Exhibit 99.1

Leading the Way in Electricity SM

Business Update

April 2008

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation, earnings, asset and rate base growth, load growth, capital investments, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s 2007 Form 10-K and subsequent reports filed with the Securities and Exchange Commission and are available on our website: www.edisoninvestor.com. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances.

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

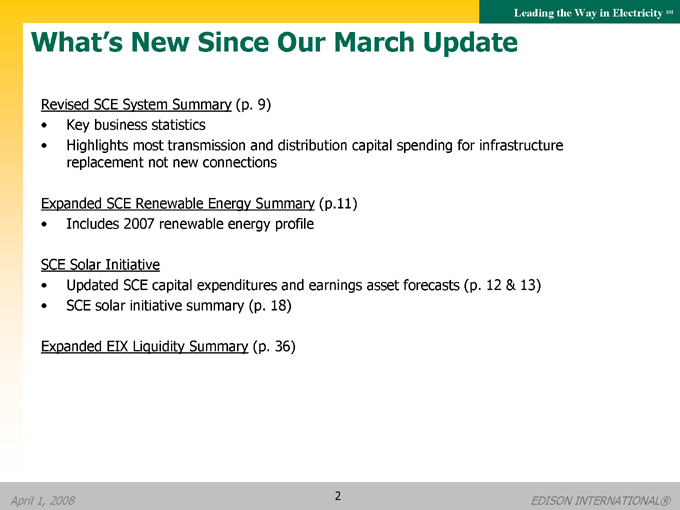

What’s New Since Our March Update

Revised SCE System Summary (p. 9)

Key business statistics

Highlights most transmission and distribution capital spending for infrastructure replacement not new connections

Expanded SCE Renewable Energy Summary (p.11)

Includes 2007 renewable energy profile

SCE Solar Initiative

Updated SCE capital expenditures and earnings asset forecasts (p. 12 & 13)

SCE solar initiative summary (p. 18) Expanded EIX Liquidity Summary (p. 36)

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Strategic Overview

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

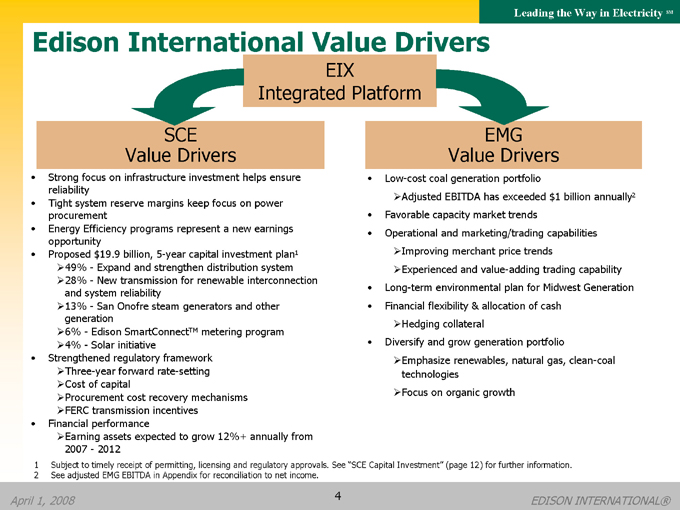

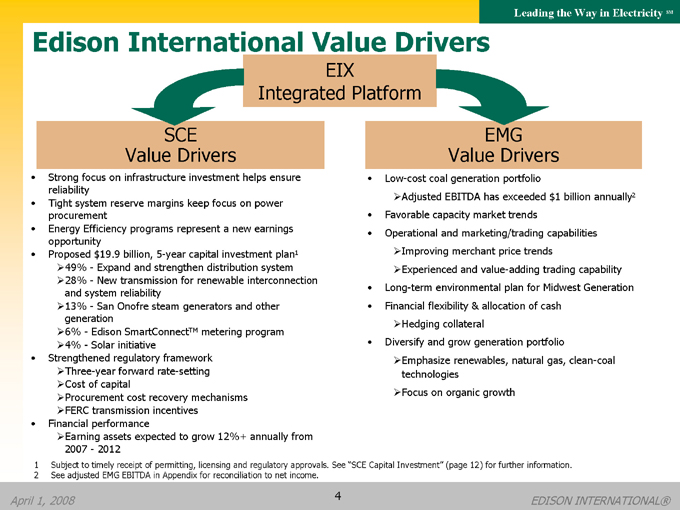

Edison International Value Drivers

EIX Integrated Platform

SCE Value Drivers

Strong focus on infrastructure investment helps ensure reliability Tight system reserve margins keep focus on power procurement Energy Efficiency programs represent a new earnings opportunity Proposed $19.9 billion, 5-year capital investment plan1

49%—Expand and strengthen distribution system

28%—New transmission for renewable interconnection and system reliability

13%—San Onofre steam generators and other generation

6%—Edison SmartConnectTM metering program

4%—Solar initiative

Strengthened regulatory framework

Three-year forward rate-setting

Cost of capital

Procurement cost recovery mechanisms

FERC transmission incentives Financial performance

Earning assets expected to grow 12%+ annually from 2007—2012

EMG Value Drivers

Low-cost coal generation portfolio

Adjusted EBITDA has exceeded $1 billion annually2 Favorable capacity market trends Operational and marketing/trading capabilities

Improving merchant price trends

Experienced and value-adding trading capability Long-term environmental plan for Midwest Generation Financial flexibility & allocation of cash

Hedging collateral

Diversify and grow generation portfolio

Emphasize renewables, natural gas, clean-coal technologies

Focus on organic growth

1 Subject to timely receipt of permitting, licensing and regulatory approvals. See “SCE Capital Investment” (page 12) for further information.

2 | | See adjusted EMG EBITDA in Appendix for reconciliation to net income. |

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

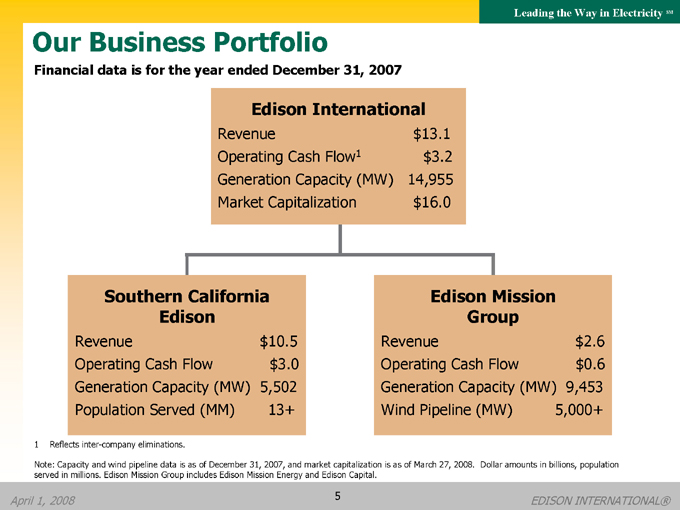

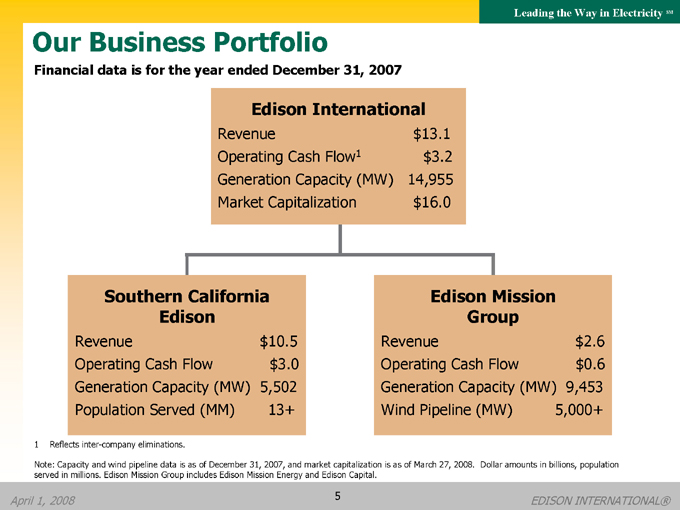

Our Business Portfolio

Financial data is for the year ended December 31, 2007

Edison International

Revenue $13.1

Operating Cash Flow1 $3.2

Generation Capacity (MW) 14,955

Market Capitalization $16.0

Southern California Edison

Revenue $10.5

Operating Cash Flow $3.0

Generation Capacity (MW) 5,502

Population Served (MM) 13+

Edison Mission Group

Revenue $2.6

Operating Cash Flow $0.6

Generation Capacity (MW) 9,453

Wind Pipeline (MW) 5,000+

1 | | Reflects inter-company eliminations. |

Note: Capacity and wind pipeline data is as of December 31, 2007, and market capitalization is as of March 27, 2008. Dollar amounts in billions, population served in millions. Edison Mission Group includes Edison Mission Energy and Edison Capital.

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

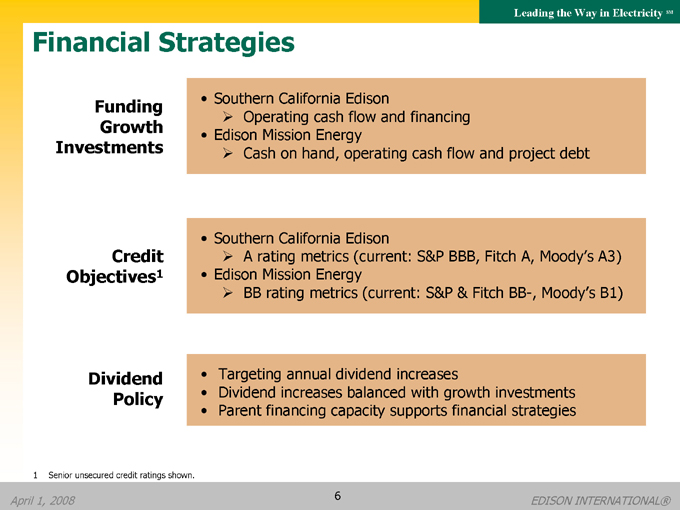

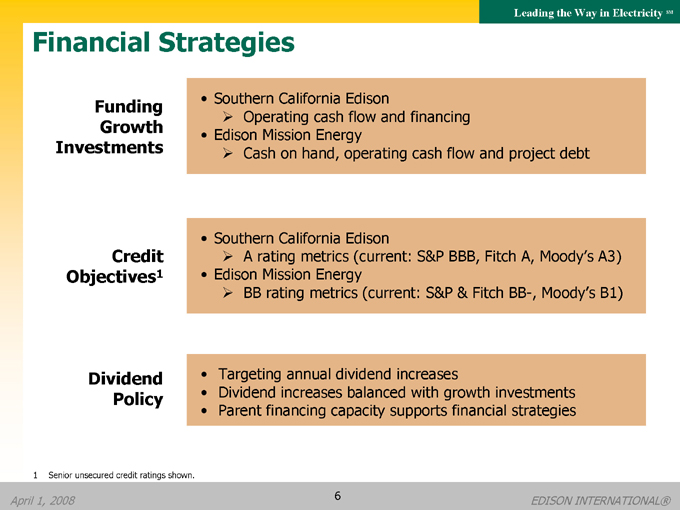

Financial Strategies

Funding Growth Investments

Southern California Edison

Operating cash flow and financing Edison Mission Energy

Cash on hand, operating cash flow and project debt

Credit Objectives1

Southern California Edison

A rating metrics (current: S&P BBB, Fitch A, Moody’s A3) Edison Mission Energy

BB rating metrics (current: S&P & Fitch BB-, Moody’s B1)

Dividend Policy

Targeting annual dividend increases

Dividend increases balanced with growth investments Parent financing capacity supports financial strategies

1 | | Senior unsecured credit ratings shown. |

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

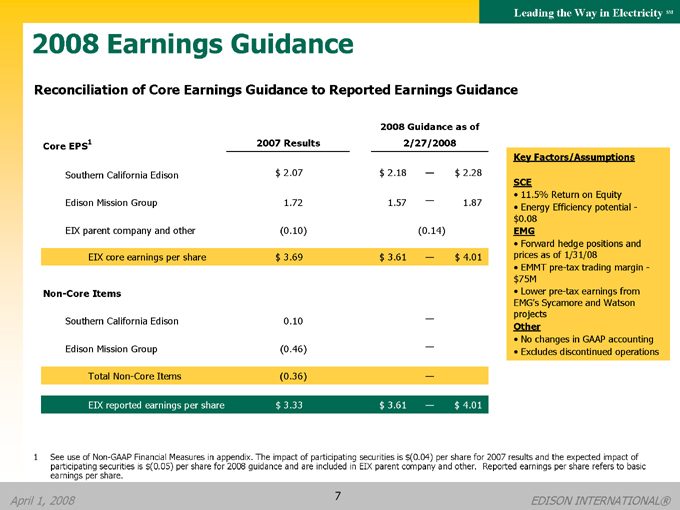

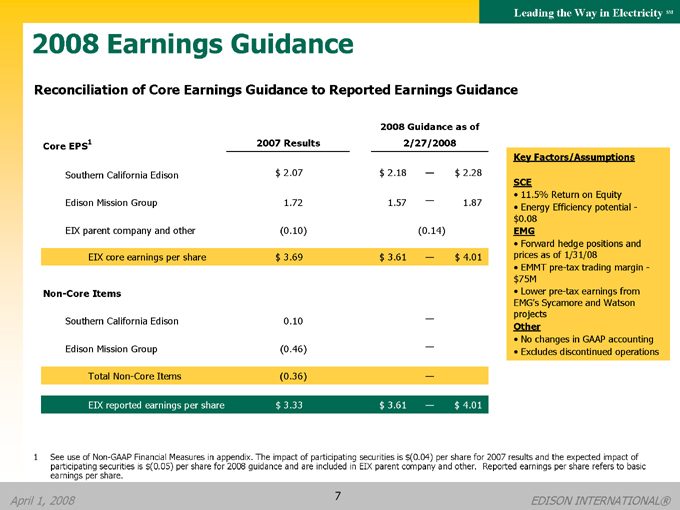

2008 Earnings Guidance

Reconciliation of Core Earnings Guidance to Reported Earnings Guidance

Core EPS1 2007 Results 2008 Guidance as of 2/27/2008

Southern California Edison $2.07 $2.18 — $2.28

Edison Mission Group 1.72 1.57 — 1.87

EIX parent company and other (0.10) (0.14)

EIX core earnings per share $3.69 $3.61 — $4.01

Non-Core Items

Southern California Edison 0.10 —

Edison Mission Group (0.46) —

Total Non-Core Items (0.36) —

EIX reported earnings per share $3.33 $3.61 — $4.01

Key Factors/Assumptions

SCE

11.5% Return on Equity

Energy Efficiency potential -$0.08

EMG

Forward hedge positions and prices as of 1/31/08

EMMT pre-tax trading margin -$75M

Lower pre-tax earnings from EMG’s Sycamore and Watson projects

Other

No changes in GAAP accounting

Excludes discontinued operations

1 See use of Non-GAAP Financial Measures in appendix. The impact of participating securities is $(0.04) per share for 2007 results and the expected impact of participating securities is $(0.05) per share for 2008 guidance and are included in EIX parent company and other. Reported earnings per share refers to basic earnings per share.

