Exhibit 99.1

Exhibit 99.1

Leading the Way in Electricity SM

Business Update

September 2009

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation, earnings, asset and rate base growth, load growth, capital investments, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors,” and “Management’s Discussion and Analysis” in Edison International’s 2008 Form 10-K, most recent Form 10-Q and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation.

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

What’s New Since Our Last Business Update

Updated Information

Q2 2009 results and standard information

Earnings Guidance as of August 7, 2009 (p. 4)

Updated SCE Capital Spending and Rate Base Forecast (p. 5 – 6)

Changing Electric System (p. 8)

Recap of Environmental Agreement with Illinois EPA (p. 11)

$207 million Wind Portfolio Financing (p. 12)

Financial Impact of Global Tax Settlement (p. 13)

SCE Regulatory Key Events (p. 16)

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Delivering Superior and Sustained Value

Edison International

A diversified and flexible platform best positions EIX in an industry undergoing unprecedented change

Leverage regulated and competitive businesses

Positioned for long-term earnings and dividend growth

Southern California Edison

Balance electric reliability, rates and public policy needs to assure long-term sustainable growth

Focus on lower risk grid reliability and transmission investments

Establish foundation for technology investments

Decoupled regulatory model mitigates demand and fuel cost risks

Edison Mission Group

Diversify generation platform by growing renewables business

Enhance liquidity by resolving wind turbine and environmental compliance issues

Effectively manage merchant coal margins

Our key operating principles emphasize financial discipline, superior execution and innovative solutions to today’s and tomorrow’s challenges

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

2009 Earnings Guidance

Reconciliation of Core Earnings to GAAP Earnings Guidance1

2009 Earnings Guidance 2009 Earnings Guidance

as of 05/08/09 Updated as of 08/07/09

Low Midpoint High Low Midpoint High

EIX core earnings per share $2.90 $3.05 $3.20 $2.90 $3.05 $3.20

Non-Core items (0.92) (0.81) (0.69) (0.72)

EIX GAAP earnings per share $1.98 $2.24 $2.51 $2.18 $2.33 $2.48

Midpoint of 2009 core guidance by key business element:

SCE $2.49

EMG 0.70

EIX parent company and other (0.14)

SCE

2009 average rate base:

Includes 2009 GRC decision

Assumes timely approval of FERC rate case and rooftop solar program

2009 Approved Capital Structure

48% Equity

11.5% Return on Equity

Potential energy efficiency earnings of $0.03 per share included

EMG

Forward hedge position and prices as of 6/30/09

EMMT pre-tax trading margin of $50-100 million

Increased MWG pre-tax operating cost by $90 to $105 million (CAIR compliance and mercury controls)

Pre-tax earnings from Big 4 lower by $45 to $55 million

Prior EMG core and GAAP guidance ranges of $0.50 to $0.90 per share provided March 2, 2009

No significant Edison Capital earnings going forward. Includes $0.06 per share MCV lease termination

Non-Core Items

Mountainview transfer of $0.14 per share in Q3 09, global tax settlement of $(0.85) per share through Q2 09, discontinued operations of $(0.01) per share through Q2 09

Other Assumptions

Normal operating and weather conditions

No changes in GAAP accounting

Excludes discontinued operations and other non-core items except as noted (impacts of the Global Tax Settlement with the IRS through second quarter included in updated GAAP guidance as a non-core item)

See Use of Non-GAAP Financial Measures in Appendix. GAAP earnings refers to basic earnings per common share attributable to Edison International common shareholders. The expected impact of participating securities is $(0.02) per share and is included in EIX parent company and other.

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Capital Investment Forecast1

July 2009

$ Billions

2009 2010 2011 2012 2013

$5 $4 $3 $2 $1 $0

5-Yr Base Case

By Classification

$ %

Solar Rooftop Program 0.8 4

Edison SmartConnect™ 1.2 6

Generation 2.5 12

Transmission 6.2 30

Distribution 9.7 48

Total 20.4 100

5-Yr Base Case

By Proceeding Type %

2009 CPUC Rate Case 33

2012 CPUC Rate Case 25

Other CPUC 12

FERC Rate Cases 30

Total 100

Base Case $3.3 $3.9 $4.3 $4.5 $4.4

Low Case2 $2.7 $3.2 $3.5 $3.7 $3.6

Subject to timely receipt of permitting, licensing and regulatory approvals. Forecast as of July 2009 and includes: (1) CPUC approval of 5 year, 250 MW, $875 million rooftop solar program at SCE and (2) SCE’s decision in May 2009 to not pursue at this time permitting of the Arizona portion of the DPV2 transmission project.

Low Case reflects the potential variability to project investment levels related to execution risk, scope change, delays, regulatory constraints, and other contingencies. The level of variability experienced in 2008 was 18%.

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

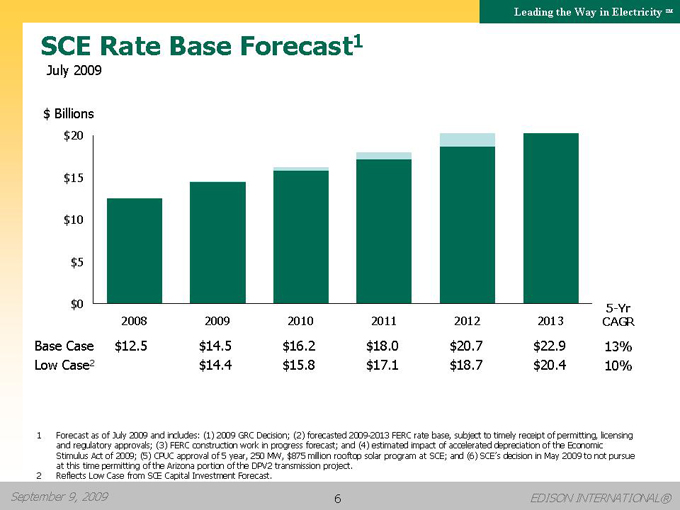

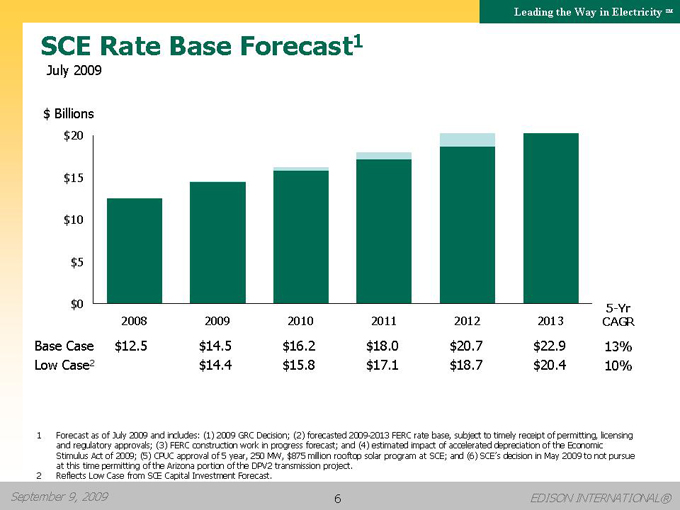

SCE Rate Base Forecast1

July 2009

$ Billions $20

$15 $10 $5 $0

5-Yr

2008 2009 2010 2011 2012 2013 CAGR

Base Case $12.5 $14.5 $16.2 $18.0 $20.7 $22.9 13%

Low Case2 $14.4 $15.8 $17.1 $18.7 $20.4 10%

Forecast as of July 2009 and includes: (1) 2009 GRC Decision; (2) forecasted 2009-2013 FERC rate base, subject to timely receipt of permitting, licensing and regulatory approvals; (3) FERC construction work in progress forecast; and (4) estimated impact of accelerated depreciation of the Economic Stimulus Act of 2009; (5) CPUC approval of 5 year, 250 MW, $875 million rooftop solar program at SCE; and (6) SCE’s decision in May 2009 to not pursue at this time permitting of the Arizona portion of the DPV2 transmission project.

Reflects Low Case from SCE Capital Investment Forecast.

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

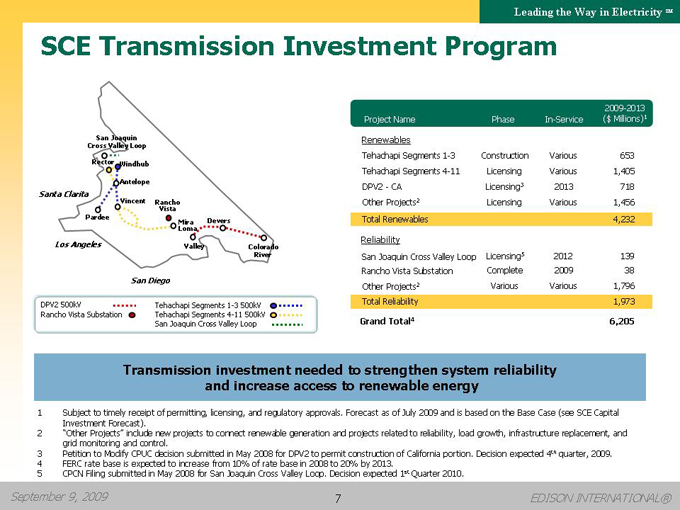

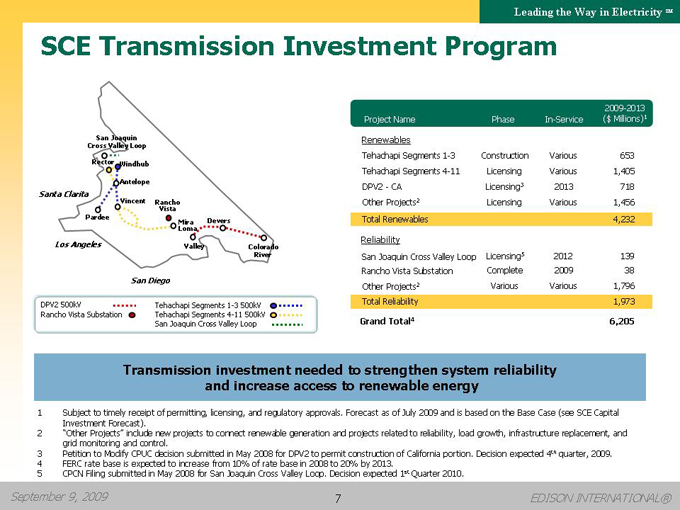

SCE Transmission Investment Program

San Joaquin Cross Valley Loop

SCE

Rector Windhub Service

Territory

Antelope

Santa Clarita Palmdale

Vincent Rancho Vista

Pardee Devers MiraLoma

Los Angeles SantaAna Valley PalmSprings Colorado River

DPV2 500kV

Rancho Vista Substation

Tehachapi Segments 1-3 500kV Tehachapi Segments 4-11 500kV San Joaquin Cross Valley Loop

2009-2013

Project Name Phase In-Service ($ Millions)1

Renewables

Tehachapi Segments 1-3 Construction Various 653

Tehachapi Segments 4-11 Licensing Various 1,405

DPV2—CA Licensing3 2013 718

Other Projects2 Licensing Various 1,456

Total Renewables 4,232

Reliability

San Joaquin Cross Valley Loop Licensing5 2012 139

Rancho Vista Substation Complete 2009 38

Other Projects2 Various Various 1,796

Total Reliability 1,973

Grand Total4 6,205

Transmission investment needed to strengthen system reliability

and increase access to renewable energy

Subject to timely receipt of permitting, licensing, and regulatory approvals. Forecast as of July 2009 and is based on the Base Case (see SCE Capital Investment Forecast).

