Exhibit 99.1

Exhibit 99.1

Leading the Way in Electricity SM

RBC Capital Markets Global Energy and Power Conference June 7, 2010

John R. Fielder

President, Southern California Edison

Linda G. Sullivan

Senior Vice President and Chief Financial Officer, Southern California Edison

June 7, 2010

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation, earnings, asset and rate base growth, load growth, capital investments, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors”, and “Management’s Discussion and Analysis” in Edison International’s 2009 Form 10-K, most recent Form 10-Q and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation.

June 7, 2010

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

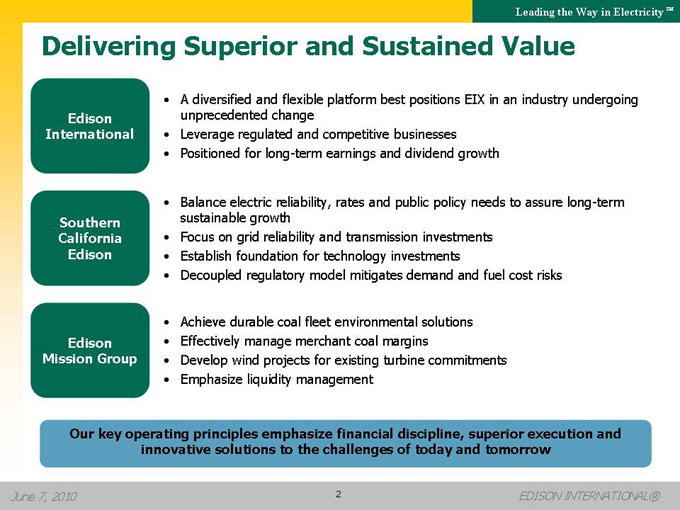

Delivering Superior and Sustained Value

Edison International

Southern California Edison

Edison Mission Group

A diversified and flexible platform best positions EIX in an industry undergoing unprecedented change Leverage regulated and competitive businesses Positioned for long-term earnings and dividend growth

Balance electric reliability, rates and public policy needs to assure long-term sustainable growth Focus on grid reliability and transmission investments Establish foundation for technology investments Decoupled regulatory model mitigates demand and fuel cost risks

Achieve durable coal fleet environmental solutions Effectively manage merchant coal margins Develop wind projects for existing turbine commitments Emphasize liquidity management

Our key operating principles emphasize financial discipline, superior execution and innovative solutions to the challenges of today and tomorrow

June 7, 2010

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

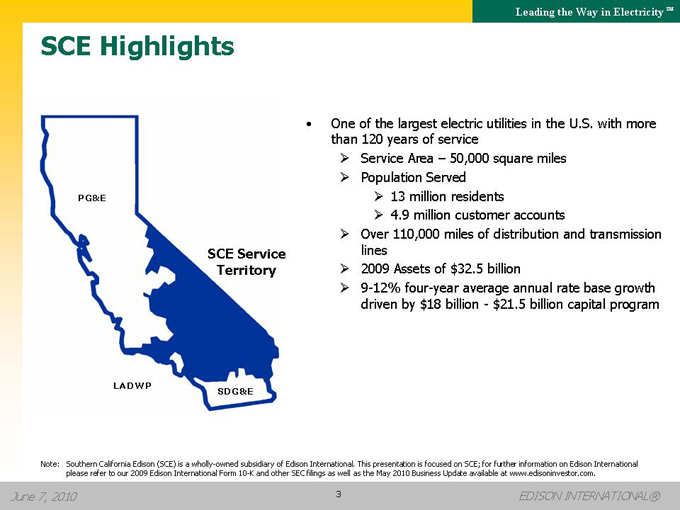

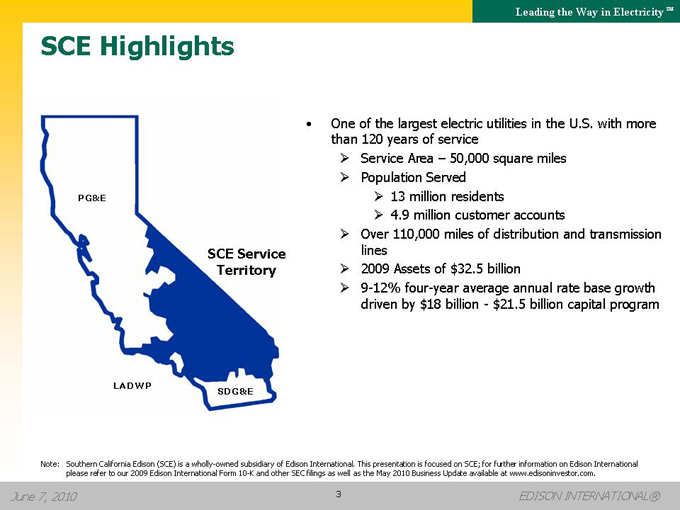

SCE Highlights

PG&E

SCE Service Territory

SDG&E

LADWP

One of the largest electric utilities in the U.S. with more than 120 years of service

Service Area – 50,000 square miles

Population Served

13 million residents

4.9 million customer accounts

Over 110,000 miles of distribution and transmission lines

2009 Assets of $32.5 billion

9-12% four-year average annual rate base growth driven by $18 billion—$21.5 billion capital program

Note: Southern California Edison (SCE) is a wholly-owned subsidiary of Edison International. This presentation is focused on SCE; for further information on Edison International please refer to our 2009 Edison International Form 10-K and other SEC filings as well as the May 2010 Business Update available at www.edisoninvestor.com.

June 7, 2010

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

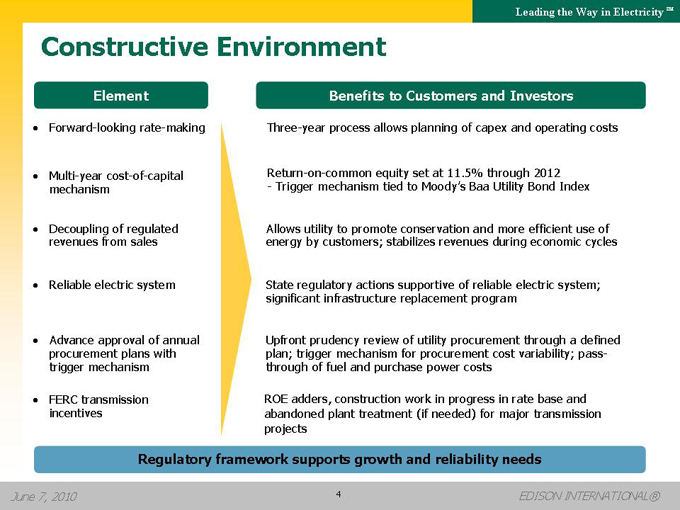

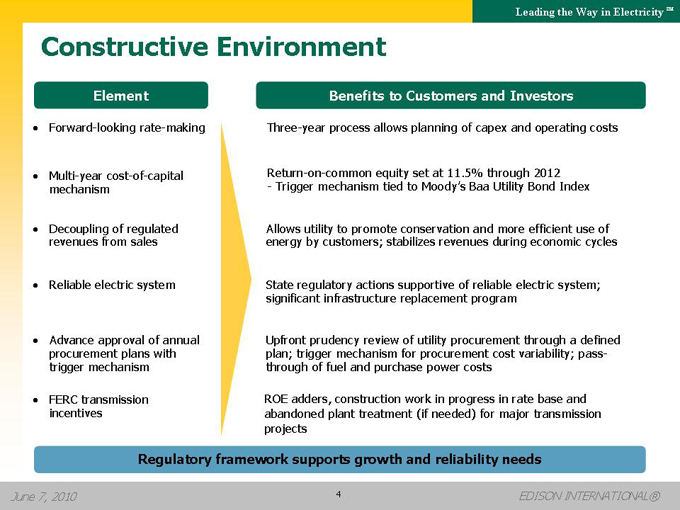

Constructive Environment

Element

Forward-looking rate-making

Multi-year cost-of-capital mechanism

Decoupling of regulated revenues from sales

Reliable electric system

Advance approval of annual procurement plans with trigger mechanism

FERC transmission incentives

Benefits to Customers and Investors

Three-year process allows planning of capex and operating costs

Return-on-common equity set at 11.5% through 2012

- Trigger mechanism tied to Moody’s Baa Utility Bond Index

Allows utility to promote conservation and more efficient use of energy by customers; stabilizes revenues during economic cycles

