Exhibit 99.1

Merrill Lynch Power & Gas Leaders Conference September 26, 2007

John Bryson, Chairman, Chief Executive Officer and President

EDISON INTERNATIONAL®

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation, earnings, asset and rate base growth, load growth, capital investments, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s 2006 Form 10-K and subsequent reports filed with the Securities and Exchange Commission and available on our website: www.edison.com. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances.

Merrill Lynch Power & Gas Leaders Conference

EDISON INTERNATIONAL®

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and EPS by principal operating subsidiary internally for financial planning and for analysis of performance. We also use core earnings and EPS by principal operating subsidiary as primary performance measurements when communicating with analysts and investors regarding our earnings results and outlook, as it allows us to more accurately compare the company’s ongoing performance across periods. Core earnings exclude earnings from discontinued operations and other non-core items. EPS by principal operating subsidiary is based on the principal operating subsidiary net income and Edison International’s weighted average outstanding common shares. The impact of participating securities (vested stock options that earn dividend equivalents that may participate in undistributed earnings with common stock) for each principal operating subsidiary is not material to each principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which we refer to as EIX Holding Company in this presentation. A reconciliation of Non-GAAP information to GAAP information, including the impact of participating securities for each principal operating subsidiary is included either on the slide where the information appears or on another slide referenced in the presentation.

Merrill Lynch Power & Gas Leaders Conference

EDISON INTERNATIONAL®

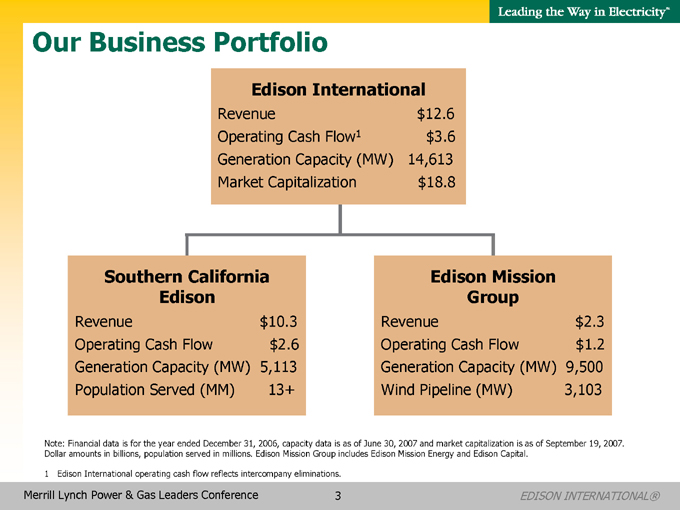

Our Business Portfolio

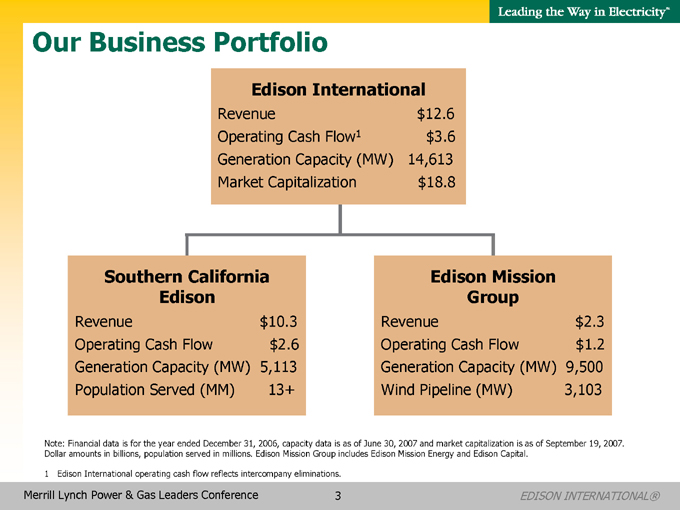

Edison International

Revenue $12.6

Operating Cash Flow1 $3.6

Generation Capacity (MW) 14,613

Market Capitalization $18.8

Southern California

Edison

Revenue $10.3

Operating Cash Flow $2.6

Generation Capacity (MW) 5,113

Population Served (MM) 13+

Edison Mission

Group

Revenue $2.3

Operating Cash Flow $1.2

Generation Capacity (MW) 9,500

Wind Pipeline (MW) 3,103

Note: Financial data is for the year ended December 31, 2006, capacity data is as of June 30, 2007 and market capitalization is as of September 19, 2007.

