Third Quarter 2007 Financial Teleconference

November 2, 2007

EDISON INTERNATIONAL®

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation, earnings, asset and rate base growth, load growth, capital investments, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s 2006 Form 10-K and subsequent reports filed with the Securities and Exchange Commission and available on our website: www.edisoninvestor.com. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances.

EDISON INTERNATIONAL®

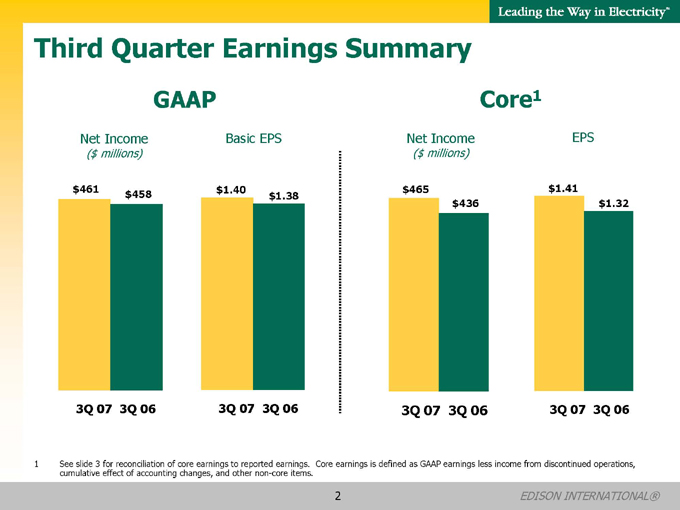

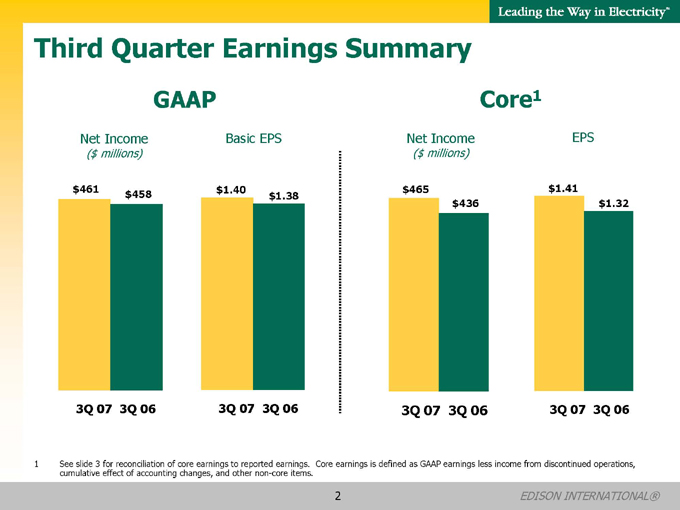

Third Quarter Earnings Summary

GAAP

Net Income

($ millions) $461 $458

Basic EPS

$1.40 $1.38

3Q 07 3Q 06

3Q 07 3Q 06

Core1

Net Income

($ millions)

EPS

$465 $436 $1.41 $1.32

3Q 07 3Q 06

3Q 07 3Q 06

1 See slide 3 for reconciliation of core earnings to reported earnings. Core earnings is defined as GAAP earnings less income from discontinued operations, cumulative effect of accounting changes, and other non-core items.

EDISON INTERNATIONAL®

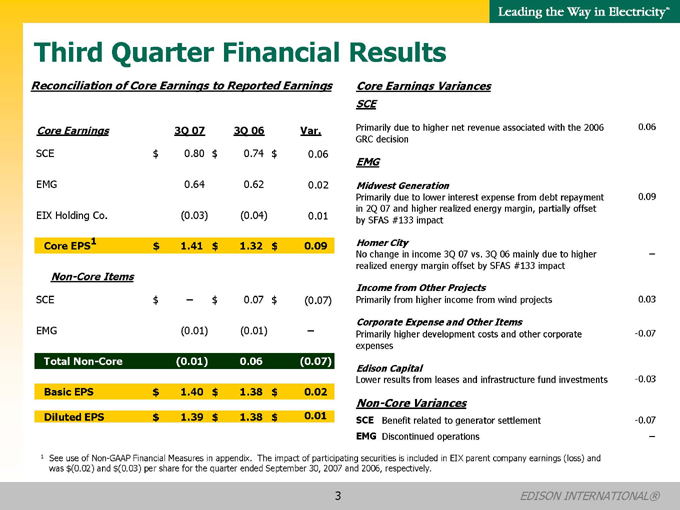

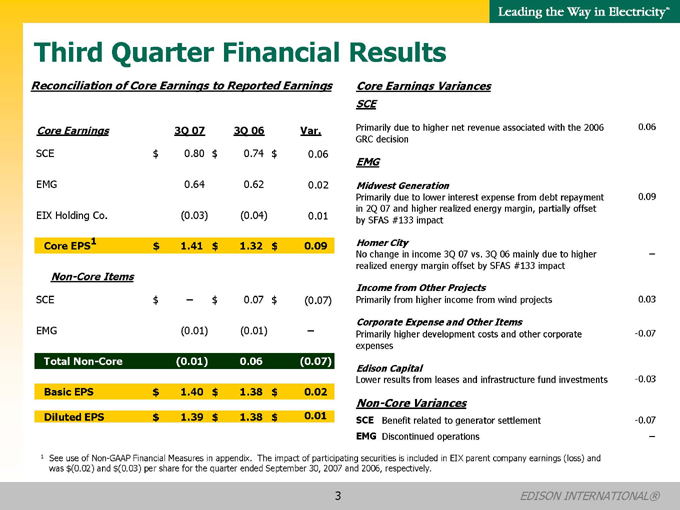

Third Quarter Financial Results

Reconciliation of Core Earnings to Reported Earnings

Core Earnings 3Q 07 3Q 06 Var.

