Exhibit 99.1

Business Update

September-October 2007

September 11, 2007 EDISON INTERNATIONAL®

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation, earnings, asset and rate base growth, load growth, capital investments, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s 2006 Form 10-K and subsequent reports filed with the Securities and Exchange Commission and available on our website: www.edison.com. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances.

September 11, 2007 1 EDISON INTERNATIONAL®

Strategic Overview

September 11, 2007 2 EDISON INTERNATIONAL®

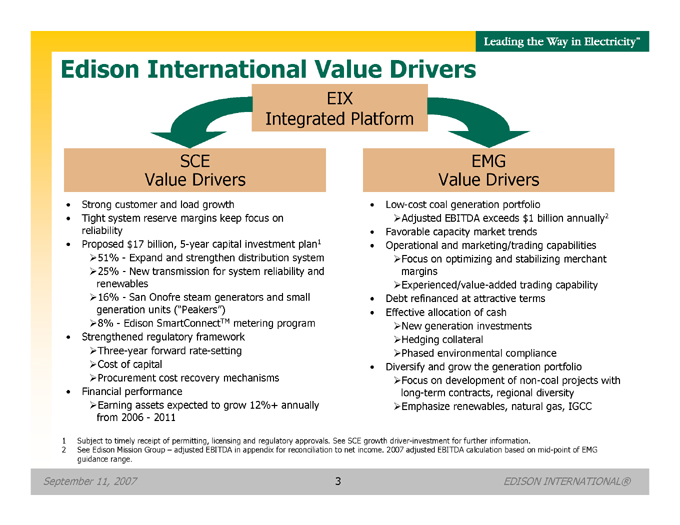

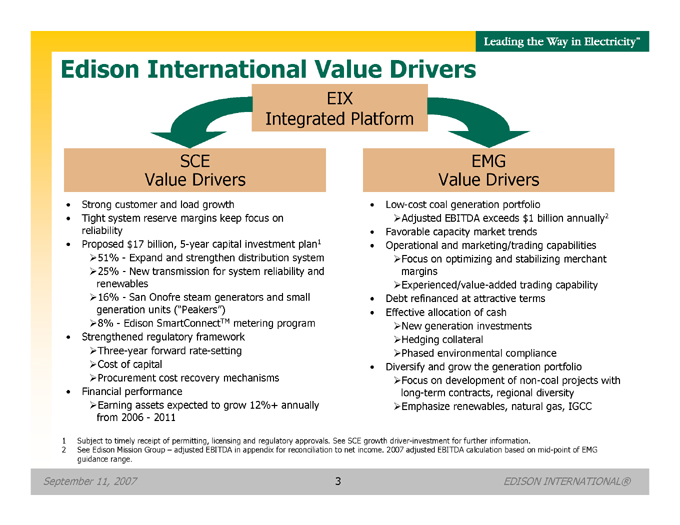

Edison International Value Drivers

EIX Integrated Platform

SCE Value Drivers

Strong customer and load growth

Tight system reserve margins keep focus on reliability

Proposed $17 billion, 5-year capital investment plan1

51%—Expand and strengthen distribution system

25%—New transmission for system reliability and renewables

16%—San Onofre steam generators and small generation units (“Peakers”)

8%—Edison SmartConnectTM metering program

Strengthened regulatory framework

Three-year forward rate-setting

Cost of capital

Procurement cost recovery mechanisms

Financial performance

Earning assets expected to grow 12%+ annually from 2006—2011

EMG Value Drivers

Low-cost coal generation portfolio

Adjusted EBITDA exceeds $1 billion annually2

Favorable capacity market trends

Operational and marketing/trading capabilities

Focus on optimizing and stabilizing merchant margins

Experienced/value-added trading capability

Debt refinanced at attractive terms

Effective allocation of cash

New generation investments

Hedging collateral

Phased environmental compliance

Diversify and grow the generation portfolio

Focus on development of non-coal projects with long-term contracts, regional diversity

Emphasize renewables, natural gas, IGCC

1 Subject to timely receipt of permitting, licensing and regulatory approvals. See SCE growth driver-investment for further information.

2 See Edison Mission Group – adjusted EBITDA in appendix for reconciliation to net income. 2007 adjusted EBITDA calculation based on mid-point of EMG guidance range.

September 11, 2007 3 EDISON INTERNATIONAL®

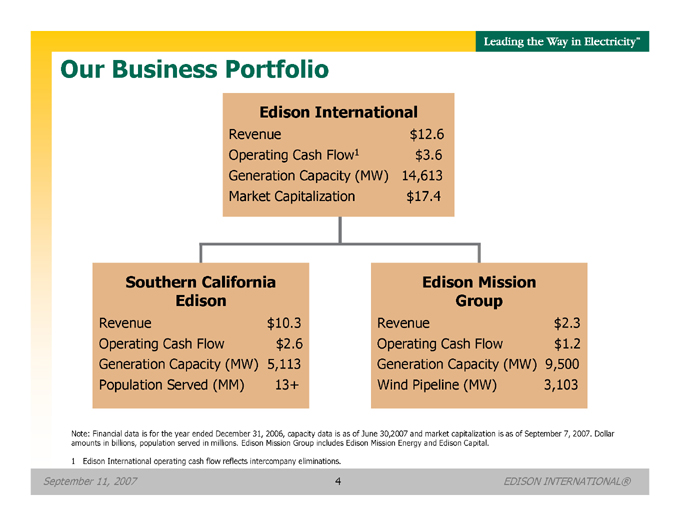

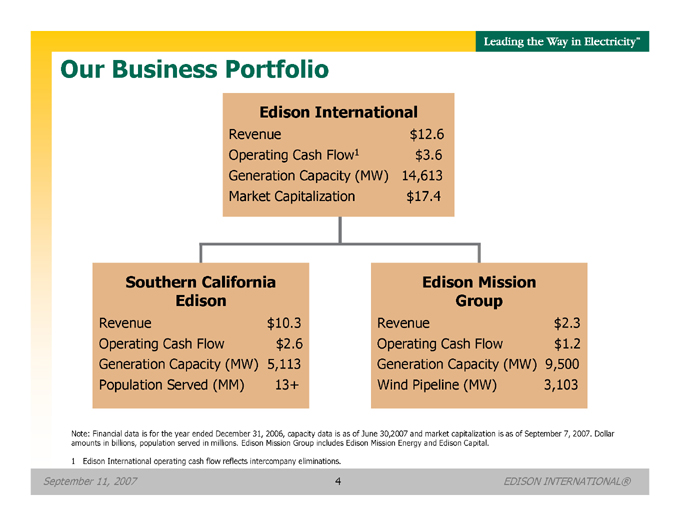

Our Business Portfolio

Edison International

Revenue $12.6 Operating Cash Flow1 $3.6 Generation Capacity (MW) 14,613 Market Capitalization $17.4

Southern California Edison

Revenue $10.3 Operating Cash Flow $2.6 Generation Capacity (MW) 5,113 Population Served (MM) 13+

Edison Mission Group

Revenue $2.3 Operating Cash Flow $1.2 Generation Capacity (MW) 9,500 Wind Pipeline (MW) 3,103

Note: Financial data is for the year ended December 31, 2006, capacity data is as of June 30, 2007 and market capitalization is as of September 7, 2007. Dollar amounts in billions, population served in millions. Edison Mission Group includes Edison Mission Energy and Edison Capital.

1 | | Edison International operating cash flow reflects intercompany eliminations. |

September 11, 2007 4 EDISON INTERNATIONAL®

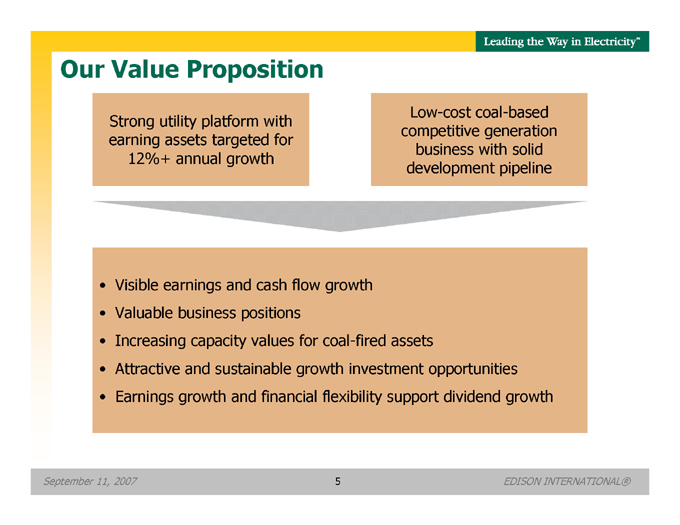

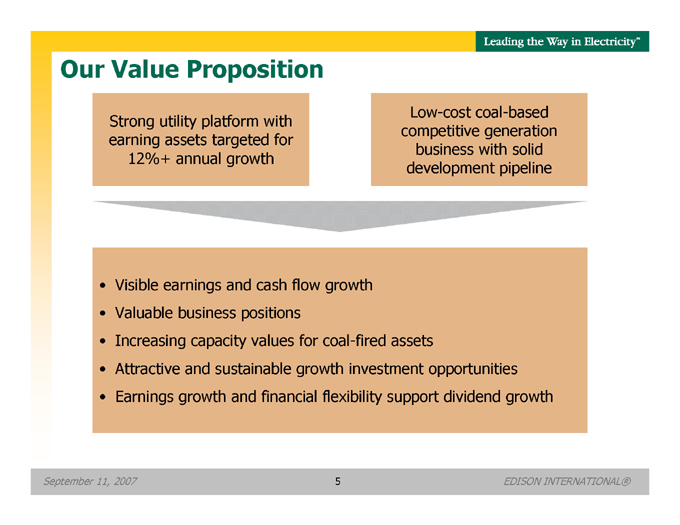

Our Value Proposition

Strong utility platform with earning assets targeted for 12%+ annual growth

Low-cost coal-based competitive generation business with solid development pipeline

Visible earnings and cash flow growth

Valuable business positions

Increasing capacity values for coal-fired assets

Attractive and sustainable growth investment opportunities

Earnings growth and financial flexibility support dividend growth

September 11, 2007 5 EDISON INTERNATIONAL®

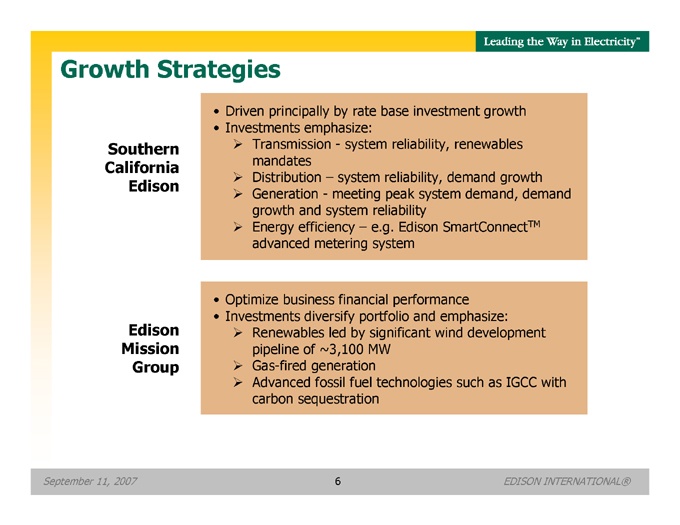

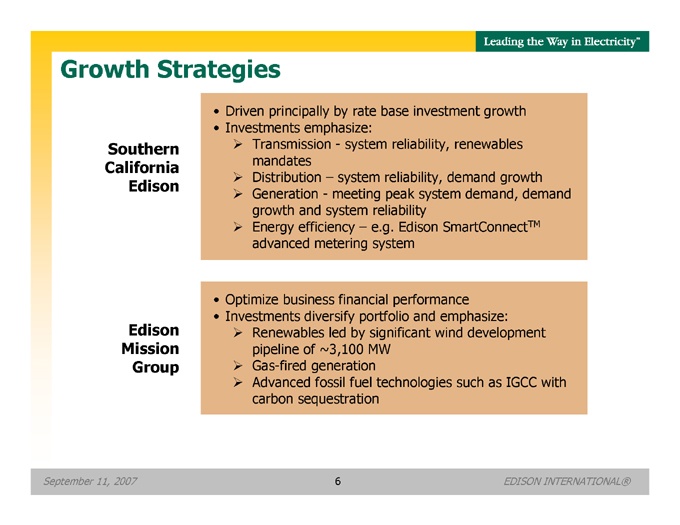

Growth Strategies

Southern California Edison

Driven principally by rate base investment growth

Investments emphasize:

Transmission—system reliability, renewables mandates

Distribution – system reliability, demand growth

Generation—meeting peak system demand, demand growth and system reliability

Energy efficiency – e.g. Edison SmartConnectTM advanced metering system

Edison Mission Group

Optimize business financial performance

Investments diversify portfolio and emphasize:

Renewables led by significant wind development pipeline of ~3,100 MW

Gas-fired generation

Advanced fossil fuel technologies such as IGCC with carbon sequestration

September 11, 2007 6 EDISON INTERNATIONAL®

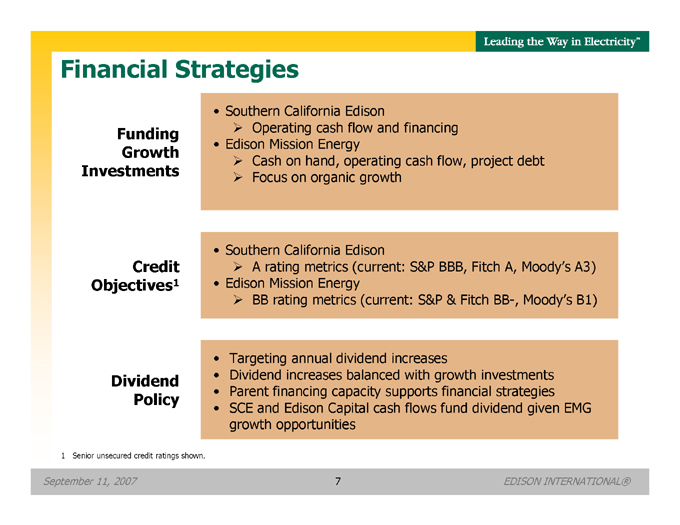

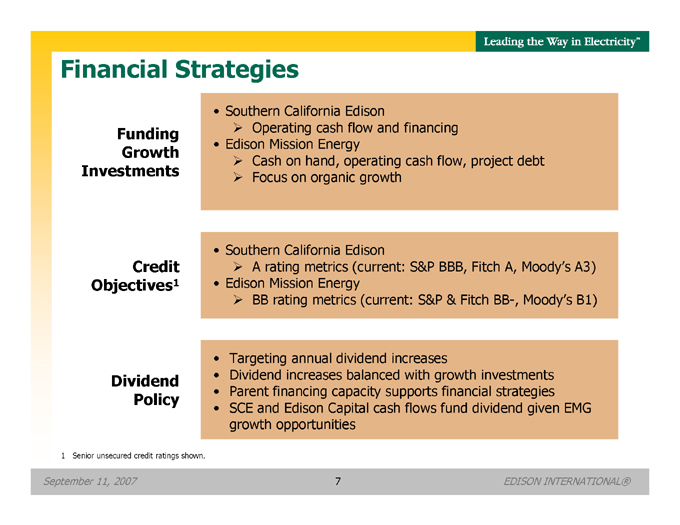

Financial Strategies

Funding Growth Investments

Southern California Edison

Operating cash flow and financing

Edison Mission Energy

Cash on hand, operating cash flow, project debt

Focus on organic growth

Credit Objectives1

Southern California Edison

A rating metrics (current: S&P BBB, Fitch A, Moody’s A3)

Edison Mission Energy

BB rating metrics (current: S&P & Fitch BB-, Moody’s B1)