Dollar amounts in billions, population served in millions. Edison Mission Group includes Edison Mission Energy and Edison Capital.

1 | | Edison International operating cash flow reflects intercompany eliminations. |

Merrill Lynch Power & Gas Leaders Conference

EDISON INTERNATIONAL®

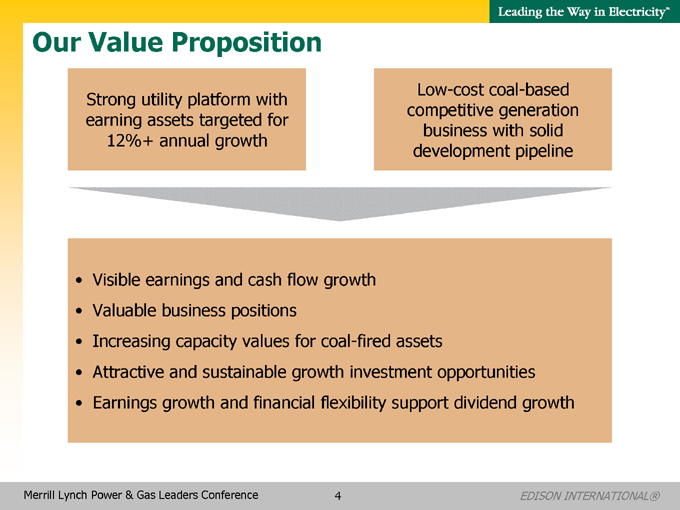

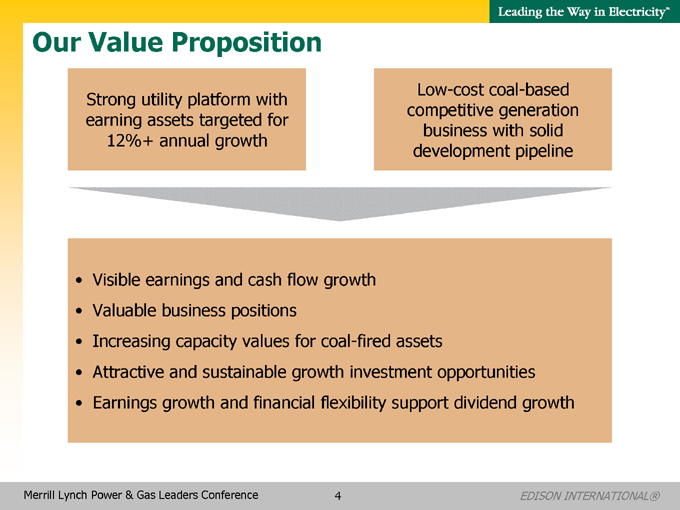

Our Value Proposition

Strong utility platform with earning assets targeted for 12%+ annual growth

Low-cost coal-based competitive generation business with solid development pipeline