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Southern California Edison (SCE)

An Investor-Owned Electric Utility

April 1, 2008

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

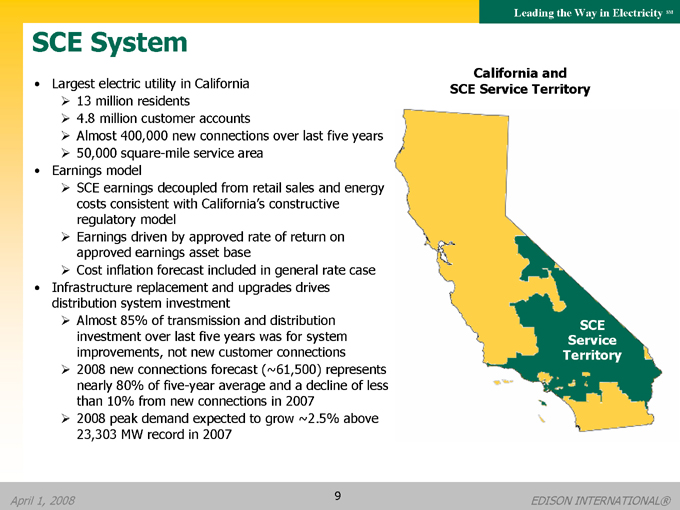

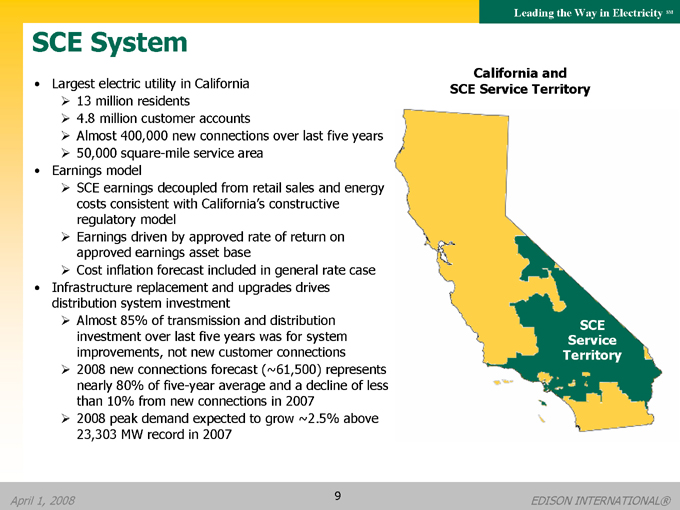

SCE System

Largest electric utility in California

13 million residents

4.8 million customer accounts

Almost 400,000 new connections over last five years

50,000 square-mile service area Earnings model

SCE earnings decoupled from retail sales and energy costs consistent with California’s constructive regulatory model

Earnings driven by approved rate of return on approved earnings asset base

Cost inflation forecast included in general rate case Infrastructure replacement and upgrades drives distribution system investment

Almost 85% of transmission and distribution investment over last five years was for system improvements, not new customer connections

2008 new connections forecast (~61,500) represents nearly 80% of five-year average and a decline of less than 10% from new connections in 2007

2008 peak demand expected to grow ~2.5% above 23,303 MW record in 2007

California and SCE Service Territory

SCE Service Territory

April 1, 2008

EDISON INTERNATIONAL®

9

Leading the Way in Electricity SM

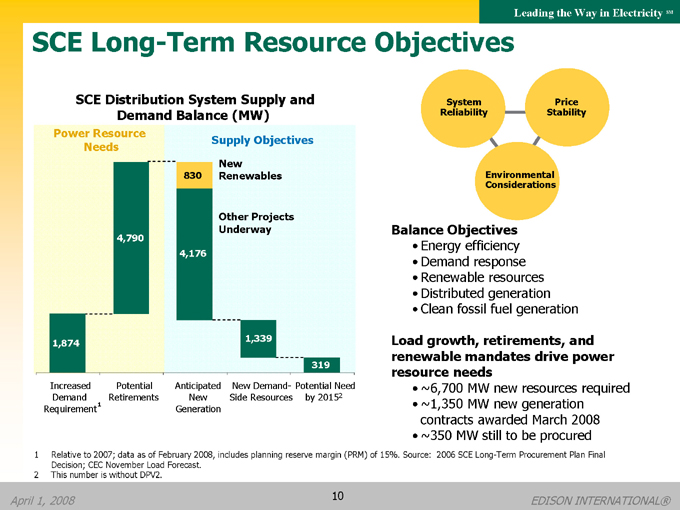

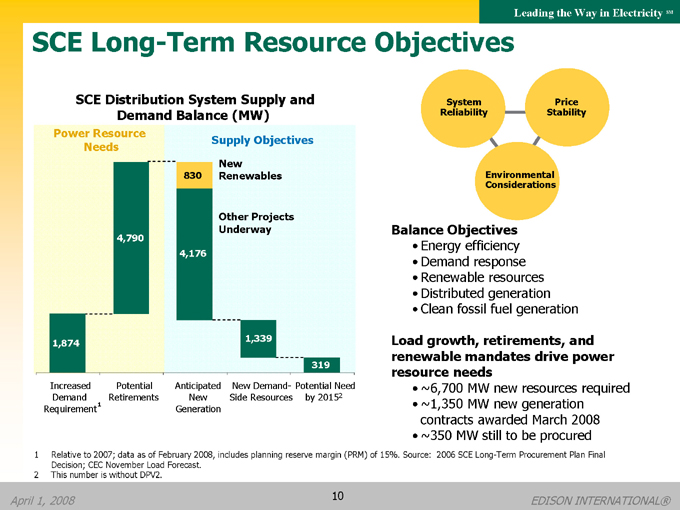

SCE Long-Term Resource Objectives

SCE Distribution System Supply and Demand Balance (MW)

Power Resource Needs

Increased Demand Requirement1

1,874

Potential Retirements

4,790

Supply Objectives

Anticipated New Generation

4,176

Other Projects Underway

830

New Renewables

New Demand-Side Resources

1,339

Potential Need by 20152

319

System Reliability

Price Stability

Environmental Considerations

Balance Objectives

Energy efficiency

Demand response

Renewable resources

Distributed generation

Clean fossil fuel generation

Load growth, retirements, and renewable mandates drive power resource needs

~6,700 MW new resources required

~1,350 MW new generation contracts awarded March 2008

~350 MW still to be procured

1 Relative to 2007; data as of February 2008, includes planning reserve margin (PRM) of 15%. Source: 2006 SCE Long-Term Procurement Plan Final Decision; CEC November Load Forecast.

2 | | This number is without DPV2. |

April 1, 2008

EDISON INTERNATIONAL®

10

Leading the Way in Electricity SM

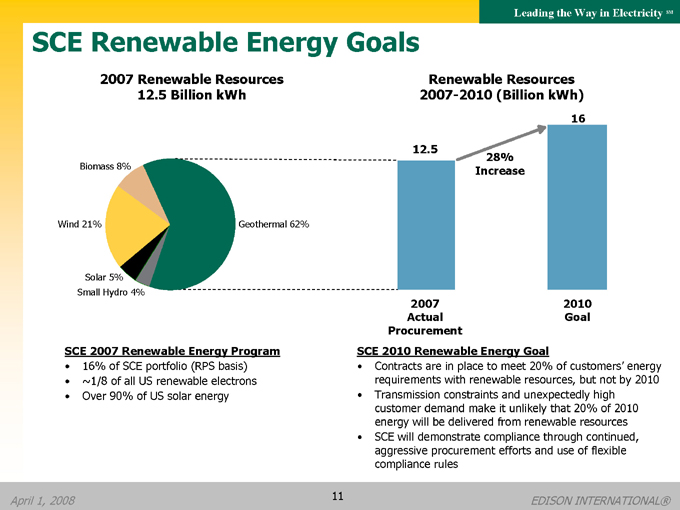

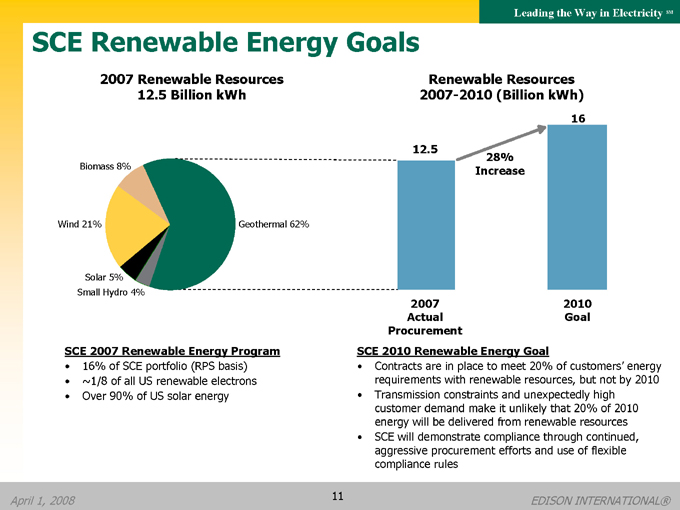

SCE Renewable Energy Goals

2007 Renewable Resources 12.5 Billion kWh

Biomass 8%

Wind 21%

Solar 5%

Small Hydro 4%

Geothermal 62%

SCE 2007 Renewable Energy Program

16% of SCE portfolio (RPS basis)

~1/8 of all US renewable electrons

Over 90% of US solar energy

Renewable Resources 2007-2010 (Billion kWh)

2007 Actual Procurement

12.5

2010 Goal

16

28% Increase

SCE 2010 Renewable Energy Goal

Contracts are in place to meet 20% of customers’ energy requirements with renewable resources, but not by 2010

Transmission constraints and unexpectedly high customer demand make it unlikely that 20% of 2010 energy will be delivered from renewable resources

SCE will demonstrate compliance through continued, aggressive procurement efforts and use of flexible compliance rules

April 1, 2008

EDISON INTERNATIONAL®

11

Leading the Way in Electricity SM

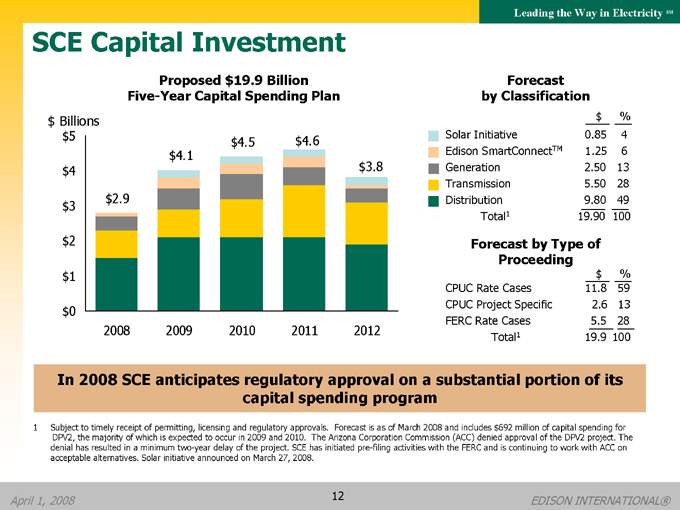

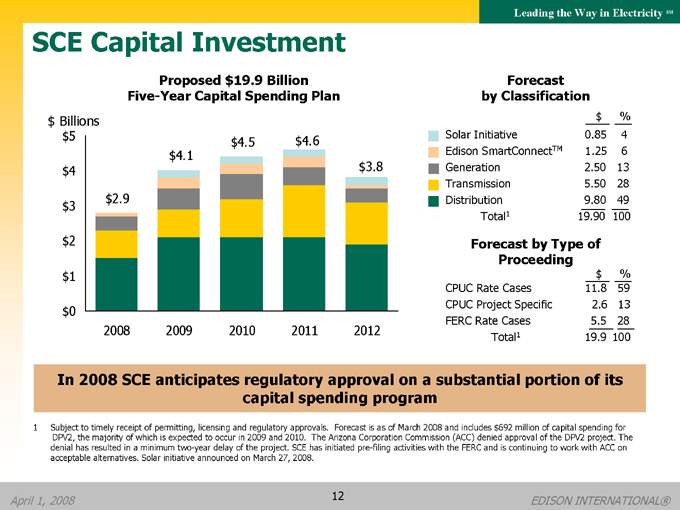

SCE Capital Investment

Proposed $19.9 Billion Five-Year Capital Spending Plan $ Billions $5 $4 $3 $2 $1 $0

2008 $2.9

2009 $4.1

2010 $4.5

2011 $4.6

2012 $3.8

Forecast by Classification

$%

Solar Initiative 0.85 4

Edison SmartConnectTM 1.25 6

Generation 2.50 13

Transmission 5.50 28

Distribution 9.80 49

Total1 19.90 100

Forecast by Type of Proceeding

$%

CPUC Rate Cases 11.8 59

CPUC Project Specific 2.6 13

FERC Rate Cases 5.5 28

Total1 19.9 100

In 2008 SCE anticipates regulatory approval on a substantial portion of its capital spending program

1 Subject to timely receipt of permitting, licensing and regulatory approvals. Forecast is as of March 2008 and includes $692 million of capital spending for DPV2, the majority of which is expected to occur in 2009 and 2010. The Arizona Corporation Commission (ACC) denied approval of the DPV2 project. The denial has resulted in a minimum two-year delay of the project. SCE has initiated pre-filing activities with the FERC and is continuing to work with ACC on acceptable alternatives. Solar initiative announced on March 27, 2008.