Dividend Policy

Targeting annual dividend increases

Dividend increases balanced with growth investments

Parent financing capacity supports financial strategies

SCE and Edison Capital cash flows fund dividend given EMG growth opportunities

1 | | Senior unsecured credit ratings shown. |

September 11, 2007 7 EDISON INTERNATIONAL®

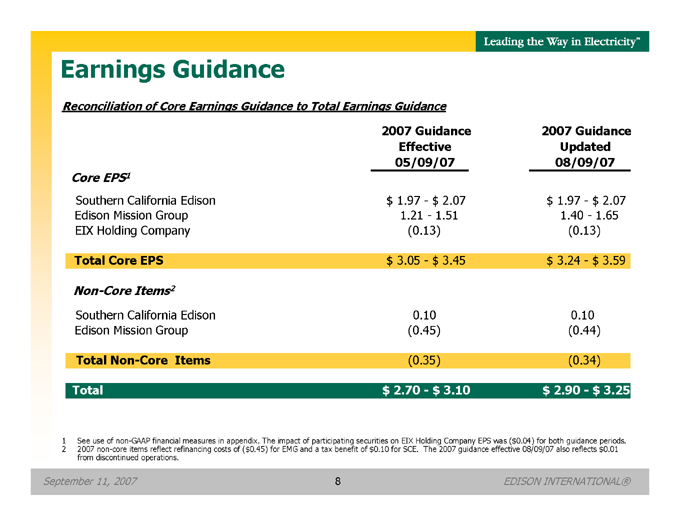

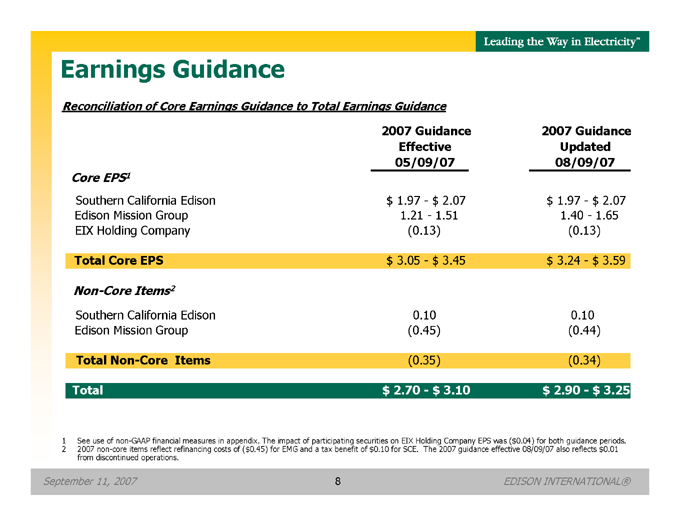

Earnings Guidance

Reconciliation of Core Earnings Guidance to Total Earnings Guidance

2007 Guidance 2007 Guidance

Effective Updated

05/09/07 08/09/07

Core EPS1

Southern California Edison $ 1.97—$ 2.07 $ 1.97—$ 2.07

Edison Mission Group 1.21— 1.51 1.40— 1.65

EIX Holding Company (0.13) (0.13)

Total Core EPS $ 3.05—$ 3.45 $ 3.24—$ 3.59

Non-Core Items 2

Southern California Edison 0.10 0.10

Edison Mission Group (0.45) (0.44)

Total Non-Core Items (0.35) (0.34)

Total $ 2.70—$ 3.10 $ 2.90—$ 3.25

1 See use of non-GAAP financial measures in appendix. The impact of participating securities on EIX Holding Company EPS was ($0.04) for both guidance periods.

2 2007 non-core items reflect refinancing costs of ($0.45) for EMG and a tax benefit of $0.10 for SCE. The 2007 guidance effective 08/09/07 also reflects $0.01 from discontinued operations.

September 11, 2007 8 EDISON INTERNATIONAL®

Southern California Edison (SCE)

An Investor-Owned Electric Utility

September 11, 2007 9 EDISON INTERNATIONAL®

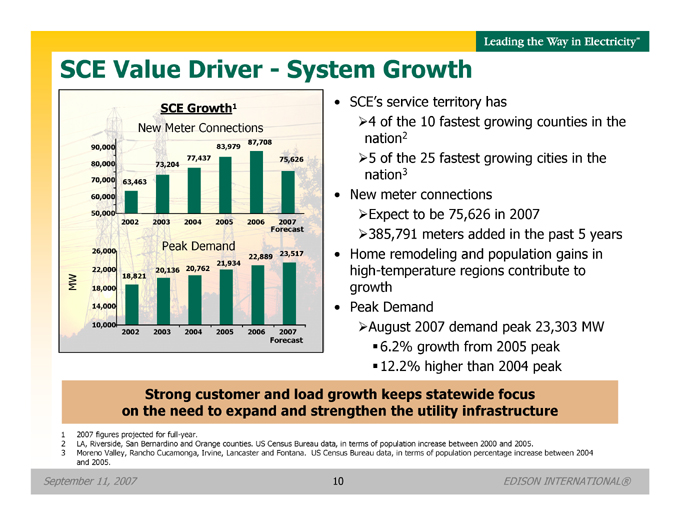

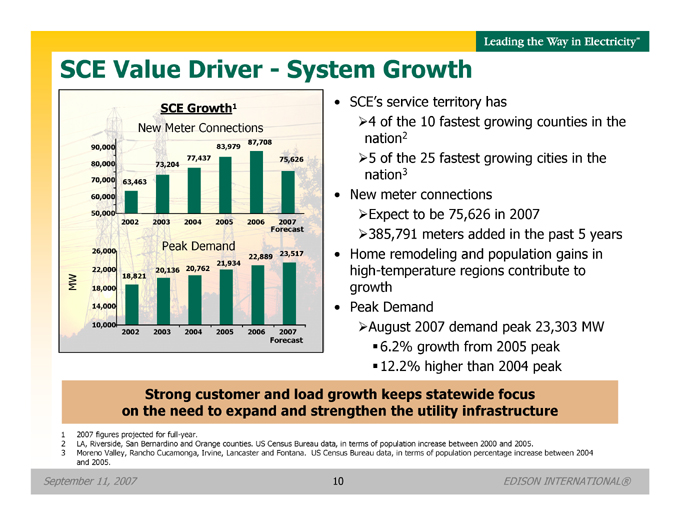

SCE Value Driver—System Growth

SCE Growth1

New Meter Connections

87,708

90,000 83,979

77,437 75,626

80,000 73,204

70,000 63,463

60,000

50,000

2002 2003 2004 2005 2006 2007

Forecast

26,000 Peak Demand

22,889 23,517

21,934

22,000 20,136 20,762

18,821

MW 18,000

14,000

10,000

2002 2003 2004 2005 2006 2007

Forecast

SCE’s service territory has

4 | | of the 10 fastest growing counties in the nation2 |

5 | | of the 25 fastest growing cities in the nation3 New meter connections |

Expect to be 75,626 in 2007

385,791 meters added in the past 5 years Home remodeling and population gains in high-temperature regions contribute to growth Peak Demand

August 2007 demand peak 23,303 MW 6.2% growth from 2005 peak 12.2% higher than 2004 peak

Strong customer and load growth keeps statewide focus on the need to expand and strengthen the utility infrastructure

1 | | 2007 figures projected for full-year. |

2 LA, Riverside, San Bernardino and Orange counties. US Census Bureau data, in terms of population increase between 2000 and 2005.

3 Moreno Valley, Rancho Cucamonga, Irvine, Lancaster and Fontana. US Census Bureau data, in terms of population percentage increase between 2004 and 2005.

September 11, 2007 10 EDISON INTERNATIONAL®

SCE Value Driver—Reliability

State law mandates that SCE serve 20% of its customers’ electricity needs with renewable energy by 2010

SCE’s current renewable portfolio (2006 data)

Renewable resources ~13 billion kWh

Represents ~17% of customer power deliveries

SCE’s 2010 renewable resources target ~16 billion kWh

Completed four renewable power solicitations to date; 2007 solicitation to be finalized by 2Q08

SCE – the nation’s leading renewable energy purchaser in 2006

Agreement with Alta Windpower Development LLC

Secures at least 1,500 MW of power, more than doubling SCE’s wind portfolio

The wind project, when completed, will be twice the size of the largest wind project in the U.S.

Projects to be built in Tehachapi, California

Expanded Geothermal Agreement with Calpine

SCE expanded agreement to purchase 225 MW of geothermal energy for 10 years

SCE entered into a new agreement for 714 MW of non-renewable capacity for 2008 – 2011

SCE signs largest wind energy contract in U.S. history & expands geothermal agreement

September 11, 2007 11 EDISON INTERNATIONAL®

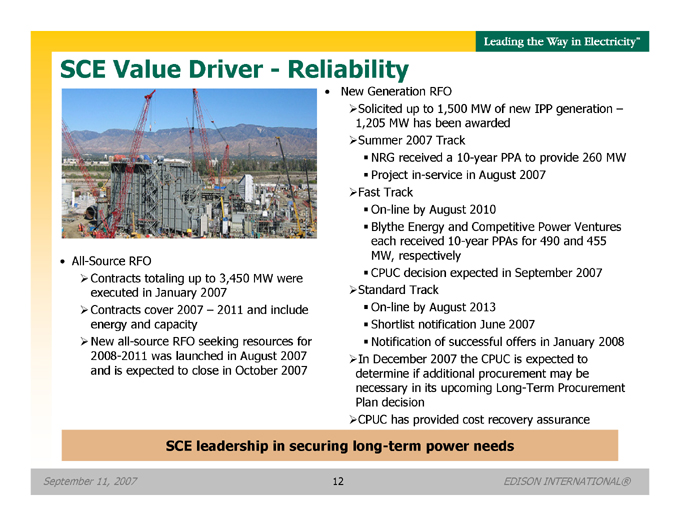

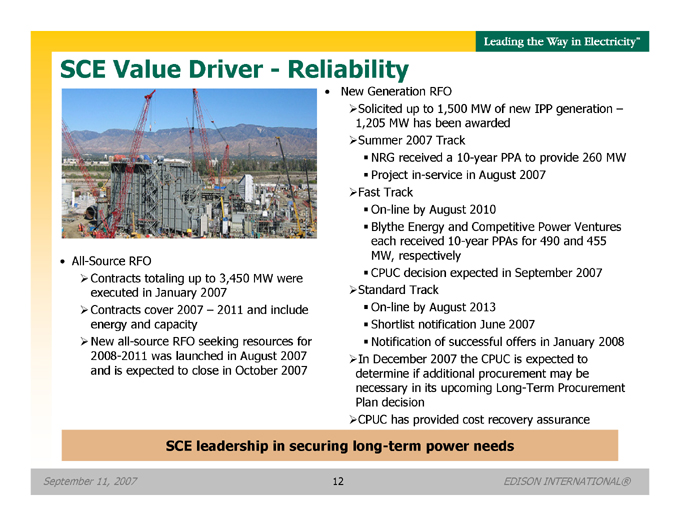

SCE Value Driver—Reliability

All-Source RFO

Contracts totaling up to 3,450 MW were executed in January 2007

Contracts cover 2007 – 2011 and include energy and capacity

New all-source RFO seeking resources for 2008-2011 was launched in August 2007 and is expected to close in October 2007

New Generation RFO

Solicited up to 1,500 MW of new IPP generation –1,205 MW has been awarded

Summer 2007 Track

NRG received a 10-year PPA to provide 260 MW Project in-service in August 2007

Fast Track

On-line by August 2010

Blythe Energy and Competitive Power Ventures each received 10-year PPAs for 490 and 455 MW, respectively CPUC decision expected in September 2007

Standard Track

On-line by August 2013 Shortlist notification June 2007

Notification of successful offers in January 2008

In December 2007 the CPUC is expected to determine if additional procurement may be necessary in its upcoming Long-Term Procurement Plan decision

CPUC has provided cost recovery assurance

SCE leadership in securing long-term power needs

September 11, 2007 12 EDISON INTERNATIONAL®

SCE Value Driver—Reliability

SCE is committed to creating, transmitting and improving end-use efficiency of electricity in an environmentally responsible manner

During the past 5 years, SCE has –

Saved more than 4 billion kWh – enough energy to power 500,000 homes for an entire year

Reduced greenhouse gas emissions by more than 2 million tons – the equivalent of removing 250,000 cars from the road

During the next 2 years, SCE will –

Help customers save an additional 2 billion kWh, reducing greenhouse gas emissions by another 1 million tons

SCE offers a wide array of energy efficiency and demand response programs which offer financial incentives and/or other benefits for saving energy and shifting usage from on-peak periods and is well-positioned to participate in future energy efficiency mechanisms that share customer economic benefits with shareholders

Time-of-Use (TOU) rates, load management programs and energy management systems (EMS) are some of the many programs offered

Regulatory mechanisms mitigate the revenue impact of changes in electricity sales

Recognized as a leader in energy efficiency by U.S. EPA & DOE

September 11, 2007 13 EDISON INTERNATIONAL®

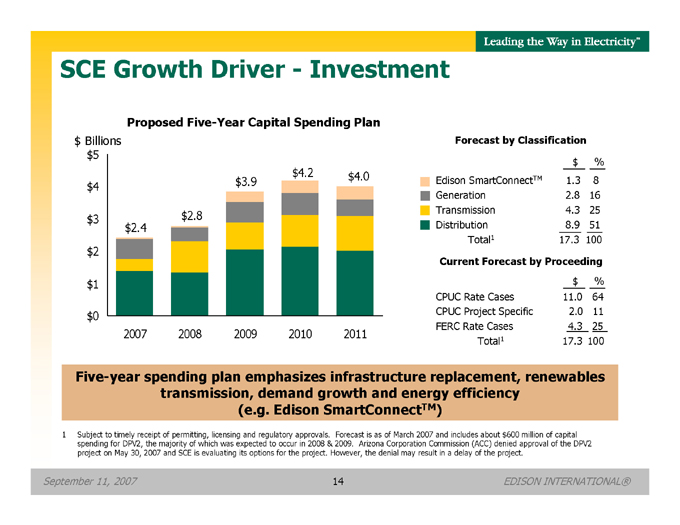

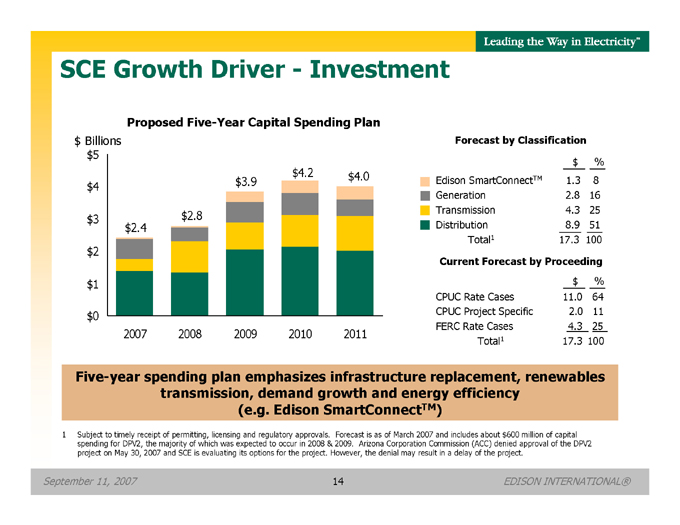

SCE Growth Driver—Investment

Proposed Five-Year Capital Spending Plan

$ Billions

$ 5

$ 4.2 $ 4.0

$ 4 $ 3.9

$ 3 $ 2.8

$ 2.4

$ 2

$ 1

$ 0

2007 2008 2009 2010 2011

Forecast by Classification

$ %

Edison SmartConnectTM 1.3 8

Generation 2.8 16

Transmission 4.3 25

Distribution 8.9 51

Total1 17.3 100

Current Forecast by Proceeding

$ %

CPUC Rate Cases 11.0 64

CPUC Project Specific 2.0 11

FERC Rate Cases 4.3 25

Total1 17.3 100

Five-year spending plan emphasizes infrastructure replacement, renewables transmission, demand growth and energy efficiency (e.g. Edison SmartConnectTM)

1 Subject to timely receipt of permitting, licensing and regulatory approvals. Forecast is as of March 2007 and includes about $600 million of capital spending for DPV2, the majority of which was expected to occur in 2008 & 2009. Arizona Corporation Commission (ACC) denied approval of the DPV2 project on May 30, 2007 and SCE is evaluating its options for the project. However, the denial may result in a delay of the project.

