- EIX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Edison International (EIX) 8-KRegulation FD Disclosure

Filed: 29 Jun 06, 12:00am

Exhibit 99.1

Financial Outlook

June 29, 2006

Forward-Looking Statement

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect Edison International’s current expectations and projections about future events based on Edison International’s knowledge of present facts and circumstances and assumptions about future events and include any statement that does not directly relate to a historical or current fact. In this presentation and elsewhere, the words “expects,” “believes,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “probable,” “may,” “will,” “could,” “would,” “should,” and variations of such words and similar expressions, or discussions of strategy or of plans, are intended to identify forward-looking statements. Such statements necessarily involve risks and uncertainties that could cause actual results to differ materially from those anticipated. Some of the risks, uncertainties and other important factors that could cause results to differ, or that otherwise could impact Edison International or its subsidiaries, include but are not limited to: the ability of Edison International to meet its financial obligations and to pay dividends on its common stock if its subsidiaries are unable to pay dividends; the ability of Southern California Edison (SCE) to recover its costs in a timely manner from its customers through regulated rates; decisions and other actions by the California Public Utilities Commission (CPUC) and other regulatory authorities and delays in regulatory actions; market risks affecting SCE’s energy procurement activities; access to capital markets and the cost of capital; changes in interest rates, rates of inflation and foreign exchange rates; governmental, statutory, regulatory or administrative changes or initiatives affecting the electricity industry, including the market structure rules applicable to each market and environmental regulations that could require additional expenditures or otherwise affect the cost and manner of doing business; risks associated with operating nuclear and other power generating facilities, including operating risks, nuclear fuel storage, equipment failure, availability, heat rate and output; the availability of labor, equipment and materials; the ability to obtain sufficient insurance, including insurance relating to SCE’s nuclear facilities; effects of legal proceedings, changes in or interpretations of tax laws, rates or policies, and changes in accounting standards; supply and demand for electric capacity and energy, and the resulting prices and dispatch volumes, in the wholesale markets to which MEHC generating units have access; the cost and availability of coal, natural gas, and fuel oil, nuclear fuel, and associated transportation; the cost and availability of emission credits or allowances for emission credits; transmission congestion in and to each market area and the resulting differences in prices between delivery points; the ability to provide sufficient collateral in support of hedging activities and purchased power and fuel; the extent of additional supplies of capacity, energy and ancillary services from current competitors or new market entrants, including the development of new generation facilities and technologies; general political, economic and business conditions; weather conditions, natural disasters and other unforeseen events; and changes in the fair value of investments and other assets accounted for using fair value accounting.

Additional information about risks and uncertainties, including more detail about the factors described above, is contained in Edison International’s reports filed with the Securities and Exchange Commission. Readers are urged to read such reports and carefully consider the risks, uncertainties and other factors that affect Edison International’s business. Readers also should review future reports filed by Edison International with the Securities and Exchange Commission. The information contained in this presentation is subject to change without notice. Forward-looking statements speak only as of the date they are made and Edison International is not obligated to publicly update or revise forward-looking statements.

1 |

|

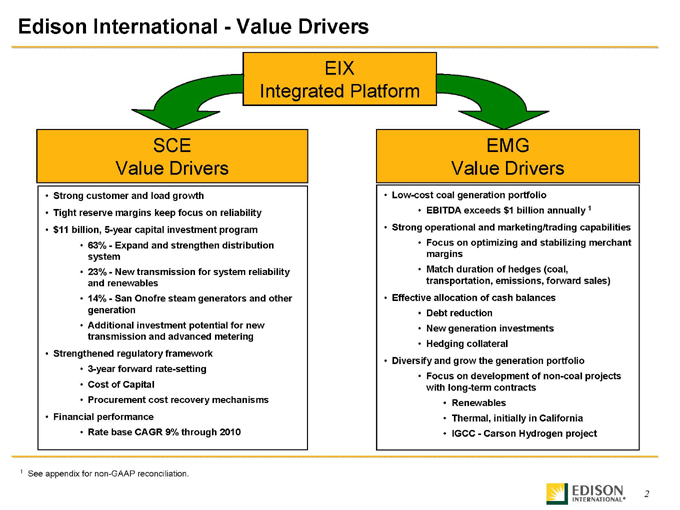

Edison International—Value Drivers

EIX Integrated Platform

SCE Value Drivers

Strong customer and load growth

Tight reserve margins keep focus on reliability $11 billion, 5-year capital investment program

63%—Expand and strengthen distribution system 23%—New transmission for system reliability and renewables 14%—San Onofre steam generators and other generation Additional investment potential for new transmission and advanced metering

Strengthened regulatory framework

3-year forward rate-setting Cost of Capital

Procurement cost recovery mechanisms

Financial performance

Rate base CAGR 9% through 2010

EMG Value Drivers

Low-cost coal generation portfolio

EBITDA exceeds $1 billion annually 1

Strong operational and marketing/trading capabilities

Focus on optimizing and stabilizing merchant margins Match duration of hedges (coal, transportation, emissions, forward sales)

Effective allocation of cash balances

Debt reduction

New generation investments Hedging collateral

Diversify and grow the generation portfolio

Focus on development of non-coal projects with long-term contracts

Renewables

Thermal, initially in California IGCC—Carson Hydrogen project

1 |

| See appendix for non-GAAP reconciliation. |

2 |

|

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

Southern California Edison (SCE)

3 |

|

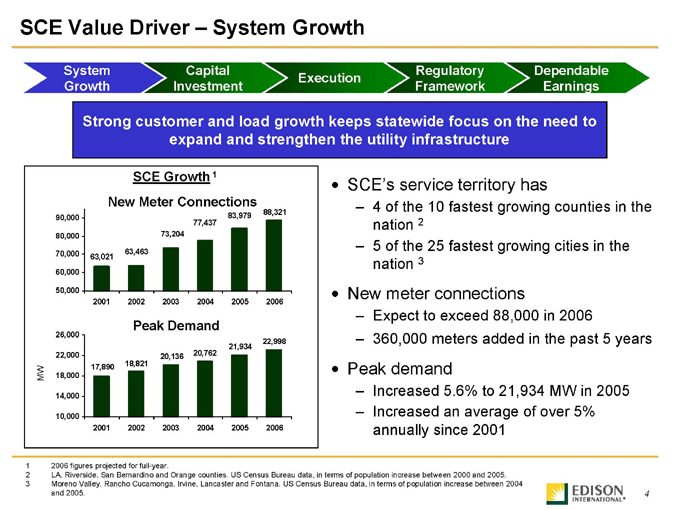

SCE Value Driver – System Growth

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

Strong customer and load growth keeps statewide focus on the need to expand and strengthen the utility infrastructure

SCE Growth 1 New Meter Connections

90,000 80,000 70,000 60,000 50,000

88,321 83,979 77,437 73,204

63,463 63,021

2001 2002 2003 2004 2005 2006

Peak Demand

MW

26,000 22,000 18,000 14,000 10,000

22,998 21,934 20,762 20,136 18,821 17,890

2001 2002 2003 2004 2005 2006

SCE’s service territory has

4 |

| of the 10 fastest growing counties in the nation 2 5 of the 25 fastest growing cities in the nation 3 |

New meter connections

Expect to exceed 88,000 in 2006

360,000 meters added in the past 5 years

Peak demand

Increased 5.6% to 21,934 MW in 2005 Increased an average of over 5% annually since 2001

1 |

| 2006 figures projected for full-year. |

2 LA, Riverside, San Bernardino and Orange counties. US Census Bureau data, in terms of population increase between 2000 and 2005.

