Exhibit 99.1

Business Update

Handout

41st EEI Financial Conference, Las Vegas

November 2006

Forward-Looking Statement

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect Edison International’s current expectations and projections about future events based on Edison International’s knowledge of present facts and circumstances and assumptions about future events and include any statement that does not directly relate to a historical or current fact. In this presentation and elsewhere, the words “expects,” “believes,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “probable,” “may,” “will,” “could,” “would,” “should,” and variations of such words and similar expressions, or discussions of strategy or of plans, are intended to identify forward-looking statements. Such statements necessarily involve risks and uncertainties that could cause actual results to differ materially from those anticipated. Some of the risks, uncertainties and other important factors that could cause results to differ, or that otherwise could impact Edison International or its subsidiaries, include but are not limited to:

• the ability of Edison International to meet its financial obligations and to pay dividends on its common stock if its subsidiaries are unable to pay dividends;

• the ability of Southern California Edison Company (SCE) to recover its costs in a timely manner from its customers through regulated rates;

• decisions and other actions by the California Public Utilities Commission and other regulatory authorities and delays in regulatory actions;

• market risks affecting SCE’s energy procurement activities;

• access to capital markets and the cost of capital;

• changes in interest rates, rates of inflation and foreign exchange rates;

• governmental, statutory, regulatory or administrative changes or initiatives affecting the electricity industry, including the market structure rules applicable to each market and environmental regulations that could require additional expenditures or otherwise affect the cost and manner of doing business;

• risks associated with operating nuclear and other power generating facilities, including operating risks, nuclear fuel storage, equipment failure, availability, heat rate, output, and availability and cost of spare parts and repairs;

• the availability of labor, equipment and materials;

• the ability to obtain sufficient insurance, including insurance relating to SCE’s nuclear facilities;

• effects of legal proceedings, changes in or interpretations of tax laws, rates or policies, and changes in accounting standards;

• the outcome of disputes with the Internal Revenue Service and other tax authorities regarding tax positions taken by Edison International;

• supply and demand for electric capacity and energy, and the resulting prices and dispatch volumes, in the wholesale markets to which Edison Mission Group Inc.’s (EMG) generating units have access;

• the cost and availability of coal, natural gas, fuel oil, nuclear fuel, and associated transportation;

• the cost and availability of emission credits or allowances for emission credits;

• transmission congestion in and to each market area and the resulting differences in prices between delivery points;

• the ability to provide sufficient collateral in support of hedging activities and purchased power and fuel;

• the risk of counter-party default in hedging transactions or fuel contracts;

• the extent of additional supplies of capacity, energy and ancillary services from current competitors or new market entrants, including the development of new generation facilities and technologies;

• the difficulty of predicting wholesale prices, transmission congestion, energy demand and other activities in the complex and volatile markets in which EMG and its subsidiaries participate;

• general political, economic and business conditions;

• weather conditions, natural disasters and other unforeseen events; and

• changes in the fair value of investments and other assets.

Additional information about risks and uncertainties, including more detail about the factors described above, is contained in Edison International’s reports filed with the Securities and Exchange Commission. Readers are urged to read such reports and carefully consider the risks, uncertainties and other factors that affect Edison International’s business. Readers also should review future reports filed by Edison International with the Securities and Exchange Commission. The information contained in this presentation is subject to change without notice. Forward-looking statements speak only as of the date they are made and Edison International is not obligated to publicly update or revise forward-looking statements.

1

| | |

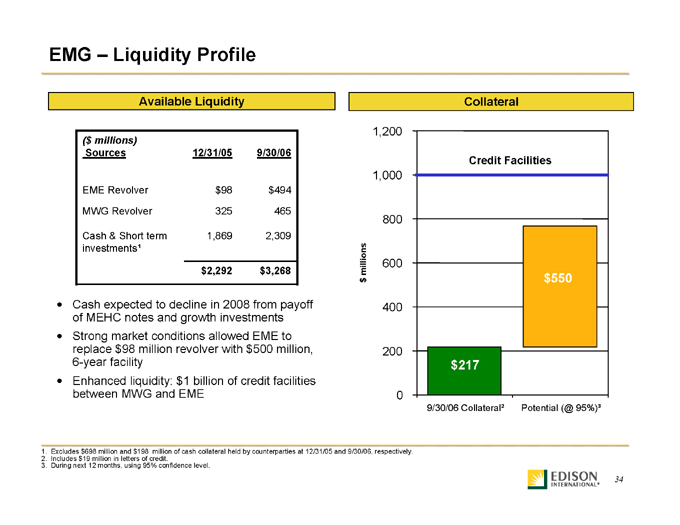

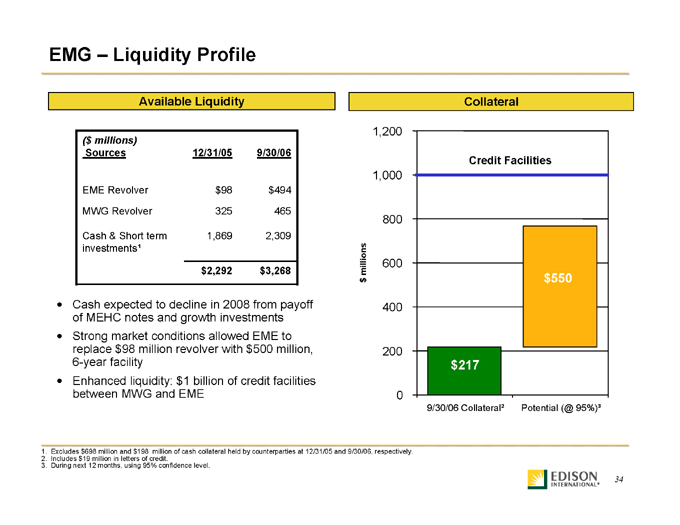

Edison International - Value Drivers | | |

Integrated Platform | | EIX |

SCE | | EMG |

Value Drivers | | Value Drivers |

• Strong customer and load growth | | • Low-cost coal generation portfolio |

• Tight reserve margins keep focus on reliability | | • EBITDA exceeds $1 billion annually1 |

• $12 billion, 5-year capital investment program | | • Strong operational and marketing/trading capabilities |

• 58% - Expand and strengthen distribution system | | • Focus on optimizing and stabilizing merchant margins |

• 21% - New transmission for system reliability and renewables | | • Match duration of hedges (coal, transportation, emissions, forward sales) |

• 12% - San Onofre steam generators and other generation | | • Effective allocation of cash balances |

• 7% - Advanced Metering Infrastructure (AMI) | | • Debt reduction |

• 2% - 5 Small Generation Units (“Peakers”) | | • New generation investments |

• Strengthened regulatory framework | | • Hedging collateral |

• 3-year forward rate-setting | | • Diversify and grow the generation portfolio |

• Cost of Capital | | • Focus on development of non-coal projects with long-term contracts |

• Procurement cost recovery mechanisms | | • Renewables |

• Financial performance | | • Thermal, initially in California |

• Rate base CAGR approx. 10% through 2010 | | • IGCC - Carson Hydrogen project |

1. See appendix for non-GAAP reconciliation. 2007 Adjusted EBITDA calculation based on the mid-point of the EMG guidance range. |

2

| | | | | | | | |

System Growth | | Capital Investment | | Execution | | Regulatory Framework | | Dependable Earnings |

Southern California Edison (SCE)

3

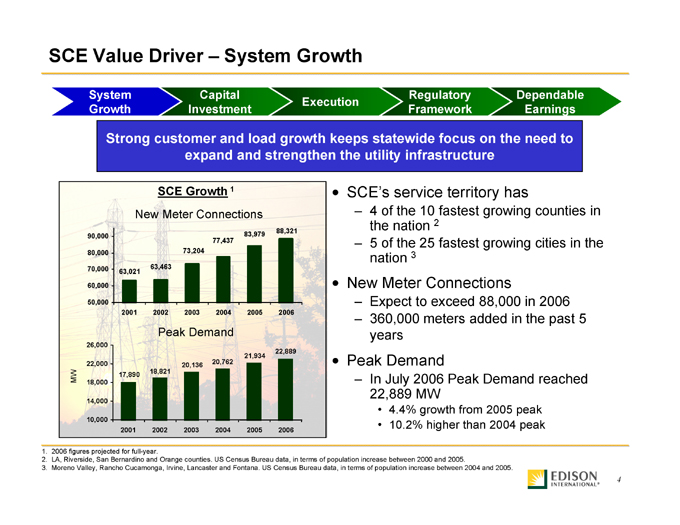

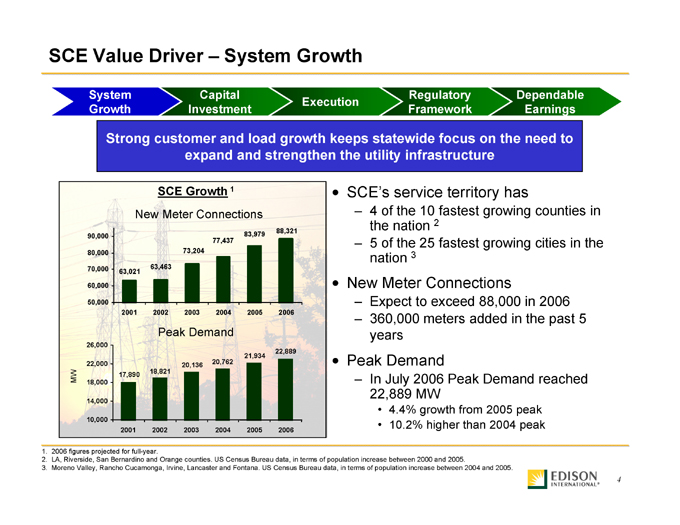

SCE Value Driver – System Growth

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

Strong customer and load growth keeps statewide focus on the need to

expand and strengthen the utility infrastructure

SCE Growth 1 • SCE’s service territory has

New Meter Connections – 4 of the 10 fastest growing counties in the nation 2

88,321

90,000 83,979

77,437 – 5 of the 25 fastest growing cities in the nation 3

80,000 73,204

70,000 63,463

63,021

60,000

• New Meter Connections

– Expect to exceed 88,000 in 2006

– 360,000 meters added in the past 5

50,000

2001 2002 2003 2004 2005 2006

Peak Demand years

26,000

22,889

21,934

22,000 20,762 • Peak Demand

20,136

18,821

MW 17,890 – In July 2006 Peak Demand reached

18,000

22,889 MW

14,000

• 4.4% growth from 2005 peak

10,000 • 10.2% higher than 2004 peak

2001 2002 2003 2004 2005 2006

1. 2006 figures projected for full-year.

