- EIX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Edison International (EIX) 8-KRegulation FD Disclosure

Filed: 29 Mar 06, 12:00am

Exhibit 99.1

Business Overview

Theodore F. Craver, Jr. Chairman and Chief Executive Officer Edison Mission Group

Credit Suisse Global Leveraged Finance Conference

March 29, 2006

Forward-Looking Statement

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect Edison International’s current expectations and projections about future events based on Edison International’s knowledge of present facts and circumstances and assumptions about future events and include any statement that does not directly relate to a historical or current fact. In this presentation and elsewhere, the words “expects,” “believes,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “probable,” “may,” “will,” “could,” “would,” “should,” and variations of such words and similar expressions, or discussions of strategy or of plans, are intended to identify forward-looking statements. Such statements necessarily involve risks and uncertainties that could cause actual results to differ materially from those anticipated. Some of the risks, uncertainties and other important factors that could cause results to differ, or that otherwise could impact Edison International or its subsidiaries, include but are not limited to:

the ability of Edison International to meet its financial obligations and to pay dividends on its common stock if its subsidiaries are unable to pay dividends; the ability of SCE to recover its costs in a timely manner from its customers through regulated rates; decisions and other actions by the California Public Utilities Commission (CPUC) and other regulatory authorities and delays in regulatory actions; market risks affecting SCE’s energy procurement activities; access to capital markets and the cost of capital; changes in interest rates, rates of inflation and foreign exchange rates;

governmental, statutory, regulatory or administrative changes or initiatives affecting the electricity industry, including the market structure rules applicable to each market and environmental regulations that could require additional expenditures or otherwise affect the cost and manner of doing business; risks associated with operating nuclear and other power generating facilities, including operating risks, nuclear fuel storage, equipment failure, availability, heat rate and output; the availability of labor, equipment and materials; the ability to obtain sufficient insurance, including insurance relating to SCE’s nuclear facilities; effects of legal proceedings, changes in or interpretations of tax laws, rates or policies, and changes in accounting standards; supply and demand for electric capacity and energy, and the resulting prices and dispatch volumes, in the wholesale markets to which MEHC generating units have access; the cost and availability of coal, natural gas, and fuel oil, nuclear fuel, and associated transportation; the cost and availability of emission credits or allowances for emission credits; transmission congestion in and to each market area and the resulting differences in prices between delivery points; the ability to provide sufficient collateral in support of hedging activities and purchased power and fuel; the extent of additional supplies of capacity, energy and ancillary services from current competitors or new market entrants, including the development of new generation facilities and technologies; general political, economic and business conditions; weather conditions, natural disasters and other unforeseen events; and changes in the fair value of investments and other assets accounted for using fair value accounting.

Additional information about risks and uncertainties, including more detail about the factors described above, is contained in Edison International’s reports filed with the Securities and Exchange Commission. Readers are urged to read such reports and carefully consider the risks, uncertainties and other factors that affect Edison International’s business. Readers also should review future reports filed by Edison International with the Securities and Exchange Commission. The information contained in this presentation is subject to change without notice. Forward-looking statements speak only as of the date they are made and Edison International is not obligated to publicly update or revise forward-looking statements.