April 1, 2008

EDISON INTERNATIONAL®

12

Leading the Way in Electricity SM

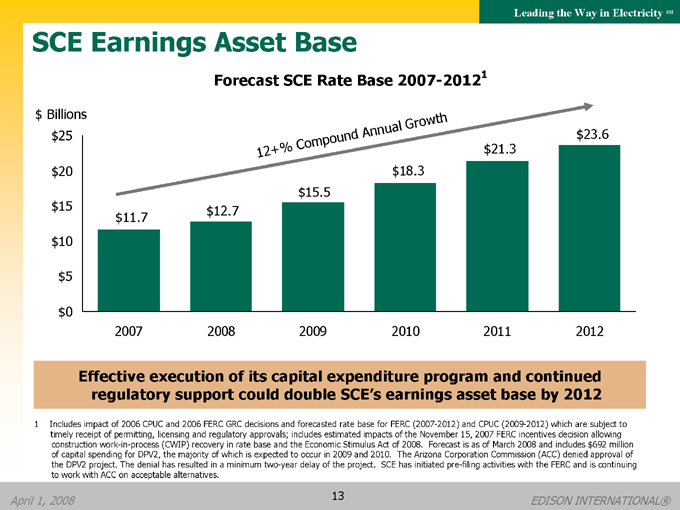

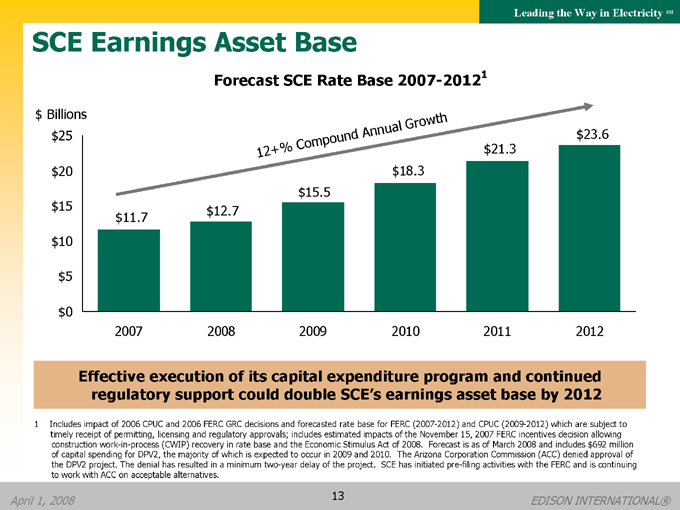

SCE Earnings Asset Base

Forecast SCE Rate Base 2007-20121 $ Billions $25 $20 $15 $10 $5 $0

2007 $11.7

2008 $12.7

2009 $15.5

2010 $18.3

2011 $21.3

2012 $23.6

12+% Compound Annual Growth

Effective execution of its capital expenditure program and continued regulatory support could double SCE’s earnings asset base by 2012

1 Includes impact of 2006 CPUC and 2006 FERC GRC decisions and forecasted rate base for FERC (2007-2012) and CPUC (2009-2012) which are subject to timely receipt of permitting, licensing and regulatory approvals; includes estimated impacts of the November 15, 2007 FERC incentives decision allowing construction work-in-process (CWIP) recovery in rate base and the Economic Stimulus Act of 2008. Forecast is as of March 2008 and includes $692 million of capital spending for DPV2, the majority of which is expected to occur in 2009 and 2010. The Arizona Corporation Commission (ACC) denied approval of the DPV2 project. The denial has resulted in a minimum two-year delay of the project. SCE has initiated pre-filing activities with the FERC and is continuing to work with ACC on acceptable alternatives.

April 1, 2008

EDISON INTERNATIONAL®

13

Leading the Way in Electricity SM

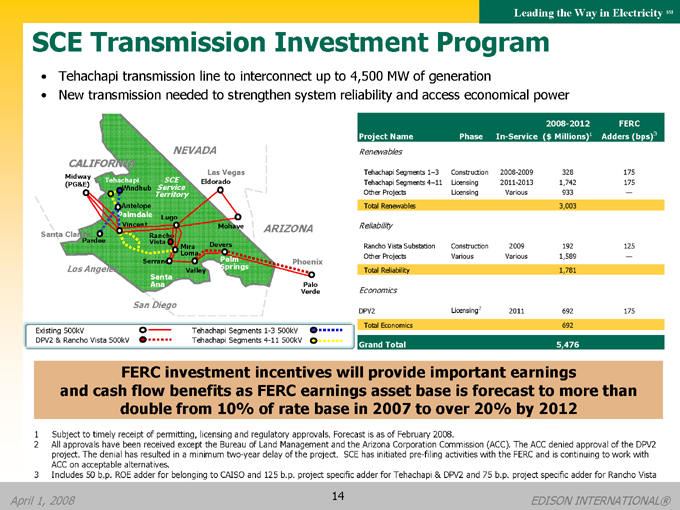

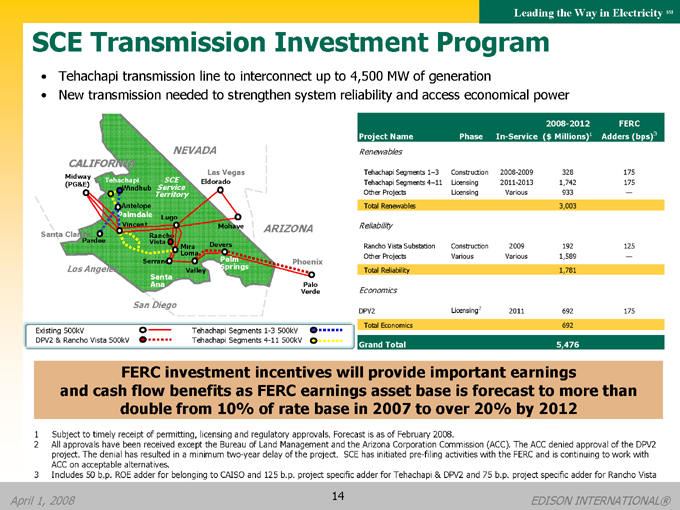

SCE Transmission Investment Program

Tehachapi transmission line to interconnect up to 4,500 MW of generation

New transmission needed to strengthen system reliability and access economical power

NEVADA

CALIFORNIA

Midway (PG&E)

Tehachapi Windhub

Antelope

Palmdale

Vincent

SCE Service Territory

Las Vegas

Eldorado

Mohave

Lugo

Santa Clarita

Pardee

Los Angeles

San Diego

Rancho Vista

Serrano

Santa Ana

Mira Devers Loma

Palm Springs

Valley

Phoenix

Palo Verde

ARIZONA

Existing 500kV

DPV2 & Rancho Vista 500kV

Tehachapi Segments 1-3 500kV Tehachapi Segments 4-11 500kV

Project Name Phase In-Service 2008-2012 ($ Millions) 1 FERC Adders (bps)3

Renewables

Tehachapi Segments 1–3 Construction 2008-2009 328 175

Tehachapi Segments 4–11 Licensing 2011-2013 1,742 175

Other Projects Licensing Various 933 —

Total Renewables 3,003

Reliability

Rancho Vista Substation Construction 2009 192 125

Other Projects Various Various 1,589 —

Total Reliability 1,781

Economics

DPV2 Licensing2 2011 692 175

Total Economics 692

Grand Total 5,476

FERC investment incentives will provide important earnings and cash flow benefits as FERC earnings asset base is forecast to more than double from 10% of rate base in 2007 to over 20% by 2012

1 | | Subject to timely receipt of permitting, licensing and regulatory approvals. Forecast is as of February 2008. |

2 All approvals have been received except the Bureau of Land Management and the Arizona Corporation Commission (ACC). The ACC denied approval of the DPV2 project. The denial has resulted in a minimum two-year delay of the project. SCE has initiated pre-filing activities with the FERC and is continuing to work with ACC on acceptable alternatives.

3 Includes 50 b.p. ROE adder for belonging to CAISO and 125 b.p. project specific adder for Tehachapi & DPV2 and 75 b.p. project specific adder for Rancho Vista

April 1, 2008

EDISON INTERNATIONAL®

14

Leading the Way in Electricity SM

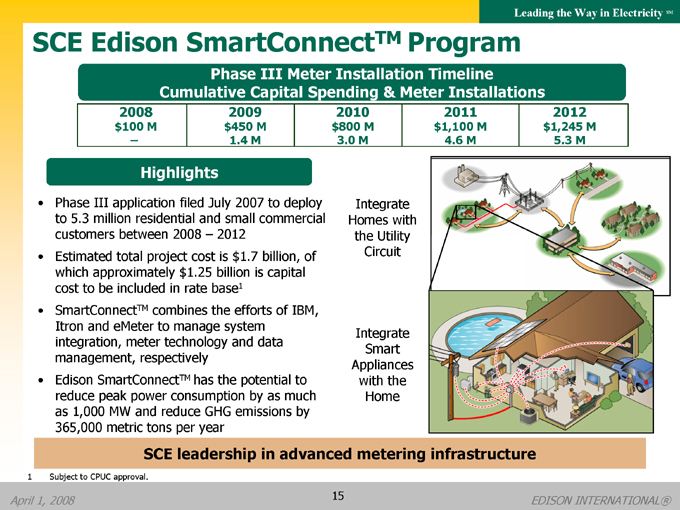

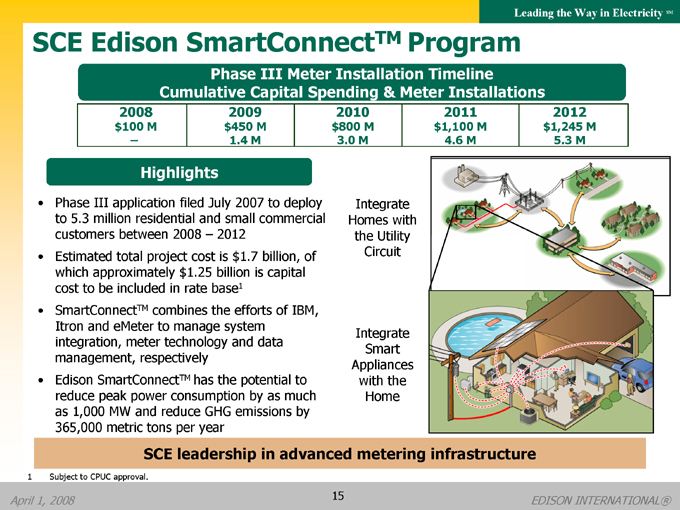

SCE Edison SmartConnectTM Program

Phase III Meter Installation Timeline Cumulative Capital Spending & Meter Installations

2008 2009 2010 2011 2012

$100 M $450 M $800 M $1,100 M $1,245 M

– 1.4 M 3.0 M 4.6 M 5.3 M

Highlights

Phase III application filed July 2007 to deploy to 5.3 million residential and small commercial customers between 2008 – 2012 Estimated total project cost is $1.7 billion, of which approximately $1.25 billion is capital cost to be included in rate base1 SmartConnectTM combines the efforts of IBM, Itron and eMeter to manage system integration, meter technology and data management, respectively Edison SmartConnectTM has the potential to reduce peak power consumption by as much as 1,000 MW and reduce GHG emissions by 365,000 metric tons per year

Integrate Homes with the Utility Circuit

Integrate Smart Appliances with the Home

SCE leadership in advanced metering infrastructure

1 | | Subject to CPUC approval. |

April 1, 2008

EDISON INTERNATIONAL®

15

Leading the Way in Electricity SM

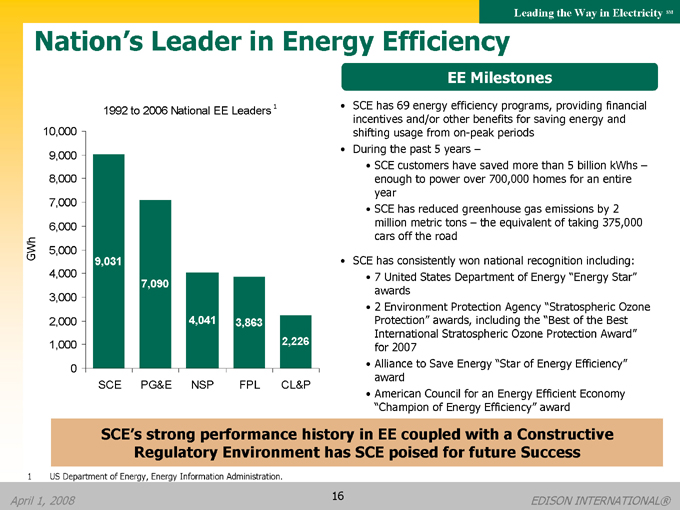

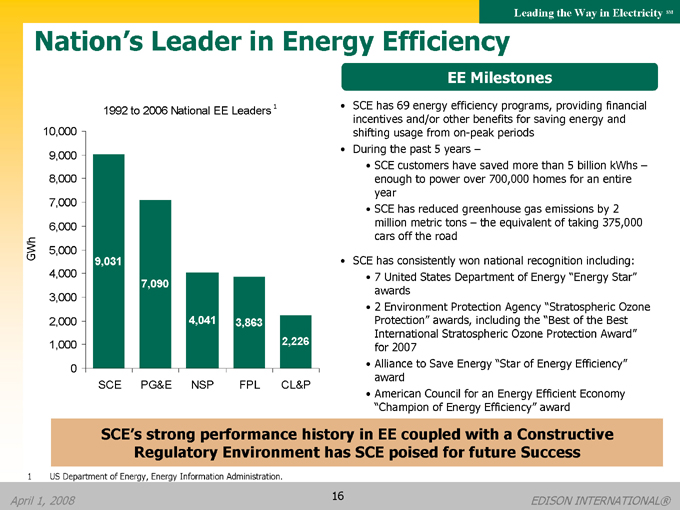

Nation’s Leader in Energy Efficiency

1992 to 2006 National EE Leaders 1

GWh

10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0

SCE

9,031

PG&E

7,090

NSP

4,041

EE Milestones

SCE has 69 energy efficiency programs, providing financial incentives and/or other benefits for saving energy and shifting usage from on-peak periods During the past 5 years –