2. LA, Riverside, San Bernardino and Orange counties. US Census Bureau data, in terms of population increase between 2000 and 2005.

3. Moreno Valley, Rancho Cucamonga, Irvine, Lancaster and Fontana. US Census Bureau data, in terms of population increase between 2004 and 2005.

4

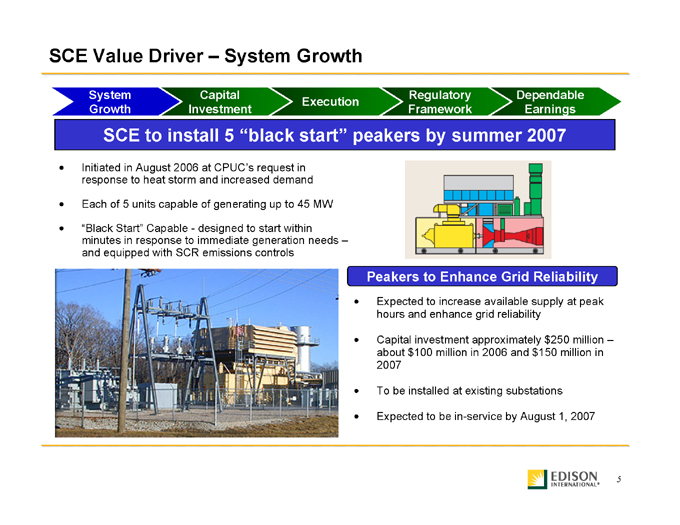

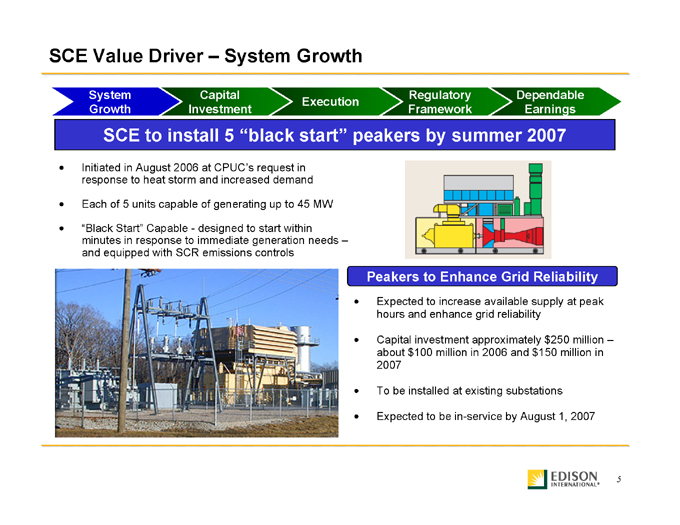

SCE Value Driver – System Growth

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

SCE to install 5 “black start” peakers by summer 2007

• Initiated in August 2006 at CPUC’s request in response to heat storm and increased demand

• Each of 5 units capable of generating up to 45 MW

• “Black Start” Capable - designed to start within minutes in response to immediate generation needs – and equipped with SCR emissions controls

Peakers to Enhance Grid Reliability

• Expected to increase available supply at peak hours and enhance grid reliability

• Capital investment approximately $250 million – about $100 million in 2006 and $150 million in 2007

• To be installed at existing substations

• Expected to be in-service by August 1, 2007

5

SCE Value Driver – System Growth

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

In September 2006, SCE received proposals for renewable and long-term power contracts for new generation

Renewable Contracts New Generation Contracts

10-, 15-, or 20-year contract proposals were received September 22, 2006

In 2005, SCE purchased and delivered to customers more than 13 billion kilowatt-hours of electricity generated with renewable energy, more than any U.S. utility

– SCE estimates that more than 16% of the power it delivers this year will come from renewable sources

CPU C has provided cost recovery assurance

C has provided cost recovery assurance

Initial offers received in September for solicitation of up to 1,500 MW of new IPP generation

10-year contracts for generation on-line as early as August 2007

In October, SCE filed a request with the CPUC to enter into contracts for up to 20-years for an additional 500 MW of new capacity.

6

SCE Value Driver – Capital Investment

System Growth Capital Investment Execution Regulatory Framework Dependable Earnings

SCE cited as industry leader in advanced metering

“SCE has taken an industry leadership position as the first U.S. utility to adopt EPRI’s IntelliGrid Architecture for a system-wide advanced metering deployment.”

Arshad Mansoor, V.P. of Power Delivery & Marketing Electric Power Research Institute (EPRI) News Release Palo Alto, CA – August 21, 2006

SCE AMI Phase I selected as “2005-2006 Best AMR Initiative in a North American IOU” by international utility peers.

Utility Planning Network and Automatic Meter Reader Association (UPN-AMRA), August 9, 2006

7

SCE Value Driver – Capital Investment

| | | | | | | | |

System Growth | | Capital Investment | | Execution | | Regulatory Framework | | Dependable Earnings |

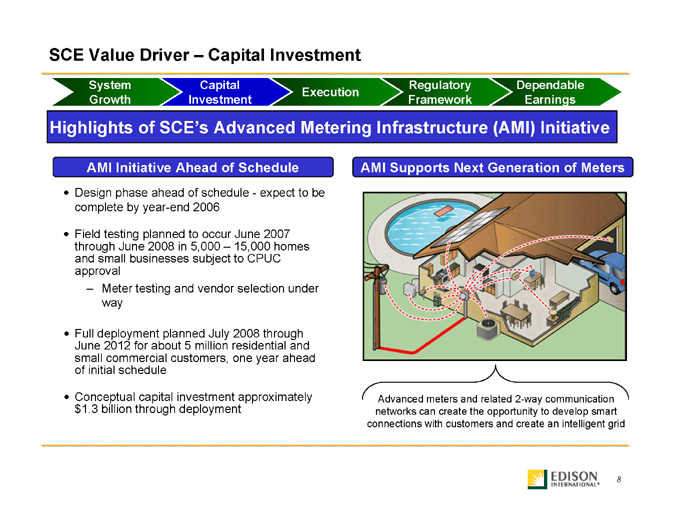

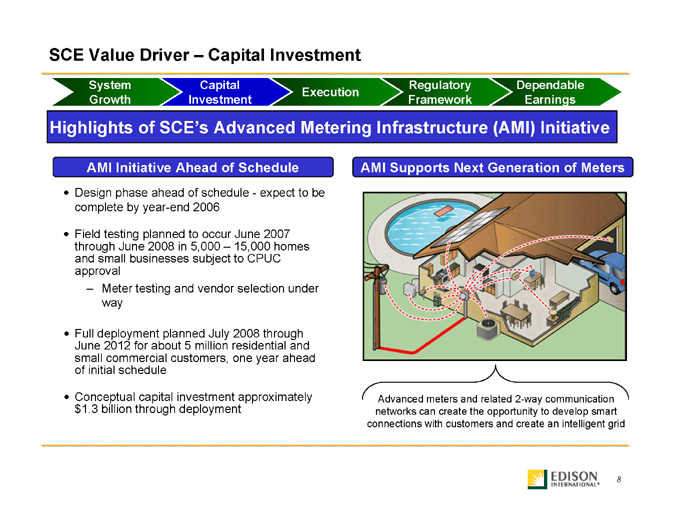

Highlights of SCE’s Advanced Metering Infrastructure (AMI) Initiative

AMI Initiative Ahead of Schedule

Design phase ahead of schedule - expect to be complete by year-end 2006

Field testing planned to occur June 2007 through June 2008 in 5,000 – 15,000 homes and small businesses subject to CPUC approval

– Meter testing and vendor selection under way

Full deployment planned July 2008 through June 2012 for about 5 million residential and small commercial customers, one year ahead of initial schedule

Conceptual capital investment approximately $1.3 billion through deployment

AMI Supports Next Generation of Meters

Advanced meters and related 2-way communication networks can create the opportunity to develop smart connections with customers and create an intelligent grid

8

SCE Value Driver – Capital Investment

| | | | | | | | |

System Growth | | Capital Investment | | Execution | | Regulatory Framework | | Dependable Earnings |

| | |

| | | Benefits of SCE’s AMI Initiative |

SCE | | Supports SCE’s strategy of modernizing its |

| | | infrastructure |

Customers | | Empowers customers to manage their energy use and cost, and provides new services via smart technologies |

| | | – Service Automation - Customers will be able to adjust their usage or choose to have SCE manage this for them automatically |

| | | – Other customer choices include cyber security, plug-in hybrids, solar metering and home automation |

CAISO * | | Better load management helps the grid to operate more efficiently, reducing the risk of power emergencies |

* California Independent System Operator

9

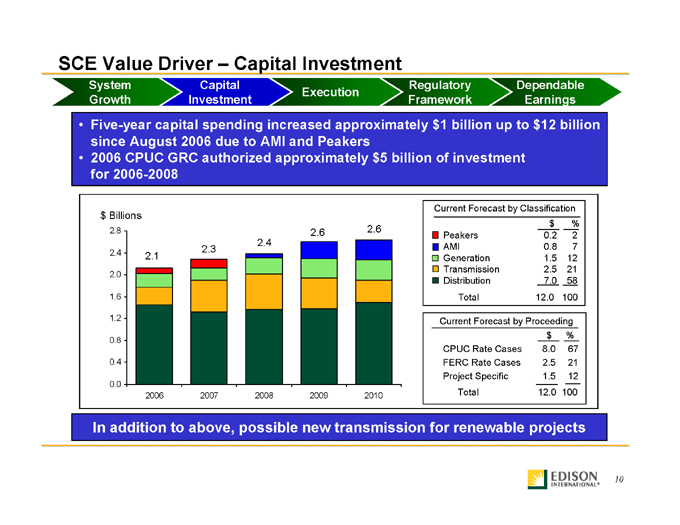

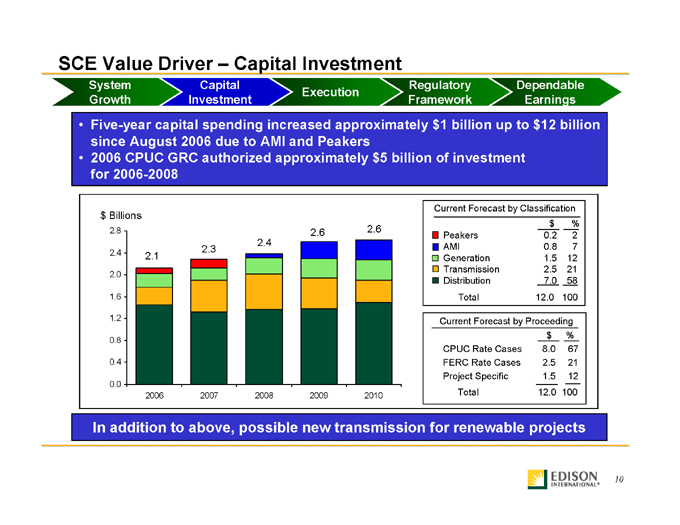

SCE Value Driver – Capital Investment

| | | | | | | | |

System Growth | | Capital Investment | | Execution | | Regulatory Framework | | Dependable Earnings |