Visible earnings and cash flow growth

Valuable business positions

Increasing capacity values for coal-fired assets

Attractive and sustainable growth investment opportunities

Earnings growth and financial flexibility support dividend growth

Merrill Lynch Power & Gas Leaders Conference

EDISON INTERNATIONAL®

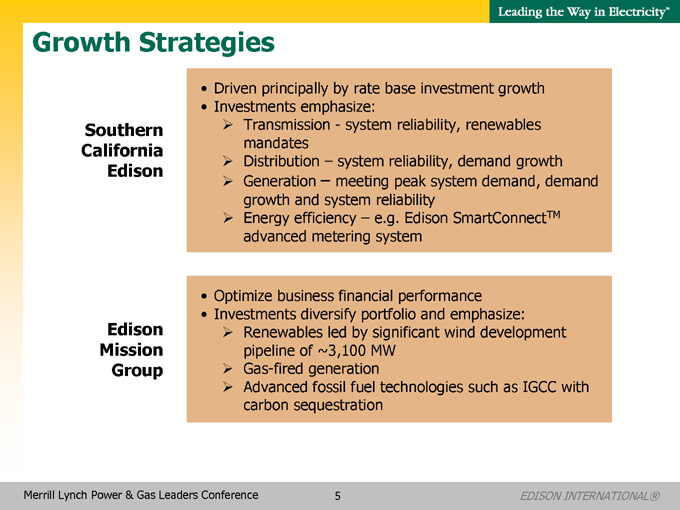

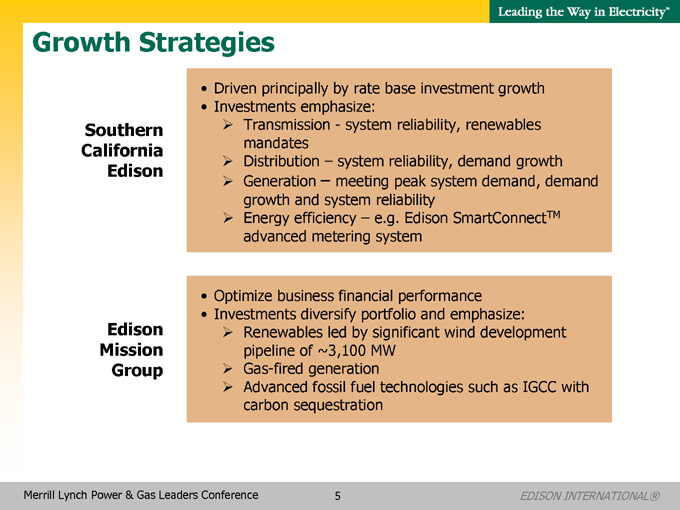

Growth Strategies

Southern California Edison

Driven principally by rate base investment growth

Investments emphasize:

Transmission - system reliability, renewables mandates

Distribution - system reliability, demand growth

Generation – meeting peak system demand, demand growth and system reliability

Energy efficiency – e.g. Edison SmartConnectTM advanced metering system

Edison Mission Group

Optimize business financial performance

Investments diversify portfolio and emphasize:

Renewables led by significant wind development pipeline of ~3,100 MW

Gas-fired generation

Advanced fossil fuel technologies such as IGCC with carbon sequestration

Merrill Lynch Power & Gas Leaders Conference

EDISON INTERNATIONAL®

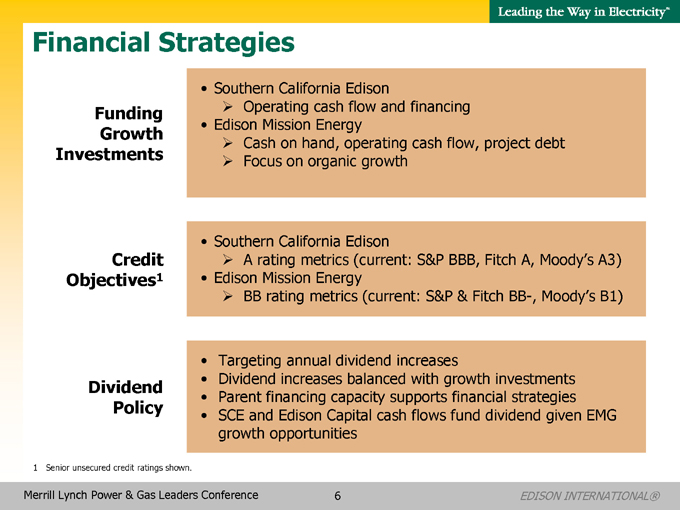

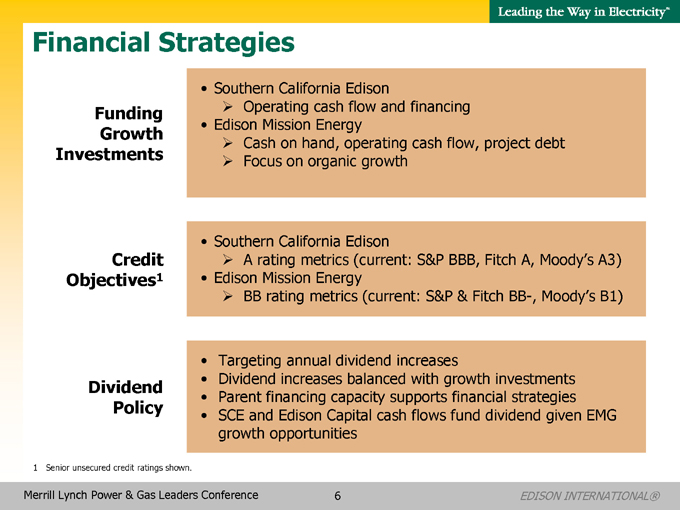

Financial Strategies

Funding Growth

Investments

Southern California Edison

Operating cash flow and financing

Edison Mission Energy

Cash on hand, operating cash flow, project debt

Focus on organic growth

Credit Objectives1

Southern California Edison

A rating metrics (current: S&P BBB, Fitch A, Moody’s A3)