3 Moreno Valley, Rancho Cucamonga, Irvine, Lancaster and Fontana. US Census Bureau data, in terms of population increase between 2004 and 2005.

4 |

|

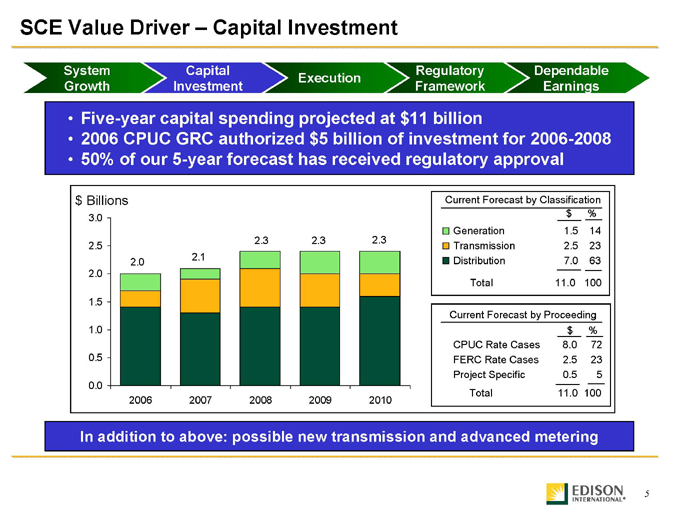

SCE Value Driver – Capital Investment

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

Five-year capital spending projected at $11 billion

2006 CPUC GRC authorized $5 billion of investment for 2006-2008 50% of our 5-year forecast has received regulatory approval $ Billions

3.0 2.5 2.0 1.5 1.0 0.5 0.0

2.3 2.3 2.3 2.1 2.0

2006 2007 2008 2009 2010

Current Forecast by Classification

$ %

Generation 1.5 14

Transmission 2.5 23

Distribution 7.0 63

Total 11.0 100

Current Forecast by Proceeding

$ %

CPUC Rate Cases 8.0 72

FERC Rate Cases 2.5 23

Project Specific 0.5 5

Total 11.0 100

In addition to above: possible new transmission and advanced metering

5 |

|

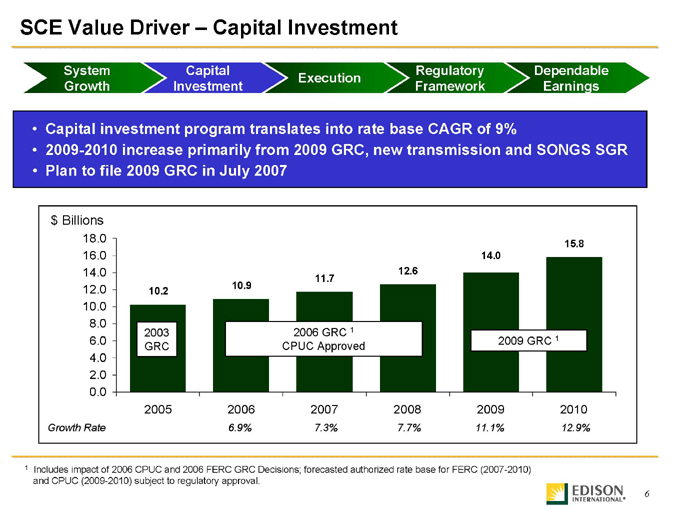

SCE Value Driver – Capital Investment

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

Capital investment program translates into rate base CAGR of 9%

2009-2010 increase primarily from 2009 GRC, new transmission and SONGS SGR Plan to file 2009 GRC in July 2007 $ Billions

18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0

Growth Rate

15.8 14.0 12.6 11.7 10.9 10.2

2003 GRC

2006 GRC 1 CPUC Approved

2009 GRC 1

2005 2006 2007 2008 2009 2010

6.9% 7.3% 7.7% 11.1% 12.9%

1 Includes impact of 2006 CPUC and 2006 FERC GRC Decisions; forecasted authorized rate base for FERC (2007-2010) and CPUC (2009-2010) subject to regulatory approval.

6 |

|

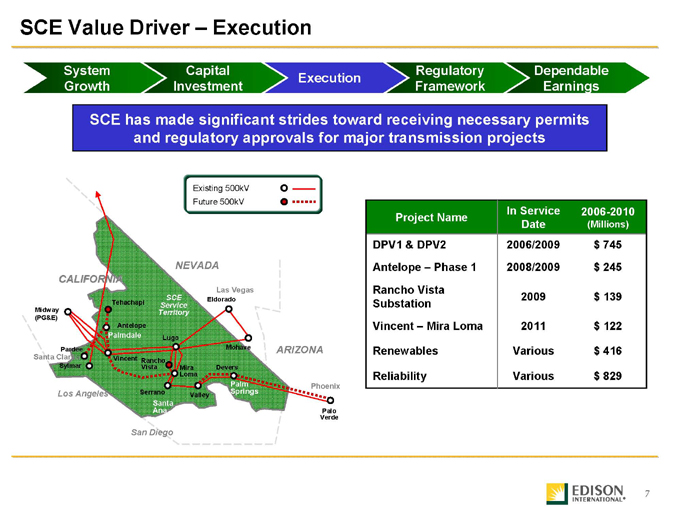

SCE Value Driver – Execution

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

SCE has made significant strides toward receiving necessary permits and regulatory approvals for major transmission projects

Existing 500kV Future 500kV

NEVADA CALIFORNIA

Las Vegas

SCE Eldorado Tehachapi Service

Midway Territory

(PG&E)

Antelope

Palmdale Lugo

Pardee Mohave ARIZONA

Santa Clarita Vincent

Rancho

Sylmar Vista Mira Devers Loma

Palm Phoenix

Los Angeles Serrano Springs

Valley

Santa

Ana Palo Verde

San Diego

In Service 2006-2010

Project Name

Date (Millions)