September 11, 2007 14 EDISON INTERNATIONAL®

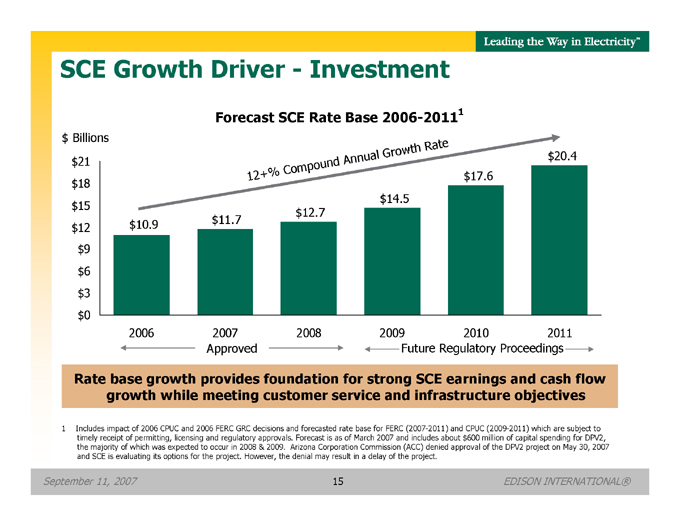

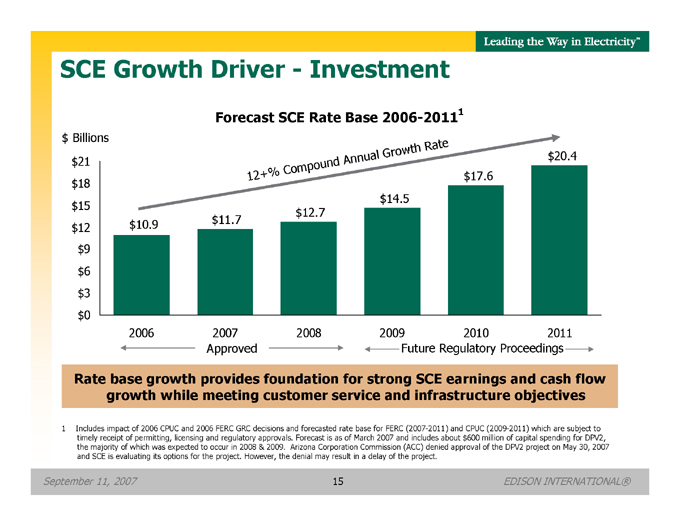

SCE Growth Driver—Investment

Forecast SCE Rate Base 2006-20111

$ Billions

$ 20.4

$ 21

$ 17.6

$ 18

$ 14.5

$ 15

$ 12.7

$ 10.9 $ 11.7

$ 12

$ 9

$ 6

$ 3

$ 0

1 2 + % COMPOUND ANNUAL GROWTH RATE

2006 2007 2008 2009 2010 2011

Approved Future Regulatory Proceedings

Rate base growth provides foundation for strong SCE earnings and cash flow growth while meeting customer service and infrastructure objectives

1 Includes impact of 2006 CPUC and 2006 FERC GRC decisions and forecasted rate base for FERC (2007-2011) and CPUC (2009-2011) which are subject to timely receipt of permitting, licensing and regulatory approvals. Forecast is as of March 2007 and includes about $600 million of capital spending for DPV2, the majority of which was expected to occur in 2008 & 2009. Arizona Corporation Commission (ACC) denied approval of the DPV2 project on May 30, 2007 and SCE is evaluating its options for the project. However, the denial may result in a delay of the project.

September 11, 2007 15 EDISON INTERNATIONAL®

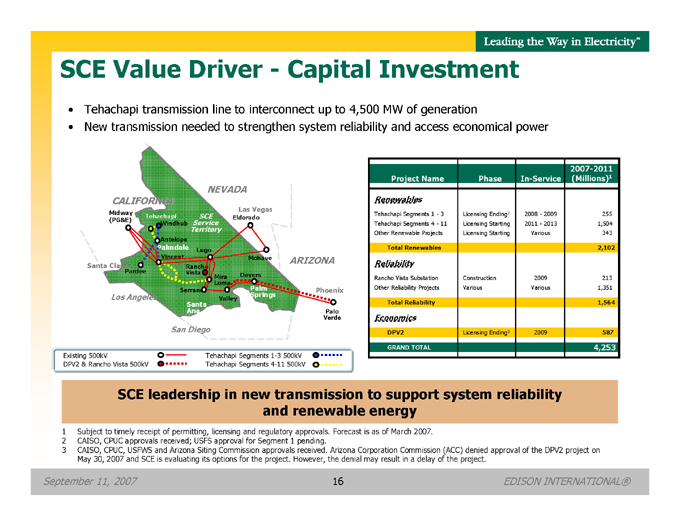

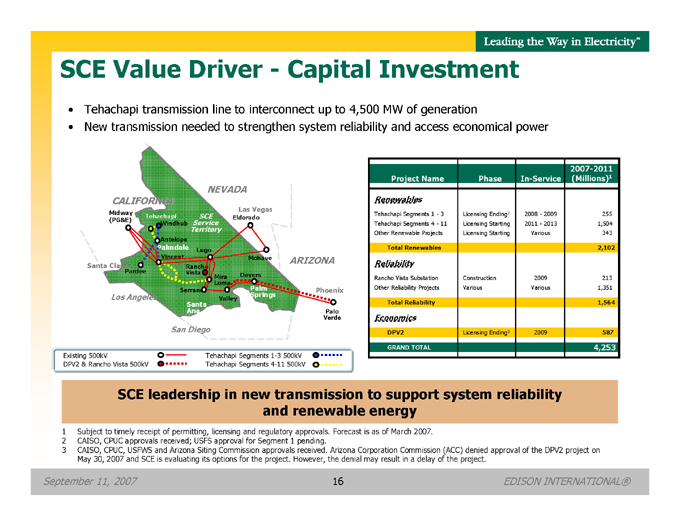

SCE Value Driver—Capital Investment

Tehachapi transmission line to interconnect up to 4,500 MW of generation

New transmission needed to strengthen system reliability and access economical power

NEVADA CALIFORNIA

Las Vegas

Midway

Tehachapi SCE Eldorado

(PG&E) Service

Windhub

Territory

Antelope

Palmdale Lugo

Vincent Mohave ARIZONA

Santa Clarita Rancho Pardee Vista

Mira Devers Loma

Serrano Palm Phoenix

Los Angeles Springs

Valley

Santa

Ana Palo Verde

San Diego

2007-2011

Project Name Phase In-Service (Millions)1

Renewables

Tehachapi Segments 1—3 Licensing Ending2 2008—2009 255

Tehachapi Segments 4—11 Licensing Starting 2011—2013 1,504

Other Renewable Projects Licensing Starting Various 343

Total Renewables 2,102

Reliability

Rancho Vista Substation Construction 2009 213

Other Reliability Projects Various Various 1,351

Total Reliability 1,564

Economics

DPV2 Licensing Ending3 2009 587

GRAND TOTAL 4,253

Existing 500kV Tehachapi Segments 1-3 500kV DPV2 & Rancho Vista 500kV Tehachapi Segments 4-11 500kV

SCE leadership in new transmission to support system reliability and renewable energy

1 | | Subject to timely receipt of permitting, licensing and regulatory approvals. Forecast is as of March 2007. |

2 | | CAISO, CPUC approvals received; USFS approval for Segment 1 pending. |

3 CAISO, CPUC, USFWS and Arizona Siting Commission approvals received. Arizona Corporation Commission (ACC) denied approval of the DPV2 project on May 30, 2007 and SCE is evaluating its options for the project. However, the denial may result in a delay of the project.

September 11, 2007 16 EDISON INTERNATIONAL®

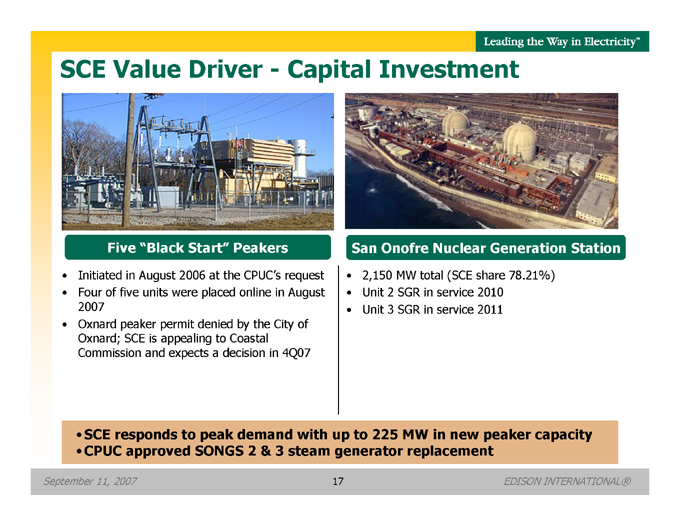

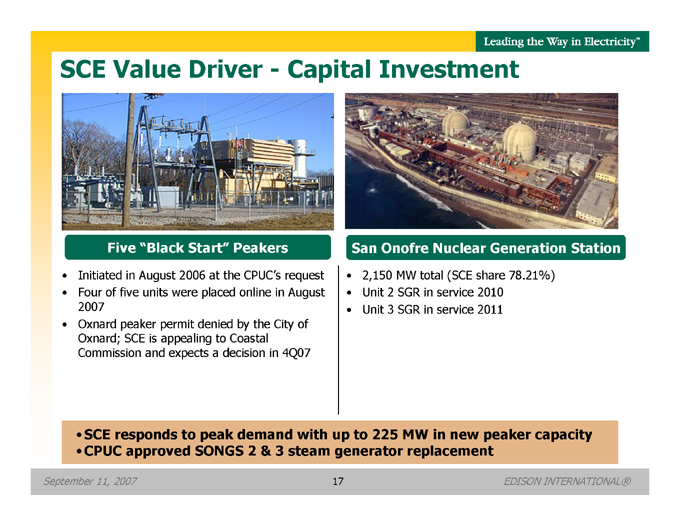

SCE Value Driver—Capital Investment

Five “Black Start” Peakers

Initiated in August 2006 at the CPUC’s request

Four of five units were placed online in August 2007

Oxnard peaker permit denied by the City of Oxnard; SCE is appealing to Coastal Commission and expects a decision in 4Q07

San Onofre Nuclear Generation Station

2,150 MW total (SCE share 78.21%)

Unit 2 SGR in service 2010

Unit 3 SGR in service 2011

SCE responds to peak demand with up to 225 MW in new peaker capacity CPUC approved SONGS 2 & 3 steam generator replacement

September 11, 2007 17 EDISON INTERNATIONAL®

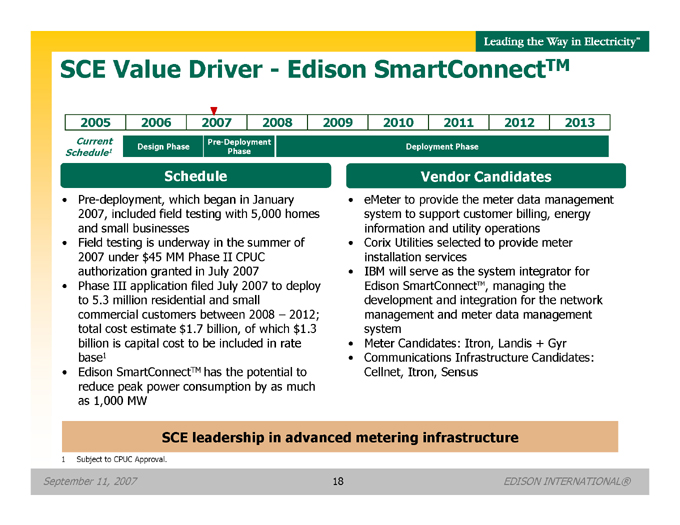

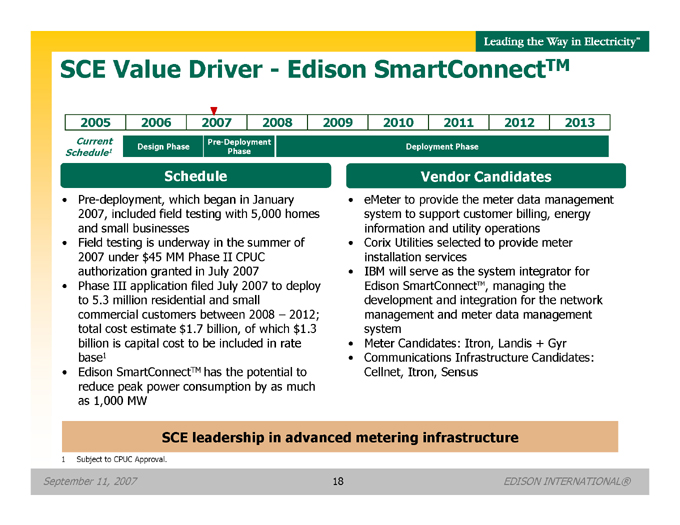

SCE Value Driver—Edison SmartConnectTM

2005 2006 2007 2008 2009 2010 2011 2012 2013

Current Schedule1 Pre-Deployment Phase

Design Phase Deployment Phase

Schedule

Pre-deployment, which began in January 2007, included field testing with 5,000 homes and small businesses

Field testing is underway in the summer of 2007 under $45 MM Phase II CPUC authorization granted in July 2007

Phase III application filed July 2007 to deploy to 5.3 million residential and small commercial customers between 2008 – 2012; total cost estimate $1.7 billion, of which $1.3 billion is capital cost to be included in rate base1

Edison SmartConnectTM has the potential to reduce peak power consumption by as much as 1,000 MW

Vendor Candidates

eMeter to provide the meter data management system to support customer billing, energy information and utility operations

Corix Utilities selected to provide meter installation services

IBM will serve as the system integrator for Edison SmartConnectTM, managing the development and integration for the network management and meter data management system

Meter Candidates: Itron, Landis + Gyr

Communications Infrastructure Candidates: Cellnet, Itron, Sensus

SCE leadership in advanced metering infrastructure

1 | | Subject to CPUC Approval. |

September 11, 2007 18 EDISON INTERNATIONAL®

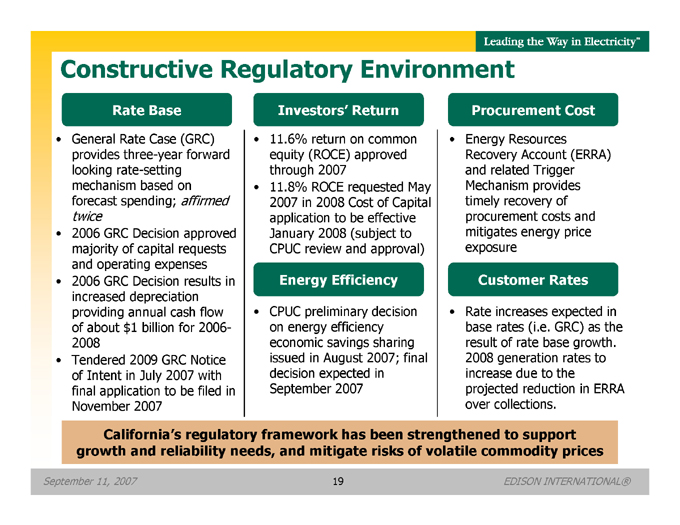

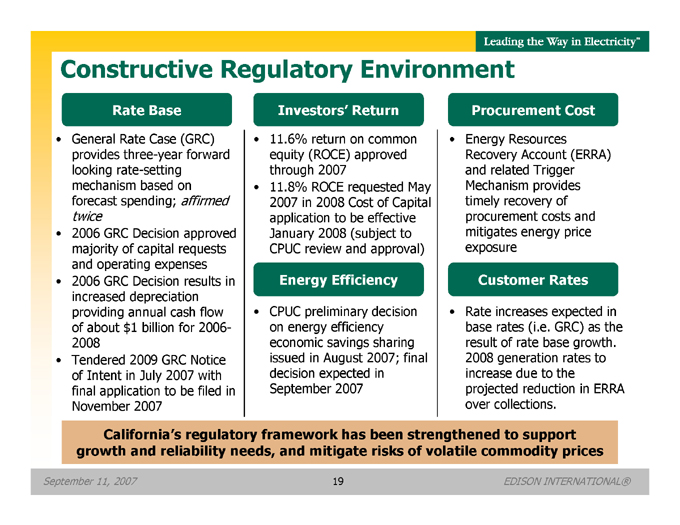

Constructive Regulatory Environment

Rate Base

General Rate Case (GRC) provides three-year forward looking rate-setting mechanism based on forecast spending; affirmed twice

2006 GRC Decision approved majority of capital requests and operating expenses

2006 GRC Decision results in increased depreciation providing annual cash flow of about $1 billion for 2006-2008

Tendered 2009 GRC Notice of Intent in July 2007 with final application to be filed in November 2007

Investors’ Return

11.6% return on common equity (ROCE) approved through 2007

11.8% ROCE requested May 2007 in 2008 Cost of Capital application to be effective January 2008 (subject to CPUC review and approval)

Energy Efficiency

CPUC preliminary decision on energy efficiency economic savings sharing issued in August 2007; final decision expected in September 2007

Procurement Cost

Energy Resources Recovery Account (ERRA) and related Trigger Mechanism provides timely recovery of procurement costs and mitigates energy price exposure

Customer Rates

Rate increases expected in base rates (i.e. GRC) as the result of rate base growth. 2008 generation rates to increase due to the projected reduction in ERRA over collections.