SCE customers have saved more than 5 billion kWhs –enough to power over 700,000 homes for an entire year

SCE has reduced greenhouse gas emissions by 2 million metric tons – the equivalent of taking 375,000 cars off the road SCE has consistently won national recognition including:

7 | | United States Department of Energy “Energy Star” awards |

2 Environment Protection Agency “Stratospheric Ozone Protection” awards, including the “Best of the Best International Stratospheric Ozone Protection Award” for 2007

Alliance to Save Energy “Star of Energy Efficiency” award

American Council for an Energy Efficient Economy “Champion of Energy Efficiency” award

Potential Earnings Profile by Year3

SCE’s strong performance history in EE coupled with a Constructive Regulatory Environment has SCE poised for future Success

1 | | US Department of Energy, Energy Information Administration. |

April 1, 2008

EDISON INTERNATIONAL®

16

Leading the Way in Electricity SM

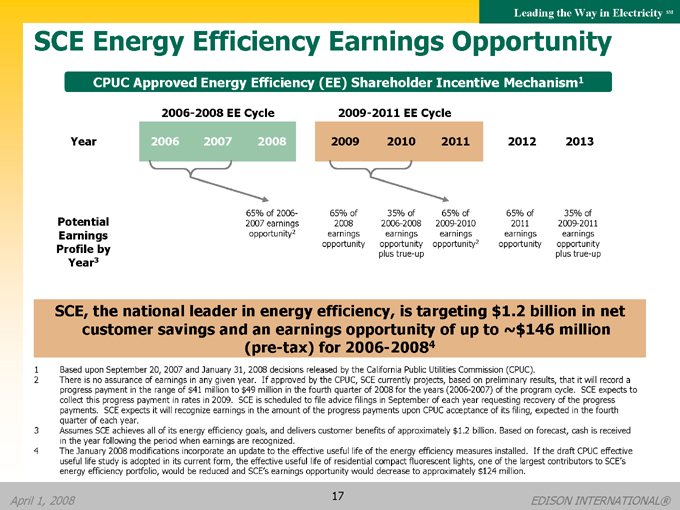

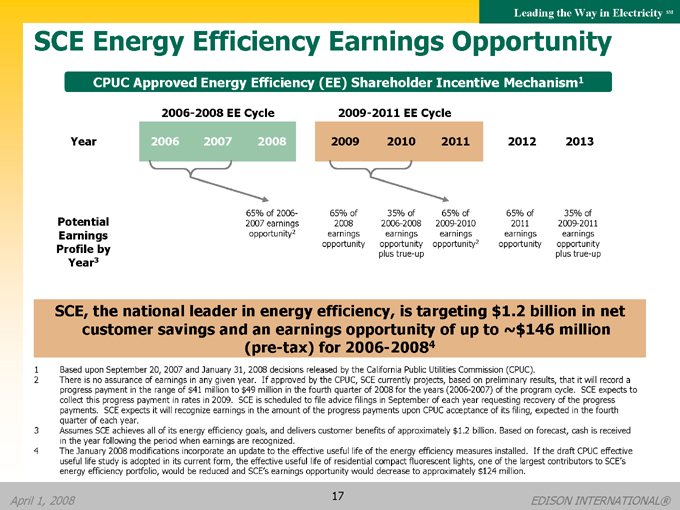

SCE Energy Efficiency Earnings Opportunity

CPUC Approved Energy Efficiency (EE) Shareholder Incentive Mechanism1

2006-2008 EE Cycle

Year

2006 2007 2008

65% of 2006-2007 earnings opportunity2

2009-2011 EE Cycle

2009 2010 2011 2012 2013

65% of 2008 earnings opportunity

35% of 2006-2008 earnings opportunity plus true-up

65% of 2009-2010 earnings opportunity2

65% of 2011 earnings opportunity

35% of 2009-2011 earnings opportunity plus true-up

SCE, the national leader in energy efficiency, is targeting $1.2 billion in net customer savings and an earnings opportunity of up to ~$146 million (pre-tax) for 2006-20084

1 Based upon September 20, 2007 and January 31, 2008 decisions released by the California Public Utilities Commission (CPUC).

2 There is no assurance of earnings in any given year. If approved by the CPUC, SCE currently projects, based on preliminary results, that it will record a progress payment in the range of $41 million to $49 million in the fourth quarter of 2008 for the years (2006-2007) of the program cycle. SCE expects to collect this progress payment in rates in 2009. SCE is scheduled to file advice filings in September of each year requesting recovery of the progress payments. SCE expects it will recognize earnings in the amount of the progress payments upon CPUC acceptance of its filing, expected in the fourth quarter of each year.

3 Assumes SCE achieves all of its energy efficiency goals, and delivers customer benefits of approximately $1.2 billion. Based on forecast, cash is received in the year following the period when earnings are recognized.

4 The January 2008 modifications incorporate an update to the effective useful life of the energy efficiency measures installed. If the draft CPUC effective useful life study is adopted in its current form, the effective useful life of residential compact fluorescent lights, one of the largest contributors to SCE’s energy efficiency portfolio, would be reduced and SCE’s earnings opportunity would decrease to approximately $124 million.

April 1, 2008

EDISON INTERNATIONAL®

17

Leading the Way in Electricity SM

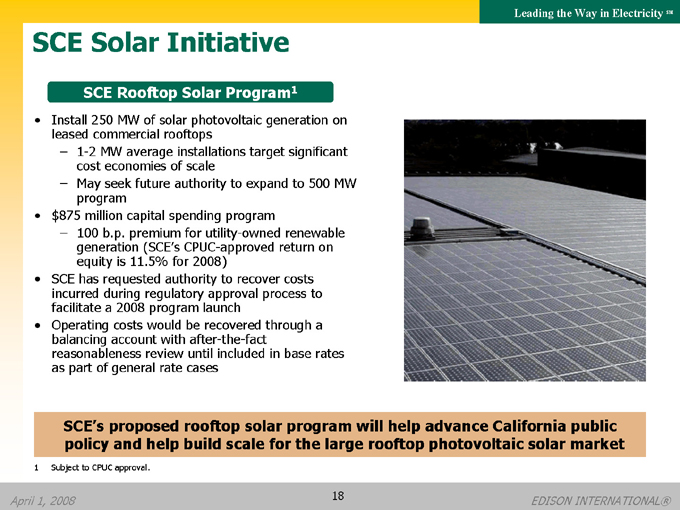

SCE Solar Initiative

SCE Rooftop Solar Program1

Install 250 MW of solar photovoltaic generation on leased commercial rooftops

– 1-2 MW average installations target significant cost economies of scale

– May seek future authority to expand to 500 MW program $875 million capital spending program

– 100 b.p. premium for utility-owned renewable generation (SCE’s CPUC-approved return on equity is 11.5% for 2008) SCE has requested authority to recover costs incurred during regulatory approval process to facilitate a 2008 program launch Operating costs would be recovered through a balancing account with after-the-fact reasonableness review until included in base rates as part of general rate cases

SCE’s proposed rooftop solar program will help advance California public policy and help build scale for the large rooftop photovoltaic solar market

1 | | Subject to CPUC approval. |

April 1, 2008

EDISON INTERNATIONAL®

18

Leading the Way in Electricity SM

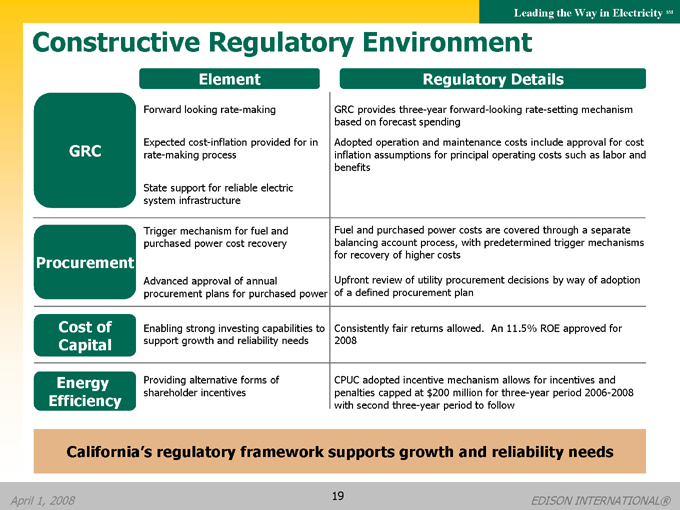

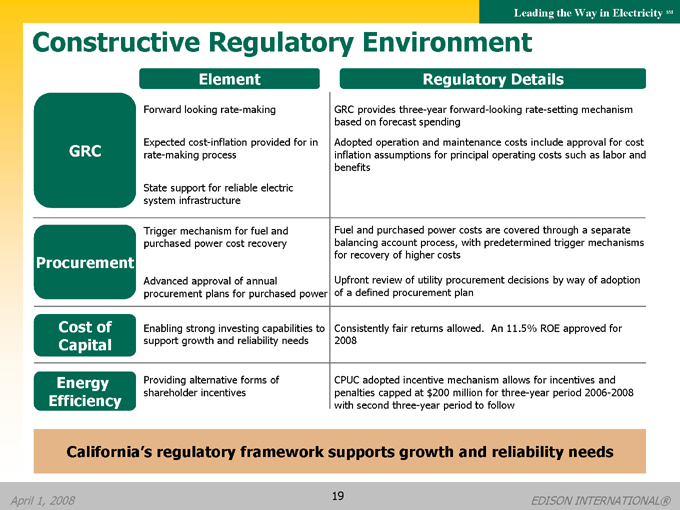

Constructive Regulatory Environment

Element Regulatory Details

Forward looking rate-making GRC provides three-year forward-looking rate-setting mechanism based on forecast spending

GRC Expected cost-inflation provided for in rate-making process Adopted operation and maintenance costs include approval for cost inflation assumptions for principal operating costs such as labor and benefits

State support for reliable electric system infrastructure

Procurement Trigger mechanism for fuel and purchased power cost recovery Fuel and purchased power costs are covered through a separate balancing account process, with predetermined trigger mechanisms for recovery of higher costs

Advanced approval of annual procurement plans for purchased power Upfront review of utility procurement decisions by way of adoption of a defined procurement plan

Cost of Capital Enabling strong investing capabilities to support growth and reliability needs Consistently fair returns allowed. An 11.5% ROE approved for 2008

Energy Efficiency Providing alternative forms of shareholder incentives CPUC adopted incentive mechanism allows for incentives and penalties capped at $200 million for three-year period 2006-2008 with second three-year period to follow

California’s regulatory framework supports growth and reliability needs

April 1, 2008

EDISON INTERNATIONAL®

19

Leading the Way in Electricity SM

Edison Mission Group (EMG)