1

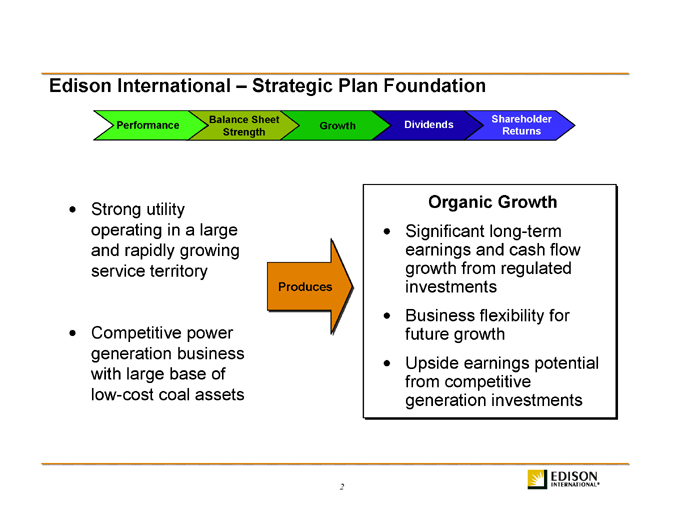

Edison International - Strategic Plan Foundation

Balance Sheet

Shareholder Performance

Growth

Dividends Strength

Returns

Strong utility operating in a large and rapidly growing service territory

Competitive power generation business with large base of low-cost coal assets

Produces

Organic Growth

Significant long-term earnings and cash flow growth from regulated investments

Business flexibility for future growth

Upside earnings potential from competitive generation investments

2

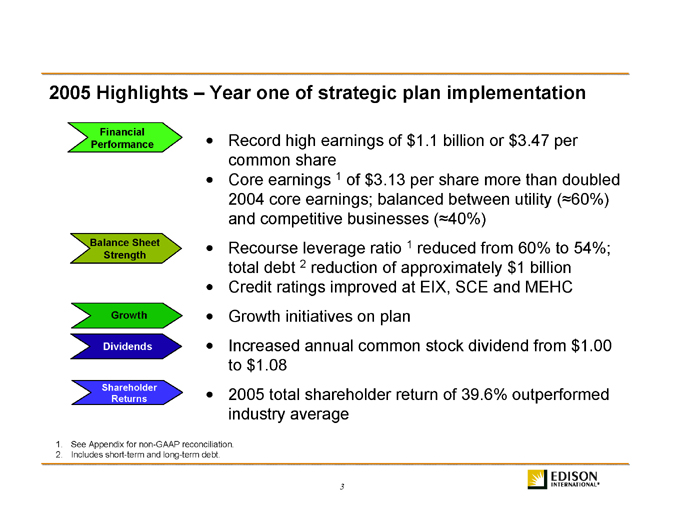

2005 Highlights - Year one of strategic plan implementation

Financial Performance

Balance Sheet Strength

Growth

Dividends

Shareholder Returns

Record high earnings of $1.1 billion or $3.47 per common share

Core earnings 1 of $3.13 per share more than doubled 2004 core earnings; balanced between utility ( 60%) and competitive businesses ( 40%)

Recourse leverage ratio 1 reduced from 60% to 54%; total debt 2 reduction of approximately $1 billion

Credit ratings improved at EIX, SCE and MEHC

Growth initiatives on plan

Increased annual common stock dividend from $1.00 to $1.08

2005 total shareholder return of 39.6% outperformed industry average

1. See Appendix for non-GAAP reconciliation.

2. Includes short-term and long-term debt.

3

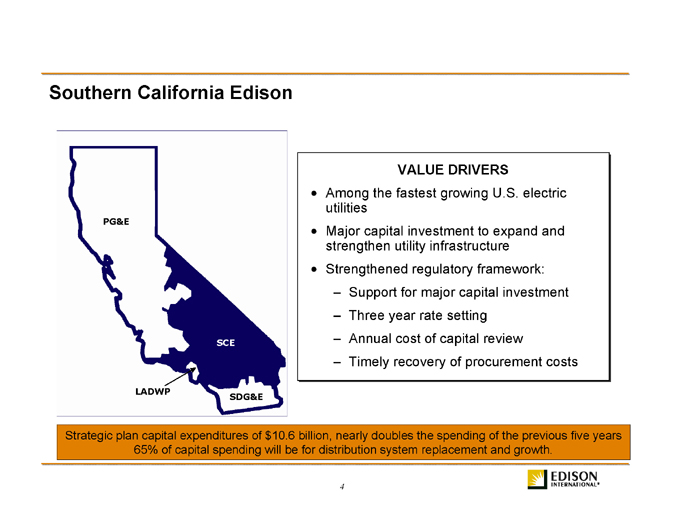

Southern California Edison

PG&E

SCE

LADWP

SDG&E

VALUE DRIVERS

Among the fastest growing U.S. electric utilities

Major capital investment to expand and strengthen utility infrastructure

Strengthened regulatory framework:

Support for major capital investment

Three year rate setting

Annual cost of capital review

Timely recovery of procurement costs

Strategic plan capital expenditures of $10.6 billion, nearly doubles the spending of the previous five years 65% of capital spending will be for distribution system replacement and growth.