California’s regulatory framework has been strengthened to support growth and reliability needs, and mitigate risks of volatile commodity prices

September 11, 2007 19 EDISON INTERNATIONAL®

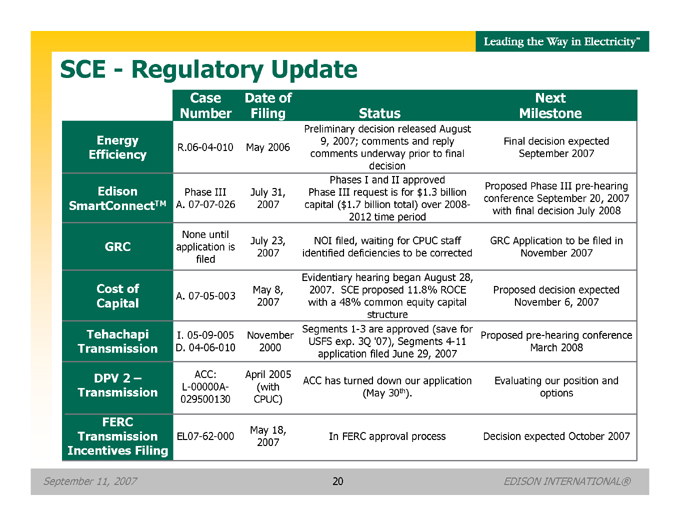

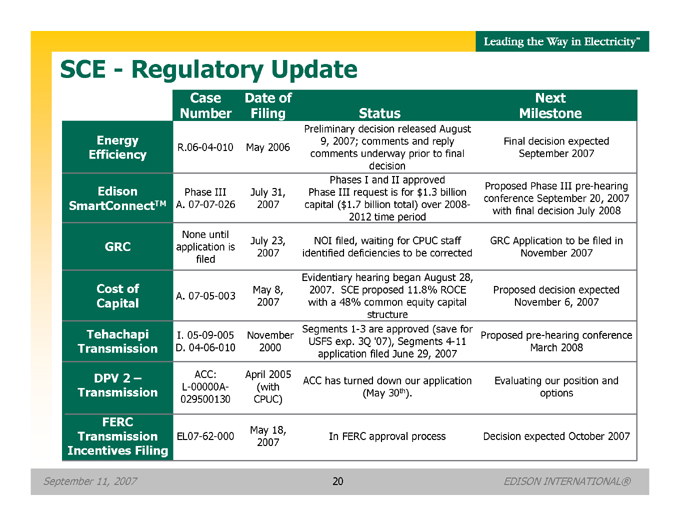

Case Date of Next

Number Filing Status Milestone

Preliminary decision released August

Energy 9, 2007; comments and reply Final decision expected

R.06-04-010 May 2006

Efficiency comments underway prior to final September 2007

decision

Phases I and II approved

Edison Proposed Phase III pre-hearing

Phase III July 31, Phase III request is for $1.3 billion

conference September 20, 2007

SmartConnectTM A. 07-07-026 2007 capital ($1.7 billion total) over 2008-

with final decision July 2008

2012 time period

None until

July 23, NOI filed, waiting for CPUC staff GRC Application to be filed in

GRC application is

2007 identified deficiencies to be corrected November 2007

filed

Evidentiary hearing began August 28,

Cost of May 8, 2007. SCE proposed 11.8% ROCE Proposed decision expected

A. 07-05-003

Capital 2007 with a 48% common equity capital November 6, 2007

structure

Tehachapi Segments 1-3 are approved (save for

I. 05-09-005 November Proposed pre-hearing conference

USFS exp. 3Q ‘07), Segments 4-11

Transmission D. 04-06-010 2000 March 2008

application filed June 29, 2007

DPV 2 – ACC: April 2005

ACC has turned down our application Evaluating our position and

L-00000A- (with

Transmission (May 30th). options

029500130 CPUC)

FERC

May 18,

Transmission EL07-62-000 In FERC approval process Decision expected October 2007

2007

Incentives Filing

SCE—Regulatory Update

September 11, 2007 20 EDISON INTERNATIONAL®

Edison Mission Group (EMG)

A Competitive Power Generation Company

September 11, 2007 21 EDISON INTERNATIONAL®

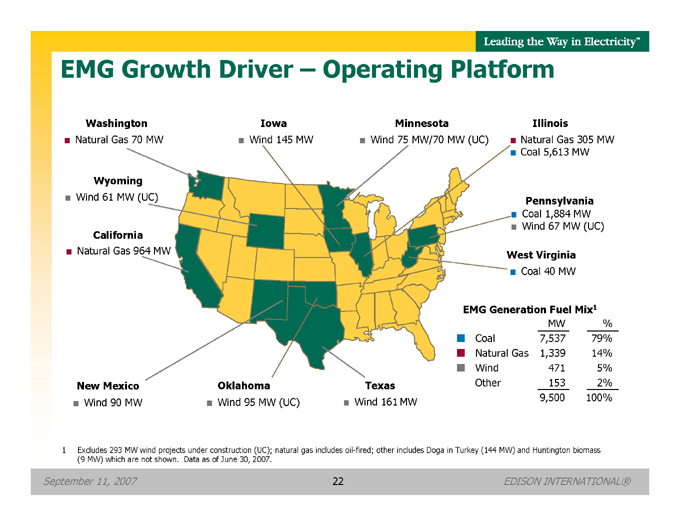

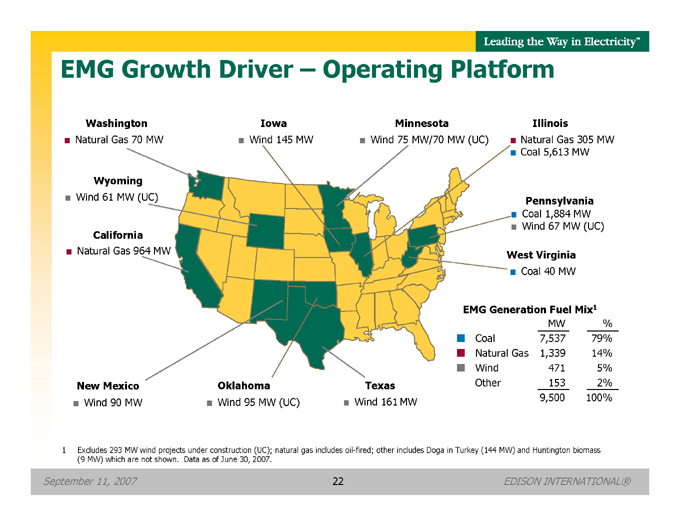

EMG Growth Driver – Operating Platform

Washington Iowa Minnesota Illinois

Natural Gas 70 MW Wind 145 MW Wind 75 MW/70 MW (UC) Natural Gas 305 MW

Coal 5,613 MW

Wyoming

Wind 61 MW (UC) Pennsylvania

Coal 1,884 MW

Wind 67 MW (UC)

California

Natural Gas 964 MW West Virginia

Coal 40 MW

New Mexico Oklahoma Texas

Wind 90 MW Wind 95 MW (UC) Wind 161 MW

EMG Generation Fuel Mix1

MW

%

Coal

7,537

79%

Natural Gas

1,339

14%

Wind

471

5%

Other

153

2%

9,500

100%

1 Excludes 293 MW wind projects under construction (UC); natural gas includes oil-fired; other includes Doga in Turkey (144 MW) and Huntington biomass (9 MW) which are not shown. Data as of June 30, 2007.

September 11, 2007 22 EDISON INTERNATIONAL®

EMG—Key Value Drivers

Low-cost coal generation driver for strong adjusted EBITDA

EMG adjusted EBITDA in excess of $1 billion for last two years, also forecasted for 20071

Strong operational and marketing/trading capabilities

Effective management of fuel, transportation, and emissions to protect gross margins

More efficient and expanding market/hedging opportunities

Experienced/value adding trading business

Long-term environmental plan for Midwest Generation

Financial flexibility with simplified capital structure

EMG liquidy2 – $2.3 billion as of June 30, 2007

Recent financing eliminates near-term maturities and high interest rate notes

Expanding capital expenditures – $1.9 billion estimated through 2009

Expansion and diversification goals

Larger scale and operational efficiencies

Greater diversification of generation technology and fuel type

Bias towards development, contract vs. merchant, low emission technologies

Focus areas – renewables, natural gas, IGCC

1 See Edison Mission Group – adjusted EBITDA in appendix for reconciliation to net income; 2007 adjusted EBITDA calculation based on mid-point of EMG guidance range.

2 | | See EMG liquidity profile. |

September 11, 2007 23 EDISON INTERNATIONAL®

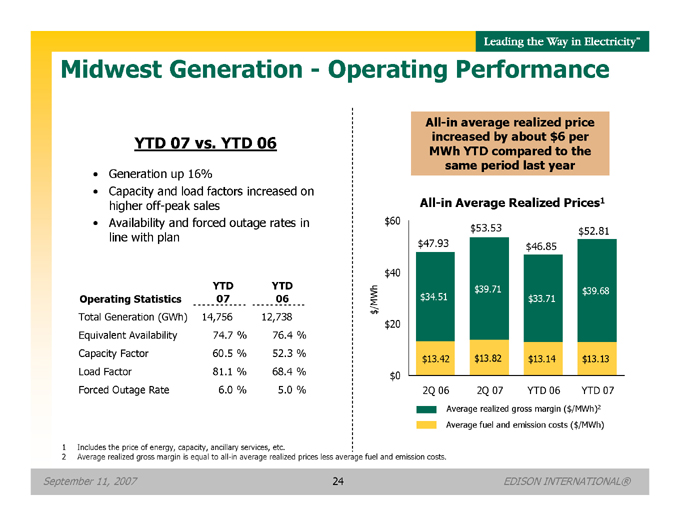

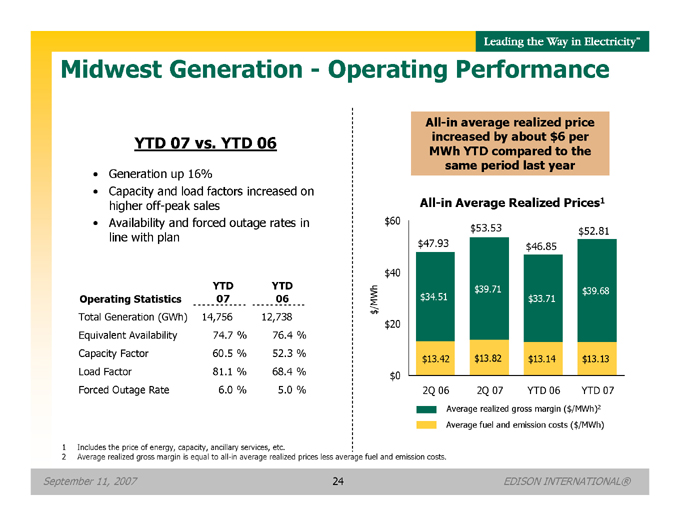

Midwest Generation—Operating Performance

YTD 07 vs. YTD 06

Generation up 16%

Capacity and load factors increased on higher off-peak sales

Availability and forced outage rates in line with plan

YTD YTD

Operating Statistics 07 06

Total Generation (GWh) 14,756 12,738

Equivalent Availability 74.7 % 76.4 %

Capacity Factor 60.5 % 52.3 %

Load Factor 81.1 % 68.4 %

Forced Outage Rate 6.0 % 5.0 %

All-in average realized price increased by about $6 per MWh YTD compared to the same period last year

All-in Average Realized Prices1

$60 $53.53 $52.81 $47.93 $46.85 $40 $39.71 $39.68 /MWh $34.51 $33.71 $ $20

$13.42 $13.82 $13.14 $13.13 $0 2Q 06 2Q 07 YTD 06 YTD 07

Average realized gross margin ($/MWh)2 Average fuel and emission costs ($/MWh)

1 | | Includes the price of energy, capacity, ancillary services, etc. |

2 | | Average realized gross margin is equal to all-in average realized prices less average fuel and emission costs. |

September 11, 2007 24 EDISON INTERNATIONAL®

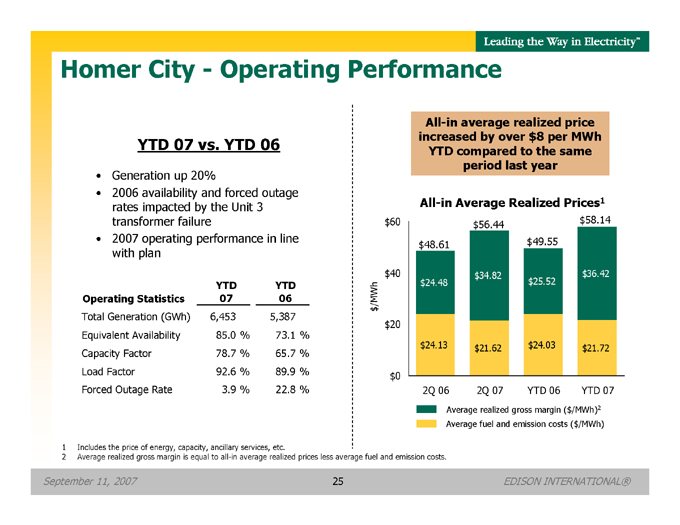

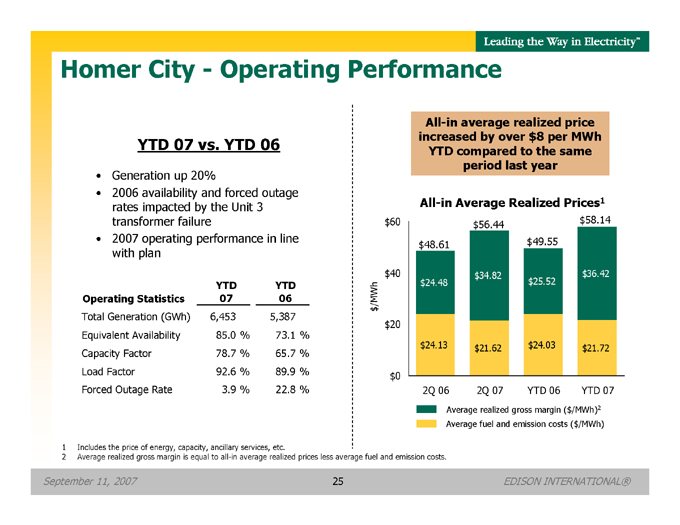

Homer City—Operating Performance

YTD 07 vs. YTD 06

Generation up 20%

2006 availability and forced outage rates impacted by the Unit 3 transformer failure

2007 operating performance in line with plan

YTD YTD

Operating Statistics 07 06

Total Generation (GWh) 6,453 5,387

Equivalent Availability 85.0 % 73.1 %

Capacity Factor 78.7 % 65.7 %

Load Factor 92.6 % 89.9 %

Forced Outage Rate 3.9 % 22.8 %

All-in average realized price increased by over $8 per MWh YTD compared to the same period last year

All-in Average Realized Prices1

$ 60 $ 56.44 $ 58.14

$ 48.61 $ 49.55

$ 40 $ 34.82 $ 36.42

$ 24.48 $ 25.52

/MWh

$

$ 20

$ 24.13 $ 21.62 $ 24.03 $ 21.72

$ 0

2Q 06 2Q 07 YTD 06 YTD 07

Average realized gross margin ($/MWh)2

Average fuel and emission costs ($/MWh)

1 | | Includes the price of energy, capacity, ancillary services, etc. |

2 | | Average realized gross margin is equal to all-in average realized prices less average fuel and emission costs. |