SCE $ 0.80 $ 0.74 $ 0.06

EMG 0.64 0.62 0.02

EIX Holding Co.(0.03)(0.04) 0.01

Core EPS1 $ 1.41 $ 1.32 $ 0.09

Non-Core Items

SCE $ – $ 0.07 $ (0.07)

EMG(0.01)(0.01) –

Total Non-Core(0.01) 0.06(0.07)

Basic EPS $ 1.40 $ 1.38 $ 0.02

Diluted EPS $ 1.39 $ 1.38 $ 0.01

Core Earnings Variances

SCE

Primarily due to higher net revenue associated with the 2006 GRC decision 0.06

EMG

Midwest Generation

Primarily due to lower interest expense from debt repayment in 2Q 07 and higher realized energy margin, partially offset by SFAS #133 impact 0.09

Homer City

No change in income 3Q 07 vs. 3Q 06 mainly due to higher realized energy margin offset by SFAS #133 impact –

Income from Other Projects

Primarily from higher income from wind projects 0.03

Corporate Expense and Other Items

Primarily higher development costs and other corporate expenses -0.07

Edison Capital

Lower results from leases and infrastructure fund investments -0.03

Non-Core Variances

SCE Benefit related to generator settlement -0.07

EMG Discontinued operations –

1 See use of Non-GAAP Financial Measures in appendix. The impact of participating securities is included in EIX parent company earnings (loss) and was $(0.02) and $(0.03) per share for the quarter ended September 30, 2007 and 2006, respectively.

EDISON INTERNATIONAL®

EDISON INTERNATIONAL®

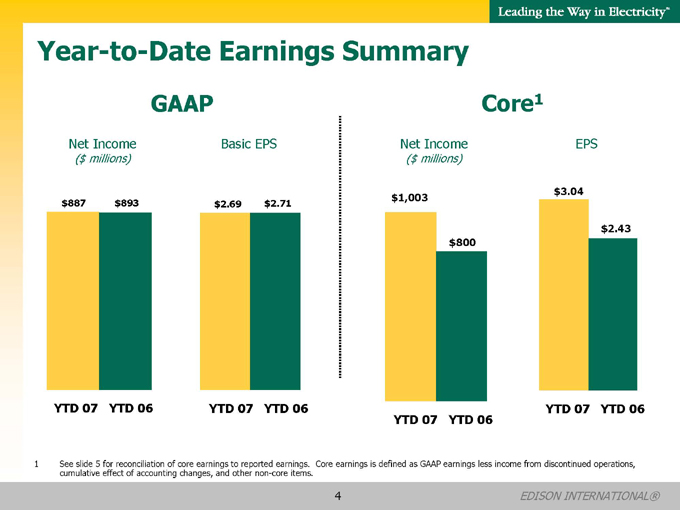

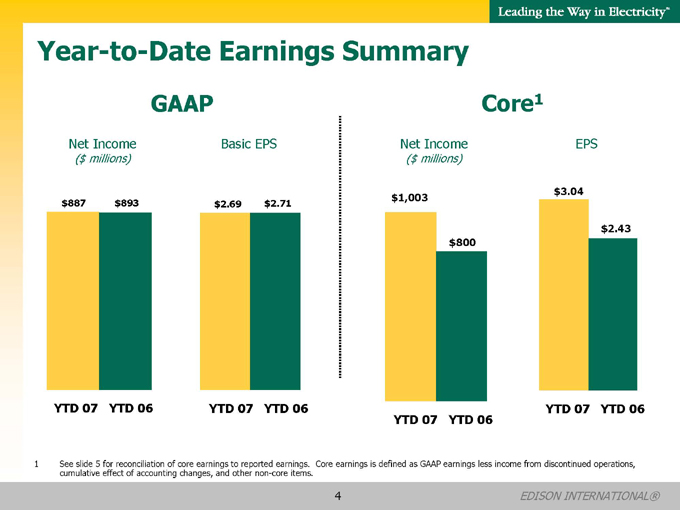

Year-to-Date Earnings Summary

GAAP

Net Income

($ millions) $887 $893

YTD 07 YTD 06

Basic EPS

YTD 07 YTD 06

Core1

Net Income

($ millions) $1,003 $800

YTD 07 YTD 06

EPS

$3.04 $2.43

YTD 07 YTD 06

1 See slide 5 for reconciliation of core earnings to reported earnings. Core earnings is defined as GAAP earnings less income from discontinued operations, cumulative effect of accounting changes, and other non-core items.

Year-to-Date Financial Results

Reconciliation of Core Earnings to Reported Earnings

Core Earnings YTD 07 YTD 06 Var.

