Exhibit 99.1

Leading the Way in Electricity SM

26th Annual

Bernstein Strategic Decisions Conference June 2, 2010

Ted Craver

Chairman, President and Chief Executive Officer

June 2, 2010 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation, earnings, asset and rate base growth, load growth, capital investments, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors,” and “Management’s Discussion and Analysis” in Edison International’s 2009 Form 10-K, most recent Form 10-Q and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation.

June 2, 2010 1 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Delivering Superior and Sustained Value

Edison International

A diversified and flexible platform best positions EIX in an industry undergoing unprecedented change Leverage regulated and competitive businesses Positioned for long-term earnings and dividend growth

Southern California Edison

Balance electric reliability, rates and public policy needs to assure long-term

sustainable growth

Focus on grid reliability and transmission investments

Establish foundation for technology investments

Decoupled regulatory model mitigates demand and fuel cost risks

Edison Mission Group

Achieve durable coal fleet environmental solutions

Effectively manage merchant coal margins

Develop wind projects for existing turbine commitments

Emphasize liquidity management

Our key operating principles emphasize financial discipline, superior execution and innovative solutions to the challenges of today and tomorrow

June 2, 2010 2 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Highlights

One of the nation’s largest electric utilities

• Over 13 million residents in service territory

• 4.9 million customer accounts

• 50,000 square-mile service area

• Over 110,000 miles of distribution and transmission lines

8-11% five-year average annual rate base growth driven by

$18 billion - $21.5 billion capital program

• System reliability investments

• Smart grid technology

• California renewable energy mandate

Constructive regulatory policy

• CPUC earnings decoupled from demand

• Energy cost changes passed through to customers

• Earnings model driven by CPUC and FERC authorized rate

of return and rate base

June 2, 2010 3 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Capital Investment Forecast

($ billions)

$4.6

$2.9

2009 2010 2011 2012 2013 2014

Total

Base Case1 $4.0 $4.4 $4.6 $4.3 $4.2 $21.5

Low Case2 $3.3 $3.7 $3.9 $3.6 $3.5 $18.0

Base Case Forecast

By Classification

$%

Solar Rooftop Program 1.0 4

Edison SmartConnect™ 1.1 5

Generation 3.0 14

Transmission 5.5 26

Distribution 10.9 51

Total 21.5 100

By Proceeding%

2009 CPUC Rate Case 22

2012 CPUC Rate Case 41

Other CPUC 11

FERC Rate Cases 26

Total 100

1 | | Subject to timely receipt of permitting, licensing and regulatory approvals. |

2 Low Case reflects a 16.5% potential variability to project investment levels related to execution risk, scope change, delays, regulatory constraints and other contingencies.

June 2, 2010 4 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Rate Base Forecast

($ billions)

$25.2

$23.0

$20.8

$18.1

$16.2

$14.8

2009 2010 2011 2012 2013 2014

5-Yr

CAGR

Base Case1 $14.8 $16.2 $18.1 $20.8 $23.0 $25.2 11%

Low Case2 $15.8 $17.2 $19.0 $20.5 $22.2 8%

1 Forecast includes: (1) 2009 CPUC GRC & FERC Decisions; (2) currently forecasted 2010-2014 FERC and 2012-2014 CPUC rate base, subject to timely receipt of permitting, licensing and regulatory approvals; (3) FERC construction work in progress forecast; (4) estimated impact of accelerated depreciation of the Economic Stimulus Act of 2009; and (5) CPUC approved solar rooftop program.

2 | | Reflects Low Case from SCE Capital Investment Forecast. |

June 2, 2010 5 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

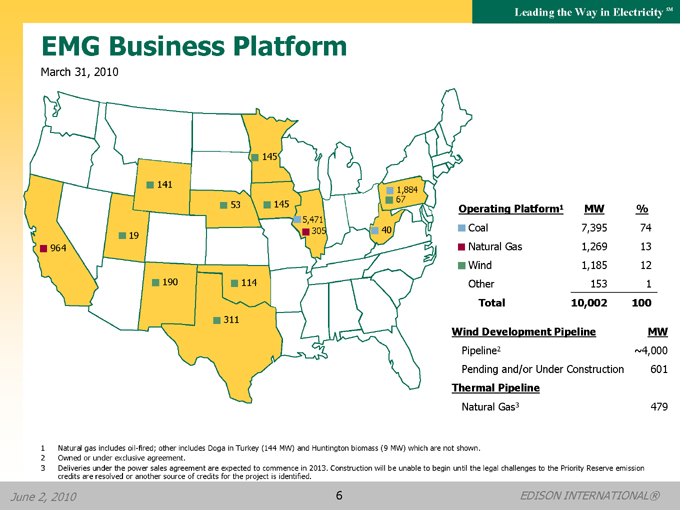

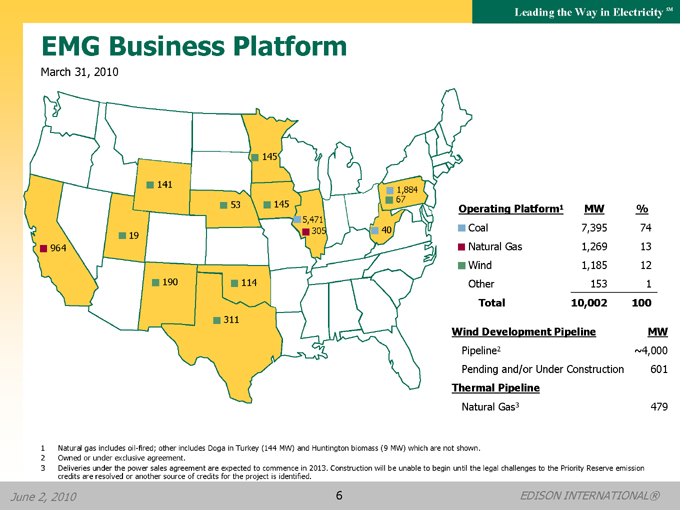

EMG Business Platform

March 31, 2010

145

141

1,884 145 67 53 5,471 305 40 19 964

190 114

311

Operating Platform1 MW %

Coal 7,395 74

Natural Gas 1,269 13

Wind 1,185 12

Other 153 1

Total 10,002 100

Wind Development Pipeline MW

Pipeline2 ~4,000

Pending and/or Under Construction 601

Thermal Pipeline

Natural Gas3 479

1 Natural gas includes oil-fired; other includes Doga in Turkey (144 MW) and Huntington biomass (9 MW) which are not shown.