“Other Projects” include new projects to connect renewable generation and projects related to reliability, load growth, infrastructure replacement, and grid monitoring and control.

Petition to Modify CPUC decision submitted in May 2008 for DPV2 to permit construction of California portion. Decision expected 4th quarter, 2009.

FERC rate base is expected to increase from 10% of rate base in 2008 to 20% by 2013.

CPCN Filing submitted in May 2008 for San Joaquin Cross Valley Loop. Decision expected 1st Quarter 2010.

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

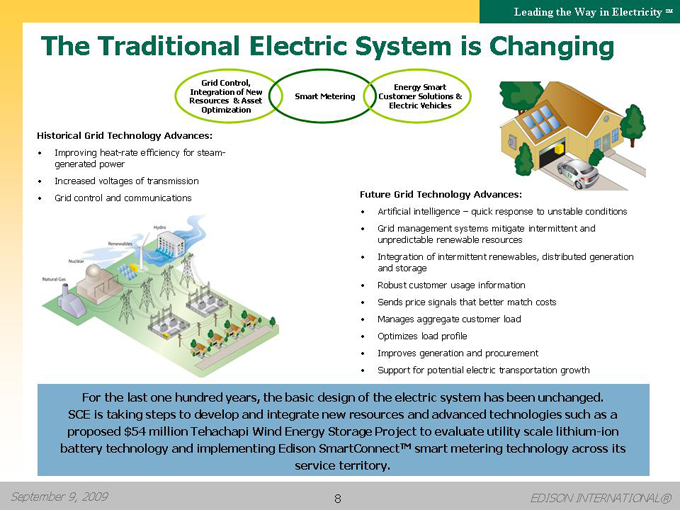

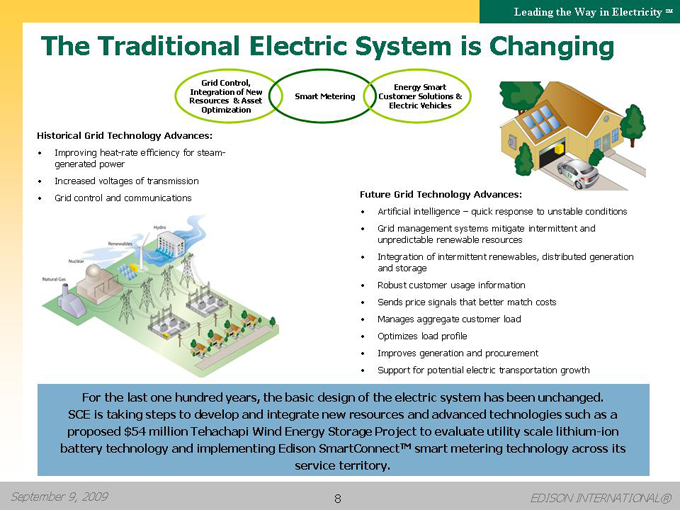

The Traditional Electric System is Changing

Grid Control, Integration of New Resources & Asset Optimization

Smart Metering

Energy Smart Customer Solutions & Electric Vehicles

Historical Grid Technology Advances:

Improving heat-rate efficiency for steam-generated power

Increased voltages of transmission

Grid control and communications

Future Grid Technology Advances:

Artificial intelligence – quick response to unstable conditions

Grid management systems mitigate intermittent and unpredictable renewable resources

Integration of intermittent renewables, distributed generation and storage

Robust customer usage information

Sends price signals that better match costs

Manages aggregate customer load

Optimizes load profile

Improves generation and procurement

Support for potential electric transportation growth

For the last one hundred years, the basic design of the electric system has been unchanged. SCE is taking steps to develop and integrate new resources and advanced technologies such as a proposed $54 million Tehachapi Wind Energy Storage Project to evaluate utility scale lithium-ion battery technology and implementing Edison SmartConnectTM smart metering technology across its service territory.

September 9, 2009 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

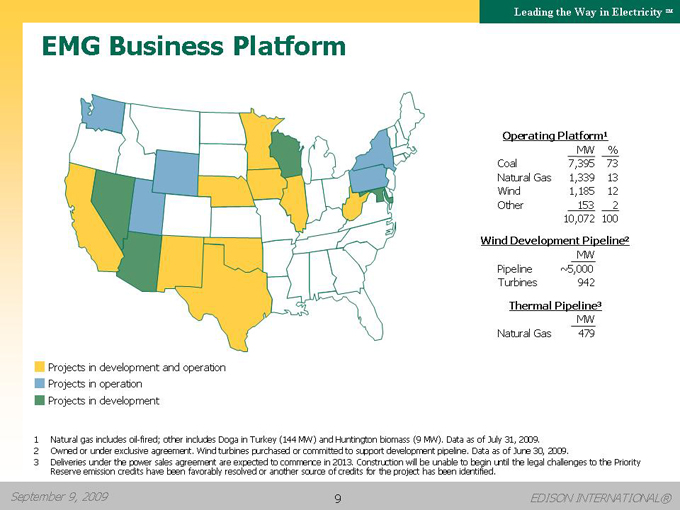

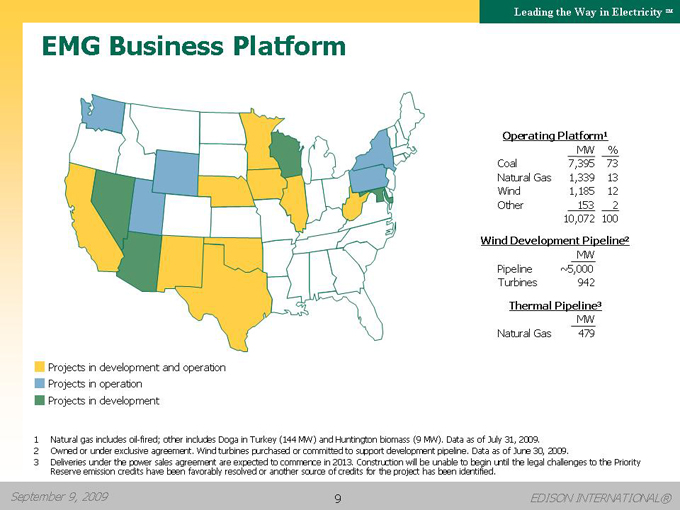

EMG Business Platform

Operating Platform1

MW %

Coal 7,395 73

Natural Gas 1,339 13

Wind 1,185 12

Other 153 2

10,072 100

Wind Development Pipeline2

MW

Pipeline ~5,000

Turbines 942

Thermal Pipeline3

MW

Natural Gas 479

Projects in development and operation

Projects in operation

Projects in development

1 Natural gas includes oil-fired; other includes Doga in Turkey (144 MW) and Huntington biomass (9 MW). Data as of July 31, 2009.

2 Owned or under exclusive agreement. Wind turbines purchased or committed to support development pipeline. Data as of June 30, 2009.

3 Deliveries under the power sales agreement are expected to commence in 2013. Construction will be unable to begin until the legal challenges to the Priority Reserve emission credits have been favorably resolved or another source of credits for the project has been identified.

September 9, 2009 EDISON INTERNATIONAL®

9

Leading the Way in Electricity SM

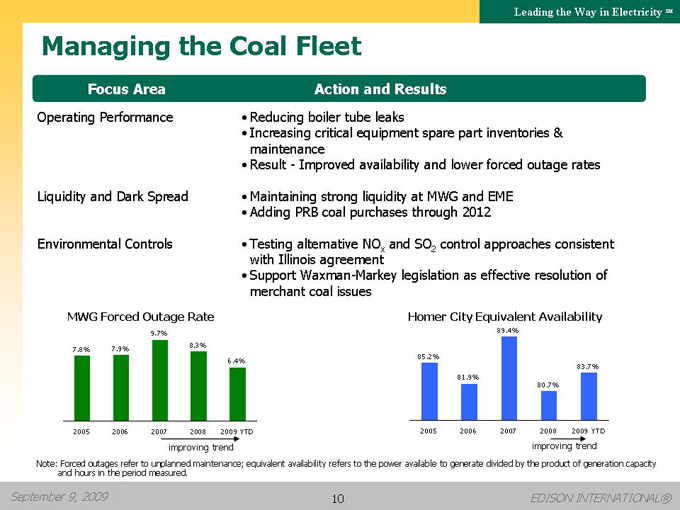

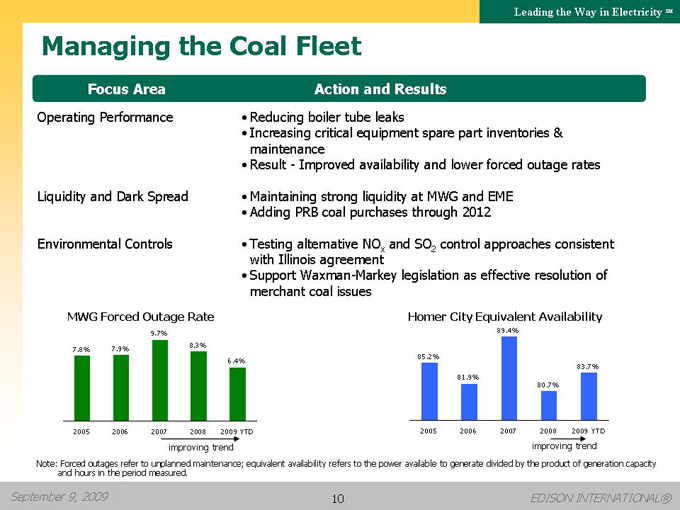

Managing the Coal Fleet

Focus Area Action and Results

Operating Performance

Liquidity and Dark Spread

Environmental Controls

Reducing boiler tube leaks

Increasing critical equipment spare part inventories & maintenance

Result - Improved availability and lower forced outage rates

Maintaining strong liquidity at MWG and EME

Adding PRB coal purchases through 2012

Testing alternative NOx and SO2 control approaches consistent with Illinois agreement

Support Waxman-Markey legislation as effective resolution of merchant coal issues

MWG Forced Outage Rate

9.7%

7.9% 8.3% 7.8%

6.4%

2005 2006 2007 2008 2009 YTD improving trend

Homer City Equivalent Availability

89.4%

85.2%

83.7% 81.9% 80.7%

2005 2006 2007 2008 2009 YTD improving trend

Note: Forced outages refer to unplanned maintenance; equivalent availability refers to the power available to generate divided by the product of generation capacity and hours in the period measured.