September 11, 2007 25 EDISON INTERNATIONAL®

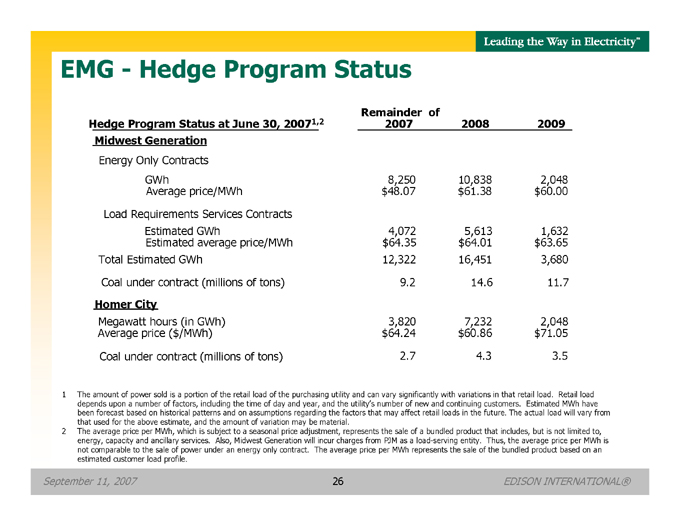

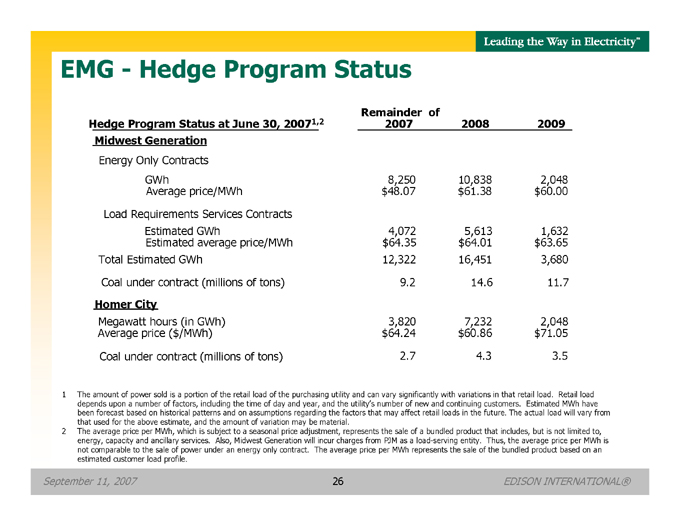

EMG—Hedge Program Status

Remainder of

Hedge Program Status at June 30, 20071,2 2007 2008 2009

Midwest Generation

Energy Only Contracts

GWh 8,250 10,838 2,048

Average price/MWh $ 48.07 $ 61.38 $ 60.00

Load Requirements Services Contracts

Estimated GWh 4,072 5,613 1,632

Estimated average price/MWh $ 64.35 $ 64.01 $ 63.65

Total Estimated GWh 12,322 16,451 3,680

Coal under contract (millions of tons) 9.2 14.6 11.7

Homer City

Megawatt hours (in GWh) 3,820 7,232 2,048

Average price ($/MWh) $ 64.24 $ 60.86 $ 71.05

Coal under contract (millions of tons) 2.7 4.3 3.5

1 The amount of power sold is a portion of the retail load of the purchasing utility and can vary significantly with variations in that retail load. Retail load depends upon a number of factors, including the time of day and year, and the utility’s number of new and continuing customers. Estimated MWh have been forecast based on historical patterns and on assumptions regarding the factors that may affect retail loads in the future. The actual load will vary from that used for the above estimate, and the amount of variation may be material.

2 The average price per MWh, which is subject to a seasonal price adjustment, represents the sale of a bundled product that includes, but is not limited to, energy, capacity and ancillary services. Also, Midwest Generation will incur charges from PJM as a load-serving entity. Thus, the average price per MWh is not comparable to the sale of power under an energy only contract. The average price per MWh represents the sale of the bundled product based on an estimated customer load profile.

September 11, 2007 26 EDISON INTERNATIONAL®

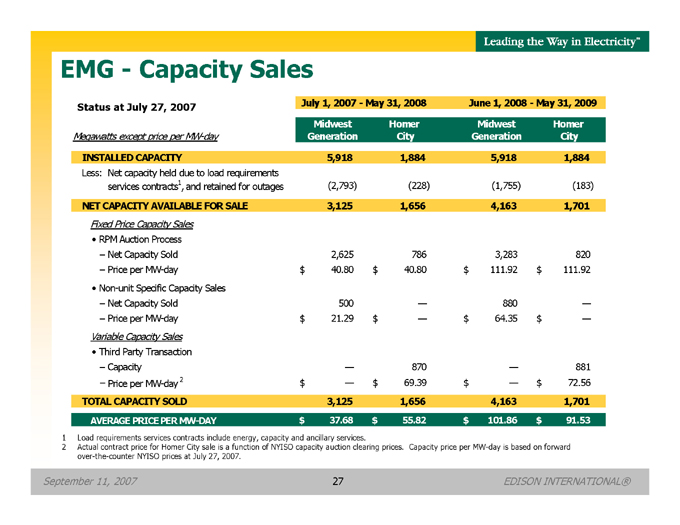

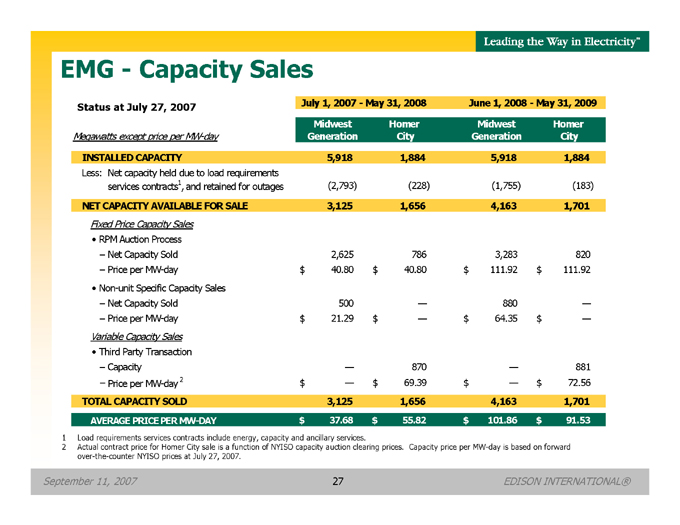

EMG—Capacity Sales

Status at July 27, 2007 July 1, 2007—May 31, 2008 June 1, 2008—May 31, 2009

Midwest Homer Midwest Homer

Megawatts except price per MW-day Generation City Generation City

INSTALLED CAPACITY 5,918 1,884 5,918 1,884

Less: Net capacity held due to load requirements

services contracts1, and retained for outages (2,793) (228) (1,755) (183)

NET CAPACITY AVAILABLE FOR SALE 3,125 1,656 4,163 1,701

Fixed Price Capacity Sales

RPM Auction Process

– Net Capacity Sold 2,625 786 3,283 820

– Price per MW-day $ 40.80 $ 40.80 $ 111.92 $ 111.92

Non-unit Specific Capacity Sales

– Net Capacity Sold 500 — 880 —

– Price per MW-day $ 21.29 $ — $ 64.35 $ —

Variable Capacity Sales

Third Party Transaction

– Capacity — 870 — 881

– Price per MW-day 2 $ — $ 69.39 $ — $ 72.56

TOTAL CAPACITY SOLD 3,125 1,656 4,163 1,701

AVERAGE PRICE PER MW-DAY $ 37.68 $ 55.82 $ 101.86 $ 91.53

1 | | Load requirements services contracts include energy, capacity and ancillary services. |

2 Actual contract price for Homer City sale is a function of NYISO capacity auction clearing prices. Capacity price per MW-day is based on forward over-the-counter NYISO prices at July 27, 2007.

September 11, 2007 27 EDISON INTERNATIONAL®

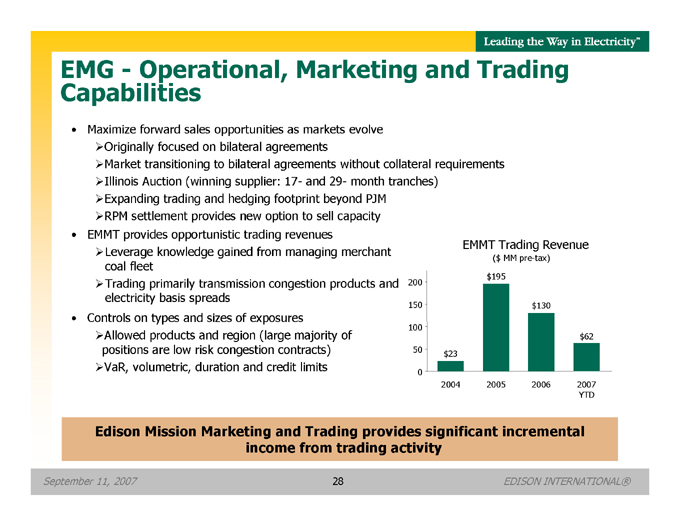

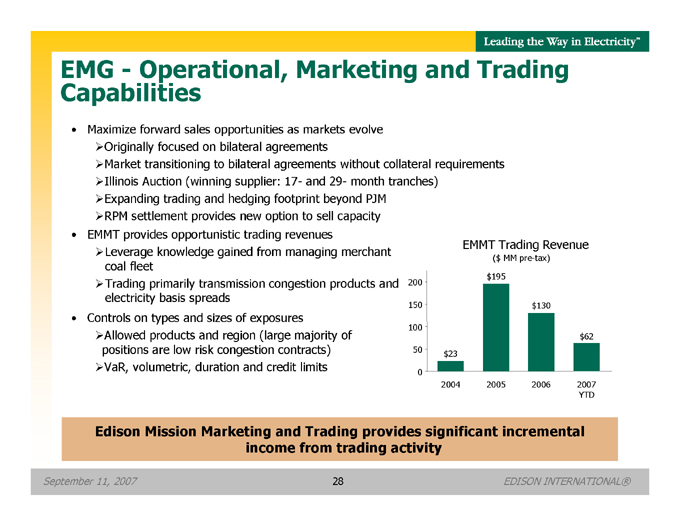

EMG—Operational, Marketing and Trading Capabilities

Maximize forward sales opportunities as markets evolve

Originally focused on bilateral agreements

Market transitioning to bilateral agreements without collateral requirements

Illinois Auction (winning supplier: 17- and 29- month tranches)

Expanding trading and hedging footprint beyond PJM

RPM settlement provides new option to sell capacity

EMMT provides opportunistic trading revenues

Leverage knowledge gained from managing merchant coal fleet

Trading primarily transmission congestion products and electricity basis spreads

Controls on types and sizes of exposures

Allowed products and region (large majority of positions are low risk congestion contracts)

VaR, volumetric, duration and credit limits

EMMT Trading Revenue

($ MM pre-tax)

$ 195

200

150 $ 130

100

$ 62

50 $ 23

0

2004 2005 2006 2007

YTD

Edison Mission Marketing and Trading provides significant incremental income from trading activity

September 11, 2007 28 EDISON INTERNATIONAL®

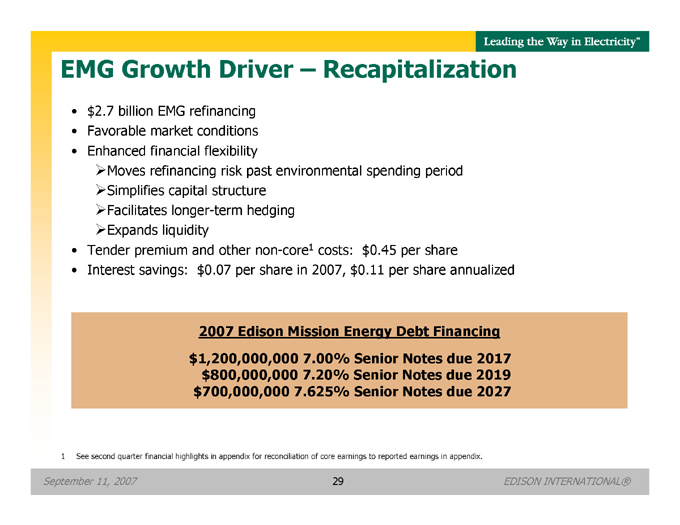

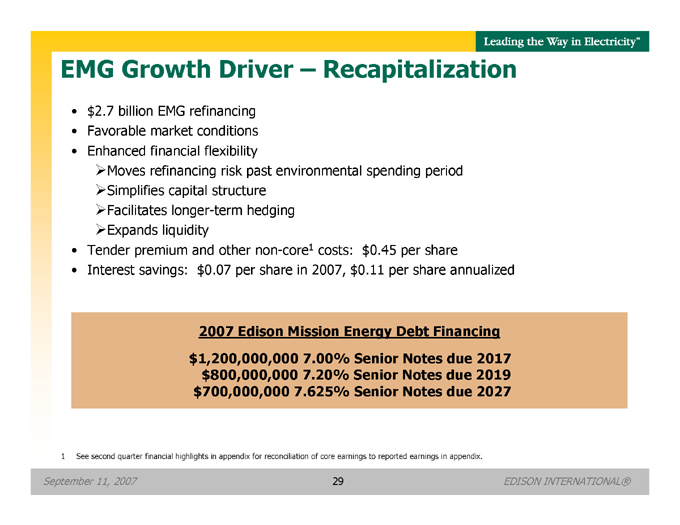

EMG Growth Driver – Recapitalization

$ 2.7 billion EMG refinancing

Favorable market conditions

Enhanced financial flexibility

Moves refinancing risk past environmental spending period

Simplifies capital structure

Facilitates longer-term hedging

Expands liquidity

Tender premium and other non-core1 costs: $0.45 per share

Interest savings: $0.07 per share in 2007, $0.11 per share annualized

2007 Edison Mission Energy Debt Financing $1,200,000,000 7.00% Senior Notes due 2017 $800,000,000 7.20% Senior Notes due 2019 $700,000,000 7.625% Senior Notes due 2027

1 See second quarter financial highlights in appendix for reconciliation of core earnings to reported earnings in appendix.

September 11, 2007 29 EDISON INTERNATIONAL®

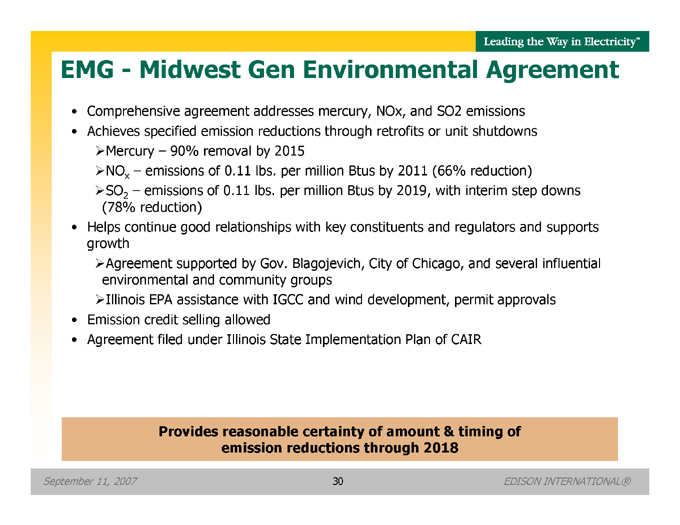

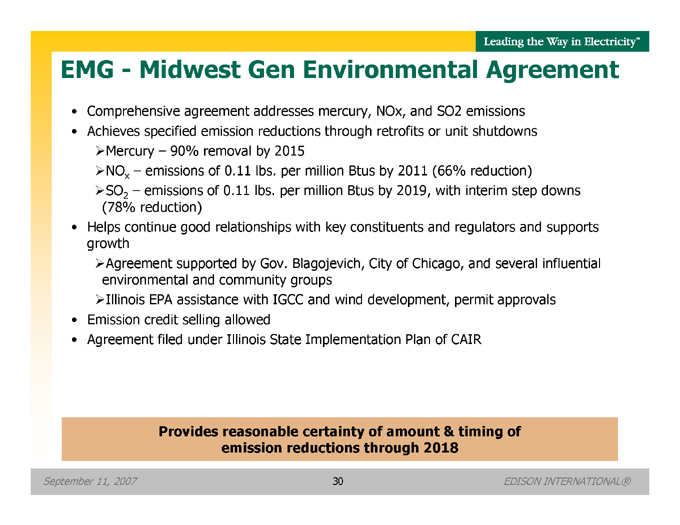

EMG—Midwest Gen Environmental Agreement

Comprehensive agreement addresses mercury, NOx, and SO2 emissions

Achieves specified emission reductions through retrofits or unit shutdowns

Mercury – 90% removal by 2015

NOx – emissions of 0.11 lbs. per million Btus by 2011 (66% reduction)