State regulatory actions supportive of reliable electric system; significant infrastructure replacement program

Upfront prudency review of utility procurement through a defined plan; trigger mechanism for procurement cost variability; pass-through of fuel and purchase power costs

ROE adders, construction work in progress in rate base and abandoned plant treatment (if needed) for major transmission projects

Regulatory framework supports growth and reliability needs

June 7, 2010

4

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

2010 – 2014 Strategic Priorities

Grid Reliability Infrastructure replacement program and load growth

Transmission Reliability and renewable driven transmission

Generation SONGS Steam Generator Replacement and Solar Photovoltaic

Smart Grid/ Advanced Technologies Edison SmartConnect™ deployment, distributed generation, energy storage, energy management, and transportation electrification

June 7, 2010

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

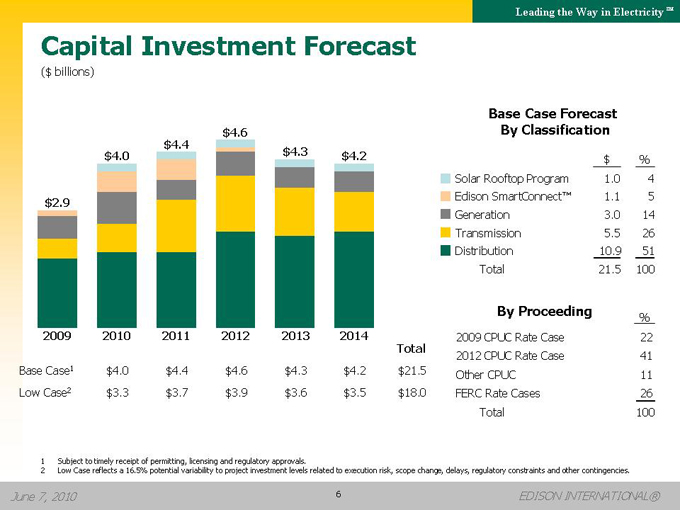

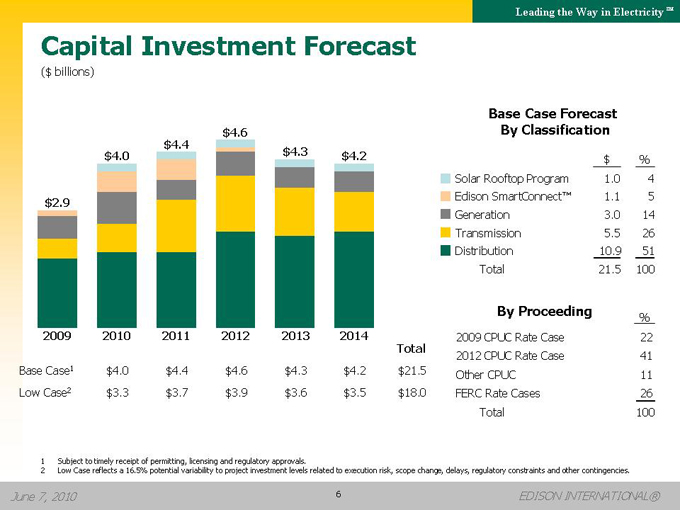

Capital Investment Forecast

($ billions)

$2.9

$4.0

$4.4

$4.6

$4.3

$4.2

2009

2010

2011

2012

2013

2014

Total

Base Case1 $4.0 $4.4 $4.6 $4.3 $4.2 $21.5

Low Case2 $3.3 $3.7 $3.9 $3.6 $3.5 $18.0

Base Case Forecast

By Classification

$ %

Solar Rooftop Program 1.0 4

Edison SmartConnect™ 1.1 5

Generation 3.0 14

Transmission 5.5 26

Distribution 10.9 51

Total 21.5 100

By Proceeding %

2009 CPUC Rate Case 22

2012 CPUC Rate Case 41

Other CPUC 11

FERC Rate Cases 26

Total 100

1 | | Subject to timely receipt of permitting, licensing and regulatory approvals. |

2 Low Case reflects a 16.5% potential variability to project investment levels related to execution risk, scope change, delays, regulatory constraints and other contingencies.

June 7, 2010

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

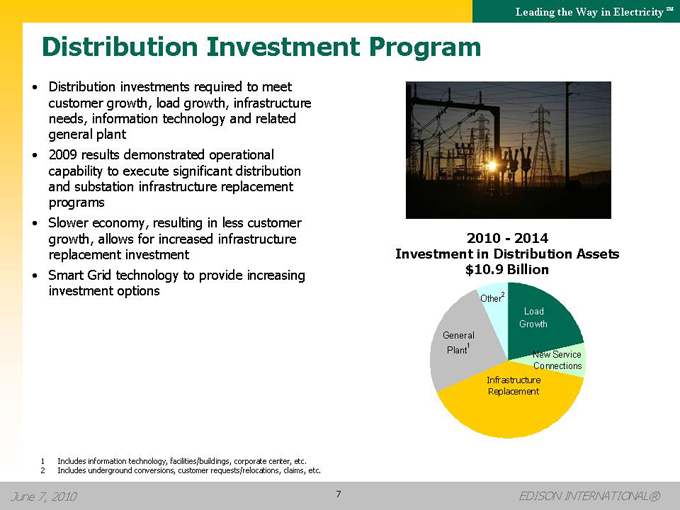

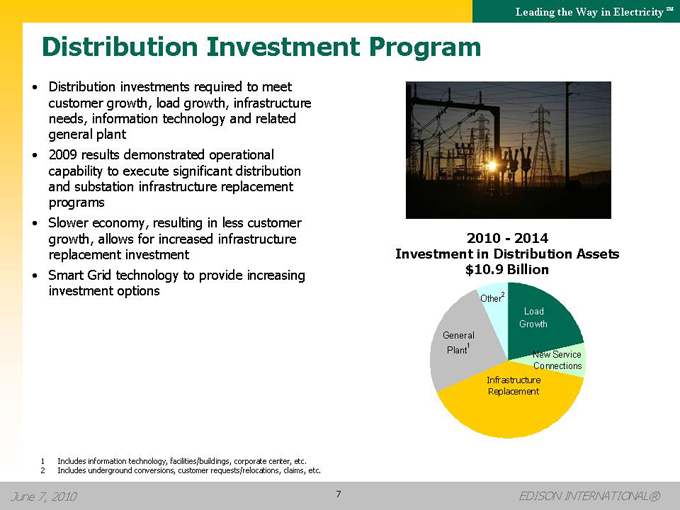

Distribution Investment Program

Distribution investments required to meet customer growth, load growth, infrastructure needs, information technology and related general plant

2009 results demonstrated operational capability to execute significant distribution and substation infrastructure replacement programs

Slower economy, resulting in less customer growth, allows for increased infrastructure replacement investment

Smart Grid technology to provide increasing investment options

2010—2014

Investment in Distribution Assets $10.9 Billion

General Plant1

Other2

Load Growth

New Service Connections

Infrastructure Replacement

1 | | Includes information technology, facilities/buildings, corporate center, etc. |

2 | | Includes underground conversions, customer requests/relocations, claims, etc. |