SCE $ 1.70 $ 1.58 $ 0.12

EMG 1.41 0.95 0.46

EIX Holding Co.(0.07)(0.10) 0.03

Core EPS1 $ 3.04 $ 2.43 $ 0.61

Non-Core Items

SCE $ 0.10 $ 0.32 $ (0.22)

EMG(0.45)(0.04)(0.41)

Total Non-Core(0.35) 0.28(0.63)

Basic EPS $ 2.69 $ 2.71 $ (0.02)

Diluted EPS $ 2.67 $ 2.71 $ (0.04)

Core Earnings Variances

SCE

Primarily due to higher net revenue associated with the 2006 GRC decision and lower income taxes 0.12

EMG

Midwest Generation

Mainly higher realized energy margin (driven by higher generation and higher average realized prices) partially offset by SFAS #133 impact, and lower interest expense 0.34

Homer City

Primarily higher realized energy margin (driven by higher generation and higher average realized energy prices), which includes higher capacity revenue resulting from the PJM RPM auction, partially offset by SFAS #133 impact 0.12

Income from Other Projects

Higher income from wind and gas-fired projects 0.08

Edison Capital

Gains on global infrastructure fund investments and higher interest income

0.04

Corporate Expense and Other Items

Higher development costs and other corporate expenses and higher net interest/other expense (Mirant income and gain on sale of 25% interest in San Juan Mesa recorded in 06) -0.12

Non-Core Variances

SCE YTD 07: $ 0.10 reflects progress made with the IRS related to the income tax treatment of certain environmental remediation costs; YTD 06: $ 0.25 relates to the resolution of an outstanding issue involving a portion of revenue collected during 2001—2003 related to state income taxes and $0.07 reflects generator settlement. -0.22

EMG YTD 07 and YTD 06 include ($0.45) and ($0.27) per share for early debt extinguishment charges; $0.01 and $ 0.26 per share from proceeds from discontinued operations related to Lakeland; and ( $0.01) and ($0.03) per share from other discontinued operations, respectively. -0.41

1 See use of Non-GAAP Financial Measures in appendix. The impact of participating securities is included in EIX parent company earnings (loss) and was $(0.03) per share for year-to-date September 30, 2007 and 2006.

EDISON INTERNATIONAL®

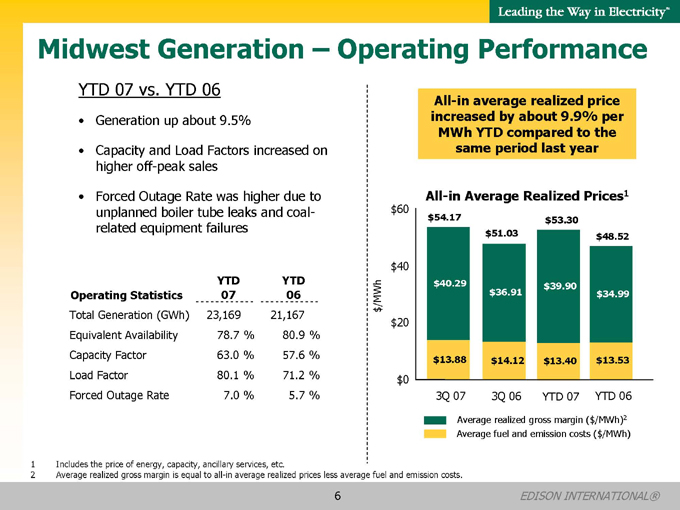

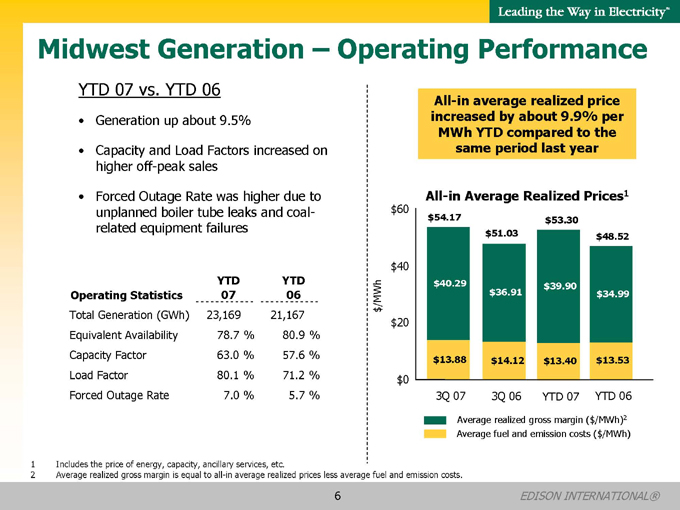

Midwest Generation – Operating Performance

YTD 07 vs. YTD 06

Generation up about 9.5%

Capacity and Load Factors increased on higher off-peak sales

Forced Outage Rate was higher due to unplanned boiler tube leaks and coal-related equipment failures

YTD YTD

Operating Statistics 07 06

Total Generation (GWh) 23,169 21,167

Equivalent Availability 78.7 % 80.9 %

Capacity Factor 63.0 % 57.6 %

Load Factor 80.1 % 71.2 %

Forced Outage Rate 7.0 % 5.7 %

1 | | Includes the price of energy, capacity, ancillary services, etc. |

2 | | Average realized gross margin is equal to all-in average realized prices less average fuel and emission costs. |

All-in average realized price increased by about 9.9% per MWh YTD compared to the same period last year

All-in Average Realized Prices1 $/MWh $60 $40 $20 $0

3Q 07 3Q 06 YTD 07 YTD 06 $54.17 $51.03 $53.30 $48.52 $40.29 $36.91 $39.90 $34.99 $13.88 $14.12 $13.40 $13.53

Average realized gross margin ($/MWh)2 Average fuel and emission costs ($/MWh)

