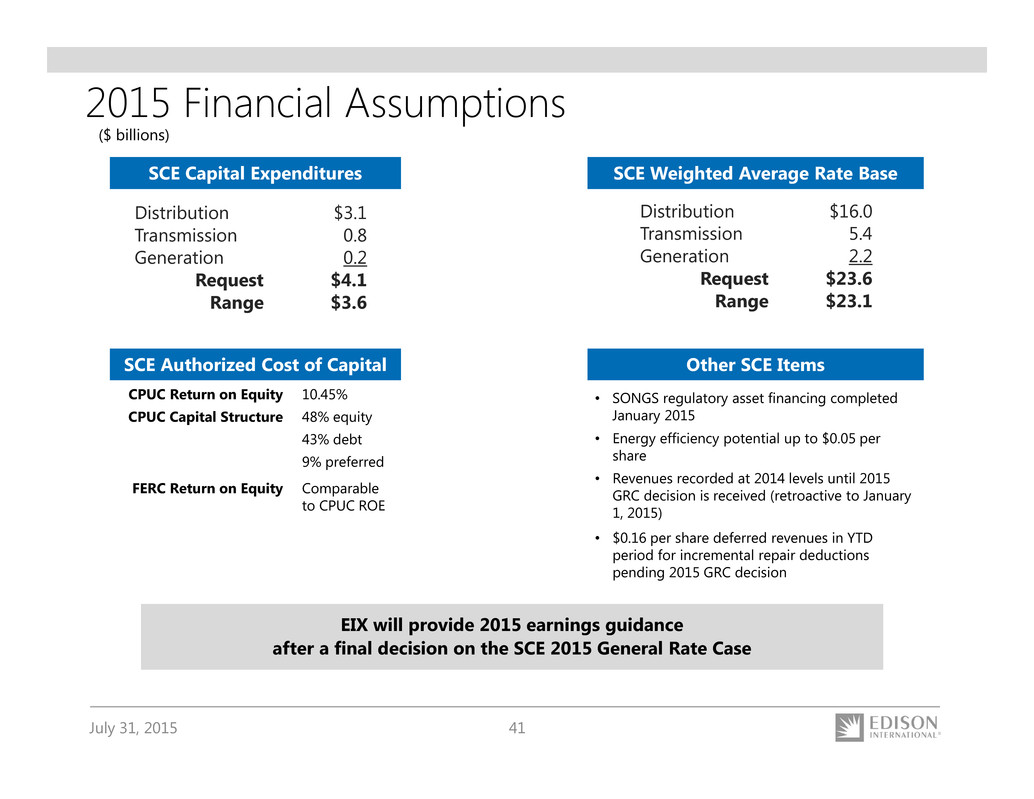

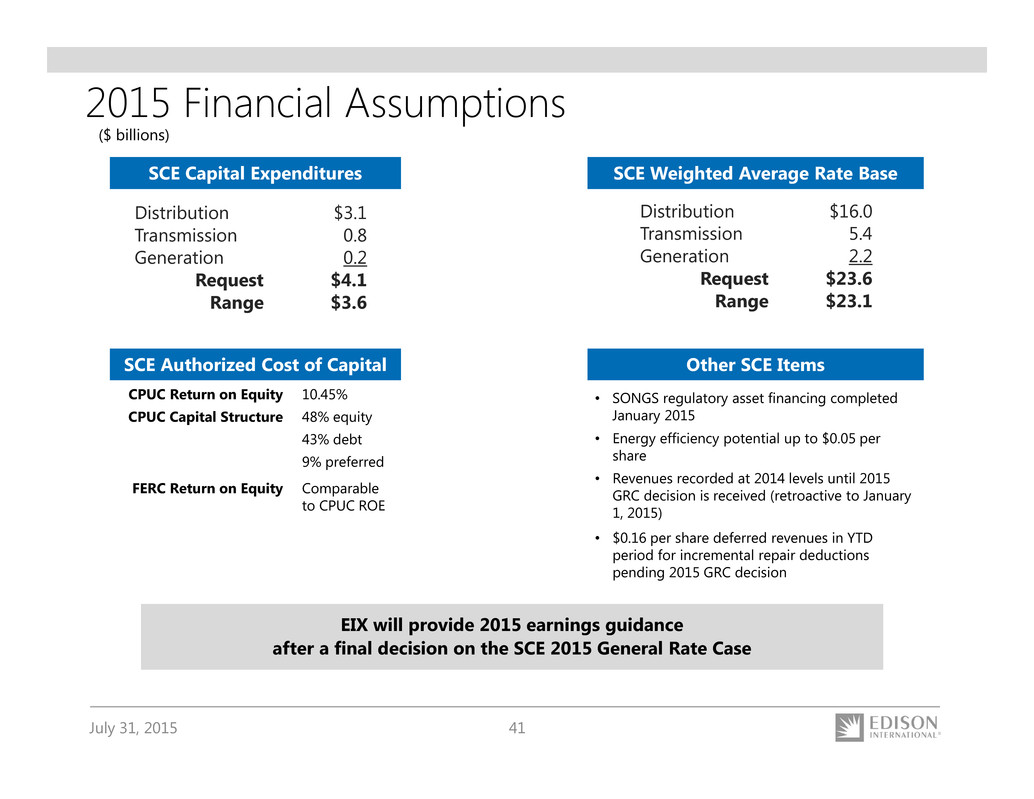

July 31, 2015 41 2015 Financial Assumptions ($ billions) SCE Capital Expenditures SCE Authorized Cost of Capital Other SCE Items CPUC Return on Equity 10.45% CPUC Capital Structure 48% equity 43% debt 9% preferred FERC Return on Equity Comparable to CPUC ROE EIX will provide 2015 earnings guidance after a final decision on the SCE 2015 General Rate Case Distribution $16.0 Transmission 5.4 Generation 2.2 Request $23.6 Range $23.1 Distribution $3.1 Transmission 0.8 Generation 0.2 Request $4.1 Range $3.6 SCE Weighted Average Rate Base • SONGS regulatory asset financing completed January 2015 • Energy efficiency potential up to $0.05 per share • Revenues recorded at 2014 levels until 2015 GRC decision is received (retroactive to January 1, 2015) • $0.16 per share deferred revenues in YTD period for incremental repair deductions pending 2015 GRC decision