June 7, 2010

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

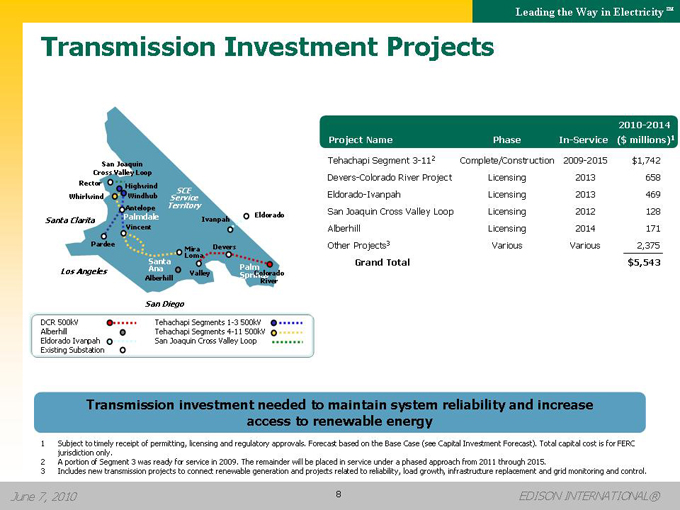

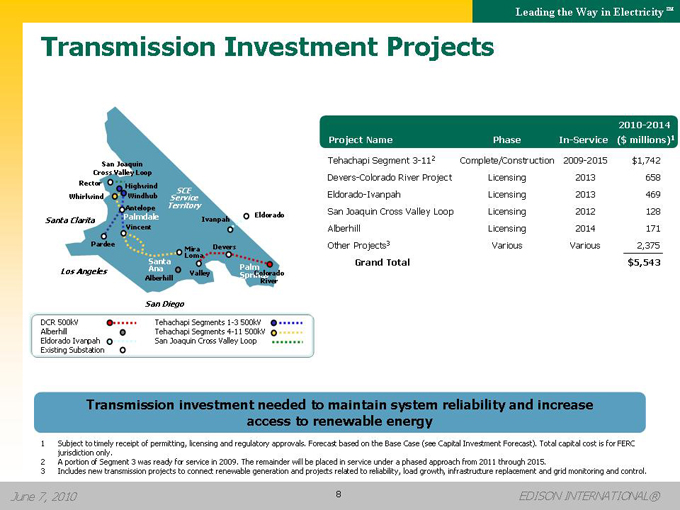

Transmission Investment Projects

San Joaquin Cross Valley Loop

Rector

Whirlwind

Santa Clarita

Los Angeles

San Diego

Eldorado

Highwind

Windhub

Antelope

Palmdale

Vincent

Pardee

SantaAna

Alberhill

MiraLoma

Valley

Devers

PalmSprings

Colorado River

Ivanpah

Service SCE Territory

DCR 500kV Alberhill Eldorado Ivanpah Existing Substation

Tehachapi Segments 1-3 500kV Tehachapi Segments 4-11 500kV San Joaquin Cross Valley Loop

2010-2014

Project Name Phase In-Service ($ millions)1

Tehachapi Segment 3-112 Complete/Construction 2009-2015 $1,742

Devers-Colorado River Project Licensing 2013 658

Eldorado-Ivanpah Licensing 2013 469

San Joaquin Cross Valley Loop Licensing 2012 128

Alberhill Licensing 2014 171

Other Projects3 Various Various 2,375

Grand Total $5,543

Transmission investment needed to maintain system reliability and increase access to renewable energy

1 Subject to timely receipt of permitting, licensing and regulatory approvals. Forecast based on the Base Case (see Capital Investment Forecast). Total capital cost is for FERC jurisdiction only.

2 A portion of Segment 3 was ready for service in 2009. The remainder will be placed in service under a phased approach from 2011 through 2015.

3 Includes new transmission projects to connect renewable generation and projects related to reliability, load growth, infrastructure replacement and grid monitoring and control.

June 7, 2010

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

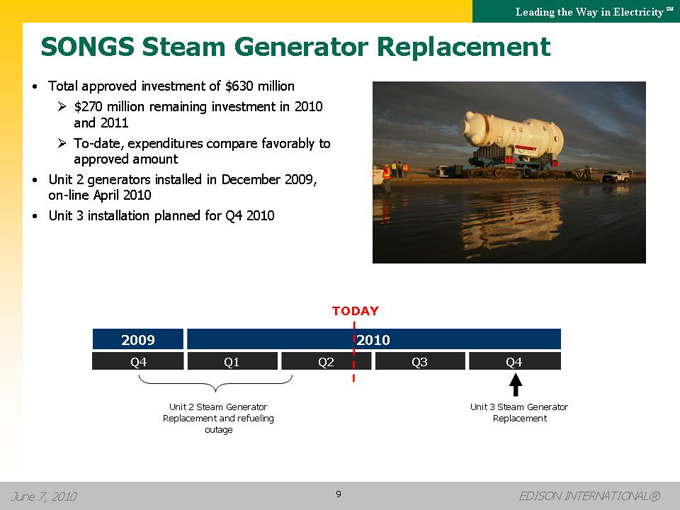

SONGS Steam Generator Replacement

Total approved investment of $630 million

??$270 million remaining investment in 2010 and 2011

??To-date, expenditures compare favorably to approved amount Unit 2 generators installed in December 2009, on-line April 2010 Unit 3 installation planned for Q4 2010

TODAY

2009 2010

Q4 Q1 Q2 Q3 Q4

Unit 2 Steam Generator Replacement and refueling outage

Unit 3 Steam Generator Replacement

June 7, 2010

9

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

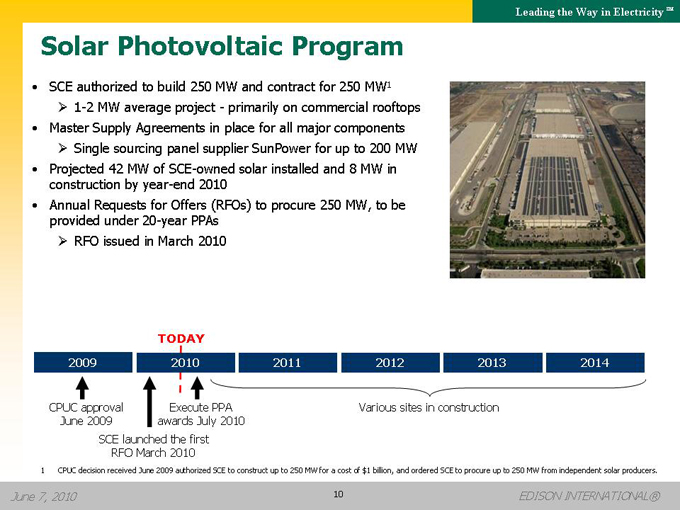

Solar Photovoltaic Program

SCE authorized to build 250 MW and contract for 250 MW1

1-2 MW average project—primarily on commercial rooftops

Master Supply Agreements in place for all major components

Single sourcing panel supplier SunPower for up to 200 MW

Projected 42 MW of SCE-owned solar installed and 8 MW in construction by year-end 2010

Annual Requests for Offers (RFOs) to procure 250 MW, to be provided under 20-year PPAs

RFO issued in March 2010

TODAY

2009 2010 2011 2012 2013 2014

CPUC approval Execute PPA Various sites in construction

June 2009 awards July 2010

SCE launched the first RFO March 2010

1 CPUC decision received June 2009 authorized SCE to construct up to 250 MW for a cost of $1 billion, and ordered SCE to procure up to 250 MW from independent solar producers.