2 | | Owned or under exclusive agreement. |

3 Deliveries under the power sales agreement are expected to commence in 2013. Construction will be unable to begin until the legal challenges to the Priority Reserve emission credits are resolved or another source of credits for the project is identified.

June 2, 2010 6 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

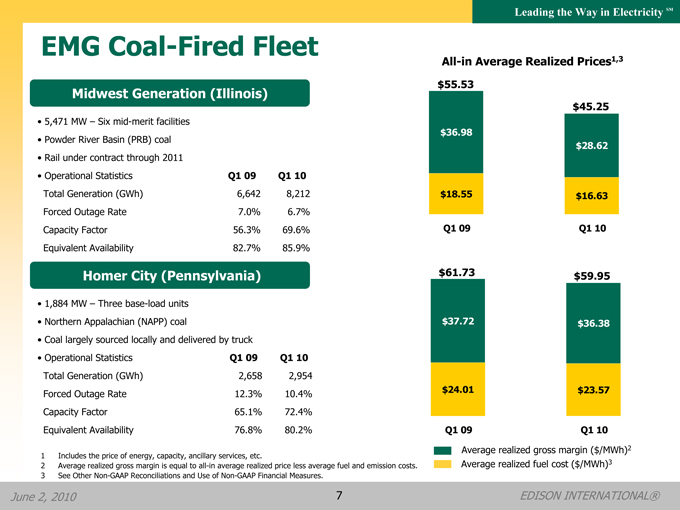

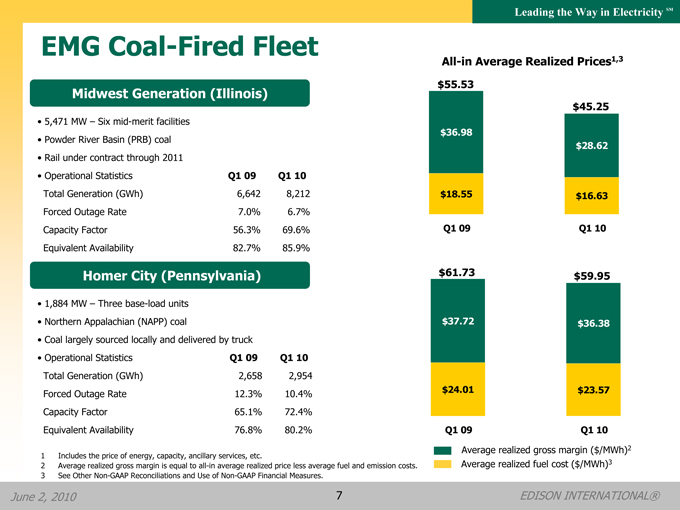

EMG Coal-Fired Fleet

Midwest Generation (Illinois)

• 5,471 MW – Six mid-merit facilities

• Powder River Basin (PRB) coal

• Rail under contract through 2011

• Operational Statistics Q1 09 Q1 10

Total Generation (GWh) 6,642 8,212

Forced Outage Rate 7.0% 6.7%

Capacity Factor 56.3% 69.6%

Equivalent Availability 82.7% 85.9%

Homer City (Pennsylvania)

• 1,884 MW – Three base-load units

• Northern Appalachian (NAPP) coal

• Coal largely sourced locally and delivered by truck

• Operational Statistics Q1 09 Q1 10

Total Generation (GWh) 2,658 2,954

Forced Outage Rate 12.3% 10.4%

Capacity Factor 65.1% 72.4%

Equivalent Availability 76.8% 80.2%

All-in Average Realized Prices1,3

$55.53

$45.25

$36.98

$28.62

$18.55 $16.63

Q1 09 Q1 10

$61.73 $59.95

$37.72 $36.38

$24.01 $23.57

Q1 09 Q1 10

Average realized gross margin ($/MWh)2

Average realized fuel cost ($/MWh)3

1 | | Includes the price of energy, capacity, ancillary services, etc. |

2 | | Average realized gross margin is equal to all-in average realized price less average fuel and emission costs. |

3 | | See Other Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures. |

June 2, 2010 7 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

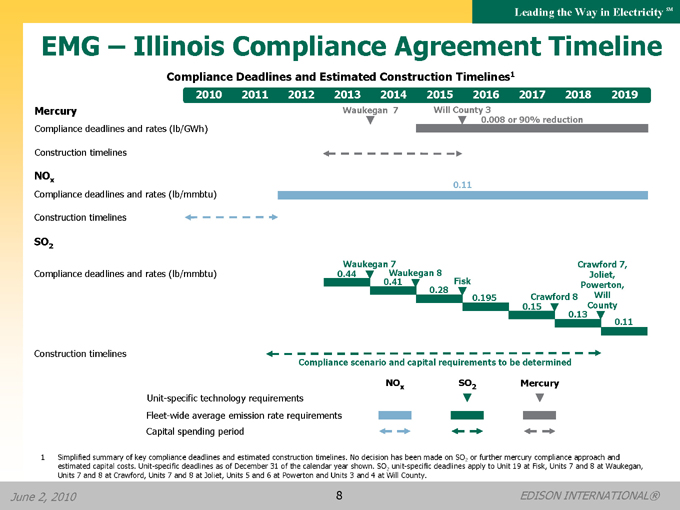

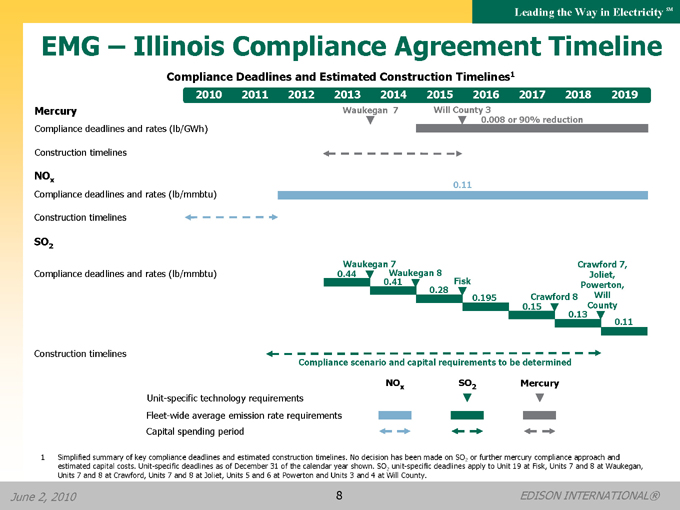

EMG – Illinois Compliance Agreement Timeline

Compliance Deadlines and Estimated Construction Timelines1

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Mercury Waukegan 7 Will County 3