4

5

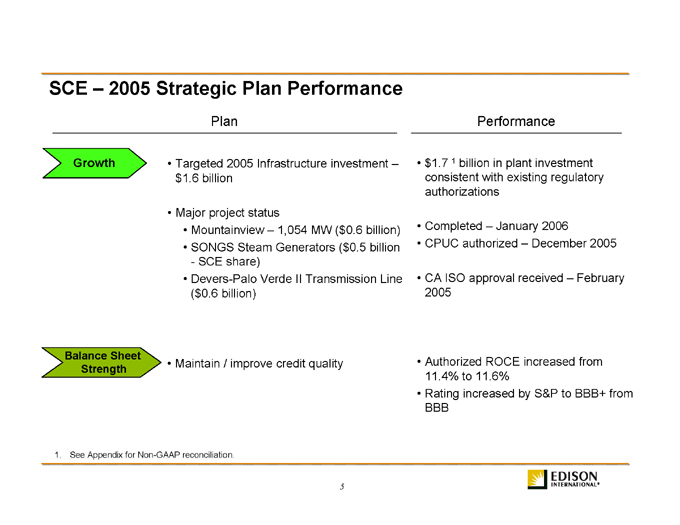

SCE - 2005 Strategic Plan Performance

Plan

Performance

Growth

Targeted 2005 Infrastructure investment -$1.6 billion $1.7 1 billion in plant investment consistent with existing regulatory authorizations

Major project status

Mountainview - 1,054 MW ($0.6 billion)

Completed - January 2006

SONGS Steam Generators ($0.5 billion

- SCE share)

CPUC authorized - December 2005

Devers-Palo Verde II Transmission Line

($ 0.6 billion)

CA ISO approval received - February 2005

Balance Sheet Strength

Maintain / improve credit quality

Authorized ROCE increased from 11.4% to 11.6%

Rating increased by S&P to BBB+ from BBB

1. See Appendix for Non-GAAP reconciliation.

6

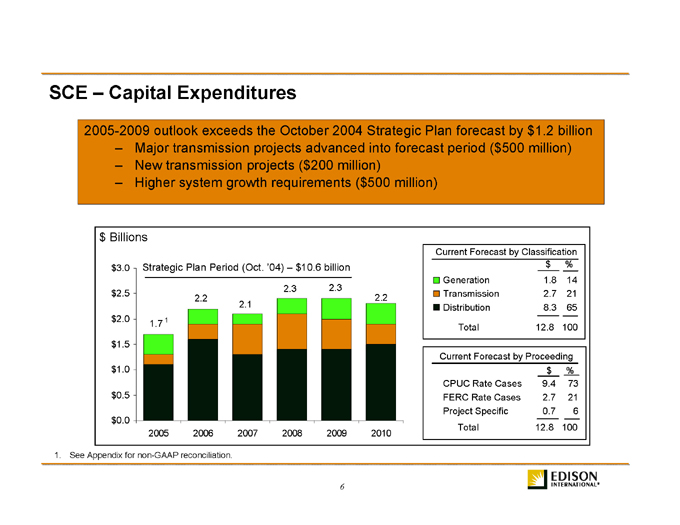

SCE - Capital Expenditures

2005-2009 outlook exceeds the October 2004 Strategic Plan forecast by $1.2 billion

- Major transmission projects advanced into forecast period ($500 million)

- New transmission projects ($200 million)

- Higher system growth requirements ($500 million) $ Billions $3.0 $2.5 $2.0 $1.5 $1.0 $0.5 $0.0