• Five-year capital spending increased approximately $1 billion up to $12 billion since August 2006 due to AMI and Peakers

• 2006 CPUC GRC authorized approximately $5 billion of investment for 2006-2008

Current Forecast by Classification

$ Billions

$ %

2.8 2.6 2.6

Peakers 0.2

2

2.4

AMI

0.8 7

2.4

2.3

2.1

Generation

1.5

12

Transmission

2.5

21

2.0

Distribution

7.0

58

1.6

Total

12.0

100

1.2

Current Forecast by Proceeding

$ %

0.8

CPUC Rate Cases

8.0

67

0.4

FERC Rate Cases

2.5

21

Project Specific 1.5 12 0.0

2006 2007 2008 2009 2010 Total 12.0 100

In addition to above, possible new transmission for renewable projects

10

SCE Value Driver – Capital Investment

| | | | | | | | |

System Growth | | Capital Investment | | Execution | | Regulatory Framework | | Dependable Earnings |

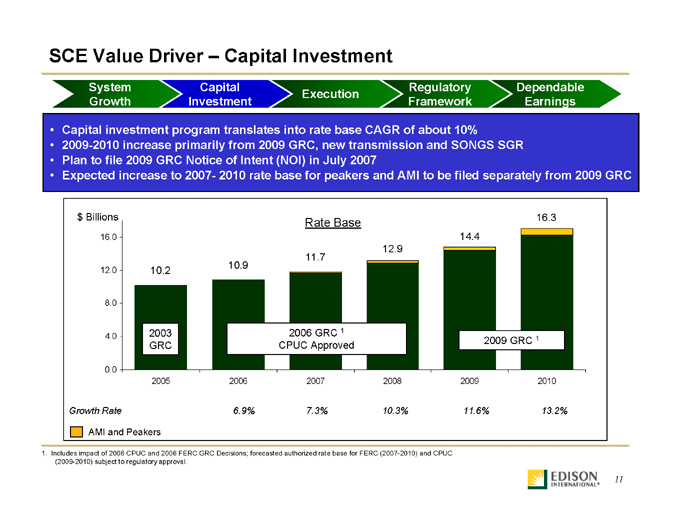

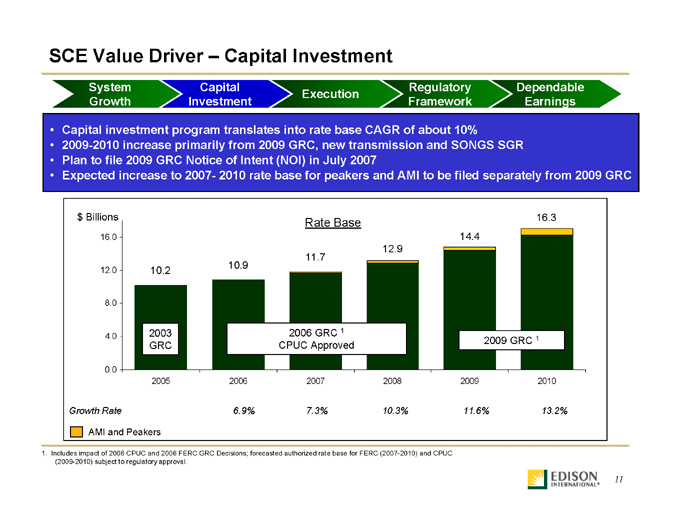

• Capital investment program translates into rate base CAGR of about 10%

• 2009-2010 increase primarily from 2009 GRC, new transmission and SONGS SGR

• Plan to file 2009 GRC Notice of Intent (NOI) in July 2007

• Expected increase to 2007- 2010 rate base for peakers and AMI to be filed separately from 2009 GRC

$ Billions 16.3

Rate Base

16.0 14.4

12.9

11.7

10.9

12.0 10.2

8.0

4.0 2003 2006 GRC 1

CPUC Approved 2009 GRC 1

GRC

0.0

2005 2006 2007 2008 2009 2010

Growth Rate 6.9% 7.3% 10.3% 11.6% 13.2%

AMI and Peakers

1. Includes impact of 2006 CPUC and 2006 FERC GRC Decisions; forecasted authorized rate base for FERC (2007-2010) and CPUC

(2009-2010) subject to regulatory approval.

11

SCE Value Driver – Execution

| | | | | | | | |

System Growth | | Capital Investment | | Execution | | Regulatory Framework | | Dependable Earnings |

SCE has made significant strides toward receiving necessary permits and regulatory approvals for major transmission projects

Existing 500kV

Future 500kV

In Service 2006-2010

Project Name

Date (Millions)

DPV1 & DPV2 2006/2009 $ 745

NEVADA Antelope – Phase 1 2008/2009 $ 245

CALIFORNIA

Las Vegas Rancho Vista

SCE Eldorado 2009 $ 139

Tehachapi Service Substation

Midway Territory

(PG&E)

Antelope Vincent – Mira Loma 2011 $ 122

Palmdale Lugo

Pardee Mohave ARIZONA Renewables Various $ 416

Santa Clarita Vincent

Rancho

Sylmar Vista Mira Devers

Loma Reliability Various $ 829

Palm Phoenix

Los Angeles Serrano Springs

Valley

Santa Total $ 2,496

Ana Palo

Verde

San Diego

12

SCE Value Driver – Execution

| | | | | | | | |

System Growth | | Capital Investment | | Execution | | Regulatory Framework | | Dependable Earnings |

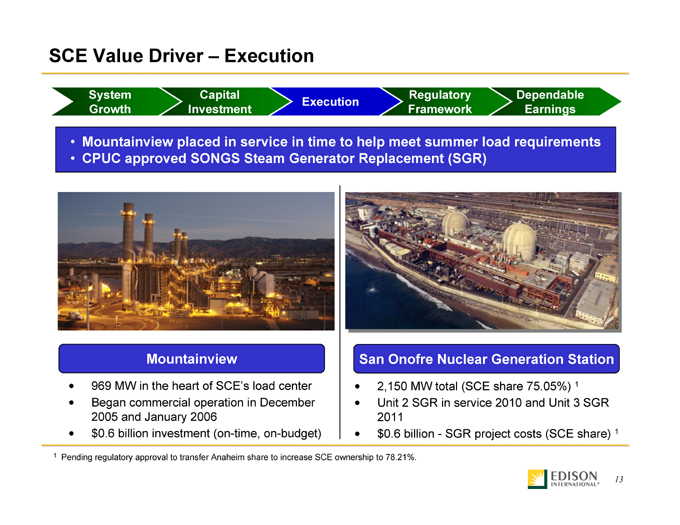

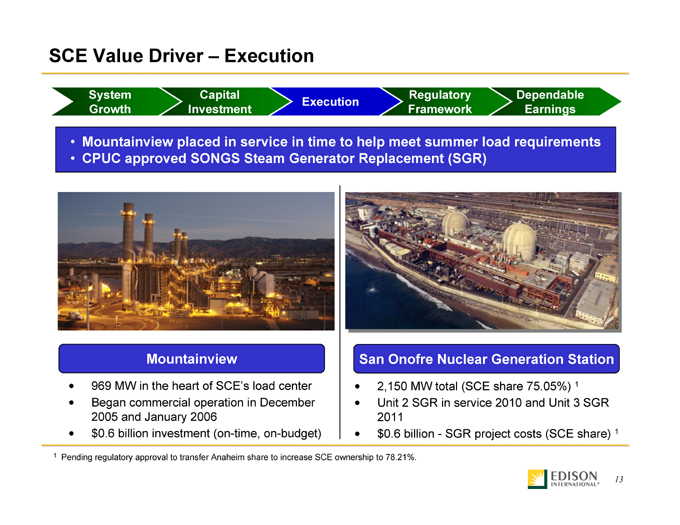

• Mountainview placed in service in time to help meet summer load requirements

• CPUC approved SONGS Steam Generator Replacement (SGR)

Mountainview

• 969 MW in the heart of SCE’s load center

• Began commercial operation in December 2005 and January 2006

• $ 0.6 billion investment (on-time, on-budget)

San Onofre Nuclear Generation Station

• 2,150 MW total (SCE share 75.05%) 1 Unit 2 SGR in service 2010 and Unit 3 SGR 2011

$0.6 billion - SGR project costs (SCE share) 1

1 Pending regulatory approval to transfer Anaheim share to increase SCE ownership to 78.21%.

13

SCE Value Driver – Regulatory Framework

| | | | | | | | |

System Growth | | Capital Investment | | Execution | | Regulatory Framework | | Dependable Earnings |

California’s regulatory framework has been strengthened to support growth, reliability needs and mitigate risks of volatile commodity prices

Rate Base and Operations

• General Rate Case (GRC), provides three-year forward looking rate-setting mechanism based on forecast spending, has been affirmed twice

• 2006 GRC Decision

• Approved 97% of 2006-2008 capital request

• Approved 95% of annual operating expense request

• 2006 GRC Decision results in increased depreciation providing annual cash flow of $900 million in 2006 growing to $1 billion in 2008

Investors’ Return

• 2006 Cost of Capital (COC) Decision

• 48% common equity

• 11.6% return on common equity (ROCE)

• Received final CPUC decision in August 2006, allowing SCE to retain its current COC and ROCE for 2007

Procurement Cost

• Energy Resources Recovery Account (ERRA) and related Trigger Mechanism provides timely recovery of procurement costs and mitigates energy price exposure (AB 57 protections)

• January 2006 ERRA Decision increased SCE’s revenue requirement $960 million mitigating substantial increase in natural gas and power prices forecast for 2006

14

| | | | | | |

Low-Cost Coal | | Operational/Marketing/ Trading Capabilities | | Cash Position | | Growth Opportunities |

Edison Mission Group (EMG)