EDISON INTERNATIONAL®

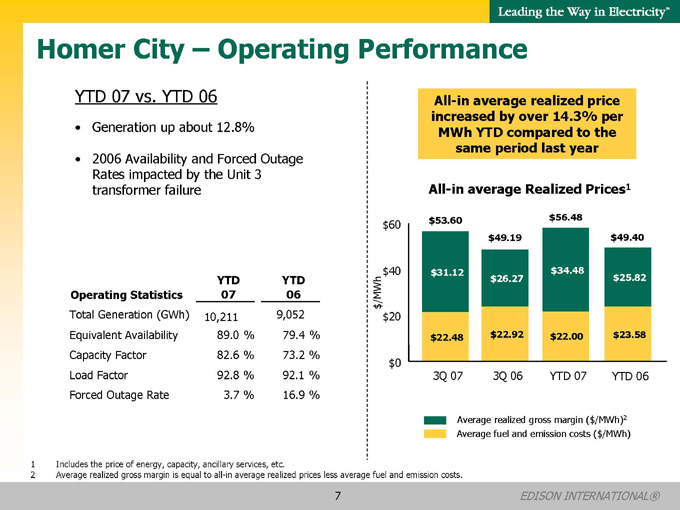

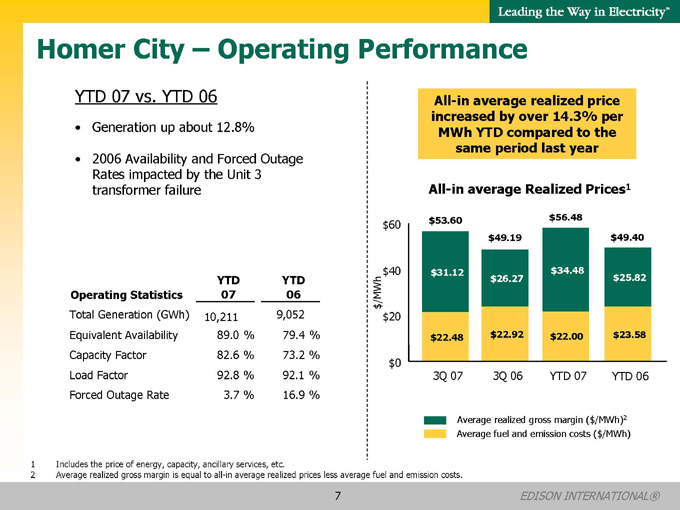

Homer City – Operating Performance

YTD 07 vs. YTD 06

Generation up about 12.8%

2006 Availability and Forced Outage Rates impacted by the Unit 3 transformer failure

YTD YTD

Operating Statistics 07 06

Total Generation (GWh) 10,211 9,052

Equivalent Availability 89.0 % 79.4 %

Capacity Factor 82.6 % 73.2 %

Load Factor 92.8 % 92.1 %

Forced Outage Rate 3.7 % 16.9 %

1 | | Includes the price of energy, capacity, ancillary services, etc. |

2 | | Average realized gross margin is equal to all-in average realized prices less average fuel and emission costs. |

All-in average realized price increased by over 14.3% per MWh YTD compared to the same period last year

All-in average Realized Prices1 $/MWh $60 $40 $20 $0

3Q 07 3Q 06 YTD 07 YTD 06 $22.48 $22.92 $22.00 $23.58 $53.60 $49.19 $56.48 $49.40 $31.12 $26.27 $34.48 $25.82

Average realized gross margin ($/MWh)2 Average fuel and emission costs ($/MWh)