June 7, 2010

10

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

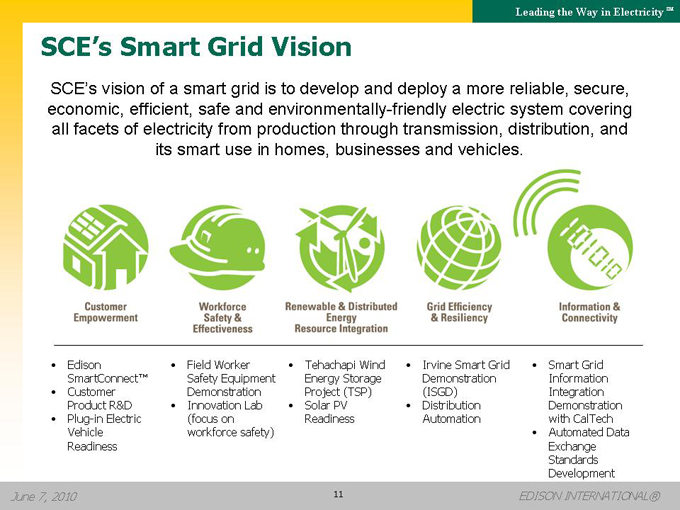

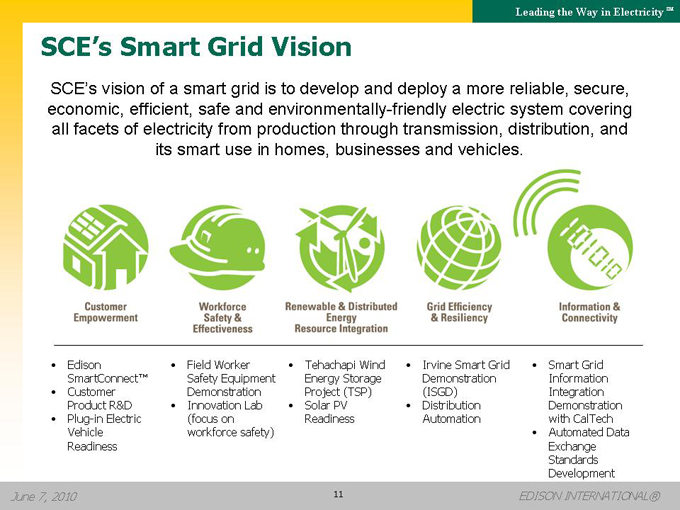

SCE’s Smart Grid Vision

SCE’s vision of a smart grid is to develop and deploy a more reliable, secure, economic, efficient, safe and environmentally-friendly electric system covering all facets of electricity from production through transmission, distribution, and its smart use in homes, businesses and vehicles.

Customer Empowerment

Workforce Safety & Effectiveness

Renewable & Distributed Energy Resource Integration

Grid Efficiency & Resiliency

Information & Connectivity

Edison SmartConnect™ Customer Product R&D

Plug-in Electric Vehicle

Readiness

Field Worker Safety Equipment Demonstration Innovation Lab (focus on workforce safety)

Tehachapi Wind Energy Storage Project (TSP) Solar PV Readiness

Irvine Smart Grid Demonstration (ISGD) Distribution Automation

Smart Grid Information Integration Demonstration with CalTech Automated Data Exchange Standards Development

June 7, 2010

11

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

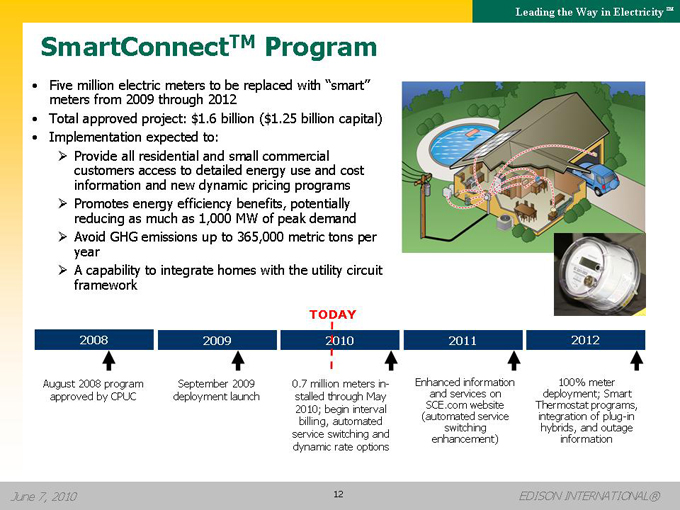

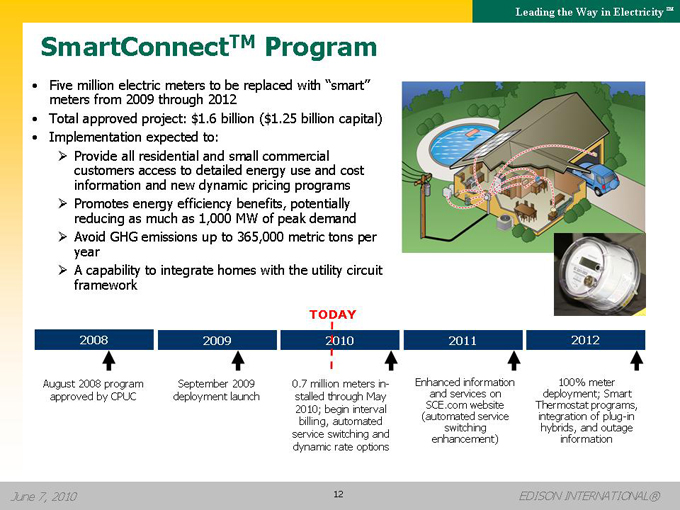

SmartConnectTM Program

Five million electric meters to be replaced with “smart” meters from 2009 through 2012 Total approved project: $1.6 billion ($1.25 billion capital) Implementation expected to:

Provide all residential and small commercial customers access to detailed energy use and cost information and new dynamic pricing programs

Promotes energy efficiency benefits, potentially reducing as much as 1,000 MW of peak demand

Avoid GHG emissions up to 365,000 metric tons per year

A capability to integrate homes with the utility circuit framework

TODAY

2008 2009 2010 2011 2012

August 2008 program approved by CPUC September 2009 deployment launch 0.7 million meters installed through May 2010; begin interval billing, automated service switching and dynamic rate options Enhanced information and services on SCE.com website (automated service switching enhancement) 100% meter deployment; Smart Thermostat programs, integration of plug-in hybrids, and outage information

June 7, 2010

12

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

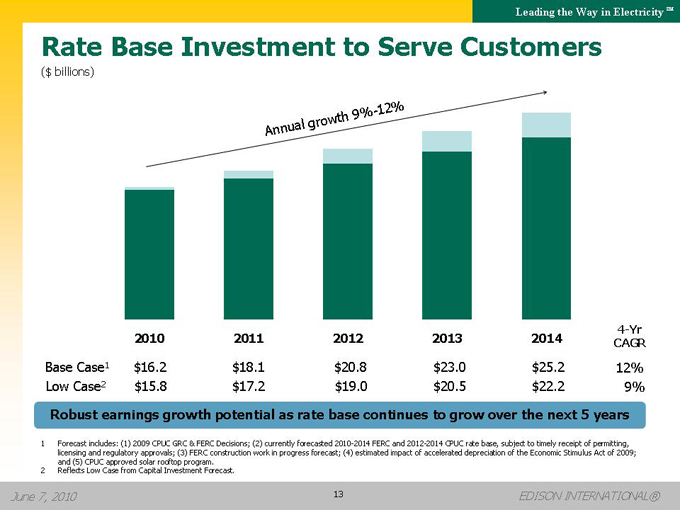

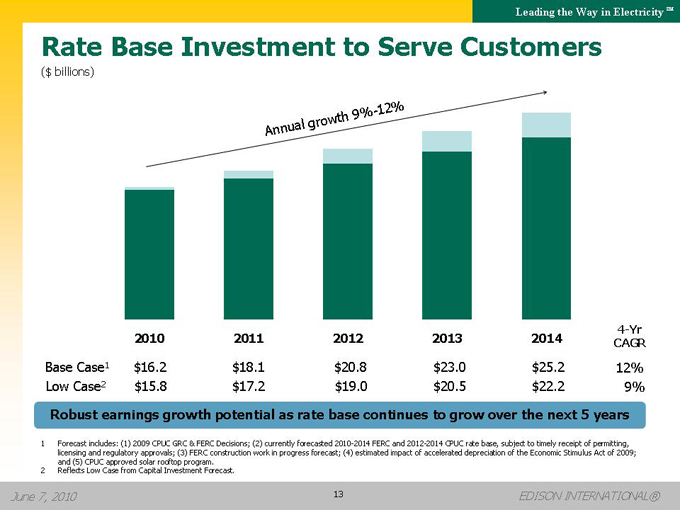

Rate Base Investment to Serve Customers

($ billions)

Annual growth 9%-12%

2010 2011 2012 2013 2014 4-Yr CAGR

Base Case1 $16.2 $18.1 $20.8 $23.0 $25.2 12%

Low Case2 $15.8 $17.2 $19.0 $20.5 $22.2 9%

Robust earnings growth potential as rate base continues to grow over the next 5 years

1 Forecast includes: (1) 2009 CPUC GRC & FERC Decisions; (2) currently forecasted 2010-2014 FERC and 2012-2014 CPUC rate base, subject to timely receipt of permitting, licensing and regulatory approvals; (3) FERC construction work in progress forecast; (4) estimated impact of accelerated depreciation of the Economic Stimulus Act of 2009; and (5) CPUC approved solar rooftop program.