A Competitive Power Generation Business

15

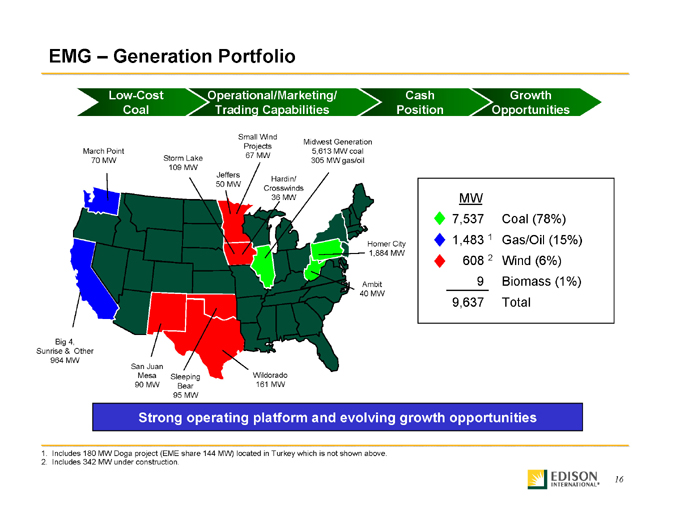

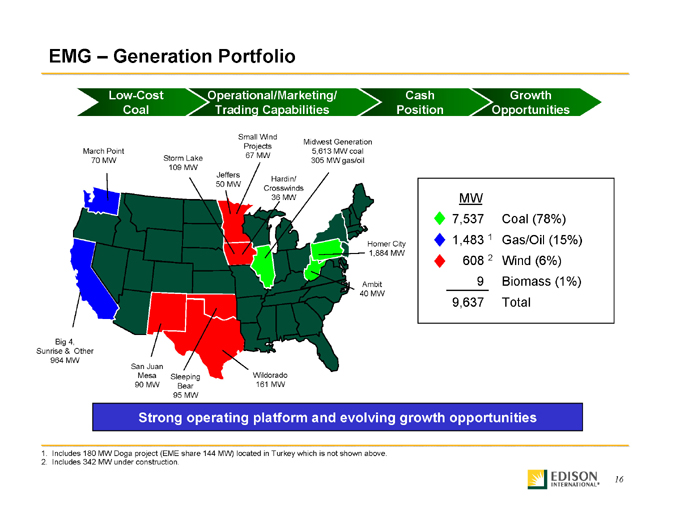

EMG – Generation Portfolio

| | | | | | |

Low-Cost Coal | | Operational/Marketing/ Trading Capabilities | | Cash Position | | Growth Opportunities |

Small Wind

Midwest Generation

Projects

March Point 5,613 MW coal

Storm Lake 67 MW

70 MW 305 MW gas/oil

109 MW

Jeffers

Hardin/

50 MW

Crosswinds

36 MW MW

à7,537 Coal (78%)

Homer Cityà 1,483 1 Gas/Oil (15%)

1,884 MW

à 608 2 Wind (6%)

Ambit 9 Biomass (1%)

40 MW

9,637 Total

Big 4,

Sunrise & Other

964 MW

San Juan

Mesa Sleeping Wildorado

90 MW Bear 161 MW

95 MW

Strong operating platform and evolving growth opportunities

1. Includes 180 MW Doga project (EME share 144 MW) located in Turkey which is not shown above.

2. Includes 342 MW under construction.

16

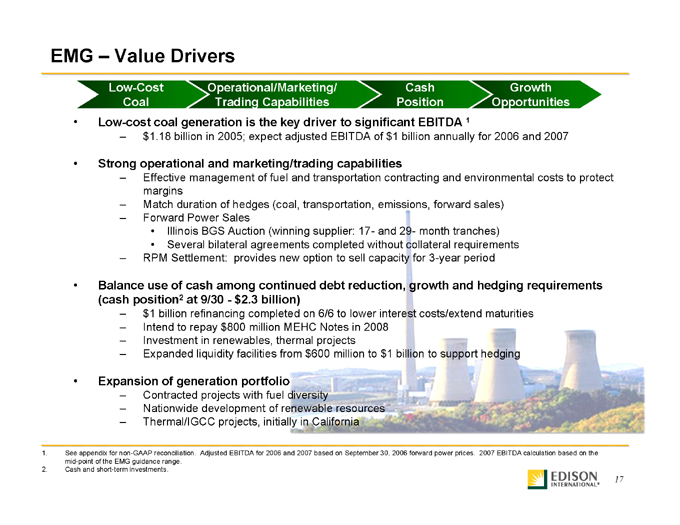

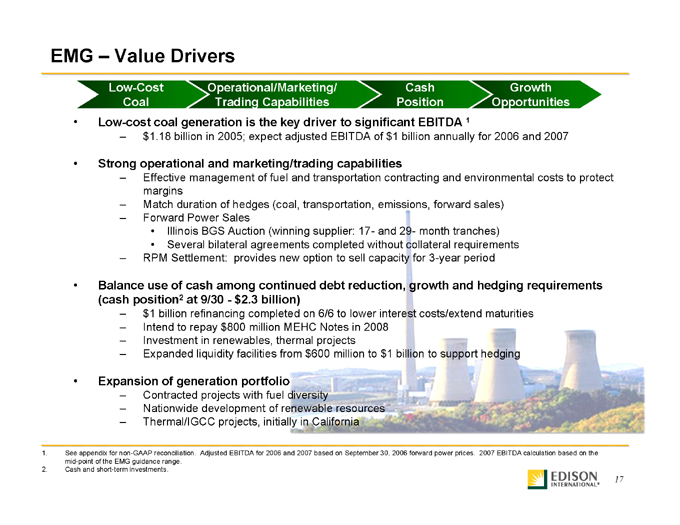

EMG – Value Drivers

| | | | | | |

Low-Cost Coal | | Operational/Marketing/ Trading Capabilities | | Cash Position | | Growth Opportunities |

• Low-cost coal generation is the key driver to significant EBITDA 1

– $1.18 billion in 2005; expect adjusted EBITDA of $1 billion annually for 2006 and 2007

• Strong operational and marketing/trading capabilities

– Effective management of fuel and transportation contracting and environmental costs to protect margins

– Match duration of hedges (coal, transportation, emissions, forward sales)

– Forward Power Sales

• Illinois BGS Auction (winning supplier: 17- and 29- month tranches)

• Several bilateral agreements completed without collateral requirements

– RPM Settlement: provides new option to sell capacity for 3-year period

• Balance use of cash among continued debt reduction, growth and hedging requirements (cash position2 at 9/30 - $2.3 billion)

– $1 billion refinancing completed on 6/6 to lower interest costs/extend maturities

– Intend to repay $800 million MEHC Notes in 2008

– Investment in renewables, thermal projects

– Expanded liquidity facilities from $600 million to $1 billion to support hedging

• Expansion of generation portfolio

– Contracted projects with fuel diversity

– Nationwide development of renewable resources

– Thermal/IGCC projects, initially in California

1. See appendix for non-GAAP reconciliation. Adjusted EBITDA for 2006 and 2007 based on September 30, 2006 forward power prices. 2007 EBITDA calculation based on the mid-point of the EMG guidance range.

2. Cash and short-term investments.

17

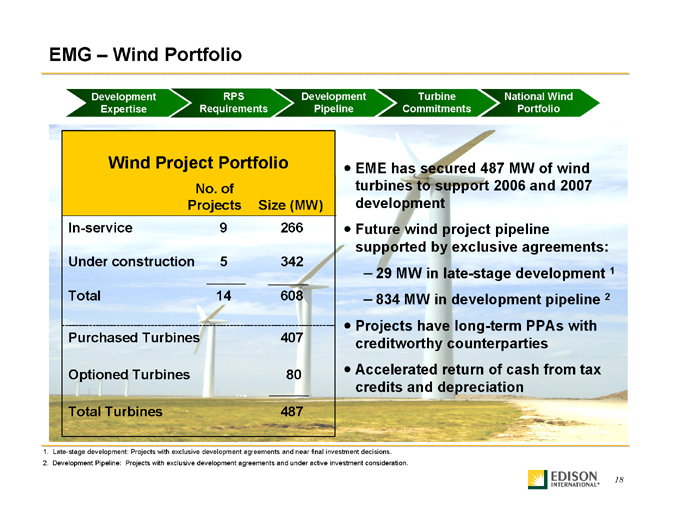

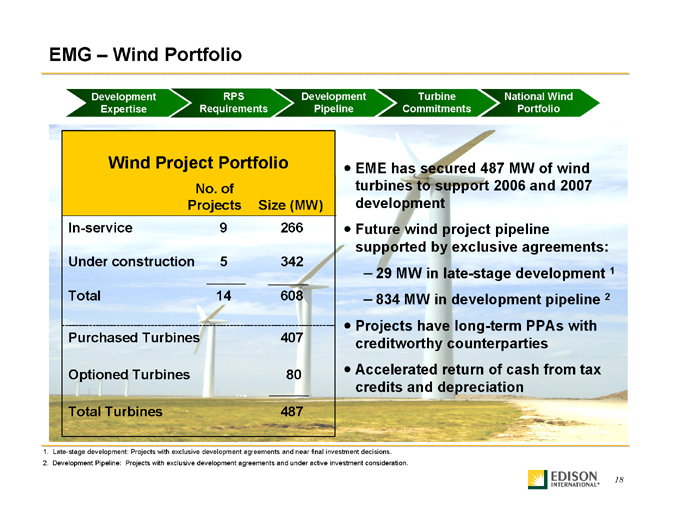

EMG – Wind Portfolio

| | | | | | | | |

Development Expertise | | RPS Requirements | | Development Pipeline | | Turbine Commitments | | National Wind Portfolio |

Wind Project Portfolio • EME has secured 487 MW of wind

No. of turbines to support 2006 and 2007

Projects Size (MW) development

In-service 9 266 • Future wind project pipeline

supported by exclusive agreements:

Under construction 5 342

– 29 MW in late-stage development 1

Total 14 608 – 834 MW in development pipeline 2

• Projects have long-term PPAs with

Purchased Turbines 407 creditworthy counterparties

Optioned Turbines 80 • Accelerated return of cash from tax

credits and depreciation

Total Turbines 487

1. Late-stage development: Projects with exclusive development agreements and near final investment decisions.

2. Development Pipeline: Projects with exclusive development agreements and under active investment consideration.

18

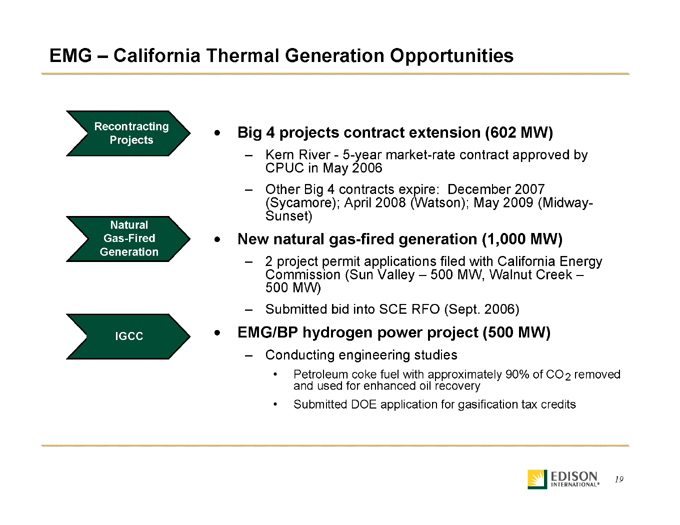

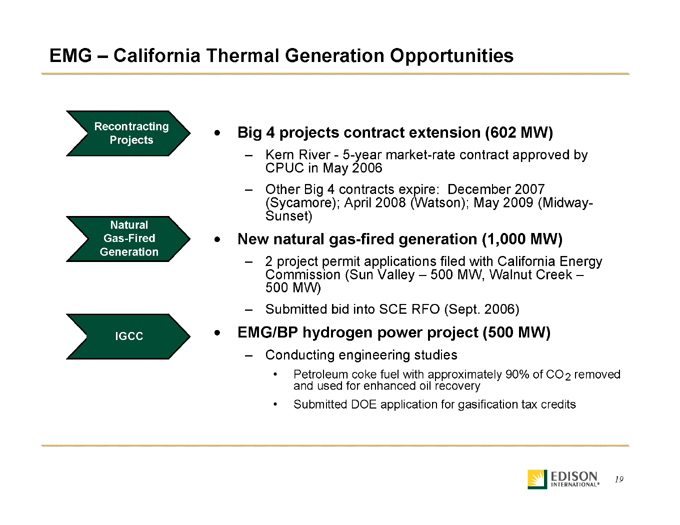

EMG – California Thermal Generation Opportunities

| | |

Recontracting Projects | | • Big 4 projects contract extension (602 MW) |

| | | -Kern River - 5-year market-rate contract approved by CPUC in May 2006 |

| | | -Other Big 4 contracts expire: December 2007 |

| | | (Sycamore); April 2008 (Watson); May 2009 (Midway-Sunset) |

Natural Gas-Fired | | • New natural gas-fired generation (1,000 MW) |

Generation | | -2 project permit applications filed with California Energy Commission (Sun Valley - 500 MW, Walnut Creek - 500 MW) |

| | | -Submitted bid into SCE RFO (Sept. 2006) |

IGCC | | • EMG/BP hydrogen power project (500 MW) |

| | | -Conducting engineering studies |

| | | • Petroleum coke fuel with approximately 90% of CO2 removed and used for enhanced oil recovery |

| | | • Submitted DOE application for gasification tax credits |

19

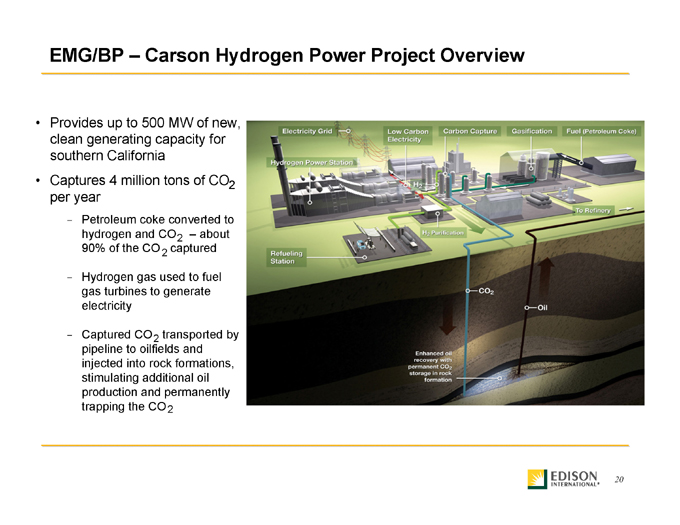

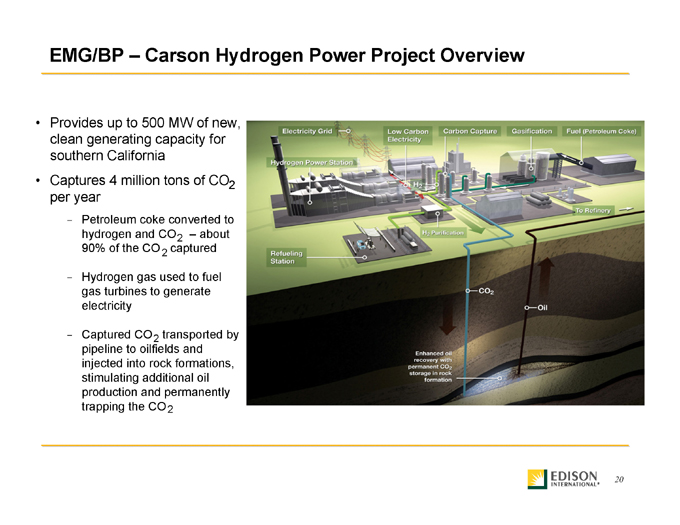

EMG/BP – Carson Hydrogen Power Project Overview

• Provides up to 500 MW of new, clean generating capacity for southern California

• Captures 4 million tons of CO 2 per year

- Petroleum coke converted to hydrogen and CO2 – about 90% of the CO2 captured

- Hydrogen gas used to fuel gas turbines to generate electricity

- Captured CO2 transported by pipeline to oilfields and injected into rock formations, stimulating additional oil production and permanently trapping the CO2

20

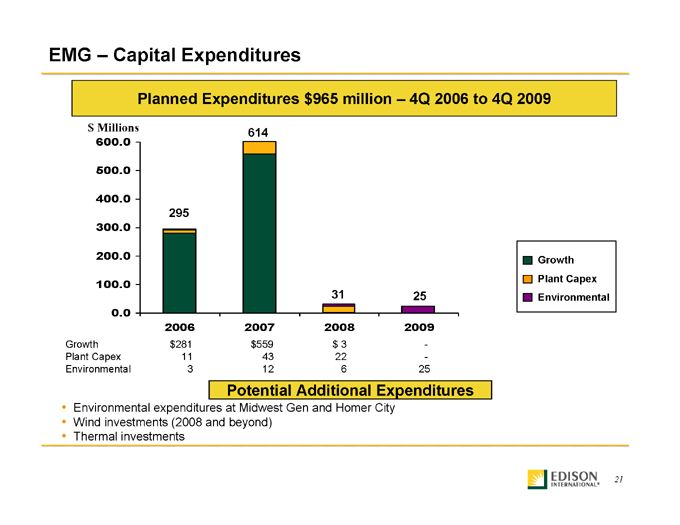

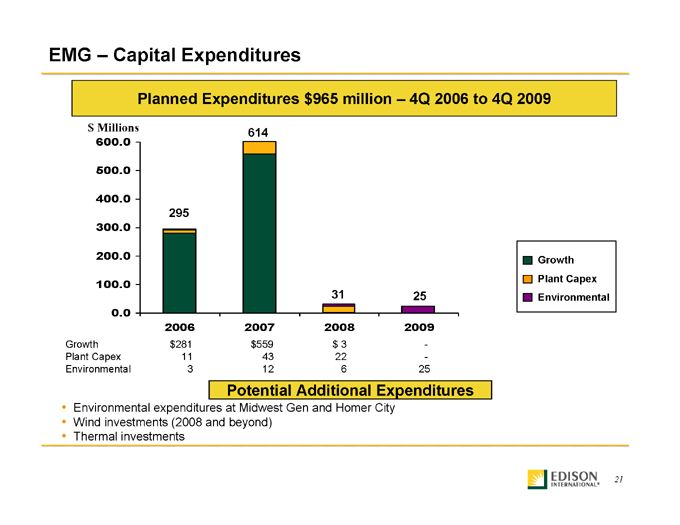

EMG – Capital Expenditures

Planned Expenditures $965 million – 4Q 2006 to 4Q 2009

$ Millions 614

600.0

500.0

400.0

295

300.0

200.0 Growth

Plant Capex

100.0

31 25 Environmental

0.0

2006 2007 2008 2009

Growth $ 281 $ 559 $ 3 -

Plant Capex 11 43 22 -

Environmental 3 12 6 25

Potential Additional Expenditures

• Environmental expenditures at Midwest Gen and Homer City

• Wind investments (2008 and beyond)

• Thermal investments

21

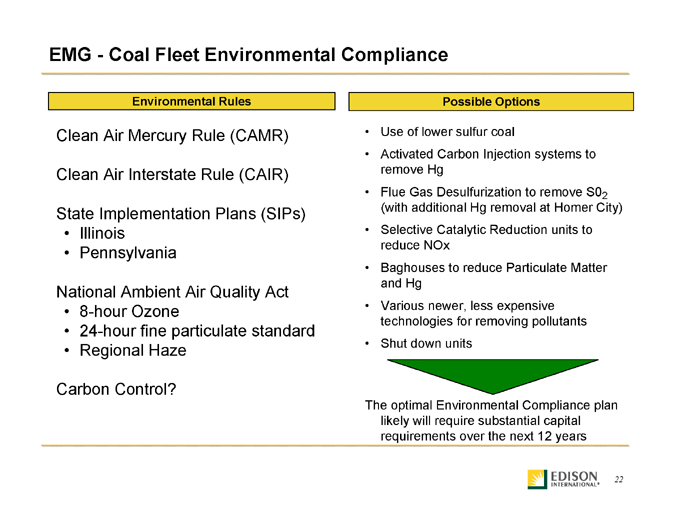

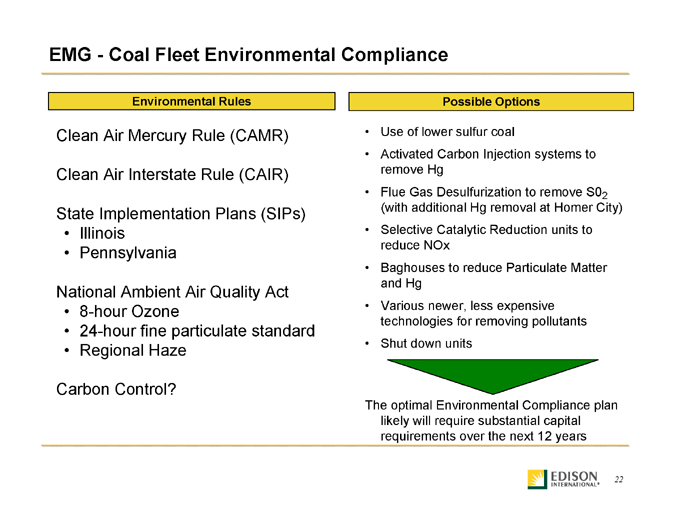

EMG - Coal Fleet Environmental Compliance

Environmental Rules Possible Options

Clean Air Mercury Rule (CAMR)Clean Air Interstate Rule (CAIR)State Implementation Plans (SIPs)• Illinois• Pennsylvania National Ambient Air Quality Act• 8-hour Ozone• 24-hour fine particulate standard• Regional HazeCarbon Control?