DPV1 & DPV2 2006/2009 $ 745

Antelope – Phase 1 2008/2009 $ 245

Rancho Vista

2009 $ 139

Substation

Vincent – Mira Loma 2011 $ 122

Renewables Various $ 416

Reliability Various $ 829

7 |

|

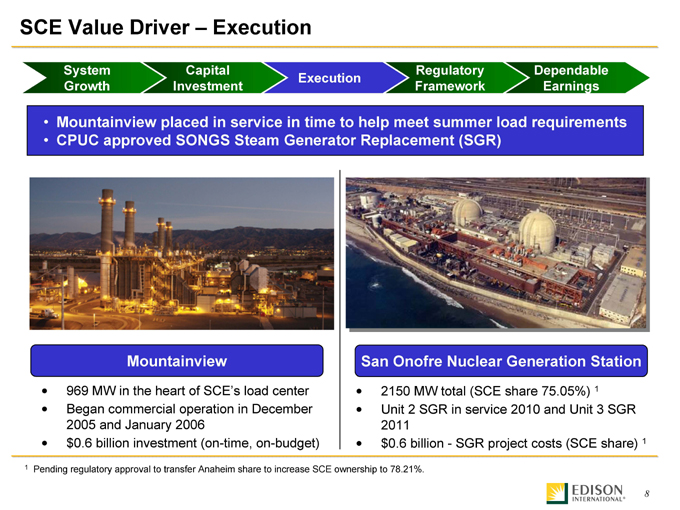

SCE Value Driver – Execution

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

Mountainview placed in service in time to help meet summer load requirements CPUC approved SONGS Steam Generator Replacement (SGR)

Mountainview

969 MW in the heart of SCE’s load center Began commercial operation in December 2005 and January 2006 $0.6 billion investment (on-time, on-budget)

San Onofre Nuclear Generation Station

2150 MW total (SCE share 75.05%) 1 Unit 2 SGR in service 2010 and Unit 3 SGR 2011 $0.6 billion—SGR project costs (SCE share) 1

1 |

| Pending regulatory approval to transfer Anaheim share to increase SCE ownership to 78.21%. |

8 |

|

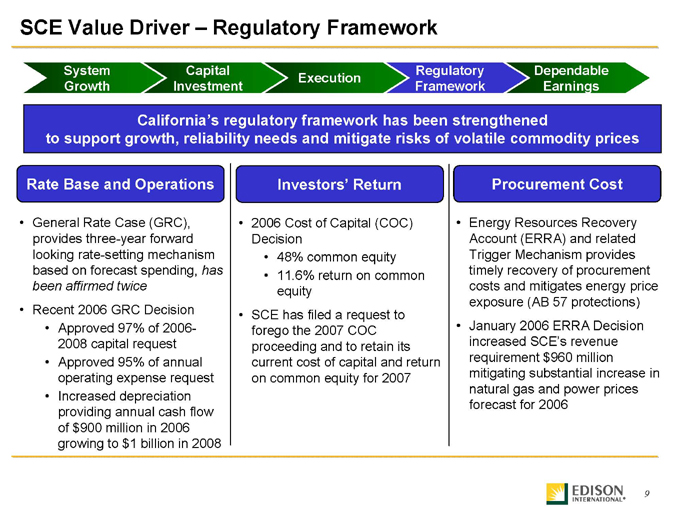

SCE Value Driver – Regulatory Framework

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

California’s regulatory framework has been strengthened to support growth, reliability needs and mitigate risks of volatile commodity prices

Rate Base and Operations

General Rate Case (GRC), provides three-year forward looking rate-setting mechanism based on forecast spending, has been affirmed twice

Recent 2006 GRC Decision

Approved 97% of 2006-2008 capital request Approved 95% of annual operating expense request Increased depreciation providing annual cash flow of $900 million in 2006 growing to $1 billion in 2008

Investors’ Return

2006 Cost of Capital (COC) Decision

48% common equity 11.6% return on common equity

SCE has filed a request to forego the 2007 COC proceeding and to retain its current cost of capital and return on common equity for 2007

Procurement Cost

Energy Resources Recovery Account (ERRA) and related Trigger Mechanism provides timely recovery of procurement costs and mitigates energy price exposure (AB 57 protections)

January 2006 ERRA Decision increased SCE’s revenue requirement $960 million mitigating substantial increase in natural gas and power prices forecast for 2006

9

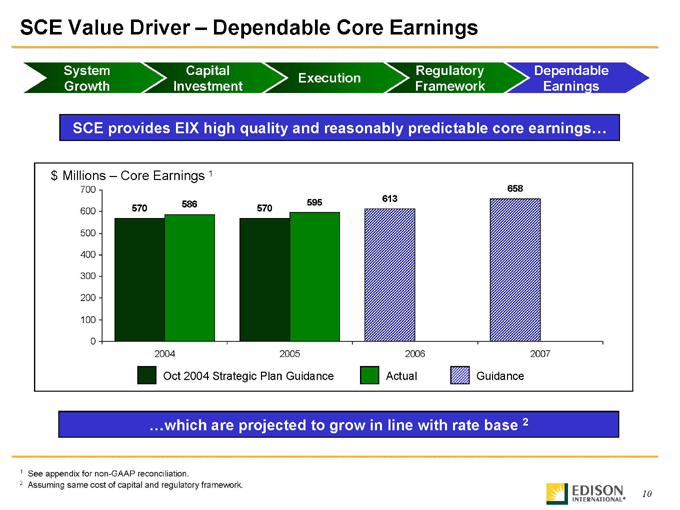

SCE Value Driver – Dependable Core Earnings

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

SCE provides EIX high quality and reasonably predictable core earnings… $ Millions – Core Earnings 1

700 600 500 400 300 200 100 0

658 595 613 570 586 570

2004 2005 2006 2007

Oct 2004 Strategic Plan Guidance Actual Guidance

…which are projected to grow in line with rate base 2

1 |

| See appendix for non-GAAP reconciliation. |

2 |

| Assuming same cost of capital and regulatory framework. |

10

Low-Cost Coal Operational/Marketing/Trading Capabilities Cash Position Growth Opportunities

Edison Mission Group (EMG)

11

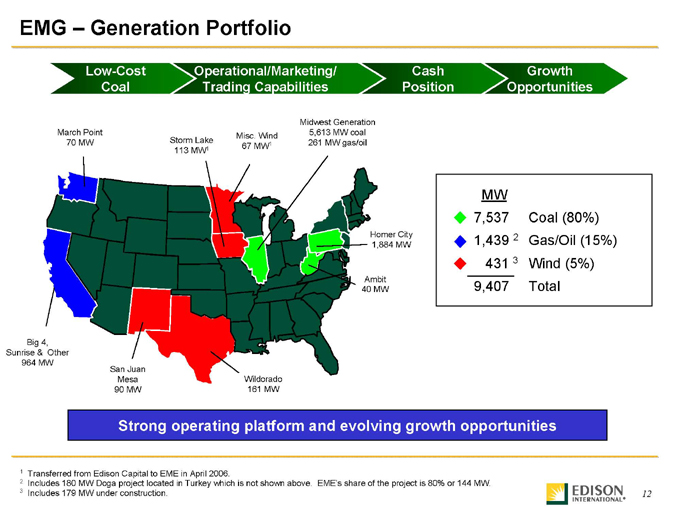

EMG – Generation Portfolio

Low-Cost Coal Operational/Marketing/Trading Capabilities Cash Position Growth Opportunities

Midwest Generation March Point Misc. Wind 5,613 MW coal 70 MW Storm Lake 261 MW gas/oil 67 MW1 113 MW1