1.7 1

2.2

Strategic Plan Period (Oct. ‘04) - $10.6 billion

2.1

2.3

2.3

2.2

2005

2006

2007

2008

2009

2010

Current Forecast by Classification $ %

Generation 1.8 14

Transmission 2.7 21

Distribution 8.3 65

Total 12.8 100

Current Forecast by Proceeding $ %

CPUC Rate Cases 9.4 73

FERC Rate Cases 2.7 21

Project Specific 0.7 6

Total 12.8 100

1. See Appendix for non-GAAP reconciliation.

7

7

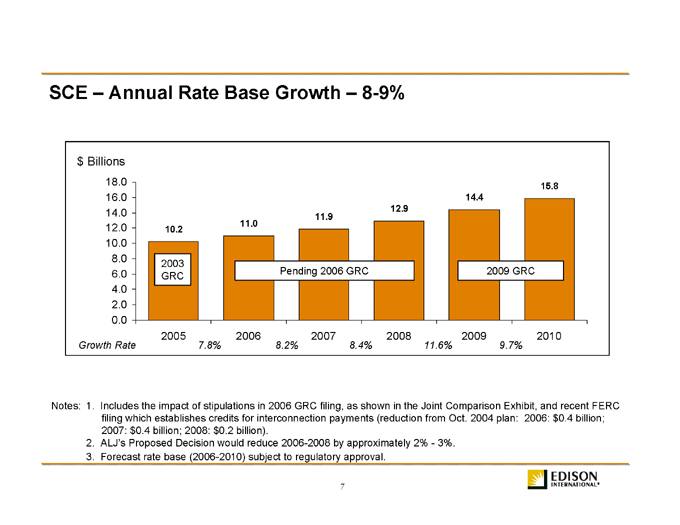

SCE - Annual Rate Base Growth - 8-9% $ Billions

18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0

10.2

11.0

11.9

12.9

14.4

15.8

2003 GRC

Pending 2006 GRC

2009 GRC

Growth Rate

2005

7.8%

2006

8.2%

2007

8.4%

2008

11.6%

2009

9.7%

2010

Notes: 1. Includes the impact of stipulations in 2006 GRC filing, as shown in the Joint Comparison Exhibit, and recent FERC filing which establishes credits for interconnection payments (reduction from Oct. 2004 plan: 2006: $0.4 billion; 2007: $0.4 billion; 2008: $0.2 billion).