• Use of lower sulfur coal• Activated Carbon Injection systems to remove Hg• Flue Gas Desulfurization to remove S02 (with additional Hg removal at Homer City) • Selective Catalytic Reduction units to reduce NOx• Baghouses to reduce Particulate Matter and Hg • Various newer, less expensive technologies for removing pollutants • Shut down units

The optimal Environmental Compliance plan likely will require substantial capital requirements over the next 12 years

22

| | | | | | | | |

Performance | | Balance Sheet Strength | | Growth | | Dividends | | Shareholder Returns |

Year to Date Performance through September 30, 2006

23

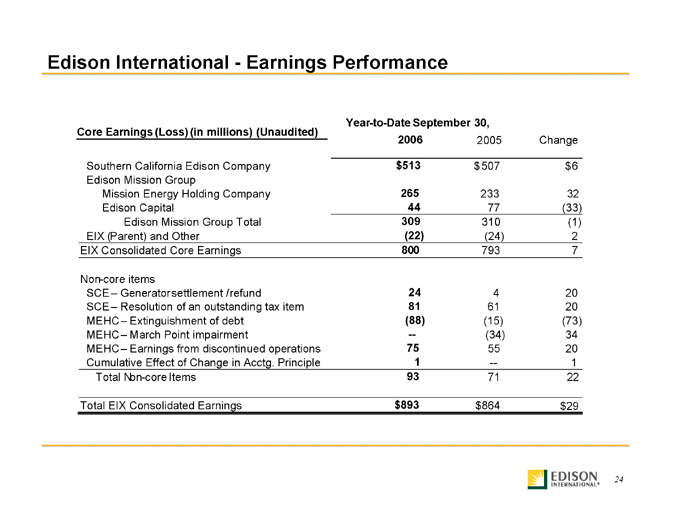

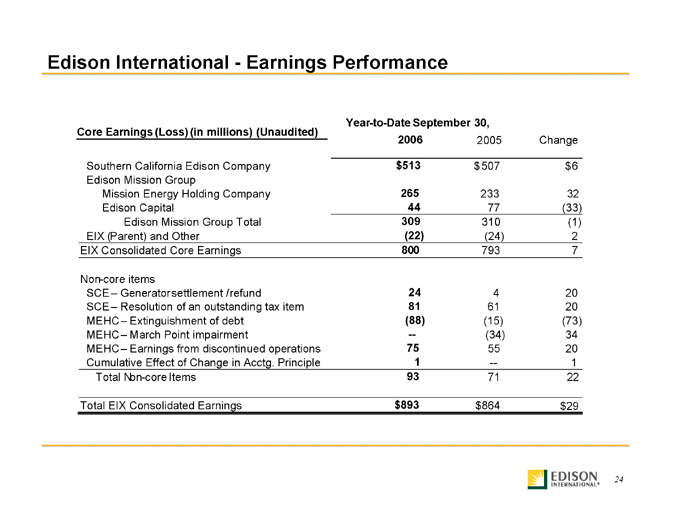

Edison International - Earnings Performance

| | | | | | |

| | | Year-to-Date September 30, |

Core Earnings (Loss) (in millions) (Unaudited) | | | | | | |

| | | 2006 | | 2005 | | Change |

Southern California Edison Company | | $513 | | $507 | | $6 |

Edison Mission Group | | | | | | |

Mission Energy Holding Company | | 265 | | 233 | | 32 |

Edison Capital | | 44 | | 77 | | (33) |

Edison Mission Group Total | | 309 | | 310 | | (1) |

EIX (Parent) and Other | | (22) | | (24) | | 2 |

EIX Consolidated Core Earnings | | 800 | | 793 | | 7 |

| | | | | | | |

Non-core items | | | | | | |

SCE – Generator settlement / refund | | 24 | | 4 | | 20 |

SCE – Resolution of an outstanding tax item | | 81 | | 61 | | 20 |

MEHC – Extinguishment of debt | | (88) | | (15) | | (73) |

MEHC – March Point impairment | | -- | | (34) | | 34 |

MEHC – Earnings from discontinued operations | | 75 | | 55 | | 20 |

Cumulative Effect of Change in Acctg. Principle | | 1 | | -- | | 1 |

Total Non-core Items | | 93 | | 71 | | 22 |

| | | | | | | |

Total EIX Consolidated Earnings | | $893 | | $864 | | $29 |

24

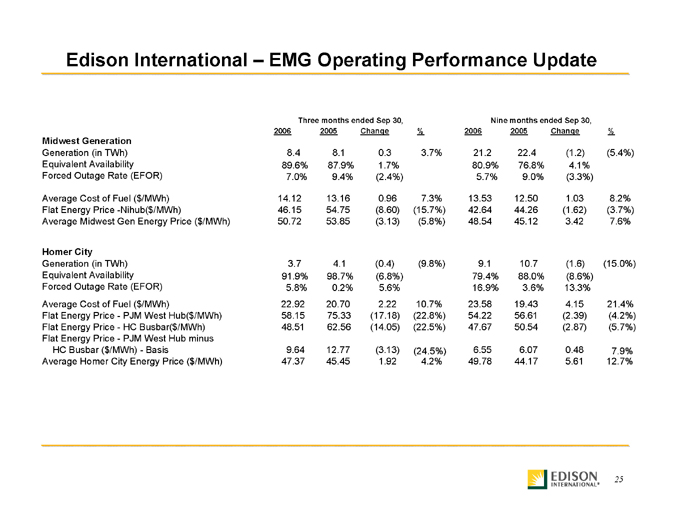

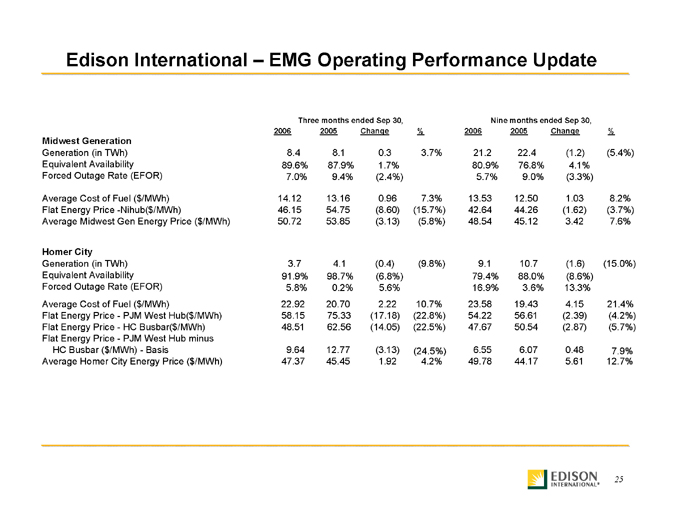

Edison International – EMG Operating Performance Update

| | | | | | | | | | | | | | | | |

| | | Three months ended

Sep 30, | | | | Nine months ended

Sep 30, | | |

| | | 2006 | | 2005 | | Change | | % | | 2006 | | 2005 | | Change | | % |

Midwest Generation | | | | | | | | | | | | | | | | |

Generation (in TWh) | | 8.4 | | 8.1 | | 0.3 | | 3.7% | | 21.2 | | 22.4 | | (1.2) | | (5.4%) |

Equivalent Availability | | 89.6% | | 87.9% | | 1.7% | | | | 80.9% | | 76.8% | | 4.1% | | |

Forced Outage Rate (EFOR) | | 7.0% | | 9.4% | | (2.4%) | | | | 5.7% | | 9.0% | | (3.3%) | | |

Average Cost of Fuel ($/MWh) | | 14.12 | | 13.16 | | 0.96 | | 7.3% | | 13.53 | | 12.50 | | 1.03 | | 8.2% |

Flat Energy Price -Nihub($/MWh) | | 46.15 | | 54.75 | | (8.60) | | (15.7%) | | 42.64 | | 44.26 | | (1.62) | | (3.7%) |

Average Midwest Gen Energy Price ($/MWh) | | 50.72 | | 53.85 | | (3.13) | | (5.8%) | | 48.54 | | 45.12 | | 3.42 | | 7.6% |

| | | | | | | | | | | | | | | | | |

Homer City | | | | | | | | | | | | | | | | |

Generation (in TWh) | | 3.7 | | 4.1 | | (0.4) | | (9.8%) | | 9.1 | | 10.7 | | (1.6) | | (15.0%) |

Equivalent Availability | | 91.9% | | 98.7% | | (6.8%) | | | | 79.4% | | 88.0% | | (8.6%) | | |

Forced Outage Rate (EFOR) | | 5.8% | | 0.2% | | 5.6% | | | | 16.9% | | 3.6% | | 13.3% | | |

Average Cost of Fuel ($/MWh) | | 22.92 | | 20.70 | | 2.22 | | 10.7% | | 23.58 | | 19.43 | | 4.15 | | 21.4% |

Flat Energy Price - PJM West Hub($/MWh) | | 58.15 | | 75.33 | | (17.18) | | (22.8%) | | 54.22 | | 56.61 | | (2.39) | | (4.2%) |

Flat Energy Price - HC Busbar($/MWh) | | 48.51 | | 62.56 | | (14.05) | | (22.5%) | | 47.67 | | 50.54 | | (2.87) | | (5.7%) |

Flat Energy Price - PJM West Hub minus | | | | | | | | | | | | | | | | |

HC Busbar ($/MWh) - Basis | | 9.64 | | 12.77 | | (3.13) | | (24.5%) | | 6.55 | | 6.07 | | 0.48 | | 7.9% |

Average Homer City Energy Price ($/MWh) | | 47.37 | | 45.45 | | 1.92 | | 4.2% | | 49.78 | | 44.17 | | 5.61 | | 12.7% |

25

EMG – Hedge Program

| | | | | | | | |

Performance | | Balance Sheet Strength | | Growth | | Dividends | | Shareholder Returns |