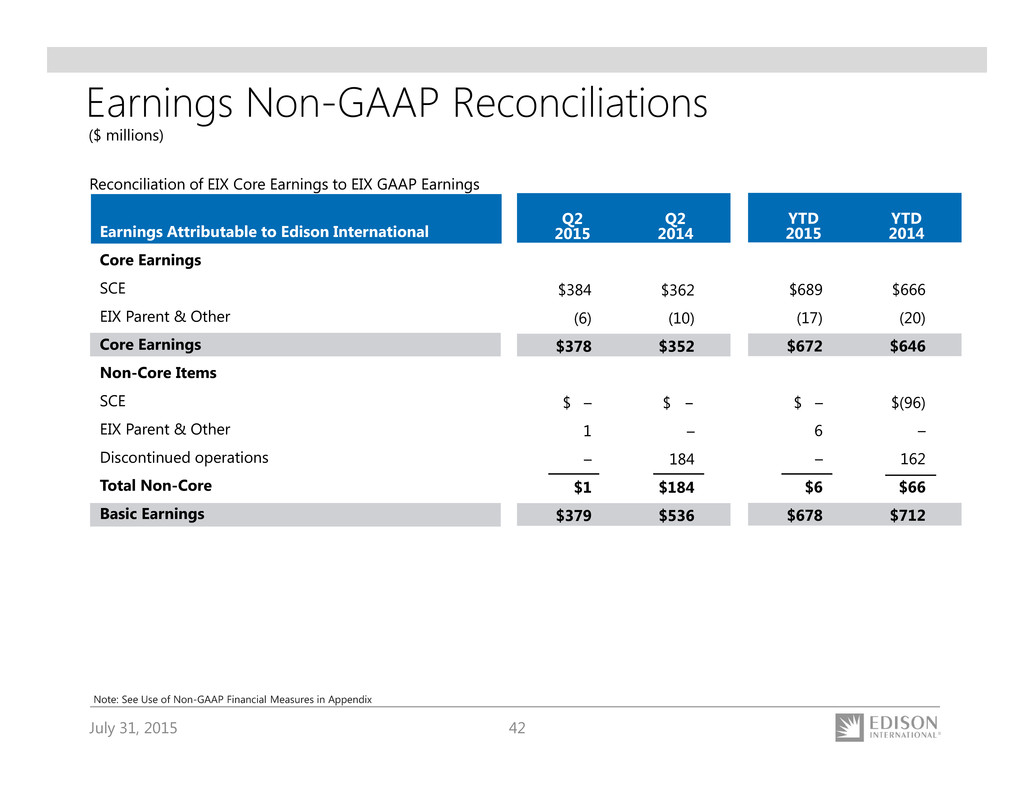

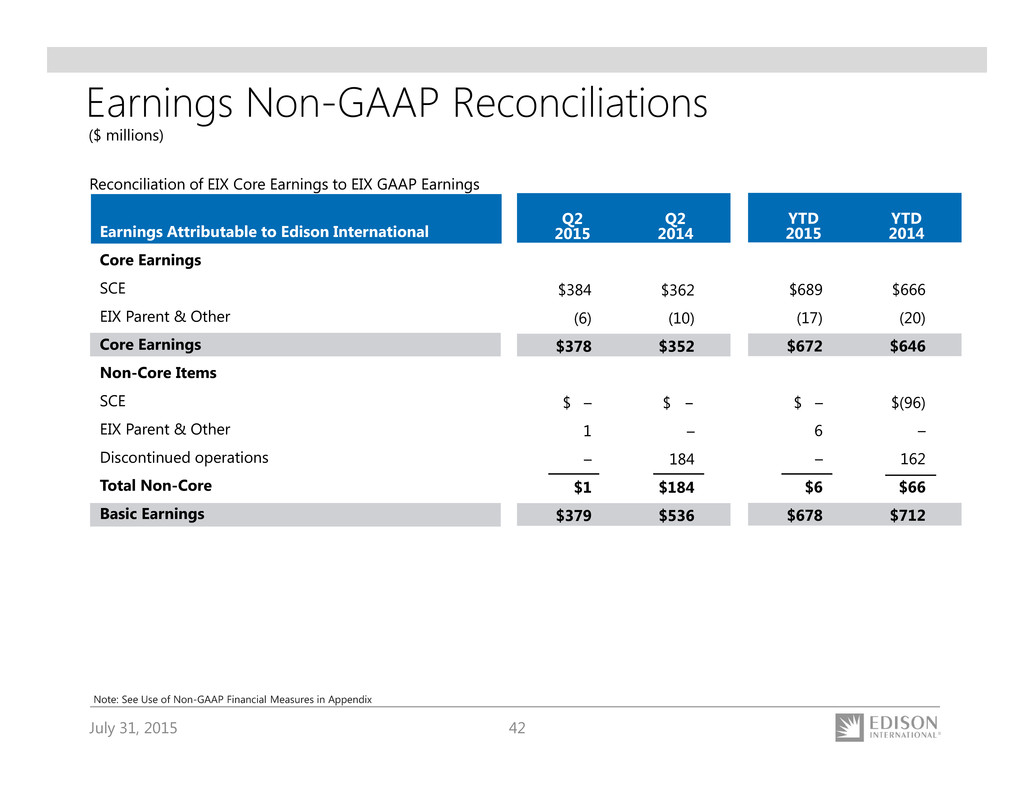

July 31, 2015 42 Earnings Non-GAAP Reconciliations ($ millions) Reconciliation of EIX Core Earnings to EIX GAAP Earnings Earnings Attributable to Edison International Core Earnings SCE EIX Parent & Other Core Earnings Non-Core Items SCE EIX Parent & Other Discontinued operations Total Non-Core Basic Earnings Q2 2014 $362 (10) $352 $ − – 184 $184 $536 Q2 2015 $384 (6) $378 $ – 1 – $1 $379 Note: See Use of Non-GAAP Financial Measures in Appendix YTD 2014 $666 (20) $646 $(96) – 162 $66 $712 YTD 2015 $689 (17) $672 $ – 6 – $6 $678