0.008 or 90% reduction

Compliance deadlines and rates (lb/GWh)

Construction timelines

NOx

0.11

Compliance deadlines and rates (lb/mmbtu)

Construction timelines

SO2

Waukegan 7 Crawford 7,

Compliance deadlines and rates (lb/mmbtu) 0.44 Waukegan 8 Joliet,

0.41 Fisk Powerton,

0.28 0.195 Crawford 8 Will

0.15 County

0.13

0.11

Construction timelines

Compliance scenario and capital requirements to be determined

NOx SO2 Mercury

Unit-specific technology requirements

Fleet-wide average emission rate requirements

Capital spending period

1 Simplified summary of key compliance deadlines and estimated construction timelines. No decision has been made on SO2 or further mercury compliance approach and estimated capital costs. Unit-specific deadlines as of December 31 of the calendar year shown. SO2 unit-specific deadlines apply to Unit 19 at Fisk, Units 7 and 8 at Waukegan, Units 7 and 8 at Crawford, Units 7 and 8 at Joliet, Units 5 and 6 at Powerton and Units 3 and 4 at Will County.

June 2, 2010 8 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

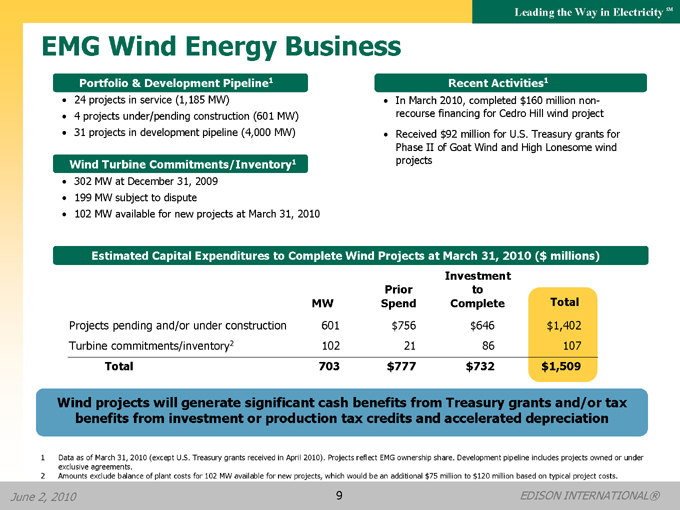

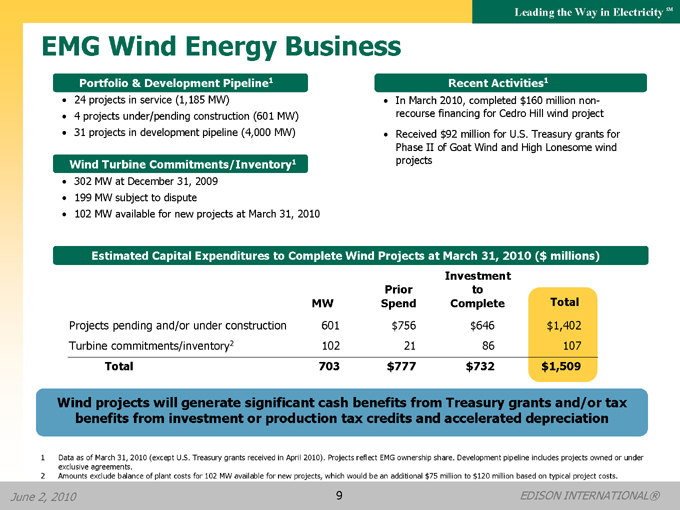

EMG Wind Energy Business

Portfolio & Development Pipeline1

24 projects in service (1,185 MW)

4 | | projects under/pending construction (601 MW) 31 projects in development pipeline (4,000 MW) |

Wind Turbine Commitments/Inventory1

302 MW at December 31, 2009 199 MW subject to dispute

102 MW available for new projects at March 31, 2010

Recent Activities1

In March 2010, completed $160 million non-recourse financing for Cedro Hill wind project Received $92 million for U.S. Treasury grants for Phase II of Goat Wind and High Lonesome wind projects

Estimated Capital Expenditures to Complete Wind Projects at March 31, 2010 ($ millions)

Investment to Complete

Prior Spend

MW

Total

Projects pending and/or under construction 601 $756 $646 $1,402

Turbine commitments/inventory2 102 21 86 107

Total 703 $777 $732 $1,509

Wind projects will generate significant cash benefits from Treasury grants and/or tax benefits from investment or production tax credits and accelerated depreciation

1 Data as of March 31, 2010 (except U.S. Treasury grants received in April 2010). Projects reflect EMG ownership share. Development pipeline includes projects owned or under exclusive agreements.

2 Amounts exclude balance of plant costs for 102 MW available for new projects, which would be an additional $75 million to $120 million based on typical project costs.

June 2, 2010 9 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Funding for 2010-11 Wind Investments

($ millions)

$289 $1,125

$104 $732 $765 $294 $471

Bank/Vendor Financing

$206 million Big Sky

$88 million Cedro Hill4

U.S. Treasury Grants

$92 million received in April 2010

$379 million anticipated in 20115

2010-2011 Spend (at 12/31/09)

Mitsubishi Turbines1

Q1 10 Spend & Other2

2010-2011 Spend3 (at 3/31/10)

Sources

1 EME’s turbine supply agreement with Mitsubishi Power Systems Americas, Inc. is subject to a legal dispute. Remaining payments subject to dispute under this agreement are $289 million.