Edison Mission Energy

BB rating metrics (current: S&P & Fitch BB-, Moody’s B1)

Dividend Policy

Targeting annual dividend increases

Dividend increases balanced with growth investments

Parent financing capacity supports financial strategies

SCE and Edison Capital cash flows fund dividend given EMG growth opportunities

1 | | Senior unsecured credit ratings shown. |

Merrill Lynch Power & Gas Leaders Conference

EDISON INTERNATIONAL®

Earnings Guidance

Reconciliation of Core Earnings Guidance to Total Earnings Guidance

2007 Guidance Effective 05/09/07 2007 Guidance Updated 08/09/07

Core EPS1

Southern California Edison $ 1.97 - $ 2.07 $ 1.97 - $ 2.07

Edison Mission Group 1.21 - 1.51 1.40 - 1.65

EIX Holding Company (0.13) (0.13)

Total Core EPS $ 3.05 - $ 3.45 $ 3.24 - $ 3.59

Non-Core Items2

Southern California Edison 0.10 0.10

Edison Mission Group (0.45) (0.44)

Total Non-Core Items (0.35) (0.34)

Total $ 2.70 - $ 3.10 $ 2.90 - $ 3.25

1 See use of non-GAAP financial measures in appendix. The impact of participating securities on EIX Holding Company EPS was ($0.04) for both guidance periods.

2 2007 non-core items reflect refinancing costs of ($0.45) for EMG and a tax benefit of $0.10 for SCE. The 2007 guidance effective 08/09/07 also reflects $0.01 from discontinued operations.

Merrill Lynch Power & Gas Leaders Conference

EDISON INTERNATIONAL®

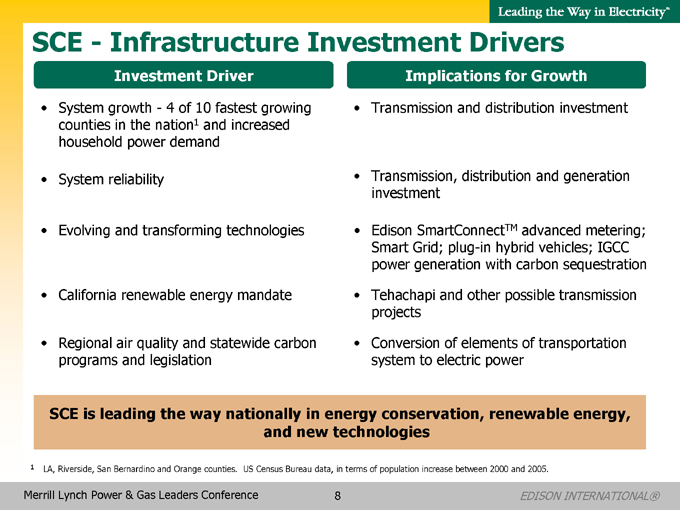

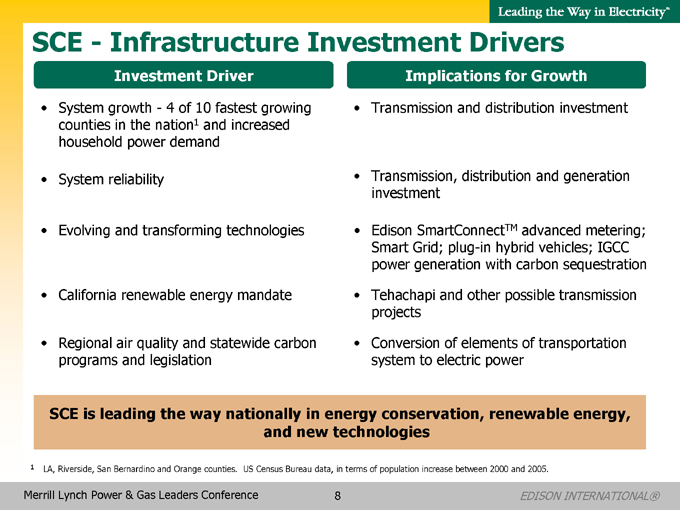

SCE - Infrastructure Investment Drivers

Investment Driver

System growth - 4 of 10 fastest growing counties in the nation1 and increased household power demand