2 | | Reflects Low Case from Capital Investment Forecast. |

June 7, 2010

13

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

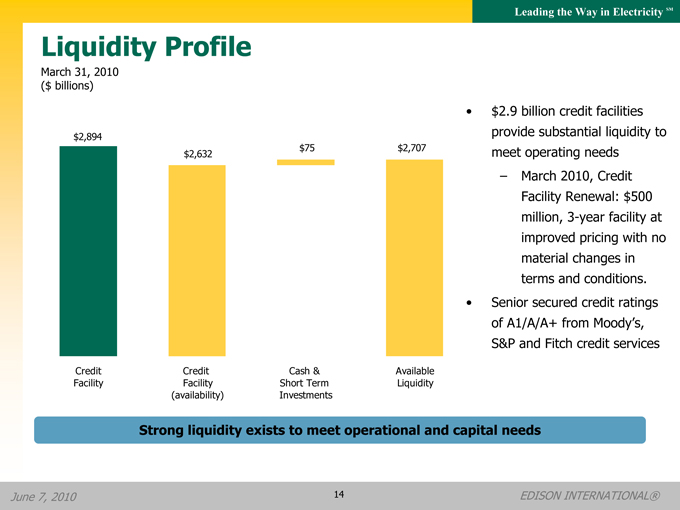

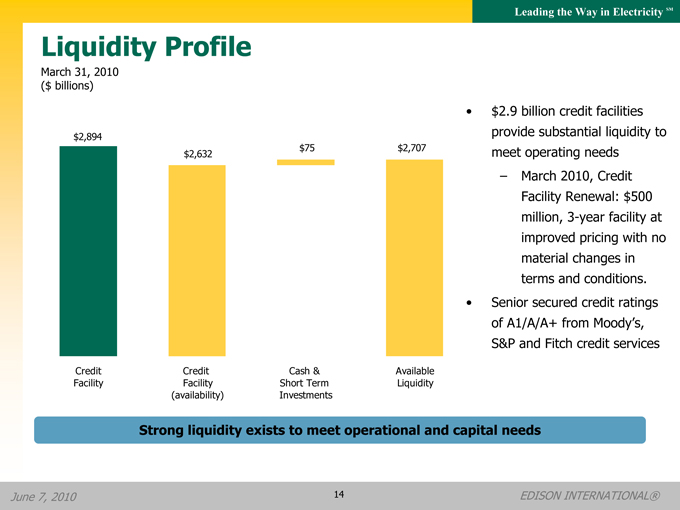

Liquidity Profile

March 31, 2010 ($ billions)

$2,894

$2,632

$75

$2,707

Credit Facility

Credit Facility (availability)

Cash & Short Term Investments

Available Liquidity

$2.9 billion credit facilities provide substantial liquidity to meet operating needs

March 2010, Credit Facility Renewal: $500 million, 3-year facility at improved pricing with no material changes in terms and conditions.

Senior secured credit ratings of A1/A/A+ from Moody’s, S&P and Fitch credit services

Strong liquidity exists to meet operational and capital needs

June 7, 2010

14

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

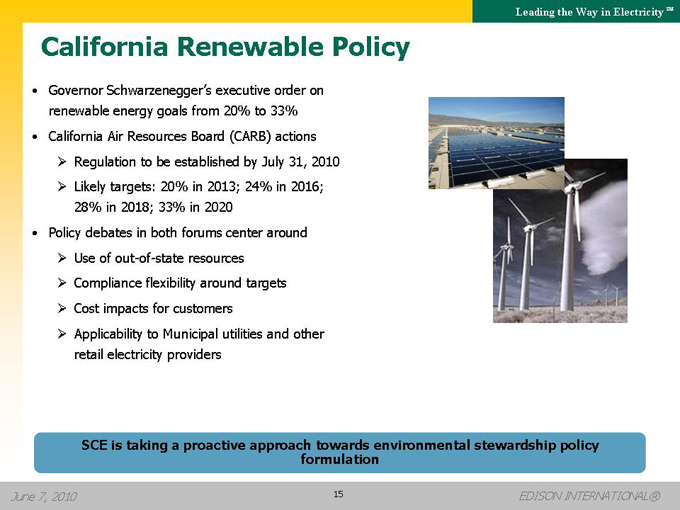

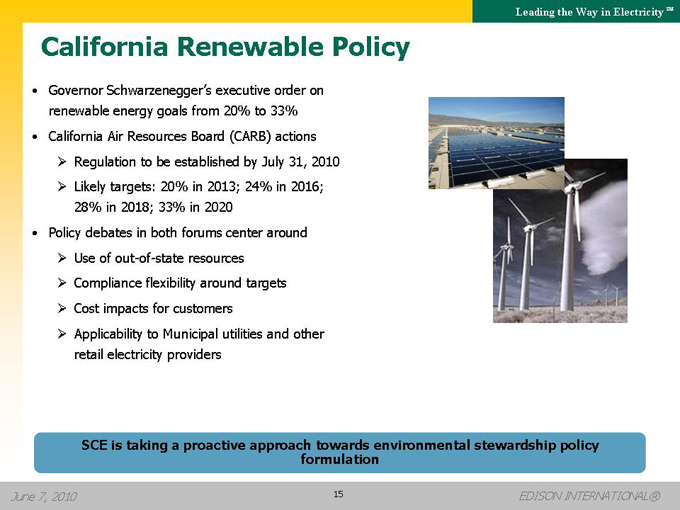

California Renewable Policy

Governor Schwarzenegger’s executive order on renewable energy goals from 20% to 33% California Air Resources Board (CARB) actions

Regulation to be established by July 31, 2010

Likely targets: 20% in 2013; 24% in 2016;

28% in 2018; 33% in 2020

Policy debates in both forums center around

Use of out-of-state resources

Compliance flexibility around targets

Cost impacts for customers

Applicability to Municipal utilities and other retail electricity providers

SCE is taking a proactive approach towards environmental stewardship policy formulation