A Competitive Power Generation Company

April 1, 2008

EDISON INTERNATIONAL®

20

Leading the Way in Electricity SM

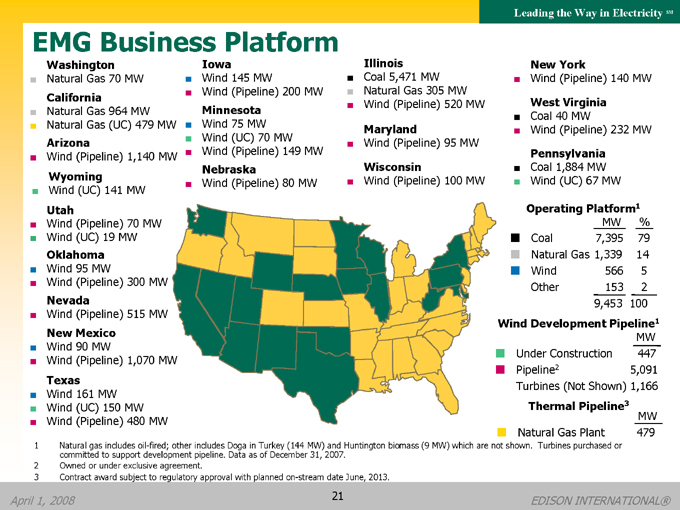

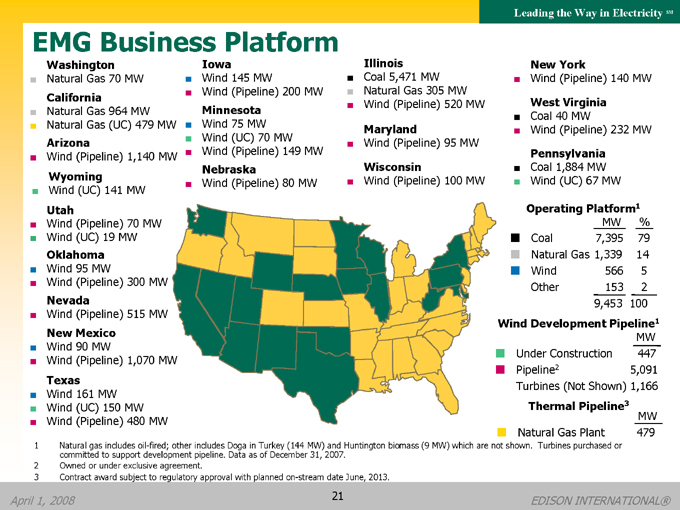

EMG Business Platform

Washington

Natural Gas 70 MW

California

Natural Gas 964 MW Natural Gas (UC) 479 MW

Arizona

Wind (Pipeline) 1,140 MW

Wyoming

Wind (UC) 141 MW

Utah

Wind (Pipeline) 70 MW Wind (UC) 19 MW

Oklahoma

Wind 95 MW

Wind (Pipeline) 300 MW

Nevada

Wind (Pipeline) 515 MW

New Mexico

Wind 90 MW

Wind (Pipeline) 1,070 MW

Texas

Wind 161 MW Wind (UC) 150 MW Wind (Pipeline) 480 MW

Iowa

Wind 145 MW

Wind (Pipeline) 200 MW

Minnesota

Wind 75 MW Wind (UC) 70 MW Wind (Pipeline) 149 MW

Nebraska

Wind (Pipeline) 80 MW

Illinois

Coal 5,471 MW Natural Gas 305 MW Wind (Pipeline) 520 MW

Maryland

Wind (Pipeline) 95 MW

Wisconsin

Wind (Pipeline) 100 MW

New York

Wind (Pipeline) 140 MW

West Virginia

Coal 40 MW

Wind (Pipeline) 232 MW

Pennsylvania

Coal 1,884 MW Wind (UC) 67 MW

Operating Platform1

MW %

Coal 7,395 79

Natural Gas 1,339 14

Wind 566 5

Other 153 2

9,453 100

Wind Development Pipeline1

MW

Under Construction 447

Pipeline2 5,091

Turbines (Not Shown) 1,166

Thermal Pipeline3

MW

Natural Gas Plant 479

1 Natural gas includes oil-fired; other includes Doga in Turkey (144 MW) and Huntington biomass (9 MW) which are not shown. Turbines purchased or committed to support development pipeline. Data as of December 31, 2007.

2 | | Owned or under exclusive agreement. |

3 | | Contract award subject to regulatory approval with planned on-stream date June, 2013. |

April 1, 2008

EDISON INTERNATIONAL®

21

Leading the Way in Electricity SM

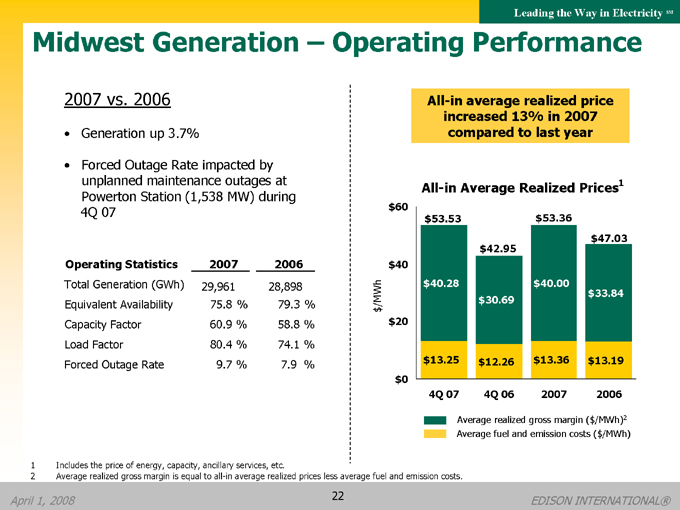

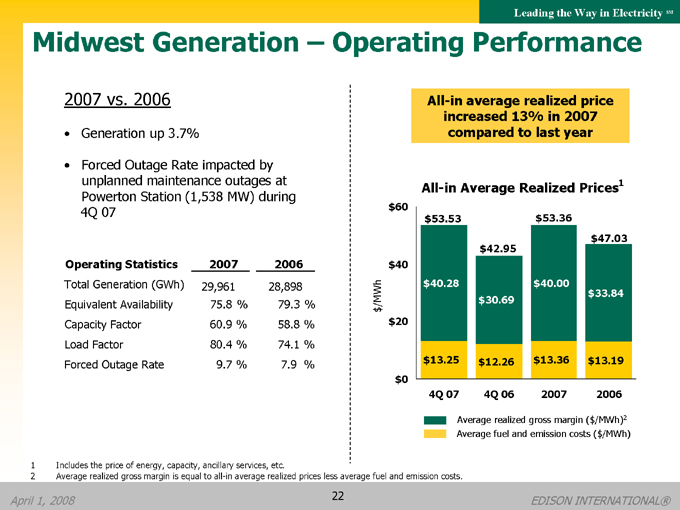

Midwest Generation – Operating Performance

2007 vs. 2006

Generation up 3.7%

Forced Outage Rate impacted by unplanned maintenance outages at Powerton Station (1,538 MW) during 4Q 07

Operating Statistics 2007 2006

Total Generation (GWh) 29,961 28,898

Equivalent Availability 75.8 % 79.3 %

Capacity Factor 60.9 % 58.8 %

Load Factor 80.4 % 74.1 %

Forced Outage Rate 9.7 % 7.9 %

All-in average realized price increased 13% in 2007 compared to last year

All-in Average Realized Prices1 $/MWh $60 $40 $20 $0

4Q 07 4Q 06 2007 2006 $53.53 $40.28 $13.25 $42.95 $30.69 $12.26 $53.36 $40.00 $13.36 $47.03 $33.84 $13.19

Average realized gross margin ($/MWh)2 Average fuel and emission costs ($/MWh)

1 | | Includes the price of energy, capacity, ancillary services, etc. |

2 | | Average realized gross margin is equal to all-in average realized prices less average fuel and emission costs. |

April 1, 2008

EDISON INTERNATIONAL®

22

Leading the Way in Electricity SM

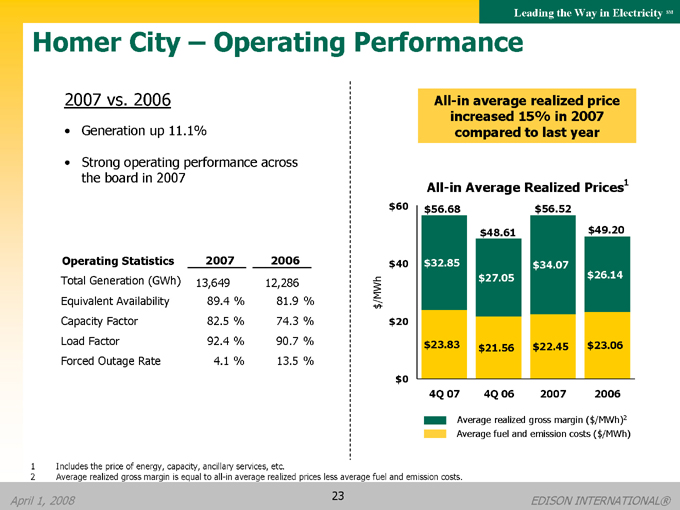

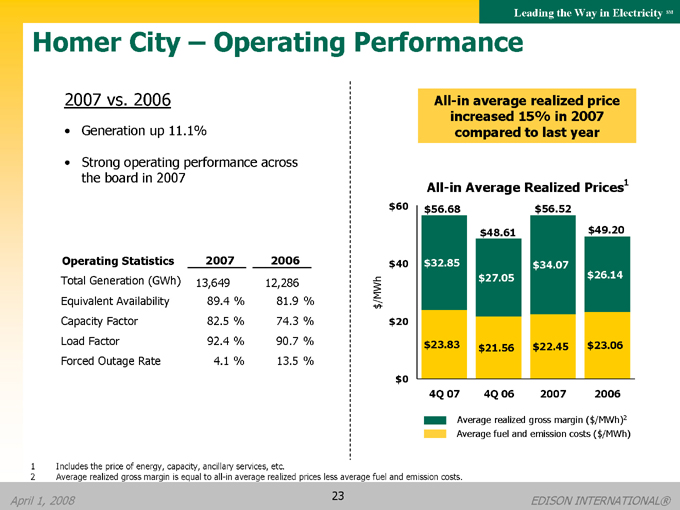

Homer City – Operating Performance

2007 vs. 2006

Generation up 11.1%

Strong operating performance across the board in 2007

Operating Statistics 2007 2006

Total Generation (GWh) 13,649 12,286

Equivalent Availability 89.4 % 81.9 %

Capacity Factor 82.5 % 74.3 %

Load Factor 92.4 % 90.7 %

Forced Outage Rate 4.1 % 13.5 %

All-in average realized price increased 15% in 2007 compared to last year

All-in Average Realized Prices1 $/MWh $60 $40 $20 $0

4Q 07 4Q 06 2007 2006 $56.68 $32.85 $23.83 $48.61

$27.05

$21.56 $56.52 $34.07 $22.45 $49.20

$26.14

$23.06

Average realized gross margin ($/MWh)2 Average fuel and emission costs ($/MWh)

1 | | Includes the price of energy, capacity, ancillary services, etc. |

2 | | Average realized gross margin is equal to all-in average realized prices less average fuel and emission costs. |

April 1, 2008

EDISON INTERNATIONAL®

23

Leading the Way in Electricity SM

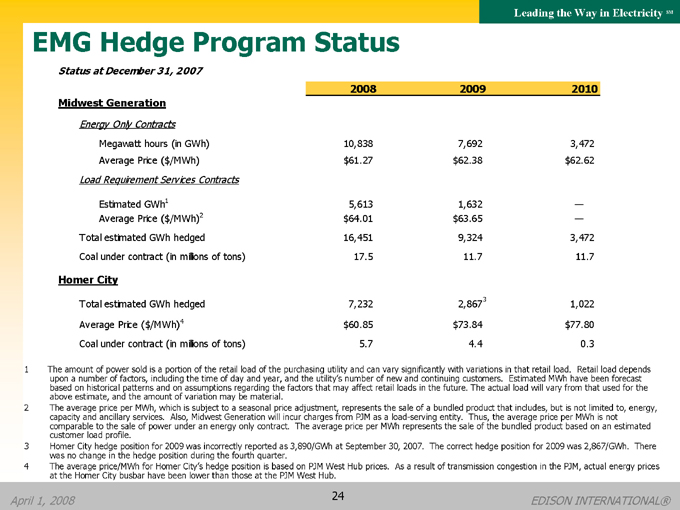

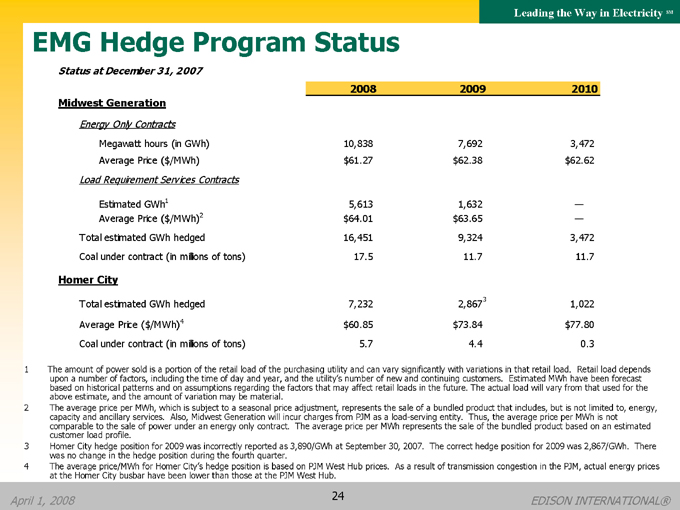

EMG Hedge Program Status

Status at December 31, 2007

2008 2009 2010 Midwest Generation

Energy Only Contracts

Megawatt hours (in GWh) 10,838 7,692 3,472 Average Price ($/MWh) $61.27 $62.38 $62.62

Load Requirement Services Contracts

Estimated GWh1 5,613 1,632 —Average Price ($/MWh)2 $64.01 $63.65 —Total estimated GWh hedged 16,451 9,324 3,472 Coal under contract (in millions of tons) 17.5 11.7 11.7

Homer City

Total estimated GWh hedged 7,232 2,8673 1,022 Average Price ($/MWh)4 $60.85 $73.84 $77.80 Coal under contract (in millions of tons) 5.7 4.4 0.3

1 The amount of power sold is a portion of the retail load of the purchasing utility and can vary significantly with variations in that retail load. Retail load depends upon a number of factors, including the time of day and year, and the utility’s number of new and continuing customers. Estimated MWh have been forecast based on historical patterns and on assumptions regarding the factors that may affect retail loads in the future. The actual load will vary from that used for the above estimate, and the amount of variation may be material.

2 The average price per MWh, which is subject to a seasonal price adjustment, represents the sale of a bundled product that includes, but is not limited to, energy, capacity and ancillary services. Also, Midwest Generation will incur charges from PJM as a load-serving entity. Thus, the average price per MWh is not comparable to the sale of power under an energy only contract. The average price per MWh represents the sale of the bundled product based on an estimated customer load profile.

3 Homer City hedge position for 2009 was incorrectly reported as 3,890/GWh at September 30, 2007. The correct hedge position for 2009 was 2,867/GWh. There was no change in the hedge position during the fourth quarter.

4 The average price/MWh for Homer City’s hedge position is based on PJM West Hub prices. As a result of transmission congestion in the PJM, actual energy prices at the Homer City busbar have been lower than those at the PJM West Hub.