2. ALJ’s Proposed Decision would reduce 2006-2008 by approximately 2% - 3%.

3. Forecast rate base (2006-2010) subject to regulatory approval.

8

8

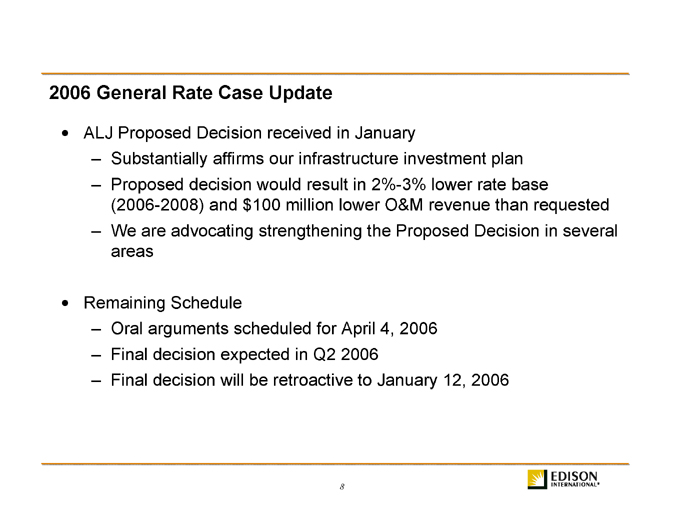

2006 General Rate Case Update

ALJ Proposed Decision received in January

Substantially affirms our infrastructure investment plan

Proposed decision would result in 2%-3% lower rate base

(2006-2008) and $100 million lower O&M revenue than requested

We are advocating strengthening the Proposed Decision in several areas

Remaining Schedule

Oral arguments scheduled for April 4, 2006

Final decision expected in Q2 2006

Final decision will be retroactive to January 12, 2006

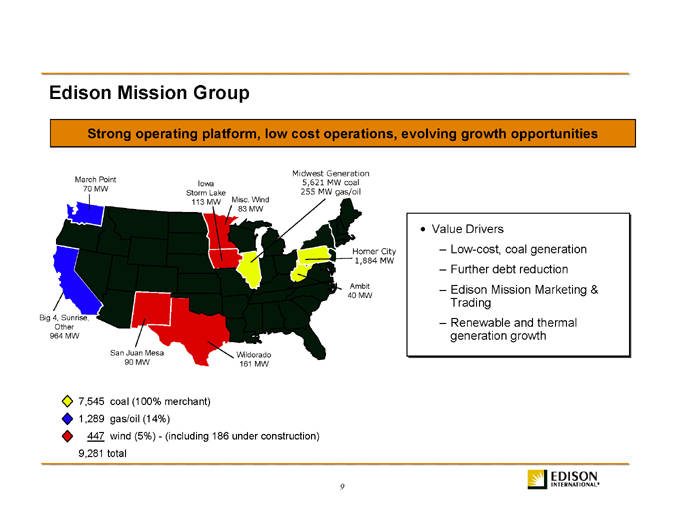

Edison Mission Group

Strong operating platform, low cost operations, evolving growth opportunities

March Point 70 MW

Big 4, Sunrise, Other 964 MW

San Juan Mesa 90 MW

Iowa Storm Lake 113 MW

Misc. Wind 83 MW

Midwest Generation 5,621 MW coal 255 MW gas/oil

Homer City 1,884 MW

Ambit 40 MW

Wildorado 161 MW

Value Drivers

Low-cost, coal generation Further debt reduction Edison Mission Marketing & Trading Renewable and thermal generation growth

7,545 coal (100% merchant) 1,289 gas/oil (14%)

447 wind (5%) - (including 186 under construction) 9,281 total

9

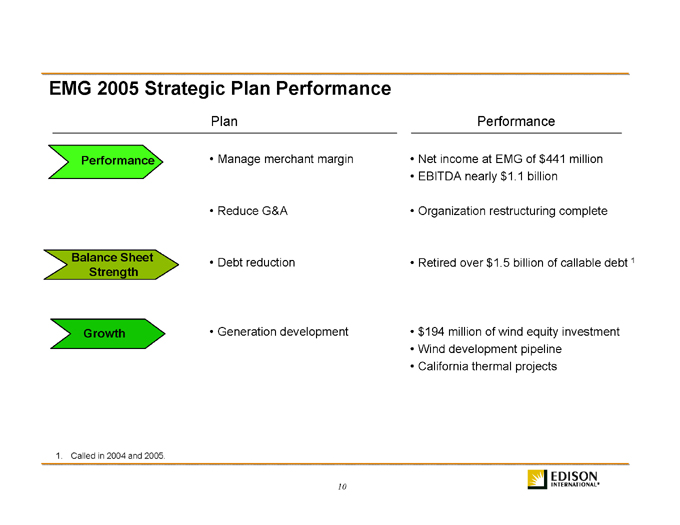

EMG 2005 Strategic Plan Performance

Plan

Performance

Performance

Manage merchant margin

Net income at EMG of $441 million

EBITDA nearly $1.1 billion

Reduce G&A

Organization restructuring complete

Balance Sheet Strength

Debt reduction

Retired over $1.5 billion of callable debt 1

Growth

Generation development $194 million of wind equity investment Wind development pipeline California thermal projects

1. Called in 2004 and 2005.

10

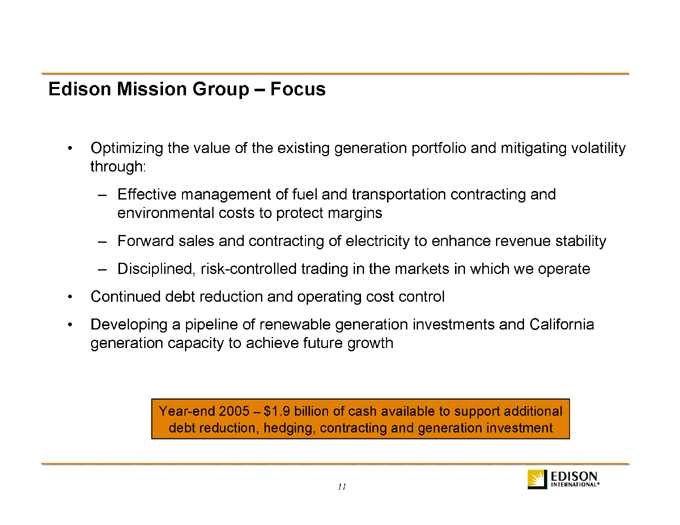

Edison Mission Group - Focus

Optimizing the value of the existing generation portfolio and mitigating volatility through:

Effective management of fuel and transportation contracting and environmental costs to protect margins Forward sales and contracting of electricity to enhance revenue stability Disciplined, risk-controlled trading in the markets in which we operate

Continued debt reduction and operating cost control

Developing a pipeline of renewable generation investments and California generation capacity to achieve future growth

Year-end 2005 - $1.9 billion of cash available to support additional debt reduction, hedging, contracting and generation investment