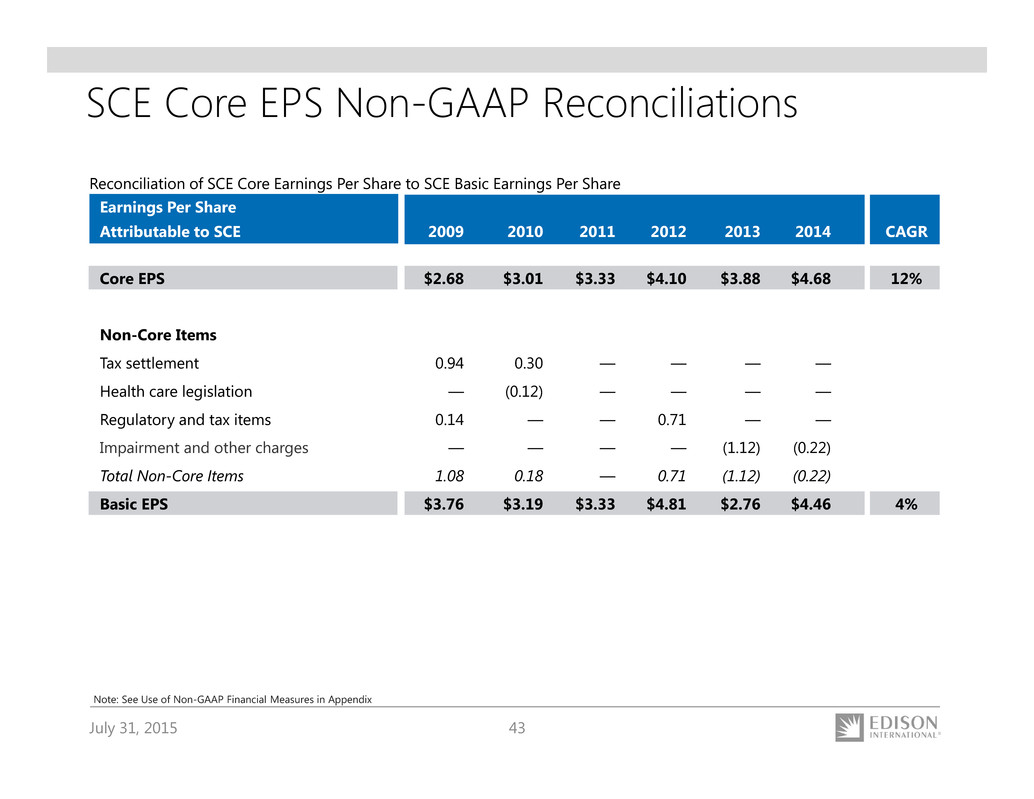

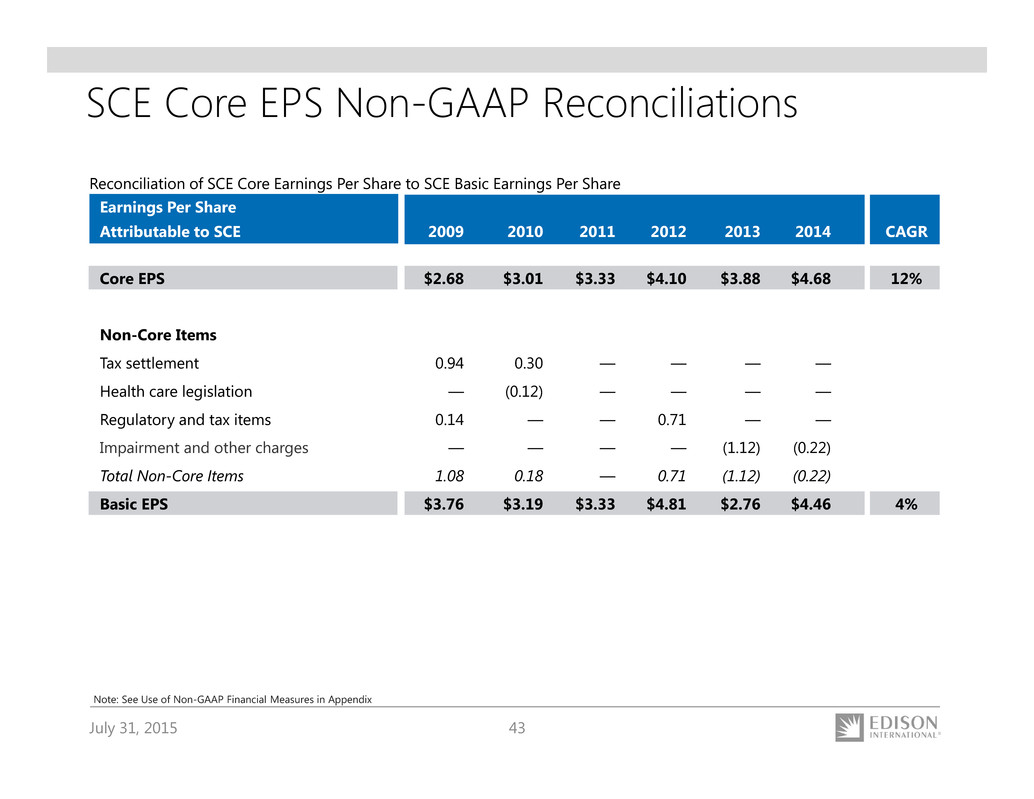

July 31, 2015 43 SCE Core EPS Non-GAAP Reconciliations Earnings Per Share Attributable to SCE Core EPS Non-Core Items Tax settlement Health care legislation Regulatory and tax items Impairment and other charges Total Non-Core Items Basic EPS Reconciliation of SCE Core Earnings Per Share to SCE Basic Earnings Per Share 2009 $2.68 0.94 — 0.14 — 1.08 $3.76 2010 $3.01 0.30 (0.12) — — 0.18 $3.19 CAGR 12% 4% 2011 $3.33 — — — — — $3.33 2012 $4.10 — — 0.71 — 0.71 $4.81 2013 $3.88 — — — (1.12) (1.12) $2.76 Note: See Use of Non-GAAP Financial Measures in Appendix 2014 $4.68 — — — (0.22) (0.22) $4.46

July 31, 2015 44 Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contact Scott Cunningham, Vice President (626) 302‐2540 scott.cunningham@edisonintl.com Allison Bahen, Senior Manager (626) 302‐5493 allison.bahen@edisonintl.com