September 9, 2009 EDISON INTERNATIONAL®

10

Leading the Way in Electricity SM

Environmental Agreement with Illinois EPA

In 2006, Midwest Generation entered into agreement with Illinois EPA to reduce Mercury, NOx and SO2 emissions at its Illinois coal plants

Key Elements

Mercury (90% removal by 2015)

Installed Dry Sorbent Injection equipment utilizing activated carbon on all units

Evaluating particulate removal upgrades to meet 2015 removal standards

NOx (Beginning Jan. 1, 2012, 0.11 lbs./mmBTU average annual emission rate)

Testing of Selective Non-Catalytic Reduction (SNCR) utilizing urea injection for NOx removal

Preliminary results conclude emission rate can be met by SNCR only

SO2 (Beginning in 2013, average annual emission rate reductions with final limit of 0.11 lbs./mmBTU by 2019)

Testing sodium based dry sorbent injection

Preliminary results on removal rates favorable

Evaluating impact on particulate removal

Comments

Testing alternative environmental compliance plan to reduce NOx & SO2

Illinois IPA granted permits for testing

Spending capital on SCR or FGD scrubber technologies infeasible given uncertainty with CO2 legislation and commodity price risk

September 9, 2009 EDISON INTERNATIONAL®

11

Leading the Way in Electricity SM

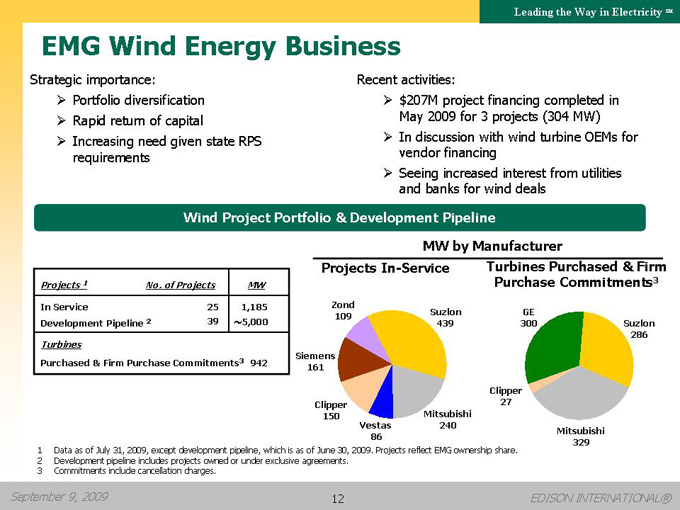

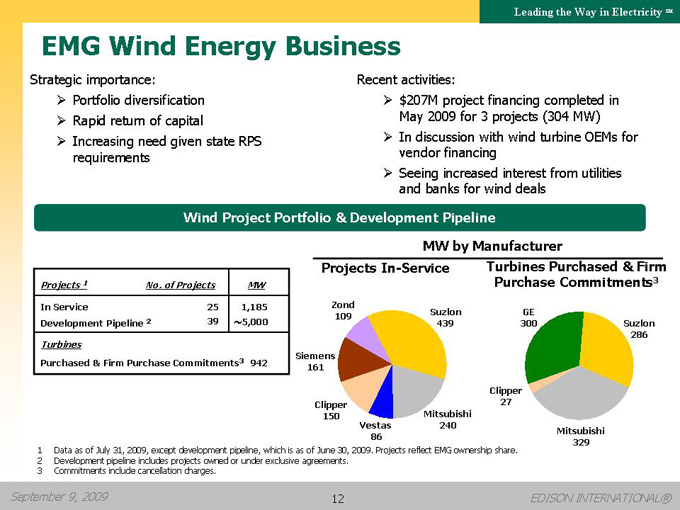

EMG Wind Energy Business

Strategic importance:

Portfolio diversification

Rapid return of capital

Increasing need given state RPS requirements

Recent activities:

$207M project financing completed in May 2009 for 3 projects (304 MW)

In discussion with wind turbine OEMs for vendor financing

Seeing increased interest from utilities and banks for wind deals

Wind Project Portfolio & Development Pipeline

Projects1 No. of Projects MW

In Service 25 1,185

Development Pipeline2 39 ~5,000

Turbines

Purchased & Firm Purchase Commitments3 942

MW by Manufacturer

Projects In-Service Turbines Purchased & Firm Purchase Commitments3

Zond

109 Suzlon GE

439 300 Suzlon 286

Siemens 161

Clipper Clipper 27 150 Mitsubishi Vestas 240

Mitsubishi 86 329

1 Data as of July 31, 2009, except development pipeline, which is as of June 30, 2009. Projects reflect EMG ownership share.

2 Development pipeline includes projects owned or under exclusive agreements.

3 Commitments include cancellation charges.

September 9, 2009 EDISON INTERNATIONAL®

12

Leading the Way in Electricity SM

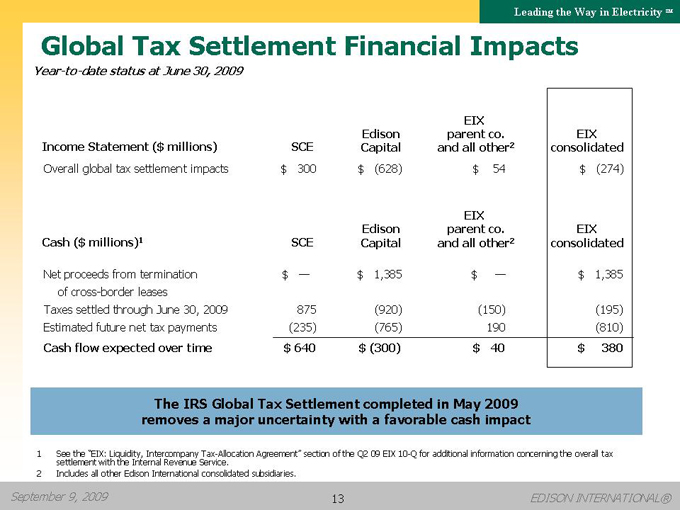

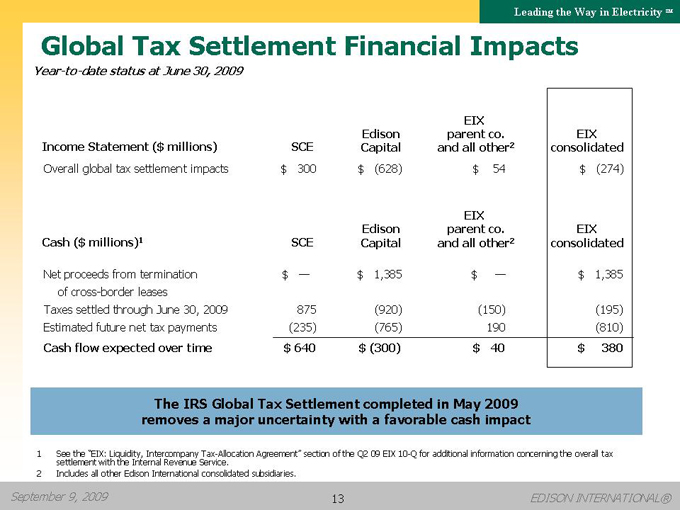

Global Tax Settlement Financial Impacts

Year-to-date status at June 30, 2009

EIX

Edison parent co. EIX

Income Statement ($ millions) SCE Capital and all other2 consolidated

Overall global tax settlement impacts $ 300 $ (628) $ 54 $ (274)

EIX

Edison parent co. EIX

Cash ($ millions)1 SCE Capital and all other2 consolidated

Net proceeds from termination $ — $ 1,385 $ — $ 1,385

of cross-border leases

Taxes settled through June 30, 2009 875 (920) (150) (195)

Estimated future net tax payments (235) (765) 190 (810)

Cash flow expected over time $ 640 $ (300) $ 40 $ 380

The IRS Global Tax Settlement completed in May 2009

removes a major uncertainty with a favorable cash impact

See the “EIX: Liquidity, Intercompany Tax-Allocation Agreement” section of the Q2 09 EIX 10-Q for additional information concerning the overall tax settlement with the Internal Revenue Service.

Includes all other Edison International consolidated subsidiaries.