11

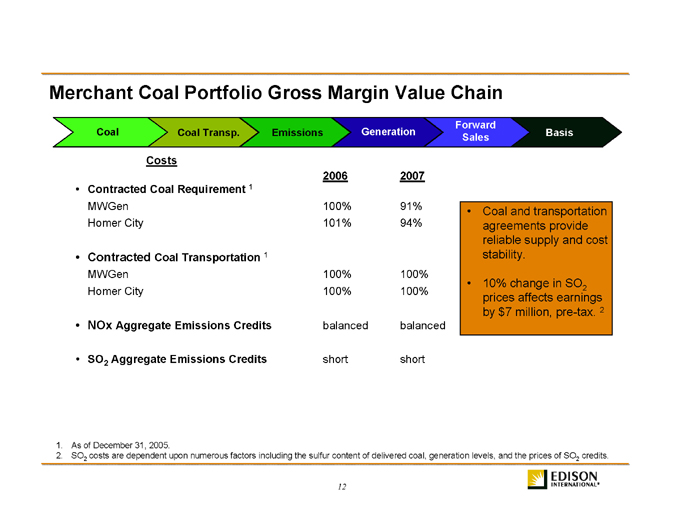

Merchant Coal Portfolio Gross Margin Value Chain

Forward

Coal Coal Transp. Emissions Generation Basis Sales

Costs

Contracted Coal Requirement 1

MWGen Homer City

2006 2007

100% 91% 101% 94%

Contracted Coal Transportation 1

MWGen Homer City

100% 100% 100% 100%

NOx Aggregate Emissions Credits balanced balanced

SO2 Aggregate Emissions Credits

short short

Coal and transportation agreements provide reliable supply and cost stability.

10% change in SO2

prices affects earnings by $7 million, pre-tax. 2

1. As of December 31, 2005.

2. SO2 costs are dependent upon numerous factors including the sulfur content of delivered coal, generation levels, and the prices of SO2 credits.

12

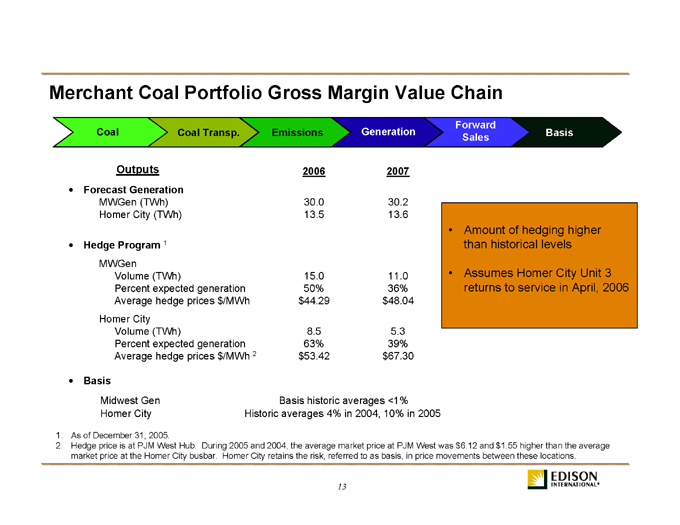

Merchant Coal Portfolio Gross Margin Value Chain

Forward

Coal Coal Transp. Emissions Generation Basis Sales

Outputs 2006 2007

Forecast Generation

MWGen (TWh) 30.0 30.2 Homer City (TWh) 13.5 13.6

Hedge Program 1

MWGen

Volume (TWh) 15.0 11.0 Percent expected generation 50% 36% Average hedge prices $/MWh $44.29 $48.04 Homer City Volume (TWh) 8.5 5.3 Percent expected generation 63% 39% Average hedge prices $/MWh 2 $53.42 $67.30

Basis

Midwest Gen Basis historic averages <1% Homer City Historic averages 4% in 2004, 10% in 2005

1. As of December 31, 2005.

2. Hedge price is at PJM West Hub. During 2005 and 2004, the average market price at PJM West was $6.12 and $1.55 higher than the average market price at the Homer City busbar. Homer City retains the risk, referred to as basis, in price movements between these locations.