Big 4, Sunrise & Other 964 MW

San Juan

Mesa Wildorado 90 MW 161 MW

Homer City 1,884 MW

Ambit 40 MW

MW

7,537 Coal (80%)

1,439 2 Gas/Oil (15%)

431 3 Wind (5%)

9,407 Total

Strong operating platform and evolving growth opportunities

1 |

| Transferred from Edison Capital to EME in April 2006. |

2 Includes 180 MW Doga project located in Turkey which is not shown above. EME’s share of the project is 80% or 144 MW.

3 |

| Includes 179 MW under construction. |

12

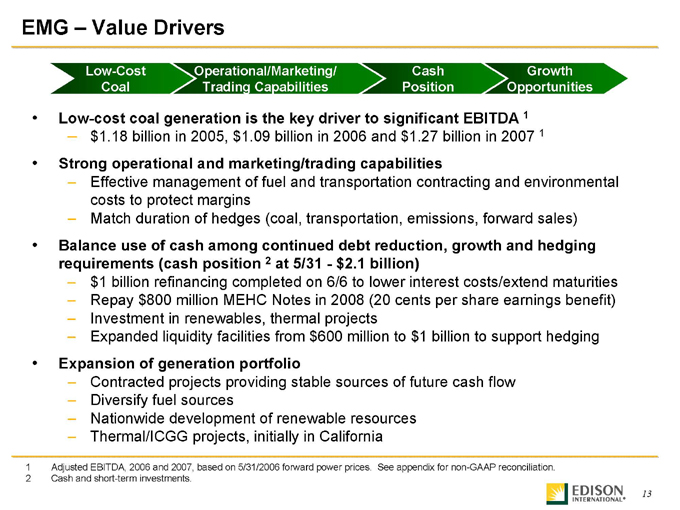

EMG – Value Drivers

Low-Cost Coal Operational/Marketing/Trading Capabilities Cash Position Growth Opportunities

Low-cost coal generation is the key driver to significant EBITDA 1 $1.18 billion in 2005, $1.09 billion in 2006 and $1.27 billion in 2007 1

Strong operational and marketing/trading capabilities

Effective management of fuel and transportation contracting and environmental costs to protect margins Match duration of hedges (coal, transportation, emissions, forward sales)

Balance use of cash among continued debt reduction, growth and hedging requirements (cash position 2 at 5/31—$2.1 billion) $1 billion refinancing completed on 6/6 to lower interest costs/extend maturities Repay $800 million MEHC Notes in 2008 (20 cents per share earnings benefit) Investment in renewables, thermal projects Expanded liquidity facilities from $600 million to $1 billion to support hedging

Expansion of generation portfolio

Contracted projects providing stable sources of future cash flow Diversify fuel sources Nationwide development of renewable resources Thermal/ICGG projects, initially in California

1 |

| Adjusted EBITDA, 2006 and 2007, based on 5/31/2006 forward power prices. See appendix for non-GAAP reconciliation. |

2 |

| Cash and short-term investments. |

13

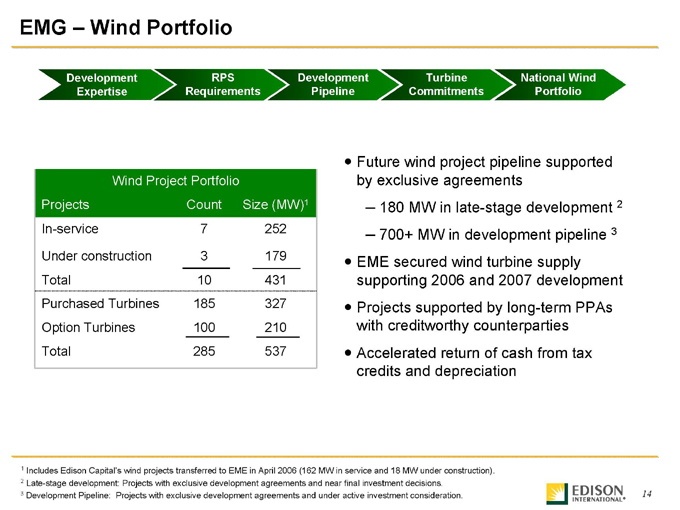

EMG – Wind Portfolio

Development Expertise RPS Requirements Development Pipeline Turbine Commitments National Wind Portfolio

Wind Project Portfolio

Projects Count Size (MW)1

In-service 7 252

Under construction 3 179

Total 10 431

Purchased Turbines 185 327

Option Turbines 100 210

Total 285 537

Future wind project pipeline supported by exclusive agreements

180 MW in late-stage development 2 700+ MW in development pipeline 3

EME secured wind turbine supply supporting 2006 and 2007 development Projects supported by long-term PPAs with creditworthy counterparties Accelerated return of cash from tax credits and depreciation

1 Includes Edison Capital’s wind projects transferred to EME in April 2006 (162 MW in service and 18 MW under construction).

2 |

| Late-stage development: Projects with exclusive development agreements and near final investment decisions. |

3 |

| Development Pipeline: Projects with exclusive development agreements and under active investment consideration. |

14

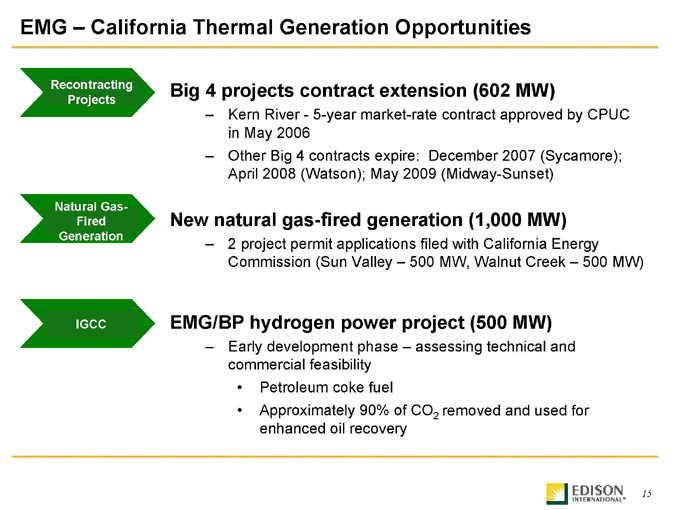

EMG – California Thermal Generation Opportunities

Recontracting Projects

Natural Gas-Fired Generation

IGCC

Big 4 projects contract extension (602 MW)

Kern River - 5-year market-rate contract approved by CPUC in May 2006 Other Big 4 contracts expire: December 2007 (Sycamore); April 2008 (Watson); May 2009 (Midway-Sunset)

New natural gas-fired generation (1,000 MW)

2 project permit applications filed with California Energy Commission (Sun Valley – 500 MW, Walnut Creek – 500 MW)

EMG/BP hydrogen power project (500 MW)