September 9, 2009 EDISON INTERNATIONAL®

13

Leading the Way in Electricity SM

Appendix

September 9, 2009 EDISON INTERNATIONAL®

14

Leading the Way in Electricity SM

Southern California Edison (SCE)

September 9, 2009 EDISON INTERNATIONAL®

15

Leading the Way in Electricity SM

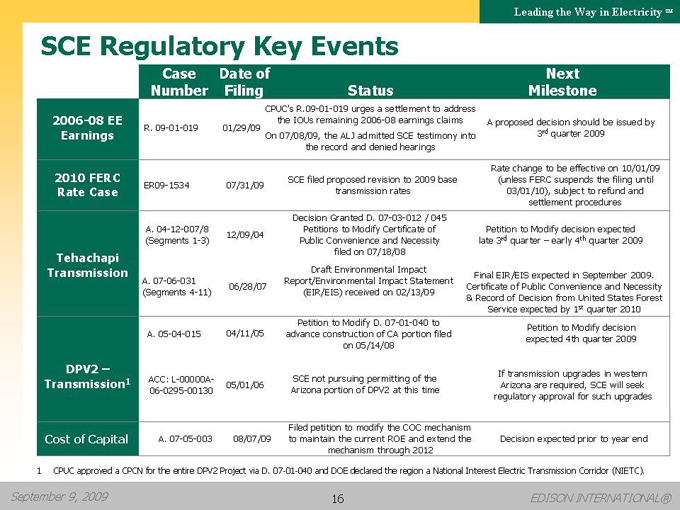

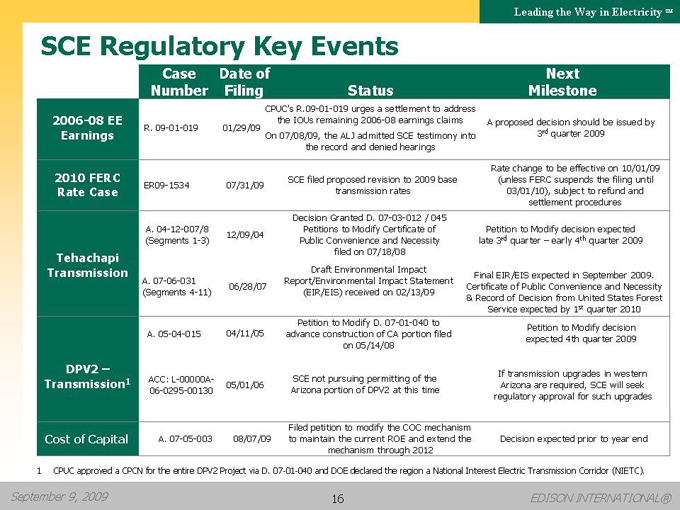

SCE Regulatory Key Events

Case Date of Next

Number Filing Status Milestone

CPUC’s R.09-01-019 urges a settlement to address

2006-08 EE the IOUs remaining 2006-08 earnings claims A proposed decision should be issued by

R. 09-01-019 01/29/09

Earnings On 07/08/09, the ALJ admitted SCE testimony into 3rd quarter 2009

the record and denied hearings

Rate change to be effective on 10/01/09

2010 FERC SCE filed proposed revision to 2009 base (unless FERC suspends the filing until

ER09-1534 07/31/09

Rate Case transmission rates 03/01/10), subject to refund and

settlement procedures

Decision Granted D. 07-03-012 / 045

A. 04-12-007/8 Petitions to Modify Certificate of Petition to Modify decision expected

12/09/04

(Segments 1-3) Public Convenience and Necessity late 3rd quarter – early 4th quarter 2009

Tehachapi filed on 07/18/08

Transmission Draft Environmental Impact Final EIR/EIS expected in September 2009.

A. 07-06-031 Report/Environmental Impact Statement

06/28/07 Certificate of Public Convenience and Necessity

(Segments 4-11) (EIR/EIS) received on 02/13/09 & Record of Decision from United States Forest

Service expected by 1st quarter 2010

Petition to Modify D. 07-01-040 to Petition to Modify decision

A. 05-04-015 04/11/05 advance construction of CA portion filed expected 4th quarter 2009

on 05/14/08

DPV2 – If transmission upgrades in western

Transmission1 ACC: L-00000A- 05/01/06 SCE not pursuing permitting of the Arizona are required, SCE will seek

06-0295-00130 Arizona portion of DPV2 at this time regulatory approval for such upgrades

Filed petition to modify the COC mechanism

Cost of Capital A. 07-05-003 08/07/09 to maintain the current ROE and extend the Decision expected prior to year end

mechanism through 2012

1 CPUC approved a CPCN for the entire DPV2 Project via D. 07-01-040 and DOE declared the region a National Interest Electric Transmission Corridor (NIETC).

September 9, 2009 EDISON INTERNATIONAL®

16

Leading the Way in Electricity SM

Edison Mission Group (EMG)

September 9, 2009 EDISON INTERNATIONAL®

17

Leading the Way in Electricity SM

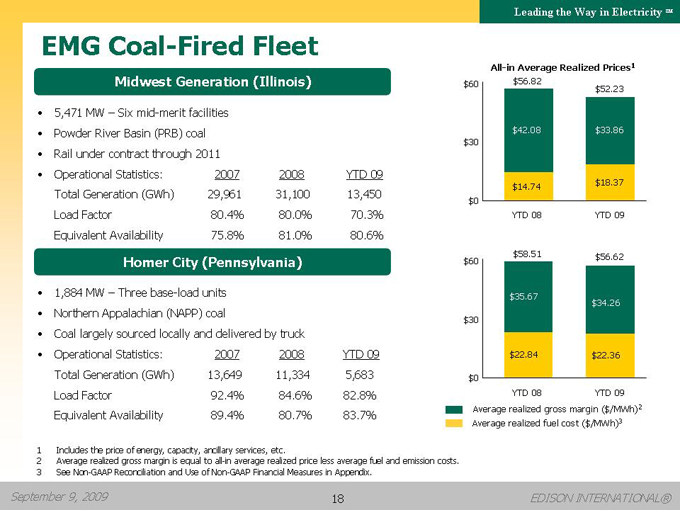

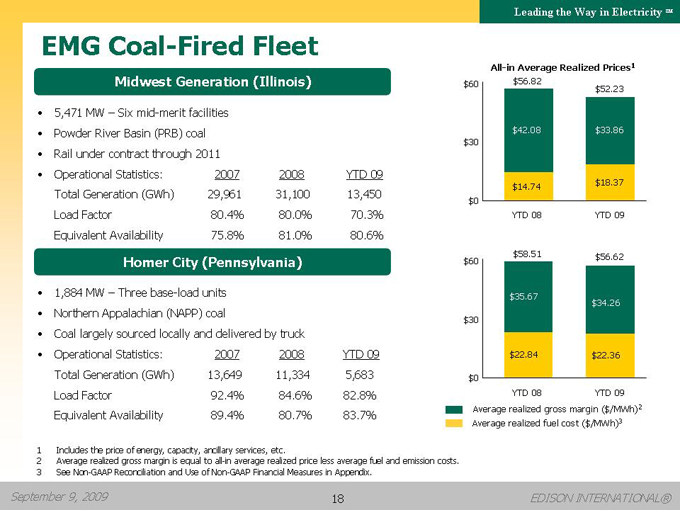

EMG Coal-Fired Fleet

Midwest Generation (Illinois)

5,471 MW – Six mid-merit facilities

Powder River Basin (PRB) coal

Rail under contract through 2011

Operational Statistics: 2007 2008 YTD 09

Total Generation (GWh) 29,961 31,100 13,450

Load Factor 80.4% 80.0% 70.3%

Equivalent Availability 75.8% 81.0% 80.6%

Homer City (Pennsylvania)

1,884 MW – Three base-load units

Northern Appalachian (NAPP) coal

Coal largely sourced locally and delivered by truck

Operational Statistics: 2007 2008 YTD 09

Total Generation (GWh) 13,649 11,334 5,683

Load Factor 92.4% 84.6% 82.8%

Equivalent Availability 89.4% 80.7% 83.7%

All-in Average Realized Prices1

$60 $56.82

$52.23

$42.08 $33.86 $30

$14.74 $18.37 $0 YTD 08 YTD 09

$58.51 $56.62 $60

$35.67

$34.26 $30

$22.84 $22.36

$0

YTD 08 YTD 09 Average realized gross margin ($/MWh)2 Average realized fuel cost ($/MWh)3

Includes the price of energy, capacity, ancillary services, etc.

Average realized gross margin is equal to all-in average realized price less average fuel and emission costs.

See Non-GAAP Reconciliation and Use of Non-GAAP Financial Measures in Appendix.

September 9, 2009 EDISON INTERNATIONAL®

18

Leading the Way in Electricity SM

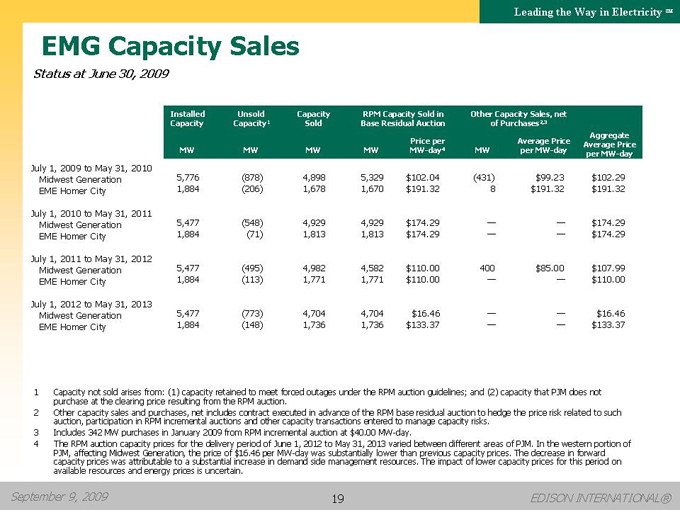

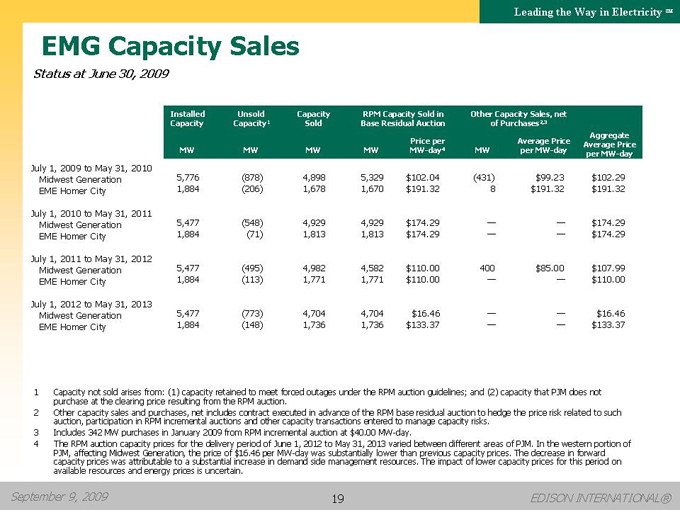

EMG Capacity Sales

Status at June 30, 2009

Installed Unsold Capacity RPM Capacity Sold in Other Capacity Sales, net

Capacity Capacity1 Sold Base Residual Auction of Purchases2,3

Aggregate

Price per Average Price Average Price

MW MW MW MW MW-day4 MW per MW-day per MW-day

July 1, 2009 to May 31, 2010

Midwest Generation 5,776 (878) 4,898 5,329 $102.04 (431) $99.23 $102.29

EME Homer City 1,884 (206) 1,678 1,670 $191.32 8 $191.32 $191.32

July 1, 2010 to May 31, 2011

Midwest Generation 5,477 (548) 4,929 4,929 $174.29 — — $174.29

EME Homer City 1,884 (71) 1,813 1,813 $174.29 — — $174.29

July 1, 2011 to May 31, 2012

Midwest Generation 5,477 (495) 4,982 4,582 $110.00 400 $85.00 $107.99

EME Homer City 1,884 (113) 1,771 1,771 $110.00 — — $110.00

July 1, 2012 to May 31, 2013

Midwest Generation 5,477 (773) 4,704 4,704 $16.46 — — $16.46

EME Homer City 1,884 (148) 1,736 1,736 $133.37 — — $133.37

Capacity not sold arises from: (1) capacity retained to meet forced outages under the RPM auction guidelines; and (2) capacity that PJM does not purchase at the clearing price resulting from the RPM auction.