System reliability

Evolving and transforming technologies

California renewable energy mandate

Regional air quality and statewide carbon programs and legislation

Implications for Growth

Transmission and distribution investment

Transmission, distribution and generation

investment

Edison SmartConnectTM advanced metering; Smart Grid; plug-in hybrid vehicles; IGCC power generation with carbon sequestration

Tehachapi and other possible transmission projects

Conversion of elements of transportation system to electric power

SCE is leading the way nationally in energy conservation, renewable energy, and new technologies

1 LA, Riverside, San Bernardino and Orange counties. US Census Bureau data, in terms of population increase between 2000 and 2005.

Merrill Lynch Power & Gas Leaders Conference

EDISON INTERNATIONAL®

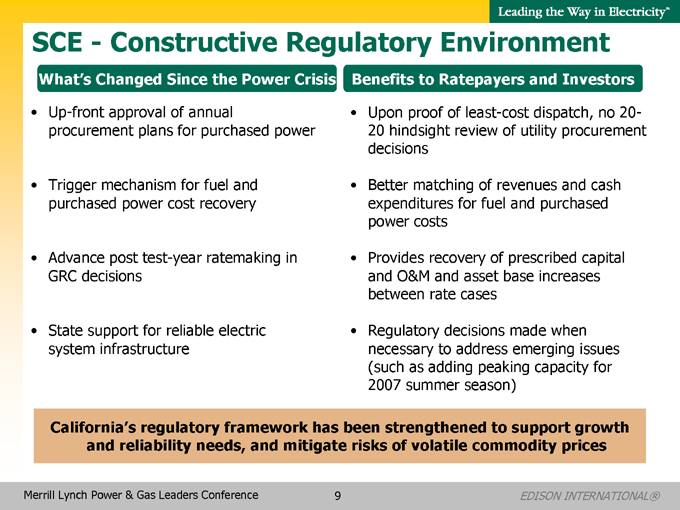

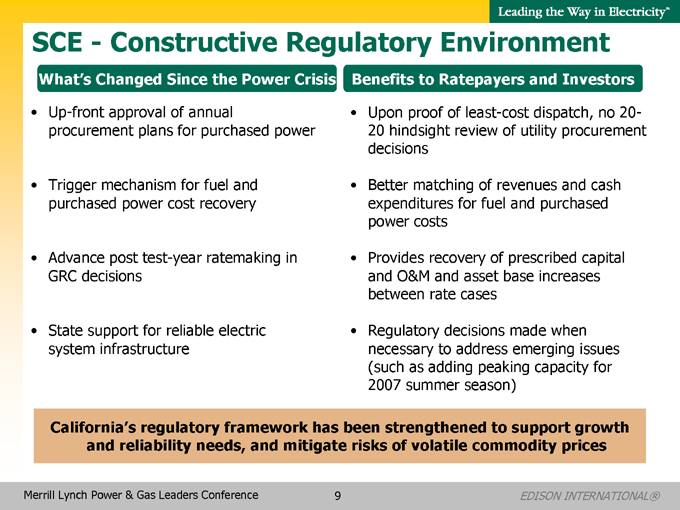

SCE - Constructive Regulatory Environment

What’s Changed Since the Power Crisis

Up-front approval of annual procurement plans for purchased power

Trigger mechanism for fuel and purchased power cost recovery

Advance post test-year ratemaking in GRC decisions

State support for reliable electric system infrastructure

Benefits to Ratepayers and Investors

Upon proof of least-cost dispatch, no 20-20 hindsight review of utility procurement decisions

Better matching of revenues and cash expenditures for fuel and purchased power costs

Provides recovery of prescribed capital and O&M and asset base increases between rate cases

Regulatory decisions made when necessary to address emerging issues (such as adding peaking capacity for 2007 summer season)

California’s regulatory framework has been strengthened to support growth and reliability needs, and mitigate risks of volatile commodity prices