EDISON INTERNATIONAL®

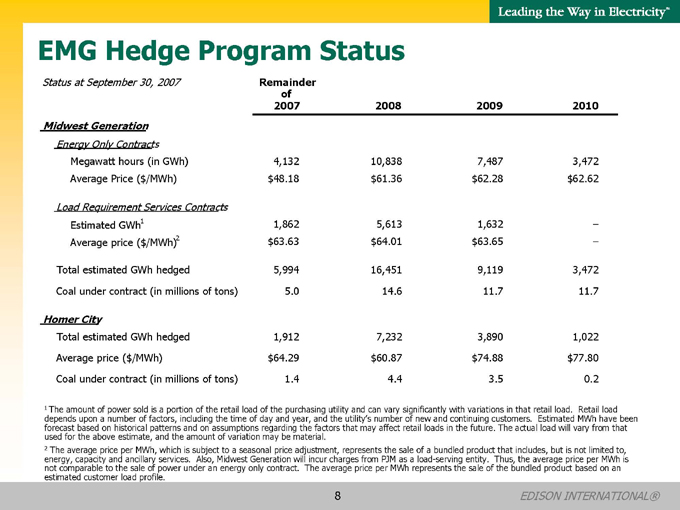

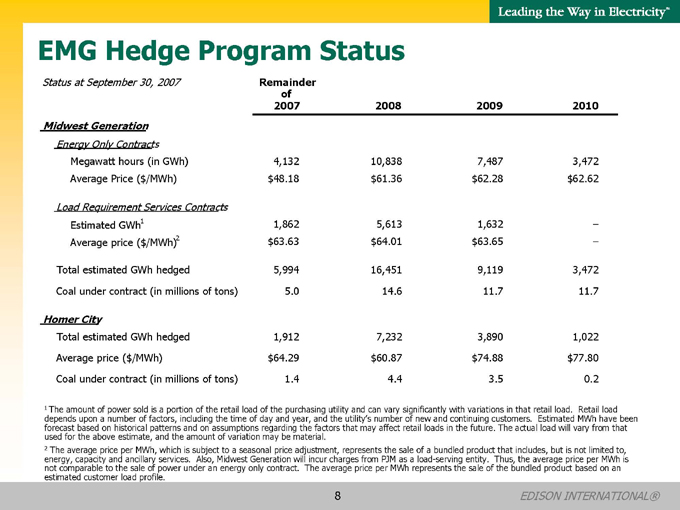

EMG Hedge Program Status

Status at September 30, 2007 Remainder of 2007 2008 2009 2010

Midwest Generation

Energy Only Contracts

Megawatt hours (in GWh) 4,132 10,838 7,487 3,472

Average Price ($/MWh) $ 48.18 $ 61.36 $ 62.28 $ 62.62

Load Requirement Services Contracts

Estimated GWh1 1,862 5,613 1,632 –

Average price ($/MWh) 2 $ 63.63 $ 64.01 $ 63.65 –

Total estimated GWh hedged 5,994 16,451 9,119 3,472

Coal under contract (in millions of tons) 5.0 14.6 11.7 11.7

Homer City

Total estimated GWh hedged 1,912 7,232 3,890 1,022

Average price ($ /MWh) $ 64.29 $ 60.87 $ 74.88 $ 77.80

Coal under contract (in millions of tons) 1.4 4.4 3.5 0.2

1 The amount of power sold is a portion of the retail load of the purchasing utility and can vary significantly with variations in that retail load. Retail load depends upon a number of factors, including the time of day and year, and the utility’s number of new and continuing customers. Estimated MWh have been forecast based on historical patterns and on assumptions regarding the factors that may affect retail loads in the future. The actual load will vary from that used for the above estimate, and the amount of variation may be material.

2 The average price per MWh, which is subject to a seasonal price adjustment, represents the sale of a bundled product that includes, but is not limited to, energy, capacity and ancillary services. Also, Midwest Generation will incur charges from PJM as a load-serving entity. Thus, the average price per MWh is not comparable to the sale of power under an energy only contract. The average price per MWh represents the sale of the bundled product based on an estimated customer load profile.

EDISON INTERNATIONAL®

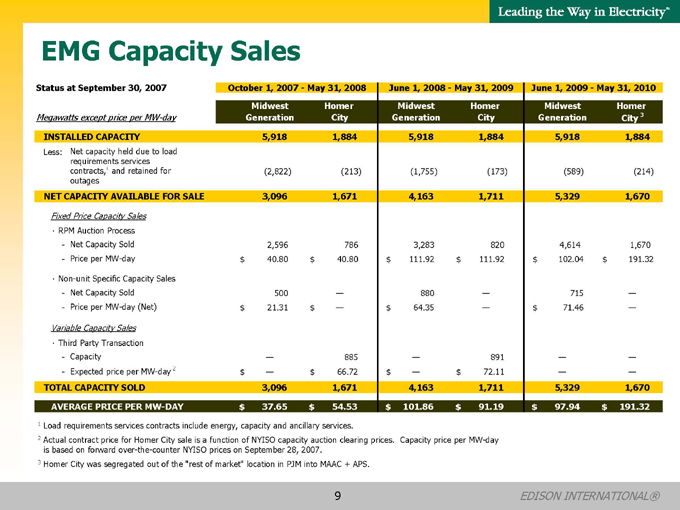

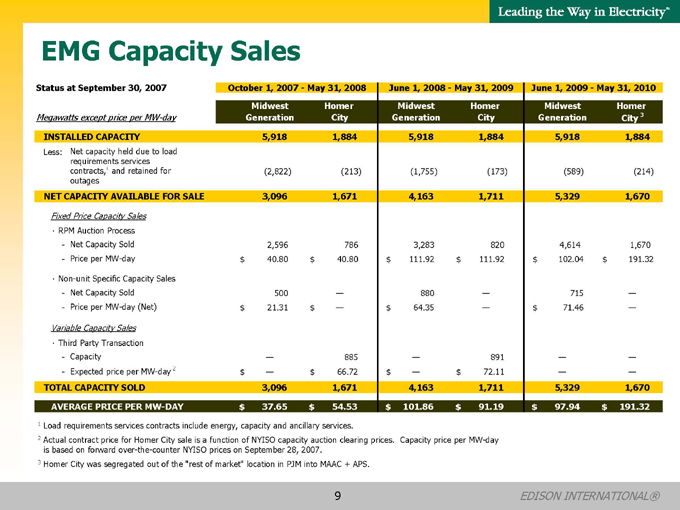

EMG Capacity Sales

Status at September 30, 2007 October 1, 2007—May 31, 2008 June 1, 2008—May 31, 2009 June 1, 2009—May 31, 2010

Megawatts except price per MW-day Midwest Generation Homer City Midwest Generation Homer City Midwest Generation Homer City 3

INSTALLED CAPACITY 5,918 1,884 5,918 1,884 5,918 1,884

Less: Net capacity held due to load requirements services contracts,1 and retained for outages(2,822)(213)(1,755)(173)(589)(214)

NET CAPACITY AVAILABLE FOR SALE 3,096 1,671 4,163 1,711 5,329 1,670

Fixed Price Capacity Sales

· RPM Auction Process

—Net Capacity Sold 2,596 786 3,283 820 4,614 1,670

- Price per MW-day $ 40.80 $ 40.80 $ 111.92 $ 111.92 $ 102.04 $ 191.32

· Non-unit Specific Capacity Sales

—Net Capacity Sold 500 — 880 — 715 —

- Price per MW-day (Net) $ 21.31 $ — $ 64.35 — $ 71.46 —

Variable Capacity Sales

· Third Party Transaction

—Capacity — 885 — 891 — —

- Expected price per MW-day 2 $ — $ 66.72 $ — $ 72.11 — —

TOTAL CAPACITY SOLD 3,096 1,671 4,163 1,711 5,329 1,670

AVERAGE PRICE PER MW-DAY $ 37.65 $ 54.53 $ 101.86 $ 91.19 $ 97.94 $ 191.32

1 | | Load requirements services contracts include energy, capacity and ancillary services. |

2 Actual contract price for Homer City sale is a function of NYISO capacity auction clearing prices. Capacity price per MW-day is based on forward over-the-counter NYISO prices on September 28, 2007.