Other capacity sales and purchases, net includes contract executed in advance of the RPM base residual auction to hedge the price risk related to such auction, participation in RPM incremental auctions and other capacity transactions entered to manage capacity risks.

Includes 342 MW purchases in January 2009 from RPM incremental auction at $40.00 MW-day.

The RPM auction capacity prices for the delivery period of June 1, 2012 to May 31, 2013 varied between different areas of PJM. In the western portion of PJM, affecting Midwest Generation, the price of $16.46 per MW-day was substantially lower than previous capacity prices. The decrease in forward capacity prices was attributable to a substantial increase in demand side management resources. The impact of lower capacity prices for this period on available resources and energy prices is uncertain.

September 9, 2009 EDISON INTERNATIONAL®

19

Leading the Way in Electricity SM

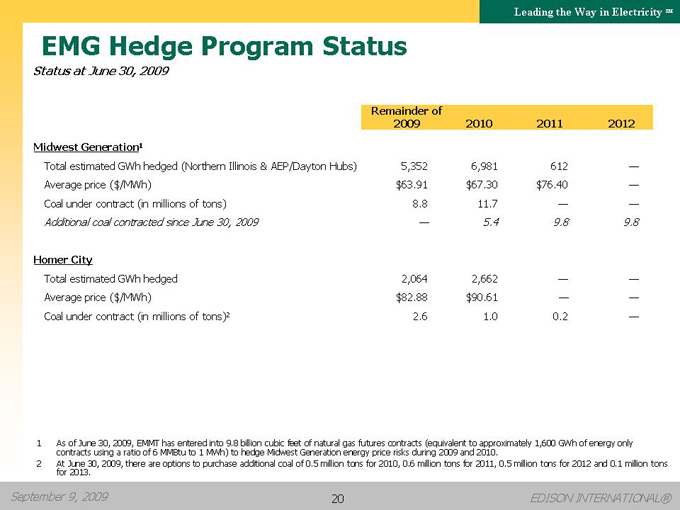

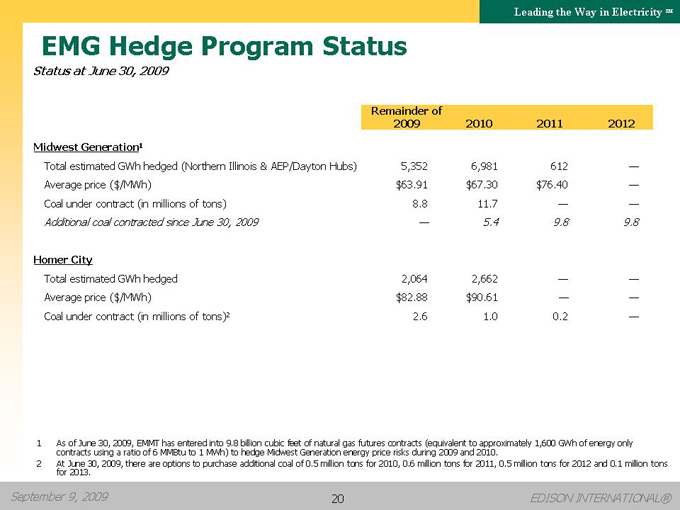

EMG Hedge Program Status

Status at June 30, 2009

Remainder of

2009 2010 2011 2012

Midwest Generation1

Total estimated GWh hedged (Northern Illinois & AEP/Dayton Hubs) 5,352 6,981 612 —

Average price ($/MWh) $63.91 $67.30 $76.40 —

Coal under contract (in millions of tons) 8.8 11.7 — —

Additional coal contracted since June 30, 2009 — 5.4 9.8 9.8

Homer City

Total estimated GWh hedged 2,064 2,662 — —

Average price ($/MWh) $82.88 $90.61 — —

Coal under contract (in millions of tons)2 2.6 1.0 0.2 —

1 As of June 30, 2009, EMMT has entered into 9.8 billion cubic feet of natural gas futures contracts (equivalent to approximately 1,600 GWh of energy only contracts using a ratio of 6 MMBtu to 1 MWh) to hedge Midwest Generation energy price risks during 2009 and 2010.

2 At June 30, 2009, there are options to purchase additional coal of 0.5 million tons for 2010, 0.6 million tons for 2011, 0.5 million tons for 2012 and 0.1 million tons for 2013.

September 9, 2009 EDISON INTERNATIONAL®

20

Leading the Way in Electricity SM

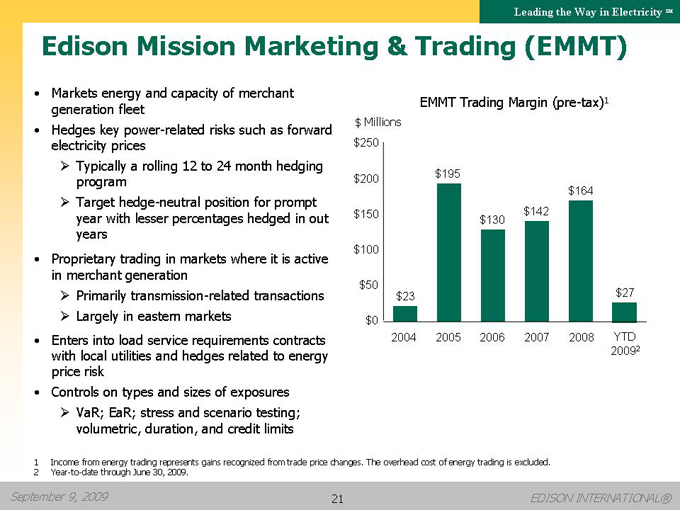

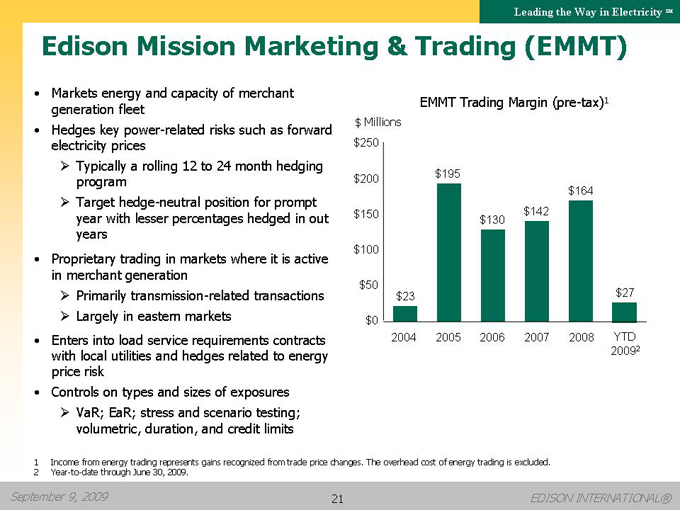

Edison Mission Marketing & Trading (EMMT)

Markets energy and capacity of merchant generation fleet

Hedges key power-related risks such as forward electricity prices

Typically a rolling 12 to 24 month hedging program

Target hedge-neutral position for prompt year with lesser percentages hedged in out years

Proprietary trading in markets where it is active in merchant generation

Primarily transmission-related transactions

Largely in eastern markets

Enters into load service requirements contracts with local utilities and hedges related to energy price risk

Controls on types and sizes of exposures

VaR; EaR; stress and scenario testing; volumetric, duration, and credit limits

EMMT Trading Margin (pre-tax)1 $ Millions $250

$200 $195 $164 $150 $142 $130

$100

$50

$23 $27 $0 2004 2005 2006 2007 2008 YTD

20092

Income from energy trading represents gains recognized from trade price changes. The overhead cost of energy trading is excluded.

Year-to-date through June 30, 2009.