Merrill Lynch Power & Gas Leaders Conference

9

EDISON INTERNATIONAL®

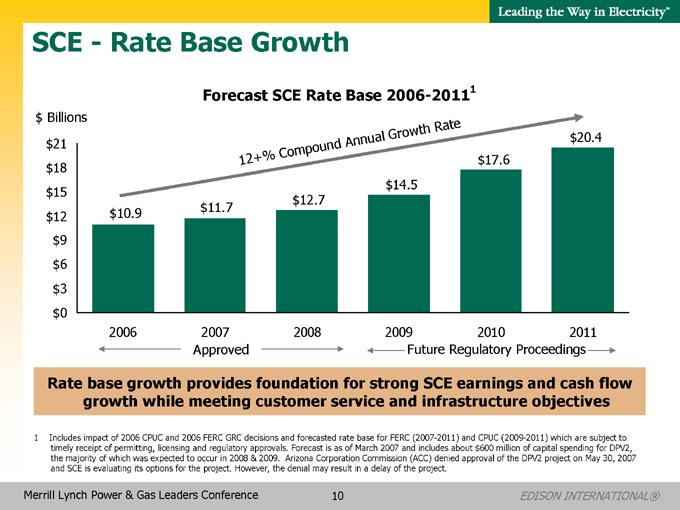

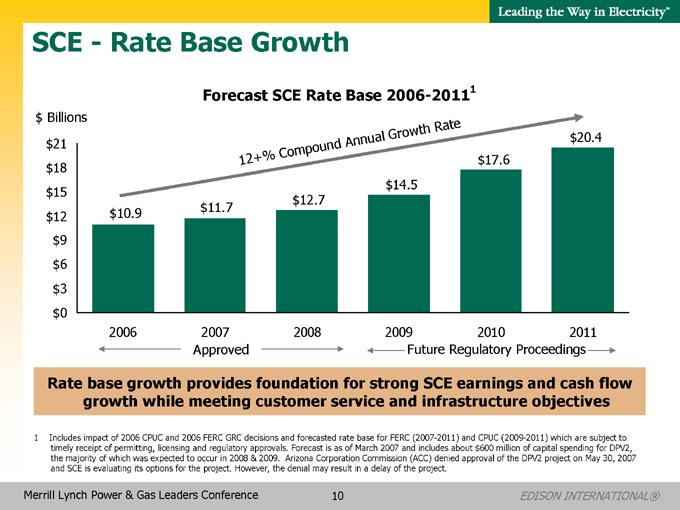

SCE - Rate Base Growth

Forecast SCE Rate Base 2006-20111

12+% Compound Annual Growth Rate

$ Billions

$21 $18 $15 $12 $9 $6 $3 $0

$10.9 $11.7

2006 2007 2008

$20.4 $17.6 $14.5 $12.7

2009 2010 2011

Approved Future Regulatory Proceedings

Rate base growth provides foundation for strong SCE earnings and cash flow growth while meeting customer service and infrastructure objectives

1 Includes impact of 2006 CPUC and 2006 FERC GRC decisions and forecasted rate base for FERC (2007-2011) and CPUC (2009-2011) which are subject to timely receipt of permitting, licensing and regulatory approvals. Forecast is as of March 2007 and includes about $ 600 million of capital spending for DPV2, the majority of which was expected to occur in 2008 & 2009. Arizona Corporation Commission (ACC) denied approval of the DPV2 project on May 30, 2007 and SCE is evaluating its options for the project. However, the denial may result in a delay of the project.