2 | | Includes adjustments to cost estimates. |

3 Excludes balance of plant costs for 102 MW available for new projects, which would be an additional $75 million to $120 million based on typical project costs.

4 | | Remaining available balance. |

5 | | Estimate based on estimated construction costs and anticipated commercial operation dates. |

June 2, 2010 10 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

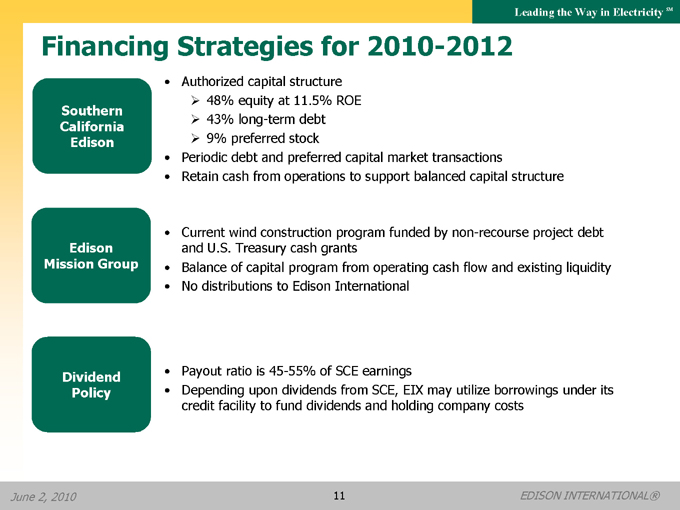

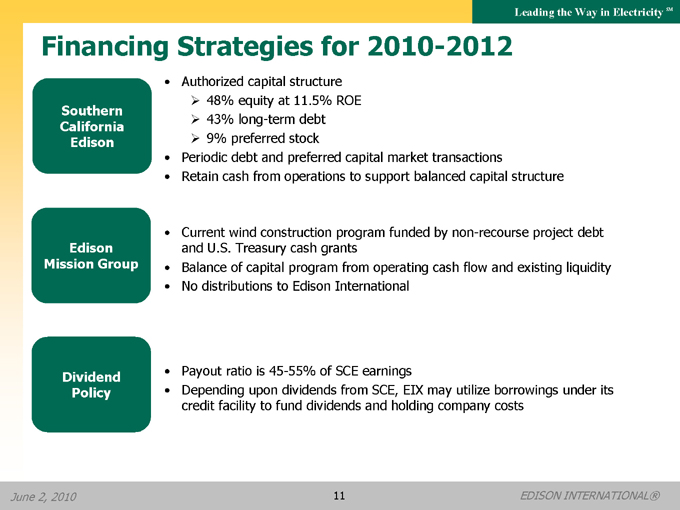

Financing Strategies for 2010-2012

Southern California Edison

Authorized capital structure

48% equity at 11.5% ROE

43% long-term debt

9% preferred stock

Periodic debt and preferred capital market transactions

Retain cash from operations to support balanced capital structure

Edison Mission Group

Current wind construction program funded by non-recourse project debt and U.S. Treasury cash grants Balance of capital program from operating cash flow and existing liquidity No distributions to Edison International

Dividend Policy

Payout ratio is 45-55% of SCE earnings

Depending upon dividends from SCE, EIX may utilize borrowings under its credit facility to fund dividends and holding company costs

June 2, 2010 11 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

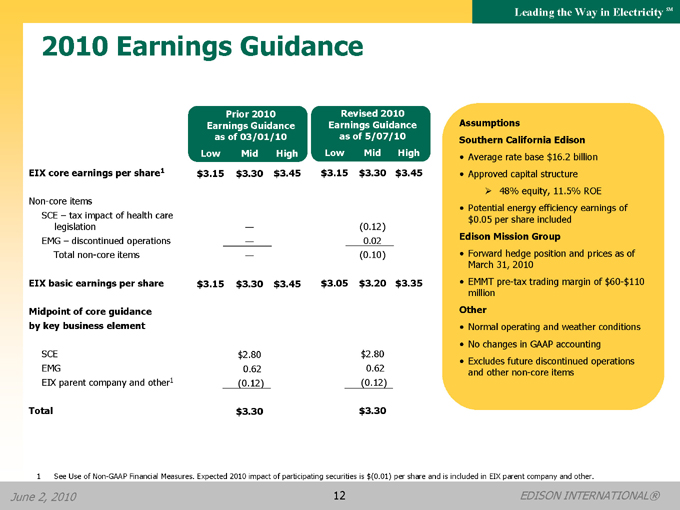

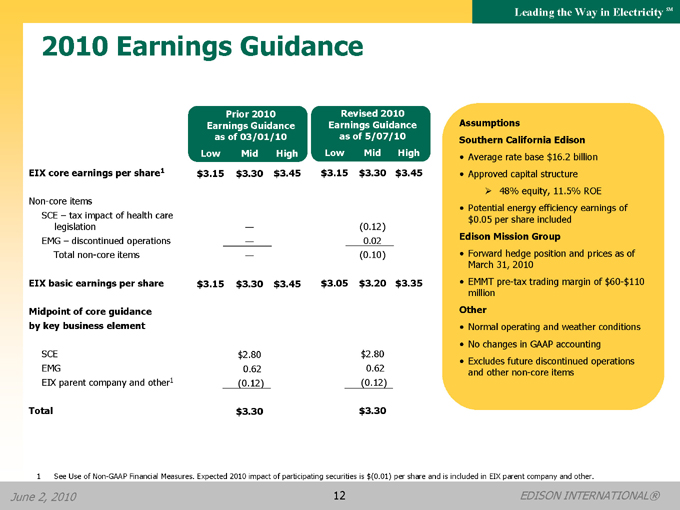

2010 Earnings Guidance

Prior 2010 Earnings Guidance as of 03/01/10 as of 5/07/10

Revised 2010 Earnings Guidance

Low Mid High Low Mid High

EIX core earnings per share1 $3.15 $3.30 $3.45 $3.15 $3.30 $3.45

Non-core items

SCE – tax impact of health care

legislation — (0.12)

EMG – discontinued operations — 0.02

Total non-core items — (0.10)

EIX basic earnings per share $3.15 $3.30 $3.45 $3.05 $3.20 $3.35

Midpoint of core guidance

by key business element

SCE $2.80 $2.80

EMG 0.62 0.62

EIX parent company and other1(0.12)(0.12)

Total $3.30 $3.30

Assumptions

Southern California Edison

• Average rate base $16.2 billion

• Approved capital structure

• 48% equity, 11.5% ROE

• Potential energy efficiency earnings of

$0.05 per share included

Edison Mission Group

• Forward hedge position and prices as of

March 31, 2010

• EMMT pre-tax trading margin of $60-$110

million

Other

• Normal operating and weather conditions

• No changes in GAAP accounting

• Excludes future discontinued operations

and other non-core items

1 See Use of Non-GAAP Financial Measures. Expected 2010 impact of participating securities is $(0.01) per share and is included in EIX parent company and other.