September 9, 2009 EDISON INTERNATIONAL®

21

Leading the Way in Electricity SM

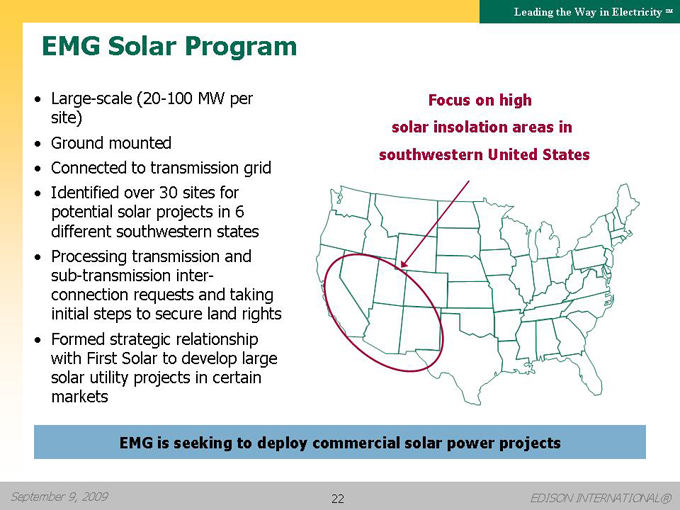

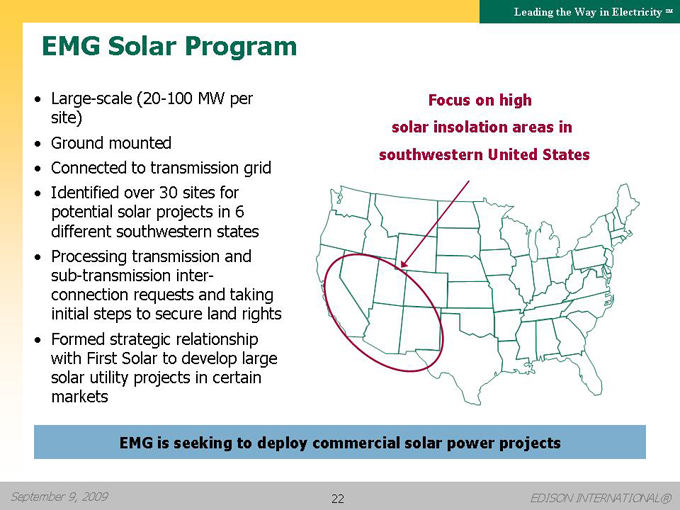

EMG Solar Program

Large-scale (20-100 MW per site)

Ground mounted

Connected to transmission grid

Identified over 30 sites for potential solar projects in 6 different southwestern states

Processing transmission and sub-transmission inter- connection requests and taking initial steps to secure land rights

Formed strategic relationship with First Solar to develop large solar utility projects in certain markets

Focus on high

solar insolation areas in

southwestern United States

EMG is seeking to deploy commercial solar power projects

September 9, 2009 EDISON INTERNATIONAL®

22

Leading the Way in Electricity SM

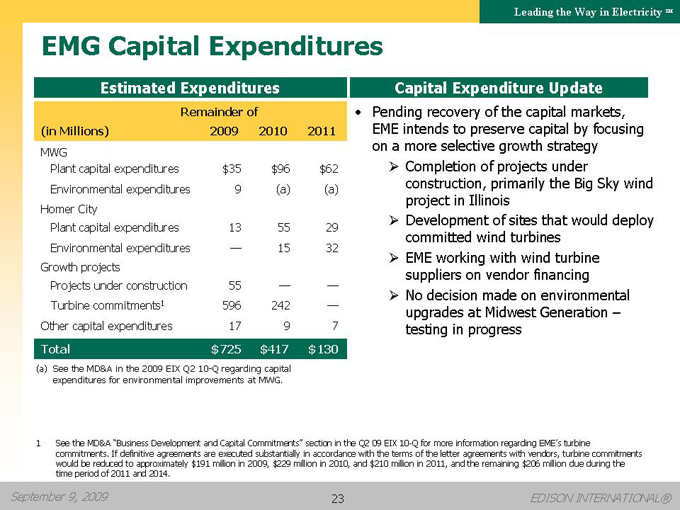

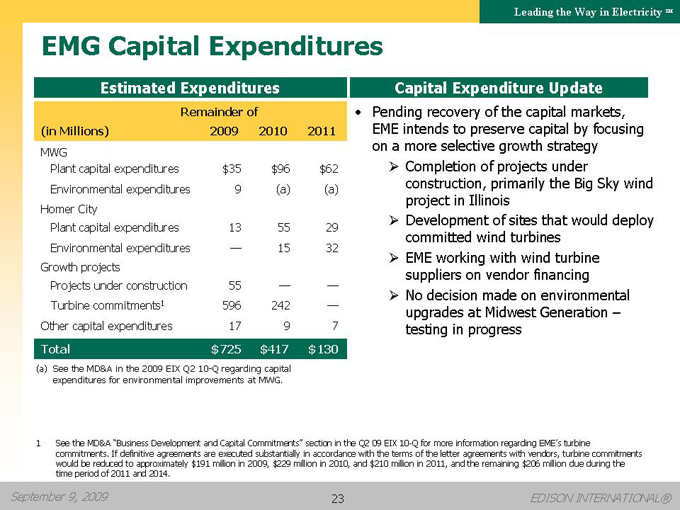

EMG Capital Expenditures

Estimated Expenditures

Remainder of

(in Millions) 2009 2010 2011

MWG

Plant capital expenditures $35 $96 $62

Environmental expenditures 9 (a) (a)

Homer City

Plant capital expenditures 13 55 29

Environmental expenditures ? 15 32

Growth projects

Projects under construction 55 ? ?

Turbine commitments1 596 242 ?

Other capital expenditures 17 9 7

Total $725 $417 $130

(a) | | See the MD&A in the 2009 EIX Q2 10-Q regarding capital |

expenditures for environmental improvements at MWG.

Capital Expenditure Update

Pending recovery of the capital markets, EME intends to preserve capital by focusing on a more selective growth strategy

?Completion of projects under construction, primarily the Big Sky wind project in Illinois

?Development of sites that would deploy committed wind turbines

?EME working with wind turbine suppliers on vendor financing

?No decision made on environmental upgrades at Midwest Generation –testing in progress

See the MD&A “Business Development and Capital Commitments” section in the Q2 09 EIX 10-Q for more information regarding EME’s turbine commitments. If definitive agreements are executed substantially in accordance with the terms of the letter agreements with vendors, turbine commitments would be reduced to approximately $191 million in 2009, $229 million in 2010, and $210 million in 2011, and the remaining $206 million due during the time period of 2011 and 2014.

September 9, 2009 EDISON INTERNATIONAL®

23

Leading the Way in Electricity SM

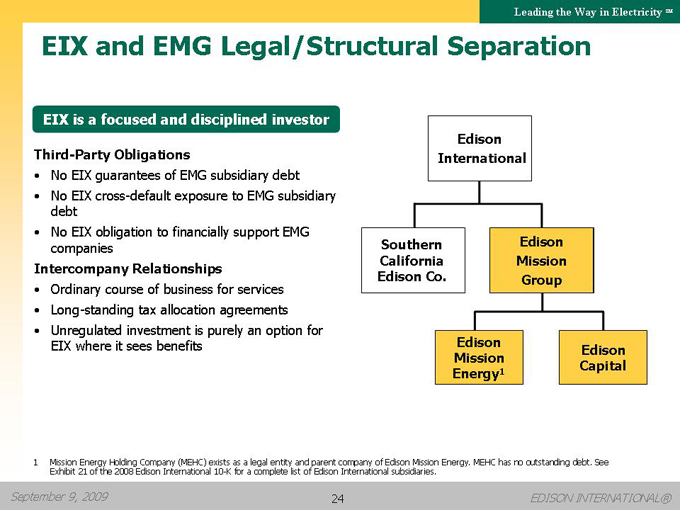

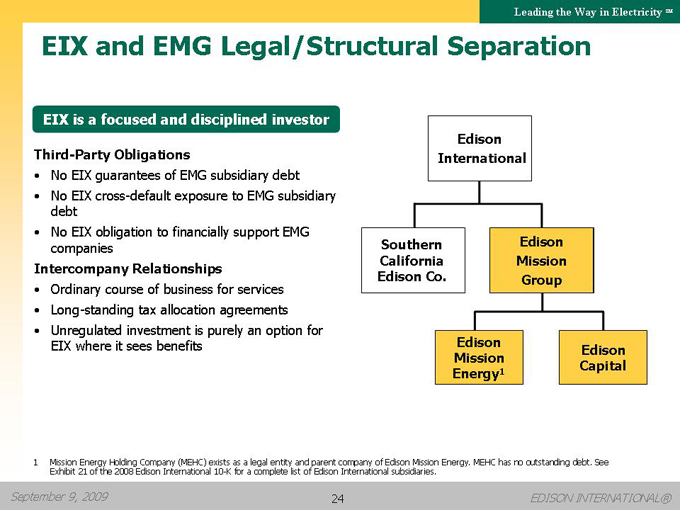

EIX and EMG Legal/Structural Separation

EIX is a focused and disciplined investor

Third-Party Obligations

No EIX guarantees of EMG subsidiary debt

No EIX cross-default exposure to EMG subsidiary debt

No EIX obligation to financially support EMG companies

Intercompany Relationships

Ordinary course of business for services

Long-standing tax allocation agreements

Unregulated investment is purely an option for EIX where it sees benefits

Edison

International

Southern California Edison Co.

Edison

Mission

Group

Edison Mission Energy1

Edison Capital

Mission Energy Holding Company (MEHC) exists as a legal entity and parent company of Edison Mission Energy. MEHC has no outstanding debt. See Exhibit 21 of the 2008 Edison International 10-K for a complete list of Edison International subsidiaries.

September 9, 2009 EDISON INTERNATIONAL®

24

Leading the Way in Electricity SM

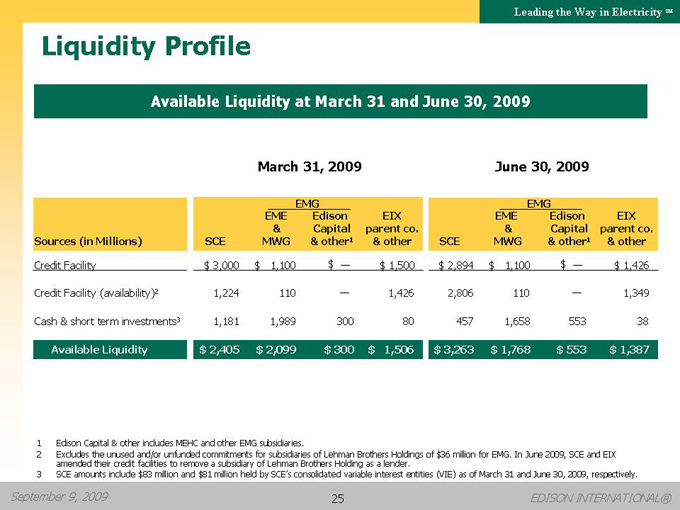

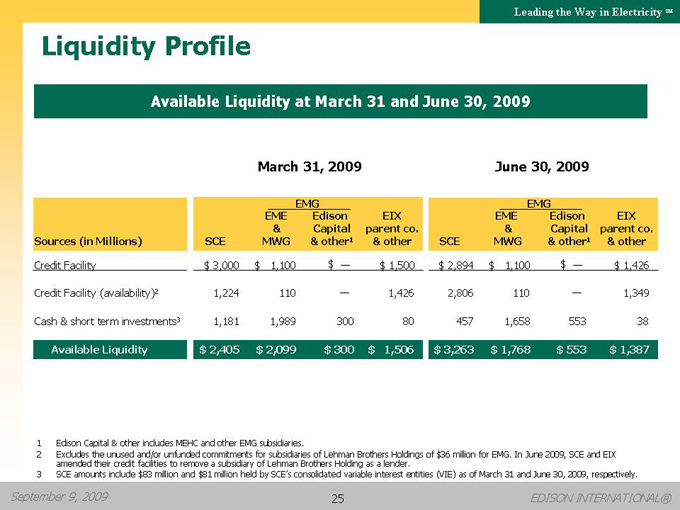

Liquidity Profile

Available Liquidity at March 31 and June 30, 2009

March 31, 2009 June 30, 2009

EMG EMG

EME Edison EIX EME Edison EIX

& Capital parent co. & Capital parent co.