Merrill Lynch Power & Gas Leaders Conference

10

EDISON INTERNATIONAL®

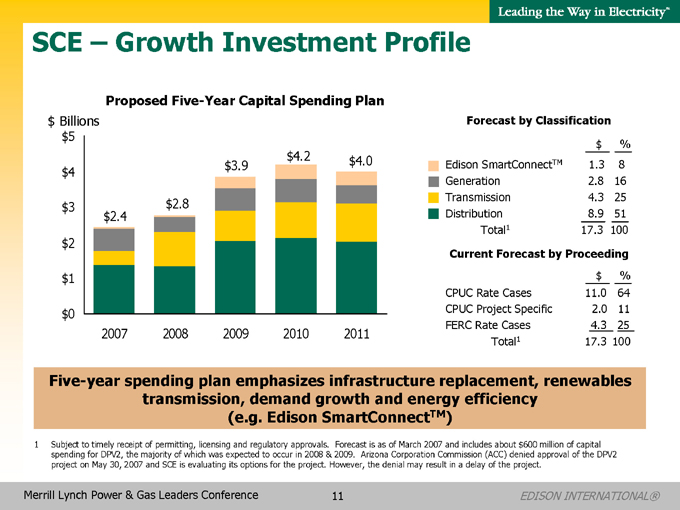

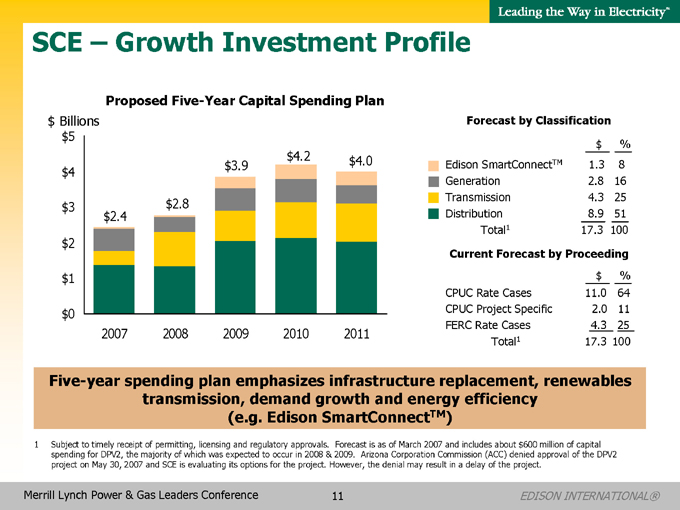

SCE – Growth Investment Profile

Proposed Five-Year Capital Spending Plan

$ Billions

$5 $4 $3 $2 $1 $0

$4.2$4.0 $3.9 $2.8 $2.4

2007 2008 2009 2010 2011

Forecast by Classification

$ %

Edison SmartConnectTM 1.3 8

Generation 2.8 16

Transmission 4.3 25

Distribution 8.9 51

Total1 17.3 100

Current Forecast by Proceeding

$ %

CPUC Rate Cases 11.0 64

CPUC Project Specific 2.0 11

FERC Rate Cases 4.3 25

Total1 17.3 100

Five-year spending plan emphasizes infrastructure replacement, renewables transmission, demand growth and energy efficiency (e.g. Edison SmartConnectTM)

1 Subject to timely receipt of permitting, licensing and regulatory approvals. Forecast is as of March 2007 and includes about $600 million of capital spending for DPV2, the majority of which was expected to occur in 2008 & 2009. Arizona Corporation Commission (ACC) denied approval of the DPV2 project on May 30, 2007 and SCE is evaluating its options for the project. However, the denial may result in a delay of the project.