Amount of hedging higher than historical levels

Assumes Homer City Unit 3 returns to service in April, 2006

13

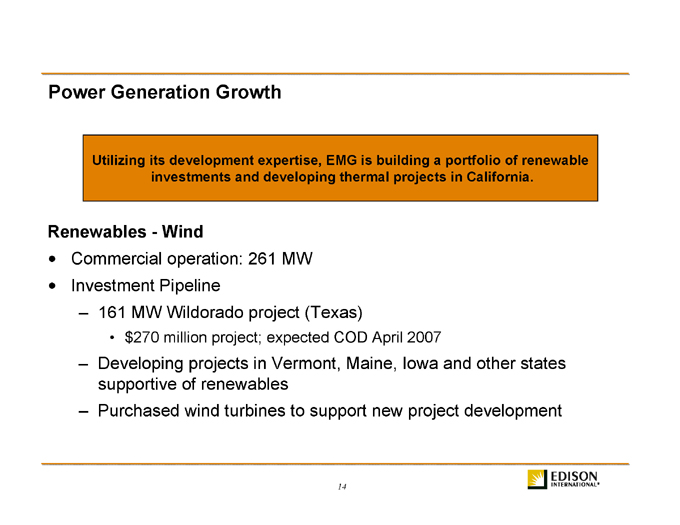

Power Generation Growth

Utilizing its development expertise, EMG is building a portfolio of renewable investments and developing thermal projects in California.

Renewables - Wind

Commercial operation: 261 MW Investment Pipeline

161 MW Wildorado project (Texas)

$ 270 million project; expected COD April 2007

Developing projects in Vermont, Maine, Iowa and other states supportive of renewables Purchased wind turbines to support new project development

14

EMG California Thermal Generation Opportunities

Big 4 projects contract extension (602 MW)

Kern River - 5-year contract submitted for CPUC approval

Other Big 4 contracts expire: December, 2007 (Sycamore); April, 2008 (Watson); May, 2009 (Midway-Sunset)

EMG pursuing 1,500 MW of new thermal generation

New natural gas-fired generation (1,000 MW)

2 project proposals filed with California Energy Commission (Sun Valley - 500 MW, Walnut Creek - 500 MW)

EMG/BP hydrogen power project (500 MW)

Early development phase - assessing technical and commercial feasibility

Petroleum coke fuel

Approximately 90% of CO2 removed and used for enhanced-oil

recovery

15

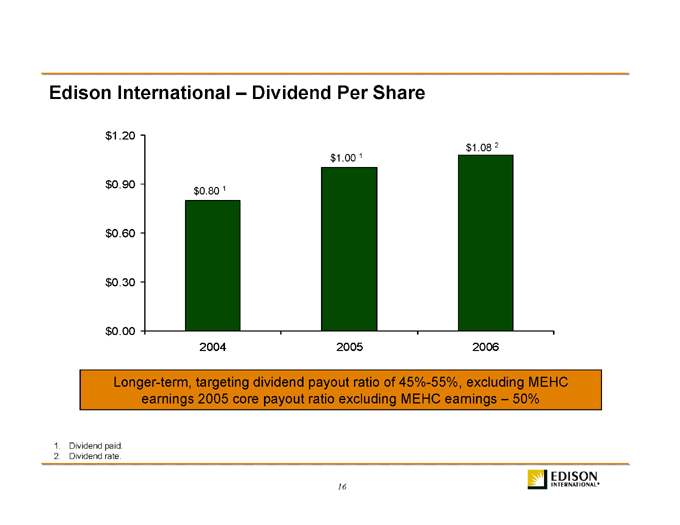

Edison International - Dividend Per Share $1.20 $0.90 $0.60 $0.30 $0.00 $0.80 1 $1.00 1 $1.08 2

2004

2005

2006

Longer-term, targeting dividend payout ratio of 45%-55%, excluding MEHC earnings 2005 core payout ratio excluding MEHC earnings - 50%