June 7, 2010

15

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

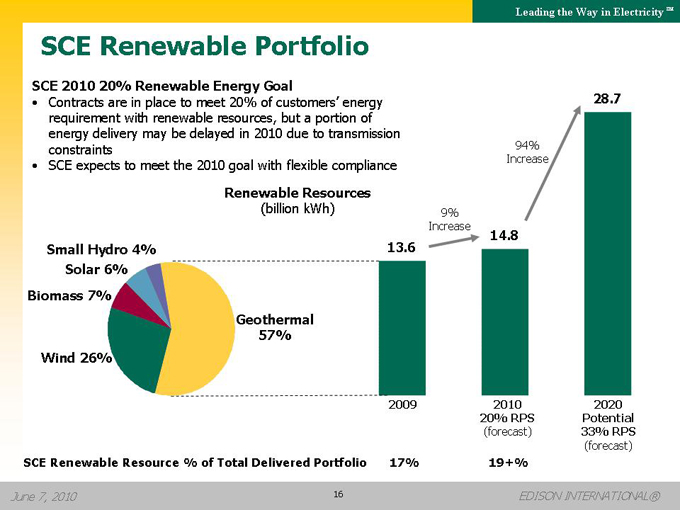

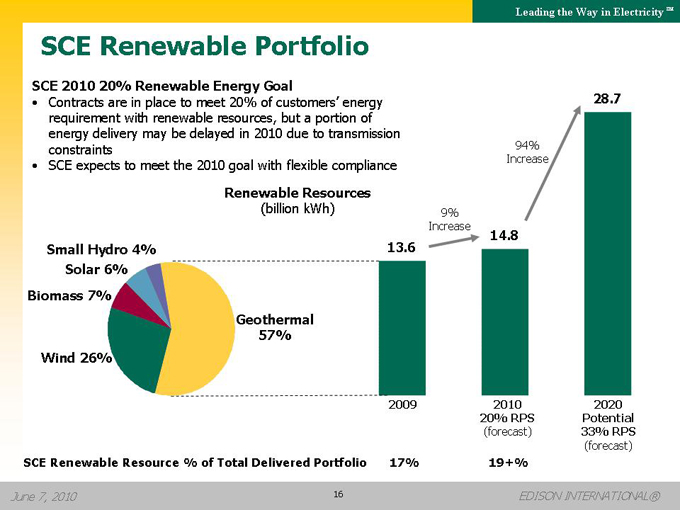

SCE Renewable Portfolio

SCE 2010 20% Renewable Energy Goal

Contracts are in place to meet 20% of customers’ energy requirement with renewable resources, but a portion of energy delivery may be delayed in 2010 due to transmission constraints SCE expects to meet the 2010 goal with flexible compliance

Renewable Resources

(billion kWh)

Small Hydro 4%

Solar 6%

Biomass 7%

Wind 26%

Geothermal 57%

13.6

9% Increase

14.8

94% Increase

28.7

2009

2010 20% RPS

(forecast)

2020 Potential 33% RPS

(forecast)

SCE Renewable Resource % of Total Delivered Portfolio

17%

19+%

June 7, 2010

16

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

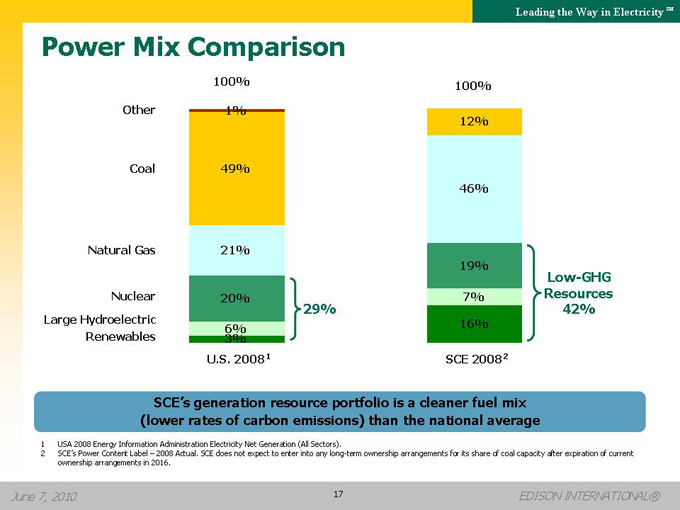

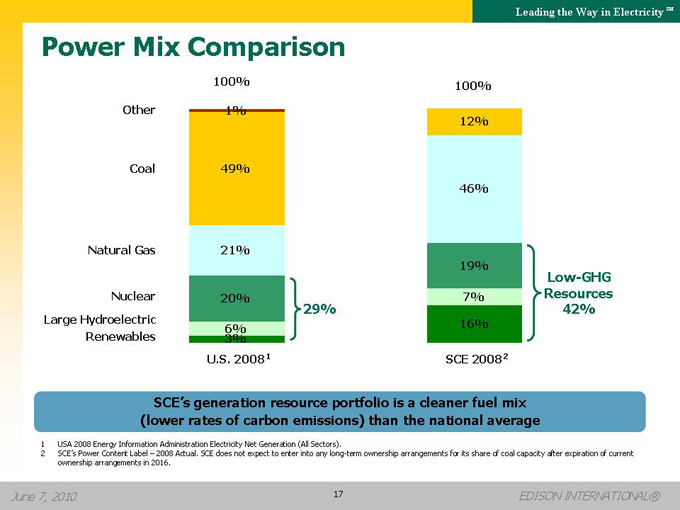

Power Mix Comparison

Other

Coal

Natural Gas

Nuclear

Large Hydroelectric

Renewables

100%

1%

49%

21%

20%

6% 3%

U.S. 20081

29%

100%

12%

46%

19%

7%

16%

SCE 20082

Low-GHG Resources 42%

SCE’s generation resource portfolio is a cleaner fuel mix (lower rates of carbon emissions) than the national average

1 | | USA 2008 Energy Information Administration Electricity Net Generation (All Sectors). |

2 SCE’s Power Content Label – 2008 Actual. SCE does not expect to enter into any long-term ownership arrangements for its share of coal capacity after expiration of current ownership arrangements in 2016.

June 7, 2010

17

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

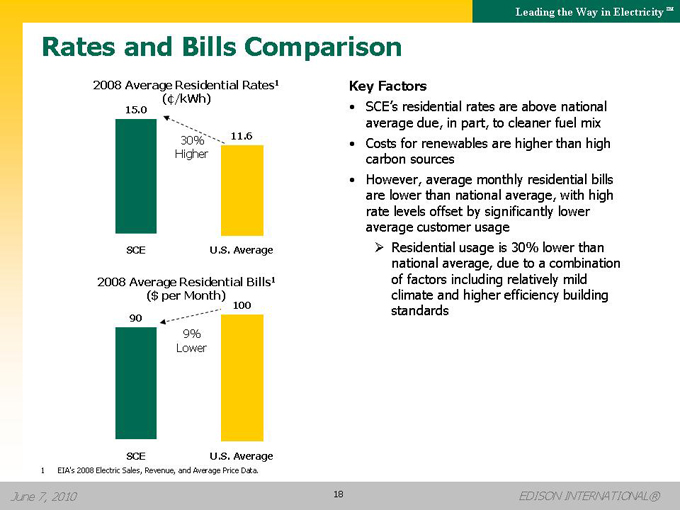

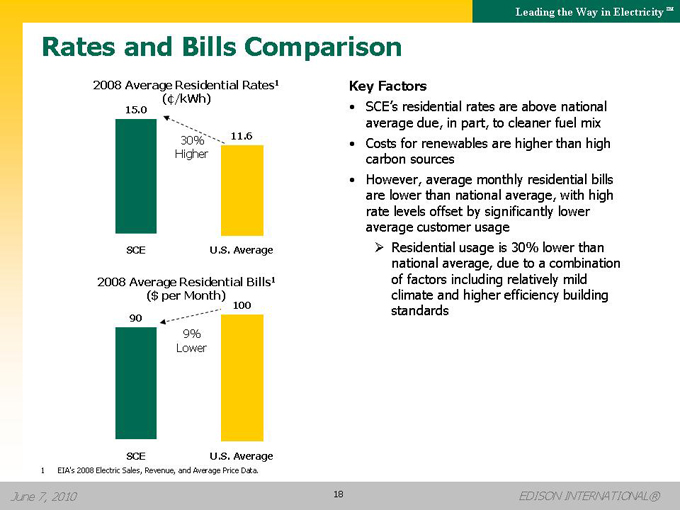

Rates and Bills Comparison

2008 Average Residential Rates1 (¢/kWh)

15.0

SCE

30% Higher

11.6

U.S. Average

2008 Average Residential Bills1 ($ per Month)

90

SCE

9%

Lower

100

U.S. Average

1 | | EIA’s 2008 Electric Sales, Revenue, and Average Price Data. |

Key Factors

SCE’s residential rates are above national average due, in part, to cleaner fuel mix

Costs for renewables are higher than high carbon sources

However, average monthly residential bills are lower than national average, with high rate levels offset by significantly lower average customer usage

Residential usage is 30% lower than national average, due to a combination of factors including relatively mild climate and higher efficiency building standards