Early development phase – assessing technical and commercial feasibility

Petroleum coke fuel

Approximately 90% of CO2 removed and used for

enhanced oil recovery

15

Performance Balance Sheet Strength Growth Dividends Shareholder Returns

Guidance

16

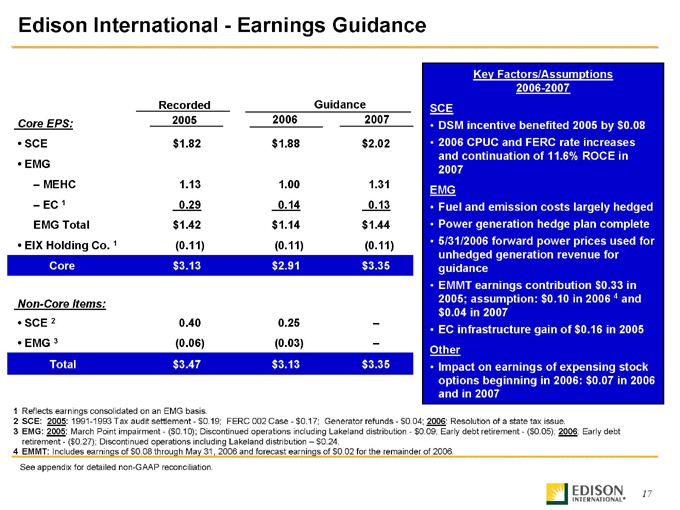

Edison International—Earnings Guidance

Recorded Guidance

Core EPS: 2005 2006 2007

SCE $1.82 $1.88 $2.02

EMG

– MEHC 1.13 1.00 1.31

– EC 1 0.29 0.14 0.13

EMG Total $1.42 $1.14 $1.44

• EIX Holding Co. 1 (0.11) (0.11) (0.11)

Core $3.13 $2.91 $3.35

Non-Core Items:

SCE 2 0.40 0.25 –

EMG 3 (0.06) (0.03) –

Total $3.47 $3.13 $3.35

Key Factors/Assumptions 2006-2007 SCE

DSM incentive benefited 2005 by $0.08 2006 CPUC and FERC rate increases and continuation of 11.6% ROCE in 2007

EMG

Fuel and emission costs largely hedged Power generation hedge plan complete 5/31/2006 forward power prices used for unhedged generation revenue for guidance EMMT earnings contribution $0.33 in 2005; assumption: $0.10 in 2006 4 and $0.04 in 2007 EC infrastructure gain of $0.16 in 2005

Other

Impact on earnings of expensing stock options beginning in 2006: $0.07 in 2006 and in 2007

1 |

| Reflects earnings consolidated on an EMG basis. |

2 SCE: 2005: 1991-1993 Tax audit settlement—$0.19; FERC 002 Case—$0.17; Generator refunds—$0.04; 2006: Resolution of a state tax issue.

3 EMG: 2005: March Point impairment—($0.10); Discontinued operations including Lakeland distribution—$0.09; Early debt retirement—($0.05); 2006: Early debt retirement—($0.27); Discontinued operations including Lakeland distribution – $0.24.

4 |

| EMMT: Includes earnings of $0.08 through May 31, 2006 and forecast earnings of $0.02 for the remainder of 2006. |

See appendix for detailed non-GAAP reconciliation.

17

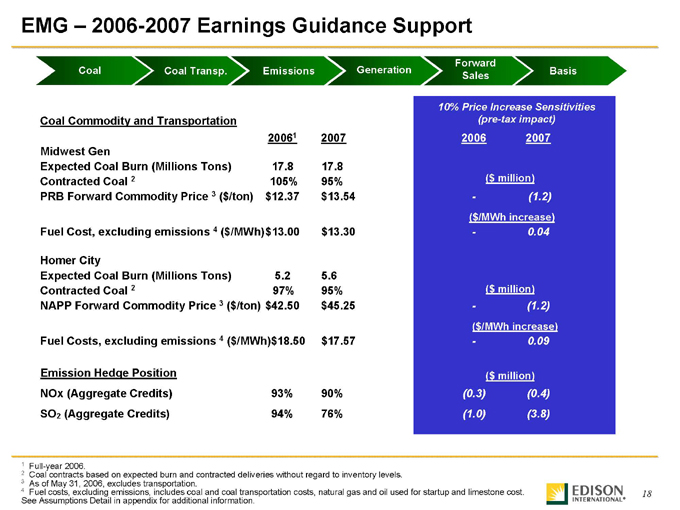

EMG – 2006-2007 Earnings Guidance Support

Coal Coal Transp. Emissions Generation Forward Sales Basis

Coal Commodity and Transportation

20061 2007

Midwest Gen

Expected Coal Burn (Millions Tons) 17.8 17.8

Contracted Coal 2 105% 95%

PRB Forward Commodity Price 3 ($/ton) $12.37 $13.54

Fuel Cost, excluding emissions 4 ($/MWh) $13.00 $13.30

Homer City

Expected Coal Burn (Millions Tons) 5.2 5.6

Contracted Coal 2 97% 95%

NAPP Forward Commodity Price 3 ($/ton) $42.50 $45.25

Fuel Costs, excluding emissions 4 ($/MWh) $18.50 $17.57

Emission Hedge Position

NOx (Aggregate Credits) 93% 90%

SO2 (Aggregate Credits) 94% 76%

10% Price Increase Sensitivities

(pre-tax impact)

2006 2007

($ million)

- (1.2)

($ /MWh increase)

- 0.04

($ million)

- (1.2)

($/MWh increase)

- 0.09

($ million)

(0.3) (0.4)

(1.0) (3.8)

1 |

| Full-year 2006. |

2 |

| Coal contracts based on expected burn and contracted deliveries without regard to inventory levels. |

3 |

| As of May 31, 2006, excludes transportation. |

4 Fuel costs, excluding emissions, includes coal and coal transportation costs, natural gas and oil used for startup and limestone cost.

See Assumptions Detail in appendix for additional information.

18

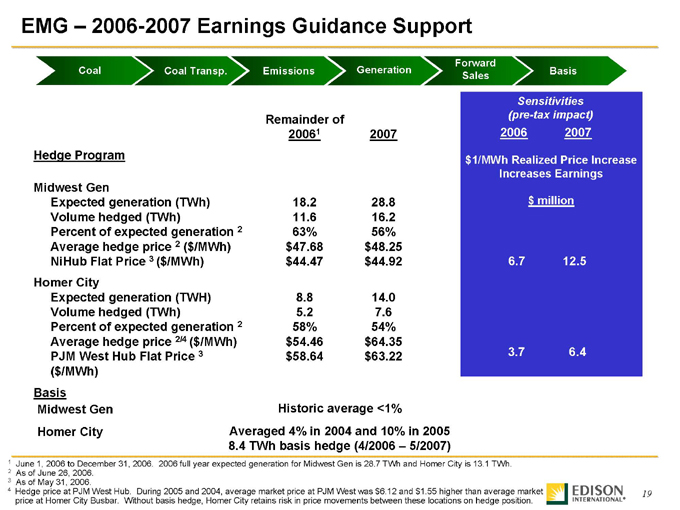

EMG – 2006-2007 Earnings Guidance Support

Coal Coal Transp. Emissions Generation Forward Sales Basis

Remainder of

20061 2007

Hedge Program

Midwest Gen

Expected generation (TWh) 18.2 28.8

Volume hedged (TWh) 11.6 16.2

Percent of expected generation 2 63% 56%

Average hedge price 2 ($/MWh) $47.68 $48.25

NiHub Flat Price 3 ($/MWh) $44.47 $44.92

Homer City

Expected generation (TWH) 8.8 14.0

Volume hedged (TWh) 5.2 7.6

Percent of expected generation 2 58% 54%

Average hedge price 2/4 ( $/MWh) $54.46 $64.35

PJM West Hub Flat Price 3 $58.64 $63.22

($/MWh)