1. Dividend paid.

2. Dividend rate.

16

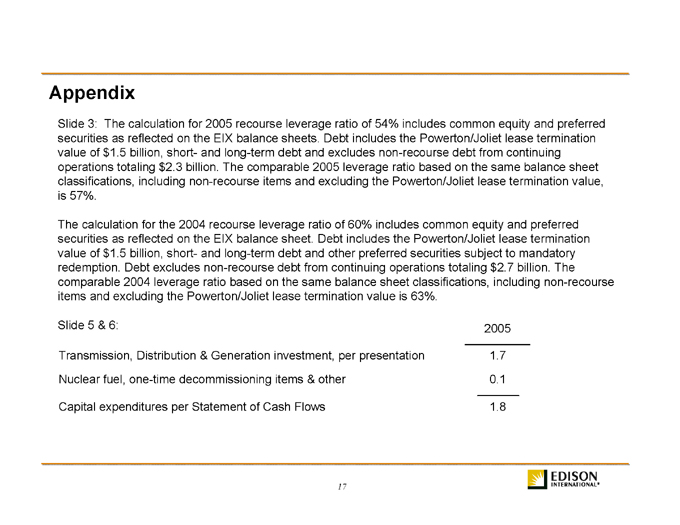

Appendix

Slide 3: The calculation for 2005 recourse leverage ratio of 54% includes common equity and preferred securities as reflected on the EIX balance sheets. Debt includes the Powerton/Joliet lease termination value of $1.5 billion, short- and long-term debt and excludes non-recourse debt from continuing operations totaling $2.3 billion. The comparable 2005 leverage ratio based on the same balance sheet classifications, including non-recourse items and excluding the Powerton/Joliet lease termination value, is 57%.

The calculation for the 2004 recourse leverage ratio of 60% includes common equity and preferred securities as reflected on the EIX balance sheet. Debt includes the Powerton/Joliet lease termination value of $1.5 billion, short- and long-term debt and other preferred securities subject to mandatory redemption. Debt excludes non-recourse debt from continuing operations totaling $2.7 billion. The comparable 2004 leverage ratio based on the same balance sheet classifications, including non-recourse items and excluding the Powerton/Joliet lease termination value is 63%.

Slide 5 & 6: 2005

Transmission, Distribution & Generation investment, per presentation 1.7 Nuclear fuel, one-time decommissioning items & other 0.1

Capital expenditures per Statement of Cash Flows 1.8

17

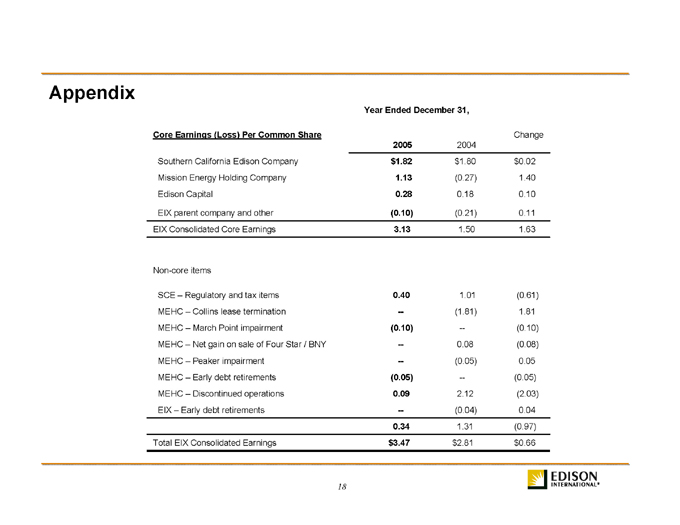

Appendix

Year Ended December 31,

Core Earnings (Loss) Per Common Share Change

2005 2004

Southern California Edison Company $1.82 $1.80 $0.02

Mission Energy Holding Company 1.13 (0.27) 1.40

Edison Capital 0.28 0.18 0.10

EIX parent company and other (0.10) (0.21) 0.11

EIX Consolidated Core Earnings 3.13 1.50 1.63

Non-core items

SCE - Regulatory and tax items 0.40 1.01 (0.61)

MEHC - Collins lease termination -- (1.81) 1.81

MEHC - March Point impairment (0.10) -- (0.10)

MEHC - Net gain on sale of Four Star / BNY -- 0.08 (0.08)

MEHC - Peaker impairment -- (0.05) 0.05

MEHC - Early debt retirements (0.05) -- (0.05)

MEHC - Discontinued operations 0.09 2.12 (2.03)

EIX - Early debt retirements -- (0.04) 0.04

0.34 1.31 (0.97)

Total EIX Consolidated Earnings $ 3.47 $2.81 $0.66

18