June 7, 2010

18

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Investment Rationale Summary

Value Drivers

Delivering on growth plan

Significant investment opportunity in wires franchise

Opportunity to earn compensatory return on invested capital

Pass through cost recovery mechanisms

Forward looking General Rate Cases

Strong liquidity to support business requirements

Complying with state-wide renewable policy objectives

Strong credit ratings

Experienced team

Opportunity for long-term shareholder value creation

June 7, 2010

19

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Appendix

June 7, 2010

20

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

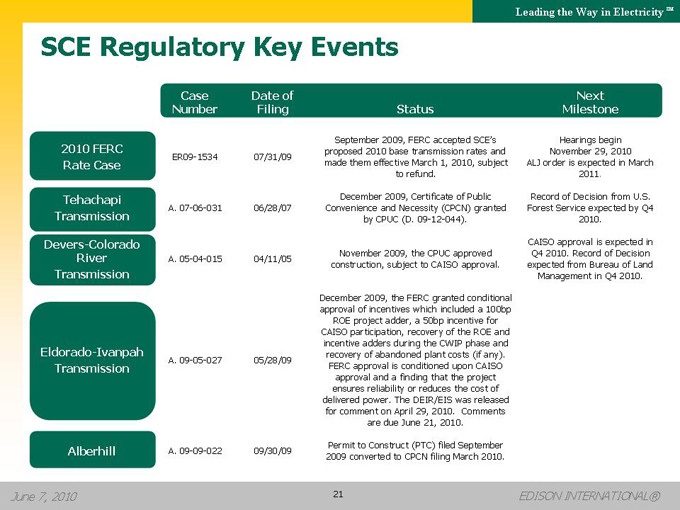

SCE Regulatory Key Events

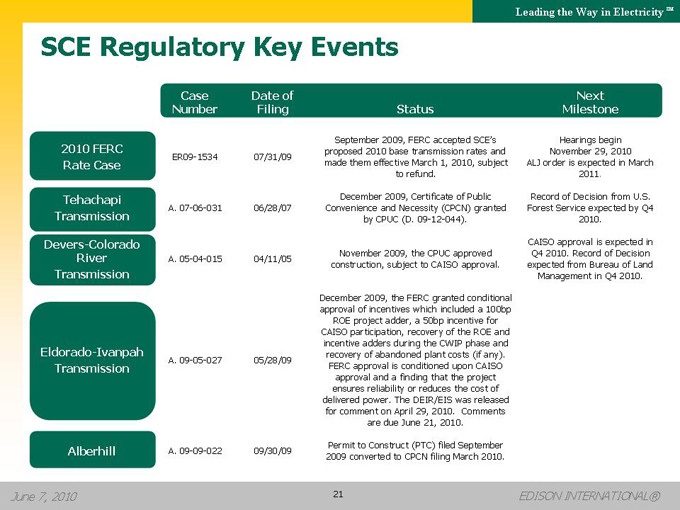

Case Number Date of Filing Status Next Milestone

2010 FERC Rate Case ER09-1534 07/31/09 September 2009, FERC accepted SCE’s proposed 2010 base transmission rates and made them effective March 1, 2010, subject to refund. Hearings begin November 29, 2010 ALJ order is expected in March 2011.

Tehachapi Transmission Devers-Colorado River Transmission A. 07-06-031 A. 05-04-015 06/28/07 04/11/05 December 2009, Certificate of Public Convenience and Necessity (CPCN) granted by CPUC (D. 09-12-044). November 2009, the CPUC approved construction, subject to CAISO approval. Record of Decision from U.S. Forest Service expected by Q4 2010. CAISO approval is expected in Q4 2010. Record of Decision expected from Bureau of Land Management in Q4 2010.

Eldorado-Ivanpah Transmission A. 09-05-027 05/28/09 December 2009, the FERC granted conditional approval of incentives which included a 100bp ROE project adder, a 50bp incentive for CAISO participation, recovery of the ROE and incentive adders during the CWIP phase and recovery of abandoned plant costs (if any). FERC approval is conditioned upon CAISO approval and a finding that the project ensures reliability or reduces the cost of delivered power. The DEIR/EIS was released for comment on April 29, 2010. Comments are due June 21, 2010.

Alberhill A. 09-09-022 09/30/09 Permit to Construct (PTC) filed September 2009 converted to CPCN filing March 2010.

June 7, 2010

21

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

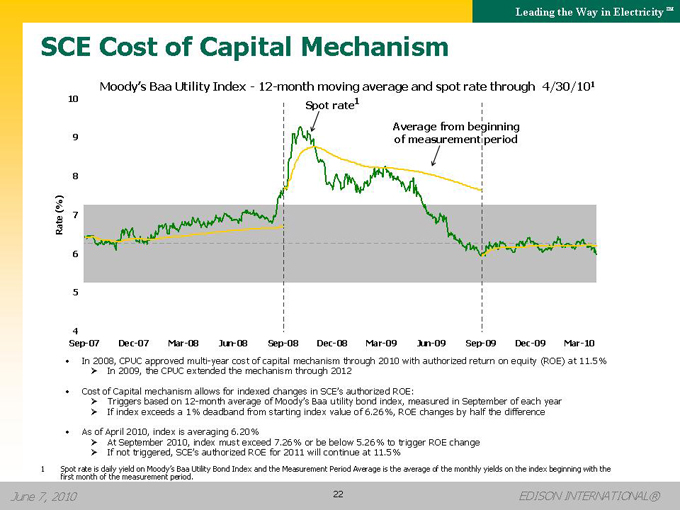

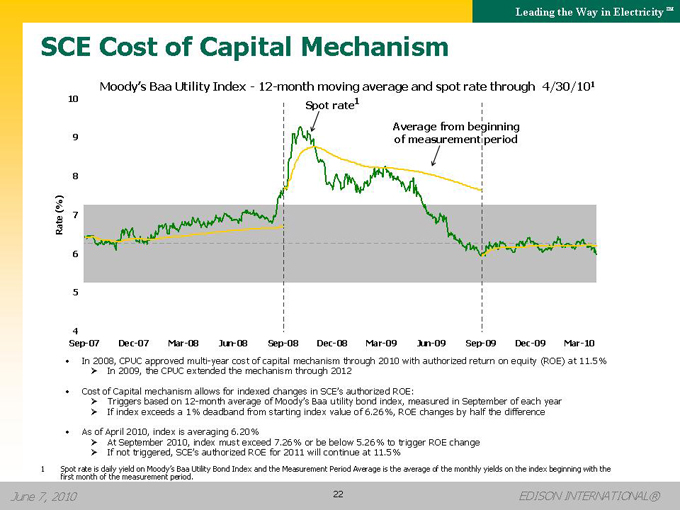

SCE Cost of Capital Mechanism

Moody’s Baa Utility Index—12-month moving average and spot rate through 4/30/101

Spot rate1

10

9

Average from beginning of measurement period

Sep-07

Dec-07

Mar-08

Jun-08

Sep-08

Dec-08

Mar-09

Jun-09

Sep-09

Dec-09

Mar-10

In 2008, CPUC approved multi-year cost of capital mechanism through 2010 with authorized return on equity (ROE) at 11.5%

??In 2009, the CPUC extended the mechanism through 2012

Cost of Capital mechanism allows for indexed changes in SCE’s authorized ROE:

??Triggers based on 12-month average of Moody’s Baa utility bond index, measured in September of each year

??If index exceeds a 1% deadband from starting index value of 6.26%, ROE changes by half the difference As of April 2010, index is averaging 6.20%

??At September 2010, index must exceed 7.26% or be below 5.26% to trigger ROE change

??If not triggered, SCE’s authorized ROE for 2011 will continue at 11.5%

1 Spot rate is daily yield on Moody’s Baa Utility Bond Index and the Measurement Period Average is the average of the monthly yields on the index beginning with the first month of the measurement period.