3 | | Homer City was segregated out of the “rest of market” location in PJM into MAAC + APS. |

9

EDISON INTERNATIONAL®

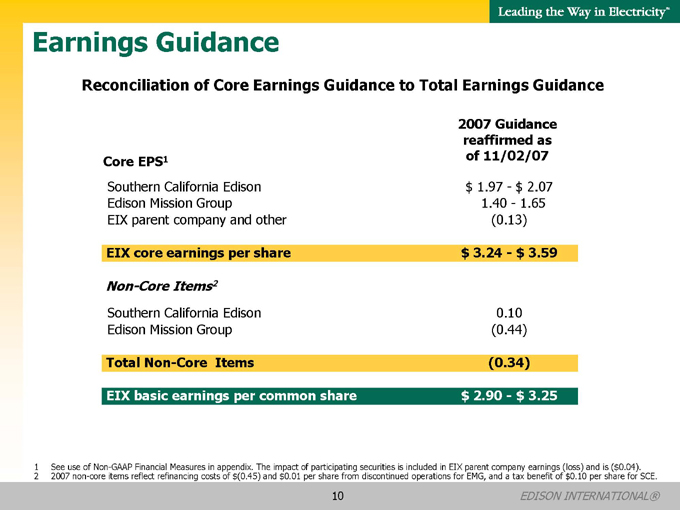

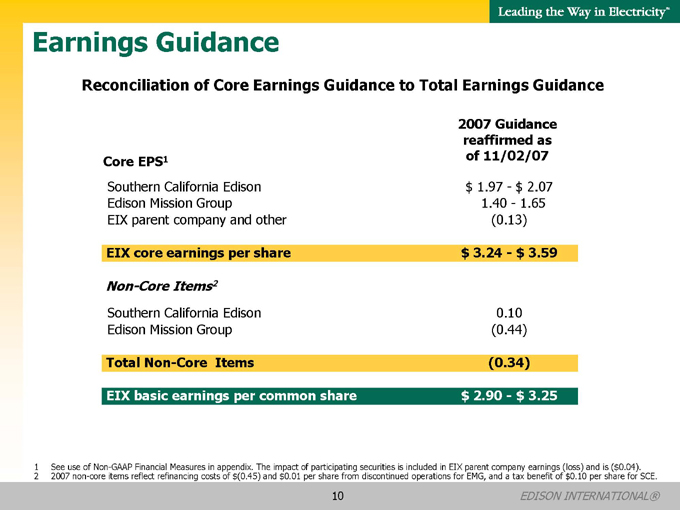

Earnings Guidance

Reconciliation of Core Earnings Guidance to Total Earnings Guidance

2007 Guidance

reaffirmed as

Core EPS1 of 11/02/07

Southern California Edison $ 1.97—$ 2.07

Edison Mission Group 1.40—1.65

EIX parent company and other(0.13)

EIX core earnings per share $ 3.24—$ 3.59

Non-Core Items2

Southern California Edison 0.10

Edison Mission Group(0.44)

Total Non-Core Items(0.34)

EIX basic earnings per common share $ 2.90—$ 3.25

1 See use of Non-GAAP Financial Measures in appendix. The impact of participating securities is included in EIX parent company earnings (loss) and is ($0.04).

2 2007 non-core items reflect refinancing costs of $(0.45) and $0.01 per share from discontinued operations for EMG, and a tax benefit of $0.10 per share for SCE.

10

EDISON INTERNATIONAL®

Appendix

11

EDISON INTERNATIONAL®

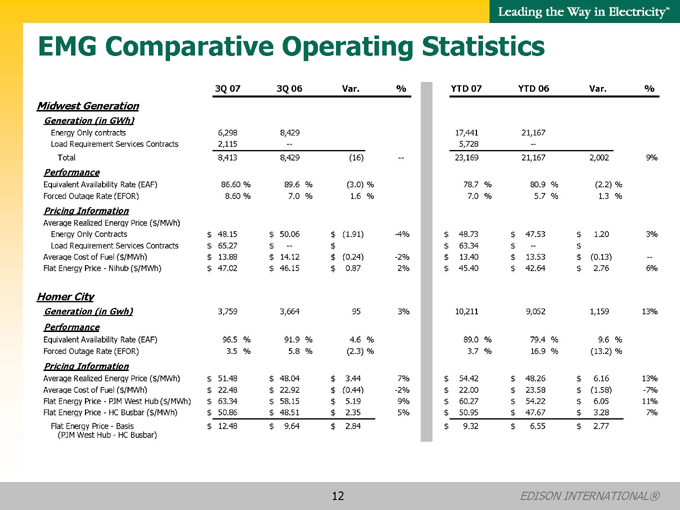

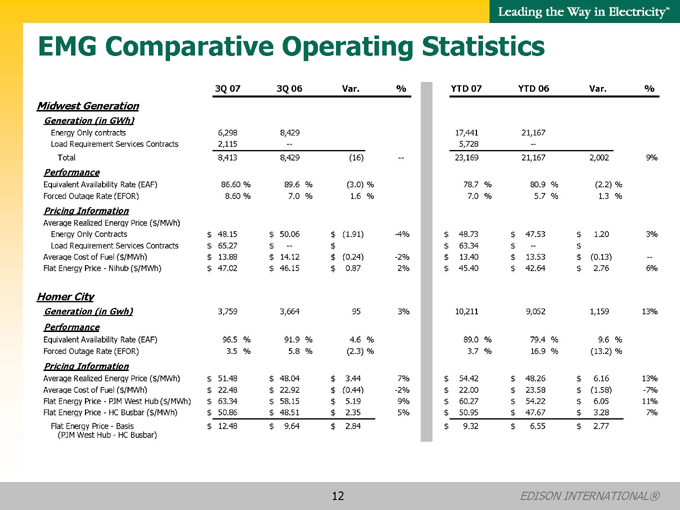

EMG Comparative Operating Statistics

3Q 07 3Q 06 Var.% YTD 07 YTD 06 Var.%

Midwest Generation

Generation (in GWh)