April 1, 2008

EDISON INTERNATIONAL®

24

Leading the Way in Electricity SM

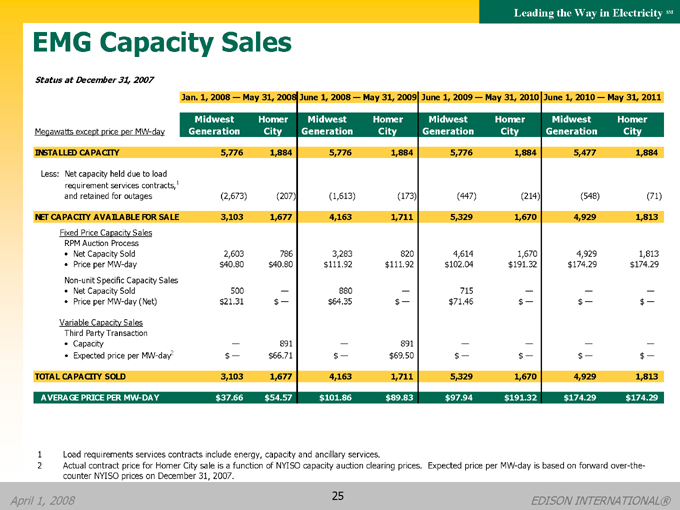

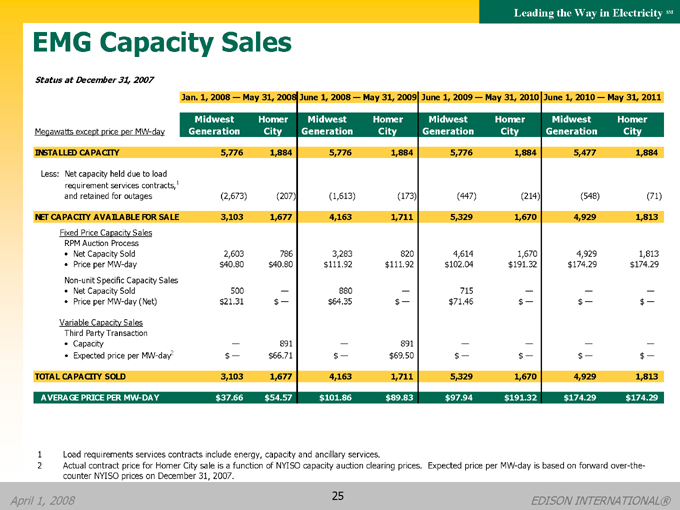

EMG Capacity Sales

Status at December 31, 2007

Jan. 1, 2008 — May 31, 2008 June 1, 2008 — May 31, 2009 June 1, 2009 — May 31, 2010 June 1, 2010 — May 31, 2011

Megawatts except price per MW-day Midwest Generation Homer City Midwest Generation Homer City Midwest Generation Homer City Midwest Generation Homer City

INSTALLED CAPACITY 5,776 1,884 5,776 1,884 5,776 1,884 5,477 1,884

Less: Net capacity held due to load requirement services contracts,1 and retained for outages (2,673) (207) (1,613) (173) (447) (214) (548) (71)

NET CAPACITY AVAILABLE FOR SALE 3,103 1,677 4,163 1,711 5,329 1,670 4,929 1,813

Fixed Price Capacity Sales

RPM Auction Process

Net Capacity Sold 2,603 786 3,283 820 4,614 1,670 4,929 1,813

Price per MW-day $40.80 $40.80 $111.92 $111.92 $102.04 $191.32 $174.29 $174.29

Non-unit Specific Capacity Sales

Net Capacity Sold 500 — 880 — 715 — — —

Price per MW-day (Net) $21.31 $— $64.35 $— $71.46 $— $— $—

Variable Capacity Sales

Third Party Transaction

Capacity — 891 — 891 — — — —

Expected price per MW-day2 $— $66.71 $— $69.50 $— $— $— $—

TOTAL CAPACITY SOLD 3,103 1,677 4,163 1,711 5,329 1,670 4,929 1,813

AVERAGE PRICE PER MW-DAY $37.66 $54.57 $101.86 $89.83 $97.94 $191.32 $174.29 $174.29

1 | | Load requirements services contracts include energy, capacity and ancillary services. |

2 Actual contract price for Homer City sale is a function of NYISO capacity auction clearing prices. Expected price per MW-day is based on forward over-the-counter NYISO prices on December 31, 2007.

April 1, 2008

EDISON INTERNATIONAL®

25

Leading the Way in Electricity SM

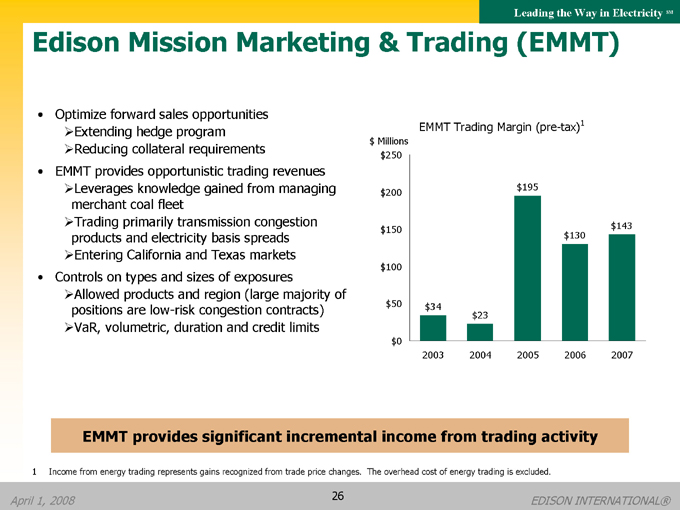

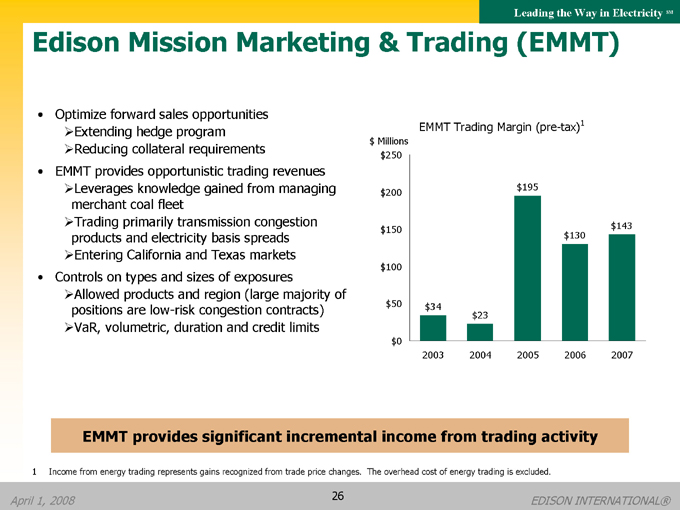

Edison Mission Marketing & Trading (EMMT)

Optimize forward sales opportunities

Extending hedge program

Reducing collateral requirements

EMMT provides opportunistic trading revenues

Leverages knowledge gained from managing merchant coal fleet

Trading primarily transmission congestion products and electricity basis spreads

Entering California and Texas markets Controls on types and sizes of exposures

Allowed products and region (large majority of positions are low-risk congestion contracts)

VaR, volumetric, duration and credit limits

EMMT Trading Margin (pre-tax)1 $ Millions $250 $200 $150 $100 $50 $0

2003 2004 2005 2006 2007 $34 $23 $195 $130 $143

EMMT provides significant incremental income from trading activity

1 Income from energy trading represents gains recognized from trade price changes. The overhead cost of energy trading is excluded.

April 1, 2008

EDISON INTERNATIONAL®

26

Leading the Way in Electricity SM

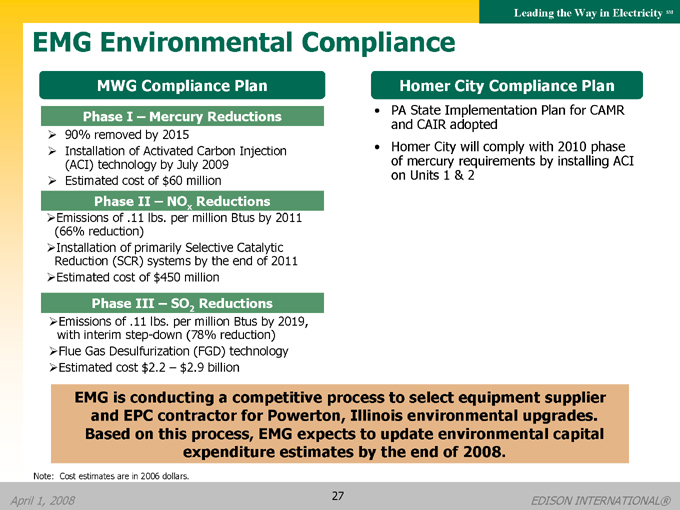

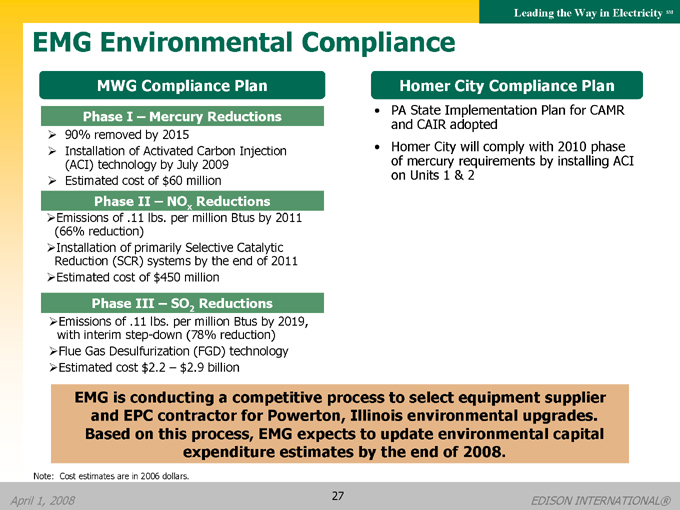

EMG Environmental Compliance

MWG Compliance Plan

Phase I – Mercury Reductions

90% removed by 2015

Installation of Activated Carbon Injection (ACI) technology by July 2009

Estimated cost of $60 million

Phase II – NOx Reductions

Emissions of .11 lbs. per million Btus by 2011 (66% reduction)

Installation of primarily Selective Catalytic Reduction (SCR) systems by the end of 2011

Estimated cost of $450 million

Phase III – SO2 Reductions

Emissions of .11 lbs. per million Btus by 2019, with interim step-down (78% reduction)

Flue Gas Desulfurization (FGD) technology

Estimated cost $2.2 – $2.9 billion

Homer City Compliance Plan

PA State Implementation Plan for CAMR and CAIR adopted Homer City will comply with 2010 phase of mercury requirements by installing ACI on Units 1 & 2

EMG is conducting a competitive process to select equipment supplier and EPC contractor for Powerton, Illinois environmental upgrades.

Based on this process, EMG expects to update environmental capital expenditure estimates by the end of 2008.

Note: Cost estimates are in 2006 dollars.

April 1, 2008

EDISON INTERNATIONAL®

27

Leading the Way in Electricity SM

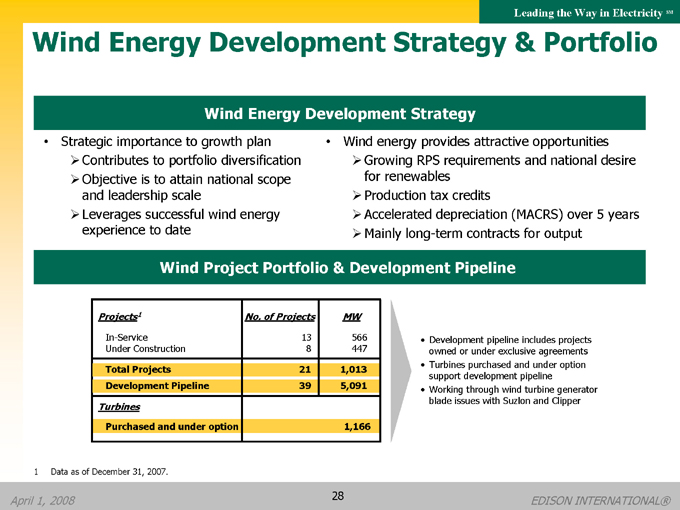

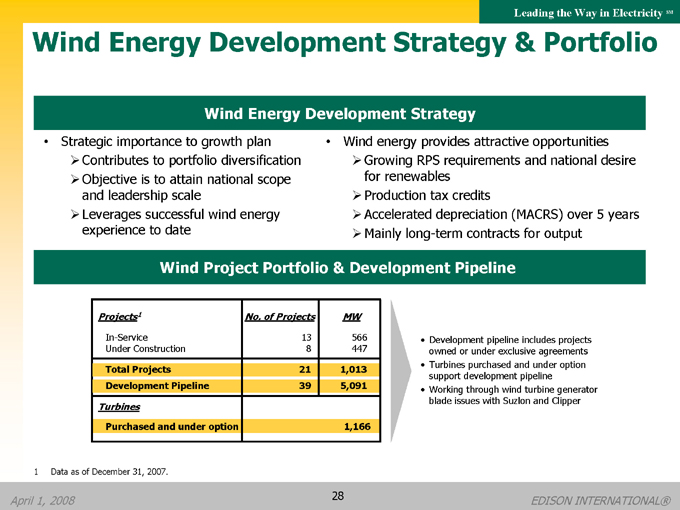

Wind Energy Development Strategy & Portfolio

Wind Energy Development Strategy

Strategic importance to growth plan

Contributes to portfolio diversification

Objective is to attain national scope and leadership scale

Leverages successful wind energy experience to date

Wind energy provides attractive opportunities

Growing RPS requirements and national desire for renewables

Production tax credits

Accelerated depreciation (MACRS) over 5 years

Mainly long-term contracts for output

Wind Project Portfolio & Development Pipeline

Projects1 No. of Projects MW

In-Service 13 566

Under Construction 8 447

Total Projects 21 1,013

Development Pipeline 39 5,091

Turbines

Purchased and under option 1,166

Development pipeline includes projects owned or under exclusive agreements Turbines purchased and under option support development pipeline Working through wind turbine generator blade issues with Suzlon and Clipper