Guidance as of November 3, 2006

26

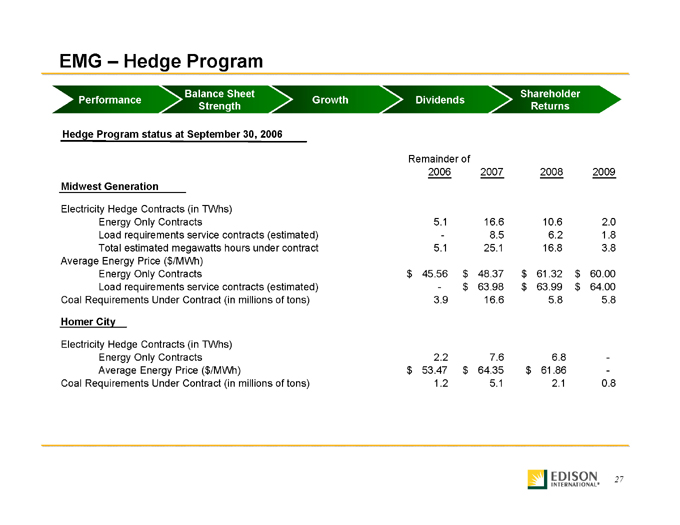

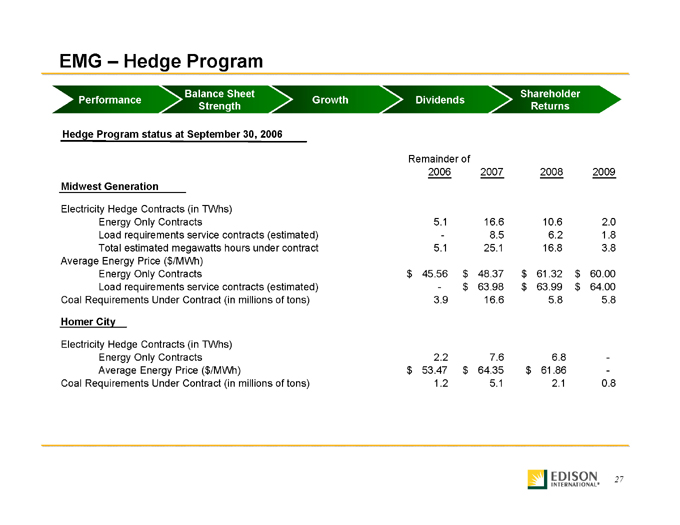

EMG – Hedge Program

| | | | | | | | |

Performance | | Balance Sheet Strength | | Growth | | Dividends | | Shareholder Returns |

| | | | | | | | |

Hedge Program status at September 30, 2006 | | | | | | | | |

| | | Remainder

of | | | | | | |

| | | 2006 | | 2007 | | 2008 | | 2009 |

Midwest Generation | | | | | | | | |

Electricity Hedge Contracts (in TWhs) | | | | | | | | |

Energy Only Contracts | | 5.1 | | 16.6 | | 10.6 | | 2.0 |

Load requirements service contracts (estimated) | | - | | 8.5 | | 6.2 | | 1.8 |

Total estimated megawatts hours under contract | | 5.1 | | 25.1 | | 16.8 | | 3.8 |

Average Energy Price ($/MWh) | | | | | | | | |

Energy Only Contracts | | $45.56 | | $48.37 | | $61.32 | | $60.00 |

Load requirements service contracts (estimated) | | - | | $63.98 | | $63.99 | | $64.00 |

Coal Requirements Under Contract (in millions of tons) | | 3.9 | | 16.6 | | 5.8 | | 5.8 |

Homer City | | | | | | | | |

Electricity Hedge Contracts (in TWhs) | | | | | | | | |

Energy Only Contracts | | 2.2 | | 7.6 | | 6.8 | | - |

Average Energy Price ($/MWh) | | $53.47 | | $64.35 | | $61.86 | | - |

Coal Requirements Under Contract (in millions of tons) | | 1.2 | | 5.1 | | 2.1 | | 0.8 |

27

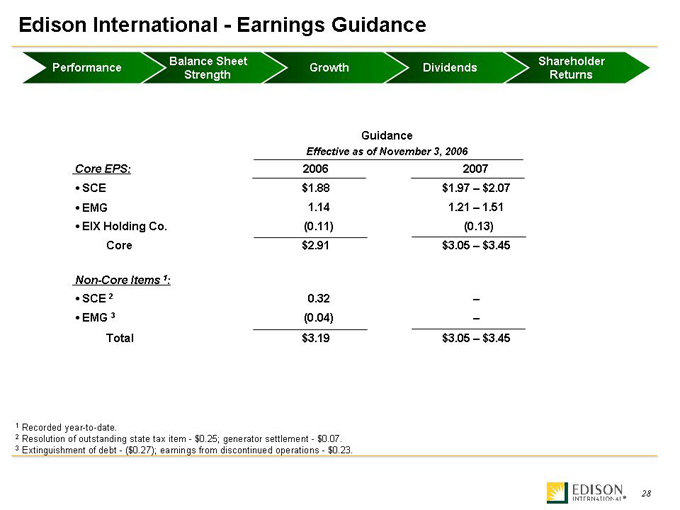

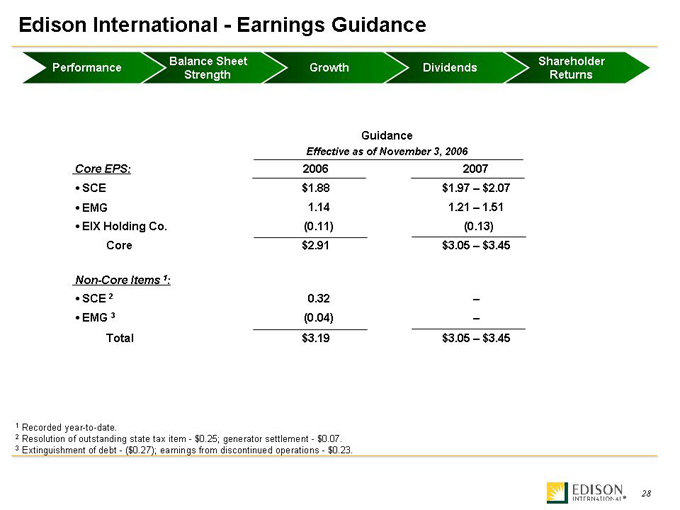

Edison International - Earnings Guidance

| | | | | | | | |

Performance | | Balance Sheet Strength | | Growth | | Dividends | | Shareholder Returns |

| | | | |

| | | Guidance Effective as of November 3, 2006 |

Core EPS: | | 2006 | | 2007 |

• SCE | | $1.88 | | $1.97 – $2.07 |

• EMG | | 1.14 | | 1.21 – 1.51 |

• EIX Holding Co. | | (0.11) | | (0.13) |

Core | | $2.91 | | $3.05 - $3.45 |

| | | | | |

Non-Core Items 1: | | | | |

• SCE 2 | | 0.32 | | - |

• EMG 3 | | (0.04) | | - |

Total | | $3.19 | | $3.05 – $3.45 |

1 Recorded year-to-date.

2 Resolution of outstanding state tax item - $0.25; generator settlement - $0.07.

3 Extinguishment of debt - ($0.27); earnings from discontinued operations - $0.23.

28

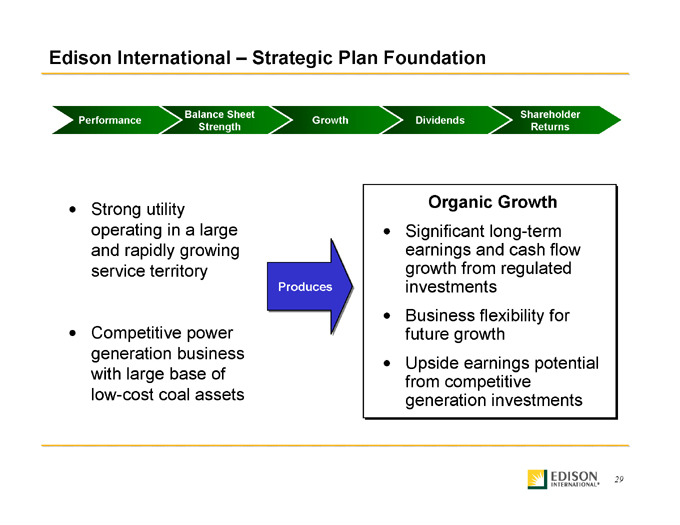

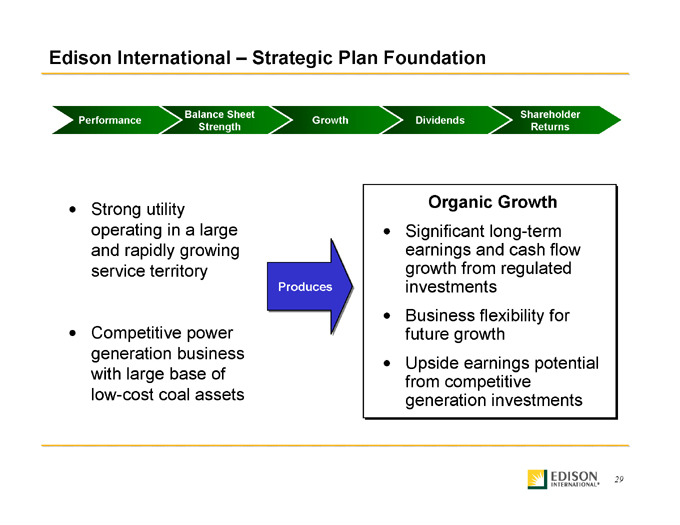

Edison International – Strategic Plan Foundation

| | | | | | | | |

Performance | | Balance Sheet Strength | | Growth | | Dividends | | Shareholder Returns |