Basis

Midwest Gen Historic average <1%

Homer City Averaged 4% in 2004 and 10% in 2005

8.4 TWh basis hedge (4/2006 – 5/2007)

Sensitivities

(pre-tax impact)

2006

2007

$1/MWh Realized Price Increase

Increases Earnings

$ million

6.7

12.5

3.7

6.4

1 June 1, 2006 to December 31, 2006. 2006 full year expected generation for Midwest Gen is 28.7 TWh and Homer City is 13.1 TWh.

2 |

| As of June 26, 2006. |

3 |

| As of May 31, 2006. |

4 Hedge price at PJM West Hub. During 2005 and 2004, average market price at PJM West was $6.12 and $1.55 higher than average market price at Homer City Busbar. Without basis hedge, Homer City retains risk in price movements between these locations on hedge position.

19

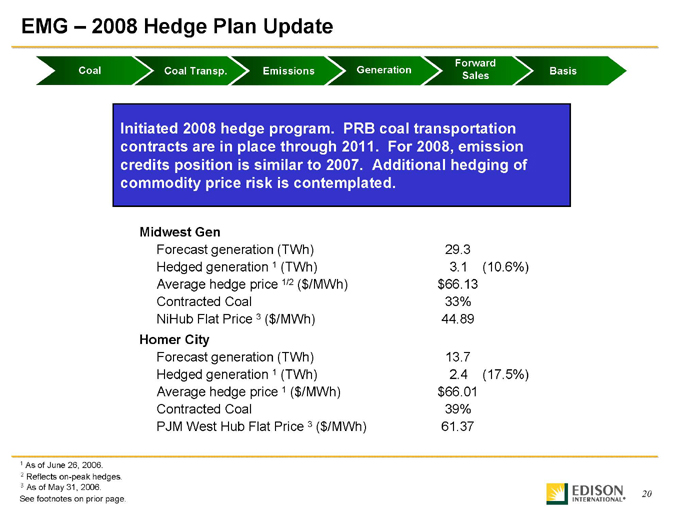

EMG – 2008 Hedge Plan Update

Coal Coal Transp. Emissions Generation Forward Sales Basis

Initiated 2008 hedge program. PRB coal transportation contracts are in place through 2011. For 2008, emission credits position is similar to 2007. Additional hedging of commodity price risk is contemplated.

Midwest Gen

Forecast generation (TWh) 29.3

Hedged generation 1 (TWh) 3.1 (10.6%)

Average hedge price 1/2 ($/MWh) $66.13

Contracted Coal 33%

NiHub Flat Price 3 ($/MWh) 44.89

Homer City

Forecast generation (TWh) 13.7

Hedged generation 1 (TWh) 2.4 (17.5%)

Average hedge price 1 ($/MWh) $66.01

Contracted Coal 39%

PJM West Hub Flat Price 3 ($/MWh) 61.37

1 |

| As of June 26, 2006. |

2 |

| Reflects on-peak hedges. |

3 |

| As of May 31, 2006. |

See footnotes on prior page.

20

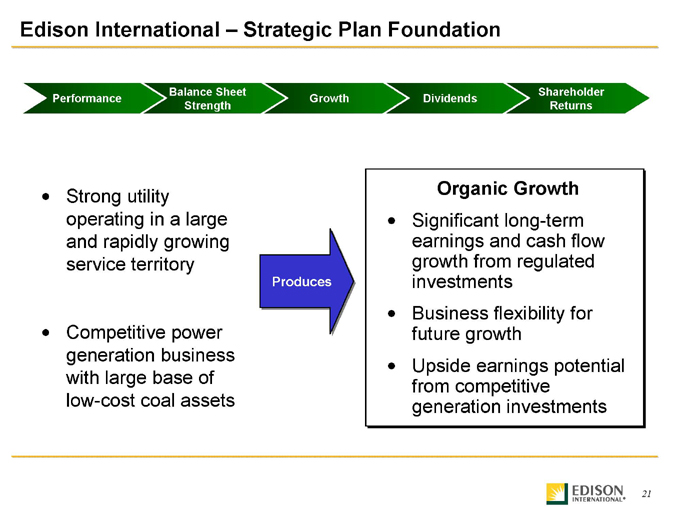

Edison International – Strategic Plan Foundation

Performance Balance Sheet Strength Growth Dividends Shareholder Returns

Strong utility operating in a large and rapidly growing service territory

Competitive power generation business with large base of low-cost coal assets

Produces

Organic Growth

Significant long-term earnings and cash flow growth from regulated investments Business flexibility for future growth Upside earnings potential from competitive generation investments

21

Appendix 22

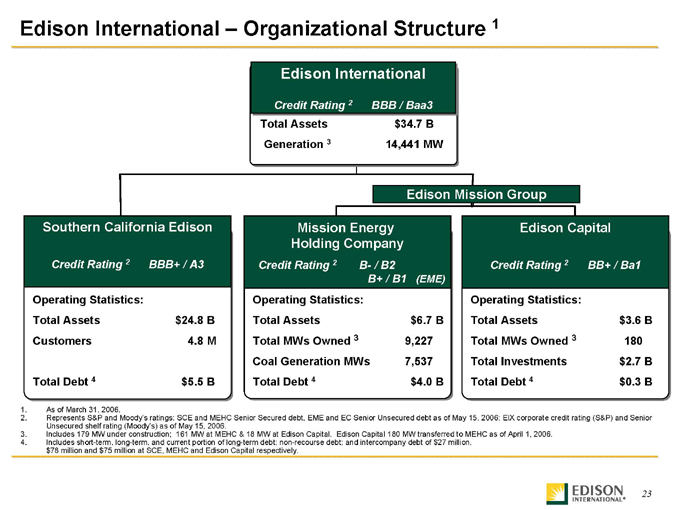

Edison International – Organizational Structure 1

Edison International

Credit Rating 2

BBB / Baa3

Total Assets

$34.7 B

Generation 3 3

14,441 MW

Edison Mission Group

Southern California Edison

Credit Rating 2 BBB+ / A3

Mission Energy Holding Company

Credit Rating 2 B- / B2

B+ / B1 (EME)

Edison Capital

Credit Rating 2 BB+ / Ba1

Operating Statistics:

Total Assets $24.8 B

Customers 4.8 M

Total Debt 4 $5.5 B

Operating Statistics:

Total Assets $6.7 B

Total MWs Owned 3 9,227

Coal Generation MWs 7,537

Total Debt 4 $4.0 B

Operating Statistics:

Total Assets $3.6 B

Total MWs Owned 3 180

Total Investments $2.7 B

Total Debt 4 $0.3 B

1. As of March 31, 2006.

2. Represents S&P and Moody’s ratings: SCE and MEHC Senior Secured debt, EME and EC Senior Unsecured debt as of May 15, 2006; EIX corporate credit rating (S&P) and Senior Unsecured shelf rating (Moody’s) as of May 15, 2006.