1 | | Data as of December 31, 2007. |

April 1, 2008

EDISON INTERNATIONAL®

28

Leading the Way in Electricity SM

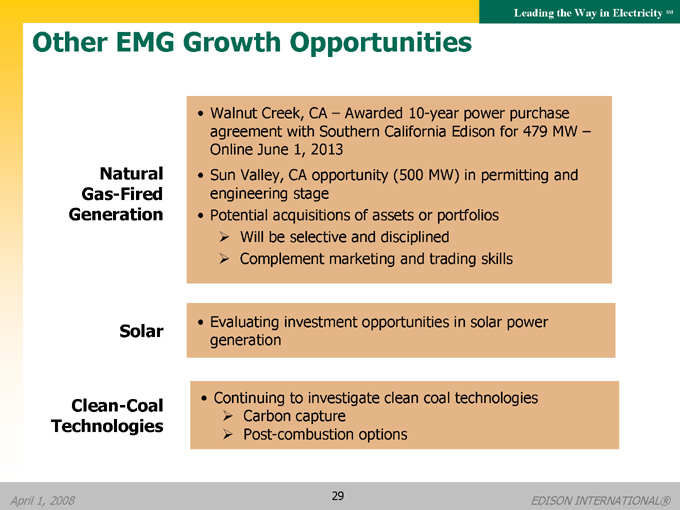

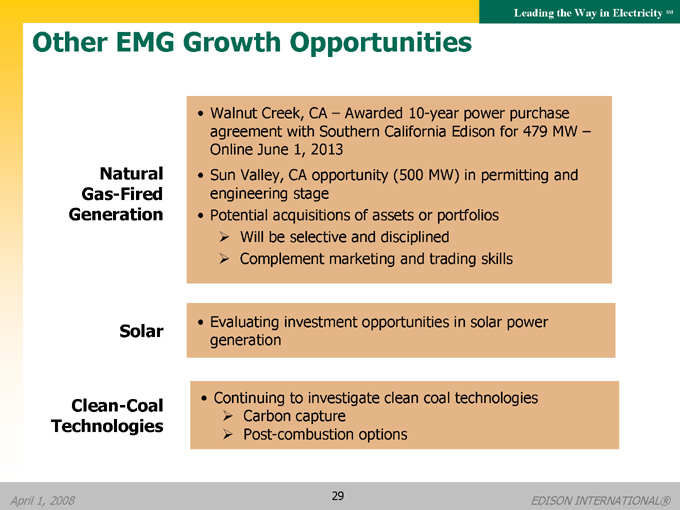

Other EMG Growth Opportunities

Natural Gas-Fired Generation

Walnut Creek, CA – Awarded 10-year power purchase agreement with Southern California Edison for 479 MW –Online June 1, 2013 Sun Valley, CA opportunity (500 MW) in permitting and engineering stage Potential acquisitions of assets or portfolios

Will be selective and disciplined

Complement marketing and trading skills

Solar

Evaluating investment opportunities in solar power generation

Clean-Coal Technologies

Continuing to investigate clean coal technologies

Carbon capture

Post-combustion options

April 1, 2008

EDISON INTERNATIONAL®

29

Leading the Way in Electricity SM

Appendix

April 1, 2008

EDISON INTERNATIONAL®

30

Leading the Way in Electricity SM

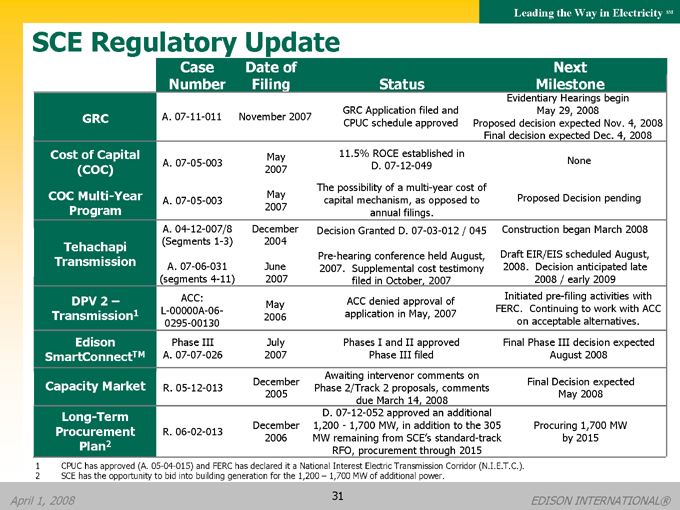

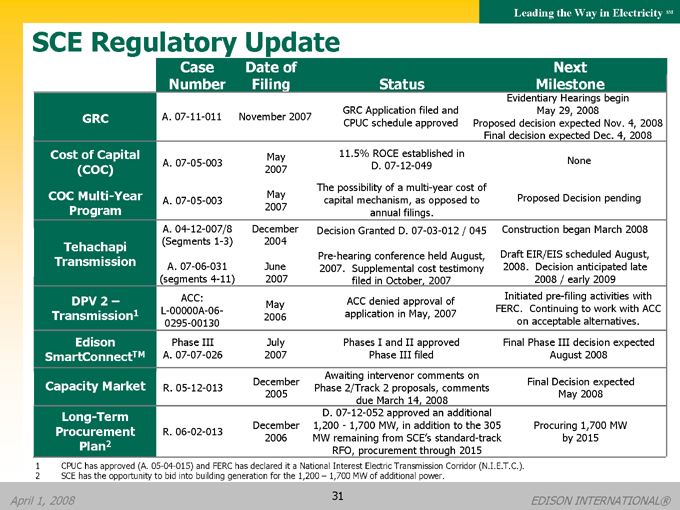

SCE Regulatory Update

Case Number Date of Filing Status Next Milestone

GRC A. 07-11-011 November 2007 GRC Application filed and CPUC schedule approved Evidentiary Hearings begin May 29, 2008 Proposed decision expected Nov. 4, 2008 Final decision expected Dec. 4, 2008

Cost of Capital A. 07-05-003 May 11.5% ROCE established in None

(COC) 2007 D. 07-12-049 The possibility of a multi-year cost of

COC Multi-Year May Proposed Decision pending

A. 07-05-003 capital mechanism, as opposed to

Program 2007

annual filings.

A. 04-12-007/8 December Decision Granted D. 07-03-012 / 045 Construction began March 2008

Tehachapi (Segments 1-3) 2004

Pre-hearing conference held August, Draft EIR/EIS scheduled August,

Transmission A. 07-06-031 June 2008. Decision anticipated late

2007. Supplemental cost testimony

(segments 4-11) 2007 filed in October, 2007 2008 / early 2009

DPV 2 – ACC: ACC denied approval of Initiated pre-filing activities with

May FERC. Continuing to work with ACC

Transmission1 L-00000A-06- application in May, 2007

2006 on acceptable alternatives.

0295-00130

Edison Phase III July Phases I and II approved Final Phase III decision expected

SmartConnectTM A. 07-07-026 2007 Phase III filed August 2008

Awaiting intervenor comments on

Capacity Market December Final Decision expected

R. 05-12-013 Phase 2/Track 2 proposals, comments

2005 May 2008

due March 14, 2008

Long-Term D. 07-12-052 approved an additional

December 1,200—1,700 MW, in addition to the 305 Procuring 1,700 MW

Procurement R. 06-02-013

2006 MW remaining from SCE’s standard-track by 2015

Plan2 RFO, procurement through 2015

1 CPUC has approved (A. 05-04-015) and FERC has declared it a National Interest Electric Transmission Corridor (N.I.E.T.C.).

2 | | SCE has the opportunity to bid into building generation for the 1,200 – 1,700 MW of additional power. |

April 1, 2008

EDISON INTERNATIONAL®

31

Leading the Way in Electricity SM

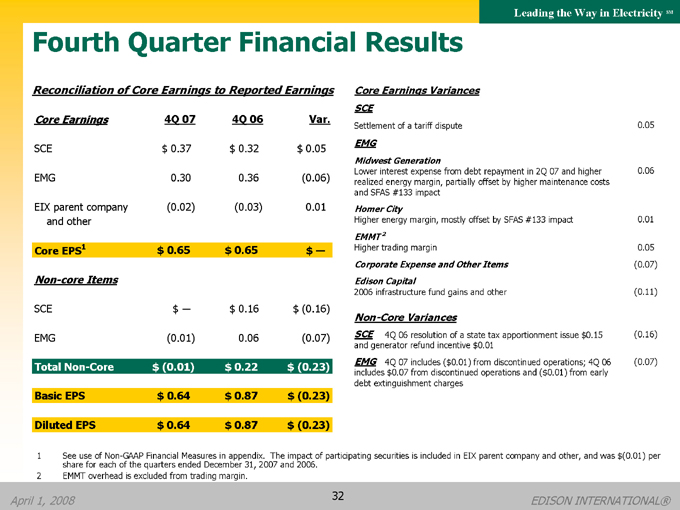

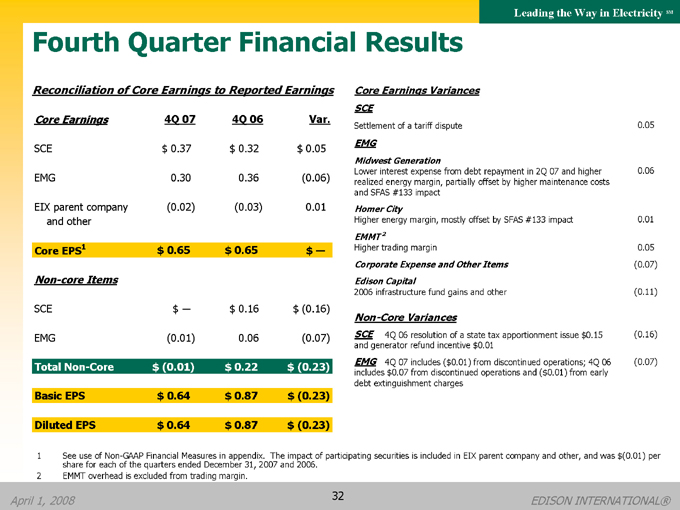

Fourth Quarter Financial Results

Reconciliation of Core Earnings to Reported Earnings

Core Earnings 4Q 07 4Q 06 Var.

SCE $0.37 $0.32 $0.05

EMG 0.30 0.36 (0.06)

EIX parent company and other (0.02) (0.03) 0.01

Core EPS1 $0.65 $0.65 $?

Non-core Items

SCE $? $0.16 $(0.16)

EMG (0.01) 0.06 (0.07)

Total Non-Core $(0.01) $0.22 $(0.23)

Basic EPS $0.64 $0.87 $(0.23)

Diluted EPS $0.64 $0.87 $(0.23)

Core Earnings Variances

SCE

Settlement of a tariff dispute 0.05

EMG

Midwest Generation

Lower interest expense from debt repayment in 2Q 07 and higher realized energy margin, partially offset by higher maintenance costs and SFAS #133 impact 0.06

Homer City

Higher energy margin, mostly offset by SFAS #133 impact 0.01

EMMT2

Higher trading margin 0.05

Corporate Expense and Other Items (0.07)

Edison Capital

2006 infrastructure fund gains and other (0.11)

Non-Core Variances

SCE 4Q 06 resolution of a state tax apportionment issue $0.15 and generator refund incentive $0.01 (0.16)

EMG 4Q 07 includes ($0.01) from discontinued operations; 4Q 06 includes $0.07 from discontinued operations and ($0.01) from early debt extinguishment charges (0.07)

1 See use of Non-GAAP Financial Measures in appendix. The impact of participating securities is included in EIX parent company and other, and was $(0.01) per share for each of the quarters ended December 31, 2007 and 2006.

2 | | EMMT overhead is excluded from trading margin. |

April 1, 2008

EDISON INTERNATIONAL®

32

Leading the Way in Electricity SM

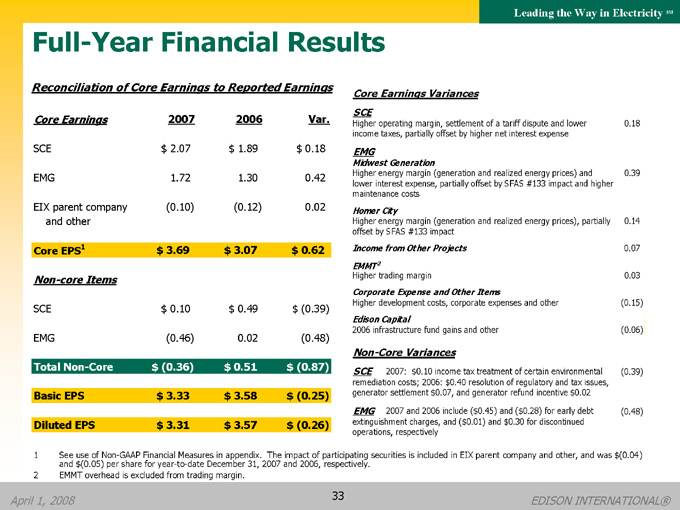

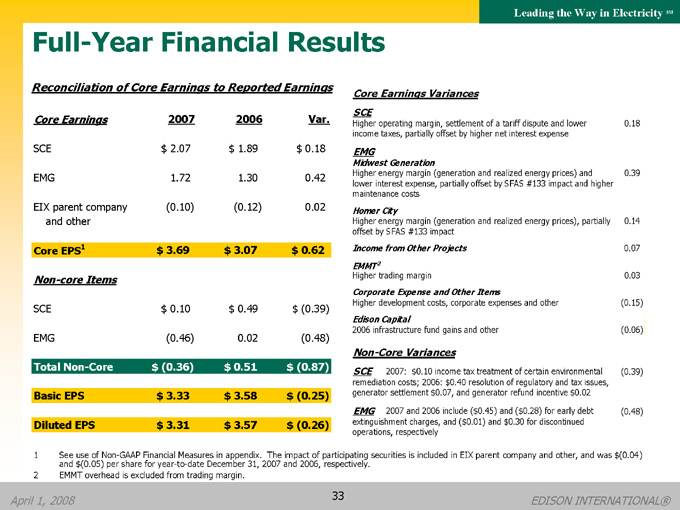

Full-Year Financial Results

Reconciliation of Core Earnings to Reported Earnings

Core Earnings 2007 2006 Var.