• Strong utility operating in a large and rapidly growing service territory

• Competitive power generation business with large base of low-cost coal assets

Produces

Organic Growth

• Significant long-term earnings and cash flow growth from regulated investments

• Business flexibility for future growth

• Upside earnings potential from competitive generation investments

29

Appendix

30

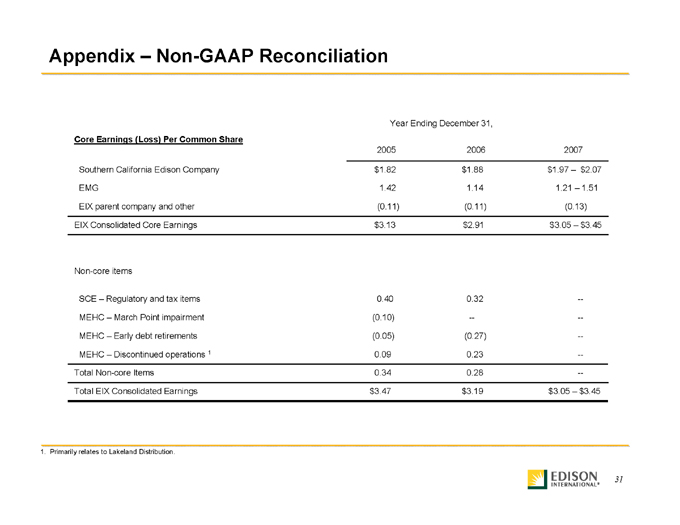

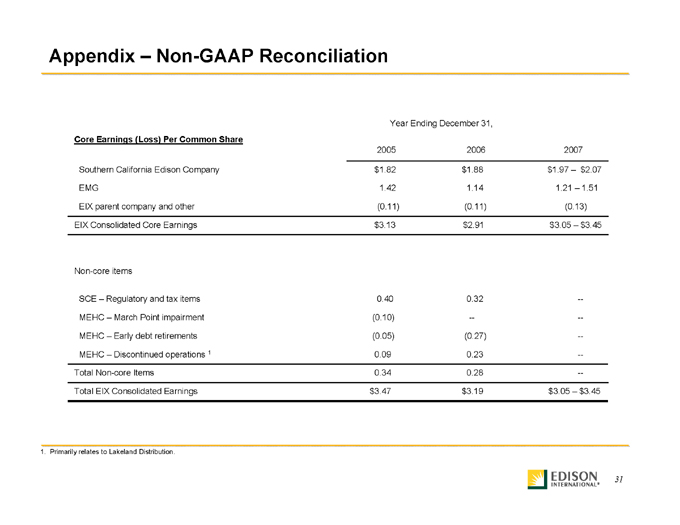

Appendix – Non-GAAP Reconciliation

| | | | | | |

| | | Year

Ending

December

31, | | |

Core Earnings (Loss) Per Common Share | | | | | | |

| | | 2005 | | 2006 | | 2007 |

Southern California Edison Company | | $1.82 | | $1.88 | | $1.97

-

$2.07 |

EMG | | 1.42 | | 1.14 | | 1.21

-

1.51 |

EIX parent company and other | | (0.11) | | (0.11) | | (0.13) |

EIX Consolidated Core Earnings | | $3.13 | | $2.91 | | $3.05

-

$3.45 |

Non-core items | | | | | | |

SCE - Regulatory and tax items | | 0.40 | | 0.32 | | -- |

MEHC - March Point impairment | | (0.10) | | -- | | -- |

MEHC - Early debt retirements | | (0.05) | | (0.27) | | -- |

MEHC - Discontinued operations 1 | | 0.09 | | 0.23 | | -- |

Total Non-core Items | | 0.34 | | 0.28 | | -- |

Total EIX Consolidated Earnings | | $3.47 | | $3.19 | | $3.05

-

$3.45 |

1. Primarily relates to Lakeland Distribution.

31

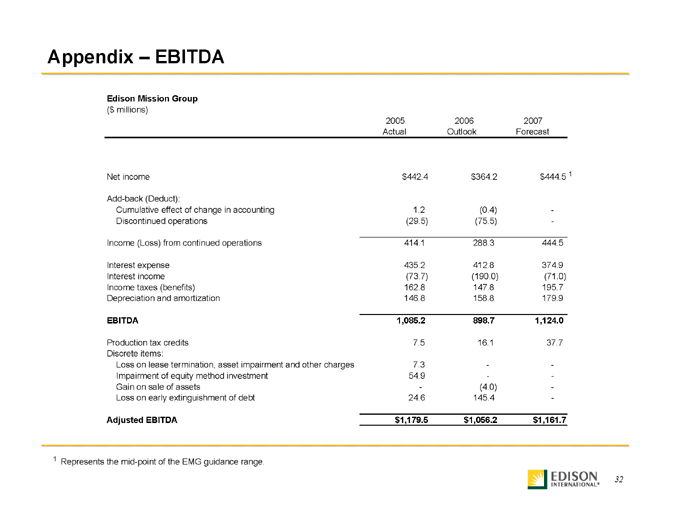

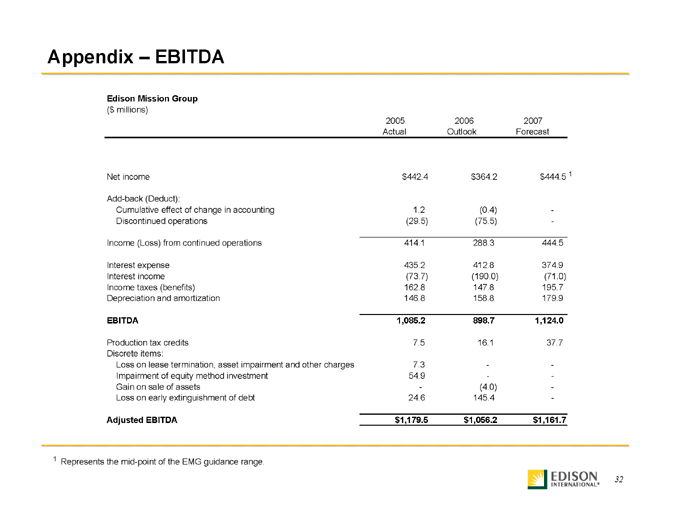

| | | | | | |

Appendix – EBITDA | | | | | | |

Edison Mission Group | | | | | | |

($ millions) | | | | | | |

| | | 2005 | | 2006 | | 2007 |

| | | Actual | | Outlook | | Forecast |

Net income | | $442.4 | | $364.2 | | $444.51 |

Add-back (Deduct): | | | | | | |

Cumulative effect of change in accounting | | 1.2 | | (0.4) | | - |

Discontinued operations | | (29.5) | | (75.5) | | - |

Income (Loss) from continued operations | | 414.1 | | 288.3 | | 444.5 |

Interest expense | | 435.2 | | 412.8 | | 374.9 |

Interest income | | (73.7) | | (190.0) | | (71.0) |

Income taxes (benefits) | | 162.8 | | 147.8 | | 195.7 |

Depreciation and amortization | | 146.8 | | 158.8 | | 179.9 |

EBITDA | | 1,085.2 | | 898.7 | | 1,124.0 |

Production tax credits | | 7.5 | | 16.1 | | 37.7 |

Discrete items: | | | | | | |

Loss on lease termination, asset impairment and other charges | | 7.3 | | - | | - |

Impairment of equity method investment | | 54.9 | | - | | - |

Gain on sale of assets | | - | | (4.0) | | - |

Loss on early extinguishment of debt | | 24.6 | | 145.4 | | - |

Adjusted EBITDA | | $1,179.5 | | $1,056.2 | | $1,161.7 |

1 Represents the mid-point of the EMG guidance range.

32

Assumptions Detail

• NAPP, “Northern Appalachian”; PRB, “Powder River Basin”

• Actual future Fuel Costs may differ from estimated future fuel costs, due to a number of factors including contractual SO2 adjustments, emissions price changes, changes in emissions rates and regulations, contractual Btu adjustments, changes in spot prices/new contracts, inventory build or reduction, changes in costs based on contractually determined escalators and exercise of options under certain agreements.

• Fuel Costs include coal and coal transportation costs, coal cleaning costs, natural gas and oil used for start-up and, at Homer City, limestone costs and includes emissions purchases. Reflects average inventory costs.

• NAPP Coal is a proxy for the actual coal purchased by Homer City. Two types of coal, ready to burn and raw, are purchased for Units 1 and 2. Ready to burn coal is of a quality that can be burned directly in Units 1 and 2, whereas the raw coal purchased for Units 1 and 2 must be cleaned in the coal cleaning plant. Coal for all three units is generally sourced within 100 miles of the facility.

• The amount of coal under contracts in tons is calculated based on contracted tons and applying an 8,800 British Thermal units (Btu) equivalent for the Illinois Plants and 13,000 Btu equivalent for the Homer City facilities.

• Average hedge price reflects the total value of the on- and off-peak hedges and is not directly comparable to the flat energy price.

33

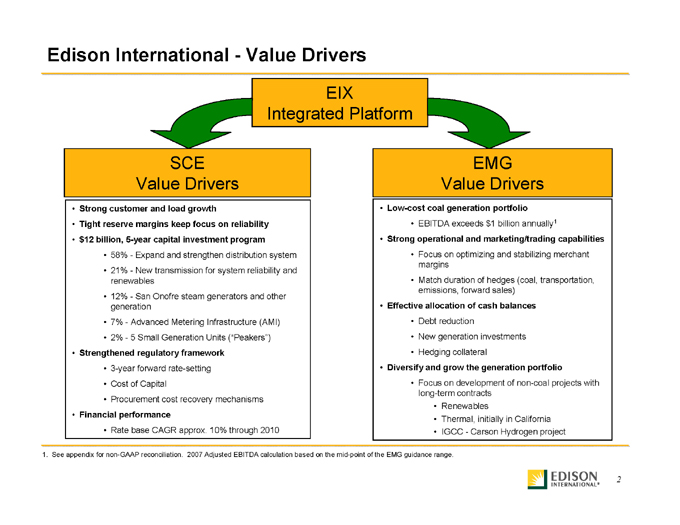

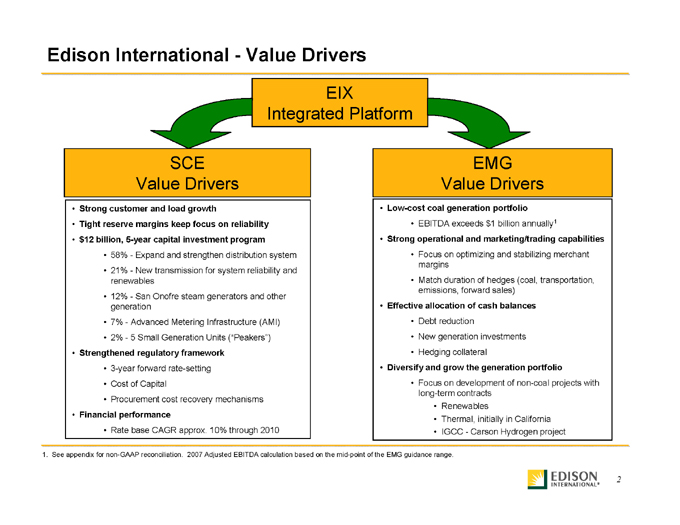

EMG – Liquidity Profile

Available Liquidity Collateral

| | | | |

($ millions) | | | | |

Sources | | 12/31/05 | | 9/30/06 |

EME Revolver | | $98 | | $494 |

MWG Revolver | | 325 | | 465 |

Cash & Short term investments¹ | | 1,869 | | 2,309 |

| | | $2,292 | | $3,268 |

• Cash expected to decline in 2008 from payoff of MEHC notes and growth investments

• Strong market conditions allowed EME to replace $98 million revolver with $500 million, 6-year facility

• Enhanced liquidity: $1 billion of credit facilities between MWG and EME

1,200

Credit Facilities

1,000

800

$ millions

600

$550

400

200

$217

0

9/30/06 Collateral²

Potential (@ 95%)³

1. Excludes $698 million and $198 million of cash collateral held by counterparties at 12/31/05 and 9/30/06, respectively.

2. Includes $19 million in letters of credit.

3. During next 12 months, using 95% confidence level.

34

C has provided cost recovery assurance

C has provided cost recovery assurance