Merrill Lynch Power & Gas Leaders Conference

11

EDISON INTERNATIONAL®

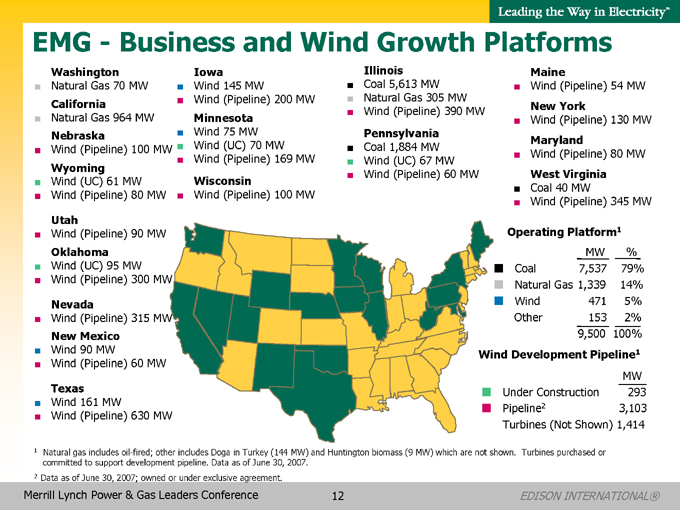

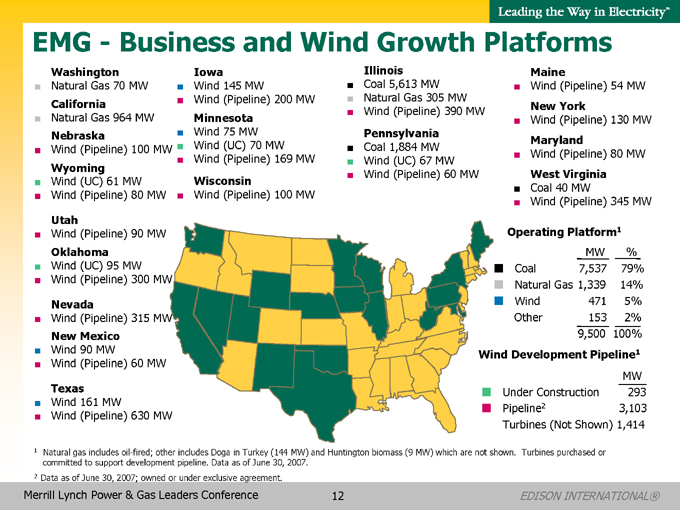

EMG - Business and Wind Growth Platforms

Washington

Natural Gas 70 MW

California

Natural Gas 964 MW

Nebraska

Wind (Pipeline) 100 MW

Wyoming

Wind (UC) 61 MW

Wind (Pipeline) 80 MW

Utah

Wind (Pipeline) 90 MW

Oklahoma

Wind (UC) 95 MW

Wind (Pipeline) 300 MW

Nevada

Wind (Pipeline) 315 MW

New Mexico

Wind 90 MW

Wind (Pipeline) 60 MW

Texas

Wind 161 MW

Wind (Pipeline) 630 MW

Iowa

Wind 145 MW

Wind (Pipeline) 200 MW

Minnesota

Wind 75 MW

Wind (UC) 70 MW Wind

(Pipeline) 169 MW

Wisconsin

Wind (Pipeline) 100 MW

Illinois

Coal 5,613 MW

Natural Gas 305 MW

Wind (Pipeline) 390 MW

Pennsylvania

Coal 1,884 MW

Wind (UC) 67 MW

Wind (Pipeline) 60 MW

Maine

Wind (Pipeline) 54 MW

New York

Wind (Pipeline) 130 MW

Maryland

Wind (Pipeline) 80 MW

West Virginia

Coal 40 MW

Wind (Pipeline) 345 MW

Operating Platform1

MW %

Coal 7,537 79%

Natural Gas 1,339 14%

Wind 471 5%

Other 153 2%

9,500 100%

Wind Development Pipeline1

MW

Under Construction 293

Pipeline2 3,103

Turbines (Not Shown) 1,414

1 Natural gas includes oil-fired; other includes Doga in Turkey (144 MW) and Huntington biomass (9 MW) which are not shown. Turbines purchased or committed to support development pipeline. Data as of June 30, 2007.

2 | | Data as of June 30, 2007; owned or under exclusive agreement. |

Merrill Lynch Power & Gas Leaders Conference

12

EDISON INTERNATIONAL®

EMG - Wind Development Model

Local or Independent Developer

EMG

Process Steps

Initial meteorological data collection/screening

Land rights

Permitting

PPA origination and negotiations

Turbine procurement

Confirm meteorological data

Construction and start-up

Operation

Financing

161 MW Wind Farm Wildorado, Texas

Merrill Lynch Power & Gas Leaders Conference

13

EDISON INTERNATIONAL®

EMG - Thermal Growth Project Opportunities

Natural Gas-Fired Generation

Thermal development (1,000 MW)

Walnut Creek and Sun Valley, CA opportunities (500 MW each) in permitting and engineering stage – SCE and other potential customers

Potential acquisitions of assets or portfolios

Will be selective and disciplined

Some regions showing developing capacity markets and higher spark spreads

Assets complement marketing and trading skills

IGCC with Carbon Sequestration

Carson Hydrogen Project (400-450 MW)

Joint Venture with BP at their Carson City refinery – petroleum coke fuel with 90% CO2 used for enhanced oil recovery

Confirming project economics and CO2 requirements

Other opportunities in early stage development

Merrill Lynch Power & Gas Leaders Conference

14

EDISON INTERNATIONAL®

Our Shareholder Value Proposition

Attractive business portfolio and growth opportunities

Southern California Edison

Demonstrated need for utility infrastructure investments

Among the best domestic electric utility growth platforms

Edison Mission Group

Favorable market conditions for unregulated generation portfolio

Strong growth pipeline led by wind investments and clean fossil fuel technologies

Commitment to long-term shareholder value creation

Incentive compensation and stock ownership guidelines consistent with shareholder interests

Edison people committed to excellence in safety and customer services

Merrill Lynch Power & Gas Leaders Conference

15

EDISON INTERNATIONAL®

Merrill Lynch Power & Gas Leaders Conference

16

EDISON INTERNATIONAL®