June 7, 2010

22

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

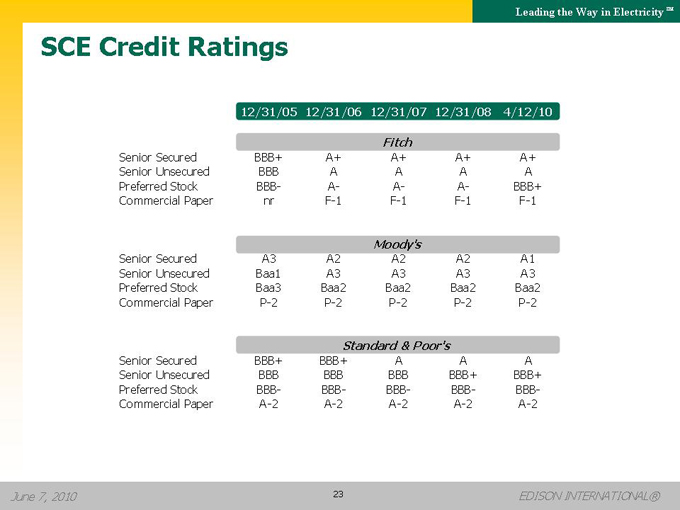

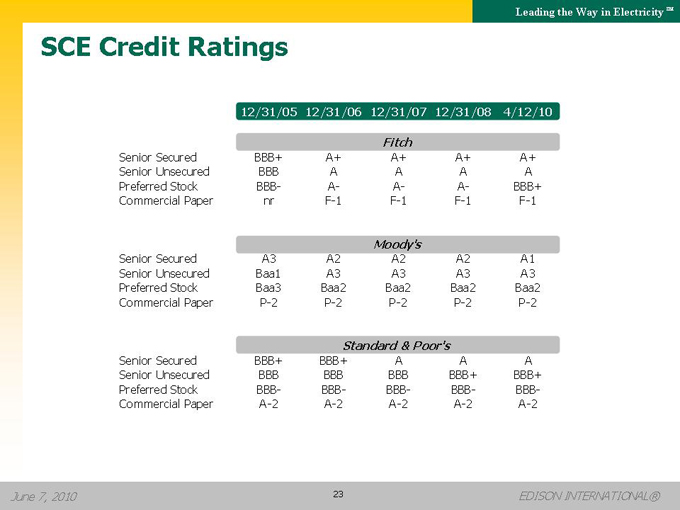

SCE Credit Ratings

12/31/05

12/31/06

12/31/07

12/31/08

4/12/10

Fitch

Senior Secured BBB+ A+ A+ A+ A+

Senior Unsecured BBB A A A A

Preferred Stock BBB- A- A- A- BBB+

Commercial Paper nr F-1 F-1 F-1 F-1

Moody’s

Senior Secured A3 A2 A2 A2 A1

Senior Unsecured Baa1 A3 A3 A3 A3

Preferred Stock Baa3 Baa2 Baa2 Baa2 Baa2

Commercial Paper P-2 P-2 P-2 P-2 P-2

Standard & Poor’s

Senior Secured BBB+ BBB+ A A A

Senior Unsecured BBB BBB BBB BBB+ BBB+

Preferred Stock BBB- BBB- BBB- BBB- BBB-

Commercial Paper A-2 A-2 A-2 A-2 A-2

June 7, 2010

23

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

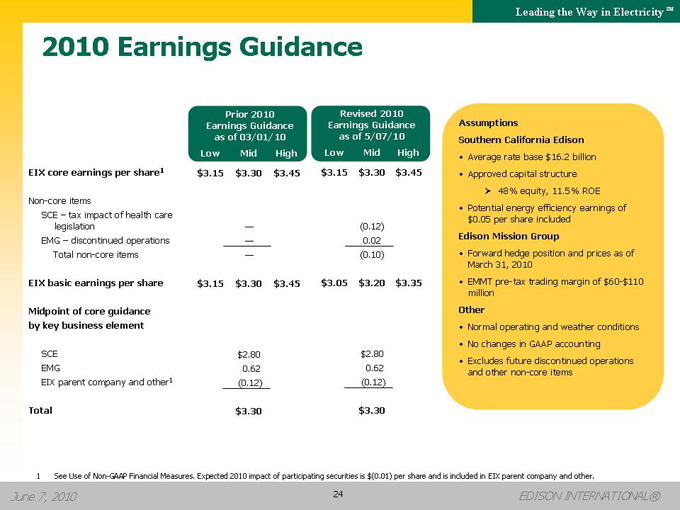

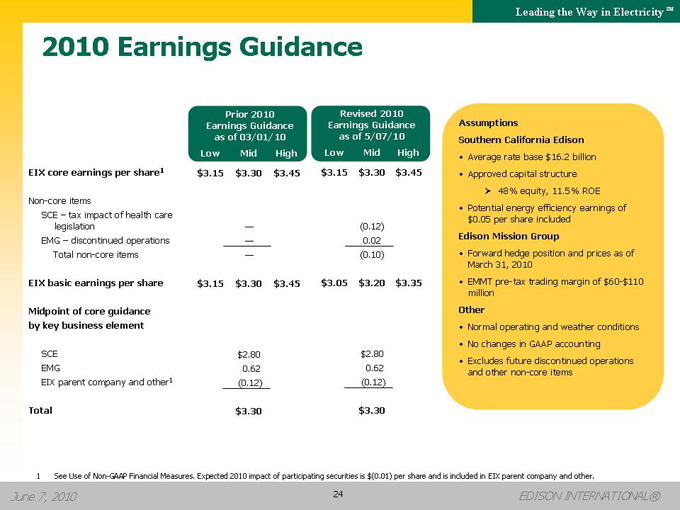

2010 Earnings Guidance

Prior 2010 Revised 2010

Earnings Guidance Earnings Guidance

as of 03/01/10 as of 5/07/10

Low Mid High Low Mid High

EIX core earnings per share1 $3.15 $3.30 $3.45 $3.15 $3.30 $3.45

Non-core items

SCE – tax impact of health care

legislation — (0.12)

EMG – discontinued operations — 0.02

Total non-core items — (0.10)

EIX basic earnings per share $3.15 $3.30 $3.45 $3.05 $3.20 $3.35

Midpoint of core guidance

by key business element

SCE $2.80 $2.80

EMG 0.62 0.62

EIX parent company and other1 (0.12) (0.12)

Total $3.30 $3.30

Assumptions

Southern California Edison

• Average rate base $16.2 billion

• Approved capital structure

??48% equity, 11.5% ROE

• Potential energy efficiency earnings of $0.05 per share included

Edison Mission Group

• Forward hedge position and prices as of March 31, 2010

• EMMT pre-tax trading margin of $60-$110 million

Other

• Normal operating and weather conditions

• No changes in GAAP accounting

• Excludes future discontinued operations and other non-core items

1 See Use of Non-GAAP Financial Measures. Expected 2010 impact of participating securities is $(0.01) per share and is included in EIX parent company and other.

June 7, 2010

24

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and EPS by principal operating subsidiary internally for financial planning and for analysis of performance. We also use core earnings and EPS by principal operating subsidiary when communicating with analysts and investors regarding our earnings results and outlook, to facilitate comparison of the company’s performance from period to period.

Core earnings is a Non-GAAP financial measure and may not be comparable to those of other companies. Core earnings and core earnings per share are defined as GAAP earnings and GAAP earnings per share excluding income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings. GAAP earnings refer to net income attributable to Edison International or attributable to the common shareholders of each subsidiary and Edison International GAAP earnings per share refers to basic earnings per common share attributable to Edison International common shareholders. EPS by principal operating subsidiary is based on the principal operating subsidiaries’ net income attributable to the common shareholders of each subsidiary, respectively, and Edison International’s weighted average outstanding common shares. The impact of participating securities (vested stock options that earn dividend equivalents that may participate in undistributed earnings with common stock) for each principal operating subsidiary is not material to each principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which we refer to as EIX parent company and other.

June 7, 2010

25

EDISON INTERNATIONAL®