June 2, 2010 12 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

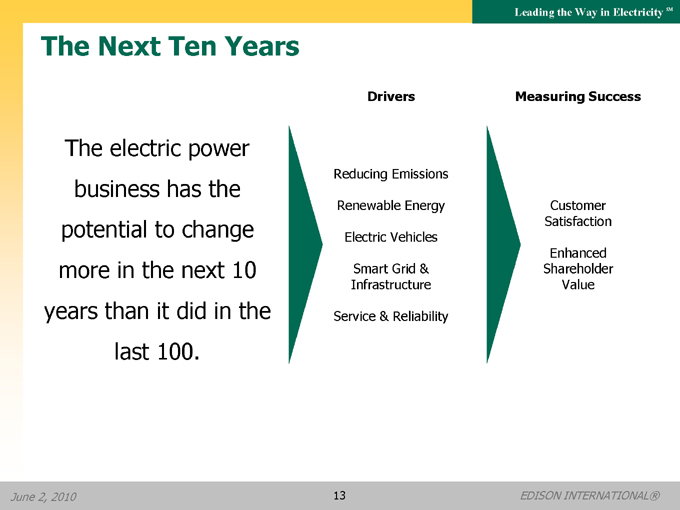

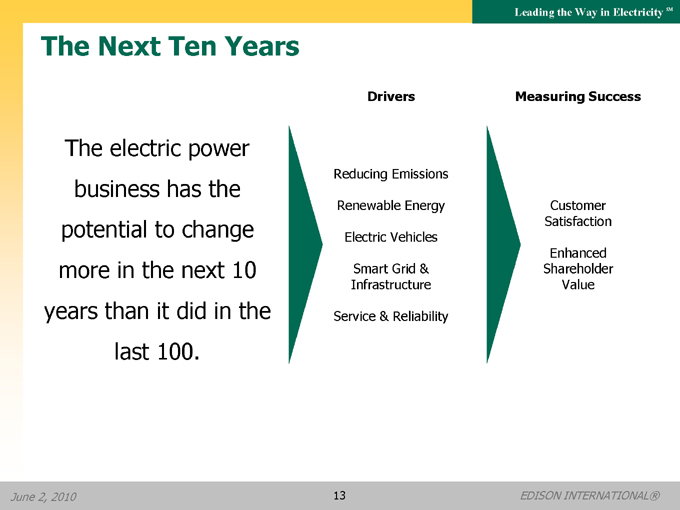

The Next Ten Years

Drivers

Measuring Success

The electric power business has the potential to change more in the next 10 years than it did in the last 100.

Reducing Emissions Renewable Energy Electric Vehicles

Smart Grid & Infrastructure

Service & Reliability

Customer Satisfaction

Enhanced Shareholder Value

June 2, 2010 13 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

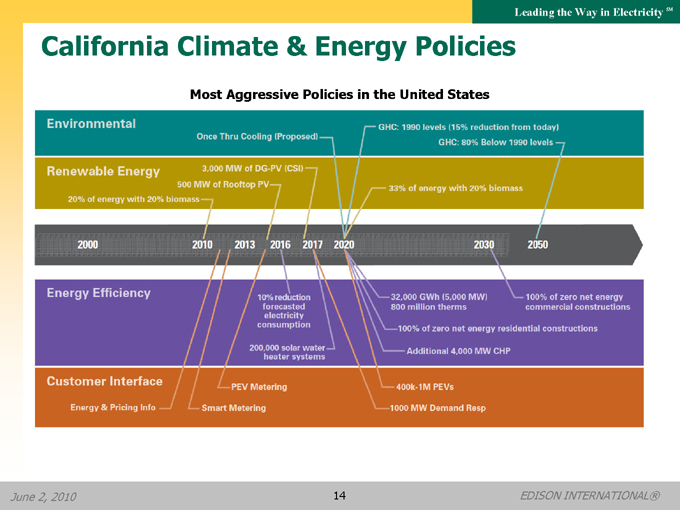

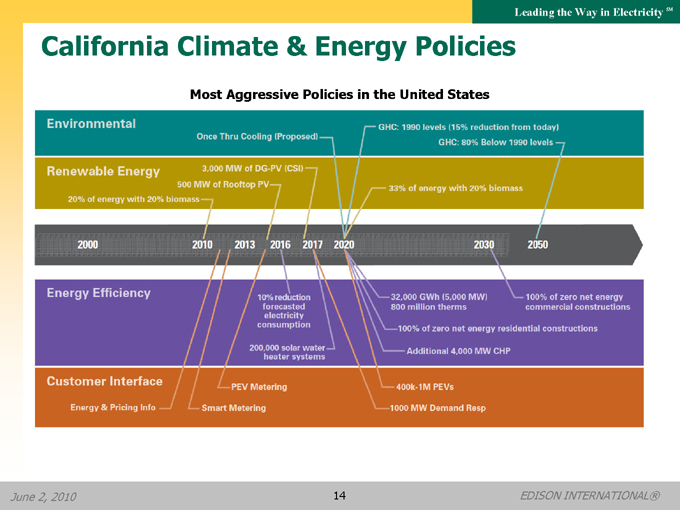

California Climate & Energy Policies

Most Aggressive Policies in the United States

Enviromental

One thru cooling (proposed)

GHC: 1990 levels (15% reduction from today)