Energy Only contracts 6,298 8,429 17,441 21,167

Load Requirement Services Contracts 2,115 — 5,728 —

Total 8,413 8,429(16) — 23,169 21,167 2,002 9%

Performance

Equivalent Availability Rate (EAF) 86.60 % 89.6 %(3.0) % 78.7 % 80.9 %(2.2) %

Forced Outage Rate (EFOR) 8.60 % 7.0 % 1.6 % 7.0 % 5.7 % 1.3 %

Pricing Information

Average Realized Energy Price ($/MWh)

Energy Only Contracts $ 48.15 $ 50.06 $ (1.91) -4% $ 48.73 $ 47.53 $ 1.20 3%

Load Requirement Services Contracts $ 65.27 $ — $ $ 63.34 $ — $

Average Cost of Fuel ($/MWh) $ 13.88 $ 14.12 $ (0.24) -2% $ 13.40 $ 13.53 $ (0.13) —

Flat Energy Price—Nihub ($/MWh) $ 47.02 $ 46.15 $ 0.87 2% $ 45.40 $ 42.64 $ 2.76 6%

Homer City

Generation (in Gwh) 3,759 3,664 95 3% 10,211 9,052 1,159 13%

Performance

Equivalent Availability Rate (EAF) 96.5 % 91.9 % 4.6 % 89.0 % 79.4 % 9.6 %

Forced Outage Rate (EFOR) 3.5 % 5.8 %(2.3) % 3.7 % 16.9 %(13.2) %

Pricing Information

Average Realized Energy Price ($/MWh) $ 51.48 $ 48.04 $ 3.44 7% $ 54.42 $ 48.26 $ 6.16 13%

Average Cost of Fuel ($/MWh) $ 22.48 $ 22.92 $ (0.44) -2% $ 22.00 $ 23.58 $ (1.58) -7%

Flat Energy Price—PJM West Hub ($/MWh) $ 63.34 $ 58.15 $ 5.19 9% $ 60.27 $ 54.22 $ 6.05 11%

Flat Energy Price—HC Busbar ($/MWh) $ 50.86 $ 48.51 $ 2.35 5% $ 50.95 $ 47.67 $ 3.28 7%

Flat Energy Price—Basis $ 12.48 $ 9.64 $ 2.84 $ 9.32 $ 6.55 $ 2.77

(PJM West Hub—HC Busbar)

12

EDISON INTERNATIONAL®

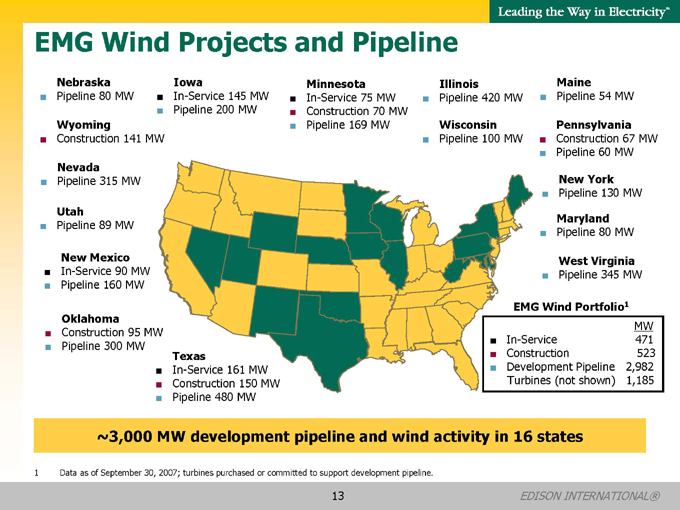

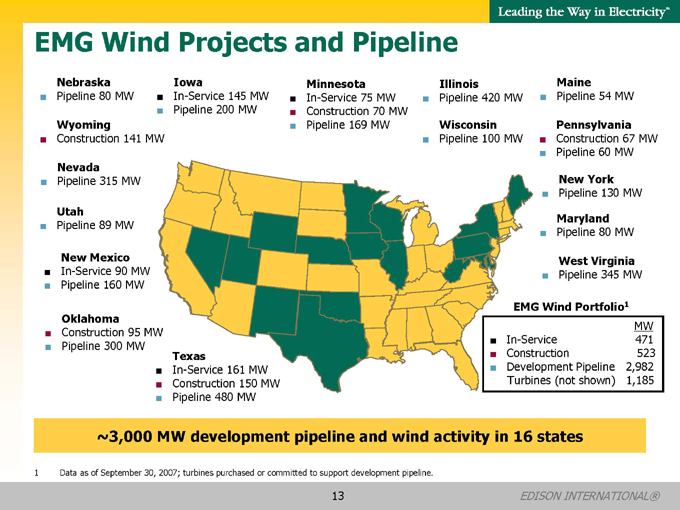

EMG Wind Projects and Pipeline

Nebraska

Pipeline 80 MW

Wyoming

Construction 141 MW

Nevada

Pipeline 315 MW

Utah

Pipeline 89 MW

New Mexico

In-Service 90 MW Pipeline 160 MW

Oklahoma

Construction 95 MW Pipeline 300 MW

Iowa

In-Service 145 MW Pipeline 200 MW

Minnesota

In-Service 75 MW Construction 70 MW Pipeline 169 MW

Illinois

Pipeline 420 MW

Wisconsin

Pipeline 100 MW

Maine

Pipeline 54 MW

Pennsylvania

Construction 67 MW Pipeline 60 MW

New York

Pipeline 130 MW

Maryland

Pipeline 80 MW

West Virginia

Pipeline 345 MW

Texas

In-Service 161 MW Construction 150 MW Pipeline 480 MW

EMG Wind Portfolio1

MW

In-Service 471

Construction 523

Development Pipeline 2,982

Turbines (not shown) 1,185

~3,000 MW development pipeline and wind activity in 16 states

1 | | Data as of September 30, 2007; turbines purchased or committed to support development pipeline. |