Sources (in Millions) SCE MWG & other1 & other SCE MWG & other1 & other

Credit Facility $ 3,000 $ 1,100 $ ? $ 1,500 $ 2,894 $ 1,100 $ ? $ 1,426

Credit Facility (availability)2 1,224 110 ? 1,426 2,806 110 ? 1,349

Cash & short term investments3 1,181 1,989 300 80 457 1,658 553 38

Available Liquidity $ 2,405 $ 2,099 $ 300 $ 1,506 $ 3,263 $ 1,768 $ 553 $ 1,387

Edison Capital & other includes MEHC and other EMG subsidiaries.

Excludes the unused and/or unfunded commitments for subsidiaries of Lehman Brothers Holdings of $36 million for EMG. In June 2009, SCE and EIX amended their credit facilities to remove a subsidiary of Lehman Brothers Holding as a lender.

SCE amounts include $83 million and $81 million held by SCE’s consolidated variable interest entities (VIE) as of March 31 and June 30, 2009, respectively.

September 9, 2009 EDISON INTERNATIONAL®

25

Leading the Way in Electricity SM

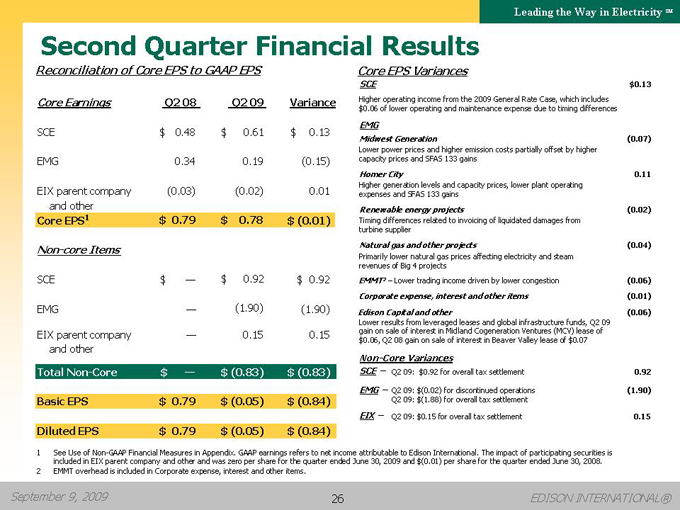

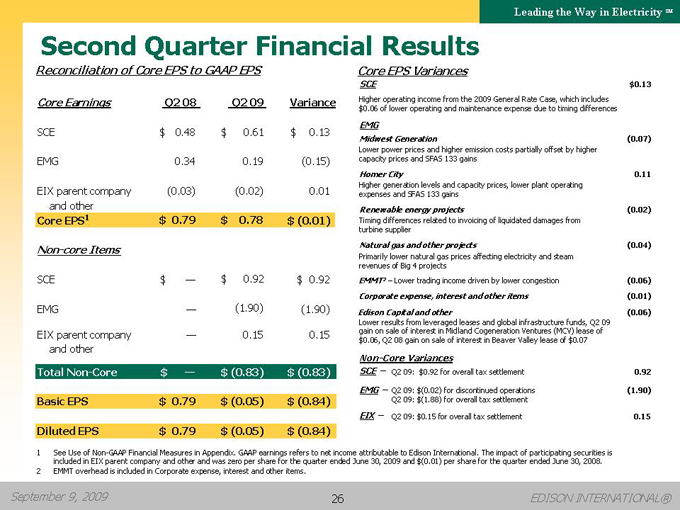

Second Quarter Financial Results

Reconciliation of Core EPS to GAAP EPS

Core Earnings Q2 08 Q2 09 Variance

SCE $ 0.48 $ 0.61 $ 0.13

EMG 0.34 0.19 (0.15)

EIX parent company (0.03) (0.02) 0.01

and other

Core EPS 1 $ 0.79 $ 0.78 $ (0.01)

Non-core Items

SCE $ — $ 0.92 $ 0.92

EMG — (1.90) (1.90)

EIX parent company — 0.15 0.15

and other

Total Non-Core $ — $ (0.83) $ (0.83)

Basic EPS $ 0.79 $ (0.05) $ (0.84)

Diluted EPS $ 0.79 $ (0.05) $ (0.84)

Core EPS Variances

SCE $0.13

Higher operating income from the 2009 General Rate Case, which includes

$0.06 of lower operating and maintenance expense due to timing differences

EMG

Midwest Generation (0.07)

Lower power prices and higher emission costs partially offset by higher

capacity prices and SFAS 133 gains

Homer City 0.11

Higher generation levels and capacity prices, lower plant operating

expenses and SFAS 133 gains

Renewable energy projects (0.02)

Timing differences related to invoicing of liquidated damages from

turbine supplier

Natural gas and other projects (0.04)

Primarily lower natural gas prices affecting electricity and steam

revenues of Big 4 projects

EMMT2 – Lower trading income driven by lower congestion (0.06)

Corporate expense, interest and other items (0.01)

Edison Capital and other (0.06)

Lower results from leveraged leases and global infrastructure funds, Q2 09

gain on sale of interest in Midland Cogeneration Ventures (MCV) lease of

$0.06, Q2 08 gain on sale of interest in Beaver Valley lease of $0.07

Non-Core Variances

SCE – Q2 09: $0.92 for overall tax settlement 0.92

EMG – Q2 09: $(0.02) for discontinued operations (1.90)

Q2 09: $(1.88) for overall tax settlement

EIX – Q2 09: $0.15 for overall tax settlement 0.15

See Use of Non-GAAP Financial Measures in Appendix. GAAP earnings refers to net income attributable to Edison International. The impact of participating securities is included in EIX parent company and other and was zero per share for the quarter ended June 30, 2009 and $(0.01) per share for the quarter ended June 30, 2008.

EMMT overhead is included in Corporate expense, interest and other items.

September 9, 2009 EDISON INTERNATIONAL®

26

Leading the Way in Electricity SM

Year-to-Date Financial Results

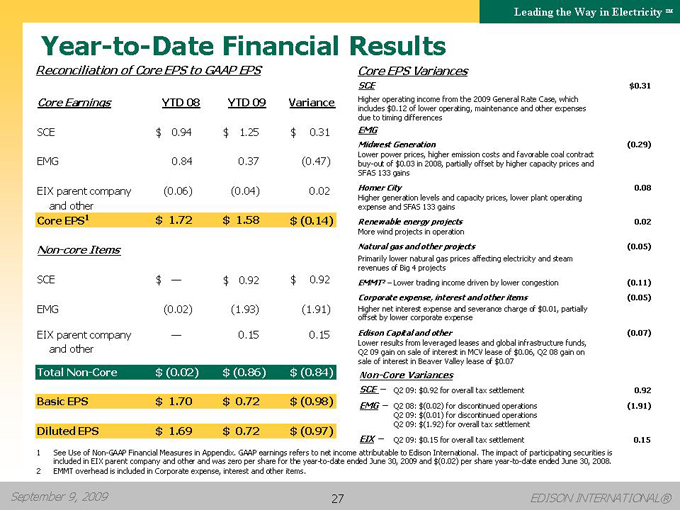

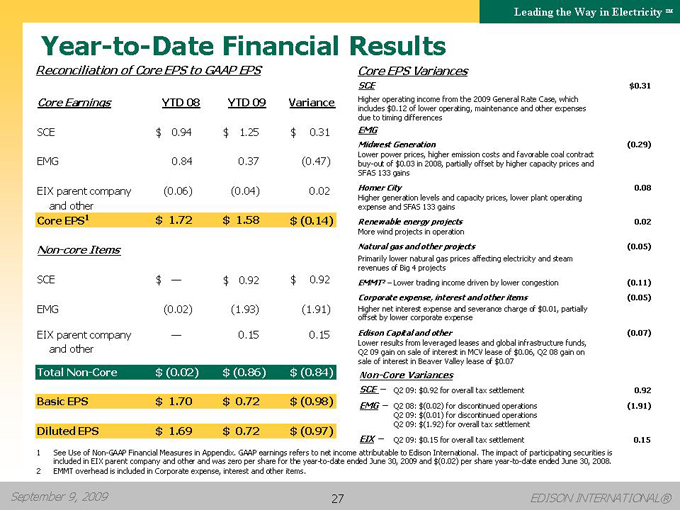

Reconciliation of Core EPS to GAAP EPS

Core Earnings YTD 08 YTD 09 Variance

SCE $ 0.94 $ 1.25 $ 0.31

EMG 0.84 0.37 (0.47)

EIX parent company (0.06) (0.04) 0.02

and other

Core EPS 1 $ 1.72 $ 1.58 $ (0.14)

Non-core Items

SCE $ — $ 0.92 $ 0.92

EMG (0.02) (1.93) (1.91)

EIX parent company — 0.15 0.15

and other

Total Non-Core $ (0.02) $ (0.86) $ (0.84)

Basic EPS $ 1.70 $ 0.72 $ (0.98)

Diluted EPS $ 1.69 $ 0.72 $ (0.97)

Core EPS Variances

SCE $0.31

Higher operating income from the 2009 General Rate Case, which

includes $0.12 of lower operating, maintenance and other expenses

due to timing differences

EMG

Midwest Generation (0.29)

Lower power prices, higher emission costs and favorable coal contract

buy-out of $0.03 in 2008, partially offset by higher capacity prices and

SFAS 133 gains

Homer City 0.08

Higher generation levels and capacity prices, lower plant operating

expense and SFAS 133 gains

Renewable energy projects 0.02

More wind projects in operation

Natural gas and other projects (0.05)

Primarily lower natural gas prices affecting electricity and steam

revenues of Big 4 projects

EMMT2 – Lower trading income driven by lower congestion (0.11)

Corporate expense, interest and other items (0.05)

Higher net interest expense and severance charge of $0.01, partially

offset by lower corporate expense

Edison Capital and other (0.07)

Lower results from leveraged leases and global infrastructure funds,

Q2 09 gain on sale of interest in MCV lease of $0.06, Q2 08 gain on

sale of interest in Beaver Valley lease of $0.07

Non-Core Variances

SCE – Q2 09: $0.92 for overall tax settlement 0.92

EMG – Q2 08: $(0.02) for discontinued operations (1.91)

Q2 09: $(0.01) for discontinued operations

Q2 09: $(1.92) for overall tax settlement

EIX – Q2 09: $0.15 for overall tax settlement 0.15

See Use of Non-GAAP Financial Measures in Appendix. GAAP earnings refers to net income attributable to Edison International. The impact of participating securities is included in EIX parent company and other and was zero per share for the year-to-date ended June 30, 2009 and $(0.02) per share year-to-date ended June 30, 2008.