GHC: 80% Below 1990 levels

Renewable Energy

3,000 MW of DG-PV (CSI)

500 MW of Rooftop PV

20% of energy with 20% biomass

33% of energy with 20% biomass

2000

2010

2013

2016

2017

2020

2030

2050

Energy Efficiency

10% reduction forecasted electricity consumption

200,000 solar water heater systems

32,000 GWh (5,000 MW) 800 million therms

100% of zero net energy residential constructions

Additional 4,000 MW CHP

100% of zero net energy commercial constructions

Customer Interface

Energy & Pricing Info

PEV Metering

Smart Metering

400k-1M PEVs

1000MV Demand Resp

June 2, 2010 14 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Renewable Portfolio

SCE 2010 20% Renewable Energy Goal

Contracts are in place to meet 20% of customers’ energy requirement with renewable resources, but a portion of energy delivery may be delayed in 2010 due to transmission constraints. SCE expects to meet the 2010 goal with flexible compliance that allows banking and earmarking of past and future renewable energy surplus.

Renewable Resources

(billion kWh)

Small Hydro 4% Solar 6% Biomass 7%

Geothermal 57% Wind 26%

SCE Renewable Resource % of Total Delivered Portfolio

9% Increase

94% Increase

13.6

14.8

28.7

2009 2010 2020

20% RPS (forecast)

Potential 33% RPS (forecast)

17% 19+%

June 2, 2010 15 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

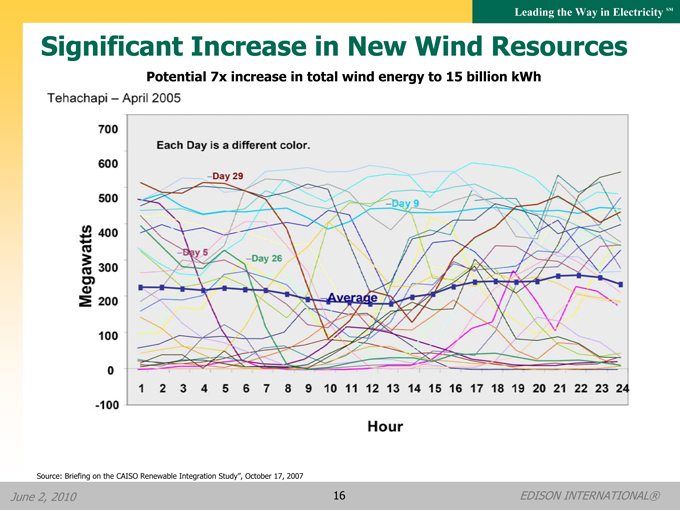

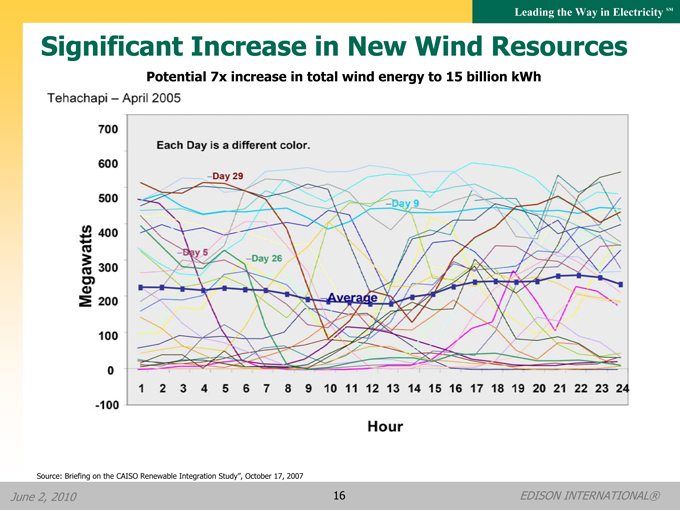

Significant Increase in New Wind Resources

Potential 7x increase in total wind energy to 15 billion kWh

Tehachapi – April 2005

Megawatts

700

600

500

400

300

200

100

0

-100

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

Hour

Each Day is a different color.