SCE $2.07 $1.89 $0.18

EMG 1.72 1.30 0.42

EIX parent company and other (0.10) (0.12) 0.02

Core EPS1 $3.69 $3.07 $0.62

Non-core Items

SCE $0.10 $0.49 $(0.39)

EMG (0.46) 0.02 (0.48)

Total Non-Core $(0.36) $0.51 $(0.87)

Basic EPS $3.33 $3.58 $(0.25)

Diluted EPS $3.31 $3.57 $(0.26)

Core Earnings Variances

SCE

Higher operating margin, settlement of a tariff dispute and lower income taxes, partially offset by higher net interest expense 0.18

EMG

Midwest Generation

Higher energy margin (generation and realized energy prices) and lower interest expense, partially offset by SFAS #133 impact and higher maintenance costs 0.39

Homer City

Higher energy margin (generation and realized energy prices), partially offset by SFAS #133 impact 0.14

Income from Other Projects 0.07

EMMT2

Higher trading margin 0.03

Corporate Expense and Other Items

Higher development costs, corporate expenses and other (0.15)

Edison Capital

2006 infrastructure fund gains and other (0.06)

Non-Core Variances

SCE 2007: $0.10 income tax treatment of certain environmental remediation costs; 2006: $0.40 resolution of regulatory and tax issues, generator settlement $0.07, and generator refund incentive $0.02 (0.39)

EMG 2007 and 2006 include ($0.45) and ($0.28) for early debt extinguishment charges, and ($0.01) and $0.30 for discontinued operations, respectively (0.48)

1 See use of Non-GAAP Financial Measures in appendix. The impact of participating securities is included in EIX parent company and other, and was $(0.04) and $(0.05) per share for year-to-date December 31, 2007 and 2006, respectively.

2 | | EMMT overhead is excluded from trading margin. |

April 1, 2008

EDISON INTERNATIONAL®

33

Leading the Way in Electricity SM

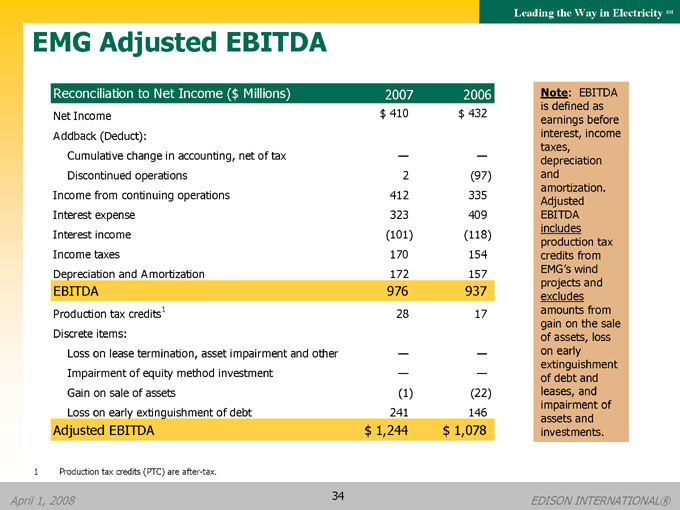

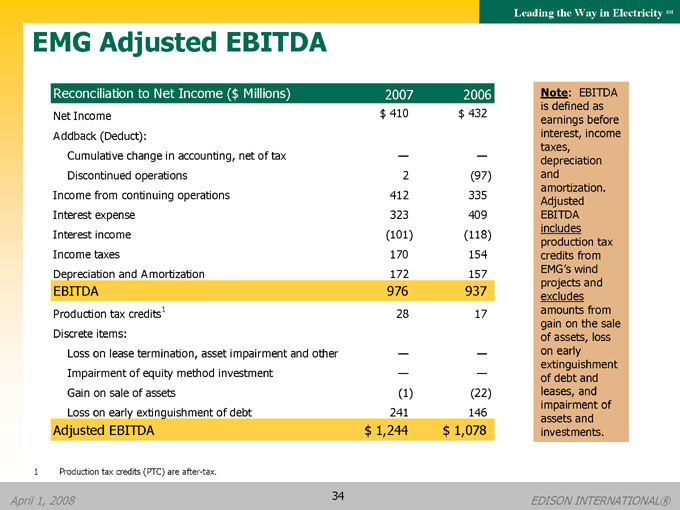

EMG Adjusted EBITDA

Reconciliation to Net Income ($ Millions) 2007 2006

Net Income $410 $432

Addback (Deduct):

Cumulative change in accounting, net of tax — —

Discontinued operations 2 (97)

Income from continuing operations 412 335

Interest expense 323 409

Interest income (101) (118)

Income taxes 170 154

Depreciation and Amortization 172 157

EBITDA 976 937

Production tax credits1 28 17

Discrete items:

Loss on lease termination, asset impairment and other — —

Impairment of equity method investment — —

Gain on sale of assets (1) (22)

Loss on early extinguishment of debt 241 146

Adjusted EBITDA $1,244 $1,078

Note: EBITDA is defined as earnings before interest, income taxes, depreciation and amortization. Adjusted EBITDA includes production tax credits from EMG’s wind projects and excludes amounts from gain on the sale of assets, loss on early extinguishment of debt and leases, and impairment of assets and investments.

1 | | Production tax credits (PTC) are after-tax. |

April 1, 2008

EDISON INTERNATIONAL®

34

Leading the Way in Electricity SM

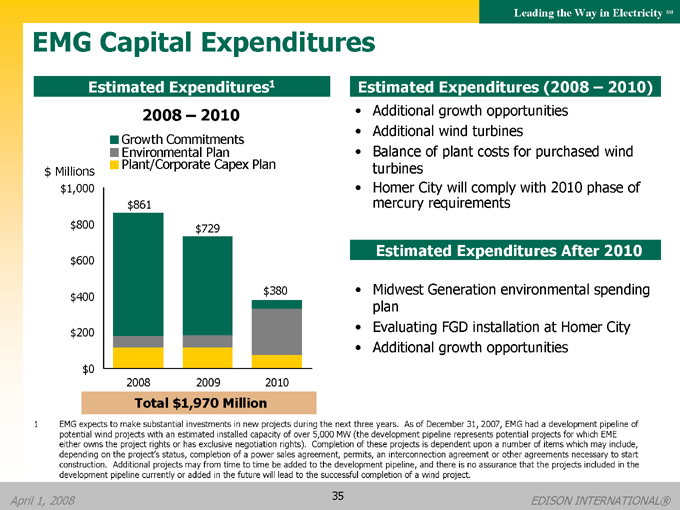

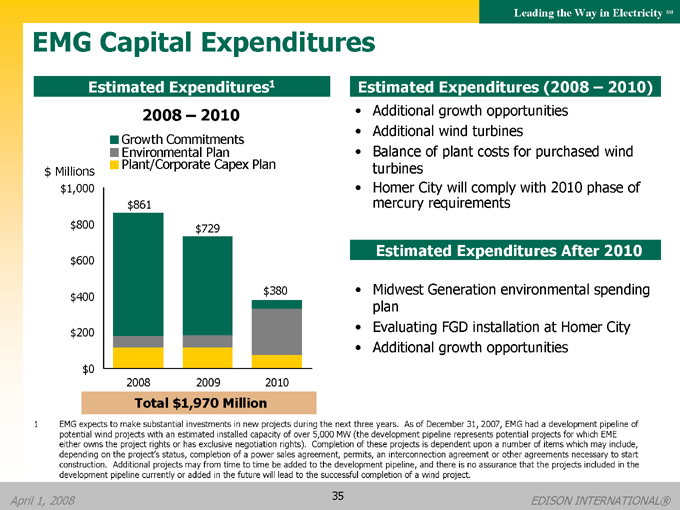

EMG Capital Expenditures

Estimated Expenditures1

2008 – 2010

Growth Commitments Environmental Plan Plant/Corporate Capex Plan $ Millions $1,000

$800 $600 $400 $200 $0

2008 2009 2010 $861 $729 $380

Total $1,970 Million

Estimated Expenditures (2008 – 2010)

Additional growth opportunities

Additional wind turbines

Balance of plant costs for purchased wind turbines

Homer City will comply with 2010 phase of mercury requirements

Estimated Expenditures After 2010

Midwest Generation environmental spending plan

Evaluating FGD installation at Homer City

Additional growth opportunities

1 EMG expects to make substantial investments in new projects during the next three years. As of December 31, 2007, EMG had a development pipeline of potential wind projects with an estimated installed capacity of over 5,000 MW (the development pipeline represents potential projects for which EME either owns the project rights or has exclusive negotiation rights). Completion of these projects is dependent upon a number of items which may include, depending on the project’s status, completion of a power sales agreement, permits, an interconnection agreement or other agreements necessary to start construction. Additional projects may from time to time be added to the development pipeline, and there is no assurance that the projects included in the development pipeline currently or added in the future will lead to the successful completion of a wind project.

April 1, 2008

EDISON INTERNATIONAL®

35

Leading the Way in Electricity SM

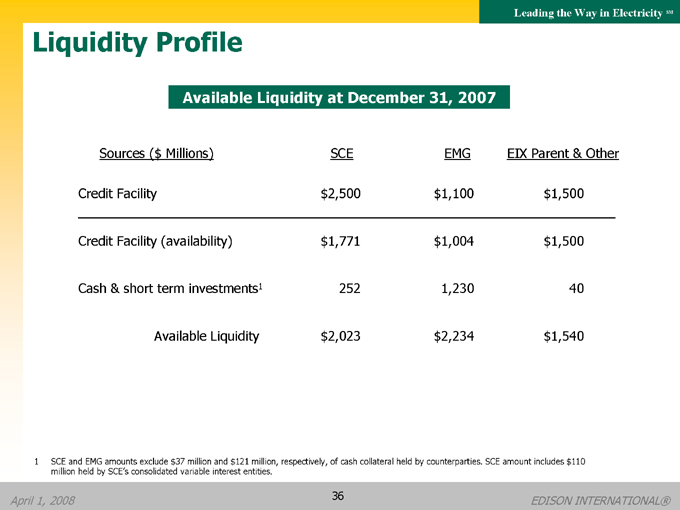

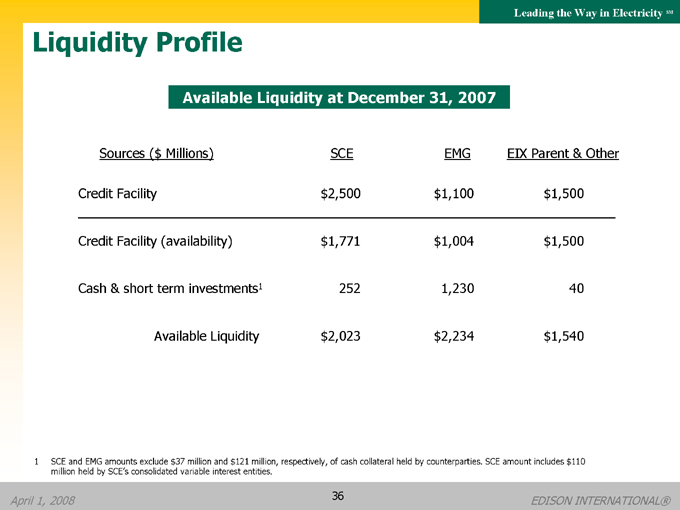

Liquidity Profile

Available Liquidity at December 31, 2007

Sources ($ Millions) SCE EMG EIX Parent & Other

Credit Facility $2,500 $1,100 $1,500

Credit Facility (availability) $1,771 $1,004 $1,500

Cash & short term investments1 252 1,230 40

Available Liquidity $2,023 $2,234 $1,540

1 SCE and EMG amounts exclude $37 million and $121 million, respectively, of cash collateral held by counterparties. SCE amount includes $110 million held by SCE’s consolidated variable interest entities.

April 1, 2008

EDISON INTERNATIONAL®

36

Leading the Way in Electricity SM

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and EPS by principal operating subsidiary internally for financial planning and for analysis of performance. We also use core earnings and EPS by principal operating subsidiary as primary performance measurements when communicating with analysts and investors regarding our earnings results and outlook, as it allows us to more accurately compare the company’s ongoing performance across periods. Core earnings exclude discontinued operations and other non-core items and are reconciled to basic earnings per common share.

EPS by principal operating subsidiary is based on the principal operating subsidiary net income and Edison International’s weighted average outstanding common shares. The impact of participating securities (vested stock options that earn dividend equivalents that may participate in undistributed earnings with common stock) for each principal operating subsidiary is not material to each principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which we refer to as EIX parent company. EPS and core EPS by principal operating subsidiary are reconciled to basic earnings per common share.

A reconciliation of Non-GAAP information to GAAP information, including the impact of participating securities, is included either on the slide where the information appears or on another slide referenced in the presentation.

April 1, 2008

EDISON INTERNATIONAL®

37