13

EDISON INTERNATIONAL®

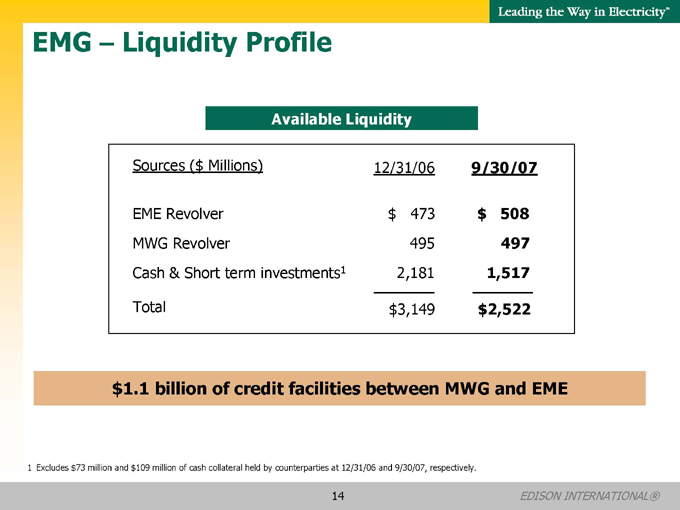

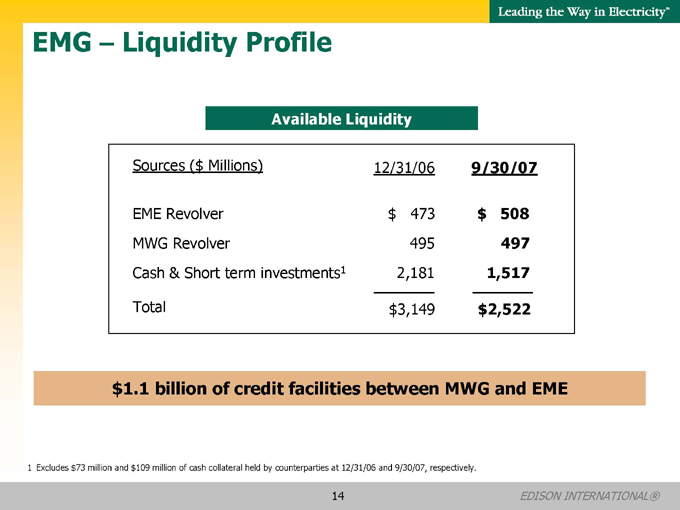

EMG – Liquidity Profile

Available Liquidity

Sources ($ Millions) 12/31/06 9/30/07

EME Revolver $ 473 $ 508

MWG Revolver 495 497

Cash & Short term investments1 2,181 1,517

Total $ 3,149 $ 2,522

$1.1 billion of credit facilities between MWG and EME

1 Excludes $73 million and $109 million of cash collateral held by counterparties at 12/31/06 and 9/30/07, respectively.

14

EDISON INTERNATIONAL®

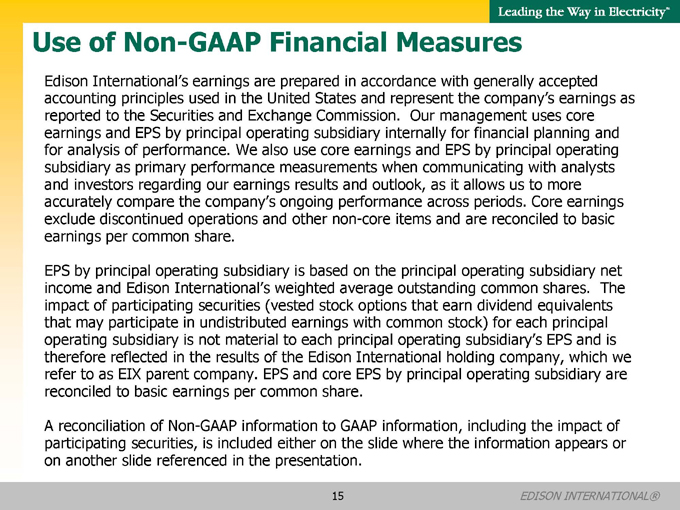

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and EPS by principal operating subsidiary internally for financial planning and for analysis of performance. We also use core earnings and EPS by principal operating subsidiary as primary performance measurements when communicating with analysts and investors regarding our earnings results and outlook, as it allows us to more accurately compare the company’s ongoing performance across periods. Core earnings exclude discontinued operations and other non-core items and are reconciled to basic earnings per common share.

EPS by principal operating subsidiary is based on the principal operating subsidiary net income and Edison International’s weighted average outstanding common shares. The impact of participating securities (vested stock options that earn dividend equivalents that may participate in undistributed earnings with common stock) for each principal operating subsidiary is not material to each principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which we refer to as EIX parent company. EPS and core EPS by principal operating subsidiary are reconciled to basic earnings per common share.

A reconciliation of Non-GAAP information to GAAP information, including the impact of participating securities, is included either on the slide where the information appears or on another slide referenced in the presentation.

15

EDISON INTERNATIONAL®