SO2 – emissions of 0.11 lbs. per million Btus by 2019, with interim step downs

(78% reduction)

Helps continue good relationships with key constituents and regulators and supports growth

Agreement supported by Gov. Blagojevich, City of Chicago, and several influential environmental and community groups

Illinois EPA assistance with IGCC and wind development, permit approvals

Emission credit selling allowed

Agreement filed under Illinois State Implementation Plan of CAIR

Provides reasonable certainty of amount & timing of emission reductions through 2018

September 11, 2007 30 EDISON INTERNATIONAL®

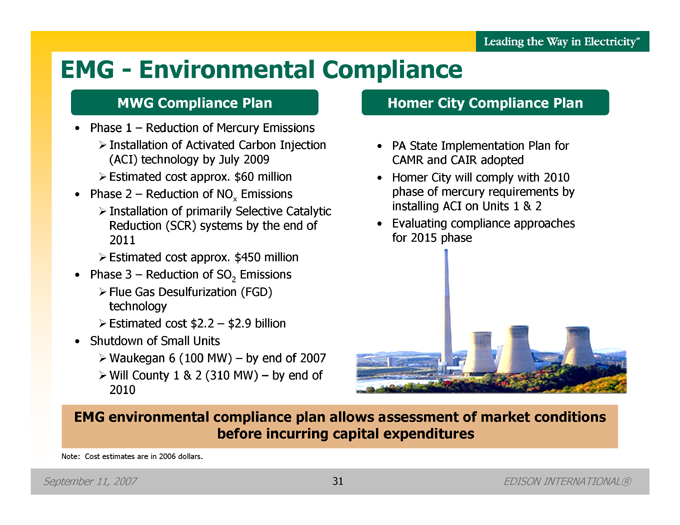

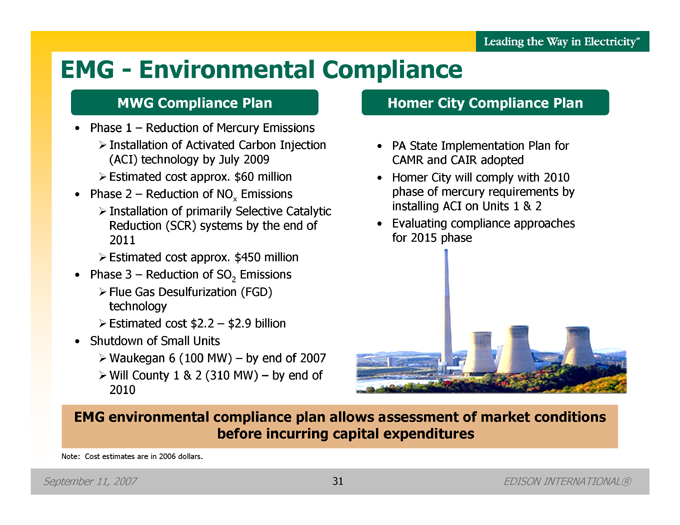

EMG—Environmental Compliance

MWG Compliance Plan

Phase 1 – Reduction of Mercury Emissions

Installation of Activated Carbon Injection (ACI) technology by July 2009

Estimated cost approx. $60 million

Phase 2 – Reduction of NOx Emissions

Installation of primarily Selective Catalytic Reduction (SCR) systems by the end of 2011

Estimated cost approx. $450 million

Phase 3 – Reduction of SO2 Emissions

Flue Gas Desulfurization (FGD) technology

Estimated cost $2.2 – $2.9 billion

Shutdown of Small Units

Waukegan 6 (100 MW) – by end of 2007

Will County 1 & 2 (310 MW) – by end of 2010

Homer City Compliance Plan

PA State Implementation Plan for CAMR and CAIR adopted

Homer City will comply with 2010 phase of mercury requirements by installing ACI on Units 1 & 2

Evaluating compliance approaches for 2015 phase

EMG environmental compliance plan allows assessment of market conditions before incurring capital expenditures

Note: Cost estimates are in 2006 dollars.

September 11, 2007 31 EDISON INTERNATIONAL®

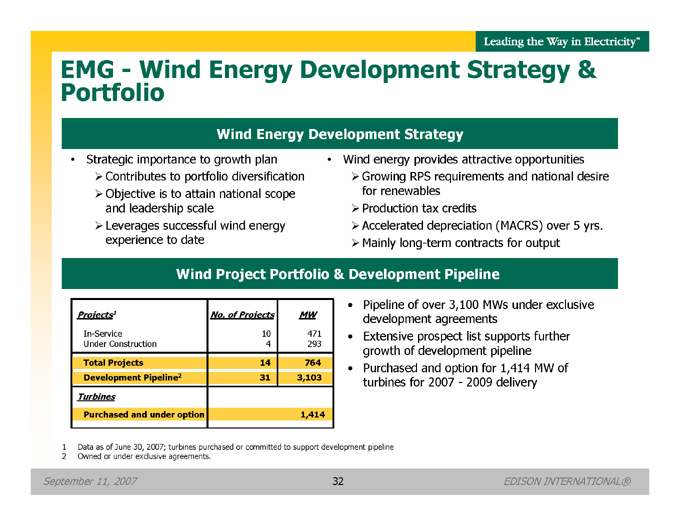

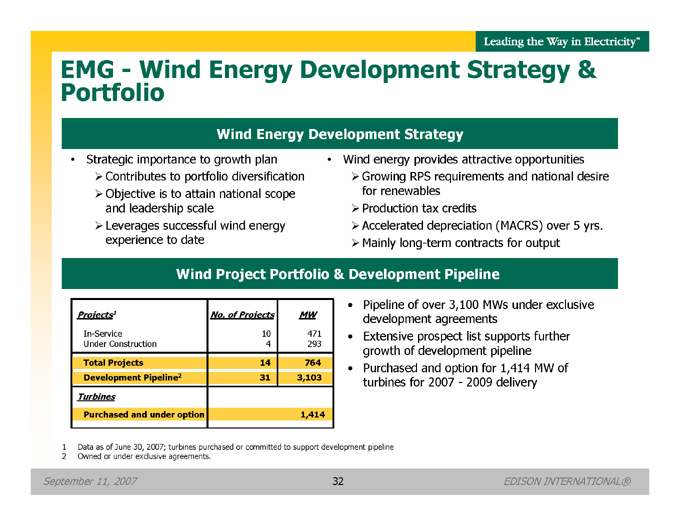

EMG—Wind Energy Development Strategy & Portfolio

Wind Energy Development Strategy

Strategic importance to growth plan

Contributes to portfolio diversification

Objective is to attain national scope and leadership scale

Leverages successful wind energy experience to date

Wind energy provides attractive opportunities

Growing RPS requirements and national desire for renewables

Production tax credits

Accelerated depreciation (MACRS) over 5 yrs.

Mainly long-term contracts for output

Wind Project Portfolio & Development Pipeline

Projects1 No. of Projects MW

In-Service 10 471

Under Construction 4 293

Total Projects 14 764

Development Pipeline2 31 3,103

Turbines

Purchased and under option 1,414

1 | | Data as of June 30, 2007; turbines purchased or committed to support development pipeline |

2 | | Owned or under exclusive agreements. |

Pipeline of over 3,100 MWs under exclusive development agreements Extensive prospect list supports further growth of development pipeline Purchased and option for 1,414 MW of turbines for 2007—2009 delivery

September 11, 2007 32 EDISON INTERNATIONAL®

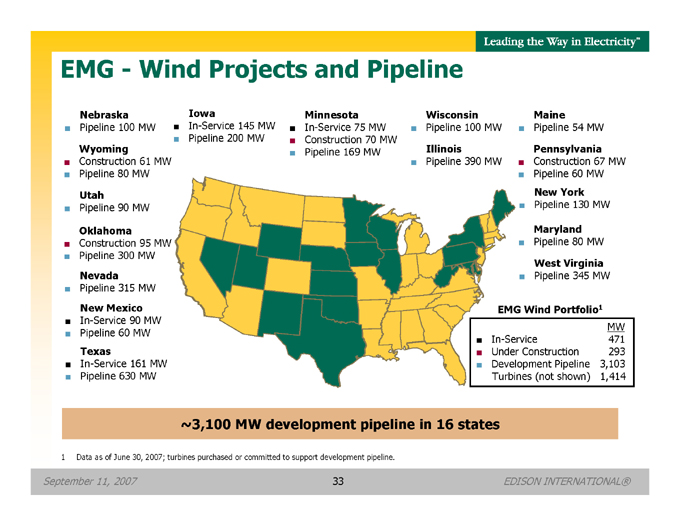

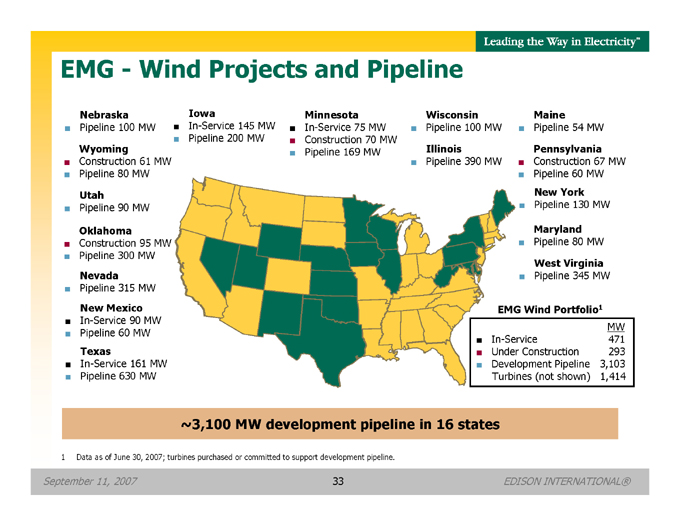

EMG—Wind Projects and Pipeline

Nebraska Iowa Minnesota Wisconsin Maine

Pipeline 100 MW In-Service 145 MW In-Service 75 MW Pipeline 100 MW Pipeline 54 MW

Pipeline 200 MW Construction 70 MW

Wyoming Pipeline 169 MW Illinois Pennsylvania

Construction 61 MW Pipeline 390 MW Construction 67 MW

Pipeline 80 MW Pipeline 60 MW

Utah New York

Pipeline 90 MW Pipeline 130 MW

Oklahoma Maryland

Construction 95 MW Pipeline 80 MW

Pipeline 300 MW

West Virginia

Nevada Pipeline 345 MW

Pipeline 315 MW

New Mexico

In-Service 90 MW

Pipeline 60 MW

Texas

In-Service 161 MW

Pipeline 630 MW

EMG Wind Portfolio 1

MW

In-Service 471

Under Construction 293

Development Pipeline 3,103

Turbines (not shown) 1,414

~3,100 MW development pipeline in 16 states

1 | | Data as of June 30, 2007; turbines purchased or committed to support development pipeline. |

September 11, 2007 33 EDISON INTERNATIONAL®

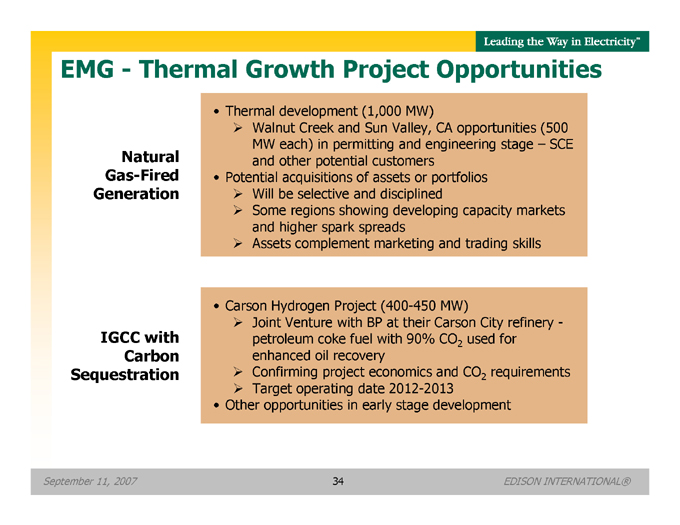

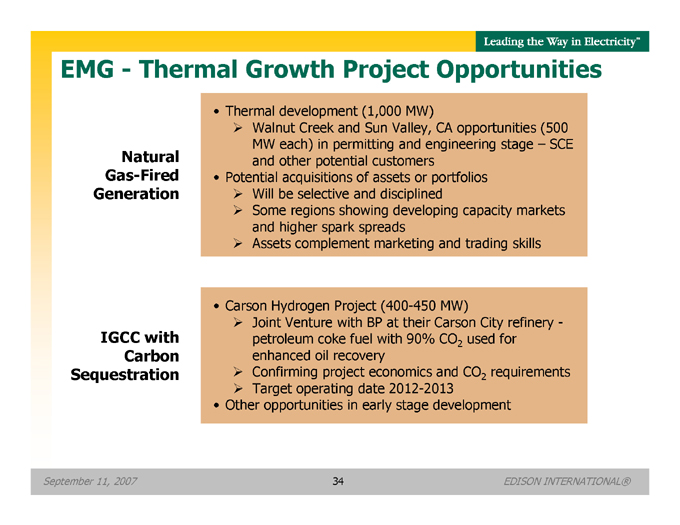

EMG—Thermal Growth Project Opportunities

Natural Gas-Fired Generation

Thermal development (1,000 MW)

Walnut Creek and Sun Valley, CA opportunities (500 MW each) in permitting and engineering stage – SCE and other potential customers

Potential acquisitions of assets or portfolios

Will be selective and disciplined

Some regions showing developing capacity markets and higher spark spreads

Assets complement marketing and trading skills

IGCC with Carbon Sequestration

Carson Hydrogen Project (400-450 MW)

Joint Venture with BP at their Carson City refinery -

petroleum coke fuel with 90% CO2 used for

enhanced oil recovery

Confirming project economics and CO2 requirements

Target operating date 2012-2013

Other opportunities in early stage development

September 11, 2007 34 EDISON INTERNATIONAL®

Appendix

September 11, 2007 35 EDISON INTERNATIONAL®

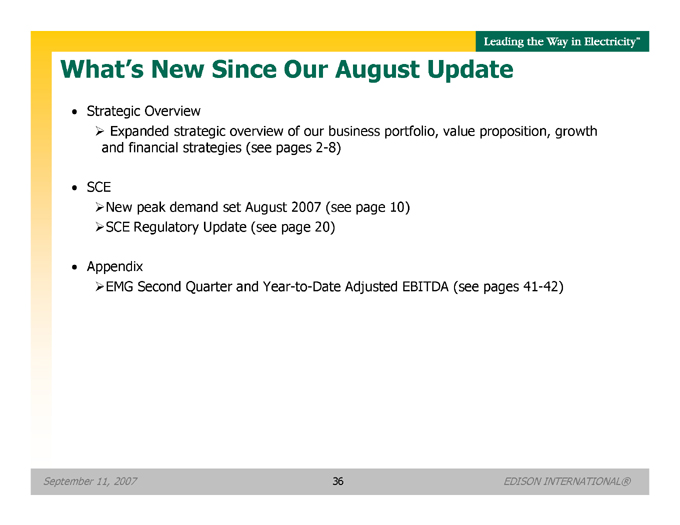

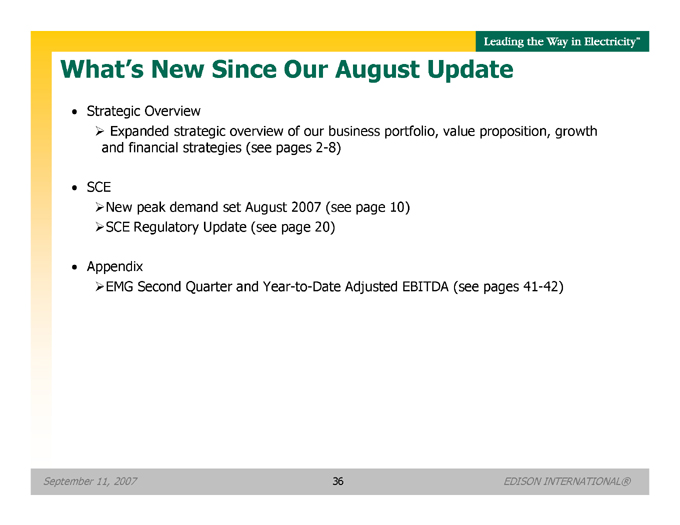

What’s New Since Our August Update

Strategic Overview

Expanded strategic overview of our business portfolio, value proposition, growth and financial strategies (see pages 2-8)