3. Includes 179 MW under construction; 161 MW at MEHC & 18 MW at Edison Capital. Edison Capital 180 MW transferred to MEHC as of April 1, 2006.

4. Includes short-term, long-term, and current portion of long-term debt; non-recourse debt; and intercompany debt of $27 million, $78 million and $75 million at SCE, MEHC and Edison Capital respectively.

23

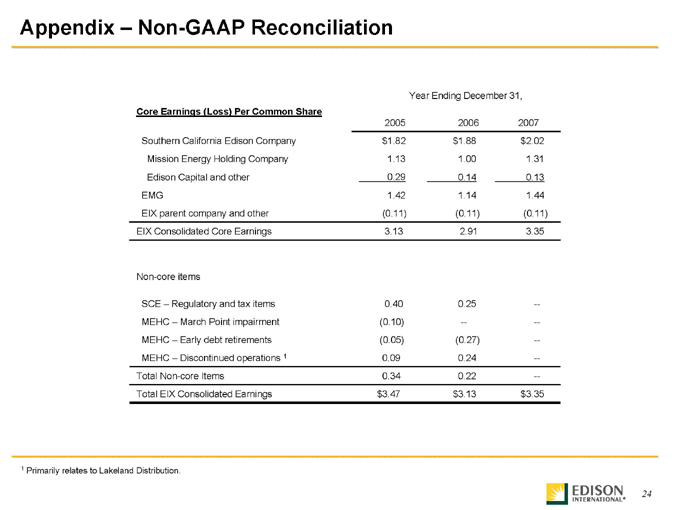

Appendix – Non-GAAP Reconciliation

Year Ending December 31,

Core Earnings (Loss) Per Common Share

2005 2006 2007

Southern California Edison Company $1.82 $1.88 $2.02

Mission Energy Holding Company 1.13 1.00 1.31

Edison Capital and other 0.29 0.14 0.13

EMG 1.42 1.14 1.44

EIX parent company and other (0.11) (0.11) (0.11)

EIX Consolidated Core Earnings 3.13 2.91 3.35

Non-core items

SCE – Regulatory and tax items 0.40 0.25 —

MEHC – March Point impairment (0.10) — —

MEHC – Early debt retirements (0.05) (0.27) —

MEHC – Discontinued operations 1 0.09 0.24 —

Total Non-core Items 0.34 0.22 —

Total EIX Consolidated Earnings $3.47 $3.13 $3.35

1 |

| Primarily relates to Lakeland Distribution. |

24

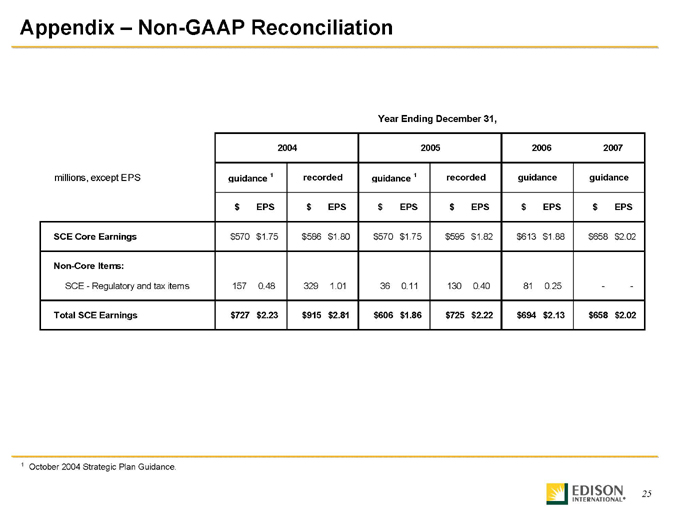

Appendix – Non-GAAP Reconciliation

Year Ending December 31,

2004 2005 2006 2007

millions, except EPS guidance 1 recorded guidance 1 recorded guidance guidance

$EPS $EPS $EPS $EPS $EPS $EPS

SCE Core Earnings $570 $1.75 $586 $1.80 $570 $1.75 $595 $1.82 $613 $1.88 $658 $2.02

Non-Core Items:

SCE—Regulatory and tax items 157 0.48 329 1.01 36 0.11 130 0.40 81 0.25 — -

Total SCE Earnings $727 $2.23 $915 $2.81 $606 $1.86 $725 $2.22 $694 $2.13 $658 $2.02

1 |

| October 2004 Strategic Plan Guidance. |

25

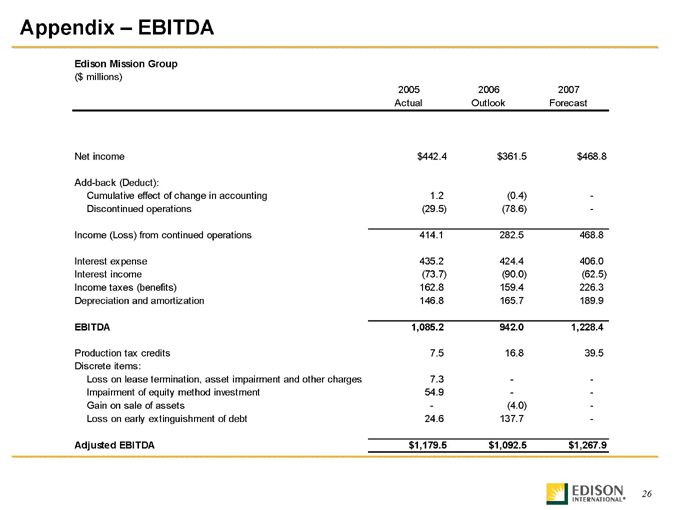

Appendix – EBITDA

Edison Mission Group

($ millions)

2005 2006 2007

Actual Outlook Forecast

Net income $442.4 $361.5 $468.8

Add-back (Deduct):

Cumulative effect of change in accounting 1.2 (0.4) -

Discontinued operations (29.5) (78.6) -

Income (Loss) from continued operations 414.1 282.5 468.8

Interest expense 435.2 424.4 406.0

Interest income (73.7) (90.0) (62.5)

Income taxes (benefits) 162.8 159.4 226.3

Depreciation and amortization 146.8 165.7 189.9

EBITDA 1,085.2 942.0 1,228.4

Production tax credits 7.5 16.8 39.5

Discrete items:

Loss on lease termination, asset impairment and other charges 7.3 — -

Impairment of equity method investment 54.9 — -

Gain on sale of assets — (4.0) -

Loss on early extinguishment of debt 24.6 137.7 -

Adjusted EBITDA $1,179.5 $1,092.5 $1,267.9

26

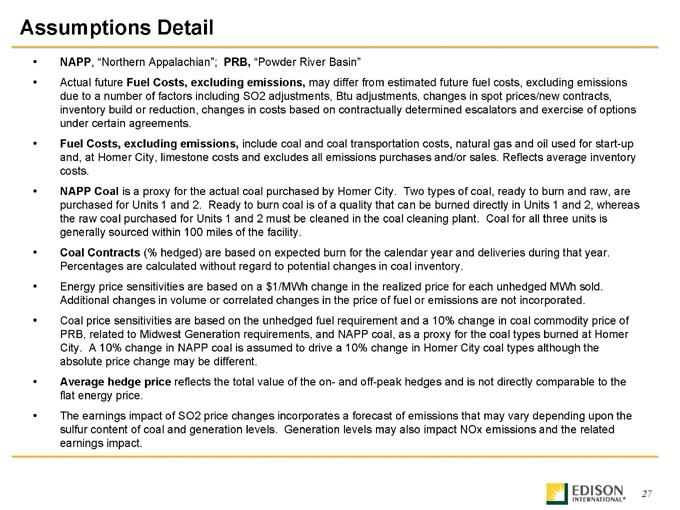

Assumptions Detail

NAPP, “Northern Appalachian”; PRB, “Powder River Basin”

Actual future Fuel Costs, excluding emissions, may differ from estimated future fuel costs, excluding emissions due to a number of factors including SO2 adjustments, Btu adjustments, changes in spot prices/new contracts, inventory build or reduction, changes in costs based on contractually determined escalators and exercise of options under certain agreements.

Fuel Costs, excluding emissions, include coal and coal transportation costs, natural gas and oil used for start-up and, at Homer City, limestone costs and excludes all emissions purchases and/or sales. Reflects average inventory costs.

NAPP Coal is a proxy for the actual coal purchased by Homer City. Two types of coal, ready to burn and raw, are purchased for Units 1 and 2. Ready to burn coal is of a quality that can be burned directly in Units 1 and 2, whereas the raw coal purchased for Units 1 and 2 must be cleaned in the coal cleaning plant. Coal for all three units is generally sourced within 100 miles of the facility.

Coal Contracts (% hedged) are based on expected burn for the calendar year and deliveries during that year. Percentages are calculated without regard to potential changes in coal inventory.

Energy price sensitivities are based on a $1/MWh change in the realized price for each unhedged MWh sold. Additional changes in volume or correlated changes in the price of fuel or emissions are not incorporated. Coal price sensitivities are based on the unhedged fuel requirement and a 10% change in coal commodity price of PRB, related to Midwest Generation requirements, and NAPP coal, as a proxy for the coal types burned at Homer City. A 10% change in NAPP coal is assumed to drive a 10% change in Homer City coal types although the absolute price change may be different.

Average hedge price reflects the total value of the on- and off-peak hedges and is not directly comparable to the flat energy price.

The earnings impact of SO2 price changes incorporates a forecast of emissions that may vary depending upon the sulfur content of coal and generation levels. Generation levels may also impact NOx emissions and the related earnings impact.

27

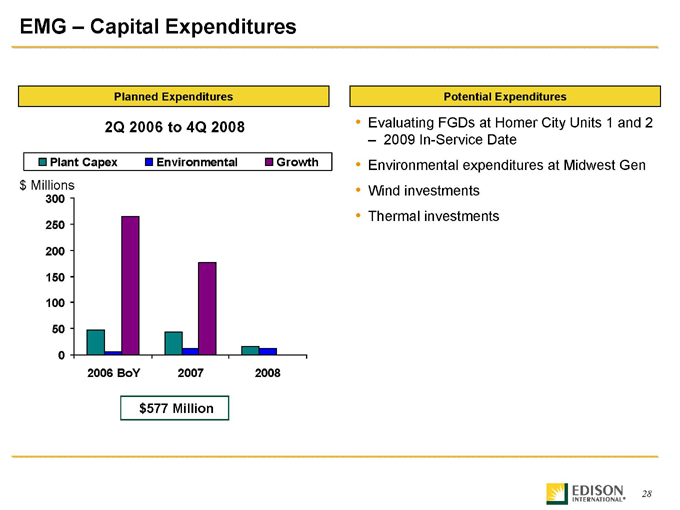

EMG – Capital Expenditures

Planned Expenditures

2Q 2006 to 4Q 2008

Plant Capex Environmental Growth $ Millions

300 250 200 150 100 50 0

2006 BoY 2007 2008

$577 Million

Potential Expenditures

Evaluating FGDs at Homer City Units 1 and 2

2009 In-Service Date

Environmental expenditures at Midwest Gen Wind investments Thermal investments

28

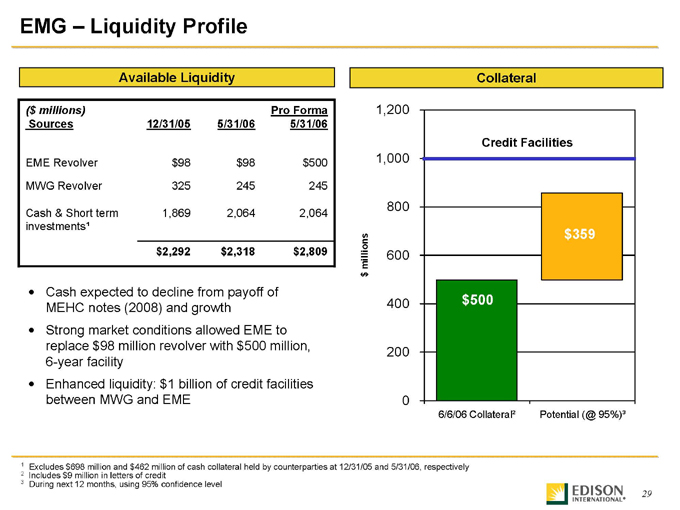

EMG – Liquidity Profile

Available Liquidity

($ millions) Pro Forma

Sources 12/31/05 5/31/06 5/31/06

EME Revolver $98 $98 $500

MWG Revolver 325 245 245

Cash & Short term 1,869 2,064 2,064

investments¹

$2,292 $2,318 $2,809

Cash expected to decline from payoff of MEHC notes (2008) and growth Strong market conditions allowed EME to replace $98 million revolver with $500 million, 6-year facility Enhanced liquidity: $1 billion of credit facilities between MWG and EME

Collateral $ millions

1,200 1,000 800 600 400 200 0

Credit Facilities $359

$500

6/6/06 Collateral² Potential (@ 95%)³

1 Excludes $698 million and $462 million of cash collateral held by counterparties at 12/31/05 and 5/31/06, respectively

2 |

| Includes $9 million in letters of credit |

3 |

| During next 12 months, using 95% confidence level |

29