EMMT overhead is included in Corporate expense, interest and other items.

September 9, 2009 EDISON INTERNATIONAL®

27

Leading the Way in Electricity SM

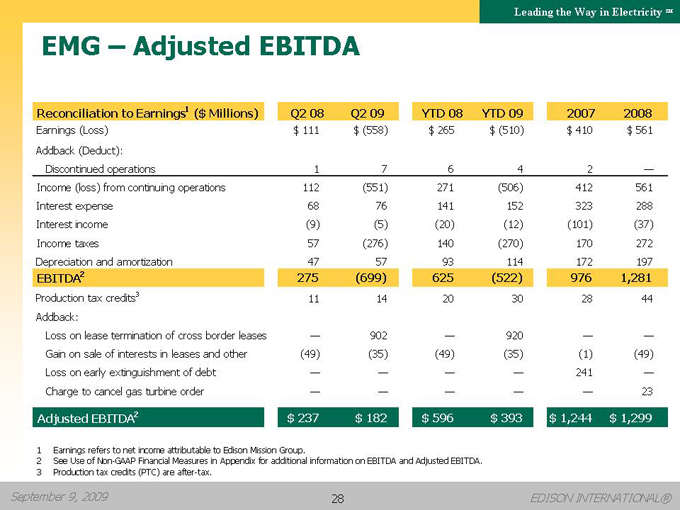

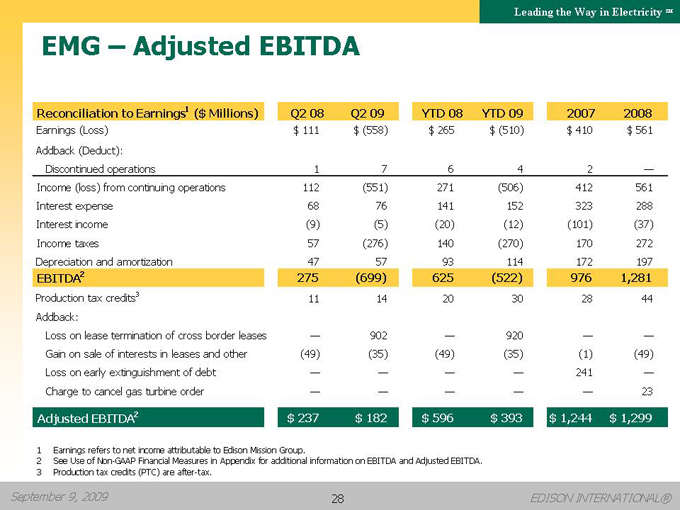

EMG – Adjusted EBITDA

Reconciliation to Earnings1 ($ Millions) Q2 08 Q2 09 YTD 08 YTD 09 2007 2008

Earnings (Loss) $ 111 $ (558) $ 265 $ (510) $ 410 $ 561

Addback (Deduct):

Discontinued operations 1 7 6 4 2 —

Income (loss) from continuing operations 112 (551) 271 (506) 412 561

Interest expense 68 76 141 152 323 288

Interest income (9) (5) (20) (12) (101) (37)

Income taxes 57 (276) 140 (270) 170 272

Depreciation and amortization 47 57 93 114 172 197

EBITDA2 275 (699) 625 (522) 976 1,281

Production tax credits3 11 14 20 30 28 44

Addback:

Loss on lease termination of cross border leases — 902 — 920 — —

Gain on sale of interests in leases and other (49) (35) (49) (35) (1) (49)

Loss on early extinguishment of debt — — — — 241 —

Charge to cancel gas turbine order — — — — — 23

Adjusted EBITDA2 $ 237 $ 182 $ 596 $ 393 $ 1,244 $ 1,299

1 Earnings refers to net income attributable to Edison Mission Group.

2 See Use of Non-GAAP Financial Measures in Appendix for additional information on EBITDA and Adjusted EBITDA.

3 Production tax credits (PTC) are after-tax.

September 9, 2009 EDISON INTERNATIONAL®

28

Leading the Way in Electricity SM

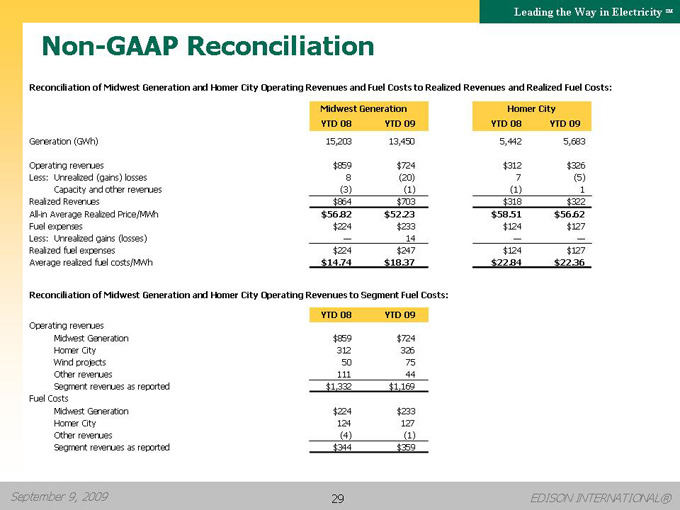

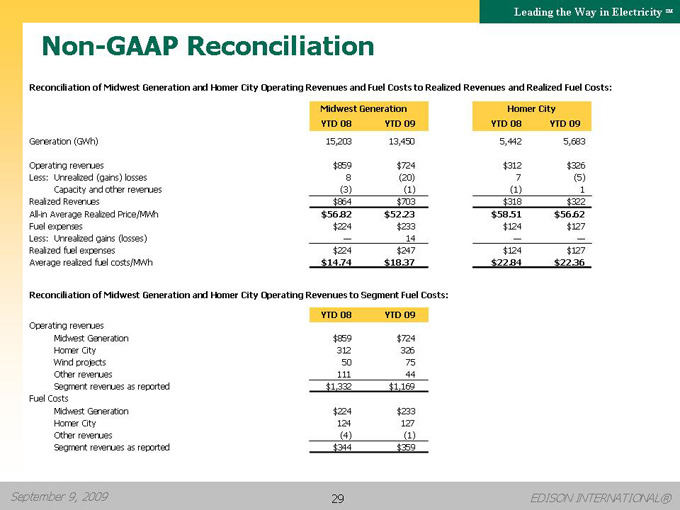

Non-GAAP Reconciliation

Reconciliation of Midwest Generation and Homer City Operating Revenues and Fuel Costs to Realized Revenues and Realized Fuel Costs:

Midwest Generation Homer City

YTD 08 YTD 09 YTD 08 YTD 09

Generation (GWh) 15,203 13,450 5,442 5,683

Operating revenues $859 $724 $312 $326

Less: Unrealized (gains) losses 8 (20) 7 (5)

Capacity and other revenues (3) (1) (1) 1

Realized Revenues $864 $703 $318 $322

All-in Average Realized Price/MWh $56.82 $52.23 $58.51 $56.62

Fuel expenses $224 $233 $124 $127

Less: Unrealized gains (losses) — 14 — —

Realized fuel expenses $224 $247 $124 $127

Average realized fuel costs/MWh $14.74 $18.37 $22.84 $22.36

Reconciliation of Midwest Generation and Homer City Operating Revenues to Segment Fuel Costs:

YTD 08 YTD 09

Operating revenues

Midwest Generation $859 $724

Homer City 312 326

Wind projects 50 75

Other revenues 111 44

Segment revenues as reported $1,332 $1,169

Fuel Costs

Midwest Generation $224 $233

Homer City 124 127

Other revenues (4) (1)

Segment revenues as reported $344 $359

September 9, 2009 EDISON INTERNATIONAL®

29

Leading the Way in Electricity SM

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and EPS by principal operating subsidiary internally for financial planning and for analysis of performance. We also use core earnings and EPS by principal operating subsidiary as primary performance measurements when communicating with analysts and investors regarding our earnings results and outlook, as it allows us to more accurately compare the company’s ongoing performance across periods. Core earnings exclude discontinued operations and other non-core items and are reconciled to basic earnings per common share.

EPS by principal operating subsidiary is based on the principal operating subsidiaries’ net income attributable to the common shareholders of each subsidiary, respectively, and Edison International’s weighted average outstanding common shares. The impact of participating securities (vested stock options that earn dividend equivalents that may participate in undistributed earnings with common stock) for each principal operating subsidiary is not material to each principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which we refer to as EIX parent company and other. EPS and core EPS by principal operating subsidiary are reconciled to basic earnings per common share.

EBITDA is defined as earnings before interest, income taxes, depreciation and amortization. Adjusted EBITDA includes production tax credits from EMG’s wind projects and excludes amounts from gain on the sale of assets, loss on early extinguishment of debt and leases, and impairment of assets and investments. Our management uses Adjusted EBITDA as an important financial measure for evaluating EMG.

The average realized energy price and average realized fuel cost is a non-GAAP performance measure since such statistical measures exclude unrealized gains or losses recorded as operating revenues and unrealized gains or losses recorded as fuel expenses. Management believes that the average realized energy price and average realized fuel cost is more meaningful for investors as it reflects the impact of hedge contracts at the time of actual generation in period-over-period comparisons or as compared to real-time market prices.

A reconciliation of Non-GAAP information to GAAP information, including the impact of participating securities, is included either on the slide where the information appears or on another slide referenced in this presentation.

September 9, 2009 EDISON INTERNATIONAL®

30