SCE

New peak demand set August 2007 (see page 10)

SCE Regulatory Update (see page 20)

Appendix

EMG Second Quarter and Year-to-Date Adjusted EBITDA (see pages 41-42)

September 11, 2007 36 EDISON INTERNATIONAL®

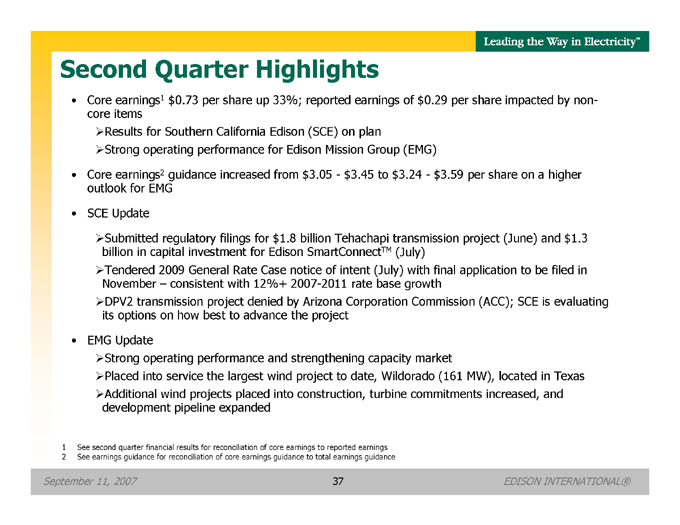

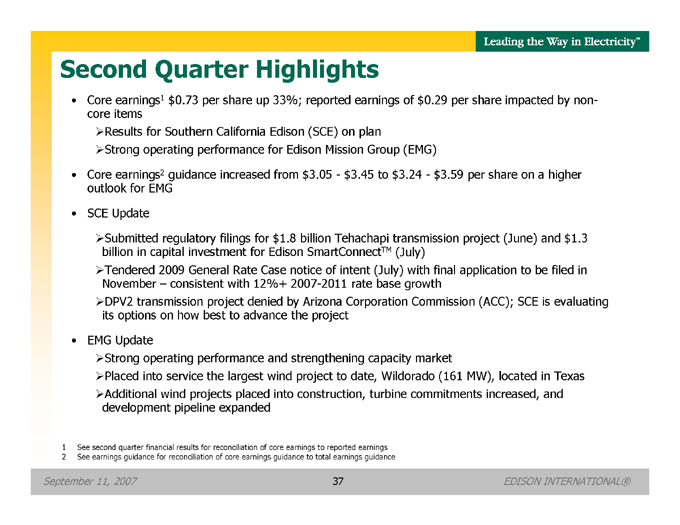

Second Quarter Highlights

Core earnings1 $0.73 per share up 33%; reported earnings of $0.29 per share impacted by non-core items

Results for Southern California Edison (SCE) on plan

Strong operating performance for Edison Mission Group (EMG)

Core earnings2 guidance increased from $3.05—$3.45 to $3.24—$3.59 per share on a higher outlook for EMG

SCE Update

Submitted regulatory filings for $1.8 billion Tehachapi transmission project (June) and $1.3 billion in capital investment for Edison SmartConnectTM (July)

Tendered 2009 General Rate Case notice of intent (July) with final application to be filed in November – consistent with 12%+ 2007-2011 rate base growth

DPV2 transmission project denied by Arizona Corporation Commission (ACC); SCE is evaluating its options on how best to advance the project

EMG Update

Strong operating performance and strengthening capacity market

Placed into service the largest wind project to date, Wildorado (161 MW), located in Texas

Additional wind projects placed into construction, turbine commitments increased, and development pipeline expanded

1 | | See second quarter financial results for reconciliation of core earnings to reported earnings |

2 | | See earnings guidance for reconciliation of core earnings guidance to total earnings guidance |

September 11, 2007 37 EDISON INTERNATIONAL®

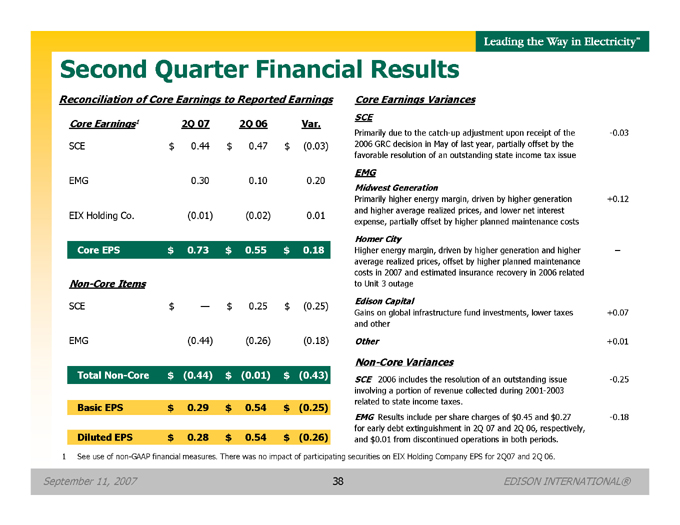

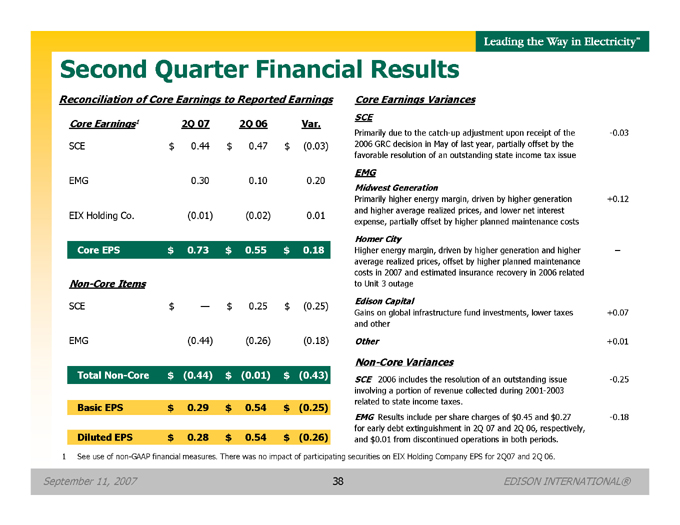

Second Quarter Financial Results

Reconciliation of Core Earnings to Reported Earnings

Core Earnings1 2Q 07 2Q 06 Var.

SCE $ 0.44 $ 0.47 $ (0.03)

EMG 0.30 0.10 0.20

EIX Holding Co. (0.01) (0.02) 0.01

Core EPS $ 0.73 $ 0.55 $ 0.18

Non-Core Items

SCE $ — $ 0.25 $ (0.25)

EMG (0.44) (0.26) (0.18)

Total Non-Core $ (0.44) $ (0.01) $ (0.43)

Basic EPS $ 0.29 $ 0.54 $ (0.25)

Diluted EPS $ 0.28 $ 0.54 $ (0.26)

Core Earnings Variances

SCE

Primarily due to the catch-up adjustment upon receipt of the -0.03

2006 GRC decision in May of last year, partially offset by the

favorable resolution of an outstanding state income tax issue

EMG

Midwest Generation

Primarily higher energy margin, driven by higher generation +0.12

and higher average realized prices, and lower net interest

expense, partially offset by higher planned maintenance costs

Homer City

Higher energy margin, driven by higher generation and higher –

average realized prices, offset by higher planned maintenance

costs in 2007 and estimated insurance recovery in 2006 related

to Unit 3 outage

Edison Capital

Gains on global infrastructure fund investments, lower taxes +0.07

and other

Other +0.01

Non-Core Variances

SCE 2006 includes the resolution of an outstanding issue -0.25

involving a portion of revenue collected during 2001-2003

related to state income taxes.

EMG Results include per share charges of $0.45 and $0.27 -0.18

for early debt extinguishment in 2Q 07 and 2Q 06, respectively,

and $0.01 from discontinued operations in both periods.

1 See use of non-GAAP financial measures. There was no impact of participating securities on EIX Holding Company EPS for 2Q07 and 2Q 06.

September 11, 2007 38 EDISON INTERNATIONAL®

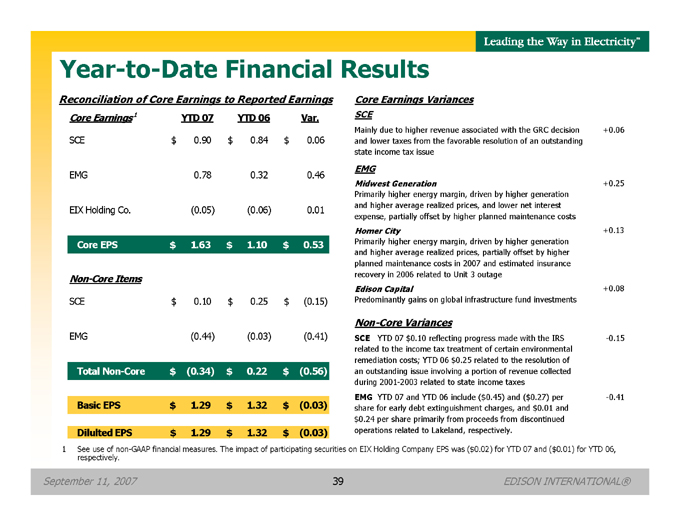

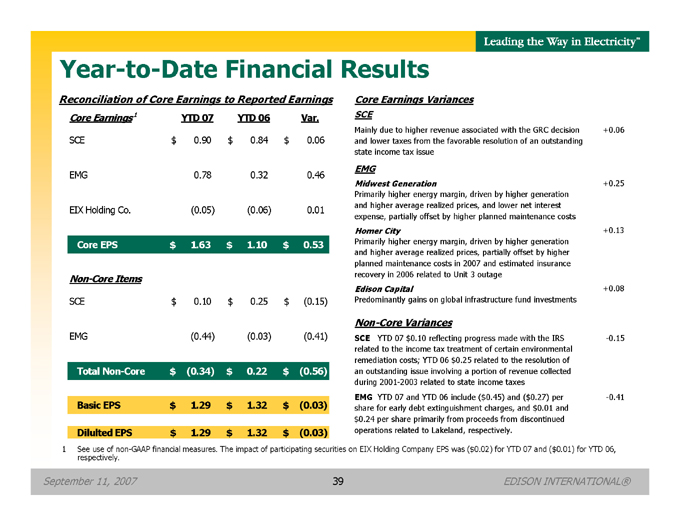

Year-to-Date Financial Results

Reconciliation of Core Earnings to Reported Earnings

Core Earnings1 YTD 07 YTD 06 Var.

SCE $ 0.90 $ 0.84 $ 0.06

EMG 0.78 0.32 0.46

EIX Holding Co. (0.05) (0.06) 0.01

Core EPS $ 1.63 $ 1.10 $ 0.53

Non-Core Items

SCE $ 0.10 $ 0.25 $ (0.15)

EMG (0.44) (0.03) (0.41)

Total Non-Core $ (0.34) $ 0.22 $ (0.56)

Basic EPS $ 1.29 $ 1.32 $ (0.03)

Dilulted EPS $ 1.29 $ 1.32 $ (0.03)

Core Earnings Variances

SCE

Mainly due to higher revenue associated with the GRC decision +0.06

and lower taxes from the favorable resolution of an outstanding

state income tax issue

EMG

Midwest Generation +0.25

Primarily higher energy margin, driven by higher generation

and higher average realized prices, and lower net interest

expense, partially offset by higher planned maintenance costs

Homer City +0.13

Primarily higher energy margin, driven by higher generation

and higher average realized prices, partially offset by higher

planned maintenance costs in 2007 and estimated insurance

recovery in 2006 related to Unit 3 outage

Edison Capital +0.08

Predominantly gains on global infrastructure fund investments

Non-Core Variances

SCE YTD 07 $ 0.10 reflecting progress made with the IRS -0.15

related to the income tax treatment of certain environmental

remediation costs; YTD 06 $ 0.25 related to the resolution of

an outstanding issue involving a portion of revenue collected

during 2001-2003 related to state income taxes

EMG YTD 07 and YTD 06 include ($0.45) and ($0.27) per -0.41

share for early debt extinguishment charges, and $0.01 and

$ 0.24 per share primarily from proceeds from discontinued

operations related to Lakeland, respectively.

1 See use of non-GAAP financial measures. The impact of participating securities on EIX Holding Company EPS was ($0.02) for YTD 07 and ($0.01) for YTD 06, respectively.

September 11, 2007 39 EDISON INTERNATIONAL®

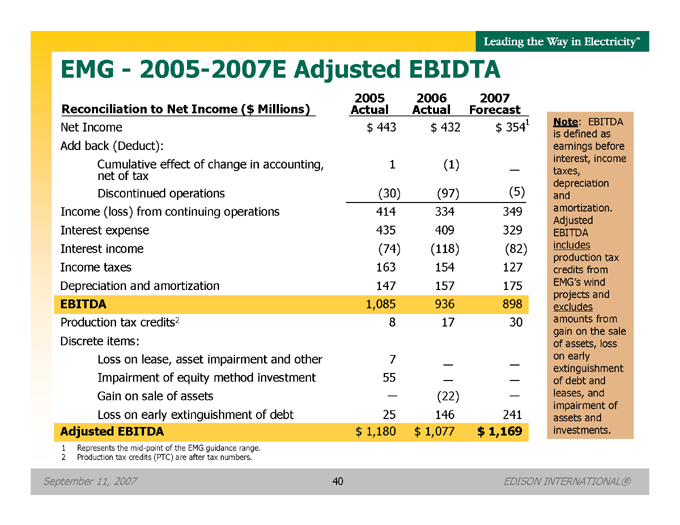

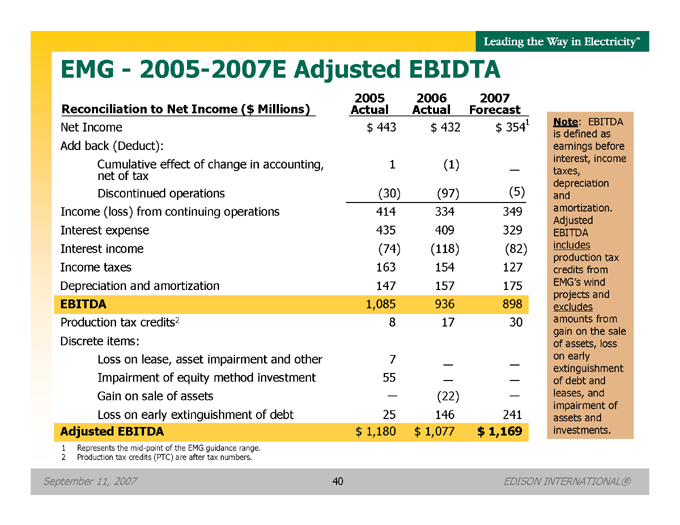

EMG—2005-2007E Adjusted EBIDTA

2005 2006 2007

Reconciliation to Net Income ($ Millions) Actual Actual Forecast

Net Income $ 443 $ 432 $ 3541

Add back (Deduct):

Cumulative effect of change in accounting, 1 (1) —

net of tax

Discontinued operations (30) (97) (5)

Income (loss) from continuing operations 414 334 349

Interest expense 435 409 329

Interest income (74) (118) (82)

Income taxes 163 154 1 27

Depreciation and amortization 147 157 175

EBITDA 1,085 936 898

Production tax credits2 8 17 30

Discrete items:

Loss on lease, asset impairment and other 7 — —

Impairment of equity method investment 55 — —

Gain on sale of assets — (22) —

Loss on early extinguishment of debt 25 146 241

Adjusted EBITDA $1,180 $1,077 $ 1,169

Note: EBITDA is defined as earnings before interest, income taxes, depreciation and amortization. Adjusted EBITDA includes production tax credits from EMG’s wind projects and excludes amounts from gain on the sale of assets, loss on early extinguishment of debt and leases, and impairment of assets and investments.