–Day 29 –Day5 –Day26 Average –Day9

Source: Briefing on the CAISO Renewable Integration Study”, October 17, 2007

June 2, 2010 16 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

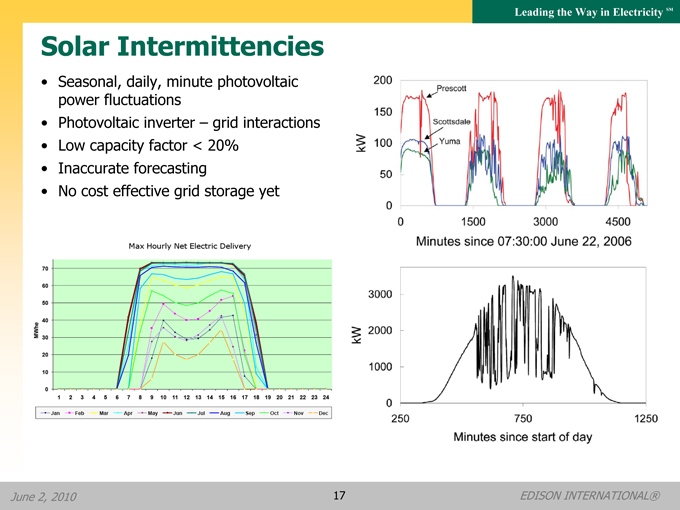

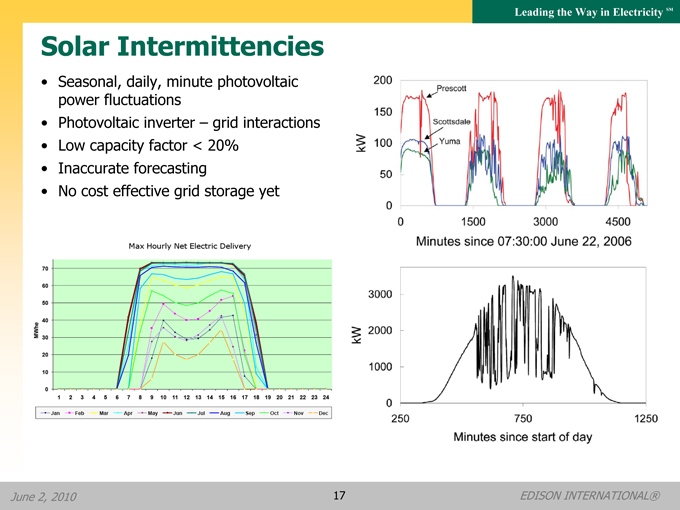

Solar Intermittencies

• Seasonal, daily, minute photovoltaic power fluctuations

• Photovoltaic inverter – grid interactions

• Low capacity factor < 20%

• Inaccurate forecasting

• No cost effective grid storage yet

June 2, 2010 17 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

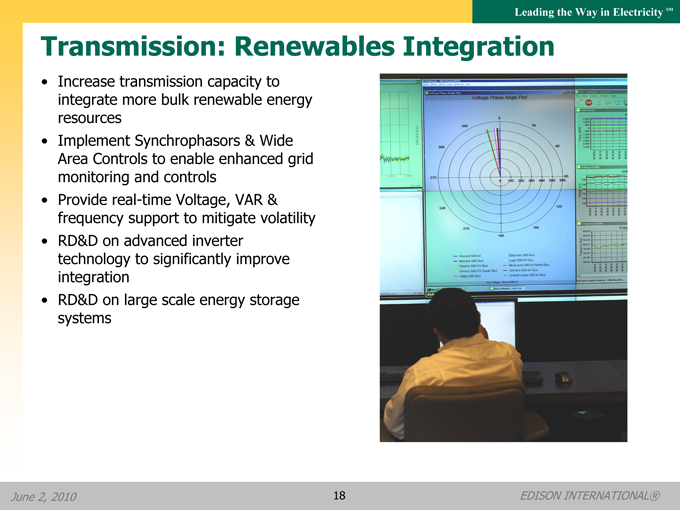

Transmission: Renewables Integration

Increase transmission capacity to integrate more bulk renewable energy resources Implement Synchrophasors & Wide Area Controls to enable enhanced grid monitoring and controls Provide real-time Voltage, VAR & frequency support to mitigate volatility RD&D on advanced inverter technology to significantly improve integration RD&D on large scale energy storage systems

June 2, 2010 18 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Plug-in Vehicle Forecast for SCE Service Area

Early Market (2010-2014) Thousands of vehicles

Modest number of PEVs

Early adopters with high expectations 1,200

Uncertainty around market development 1,000

New policies and standards

developed & implemented 800

Growing Market (2015+) 600

Growing number of PEVs;

Some clarity around customer charging behavior and impacts to electric grid 400

Growing significance of load

management 200

0

High Mid Low

2010 2012 2014 2016 2018 2020

June 2, 2010 19 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

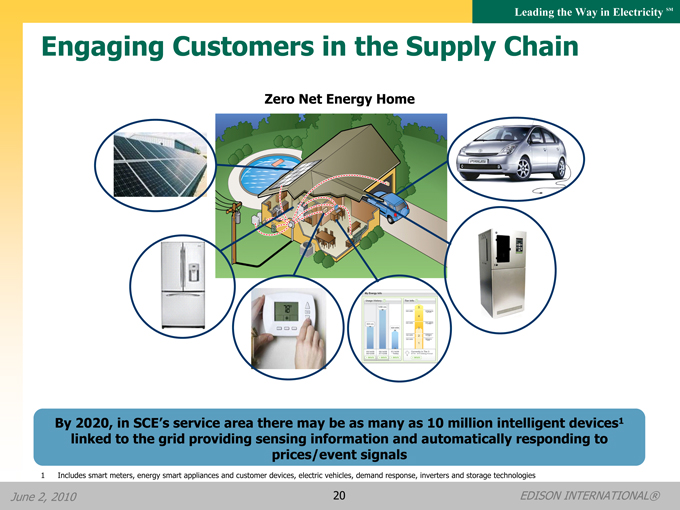

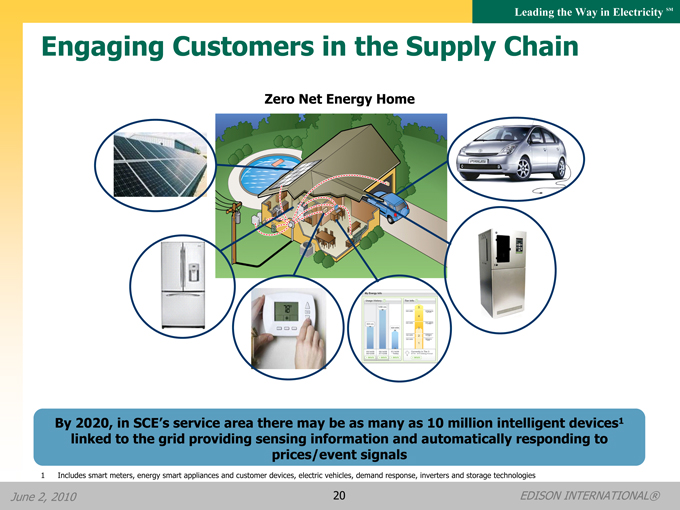

Engaging Customers in the Supply Chain

Zero Net Energy Home

By 2020, in SCE’s service area there may be as many as 10 million intelligent devices1 linked to the grid providing sensing information and automatically responding to prices/event signals

1 Includes smart meters, energy smart appliances and customer devices, electric vehicles, demand response, inverters and storage technologies

June 2, 2010 20 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Realizing a Smarter Grid

• Intelligent and communicating PEVs that integrate gracefully with the grid

• Cost effective energy storage at bulk transmission and distribution

• Commercial products based on open, non-proprietary standards that are secure

• Seamless and secure telecommunications infrastructure that integrates millions of

intelligent devices to produce actionable information that is used to control the electric

system

• Workforce with the skills and knowledge to engineer, build, operate and maintain an

electric grid with pervasive information technology embedded

• Progress to date (SCE examples)

Synchrophasors on bulk transmission systems = 27

Circuits with outage mitigation (% of 4,400 circuits) = 41%

Substations automated (% of 900 substations) = 56%

Total demand response capacity = 1,548 MW

Residential and small commercial and industrial smart meters = 635,000+

June 2, 2010 21 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Our Shareholder Value Proposition

Dual platform operating across the full spectrum of the

electricity industry

Southern California Edison

Among the best domestic electric utility growth

platforms

Supportive regulatory framework

Leadership in renewable energy, energy efficiency,

electric vehicles and smart grid development

Edison Mission Group

See real equity value in the portfolio

Working coal fleet environmental compliance issues

Current wind construction program is self-funding

Commitment to long-term shareholder value creation

Incentive compensation and stock ownership guidelines

consistent with shareholder interests

Edison people committed to excellence in safety and

customer service

June 2, 2010 22 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

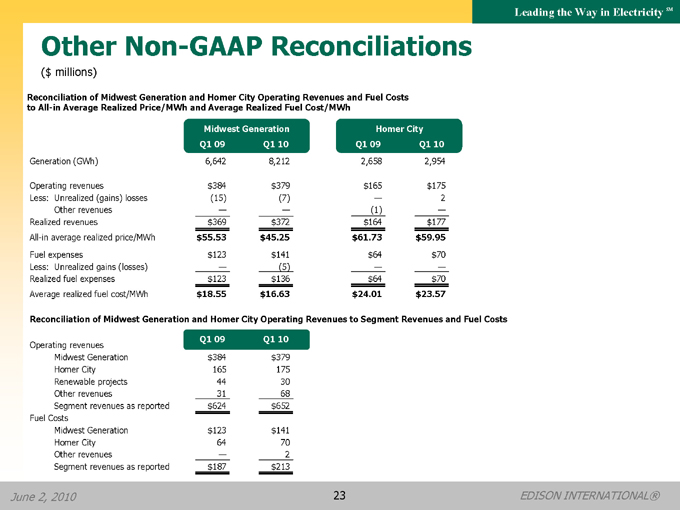

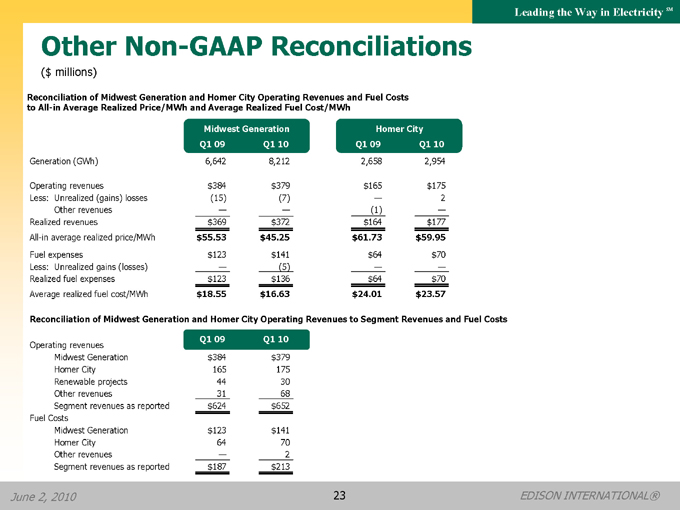

Other Non-GAAP Reconciliations

($ millions)

Reconciliation of Midwest Generation and Homer City Operating Revenues and Fuel Costs to All-in Average Realized Price/MWh and Average Realized Fuel Cost/MWh

Midwest Generation Homer City

Q1 09 Q1 10 Q1 09 Q1 10

Generation (GWh) 6,642 8,212 2,658 2,954

Operating revenues $384 $379 $165 $175

Less: Unrealized (gains) losses (15) (7) — 2

Other revenues — — (1) —

Realized revenues $369 $372 $164 $177

All-in average realized price/MWh $55.53 $45.25 $61.73 $59.95

Fuel expenses $123 $141 $64 $70

Less: Unrealized gains (losses) — (5) — —

Realized fuel expenses $123 $136 $64 $70

Average realized fuel cost/MWh $18.55 $16.63 $24.01 $23.57

Reconciliation of Midwest Generation and Homer City Operating Revenues to Segment Revenues and Fuel Costs

Operating revenues Q1 09 Q1 10

Midwest Generation $384 $379

Homer City 165 175

Renewable projects 44 30

Other revenues 31 68

Segment revenues as reported $624 $652

Fuel Costs

Midwest Generation $123 $141

Homer City 64 70

Other revenues — 2

Segment revenues as reported $187 $213

June 2, 2010 23 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and EPS by principal operating subsidiary internally for financial planning and for analysis of performance. We also use core earnings and EPS by principal operating subsidiary when communicating with analysts and investors regarding our earnings results and outlook, to facilitate the company’s performance from period to period.

Core earnings is a Non-GAAP financial measure and may not be comparable to those of other companies. Core earnings and core earnings per share are defined as GAAP earnings and GAAP earnings per share excluding income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings. GAAP earnings refer to net income attributable to Edison International or attributable to the common shareholders of each subsidiary and Edison International GAAP earnings per share refers to basic earnings per common share attributable to Edison International common shareholders. EPS by principal operating subsidiary is based on the principal operating subsidiaries’ net income attributable to the common shareholders of each subsidiary, respectively, and Edison International’s weighted average outstanding common shares. The impact of participating securities (vested stock options that earn dividend equivalents that may participate in undistributed earnings with common stock) for each principal operating subsidiary is not material to each principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which we refer to as EIX parent company and other.

EBITDA is defined as earnings before interest, income taxes, depreciation and amortization. Adjusted EBITDA includes production tax credits from EMG’s wind projects and excludes amounts from gain on the sale of assets, loss on early extinguishment of debt and leases, and impairment of assets and investments. Our management uses Adjusted EBITDA as an important financial measure for evaluating EMG.

The average realized energy price and average realized fuel cost is a non-GAAP performance measure since such statistical measures exclude unrealized gains or losses recorded as operating revenues and unrealized gains or losses recorded as fuel expenses. Management believes that the average realized energy price and average realized fuel cost is more meaningful for investors as it reflects the impact of hedge contracts at the time of actual generation in period-over-period comparisons or as compared to real-time market prices.

A reconciliation of Non-GAAP information to GAAP information, including the impact of participating securities, is included either on the slide where the information appears or on another slide referenced in this presentation.

24