1 | | Represents the mid-point of the EMG guidance range. |

2 | | Production tax credits (PTC) are after tax numbers. |

September 11, 2007 40 EDISON INTERNATIONAL®

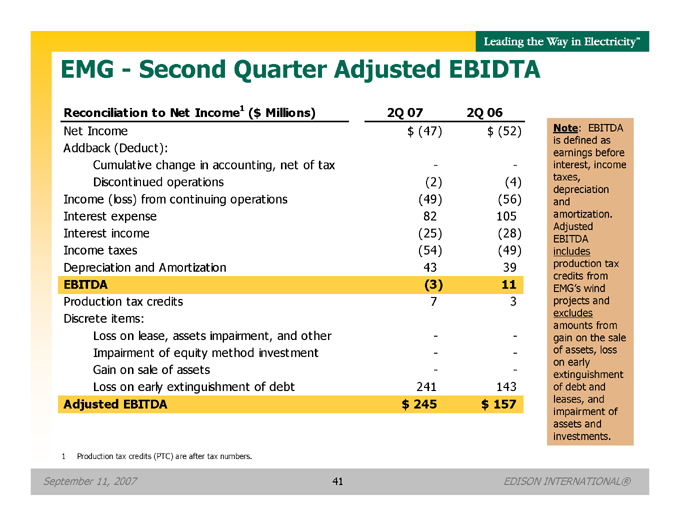

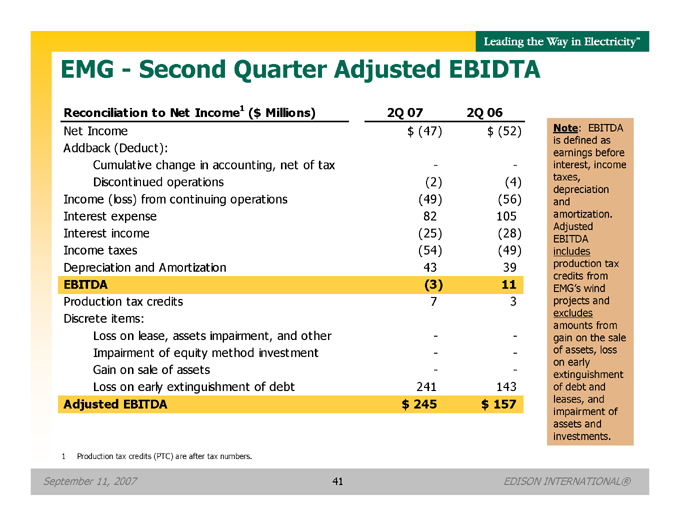

EMG—Second Quarter Adjusted EBIDTA

Reconciliation to Net Income1 ($ Millions) 2Q 07 2Q 06

Net Income $(47) $ (52)

Addback (Deduct):

Cumulative change in accounting, net of tax — -

Discontinued operations (2) (4)

Income (loss) from continuing operations (49) (56)

Interest expense 82 105

Interest income (25) (28)

Income taxes (54) (49)

Depreciation and Amortization 43 39

EBITDA (3) 11

Production tax credits 7 3

Discrete items:

Loss on lease, assets impairment, and other — -

Impairment of equity method investment — -

Gain on sale of assets — -

Loss on early extinguishment of debt 241 143

Adjusted EBITDA $245 $157

Note: EBITDA is defined as earnings before interest, income taxes, depreciation and amortization. Adjusted EBITDA includes production tax credits from EMG’s wind projects and excludes amounts from gain on the sale of assets, loss on early extinguishment of debt and leases, and impairment of assets and investments.

1 | | Production tax credits (PTC) are after tax numbers. |

September 11, 2007 41 EDISON INTERNATIONAL®

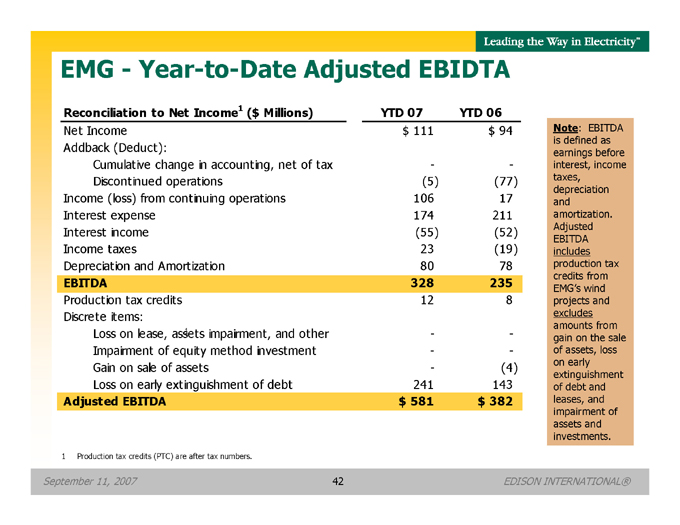

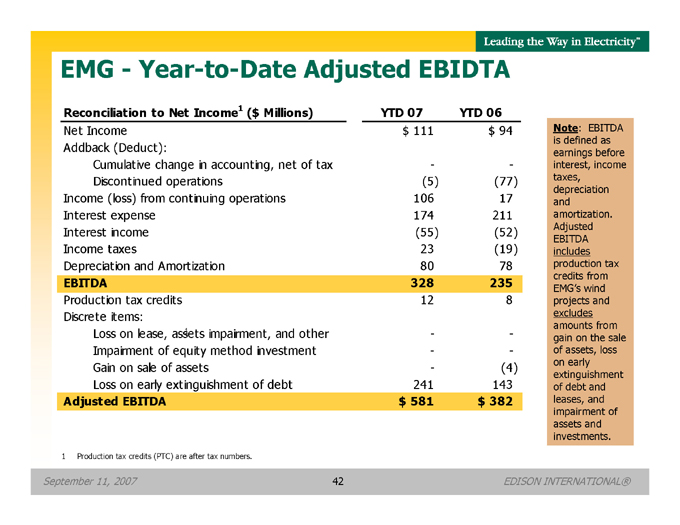

EMG—Year-to-Date Adjusted EBIDTA

Reconciliation to Net Income1 ($ Millions) YTD 07 YTD 06

Net Income $ 111 $ 94

Addback (Deduct):

Cumulative change in accounting, net of tax — -

Discontinued operations (5) (77)

Income (loss) from continuing operations 106 17

Interest expense 174 211

Interest income (55) (52)

Income taxes 23 (19)

Depreciation and Amortization 80 78

EBITDA 328 235

Production tax credits 1 2 8

Discrete items:

1 | | Loss on lease, assets impairment, and other — - |

Impairment of equity method investment — -

Gain on sale of assets - (4)

Loss on early extinguishment of debt 241 143

Adjusted EBITDA $ 581 $ 382

Note: EBITDA is defined as earnings before interest, income taxes, depreciation and amortization. Adjusted EBITDA includes production tax credits from EMG’s wind projects and excludes amounts from gain on the sale of assets, loss on early extinguishment of debt and leases, and impairment of assets and investments.

1 | | Production tax credits (PTC) are after tax numbers. |

September 11, 2007 42 EDISON INTERNATIONAL®

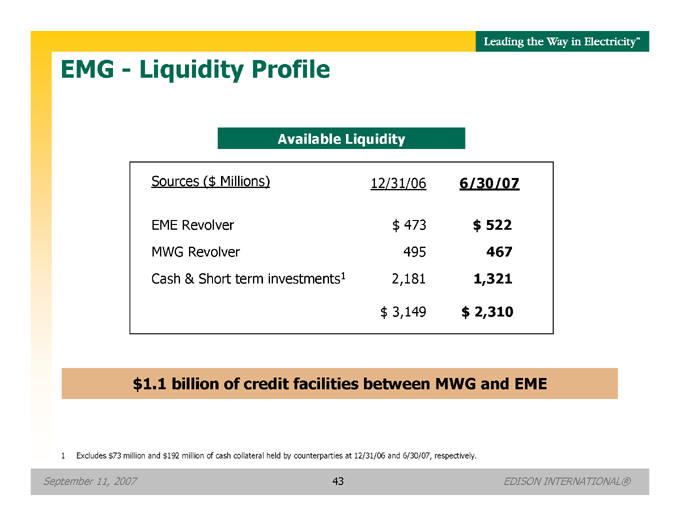

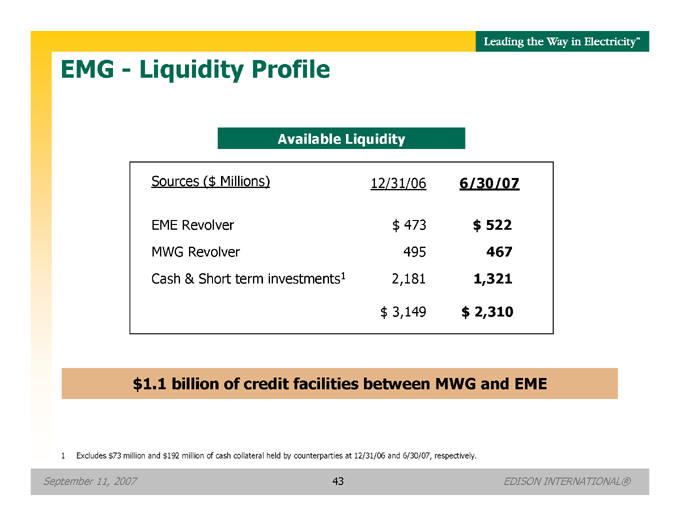

EMG—Liquidity Profile

Available Liquidity

Sources ($ Millions) 12/31/06 6/30/07

EME Revolver $ 473 $ 522

MWG Revolver 495 467

Cash & Short term investments1 2,181 1,321

$ 3,149 $ 2,310

$1.1 billion of credit facilities between MWG and EME

1 Excludes $73 million and $192 million of cash collateral held by counterparties at 12/31/06 and 6/30/07, respectively.

September 11, 2007 43 EDISON INTERNATIONAL®

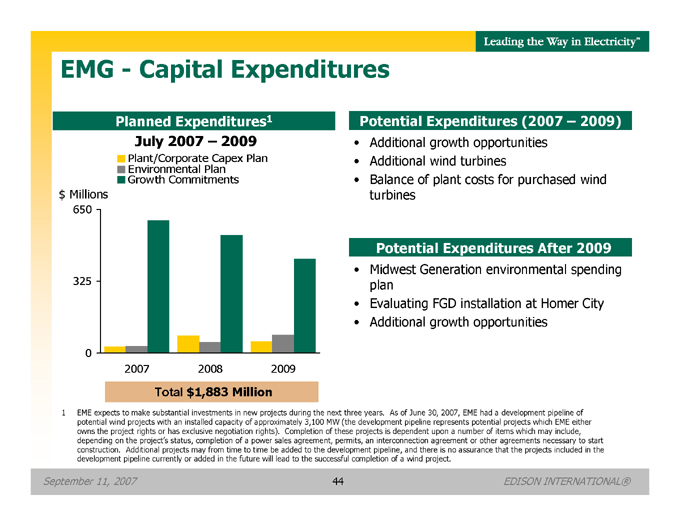

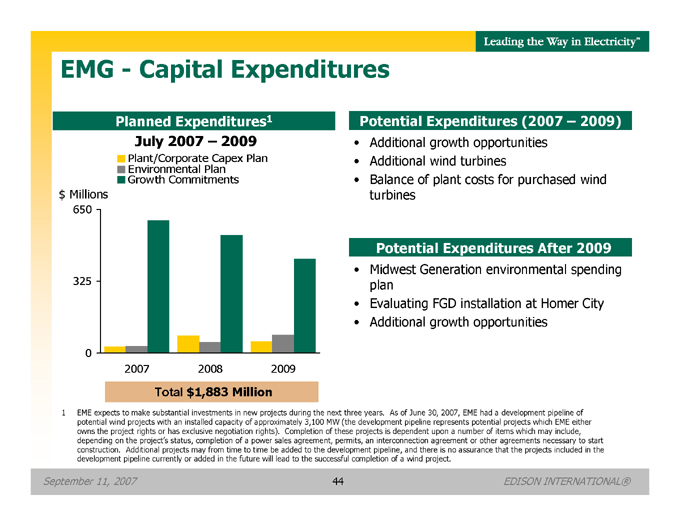

EMG—Capital Expenditures

Planned Expenditures1

July 2007 – 2009

Plant/Corporate Capex Plan Environmental Plan Growth Commitments

$ Millions

650

325

0

2007 2008 2009

Total $1,883 Million

1 EME expects to make substantial investments in new projects during the next three years. As of June 30, 2007, EME had a development pipeline of potential wind projects with an installed capacity of approximately 3,100 MW (the development pipeline represents potential projects which EME either owns the project rights or has exclusive negotiation rights). Completion of these projects is dependent upon a number of items which may include, depending on the project’s status, completion of a power sales agreement, permits, an interconnection agreement or other agreements necessary to start construction. Additional projects may from time to time be added to the development pipeline, and there is no assurance that the projects included in the development pipeline currently or added in the future will lead to the successful completion of a wind project.

Potential Expenditures (2007 – 2009)

Additional growth opportunities

Additional wind turbines

Balance of plant costs for purchased wind turbines

Potential Expenditures After 2009

Midwest Generation environmental spending plan

Evaluating FGD installation at Homer City

Additional growth opportunities

September 11, 2007 44 EDISON INTERNATIONAL®

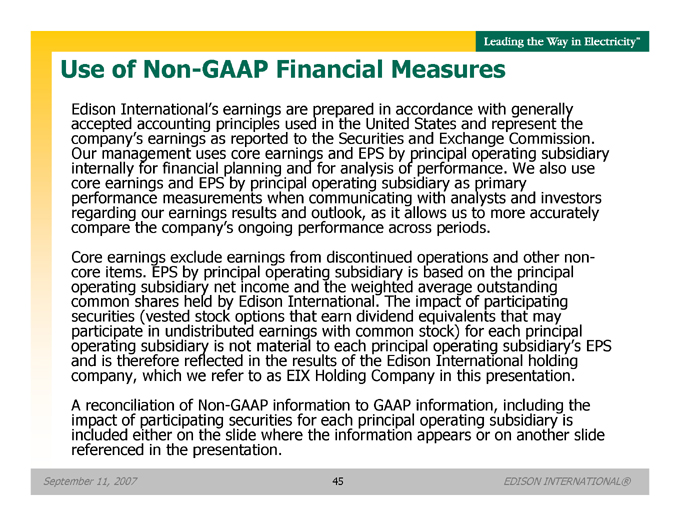

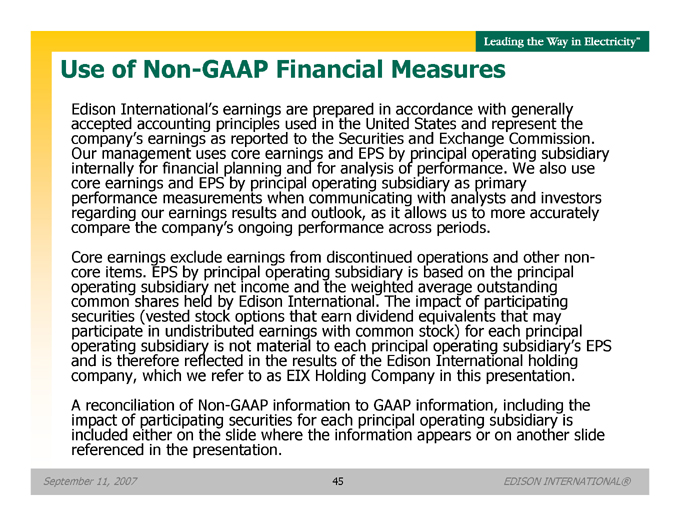

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and EPS by principal operating subsidiary internally for financial planning and for analysis of performance. We also use core earnings and EPS by principal operating subsidiary as primary performance measurements when communicating with analysts and investors regarding our earnings results and outlook, as it allows us to more accurately compare the company’s ongoing performance across periods. Core earnings exclude earnings from discontinued operations and other non-core items. EPS by principal operating subsidiary is based on the principal operating subsidiary net income and the weighted average outstanding common shares held by Edison International. The impact of participating securities (vested stock options that earn dividend equivalents that may participate in undistributed earnings with common stock) for each principal operating subsidiary is not material to each principal operatingsubsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which we refer to as EIX Holding Company in this presentation. A reconciliation of Non-GAAP information to GAAP information, including the impact of participating securities for each principal operating subsidiary is included either on the slide where the information appears or on another slide referenced in the presentation.

September 11, 2007 45 EDISON INTERNATIONAL®